UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

SEMIANNUAL REPORT

SEMIANNUAL REPORT PURSUANT TO REGULATION A

For the Semiannual Period Ended June 30, 2023

DNALabs Canada Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 024-11994

Canada

(State or other jurisdiction of incorporation or organization)

98-1561597

(I.R.S. Employer Identification No.)

1920 Yonge Street, Suite 200

Toronto, Ontario, M4S 3E2, Canada

(Address of principal executive offices)

519-953-4362

Issuer’s telephone number, including area code

1,111,111 Shares of Non-Voting Class B Common Stock

(Title of each class of securities issued pursuant to Regulation A)

1

In this Form 1-SA, the term “DNALabs Canada Inc.”, “DNALabs”, “we,” or “the company” refers to DNALabs Canada Inc.

This report may contain forward-looking statements and information relating to, among other things, the company, its business plan and strategy, and its industry. These forward-looking statements are based on the beliefs of, assumptions made by, and information currently available to the company’s management. When used in this report, the words “estimate,” “project,” “believe,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements, which constitute forward looking statements. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties that could cause the company’s actual results to differ materially from those contained in the forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company does not undertake any obligation to revise or update these forward-looking statements to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events.

Item 1.Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of the Company's financial condition and results of the Company's operations together with the Company's financial statements and related notes appearing at the end of this Form 1-SA. This discussion contains forward-looking statements reflecting the Company’s current expectations that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in the section entitled “Risk Factors” and elsewhere in the Company’s Offering Circular.

DNALabs Canada Inc., a Canadian Corporation ("DNALabs" or the "Company" "Us" or "We") and its subsidiary are engaged in the provision of DNA testing services for various medical and non-medical purposes in Canada and the United States of America.

DNALabs’ mission is to develop and create innovative, useful and affordable, independent DNA testing products with a hallmark for excellence, that will help everyone unlock their own puzzle to know more about themselves.

A.Operating Results Overview

DNALabs Canada Inc. (“DNALabs” or the “Company” “Us” or “We”) was incorporated on November 23, 2016 as a Canadian Corporation with its registered office located at 1920 Yonge Street, Suite 200, Toronto, Ontario, M4S 3E2, Canada, and the Company’s subsidiary, DNALabs Corp. was incorporated in the state of Delaware, USA, on June 17, 2021, with its office located at 3651 FAU Blvd., Suite 400, Boca Raton, Florida 33431, USA.

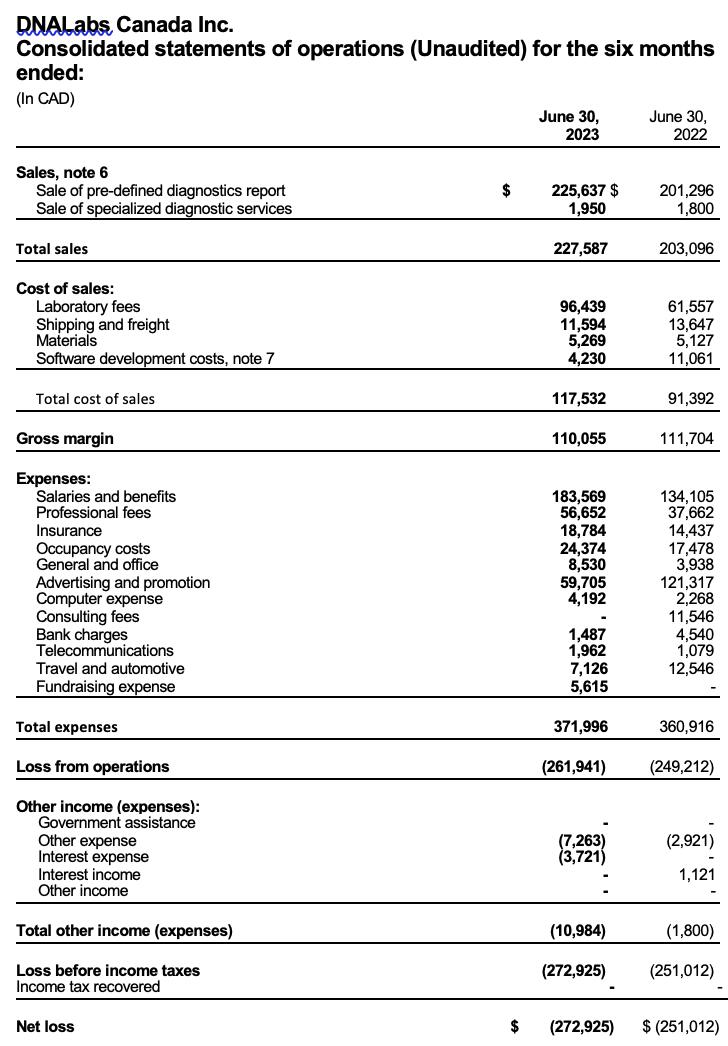

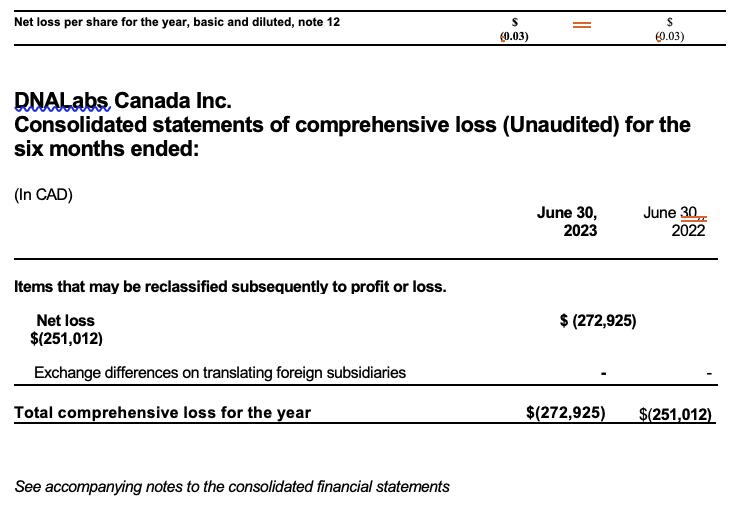

Results of Operations

The period of January 1, 2023 to June 30, 2023

2

Important Note: The Company’s consolidated financial statements attached are presented in Canadian dollars, which is the Company’s functional currency. In this report, unless otherwise noted, all monetary amounts are presented in U.S. dollars, not Canadian dollars.

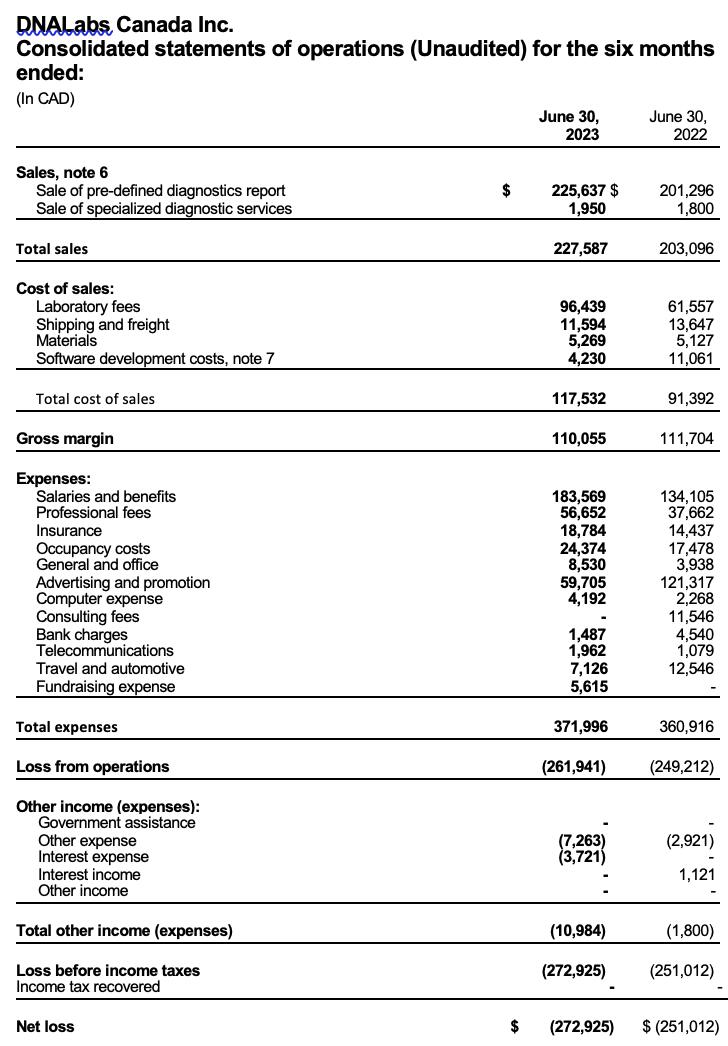

Revenue. Total revenue for the period of January 1, 2023 to June 30, 2023 was $ 168,871 primarily from the sale of DNA testing services for various medical and non-medical purposes.

Cost of Sales. Cost of sales for the period of January 1, 2023 to June 30, 2023 were $ 87,209. Cost of sales for the period comprised of laboratory processing costs, material, and shipping.

Administrative Expenses. Operating expenses for the period of January 1, 2023 to June 30, 2023 were $ 276,023. Operating expenses for the period were comprised of advertising, marketing, payroll, rent and office expenses, professional fees, insurance, and other administrative expenses.

Net Loss. Net loss for the period of January 1, 2023 to June 30, 2023 was $ 202,512. This net loss was primarily due to operating expenses exceeding early stage operating revenues.

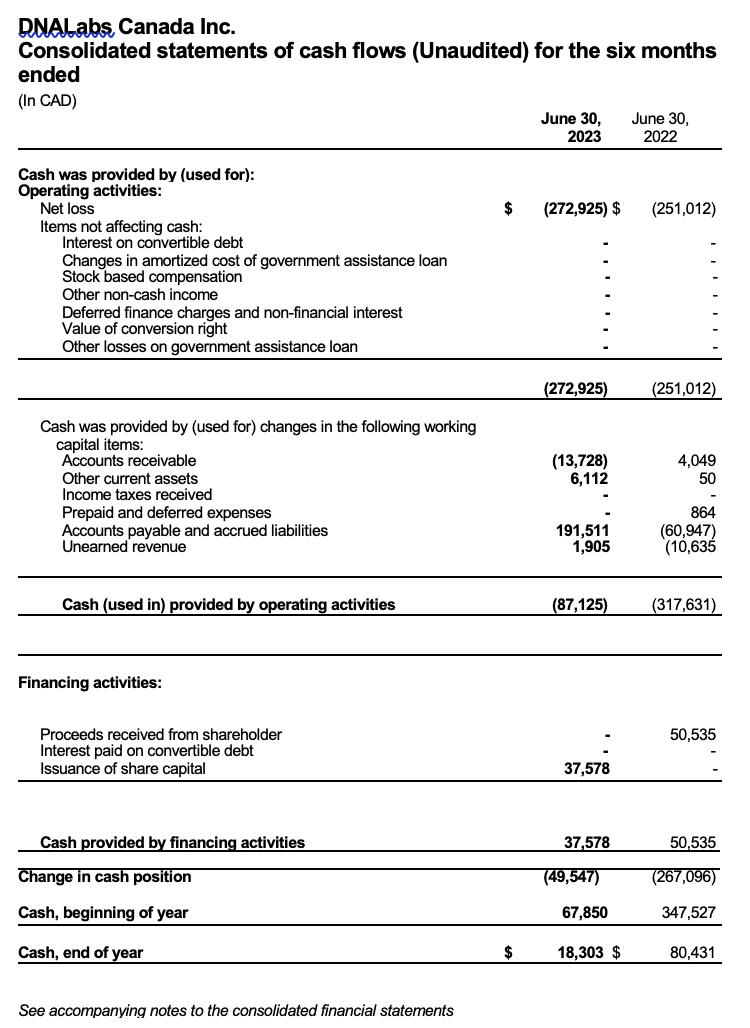

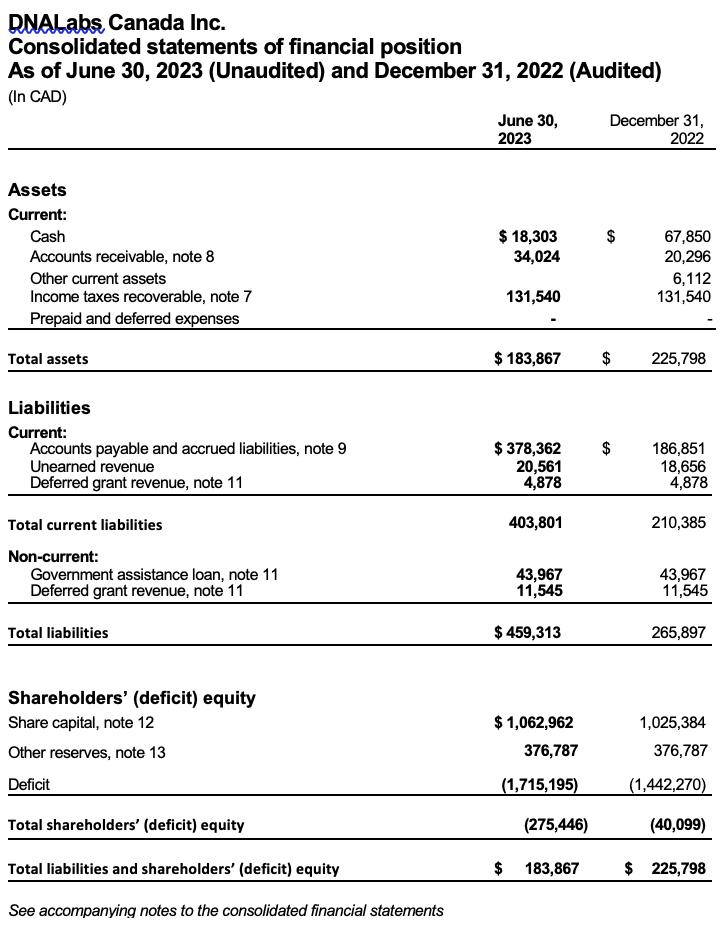

B.Liquidity and Capital Resources

We had net cash of $ 13,824 at June 30, 2023.

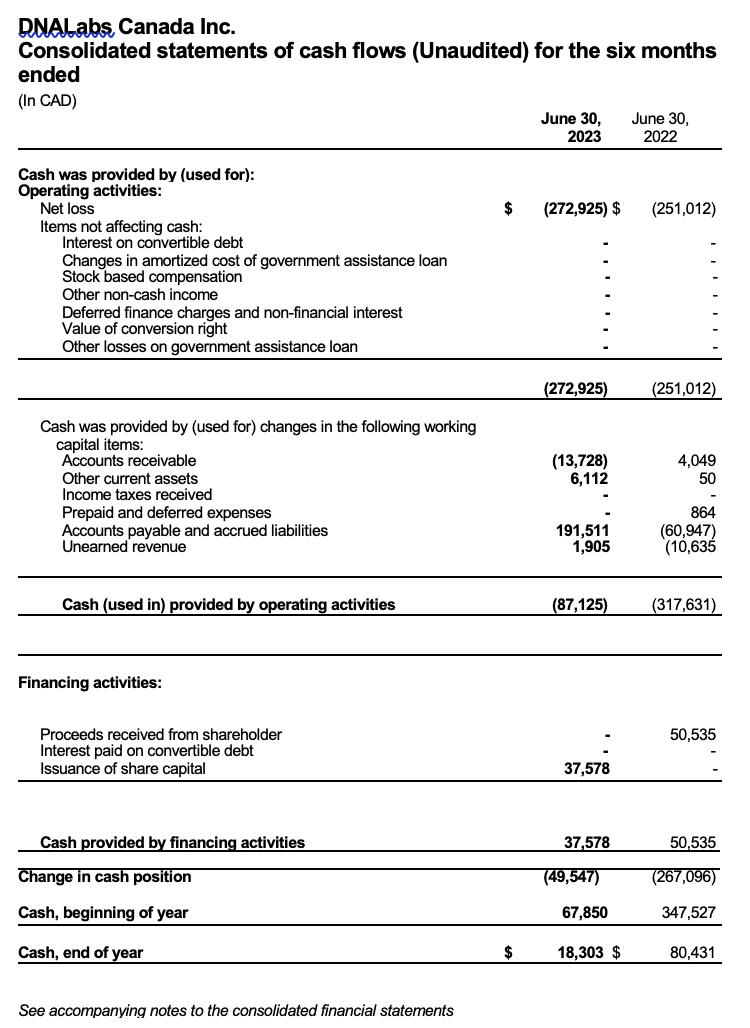

During the period of January 1, 2023 to June 30, 2023, operating activities used cash of ($ 65,804) primarily due to net changes in working capital accounts.

Cash provided by financing activities during the period of January 1, 2023 to June 30, 2023 was $28,832 and was related to proceeds from the sale of stock.

C.Plan of Operations

Our plan of operation for the period of January 1, 2023 to June 30, 2023 is as follows:

As of June 30, 2023, DNALabs continued its expansion in the Canadian as well as into the US markets through new partnerships that were established with healthcare professionals, and continued our research and development for updating our existing tests and the development of new ones.

D.Trend Information

DNALabs believes that we are active in a growing field. The global genetic testing market is expected to continue its growth, and DNALabs is well positioned to take advantage of that.

E.Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or

3

expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

F.Critical Accounting Policies

We have identified the policies outlined below as critical to our business operations and an understanding of our results of operations. The list is not intended to be a comprehensive list of all our accounting policies. In many cases, the accounting treatment of a particular transaction is specifically dictated by accounting principles generally accepted in the United States, with no need for management's judgment in their application. The impact and any associated risks related to these policies on our business operations is discussed throughout Management's Discussion and Analysis of Financial Condition and Results of Operations where such policies affect our reported and expected financial results. Note that our preparation of the consolidated financial statements requires us to make estimates and assumptions that affect the reported amount of assets and liabilities, disclosure of contingent assets and liabilities at the date of our consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. There can be no assurance that actual results will not differ from those estimates.

These consolidated financial statements are prepared in accordance with IFRS. The significant accounting policies are detailed as follows:

Significant accounting judgments, estimates, and assumptions

Reclassifications

Certain accounts in the prior-year financial statements have been reclassified for comparative purposes to conform with the presentation in the current-year financial statements.

The preparation of the consolidated financial statements in accordance with IFRS requires management to make judgments, estimates, and assumptions in order to apply the Company’s accounting policies, which have an effect on the reported amounts and disclosures made in the consolidated financial statements and accompanying notes. The following are the critical judgments and key sources of estimation:

Current versus noncurrent classification

The Company presents its assets and liabilities in the consolidated statement of consolidated statements of financial position based on current/non-current classification. An asset is current when it is:

*Expected to be realized or intended to be sold or consumed in the normal operating cycle

*Held primarily for the purpose of trading

*Expected to be realized within 12 months after the reporting period

Or

4

*Cash unless restricted from being exchanged or used to settle a liability for at least 12 months after the reporting period.

All other assets are classified as noncurrent.

A liability is current when:

*It is expected to be settled in the normal operating cycle

*It is held primarily for the purpose of trading

*It is due to be settled within 12 months after the reporting period

*There is no unconditional right to defer the settlement of the liability for at least 12 months after the reporting period

*The terms of the liability that could, at the option of the counterparty, result in its settlement by the issue of equity instruments do not affect its classification.

The Company classifies all other liabilities as noncurrent.

Deferred tax assets and liabilities are classified as noncurrent assets and liabilities.

Revenue recognition

Further disclosures on revenue are provided in the following note:

The Company recognizes revenue from the following major sources:

*sale of pre-defined diagnostics report; and

*sale of specialized diagnostic services.

Both types for above reports are generated through test conducted using a DNA testing kit (“Kit”), which is provided to consumers at the time of sales order. Testing is completed when these kits are returned by the consumers for lab testing purposes. Completed kits containing the specimen are sent to a laboratory for processing. The Company analyzes the resulting genotype, generating a report for release to the consumer or ordering party. In management’s judgment, the Company’s activities comprise a single performance obligation as the various tasks are not distinct within the context of the contract: the Company’s obligation is to combine these inputs and only transfers control of the final report to the customer.

Sale of pre-defined diagnostics report

The Company sells pre-defined diagnostics reports through multiple channels including hospitals, healthcare practitioners, and direct to consumers via the Company’s website. The performance obligation is satisfied, and revenues are recognized when diagnostics reports are released to the customer, in an amount that reflects the consideration the Company expects to collect. A receivable is recognized by the Company as this represents the point in time at which the right to consideration becomes unconditional, as only the passage of time is required before payment is due.

5

Sale of specialized diagnostic services

The Company provides specialized diagnostic services to hospitals, healthcare practitioners, and various research facilities. The terms of the reports along with the price is agreed upon in the contract entered between the parties. The performance obligation is satisfied and revenues are recognized when diagnostics services have been performed and reports are released to the ordering party in an amount that reflects the consideration the Company expects to collect. A receivable is recognized by the Company as this represents the point in time at which the right to consideration becomes unconditional, as only the passage of time is required before payment is due.

For both revenue streams, the transaction price is generally determined based on a stated price per unit and does not require significant judgment.

For both revenue streams, revenue is recognized at the point in time the DNA test report is made available to the customer. In management’s judgment, this occurs once the test and analysis are complete, after the results are reviewed by Company personnel, and released in the Company’s reporting system to be available for the customer to view.

Amounts collected in advance of services being provided are recorded as unearned revenue on the statement of consolidated statements of financial position. The associated revenue is recognized and the unearned revenue is reduced as the contracted services are subsequently performed. Sales to consumers are paid upfront prior to the Company sending a kit. Sales to institutional customers generally are paid on credit terms 10 to 90 days after the sample is received from the client for processing, or in some cases, prepaid by the institutional customer.

The Company collects sales tax on the revenues as per the laws of the jurisdiction, from where the services are provided or goods are sold. Sales tax collected and remains payable to the relevant government agency is included in accounts payable and accrued liabilities.

The Company elected to expense sales commission and other costs incurred to obtain sales contracts for agreements that are expected to have terms of less than 12 months.

Financial instruments - initial recognition and subsequent measurement

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Financial assets

Initial recognition and measurement

Financial assets are classified, at initial recognition, as subsequently measured at amortized cost, fair value through other comprehensive income (“OCI”), and fair value through profit or loss.

The classification of financial assets at initial recognition depends on the financial assets contractual cash flow characteristics and the Company’s business model for managing them. With the exception of trade receivables that do not contain a significant financing component or for

6

which the Company has applied the practical expedient, the Company initially measures a financial asset at its fair value plus, in the case of a financial asset not at fair value through profit or loss, transaction costs. Trade receivables that do not contain a significant financing component or for which the Company has applied the practical expedient are measured at the transaction price as disclosed in revenue recognition note.

The Company’s business model for managing financial assets refers to how it manages its financial assets in order to generate cash flows. The business model determines whether cash flows will result from collecting contractual cash flows, selling the financial assets, or both. Financial assets classified and measured at amortized cost are held within a business model with the objective to hold financial assets in order to collect contractual cash flows while financial assets classified and measured at fair value through OCI are held within a business model with the objective of both holding to collect contractual cash flows and selling.

Purchases or sales of financial assets that require delivery of assets within a time frame established by regulation or convention in the marketplace (regular way trades) are recognized on the trade date, i.e., the date the Company commits to purchase or sell the asset.

Subsequent measurement

For purposes of subsequent measurement, financial assets are classified in two categories which are most relevant to the Company:

*Financial assets at amortized cost

*Financial assets at fair value through profit or loss

Financial assets at amortized cost

The Company’s financial assets include cash, accounts receivable and receivables from shareholder which are carried at amortized cost.

Derecognition

A financial asset (or, where applicable, a part of a financial asset or part of a group of similar financial assets) is primarily derecognized (i.e., removed from the Company’s statement of financial position) when:

*The rights to receive cash flows from the asset have expired, or

*The Company has transferred its rights to receive cash flows from the asset or has assumed an obligation to pay the received cash flows in full without material delay to a third party under a ‘pass-through’ arrangement and either (a) the Company has transferred substantially all the risks and rewards of the asset, or (b) the Company has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset

When the Company has transferred its rights to receive cash flows from an asset or has entered into a pass-through arrangement, it evaluates if, and to what extent, it has retained the risks and

7

rewards of ownership. When it has neither transferred nor retained substantially all of the risks and rewards of the asset, nor transferred control of the asset, the Company continues to recognize the transferred asset to the extent of its continuing involvement. In that case, the Company also recognizes an associated liability.

The transferred asset and the associated liability are measured on a basis that reflects the rights and obligations the Company has retained.

The Company recognizes an allowance for expected credit losses (“ECLs”) for all debt instruments not held at fair value through profit or loss. ECLs are based on the difference between the contractual cash flows due in accordance with the contract and all the cash flows the Company expects to receive, discounted at an approximation of the original effective interest rate. The expected cash flows will include cash flows from the sale of collateral held or other credit enhancements that are integral to the contractual terms.

ECLs are recognized in two stages. For credit exposures for which there has not been a significant increase in credit risk since initial recognition, ECLs are provided for credit losses that result from default events that are possible within the next 12-months (a 12-month ECL). For those credit exposures for which there has been a significant increase in credit risk since initial recognition, a loss allowance is required for credit losses expected over the remaining life of the exposure, irrespective of the timing of the default (a lifetime ECL).

For trade receivables, the Company applies a simplified approach in calculating ECLs. Therefore, the Company does not track changes in credit risk, but instead recognizes a loss allowance based on lifetime ECLs at each reporting date.

The Company considers a financial asset in default when contractual payments are 90-days past due. However, in certain cases, the Company may also consider a financial asset to be in default when internal or external information indicates the Company is unlikely to receive the outstanding contractual amounts in full before taking into account any credit enhancements held by the Company. A financial asset is written off when there is no reasonable expectation of recovering the contractual cash flows.

Financial liabilities

Initial recognition and measurement

All financial liabilities are recognized initially at fair value and, in the case of loans and borrowings and payables, net of directly attributable transaction costs.

Subsequent measurement

*For purposes of subsequent measurement, financial liabilities are classified as financial liabilities at amortized cost.

Financial liabilities at amortized cost (accounts payable and accrued liabilities)

8

This is the category most relevant to the Company. After initial recognition, loans and borrowings are subsequently measured at amortized cost using the effective interest rate (“EIR”) method. Gains and losses are recognized in profit or loss when the liabilities are derecognized as well as through the EIR amortization process.

Amortized cost is calculated by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the EIR. The EIR amortization is included as finance costs in the statement of profit or loss.

Accounts payable and accrued liabilities are paid according to vendor terms, generally within 30 days. Due to the short duration, the carrying values equal the stated amounts due.

Derecognition

A financial liability is derecognized when the obligation under the liability is discharged or canceled or expires. When an existing financial liability is replaced by another from the same lender on substantially different terms, or the terms of an existing liability are substantially modified, such an exchange or modification is treated as the derecognition of the original liability and the recognition of a new liability.

Offsetting of financial instruments

Financial assets and financial liabilities are offset and the net amount is reported in the statement of financial position if there is a currently enforceable legal right to offset the recognized amounts and there is an intention to settle on a net basis, to realize the assets and settle the liabilities simultaneously.

Taxes

Further disclosure relating to the taxes is also provided in the following note:

*Income taxes (Note 14)

The Company has elected to include investment tax credits as a component of its income tax provision.

Current income tax

Current income tax assets and liabilities are measured at the amount expected to be recovered from or paid to the taxation authorities. The tax rates and tax laws used to compute the amount are those that are enacted or substantively enacted at the reporting date.

Current income tax relating to items recognized directly in equity is recognized in equity and not in the consolidated statements of operations. Management periodically evaluates positions taken in the tax returns with respect to situations in which applicable tax regulations are subject to interpretation and establishes provisions where appropriate.

9

Deferred tax

Deferred tax is provided using the liability method on temporary differences between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes at the reporting date.

Deferred tax liabilities are recognized for all taxable temporary differences.

Deferred tax assets are recognized for all deductible temporary differences, the carry forward of unused tax credits and any unused tax losses. Deferred tax assets are recognized to the extent that it is probable that taxable profit will be available against which the deductible temporary differences, and the carry forward of unused tax credits and unused tax losses can be utilized.

The carrying amount of deferred tax assets is reviewed at each reporting date and reduced to the extent that it is no longer probable that sufficient taxable profit will be available to allow all or part of the deferred tax asset to be utilized. Unrecognized deferred tax assets are reassessed at each reporting date and are recognized to the extent that it has become probable that future taxable profits will allow the deferred tax asset to be recovered.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply in the year when the asset is realized or the liability is settled, based on tax rates (and tax laws) that have been enacted or substantively enacted at the reporting date.

Deferred tax relating to items recognized outside profit or loss is recognized outside profit or loss. Deferred tax items are recognized in correlation to the underlying transaction either in OCI or directly in equity.

The Company offsets deferred tax assets and deferred tax liabilities if and only if it has a legally enforceable right to set off current tax assets and current tax liabilities and the deferred tax assets and deferred tax liabilities relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities which intend either to settle current tax liabilities and assets on a net basis, or to realize the assets and settle the liabilities simultaneously, in each future period in which significant amounts of deferred tax liabilities or assets are expected to be settled or recovered.

G.Additional Company Matters

The Company has not filed for bankruptcy protection nor has it ever been involved in receivership or similar proceedings. The Company is not presently involved in any legal proceedings material to the business or financial condition of the Company. The Company does not anticipate any material reclassification, merger, consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business, in the next 12 months.

10

Item 2.Other Information

None.

Item 3.Financial Statements

Attached below signature page.

INDEX TO FINANCIAL STATEMENTS |

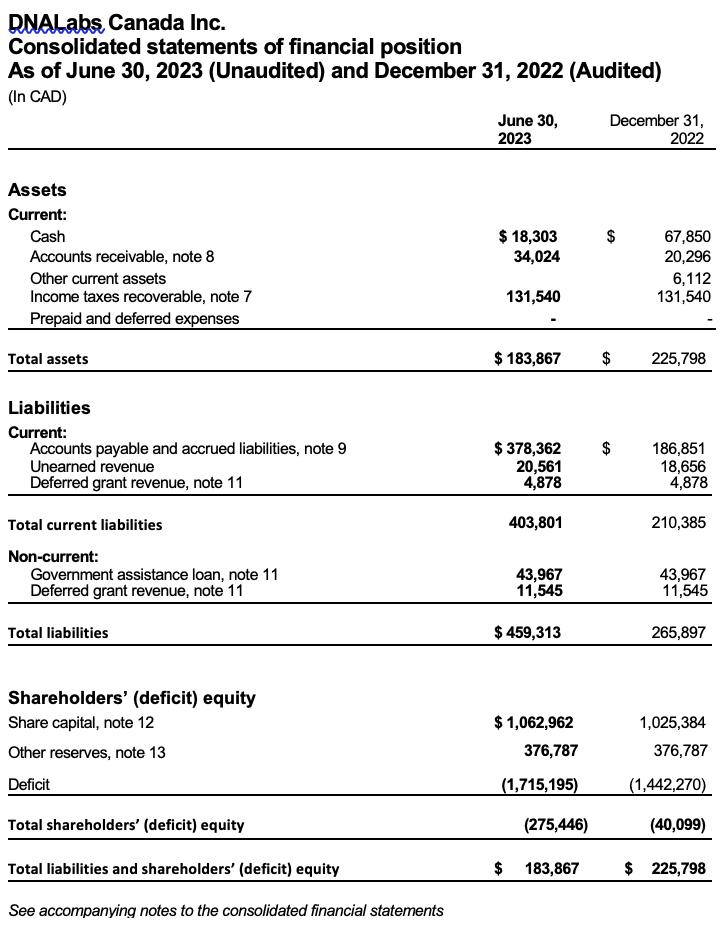

Consolidated statements of financial position | 14 |

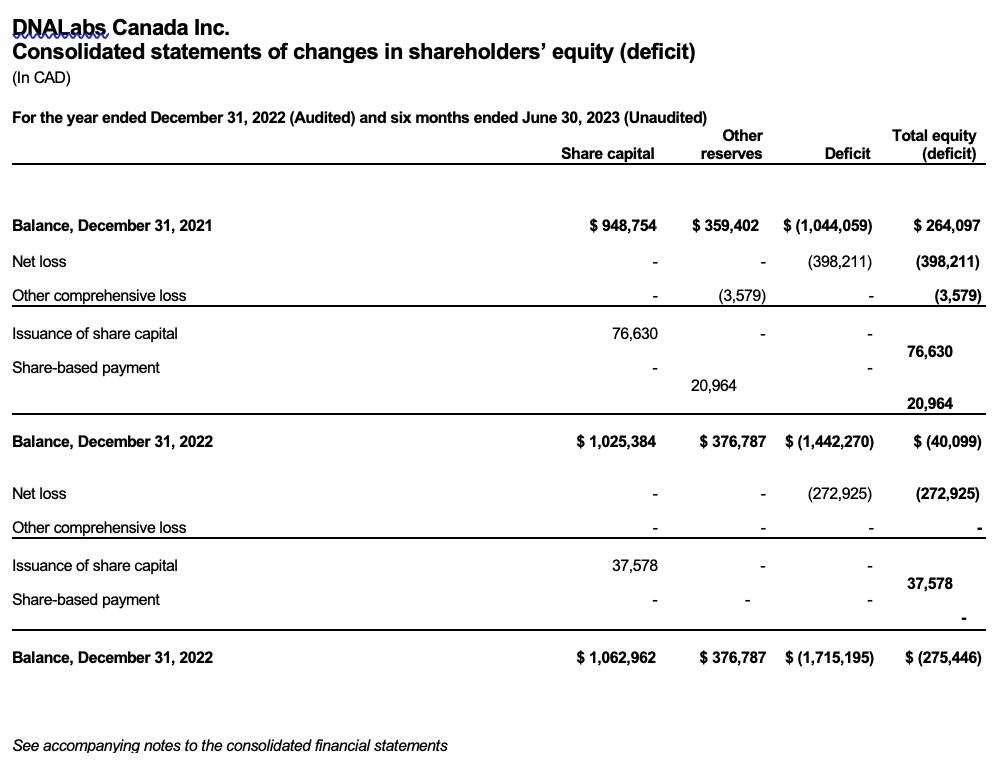

Consolidated statements changes in shareholders’ equity (deficit) | 15 |

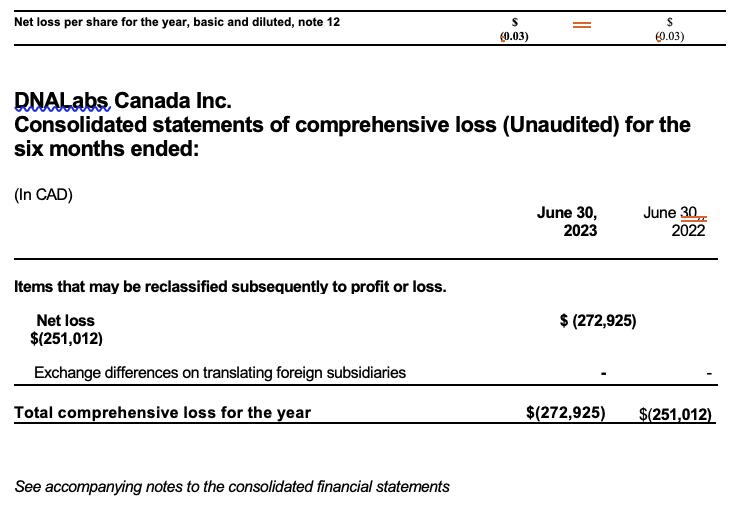

Consolidated statements of comprehensive loss | 16 |

Consolidated statements of cash flows | 17 |

Consolidated statements of operations | 18 |

Notes to the consolidated financial statements | 19-39 |

11

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized in Boca Raton, Florida on October 3, 2023.

DNALABS CANADA INC.

By: /s/ Moni Lustig

Chief Executive Officer and Director

Pursuant to the requirements of Regulation A, this report has been signed below by the following persons on behalf of the issuer in the capacities and on the dates indicated.

SignatureTitle

By: /s/ Moni Lustig President, Chief Executive Officer and Director (also principal executive officer, principal financial officer, principal accounting officer,

DNALabs Canada Inc.

October 3, 2023

12

DNALabs Canada Inc.

Consolidated financial statements (Unaudited)

As of June 30, 2023 and December 31, 2022 and

For the six-month periods ended June 30, 2023 and 2022

13

14

15

16

17

18

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Note 1—Nature of operations

These consolidated financial statements includes the financial results DNALabs Canada Inc. (the “Company” or “Parent”) and its wholly owned subsidiary DNALabs Corp. The Company is a limited privately held company incorporated and domiciled in Canada. The registered office is located at 200 – 1920 Yonge Street, Toronto, Ontario, Canada. The Company has no ultimate beneficial owner as of June 30, 2023 and December 31, 2022.

The Company’s wholly-owned subsidiary, DNALab Corp, was incorporated under the laws of State of Delaware in the United States of America with its office located at 3651 FAU Boulevard, Suite 400, Boca Raton, Florida, United States.

The Company is principally engaged in the provision of deoxyribonucleic acid (“DNA”) testing services for various medical and non-medical purposes in Canada and the United States of America.

Note 2—Basis of presentation

Statement of Compliance – These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

The preparation of consolidated financial statements in compliance with adopted IFRS requires the use of certain critical accounting estimates. It also requires Company management to exercise judgment in applying the Company’s accounting policies. The areas where significant judgments and estimates have been made in preparing the consolidated financial statements and their effects are disclosed in Company’s significant accounting policies.

Basis of Measurement – A summary of the Company’s significant accounting policies under IFRS is presented in Note 5.

These consolidated financial statements have been presented in Canadian dollars which is the functional currency of the Company and are prepared under the historical cost basis, unless otherwise stated.

Note 3—Basis of consolidation

The consolidated financial statements comprise the financial statements of the Company and its subsidiary. Control is achieved when the group is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. Specifically, the Company controls an investee if, and only if, the Company has:

-power over the investee (i.e., existing rights that give it the current ability to direct the relevant activities of the investee)

-exposure, or rights, to variable returns from its involvement with the investee

-The ability to use its power over the investee to affect its returns

Generally, there is a presumption that a majority of voting rights results in control. To support this presumption and when the Company has less than a majority of the voting or similar rights of an investee, the Company considers all relevant facts and circumstances in assessing whether it has power over an investee, including:

19

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

-The contractual arrangement(s) with the other vote holders of the investee

-Rights arising from other contractual arrangements

-The group’s voting rights and potential voting rights

Note 3—Basis of consolidation (continued)

The Company re-assesses whether or not it controls an investee if facts and circumstances indicate that there are changes to one or more of the three elements of control. Consolidation of a subsidiary begins when the Company obtains control over the subsidiary and ceases when the Company loses control of the subsidiary. Assets, liabilities, income and expenses of a subsidiary acquired or disposed of during the year are included in the consolidated financial statements from the date the group gains control until the date the group ceases to control the subsidiary.

Profit or loss and each component of other comprehensive income (“OCI”) are attributed to the equity holders of the parent of the group and to the non-controlling interests, even if this results in the non-controlling interests having a deficit balance. When necessary, adjustments are made to the consolidated financial statements of subsidiaries to bring their accounting policies in line with the Company’s accounting policies. All intra-group assets and liabilities, equity, income, expenses and cash flows relating to transactions between members of the group are eliminated in full on consolidation.

A change in the ownership interest of a subsidiary, without a loss of control, is accounted for as an equity transaction.

If the Company loses control over a subsidiary, it derecognises the related assets (including goodwill), liabilities, non-controlling interest and other components of equity, while any resultant gain or loss is recognized in profit or loss. Any investment retained is recognized at fair value.

Note 4—Going concern

These consolidated financial statements are presented on the basis that the Company will continue as a going concern. The going concern basis assumes the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities and commitments in the normal course of business. During the six months ended June 30,2023, the Company sustained a net comprehensive loss of $ 272,925, and has an excess of liabilities over assets amounting to $ 275,446 at June 30, 2023, and had negative cash flows from operations. These conditions cast significant doubt on the company’s ability to continue as a going concern, and therefore that it may be unable to realize its assets and discharge its liabilities in the normal course of business. Management is working to improve the financial results to more traditional levels by focusing on the business plan increasing sales within the United States and Canada. Management believes that anticipated cash flow from operations and cash increases as a result of improvements in working capital, will be sufficient to fund current operations and current working capital needs. Management believes the actions presently being taken to further implement its business plan and generate sufficient revenues in addition to raising additional capital, provide the opportunity for the Company to continue as a going concern. The Company will be required to raise additional funds through public or private financing, additional collaborative relationships, or other arrangements until revenue increases to a point of positive cash flow. At present, the Company is engaged in a Regulation A securities offering, which, if successful, will provide additional capital to help fund current operations.

20

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Note 5—Significant accounting policies

These consolidated financial statements are prepared in accordance with IFRS. The significant accounting policies are detailed as follows:

Significant accounting judgments, estimates, and assumptions

Reclassifications

Certain accounts in the prior-year financial statements have been reclassified for comparative purposes to conform with the presentation in the current-year financial statements.

The preparation of the consolidated financial statements in accordance with IFRS requires management to make judgments, estimates, and assumptions in order to apply the Company’s accounting policies, which have an effect on the reported amounts and disclosures made in the consolidated financial statements and accompanying notes. The following are the critical judgments and key sources of estimation:

Current versus noncurrent classification

The Company presents its assets and liabilities in the consolidated statement of consolidated statements of financial position based on current/non-current classification. An asset is current when it is:

*Expected to be realized or intended to be sold or consumed in the normal operating cycle

*Held primarily for the purpose of trading

*Expected to be realized within 12 months after the reporting period

Or

*Cash unless restricted from being exchanged or used to settle a liability for at least 12 months after the reporting period.

All other assets are classified as noncurrent.

A liability is current when:

*It is expected to be settled in the normal operating cycle

*It is held primarily for the purpose of trading

*It is due to be settled within 12 months after the reporting period

*There is no unconditional right to defer the settlement of the liability for at least 12 months after the reporting period

*The terms of the liability that could, at the option of the counterparty, result in its settlement by the issue of equity instruments do not affect its classification.

The Company classifies all other liabilities as noncurrent.

21

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Deferred tax assets and liabilities are classified as noncurrent assets and liabilities.

Revenue recognition

Further disclosures on revenue are provided in the following note:

*Note 6

The Company recognizes revenue from the following major sources:

*sale of pre-defined diagnostics report; and

*sale of specialized diagnostic services.

Both types for above reports are generated through test conducted using a DNA testing kit (“Kit”), which is provided to consumers at the time of sales order. Testing is completed when these kits are returned by the consumers for lab testing purposes. Completed kits containing the specimen are sent to a laboratory for processing. The Company analyzes the resulting genotype, generating a report for release to the consumer or ordering party. In management’s judgment, the Company’s activities comprise a single performance obligation as the various tasks are not distinct within the context of the contract: the Company’s obligation is to combine these inputs and only transfers control of the final report to the customer.

Sale of pre-defined diagnostics report

The Company sells pre-defined diagnostics reports through multiple channels including hospitals, healthcare practitioners, and direct to consumers via the Company’s website. The performance obligation is satisfied, and revenues are recognized when diagnostics reports are released to the customer, in an amount that reflects the consideration the Company expects to collect. A receivable is recognized by the Company as this represents the point in time at which the right to consideration becomes unconditional, as only the passage of time is required before payment is due.

Sale of specialized diagnostic services

The Company provides specialized diagnostic services to hospitals, healthcare practitioners, and various research facilities. The terms of the reports along with the price is agreed upon in the contract entered between the parties. The performance obligation is satisfied and revenues are recognized when diagnostics services have been performed and reports are released to the ordering party in an amount that reflects the consideration the Company expects to collect. A receivable is recognized by the Company as this represents the point in time at which the right to consideration becomes unconditional, as only the passage of time is required before payment is due.

For both revenue streams, the transaction price is generally determined based on a stated price per unit and does not require significant judgment.

For both revenue streams, revenue is recognized at the point in time the DNA test report is made available to the customer. In management’s judgment, this occurs once the test and analysis are complete, after the results are reviewed by Company personnel, and released in the Company’s reporting system to be available for the customer to view.

Amounts collected in advance of services being provided are recorded as unearned revenue on the statement of consolidated statements of financial position. The associated revenue is recognized and the unearned revenue is reduced as the contracted services are subsequently performed. Sales to consumers

22

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

are paid upfront prior to the Company sending a kit. Sales to institutional customers generally are paid on credit terms 10 to 90 days after the sample is received from the client for processing, or in some cases, prepaid by the institutional customer.

The Company collects sales tax on the revenues as per the laws of the jurisdiction, from where the services are provided or goods are sold. Sales tax collected and remains payable to the relevant government agency is included in accounts payable and accrued liabilities.

The Company elected to expense sales commission and other costs incurred to obtain sales contracts for agreements that are expected to have terms of less than 12 months.

Financial instruments - initial recognition and subsequent measurement

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Financial assets

Initial recognition and measurement

Financial assets are classified, at initial recognition, as subsequently measured at amortized cost, fair value through other comprehensive income (“OCI”), and fair value through profit or loss.

The classification of financial assets at initial recognition depends on the financial assets contractual cash flow characteristics and the Company’s business model for managing them. With the exception of trade receivables that do not contain a significant financing component or for which the Company has applied the practical expedient, the Company initially measures a financial asset at its fair value plus, in the case of a financial asset not at fair value through profit or loss, transaction costs. Trade receivables that do not contain a significant financing component or for which the Company has applied the practical expedient are measured at the transaction price as disclosed in revenue recognition note.

The Company’s business model for managing financial assets refers to how it manages its financial assets in order to generate cash flows. The business model determines whether cash flows will result from collecting contractual cash flows, selling the financial assets, or both. Financial assets classified and measured at amortized cost are held within a business model with the objective to hold financial assets in order to collect contractual cash flows while financial assets classified and measured at fair value through OCI are held within a business model with the objective of both holding to collect contractual cash flows and selling.

Purchases or sales of financial assets that require delivery of assets within a time frame established by regulation or convention in the marketplace (regular way trades) are recognized on the trade date, i.e., the date the Company commits to purchase or sell the asset.

Subsequent measurement

For purposes of subsequent measurement, financial assets are classified in two categories which are most relevant to the Company:

*Financial assets at amortized cost

*Financial assets at fair value through profit or loss

23

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Financial assets at amortized cost

The Company’s financial assets include cash, accounts receivable and receivables from shareholder which are carried at amortized cost.

Derecognition

A financial asset (or, where applicable, a part of a financial asset or part of a group of similar financial assets) is primarily derecognized (i.e., removed from the Company’s statement of financial position) when:

*The rights to receive cash flows from the asset have expired, or

*The Company has transferred its rights to receive cash flows from the asset or has assumed an obligation to pay the received cash flows in full without material delay to a third party under a ‘pass-through’ arrangement and either (a) the Company has transferred substantially all the risks and rewards of the asset, or (b) the Company has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset

When the Company has transferred its rights to receive cash flows from an asset or has entered into a pass-through arrangement, it evaluates if, and to what extent, it has retained the risks and rewards of ownership. When it has neither transferred nor retained substantially all of the risks and rewards of the asset, nor transferred control of the asset, the Company continues to recognize the transferred asset to the extent of its continuing involvement. In that case, the Company also recognizes an associated liability.

The transferred asset and the associated liability are measured on a basis that reflects the rights and obligations the Company has retained.

The Company recognizes an allowance for expected credit losses (“ECLs”) for all debt instruments not held at fair value through profit or loss. ECLs are based on the difference between the contractual cash flows due in accordance with the contract and all the cash flows the Company expects to receive, discounted at an approximation of the original effective interest rate. The expected cash flows will include cash flows from the sale of collateral held or other credit enhancements that are integral to the contractual terms.

ECLs are recognized in two stages. For credit exposures for which there has not been a significant increase in credit risk since initial recognition, ECLs are provided for credit losses that result from default events that are possible within the next 12-months (a 12-month ECL). For those credit exposures for which there has been a significant increase in credit risk since initial recognition, a loss allowance is required for credit losses expected over the remaining life of the exposure, irrespective of the timing of the default (a lifetime ECL).

For trade receivables, the Company applies a simplified approach in calculating ECLs. Therefore, the Company does not track changes in credit risk, but instead recognizes a loss allowance based on lifetime ECLs at each reporting date.

The Company considers a financial asset in default when contractual payments are 90-days past due. However, in certain cases, the Company may also consider a financial asset to be in default when internal or external information indicates the Company is unlikely to receive the outstanding contractual amounts in full before taking into account any credit enhancements held by the Company. A financial asset is written off when there is no reasonable expectation of recovering the contractual cash flows.

24

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Financial liabilities

Initial recognition and measurement

All financial liabilities are recognized initially at fair value and, in the case of loans and borrowings and payables, net of directly attributable transaction costs.

Subsequent measurement

*For purposes of subsequent measurement, financial liabilities are classified as Financial liabilities at amortized cost.

Financial liabilities at amortized cost (accounts payable and accrued liabilities)

This is the category most relevant to the Company. After initial recognition, loans and borrowings are subsequently measured at amortized cost using the effective interest rate (“EIR”) method. Gains and losses are recognized in profit or loss when the liabilities are derecognized as well as through the EIR amortization process.

Amortized cost is calculated by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the EIR. The EIR amortization is included as finance costs in the statement of profit or loss.

Accounts payable and accrued liabilities are paid according to vendor terms, generally within 30 days. Due to the short duration, the carrying values equal the stated amounts due.

Derecognition

A financial liability is derecognized when the obligation under the liability is discharged or canceled or expires. When an existing financial liability is replaced by another from the same lender on substantially different terms, or the terms of an existing liability are substantially modified, such an exchange or modification is treated as the derecognition of the original liability and the recognition of a new liability.

Offsetting of financial instruments

Financial assets and financial liabilities are offset and the net amount is reported in the statement of financial position if there is a currently enforceable legal right to offset the recognized amounts and there is an intention to settle on a net basis, to realize the assets and settle the liabilities simultaneously.

Taxes

Further disclosure relating to the taxes is also provided in the following note:

*Income taxes (Note 14)

The Company has elected to include investment tax credits as a component of its income tax provision.

25

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Current income tax

Current income tax assets and liabilities are measured at the amount expected to be recovered from or paid to the taxation authorities. The tax rates and tax laws used to compute the amount are those that are enacted or substantively enacted at the reporting date.

Current income tax relating to items recognized directly in equity is recognized in equity and not in the consolidated statements of operations. Management periodically evaluates positions taken in the tax returns with respect to situations in which applicable tax regulations are subject to interpretation and establishes provisions where appropriate.

Deferred tax

Deferred tax is provided using the liability method on temporary differences between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes at the reporting date.

Deferred tax liabilities are recognized for all taxable temporary differences.

Deferred tax assets are recognized for all deductible temporary differences, the carry forward of unused tax credits and any unused tax losses. Deferred tax assets are recognized to the extent that it is probable that taxable profit will be available against which the deductible temporary differences, and the carry forward of unused tax credits and unused tax losses can be utilized.

The carrying amount of deferred tax assets is reviewed at each reporting date and reduced to the extent that it is no longer probable that sufficient taxable profit will be available to allow all or part of the deferred tax asset to be utilized. Unrecognized deferred tax assets are reassessed at each reporting date and are recognized to the extent that it has become probable that future taxable profits will allow the deferred tax asset to be recovered.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply in the year when the asset is realized or the liability is settled, based on tax rates (and tax laws) that have been enacted or substantively enacted at the reporting date.

Deferred tax relating to items recognized outside profit or loss is recognized outside profit or loss. Deferred tax items are recognized in correlation to the underlying transaction either in OCI or directly in equity.

The Company offsets deferred tax assets and deferred tax liabilities if and only if it has a legally enforceable right to set off current tax assets and current tax liabilities and the deferred tax assets and deferred tax liabilities relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities which intend either to settle current tax liabilities and assets on a net basis, or to realize the assets and settle the liabilities simultaneously, in each future period in which significant amounts of deferred tax liabilities or assets are expected to be settled or recovered.

Foreign exchange

The Company’s consolidated financial statements are presented in Canadian dollars ($), which is Company’s functional currency. The functional currency of the US subsidiary of the Company is United States dollars. The foreign exchange rates were as follows:

26

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

| 2023 | 2022 |

USD/CAD closing rate at 31 December | | 1.3544 |

USD/CAD average rates for the year | | 1.3013 |

USD/CAD closing rate at 30 June | 1.324 | 1.2678 |

USD/CAD average rates for the 6 months end June 30 | 1.3477 | 1.2535 |

Transactions and balances

Transactions in foreign currencies are initially recorded by the Company at their respective functional currency spot rates at the date the transaction first qualifies for recognition.

Monetary assets and liabilities denominated in foreign currencies are translated at the functional currency spot rates of exchange at the reporting date.

Differences arising on settlement or translation of monetary items are recognized in profit or loss.

Non-monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rates at the dates of the initial transactions. Non-monetary items measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value is determined.

The gain or loss arising on translation of non-monetary items measured at fair value is treated in line with the recognition of the gain or loss on the change in fair value of the item (i.e., translation differences on items whose fair value gain or loss is recognized in OCI or profit or loss are also recognized in OCI or profit or loss,. respectively) In determining the spot exchange rate to use on initial recognition of the related asset, expense, or income (or part of it) on the derecognition of a non-monetary asset or non-monetary liability relating to advance consideration, the date of the transaction is the date on which the Company initially recognizes the non-monetary asset or non-monetary liability arising from the advance consideration. If there are multiple payments or receipts in advance, the Company determines the transaction date for each payment or receipt of advance consideration.

On consolidation, the assets and liabilities of foreign operations are translated into Canadian dollars at the rate of exchange prevailing at the reporting date and their statements of profit or loss are translated at exchange rates prevailing at the dates of the transactions. The exchange difference arising on translation was presented within other comprehensive income (and classified in Other reserves) for the year ended December 31, 2022.

Government assistance

Government assistance is recognized where there is reasonable assurance the assistance will be received, and all attached conditions will be complied with.

The Company applied for financial assistance under available government subsidy programs for employers impacted by COVID-19. During 2022 and 2021, the Company received Canada Emergency Wage

27

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Subsidies (“CEWS”) of approximately $0 and $2,900, respectively. Government assistance related to the wage subsidy has been recorded as a reduction of salaries and benefits.

The Company also received Canada Emergency Rent Subsidy (“CERS”) in 2022 and 2021 of approximately $0 and $285, respectively. Government assistance related to the rent subsidy has been recorded as a reduction of occupancy costs.

In addition, the Company received a loan under the Canada Emergency Business Account program as disclosed in Note 11.

Cash

Cash in the consolidated statement of financial position comprise cash at banks and on hand and short-term, highly-liquid deposits with a maturity of three months or less, that are readily convertible to a known amount of cash and subject to an insignificant risk of changes in value.

Provisions and Contingencies

Provisions represent liabilities to the Company for which the amount or timing is uncertain. Provisions are recognized when the Company has a present obligation (legal or constructive) as a result of a past event, it is probable the Company will be required to settle that obligation and a reliable estimate can be made of the amount of the obligation.

The amount recognized as a provision is the best estimate of the consideration required to settle the present obligation at the end of the reporting period, taking into account the risks and uncertainties surrounding the obligation. Provisions are measured at the present value of the expected consideration to settle the obligation which, when the effect of the time value of money is material, is determined using a discount rate that reflects current market assessments of the time value of money and the risks specific to the obligation. The increase in the provision during the period to reflect the passage of time is recognized in earnings as a finance cost.

Contingent liabilities also include obligations that are not recognized because their amount cannot be measured reliably or because settlement is not probable. Contingent liabilities do not include provisions for which it is certain the Company has a present obligation that is more likely than not to lead to an outflow of cash or other economic resources, even though the amount or timing is uncertain. A contingent liability is not recognized in the consolidated statement of financial position. However, unless the possibility of an outflow of economic resources is remote, a contingent liability is disclosed in the notes.

Note 6—Revenue

The Company derives its revenue mainly from the following two channels:

Institutional consumers include hospital, wellness clinics, and other healthcare practitioners. DNA tests ordered through the Company’s website are included in retail consumers.

There was no revenue recognized in the 6 months ended June 30, 2023 and June 30,2022 from performance obligations satisfied in the prior periods, such as changes in transaction prices. Management expects to recognize the Company’s $ 20,561 unearned revenue at June 30, 2023 upon completion of the underlying reports from kits within a few weeks of end of fiscal period.

28

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Note 7—Income taxes recoverable

The Company is entitled to Canadian federal and provincial investment tax credits which are earned as a percentage of eligible research and development expenditures incurred in each taxation year. Investment tax credits are recorded provided the Company prepared the applicable submissions, and it has reasonable assurance that the tax credits will be realized. During 2022 and 2021, the Company recorded investment tax credits as income tax recovered in the amount of $131,540 and $99,959 respectively.

Note 8—Accounts receivable

| | June 30,

2023 | December 31,

2022 |

| | | |

Trade receivables | | $34,024 | $20,296 |

| | $34,024 | $20,296 |

| | | |

Current | | $23,854 | $12,104 |

1-30 days | | $3,491 | $2,281 |

31-60 days | | $6,000 | $5,029 |

61-90 days | | - | $565 |

91 days and over | | $679 | $317 |

| | $34,024 | $20,296 |

Trade receivables are non-interest bearing and are generally on terms of 10 to 90 days. Management is of opinion that no material expected credit losses are to be recognized as of December 31, 2022 and June 30, 2023.

Note 9—Accounts payable and accrued liabilities

Accounts payable and accrued liabilities relate to short-term expenses incurred by the Company.

Note 10—Convertible notes

The Company issued non-interest bearing convertible promissory notes for $670,000 on November 15, 2018. During the year notes were convertible into 6,210.30 common shares of the Company, at the option of the holder, or repayable on December 31, 2023.

29

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

On January 31, 2020 the Company issued convertible promissory notes bearing annual interest of 24% for $50,111. During the year ended December 31, 2021, notes were convertible into 2,019 common shares of the Company, at the option of the holder, or repayable on December 31, 2023. Interest on these notes was payable quarterly in arrears.

The convertible notes issued in both 2018 and 2020 were secured by all assets of the Company.

All convertible notes were converted to equity by the holders during the fiscal year ended December 31, 2021.

Note 11—Government assistance loan

The Company applied for a loan under the Canada Emergency Business Account (“CEBA”) program introduced by the Government of Canada to support businesses impacted by the pandemic COVID-19. The loan is interest-free to December 31, 2023 (extended from December 31, 2022 by Canadian government), and if fully repaid will result in loan forgiveness of $20,000. The balance outstanding after this date will bear interest at 5.00% per annum to December 31, 2025, and the Company will not be eligible for loan forgiveness.

At December 31, 2022, the outstanding principal balance was $60,000 (at December 31, 2021 – the same). The loan was initially recognized in 2020 at fair value using market interest rate determined by independent appraiser (15.74%). The difference between the nominal value and fair value was recognized as deferred income (deferred government assistance) and is recognized in income statement over the initial loan term. The anticipated income from loan forgiveness is not accounted for in the calculations and will be recognized if and when the requirements for the waiver have been substantially met by the Company.

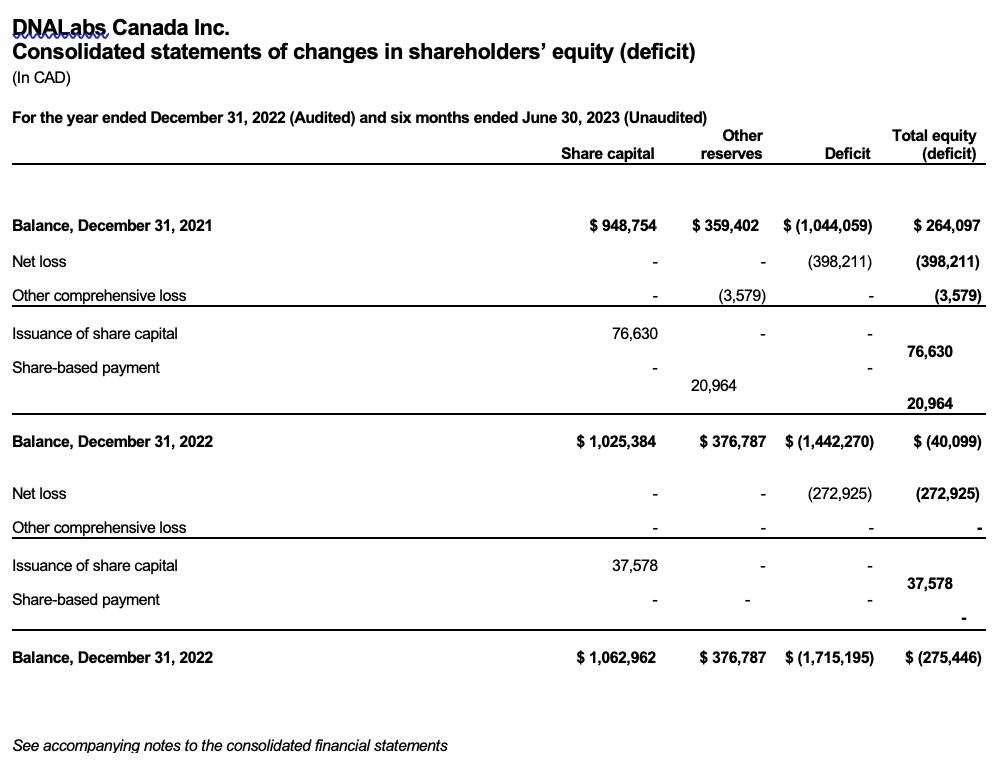

Note 12—Share capital and net loss per share

The Company is authorized to issue an unlimited number of common shares class A, B and a few other classes with characteristics identical to class A. All common shares have no par value.

In a special meeting of the shareholders of the corporation that was held on September 8, 2022, the shareholders approved a forward stock split of 600:1 in connection with the issued and outstanding Class A Common shares of the Corporation. The 14,248.46 issued and outstanding Class A Common Shares of the Corporation changed to 8,549,076 issued and outstanding Class A Common Shares on a 600:1 basis. All comparative information has been adjusted to present stock split retrospectively.

In the same special meeting of the shareholders of the Corporation that was held on September 8, 2022, the shareholders approved an amendment changing the Class B Common shares of the Corporation to Non-Voting Common Shares.

The table below presents a reconciliation of the number of shares outstanding at the beginning and at the end of the period:

30

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Reconciliation of shares outstanding | | Class A | Class B |

Outstanding at January 1, 2023 | | 8,549,076 | 6,275 |

Issued during 6 months ended June 30,2023 | | - | 3,074 |

Outstanding at June 30, 2023 | | 8,549,076 | 9,349 |

Outstanding at January 1, 2022 | | 8,549,076 | - |

Issued during year | | - | 6,275 |

Outstanding at December31, 2021 | | 8,549,076 | 6,275 |

(*) Number of all shares has been adjusted retroactively for 600:1 stock split effected in 2022.

All issued shares are fully paid at June 30, 2023

The weighted average number of ordinary shares for both basic and diluted loss per share is 8,550,645 for 2022 and 8,557,400 for the 6 months ended June 30, 2023.

Note 13—Other reserves

Other reserves consist of:

$359,402 relating to the fair value of the conversion rights relating to the convertible notes issued in 2018 and 2020 and subsequently converted to common shares in 2021 as described in Note 10 and 12;

$(3,579) of cumulative loss on translation of the Company’s wholly-owned subsidiary, DNALab Corp; and

$20,964 of share based compensation costs during the 2022 (see below)

On June 22, 2022, the Corporation entered into a consulting agreement with Kendall Almerico (the “Consultant”) whereby the Corporation retained to services of the Consultant as a general consultant acting in connection with the Corporation’s use of the JOBS Act related to equity crowdfunding under Regulation A. The consulting agreement provides for the Consultant to receive compensation by way of 11,400 options exercisable within 5 years for $4.50 once the total amount of capital raised exceeds USD 100,000 (or if the Company discontinues collaboration).

This arrangement has been classified as an equity-settled share-based payment under IFRS 2. The Corporation recognised $20,964 of share-based payment expense relating to the services received in 2022 under this agreement. The recognised expense was measured with reference to fair value of services received.

No milestone was reached during the year ended December 31, 2022 or the six months ended June 30, 2023, and therefore no options were issued during that period to the Consultant.

No provision has been created by the Company in respect of this and certain other agreements with legal consultants that provide for additional 17,100 options to be issued and cash outflows once total amount of capital raised reaches USD 1,000,000.

31

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Note 14—Income taxes

The major components of income tax expense (recovered) are outlined below for each of the years ended December 31, 2022 and December 31, 2021:

| | December 31,

2022 | December 31,

2021 |

Current income taxes recovered | | (131,540) | (99,959) |

Temporary differences | | - | - |

Total deferred tax expense | | - | - |

Total income taxes recovered | | (131,540) | (99,959) |

The tables below present an analysis and expiry dates for all tax losses carried forward. The group did not recognise deferred tax assets for these losses.

Analysis of tax losses carry forward: | | December 31,

2022 | December 31,

2021 |

Non-capital tax losses carried forward | | 589,607 | 360,268 |

Non-capital tax losses current year | | 181,558 | 229,339 |

Non-capital tax losses utilized | | - | - |

| | 771,165 | 589,607 |

Expiry of all losses carried forward | | December 31,

2022 | December 31,

2021 |

2037 | | 209,244 | 209,244 |

2038 | | 113,912 | 113,912 |

2039 | | 37,112 | 37,112 |

2041 | | 229,339 | 229,339 |

2042 | | 181,558 | - |

| | 771,165 | 589,607 |

The Company has non-capital losses carried forward for tax purposes. This tax difference results in a future tax asset of $97,273 assessing the recoverability of the future tax asset, management considers whether it is more likely than not that some portion or all of the future tax asset will be realized. The ultimate realization of future tax assets is dependent upon the generation of future taxable income. As the Company is in start-up stage, there is a doubt regarding the future utilization of the asset and, therefore, an impairment of $97,273 on the deferred tax assets has not been recognized. If and when recognized, the tax benefits related to any reversal of the impairment on deferred tax asset as of December 31, 2022, will be accounted for as a reduction in income tax expense (income taxes recovered).

32

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Current year’s tax loss utilization resulted from the research and development grant from the government of Canada, which is dependent on the qualified research and development incurred by the Company.

The reconciliation of the combined Canadian federal and provincial statutory income tax rate to the Company’s effective income tax rate is detailed as follows for each of the years ended December 31:

| | 2022 | 2021 |

Combined Canadian federal and provincial income tax rate | 38.00% | 38.00% |

Federal tax abatement | | 10.00% | 10.00% |

Federal and provincial small business deduction | 15.80% | 15.80% |

Impairment of deferred tax asset | | 12.20% | 12.20% |

Scientific research and development credit - federal and provincial | 37.16% | 37.16% |

Effective rate | | 37.16% | 37.16% |

Calculation of effective tax rate | | December 31,

2022 | December 31,

2021 |

Loss before taxes | | (353,983) | (269,000) |

Estimated tax recovery | | (131,540) | (99,959) |

Effective tax rate | | 37.16% | 37.16% |

Difference between effective and expected tax |

Loss before taxes | | (353,983) | (269,000) |

Expected actual tax rate | | 12.20% | 12.20% |

Earnings before tax at expected actual rate | (43,186) | (32,818) |

Total tax recovery | | 131,540 | 99,959 |

Difference between expected and effective | 88,354 | 67,141 |

Note 15—Capital management

The Company’s objectives in managing capital are to ensure sufficient liquidity to pursue its strategy for growth and maximize the return to its shareholders. The capital structure of the company consists of cash, other borrowings, and shareholders’ equity. In order to maintain or adjust its capital structure, Company may issue new common shares from time to time.

33

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

Note 16—Financial instruments and risk management

The Company classifies fair value measurements within a hierarchy which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

The three levels of the fair value hierarchy are:

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date;

Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly; and

Level 3 - Inputs are unobservable for the asset or liability.

The carrying amounts of the following financial assets and liabilities are considered a reasonable approximation of fair value given their short maturity periods: cash, accounts receivable, accounts payable, and accrued expenses.

The government assistance loan and convertible notes were initially recognized at fair value using Level 3 input. In determining fair value for Level 3 instruments, the Company applies discounted cash-flow method. To determine the Company’s credit risk, the Company estimates credit risk by benchmarking the rate of return on expected of its debt to publicly-available comparable data from related companies. Using the estimated rating, the Company’s credit risk was quantified by reference to publicly-traded debt with a corresponding rating.

The Company manages its exposure to financial risk under the direction of its Board of Directors and focuses on actively securing the Company’s short-term to medium term cash flows by minimizing the exposure to financial markets. The Company's significant financial risks are described below.

Liquidity risk

Liquidity risk is the risk the company is not able to meet its obligations associated with its financial instruments. The company is exposed to this risk primarily through its accounts payable and accrued expenses, and other borrowings as well as from issue of common shares and convertible instruments. The company finances its operations through a combination of cash flows from operations and borrowings. Liquidity needs are actively monitored by management.

The below details financial liabilities by maturity based on remaining period from December 31, 2022 and December 31, 2021 to contractual maturity date. The amounts disclosed are the contractual undiscounted cash flows:

34

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

December 30, 2023 | | Less than 3 months | 2025 | Total |

| | | | |

Accounts payable and accrued liabilities | 378,362 | - | 378,362 |

Government assisted loan | | - | 60,000 | 60,000 |

| | 378,362 | 60,000 | 438,362 |

December 31, 2022 | | Less than 3 months | 2025 | Total |

| | | | |

Accounts payable and accrued liabilities | 186,851 | - | 186,851 |

Government assisted loan | | - | 60,000 | 60,000 |

| | 186,851 | 60,000 | 246,851 |

Concentration and credit risk

Credit risk is the risk one party to a transaction will fail to discharge an obligation and cause the other party to incur a financial loss. The company is exposed to credit risk on the accounts receivable from clients. The maximum exposure to credit risk equals to the carrying amounts of financial assets in the statement of financial position. In order to reduce its credit risk, the company has adopted credit policies which include the regular review of outstanding accounts receivable.

For the year ended December 31, 2022 the Company did not have sales to any individual customer exceeding 10% of total Company revenue. For the six months ended June 30, 2023, one customer with revenue greater than 10% of the Company’s total revenue comprised approximately 11% of the Company’s revenue. The accounts receivable for this customer totaled $6,328 at June 30, 2023.

Certain of the raw materials, components, and equipment associated with the DNA microarrays and kits used by the Company in the delivery of its services are available only from third party suppliers. The Company also relies on a third party laboratory service for the processing of its customer samples. Shortages and slowdowns could occur in these essential materials, components, equipment, and laboratory services due to an interruption of supply or increased demand in the industry. If the Company were unable to procure certain materials, components, equipment, or laboratory services at acceptable prices, it would be required to reduce its laboratory operations, which could have a material, adverse effect on its results of operations. A single supplier accounted for 100% of the Company’s total purchases of microarrays and the same single supplier accounted for 100% of the Company’s total purchases of kits for the year ended December 31, 2022 and the six months ended June 30, 2023. One laboratory service provider accounted

35

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

for 100% of the Company’s processing of customer samples for the year ended December 31, 2022 and and the six months ended June 30, 2023.

Market risk

Market risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk is comprised of three types of risks: foreign currency risk, interest rate risk, and price risk. The Company is exposed to foreign currency risk and price risk.

Foreign currency risk

The Company’s activities involve holding foreign currencies and purchases and sales denominated in foreign currencies. These activities result in exposure to fluctuations in foreign currency exchange rates. At statement date of June 30, 2023 and December 31, 2022, the Company had net liabilities denominated in U.S. dollars of approximately $212,387 and $110,320, respectively. The Company does not use derivative financial instruments to manage its exposure to currency risk.

An increase of 10% in the Canadian dollar relative to the U.S. dollar, with all other variables remaining constant, would decrease the Company’s net loss for the year ended December 31, 2022 and six months ended June 30, 2023 by approximately $14,941 and $28,094, respectively while a decrease of 10% would increase the net loss by approximately $14,941 and $28,094, respectively .

Price risk

The Company’s primary cost of fulfilling its sales contracts relates to laboratory processing fees. The Company manages by having under contract the laboratory fees on a fixed per unit processed. The laboratory contract renews on an annual basis with the service provider, with no committed quantities by the Company. The Company also manages this risk with its customers by providing customer pricing specific to the order for immediate or short duration expected fulfillment, or under customer contract for not longer than two years.

Note 17—Segment reporting and disclosures by geographic location

The Company determined that it operates as one operating segment. The Board of Directors is the chief operating decision maker (“CODM”). The CODM makes decisions based on the Company as a whole. In addition, the Company has a common basis for organization and types of products and services which derive revenues and consistent product margins. Accordingly, the Company operates and makes decisions as one reportable segment.

The following table presents geographic information about revenue attributed to countries based on the location of external customers for each of the year ended December 31, 2022 and the six months ended June 30, 2023.

36

DNALABS CANADA, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(In CAD)

As of June 30, 2023 and December 31, 2022, and for the six month period ended June 30, 2023 and June 30, 2022.

| June 30, | December 31, |