Issuer Free Writing Prospectus dated November 24, 2023

Filed Pursuant to Rule 433 of the Securities Act of 1933

Registration statement no. 333-275077

H E AT T R A N S F E R & R E F L E C T I V E T R I M S S P E C I A L I S T J - LONG GROUP LIMITED (JL) Investor Presentation November 2023 Issuer Free Writing Prospectus dated November 24, 2023 Filed Pursuant to Rule 433 of the Securities Act of 1933 Registration statement no. 333 - 275077

FREE WRITING PROSPECTUS STATEMENT This free writing prospectus relates to the initial public offering of ordinary shares of J - Long Group Limited (the “Company”) and should be read together with the preliminary prospectus dated November 21 , 2023 (the “Preliminary Prospectus”) that was included in Amendment No . 2 to the Registration Statement on Form F - 1 (File No . 333 - 275077 ), which can be accessed through the following web link : https : //w ww . sec . gov/Archives/edgar/data/ 1948436 / 000121390023089286 /ff 12023 a 2 _jlonggroup . htm . The Company has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents the Company has filed with the United States Securities and Exchange Commission (“SEC”) for more complete information about the Company and the proposed offering . You may get these documents for free by visiting EDGAR on the SEC website at www . sec . gov . Alternatively, we or any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting Tom Li from Eddid Securities USA Inc at 11 Broadway Suite 801 . New York, NY 10004 United States or through email at ecm@eddidusa . com or Edwin Wong from J - Long Group Limited on ( 852 ) 2408 0077 .

FORWARD - LOOKING STATEMENTS

RISK F A C T ORS Risks relating to doing business in Hong Kong and our industry • All of our operations are in Hong Kong, a special administrative region of the PRC. Due to the long - arm provisions under the current PRC laws and regulations, the PRC government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares. The PRC government may intervene or impose restrictions on our ability to move money out of Hong Kong to distribute earnings and pay dividends or to reinvest in our business outside of Hong Kong. Changes in the policies, regulations, rules, and the enforcement of laws of the PRC government may also be quick with little advance notice and our assertions and beliefs of the risk imposed by the PRC legal and regulatory system cannot be certain. • Hong Kong and the PRC’s legal systems are evolving and have inherent uncertainties that could limit the legal protection available to you • Uncertainties regarding the interpretation and enforcement of PRC laws, rules, and regulations, which could change at any time with little advance notice, could limit the legal protections available to us. • It may be difficult for overseas and/or regulators to conduct investigations or collect evidence within the territory of China, including Hong Kong • Adverse regulatory developments in China may subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted by the SEC in response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies like us with Hong Kong - based operations, all of which could increase our compliance costs and subject us to additional disclosure requirements. • We may become subject to a variety of PRC laws and other obligations regarding data security offerings that are conducted overseas and/or foreign investment in China - based issuers, and any failure to comply with applicable laws and obligations could have a material and adverse effect on our business, financial condition, and results of operations and may hinder our ability to offer or continue to offer Ordinary Shares to investors and cause the value of our Ordinary Shares to significantly decline or be worthless. • Although the audit report included in this prospectus is prepared by U.S. auditors who are currently inspectable by the PCAOB, there is no guarantee that future audit reports will be issued by auditors inspectable by the PCAOB, and, as such, in the future, investors may be deprived of the benefits of the PCAOB inspection program. Furthermore, trading in our securities may be prohibited under the HFCA Act if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely, and as a result, U.S. national securities exchanges, such as the Nasdaq, may determine to delist our securities. Furthermore, on December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was enacted, which amended the HFCA Act by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, and thus, reduced the time before our Ordinary Shares may be prohibited from trading or delisted. • We have not entered into long - term sales agreements with our customers and rely on demands from our major customers and our sales may fluctuate subject to our customers’ demands. • We may be unable to timely and accurately respond to changes in the latest market trends in outerwear, sportswear and fashion apparel. • Increases in the procurement price at which we purchase our materials and products from our materials suppliers and manufacturing services suppliers may materially and adversely affect our business, financial condition and results of operations. • We depend on a U.S. licensor for most of our products. • We depend on our suppliers for the timely delivery of large quantities of reliable quality materials. • We are subject to risks relating to the warehousing of our products. If any of these risks materializes, our business, financial condition and results of operations could be materially and adversely affected. • We may not be able to meet the delivery schedule of our customers and may experience loss of revenue. • We rely on our manufacturing services suppliers to convert and manufacture our products. • Our business is substantially dependent on our relationship with our major suppliers. Changes or difficulties in our relationships with our suppliers may harm our business and financial results. • JLHK may be exposed to claims by third parties for infringement of intellectual property rights. • The licensing of our intellectual property rights is subject to certain contractual limitations, and any disputes or disagreements arising between the owner of such rights and us could negatively impact our sales and prospects, which lead to the decline in our business profitability.

OFFERING SUMMARY J - LONG GROUP LIMITED ISSUER Ordinary Shares Securities JL Ticker 30,000,000 Pre - Offering Ordinary Shares Outstanding 1,400,000 Ordinary Shares offered by the Company (excluding Ordinary Shares to be sold pursuant to the Resale Prospectus) or 1,610,000 Ordinary Shares assuming the underwriter exercises its over - allotment option in full Number of Shares Offered 31,400,000 Ordinary Shares or 31,610,000 Ordinary Shares assuming the underwriter exercises its over - allotment option in full Post - Offering Shares Outstanding 15% of the Ordinary Shares offered by the Company Over - Allotment We are also registering for resale up to 8,910,000 Ordinary Shares by the Selling Shareholders. These Ordinary Shares will not be part of this offering. Resale shares Between US$4 and US$6 per Ordinary Shares Offering Price per Share Net proceeds: US$4,068,944 if over - allotment is not exercised (based upon an assumed initial public offering price of US$5 per Ordinary Share, which is the midpoint of the estimated initial public offering price range) Net proceeds (i) approximately 30% for potential strategic acquisition of and investment in other reflective materials distributors or providers as well as upstream and downstream businesses along the industry value chain, which the Company may seek from time to time to supplement and expand its business operation; (ii) approximately 20% for strengthening the Company’s research and development capabilities for new products; (iii) approximately 20% for further increasing the Company’s warehouse and storage capacity; and (iv) the balance to fund working capital and for other general corporate purpose. Estimated Use of Net Proceeds, As % of Gross Offering Eddid Securities USA Inc. Underwriters Note: See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss .

TABLE OF CONTENTS 1. Company Overview 2. Investment Highlight 3. Industry Overview 4. Growth Strategies 5. Financials 6. Corporate Structure

COMPANY OVERVIEW

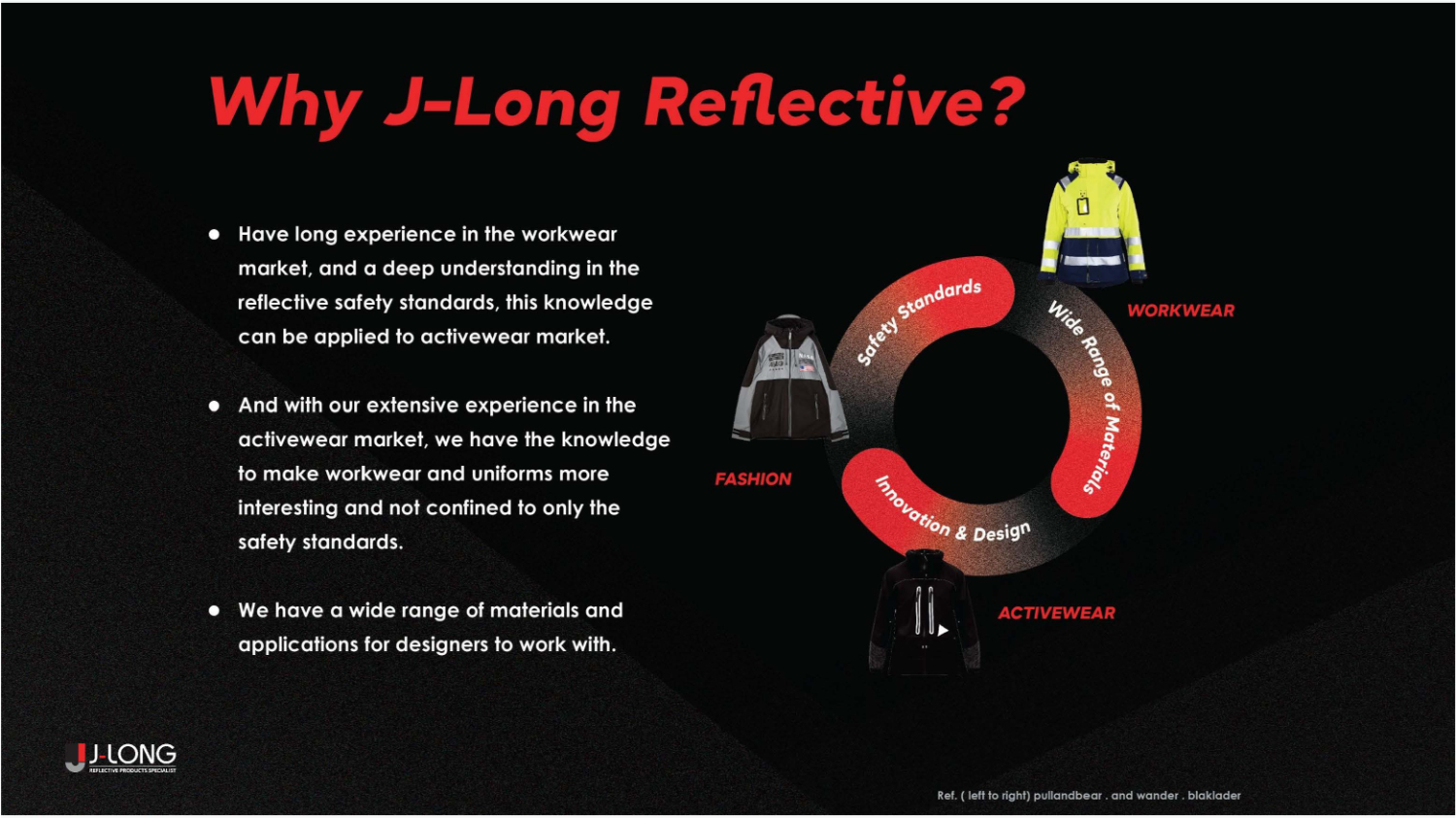

» J - Long Limited was established in 1985 » We have set up regional sales networks in Denmark, Italy and the United States to serve our growing customer base » We are an established distributor in Hong Kong of reflective and non - reflective garment trims » Nearly 30 years of experience in the apparel industry and have served over 100 international outerwear and sportswear brands, uniform and safety workwear brands and fashion brands across the world J - LONG GROUP WHO WE ARE:

WE ARE A… » ESTABLISHED DISTRIBUTOR OF REFLECTIVE AND NON - REFLECTIVE GARMENT TRIMS » HEAT TRANSFERS » FABRICS » WOVEN LABELS AND TAPES » SWEING BADGES » PIPING » ZIPPER PULLERS » DRAWCORDS

SUSTAINABILITY MAKE IT A LIFESTYLE, NOT A DUTY

BLUESIGN® SYSTEM partner Recognizes our products are made of Bluesign® approved textile accessories for apparel and demonstrates our effort in sustainable process, such as our products are produced in a safe and resource conserving way with a minimum impact on people and the environment SUSTAINABILITY

SUSTAINABILITY OEKO - TEX® STANDARD 100 We are also an Oeko - Tex Standard 100 Class I supplier, this certificate ensures our products are produced by using materials certified according to STANDARD 100 by OEKO - TEX®. HIGG INDEX FEM Joined in 2019, a self - assessment standard for assessing environmental and social sustainability throughout the supply chain Global Recycled Standard (GRS) The GRS also ensures that recycled products are processed in a more climate - friendly way.

FOR MANY GLOBAL OUTERWEAR AND SPORTSWEAR BRANDS

INVESTMENT HIGHLIGHT

» WE OFFER A WIDE RANGE OF DIFFERENET QUALITIES OF HEAT TRANSFER SUPPLIER IN TERMS OF PRODUCT RANGE. » IN RAISED OR FLAT FINISH » REFLECTIVE OR NON - REFLECTIVE PRODUCT RANGE

INDUSTRY OVERVIEW

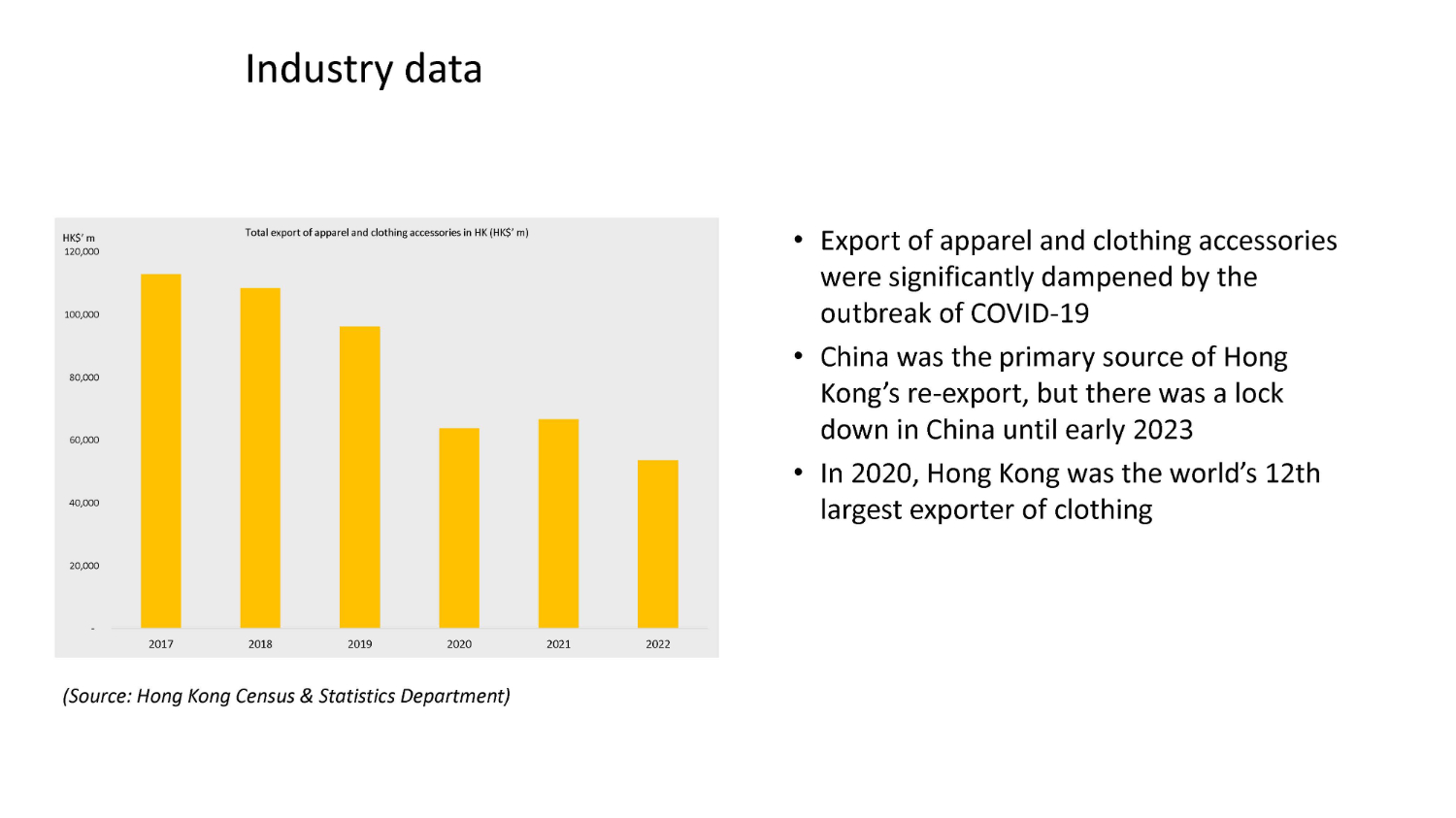

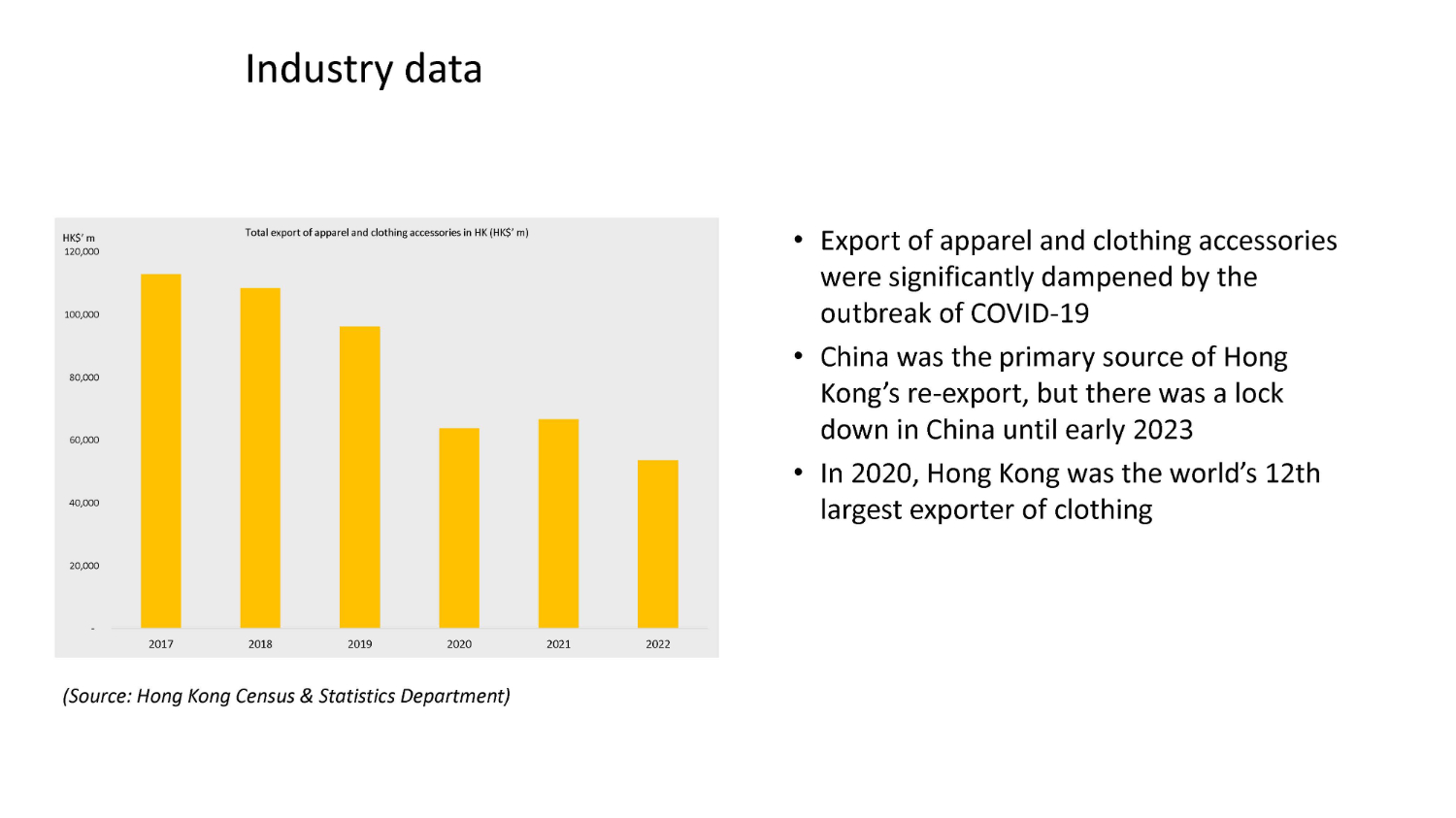

Industry data - 20,000 40,000 60,000 80,000 100,000 2017 2018 2019 2020 2021 2022 Total export of apparel and clothing accessories in HK (HK$’ m) HK$’ m 120,000 • Export of apparel and clothing accessories were significantly dampened by the outbreak of COVID - 19 • China was the primary source of Hong Kong’s re - export, but there was a lock down in China until early 2023 • In 2020 , Hong Kong was the world’s 12 th largest exporter of clothing (Source: Hong Kong Census & Statistics Department)

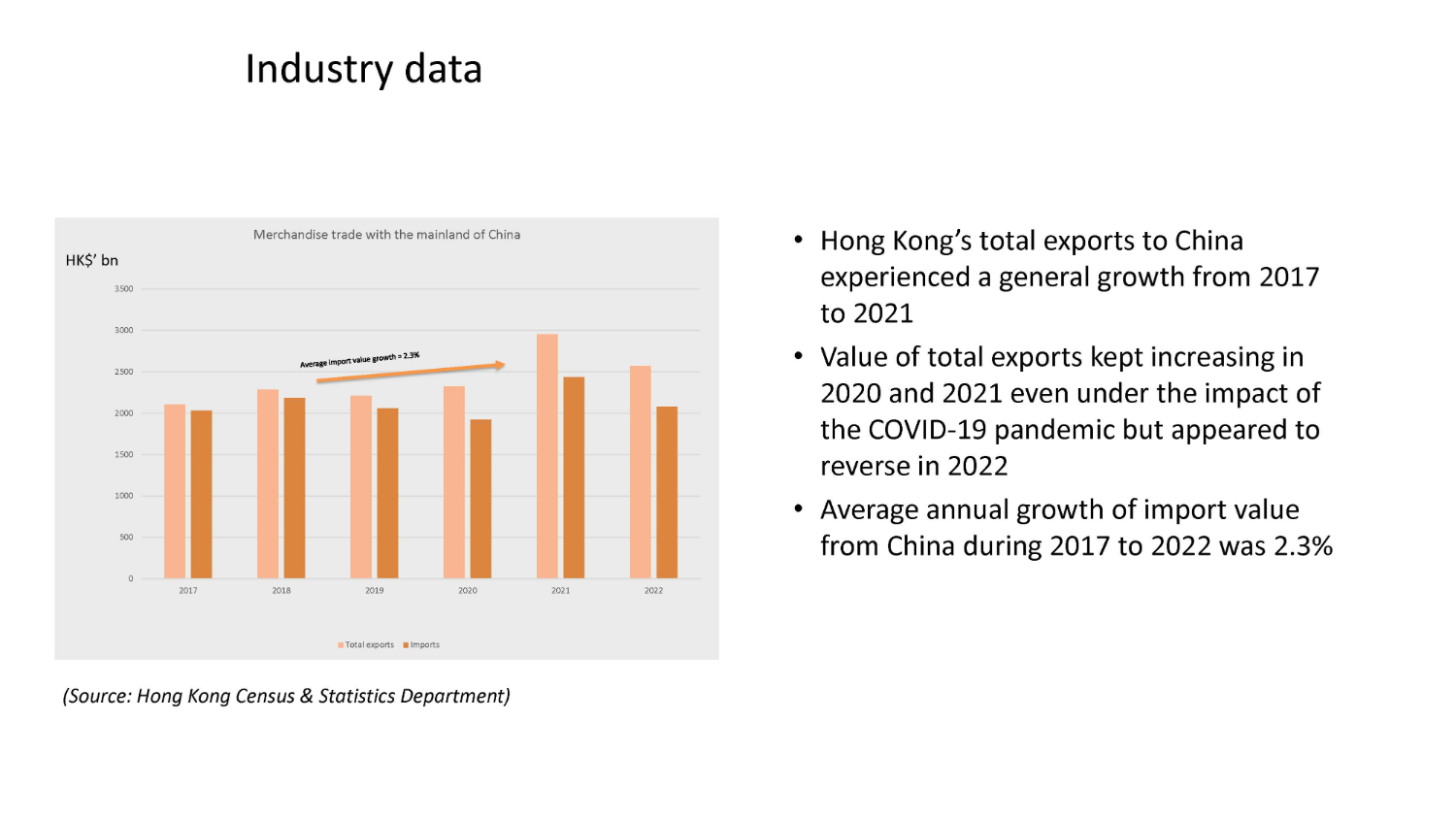

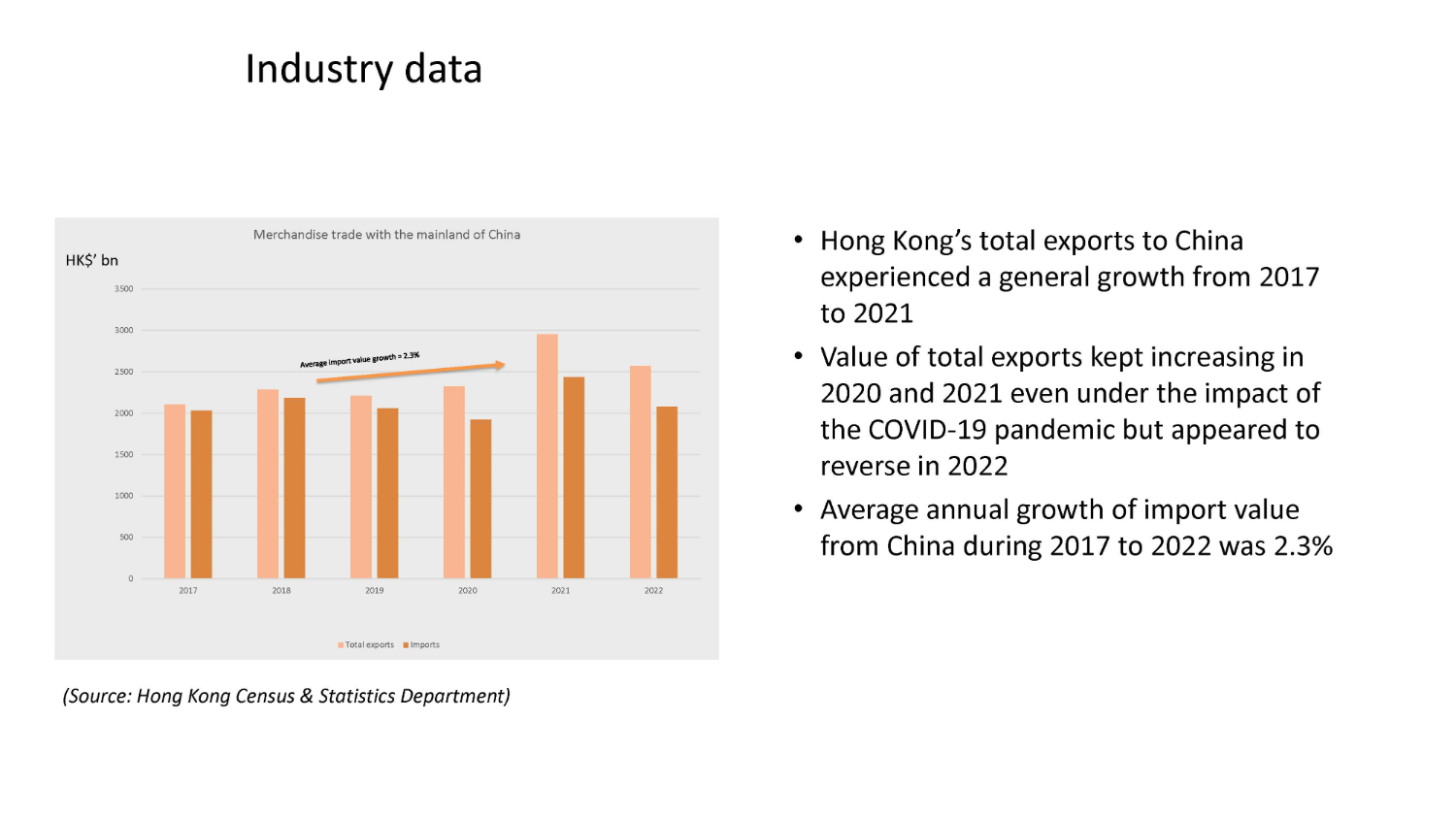

Industry data 0 500 1000 1500 2000 2500 3000 2017 2018 2019 2020 2021 2022 Merchandise trade with the mainland of China Total exports Imports HK$’ bn 3500 (Source: Hong Kong Census & Statistics Department) • Hong Kong’s total exports to China experienced a general growth from 2017 to 2021 • Value of total exports kept increasing in 2020 and 2021 even under the impact of the COVID - 19 pandemic but appeared to reverse in 2022 • Average annual growth of import value from China during 2017 to 2022 was 2.3%

GROWTH STRATEGIES

» We may in the future pursue acquisitions and joint ventures as part of our growth strategy » As the apparel industry is constantly changing, we need to strengthen our research and development capabilities for new products » As we aim to serve more customers and expand product range, we plan to further increase our warehouse and storage capacity Growth Strategies

FINANCIALS

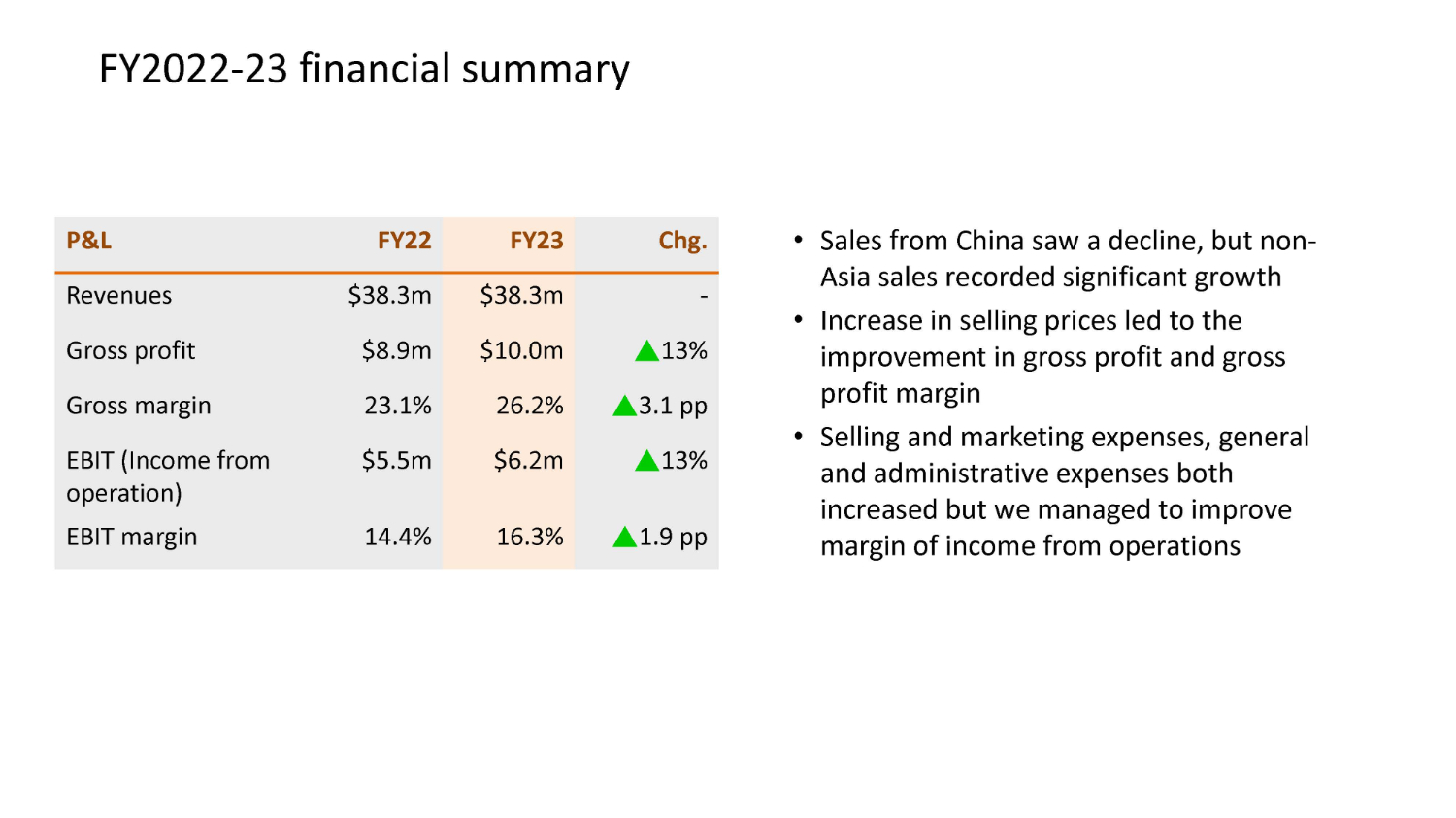

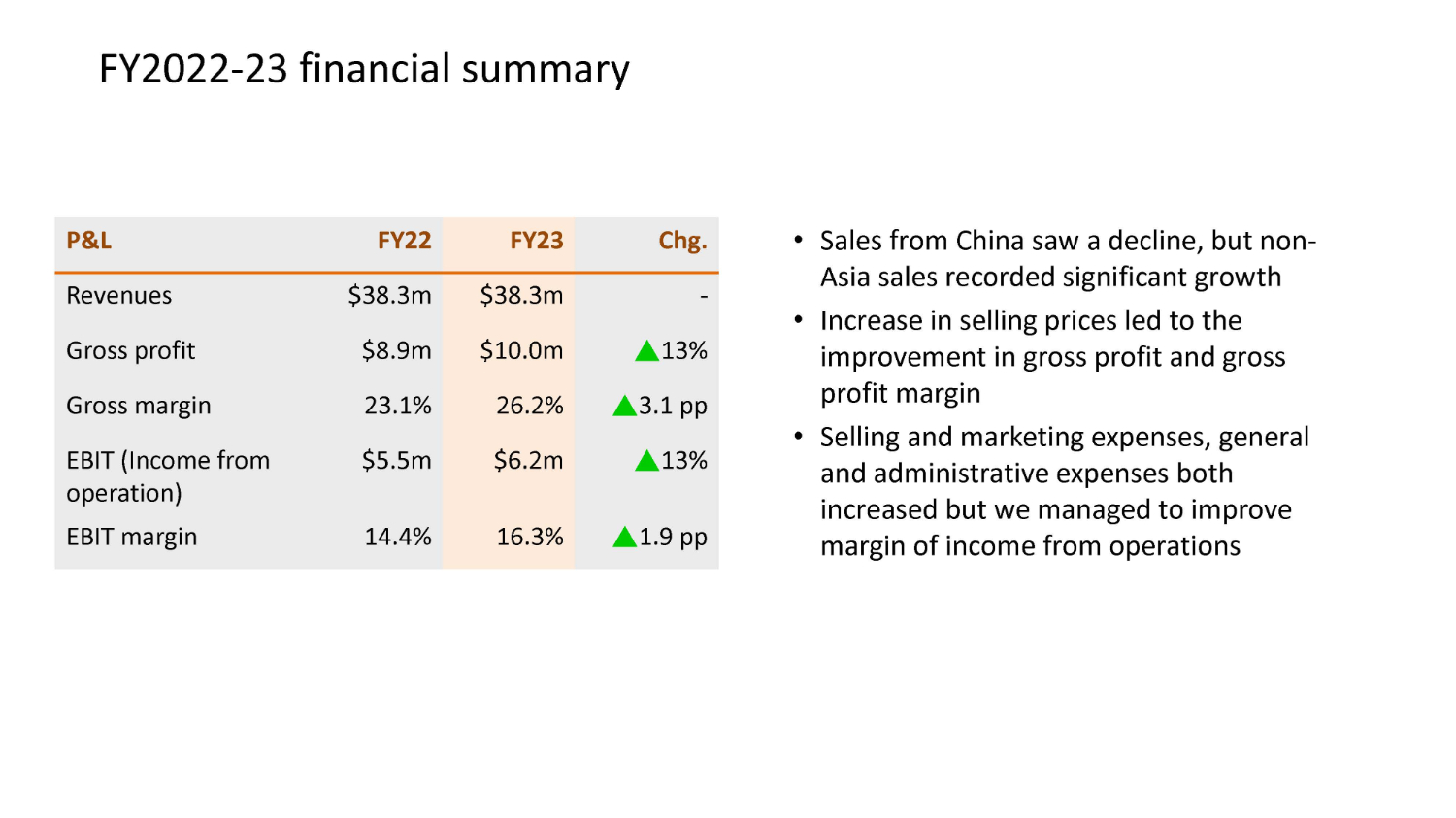

FY2022 - 23 financial summary Chg. FY23 FY22 P&L - $38.3m $38.3m Revenues Ÿ 13% $10.0m $8.9m Gross profit Ÿ 3.1 pp 26.2% 23.1% Gross margin Ÿ 13% $6.2m $5.5m EBIT (Income from operation) Ÿ 1.9 pp 16.3% 14.4% EBIT margin • Sales from China saw a decline, but non - Asia sales recorded significant growth • Increase in selling prices led to the improvement in gross profit and gross profit margin • Selling and marketing expenses, general and administrative expenses both increased but we managed to improve margin of income from operations

FY2022 - 23 financial summary Chg. FY23 FY22 Financial position Ÿ 65% 2.8X 1.7X Current ratio ź 57% $0.6m $1.4m Short - term debt and current portion of long - term debt ź 40% $2.6m $4.3m Total debt ź 19% $6.0m $7.4m Cash and equivalents N/A $(3.3m) $(3.1m) Net debt • Some bank loans were repaid due to the sale of property, plant and equipment • As a result, short - term debt and total debt as end of FY23 reduced and we had a higher net cash position • Current assets increased, current liabilities decreased, leading to the increase in current ratio

Corporate Structure

(1) Wise Total Solutions Group Limited, one of the Selling Shareholders selling 1,485,000 Ordinary Shares pursuant to the Resale Prospectus, has agreed to enter into customary lock - up agreement in favor of Eddid Securities USA Inc. for a period of two (2) months after the effective date of the registration statement. (2) Jipsy Trade Limited, one of the Selling Shareholders selling 1,485,000 Ordinary Shares pursuant to the Resale Prospectus, has agreed to enter into a leak - out agreement with the Company, pursuant to which the sale of such 1,485,000 Ordinary Shares is subject to certain resale restrictions based on the closing price and the average daily trading volume of the Company's Ordinary Shares on Nasdaq. (3) Assuming all of the 1,485,000 Ordinary Shares held by Jipsy Trade Limited being subject to a leak - out agreement and all of the 1,485,000 Ordinary Shares held by Wise Total Solutions Group Limited being subject to a lock - up agreement will be sold pursuant to the Resale Prospectus. Corporate structure after offering

Chairman of the board and Director Mr. Danny Tze Ching Wong, has over 35 years of experience in the apparel industry specializing in the development and supply of reflective and non - reflective garment trims and has played a key management and leadership role in our development. Chief Executive Officer and Director Mr. Edwin Chun Yin Wong, has over 10 years of experience in the trading and retail of garment products Chief Financial Officer Ms. Wai Ha Tang (“Ms. Tang”) has served as our chief financial officer since December 2022. Ms. Tang has over 30 years of experience in accounting and finance. Ms. Tang had previously worked for extensive periods of time in China, the UK, Vietnam and Cambodia as auditor, business and tax advisor, chief financial officer, chief operation officer, listed and non - listed company director and entrepreneur Board and Management Team

Mr. Danny Wong Danny has served as the Company’s chairman of the board since July 2022 and is our Controlling Shareholder. Mr. Danny Wong has over 35 years of experience in the apparel industry specializing in the development and supply of reflective and non - reflective garment trims. Since 1985, Mr. Danny Wong founded and served as the managing director of our operating subsidiary JLHK, one of the first authorized 3M Œ Scotchlite Œ Reflective Distributors in Asia Pacific, serving international outerwear, sports apparel brands and fashion brands worldwide. He has been primarily responsible for our corporate strategic planning, business development and overall management and operations. His activities include consultations, marketing and sales development, execution of business plans, account management, recruiting and training new colleagues, and being a point of contact for customers and suppliers. Prior to founding JLHK, he also worked in the safety and security department of a world - renowned leading reflective material brand in the U.S. Mr. Danny Wong is the father of Mr. Edwin Wong, another director of the Company. Mr . Edwin Wong Edwin has served as our chief executive officer since July 2022 and director since July 2022 . He has over 10 years of experience in the trading and retail of garment products . Mr . Edwin Wong concurrently serves as director of JLHK since June 2012 . He has been responsible for maintaining business growth while building our customer base in both occupational and customer markets . In addition, he oversees core aspects of our business operations from market research and trend analysis to product designs, development, manufacturing, quality control and shipment . Mr . Edwin Wong has obtained a bachelor’s degree in business administration from the University of Southern California’s Marshall School of Business in January 2009 . Mr . Edwin Wong is the son of Mr . Danny Wong, another director of the Company . Ms. Martha Tang Martha has served as our chief financial officer since December 2022. Ms. Tang has over 30 years of experience in accounting and finance. Ms. Tang had previously worked for extensive periods of time in China, the UK, Vietnam and Cambodia as auditor, business and tax advisor, chief financial officer, chief operation officer, listed and non - listed company director and entrepreneur. She has been involved in various industries including fashion, garment manufacturing, environmental, retail and distribution. Martha is a fellow chartered accountant (FCA) of the Institute of Chartered Accountants in England and Wales, certified public accountant (CPA) of the Hong Kong Institute of Certified Public Accountants, chartered financial analyst (CFA) level 1 candidate of the Chartered Financial Analyst Institute, and Business and Finance Professional (BFP) of the Institute of Chartered Accountants in England and Wales. Ms. Tang received a bachelor’s degree in education from the University of Bristol in 1988 and a master of business administration from Oxford University’s Said Business School in 2021. Directors Chief Financial Officer

Mr. To Wai Suen Mr. Suen will serve as our independent director and will be the chairman of the audit committee and a member of the nominating and corporate governance committee and compensation committee of JL. Mr. Suen has over 15 years of experience in accounting and finance. He is currently an independent director of MingZhu Logistics Holdings Limited, a company listed on NASDAQ (stock code: YGMZ), since April 2018 and October 2020, respectively. In addition, he has served as an independent non - executive director of Ping An Securities Group (Holdings) Limited, a company listed on the Stock Exchange of Hong Kong (stock code: 231) since February 2020; Huisen Household International Group, a company listed on the Stock Exchange of Hong Kong (stock code: 2127) since December 2020; and Huajin International Holdings Limited, a company listed on the Stock Exchange of Hong Kong (stock code: 2738) since March 2023. He was an independent non - executive director of CT Environmental Group Limited, a company listed on the Stock Exchange of Hong Kong (stock code: 1363), from February 2018 to April 2019. He also worked at Deloitte Touche Tohmatsu from January 2001 to January 2012 with his last position as a senior manager. Mr. Suen is a practising member of the HKICPA. Mr. Stephen Wayland Kan Stephen will serve as our independent director and will be the chairman of the nominating and corporate governance committee and a member of the audit committee and compensation committee of JL . Mr . Kan has nearly 40 years of work experience and has vast experience in import, retail and wholesale trade . Since June 1996 , Mr . Kan has co - founded and served as chief executive officer of KRW International, Inc, a company engaged in import and export trade and wholesale . Mr . Kan also holds professional qualifications and substantial work experience in accounting and finance . From 2002 to 2011 , he served as the Manager of Special Projects and Business Controls at San Diego Gas and Electric Company . He is a fellow member of the Institute of Management Accountants since 1993 . He received a Bachelor of Science degree in accounting from the University of California, Berkeley in 1975 and a Master of Business Administration from the California State University in 1982 . Mr . Nathaniel Clifton Chan Nathaniel will serve as our independent director and will be the chairman of the compensation committee and a member of the audit committee and nominating and corporate governance committee of JL . Mr . Chan has over 15 years of work experience in the financial industry . Since February 2019 , Mr . Chan has served as a team senior relationship manager at HSBC Global Private Bank . From October 2008 to September 2018 , Mr . Chan served as an associate and then as a director at UBS AG Private Wealth Management . From December 2006 to September 2008 , Mr . Chan served as a manager and then as an assistant vice president in the public sector division of Asia Pacific corporate banking at Citi . From January 2005 to December 2006 , Mr . Chan served as a management associate and then as an assistant manager in the real estate division of Hong Kong corporate banking at Citi . He has obtained a bachelor’s degree in science from the University of Southern California’s Marshall School of Business in May 2003 . Independent Directors

C ON T A C T S

THANK YOU TO VISIT US: WWW.J - LONG.COM