- USGO Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

U.S. GoldMining (USGO) S-1/AIPO registration (amended)

Filed: 13 Apr 23, 9:47pm

As filed with the U.S. Securities and Exchange Commission on April 13, 2023

Registration No. 333-269693

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 5

to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

U.S. GOLDMINING INC.

(Exact name of registrant as specified in its charter)

| Nevada | 1040 | 37-1792147 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

1030 West Georgia Street

Suite 1830

Vancouver, BC, Canada

V6E 2Y3

Tel.: (604) 388-9788

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Suite 200, Office 203

301 Calista Court

Anchorage, AK 99518

Tel.: (833) 388-9788

(Address, including zip code, and telephone number, including area code, of registrant’s head operating offices)

Tim Smith, CEO

Suite 200, Office 203

301 Calista Court

Anchorage, AK 99518

Tel.: (833) 388-9788

(Name, address, including zip code, and telephone number, including area code, of agent for service)

It is requested that copies of notices and communications from the Securities and Exchange Commission be sent to:

Rick A. Werner, Esq. Haynes and Boone, LLP 30 Rockefeller Plaza, 26th Floor New York, NY 10112 Tel.: (212) 659-7300 | Rod Talaifar, Esq. Sangra Moller LLP 1000 Cathedral Place 925 West Georgia Street Vancouver, BC, Canada V6C 3L2 Tel.: (604) 662-8808 | Robert F. Charron, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 Tel.: (212) 370-1300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION DATED APRIL 13, 2023 |

2,000,000 Units

Each Unit Consisting of One Share of Common Stock and

One Warrant to Purchase One Share of Common Stock

U.S. GOLDMINING INC.

This is the initial public offering of securities of U.S. GoldMining Inc., a Nevada corporation. We are offering 2,000,000 units, or “Units”, with each Unit consisting of (i) one share of our common stock, par value $0.001 per share and (ii) one warrant, or “Warrant”. Each Warrant entitles the holder thereof to purchase one share of common stock at an exercise price of $13.00. Only whole Warrants are exercisable. Each Warrant will be immediately exercisable for a three-year period after the date of issuance.

Prior to this offering, there has been no public market for our common stock or Warrants. We expect the initial public offering price to be $10.00 per Unit.

We have applied to list our common stock and Warrants for trading on the Nasdaq Capital Market under the symbols “USGO” and “USGOW”, respectively. The offering is conditioned upon the approval of our listing by the Nasdaq Capital Market, which approval may not be granted. If our listing is not approved by the Nasdaq Capital Market, we will not be able to complete the offering.

Investing in our securities involves a high degree of risk. See the section titled “Risk Factors” beginning on page 15 to read about factors you should consider before investing in our securities.

| Per Unit | Total | |||||||

| Initial public offering price (1) | $ | 10.00 | $ | 20,000,000 | ||||

| Underwriting discount and commissions (2) | $ | 0.70 | $ | 1,400,000 | ||||

| Proceeds to us, before expenses (3) | $ | 9.30 | $ | 18,600,000 | ||||

(1) The initial public offering price and underwriting discount corresponds to (i) a public offering price per share of common stock of $9.9999 and (ii) a public offering price per Warrant of $0.0001.

(2) Represents underwriting discount and commissions equal to 7.0% of the aggregate purchase price paid by the underwriters to us per Unit. However, a reduced underwriting discount of 2.0% will be payable on the gross proceeds sold to certain purchasers. We have also agreed to reimburse the representative of the underwriters for certain of its expenses. See “Underwriting” for additional information regarding total underwriter compensation.

(3) Does not include proceeds from the exercise of Warrants.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

GoldMining Inc., or “GoldMining”, a company organized under the laws of Canada, is our parent company and a majority stockholder that will control approximately 78% of the voting power of our common stock upon completion of this offering, if Goldmining does not purchase any Units in this offering. We are, therefore, a “controlled company”, within the meaning of the Nasdaq corporate governance requirements. As a “controlled company”, we expect to avail ourselves of certain corporate governance exemptions provided in the Nasdaq corporate governance requirements. See “Risk Factors – Risks Relating to Our Securities and this Offering”.

GoldMining has indicated an interest in purchasing an aggregate of up to approximately 300,000 Units in this offering at the initial public offering price. If Goldmining purchases all 300,000 Units it has indicated an interest in purchasing, Goldmining will control approximately 81% of the voting power of our common stock upon completion of this offering. However, because an indication of interest is not a binding agreement or a commitment to purchase, GoldMining may determine to purchase fewer Units than it indicated an interest in purchasing or not purchase any Units in this offering. In addition, GoldMining may purchase additional shares of our common stock or Warrants in the open market.

Bank of Montreal, an affiliate of BMO Nesbitt Burns Inc. and BMO Capital Markets Corp., is the lender under the margin loan agreement dated October 28, 2021, as amended, by and among GoldMining, our parent company, the Bank of Montreal and BMO Nesbitt Burns Inc. (the “BMO Margin Loan Agreement”). Our parent company may repay its existing loan facility with the Bank of Montreal and BMO Nesbitt Burns Inc. (the “BMO Credit Facility”), from time to time, in accordance with the terms of the BMO Margin Loan Agreement, utilizing net proceeds of the offering received through our intercompany loan agreement with our parent company. Consequently, the Company may be considered a “connected issuer” of BMO Nesbitt Burns Inc. under applicable securities laws and a “conflict of interest” may be deemed to exist under FINRA Rule 5121(f)(5)(C)(i) if five percent of the net offering proceeds, not including underwriters’ compensation, are intended to be used to reduce or retire the balance of the BMO Credit Facility. However, our parent company does not expect to use five percent or more of the net offering proceeds to reduce or retire the BMO Credit Facility. See “Underwriting”.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Units against payment in New York, New York on or about , 2023.

Joint Book-Running Managers

| H.C. Wainwright & Co. | BMO Capital Markets |

Co-Managers

Laurentian Bank Securities Inc. Sprott Capital Partners LP

Prospectus dated , 2023.

TABLE OF CONTENTS

Through and including , 2023 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses that we have prepared. Neither we nor the underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the Units offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the Units. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

| 2 |

BASIS OF PRESENTATION

Unless otherwise indicated, references in this prospectus to “U.S. GoldMining”, “the Company”, “we”, “us” and “our” refer to U.S. GoldMining Inc., a Nevada corporation.

We express all amounts in this prospectus in U.S. dollars, except where otherwise indicated. References to “$” and “US$” are to U.S. dollars and references to “C$” are to Canadian dollars.

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

MARKET, INDUSTRY AND OTHER DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry and the market in which we operate, including our market position, market opportunity and market size, is based on information from various sources such as industry publications, on assumptions that we have made based on such data and other similar sources and on our knowledge of the markets for our products. These data involve a number of assumptions and limitations. We have not independently verified any third-party information.

In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the sections entitled “Risk Factors”, “Cautionary Note Regarding Forward-Looking Statements”, and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

CONCURRENT CANADIAN PROSPECTUS OFFERING

We intend to file a prospectus with the securities regulatory authorities in each province and territory of Canada, other than Quebec. In connection therewith, we are required to prepare and file with Canadian securities regulators a technical report on our material property prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”), which is an instrument developed by the Canadian Securities Administrators and administered by the provincial and territorial securities commissions that governs how issuers in Canada disclose scientific and technical information about their mineral projects to the public.

NOTICE REGARDING MINERAL DISCLOSURE

The technical report summary for the Whistler Project, located in Alaska, included herewith, has been prepared in accordance with subpart 1300 of Regulation S-K - Disclosure by Registrants Engaged in Mining Operations, or “S-K 1300” as issued by the U.S. Securities and Exchange Commission (the “SEC”), under the United States Securities Act of 1933, as amended, (the “Securities Act”), which governs disclosure for mining registrants. Such technical report summary is included as Exhibit 96.1 to the registration statement of which this prospectus forms a part.

“Inferred mineral resources” are subject to uncertainty as to their existence and as to their economic and legal feasibility. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability.

For the meanings of certain technical terms used in this prospectus, see “Glossary of Technical Terms.”

As this offering is being conducted in the United States and Canada, our disclosure regarding our mineral property is prepared in accordance with S-K 1300, and NI 43-101. Both of these reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions.

| 3 |

In our public filings in the United States and Canada, we report indicated and inferred resources, each as defined in S-K 1300 and NI 43-101. As currently reported, there are no material differences in our disclosed measured, indicated and inferred resources under each of S-K 1300 and NI 43-101. The estimation of Indicated Mineral Resources involves greater uncertainty as to their existence and economic feasibility than the estimation of Proven and Probable Mineral Reserves, and therefore investors are cautioned not to assume that all or any part of Indicated Mineral Resources will ever be converted into S-K 1300-compliant or NI 43-101-compliant Mineral Reserves. The estimation of Inferred Mineral Resources involves greater uncertainty as to their existence and economic viability than the estimation of other categories of Mineral Resources.

GLOSSARY

Abbreviations

In this prospectus, the following abbreviations are used to express elements:

| Abbreviation | Meaning | Abbreviation | Meaning | |||

| “Ag” | silver | “Cu” | copper | |||

| “Au” | gold |

In this prospectus, the following abbreviations are used to express units of measurement:

| Abbreviation | Meaning | Abbreviation | Meaning | |||

| “g/t” | grams per metric tonne | “Moz” | million troy ounces | |||

| “Mt” | million metric tonnes | |||||

| “km” | kilometers | “Mlbs” | million pounds | |||

| “m” | meters | “μm” | micrometer | |||

| “Ma” | million years | “oz” | troy ounces, with each troy ounce being equal to 31.1034768 grams | |||

| “masl” | meters above sea level | “ppb” | parts per billion | |||

| “mm” | millimeters | “ppm” | parts per million | |||

| “km2” | square kilometers | |||||

| “wmt” | wet metric tonnes | “NSR” | net smelter return |

GLOSSARY OF TECHNICAL TERMS

This prospectus utilizes the following defined terms:

The term “Indicated Mineral Resource” or “Indicated Resource” means that part of a mineral resource for which quantity and quality, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

| 4 |

The term “Induced Polarization” or “IP” refers to a method of ground geophysical surveying employing an electrical current to determine indications of mineralization.

The term “Inferred mineral resource” or “Inferred resource” is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

The term “Measured Mineral Resource” means, under NI 43-101, that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques.

The term “Mineral Reserve” means the economically mineable part of a Measured Mineral Resource or Indicated Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined.

The term “Mineral Resource” means a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

The term “Preliminary Economic Assessment” or “PEA” means a preliminary economic assessment as defined under S-K 1300 and NI 43-101.

The term “Probable Mineral Reserve” means the economically mineable part of an indicated and, in some cases, a measured mineral resource.

The term “Proven Mineral Reserve” means the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. This preliminary feasibility study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

The term “QA/QC” means quality assurance/quality control.

| 5 |

PROSPECTUS SUMMARY

The following summary highlights certain information in this prospectus and should be read together with the more detailed information and financial data and statements contained elsewhere in this prospectus. This summary does not contain all of the information that may be important to you. You should read and carefully consider the following summary together with the entire prospectus, especially the “Risk Factors” section of this prospectus and our financial statements and the notes thereto appearing elsewhere in this prospectus before deciding to invest in our Units. For more information on our business, refer to the “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” sections of this prospectus. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections of this prospectus. See “Cautionary Note Regarding Forward-Looking Statements”.

As used herein, references to the “S-K 1300 Report” are to the technical report summary titled “S-K 1300 Technical Report Summary Initial Assessment for the Whistler Project, South Central Alaska” prepared by Moose Mountain Technical Services with an effective date of September 22, 2022, date of issue of September 23, 2022 and revised date of issue of December 16, 2022, which was prepared in accordance with S-K 1300. The Whistler Technical Report is filed as Exhibit 96.1 to the registration statement of which this prospectus forms a part.

Overview

We are an exploration stage company and our sole project is currently the Whistler Project. We have no operating revenues and do not anticipate generating revenues for the foreseeable future. The Whistler Project is a gold-copper exploration project located in the Yentna Mining District, approximately 150 km northwest of Anchorage, Alaska. See “Business – Property, Plant and Equipment” for further information regarding the Whistler Project. We may also in the future evaluate and acquire additional interests in gold and gold-copper projects in the Americas.

We were incorporated on June 30, 2015 in Alaska as “BRI Alaska Corp.” On September 8, 2022, we redomiciled to Nevada and changed our name to “U.S. GoldMining Inc.” We are a subsidiary of GoldMining, a company organized under the laws of Canada and listed on the Toronto Stock Exchange and NYSE American exchange. GoldMining is a public mineral exploration company that was incorporated in 2009 and is focused on the acquisition and development of gold assets in the Americas.

Our principal executive offices are located at 1030 West Georgia Street, Suite 1830, Vancouver, British Columbia, Canada V6E 2Y3 and our head operating offices are located at 301 Calista Court, Suite 200, Office 203, Anchorage, Alaska, 99518. Our website address is www.us.goldmining.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

Our Strategy

Our strategy is to enhance and grow the value of our asset base, with a focus on exploring and advancing the Whistler Project in Alaska. Our longer-term strategy may include seeking out compelling acquisition opportunities that enhance the value of our assets and demonstrate potential for significant growth through exploration and development.

Our management team and board of directors have extensive combined mining sector related experience, including exploration, development, operating and capital markets experience. We intend to capitalize on this significant experience as we seek to advance the Whistler Project and otherwise grow our business, following best practices with a dedication to safety, the environment and sustainable development for local communities.

As part of our strategy, we expect to utilize a cost-efficient business model by operating with an efficient, highly experienced team and calling upon third-party resources to supplement our skill set as opportunities and needs may arise. This strategy should enable us to maintain a high degree of flexibility in our cost structure. We believe it will also help to ensure that our business model is scalable and allows us to seek new growth opportunities in a cost effective and value enhancing manner.

| 6 |

The Whistler Project

The following information is condensed and extracted from the S-K 1300 Report. Readers should refer to the full text of the S-K 1300 Report for further information regarding the Whistler Project.

Project Description, Location and Access

The Whistler Project is a gold-copper exploration project located in the Yentna Mining District of Alaska, approximately 150 km northwest of Anchorage.

The Whistler Project comprises 377 State of Alaska mining claims covering an aggregate area of approximately 217.5 km2 (approximately 53,700 acres). A base camp and gravel airstrip for wheel-based aircraft is established adjacent to the Skwentna River. The camp is equipped with diesel generators, a satellite communication link, tent structures on wooden floors and several wood-frame buildings. Although chiefly used for summer field programs, the camp is winterized. The camp has been maintained in good condition, although some of the tent-based structures have been damaged by heavy snow loads and will need to be repaired or replaced.

The following map sets forth the location of the Whistler Project.

Geological Setting, Mineralization and Deposit Types

Geological Setting

The Whistler Project is located in the Alaska Range. The Alaska Range is a continuation of the Pacific Coastal Mountains extending in an arc across the northern Pacific, and represents a long-lived continental arc characterized by multiple magmatic events ranging in age from about 70 Ma to 30 Ma and associated with a wide range of base and precious metals contained within hydrothermal sulphide bearing mineralization. The geology of the Whistler Project is characterized by a thick succession of Cretaceous to early Tertiary (ca. 97 to 65 Ma) volcano-sedimentary rocks intruded by a diverse suite of plutonic rocks of Jurassic to mid-Tertiary age.

Two main intrusive suites are important in the Whistler Project area:

| ● | The Whistler Igneous Suite comprises alkali-calcic basalt-andesite, diorite and monzonite intrusive rocks approximately 76 Ma with restricted extrusive equivalent. These intrusions are commonly associated with gold-copper porphyry-style mineralization (the “Whistler Deposit”). |

| 7 |

| ● | The Composite Suite intrusions vary in composition from peridotite to granite and their ages span from 67 to about 64 Ma. Gold-copper veinlets and pegmatitic occurrences are characteristics of the composite plutons (e.g. the Mt. Estelle prospect, the Muddy Creek prospect). |

Mineralization and Deposit Types

Exploration on the Whistler Project by Cominco Alaska, referred to as “Cominco”, Kennecott Exploration, referred to as “Kennecott”, Geoinformatics Alaska Exploration Inc., referred to as “Geoinformatics”, and Kiska Metals Corporation, referred to as “Kiska”, has identified three primary exploration targets for porphyry-style gold-copper mineralization. These include the Whistler Deposit, the Raintree West prospect, approximately 1500m east of the Whistler Deposit (“Raintree West”), and the Island Mountain Breccia Zone (the “Island Mountain Deposit”). All of the porphyry prospects in the Whistler area share similar styles of alteration, mineralization, veining and cross-cutting relationships that are generally typical of porphyry systems associated with relatively oxidized magma series (A- and B-type quartz vein stockwork, chalcopyrite-pyrite mineralization assemblage, presence of sulphates, core of potassic alteration with well-developed peripheral phyllic alteration zones).

The Whistler and Island Mountain areas also host multiple secondary porphyry-like prospects defined by drilling, anomalous soil samples, alteration, veining, surface rock samples, Induced Polarization chargeability/resistivity anomalies, airborne magnetic anomalies and airborne electromagnetic anomalies. These include the Raintree North, Rainmaker, Round Mountain, Puntilla, Snow Ridge, Dagwood, Super Conductor, Howell Zone and Cirque Zones.

Island Mountain exhibits a different style of alteration, veining and sulphide mineralization. Principally the occurrence of pyrrhotite and arsenopyrite associated with Au-Cu mineralization, strong sodic-calcic alteration, lack of significant sulphates, minor hydrothermal quartz and weak to insignificant phyllic alteration. For these reasons, the porphyry system at Island Mountain may belong to the “reduced” subclass of porphyry copper-gold deposits.

The Muddy Creek area represents an additional exploration target with the potential to host a bulk tonnage, intrusion-related gold deposit. The intrusive complex at Muddy Creek is predominantly monzonitic grading to more mafic marginal phases. Mineralization is restricted to sheeted vein zones.

Drilling

A total of 70,247m of diamond drilling in 257 holes has been completed on the Whistler Project by Cominco, Kennecott, Geoinformatics and Kiska from 1986 to the end of 2011. Of these drill holes, 21,132m in 52 holes have been drilled in the Whistler Deposit area, 20,479m in 94 holes have been drilled in the Raintree area and 14,410m in 36 holes comprise the Island Mountain resource area. There are 14,226m in 75 holes in areas outside the three resource areas.

Mineral Processing and Metallurgical Testing

Metallurgical testing had been carried out in three phases starting with the 2004/05 preliminary testing in Salt Lake City under the general supervision of Kennecott and culminating in the two phases under Kiska conducted at G&T Laboratories in Kamloops during 2010 to 2012.

Whistler Deposit preliminary metallurgical test work included gravity concentration or flotation to recover the copper and gold. From the metallurgical test work results and subsequent analysis it appears that the Whistler Deposit is metallurgically amenable to a conventional flotation route to produce saleable high quality copper concentrates with gold credits, despite the low head grade, and that the levels of recovery and upgrade for both copper and gold are relatively insensitive to feed grade. We believe that there are no processing factors or deleterious elements that could have significant effect of potential economic extraction.

The preliminary testing indicated that the Island Mountain material tested is amenable to copper recovery by flotation and that the expected gold is relatively free milling. The results indicate that in the range of 90% of the gold can be recovered by either whole ore leaching or a combination of flotation and leaching of the tailings.

| 8 |

For both deposits further metallurgical development and assessment work is required to develop the best flowsheet with respect to capital and operating costs, metal recoveries and overall economics.

As of the date hereof, no metallurgical testing has been carried out on rocks from the Raintree West Deposit, however, given the similarities in geological setting, host rock, mineralization and alteration between Raintree West and the Whistler Deposits, it has been assumed by us that metallurgical processes and metal recoveries determined for the Whistler Deposit are a reasonable approximation for the Raintree West Deposit at this time.

Metal recoveries reported for the Whistler Project resource estimate include 83% for copper, 70% for gold and 65% for silver with silver grades below 10 g/t and 0% for silver grades above 10 g/t.

Mineral Resource Estimates

The following table sets forth the mineral resource estimate in the S-K 1300 Report, with an effective date of September 22, 2022, date of issue of September 23, 2022 and revised date of issue of December 16, 2022.

| Deposit | In Situ Grade | In Situ Metal | ||||||||||||||||||||||||||||||||||||||||||

| NSR Cutoff | Tonnage | NSR | Gold | Silver | Copper | Gold Eq | Gold | Silver | Copper | Gold Eq | ||||||||||||||||||||||||||||||||||

| (US$/t) | (Mt) | (US$/t) | (g/t) | (g/t) | (%) | (g/t) | (Moz) | (Moz) | (Mlbs) | (Moz) | ||||||||||||||||||||||||||||||||||

| Indicated Resources | ||||||||||||||||||||||||||||||||||||||||||||

| Whistler | 10.50 | 107.77 | 26.44 | 0.50 | 1.95 | 0.17 | 0.79 | 1.75 | 6.76 | 399 | 2.74 | |||||||||||||||||||||||||||||||||

| Raintree (Open Pit) | 10.50 | 7.76 | 20.61 | 0.49 | 4.88 | 0.09 | 0.67 | 0.12 | 1.22 | 15 | 0.17 | |||||||||||||||||||||||||||||||||

| Total Indicated (Open Pit) | 10.50 | 115.53 | 26.05 | 0.50 | 2.15 | 0.16 | 0.78 | 1.87 | 7.97 | 414 | 2.90 | |||||||||||||||||||||||||||||||||

| Raintree (Underground) | 25.00 shell | 2.68 | 34.02 | 0.79 | 4.18 | 0.13 | 1.03 | 0.07 | 0.36 | 8 | 0.09 | |||||||||||||||||||||||||||||||||

| Total Indicated | varies | 118.20 | 26.23 | 0.51 | 2.19 | 0.16 | 0.79 | 1.94 | 8.33 | 422 | 2.99 | |||||||||||||||||||||||||||||||||

| Inferred Resources | ||||||||||||||||||||||||||||||||||||||||||||

| Whistler | 10.50 | 153.54 | 19.17 | 0.35 | 1.48 | 0.13 | 0.57 | 1.71 | 7.31 | 455 | 2.83 | |||||||||||||||||||||||||||||||||

| Island Mountain | 10.50 | 111.90 | 18.99 | 0.47 | 1.06 | 0.05 | 0.57 | 1.70 | 3.81 | 131 | 2.04 | |||||||||||||||||||||||||||||||||

| Raintree (Open Pit) | 10.50 | 11.77 | 24.28 | 0.62 | 4.58 | 0.07 | 0.77 | 0.23 | 1.73 | 18 | 0.29 | |||||||||||||||||||||||||||||||||

| Total Inferred (Open Pit) | 10.50 | 277.21 | 19.32 | 0.41 | 1.44 | 0.10 | 0.58 | 3.64 | 12.85 | 604 | 5.16 | |||||||||||||||||||||||||||||||||

| Raintree (Underground) | 25.00 shell | 39.77 | 32.65 | 0.80 | 2.51 | 0.12 | 1.00 | 1.03 | 3.21 | 107 | 1.28 | |||||||||||||||||||||||||||||||||

| Total Inferred | varies | 316.98 | 20.99 | 0.46 | 1.58 | 0.10 | 0.63 | 4.67 | 16.06 | 711 | 6.45 | |||||||||||||||||||||||||||||||||

Notes:

| 1. | Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves. |

| 2. | The Mineral Resource for Whistler deposit and the upper portions of the Raintree West deposits have been confined by an open pit with “reasonable prospects of eventual economic extraction” using the 150% pit case and the following assumptions: |

| ● | Metal prices of US$1,600/oz Au, US$3.25/lb Cu and US$21/oz Ag; | |

| ● | Payable metal of 99% payable Au, 90% payable Ag and 1% deduction for Cu; | |

| ● | Offsite costs (refining, transport and insurance) of US$136/wmt proportionally distributed between Au, Ag and Cu; | |

| ● | Royalty of 3% NSR has been assumed; | |

| ● | Pit slopes are 50 degrees; | |

| ● | Mining cost of US$1.80/t for waste and US$2.00/t for mineralized material; and | |

| ● | Processing, general and administrative costs of US$10.50/t. |

| 3. | The lower portion of the Raintree West deposit has been constrained by a mineable shape with “reasonable prospects of eventual economic extraction” using a US$25.00/t cut-off. |

| 9 |

| 4. | Metallurgical recoveries are: 70% for Au, 83% for Cu, and 65% Ag for Ag grades below 10g/t. The Ag recovery is 0% for values above 10g/t for all deposits. |

| 5. | The NSR equations are: below 10g/t Ag: NSR (US$/t)=(100%-3%)*((Au*70%*US$49.273g/t) + (Cu*83%*US$2.966*2204.62 + Ag*65%*US$0.574)), and above 10g/t Ag: NSR (US$/t)=(100%-3%)*((Au*70%*US$49.256g/t) + (Cu*83%*US$2.965*2204.62)) |

| 6. | The Au Equivalent equations are: below 10g/t Ag: AuEq=Au + Cu*1.5733 +0.0108Ag, and above 10g/t Ag: AuEq=Au + Cu*1.5733 |

| 7. | The specific gravity for each deposit and domain ranges from 2.76 to 2.91 for Island Mountain, 2.60 to 2.72 for Whistler with an average value of 2.80 for Raintree West. |

| 8. | Numbers may not add due to rounding. |

Summary Risk Factors

Investing in our securities is speculative and involves substantial risk. You should carefully consider all of the information in this prospectus prior to investing in our securities. There are numerous risk factors related to our business that are described under “Risk Factors” and elsewhere in this prospectus. These risks could materially and adversely impact our business, results of operations, financial condition and future prospects, which could cause the trading price of our securities to decline and could result in a loss of your investment. Among these important risks are the following:

Risks Relating to our Business and Industry

| ● | Our success depends on the exploration development and operation of the Whistler Project, an exploration stage project, which is currently our only project. | |

| ● | We do not operate any mines and the development of our mineral project into a mine is highly speculative in nature, may be unsuccessful and may never result in the development of an operating mine. | |

| ● | Resource exploration and development is a high risk, speculative business. | |

| ● | Mineral resource estimates are based on interpretation and assumptions and could be inaccurate or yield less mineral production under actual conditions than is currently estimated. Any material changes in these estimates could affect the economic viability of the Whistler Project, our financial condition and ability to be profitable. | |

| ● | We may not be able to obtain all required permits and licenses to place any of our properties into future production. | |

| ● | We have negative cash flows from operating activities. | |

| ● | We have no history of earnings, and there are no known commercial quantities of mineral reserves on the Whistler Project. | |

| ● | We will require additional financing to fund exploration and, if warranted, development and production. Failure to obtain additional financing could have a material adverse effect on our financial condition and results of operation and could cast uncertainty on our ability to continue our operations in the future. | |

| ● | The development of the Whistler Project or any other projects we may acquire in the future into an operating mine will be subject to all of the risks associated with establishing and operating new mining operations. | |

| ● | Our growth strategy and future exploration and development efforts may be unsuccessful. | |

| ● | We may issue additional shares of our common stock from time to time for various reasons, resulting in the potential for significant dilution to existing stockholders. | |

| ● | Our board of directors may modify or accelerate the vesting of certain outstanding restricted stock awards, which may result in material dilution to our stockholders since such shares would no longer be subject to forfeiture. | |

| ● | We may face pressure to demonstrate that, in addition to seeking to generate returns for its stockholders, other stakeholders benefit from our activities. | |

| ● | Legislation has been proposed that would significantly affect the mining industry and our business. | |

| ● | Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations. | |

| ● | Mining and project development is inherently risky and subject to conditions or events some of which are beyond our control, and which could have a material adverse effect on our business. |

| 10 |

| ● | The validity of our title to the Whistler Project and future mineral properties may be disputed by others claiming title to all or part of such properties. | |

| ● | We may in the future enter into transactions with related parties and such transactions present possible conflicts of interest. | |

| ● | We face various risks related to health epidemics, pandemics or other health crises, which may have material adverse effects on our business, financial position, results of operations and/or cash flows. | |

| ● | Increasing attention to Environmental, Social and Governance (“ESG”) matters and conservation measures may adversely impact our business. | |

| ● | We rely on third-party contractors. | |

| ● | We are subject to various laws and regulations, and the costs associated with compliance with such laws and regulations may cause substantial delays and require significant cash and financial expenditure, which may have a material adverse effect on our business. | |

| ● | We rely on information technology systems and any inadequacy, failure, interruption or security breaches of those systems may harm our reputation and ability to effectively operate our business. | |

| ● | Global financial markets can have a profound impact on the global economy in general and on the mining industry in particular. | |

| ● | The volatility in gold and other commodity prices may adversely affect any future operations and, if warranted, our ability to develop our properties. | |

| ● | The mining industry is intensely competitive in all of its phases, and we compete with many companies possessing greater financial and technical resources. | |

| ● | We may be adversely affected by the effects of inflation. | |

| ● | We are currently operating in a period of economic uncertainty and capital markets disruptions, which have been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. | |

| ● | If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected. | |

| ● | Our results of operations could be affected by currency fluctuations. | |

| ● | We are dependent on key personnel and the absence of any of these individuals could adversely affect our business. We may experience difficulty attracting and retaining qualified personnel. | |

| ● | Litigation or legal proceedings could expose us to significant liabilities and have a negative impact on our reputation or business. | |

| ● | Certain of our directors and officers also serve as directors and officers of other companies involved in natural resource exploration and development, which may cause them to have conflicts of interest and not have adequate time and attention to dedicate to the Company. | |

| ● | There will be significant hazards associated with our mining activities, some of which may not be fully covered by insurance. To the extent we must pay the costs associated with such risks, our business may be negatively affected. | |

| ● | Capital and operating cost estimates made in respect of our current and future development projects and mines may not prove to be accurate. |

Risks Relating to Our Securities and this Offering

| ● | The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members. | |

| ● | We are an “emerging growth company”, and any decision on our part to comply only with certain reduced reporting and disclosure requirements applicable to emerging growth companies could make our securities less attractive to investors. | |

| ● | A small number of our stockholders could significantly influence our business. | |

| ● | We will be a “controlled company” within the meaning of the Nasdaq corporate governance requirements. As a result, we will qualify for exemptions from certain U.S. corporate governance requirements and such exemptions could have an adverse effect on our public stockholders. | |

| ● | The market price of our securities may be volatile, which could result in substantial losses for investors purchasing securities in this offering. | |

| ● | Certain recent initial public offerings of companies with relatively small public floats comparable to our anticipated public float have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company, and our securities may potentially experience rapid and substantial price volatility, which may make it difficult for prospective investors to assess the value of our securities. | |

| ● | An active, liquid and orderly trading market for our securities may not develop. |

| 11 |

| ● | Substantial future sales of our securities, or the perception that these sales could occur, may cause the price of our securities to drop significantly, even if our business is performing well. | |

| ● | The Units are equity interests and would be subordinate to future issuances by us of either indebtedness or preferred shares. | |

| ● | We do not anticipate paying cash dividends, and accordingly, stockholders must rely on share appreciation for any return on their investment. | |

| ● | Investors in this offering will pay a much higher price than the book value of our common stock and therefore you will incur immediate and substantial dilution of your investment. | |

| ● | The Nasdaq Capital Market may in the future delist our securities from its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions. | |

| ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our share price and trading volume could decline. | |

| ● | The Warrants will designate the state and federal courts sitting in the City of New York, Borough of Manhattan as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by holders of such warrants, which could limit the ability of such holders to obtain a favorable judicial forum for disputes with the Company. | |

| ● | U.S. civil liabilities may not be enforceable against our directors, our officers or certain experts named in this prospectus. Similarly, it may be difficult for investors to enforce civil liabilities against us, our directors and officers residing outside of the United States. | |

| ● | Any issuance of preferred shares could make it difficult for another company to acquire us or could otherwise adversely affect holders of our common stock, which could depress the market price of our common stock. |

As a result of these risks and other risks described under “Risk Factors”, there is no guarantee that we will experience growth or profitability in the future.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” pursuant to the Jumpstart Our Business Startups Act, or the JOBS Act. An emerging growth company may take advantage of specified exemptions from various requirements that are otherwise applicable generally to public companies in the United States. These exceptions include:

| ● | an exemption to include in an initial public offering registration statement less than five years of selected financial data; | |

| ● | an exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting; and | |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements. |

The JOBS Act also permits an emerging growth company such as us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to avail ourselves of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards.

We will remain an emerging growth company until the earliest of:

| ● | the last day of our fiscal year during which we have total annual gross revenues of at least $1.235 billion; | |

| ● | the last day of our fiscal year following the fifth anniversary of the completion of this offering; | |

| ● | the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; or | |

| ● | the date on which we are deemed to be a “large accelerated filer” under the Exchange Act. |

We have availed ourselves in this prospectus of the reduced reporting requirements described above with respect to selected financial data. As a result, the information that we are providing to you may be less comprehensive than what you might receive from other public companies. When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

| 12 |

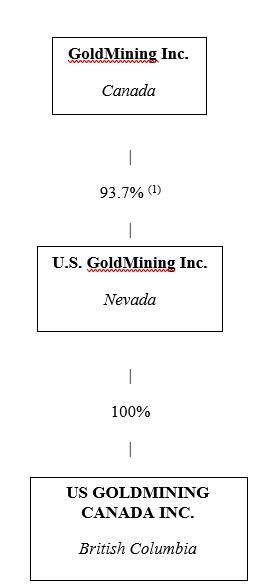

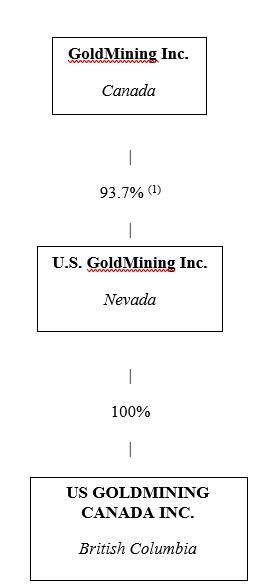

Organizational Structure

The following chart sets forth our current corporate organization as of the date hereof and prior to completion of this offering.

(1) GoldMining holds 100% of the issued and outstanding common stock of the Company, less 635,000 shares of performance based restricted common stock of the Company held by certain of our and GoldMining’s executive officers and directors. See “Executive and Director Compensation”.

Company Information

We were incorporated on June 30, 2015 in Alaska as “BRI Alaska Corp.” On September 8, 2022, we redomiciled to Nevada and changed our name to “U.S. GoldMining Inc.” Our principal executive offices are located at 1030 West Georgia Street, Suite 1830, Vancouver, British Columbia, Canada V6E 2Y3 and our head operating offices are located at 301 Calista Court, Suite 200, Office 203, Anchorage, Alaska, 99518. Our website address is www.us.goldmining.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

| 13 |

The Offering

| Securities offered by us | 2,000,000 Units, with each Unit consisting of (i) one share of our common stock, par value $0.001 per share, and (ii) one Warrant. The share of our common stock and Warrant comprising each Unit are immediately separable and will be issued separately in this offering. This prospectus also relates to the offering of our shares of common stock issuable upon the exercise of the Warrants included in the Units. | |

| Warrants | Each Warrant entitles the holder thereof to purchase one share of our common stock at a price of $13.00 per share. Only whole Warrants are exercisable. The Warrants are exercisable at any time for period of 36 months from the date on which such Warrants were issued. The Warrants and the shares of our common stock will be purchased together in this offering. The exercise price and the number of shares into which the Warrant may be exercised are subject to adjustments in certain circumstances. See “Description of Securities—Warrants” for a discussion of the terms of the Warrants. | |

| Indication of Interest | GoldMining has indicated an interest in purchasing an aggregate of up to approximately 300,000 Units in this offering at the initial public offering price. However, because an indication of interest is not a binding agreement or a commitment to purchase, GoldMining may determine to purchase fewer Units than it indicated an interest in purchasing or not purchase any Units in this offering. In addition, GoldMining may purchase additional shares of our common stock or Warrants in the open market. | |

| Common stock to be outstanding after this offering | 12,135,001 shares of our common stock (assuming no exercise of the Warrants included in this offering). | |

| Use of proceeds | We estimate that we will receive net proceeds from this offering of approximately $17,300,000, based on an initial public offering price of $10.00 per Unit, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to implement our growth and acquisition strategy, and for other general working capital purposes. See “Use of Proceeds”. | |

| Proposed Nasdaq Capital Market Symbols | “USGO” for our common stock and “USGOW” for the Warrants. | |

| Voting Rights | Holders of our common stock are entitled to one vote per share. See “Description of Capital Stock”. | |

| Dividend Policy | We have never paid or declared any dividends on our common stock or any of our other securities. We currently intend to retain any future earnings to finance the growth and development of our business, and we do not anticipate that we will declare or pay any cash dividends in the foreseeable future. See “Dividend Policy”. | |

| Risk factors | See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider carefully before investing in our securities. | |

| Lock-ups | We and our directors, officers and principal stockholders of our common stock have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock for a period of 180 days after the closing date of this offering. See “Underwriting” on page 95. |

The number of shares of common stock to be outstanding after this offering is based on 10,135,001 shares of our common stock outstanding as of February 28, 2023, and excludes 1,378,500 shares of our common stock reserved for future issuance under our share-based compensation plans.

Unless otherwise indicated, all information in this prospectus reflects and assumes:

| ● | no exercise of the Warrants described above; and | |

| ● | no issuance or exercise of options after , 2023. |

| 14 |

Summary Historical Financial Data

U.S. GoldMining Inc. was incorporated on June 30, 2015 in Alaska as “BRI Alaska Corp.” On September 8, 2022, U.S. GoldMining Inc. redomiciled to Nevada and changed its name from “BRI Alaska Corp.” to “U.S. GoldMining Inc.”

The following tables set forth a summary of our financial data. The summary statements of operations data for the fiscal years ended November 30, 2022, 2021 and 2020 are derived from our audited financial statements included elsewhere in this prospectus. The statement of operations data for the three months ended February 28, 2023 and 2022 are derived from our unaudited interim condensed consolidated financial statements for the three months ended February 28, 2023 included in this prospectus. You should read this summary data together with our financial statements and related notes included elsewhere in this prospectus and the information in the section of this prospectus titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The summary financial data in this section are not intended to replace the financial statements and related notes included elsewhere in this prospectus.

| Three Months Ended | Year Ended | |||||||||||||||||||

| February 28, 2023 | February 28, 2022 | November 30, 2022 | November 30, 2021 | November 30, 2020 | ||||||||||||||||

| Statement of Operations Data | ||||||||||||||||||||

| Total operating expenses | $ | 889,967 | $ | 86,346 | $ | 1,735,387 | $ | 697,311 | $ | 595,010 | ||||||||||

| Loss from operations | $ | (889,967 | ) | $ | (86,346 | ) | $ | (1,735,387 | ) | $ | (697,311 | ) | $ | (595,010 | ) | |||||

| Loss before income taxes | $ | (884,914 | ) | $ | (86,327 | ) | $ | (1,738,657 | ) | $ | (697,311 | ) | $ | (595,010 | ) | |||||

| Income tax expense | — | — | — | — | — | |||||||||||||||

| Net loss | $ | (884,914 | ) | $ | (86,327 | ) | $ | (1,738,657 | ) | $ | (697,311 | ) | $ | (595,010 | ) | |||||

| Basic and diluted net loss per share(1) | $ | (0.09 | ) | $ | (0.01 | ) | $ | (0.17 | ) | $ | (0.07 | ) | $ | (0.06 | ) | |||||

(1) Adjusted to reflect a 2.714286-for-1 split of our common stock completed on September 22, 2022.

RISK FACTORS

Investing in our securities is speculative and involves a high degree of risk. You should consider carefully the following risk factors, as well as the other information in this prospectus, including our financial statements and notes thereto, before you decide to purchase our securities. If any of the following risks actually occur, our business, financial conditions, results of operations and prospects could be materially adversely affected, the value of our securities could decline, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including the risks described below. See “Cautionary Note Regarding Forward-Looking Statements”.

Risks Relating to our Business and Industry

Our success depends on the exploration development and operation of the Whistler Project, an exploration stage project which is currently our only project.

At present, our only mineral property is the interest that we hold in the Whistler Project, which is in the exploration stage. Unless we acquire or develop additional mineral properties, we will be solely dependent upon this property and our future success will be largely driven by our ability to explore and develop the Whistler Project successfully, including the results of such exploration and development efforts. If no additional mineral properties are acquired by us, any adverse development affecting our operations and further exploration or development of the Whistler Project may have a material adverse effect on our financial condition and results of operations.

| 15 |

We do not operate any mines and the development of our mineral project into a mine is highly speculative in nature, may be unsuccessful and may never result in the development of an operating mine.

The Whistler Project is at the exploration stage and is without identified mineral reserves. We do not have any interest in any mining operations or mines in development.

Mineral exploration and mine development are highly speculative in nature, involve many uncertainties and risks and are frequently unsuccessful. Mineral exploration is performed to demonstrate the dimensions, position and mineral characteristics of mineral deposits, estimate mineral resources, assess amenability of the deposit to mining and processing scenarios and estimate potential deposit size. Once mineralization is discovered, it may take a number of years from the initial exploration phases before mineral development and production is possible, during which time the potential feasibility of the project may change adversely.

Mineralization may not be economic to mine. A significant number of years, several studies, and substantial expenditures are typically required to establish economic mineralization in the form of proven mineral reserves and Probable Mineral Reserves, to determine processes to extract the metals and, if required, to construct mining, processing, and tailing facilities and obtain the rights to the land and the resources (including capital) required to develop the mining operation.

In addition, if we discover mineralization that becomes a mineral reserve, it will take several years to a decade or more from the initial phases of exploration until production is possible. During this time, the economic feasibility of production may change. As a result of these uncertainties, we may not be able to successfully develop a commercially viable producing mine.

In addition, whether developing a producing mine is economically feasible will depend upon numerous additional factors, most of which are beyond our control, including the availability and cost of required development capital and labor, movement in the price of commodities, securing and maintaining title to mineral and other property rights as well as obtaining all necessary consents, permits and approvals for the development of the mine. The economic feasibility of development projects is based upon many factors, including the accuracy of mineral resource and mineral reserve estimates; metallurgical recoveries; capital and operating costs; government regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting and environmental protection; and metal prices, which are highly volatile. Development projects are also subject to the successful completion of feasibility studies, issuance of necessary governmental permits and availability of adequate financing. Any of these factors may result in us being unable to successfully develop a commercially viable operating mine.

Resource exploration and development is a high risk, speculative business.

While the discovery of an ore body may result in substantial rewards, few mineral properties which are explored are ultimately developed into producing mines. Most exploration projects do not result in the discovery of commercially mineable deposits. Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits that, though present, are insufficient in quantity or quality to return a profit from production. The marketability of minerals acquired or discovered by us may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulations, including regulations relating to allowable production, importing and exporting of minerals, and environmental protection, the combination of which factors may result in our not receiving an adequate return of investment capital.

There is no assurance that our mineral exploration and development activities will result in any discoveries of commercial bodies of ore. The long-term profitability of our operations will in part be directly related to the costs and success of our exploration programs, which may be affected by a number of factors. Substantial expenditures are required to establish reserves through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis.

| 16 |

Additionally, significant capital investment is required to discover commercial ore and to commercialize production from successful exploration effort and maintain mineral concessions and other rights through payment of applicable taxes, advance royalties and other fees. The commercial viability of a mineral deposit is dependent on a number of factors, including, among others: (i) deposit attributes such as size, grade and proximity to infrastructure; (ii) current and future metal prices; and (iii) governmental regulations, including those relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and necessary supplies and environmental protection. The complete impact of these factors, either alone or in combination, cannot be entirely predicted and their impact may result in our not achieving an adequate return on invested capital.

There is no certainty that the expenditures made by us towards the search for and evaluation of mineral deposits will result in discoveries of commercial quantities of ore.

Mineral resource estimates are based on interpretation and assumptions and could be inaccurate or yield less mineral production under actual conditions than is currently estimated. Any material changes in these estimates could affect the economic viability of the Whistler Project, our financial condition and ability to be profitable.

The estimates for mineral resources contained herein are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved. There are numerous uncertainties inherent in estimating mineral resources, including many factors beyond our control. Such estimation is a subjective process, and the accuracy of any mineral resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. In addition, there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production, if any. If our actual mineral resources are less than current estimates or if we fail to develop our Mineral Resource base through the realization of identified mineralized potential, our results of operations or financial condition may be materially and adversely affected. Evaluation of mineral resources occurs from time to time and they may change depending on further geological interpretation, drilling results and metal prices. The category of inferred mineral resource is often the least reliable mineral resource category and is subject to the most variability. We regularly evaluate our mineral resources and consider the merits of increasing the reliability of its overall mineral resources.

We may not be able to obtain all required permits and licenses to place any of our properties into future production.

We may not be able to obtain all required permits and licenses to place any of our properties into production. Our future operations may require permits from various governmental authorities and will be governed by laws and regulations governing prospecting, development, mining, production, export, taxes, labor standards, occupational health, waste disposal, land use, environmental protections, mine safety and other matters. There can be no guarantee that we will be able to obtain all necessary licenses, permits and approvals that may be required to undertake exploration activity or commence construction or operation of mine facilities at the Whistler Project. Additionally, there can be no assurance that all permits and licenses we may require for future exploration or possible future development will be obtainable at all or on reasonable terms.

Mining and exploration activities are also subject to various laws and regulations relating to the protection of the environment. Although we believe that our exploration activities are currently carried out in accordance with all of the applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner that could limit or curtail the production or development of the Whistler Project. Amendments to current laws and regulations governing our operations and activities or a more stringent implementation thereof could have a material adverse effect on our business, financial condition and results of operations.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, the installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of mining activities and may be subject to civil or criminal fines or penalties for violations of applicable laws or regulations.

| 17 |

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or a more stringent implementation thereof, could have a material adverse impact on us and cause increases in exploration expenses, capital expenditures or production costs, reduction in levels of production at producing properties, or abandonment or delays in development of new mining properties.

We have negative cash flows from operating activities.

We had negative cash flow from operating activities in the period from our incorporation until the date of this prospectus. We expect that we will use a portion of the proceeds of this offering to fund anticipated negative cash flow from operating activities in future periods. Given that we have no operating revenues, and do not anticipate generating operating revenues for the foreseeable future, we expect that expenditures to fund operating activities will be provided by financings. There is no assurance that future financings can be completed on acceptable terms or at all, and our failure to raise capital when needed could limit our ability to continue our operations in the future.

We have no history of earnings or mineral production, and there are currently no known commercial quantities of mineral reserves on the Whistler Project.

We have no history of earnings or mineral production and may never engage in mineral production. There are currently no known commercial quantities of mineral reserves on the Whistler Project. Development of the Whistler Project and any other projects we may acquire in the future will only follow upon obtaining satisfactory results of further exploration work and geological and other studies. Exploration and the development of natural resources involve a high degree of risk and few properties which are explored are ultimately developed into producing properties. There is no assurance that our exploration and development activities will result in any discoveries of commercial bodies of ore. The long-term profitability of our operations will be in part directly related to the cost and success of our exploration programs, which may be affected by a number of factors. Even if commercial quantities of minerals are discovered, the Whistler Project may not be brought into a state of commercial production. The commercial viability of a mineral deposit once discovered is also dependent on various factors, including particulars of the deposit itself, proximity to infrastructure, metal prices, and availability of power and water to permit development.

Further, we are subject to many risks common to mineral exploration companies, including under-capitalization, cash shortages, limitations with respect to personnel, financial and other resources and the lack of revenues. There is no assurance we will be successful in achieving a return on stockholder’s investment and the likelihood of success must be considered in light of its early-stage operations.

We will require additional financing to fund exploration and, if warranted, development and production. Failure to obtain additional financing could have a material adverse effect on our financial condition and results of operation and could cast uncertainty on our ability to continue our operations in the future.

We have no history of earnings, and, due to the nature of our business, there can be no assurance that we will be profitable. We have paid no dividends on our common stock or any of our other securities since incorporation and do not anticipate doing so in the foreseeable future. To fund our operations prior to the offering, we have a committed source of financing by way of an inter-company agreement with GoldMining, until the earlier of May 22, 2024, or until such time as we complete the offering. After the offering, the only immediate source of funds available to us is expected to be through the sale of our equity shares in this offering and potential future equity financings. If the financing provided by the inter-company agreement with GoldMining is interrupted or terminated prior to the earlier of (i) the completion of the offering contemplated by the Registration Statement and (ii) May 22, 2024, the Company is expected to seek an alternative source of financing in order to continue its business although there is no assurance that alternative financing funds will be available on acceptable terms, or at all. The Company may not be able to complete this Offering if such alternative financing is required and the Company does not obtain it.

Even if the results of exploration are encouraging, we may not have sufficient funds to conduct the further exploration that may be necessary to determine whether or not a commercially minable deposit exists on any portion of the Whistler Project. While we may generate additional working capital through further equity offerings, there is no assurance that any such funds will be available on acceptable terms, or at all. If available, future equity financing may result in substantial dilution to stockholders. At present it is impossible to determine what amounts of additional funds, if any, may be required.

| 18 |

The development of the Whistler Project or any other projects we may acquire in the future into an operating mine will be subject to all of the risks associated with establishing and operating new mining operations.

If the development of the Whistler Project or any other projects we may acquire in the future is found to be economically feasible and we seek to develop an operating mine, the development of such a mine will require obtaining permits and financing the construction and operation of the mine itself, processing plants and related infrastructure. As a result, we will be subject to certain risks associated with establishing new mining operations, including:

| ● | uncertainties in timing and costs, which can be highly variable and considerable in amount, of the construction of mining and processing facilities and related infrastructure; | |

| ● | we may find that skilled labor, mining equipment and principal supplies needed for operations, including explosives, fuels, chemical reagents, water, power, equipment parts and lubricants are unavailable or available at costs that are higher than we anticipated; | |

| ● | we will need to obtain necessary environmental and other governmental approvals and permits and the receipt of those approvals and permits may be delayed or extended beyond what we anticipated, or that the approvals and permits may contain conditions and terms that materially impact our ability to operate a mine; | |

| ● | we may not be able to obtain the financing necessary to finance construction and development activities or such financing may be on terms and conditions costlier than anticipated, which may make mine development activities uneconomic; | |

| ● | we may suffer industrial accidents as part of building or operating a mine that may subject us to significant liabilities; | |

| ● | we may suffer mine failures, shaft failures or equipment failures which delay, hinder or halt mine development activities or mining operations; | |

| ● | our mining projects may suffer from adverse natural phenomena such as inclement weather conditions, floods, droughts, rock slides and seismic activity; | |

| ● | we may discover unusual or unexpected geological and metallurgical conditions that could cause us to have to revise or modify mine plans and operations in a materially adverse manner; and | |

| ● | the development or operation of our mines may become subject to opposition from nongovernmental organizations, environmental groups or local groups, which may delay, prevent, hinder or stop development activities or operations. |

In addition, we may find that the costs, timing and complexities of developing the Whistler Project or any other future projects to be greater than we anticipated. Cost estimates may increase significantly as more detailed engineering work is completed on a project. It is common in mining operations to experience unexpected costs, problems and delays during construction, development and mine start-up. Accordingly, our activities may not result in profitable mining operations at our mineral properties.

Our growth strategy and future exploration and development efforts may be unsuccessful.

In order to grow our business and pursue our long-term growth strategy, we may seek to acquire additional mineral interests or merge with or invest in new companies or opportunities. A failure to make acquisitions or investments may limit our growth. In pursuing acquisition and investment opportunities, we face competition from other companies having similar growth and investment strategies, many of which may have substantially greater resources than us. Competition for these acquisitions or investment targets could result in increased acquisition or investment prices, higher risks and a diminished pool of businesses, services or products available for acquisition or investment. Additionally, if we lose or abandon our interest in any of our mineral projects, there is no assurance that we will be able to acquire another mineral property of merit or that such an acquisition would be approved by applicable regulators.

| 19 |

We may issue additional shares of our common stock from time to time for various reasons, resulting in the potential for significant dilution to existing stockholders.