- SXTP Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

60 Degrees Pharmaceuticals (SXTP) S-1IPO registration

Filed: 14 Feb 25, 4:37pm

As filed with the U.S. Securities and Exchange Commission on February 14, 2025.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

60 DEGREES PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 45-2406880 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

1025 Connecticut Avenue NW Suite 1000

Washington, D.C. 20036

202-327-5422

Geoffrey S. Dow

President and Chief Executive Officer

60 Degrees Pharmaceuticals, Inc.

1025 Connecticut Avenue NW Suite 1000

Washington, D.C. 20036

(202) 327-5422

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Ross D. Carmel, Esq.

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas, 31st Floor

New York, New York 10036

Telephone: (212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 14, 2025

PRELIMINARY PROSPECTUS

3,735,977 Shares of Common Stock

60 Degrees Pharmaceuticals, Inc.

This prospectus relates to the resale, from time to time, of up to an aggregate of 3,735,977 shares of common stock, par value $0.0001 per share (the “common stock”), of 60 Degrees Pharmaceuticals, Inc., by the selling stockholders named elsewhere in this prospectus (“Selling Stockholders”). The shares of common stock included in this prospectus consist of: (i) 2,043,098 shares of our common stock issuable upon exercise of common warrants (the “January 2025 Common Warrants”) at an exercise price of $0.771 per share acquired by certain of the Selling Stockholders in the private placement that closed on January 30, 2025 (the “January 2025 Offering”); (ii) 1,503,500 shares of our common stock issuable upon exercise of common warrants (the “February 2025 Common Warrants” and, together with the January 2025 Common Warrants, the “Common Warrants”) at an exercise price of $0.59 per share acquired by certain of the Selling Stockholders in the private placement that closed on February 6, 2025 (the “February 2025 Offering”); (iii) 76,616 shares of our common stock issuable upon exercise of warrants (the “January 2025 Placement Agent Warrants”) at an exercise price of $1.2763 per share acquired by the placement agent in the January 2025 Offering; and (iv) 112,763 shares of our common stock issuable upon exercise of warrants (the “February 2025 Placement Agent Warrants” and, together with the January 2025 Placement Agent Warrants, the “Placement Agent Warrants”) at an exercise price of $0.8938 per share acquired by the placement agent in the February 2025 Offering.

Each Common Warrant was immediately exercisable upon the issuance date and will expire twenty-four months from the date of from issuance, and each Placement Agent Warrant was immediately exercisable upon the issuance date and will expire twenty-four months from the date of issuance.

This prospectus also covers any additional shares of common stock that may become issuable upon any adjustment pursuant to the terms of the Common Warrants and the Placement Agent Warrants issued to the Selling Stockholders by reason of stock splits, stock dividends and other events described therein.

The Selling Stockholders, or their respective transferees, pledgees, donees or other successors-in-interest, may sell the shares of common stock at prevailing market or privately negotiated prices, including in one or more transactions that may take place by ordinary broker’s transactions, privately negotiated transactions or through sales to one or more dealers for resale. The Selling Stockholders may sell any, all or none of the securities offered by this prospectus, and we do not know when or in what amount the Selling Stockholders may sell the shares underlying the Common Warrants and Placement Agent Warrants, as applicable, hereunder following the effective date of this registration statement of which this prospectus forms a part. We provide more information about how a Selling Stockholder may sell its shares in the section titled “Plan of Distribution” on page 131 of this prospectus.

We cannot predict when and in what amounts or if any of the Common Warrants or the Placement Agent Warrants will be exercised. We have agreed to bear all of the expenses incurred in connection with the registration of the shares underlying the Common Warrants and the Placement Agent Warrants. The Selling Stockholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of the shares underlying the Common Warrants and the Placement Agent Warrants.

See the section entitled, “Selling Stockholders” for additional information regarding the Selling Stockholders.

We are registering the shares underlying the Common Warrants and the Placement Agent Warrants on behalf of the Selling Stockholders, to be offered and sold by them from time to time. We will not receive any proceeds from the sale of the shares of common stock by the Selling Stockholders in the offering described in this prospectus. However, we will receive aggregate proceeds of up to approximately (i) $1,575,229 from the cash exercise of the January 2025 Common Warrants; (ii) $887,065 from the cash exercise of the February 2025 Common Warrants; (iii) $97,785 from the cash exercise of the January 2025 Placement Agent Warrants; and (iv) $100,788 from the cash exercise of the February 2025 Placement Agent Warrants. See “Use of Proceeds.”

We are an “emerging growth company” and a “smaller reporting company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and have elected to comply with certain reduced public company reporting requirements. See “Summary—Implications of Being an Emerging Growth Company and Smaller Reporting Company.”

Our common stock is listed on The Nasdaq Capital Market under the symbol “SXTP.” The closing price of our common stock on February 13, 2025 as reported by The Nasdaq Capital Market, was $0.626. There is no established trading market for the Common Warrants and the Placement Agent Warrants and we do not intend to list the Common Warrants and the Placement Agent Warrants on any securities exchange or nationally recognized trading system.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 26 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

Throughout this prospectus, unless otherwise designated or the context suggests otherwise,

| ● | all references to the “Company,” “60P,” the “registrant,” “we,” “our,” or “us” mean 60 Degrees Pharmaceuticals, Inc., a Delaware corporation, and majority owned subsidiary 60P Australia Pty Ltd, an Australian proprietary company limited by shares; |

| ● | “year” or “fiscal year” means the year ending December 31; and |

| ● | all dollar or $ references, when used in this prospectus, refer to United States dollars. |

Except as otherwise indicated, all information in this prospectus assumes that:

| ● | no shares of common stock have been issued pursuant to any warrants, including the Common Warrants and the Placement Agent Warrants. |

TRADEMARKS

Solely for convenience, our trademarks and tradenames referred to in this prospectus, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights to these trademarks and tradenames. All other trademarks, service marks and trade names included or incorporated by reference into this prospectus or the accompanying prospectus are the property of their respective owners.

GLOSSARY OF SELECTED TERMS

The following are definitions of certain terms that are commonly used in the medical industry and in this prospectus:

“8-aminoquinoline” refers to the structural class of antimalarials to which Tafenoquine and Primaquine belong. 8-aminoquinolines are characterized by the presence of an 8-amino substitution on their core quinoline ring, which confers their unique properties including an oxidative Mode of Action and activity against the relapsing liver forms of Plasmodium vivax.

“Agency of Record” refers to a marketing/advertising agency used by a Company to develop marketing collateral for a commercial pharmaceutical product.

“API” means active pharmaceutical ingredient, the active molecule contained in a pharmaceutical product.

ii

“Arakoda” means ARAKODA®, the 60P-owned and FDA-approved product to prevent malaria in travelers, which contains as its active pharmaceutical ingredient, Tafenoquine succinate.

“Broad Spectrum of Activity” refers to a molecule or drug that is active against a range of different pathogens.

“CAR-T” means chimeric antigen receptor therapy.

“CLIA” means The Clinical Laboratory Improvements Amendment of 1988.

“Dengue” means a mosquito-borne viral disease occurring in tropical and subtropical areas.

“Ethics Committee” a stand-alone or institutional committee responsible for ensuring clinical trials are conducted ethically, and from whom permission is required for a clinical trial to proceed.

“EUA” means Emergency Use Authorization.

“FDA” refers to the U.S. Food and Drug Administration.

“G6PD” means glucose-6-phosphate dehydrogenase.

“GMP” means Good Manufacturing Practices.

“IND” means investigational new drug application.

“Kodatef” is the brand name of Arakoda outside the United States. Kodatef has been approved for use in Australia by the Therapeutic Goods Administration.

“Legacy Studies” is a reference to the collection of clinical and non-clinical studies involving Tafenoquine, which were conducted by the U.S. Army prior to 2014, and which were included in the new drug application submitted by 60P to the FDA in 2018. Some of those Legacy Studies are described in the account of the Army development program published by Zottig et. al.

“Mode of Action” is the process by which an anti-infective or other pharmaceutical product is known or suspected to affect a disease process. This process is different for each drug and may or may not be known at the time of FDA approval.

“Named-patient” use of a drug refers to the prescription by a physician of a drug to one of their patients in a jurisdiction in which the prescribed drug has not received marketing authorization, but is believed by said physician to be safe and medically necessary. Also, sometimes referred to as “compassionate use.”

“NIH” means the National Institutes of Health.

“PDUFA” means The Prescription Drug User Fee Act.

“PMA” means Premarket Approval by the FDA.

“Primaquine” is the FDA-approved antimalarial from which Tafenoquine is chemically derived.

“P. vivax” is an abbreviation for Plasmodium vivax, one of the two most important malaria parasites, characterized by its ability to relapse utilizing a dormant life cycle stage that persists in the human liver following a bite from an infected mosquito.

“RSV” means respiratory syncytial virus, which is a common respiratory virus that usually causes cold-like symptoms.

“Repositioned Molecule” is one which was approved by the FDA or other regulatory authorities to treat one disease, and is being developed for a new disease.

“Spp” is shorthand use to refer to multiple species of organisms in a particular genus. Thus, Candida spp refers collectively to Candida auris, Candida albicans and other Candida species.

iii

“Tafenoquine” is the shortened name of the active ingredient of Arakoda and Kodatef, Tafenoquine succinate.

“TGA” is the Therapeutic Goods Administration, the Australian equivalent of the FDA.

“TMPRSS2” means transmembrane protease, serine 2, which is an enzyme that in humans is encoded by the TMPRSS2 gene, and belongs to the TMPRSS family of proteins, whose members are transmembrane proteins which have a serine protease activity.

“Zika” means a mosquito-borne viral disease occurring in tropical and subtropical areas.

In connection with presentation of scientific data, this prospectus references “P-values” at various points. These values are provided to convey the likelihood of a particular set of data occurring by chance. For example, a P-value of 0.12 associated with a stand-alone, pre-conceived hypothesis is generally understood to mean that the likelihood of that particular outcome occurring purely by chance is 12%. It is scientific convention that a particular observation is “proven” if its associated P value is lower than 0.05 (i.e., associated with a likelihood of occurring by chance of < 5%). However, clinical observations of interest are routinely reported in the peer-reviewed scientific literature even if their associated P-values are > 0.05, because they may represent important therapeutic signals, and motivate additional research.

USE of PRODUCT VERSUS GENERIC NAMES

This prospectus makes reference to two commercial products owned/manufactured by 60P, Arakoda and Kodatef, which are approved by regulators in the United States and Australia, respectively, for the prevention of malaria. The active molecule in those products is Tafenoquine succinate (Tafenoquine for short), which we are repositioning for other indications using either (i) the same dosing regimen employed in the commercial Arakoda product (in which case reference is made to the “Arakoda regimen of Tafenoquine” or (ii) different dosing regimens (in which case reference is made to “Tafenoquine”). We also utilize the molecular name (Tafenoquine), where the active ingredient of Arakoda and Kodatef was tested in cell culture or animal models. These different usages have been employed both for convenience and to avoid any assertions that Arakoda or Kodatef have been granted marketing authorization by regulators for uses other than the prevention of malaria.

MARKET DATA

Market data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. To our knowledge, certain third-party industry data that includes projections for future periods does not take into account the effects of the worldwide coronavirus (COVID-19) pandemic. Accordingly, those third-party projections may be overstated and should not be given undue weight. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements regarding our market position are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

iv

PROSPECTUS SUMMARY

Our Business

We are a specialty pharmaceutical company with a goal of using cutting-edge biological science and applied research to further develop and commercialize new therapies for the prevention and treatment of infectious diseases. We have successfully achieved regulatory approval of Arakoda, a malaria preventative treatment that has been on the market since late 2019. Currently, 60P’s pipeline under development covers development programs for vector-borne, fungal, and viral diseases utilizing three of the Company’s future products: (i) new products that contain the Arakoda regimen of Tafenoquine; (ii) new products that contain Tafenoquine; and (iii) Celgosivir.

Mission

Our mission is to address the unmet medical need associated with infectious diseases through the development and commercialization of new small molecule therapeutics, focusing on synthetic drugs (made by chemists in labs, excluding biologics) with good safety profiles based on prior clinical studies, in order to reduce cost, risk, and capitalize on existing research. We are seeking to expand Arakoda’s use beyond malaria prevention and to demonstrate clinical benefit for other disease indications. We are further testing the viability of another product (Celgosivir) to determine whether to advance it into further clinical development, and may seek to develop and license other molecules in the future. Celgosivir is being considered for development as an antiviral product for a number of diseases.

Market Opportunity

Malaria Prevention

In 2018, the FDA approved Arakoda for malaria prevention in individuals 18 years and older. Arakoda entered the U.S. supply chain in the third quarter of 2019, just prior to the COVID-19 pandemic. As the approved indication is for travel medicine, and international travel was substantially impacted by the pandemic, we did not undertake any active marketing efforts for Arakoda. Following our recent financing the Company hired a Chief Commercial Officer and commissioned IQVIA market data and a qualitative marketing demand study. That research, recently completed, suggests that prescribing for malaria prevention therapies has returned to pre-pandemic levels, and that the total U.S. market represents around 1.1 million prescriptions (one prescription per three weeks of travel). Based on consumer and HCP demand research, the Company estimates that the accessible market for Arakoda represents about one third of this volume (about 330,000 prescriptions). Barriers to entry include low brand awareness in the prescriber community and the low cost of some of the generic alternatives. In the second half of 2024 we will conduct a pilot commercialization study to confirm these barriers can be overcome (see “Strategy”).

1

Treatment and Prevention of Tick-Borne Disease (Babesiosis)

We are repositioning the Arakoda regimen of Tafenoquine for several potential new therapeutic indications that have substantial U.S. caseloads, as further described below:

| ● | Treatment of Chronic Tick-Borne Disease (Babesiosis). Babesia parasites are co-transmitted by the same ticks that transmit Borrelia, the Lyme disease bacterium. Although Lyme in the acute phase is generally viewed by the medical community as being treatable with antibiotics, individuals who are not treated, or fail treatment, may go on to develop long term, and potentially debilitating, chronic symptoms such as fatigue, body aches, and cognitive problems.1 This condition is defined by the Centers for Disease Control and Prevention (“CDC”) as Post-Treatment Lyme Disease Syndrome (“PTLDS”) or simply as Lyme in the patient community.2 Although there are no published estimates, key opinion leaders have stated that as many as 50% of Lyme/PTLDS patients are believed to be co-infected with Babesia parasites, a diagnosis referred to in the Lyme community as “Chronic Babesiosis.” Prescribers in the Lyme disease community utilize a number of therapeutic modalities to manage the symptoms of Chronic Babesiosis, including FDA-approved pharmaceuticals such as atovaquone and azithromycin (these are assumed to suppress the growth of Babesia parasites).3 |

Recent market data shows that Tafenoquine appears to be increasingly prescribed by Lyme physicians to manage Chronic Babesiosis. This trend may follow the recent publication of several case reports demonstrating activity in immunosuppressed patients with acute babesiosis, and animal data showing eradication of Babesia parasites, Tafenoquine (primarily as Arakoda).4 The Company believes the recent increases in sales of Arakoda have been driven by organic growth of these activities. There are no formal epidemiological publications articulating the incidence or prevalence of Chronic Babesiosis, so these metrics must be inferred based on data for PTLDS and the rate of coinfection with Babesia parasites. Thus, the cumulative case load of Chronic Babesiosis may be as high as1.01 million patients in the United States.5 We believe, based on our market research that at least 37% of this market, or 375,000 cases, may be addressable with Tafenoquine during the remainder of its market exclusivity window for malaria. We are undertaking additional research to determine how much additional market capture might be feasible.

Acute infection with many different organisms (e.g. Borrelia, SARS-Cov-2, Epstein Barr virus) trigger “Long Syndromes” in a minority of cases, characterized by cognitive dysfunction, fatigue and post-exertional malaise.6 For many years, such conditions have been confusing to the mainstream medical community because there may not be formal diagnostic criteria or an established theory of disease. This is changing with the advent of Long COVID, and a recent prominent paper outlined the pathophysiological mechanisms for the first time.7 Although there is not yet supporting evidence in the medical literature, some key opinion leaders in the Lyme community have postulated, using the veterinary literature as an analog, that life-long infection by sequestering forms of Babesia (e.g., B. odocoilei) may be a significant driver of chronic fatigue symptoms.8 If this is true, the addressable market for antibabesial drugs may be substantially larger than stated above, since the prevalence of chronic fatigue syndrome in the U.S. is at least 3.3 million cases (excluding Long COVID and PTLDS).9

| 1 | See https://www.cdc.gov/lyme/signs-symptoms/chronic-symptoms-and-lyme-disease.html. | |

| 2 | See https://www.cdc.gov/lyme/signs-symptoms/chronic-symptoms-and-lyme-disease.html. | |

| 3 | Conclusions from Company-commissioned market research. | |

| 4 | Conclusions from Company-commissioned market research. | |

| 5 | Maximum prevalence determined by multiplying the rate of Babesia coinfection in PTLDS patients (52%, from Parveen & Bhanot, Pathogens 2019;8(3):117) by the highest estimate of the cumulative prevalence of PTLDS (1,994,189, from Delong et al. BMC Public Health 2019;19(1):352). Maximum new cases determined by multiplying the number of new Lyme cases per year (476,000, from Krugeler et al (Emerg Infect Dis 2021;27:616-61) by the number of new cases that subsequently become chronic cases (up to 10%, from Delong et al. BMC Public Health 2019;19(1):352) by the proportion of such patients coinfected with Babesia (52%, from Parveen & Bhanot, Pathogens 2019;8(3):117). | |

| 6 | See https://www.cdc.gov/lyme/signs-symptoms/chronic-symptoms-and-lyme-disease.html. | |

| 7 | Walitt et al Nature Communications 2024;15:907. | |

| 8 | Lindner HH. 2022. Chronic babesiosis caused by B. odocoilei: Diagnosis, pathophysiology & treatment. Presentation at the 2022 ILADS scientific meeting, Orlando Florida. | |

| 9 | See https://www.cdc.gov/nchs/data/databriefs/db488.pdf. |

2

Separately from the clinical indication, based on estimates from industry experts, there may be somewhere between several hundred and several thousand cases of canine babesiosis each year in the United States, and thousands more globally. Currently, standard of care treatment for babesiosis in dogs is a ten-day course of atovaquone and azithromycin, which costs about $1,350 out of pocket. A treatment course of Tafenoquine mirroring the human prophylactic dose in dogs might cost < $300, offering a compelling alternative to standard of care. The additional resources required to generate enabling data for veterinary uses are much less expensive than human clinical trials and we are already funding a pilot study at North Carolina State University related to this indication.

| ● | Treatment of Acute Babesiosis. There are up to 38,000 cases of potentially treatable acute symptomatic babesiosis (red blood cell infections caused by deer tick bites) in the United States each year.10 Approximately 650 of these cases are hospitalizations, a smaller fraction of which represents immunosuppressed individuals.11 Symptomatic babesiosis is usually treated with a minimum ten day course of atovaquone and azithromycin which is extended to six weeks in the immunosuppressed, who may also experience relapses requiring multiple hospitalizations.12 This is much longer than equivalent serious parasitic diseases such as malaria where the goal is a three-day regimen. In a recently published case series Tafenoquine in combination with standard of care cured 80% of immunosuppressed patients with relapsing babesiosis and the investigators stated in a press release that “Tafenoquine is going to make a huge difference, I think, in people who are severely immunocompromised.” 13 |

| ● | Prevention of Tick-Borne Diseases. Post-exposure prophylaxis or early treatment with, respectively, a single dose or several week regimen of doxycycline following a tick-bite is a recognized indication to prevent the complications of Lyme disease. There may be more than 400,000 such tick bites in the United States requiring medical treatment each year. This estimate is based on the observation that approximately 50,000 tick bites are treated in U.S. hospital emergency rooms each year; however, this calculation represents only about 12% of actual treated tick bites based on observations from comparable ex-U.S health systems.14 Unlike Lyme disease, there is no characteristic rash associated with early infection and no reliable diagnostic tests. Thus, an individual bitten by a tick cannot know whether they have also been infected with babesiosis. It is likely that a drug proven to be effective for this indication for babesiosis would also be used in conjunction with Lyme prophylaxis. |

Treatment and Prevention of Fungal Infections

We are evaluating Tafenoquine for potential utility in the following fungal diseases:

| ● | Treatment of Candida infections. According to the CDC, there are 50,000 reported cases of candidiasis (a type of fungal infection) each year in the United States and up to 1,900 clinical cases of C. auris, for which there are few available treatments.15 Since it has broad-spectrum activity against drug-resistant Candida spp in culture, Tafenoquine, has the potential to be a market leading therapy for treatment/prevention of C. auris, and to be added to the standard of care regimens for other Candida infections.16 |

| 10 | This estimate is based on the observations of Krugeler et al (Emerg Infect Dis 2021;27:616-61) who reported that 476,000 cases of Lyme disease occur in U.S. states where babesiosis is endemic and Krause et. al. (JAMA 1996;275:1657-16602) who reported that 10% of Lyme disease patients are co-infected with babesiosis and that according to Krause et al (AJTMH 2003;6:431-436) fact that about 80% of cases are symptomatic (thus 476,000*10%*80% = 38,000 cases of babesiosis per year). |

| 11 | Bloch et al Open Forum Infect Dis 2022;9(11):ofac597. |

| 12 | According to IDSA guidelines. |

| 13 | See Krause et al Clin Infect Dis 2024; doi:10.1093/cid/ciae238 and https://ysph.yale.edu/news-article/antimalarial-drug-is-effective-against-tick-borne-infection-babesiosis/. |

| 14 | Marx et. al., MMWR 2021;70:612-616. |

| 15 | https://www.cdc.gov/fungal/diseases/candidiasis/invasive/statistics.html.; https://www.cdc.gov/fungal/candida-auris/tracking-c-auris.html. |

| 16 | Dow and Smith New Microb New Infect 2022;45:100964. |

3

| ● | Prevention of fungal pneumonias. There are up to ~ 91-92,000 new patient cases each year in the United States for which antifungal prophylaxis is recommended, including acute lymphoblastic leukemia (up to 6,540 cases) and large B-cell lymphoma (up to 18,000 cases) patients receiving CAR-T therapy, solid organ transplant patients (up to 42,887 cases), allogeneic (~ 9,000 cases) and autologous (~ 15,000 cases) hematopoietic stem cell transplant patients.17 Despite the availability and use of antifungal prophylaxis, the risk of some patient groups contracting fungal pneumonia exceeds the risk of contracting malaria during travel to West Africa.18 Since it has broad spectrum antifungal effects in cell culture, and activity against Pneumocystis in animal models, Tafenoquine has the potential to be added to existing standard of care regimens for the prevention of fungal pneumonias.19 |

Viral Diseases

Celgosivir, a potential clinical candidate of 60P’s, has activity in a number of animal models of important viral diseases such as Dengue and RSV. According to the European CDC, Dengue is associated with at least 4.1 million cases globally. 20 And, according to the U.S. CDC, RSV is responsible for up to 240,000 hospitalizations in children less than five years of age and adults greater than 65 years of age in the United States each year.21 As outlined in the “Strategy” section below, we expect to evaluate Celgosivir in additional non-clinical disease models before making a decision regarding clinical development.

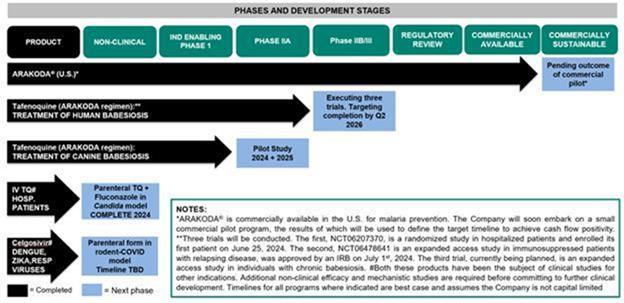

More information about our products is provided in the next section, and the status of various development efforts for the above-mentioned diseases is outlined in Figure A, below.

Figure A

Products

Arakoda (Tafenoquine) for malaria prevention

We entered into a cooperative research and development agreement with the United States Army in 2014 to complete development of Arakoda for prevention of malaria.22 With the U.S. Army, and other private sector entities as partners, we coordinated the execution of two clinical trials, development of a full manufacturing package, gap-filling non-clinical studies, compilation of a full regulatory dossier, successful defense of our program at an FDA advisory committee meeting and submitted a new drug application (“NDA”) to the FDA in 2018. The history of that collaboration has been publicly communicated by the U.S. Army.23

| 17 | See statistics for solid organ transplants at the Organ Transplant and Procurement Network at: National data - OPTN (hrsa.gov); See statistics for hematopoietic stem cell transplant in Dsouza et al Biology of Blood and Bone Marrow Transplantation 202;26: e177-e182; See statistics for acute lymphoblastic leukemia at: Key Statistics for Acute Lymphocytic Leukemia (ALL) (cancer.org); See statistics for large cell large B-cell lymphoma at; Diffuse Large B-Cell Lymphoma - Lymphoma Research Foundation; Treatment guidelines recommending antifungal prophylaxis for these diseases can be reviewed in (i) Fishman et al Clinical Transplantation. 2019;33:e13587, (ii) Hematopoietic Cell Transplantation (cancernetwork.com), (iii) Cooper et al Journal of the National Comprehensive Cancer Network 2016;14:882-913 and (iv) Los Arcos et al Infection (2021) 49:215–231. |

| 18 | Aguilar-Guisado et al Clin Transplant 2011;25:E629–38; Mace et al MMWR 202;70:1–35. |

| 19 | Queener et al JID 1997;165:764-768; Dow and Smith New Microb New Infect 2022;45:100964 |

| 20 | https://www.ecdc.europa.eu/en/dengue-monthly#:~:text=This%20is%20an%20increase%20of%2032%20653%20cases% 20and%2032,853%20deaths%20have%20been%20reported. |

| 21 | https://www.cdc.gov/rsv/php/surveillance/index.html#cdc_survey_profile_surveys_used-rsv-burden-estimates. |

| 22 | In 2014, we signed a cooperative research and development agreement with the United States Army Medical and Materiel Development Activity (Agreement W81XWH-14-0313). Under this agreement, we agreed to submit an NDA for Tafenoquine to the FDA (as Arakoda), while the US Army agreed to finance the bulk of the necessary development activities in support of that goal. |

| 23 | Zottig et al Military Medicine 2020; 185 (S1): 687. |

4

The FDA and Australia’s medicinal regulatory agency, the Therapeutic Goods Administration, subsequently approved Arakoda (brand name in the U.S.) and Kodatef (brand name in Australia), respectively, for prevention of malaria in travelers in 2018. Prescribing information and guidance for patients can be found at www.arakoda.com. The features and benefits of Tafenoquine for malaria prophylaxis, some of which have been noted by third-party experts, include: convenient once weekly dosing following a three day load; the absence of reports of drug resistance during malaria prophylaxis; activity against liver and blood stages of malaria as well as both the major malaria species (Plasmodium vivax and Plasmodium falciparum); absence of any black-box safety warnings; good tolerability, including in women and individuals with prior psychiatric medical history; and a comparable adverse event rate to placebo with up to 12 months continuous dosing.24 Tafenoquine entered the commercial supply chains in the U.S. and Australia in the third quarter of 2019.

The only limitation of Arakoda is the requirement for a G6PD test prior to administration.25 The G6PD test must be administered to a prospective patient prior to administration of Arakoda in order to prevent the potential occurrence of hemolytic anemia in individuals with G6PD deficiency.26 G6PD is one of the most common enzyme deficiencies and is implicated in hemolysis following administration/ingestion of a variety of oxidant drugs/food. G6PD must also be ruled out as a possible cause when diagnosing neonatal jaundice. As a consequence, G6PD testing is widely available in the United States through commercial pathology service providers (e.g., Labcorp, Quest Diagnostics, etc.). Although these tests have a turn-around time of up to 72 hours, the test needs only to be administered once. Thus, existing U.S. testing infrastructure is sufficient to support the FDA-approved use of the product (malaria prevention) by members of the armed forces (who automatically have a G6PD test when they enlist), civilian travelers with a long planning horizon, or repeat travelers.

Tafenoquine for Other (Infectious) Diseases

During the pandemic, we also worked with NIH to evaluate the utility of Tafenoquine as an antifungal. We, and the NIH, found that Tafenoquine exhibits a Broad Spectrum of Activity in cell culture against Candida and other yeast strains via a different Mode of Action than traditional antifungals and also exhibits antifungal activity against some fungal strains at clinically relevant doses in animal models.27 Our work followed Legacy Studies that show Tafenoquine is effective for treatment and prevention of Pneumocystis pneumonia in animal models.28 We believe that if added to the standard of care for anti-fungal and yeast infection treatments for general use, Tafenoquine has the potential to improve patient outcomes in terms of recovery from yeast infections, and prevention of fungal pneumonias in immunosuppressed patients. There are limited treatment options available for these indications, and Tafenoquine’s novel mechanism of action might also mitigate problems of resistance. Clinical trial(s) to prove safety and efficacy, and approval by the FDA and other regulators, would be required before Tafenoquine could be marketed for these indications.

Tafenoquine monotherapy, or use in combination with other antibabesial medications, clears and eradicates Babesia infections, respectively, in both immunocompetent and immunocompromised animal models of babesiosis (tick borne red blood cell infections).29 In up to 80% of cases Tafenoquine administered in combination with antibabesial drugs after prior failure of conventional antibiotics in immunosuppressed babesiosis patients resulted in cures.30 Tafenoquine is also increasingly being utilized by Lyme disease prescribers to manage symptoms of Chronic Babesiosis. Consequently, we believe that (i) if combined with standard of care products, Tafenoquine has the potential to accelerate parasite clearance and reduce the duration of illness and treatment with antibiotic therapy in immunosuppressed patients hospitalized with severe illness, (ii) once appropriate clinical studies have been conducted, it is likely that Tafenoquine would be quickly embraced for post-exposure prophylaxis of babesiosis in patients with tick bites, and (iii) Tafenoquine could become the leading treatment for Chronic Babesiosis. Clinical trial(s) to prove safety and efficacy, and approval by FDA and other regulators, would be required before Tafenoquine could be marketed for these indications.

| 24 | Tan and Hwang Journal of Travel Medicine, 2018, 1–2; Baird Journal of Travel Medicine 2018:, 1–13; Schlagenhauf et al Travel Medicine and Infectious Disease 2022; 46:102268; See Arakoda prescribing information at www.arakoda.com; McCarthy et al CID 2019:69:480-486; Dow et al. Malar J (2015) 14:473; Dow et al. Malaria Journal 2014, 13:49; Novitt-Moreno et al Travel Med Infect Dis 2022 Jan-Feb;45:102211. |

| 25 | See prescribing information at www.arakoda.com. |

| 26 | See prescribing information at www.arakoda.com. |

| 27 | Dow and Smith, New Microbe and New Infect 2022; 45: 100964. |

| 28 | Queener et al Journal of Infectious Diseases 1992;165:764-8). |

| 29 | Liu et al. Antimicrobial Agents Chemo 2021;65:e00204-21, Marcos et al. IDCases 2022;27:e01460; Rogers et al. Clin Infect Dis. 2022 Jun 10:ciac473, Prasad and Wormsner. Pathogens 2022;11:1015. |

| 30 | Krause et al Clin Infect Dis 2024; doi:10.1093/cid/ciae238. |

5

Celgosivir

Celgosivir is a host targeted glucosidase inhibitor that was developed separately by other sponsors for HIV then for hepatitis C.31 The sponsors abandoned Celgosivir after completion of Phase II clinical trials involving 700+ patients, because other antivirals in development at the time had superior activity. The National University of Singapore initiated development of Celgosivir independently for Dengue fever. A clinical study, conducted in Singapore, the results of which were accepted for publication in the peer-reviewed journal Lancet Infectious Diseases, confirmed its safety but the observed reduction in viral load was lower than what the study was powered to detect.32 Celgosivir (as with other Dengue antivirals) exhibits greater capacity to cure Dengue infections in animal models when administered prior to symptom onset when compared to administration post-symptom onset. In animal models, this problem can be addressed by administering the same dose of drug split into four doses per day rather than two doses per day (as was the case in the Singaporean clinical trial).33 This observation led to the filing and approval of a patent related to Dengue, which we licensed from the National University of Singapore.

Additional clinical studies would be required to prove that such a 4x daily dosing regimen would be safe and effective in Dengue patients to regulators’ satisfaction. To that end, earlier in our history, we, in partnership with the National University of Singapore, and Singapore General Hospital, successfully secured a grant from the government of Singapore for a follow-on clinical trial. Unfortunately, we were unable at that time to raise matching private sector funding. We concluded as a result that development of Repositioned Molecules for Dengue, solely and without simultaneous development for other therapeutic use, despite substantial morbidity and mortality in tropical countries, was an effort best suited for philanthropic entities. Accordingly, during the pandemic, we undertook an effort (in partnership with NIH’s Division of Microbiology and Infectious Diseases program and Florida State University) to determine whether Celgosivir might be more broadly useful for respiratory diseases that have impact in both tropical and temperate countries. Preliminary data suggest that Celgosivir inhibits the replication of the virus that causes COVID-19 (SARS-CoV-2) in cell culture, and the RSV virus in cell culture and provides benefits in animals. We have filed and/or licensed patents in relation to Celgosivir for these other viruses as we believe there is potential applications to fight respiratory diseases that might have more commercial viability than historical development of Celgosivir to combat Dengue fever.

Competitive Strengths

Our main competitive strength has been our ability to achieve important clinical milestones inexpensively in therapeutic areas that other entities have found extremely challenging. With a small virtual management team, we have successfully built productive research partnerships with public and academic entities, and licensed products with well characterized safety profiles in prior clinical studies, thereby reducing the cost and risk of clinical development. This business and product model enabled Arakoda to be approved in 2018, with a total operating expense of < $10 million. We plan to focus in the future on generating proof of concept clinical data sets for the approved Arakoda regimen of Tafenoquine in other therapeutic areas, all of which is expected to foster and continue our existing tradition of inexpensive product development.

Strategy

Following our initial public offering in July 2023, our initial strategic priority was to conduct a Phase IIB that would have evaluated the potential of the Arakoda regimen of Tafenoquine to accelerate disease recovery in COVID-19 patients with low risk of disease progression. In October 2023, we made a decision to suspend this study. This was a consequence of advice previously received from the FDA, which we interpreted to mean that the Agency would not have granted clearance for the study to proceed unless we redesigned it to (i) enroll a patient population in which receipt of Paxlovid or Lagevrio would be medically contraindicated, or (ii) compare Tafenoquine to placebo in patients taking a “standard of care” regimen (defined by the FDA as Lagevrio or Paxlovid). The FDA’s position was somewhat surprising given that neither Paxlovid nor Lagevrio is indicated for treatment of COVID-19 in low-risk patients. We determined that conducting our study in an alternate population in the United States would be unfeasible, and that conducting an add-on-to standard of care study might not be Phase III enabling. Accordingly, the Company made a decision to pivot back to continue commercialization of Arakoda for malaria, and further evaluation of the Arakoda regimen of Tafenoquine for babesiosis and other diseases. We believe such an approach is both less risky and less expensive.

Moving forward, our general strategy to achieve profitability and grow shareholder value has three facets: (i) increase sales of Arakoda; (ii) conduct clinical trials to expand the number of patients who can use Tafenoquine for new indications in the future; and (iii) reposition small molecule therapeutics with good clinical safety profiles for new indications.

| 31 | Sorbera et al, Drugs of the Future 2005; 30:545-552. |

| 32 | Low et. al., Lancet ID 2014; 14:706-715. |

| 33 | Watanabe et al, Antiviral Research 2016; 10:e19. |

6

Expansion of U.S. Arakoda Sales

Hiring of Chief Commercial Officer. In February 2024, we hired Kristen Landon to lead our commercial efforts to reintroduce Arakoda for malaria prevention and conduct new product planning initiatives in tick-borne disease for babesiosis. We spent the first quarter analyzing the current landscape in the malaria prevention market, conducting primary market research among providers and consumers, and assessing agency partners for a virtual/digital marketing pilot program. Additionally, we kicked off a market assessment on the babesiosis space including desk top research and qualitative interviews with Key Opinion Leaders in the Infectious Disease and Lyme Community.

P&L Contract Review. We will conduct a review of all of our supply chain and formulary contracts to determine whether it is possible to increase our margin on Arakoda without increasing prices, or to compensate for any price adjustments which may be necessary to support repositioning efforts (see below).

Repositioning of Arakoda Relative to Malarone and Generic Equivalent Atovaquone-Proguanil. A malaria demand study was conducted to assess the attractiveness and acceptability of the Arakoda product profile and current pricing among health care providers and consumers. The product profile was well received among both stakeholders; however, price sensitivity on out-of-pocket costs was noted among both groups. Generic atovaquone-proguanil, our primary competitor is substantially cheaper than Arakoda for the average trip length (three weeks) and has superior formulary positioning (Tier 1 vs. Tier 3). However, generic-atovaquone proguanil does not provide the same level of confidence a traveler may experience from taking a product with a convenient weekly dosing regimen during travel, that works everywhere in the world against all malaria species and drug resistant strains, and which requires only a single dose for post-exposure prophylaxis upon return from a malarious area. The value those advantages confer needs to be communicated with key stakeholders.

Market Segment Definition and Targeting. We purchased market data to understand the malaria market landscape over the past decade and identified the current prescribers of Malarone and the generic equivalent atovaquone-proguanil, the main generic competitor to Arakoda for malaria prophylaxis. Beginning in the third quarter of 2024, we plan to reach out to prescribers covering the top 80% of atovaquone-proguanil prescribers in order to educate them about the value proposition of Arakoda. We will also compile a list of the top institutions/organizations that have ex-U.S. deployed workforces and internal occupational health and safety programs, and target these organizations with messaging regarding the convenience and global effectiveness of Arakoda. We do not initially plan to target U.S. government agencies as these organizations, such as the Department of Defense, are expected to be extremely price sensitive until operational considerations justify the use of superior products – for example, the DOD used inexpensive doxycycline for malaria prevention in the low malaria risk setting of Afghanistan, but chose superior weekly mefloquine, despite safety concerns, for the Ebola mission to west Africa in 2014, where malaria rates were extremely high.

Digital Revamp and Collateral: We will work with an agency of record to develop a marketing strategy for the proposed pilot and develop marketing assets that we believe best highlight the features and benefits of Arakoda, namely the convenience of the travel and post-travel regimen, and global effectiveness. We are currently assessing a co-pay or point of sale offer for travelers to offset out-of-pocket costs. We launched our Arakoda product website, which went live in April 2024.

Revised Forecast. We have developed an internal forecast for the malaria and Babesiosis indications and have contracted a third-party vendor to validate our analyses.

7

Development of the Arakoda Regimen of Tafenoquine for Babesiosis

In animal models, Tafenoquine monotherapy has been shown to suppress acute babesiosis infections to the point where the immune system can control them following single or multiple doses similar to those effective against malaria parasites, and longer regimens alone or in combination with atovaquone leads to complete radical cure and to the conference of sterile immunity.34 In three case studies in individuals with immunosuppression and/or refractory parasites, Tafenoquine alone or in combination with various standard of care antimalarials and antibiotics successfully cleared parasites, leading to three consecutive negative PCR tests, and prevention of further relapses in two of three individuals.35 Our market research has revealed that recent sales growth for Arakoda is primarily attributable to organic growth in prescribing by Lyme community prescribers for Chronic Babesiosis. Collectively these data suggest Tafenoquine might have utility alone or in combination as treatment or post-exposure prophylaxis of babesiosis (both acute and chronic).

The Company is planning three clinical trials to aid further development and commercialization of a Babesiosis indication for Tafenoquine. Trial 1 is a randomized, placebo-controlled, evaluation of Tafenoquine (200 mg per day for a total of 800 mg) in patients hospitalized with babesiosis who are also taking standard of care treatment (10 days of atovaquone-azithromycin). The primary endpoint will be time to clinical recovery of 11 common babesiosis symptoms as reported by patients. The key secondary endpoint will be time to molecular cure as assessed by an FDA-approved Babesia nucleic acid test that is used for blood donation screening. The study will enroll a minimum of 24 and up to 33 patients before an interim analysis is conducted, which will include both a test of significance and a sample size re-estimation in case this is required. The study design was reviewed by the FDA. We have signed clinical trial agreements with Tufts Medical Group, Yale, Rhode Island Hospital, and Brigham & Women’s Hospital. The first patient was randomized on June 25, 2024, and six patients have now completed the study. The earliest possible date that date would be available from the interim analysis would be January 31, 2026, assuming a minimum of 24 patients are enrolled prior to September 30, 2025. Further details are available on the clinicaltrials.gov website.36

Trial 2 will be an expanded use study utilizing commercially available Arakoda. The Company, if approved by an Institutional Review Board (“IRB,” also known as an ethics committee), plans to offer up to one year of Arakoda at no cost to about 10 patients per year (i.e., immunocompromised patients who have previously failed standard of care treatment). Informed consent will be obtained from patients to collect a blood sample for PCR testing at the end of treatment, and patients will be asked to complete a babesiosis symptom questionnaire. The goal of the study is to generate additional prospective data to confirm the observation by Krause et al in a recent publication that an extended regimen of Tafenoquine cured 80% of immunocompromised patients with relapsing babesiosis. As of the date of this filing, we had enrolled one patient in this study. More details about the study can be found on the clinicaltrials.gov website.37

| 34 | Liu et al. Antimicrobial Agents Chemo 2021;65:e00204-21. Vydyam et al. J Infect Dis. 2024 Jan 3:jiad315. doi:10.1093/infdis/jiad315. |

| 35 | Marcos et al. IDCases 2022;27:e01460; Rogers et al. Clin Infect Dis. 2022 Jun 10:ciac473, Prasad and Wormsner. Pathogens 2022;11:1015. |

| 36 | See: https://classic.clinicaltrials.gov/ct2/show/NCT06207370. |

| 37 | See: https://clinicaltrials.gov/study/NCT06478641. |

8

Trial 3 will be a Phase II open label study utilizing commercially available Arakoda. The Company, plans to offer an approximately three-month supply of Arakoda at no cost to patients who have a clinical diagnosis, are willing to submit biological samples for testing, and answer babesiosis and standardized fatigue inventories before and after treatment. The goal of this study will be to ascertain whether Arakoda treatment improves patient-reported fatigue symptoms in individuals who symptoms of severe fatigue lasting more than six months and a diagnosis of chronic babesiosis. Secondary objectives include assessing confirmable Babesia infection rates in these populations using validated molecular assays, and assessing the safety and tolerability profile of Arakoda in this patient population. This trial will be gated by the outcome of an epidemiology study we have financed at North Carolina State University (see below).

In May 2024, we signed a research and collaboration agreement with North Carolina State University in which the College of Veterinary Medicine will screen 300 archived blood samples from patients exhibiting symptoms consistent with chronic fatigue symptoms by PCR for the presence of Babesia spp. This work is now complete, and a manuscript for publication is now in preparation.

In March 2024, we initiated, in collaboration with the North Carolina State University College of Veterinary Medicine, a pilot study of Tafenoquine for treatment of canine babesiosis in the United States under a sponsored research program. Should this potential collaboration be successful, we believe that the data from that study may provide supportive data for the clinical babesiosis development program, and could provide proof of concept for an expanded study to prove utility for veterinary indications.

We believe, if the Company does not become capital-limited, and no recruitment issues are encountered, that the results of the above studies will come to fruition in the first quarter of 2026, potentially facilitating submission of a supplementary new drug application (or other appropriate regulatory filing) to FDA, with the goal of obtaining marketing approval of Arakoda for treatment of Babesiosis. If successful, this will allow the Company to actively market Arakoda for Babesiosis.

Parenteral Tafenoquine for Fungal Infections

We plan to support a series of studies in animal models to determine whether single dose parenteral administration of Tafenoquine exhibits efficacy against Candida spp including C. auris. These studies are being conducted under a sponsored research agreement with Monash University in Melbourne, Australia.

Combination Partner for Tafenoquine for Malaria

Most new antimalarial treatment products are developed as drug combinations to proactively combat drug resistance. We believe that Tafenoquine, due to its long half-life and activity against all parasite species and strains, would be an ideal partner in a drug combination. Recently, Kentucky Technology Inc. (“KTI”), completed Phase IIA studies in P. vivax malaria, in which they evaluated the safety and efficacy of SJ733, their ATP4 inhibitor in combination with Tafenoquine as the combination partner drug. It was recently announced that the SJ733 development program would be partially supported by a grant from the Global Health Innovative Technology Fund (“GHIT”). As part of its shares for services agreement with KTI, the Company recently received a detailed feasibility assessment and business plan for the project, including an assessment of potential PRV eligibility. The Company has provided KTI with a right of reference to its Arakoda IND, in order to assist with regulatory approvals of forthcoming clinical trials.

Celgosivir for Antiviral Diseases

Reviewing prior studies of Celgosivir for Zika, Dengue and RSV, it is evident that the drug protects against the pathological effects of viruses through a combination of anti-inflammatory and antiviral effects. These properties suggest it might have a beneficial effect in several viral diseases. Celgosivir is synthesized from Castanospermine, which is obtained from botanical sources in low yield, making its inherent cost of goods potentially high. Castanospermine is also quite water soluble, making it amenable to intravenous formulation. We plan to conduct a proof-of-concept study in a hamster-COVID-19 model to evaluate whether parenterally administered Castanospermine can ameliorate the pathological effects of SARS CoV-2 via modulation of cytokine response to infection. Following this offering this project will be added to our statement of work for our services agreement with Florida State University Research Foundation (“FSURF”), and will commence when there are sufficient proceeds from the sale of FSURF’s 60P shares to support this research. The data generated from the study will allow us to assess whether to move forward with IND enabling studies of parenteral Castanospermine (or Celgosivir) for viral indications.

Post-Marketing Requirements

We have an FDA post-marketing requirement to conduct a malaria prophylaxis study of Arakoda in pediatric and adolescent subjects. We proposed to the FDA, in late 2021, that this might not be safe to execute given that malaria prevention is administered to asymptomatic individuals and that methemoglobinemia (damage to the hemoglobin in blood that carries oxygen) occurred in 5% of patients, and exceeded a level of 10% in 3% of individuals in a study conducted by another sponsor in pediatric subjects with symptomatic vivax malaria.38 The FDA has asked us to propose an alternate design, for which we submitted a concept protocol in the fourth quarter of 2022, and submitted a full protocol in July, 2024. We estimate the cost of conducting the study proposed by the FDA, if conducted in the manner suggested by the FDA, would be $2 million, and, due to the time periods required to secure protocol approvals from the FDA and Ethics Committees, could not be initiated any earlier than the first quarter of 2026.

Capitalization and Future Financing

We previously filed Registration Statement on form S-3 on July 12, 2024 enabling us to raise up to $15,000,000, of which approximately $2.0 million was already raised under the At the Market Issuance Sales Agreement with WallachBeth Capital LLC. We anticipate that those funds, and the funds from the current offering if consummated in full (exercise of all Pre-Funded and Series A and B Warrants in this offering) should be sufficient to execute the commercial and research and development activities described herein.

| 38 | Velez et al 2021 - Lancet Child Adolesc Health 2022; 6: 86–95. |

9

Intellectual Property

We are co-owners, with the U.S. Army, of patents in the United States and certain foreign jurisdictions directed toward use of Tafenoquine for malaria and have obtained an exclusive worldwide license from the U.S. Army to practice these inventions. We also have an exclusive worldwide license to use manufacturing information and non-clinical and clinical data that the U.S. Army possesses relating to use of Tafenoquine for all therapeutic applications and uses excluding radical cure of symptomatic vivax malaria. We have pending patent applications in the United States and certain foreign jurisdictions for use of Tafenoquine for COVID-19, fungal lung infections, tick-borne diseases, and other infectious and non-infectious diseases in which induction of host cytokines/inflammation is a component of the disease process. The United States Patent and Trademark Office (“USPTO”) allowed our first COVID-19 patent for Tafenoquine in 2023. We have optioned or licensed patents involving Celgosivir for the treatment and prevention of Dengue (from the National University of Singapore), COVID-19 & Zika (Florida State University), and have pending patent applications related to Celgosivir for RSV. We have optioned or own manufacturing methods related to Celgosivir. A detailed list of our intellectual property is as follows:

Patents

| Title | Patent No. | Country | Status | US Patent Date | Application No. | Estimated/ Anticipated Expiration Date | ||||||

| Dosing Regimen For Use Of Celgosivir As An Antiviral Therapeutic For Dengue Virus Infections | 2013203400 | Australia | 2013203400+ | 10-April-2033* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 2014228035 | Australia | 2014228035 | 14-Mar-2034* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | MY-170991-A | Malaysia | PI2015002372 | 14-Mar-2034* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 378015 | Mexico | MX/a/2015/013115 | 14-Mar-2034* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 11201507254V | Singapore | 11201507254V | 14-Mar-2034* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | Pending | Singapore | Pending | 10201908089V | 14-Mar-2034* | |||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 9763921 | US | 9/19/2017 | 14/772,873 | 14-Mar-2034^ | |||||||

| Novel Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 10517854 | US | 12/31/2019 | 15/706,845 | 14-Mar-2034^ | |||||||

| Dosing Regimens Of Celgosivir For The Treatment Of Dengue | 11219616 | US | 1/11/2022 | 16/725,387 | 14-Mar-2034^ | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | 2015358566 | Australia | 2015358566 | 02-Dec-2035* | ||||||||

| Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | 2968694 | Canada | 2968694 | 02-Dec-2035* | ||||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | 10342791 | US | 7/9/2019 | 15/532,280 | 02-Dec-2035^ | |||||||

| Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naive Subjects | 10888558 | US | 1/12/2021 | 16/504,533 | 02-Dec-2035^ | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | 10201904908Q | Singapore | 10201904908Q | 02-Dec-2035* | ||||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | Pending | EP | Pending | 15865264.4 | 02-Dec-2035* | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | Pending | Hong Kong | Pending | 18103081.4 | 02-Dec-2035* | |||||||

| Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naive Subjects | 11744828 | US | 9/5/2023 | 17/145,530 | 02-Dec-2035^ | |||||||

| Novel Regimens Of Tafenoquine For Prevention Of Malaria In Malaria-Naïve Subjects | 731813 | New Zealand | 731813 | 02-Dec-2035* |

10

| Title | Patent No. | Country | Status | US Patent Date | Application No. | Estimated/ Anticipated Expiration Date | ||||||

| Regimens of Tafenoquine for Prevention of Malaria in Malaria-Naive Subjects | Pending | US | Pending | 18/240,049 | 02-Dec-2035^ | |||||||

| Novel Dosing Regimens Of Celgosivir For The Prevention Of Dengue | 2016368580 | Australia | 2016368580 | 09-Dec-2036* | ||||||||

| Novel Dosing Regimens Of Celgosivir For The Prevention Of Dengue | Pending | Singapore | Pending | 10201912141Y | 09-Dec-2036* | |||||||

| Dosing Regimens Of Celgosivir For The Prevention Of Dengue | 11000516 | US | 5/11/2011 | 16/060,945 | 09-Dec-2036^ | |||||||

| Methods For The Treatment And Prevention Of Lung Infections By Administration Of Tafenoquine | Pending | EP | Pending | 21764438.4 | 02-Mar-2041* | |||||||

| Methods For The Treatment And Prevention Of Lung Infections By Administration Of Tafenoquine | Pending | China | Pending | 202180029643.7 | 02-Mar-2041* | |||||||

| Methods For The Treatment And Prevention Of Lung Infections By Administration Of Tafenoquine | 2021231743 | Australia | 2021231743 | 02-Mar-2041* | ||||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Gram-Positive Bacteria, Fungus, Or Virus By Administration Of Tafenoquine | Pending | Hong Kong | Pending | 62023078645.6 | 02-Mar-2041* | |||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Gram-Positive Bacteria, Fungus, Or Virus By Administration Of Tafenoquine | 11633391 | US | 4/25/2023 | 17/189,544 | 05-May-2041^ | |||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Gram-Positive Bacteria, Fungus, Or Virus By Administration Of Tafenoquine | Pending | US | Pending | 18/300,805 | 02-Mar-2041^ | |||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Fungus By Administration Of Tafenoquine | Pending | US | Pending | 17/683,679 | 02-Mar-2041^ | |||||||

| Methods For The Treatment And Prevention Of Lung Infections Caused By Sars-Cov-2 Virus By Administration Of Tafenoquine | Pending | US | Pending | 17/683,718 | 02-Mar-2041^ | |||||||

| Treatment Of Human Coronavirus Infections Using Alpha-Glucosidase Glycoprotein Processing Inhibitors | 11,369,592 | US | 6/28/2022 | 17/180,140# | 19-Feb-2041^ | |||||||

| Treatment Of Human Coronavirus Infections Using Alpha-Glucosidase Glycoprotein Processing Inhibitors | Pending | US | Pending | 17/664,693# | 19-Feb-2041^ | |||||||

| Treatment Of Human Coronavirus Infections Using Alpha-Glucosidase Glycoprotein Processing Inhibitors | Pending | EP | Pending | 2021757552# | 19-Feb-2041* |

11

| Title | Patent No. | Country | Status | US Patent Date | Application No. | Estimated/ Anticipated Expiration Date | ||||||

| Methods For The Treatment And Prevention Of Non-Viral Tick-Borne Diseases And Symptoms Thereof | Pending | US | Pending | 18/640,657 | 19-Apr-2044^ | |||||||

| Methods For The Treatment And Prevention Of Non-Viral Tick-Borne Diseases And Symptoms Thereof | Pending | US | Pending | 18/640,695 | 19-Apr-2044^ | |||||||

| Methods For The Treatment And Prevention Of Non-Viral Tick-Borne Diseases And Symptoms Thereof | Pending | US | Pending | 18/640,611 | 19-Apr-2044^ | |||||||

| Methods For The Treatment And Prevention Of Non-Viral Tick-Borne Diseases And Symptoms Thereof | Pending | PCT | Pending | PCT/US24/025436 | 19-Apr-2044* | |||||||

| Methods For The Treatment And Prevention Of Non-Viral Tick-Borne Diseases And Symptoms Thereof | Pending | PCT | Pending | PCT/US24/025458 | 19-Apr-2044* | |||||||

| Methods For The Treatment And Prevention Of Non-Viral Tick-Borne Diseases And Symptoms Thereof | Pending | PCT | Pending | PCT/US24/025472 | 19-Apr-2044* | |||||||

| Methods To Treat Respiratory Infection Utilizing Castanospermine Analogs | Pending | US | Pending | 18/218,202 | 05-Jul-2043^ | |||||||

| Methods To Treat Respiratory Infection Utilizing Castanospermine Analogs | Pending | CN | Pending | Nat. Phase of PCT/US23/26884 | 05-Jul-2043* | |||||||

| Methods To Treat Respiratory Infection Utilizing Castanospermine Analogs | Pending | AU | Pending | 2023304186 | 05-Jul-2043* | |||||||

| Methods To Treat Respiratory Infection Utilizing Castanospermine Analogs | Pending | CA | Pending | 3261048 | 05-Jul-2043* | |||||||

| Methods To Treat Respiratory Infection Utilizing Castanospermine Analogs | Pending | EP | Pending | 23836044.0 | 05-Jul-2043* | |||||||

| Methods For The Treatment And Prevention Of Diseases Or Infections With MCP-1 Involvement By Administration Of Tafenoquine | Pending | US | Pending | 18/375,070 | 29-Sep-2043^ | |||||||

| Methods For The Treatment And Prevention Of Diseases Or Infections With MCP-1 Involvement By Administration Of Tafenoquine | Pending | PCT | Pending | PCT/US23/34169 | 29-Sep-2043* | |||||||

| Treatment Of Zika Virus Infections Using Alpha Glucosidase Inhibitors | 10328061+ | US | 6-25-2019 | 15/584,952+ | 2-May-2037 | |||||||

| Treatment Of Zika Virus Infections Using Alpha Glucosidase Inhibitors | 10561642+ | US | 2-18-2020 | 15/856,377+ | 2-May-2037 |

| * = | For foreign patents and applications, the estimated and/or anticipated patent expiration is the date that is twenty years from the PCT filing date. For all issued Australian patents, this estimated date was also confirmed through the Australian patent office web database. |

| ^ = | For issued U.S. patents, the estimated patent expiration was calculated using information from the front cover of the patent, i.e., 20 years from the date of the nonprovisional filing plus any listed Patent Term Adjustment less any time disclaimed through a Terminal Disclaimer. For pending U.S. applications, the anticipated patent expiration is the date twenty years from the earliest nonprovisional filing date and does not account for possible Patent Term Adjustment (PTA), Patent Term Extension (PTE), or Terminal Disclaimers. |

| + = | 60 Degrees Pharmaceuticals, Inc. is not a listed Applicant and Geoffrey S. Dow, Ph.D. is not a listed inventor. |

| # = | 60 Degrees Pharmaceuticals, Inc. is not a listed Applicant, but Geoffrey S. Dow, Ph.D. is a listed inventor. |

All patents not designated with a “+” list Geoffrey S. Dow, Ph.D. as an inventor.

All patents not designated with a “+” or a “#” list 60 Degrees Pharmaceuticals, Inc. as an applicant.

All estimated patent expiration dates and anticipated patent expiration assume payment of any maintenance/annuity fees during the patent term.

12

Trademarks

| Country | Mark | Status | Application Number | Date Filed | Registration Date | Registration Number | BIR Ref Number | Due Date | Due Date Description | |||||||||

| Australia | KODATEF | Registered | 1774631 | 2-Jun-16 | 6/2/2016 | 1774631 | 0081716-000029 | 2-Jun-26 | Renewal Due | |||||||||

| Canada | KODATEF | Registered | 1785098 | 1-Jun-16 | 11/26/2019 | TMA1,064,371 | 0081716-000028 | 26-Nov-29 | Renewal Due | |||||||||

| Canada | ARAKODA | Registered | 1899317 | 15-May-18 | 8/20/2020 | TMA1,081,180 | 0081716-000053 | 20-Aug-30 | Renewal Due | |||||||||

| China | KODATEF | Registered | 20842242 | 2-Aug-16 | 9/28/2017 | 20842242 | 0081716-000035 | 27-Sep-27 | Renewal Due | |||||||||

| European Union | KODATEF | Registered | 15508872 | 3-Jun-16 | 9/21/2016 | 15508872 | 0081716-000034 | 3-Jun-26 | Renewal Due | |||||||||

| European Union | ARAKODA | Registered | 17900852 | 16-May-18 | 9/20/2018 | 17900852 | 0081716-000054 | 16-May-28 | Renewal Due | |||||||||

| Israel | KODATEF | Registered | 285476 | 6-Jun-16 | 6/6/2016 | 285476 | 0081716-000033 | 6-Jun-26 | Renewal Due | |||||||||

| New Zealand | KODATEF | Registered | 1044407 | 7-Jun-16 | 12/8/2016 | 1044407 | 0081716-000031 | 6-May-26 | Renewal Due | |||||||||

| Russian Federation | KODATEF | Registered | 2016720181 | 6-Jun-16 | 7/10/2017 | 623174 | 0081716-000032 | 6-Jun-26 | Renewal Due | |||||||||

| Singapore | KODATEF | Registered | 40201707950V | 2-May-17 | 11/8/2017 | 40201707950V | 0081716-000040 | 2-May-27 | Renewal Due | |||||||||

| United Kingdom | ARAKODA | Registered | 17900852 | 16-May-18 | 9/20/2018 | UK00917900852 | 0081716-000054 | 16-May-28 | Renewal Due | |||||||||

| United Kingdom | KODATEF | Registered | 15508872 | 3-Jun-16 | 9/21/2016 | UK009015508872 | 0081716-000072 | 3-Jun-26 | Renewal Due | |||||||||

| United States of America | TQ 100 & TABLET DESIGN | Registered | 87608493 | 14-Sep-17 | 9/11/2018 | 5562900 | 0081716-000037 | 11-Sep-24 | Section 8 & 15 Due | |||||||||

| United States of America | ARAKODA | Registered | 87688137 | 16-Nov-17 | 12/31/2019 | 5950691 | 0081716-000050 | 31-Dec-25 | Section 8 & 15 Due | |||||||||

| United States of America | KODATEF | Abandoned- | 90072885 | 24-Jul-20 | 0081716-000069 | 16-Aug-23 | Statement of Use/3rd Extension of Time Due | |||||||||||

| United States of America | KODATEF | Allowed | 98/363,219 | 18-Jan-24 | 0081716-000074 | 12-May-25 | Statement of Use/1st Extension of Time Due |

Key Relationships & Licenses

On May 30, 2014, we entered into the Exclusive License Agreement (the “2014 NUS-SHS Agreement”) with National University of Singapore (“NUS”) and Singapore Health Services Pte Ltd (“SHS”) in which we were granted a license from NUS and SHS with respect to their share of patent rights regarding “Dosing Regimen for Use of Celgosivir as an Antiviral Therapeutic for Dengue Virus Infection” to develop, market and sell licensed products. The 2014 NUS-SHS Agreement continues in force until the expiration of the last to expire of any patents under the patent rights unless terminated earlier in accordance with the 2014 NUS-SHS Agreement. We are obligated to pay royalties at the rate of 1.5% of gross sales.

13

On July 15, 2015, we entered into the Exclusive License Agreement with the U.S. Army Medical Materiel Development Activity (the “U.S. Army”), which was subsequently amended (the “U.S. Army Agreement”), in which we obtained a license to develop and commercialize the licensed technology with respect to all therapeutic applications and uses excluding radical cure of symptomatic vivax malaria. This exclusion does not impact our ability to market Arakoda for the FDA-approved use, which is the prevention of malaria utilizing the indicated dose in asymptomatic individuals traveling to high-malaria or malaria-prone regions (whereas the license exclusion relates to its use to treat symptomatic vivax malaria in a patient already presenting with that disease). The term of the U.S. Army Agreement will continue until the expiration of the last to expire of the patent application or valid claim of the licensed technology, or 20 years from the start date of the U.S. Army Agreement, unless terminated earlier by the parties. We will be required to make a minimum annual royalty payment of 3% of net sales for net sales < $35 million, and 5% of net sales greater than $35 million, with US government sales excluded from the definition of net sales. In addition, we must pay a milestone fee of $75,000 once cumulative net sales from all sources exceeds $6 million, $100,000 if we are acquired or merge, and regulatory approval milestone payments once marketing authorizations are achieved in Canada ($5,000) and Europe ($5,000). Also, we will be required to obtain the U.S. Army Medical Materiel Development Activity’s consent prior to a change of control of the Company, which consent was obtained on September 2, 2022.

On September 15, 2016, we entered into the Exclusive License Agreement (the “2016 NUS-SHS Agreement”) with National University of Singapore and Singapore Health Services Pte Ltd (“SHS”) in which we were granted a license from NUS and SHS with respect to their share of patent rights regarding “Novel Dosing Regimens of Celgosivir for The Prevention of Dengue” to develop, market and sell licensed products. The 2016 NUS-SHS Agreement continues in force until the expiration of the last to expire of any patents under the patent rights unless terminated earlier in accordance with the 2016 NUS-SHS Agreement. We are obligated to pay at the rate of 1.5% of gross sales or minimum annual royalty ($5,000 in 2022 and $15,000 in 2023). In July 2022, we renegotiated the timing of a license fee of $85,000 Singapore Dollars, payable to NUS, such that payment would be due at the earlier of (i) enrollment of a patient in a Phase II clinical trial involving Celgosivir, (ii) two years from the agreement date and (iii) an initial public offering.

On December 4, 2020, we entered into the Other Transaction Authority for Prototype Agreement (“OTAP Agreement”) with the Natick Contracting Division of the U.S. government in which we will, among other things, conduct activities for a Phase II clinical trial to assess the safety and efficacy of Tafenoquine for the treatment of mild to moderate COVID-19 disease, with the goal of delivering Tafenoquine with an FDA Emergency Use Authorization (“EUA”) approved as a countermeasure against COVID-19. The total amount of the OTAP Agreement is $4,999,814. The term of the OTAP Agreement commenced on December 4, 2020 and was completed in the third quarter of 2022. Pursuant to the OTAP Agreement, we will not offer, sell or otherwise provide the EUA or licensed version of the prototype (Tafenoquine) that is FDA approved for COVID-19 or any like product to any entity at a price lower than that offered to the DoD, which applies only to products sold in the U.S., European Union and Canada related to COVID-19.