UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-56484

KKR Infrastructure Conglomerate LLC

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 92-0477563 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

| 30 Hudson Yards, New York, NY | 10001 |

| (Address of principal executive offices) | (Zip Code) |

(212) 750-8300

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None. | None. | None. |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | o | |

| Non-accelerated filer | ☒ | | Smaller reporting company | o | |

| | | | Emerging growth company | ☒ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ☒

As of November 5, 2024, the registrant had 10,181,551 Class I Shares, 12,656,746 Class S Shares, 46,999,153 Class U Shares, 765,609 Class R-D Shares, 29,411,348 Class R Shares, 867,134 Class D Shares, 40 Class E Shares, 1,191,769 Class F Shares, 40 Class G Shares and 40 Class H Shares outstanding (rounded to the nearest whole number). The number of Shares outstanding excludes November 1, 2024 subscriptions since the issuance price is not yet finalized as of the date of this filing.

Table of Contents

| | | | | |

| Page |

Part I - Financial Information | |

| Item 1. Financial Statements | |

| Consolidated Statements of Assets and Liabilities as of September 30, 2024 (Unaudited) and December 31, 2023 | |

| Consolidated Statements of Operations for the three and nine months ended September 30, 2024 and 2023 (Unaudited) | |

| Consolidated Statement of Changes in Net Assets for the three and nine months ended September 30, 2024 and 2023 (Unaudited) | |

| Consolidated Statement of Cash Flows for the nine months ended September 30, 2024 and 2023 (Unaudited) | |

| Condensed Consolidated Schedules of Investments as of September 30, 2024 (Unaudited) and December 31, 2023 | |

| Notes to Consolidated Financial Statements (Unaudited) | |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. Quantitative and Qualitative Disclosures about Market Risk | |

| Item 4. Controls and Procedures | |

| |

| |

| Item 1. Legal Proceedings | |

| Item 1A. Risk Factors | |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

| Item 3. Defaults Upon Senior Securities | |

| Item 4. Mine Safety Disclosures | |

| Item 5. Other Information | |

| Item 6. Exhibits | |

| |

| Signatures | |

| |

Special Note Regarding Forward-Looking Statements

Some of the statements in this Quarterly Report on Form 10-Q constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this Quarterly Report on Form 10-Q may include statements as to:

•our future operating results;

•our business prospects and the prospects of the Infrastructure Assets (as defined herein) we own and control;

•our ability to raise sufficient capital to execute our acquisition strategies;

•the ability of the Manager (as defined herein) to source adequate acquisition opportunities to efficiently deploy capital;

•the ability of our Infrastructure Assets to achieve their objectives;

•our current and expected financing arrangements;

•changes in the general interest rate environment;

•the adequacy of our cash resources, financing sources and working capital;

•the timing and amount of cash flows, distributions and dividends, if any, from our Infrastructure Assets;

•our contractual arrangements and relationships with third parties;

•actual and potential conflicts of interest with the Manager or any of its affiliates;

•the dependence of our future success on the general economy and its effect on the industries in which we own and control Infrastructure Assets;

•our use of financial leverage;

•the ability of the Manager to identify, acquire and support our Infrastructure Assets;

•the ability of the Manager or its affiliates to attract and retain highly talented professionals;

•our ability to structure acquisitions and joint ventures in a tax-efficient manner and the effect of changes to tax legislation and our tax position; and

•the tax status of the enterprises through which we own and control Infrastructure Assets.

In addition, words such as “anticipate,” “believe,” “expect” and “intend” indicate a forward-looking statement, although not all forward-looking statements include these words. The forward-looking statements contained in this Quarterly Report on Form 10-Q involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth elsewhere in this Quarterly Report on Form 10-Q, “Part I, Item 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”). Other factors that could cause actual results to differ materially include:

•changes in the economy;

•risks associated with possible disruption in our operations or the economy generally due to terrorism, natural disasters, epidemics or other events having a broad impact on the economy; and

•future changes in laws or regulations and conditions in our operating areas.

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Quarterly Report on Form 10-Q should not be regarded as a representation by us that our plans and objectives will be achieved. These forward-looking statements apply only as of the date of this Quarterly Report on Form 10-Q. Moreover, we assume no duty and do not undertake to update the forward-looking statements, except as required by law.

Part I. Financial Information

Item 1. Financial Statements

KKR Infrastructure Conglomerate LLC

Consolidated Statements of Assets and Liabilities

(Amounts in Thousands, Except Share and Per Share Data)

| | | | | | | | | | | | | | |

| | September 30, 2024 (Unaudited) | | December 31, 2023 |

| Assets | | | | |

| Investments at fair value (cost of $2,506,587 and $895,257, respectively) | | $ | 2,826,612 | | | $ | 983,552 | |

| Cash and cash equivalents | | 291,591 | | | 278,417 | |

| Foreign currencies at fair value (cost of $4,459 and $—, respectively) | | 4,563 | | | — | |

| Deferred financing costs | | 9,373 | | | — | |

| Prepaids and other assets | | 100 | | | — | |

| Deferred offering costs | | — | | | 826 | |

| Due from Manager | | — | | | 16,549 | |

| Dividends receivable | | 1,544 | | | 1,429 | |

| Unrealized appreciation on foreign currency forward contracts | | — | | | 28 | |

| Total assets | | 3,133,783 | | | 1,280,801 | |

| | | | |

| Liabilities | | | | |

| Unrealized depreciation on foreign currency forward contracts | | 5,238 | | | 18,890 | |

| Line of credit | | 249,128 | | | — | |

| Accrued performance participation allocation | | 33,038 | | | 8,335 | |

| Accrued shareholder servicing fees and distribution fees | | 101,308 | | | 51,440 | |

| Distributions payable | | 25,590 | | | 9,480 | |

| Directors' fees and expenses payable | | 115 | | | 116 | |

| Payable for settlement of foreign currency forward contracts | | 65,310 | | | — | |

| Other accrued expenses and liabilities | | 12,034 | | | 2,938 | |

| Due to Manager and affiliates | | 6,129 | | | 19,174 | |

| Organization costs payable | | — | | | 48 | |

| Offering costs payable | | — | | | 8 | |

| Total liabilities | | 497,890 | | | 110,429 | |

| | | | |

| Commitments and contingencies (Note 9) | | | | |

| | | | |

| Net assets | | $ | 2,635,893 | | | $ | 1,170,372 | |

| | | | |

| Net assets are comprised of | | | | |

| Class I Shares, 8,652,114 and 131,691 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | | $ | 244,448 | | | $ | 3,552 | |

| Class S Shares, 10,587,646 shares authorized, issued and outstanding as of September 30, 2024 | | 279,848 | | | — | |

| Class U Shares, 46,754,980 and 28,088,229 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | | 1,241,328 | | | 706,586 | |

| Class R-D Shares, 758,156 and 353,076 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | | 21,026 | | | 9,328 | |

| | | | | | | | | | | | | | |

| Class R Shares, 29,221,814 and 16,671,146 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | | 825,633 | | | 449,523 | |

| Class D Shares, 793,618 and 380 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | | 21,984 | | | 11 | |

| Class E Shares, 40 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023 | | 1 | | | 1 | |

| Class F Shares, 55,709 and 49,830 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | | 1,623 | | | 1,369 | |

| Class G Shares, 40 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023 | | 1 | | | 1 | |

| Class H Shares, 40 shares authorized, issued and outstanding as of September 30, 2024 and December 31, 2023 | | 1 | | | 1 | |

| Net assets | | $ | 2,635,893 | | | $ | 1,170,372 | |

See notes to financial statements.

KKR Infrastructure Conglomerate LLC

Consolidated Statements of Operations (Unaudited)

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Investment income | | | | | | | | |

| Dividend and other income | | $ | 14,708 | | | $ | 7,884 | | | $ | 29,262 | | | $ | 8,568 | |

| Total investment income | | 14,708 | | | 7,884 | | | 29,262 | | | 8,568 | |

| | | | | | | | |

| Operating expenses | | | | | | | | |

| Performance participation allocation | | 13,991 | | | 1,281 | | | 24,728 | | | 2,595 | |

| Management fee expense | | 6,834 | | | 1,357 | | | 15,861 | | | 1,532 | |

| General and administration expenses | | 3,173 | | | 4,595 | | | 10,262 | | | 6,261 | |

| Interest expense | | 909 | | | — | | | 1,997 | | | — | |

| Directors' fees and expenses | | 115 | | | 115 | | | 369 | | | 230 | |

| Deferred offering costs amortization | | — | | | 495 | | | 825 | | | 661 | |

| Organization costs | | — | | | — | | | — | | | 3,333 | |

| Total operating expenses | | 25,022 | | | 7,843 | | | 54,042 | | | 14,612 | |

| Less: Expenses reimbursed by Manager | | — | | | (3,906) | | | (2,377) | | | (8,640) | |

| Add: Expenses recouped by Manager | | 776 | | | — | | | 816 | | | — | |

| Less: Management fee and expense credits | | (6,834) | | | (339) | | | (17,251) | | | (339) | |

| Net operating expenses | | 18,964 | | | 3,598 | | | 35,230 | | | 5,633 | |

| Net investment income (loss) | | (4,256) | | | 4,286 | | | (5,968) | | | 2,935 | |

| | | | | | | | |

| Net realized gain (loss) on investments, foreign currency and foreign currency forward contracts | | | | | | | | |

| Net realized gain (loss) on | | | | | | | | |

| Foreign currency | | 729 | | | — | | | (955) | | | — | |

| Foreign currency forward contracts | | (65,339) | | | — | | | (65,602) | | | — | |

| Total net realized gain (loss) | | (64,610) | | | — | | | (66,557) | | | — | |

| | | | | | | | |

| Net change in unrealized appreciation (depreciation) on investments, foreign currency translation and foreign currency forward contracts | | | | | | | | |

| Net change in unrealized appreciation (depreciation) before income taxes on | | | | | | | | |

| Investments | | 80,972 | | | 4,893 | | | 157,960 | | | 23,885 | |

| Foreign currency | | 104 | | | — | | | 104 | | | — | |

| Foreign currency translation | | 92,471 | | | (13,281) | | | 73,768 | | | (849) | |

| Foreign currency forward contracts | | (6,809) | | | 13,777 | | | 13,625 | | | 6,270 | |

| Total net change in unrealized appreciation (depreciation) before income taxes | | 166,738 | | | 5,389 | | | 245,457 | | | 29,306 | |

| Provision for (benefit from) income taxes | | 564 | | | — | | | 1,492 | | | — | |

| Total net change in unrealized appreciation (depreciation) after income taxes | | 166,174 | | | 5,389 | | | 243,965 | | | 29,306 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Net increase in net assets resulting from operations | | $ | 97,308 | | | $ | 9,675 | | | $ | 171,440 | | | $ | 32,241 | |

See notes to financial statements.

KKR Infrastructure Conglomerate LLC

Consolidated Statement of Changes in Net Assets

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class I Shares | | Class S Shares | | Class U Shares | | Class R-D Shares | | Class R Shares | | Class D Shares | | Class R-S Shares | | Class E Shares | | Class F Shares | | Class G Shares | | Class H Shares | | Total Shareholders' Equity (Net Assets) |

| Balance at June 30, 2024 (Unaudited) | | $ | 69,772 | | | $ | 76,499 | | | $ | 1,199,492 | | | $ | 20,253 | | | $ | 796,428 | | | $ | 10,726 | | | $ | — | | | $ | 1 | | | $ | 1,498 | | | $ | 1 | | | $ | 1 | | | $ | 2,174,671 | |

| Consideration from the issuance of shares | | 169,846 | | | 211,164 | | | (1) | | | — | | | — | | | 10,963 | | | — | | | — | | | 72 | | | — | | | — | | | 392,044 | |

| Repurchases of shares | | — | | | — | | | (1,033) | | | — | | | (27) | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,060) | |

| Reinvestment of distributions | | 496 | | | 558 | | | 8,484 | | | 201 | | | 5,995 | | | 103 | | | — | | | — | | | 1 | | | — | | | — | | | 15,838 | |

| Transfers in | | 38 | | | — | | | — | | | — | | | 1,141 | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,179 | |

| Transfers out | | — | | | — | | | (1,179) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,179) | |

| Accrued shareholder servicing fees and distribution fees | | — | | | (14,564) | | | (2,566) | | | (14) | | | — | | | (226) | | | — | | | — | | | — | | | — | | | — | | | (17,370) | |

| Distributions declared | | (2,596) | | | (2,542) | | | (11,231) | | | (214) | | | (8,767) | | | (224) | | | — | | | — | | | (17) | | | — | | | — | | | (25,591) | |

| Early repurchase fee | | 4 | | | 5 | | | 27 | | | — | | | 17 | | | — | | | — | | | — | | | — | | | — | | | — | | | 53 | |

| Net investment income (loss) | | (162) | | | (223) | | | (2,349) | | | (38) | | | (1,471) | | | (19) | | | — | | | — | | | 6 | | | — | | | — | | | (4,256) | |

| Net realized gain (loss) | | (5,783) | | | (7,071) | | | (31,163) | | | (506) | | | (19,519) | | | (530) | | | — | | | — | | | (38) | | | — | | | — | | | (64,610) | |

| Net change in unrealized appreciation (depreciation) | | 12,833 | | | 16,022 | | | 82,847 | | | 1,344 | | | 51,836 | | | 1,191 | | | — | | | — | | | 101 | | | — | | | — | | | 166,174 | |

| Balance at September 30, 2024 (Unaudited) | | $ | 244,448 | | | $ | 279,848 | | | $ | 1,241,328 | | | $ | 21,026 | | | $ | 825,633 | | | $ | 21,984 | | | $ | — | | | $ | 1 | | | $ | 1,623 | | | $ | 1 | | | $ | 1 | | | $ | 2,635,893 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class I Shares | | Class S Shares | | Class U Shares | | Class R-D Shares | | Class R Shares | | Class D Shares | | Class R-S Shares | | Class E Shares | | Class F Shares | | Class G Shares | | Class H Shares | | Total Shareholders' Equity (Net Assets) |

| Balance at December 31, 2023 | | $ | 3,552 | | | $ | — | | | $ | 706,586 | | | $ | 9,328 | | | $ | 449,523 | | | $ | 11 | | | $ | — | | | $ | 1 | | | $ | 1,369 | | | $ | 1 | | | $ | 1 | | | $ | 1,170,372 | |

| Consideration from the issuance of shares | | 220,714 | | | 290,362 | | | 496,346 | | | 10,097 | | | 338,837 | | | 21,882 | | | 2,557 | | | — | | | 162 | | | — | | | — | | | 1,380,957 | |

| Repurchases of shares | | — | | | — | | | (2,278) | | | — | | | (813) | | | — | | | — | | | — | | | — | | | — | | | — | | | (3,091) | |

| Reinvestment of distributions | | 498 | | | 558 | | | 18,845 | | | 392 | | | 13,516 | | | 103 | | | 6 | | | — | | | 2 | | | — | | | — | | | 33,920 | |

| Transfers in | | 18,823 | | | 2,568 | | | — | | | 527 | | | 8,655 | | | — | | | — | | | — | | | — | | | — | | | — | | | 30,573 | |

| Transfers out | | (3,552) | | | — | | | (5,725) | | | — | | | (18,728) | | | — | | | (2,568) | | | — | | | — | | | — | | | — | | | (30,573) | |

| Accrued shareholder servicing fees and distribution fees | | — | | | (20,049) | | | (35,834) | | | (225) | | | — | | | (441) | | | (1) | | | — | | | — | | | — | | | — | | | (56,550) | |

| Distributions declared | | (3,334) | | | (3,232) | | | (30,233) | | | (542) | | | (23,577) | | | (333) | | | (6) | | | — | | | (46) | | | — | | | — | | | (61,303) | |

| Early repurchase fee | | 5 | | | 5 | | | 84 | | | 1 | | | 53 | | | — | | | — | | | — | | | — | | | — | | | — | | | 148 | |

| Net investment income (loss) | | (261) | | | (350) | | | (3,239) | | | (58) | | | (2,037) | | | (36) | | | — | | | — | | | 13 | | | — | | | — | | | (5,968) | |

| Net realized gain (loss) | | (5,819) | | | (7,110) | | | (32,301) | | | (524) | | | (20,229) | | | (535) | | | — | | | — | | | (39) | | | — | | | — | | | (66,557) | |

| Net change in unrealized appreciation (depreciation) | | 13,822 | | | 17,096 | | | 129,077 | | | 2,030 | | | 80,433 | | | 1,333 | | | 12 | | | — | | | 162 | | | — | | | — | | | 243,965 | |

| Balance at September 30, 2024 (Unaudited) | | $ | 244,448 | | | $ | 279,848 | | | $ | 1,241,328 | | | $ | 21,026 | | | $ | 825,633 | | | $ | 21,984 | | | $ | — | | | $ | 1 | | | $ | 1,623 | | | $ | 1 | | | $ | 1 | | | $ | 2,635,893 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class I Shares | | Class S Shares | | Class U Shares | | Class R-D Shares | | Class R Shares | | Class D Shares | | Class R-S Shares | | Class E Shares | | Class F Shares | | Class G Shares | | Class H Shares | | Total Shareholders' Equity (Net Assets) |

| Balance at June 30, 2023 (Unaudited) | | $ | — | | | $ | — | | | $ | 122,182 | | | $ | — | | | $ | 77,351 | | | $ | — | | | $ | — | | | $ | 262,375 | | | $ | — | | | $ | 1 | | | $ | 1 | | | $ | 461,910 | |

| Consideration from the issuance of shares | | 1,086 | | | — | | | 343,780 | | | — | | | 220,790 | | | 118 | | | — | | | — | | | 979 | | | — | | | — | | | 566,753 | |

| Repurchases of shares | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (262,727) | | | — | | | — | | | — | | | (262,727) | |

| Accrued shareholder servicing fees and distribution fees | | — | | | — | | | (22,876) | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | | | — | | | (22,878) | |

| Distributions declared | | (5) | | | — | | | (2,455) | | | — | | | (2,009) | | | (1) | | | — | | | (347) | | | (4) | | | — | | | — | | | (4,821) | |

| Net investment (loss) income | | 7 | | | — | | | 2,621 | | | — | | | 1,633 | | | 1 | | | — | | | 16 | | | 8 | | | — | | | — | | | 4,286 | |

| Net change in unrealized appreciation (depreciation) | | 3 | | | — | | | 2,853 | | | — | | | 1,847 | | | 1 | | | — | | | 683 | | | 2 | | | — | | | — | | | 5,389 | |

| Balance at September 30, 2023 (Unaudited) | | $ | 1,091 | | | $ | — | | | $ | 446,105 | | | $ | — | | | $ | 299,612 | | | $ | 117 | | | $ | — | | | $ | — | | | $ | 985 | | | $ | 1 | | | $ | 1 | | | $ | 747,912 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class I Shares | | Class S Shares | | Class U Shares | | Class R-D Shares | | Class R Shares | | Class D Shares | | Class R-S Shares | | Class E Shares | | Class F Shares | | Class G Shares | | Class H Shares | | Total Shareholders' Equity (Net Assets) |

| Balance at December 31, 2022 | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 1 | | | $ | — | | | $ | 1 | |

| Consideration from the issuance of shares | | 1,086 | | | — | | | 469,089 | | | — | | | 294,726 | | | 118 | | | — | | | 444,013 | | | 979 | | | — | | | 1 | | | 1,210,012 | |

| Repurchases of shares | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (457,727) | | | — | | | — | | | — | | | (457,727) | |

| Accrued shareholder servicing fees and distribution fees | | — | | | — | | | (31,791) | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | | | — | | | (31,793) | |

| Distributions declared | | (5) | | | | | (2,455) | | | | | (2,009) | | | (1) | | | | | (347) | | | (4) | | | | | | | (4,821) | |

| Net investment (loss) income | | 7 | | | — | | | 1,723 | | | — | | | 1,103 | | | 1 | | | — | | | 92 | | | 8 | | | — | | | — | | | 2,934 | |

| Net change in unrealized appreciation (depreciation) | | 3 | | | — | | | 9,539 | | | — | | | 5,792 | | | 1 | | | — | | | 13,969 | | | 2 | | | — | | | — | | | 29,306 | |

| Balance at September 30, 2023 (Unaudited) | | $ | 1,091 | | | $ | — | | | $ | 446,105 | | | $ | — | | | $ | 299,612 | | | $ | 117 | | | $ | — | | | $ | — | | | $ | 985 | | | $ | 1 | | | $ | 1 | | | $ | 747,912 | |

See notes to financial statements.

KKR Infrastructure Conglomerate LLC

Consolidated Statement of Cash Flows (Unaudited)

(Amounts in Thousands)

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2024 | | 2023 |

| Operating activities | | | | |

| Net increase in net assets from operations | | $ | 171,440 | | | $ | 32,241 | |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

| Class F Shares issued as payment of Management Fees | | — | | | 888 | |

| Class F Shares issued as payment of directors' fees and expenses | | 137 | | | 91 | |

| Class F Shares issued as payment of performance participation allocation | | 25 | | | — | |

| Deferred financing costs amortization | | 1,146 | | | — | |

| Deferred offering costs amortization | | 825 | | | 661 | |

| Acquisition of Infrastructure Assets | | (1,290,124) | | | (12,500) | |

| Proceeds from return of capital on Infrastructure Assets | | 2,353 | | | — | |

| Net change in unrealized (appreciation) depreciation on investments | | (157,960) | | | (23,885) | |

| Net change in unrealized (appreciation) depreciation on foreign currency translation | | (73,768) | | | 849 | |

| Net change in unrealized (appreciation) depreciation on foreign currency forward contracts | | (13,625) | | | (6,270) | |

| Changes in operating assets and liabilities: | | | | |

| (Increase) Decrease in prepaids and other assets | | (100) | | | 480 | |

| (Increase) Decrease in deferred offering costs | | — | | | (1,315) | |

| (Increase) Decrease in due from Manager | | 16,549 | | | (8,639) | |

| (Increase) Decrease in dividends receivable | | (115) | | | (1,297) | |

| Increase (Decrease) in management fee payable | | — | | | 306 | |

| Increase (Decrease) in accrued performance participation allocation | | 24,703 | | | 2,595 | |

| Increase (Decrease) in directors' fees and expenses payable | | (1) | | | 115 | |

| Increase (Decrease) in payable for settlement of foreign currency forward contracts | | 65,310 | | | — | |

| Increase (Decrease) in other accrued expenses and liabilities | | 4,669 | | | 3,403 | |

| Increase (Decrease) in due to Manager | | (15,037) | | | 7,376 | |

| Increase (Decrease) in organization costs payable | | (48) | | | (1,154) | |

| Increase (Decrease) in offering costs payable | | (8) | | | 826 | |

| Net cash used in operating activities | | (1,263,629) | | | (5,229) | |

| Financing activities | | | | |

| Proceeds from issuance of shares | | 1,380,795 | | | 765,021 | |

| Proceeds from credit facility | | 150,000 | | | — | |

| Repayment of credit facility | | (150,000) | | | — | |

| Repayment of line of credit | | (70,000) | | | — | |

| Payment of deferred financing costs | | (8,280) | | | — | |

| Payment on repurchases of shares | | (2,943) | | | (457,727) | |

| Payment of shareholder servicing fees and distribution fees | | (4,959) | | | — | |

| Payment for offering costs | | (1,974) | | | — | |

| Distributions | | (11,273) | | | — | |

| Net cash provided by financing activities | | 1,281,366 | | | 307,294 | |

| Net increase in cash and cash equivalents and foreign currencies at fair value | | 17,737 | | | 302,065 | |

| Cash and cash equivalents and foreign currencies at fair value, beginning of period | | 278,417 | | | 1 | |

| Cash and cash equivalents and foreign currencies at fair value, end of period | | $ | 296,154 | | | $ | 302,066 | |

| Supplemental disclosure of cash flow information | | | | |

| Proceeds from credit facility | | $ | 319,128 | | | $ | — | |

| Change in shareholder servicing fees and distribution fees payable | | 56,550 | | | — | |

| Reinvestment of distributions | | 33,920 | | | — | |

| Change in payable for investments acquired | | 4,430 | | | — | |

| | | | | | | | | | | | | | |

| Change in deferred financing costs payable | | 2,239 | | | — | |

| Cash paid for interest | | (666) | | | — | |

| Shares issued in exchange for Infrastructure Assets | | — | | | 444,013 | |

See notes to financial statements.

KKR Infrastructure Conglomerate LLC

Condensed Consolidated Schedule of Investments (Unaudited) as of September 30, 2024

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | | Asset | | Industry | | Geography (1) | | Valuation Level | | Currency | | Settlement Date | | Notional | | Estimated Fair Value | | Estimated Fair Value as a Percentage of Net Assets |

| Infrastructure Assets | | | | | | | | | | | | | | | | | | |

| Digital Infrastructure - 39.5% | | | | | | | | | | | | | | | | | | |

| Vantage Towers AG | | Equity Interest Held Through KKR Oak Aggregator L.P. | | Digital Infrastructure | | EMEA | | Level III | | EUR | | N/A | | N/A | | $ | 506,927 | | | 19.2 | % |

| Telecom Italia NetCo | | Equity Interest Held Through Optics HoldCo Srl | | Digital Infrastructure | | EMEA | | Level III | | EUR | | N/A | | N/A | | 497,801 | | | 18.9 | % |

| Other Infrastructure Assets | | Equity Interest Held Through Stellar Asia Holdings I Pte. Ltd. | | Digital Infrastructure | | Asia-Pacific | | Level III | | SGD | | N/A | | N/A | | 36,164 | | | 1.4 | % |

| Energy Security - 8.1% | | | | | | | | | | | | | | | | | | |

| Pembina Gas Infrastructure Inc. | | Equity Interest Held Through KKR Eagle Aggregator L.P. | | Energy Security | | North America | | Level III | | CAD | | N/A | | N/A | | 156,725 | | | 5.9 | % |

| Other Infrastructure Assets | | Equity Interest Held Through KKR Denali Aggregator L.P. | | Energy Security | | North America | | Level III | | USD | | N/A | | N/A | | 57,500 | | | 2.2 | % |

| Energy Transition - 34.3% | | | | | | | | | | | | | | | | | | |

| Smart Metering Services plc | | Equity Interest Held Through KKR Sienna Aggregator L.P. | | Energy Transition | | EMEA | | Level III | | GBP | | N/A | | N/A | | 299,230 | | | 11.4 | % |

| Avantus LLC | | Equity Interest Held Through KKR Eight Mile Aggregator L.P. | | Energy Transition | | North America | | Level III | | USD | | N/A | | N/A | | 230,000 | | | 8.7 | % |

| Albioma SA | | Equity Interest Held Through KKR Kyoto Aggregator L.P. | | Energy Transition | | EMEA | | Level III | | EUR | | N/A | | N/A | | 204,484 | | | 7.8 | % |

| Greenvolt Energias Renovaveis S.A. | | Equity Interest Held Through KKR GV Investor Aggregator L.P. | | Energy Transition | | EMEA | | Level III | | EUR | | N/A | | N/A | | 148,316 | | | 5.6 | % |

| Other Infrastructure Assets | | Equity Interest Held Through KKR Global Climate Zeus Aggregator L.P. | | Energy Transition | | EMEA | | Level III | | GBP | | N/A | | N/A | | 20,859 | | | 0.8 | % |

| Industrial Infrastructure - 6.9% | | | | | | | | | | | | | | | | | | |

| Refresco Group B.V. | | Equity Interest Held Through KKR Pegasus Aggregator L.P. | | Industrial Infrastructure | | EMEA | | Level III | | EUR | | N/A | | N/A | | 182,986 | | | 6.9 | % |

| Social Infrastructure - 16.7% | | | | | | | | | | | | | | | | | | |

| Grove Education Partners Holdco Limited | | Equity Interest Held Through KKR Percival Aggregator L.P. | | Social Infrastructure | | EMEA | | Level III | | GBP | | N/A | | N/A | | 440,620 | | | 16.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Transportation - 1.7% | | | | | | | | | | | | | | | | | | |

Other Infrastructure Assets (2) | | Equity Interest Held Through KKR Panda Aggregator L.P. | | Transportation | | North America | | N/A | | USD | | N/A | | N/A | | 45,000 | | | 1.7 | % |

| Total Infrastructure Assets Investments (cost of $2,506,587) | | | | | | | | | | | | | | | | 2,826,612 | | | 107.2 | % |

| | | | | | | | | | | | | | | | | | |

| Foreign Currency Forward Contracts | | | | | | | | | | | | | | | | | | |

| Barclays Bank PLC | | Sell CAD/USD | | N/A | | N/A | | Level II | | CAD | | October 7, 2025 | | 4,000 | | (3) | | | — | % |

| Barclays Bank PLC | | Sell SGD/USD | | N/A | | N/A | | Level II | | SGD | | October 7, 2025 | | 11,550 | | (47) | | | — | % |

| Barclays Bank PLC | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | October 7, 2025 | | 172,500 | | (626) | | | — | % |

| Barclays Bank PLC | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | October 7, 2025 | | 77,500 | | (353) | | | — | % |

| Goldman, Sachs & Co. | | Sell SGD/USD | | N/A | | N/A | | Level II | | SGD | | October 7, 2025 | | 21,100 | | (79) | | | — | % |

| Goldman, Sachs & Co. | | Sell CAD/USD | | N/A | | N/A | | Level II | | CAD | | October 7, 2025 | | 82,430 | | (25) | | | — | % |

| Goldman, Sachs & Co. | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | October 7, 2025 | | 27,790 | | (127) | | | — | % |

| Goldman, Sachs & Co. | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | October 7, 2025 | | 456,500 | | (864) | | | — | % |

| Macquarie Bank Limited | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | October 7, 2025 | | 195,000 | | (706) | | | — | % |

| Royal Bank of Canada | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | October 7, 2025 | | 27,400 | | (103) | | | — | % |

| Royal Bank of Canada | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | October 7, 2025 | | 130,100 | | (384) | | | — | % |

| Nomura International PLC | | Sell CAD/USD | | N/A | | N/A | | Level II | | CAD | | October 7, 2025 | | 101,500 | | (70) | | | — | % |

| Nomura International PLC | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | October 7, 2025 | | 410,000 | | (1,538) | | | (0.1) | % |

| Nomura International PLC | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | October 7, 2025 | | 74,500 | | (313) | | | — | % |

| Total Foreign Currency Forward Contracts | | | | | | | | | | | | | | | | (5,238) | | | (0.1) | % |

| | | | | | | | | | | | | | | | | | |

| Investments in Money Market Funds | | | | | | | | | | | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds Government Portfolio | | | | N/A | | N/A | | Level I | | USD | | N/A | | N/A | | 291,434 | | | 11.1 | % |

| Total Investments in Money Market Funds (cost of $291,434) | | | | | | | | | | | | | | | | 291,434 | | | 11.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total Investments and Cash Equivalents (cost of $2,798,021) | | | | | | | | | | | | | | | | $ | 3,112,808 | | | 118.2 | % |

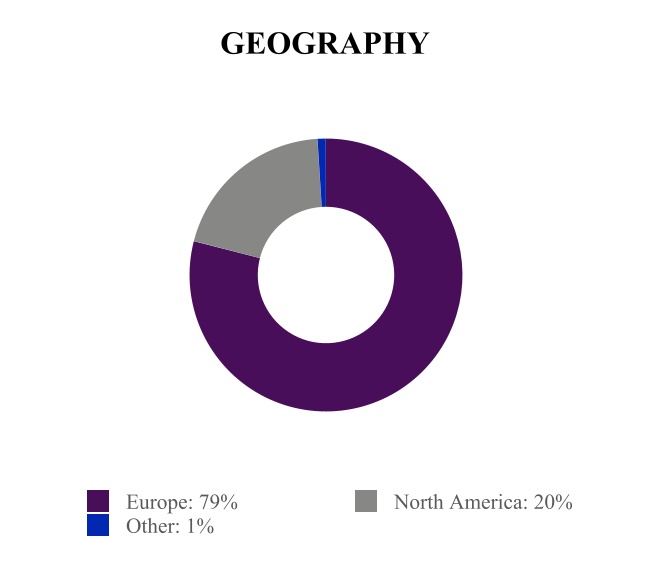

(1) As of September 30, 2024, approximately 18.5%, 87.3% and 1.4% of the Company’s infrastructure assets were in North America, EMEA and Asia-Pacific, respectively, based upon the net asset value. The cost basis of infrastructure assets in North America, EMEA and Asia-Pacific, were $464,973, $2,019,730 and $21,884, respectively. The fair value of infrastructure assets in North America, EMEA and Asia-Pacific were $489,225, $2,301,223 and $36,164, respectively.

(2) As of September 30, 2024, the Company had funded cash into KKR Panda Aggregator L.P. in connection with acquiring an indirect interest in Other Infrastructure Assets on October 1, 2024. This investment is measured at fair value using the net asset value practical expedient under Accounting Standards Codification 820, Fair Value Measurements and Disclosure (“ASC 820”).

See notes to financial statements.

KKR Infrastructure Conglomerate LLC

Condensed Consolidated Schedule of Investments as of December 31, 2023

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | | Asset | | Industry | | Geography | | Valuation Level | | Currency | | Settlement Date | | Notional | | Estimated Fair Value | | Estimated Fair Value as a Percentage of Net Assets |

| Infrastructure Assets | | | | | | | | | | | | | | | | | | |

| Digital Infrastructure - 10.0% | | | | | | | | | | | | | | | | | | |

| Vantage Towers AG | | Equity Interest Held Through KKR Oak Aggregator L.P. | | Digital Infrastructure | | EMEA | | Level III | | EUR | | N/A | | N/A | | $ | 111,983 | | | 9.6 | % |

| Other Infrastructure Assets | | Equity Interest Held Through Stellar Asia Holdings I Pte. Ltd. | | Digital Infrastructure | | Asia-Pacific | | Level III | | SGD | | N/A | | N/A | | 4,689 | | | 0.4 | % |

| Energy Security - 14.7% | | | | | | | | | | | | | | | | | | |

| Pembina Gas Infrastructure Inc. | | Equity Interest Held Through KKR Eagle Aggregator L.P. | | Energy Security | | North America | | Level III | | CAD | | N/A | | N/A | | 156,178 | | | 13.3 | % |

| Other Infrastructure Assets | | Equity Interest Held Through KKR Denali Aggregator L.P. | | Energy Security | | North America | | Level III | | USD | | N/A | | N/A | | 16,830 | | | 1.4 | % |

| Energy Transition - 15.6% | | | | | | | | | | | | | | | | | | |

| Albioma SA | | Equity Interest Held Through KKR Kyoto Aggregator L.P. | | Energy Transition | | EMEA | | Level III | | EUR | | N/A | | N/A | | 173,823 | | | 14.9 | % |

| Other Infrastructure Assets | | Equity Interest Held Through KKR Global Climate Zeus Aggregator L.P. | | Energy Transition | | EMEA | | Level III | | GBP | | N/A | | N/A | | 9,015 | | | 0.8 | % |

| Industrial Infrastructure - 14.7% | | | | | | | | | | | | | | | | | | |

| Refresco Group B.V. | | Equity Interest Held Through KKR Pegasus Aggregator L.P. | | Industrial Infrastructure | | EMEA | | Level III | | EUR | | N/A | | N/A | | 172,087 | | | 14.7 | % |

| Social Infrastructure - 29.0% | | | | | | | | | | | | | | | | | | |

| Grove Education Partners Holdco Limited | | Equity Interest Held Through KKR Percival Aggregator L.P. | | Social Infrastructure | | EMEA | | Level III | | GBP | | N/A | | N/A | | 338,947 | | | 29.0 | % |

| Total Infrastructure Assets Investments (cost of $895,257) | | | | | | | | | | | | | | | | $ | 983,552 | | | 84.1 | % |

| | | | | | | | | | | | | | | | | | |

| Foreign Currency Forward Contracts | | | | | | | | | | | | | | | | | | |

| Goldman, Sachs & Co. | | Sell CAD/USD | | N/A | | N/A | | Level II | | CAD | | June 28, 2024 | | 91,000 | | $ | (1,222) | | | (0.1) | % |

| Nomura International PLC | | Sell CAD/USD | | N/A | | N/A | | Level II | | CAD | | June 28, 2024 | | 91,000 | | (1,246) | | | (0.1) | % |

| Goldman, Sachs & Co. | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | June 28, 2024 | | 123,000 | | (2,460) | | | (0.2) | % |

| Nomura International PLC | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | June 28, 2024 | | 123,000 | | (2,491) | | | (0.2) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Barclays Bank PLC | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | June 28, 2024 | | 9,000 | | 28 | | | — | % |

| Nomura International PLC | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | June 28, 2024 | | 74,500 | | (4,613) | | | (0.4) | % |

| Barclays Bank PLC | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | June 28, 2024 | | 74,500 | | (4,631) | | | (0.4) | % |

| Royal Bank of Canada | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | June 28, 2024 | | 27,400 | | (1,115) | | | (0.1) | % |

| Goldman, Sachs & Co. | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | June 28, 2024 | | 6,200 | | (225) | | | — | % |

| Goldman, Sachs & Co. | | Sell SGD/USD | | N/A | | N/A | | Level II | | SGD | | June 28, 2024 | | 5,600 | | (58) | | | — | % |

| Nomura International PLC | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | June 28, 2024 | | 36,300 | | (808) | | | (0.1) | % |

| Goldman, Sachs & Co. | | Sell GBP/USD | | N/A | | N/A | | Level II | | GBP | | June 28, 2024 | | 9,000 | | (21) | | | — | % |

| Total Foreign Currency Forward Contracts | | | | | | | | | | | | | | | | $ | (18,862) | | | (1.6) | % |

| | | | | | | | | | | | | | | | | | |

| Investments in Money Market Funds | | | | | | | | | | | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds Government Portfolio | | | | N/A | | N/A | | Level I | | USD | | N/A | | N/A | | $ | 278,417 | | | 23.8 | % |

| Total Investments in Money Market Funds (cost of $278,417) | | | | | | | | | | | | | | | | $ | 278,417 | | | 23.8 | % |

| | | | | | | | | | | | | | | | | | |

| Total Investments and Cash Equivalents (cost of $1,173,674) | | | | | | | | | | | | | | | | $ | 1,243,107 | | | 106.3 | % |

See notes to financial statements.

KKR Infrastructure Conglomerate LLC

Notes to Financial Statements (Unaudited)

(All Amounts in Thousands, Except Share and Per Share Data)

1.Organization

KKR Infrastructure Conglomerate LLC (“K-INFRA” and the “Company”) was formed on September 23, 2022 as a limited liability company under the laws of the state of Delaware, and the Company operates its business in a manner permitting it to be excluded from the definition of an “investment company” under the Investment Company Act of 1940, as amended. The Company is a holding company that seeks to acquire, own and control portfolio companies, special purpose vehicles and other entities through which infrastructure assets or businesses will be held (“Infrastructure Assets”), with the objective of generating attractive risk-adjusted returns consisting of both current income and capital appreciation. The Company commenced principal operations on June 1, 2023.

K-INFRA conducts a continuous private offering of the following investor shares: Class S Shares, Class D Shares, and Class I Shares (collectively with the Class U Shares, Class R-D Shares, Class R-S Shares and Class R Shares, the “Investor Shares” and, collectively with the Class E Shares, Class F Shares, Class G Shares and Class H Shares, the “Shares”) in reliance on exemptions from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), including under Regulation D and Regulation S, (i) to accredited investors (as defined in Regulation D under the Securities Act) and (ii) in the case of shares sold outside of the United States, to persons that are not “U.S. persons” (as defined in Regulation S under the Securities Act).

Holders of Investor Shares have equal rights and privileges with each other, except that Class D Shares, Class U Shares, Class I Shares, Class R-D Shares and Class R Shares do not pay a sales load or dealer-manager fees, the Class I Shares and Class R Shares are not subject to any servicing or distribution fees and the Class D Shares or Class R-D Shares are not subject to any distribution fees.

Holders of Class E Shares, Class F Shares, Class G Shares and Class H Shares (collectively, the “KKR Shares”) have equal rights and privileges with each other and, except for the Class G Shares, no class of shares will have any rights, powers or preferences with respect to determining the number of directors constituting the entire Board of Directors the (“Board”) or the appointment, election, or removal of any directors of officers of the Company. Kohlberg Kravis Roberts & Co. L.P. (together with its subsidiaries, “KKR”), through its ownership of all of the Company’s outstanding Class G Shares, hold, directly and indirectly, all of the voting power of the Company. The KKR Shares are not subject to the Management Fee (defined herein) or the Performance Participation Allocation (defined herein), and are not subject to any servicing or distribution fees.

The Company is sponsored by KKR and benefits from KKR’s infrastructure sourcing and management platform pursuant to a management agreement entered into with KKR DAV Manager LLC (the “Manager”) to support the Company in managing its portfolio of Infrastructure Assets with the objective of generating attractive risk-adjusted returns consisting of both current income and capital appreciation for holders of Shares (the “Shareholders”).

2.Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements (referred to hereafter as the “financial statements”) are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and are stated in United States (“U.S.”) dollars. The preparation of consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in these consolidated financial statements. Actual results could differ from those estimates.

The Company’s consolidated financial statements are prepared using the accounting and reporting guidance under Accounting Standards Codification 946, Financial Services—Investment Companies (“ASC 946”).

Basis of Consolidation

As provided under Regulation S-X and ASC 946, the Company will generally not consolidate its investment in a company other than a wholly owned investment company or controlled operating company whose business consists of providing services to the Company. Accordingly, the Company consolidates in its consolidated financial statements the accounts of certain wholly owned subsidiaries that meet the criteria. All significant intercompany balances and transactions have been eliminated in consolidation.

Adoption of new and revised accounting standards

The Company has reviewed recently issued accounting pronouncements and concluded that such pronouncements are either not applicable to the Company or no material impact is expected in the consolidated financial statements as a result of future adoption.

For a detailed discussion about the Company’s significant accounting policies, see Note 2 to the audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023. During the nine months ended September 30, 2024, there were no significant updates to the Company’s significant accounting policies.

3.Investments

Summarized Infrastructure Assets Financial Information

The following table presents unaudited summarized financial information for the three and nine months ended September 30, 2024 and 2023 for the Infrastructure Assets in the aggregate in which the Company has an indirect equity interest:

Summarized Operating Data:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | 2024 | | 2023 | | 2024 | | 2023 | |

| Revenues | | $ | 2,821,815 | | | $ | 2,164,345 | | | $ | 7,771,693 | | | $ | 6,309,620 | | |

| Expenses | | 2,704,652 | | | 2,083,509 | | | 7,622,928 | | | 6,183,547 | | |

| Income before taxes | | 117,163 | | | 80,836 | | | 148,765 | | | 126,073 | | |

| Income tax expense (benefit) | | 56,217 | | | 24,894 | | | (27,149) | | | 51,975 | | |

| Consolidated net income (loss) | | 60,946 | | | 55,942 | | | 175,914 | | | 74,098 | | |

| Net income (loss) attributable to non-controlling interests | | (7,171) | | | 3,083 | | | (20,094) | | | 10,547 | | |

| Net income (loss) | | $ | 68,117 | | | $ | 52,859 | | | $ | 196,008 | | | $ | 63,551 | | |

The net income above represents the aggregated net income attributable to the controlling interests in each of the Company’s Infrastructure Assets and does not represent the Company’s proportionate share of income.

4.Fair Value Measurements - Investments

The following tables present fair value measurements of investments, by major class, according to the fair value hierarchy:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2024 | |

| Investments | | Level I | | Level II | | Level III | | Investments Measured at Net Asset Value (1) | | Fair Value | |

| Infrastructure Assets | | $ | — | | | $ | — | | | $ | 2,781,612 | | | $ | 45,000 | | | $ | 2,826,612 | | |

| Unrealized appreciation on foreign currency forward contracts | | — | | | — | | | — | | | — | | | — | | |

| Unrealized depreciation on foreign currency forward contracts | | — | | | (5,238) | | | — | | | — | | | (5,238) | | |

| Investments in Money Market Funds | | 291,434 | | | — | | | — | | | — | | | 291,434 | | |

| Total | | $ | 291,434 | | | $ | (5,238) | | | $ | 2,781,612 | | | $ | 45,000 | | | $ | 3,112,808 | | |

(1) Certain investments that are measured at fair value using the net asset value practical expedient under ASC 820 have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Consolidated Statements of Assets and Liabilities.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | |

| Investments | | Level I | | Level II | | Level III | | Fair Value | |

| Infrastructure Assets | | $ | — | | | $ | — | | | $ | 983,552 | | | $ | 983,552 | | |

| Unrealized appreciation on foreign currency forward contracts | | — | | | 28 | | | — | | | 28 | | |

| Unrealized depreciation on foreign currency forward contracts | | — | | | (18,890) | | | — | | | (18,890) | | |

| Investments in Money Market Funds | | 278,417 | | | — | | | — | | | 278,417 | | |

| Total | | $ | 278,417 | | | $ | (18,862) | | | $ | 983,552 | | | $ | 1,243,107 | | |

The following table provides a reconciliation of the beginning and ending balances for investments that use Level III inputs for the nine months ended September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments | | Balance as of December 31, 2023 | | Purchases | | Proceeds from sales and repayments | | Net change in unrealized appreciation on investments | | Net change in unrealized appreciation on foreign currency translation | | Balance as of September 30, 2024 | |

| Infrastructure Assets | | $ | 983,552 | | | $ | 1,568,685 | | | $ | (2,353) | | | $ | 157,960 | | | $ | 73,768 | | | $ | 2,781,612 | | |

| Total | | $ | 983,552 | | | $ | 1,568,685 | | | $ | (2,353) | | | $ | 157,960 | | | $ | 73,768 | | | $ | 2,781,612 | | |

The total change in unrealized appreciation included in the Consolidated Statements of Operations within net change in unrealized appreciation (depreciation) for the nine months ended September 30, 2024 attributable to Level III investments and foreign currency translation still held at September 30, 2024 was $157,960 and $73,768, respectively.

The following table provides a reconciliation of the beginning and ending balances for investments that use Level III inputs for the nine months ended September 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments | | Balance as of December 31, 2022 | | Purchases | | Net change in unrealized appreciation on investments | | Net change in unrealized depreciation on foreign currency translation | | Balance as of September 30, 2023 | |

| Infrastructure Assets | | $ | — | | | $ | 456,513 | | | $ | 23,885 | | | $ | (849) | | | $ | 479,549 | | |

| Total | | $ | — | | | $ | 456,513 | | | $ | 23,885 | | | $ | (849) | | | $ | 479,549 | | |

The total change in unrealized appreciation included in the Consolidated Statements of Operations within net change in unrealized appreciation (depreciation) for the nine months ended September 30, 2023 attributable to Level III investments and foreign currency translation still held at September 30, 2023 was $23,885 and $(849), respectively.

Derivative Instruments

The Company enters into foreign currency forward contracts to hedge against foreign currency exchange rate risk on its non-U.S. dollar denominated securities or to facilitate settlement of foreign currency denominated Infrastructure Asset transactions. A foreign currency forward contract is an agreement between two parties to buy and sell a currency at a set price with delivery and settlement at a future date. These contracts are marked-to-market by recognizing the difference between the contract forward exchange rate and the forward market exchange rate on the last day of the period as unrealized appreciation or depreciation. When a foreign currency forward contract is closed, through either delivery or offset by entering into another foreign currency forward contract, the Company recognizes realized appreciation or forward contracts involve elements of market risk in excess of the amounts reflected on the Consolidated Statements of Assets and Liabilities. The Company’s primary risk related to hedging is the risk of an unfavorable change in the foreign exchange rate underlying the foreign currency forward contract.

The following table presents the quantitative information about Level III fair value measurements of the Company’s Infrastructure Assets as of September 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | As of September 30, 2024 | | As of December 31, 2023 | | | |

| Level III Assets | | Fair Value September 30, 2024 | | Fair Value December 31, 2023 | | Valuation Methodology & Inputs | | Unobservable Input(s) (1) | | Weighted Average (2) | | Range | | Weighted Average (2) | | Range | | Impact to Valuation from an Increase in Input (3) | |

| Infrastructure Assets | | $2,781,612 | | $983,552 | | Inputs to market comparables, discounted cash flow and transaction price/other | | Illiquidity Discount | | 5.8% | | 5.0% - 10.0% | | 5.1% | | 5.0% - 10.0% | | Decrease | |

| | | | | | | | Weight Ascribed to Market Comparables | | 1.4% | | 0.0% - 25.0% | | 4.0% | | 0.0% - 25.0% | | (4) | |

| | | | | | | | Weight Ascribed to Discounted Cash Flow | | 90.3% | | 0.0% - 100.0% | | 94.6% | | 0.0% - 100.0% | | (5) | |

| | | | | | | | Weight Ascribed to Transaction Price/Other | | 8.3% | | 0.0% - 100.0% | | 1.4% | | 0.0% - 100.0% | | (6) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | Market comparables | | Enterprise Value / Forward EBITDA Multiple | | 11.0x | | 11.0x - 11.0x | | 10.5x | | 10.5x - 10.5x | | Increase | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | Discounted cash flow | | Weighted Average Cost of Capital | | 9.6% | | 6.4% - 15.1% | | 9.7% | | 6.7% - 12.1% | | Decrease | |

| | | | | | | | Enterprise Value / LTM EBITDA Exit Multiple | | 14.5x | | 7.0x - 23.0x | | 13.9x | | 9.5x - 21.0x | | Increase | |

(1) In determining the inputs, management evaluates a variety of factors including economic conditions, industry and market developments, market valuations of comparable companies, and company-specific developments including exit strategies and realization opportunities. The Manager has determined that market participants would take these inputs into account when valuing the investments. “LTM” means Last Twelve Months.

(2) Inputs are weighted based on fair value of the investments included in the range.

(3) Unless otherwise noted, this column represents the directional change in the fair value of the Level III investments that would result from an increase to the corresponding unobservable input. A decrease to the unobservable input would have the opposite effect. Significant increases and decreases in these inputs in isolation could result in significantly higher or lower fair value measurements.

(4) The directional change from an increase in the weight ascribed to the market comparables approach would increase the fair value of the Level III investments if the market comparables approach results in a higher valuation than the discounted cash flow approach and transaction price approach. The opposite would be true if the market comparables approach results in a lower valuation than the discounted cash flow approach and transaction price approach.

(5) The directional change from an increase in the weight ascribed to the discounted cash flow approach would increase the fair value of the Level III investments if the discounted cash flow approach results in a higher valuation than the market comparables approach and transaction price approach. The opposite would be true if the discounted cash flow approach results in a lower valuation than the market comparables approach and transaction price approach.

(6) The directional change from an increase in the weight ascribed to the transaction price approach would increase the fair value of the Level III investments if the transaction price approach results in a higher valuation than the market comparables approach and discounted cash flow approach. The opposite would be true if the transaction price approach results in a lower valuation than the market comparables approach and discounted cash flow approach.

Valuations involve subjective judgments and may not accurately reflect realizable value. The assumptions above are determined by the Manager and reviewed by the Manager’s independent valuation advisor. A change in these assumptions or factors would impact the calculation of the value of our assets.

5.Related Party Transactions

Management Agreement

On September 25, 2023, the Company entered into an Amended and Restated Management Agreement with the Manager (the “Management Agreement”). Pursuant to the Management Agreement, the Manager is responsible for sourcing, evaluating and monitoring the Company’s acquisition opportunities and making recommendations to the Company’s executive committee related to the acquisition, management, financing and disposition of the Company’s assets, in accordance with the Company’s objectives, guidelines, policies and limitations, subject to oversight by the Board.

Pursuant to the Management Agreement, the Manager is entitled to receive a management fee (the “Management Fee”) from the Company in an amount equal to (i) 1.25% per annum of the month-end Net Asset Value attributable to Class D Shares, Class I Shares and Class S Shares, (ii) 1.00% per annum of the month-end NAV for a 60-month period following June 1, 2023 (the “Initial Offering”) attributable to Class U Shares, Class R-D Shares, Class R-S Shares and Class R Shares (provided, in the case of Class U Shares, Class R-S Shares and Class R Shares, that such Class U Shares, Class R-S Shares and Class R Shares are purchased by an investor as part of an intermediary’s aggregate subscription for at least $100,000 during the 12-month period following the Initial Offering) and 1.25% per annum of the month-end NAV attributable to Class U Shares, Class R-D Shares, Class R-S Shares and Class R Shares thereafter, each before giving effect to any accruals for certain fees and expenses. Such Management Fee is calculated based on the Company’s transactional net asset value, which is used to determine the price at which the Company sells and repurchases its Shares.

KKR or its affiliates (and in the case of directors’ fees, KKR executives) are expected to be paid transaction fees and monitoring fees in connection with the acquisition, ownership, control and exit of Infrastructure Assets, and KKR or its affiliates are expected to be entitled to receive “break-up” or similar fees in connection with unconsummated transactions (“Other Fees”). The Management Fee payable in any monthly period is subject to reduction, but not below zero, by an amount equal to any Other Fees allocable to Investor Shares pursuant to the terms of the Management Agreement. The Manager, in its sole discretion, may forgo reimbursement by the Company of certain expenses incurred by the Manager or its affiliates (other than the Company and its subsidiaries) on behalf of the Company in each calendar month to the extent there remains any Other Fees that are not used to offset the Management Fee. Any Other Fees used to offset such expenses will not be applied again to offset future Management Fees.

For the three and nine months ended September 30, 2024, the Manager earned $6,834 and $15,861 in gross Management Fees, respectively. For the three and nine months ended September 30, 2024, the Company offset Management Fees and certain operating expenses of $6,834 and $17,251, respectively.

For the three and nine months ended September 30, 2023, the Manager earned $1,357 and $1,532 in gross Management Fees, respectively. For both the three and nine months ended September 30, 2023, the Company offset Management Fees and certain operating expenses of $339.

As of September 30, 2024 and December 31, 2023, there were unapplied credits of $18,582 and $6,533, respectively, to be carried forward that relate to Other Fees earned.

As of September 30, 2024 and December 31, 2023, the Company does not owe a net Management Fee to the Manager. Pursuant to the Management Agreement, such amounts earned may be offset by the Manager against amounts due to the Company from the Manager.

Performance Participation Allocation

Under the limited liability company agreement of the Company (as amended, the “LLC Agreement”), for as long as the Management Agreement has not been terminated, the Class H Members may receive a Performance Participation Allocation from the Company. The Class H Member is an affiliate of KKR.

KKR is allocated a “Performance Participation Allocation” equal to 12.5% of the Total Return attributable to Investor Shares subject to the annual Hurdle Amount and a High Water Mark, with a 100% Catch-Up (each as defined in the LLC Agreement). Such allocation will be measured and allocated or paid annually (excluding the initial Reference Period, as defined in the LLC Agreement) and accrued monthly (subject to pro-rating for partial periods). KKR may elect to receive the Performance Participation Allocation in cash and/or Class F Shares. Specifically, promptly following the end of each

Reference Period (and at other times as described below), KKR is allocated a Performance Participation Allocation in an amount equal to:

•First, if the Total Return for the applicable period exceeds the sum of (i) the Hurdle Amount for that period and (ii) the Loss Carryforward Amount (any such excess, “Excess Profits”), 100% of such Excess Profits until the total amount allocated to KKR equals 12.5% of the sum of (x) the Hurdle Amount for that period and (y) any amount allocated to KKR pursuant to this clause (any such amount, the “Catch-Up”); and

•Second, to the extent there are remaining Excess Profits, 12.5% of such remaining Excess Profits.

KKR will also be allocated a Performance Participation Allocation with respect to all Investor Shares that are repurchased in connection with repurchases of Shares in an amount calculated as described above with the relevant period being the portion of the “Reference Period” (which is the applicable year beginning on October 1 and ending on September 30 of the next succeeding year, with the initial Reference Period being the period from June 1, 2023 to September 30, 2024) for which such Shares were outstanding, and proceeds for any such Share repurchases will be reduced by the amount of any such Performance Participation Allocation. Such Performance Participation Allocation is calculated based on the Company’s transactional net asset value, which is used to determine the price at which the Company sells and repurchases its Shares.

If the Performance Participation Allocation is paid in Class F Shares, such Shares may be repurchased at KKR’s request and will be subject to the repurchase limitations of our share repurchase plan.

A Performance Participation Allocation accrual of $33,038 and $8,335 was recorded as of September 30, 2024 and December 31, 2023 in the Consolidated Statements of Assets and Liabilities. The Consolidated Statements of Operations reflects a $13,991 and $24,728 Performance Participation Allocation for the three and nine months ended September 30, 2024, respectively. The Consolidated Statements of Operations reflects a $1,281 and $2,595 Performance Participation Allocation for the three and nine months ended September 30, 2023, respectively. During the three and nine months ended September 30, 2024, the Company issued approximately 339 and 873 Class F Shares for $10 and $25 to the Class H Member, respectively, for payment of the Performance Participation Allocation resulting from repurchases of Investor Shares.

Dealer-Manager Agreement

On September 25, 2023, the Company entered into an Amended and Restated Dealer-Manager Agreement (as amended from time to time, the “Dealer-Manager Agreement”) with KKR Capital Markets LLC (the “Dealer-Manager”).

Pursuant to the Dealer-Manager Agreement, the Dealer-Manager solicits sales of the Company’s Shares authorized for issue in accordance with the Company’s confidential Private Placement Memorandum (the “PPM”) and provides certain administrative and shareholder services to the Company, subject to the terms and conditions set forth in the Dealer-Manager Agreement. The Dealer-Manager receives certain front-end sales charges, Distribution Fees, Servicing Fees and certain other fees as described in the PPM.

Distribution Fees and Servicing Fees

The Company will pay KKR Capital Markets LLC ongoing distribution and servicing fees (a) of 0.85% of NAV per annum for Class S Shares, Class R-S Shares and Class U Shares only (consisting of a 0.60% distribution fee (the “Distribution Fee”) and a 0.25% shareholder servicing fee (the “Servicing Fee”)), payable monthly in arrears, as they become contractually due and (b) of 0.25% for Class D Shares and Class R-D Shares only (all of which constitutes payment for shareholder services, with no payment for distribution services) in each case as accrued, and payable monthly. Such Distribution Fee and Servicing Fee are calculated based on the Company’s transactional net asset value, which is used to determine the price at which the Company sells and repurchases its Shares. Class I Shares, Class R Shares, Class E Shares, Class F Shares, Class G Shares and Class H Shares do not incur Distribution Fees or Servicing Fees. All or a portion of the Distribution Fee or Servicing Fee may be used to pay for sub-transfer agency, platform, sub-accounting and certain other administrative services. The Dealer-Manager (defined below) generally expects to reallow the Distribution Fee and the Servicing Fee to participating broker dealers or other intermediaries. The Company also pays for certain sub-transfer agency, sub-accounting and administrative services outside of the Distribution Fee and Servicing Fee.

Under GAAP, the Company accrues the cost of the Servicing Fees and Distribution Fees, as applicable, for the estimated life of the shares as an offering cost at the time the Company sells Class S Shares, Class U Shares, Class D Shares, Class R-D Shares and Class R-S Shares. As of September 30, 2024 and December 31, 2023, the Company has accrued $101,308 and $51,440, respectively, of Servicing Fees and Distribution Fees payable to the Dealer-Manager (defined below) related to the Class S Shares, Class U Shares, Class D Shares, and Class R-D Shares sold.

Expense Limitation and Reimbursement Agreement

On December 16, 2023, the Company entered into a Second Amended and Restated Expense Limitation and Reimbursement Agreement (the “Expense Limitation Agreement”) with the Manager, which amended and restated the Amended and Restated Expense Limitation and Reimbursement Agreement, dated as of May 10, 2023. The Expense Limitation Agreement extends the Limitation Period (as defined in the Expense Limitation Agreement) to December 31, 2024. Pursuant to the Expense Limitation Agreement, the Manager will forgo an amount of its monthly management fee and/or pay, absorb or reimburse certain expenses of the Company, to the extent necessary so that, for any fiscal year, the Company’s annual Specified Expenses (defined below) do not exceed 0.60% of the Company’s net assets as of the end of each calendar month. “Specified Expenses” is defined to include all expenses incurred in the business of the Company, including organizational and offering costs, with the exception of (i) the management fee, (ii) the Performance Participation Allocation, (iii) the Servicing Fee, (iv) the Distribution Fee, (v) asset or entity level expenses, (vi) brokerage costs or other investment-related out-of-pocket expenses, including with respect to unconsummated transactions, (vii) dividend/interest payments (including any dividend payments, interest expenses, commitment fees, or other expenses related to any leverage incurred by the Company), (viii) taxes, (ix) ordinary corporate operating expenses (including costs and expenses related to hiring, retaining, and compensating employees and officers of the Company), (x) certain insurance costs and (xi) extraordinary expenses (as determined in the sole discretion of the Manager).

The Expense Limitation Agreement will be in effect through and including December 31, 2024, but may be renewed by the mutual agreement of the Manager and the Company for successive terms. Under the Expense Limitation Agreement, the Company has agreed to carry forward the amount of the foregone management fees and/or expenses paid, absorbed or reimbursed by the Manager for a period not to exceed three years from the end of the month in which the Manager waived or reimbursed such fees or expenses and to reimburse the Manager for such fees or expenses in accordance with the Expense Limitation Agreement.

For the three months ended September 30, 2024, the Manager did not reimburse expenses incurred by the Company, pursuant to the Expense Limitation Agreement. For the nine months ended September 30, 2024, the Manager agreed to reimburse expenses of $2,377 incurred by the Company, pursuant to the Expense Limitation Agreement, which amount is subject to recoupment within a three year period.

For the three and nine months ended September 30, 2023, the Manager agreed to reimburse expenses of $3,906 and $8,640, respectively, incurred by the Company, pursuant to the Expense Limitation Agreement.

For the three and nine months ended September 30, 2024, the Manager recouped expenses of $776 and $816, respectively, incurred by the Company, pursuant to the Expense Limitation Agreement.

For both the three and nine months ended September 30, 2023, the Manager did not recoup expenses incurred by the Company, pursuant to the Expense Limitation Agreement.

On the Company’s Consolidated Statement of Assets and Liabilities, as of September 30, 2024, the Company has recorded $6,129 as amounts Due to Manager and affiliates related to amounts paid by the Manager on behalf of the Company, amounts recouped under the Expense Limitation Agreement and payable for Infrastructure Assets acquired.

On the Company’s Consolidated Statement of Assets and Liabilities, as of December 31, 2023, the Company has recorded $16,549 as amounts Due from Manager related to amounts waived under the Expense Limitation Agreement and $19,174 as amounts Due to Manager and affiliates related to amounts paid by the Manager on behalf of the Company.

The following table reflects the amounts subject to recoupment pursuant to the Expense Limitation Agreement and the expiration for future possible recoupments by the Manager as of September 30, 2024:

| | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | Amount | | Last Expiration Date | |

| September 30, 2022 | | $ | 2,822 | | | September 30, 2025 | |

| December 31, 2022 | | 1,797 | | | December 31, 2025 | |

| March 31, 2023 | | 2,963 | | | March 31, 2026 | |

| June 30, 2023 | | 1,771 | | | June 30, 2026 | |

| September 30, 2023 | | 3,906 | | | September 30, 2026 | |

| December 31, 2023 | | 2,474 | | | December 31, 2026 | |

| March 31, 2024 | | 1,923 | | | March 31, 2027 | |

| June 30, 2024 | | 454 | | | June 30, 2027 | |

| September 30, 2024 | | — | | | September 30, 2027 | |

| Total | | $ | 18,110 | | | | |

As of September 30, 2024, management believed that it is not probable for the Company to be required to reimburse the expenses waived by the Manager.

Line of Credit

On August 9, 2024, a wholly-owned subsidiary of the Company (collectively with future subsidiaries of the Company as may be added and removed from time to time, the “Line of Credit Borrowers”), entered into an unsecured, uncommitted line of credit (the “Line of Credit”) to provide for up to a maximum aggregate principal amount of $350,000 with KKR Alternative Assets LLC (the “Lender”), an affiliate of the Company.

The Line of Credit expires on August 8, 2025, subject to six-month extension options requiring the Lender’s approval. The applicable interest rate is a rate up to the then-current rate offered by a third-party lender or, if no such rate is available, up to the sum of the Secured Overnight Financing Rate applicable to such loan plus 3.25% per annum. Each advance under the Line of Credit is repayable on the earliest of (i) the 180th day following the earlier of (x) the Lender’s demand and (y) the expiration of the Line of Credit and (ii) if specified, the scheduled date of repayment for each such loan as set forth in the relevant loan request (the “Scheduled Repayment Date”), which date shall in no case be later than 364 days following the borrowing of such loan (unless the Lender, in its sole discretion, consents to a Scheduled Repayment Date that is later than 364 days following the borrowing of such loan). To the extent the Company has not repaid all loans and other obligations under the Line of Credit after a repayment event has occurred, the Company is obligated to apply excess available cash proceeds to the repayment of such loans and other obligations; provided that the Line of Credit Borrowers will be permitted to (i) make payments to fulfill any repurchase requests pursuant to the Company’s share repurchase plan or any excess tender offer on the terms described in the Company’s private placement memorandum, (ii) use funds to close any acquisition to which the Company committed to prior to receiving a demand notice, (iii) make elective distributions of an amount not to exceed amounts paid in the immediately preceding fiscal quarter and (iv) pay any taxes when due. The Line of Credit also permits voluntary prepayment of principal and accrued interest without any penalty other than customary breakage costs subject to the Lender’s discretion. Each Line of Credit Borrower may withdraw from the Line of Credit at the time all such obligations held by such Line of Credit Borrower to the Lender under the Line of Credit have been repaid to the Lender in full. The Line of Credit contains customary events of default. As is customary in such financings, if an event of default occurs under the Line of Credit, the Lender may accelerate the repayment of amounts outstanding under the Line of Credit and exercise other remedies subject, in certain instances, to the expiration of an applicable cure period.

None of the Lender and its assignees shall have any recourse to any entities with interests in the Line of Credit Borrowers such as a general partner or investor, including the Company, or any of their respective assets for any indebtedness or other monetary obligation incurred under the Line of Credit.

As of September 30, 2024, the Line of Credit Borrowers had an outstanding balance of $249,128 under the Line of Credit. The Line of Credit Borrowers and Lender agreed to a 0.00% per annum interest rate on all borrowings outstanding as of September 30, 2024. The carrying amount outstanding under the Line of Credit approximates its fair value as of September 30, 2024.

Infrastructure Assets

For both the three and nine months ended September 30, 2024, KKR Alternative Assets LLC, an indirect subsidiary of KKR, contributed ownership interests in certain Infrastructure Assets to the Company for aggregate consideration of $378,487 in exchange for cash and borrowings under the Line of Credit.

For the three months ended September 30, 2023, the Company did not issue Class E Shares of the Company to KKR Alternative Assets LLC for aggregate consideration in exchange for the contribution to the Company of ownership interests in certain Infrastructure Assets. For the nine months ended September 30, 2023, the Company issued Class E Shares of the Company to KKR Alternative Assets LLC for aggregate consideration of $444,013 in exchange for the contribution to the Company of ownership interests in certain Infrastructure Assets.

6.Shareholders’ Equity

The following table is a summary of the movement in the Company’s outstanding Shares during the three months ended September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares Outstanding as of June 30, 2024 | | Shares Issued During the Period | | Shares Repurchased During the Period | | Shares Issued Upon Reinvestment of Distributions During the Period | | Transfers In | | Transfers Out | | Shares Outstanding as of September 30, 2024 | |

| Class I Shares | | 2,537,525 | | | 6,095,191 | | | — | | | 18,030 | | | 1,368 | | | — | | | 8,652,114 | | |

| Class S Shares | | 2,977,216 | | | 7,590,155 | | | — | | | 20,275 | | | — | | | — | | | 10,587,646 | | |

| Class U Shares | | 46,526,340 | | | — | | | (37,579) | | | 308,755 | | | — | | | (42,536) | | | 46,754,980 | | |

| Class R-D Shares | | 750,832 | | | — | | | — | | | 7,324 | | | — | | | — | | | 758,156 | | |

| Class R Shares | | 28,963,732 | | | — | | | (1,000) | | | 218,030 | | | 41,052 | | | — | | | 29,221,814 | | |