Filed pursuant to Rule 253(g)(2)

File No. 024-12488

SUPPLEMENT NO. 9 DATED DECEMBER 5, 2024

TO THE OFFERING CIRCULAR DATED SEPTEMBER 6, 2024

____________________________________

STARFIGHTERS SPACE, INC.

Reusable Launch Hangar, Hangar Rd.

Cape Canaveral, FL, 32920

312-261-0900

This document supplements, and should be read in conjunction with, the offering circular of Starfighters Space, Inc. (“we,” “our,” “us,” or the “Company”), dated September 6, 2024 (the “Offering Circular”), Supplement No. 1 to Offering Circular filed with the Securities and Exchange Commission (the “SEC”) on September 23, 2024, Supplement No. 2 to Offering Circular filed with the SEC on September 25, 2024, Supplement No. 3 to Offering Circular filed with the SEC on October 8, 2024, Supplement No. 4 to Offering Circular filed with the SEC on October 28, 2024, Supplement No. 5 to Offering Circular filed with the SEC on October 30, 2024, Supplement No. 6 to Offering Circular filed with the SEC on November 6, 2024, Supplement No. 7 to Offering Circular filed with the SEC on November 13, 2024 and Supplement No. 8 to Offering Circular filed with the SEC on December 2, 2024. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the Offering Circular.

This supplement is being filed to include the information in our Special Financial Report on Form 1-SA filed by the Company with the SEC on December 5, 2024 (the “Form 1-SA”). Other than Exhibit 6.30 to the Form 1-SA, the exhibits to the Form 1-SA are not included with this supplement and are not incorporated by reference herein.

Investing in our Common Stock involves a high degree of risk. These are speculative securities. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” in the Offering Circular starting on page 10 for a discussion of certain risks that you should consider in connection with an investment in our securities.

THE SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The date of this Supplement No. 9 to the Offering Circular is December 5, 2024.

Special Financial Report on Form 1-SA

(See attached)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

☐ SEMIANNUAL REPORT PURSUANT TO REGULATION A

or

☒ SPECIAL FINANCIAL REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended June 30, 2024

STARFIGHTERS SPACE, INC.

(Exact name of issuer as specified in its charter)

Delaware | | 92-1012803 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

Reusable Launch Vehicle Hangar, Hagar Rd.

Cape Canaveral, FL, 32920

(Full mailing address of principal executive offices)

321-261-0900

(Issuer's telephone number, including area code)

TABLE OF CONTENTS

Item 1. Management's Discussion and Analysis of Financial Condition and Results of Operations

Use of Terms

Except as otherwise indicated by the context and for the purposes of this Special Report on Form 1-SA only, references in this report to "Starfighters," "we," "us," "our," "our company" or the "Company" refer to Starfighters Space, Inc., a Delaware corporation, and its consolidated subsidiaries.

Special Note Regarding Forward-Looking Statements

Certain information contained in this report includes forward-looking statements. The statements herein which are not historical reflect our current expectations and projections about our future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to us and our interpretation of what is believed to be significant factors affecting the businesses, including many assumptions regarding future events.

Forward-looking statements are generally identifiable by use of the words "may," "should," "expect," "anticipate," "estimate," "believe," "intend," "will," "plan," "potential," "could," "would," or "project" or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under "Risk Factors" included in our Offering Circular, dated September 6, 2024, as amended or supplemented, and matters described in this report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this report will in fact occur.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

Overview

The Company's mission statement is to make space accessible to entrepreneurs, researchers, industry, and government at a high cadence and the right cost.

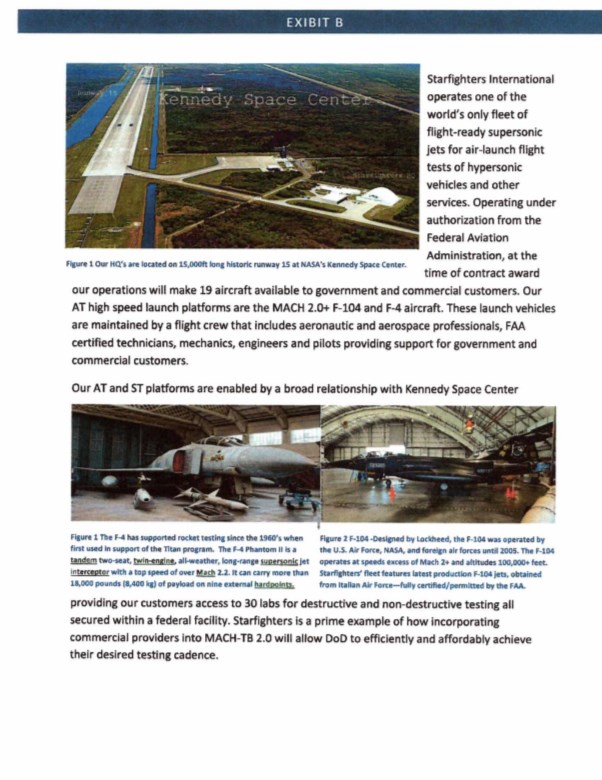

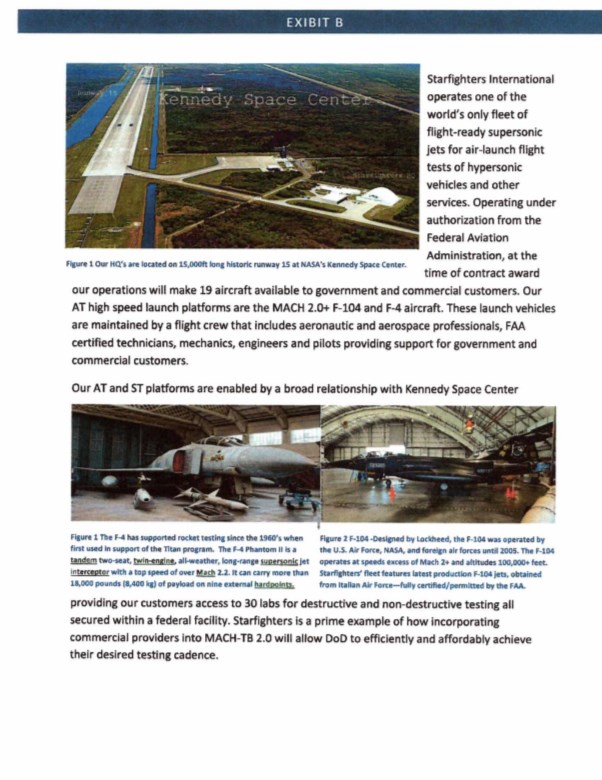

Currently, the Company operates the world's only commercial fleet of flight-ready F-104 supersonic aircraft ("Lockheed F-104"). The Lockheed F-104 was developed as a supersonic aircraft for the United States Armed Forces. The single engine interceptor was favored for its maximum altitude and climb performance. It was the first production aircraft to reach over MACH 2 in sustained, level flight, which was one of the key criteria as to why the National Aeronautics and Space Administration ("NASA") used the Lockheed F-104 for high-speed flight research at the Dryden Flight Research Center. The Lockheed F-104 also performed many safety chase missions in support of advanced research aircraft and provided a launch platform for sounding rockets. Test flights showed that a Lockheed F-104 launched single-stage Viper sounding rocket attain a maximum 112km in altitude. In total, the Lockheed F-104 flew over 18,000 missions for NASA. NASA retired the Lockheed F-104 in 1995, with transition to the McDonnell Douglas F/A-18 Hornet supersonic Aircraft.

Recent increases in government expenditures and commercial investment are driving growth in the space economy. The Company believes this increase has created a demand for services similar to what the Lockheed F-104s formerly owned by NASA used to provide. That demand is for commercial, research and defense technologies including hypersonic research. To the Company's knowledge, there is currently no other aircraft commercially available to the public with the capabilities of the Lockheed F-104 in terms of speed and climbing performance.

The Company aims to address these needs through its existing fleet of seven Lockheed F-104 Aircraft, currently based at NASA's Kennedy Space Center (the "KSC"), as well as through the acquisition of the Platform II Aircraft which the Company believes will provide more advanced capabilities and have a longer operating lifespan. Starfighters is providing its core group of Historical Services, while developing the capacity for New Services. The Company organizes its services into the following categories:

• Historical Services:

o Pilot and Astronaut Training; Launch Services and Access to Space; and

o In-flight Testing.

• New Services:

o Launch Services and "Access to Space" (commercial, academic, civil and government); and

o Airborne Testbed for Hypersonic Research and Development ("R&D") and Test and Evaluation ("T&E") Test Bed (commercial, academic, civil and government).

Recent Developments

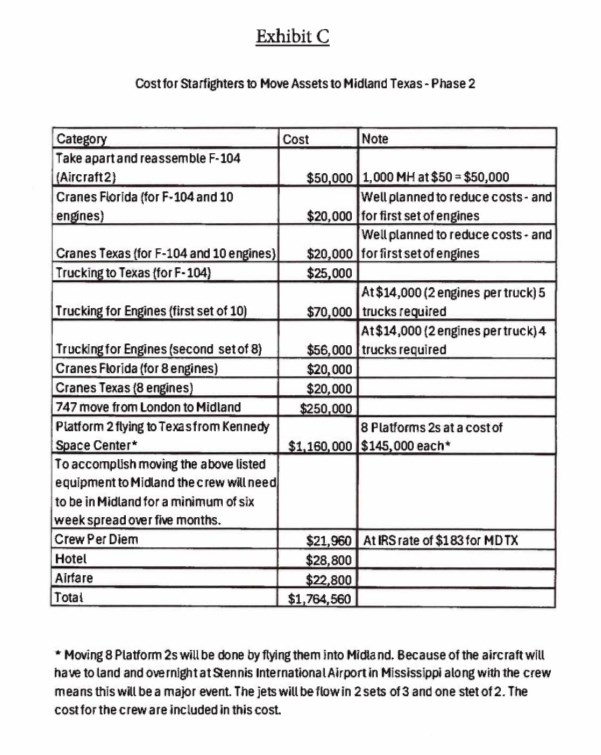

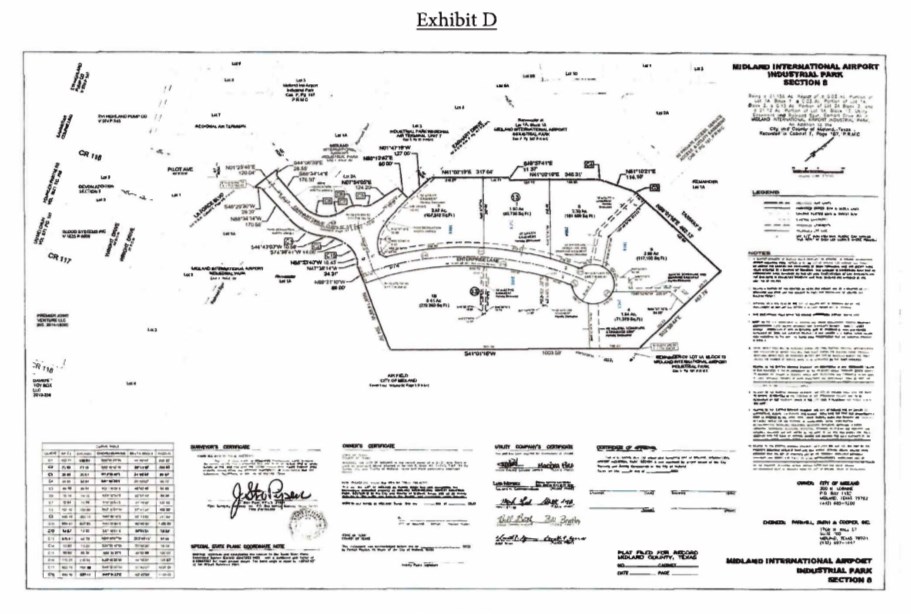

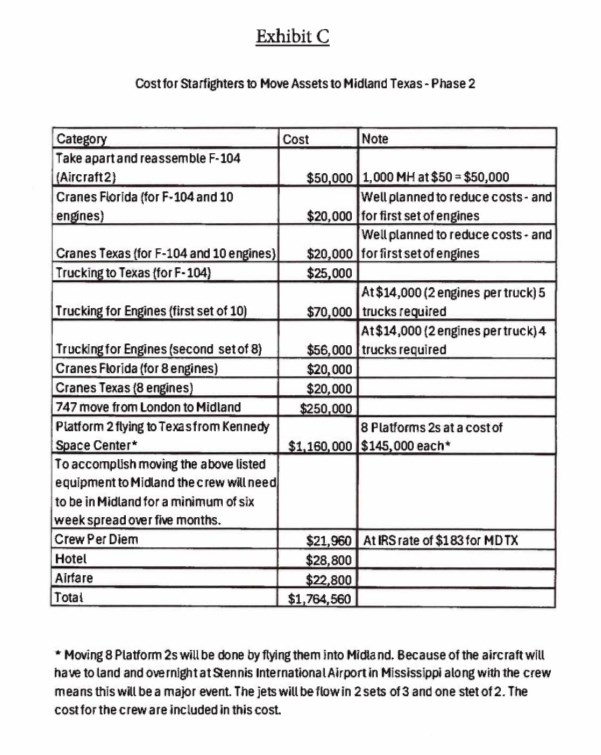

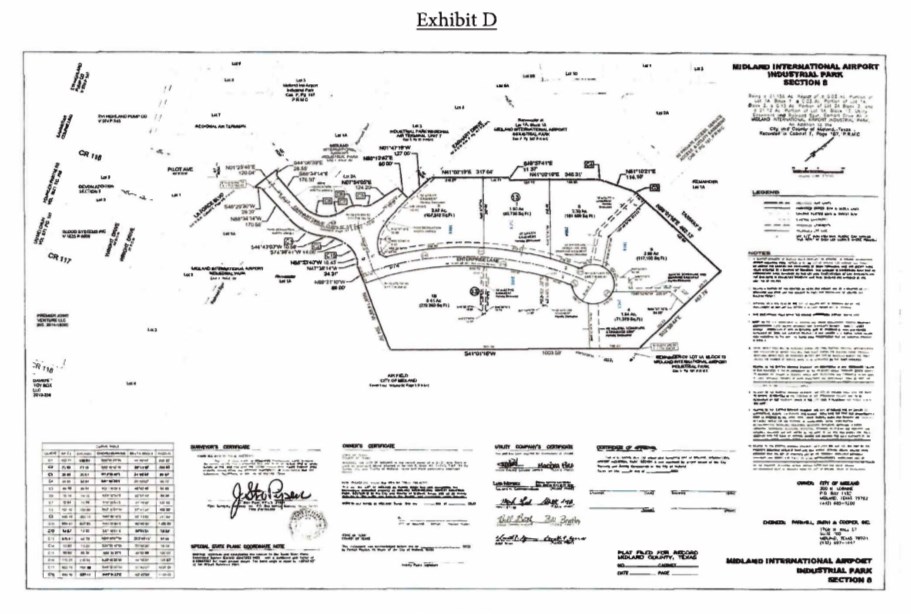

On October 7, 2024, we through our wholly owned subsidiary, Starfighters Space Texas, Incorporated ("SST"), a Texas corporation, entered into an economic development agreement (the "Economic Development Agreement") with Midland Development Corporation ("MDC"), a Type A corporation pursuant to Chapter 504 of the Texas Local Government Code, as amended, having an effective date of September 24, 2024, whereby MDC has agreed to provide certain incentives to SST as consideration for SST's (i) expansion of its business operations to the Midland International Air & Space Port, (ii) creation and retention of primary jobs within the corporate limits of the City of Midland, and (iii) relocation of certain capital assets and equipment at the Midland International Air & Space Port. In connection with the Economic Development Agreement, MDC and SST agree to collaborate to obtain FAA approval and certification of a high-speed airspace corridor between Midland International Air & Space Port and Spaceport America, utilizing supersonic aircraft owned by the Company or its subsidiaries. In addition, SST agrees to exercise reasonable efforts to employ Midland residents and to advertise the availability of job opening in Midland, Texas, and additionally, when it is not possible to hire Midland residents, SST will exercise its best efforts to recruit new residents to live in Midland, Texas, and to advertise the availability of job openings in Midland, Texas. SST's obligations under the Economic Development Agreement include: (i) the relocation of assets to a facility at the Midland International Air & Space Port in the amount of assets totaling $60 million by December 31, 2025 and assets totaling $78 million by December 31, 2027; (ii) to use commercially reasonable efforts to relocate, create, and/or maintain full-time jobs with three (3) full-time jobs as of December 31, 2026, ten (10) full-time jobs as of December 31, 2030, fifteen (15) full-time jobs as of December 31, 2031, twenty (20) full-time jobs as of December 31, 2032 and twenty-three (23) full-time jobs as of December 31, 2033; (iii) complete annual compliance certifications setting out the full-time jobs created and maintained, and the total assets located at the Midland International Air & Space Port as of the last day of such compliance year; (iv) continuously conduct its business during the term of the Economic Development Agreement; (v) enter into a temporary hangar lease, short-term hangar lease and long-term hangar lease as and when such become available and any long-term hangar lease is subject to satisfaction of MDC's obligation under the Economic Development Agreement related to new hangar construction. MDC's obligations under the Economic Development Agreement include: (i) providing SST with relocation costs as set out in Exhibit C to the Economic Development Agreement up to an amount of $2,051,560.00; (ii) during the terms of a temporary hangar lease and short-term hangar lease, provide SST a monthly reimbursement in an amount not to exceed $8,000.00; and (iii) entering into a long-term ground lease with the City of Midland on real property located at the Midland International Air & Space Port and to construct a new hangar facility with approximately 100,000 square feet of usable space and to enter into a long-term hangar sublease with SST for same. The Economic Development Agreement shall terminate (i) on the tenth anniversary of the effective date, (ii) when terminated by mutual agreement of the parties, or (iii) when terminated as set forth in Section VIII or Section X.E of the Economic Development Agreement.

The foregoing description of the terms of the Economic Development Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the Economic Development Agreement, which is filed as Exhibit 6.30 to this Special Report on Form 1-SA and is incorporated herein by reference.

On October 29, 2024, we, our indirect wholly owned subsidiary, Starfighters, Inc. (the "SFI") and Space Florida, an independent special district, a body politic and corporate, and a subdivision of the State of Florida (the "Space Florida") entered into an Amendment to Loan and Security Agreements (the "Amendment to Loan and Security Agreements") effective November 1, 2024 (the "Effective Date"), to among other things:

(i) confirm that SFI and/or Space Florida previously executed and delivered the following loan documents: (a) Loan Agreement 12-096 dated February 16, 2012 (the "Loan Agreement"), (b) Security Agreement dated February 16, 2012, by SFI in favor of Space Florida (the "Security Agreement"), and (c) a Promissory Note dated February 16, 2012, made by SFI in favor of Space Florida in the principal amount of $1,436,000.63 (the "Promissory Note", and together with the Loan Agreement and the Security Agreement, the "Loan Documents"; the borrowing under the Loan Documents, as amended by the Amendment to Loan and Security Agreements, being referred to as the "Loan");

(ii) confirm that the Loan was originally made by Space Florida to SFI to purchase equipment used in SFI's business and that the Loan is secured by a first-priority security interest in the personal property described in Exhibit A to the Amendment to Loan and Security Agreement (the "Collateral"), which is owned by SFI free and clear of all other security interests or liens;

(iii) confirm that on or about September 16, 2022 (the "Rate Adjustment Date"), SFI and Space Florida agreed to make the Loan subject to a new interest rate of three percent (3%) per annum (the "Adjusted Rate") and began to accrue the interest on the Loan in accordance with the Adjusted Rate beginning on the Rate Adjustment Date, but did not memorialize the Adjusted Rate in writing;

(iv) confirm that the Adjusted Rate has been in effect as of the Rate Adjustment Date, and that the outstanding principal amount of the Loan, together with the accrued and unpaid interest thereon, is $1,512,627.17 as of the Effective Date; and

(v) memorialize the parties' agreement that, in full and final settlement of the aggregate principal amount of the Loan outstanding plus all accrued and unpaid interest outstanding (the "Conversion Amount"), will convert into shares of common stock of the Company ("Conversion Shares") on the date the Company completes a public listing on any national securities exchange registered under Section 6 of the United States Securities Exchange Act of 1934, as amended, which includes The Nasdaq Stock Market (a "Public Listing").

The Amendment to Loan and Security Agreements contemplates that the Conversion Amount will convert at (a) the price per security of the Company's initial public offering, (i) the deemed share price at which any other transaction involving the Company is effected, including without limitation, a merger, business combination, amalgamation arrangement, share exchange, reverse-takeover, capital pool transaction, or any similar transaction resulting in the shares, a derivative of the shares or common shares of another issuer exchanged therefor being listed on a national securities exchange in the United States, or (c) the reference price per share calculated in accordance with the policies of the applicable national securities exchange in the event the Company completes a direct public listing.

Space Florida has agreed that, upon the issuance of the Conversion Shares:

(i) all payment and other obligations of SFI to Space Florida under or in connection with the Loan Documents shall be satisfied in full and be terminated and Space Florida shall have no further obligation to extend further credit to SFI under or in connection with the Loan Documents;

(ii) Space Florida's security interests in, and other liens, charges, caveats or other encumbrances of any kind or character whatsoever on the Collateral, and any and all real or personal property, assets or undertaking of SFI granted under or in connection with the Loan Documents (collectively, the "Discharged Security Interests"), shall be immediately released;

(iii) Space Florida will (A) execute and deliver to SFI or as SFI may request, as soon as practicable, but in no event prior to the receipt of a certificate from the Company evidencing the Conversion Shares, registrable discharges and releases or similar instruments of the Discharged Security Interests, provided that all the foregoing shall be prepared at the cost of SFI, and (B) return to SFI or as SFI may direct, any and all assets or properties of SFI in its possession, in each case to effect the discharge and release of the Discharged Security Interests;

(iv) without limiting Space Florida's obligation to execute and the deliver discharges set out in paragraph (iii) immediately above, upon Space Florida's receipt of the certificates evidencing the Conversion Shares, Space Florida or any agent on its behalf, shall prepare, execute and file registrable discharges and releases of any and all security interests or any financing statement or notice in respect thereof representing the Discharged Security Interests; and

(v) the Loan Documents shall be terminated, cancelled and of no further force and effect.

The foregoing description of the Amendment to Loan and Security Agreements does not purport to be complete and is subject to, and qualified in its entirety by reference to the Amendment to Loan and Security Agreements, which was filed as Exhibit 6.1 to our Current Report on Form 1-U filed with the SEC on October 30, 2024, and is incorporated herein by reference.

On October 31, 2024, our wholly owned subsidiary, Starfighters International, Inc. ("Starfighters International") entered into an aircraft acquisition agreement (the "Aircraft Agreement") with Aerovision LLC, a Florida limited liability company ("Aerovision"), pursuant to which Starfighters International agreed to purchase from Aerovision various used aircraft and associated spare equipment (the "Aircraft Transactions") in phases. The Aircraft Agreement contemplates that each Aircraft Transaction will be completed pursuant to a definitive agreement (each, a "Definitive Agreement") to be settled between the parties, in each case with a corresponding bill of sale and associated closing documents. The Aircraft Agreement provides that it, and any Definitive Agreement entered into by the parties, may be amended and/or extended in writing by the parties on a case-by-case basis.

The subject aircraft for acquisition pursuant to the Aircraft Agreement are: (i) twelve F-4 Phantom II aircraft, (ii) one MD-83 with U.S. Federal Aviation Administration ("FAA") Registration N572AA, and (iii) one DC-9 with FAA Registration N932NA. The subject aircraft are used-serviceable surplus aircraft offered on an "as-is-where-is" basis, with no warranty express or implied. The twelve F-4 Phantom II aircraft have recently been decommissioned by the Republic of Korea Air Force, and will have to be registered with the FAA after they are imported into the United States from South Korea.

The Aircraft Agreement requires an initial deposit advance in the amount of $5,000,000.00 to be made no later than ten business days from the signing of the Aircraft Agreement, which has been paid from funds received from the Company's Regulation A Tier 2 Offering. The payment of the deposit is considered to constitute "Phase 1" under the Aircraft Agreement.

Phase 2 will involve the payment of an additional $5,000,000.00 for the acquisition of eight of the twelve F-4 Phantom II aircraft. Such payment is due no later than December 15, 2024.

Phase 3 will involve the payment of an additional $5,000,000.00 for the acquisition of the final four F-4 Phantom II aircraft. Such payment is due no later than March 15, 2025.

Phase 4 shall involve the payment of an additional $5,000,000.00 for the acquisition of the MD-83 aircraft with FAA Registration N572AA, and the DC-9 aircraft with FAA Registration N932NA. The parties are to use their reasonable best efforts to complete Phase 4 by April 15, 2025.

The foregoing description of the terms of the Aircraft Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the Aircraft Agreement, which was filed as Exhibit 6.1 to our Current Report on Form 1-U filed on November 4, 2024, and is incorporated herein by reference.

On October 23, 2024, November 11, 2024 and November 29, 2024, we conducted closings of our offering under Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offerings, pursuant to which we sold an aggregate of 2,457,510 shares of common stock at a price of $3.59 per share, for gross proceeds of $8,822,461.

Results of Operations

Comparison of the Six Months Ended June 30, 2024 and 2023

The following table sets forth key components of our results of operations during the six months ended June 30, 2024 and 2023.

| | | Six months ended

June 30, | |

| | | 2024 | | | 2023 | |

| | | | | | | |

| Operating expenses | | | | | | |

| Advertising and promotion | $ | 98,915 | | $ | 55,569 | |

| Bank and interest charges | | 1,304 | | | 691 | |

| Business development | | 180,000 | | | 180,000 | |

| Consulting fees | | 434,400 | | | 396,750 | |

| Contract labor and fuel | | 181,700 | | | 232,520 | |

| Custom fees | | - | | | 6,416 | |

| Depreciation | | 3,683 | | | 6,138 | |

| Directors fees | | 80,000 | | | 84,000 | |

| Filing fees | | 15,404 | | | - | |

| Insurance | | 43,872 | | | 36,817 | |

| Licenses | | 370 | | | 501 | |

| Management fees | | 111,000 | | | 111,000 | |

| Office and administrative | | 85,716 | | | 56,395 | |

| Professional fees | | 489,955 | | | 146,879 | |

| Rent expense | | 141,466 | | | 93,542 | |

| Repairs and maintenance | | 41,967 | | | 70,472 | |

| Travel and entertainment | | 96,366 | | | 229,454 | |

| Vehicle | | 28,939 | | | 376 | |

| Total operating expenses | | (2,035,057 | ) | | (1,707,520 | ) |

| | | | | | | |

| Other income (expense) | | | | | | |

| Amortization of debt discount | | (757,152 | ) | | (220,206 | ) |

| Change in fair value of derivative liability | | (1,743,378 | ) | | (22,114 | ) |

| Other income | | - | | | 199,980 | |

| Interest expense | | (314,951 | ) | | (97,836 | ) |

| Interest income | | 19,084 | | | 20,017 | |

| Exchange loss | | (22 | ) | | (2,847 | ) |

| Total other income (expense) | | (2,796,419 | ) | | (123,006 | ) |

| | | | | | | |

| Net loss | $ | (4,831,476 | ) | $ | (1,830,526 | ) |

Revenue

During the six months ended June 30, 2024 and 2023, the Company reported $0 revenues from operations and other income of $0 and $199,980, respectively.

Operating Expenses

Our total operating expenses for the six months ended June 30, 2024 and 2023 were $2,035,057 and $1,707,520, respectively. The change in operating expenses is explained by the following:

Advertising and promotion

During the six months ended June 30, 2024, the Company incurred advertising and promotional expenses of $98,915 compared to $55,569 for the six months ended June 30, 2023, an increase of $43,346 year over year. The increase is mainly due to the Company embarking on a public relations campaign to raise awareness about its brand and business in light of the Company's plans to go public.

Business development

During the six months ended June 30, 2024, the Company incurred business development expenses of $180,000 compared to $180,000 for the six months ended June 30, 2023, which is consistent year over year.

Consulting fees

During the six months ended June 30, 2024, the Company incurred consulting fees of $434,400 compared to $396,750 for the six months ended June 30, 2023, which is relatively consistent year over year, as the Company continues to incur expenses to facilitate the Company's go public plans.

Directors' fees

During the six months ended June 30, 2024, the Company incurred directors' fees of $80,000 compared to $84,000 for the six months ended June 30, 2023, which is relatively consistent year over year.

Filing fees

During the six months ended June 30, 2024, the Company incurred filing fees of $15,404 compared to $0 for the six months ended June 30, 2023. The increase is due to fees incurred relating to the Company's go public process in 2024.

Insurance

During six months ended June 30, 2024, the Company incurred insurance expense of $43,872 compared to $36,817 for the six months ended June 30, 2023, which is relatively consistent year over year.

Management fees

Management fees for the six months ended June 30, 2024 was $111,000 compared to $111,000 for the six months ended June 30, 2023. Management fees consist of monthly management fees paid to the Company's CEO for overseeing the day to day operations.

Office and administrative

During the six months ended June 30, 2024, the Company incurred office and administrative expenses of $85,716 compared to $56,395 for the six months ended June 30, 2023, an increase of $29,321 year over year. The increase in administrative expenses is correlated to the additional administrative work required to facilitate the Company's go public process and financings undertaken in 2024.

Professional fees

During the six months ended June 30, 2024, the Company incurred professional fees of $489,955 compared to $146,879 for the six months ended June 30, 2023, an increase of $343,076 year over year. The year over year increase relates to additional legal and accounting fees incurred for audit services, as the well as to facilitate the Company's go public plans and financings undertaken in 2024.

Rent expense

During the six months ended June 30, 2024, the Company incurred rent expense of $141,466 compared to $93,542 for the six months ended June 30, 2023, an increase of $47,924 year over year. The Company entered into a short-term lease starting fiscal 2024 for an office space, which contributed to the increase year over year.

Repairs and maintenance

During the six months ended June 30, 2024, the Company incurred repair and maintenance expenses of $41,967 compared to $70,472 for the six months ended June 30, 2024, which is driven by the timing differences in repair and maintenance cycles of the Company's equipment.

Other income

The changes in other income are explained by the following:

Amortization of debt discount

During the six months ended June 30, 2024, the Company recognized amortization of the discount on its convertible debt was $757,152, compared to $220,206 for the six months ended June 30, 2023. The discount on the convertible debt relates to the fair value of the conversion option, which is bifurcated, and the transaction costs incurred for the financing and is amortized over the term of the convertible debt. The increase year over year is due to additional tranches of the convertible debt being closed since June 30, 2023.

Change in fair value of derivative liability

During the six months ended June 30, 2024, the Company recorded a change in the fair value of its derivative liability of $1,743,378, compared to $22,114 for the six months ended June 30, 2023. The derivative liability results from the conversion option on the Company's convertible debt which has been bifurcated as the number of shares to be issued upon conversion may vary.

Other income

During the six months ended June 30, 2024, the Company earned other income of $0 compared to $199,980 for the six months ended June 30, 2023, a decrease of $199,980 year over year. Other income consists of ancillary income earned for providing pilot training and equipment testing services.

Interest expense

During the six months ended June 30, 2024, the Company incurred interest expenses of $314,951 compared to $97,836 for the six months ended June 30, 2023, an increase of $217,115 year over year. The increase year over year is due to additional tranches of convertible debt being in issue during the six months ended June 30, 2024, at five tranches, compared to only one tranche in issue during the six months ended June 30, 2023.

Interest income

During the six months ended June 30, 2024, the Company earned interest income of $19,084 compared to $20,017 for the six months ended June 30, 2024, which are relatively consistent year over year.

Net Loss

During the six months ended June 30, 2024, the Company incurred a net loss of $4,831,476 compared to net loss of $1,830,526 for the six months ended June 30, 2023. An analysis of the increase in net loss of $3,000,950 including the major components of our results for the periods, is as set forth above.

Liquidity and Capital Resources

Working Capital

As of June 30, 2024, the Company had a working capital deficit of $14,056,959, and cash of $425,928. As of June 30, 2024, other current assets consisted of short-term investments of $292,779, prepaid expenses of $152,666 and $4,074 due from related parties. As of December 31, 2023, the Company had a working capital deficit of $679,291, and cash of $1,694,109. As of December 31, 2023, other current assets consisted of short-term investments of $288,110, prepaid expenses of $154,440 and $4,074 due from related parties.

The Company is dependent on the equity and debt markets as its primary source of operating working capital. There can be no assurance that financing, whether debt or equity, will be available to the Company in the amount required at the time required, or, if available, that it can be obtained on acceptable terms.

Cash Flow used in operating activities

For the six months ended June 30, 2024, the Company used $1,682,751 in cash with respect to its operating activities as compared to $1,441,051 in cash used in operating activities for the six months ended June 30, 2023. The increase in cash used in operating activities of $241,700 for the six months ended June 30, 2024 compared to the six months ended June 30, 2023 was primarily due to an increase in the net loss of $4,831,476 (June 30, 2023: $1,830,526), an increase in amortization of debt discount of $757,152 (June 30, 2023: $220,206), and increase in change in fair value of derivative liability of $1,743,378 (June 30, 2023: $22,114), an increase in accrued interest of $306,017 (June 30, 2023: $82,676), an increase in accounts payable and accrued liabilities of $291,961 (June 30, 2023: ($108,135)); offset by a decrease in accounts receivable of $0 (June 30, 2023: $90,000), a decrease in deferred income of $47,900 (June 30, 2023: $186,900), and a decrease in prepaid expenses of $1,774 (June 30, 2023: ($96,134)).

Cash Flow used in investing activities

For the six months ended June 30, 2024, the Company used $50,000 in investing activities for additions to long-term deposits as compared to $778,276 in the six months ended June 30, 2023 of which $500,000 was used for additions to long-term deposits and $278,276 was used for purchase of short-term investments.

Cash Flow provided by financing activities

During the six months ended June 30, 2024, net cash provided by financing activities was $464,570 compared to $2,535,783 during the six months ended June 30, 2023. The decrease was mainly due to a decrease in proceeds from debentures not yet issued of $28,120 (June 30, 2023: $609,805), a decrease in proceeds from convertible debentures of $501,400 (June 30, 2023: $2,131,060), and a decrease in debt issuance costs of $19,950 (June 30, 2023: $70,082).

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Subsequent Events

On August 14, 2024, the Company closed the sixth tranche ("Tranche 6") of the secured convertible debenture financing, which was not closed as of June 30, 2024. The gross proceeds from Tranche 6 was $242,000.

The convertible debentures bear interest at a rate of 5.00% per annum, have a maturity date of February 24, 2025, and automatically convert upon the event of an initial public offering ("IPO") at the lesser of a 40% discount of the price of the IPO, or $4.00 per share.

As more fully explained above under "Recent Developments" in this Item 1, on October 7, 2024, but having an effective date of September 24, 2024, the Company entered into an economic development agreement with MDC, in which MDC will allow for the expansion of the Company's business operations to the Midland International Air & Space Port in Midland, Texas. In consideration for this, the Company has agreed to employ Midland residents and relocate at least $78,000,000 in capital assets and equipment to the Midland International Air & Space Port by December 31, 2027.

On October 23, 2024, November 11, 2024 and November 29, 2024, we conducted closings of our offering under Regulation A of Section 3(b) of the Securities Act of 1933, as amended (the "Securities Act"), for Tier 2 offerings, pursuant to which we sold 1,084,400 shares, 810,413 shares and 562,697 shares at a price of $3.59 per share for gross proceeds of $3,892,996, $2,909,382.67 and $2,020,082.23, respectively.

In connection with the three closings of our offering under Regulation A of Section 3(b) of the Securities Act for Tier 2 offerings, we issued agent's warrants to Digital Offering LLC on each of October 23, 2024, November 11, 2024 and November 29, 2024 in the amounts of 10,844 agent's warrants, 8,104 agent's warrants and 5,626 agent's warrants, respectively. Each agent's warrant is exercisable into one share of common stock of the Company at an exercise price of $3.59 per share until September 6, 2029.

As more fully explained above under "Recent Developments" in this Item 1, on October 29, 2024, the Company, SFI and Space Florida entered into the Amendment to Loan and Security Agreements, effective November 1, 2024, whereby the parties agreed among other things, that all outstanding principal and accrued but unpaid interest would be converted into shares of the Company on the date that the Company completes a public listing on any national securities exchange at:

(a) the price per security of the Company's initial public offering;

(b) the deemed share price at which any other transaction involving the Company is effected, including without limitation, a merger, business combination, amalgamation arrangement, share exchange, reverse-takeover, capital pool transaction, or any similar transaction resulting in the shares, a derivative of the shares or common shares of another issuer exchanged therefor being listed on a national securities exchange in the United States; or

(c) the reference share price per share calculated in accordance with the policies of the applicable national securities exchange in the event the Company completes a direct public listing.

As more fully explained above under "Recent Developments" in this Item 1, on October 31, 2024, our subsidiary, Starfighters International, entered into the Aircraft Agreement with Aerovision LLC, pursuant to which Starfighters International agreed to purchase from Aerovision various used aircraft and associated spare equipment in phases. The subject aircraft for acquisition pursuant to the Aircraft Agreement are: (i) twelve F-4 Phantom II aircraft, (ii) one MD-83 with U.S. Federal Aviation Administration ("FAA") Registration N572AA, and (iii) one DC-9 with FAA Registration N932NA. An initial advance deposit of $5,000,000 (Phase 1) was required to be paid no later than ten business days from signing the Aircraft Agreement, which has been paid. Phase 2 involves the payment of an additional $5,000,000 by December 15, 2024, for the acquisition of eight of the twelve F-4 Phantom II aircraft. Phase 3 involves the payment of an additional $5,000,000 by March 15, 2025, for the acquisition of the remaining four F-4 Phantom II aircraft. Phase 4 involves the payment of an additional $5,000,000 for the acquisition of the MD-83 aircraft and the DC-9 aircraft.

Going Concern

These financial statements have been prepared on a going concern basis, which assumes that the Company will be able to meet its obligations and continue its operations for the next twelve months. The Company expects to incur further losses in the development of the business. These factors indicate the existence of material uncertainties that raise substantial doubt upon the Company's ability to continue as a going concern. As a result, the Company may be unable to realize its assets and discharge its liabilities in the normal course of business. The Company's ability to continue as a going concern is dependent on its ability to obtain necessary financing to meet its operating expenditures and discharge its liabilities in the normal course of business. Although the Company has been successful in obtaining financing during the six months ended June 30, 2024, there can be no assurance that the Company will be able to obtain adequate financing in the future or that such financing will be on terms advantageous to the Company.

Critical Accounting Policies

Our unaudited condensed consolidated interim financial statements are prepared in accordance with generally accepted accounting principles in the U.S. The preparation of our unaudited condensed consolidated interim financial statements and related disclosures requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, costs and expenses, and the disclosure of contingent assets and liabilities in our unaudited condensed consolidated interim financial statements. We base our estimates on historical experience, known trends and events and various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. We evaluate our estimates and assumptions on an ongoing basis. Our actual results may differ from these estimates under different assumptions or conditions.

While our significant accounting policies are described in more detail in the notes to our unaudited condensed consolidated interim financial statements, we believe that the following accounting policies are those most critical to the judgments and estimates used in the preparation of our consolidated financial statements.

Derivative Liabilities

The Company evaluates its financial instruments and other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for in accordance with ASC 815. The result of this accounting treatment is that the fair value of the embedded derivative is marked-to-market at each balance sheet date and recorded as a liability and the change in fair value is recorded in the consolidated statements of operations. Upon conversion or exercise of a derivative instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity.

The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is reassessed at the end of each reporting period. Derivative instruments that become subject to reclassification are reclassified at the fair value of the instrument on the reclassification date. Derivative instrument liabilities will be classified in the balance sheet as current or non-current based on whether or not settlement of the derivative instrument is expected within 12 months of the balance sheet date.

The Company uses the Monte Carlo simulation model to value derivative liabilities. This model uses Level 3 inputs in the fair value hierarchy established by ASC 820, Fair Value Measurement.

Item 2. Other Information

We have no information to disclose that was required to be in a Current Report on Form 1-U during the semiannual period covered by this Special Report on Form 1-SA, but was not reported.

Item 3. Financial Statements

INDEX TO UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS FOR STARFIGHTERS SPACE, INC.

STARFIGHTERS SPACE, INC.

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED JUNE 30, 2024 AND 2023

(Unaudited - Stated in United States dollars)

STARFIGHTERS SPACE, INC.

CONDENSED CONSOLIDATED INTERIM BALANCE SHEETS

| | | June 30, 2024

(unaudited) | | | December 31, 2023

(audited) | |

| Assets | | | | | | |

| | | | | | | |

| Current assets | | | | | | |

| Cash | $ | 425,928 | | $ | 1,694,109 | |

| Short-term investments | | 292,779 | | | 288,110 | |

| Due from related parties | | 4,074 | | | 4,074 | |

| Prepaid expenses | | 152,666 | | | 154,440 | |

| Total current assets | | 875,447 | | | 2,140,733 | |

| | | | | | | |

| Right of use assets - operating lease, net | | 282,426 | | | 319,715 | |

| Property, plant, and equipment, net | | 94,258 | | | 18,412 | |

| Long-term deposits | | 1,123,003 | | | 1,152,532 | |

| Total assets | $ | 2,375,134 | | $ | 3,631,392 | |

| | | | | | | |

| Liabilities and Stockholders' Deficit | | | | | | |

| | | | | | | |

| Current liabilities | | | | | | |

| Accounts payable and accrued liabilities | $ | 768,523 | | $ | 476,562 | |

| Deferred income | | 444,900 | | | 397,000 | |

| Derivative liability | | 4,457,616 | | | - | |

| Lease liability | | 83,466 | | | 75,801 | |

| Interest payable | | 117,439 | | | 59,929 | |

| Convertible debentures not yet issued | | 28,120 | | | - | |

| Convertible debentures, net | | 5,966,141 | | | - | |

| Notes payable | | 1,436,001 | | | 135,532 | |

| Related party notes payable | | 1,630,200 | | | 1,675,200 | |

| Total current liabilities | | 14,932,406 | | | 2,820,024 | |

| | | | | | | |

| Notes payable | | - | | | 1,300,469 | |

| Convertible debentures, net | | - | | | 4,776,407 | |

| Derivative liability | | - | | | 2,416,863 | |

| Lease liability - non-current | | 210,492 | | | 253,917 | |

| Total liabilities | $ | 15,142,898 | | $ | 11,567,680 | |

| | | | | | | |

| Commitments and contingencies - see Note 11 | | | | | | |

| | | | | | | |

| Stockholders' Deficit | | | | | | |

| Common stock, $0.00001 par value, 200,000,000 shares authorized; 16,720,200 issued and outstanding as of June 30, 2024, and December 31, 2023 | | 167 | | | 167 | |

| Additional paid-in-capital | | 1,041,583 | | | 1,041,583 | |

| Accumulated deficit | | (13,809,514 | ) | | (8,978,038 | ) |

| Total stockholders' deficit | | (12,767,764 | ) | | (7,936,288 | ) |

| Total liabilities and stockholders' deficit | $ | 2,375,134 | | $ | 3,631,392 | |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements

STARFIGHTERS SPACE, INC.

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS

| | | Six months ended

June 30, | |

| | | 2024 | | | 2023 | |

| | | | | | | |

| Operating expenses | | | | | | |

| Advertising and promotion | $ | 98,915 | | $ | 55,569 | |

| Bank and interest charges | | 1,304 | | | 691 | |

| Business development | | 180,000 | | | 180,000 | |

| Consulting fees | | 434,400 | | | 396,750 | |

| Contract labor and fuel | | 181,700 | | | 232,520 | |

| Custom fees | | - | | | 6,416 | |

| Depreciation | | 3,683 | | | 6,138 | |

| Directors fees | | 80,000 | | | 84,000 | |

| Filing fees | | 15,404 | | | - | |

| Insurance | | 43,872 | | | 36,817 | |

| Licenses | | 370 | | | 501 | |

| Management fees | | 111,000 | | | 111,000 | |

| Office and administrative | | 85,716 | | | 56,395 | |

| Professional fees | | 489,955 | | | 146,879 | |

| Rent expense | | 141,466 | | | 93,542 | |

| Repairs and maintenance | | 41,967 | | | 70,472 | |

| Travel and entertainment | | 96,366 | | | 229,454 | |

| Vehicle | | 28,939 | | | 376 | |

| Total operating expenses | | (2,035,057 | ) | | (1,707,520 | ) |

| | | | | | | |

| Other income (expense) | | | | | | |

| Amortization of debt discount | | (757,152 | ) | | (220,206 | ) |

| Change in fair value of derivative liability | | (1,743,378 | ) | | (22,114 | ) |

| Other income | | - | | | 199,980 | |

| Interest expense | | (314,951 | ) | | (97,836 | ) |

| Interest income | | 19,084 | | | 20,017 | |

| Exchange loss | | (22 | ) | | (2,847 | ) |

| Total other income (expense) | | (2,796,419 | ) | | (123,006 | ) |

| | | | | | | |

| Net loss | $ | (4,831,476 | ) | $ | (1,830,526 | ) |

| | | | | | | |

| Weighted average number of shares - Basic and diluted | | 16,720,200 | | | 16,720,200 | |

| | | | | | | |

| Loss per share - Basic and diluted | $ | (0.29 | ) | $ | (0.11 | ) |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements

STARFIGHTERS SPACE, INC.

UNAUDITED CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN STOCKHOLDERS' DEFICIT

| | | Common Stock | | | | | | | | | | |

| | | Number of

Shares | | | Amount | | | Additional

Paid-In-

Capital | | | Deficit | | | Total

Stockholders'

Deficit | |

| Balance, January 1, 2023 | | 16,720,200 | | $ | 167 | | $ | 1,010,083 | | $ | (4,296,455 | ) | $ | (3,286,205 | ) |

| Net loss | | - | | | - | | | - | | | (1,830,526 | ) | | (1,830,526 | ) |

| Balance, June 30, 2023 | | 16,720,200 | | | 167 | | $ | 1,010,083 | | | (6,126,981 | ) | | (5,116,731 | ) |

| | | | | | | | | | | | | | | | |

| Balance, January 1, 2024 | | 16,720,200 | | | 167 | | | 1,041,583 | | | (8,978,038 | ) | | (7,936,288 | ) |

| Net loss | | - | | | - | | | - | | | (4,831,476 | ) | | (4,831,476 | ) |

| Balance, June 30, 2024 | | 16,720,200 | | $ | 167 | | $ | 1,041,583 | | $ | (13,809,514 | ) | $ | (12,767,764 | ) |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements

STARFIGHTERS SPACE, INC.

UNAUDITED CONSENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

| | | Six months ended June 30, | |

| | | 2024 | | | 2023 | |

| | | | | | | |

| Cash flows from operating activities | | | | | | |

| Net loss | $ | (4,831,476 | ) | $ | (1,830,526 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | |

| Depreciation | | 3,683 | | | 6,138 | |

| Amortization of ROU asset | | 37,289 | | | 31,876 | |

| Unrealized gain on short-term investment | | (4,669 | ) | | - | |

| Amortization of debt discount | | 757,152 | | | 220,206 | |

| Change in fair value of derivative liability | | 1,743,378 | | | 22,114 | |

| | | | | | | |

| Changes in operating assets and liabilities: | | | | | | |

| Accrued interest | | 306,017 | | | 82,676 | |

| Accounts receivable | | - | | | 90,000 | |

| Accounts payable and accrued liabilities | | 291,961 | | | (108,135 | ) |

| Due to related parties | | - | | | (1,640 | ) |

| Deferred income | | 47,900 | | | 186,900 | |

| Prepaid expenses | | 1,774 | | | (96,134 | ) |

| Lease liability | | (35,760 | ) | | (44,526 | ) |

| Net cash from operating activities | | (1,682,751 | ) | | (1,441,051 | ) |

| | | | | | | |

| Cash flows from investing activities | | | | | | |

| Additions to long-term deposits | | (50,000 | ) | | (500,000 | ) |

| Purchase of short-term investments | | - | | | (278,276 | ) |

| Net cash used in investing activities | | (50,000 | ) | | (778,276 | ) |

| | | | | | | |

| Cash flows from financing activities | | | | | | |

| Proceeds from debentures not yet issued | | 28,120 | | | 609,805 | |

| Repayment of related party loans | | (45,000 | ) | | (135,000 | ) |

| Proceeds from convertible debenture | | 501,400 | | | 2,131,060 | |

| Debt issuance costs | | (19,950 | ) | | (70,082 | ) |

| Net cash provided by financing activities | | 464,570 | | | 2,535,783 | |

| Increase (decrease) in cash | | (1,268,181 | ) | | 316,456 | |

| Cash, beginning of year | | 1,694,109 | | | 2,224,011 | |

| Cash, end of year | $ | 425,928 | | $ | 2,540,467 | |

| | | | | | | |

| Supplemental cash flow information | | | | | | |

| Income taxes paid | $ | - | | $ | - | |

| Interest paid | $ | 8,935 | | $ | 14,360 | |

| | | | | | | |

| Supplemental disclosure of non-cash investing and financing activities | | | | | | |

| Initial derivative liability from issuance of convertible notes | $ | 297,375 | | $ | 1,482,763 | |

The accompanying notes are an integral part of these unaudited condensed consolidated interim financial statements

1. NATURE OF OPERATIONS

Starfighters Space Inc. ("SFS" or the "Company") was incorporated on September 6, 2022, under the laws of the State of Delaware. The Company's registered office is held at 850 New Burton Road, Suite 201, Dover, DE 19904. The Company's principal operating facility is located in Cape Canaveral, Florida. The Company operates from the NASA Kennedy Space Center in Florida and has a fleet of seven F104 Fighter jets that are capable of flying MACH 2+. The Company is currently in the process of gaining a launch waiver and license for its first space launch to launch rockets carrying payloads for data testing from their jets into suborbital space. Upon successful suborbital space flight, the Company intends to develop infrastructure for orbital space launch.

On September 9, 2022, the Company entered into an equity exchange agreement (the "Equity Exchange Transaction") for the acquisition of Starfighters International, Inc. ("SFII") (Note 4). As part of the Equity Exchange Transaction, the Company and the sole owner of SFII agreed to exchange 100% interests in SFII for 100% ownership of the Company. As a result of the share exchange, Starfighters International Inc became a wholly-owned subsidiary of the Company. The combination met the criteria outlined in ASC 850 to be accounted for as a transaction between entities under common control and therefore the financial statements are being presented as if the transfer happened at the beginning of the period and prior year financial information has been retrospectively adjusted to furnish comparative information.

Risks and Uncertainties

Disruption of global financial markets and a recession or market correction, including the ongoing military conflicts between Russia and Ukraine and the related sanctions imposed against Russia as well as the conflict between Israel and Hamas, the ongoing effects of the COVID-19 pandemic, and other global macroeconomic factors such as inflation and rising interest rates, could reduce the Company's ability to access capital, which could in the future negatively affect the Company's liquidity and could materially affect the Company's business and the value of its common stock.

2. BASIS OF PRESENTATION

a) Basis of presentation

The accompanying unaudited condensed consolidated interim financial statements are presented in conformity with accounting principles generally accepted in the United States of America ("U.S. GAAP") for interim financial information and in accordance with the instructions to Form 10-Q and Article 8 of Regulation S-X of the SEC. Certain information or footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted, pursuant to the rules and regulations of the SEC for interim financial reporting. Accordingly, they do not include all the information and footnotes necessary for a complete presentation of financial position, results of operations, or cash flows. In the opinion of management, the accompanying unaudited condensed consolidated interim financial statements include all adjustments, consisting of a normal recurring nature, which are necessary for a fair presentation of the financial position, operating results and cash flows for the periods presented.

The accompanying unaudited condensed consolidated interim financial statements should be read in conjunction with the Company's audited financial statements and notes thereto as of and for the years ended December 31, 2023 and 2022 which report is dated April 15, 2024. The interim results for the six months ended June 30, 2024 are not necessarily indicative of the results to be expected for the year ending December 31, 2024 or for any future periods.

2. BASIS OF PRESENTATION (CONTINUED)

As of June 30, 2024, the Company's subsidiaries were:

Name of subsidiary | Place of incorporation | Incorporated | Ownership |

Starfighters International Inc. | Florida, the United States | March 3, 2018 | 100% |

Starfighters Inc. | Florida, the United States | November 16, 1995 | 100% |

Starfighters Space Texas, Incorporated | Texas, the United States | March 29, 2024 | 100% |

b) Going concern

The unaudited condensed consolidated interim financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. During the six months ended June 30, 2024 and 2023, the Company recorded a net loss of $4,831,476 and $1,830,526, respectively. As at June 30, 2024 and December 31, 2023, the Company has a deficit of $13,809,514 and $8,978,038 as of those dates, respectively.

These factors raise substantial doubt about the Company's ability to continue as a going concern within one year after the date of the unaudited condensed consolidated interim financial statements being issued. The ability of the Company to continue as a going concern is dependent upon the Company's ability to raise additional funds and implement its business plan. The unaudited condensed consolidated interim financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. Such adjustments could be material.

As of June 30, 2024, the Company had cash in the amount of $425,928. The continuation of the Company as a going concern is dependent upon its ability to obtain necessary debt or equity financing to continue operations until it begins generating positive cash flow. No assurance can be given that any future financing will be available or, if available, that it will be on terms that are satisfactory to the Company. Even if the Company is able to obtain additional financing, it may contain undue restrictions on our operations, in the case of debt financing, or cause substantial dilution for our stockholders, in the case or equity financing.

c) Functional and presentation currencies

The unaudited condensed consolidated interim financial statements of the Company are presented in United States dollars. The functional currency of the Company and its subsidiaries is the United States dollar.

d) Emerging growth company

The Company is an "Emerging Growth Company", as defined in Section 2(a) of the Securities Act of 1933, as amended (the "Securities Act"), as modified by the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), and it has taken advantage of certain exemptions that are not applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the independent registered public accounting firm attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

2. BASIS OF PRESENTATION (CONTINUED)

Further, Section 102(b) (1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial reporting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable.

The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public and private companies, the Company, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard.

e) Use of estimates

The preparation of these unaudited condensed consolidated interim financial statements in conformity with US GAAP requires the Company's management to make judgments, estimates and assumptions about future events that the amounts reported in the unaudited condensed consolidated interim financial statements. Actual results may differ from these estimates.

3. SIGNIFICANT ACCOUNTING POLICIES

The significant accounting policies applied in the preparation of these unaudited condensed consolidated interim financial statements are consistent with the accounting policies disclosed in the Company's audited consolidated financial statements for the year ended December 31, 2023.

4. PROPERTY, PLANT, AND EQUIPMENT

Property, plant, and equipment consist of the following:

| | | June 30,

2024 | | | December 31,

2023 | |

| Vehicles | $ | 51,149 | | $ | 51,149 | |

| Aircraft improvements | | 79,529 | | | - | |

| | | 130,678 | | | 51,149 | |

| | | | | | | |

| Accumulated depreciation | | (36,420 | ) | | (32,737 | ) |

| Net book value | $ | 94,258 | | $ | 18,412 | |

Depreciation expense for the six months ended June 30, 2024 and 2023, was $3,683 and $6,138, respectively. As of June 30, 2024, the aircraft improvements are not yet place in service.

5. NOTES PAYABLE

On February 16, 2012, the Company secured a loan with Space Florida in the amount of $1,436,001, maturing September 16, 2022. The loan bears interest at 1.00% per annum, no payments are due on the loan for 12 months from the date of first disbursement of the loan and interest-only payments are applicable over the next 114 months. On September 16, 2022, the Company and Space Florida amended the agreement to extend the maturity date to November 1, 2033 and to increase the interest rate to 3.00% per annum and 8.00% per annum in the event of default. Additionally, starting December 1, 2023 the Company is to make monthly installments of $13,866. The loan is secured by a DASH-7 aircraft engine with a book value of $0.

5. NOTES PAYABLE (CONTINUED)

As of June 30, 2024 and December 31, 2023, the principal balance of $1,436,001 and $1,436,001, respectively and accrued interest of $117,439 and $59,929, respectively, was outstanding for this loan. Interest expense was $66,445 and $21,660 for the six months ended June 30, 2024 and 2023, respectively. As of June 30, 2024, the Company has not made any of the required principal payments on this loan. As a result, the loan is in default and is due on demand and therefore is included in current liabilities on the condensed balance sheet.

6. CONVERTIBLE DEBENTURES TO BE ISSUED

Starting November 2022, the Company entered into a secured convertible debenture financing for gross proceeds up to $8,000,000 (Note 7). The convertible debentures shall bear interest at 5.00% per annum and shall mature on February 24, 2025, being 2 years following the closing date of the first tranche of the financing. There are no required monthly principal payments until maturity. Upon the IPO date, outstanding principal plus any accrued and unpaid interest will be automatically convertible into common shares of the Company at a conversion price equal to the lesser of:

a) a 40% discount at the price per security of the Company's initial public offering ("IPO") on the NASDAQ or other recognized stock exchange in the US; and

b) $4.00

Pursuant to terms of the subscription agreement, the Company reserves the right, in its absolute discretion, to reject any subscriptions related to the financing, in whole or in part, at any time prior to the closing date. Subscriptions received may be treated as an interest-free loan and use such proceeds from time to time in its discretion until the earlier of the closing date or the date that the Company rejects the subscription.

The Company closed four tranches of the financing during the year ended December 31, 2023. For the six months ended June 30, 2024, one tranche of the financing had closed while a second tranche had not closed with the Company receiving $28,120 in subscription proceeds related to this second tranche. As such, as of June 30, 2024, all related subscribed funds received have been recognized as interest-free loans which are due on demand. The second tranche closed subsequent to the six months ended June 30, 2024 (Note 12).

7. CONVERTIBLE DEBENTURES

As disclosed in Note 6, the convertible debentures bear interest at 5.00% per annum, have a maturity date of February 24, 2025, and automatically convert upon the event of an IPO at the lesser of a 40% discount of the price of the IPO and $4.00 per share.

During the six months ended June 30, 2024, the Company closed the secured convertible debenture financing (Note 6) as follows:

- Tranche 5, on May 14, 2024 for gross proceeds of $501,400

The convertible debentures were determined to be hybrid financial instruments comprised of a debt host liability and an embedded derivative liability, as under the conversion feature, the number of shares that will or may be issued to settle the debentures may vary. Upon issuance, the fair value of the debt host liability was determined to be $501,400 and the respective embedded derivative liability was valued at $297,375. The derivative liability conversion feature was valued first and the residual was allocated to the debt host liability. The Company uses the Monte Carlo model to determine the fair value of the embedded derivative liability based on a common stock simulation model and future projections of various potential outcomes. The Company incurred $19,950 in transaction costs. The fair value of the initial derivative and the transaction costs incurred were recorded as debt discount and are amortized over the life of the convertible notes using the effective interest method.

7. CONVERTIBLE DEBENTURE (CONTINUED)

During the year ended December 31, 2023, the Company closed the secured convertible debenture financing as follows:

- Tranche 1, on February 24, 2023 for gross proceeds of $4,413,400

- Tranche 2, on July 14, 2023 for gross proceeds of $804,100

- Tranche 3, on September 15, 2023 for gross proceeds of $448,000

- Tranche 4, on December 28, 2023 for gross proceeds of $680,500

The convertible debentures were determined to be hybrid financial instruments comprised of a debt host liability and an embedded derivative liability, as under the conversion feature the number of shares that will or may be issued to settle the notes may vary. Upon issuance, the fair value of the debt host liability was determined to be $6,346,000 and the respective embedded derivative liability was valued at $2,352,602. The derivative liability conversion feature was valued first and the residual was allocated to the debt host liability. The Company uses the Monte Carlo model to determine the fair value of the embedded derivative liability based on a common stock simulation model and future projections of various potential outcomes. The Company incurred $86,506 in transaction costs. The fair value of the initial derivative and the transaction costs incurred were recorded as debt discount and are amortized over the life of the convertible notes using the effective interest method.

Debt discount amortization during the six months ended June 30, 2024 and 2023 was $757,152 and $220,206, respectively. Unamortized debt discount as of June 30, 2024 and December 31, 2023 was $881,259 and $1,782,584, respectively. Interest expense on the convertible notes for the six months ended June 30, 2024 and 2023 was $248,506 and $76,176, respectively.

A summary of convertible debt as of and for the six months ended June 30, 2024, as of and for the year ended December 31, 2023 is as follows:

| | | Tranche 1 | | | Tranche 2 | | | Tranche 3 | | | Tranche 4 | | | Tranche 5 | | | Total | |

| As of December 31, 2022 | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| Issuances | | 4,413,400 | | | 804,100 | | | 448,000 | | | 680,500 | | | - | | | 6,346,000 | |

| Fair value of conversion feature | | (1,482,763 | ) | | (321,144 | ) | | (208,539 | ) | | (340,156 | ) | | - | | | (2,352,602 | ) |

| Transaction costs | | (70,882 | ) | | (11,730 | ) | | - | | | (3,885 | ) | | - | | | (86,506 | ) |

| Amortization of debt discount | | 570,553 | | | 61,803 | | | 23,068 | | | 1,100 | | | - | | | 656,524 | |

| Interest | | 187,418 | | | 18,726 | | | 6,567 | | | 280 | | | - | | | 212,991 | |

| As of December 31, 2023 | $ | 3,617,726 | | $ | 551,746 | | $ | 269,096 | | $ | 337,839 | | $ | - | | $ | 4,776,407 | |

| Issuances | | - | | | - | | | - | | | - | | | 501,400 | | | 501,400 | |

| Fair value of conversion feature | | - | | | - | | | - | | | - | | | (297,375 | ) | | (297,375 | ) |

| Transaction costs | | - | | | - | | | - | | | - | | | (19,950 | ) | | (19,950 | ) |

| Amortization of debt discount | | 409,357 | | | 117,219 | | | 74,749 | | | 121,054 | | | 34,773 | | | 757,152 | |

| Interest | | 110,033 | | | 35,468 | | | 23,628 | | | 45,584 | | | 33,794 | | | 248,507 | |

| As of June 30, 2024 | $ | 4,137,116 | | $ | 704,433 | | $ | 367,473 | | $ | 504,477 | | $ | 252,642 | | $ | 5,966,141 | |

7. CONVERTIBLE DEBENTURE (CONTINUED)

A roll-forward of the derivative liability, which is categorized at Level 3 on the fair value hierarchy, for the year ended December 31, 2023 and six months ended June 30, 2024 is as follows:

| | | Derivative liabilities | |

| As of December 31, 2022 | $ | - | |

| Fair value of embedded derivative liability recognized | | 2,352,602 | |

| Change in fair value | | 64,261 | |

| As of December 31, 2023 | $ | 2,416,863 | |

| Fair value of embedded derivative liability recognized | | 297,375 | |

| Change in fair value | | 1,743,378 | |

| As of June 30, 2024 | $ | 4,457,616 | |

The key inputs used in the Monte Carlo model for the embedded conversion feature at initial measurement were as follows:

| | | Tranche 1 | | | Tranche 2 | | | Tranche 3 | | | Tranche 4 | | | Tranche 5 | |

| Risk-free interest rate | | 4.67% | | | 4.90% | | | 5.11% | | | 4.69% | | | 5.01% | |

| Expected term (years) | | 2.00 | | | 2.00 | | | 2.00 | | | 2.00 | | | 2.00 | |

| Expected volatility | | 74.6% | | | 74.2% | | | 75.8% | | | 75.9% | | | 69.3% | |

| Probability of an IPO | | 50.00% | | | 60.00% | | | 70.00% | | | 75.00% | | | 95.00% | |

| Stock price | $ | 0.5135 | | $ | 0.5477 | | $ | 0.5632 | | $ | 0.5886 | | $ | 2.0627 | |

The Company's use of a Monte Carlo simulation model required the use of the subjective assumptions:

- The stock price was determined from a 409a valuation;

- The volatility was derived from comparable public companies;

- For the early redemption option the Company estimated this at 0% for all valuation dates. The Company estimated this default at 0% for all valuation dates;

- The probability of a successful IPO occurring was based on management's best estimate;

- The conversion price is not subject to reset provisions for subsequent financing events.

The key inputs used in the Monte Carlo model for the embedded conversion feature at June 30, 2024 were as follows:

| | | Tranche 1 | | | Tranche 2 | | | Tranche 3 | | | Tranche 4 | | | Tranche 5 | |

| Risk-free interest rate | | 4.98% | | | 4.99% | | | 4.98% | | | 4.97% | | | 4.95% | |

| Expected term (years) | | 1.25 | | | 1.04 | | | 1.21 | | | 1.49 | | | 1.87 | |

| Expected volatility | | 84.3% | | | 79.3% | | | 77.6% | | | 74.8% | | | 71.1% | |

| Probability of an IPO | | 95.00% | | | 95.00% | | | 95.00% | | | 95.00% | | | 95.00% | |

| Stock price | $ | 2.5325 | | $ | 2.5325 | | $ | 2.5325 | | $ | 2.5325 | | $ | 2.5325 | |

The key inputs used in the Monte Carlo model for the embedded conversion feature at December 31, 2023 were as follows:

| | | Tranche 1 | | | Tranche 2 | | | Tranche 3 | | | Tranche 4 | |

| Risk-free interest rate | | 4.74% | | | 4.71% | | | 4.70% | | | 4.68% | |

| Expected term (years) | | 1.15 | | | 1.54 | | | 1.71 | | | 1.99 | |

| Expected volatility | | 72.0% | | | 71.8% | | | 71.8% | | | 71.7% | |

| Probability of an IPO | | 50.00% | | | 60.00% | | | 70.00% | | | 75.00% | |

| Stock price | $ | 0.5894 | | $ | 0.5894 | | $ | 0.5894 | | $ | 0.5894 | |

8. LEASES

On June 1, 2022, the Company entered into a one-year lease for hangar space. The lease agreement provided for four renewal terms of one year each. Management has determined that the renewals are likely to be utilized and the renewal terms are included in the calculation of the lease liability and right of use asset. In 2022, the Company recognized a right of use operating lease asset in the amount of $421,000 for this lease.

Lease liabilities are measured at the commencement date based on the present value of future lease payments. As the Company's lease did not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at the commencement date in determining the present value of future payments. The Company used a discount rate of 15.00% in determining its lease liabilities.

The discount is the rate of interest that the Company would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of comparable value to the right-of-use asset in a similar economic environment. The discount rate therefore reflects what the Company "would have to pay", which requires estimation when no observable rates are available or where the applicable rates need to be adjusted to reflect the terms and conditions of the lease. The Company estimates the discount using observable inputs (such as market interest rates) when available and is required to make certain entity-specific estimates. The Company determined its discount rated based on the rate used by comparable public companies.

The following table presents net lease cost and other supplemental lease information:

| | | June 30, 2024 | | | June 30, 2023 | |

| Lease cost: | | | | | | |

| Operating lease cost | $ | 60,789 | | $ | 31,877 | |

| Short term lease cost | | 53,045 | | | 20,497 | |

| Net lease cost | | 113,834 | | | 52,374 | |

| Cash paid for operating lease liabilities | $ | (35,760 | ) | $ | (44,526 | ) |

As of June 30, 2024 and December 31, 2023, the Company's lease liability is as follows:

| Lease liability | | June 30, 2024 | | | December 31,

2023 | |

| Current portion of operating lease liability | $ | 83,466 | | $ | 75,801 | |

| Long-term portion of operating lease liability | | 210,492 | | | 253,917 | |

| | $ | 293,958 | | $ | 329,718 | |

Future minimum lease payments to be paid by the Company as a lessee as of June 30, 2024 are as follows:

| Operating lease commitments and lease liability | | |

| 2024 (remaining) | | 60,736 | |

| 2025 | | 123,599 | |

| 2026 | | 127,307 | |

| 2027 | | 53,696 | |

| Total future minimum lease payments | | 365,338 | |

| Discount | | (71,380) | |

| Total | $ | 293,958 | |

The lease has a remaining term of 2.92 years.

9. STOCKHOLDERS' DEFICIT

a) Common stock

There was no common stock activity during the six months ended June 30, 2024.

There was no common stock activity during the year ended December 31, 2023.

b) Warrants

A summary of Common Stock warrant activity during the six months ended June 30, 2024 is as follows:

| | | Number of

warrants | | | Weighted

average

exercise

price | | | Weighted

average

remaining

contractual

life in years | | | Aggregate

intrinsic

value | |

| Outstanding, December 31, 2023 | | 18,150,000 | | $ | 0.33 | | | 4.00 | | $ | 4,708,110 | |

| Issued | | - | | | - | | | - | | | - | |

| Expired | | - | | | - | | | - | | | - | |

| Outstanding, June 30, 2024 | | 18,150,000 | | | 0.33 | | | 4.00 | | $ | 39,975,375 | |

| Exercisable, June 30, 2024 | | - | | | - | | | - | | | - | |

In September 2023, the Company issued 3,150,000 stand-alone warrants at a price of $0.01 for proceeds of $31,500. Each warrant entitles the holder to purchase one common share at a price of $0.33. The warrants become exercisable upon the earlier of the date of a successful initial public offering, a fundamental transaction or September 6, 2025, and will expire 4 years thereafter.

10. RELATED PARTY TRANSACTIONS

Due From Related Party

As of June 30, 2024 and December 31, 2023, $4,074 and $4,074, respectively, was due from related parties. The amounts are unsecured, non-interest bearing and due on demand.

Management Fees

During the six months ended June 30, 2024 and 2023, management fees of $111,000 and $111,000, respectively, were incurred to a Shareholder of the Company. As of June 30, 2024, and December 31, 2023, $111,000 and $18,500, respectively, of management fees were included in accounts payable and accrued liabilities.

Consulting Fees

During the six months ended June 30, 2024 and 2023, the Company incurred an expense of $25,000 and $20,000, respectively, of fees to a BOD member. As of June 30, 2024 and December 31, 2023, $0 and $0 of these fees were unpaid, respectively.

During the six months ended June 30, 2024 and 2023, the Company incurred an expense of $45,000 and $105,000, respectively, of fees to a Company for which a BOD member is part of senior management. As of June 30, 2024 and December 31, 2023, $7,500 and $0 of these fees were included in accounts payable and accrued liabilities, respectively.

10. RELATED PARTY TRANSACTIONS (CONTINUED)

During the six months ended June 30, 2024 and 2023, the Company incurred an expense of $24,000 and $28,000, respectively, of fees to an entity owned by the spouse of the Shareholder. As of June 30, 2024 and December 31, 2023, $20,000 and $4,000 of these fees were included in accounts payable and accrued expenses.

During the six months ended June 30, 2024 and 2023, the Company incurred an expense of $0 and $33,750, respectively, of fees to the former CFO (current at the time the expenses were incurred) of the Company. As of June 30, 2024 and December 31, 2023, $0 and $0 of these fees were unpaid, respectively.

Contract Labor

During the six months ended June 30, 2024 and 2023, the Company incurred expenses of $0 and $7,500, respectively, to an immediate family member of the Shareholder. As of June 30, 2024 and December 31, 2023, $0 and $0 of these fees were unpaid, respectively.

Director Fees

During the six months ended June 30, 2024 and 2023, directors fees of $80,000 and $84,000, respectively, were incurred to related parties. As of June 30, 2024 and December 31, 2023, $82,000 and $56,000, respectively, of directors fees were included in accounts payable and accrued liabilities.

Professional Fees

During the six months ended June 30, 2024 and 2023, the Company incurred professional fee expenses of $45,000 and $45,000, respectively, with the VP of Development. There were $7,500 owed to this related party as of June 30, 2024 and $0 owed at December 31, 2023.

During the six months ended June 30, 2024 and 2023, the Company incurred professional fee expenses of $51,000 and $0, respectively, to the CFO of the Company. There were no amounts owed to this related party as of June 30, 2024 and December 31, 2023.

Commitments and Contingencies

The Company entered into an agreement with a company owned 50% by the CEO and majority shareholder. The agreement is to buy jet engines. The purchase price of the jet engines is $2,200,000. As of June 30, 2024 and December 31, 2023, the Company had deposits recorded for this agreement of $800,000 and $750,000, respectively. These deposits are shown as long-term deposits on the condensed balance sheet. As of June 30, 2024, the agreement has not closed.

Notes Payable

On August 14, 2010, Company entered into a loan agreement with the Shareholder in the amount of $865,000. The loan bears no interest, with no terms of repayment and is due on demand. During the six months ended June 30, 2024 and year ended of December 31, 2023, repayments of $45,000 and $247,500, respectively, were made. As of June 30, 2024 and December 31, 2023, $190,050 and $235,050, respectively was outstanding for this loan.

On August 14, 2010, Company entered into a loan agreement with the Shareholder in the amount of $175,150. The loan bears no interest, with no terms of repayment, and is due on demand. As of June 30, 2024 and December 31, 2023, $175,150 was outstanding for this loan.

10. RELATED PARTY TRANSACTIONS (CONTINUED)