Filed by Delta Corp Holdings Limited

Pursuant to Rule 425 under the Securities Act of 1933, and

deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934

Subject Company:

Delta Corp Holdings Limited

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 23, 2024

Kaival Brands Innovations Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 001-40641 | | 83-3492907 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

4460 Old Dixie Highway

Grant-Valkaria, Florida 32949

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (833) 452-4825

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | KAVL | | The Nasdaq Stock Market, LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On September 23, 2024, Kaival Brands Innovations Group, Inc., a Delaware corporation (the “Company” or “Kaival Brands”) entered into a definitive Merger and Share Exchange Agreement (the “Merger Agreement”) with Delta Corp Holdings Limited, a company incorporated in England and Wales (together with its successors and assigns, “Delta”), Delta Corp Holdings Limited, a Cayman Islands exempted company (“Pubco”), KAVL Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Pubco (“Merger Sub”) and Delta Corp Cayman Limited (the “Sellers”). The Company, Delta, Pubco, Merger Sub and the Sellers are sometimes referred to herein individually as a “Party” and, collectively, as the “Parties”. All of the transactions contemplated by the Merger Agreement are collectively referred to herein as the “Business Combination.”

On September 23, 2024, Kaival Brands and Delta issued a press release announcing their execution of the Merger Agreement. A copy of the press release is furnished hereto as Exhibit 99.2 and is incorporated herein by reference.

On September 23, 2024, Delta provided information in connection with the proposed Business Combination in a presentation (the “Presentation”), which is furnished as Exhibit 99.1 hereto, and incorporated herein by reference.

The information in this Item 7.01 and each of Exhibits 99.1 and 99.2 attached hereto will not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference in such filing.

Additional Information and Where to Find It

In connection with the proposed Business Combination, Pubco, Kaival Brands and Delta plan to file or cause to be filed relevant materials with the SEC, including a Pubco registration statement on Form F-4 (the “Registration Statement”) that will contain a proxy statement of Kaival Brands and a prospectus for registration of shares of Pubco. The Registration Statement has not been filed with or declared effective by the SEC. Following and subject to the Registration Statement being declared effective by the SEC, its definitive proxy statement/prospectus would be mailed or otherwise disseminated to Kaival Brands’ stockholders. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF KAIVAL BRANDS ARE URGED TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DELTA, KAIVAL BRANDS, THE PROPOSED BUSINESS COMBINATION, AND RELATED MATTERS. The proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by Pubco and Kaival Brands with the SEC, may be obtained free of charge at the SEC website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Kaival Brands by directing a written request to: Kaival Brands Innovations Group, Inc., 4460 Old Dixie Highway Grant-Valkaria, Florida. Investors and security holders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed Business Combination.

Participants in the Solicitation

Kaival Brands and its directors, executive officers and certain other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from the shareholders of Kaival Brands with respect to the proposed Business Combination and related matters. Information about the directors and executive officers of Kaival Brands, including their ownership of shares of Kaival Brands common stock, is included in Kaival Brands’ Annual Report on Form 10-K for the year ended October 31, 2023, which was filed with the SEC on February 14, 2024. Additional information regarding the persons or entities who may be deemed participants in the solicitation of proxies from Kaival Brands shareholders, including a description of their interests in the proposed business combination by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant documents to be filed with the SEC when they become available. The directors and officers of Delta do not currently hold any interests, by security holdings or otherwise, in Kaival Brands.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction. No offering of securities in connection with the proposed business combination shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward-Looking Statements

This Form 8-K, including the exhibits thereto contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed Business Combination between Pubco, Kaival Brands and Delta. All statements other than statements of historical facts contained in this Form 8-K, including statements regarding Pubco’s, Kaival Brands’ or Delta’s future results of operations and financial position, Pubco’s, Kaival Brands’ and Delta’s business strategy, prospective costs, timing and likelihood of success, plans and objectives of management for future operations, future results of current and anticipated operations of Pubco, Kaival Brands and Delta, and the expected value of the combined company after the transactions, are forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to, the following risks relating to the proposed Business Combination: the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Kaival Brands’ securities; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; the inability to complete the transactions contemplated by the definitive agreement, including due to failure to obtain approval of the shareholders of Kaival Brands or other conditions to closing in the definitive agreement; the inability to obtain or maintain the listing of Pubco ordinary shares on Nasdaq following the business combination; the risk that the transactions contemplated by the Business Combination disrupt current plans and operations of Kaival Brands as a result of the announcement and consummation of these transactions; the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth economically and hire and retain key employees; costs related to the Business Combination; changes in applicable laws or regulations; the possibility that Pubco, Delta or Kaival Brands may be adversely affected by other economic, business, and/or competitive factors; and other risks and uncertainties to be identified in the Registration Statement and accompanying proxy statement/prospectus (when available) relating to the transactions, including those under “Risk Factors” therein, and in other filings with the SEC made by Pubco and Kaival Brands. Moreover, Pubco, Delta and Kaival Brands operate in very competitive and rapidly changing environments. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond Pubco’s, Delta’s and Kaival Brands’ control, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements speak only as of the date they are made. None of Pubco, Delta or Kaival Brands gives any assurance that either Delta or Kaival Brands or Pubco will achieve its expectations. Readers are cautioned not to put undue reliance on forward-looking statements, and except as required by law, Pubco, Delta and Kaival Brands assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01. Financial Statements and Exhibits.

| Exhibit No. | | Description |

| | | |

| 99.1 | | Presentation |

| | | |

| 99.2 | | Press Release |

| | |

| 104 | | Cover Page Interactive Data File (Embedded within the Inline XBRL document and included in Exhibit) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Dated: September 23, 2024 | Kaival Brands Innovations Group, Inc. |

| | | |

| | By: | /s/ Mark Thoenes |

| | | Mark Thoenes |

| | | Chief Executive Officer |

Exhibit 99.1

DELTA CORP HOLDINGS LIMITED September 2024 | Introduction

September 2024 | Introduction to Delta Corp 2 FORWARD LOOKING STATEMENTS & DISCLAIMER Presentation Disclaimer This presentation (the “Presentation”) is for informational purposes only with respect to the proposed business combination b etw een Delta Corp Holdings Limited (“Delta”) and expected T arget Co . (“T arget ”), Delta Corp Holding Limited, a Cayman Islands exempted company (“ Pubco ”), shareholders of Delta and the parties thereto, and which we refer to as the “Business Combination.” This Presentation is not any recommendation relating to the voting, purchase or sale of any se cur ity or as to any other matter by Delta, Target , Pubco or any other person. This Presentation does not purport to contain all of the information that may be required to evaluate th e Business Combination and is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax, financial or legal advice . N o representation or warranty, express or implied, is or will be given by Delta, T arget , Pubco or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or c om pleteness of the information in this Presentation. None of Delta, target or Pubco assume any obligation to update the information in this Presentation. Information contained in this Presentation ( i ) is preliminary in nature and is subject to change, and any such changes may be material and (ii) should be considered in the con text of the circumstances prevailing at the time and has not been, and will not be, updated to reflect material developments which may occur after the date of this Presentation. To the fullest extent permitted by law, in no circumstances will Delta, Target or Pubco or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, a dvisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presen tat ion, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation to or otherwise arising in connection with the forego ing or this Presentation. Additional Information and Where to Find It Pubco has earlier confidentially submitted with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F - 4 (as may be amended from time to time, the “Registration Statement”), Upon the future filing of the Registration Statement, Securityholders of any of the part ies and other interested persons are urged to read, when available, the Registration Statement, preliminary proxy statement/prospectus, and any amendments thereto, and all other re levant documents filed or that will be filed with the SEC in connection with the proposed Business Combination as they become available, because they contain important in for mation about Delta, T arget , Pubco and the Business Combination. Forward - Looking Information This Presentation contains “forward looking statements” within the meaning of Section 27 A of the Securities Act of 1933 as amended, or the Securities Act, and Section 21 E of the Securities Exchange Act of 1934 or the Exchange Act .

September 2024 | Introduction to Delta Corp 3 FORWARD LOOKING STATEMENTS & DISCLAIMER ( con’t ) All statements other than statements of historical facts contained in this Presentation, including statements regarding any of Delta’s, Target or Pubco’s strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward looking statements . These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the “forward looking statements . ” The words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “ project,” “ should,” “ target,” “will,” and similar expressions are intended to identify forward looking statements, although not all forward looking statements contain these identifying words . These “forward looking statements” are only estimations, and any of Delta, Coffee or Pubco , or all of them, may not actually achieve the plans, intentions or expectations disclosed in “forward looking statements,” so you should not place undue reliance on “forward looking statements . ” Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward looking statements made in this Presentation . Management of Delta, target and/or Pubco have based these “forward looking statements” largely on current expectations and projections about future events and trends that such persons believe may affect business, financial condition and operating results . “Forward looking statements” contained in this Presentation are made as of this date, and none of Delta, Target nor Pubco undertakes any duty to update such information except as required under applicable law . This Presentation contains estimates made, and other statistical data published, by independent parties relating to market size and growth and other data about industries of Delta, Target or Pubco , as well as by respective management’s estimates . This data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which Delta,Target and Pubco operate that are subject to a high degree of uncertainty . We caution you not to give undue weight to such projections, assumptions and estimates . No Offer or Solicitation This Presentation does not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to buy, any securities in any jurisdiction, or the solicitation of any vote, consent, proxy or approval in any jurisdiction in connection with the Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction . This Presentation does not constitute either advice or a recommendation regarding any securities . No offering of securities shall be made except by means of a prospectus meeting the requirements of the U . S . Securities Act of 1933 or an exemption therefrom .

September 2024 | Introduction to Delta Corp 4 FORWARD LOOKING STATEMENTS & DISCLAIMER ( con’t ) Financial Information The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X promulgated by the SEC . In addition, Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in any proxy statement or registration statement to be filed by Pubco with the SEC . Use of Projections The projections, estimates and targets in this Presentation, if any, are forward - looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of any of Delta, Target or Pubco . See “ Forward - Looking Statements ” above . The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory, competitive, technological and other risks and uncertainties that could cause actual results to differ materially from those contained in such projections, estimates and targets . Any prospective information are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results . While all projections, estimates and targets are necessarily speculative, each of Target , Delta and Pubco believe that the preparation of prospective information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation . Accordingly, there can be no assurance that prospective results are indicative of future performance or that actual results will not differ materially from any results presented or indicated in the prospective information . The inclusion of projections, estimates and targets in this Presentation should not be regarded as an indication that any of the Delta, Target or Pubco , or their respective representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events . Neither the independent auditors of Delta nor Coffee has audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purposes of this Presentation . Trademarks This Presentation contains trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners . The use or display of third parties ’ trademarks, service marks, trade names or products in this Presentation are not intended to, and do not imply, a relationship with any of Target , Delta or Pubco . Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that any of Target , Delta or Pubco or the any third - party will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights .

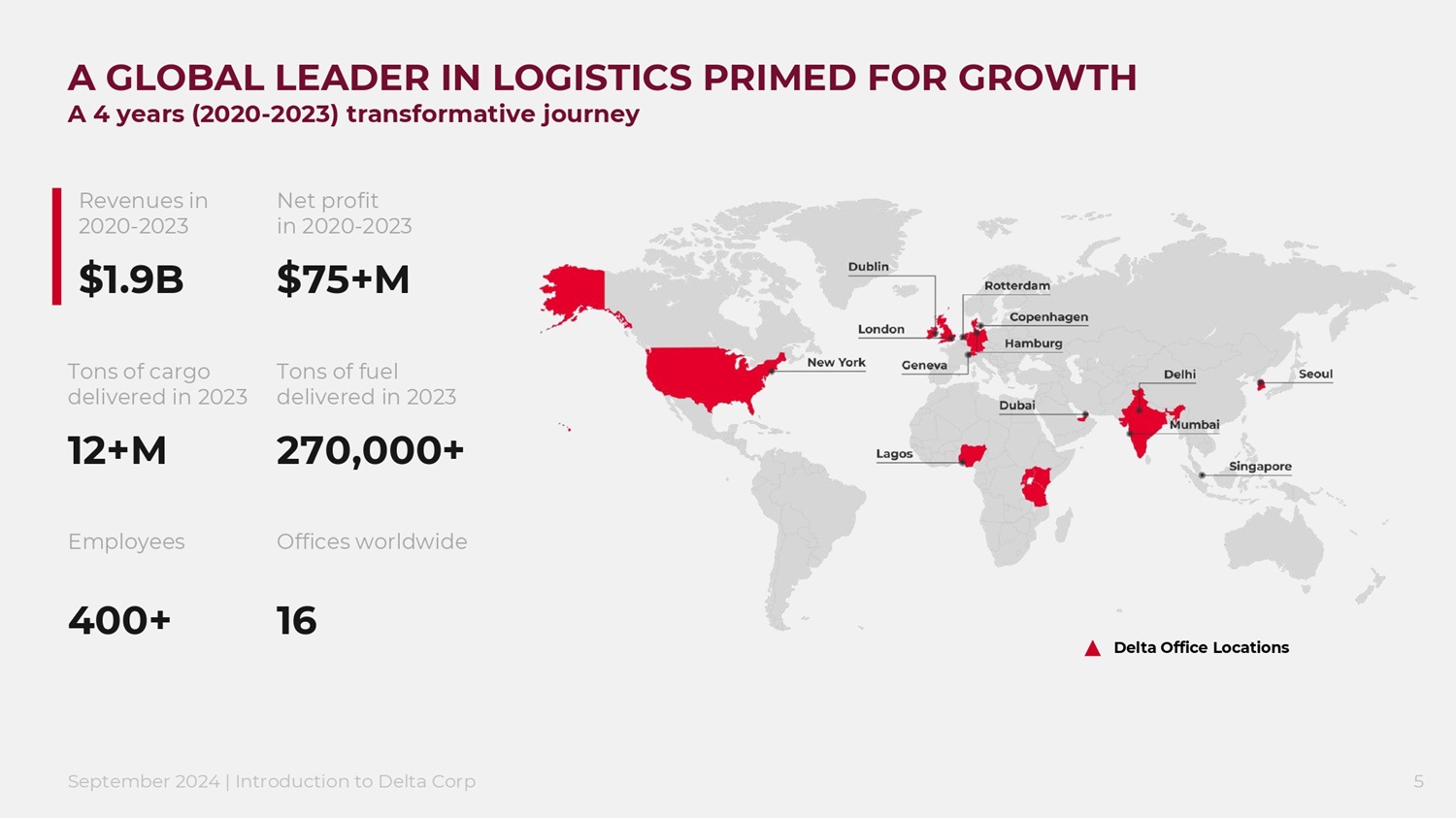

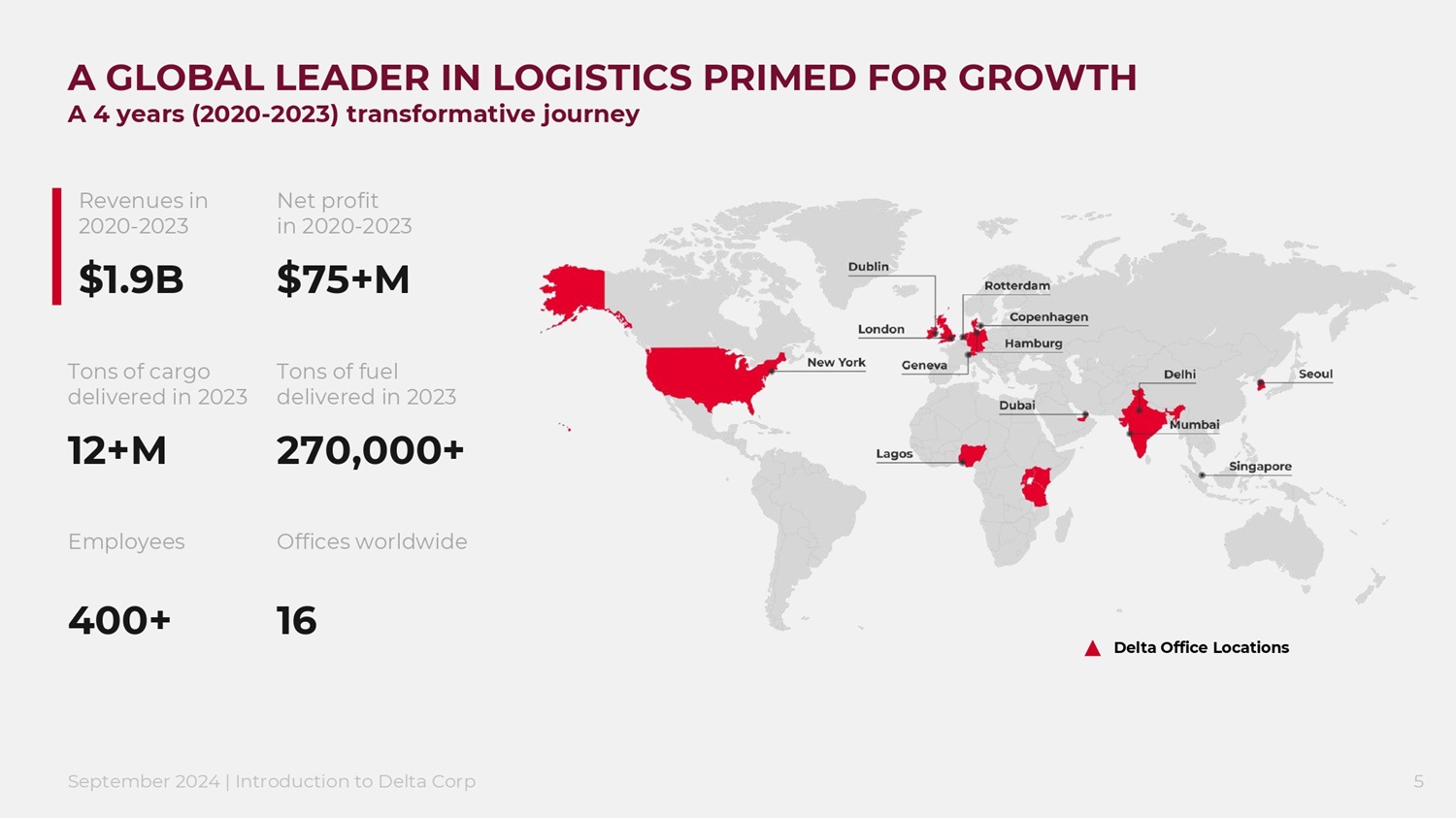

September 2024 | Introduction to Delta Corp 5 A GLOBAL LEADER IN LOGISTICS PRIMED FOR GROWTH A 4 years (2020 - 2023) transformative journey Net profit in 2 020 - 2023 $ 75+ M Tons of cargo delivered in 202 3 12+M Tons of fuel d elivered in 202 3 270,000+ Employees 400+ Offices worldwide 16 Revenues in 2020 - 2023 $ 1.9B Delta Office Locations

September 2024 | Introduction to Delta Corp 6 FULLY INTEGRATED ONE - STOP LOGISTICS PROVIDER Cargo & Commodity Producers/Suppliers Trans - shipment Ocean transportation Loading Storage Port logistics Receiving Warehousing Stocking piling Delivery to end user International supply chain Delta’s service offerings cover every stage of the supply chain, including transportation and route optimization, fuel and lubricant supply, and management of logistics assets DELTA ’S ROLE Bulk Logistics Energy Logistics Asset Management

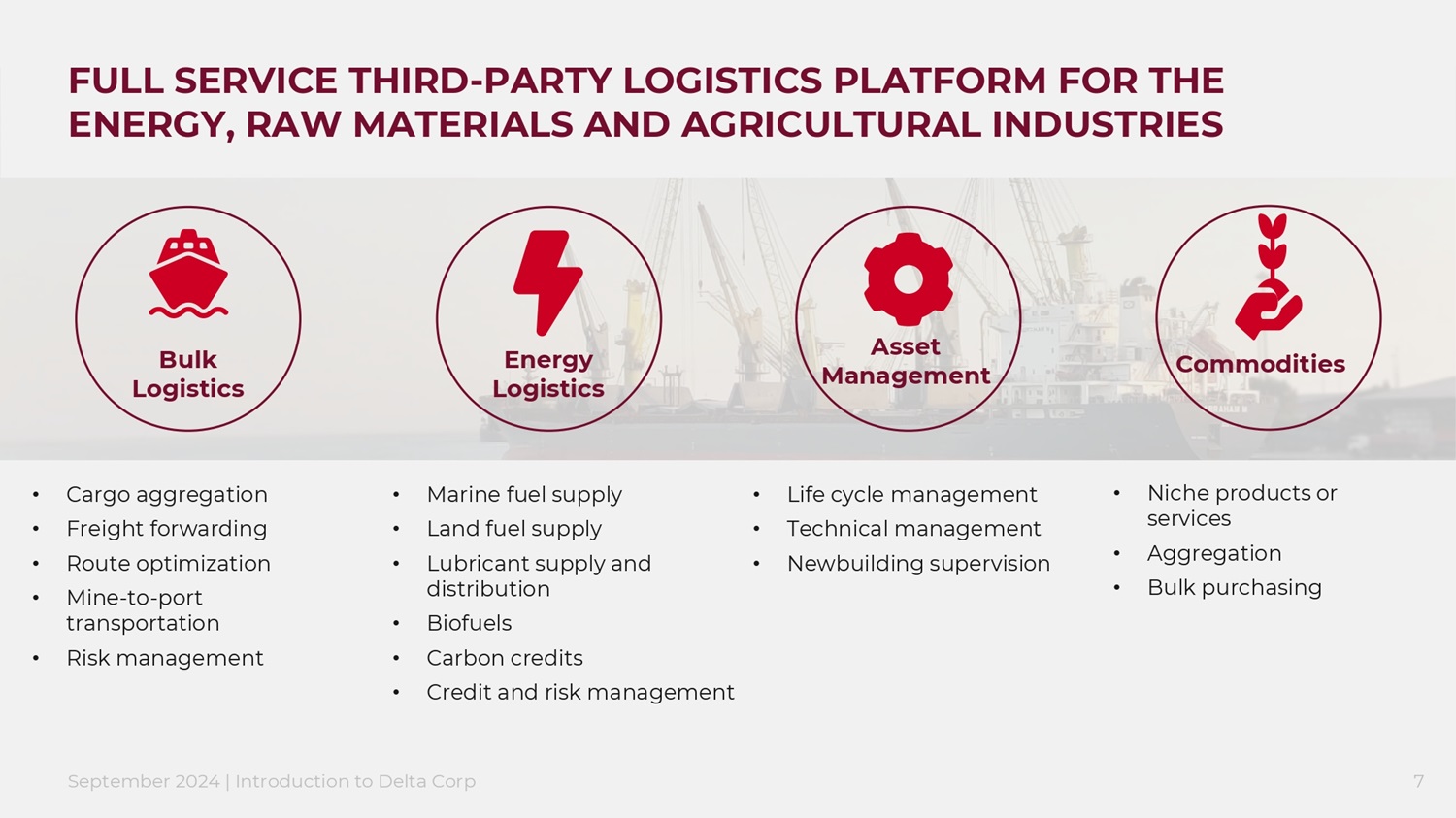

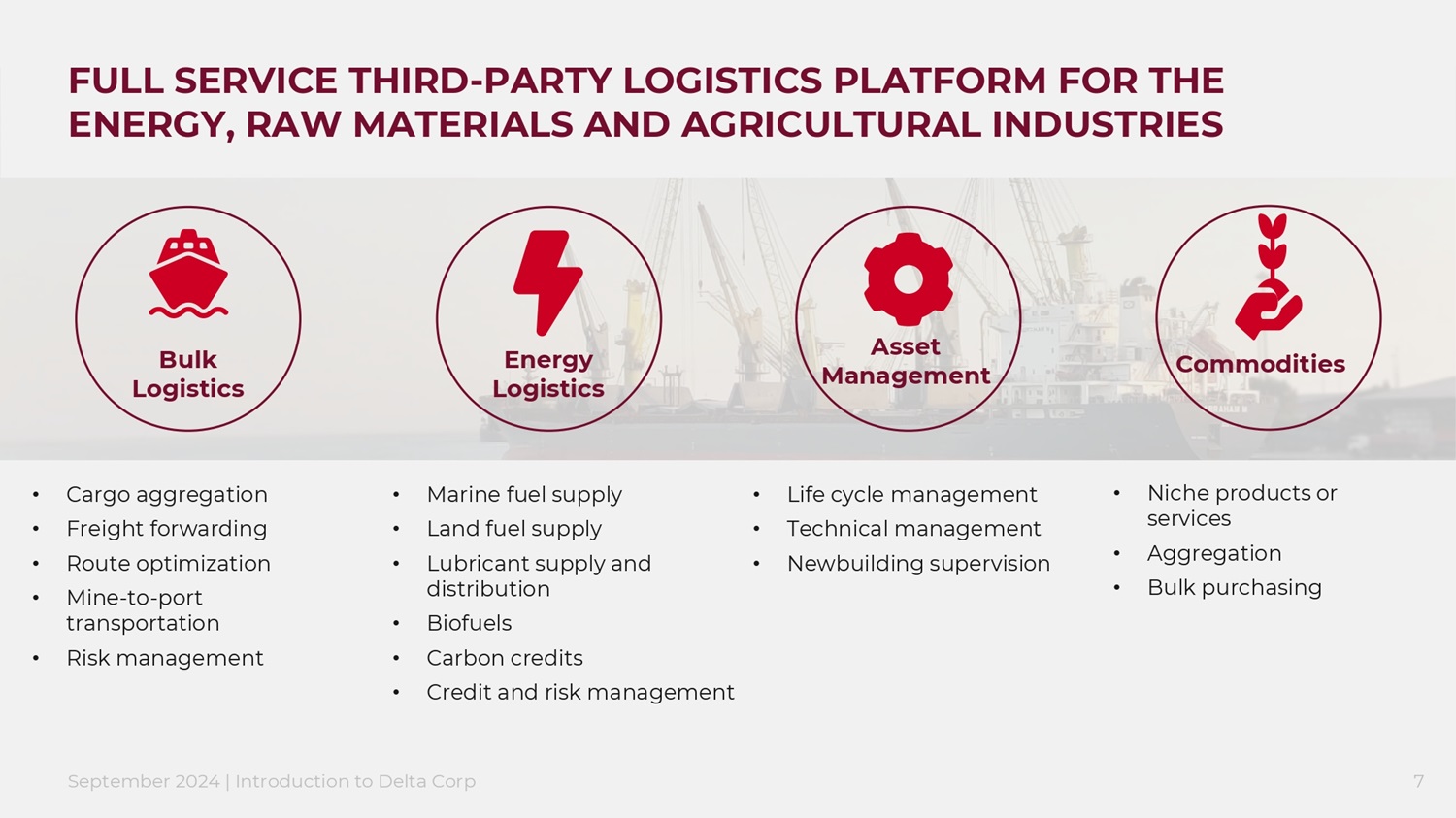

September 2024 | Introduction to Delta Corp 7 FULL SERVICE THIRD - PARTY LOGISTICS PLATFORM FOR THE ENERGY, RAW MATERIALS AND AGRICULTURAL INDUSTRIES Energy Logistics • Marine fuel supply • Land fuel supply • Lubricant supply and distribution • Biofuels • Carbon credits • Credit and risk management Asset Management • Life cycle management • Technical management • Newbuilding supervision • Cargo aggregation • Freight forwarding • Route optimization • Mine - to - port transportation • Risk management Bulk Logistics • Niche products or services • Aggregation • Bulk purchasing Commodities

September 2024 | Introduction to Delta Corp 8 DELTA’S LEADERSHIP TEAM HAS A TRACK RECORD OF SUCCESS BUILDING GLOBAL BUSINESSES Board of Directors Peter Shaerf Non Exec Chairman Mudit Paliwal Founder, CEO, Director Elizabeth Turnbull Independent Director Lelia Konyn Independent Director Michelle Bockmann Independent Director

September 2024 | Introduction to Delta Corp 9 DELTA’S LEADERSHIP TEAM HAS A TRACK RECORD OF SUCCESS BUILDING GLOBAL BUSINESSES Joseph Nelson Chief Financial Officer Andrew Benjamin EVP, Logistics Chris Todd EVP, Energy Caroline Huot SVP, Asset Management Mudit Paliwal Founder, CEO, Director Management Team

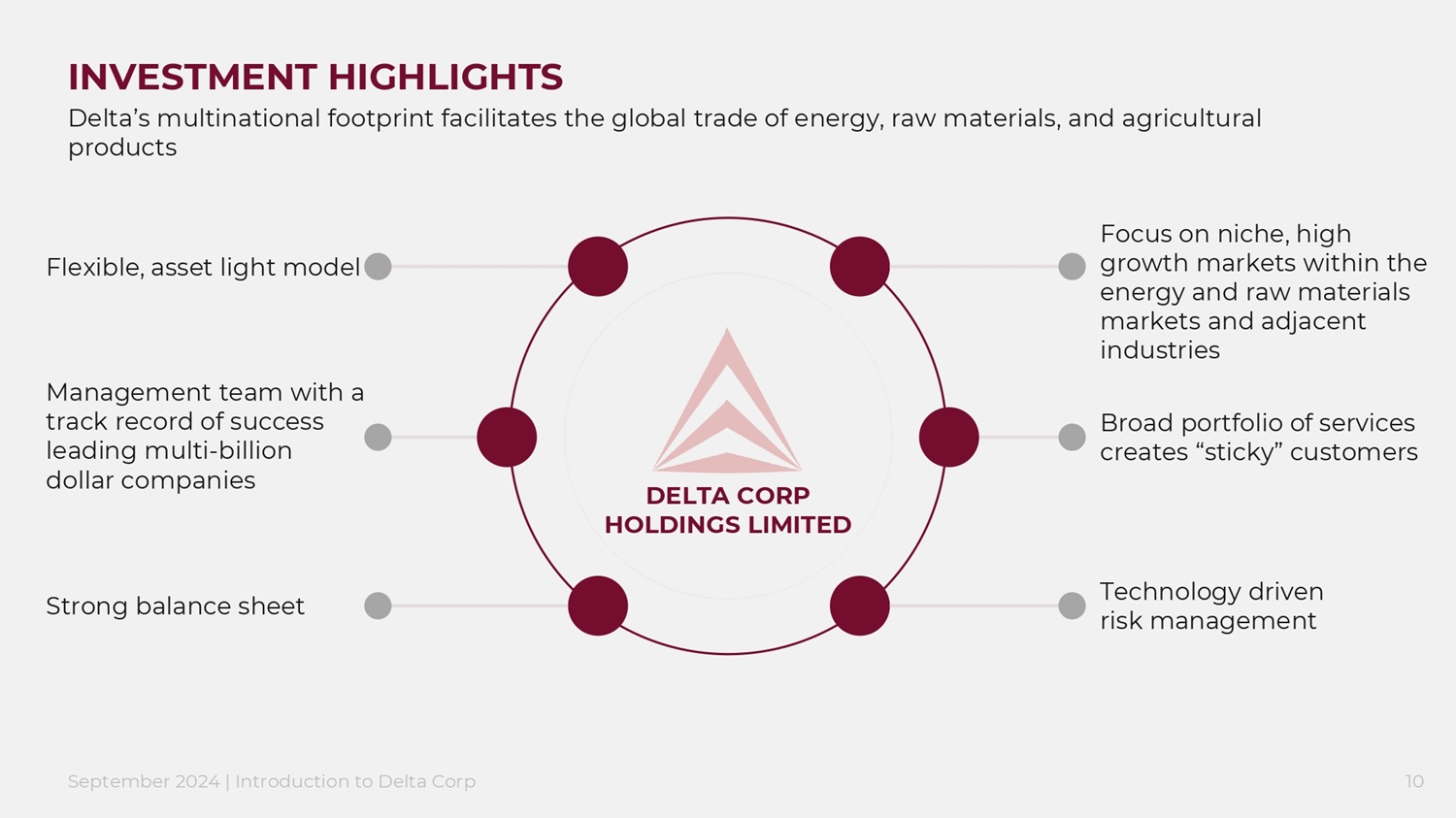

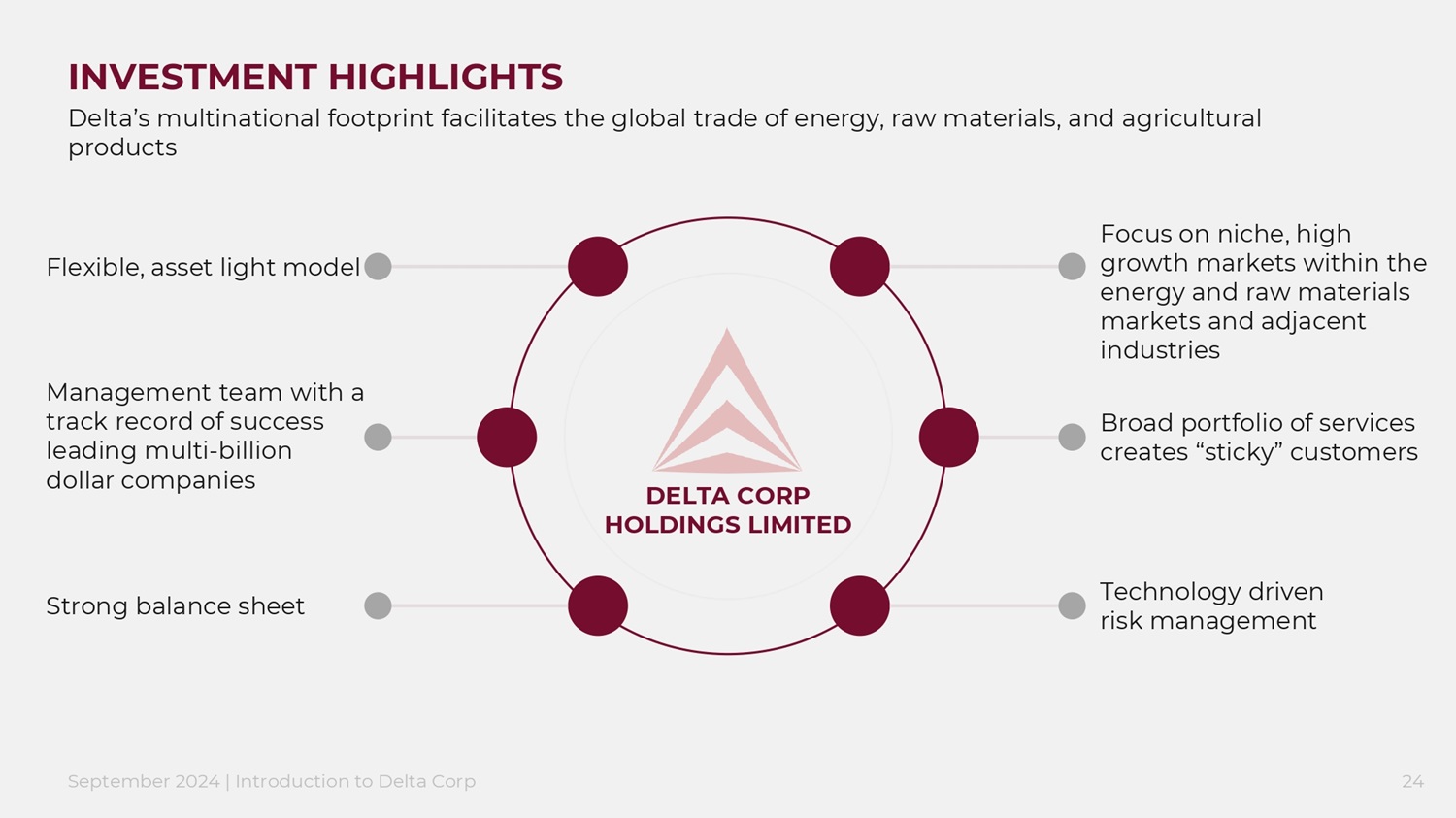

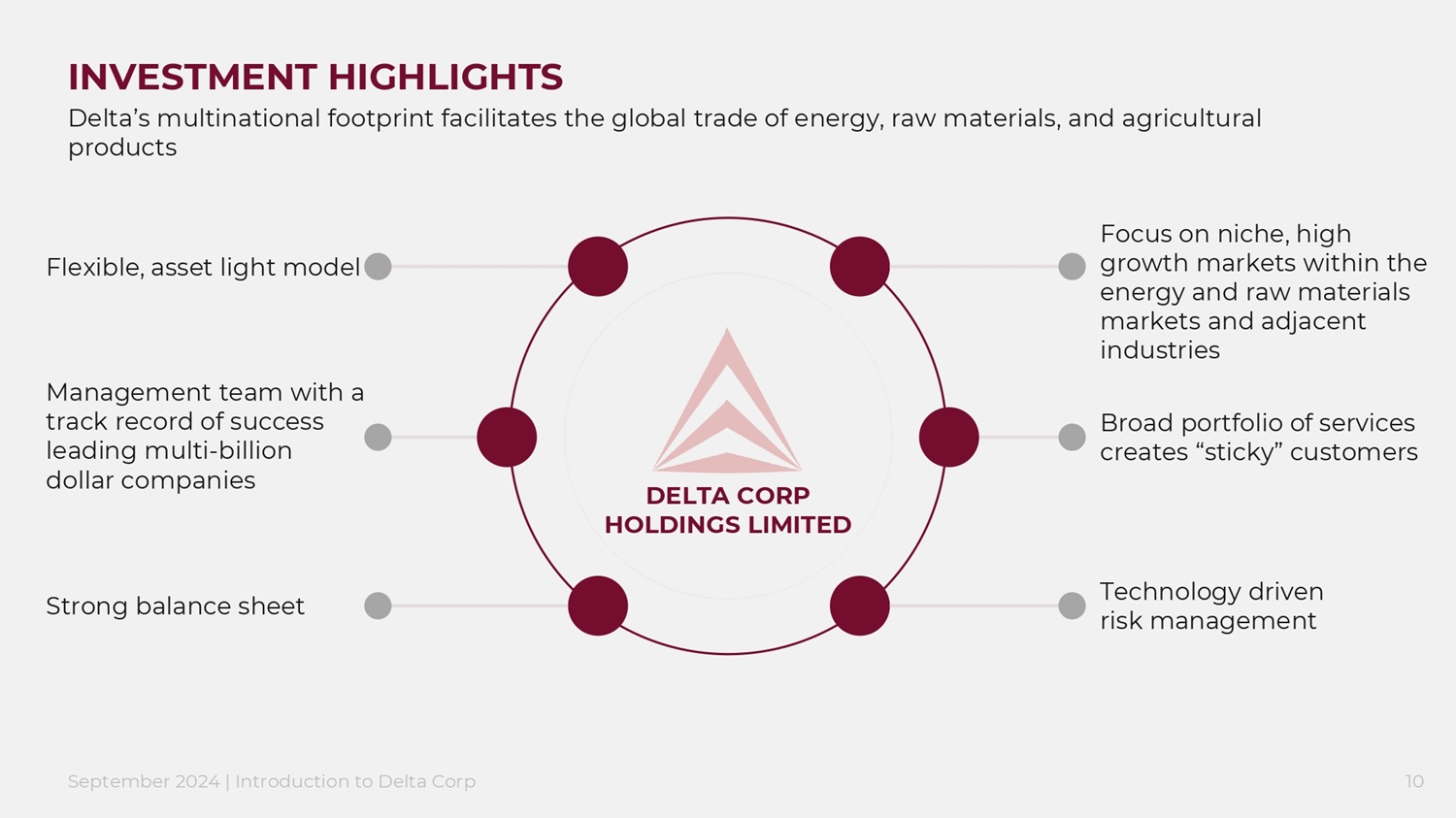

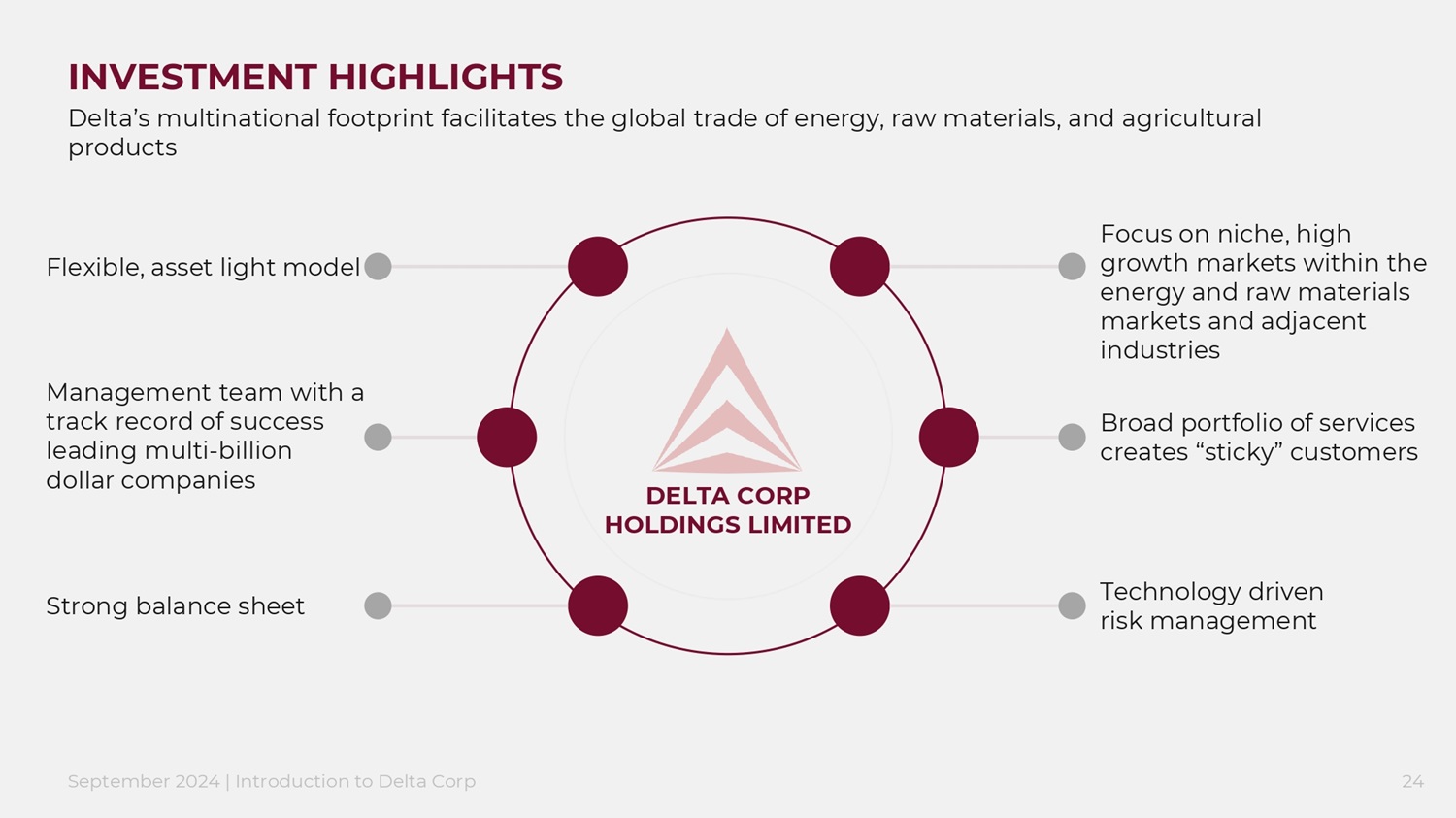

September 2024 | Introduction to Delta Corp 10 INVESTMENT HIGHLIGHTS Strong balance sheet Flexible, asset light model Management team with a track record of success leading multi - billion dollar companies DELTA CORP HOLDINGS LIMITED Focus on niche, high growth markets within the energy and raw materials markets and adjacent industries Broad portfolio of services creates “sticky” customers Technology driven risk management Delta’s multinational footprint facilitates the global trade of energy, raw materials, and agricultural products

September 2024 | Introduction to Delta Corp 11 LOGISTICS PROVIDER TO SOME OF THE WORLD’S LARGEST BUSINESSES Delta’s business is supported by industry leading suppliers, banks, insurers and risk managers Bulk Logistics Energy Logistics Customers Suppliers Partnerships

BUSINESS OVERVIEW BULK LOGISTICS 1 ENERGY LOGISTICS 2 ASSET MANAGEMENT 3

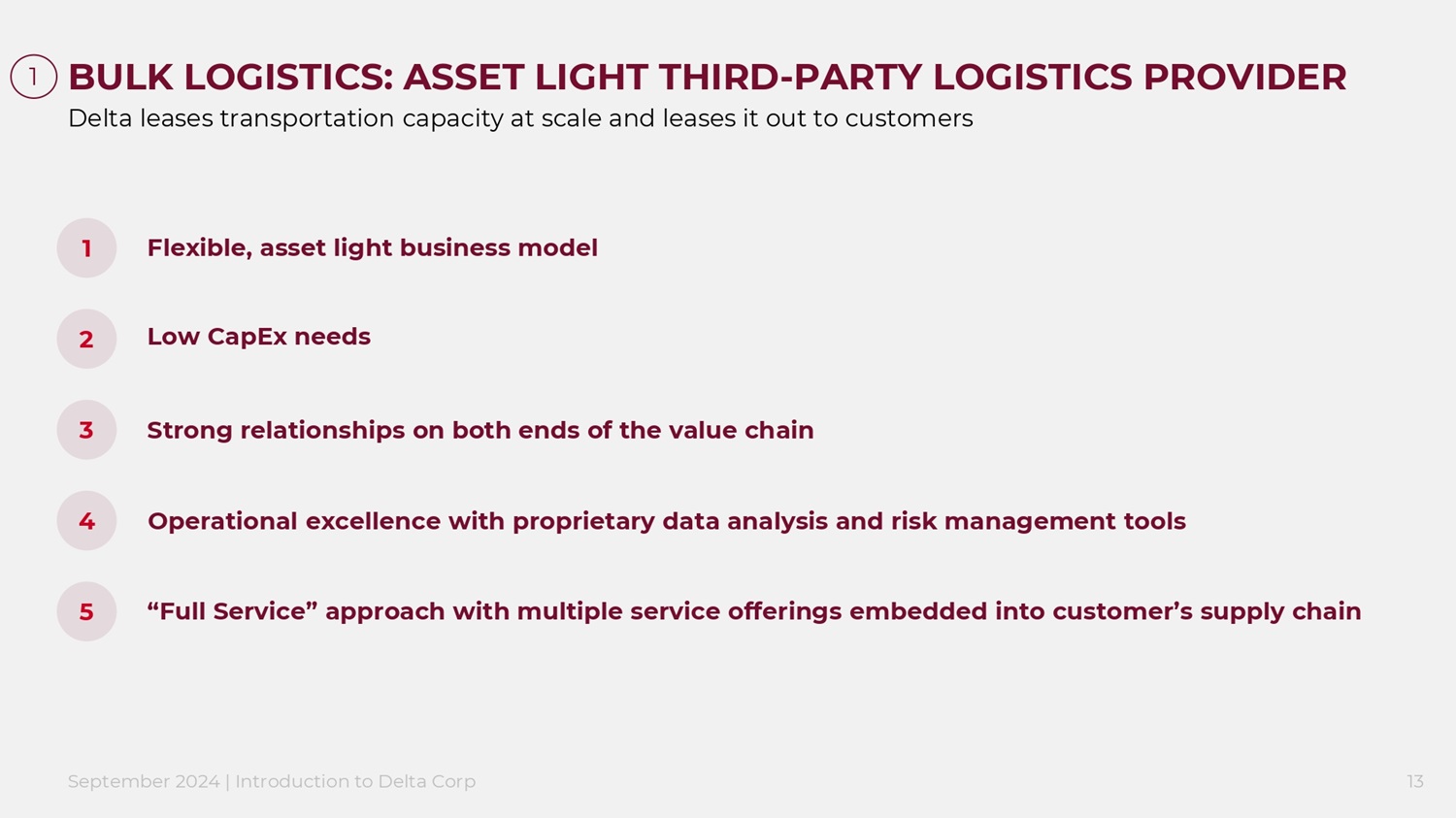

September 2024 | Introduction to Delta Corp 13 1 BULK LOGISTICS: ASSET LIGHT THIRD - PARTY LOGISTICS PROVIDER Delta leases transportation capacity at scale and leases it out to customers Flexible, asset light business model Strong relationships on both ends of the value chain Operational excellence with proprietary data analysis and risk management tools “Full Service” approach with multiple service offerings embedded into customer’s supply chain Low CapEx needs 1 2 3 4 5

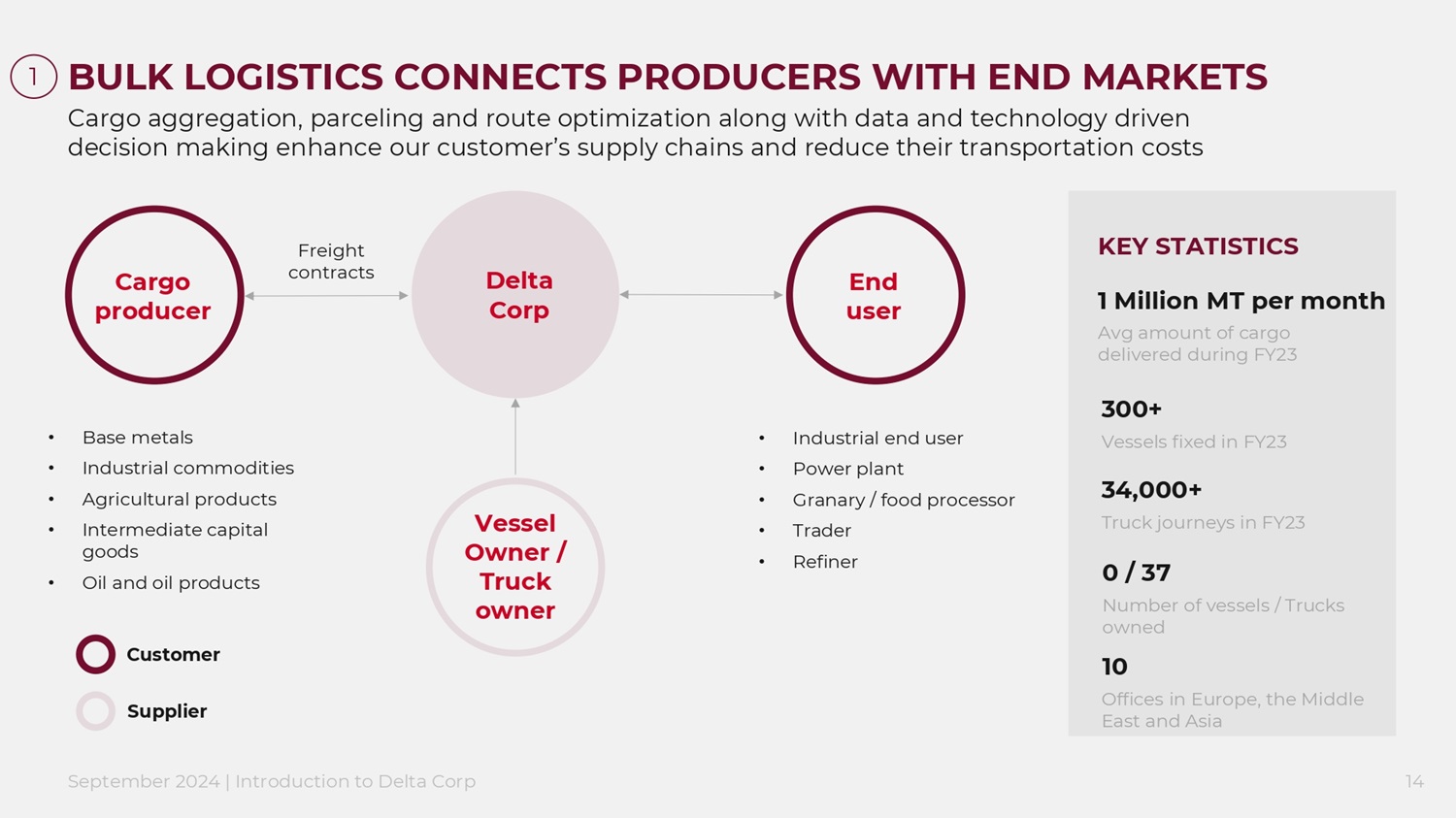

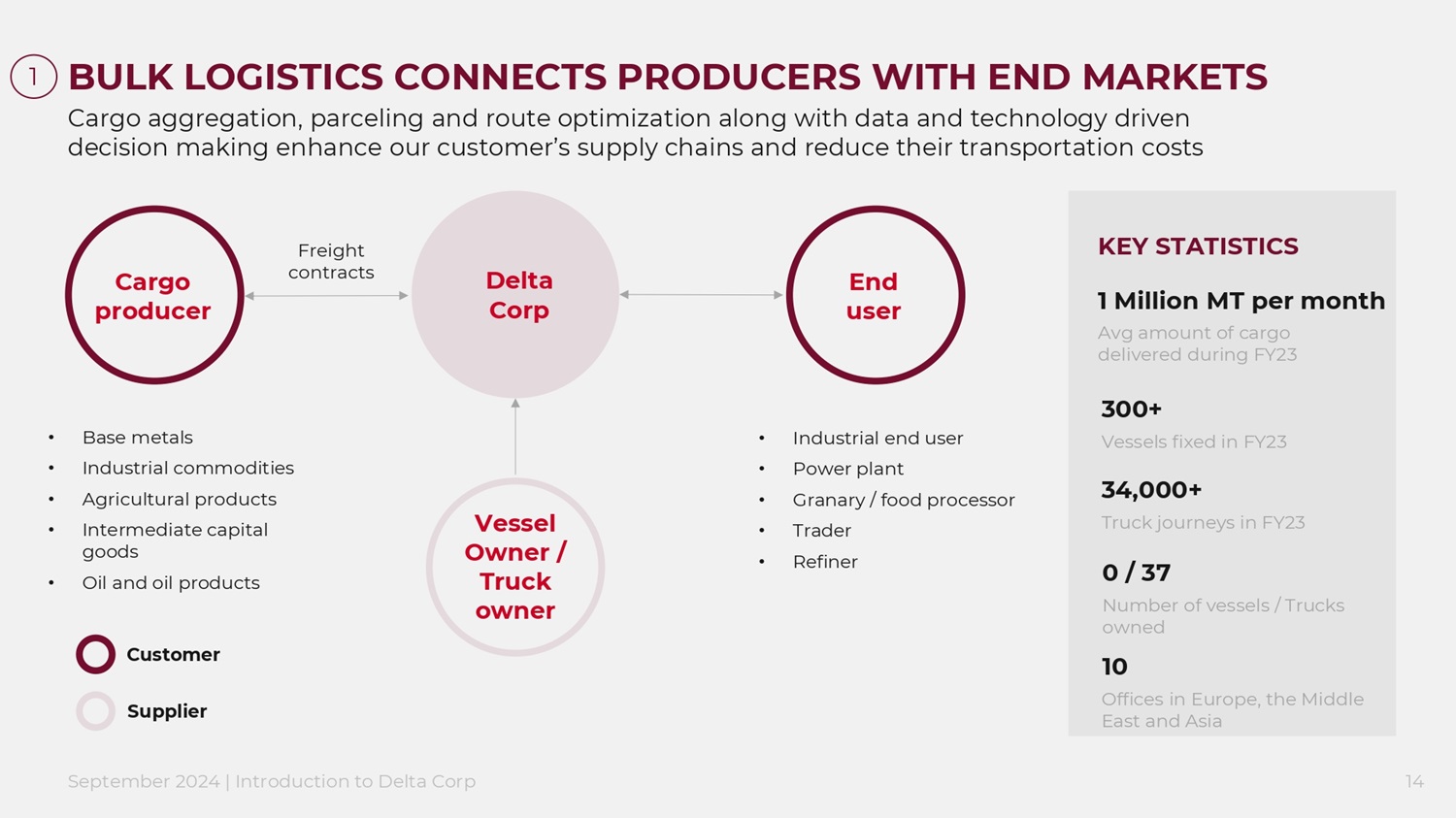

September 2024 | Introduction to Delta Corp 14 BULK LOGISTICS CONNECTS PRODUCERS WITH END MARKETS Cargo aggregation, parceling and route optimization along with data and technology driven decision making enhance our customer’s supply chains and reduce their transportation costs Cargo producer Delta Corp End user Freight contracts Vessel Owner / Truck owner Customer • Base metals • Industrial commodities • Agricultural products • Intermediate capital goods • Oil and oil products • Industrial end user • Power plant • Granary / food processor • Trader • Refiner Supplier 1 Million MT per month Avg amount of cargo delivered during FY23 300+ Vessels fixed in FY23 0 / 37 Number of vessels / Trucks owned 10 Offices in Europe, the Middle East and Asia KEY STATISTICS 1 34,000+ Truck journeys in FY23

September 2024 | Introduction to Delta Corp 15 270,000 MT of fuel delivered in FY23 2000 + Transactions in 2023 11 Offices in Europe, the Middle East and Asia 1 Leased carbon neutral barges delivering fuel in Europe KEY STATISTICS ENERGY LOGISTICS SUPPLIES INDUSTRY LEADING FUELS, REDUCING CUSTOMERS’ ENVIRONMENTAL IMPACT • Supplier of high - quality marine fuels and lubricants • Backed by industry leading producers • Thames, UK served with 1 leased barge • Digital procurement system • Transparent pricing • Quality control monitoring • Seamless integration • Price and supply risk • Hedging ▪ Biofuel supply ▪ Carbon credit trading ▪ Carbon offsetting with VERRA and Gold Standard projects 2

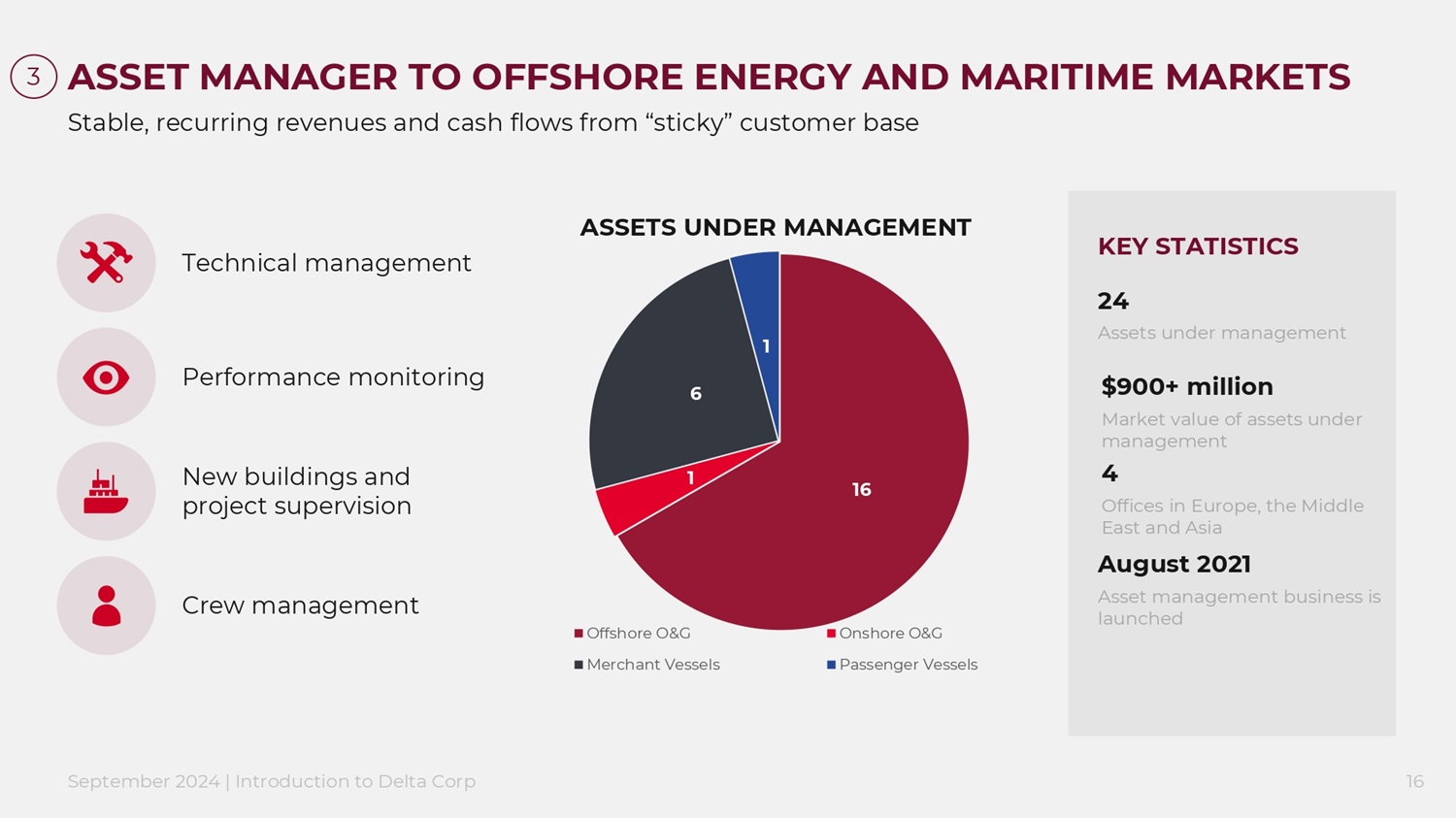

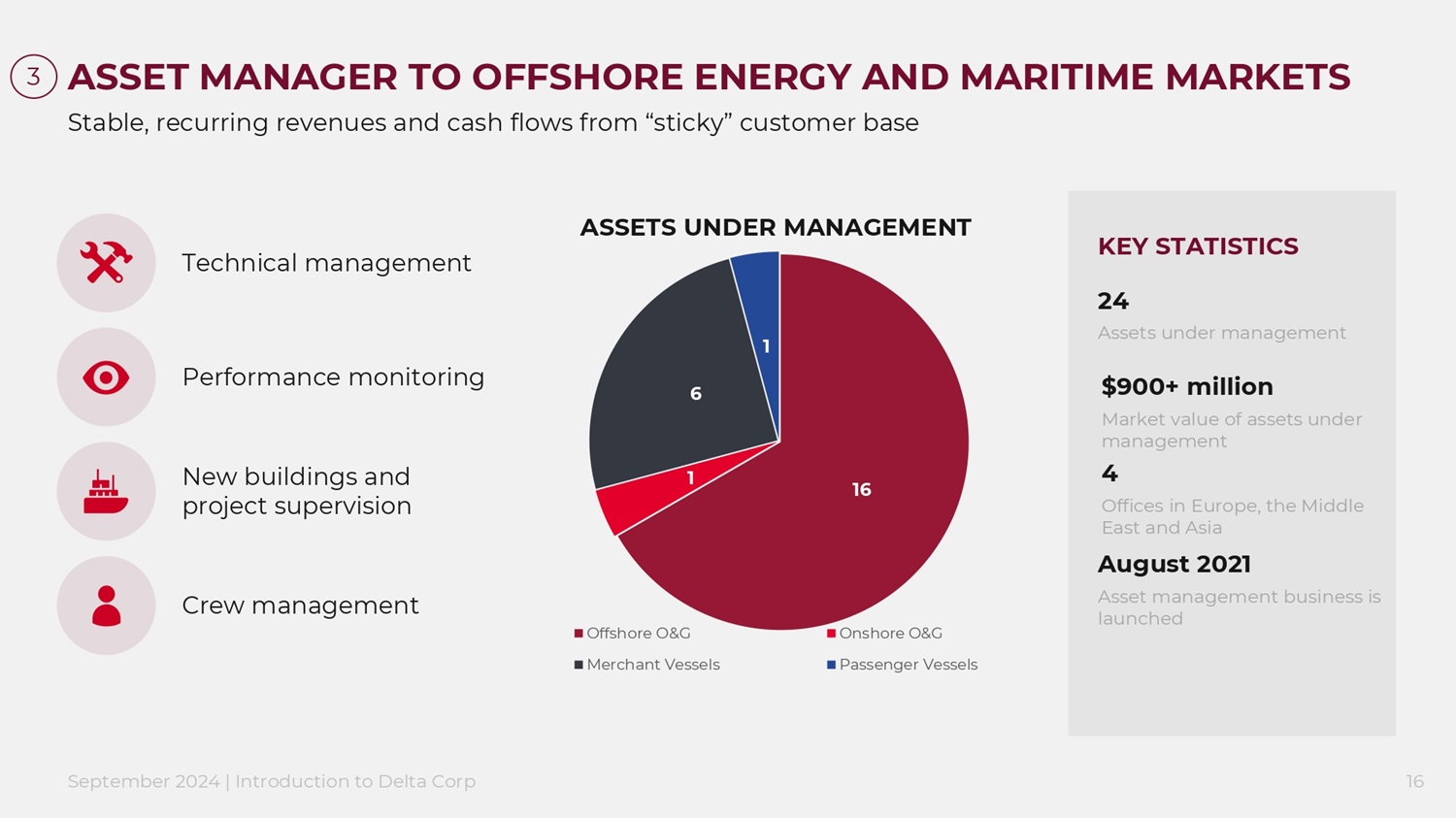

September 2024 | Introduction to Delta Corp 16 16 1 6 1 Offshore O&G Onshore O&G Merchant Vessels Passenger Vessels ASSET MANAGER TO OFFSHORE ENERGY AND MARITIME MARKETS ASSETS UNDER MANAGEMENT Technical management Performance monitoring New buildings and project supervision Crew management 2 4 Assets under management $900+ million Market value of assets under management 4 Offices in Europe, the Middle East and Asia KEY STATISTICS 3 Stable, recurring revenues and cash flows from “sticky” customer base August 2021 Asset management business is launched

GROWTH ACCELERATORS

September 2024 | Introduction to Delta Corp 18 PUBLIC MARKETS, A CATALYST TO ACCELERATE GROWTH Geographic expansion Terminals / Warehousing Mine - to - port logistics EV / last mile services Geographic expansion Alternative fuels (LNG, ammonia, petroleum & refined products) Carbon offsets and carbon credits Retail fueling stations Lubricant manufacturing & distribution Portfolio expansion Industry consolidator Expand services across Delta Corp Cash flow and access to the debt capital markets is expected to provide opportunity for accelerated growth Energy Logistics Asset Management Bulk Logistics Targeted areas of organic growth expansion

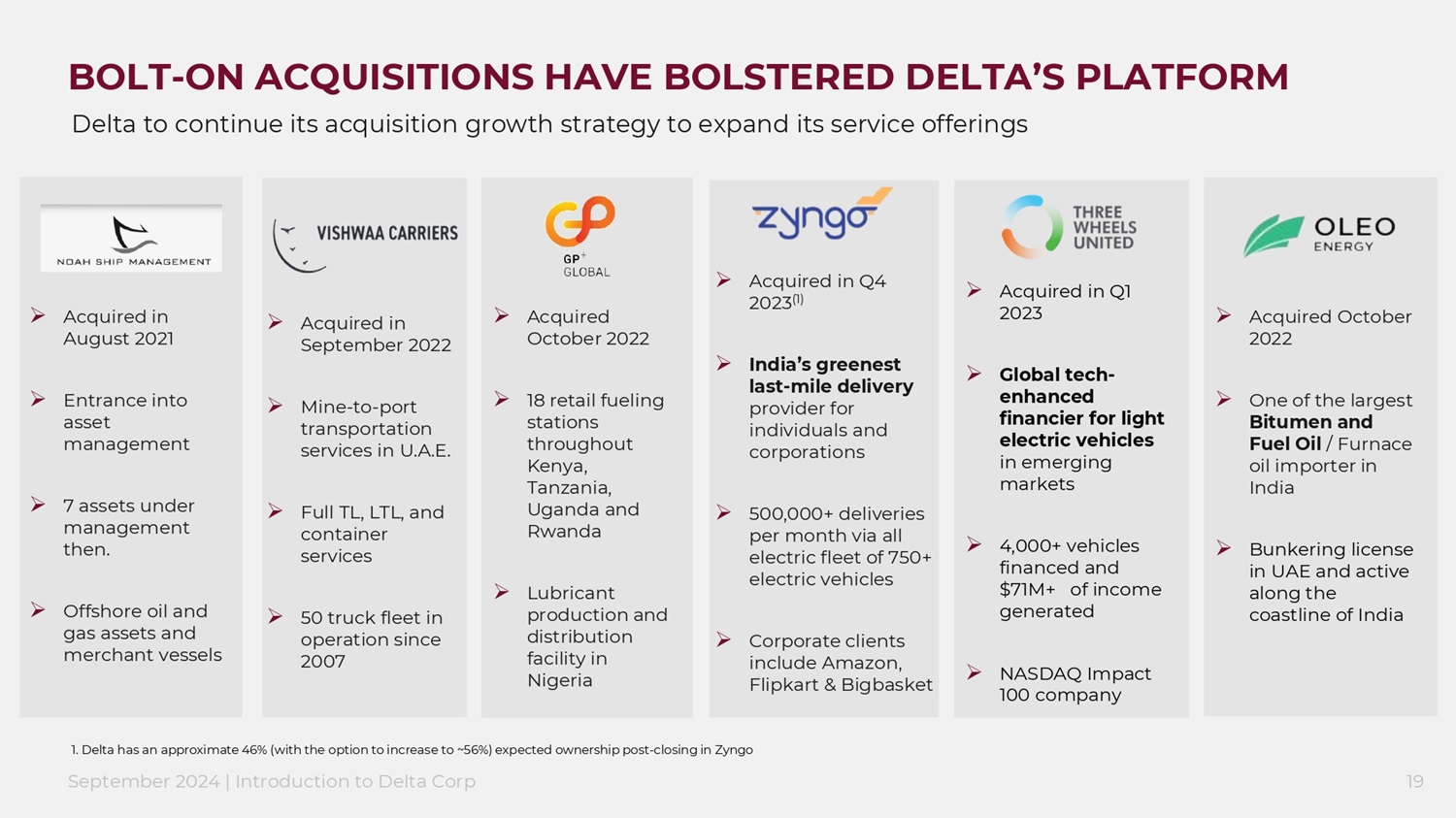

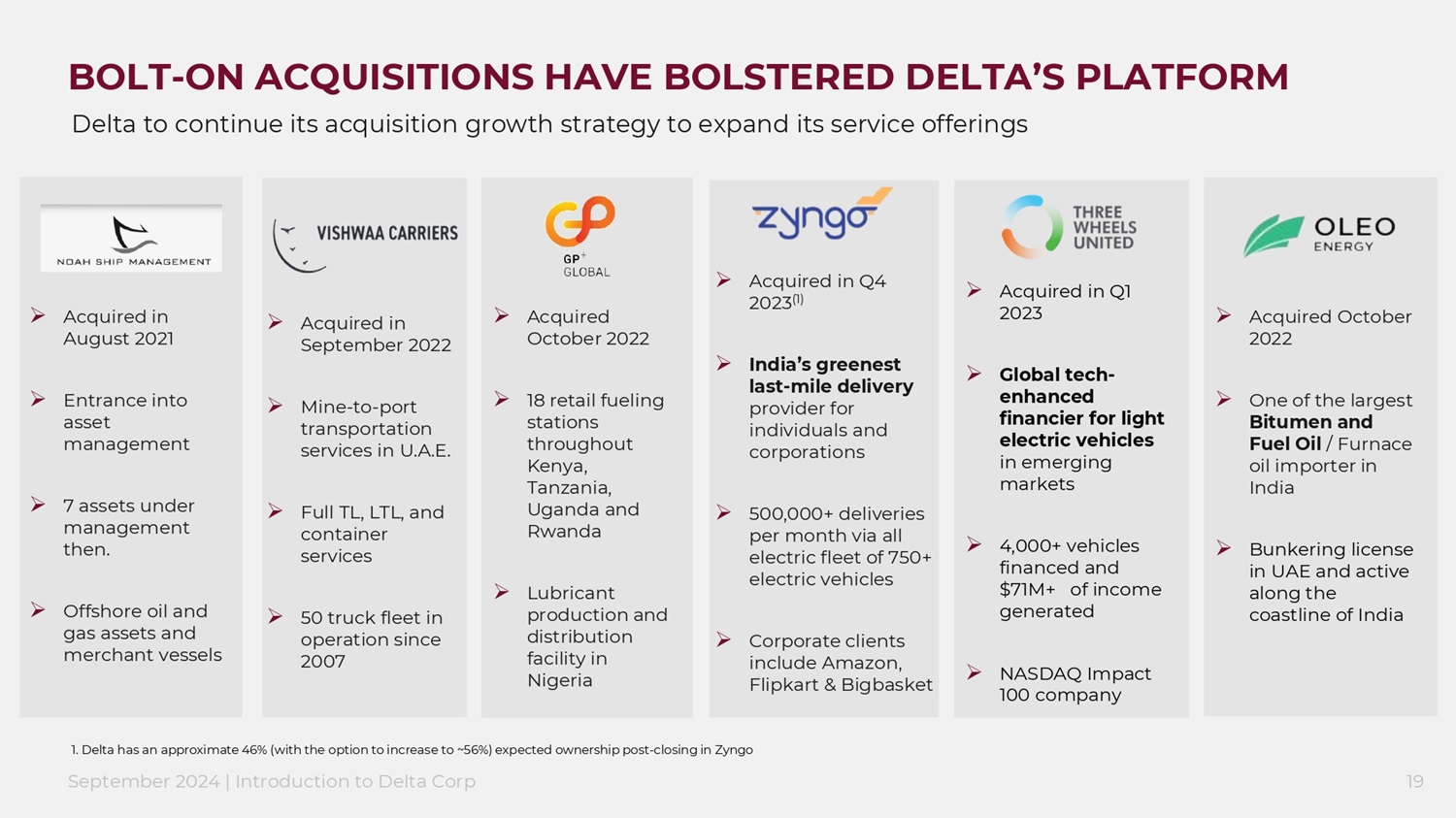

September 2024 | Introduction to Delta Corp 19 Delta to continue its acquisition growth strategy to expand its service offerings » Acquired in August 2021 » Entrance into asset management » 7 assets under management then. » Offshore oil and gas assets and merchant vessels » Acquired in September 2022 » Mine - to - port transportation services in U.A.E. » Full TL, LTL, and container services » 50 truck fleet in operation since 2007 » Acquired in Q1 2023 » Global tech - enhanced financier for light electric vehicles in emerging markets » 4,000+ vehicles financed and $71M+ of income generated » NASDAQ Impact 100 company » Acquired in Q4 2023 (1) » India’s greenest last - mile delivery provider for individuals and corporations » 500,000+ deliveries per month via all electric fleet of 750+ electric vehicles » Corporate clients include Amazon, Flipkart & Bigbasket 1. Delta has an approximate 46% (with the option to increase to ~56%) expected ownership post - closing in Zyngo BOLT - ON ACQUISITIONS HAVE BOLSTERED DELTA’S PLATFORM » Acquired October 2022 » 18 retail fueling stations throughout Kenya, Tanzania, Uganda and Rwanda » Lubricant production and distribution facility in Nigeria » Acquired October 2022 » One of the largest Bitumen and Fuel Oil / Furnace oil importer in India » Bunkering license in UAE and active along the coastline of India

FINANCIALS & TRANSACTION OVERVIEW

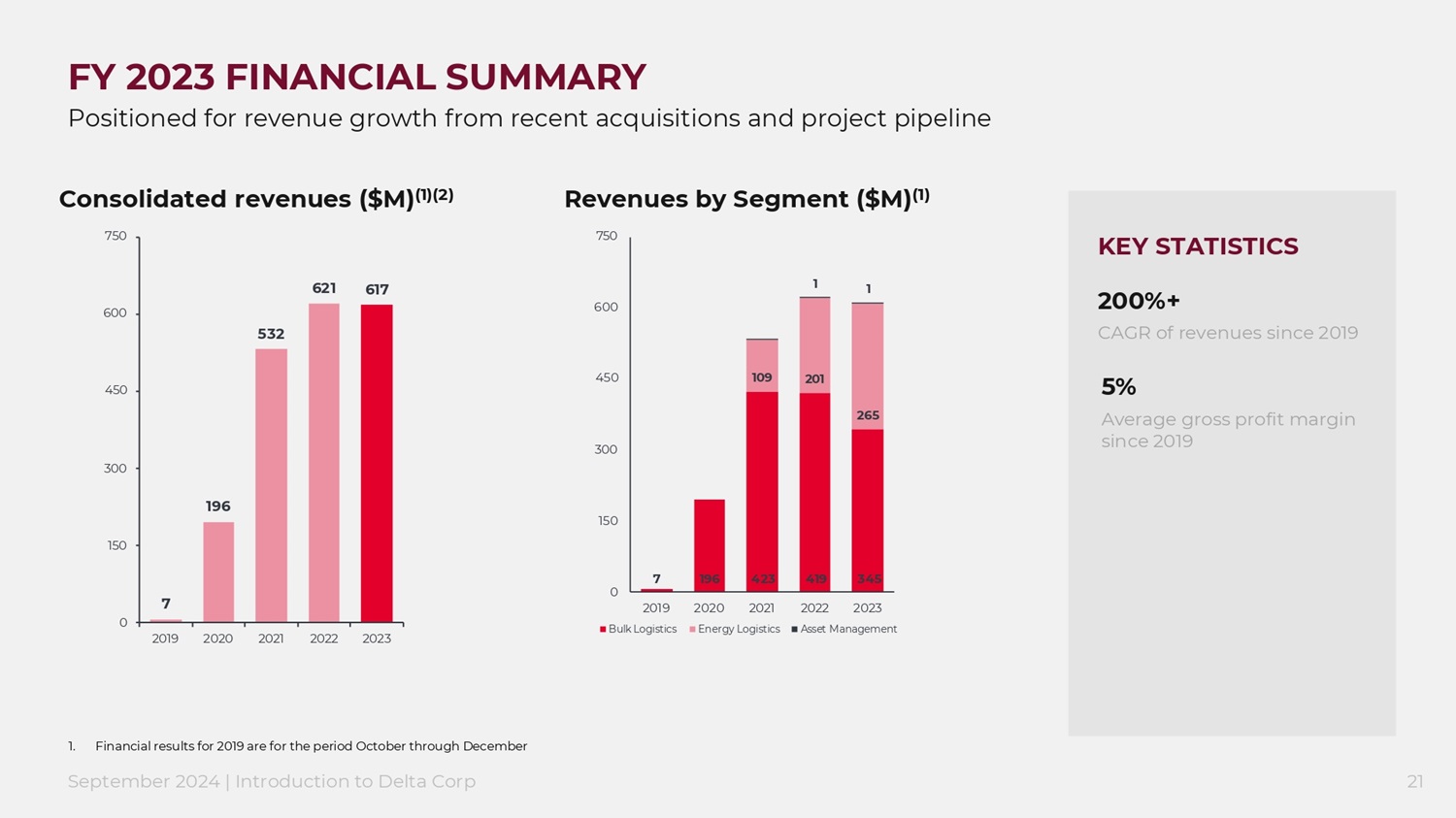

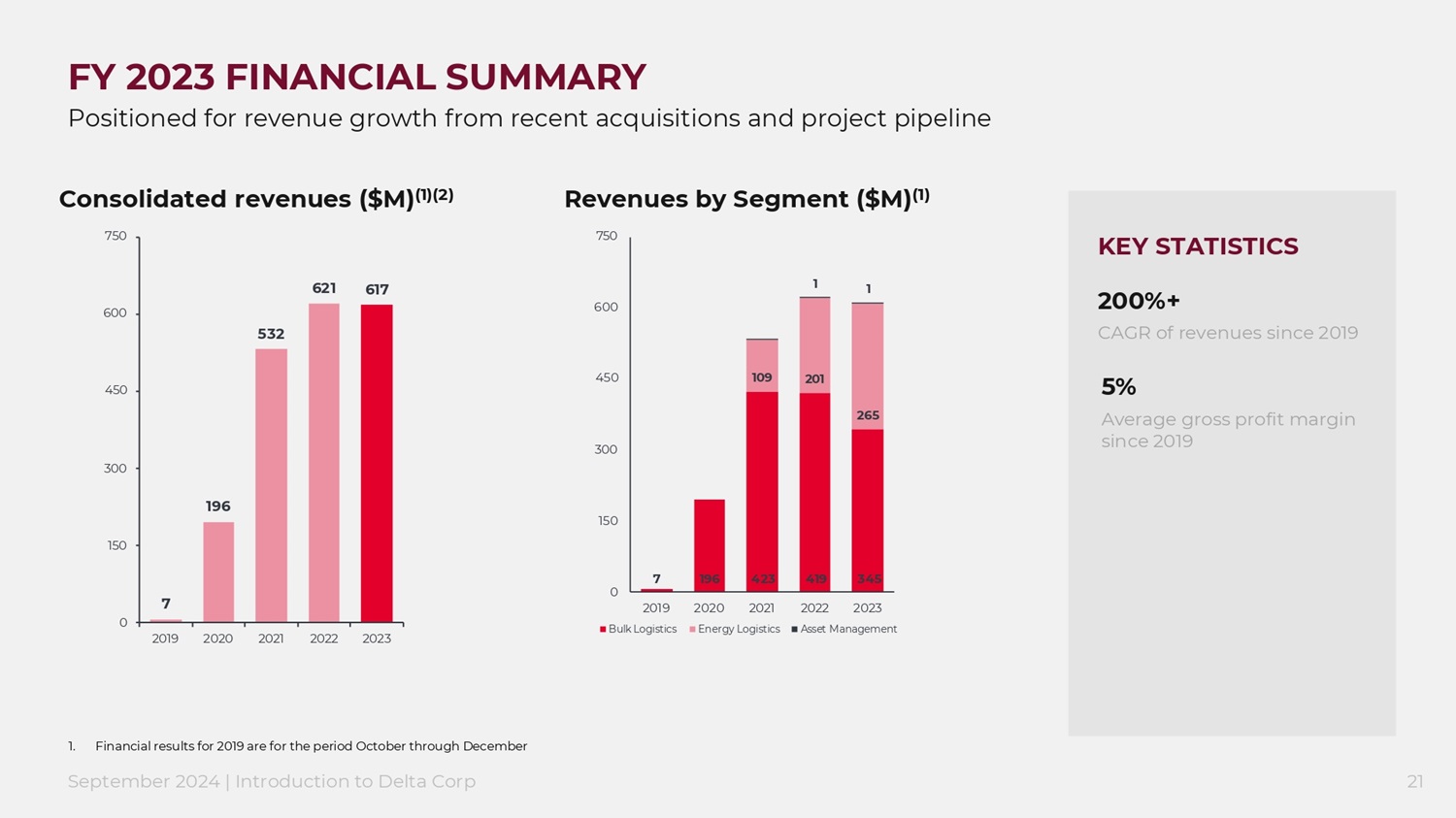

September 2024 | Introduction to Delta Corp 21 FY 2023 FINANCIAL SUMMARY Consolidated revenues ($M) (1)(2) ו חה דבא הא הו ד ב גד ה וד אח אא אא אאא אאב Revenues by Segment ($M) (1) ו חה גאב גח בגד ח א אהד ד ב גד ה וד אח אא אא אאא אאב ɖǼǸnȒǕǣɀɎǣƬɀ 0ȇƺȸǕɵnȒǕǣɀɎǣƬɀ ɀɀƺɎxƏȇƏǕƺȅƺȇɎ Positioned for revenue growth from recent acquisitions and project pipeline 1. Financial results for 2019 are for the period October through December 200%+ CAGR of revenues since 2019 5% Average gross profit margin since 2019 KEY STATISTICS

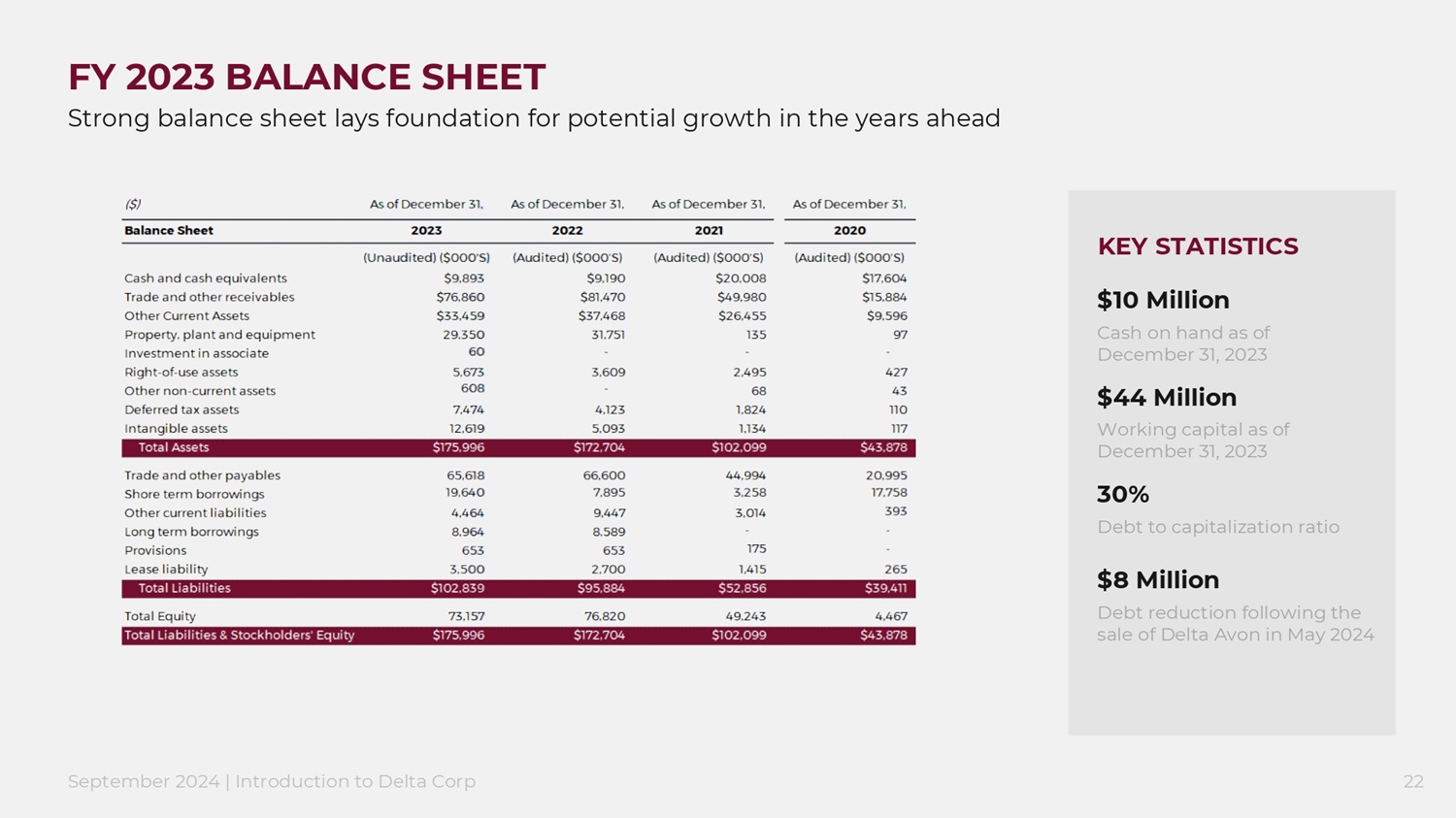

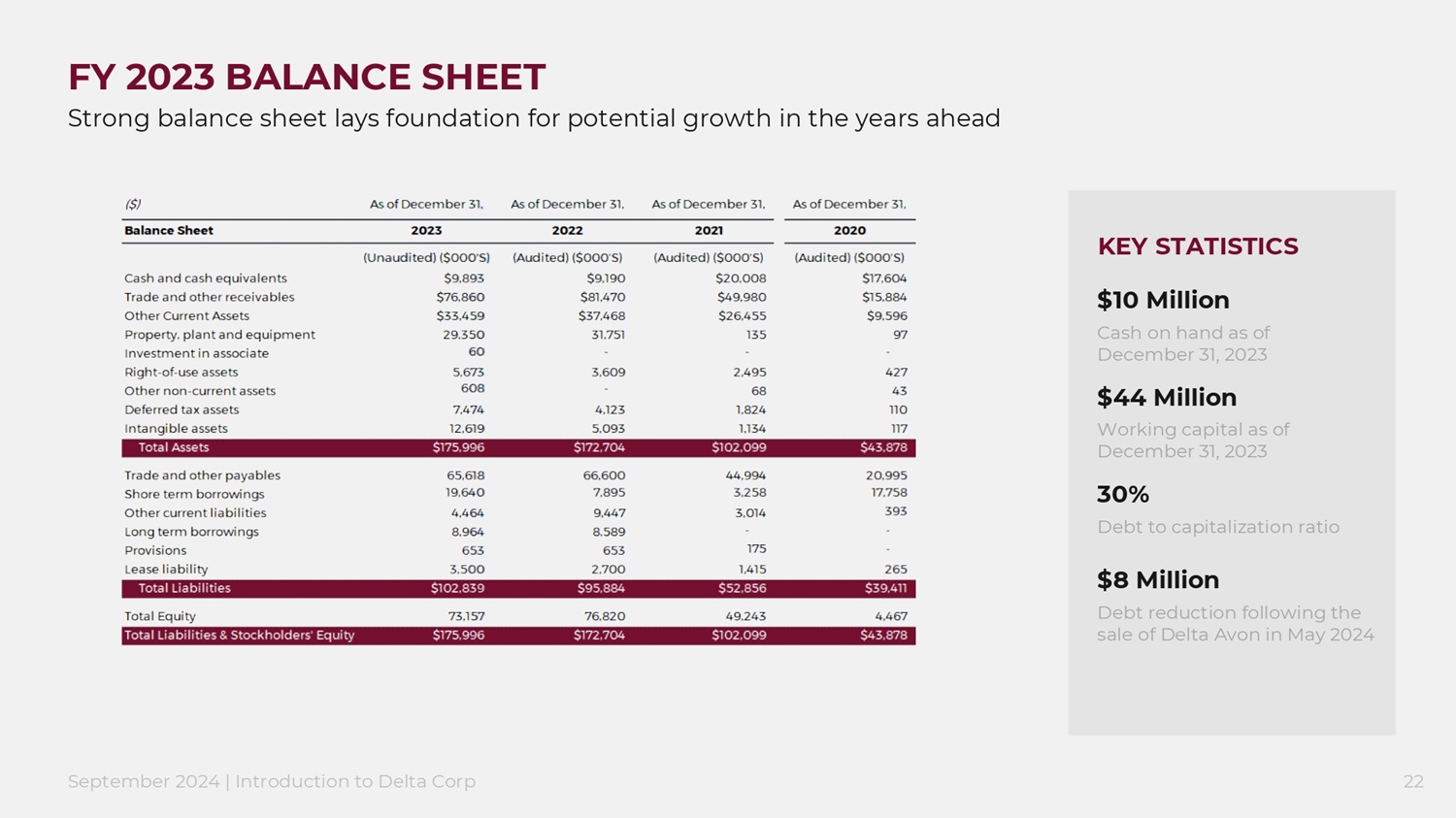

September 2024 | Introduction to Delta Corp 22 FY 2023 BALANCE SHEET Strong balance sheet lays foundation for potential growth in the years ahead $10 Million Cash on hand as of December 31, 2023 $44 Million Working capital as of December 31, 2023 30% Debt to capitalization ratio KEY STATISTICS $8 Million Debt reduction following the sale of Delta Avon in May 2024

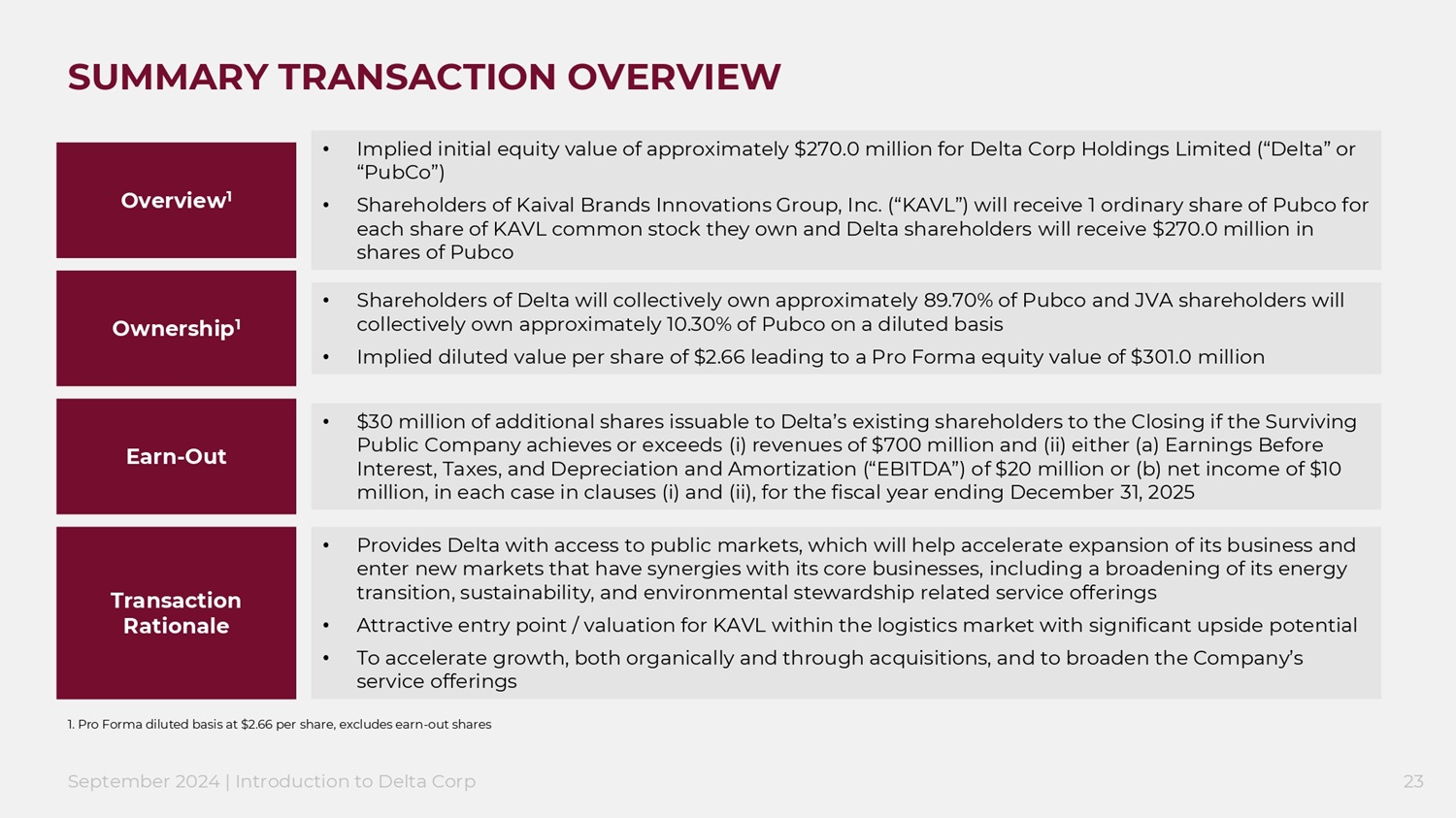

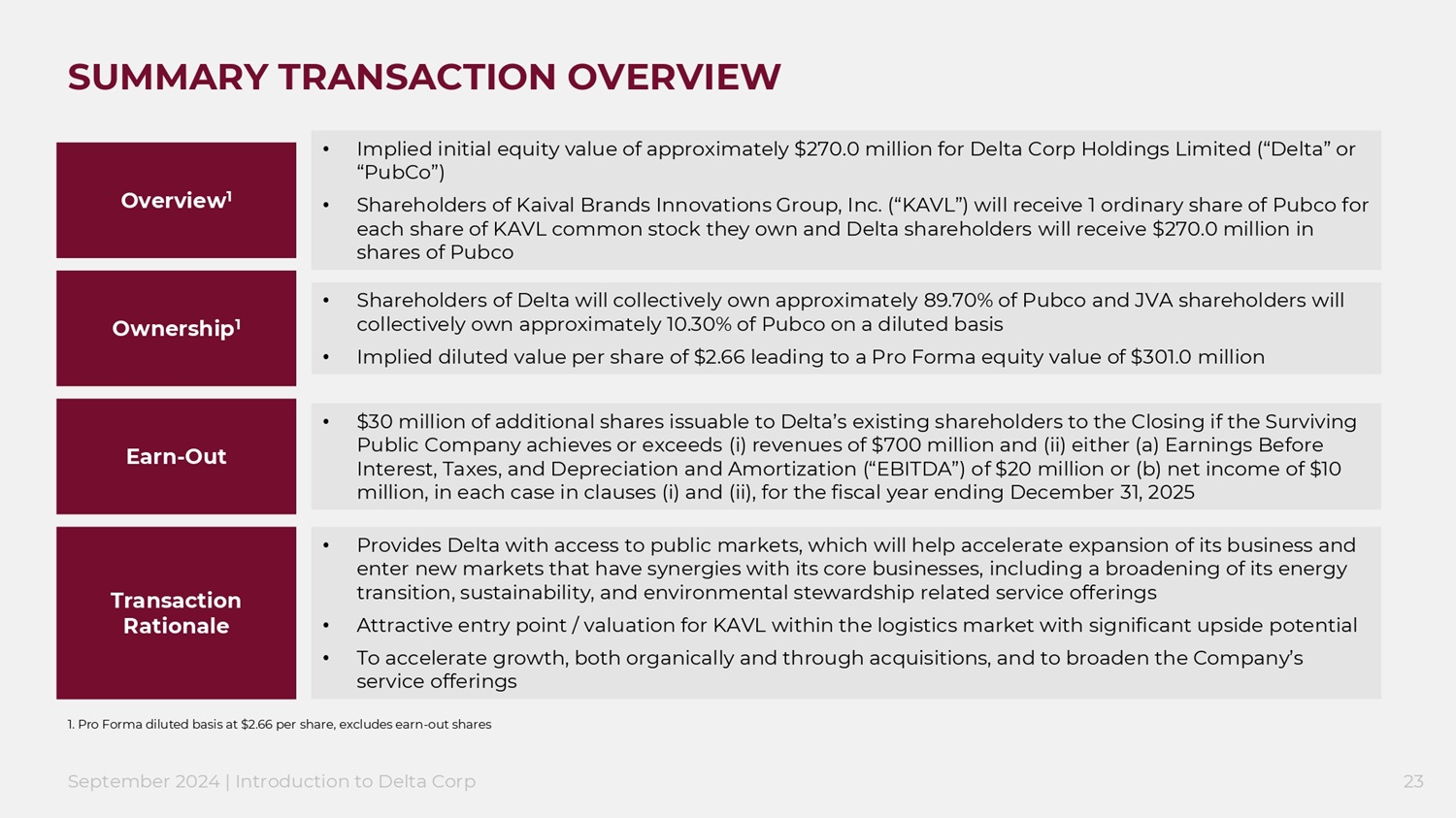

September 2024 | Introduction to Delta Corp 23 SUMMARY TRANSACTION OVERVIEW • Implied initial equity value of approximately $ 270 .0 million for Delta Corp Holdings Limited (“Delta” or “ PubCo ”) • Shareholders of Kaival Brands Innovations Group, Inc. (“ KAVL ”) will receive 1 ordinary share of Pubco for each share of KAVL common stock they own and Delta shareholders will receive $ 270 .0 million in shares of Pubco Overview 1 • Shareholders of Delta will collectively own approximately 89 .70% of Pubco and JVA shareholders will collectively own approximately 10.30% of Pubco on a diluted basis • Implied diluted value per share of $2.66 leading to a Pro Forma equity value of $3 01 .0 million Ownership 1 • $30 million of additional shares issuable to Delta’s existing shareholders to the Closing if the Surviving Public Company achieves or exceeds (i) revenues of $700 million and (ii) either (a) Earnings Before Interest, Taxes, and Depreciation and Amortization (“EBITDA”) of $20 million or (b) net income of $10 million, in each case in clauses (i) and (ii), for the fiscal year ending December 31, 2025 Earn - Out • Provides Delta with access to public markets, which will help accelerate expansion of its business and enter new markets that have synergies with its core businesses, including a broadening of its energy transition, sustainability, and environmental stewardship related service offerings • Attractive entry point / valuation for KAVL within the logistics market with significant upside potential • To accelerate growth, both organically and through acquisitions, and to broaden the Company’s service offerings Transaction Rationale 1. Pro Forma diluted basis at $2.66 per share, excludes earn - out shares

September 2024 | Introduction to Delta Corp 24 INVESTMENT HIGHLIGHTS Strong balance sheet Flexible, asset light model Management team with a track record of success leading multi - billion dollar companies DELTA CORP HOLDINGS LIMITED Focus on niche, high growth markets within the energy and raw materials markets and adjacent industries Broad portfolio of services creates “sticky” customers Technology driven risk management Delta’s multinational footprint facilitates the global trade of energy, raw materials, and agricultural products

APPENDIX 1 2 CORPORATE DEVELOPMENT TECHNOLOGY PLATFORMS OVERVIEW

TECHNOLOGY PLATFORMS OVERVIEW 1 2 DELTA - Q PLATFORM 3 QUANTSHIP.AI THREE WHEELS UNITED – EV FINTECH

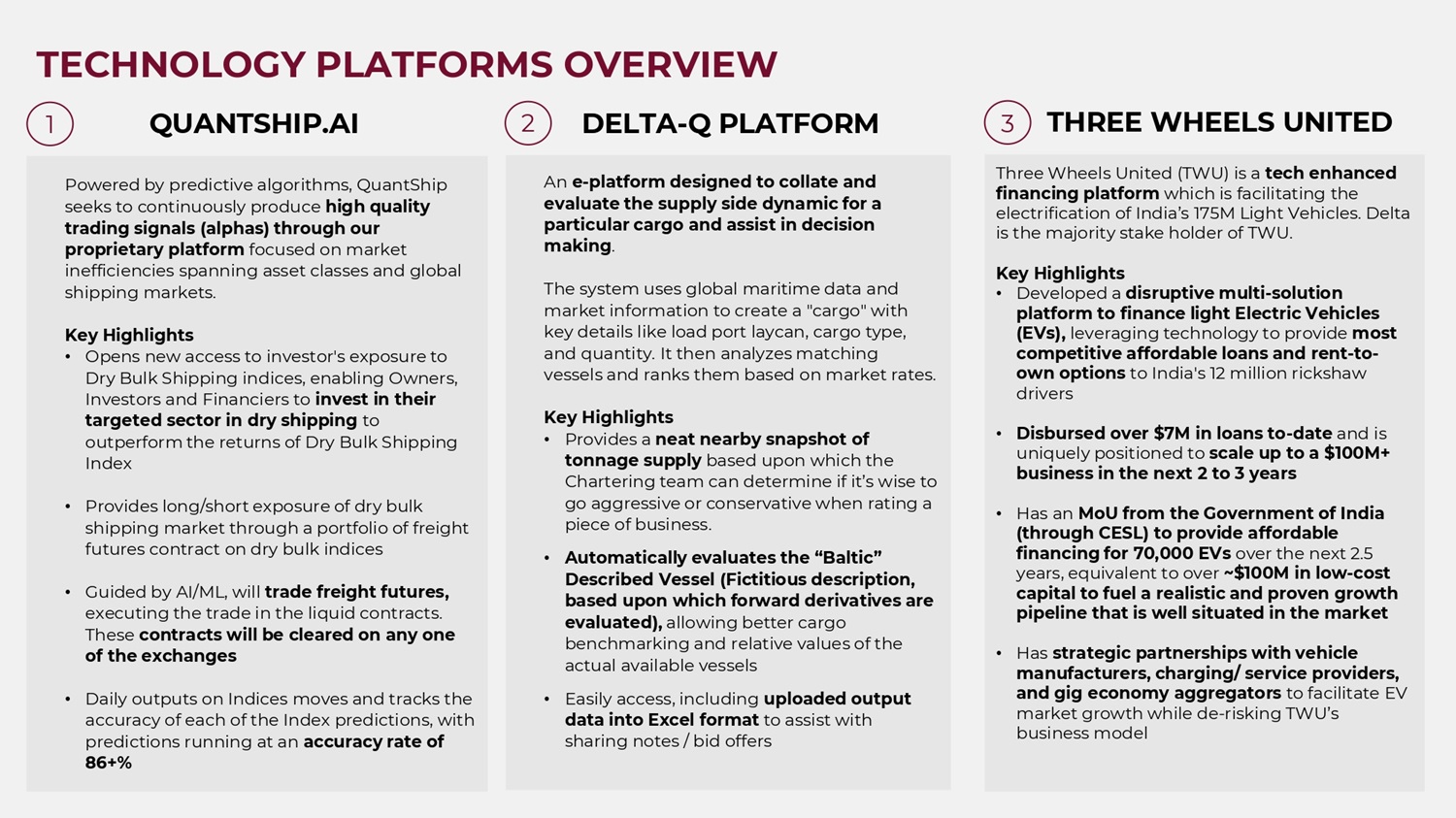

September 2024 | Introduction to Delta Corp 27 TECHNOLOGY PLATFORMS OVERVIEW Powered by predictive algorithms, QuantShip seeks to continuously produce high quality trading signals (alphas) through our proprietary platform focused on market inefficiencies spanning asset classes and global shipping markets. Key Highlights • Opens new access to investor's exposure to Dry Bulk Shipping indices, enabling Owners, Investors and Financiers to invest in their targeted sector in dry shipping to outperform the returns of Dry Bulk Shipping Index • Provides long/short exposure of dry bulk shipping market through a portfolio of freight futures contract on dry bulk indices • Guided by AI/ML, will trade freight futures , executing the trade in the liquid contracts . These contracts will be cleared on any one of the exchanges • Daily outputs on Indices moves and tracks the accuracy of each of the Index predictions, with predictions running at an accuracy rate of 86+% DELTA - Q PLATFORM QUANTSHIP.AI THREE WHEELS UNITED An e - platform designed to collate and evaluate the supply side dynamic for a particular cargo and assist in decision making . The system uses global maritime data and market information to create a "cargo" with key details like load port laycan, cargo type, and quantity. It then analyzes matching vessels and ranks them based on market rates. Key Highlights • Provides a neat nearby snapshot of tonnage supply based upon which the Chartering team can determine if it’s wise to go aggressive or conservative when rating a piece of business. • Automatically evaluates the “Baltic” Described Vessel (Fictitious description, based upon which forward derivatives are evaluated), allowing better cargo benchmarking and relative values of the actual available vessels • Easily access, including uploaded output data into Excel format to assist with sharing notes / bid offers Three Wheels United (TWU) is a tech enhanced financing platform which is facilitating the electrification of India’s 175M Light Vehicles. Delta is the majority stake holder of TWU. Key Highlights • Developed a disruptive multi - solution platform to finance light Electric Vehicles (EVs) , leveraging technology to provide most competitive affordable loans and rent - to - own options to India's 12 million rickshaw drivers • Disbursed over $7M in loans to - date and is uniquely positioned to scale up to a $100M+ business in the next 2 to 3 years • Has an MoU from the Government of India (through CESL) to provide affordable financing for 70,000 EVs over the next 2.5 years, equivalent to over ~$100M in low - cost capital to fuel a realistic and proven growth pipeline that is well situated in the market • Has strategic partnerships with vehicle manufacturers, charging/ service providers, and gig economy aggregators to facilitate EV market growth while de - risking TWU’s business model 1 2 3

CORPORATE DEVELOPMENT 1 2 MULTIMODAL LOGISTICS PARK 3 CARBON CREDIT LAST MILE CARBON EMISSION FREE LOGISTICS 4 ENERGY DISTRIBUTION LLYOD'S LIST 5

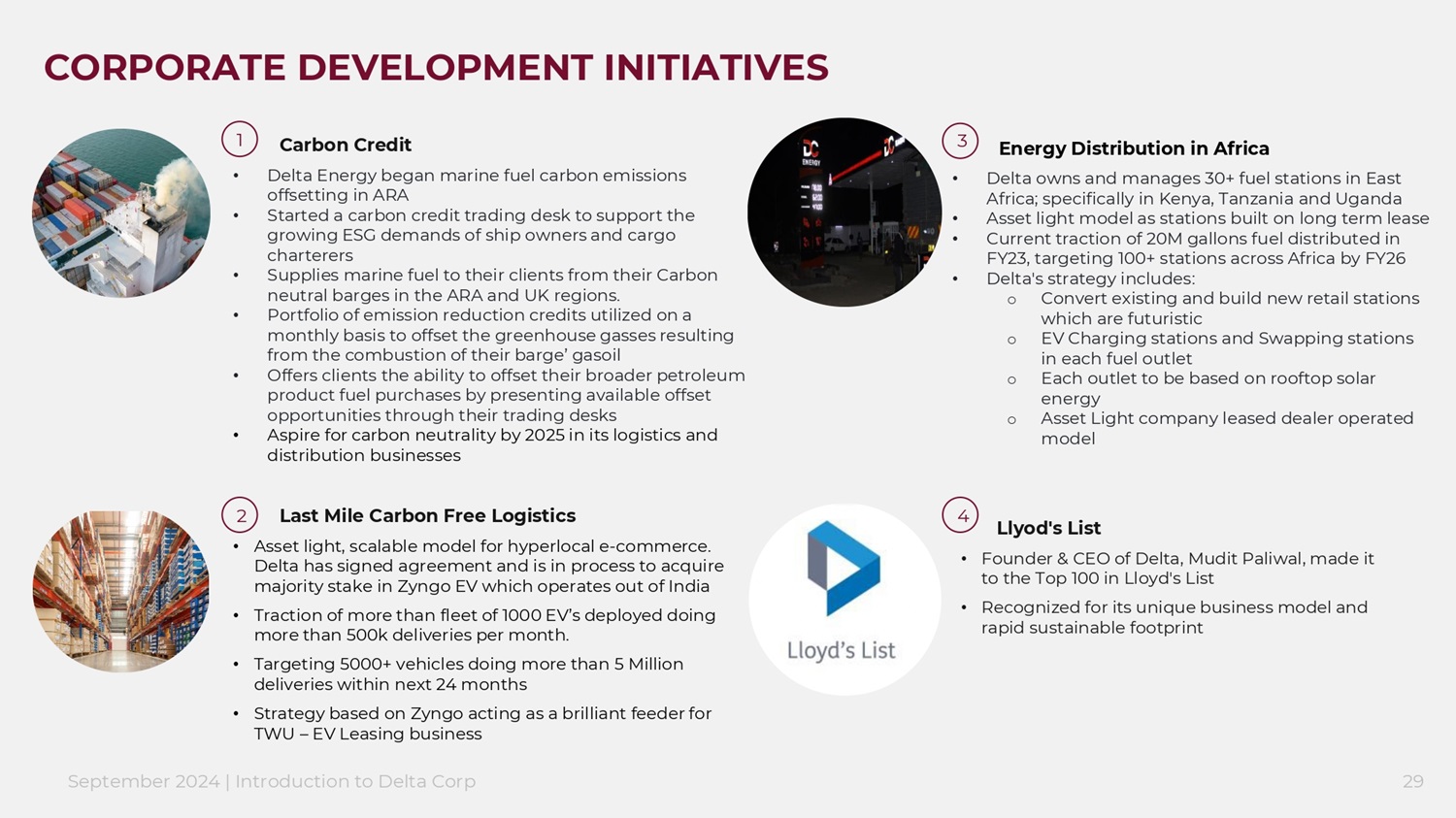

September 2024 | Introduction to Delta Corp 29 CORPORATE DEVELOPMENT INITIATIVES Carbon Credit • Delta Energy began marine fuel carbon emissions offsetting in ARA • Started a carbon credit trading desk to support the growing ESG demands of ship owners and cargo charterers • Supplies marine fuel to their clients from their Carbon neutral barges in the ARA and UK regions. • Portfolio of emission reduction credits utilized on a monthly basis to offset the greenhouse gasses resulting from the combustion of their barge’ gasoil • Offers clients the ability to offset their broader petroleum product fuel purchases by presenting available offset opportunities through their trading desks • Aspire for carbon neutrality by 2025 in its logistics and distribution businesses Last Mile Carbon Free Logistics • Asset light, scalable model for hyperlocal e - commerce. Delta has signed agreement and is in process to acquire majority stake in Zyngo EV which operates out of India • Traction of more than fleet of 1000 EV’s deployed doing more than 500k deliveries per month. • Targeting 5000+ vehicles doing more than 5 Million deliveries within next 24 months • Strategy based on Zyngo acting as a brilliant feeder for TWU – EV Leasing business Energy Distribution in Africa • Delta owns and manages 30+ fuel stations in East Africa; specifically in Kenya, Tanzania and Uganda • Asset light model as stations built on long term lease • Current traction of 20M gallons fuel distributed in FY23, targeting 100+ stations across Africa by FY26 • Delta's strategy includes: o Convert existing and build new retail stations which are futuristic o EV Charging stations and Swapping stations in each fuel outlet o Each outlet to be based on rooftop solar energy o Asset Light company leased dealer operated model Llyod's List • Founder & CEO of Delta, Mudit Paliwal, made it to the Top 100 in Lloyd's List • Recognized for its unique business model and rapid sustainable footprint 1 3 2 4

September 2024 | Introduction to Delta Corp 30 MULTIMODAL LOGISTICS PARK | NAGPUR, INDIA Awarded a state - of - the - art multimodal logistics park (MMLP) in Nagpur, India, by the National Highways Logistics Management , a subsidiary of the National Highways Authority of India. The MMLP is slated to develop over 150.3 acres of land. Delta will oversee the facility's construction, operation, and maintenance for a 45 - year lease term . The goal is to reduce logistics bottlenecks and transportation in one of India’s fastest - growing regions. The project is crucial, aligning with the Indian government’s PM Gati Shakti’s National Master Plan for Multi - Modal Connectivity to support regional growth and infrastructure. Project Highlights: ▪ Marks a pivotal step in Delta’s strategic growth initiatives , further positioning the Company as a significant participant in the international logistics landscape. ▪ Total investment of approximately $34 million for all three phases is estimated, at prevailing exchange rates. The first phase is expected to cost roughly $18.3 million, and completion is estimated by the end of Q1 2026. ▪ Anticipated average annual revenues and EDITBA of approximately $67 million and $22 million respectively, over the 45 - year lease term. ▪ Intends to finance 70% of the project’s cost from local commercial banks, with the balance coming from cash on hand and cash flow from operations. Artist rendition of Nagpur MMLP 5

Exhibit 99.2

Delta Corp Holdings Limited, a Fast Growing Asset-Light Logistics Company Enters into a Definitive

Merger and Share Exchange Agreement with Kaival Brands Innovations Group, Inc.

| | ● | Proposed business combination will create a public company engaged in Bulk & Energy logistics, fuel supply, commodities, and asset management related services that operates an asset-light business model |

| | ● | Delta has a multinational footprint which facilitates the global trade of energy, raw materials, and agricultural products |

| | ● | Delta has an established and diversified customer base leading to revenue of over $619 million for fiscal year ended December 31, 2023 |

| | ● | Transaction to be completed at a 359% premium to Kaival Brands current stock price, translating into an implied price per share of $2.66 |

GRANT-VALKARIA, Fla., September 23, 2024 (GLOBE NEWSWIRE) -- Kaival Brands Innovations Group, Inc., (NASDAQ: KAVL) (“Kaival Brands”, the “Company”), the exclusive U.S. distributor of the Bidi® Stick and certain other products manufactured by Bidi Vapor, LLC (“Bidi Vapor”), and Delta Corp Holdings Limited (“Delta”), a privately held holding company for global businesses engaged in Bulk & Energy logistics, fuel supply, commodities, and asset management, announced today that the companies have entered into a definitive merger and share exchange agreement (the “definitive agreement”), whereby Kavial Brands and Delta will each become wholly owned subsidiaries of a specially created holding company incorporated under the laws of the Cayman Islands, Delta Corp Holdings Limited (“Pubco”). The closing of the transactions contemplated by the definitive agreement (the “business combination”) is subject to certain conditions, including, without limitation, the approval of the shareholders of Kaival Brands and the approval of the listing of the shares of Pubco on the Nasdaq Stock Market (“Nasdaq”). Delta shareholders will become the majority shareholders of Pubco as further detailed below.

Following closing of the transactions, which the parties expect will occur in the fourth quarter of 2024, the combined company would be traded on Nasdaq. The combined company will continue to operate under the Delta management team led by Mudit Paliwal, Chief Executive Officer and Founder; Peter Shaerf, Non-Executive Chairman; and Joseph Nelson, Chief Financial Officer, with Kaival Brands as a wholly owned subsidiary of the Pubco.

Mark Thoenes, Interim Chief Executive Officer of Kaival Brands, stated, “This transaction marks an exciting new chapter for Kaival Brands. Delta’s flexible, asset-light business model positions the combined Company to capitalize on high growth areas within the energy and raw materials markets and offers our shareholders a unique opportunity. We are confident that this partnership will deliver substantial value to Kaival Brands shareholders and employees.”

“We are excited about the proposed business combination between Delta and Kaival Brands, given its potential to bring substantial value to the stakeholders of both parties,” stated Mudit Paliwal, Delta’s Chief Executive Officer and Founder. “Since its inception, Delta has established itself as a trusted global logistics leader, serving some of the world’s top natural resource, industrial, and energy companies. This success is a direct result of our unwavering commitment to finding solutions for our customers’ complex global supply chains through continuous innovation, all driven by a leadership team with a proven track record of success. We believe the business combination with Kaival will enable us to continue our robust growth in the public markets.”

Peter Shaerf, Delta’s Non-Executive Chairman of the Board of Directors, stated, “This merger marks a pivotal step forward for Delta. KAVL’s engaged shareholder base paired with the transparency of a public listing, provide a solid foundation for Delta’s growth, accelerating our momentum. This partnership will support our efforts to expand core business lines and extend our geographical reach, positioning Delta for sustained success and long-term value creation.”

Delta – A Fast-Growing, Asset-Light Third-Party Logistics Company

Delta is a fully-integrated, global business engaged in logistics, fuel supply and asset management related services, primarily servicing the international supply chains of commodity, energy, and capital goods producers. Delta has been in operation since 2019 and its businesses facilitate the global trade of energy, raw materials, intermediate goods, and agricultural products. Delta is a multinational business with over 400 personnel and has a global footprint through a network of offices in 16 countries throughout Europe, the Middle East, Asia, and Africa.

Delta’s business is asset-light, and it relies on its people, technology, customer relationships and differentiated service offerings to drive its business and its growth. Delta believes its asset-light business model differentiates it from competitors and leads to greater profitability while reducing risk. Delta has leadership positions in niche markets where it has a specialized competitive advantage which allows it to leverage its broad portfolio of service offerings to reduce its customers’ logistics costs while enhancing its profitability.

Delta operates its business through three segments: Bulk Logistics, Energy Logistics and Asset Management. Each segment is headed by proven management teams which share a commitment to the value of client focus and a vision of setting a new standard of excellence within the sectors in which Delta operates. Delta seeks high-growth niche opportunities within its core business offerings or adjacent industries and leverages its diverse service offering to penetrate its markets.

Key Transaction Terms

The business combination will be effectuated through a holding company structure, whereby Kaival Brands and Delta will each become wholly-owned subsidiaries of Pubco. Under the agreement, shareholders of Kaival Brands will receive 1 ordinary share of Pubco for each share of Kaival Brands common stock they own as of the closing of the business combination, and Delta shareholders will exchange their shares of Delta for $270 million in ordinary shares of Pubco, subject to certain adjustments, at an implied value per share of $2.66, as set forth in the definitive agreement (including adjustment as applicable for Nasdaq listing purposes). Immediately prior to the closing of the business combination, the stockholders of Kaival Brands are anticipated to collectively own approximately 10.30% of the outstanding ordinary shares of Pubco, and Delta shareholders immediately following this closing are anticipated to collectively own approximately 89.70% of the outstanding ordinary shares of Pubco.

The definitive agreement also includes an earnout to existing shareholders of Delta, which, if earned, consists of $30 million of additional ordinary shares of Pubco, which would be issued to Delta shareholders if the Surviving Public Company achieves or exceeds (i) revenues of $700 million and (ii) either (a) Earnings Before Interest, Taxes, and Depreciation and Amortization (“EBITDA”) of $20 million or (b) net income of $10 million, in each case for the fiscal year ending December 31, 2025.

The definitive agreement contains customary representations, warranties and covenants made by Kaival Brands and Delta, including covenants relating to both parties using their commercially reasonably efforts to cause the transactions contemplated by the agreement to be satisfied, covenants regarding obtaining the requisite approval of Kaival Brands’ shareholders, covenants regarding indemnification of directors and officers, and covenants regarding Kaival Brands’ and Delta’s conduct of their respective businesses between the date of signing of the agreement and the closing. The definitive agreement also contains certain termination rights for both Kaival Brands and Delta, and, in connection with the termination of the agreement under certain circumstances, Kaival Brands and Delta may be required to pay the other party a termination fee.

The definitive agreement has been unanimously approved by the Board of Directors of Kaival Brands and by the Board of Directors of Delta. The Kaival Brands Board of Directors has also recommended to Kaival Brands’ shareholders that they vote to approve the definitive agreement and the business combination. Kaival Brands also received a fairness opinion in connection with the business combination. The business combination is expected to close in the fourth quarter of 2024, subject to certain conditions set forth in the definitive agreement, including the approvals by the requisite shareholders of Kaival Brands described above, the listing of Pubco ordinary shares on Nasdaq, as applicable, and other customary closing conditions.

A more complete description of the terms of and conditions of the proposed business combination and related matters will be included in a current report on Form 8-K to be filed by Kaival Brands with the U.S. Securities and Exchange Commission (“SEC”) on or about September 23, 2024. A copy of the definitive agreement will be an exhibit to the Form 8-K. All parties desiring details regarding the terms and conditions of the proposed business combination are urged to review that Form 8-K, and the exhibits attached thereto, which will be available at the SEC’s website at www.sec.gov.

Advisors

Maxim Group LLC is serving as exclusive financial advisor to Kaival Brands. Sichenzia Ross Ference Carmel LLP is serving as counsel to Kaival Brands.

Ellenoff Grossman & Schole LLP is serving as counsel to Delta.

About Kaival Brands

Based in Grant-Valkaria, Florida, Kaival Brands is a company focused on incubating and commercializing innovative products into mature and dominant brands, with a current focus on the distribution of electronic nicotine delivery systems (ENDS) also known as “e-cigarettes” for use by customers 21 years and older. Our business plan is to seek to diversify into distributing other nicotine and non-nicotine delivery system products (including those related to hemp-derived cannabidiol (known as CBD) products). Kaival Brands and Philip Morris Products S.A. (via sublicense from Kaival Brands) are the exclusive global distributors of all products manufactured by Bidi Vapor LLC. Based in Melbourne, Florida, Bidi Vapor maintains a commitment to responsible, adult-focused marketing, supporting age-verification standards and sustainability through its BIDI® Cares recycling program. Bidi Vapor’s premier device, the BIDI® Stick, which is distributed exclusively by Kaival Brands, is a premium product made with high-quality components, a UL-certified battery and technology designed to deliver a consistent vaping experience for adult smokers 21 and over.

Learn more about Kaival Brands at https://ir.kaivalbrands.com/overview/default.aspx.

About Delta

Delta Corp Holdings Limited is a fully integrated global enterprise engaged in logistics, fuel supply, and asset management services, primarily supporting the international supply chains of commodity, energy, and capital goods producers. With its headquarters in London, Delta operates through three main segments: Bulk Logistics, Energy Logistics, and Asset Management. The company also maintains executive offices in Dubai and New York, and boasts a significant commercial presence in Singapore, Rotterdam, New Delhi, and Mumbai. For more information, please see Delta’s website at www.wearedelta.com.

Additional Information and Where to Find It

In connection with the proposed business combination, Pubco, Kaival Brands and Delta plan to file or cause to be filed relevant materials with the SEC, including a Pubco registration statement on Form F-4 (the “Registration Statement”) that will contain a proxy statement of Kaival Brands and a prospectus for registration of shares of Pubco. The Registration Statement has not been filed with or declared effective by the SEC. Following and subject to the Registration Statement being declared effective by the SEC, its definitive proxy statement/prospectus would be mailed or otherwise disseminated to Kaival Brands stockholders. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF KAIVAL BRANDS ARE URGED TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DELTA, KAIVAL BRANDS, THE PROPOSED BUSINESS COMBINATION, AND RELATED MATTERS. The proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by Pubco and Kaival Brands with the SEC, may be obtained free of charge at the SEC website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Kaival Brands by directing a written request to: Kaival Brands Innovations Group, Inc., 4460 Old Dixie Highway Grant-Valkaria, Florida. Investors and security holders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed business combination.

Participants in the Solicitation

Kaival Brands and its directors, executive officers and certain other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from the shareholders of Kaival Brands with respect to the proposed business combination and related matters. Information about the directors and executive officers of Kaival Brands, including their ownership of shares of Kaival Brands common stock, is included in Kaival Brands’ Annual Report on Form 10-K for the year ended October 31, 2023, which was filed with the SEC on February 14, 2024. Additional information regarding the persons or entities who may be deemed participants in the solicitation of proxies from Kaival Brands shareholders, including a description of their interests in the proposed business combination by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant documents to be filed with the SEC when they become available. The directors and officers of Delta do not currently hold any interests, by security holdings or otherwise, in Kaival Brands.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction. No offering of securities in connection with the proposed business combination shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed business combination between Pubco, Kaival Brands and Delta. All statements other than statements of historical facts contained in this press release, including statements regarding Pubco’s, Kaival Brands’ or Delta’s future results of operations and financial position, Pubco’s, Kaival Brands’ and Delta’s business strategy, prospective costs, timing and likelihood of success, plans and objectives of management for future operations, future results of current and anticipated operations of Pubco, Kaival Brands and Delta, and the expected value of the combined company after the transactions, are forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to, the following risks relating to the proposed business combination: the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Kaival Brands’ securities; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; the inability to complete the transactions contemplated by the definitive agreement, including due to failure to obtain approval of the shareholders of Kaival Brands or other conditions to closing in the definitive agreement; the inability to obtain or maintain the listing of Pubco ordinary shares on Nasdaq following the business combination; the risk that the transactions contemplated by the business combination disrupt current plans and operations of Kaival Brands as a result of the announcement and consummation of these transactions; the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth economically and hire and retain key employees; costs related to the business combination; changes in applicable laws or regulations; the possibility that Pubco, Delta or Kaival Brands may be adversely affected by other economic, business, and/or competitive factors; and other risks and uncertainties to be identified in the Registration Statement and accompanying proxy statement/prospectus (when available) relating to the transactions, including those under “Risk Factors” therein, and in other filings with the SEC made by Pubco and Kaival Brands. Moreover, Pubco, Delta and Kaival Brands operate in very competitive and rapidly changing environments. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond Pubco’s, Delta’s and Kaival Brands’ control, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements speak only as of the date they are made. None of Pubco, Delta or Kaival Brands gives any assurance that either Delta or Kaival Brands or Pubco will achieve its expectations. Readers are cautioned not to put undue reliance on forward-looking statements, and except as required by law, Pubco, Delta and Kaival Brands assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

For further information, contact:

Kaival Brands Innovations Group, Inc.

Brett Maas, Managing Partner

Hayden IR

(646) 536-7331

brett@haydenir.com

Delta Corp Holdings Limited

Joseph Nelson

Chief Financial Officer

Phone: +44 0203 753 5598

Email: ir@wearedelta.com