Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant | |

| | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☑ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under §240.14a-12 |

Sitio Royalties Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | |

Table of Contents

Table of Contents

Table of Contents

Sitio Royalties Corp.

1401 Lawrence Street, Suite 1750

Denver, CO 80202

Letter from the Chairman of the Board

Dear Fellow Shareholders:

It is my pleasure to invite you to attend the 2024 Annual Meeting of Stockholders of Sitio Royalties Corp. (the “Annual Meeting”) to be held on Tuesday, May 14, 2024, at 11:00 AM Central Time, at www.virtualshareholdermeeting.com/STR2024.

The following Notice of Annual Meeting describes the business to be conducted at the Annual Meeting. We encourage you to review the materials and vote your shares.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU CAST YOUR VOTE “FOR” PROPOSALS 1, 2, AND 3, AS DESCRIBED IN THE PROXY STATEMENT.

The Board of Directors of Sitio Royalties Corp. (the “Board”) has fixed the close of business on March 22, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof. Accordingly, only stockholders of record at the close of business on the Record Date are entitled to notice of, and shall be entitled to vote at, the Annual Meeting or any postponement or adjournment thereof. Attendance is limited to stockholders of the Company, their proxy holders and our guests. Stockholders holding stock in brokerage accounts must bring a legal proxy or other evidence of share ownership as of March 22, 2024 to be admitted to the meeting.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. You can ensure that your shares are represented and voted at the meeting by submitting your proxy/voting instruction over the Internet or by telephone. If you received your proxy materials by mail, you may also submit your proxy/voting instruction by mail by using the traditional proxy/voting instruction card that was included. Instructions for these convenient ways to vote are set forth on both the Notice of Internet Availability of Proxy Materials and the proxy/ voting instruction card.

The Annual Meeting will be completely virtual to enable our stockholders to participate from any location around the world that is convenient to them. You will be able to attend the Annual Meeting at www.virtualshareholdermeeting.com/STR2024. If the Annual Meeting is postponed or adjourned, your proxy will still be valid and may be voted at the rescheduled meeting. You may change or revoke your proxy until it is voted. If you are planning to attend our meeting, please monitor the Investor Relations section of our website at https://investors.sitio.com for updated information. To ensure your vote is counted, we encourage you to vote your shares prior to the Annual Meeting.

Thank you for your continued support of Sitio Royalties Corp.

Sincerely,

Noam Lockshin Noam Lockshin

Chairman of the Board | |  |

VOTING YOUR SHARES IS IMPORTANT.

PLEASE SUBMIT YOUR PROXY/VOTING INSTRUCTION OVER THE INTERNET OR BY TELEPHONE. YOU CAN ALSO COMPLETE, SIGN, DATE AND PROMPTLY RETURN YOUR PROXY/VOTING INSTRUCTION CARD IF YOU RECEIVED PROXY MATERIALS BY MAIL.

Table of Contents

Sitio Royalties Corp.

1401 Lawrence Street, Suite 1750

Denver, CO 80202

Letter from the CEO

Dear Fellow Shareholders:

When we sent this letter to you last year, we had recently completed our merger with Brigham Minerals, our second public company merger of 2022. We were fortunate to retain a talented group of professionals from Brigham, and the process of integrating them into the outstanding team at Sitio and of integrating the Brigham assets into Sitio was seamless. While Sitio acquired fewer mineral and royalty interests in 2023 compared to 2022 (a very high bar for comparison!), we made tremendous progress on our three strategic goals: continuing the consolidation of the highly fragmented and inefficiently managed minerals sector, professionally and actively managing the minerals we own to maximize value for our shareholders, and innovating to differentiate Sitio.

Our acquisitions completed in 2023 included our first two asset acquisitions as a public company in which we used our equity as a currency to acquire minerals. Both acquisitions shared many common themes – they were with sellers we have known for years and transacted with in the past, enhanced our footprint in areas where we had lower exposure in our portfolio (one in New Mexico, one in the Midland Basin), and were accretive to our shareholders. Our largest cash acquisition in 2023 was similarly with a seller we have known and pursued for years. Although we continue to see the benefits of scale with each acquisition, we sold assets in 2023 for the first time in our company history. We sold our mature Appalachia and Anadarko Basin assets and allocated those proceeds into our recently announced acquisition of DJ Basin assets which are being actively developed by a high-quality group of operators. As stewards of our shareholders’ capital, we saw this as a unique opportunity to redirect asset sale proceeds into a higher rate of return acquisition.

The less visible, but equally important, aspect of our business involves actively managing the minerals we own – proactively seeking opportunities to lease our minerals to operators on terms that incentivize development and pursuing all royalty payments due to Sitio. Given the scale of our business today which includes over 9,000 leases, interests in over 27,000 wells, and relationships with approximately 189 operators, data management is critical to our success. We have developed customized systems to track all of our interests and verify whether we are missing any payments from our operators. In 2023 alone, we collected more missing payments than we spent on all of our cash G&A for the year. This is a clear demonstration of Sitio Minerals Management adding shareholder value.

In addition to the attractive DJ Basin asset acquisition, we also recently announced a $200 million stock buyback authorization. We remain committed to returning at least 65% of our Discretionary Cash Flow to our shareholders, and now we have the ability to include share buybacks as part of that return of capital. The buyback authorization is a reflection of our outlook for Sitio’s business, which has never been stronger.

Sincerely,

Christopher L. Conoscenti Christopher L. Conoscenti

Chief Executive Officer & Director | |  |

Table of Contents

Notice of Annual Meeting of Stockholders

| Date and Time

Tuesday, May 14, 2024

11:00 AM Central Time |  | Location

Online www.virtualshareholdermeeting.com/STR2024 |  | Record Date

March 22, 2024 |

| Agenda | | Board Recommendation | | Page Reference |

| 1 | | To elect the director nominees named in the accompanying proxy statement (the “Proxy Statement”) to our Board | | | “FOR” each of the nominees | | | 18 |

| 2 | | To conduct a non-binding advisory vote to approve the Company’s compensation of its named executive officers (the “Say-on-Pay Vote”) | | | “FOR” | | | 50 |

| 3 | | To amend the Company’s Restated Certificate of Incorporation (the “Restated Certificate of Incorporation”) to Eliminate the Supermajority Voting Provision | | | “FOR” | | | 51 |

Stockholders will also transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The Proxy Statement more fully describes these matters. We have not received notice of any other matter that may be properly presented at the Annual Meeting.

Only holders of common stock of record at the close of business on March 22, 2024, are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. The use of cameras, sound recording equipment, communication devices or other similar equipment is prohibited.

Your vote is important. Please submit your proxy/voting instruction over the Internet or by telephone by following the instructions on your Notice of Internet Availability of Proxy Materials about how to view the proxy materials. If you received your proxy materials by mail, you may submit your proxy/voting instruction over the Internet or by telephone or by completing, signing, dating and promptly mailing your proxy/voting instruction card that was included. If you attend and plan to participate in the Annual Meeting via live webcast, you may vote online during the meeting using your smartphone or computer.

By Order of the Board of Directors,

Brett S. Riesenfeld

Brett S. Riesenfeld

Executive Vice President, General Counsel and SecretaryIMPORTANT NOTICE

Voting your shares is important. If you do not expect to attend the Annual Meeting via live webcast, or if you plan to attend but wish to vote by proxy, please submit your proxy/voting instruction over the Internet or by telephone. If you received your proxy materials by mail, you may also submit your proxy/voting instruction by completing, signing, dating and promptly mailing the proxy/voting instruction card that was included and for which a postage-paid return envelope was provided. |

| Internet

Visit www.proxyvote.com

Available until 11:59 PM Eastern Time on May 13, 2024. You must have the control number that appears on your Notice of Internet Availability of Proxy Materials or proxy/voting instruction card. |  | Telephone

Call 1-800-690-6903

Available until 11:59 PM Eastern Time on May 13, 2024. You must have the control number that appears on your Notice of Internet Availability of Proxy Materials or proxy/voting instruction card. |

| Mail

Complete, sign and date your proxy/voting instruction card and mail in the postage paid return envelope. |  | Virtual Meeting

If you attend and plan to participate in the Annual Meeting via the live webcast, you may vote online during the meeting using your smartphone or computer. |

Table of Contents

Highlights

Company Overview

Sitio is a stockholder returns driven company focused on large-scale consolidation of high-quality oil and gas mineral and royalty interests across premium basins, with a diversified set of top-tier operators. Sitio has an objective of generating cash flow from operations that can be distributed to stockholders and reinvested to expand its mineral and royalty interest portfolio.

| | | |

| 252,000+ | 190+ | 27,000+ |

| Net Royalty Acres (“NRAs“) (1/8 basis) | Total Acquisitions to Date | Gross Wells |

| | | |

Our Investment Thesis

| 1 | | 2 | | 3 | | 4 | | 5 | |

| Mineral and royalty interest ownership provides unique, cost advantaged oil and gas exposure | Differentiated, large-scale consolidation strategy across diversified operators, active minerals management and focus on value-creating innovation | Premier asset base focused at the front end of operators’ cost curves | Disciplined capital allocation focused on value creation and returns | Best-in-class governance model led by experienced board and management |

2023 Financial and Operational Highlights

| | | | | | |

| | Returns-Focused Capital Allocation | | | Cash Margin Enhancement | |

| ■ Acquired 14,227 NRAs in the Permian Basin for $249.3 million across 6 transactions ■ Monetized mature, declining assets in the Appalachia and Anadarko Basins for $114 million | | | ■ Refinanced private unsecured notes with $600 million offering of public unsecured notes, reducing expected interest expense by $11 million per year ■ Reduced cash G&A / Boe by 30% vs. 2022 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Return of Cash to Shareholders | | | Diversified, Large-Scale & High Quality Asset Base | |

| ■ Paid over $320 million in dividends and distributions ■ Equates to $1.99 / share, or an 8.5% yield based on 12/29/23 closing price | | | ■ Pro forma for all announced acquisitions, Sitio has exposure to >35% of the Permian Basin and nearly 50% of the Greater Wattenberg Field in the DJ Basin ■ Record-high pro forma 53.4 net line-of-sight wells at year-end(1) | |

| | | | | | |

| (1) | Includes the impacts from the January 2024 agreement to acquire 13,062 NRAs in the DJ Basin, subject to closing adjustments. |

Table of Contents

Highlights

Mineral and Royalty Businesses are a Structurally Advantaged Asset Class

| | Simplicity | | Profitability | |

| | | |

| ■ Mineral interests are perpetual real property interests and, when leased for royalties, have no development capital expenses ■ No physical operations or associated regulatory risks ■ No environmental liabilities: zero scope 1 emissions and scope 2 emissions are only from power consumption at Sitio office locations | | ■ Highest margin component of the energy value chain, with limited direct exposure to cost inflation, enables sector leading EBITDA to free cash flow conversion ratios ■ Ability to return a majority of discretionary cash flow to stockholders while maintaining a conservative balance sheet | |

| Efficiency | | Scalability | |

| | | |

| ■ No field staff or lease operating expenses and 100% of capital expenditures are discretionary and tied to corporate investments and acquisitions ■ Data management systems improve royalty management capabilities | | ■ Highly fragmented mineral and royalty ownership with limited number of buyers capable of large-scale acquisitions ■ G&A expenses do not increase linearly with company scale | |

Corporate Responsibility

| ■ | Zero environmental liabilities |

| ■ | No scope 1 emissions; scope 2 emissions are only from power consumption at Sitio office locations |

| ■ | Sitio’s lease form provides an economic disincentive for flaring gas |

| ■ | Target leasing minerals to operators with strong environmental track records |

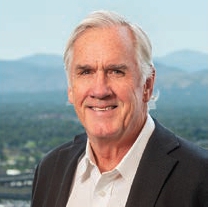

| ■ | Employee base and Board reflective of a culture that values diversity |

| ■ | ~47% of Sitio’s current employees are women |

| ■ | 5 out of 9 current board members are diverse |

| ■ | Management team and employees have experience across the oil and gas value chain to provide unique perspectives on minerals |

Table of Contents

Proxy Summary

| PROPOSAL 1 | | |

| |

Election of Directors |

| The election of each of the director nominees named in this Proxy Statement to hold office until our 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”) or until their respective successors are duly elected and qualified. |

The Board recommends that stockholders vote FOR the election of each of the nominees. The Board recommends that stockholders vote FOR the election of each of the nominees. | See page 18 |

The following table provides summary information about each of the director nominees standing for election to the Board for a one-year term expiring on the date of our 2025 Annual Meeting or until their respective successors are duly elected and qualified. The nominees for director, each of whom has consented to serve, if elected, are as follows:

|  |  |

Noam Lockshin, 39

Chairman of the Board

Independent

Committee Memberships:  | Christopher L. Conoscenti, 48

Chief Executive Officer and Director | Morris R. Clark, 56

Independent Board Member

Committee Memberships:  |

| | | |

|  |  |

Alice E. Gould, 62

Independent Board Member

Committee Memberships:  | Claire R. Harvey, 44

Independent Board Member

Committee Memberships:  | Gayle L. Burleson, 58

Independent Board Member

Committee Memberships:  |

| | | |

|  |  |

Jon-Al Duplantier, 56

Independent Board Member

Committee Memberships:  | Richard K. Stoneburner, 70

Independent Board Member

Committee Memberships:  | John R. (“J.R.”) Sult, 64

Independent Board Member

Committee Memberships:  |

| AC – Audit Committee | NCGC – Nominating and Corporate Governance Committee | ■ – Member | ■ – Chair |

| CC – Compensation Committee | | | |

Board Snapshot

Table of Contents

Proxy Summary

Skills and Experience

Best in Class Governance Incentivizes Board and Management to Optimize Stockholder Returns

| Stockholders | Board of Directors | Compensation & Management |

■ Board and management compensation is structured to drive absolute total long-term stockholder returns ■ Capital allocation policy prioritizes return of capital to stockholders while preserving balance sheet strength using retained cash | ■ 8 of 9 members of the Board are independent ■ Director compensation is substantially equity-based and required to be held until the end of Board service ■ Seven-year term limits for outside directors | ■ Incentive compensation is 100% equity based, with emphasis on absolute total stockholder return instead of relative returns or growth with no relationship to stockholder returns ■ Experienced, dedicated management team is 100% focused on Sitio’s business |

| PROPOSAL 2 | | |

| |

Non-Binding Advisory Vote to Approve Company’s Compensation of Named Executive Officers |

| The approval, on a non-binding, advisory basis, of the Company’s compensation of its named executive officers. |

The Board recommends that stockholders vote FOR this proposal. The Board recommends that stockholders vote FOR this proposal. | See page 50 |

Executive Compensation Alignment with Long-Term

Stockholder Value

| | | | |

| | No short-term incentive compensation / cash

bonus for executives | 75% of long-term incentive compensation tied to

absolute total shareholder return | |

| | | | |

| | | | |

| | No portion of compensation tied to

relative metrics | Compensation program provides industry-leading

alignment with shareholders | |

| | | | |

Table of Contents

Proxy Summary

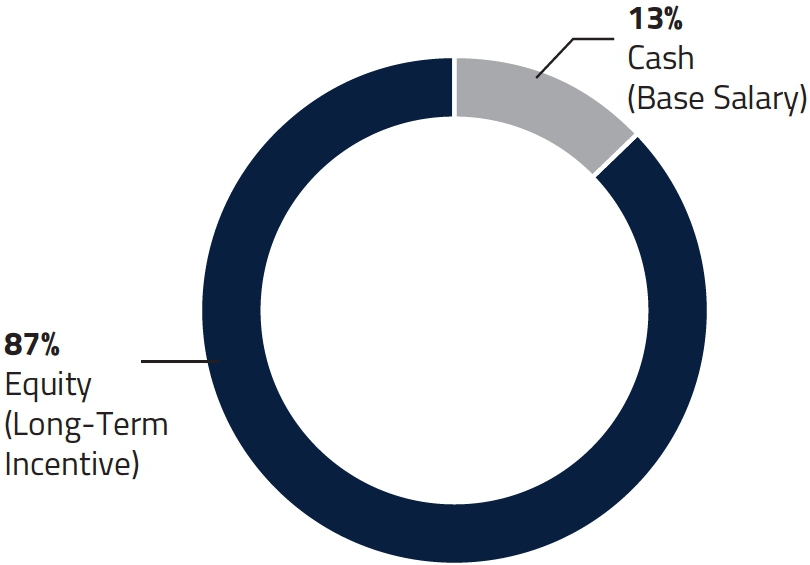

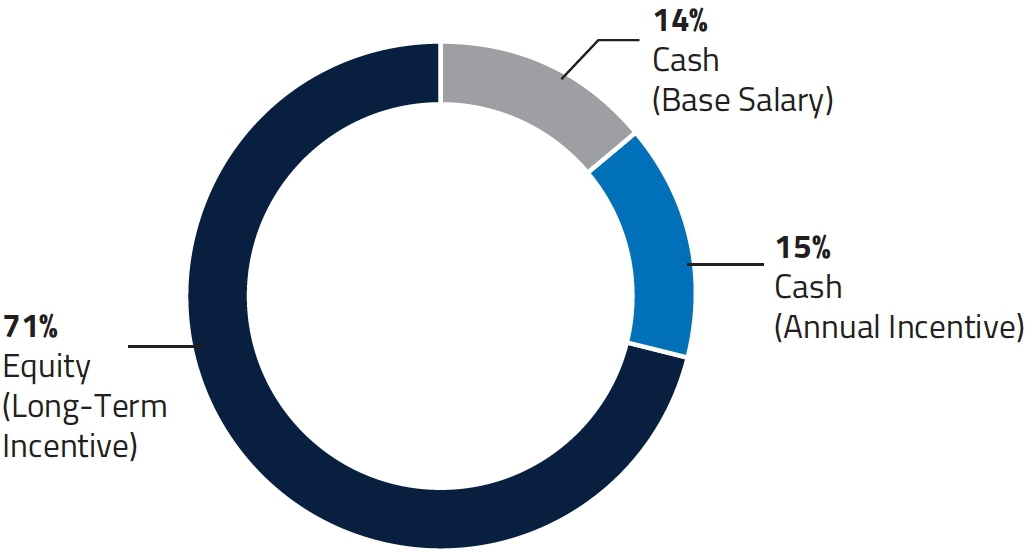

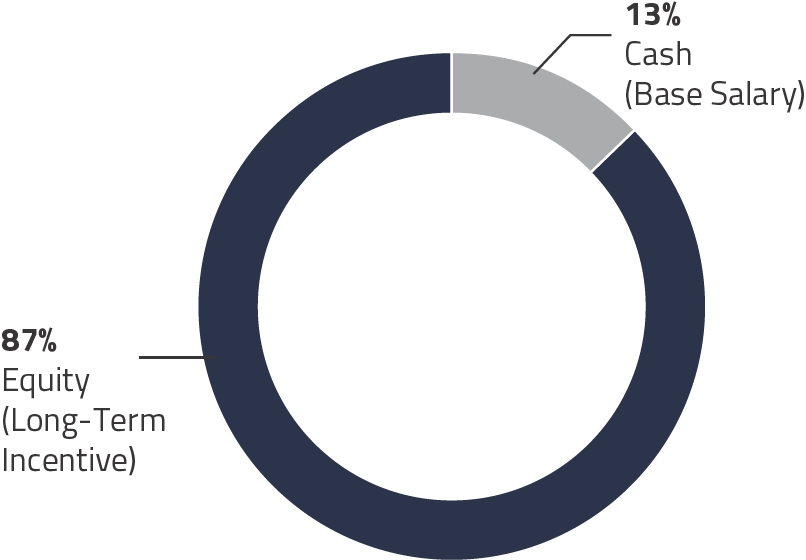

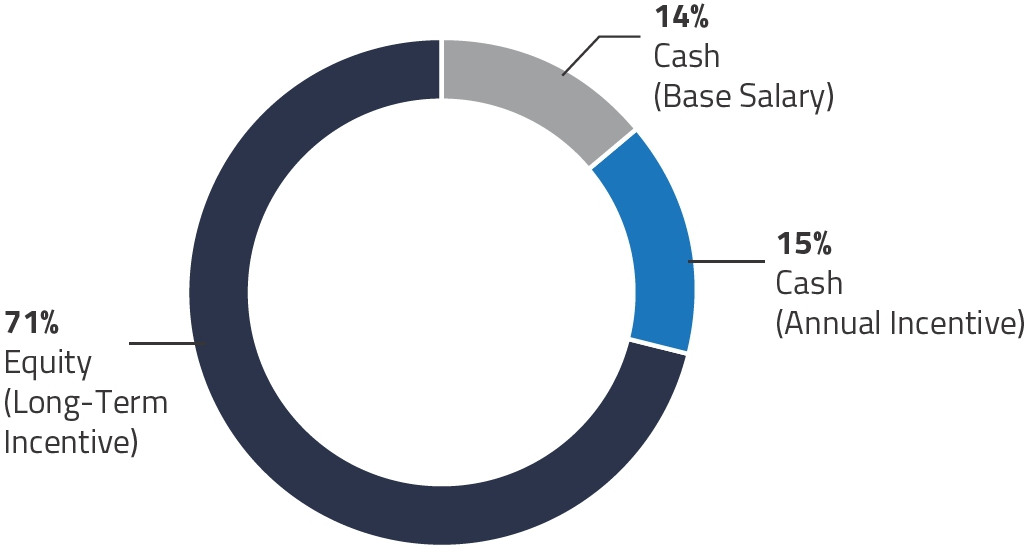

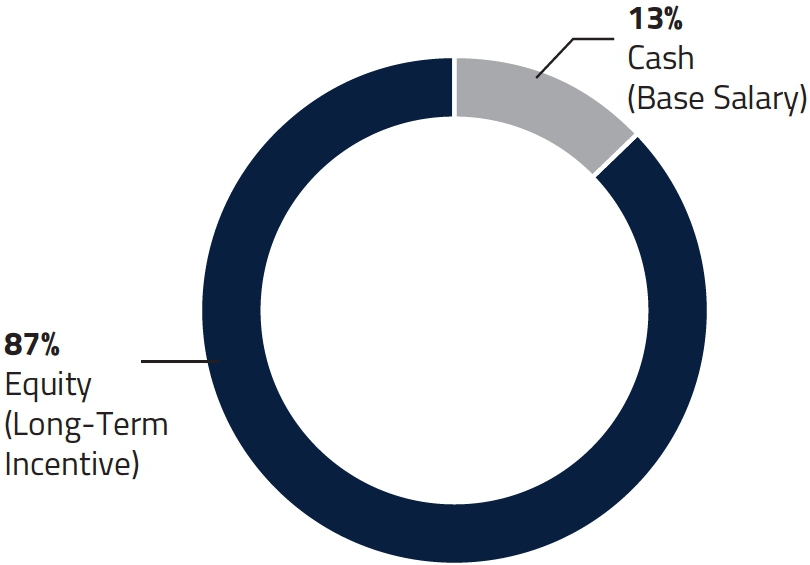

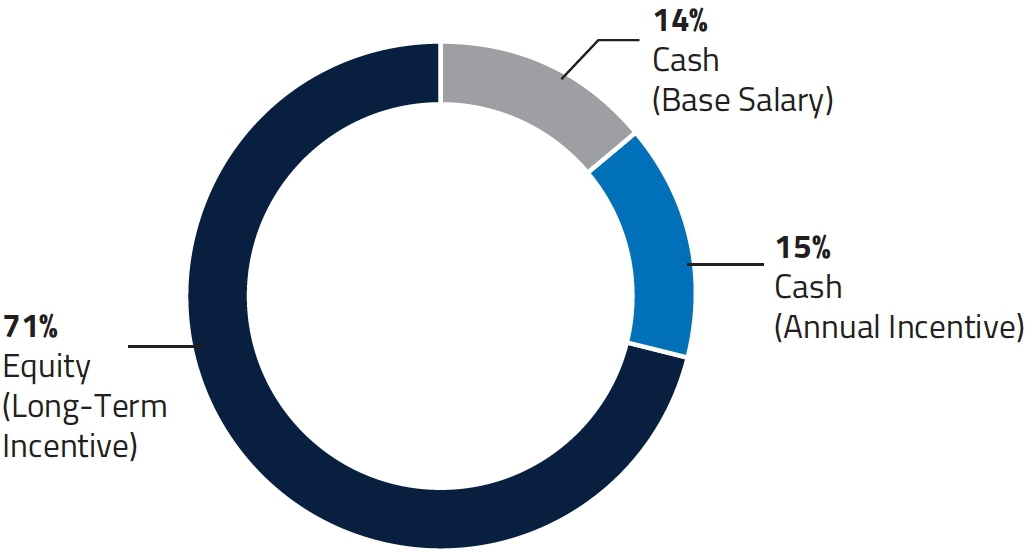

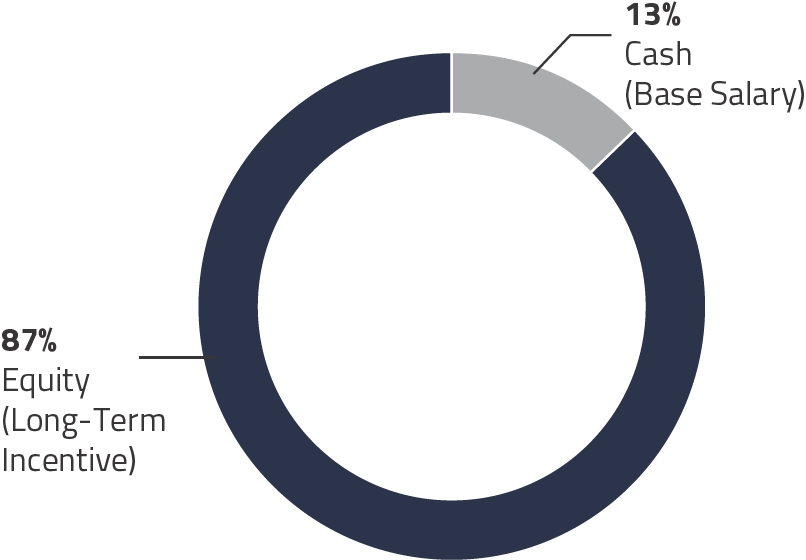

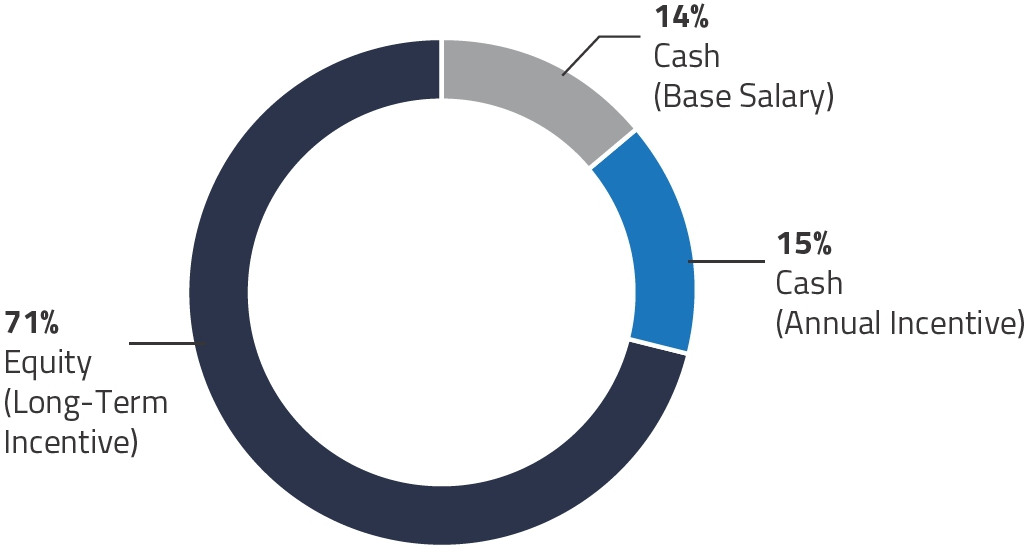

Target Pay Mix

| Conoscenti 2024 Target Total Compensation | Peer Group CEO 2024 Target Total Compensation |

|  |

Compensation Program Governance

| What We Do | | |  | What We Don’t Do | |

| | | |

| | | | | | | |

| | | ✓ Focus on absolute total stockholder return ✓ Significant portion of pay is at risk ✓ Majority of equity awards are in the form of performance-based compensation ✓ Annual equity awards for executive officers subject to three-year vesting periods ✓ Maintain policy prohibiting hedging transactions and short sales by insiders ✓ Regularly evaluate risks of our compensation policy ✓ Compensation Committee engages an independent compensation consultant and follows a comprehensive process ✓ Consider peer group reports when establishing compensation | | | | ✕ NO payout of PSUs when absolute TSR is negative ✕ NO cash bonuses ✕ NO performance awards issued based on relative achievement ✕ NO excessive benefits or perquisites ✕ NO single-trigger change in control acceleration on time-vested awards ✕ NO short-term incentive compensation ✕ NO employment agreements ✕ NO tax gross up in connection with a change in control. |

| PROPOSAL 3 | | |

| |

Amend the Restated Certificate of Incorporation to Eliminate the Supermajority Voting Provision |

| The approval of the amendment to the Restated Certificate of Incorporation to eliminate the supermajority voting provision. |

The Board recommends that stockholders vote FOR this proposal. The Board recommends that stockholders vote FOR this proposal. | See page 51 |

Table of Contents

Annual Meeting of Stockholders

This Proxy Statement is furnished to stockholders of Sitio for use at its Annual Meeting to be held at 11:00 AM Central Time, on Tuesday, May 14, 2024, at www.virtualshareholdermeeting.com/STR2024, or at any postponements or adjournments of the Annual Meeting for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The approximate date on which this Proxy Statement and the enclosed proxy card are first being furnished or sent to stockholders is March [29], 2024.

Proxy Statement for 2024 Annual Meeting of Stockholders

The Board of Directors (the “Board”) of Sitio Royalties Corp. (which we refer to as “Sitio,” “Sitio Royalties,” the “Company,” “we,” “our” or “us”) is furnishing this Proxy Statement to you over the Internet or delivering this Proxy Statement to you by mail in connection with the solicitation of proxies by the Board and the solicitation of voting instructions, in each case for use at the Annual Meeting to be held on May 14, 2024, and at any adjournments or postponements thereof.

On or about March [29], 2024, we will commence mailing the Notice of Internet Availability of Proxy Materials to most of our stockholders, and we also will commence mailing to some of our stockholders, and make available electronically over the Internet to all of our stockholders: (1) the Notice of 2024 Annual Meeting of Stockholders and this Proxy Statement and (2) our 2024 Annual Report for Stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2023 and our audited financial statements. If you receive your proxy materials by mail, a proxy/voting instruction card will be included.

Table of Contents

Table of Contents

Table of Contents

Information About the Proxy Process and Voting

What is a proxy and what is a proxy statement?

A proxy is your legal designation of another person to vote the shares you own. That other person is called a proxy. If you designate someone as your proxy, the document in which you make that designation also is called a proxy. This document is a proxy statement. It is a document that we are required by law to provide to you when we ask you to name a proxy to vote your shares. We encourage you to read this Proxy Statement carefully.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a paper copy of the proxy materials?

The rules of the U.S. Securities and Exchange Commission (the “SEC”) permit us to furnish proxy materials over the Internet. As a result, we are mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials instead of a paper copy of our proxy materials. All stockholders receiving the Notice of Internet Availability of Proxy Materials will have the ability to access our proxy materials over the Internet and, if desired, to request to receive a paper copy of our proxy materials by mail. Instructions on how to access our proxy materials over the Internet or to request a paper copy may be found in the Notice of Internet Availability of Proxy Materials. In addition, the Notice of Internet Availability of Proxy Materials contains instructions on how you may elect to receive future proxy materials electronically on an ongoing basis.

Why didn’t I receive a notice in the mail about the Internet availability of the proxy materials?

We are providing paper copies of our proxy materials instead of a Notice of Internet Availability of Proxy Materials to our stockholders who have previously requested to receive paper copies of our proxy materials. In addition, we are providing notice of the availability of our proxy materials by e-mail to our stockholders who have previously elected to receive proxy materials electronically. Those stockholders should have received an e-mail containing instructions and links to the website where our proxy materials are available and to the proxy voting website.

How can I access the proxy materials over the Internet?

Your Notice of Internet Availability of Proxy Materials or proxy/voting instruction card contains instructions on how to (1) view our proxy materials for the Annual Meeting over the Internet and (2) elect to receive future proxy materials electronically by e-mail. Our proxy materials also are available on our website at https://investors.sitio.com.

Electing to receive future proxy materials electronically will help us conserve natural resources and reduce the cost of delivering our proxy materials. If you elect to receive future proxy materials electronically, you will receive an e-mail containing instructions and links to the website where our proxy materials are available and to the proxy voting website. Your election to receive proxy materials electronically by e-mail will remain in effect until you terminate it.

How may I obtain a paper copy of the proxy materials?

If you receive a Notice of Internet Availability of Proxy Materials by mail, you will find instructions about how to obtain a paper copy of our proxy materials on the Notice of Internet Availability of Proxy Materials. If you receive notice of the availability of our proxy materials by e-mail, you will find instructions about how to obtain a paper copy of our proxy materials included in that e-mail. Stockholders who do not receive a Notice of Internet Availability of Proxy Materials or an e-mail regarding the availability of our proxy materials will receive a paper copy of our annual report, Proxy Statement and proxy card by mail.

What is a record date and who is entitled to vote at the meeting?

A record date is the date, as of the close of business on which, stockholders of record are entitled to notice of and to vote at a meeting of stockholders. The Record Date for the Annual Meeting is March 22, 2024 and was established by our Board as required under the laws of Delaware, our state of incorporation. Thus, owners of record of shares of Sitio’s Class A common stock, par value $0.0001 per share (the “Class A common stock”) and Class C common stock, par value $0.0001 per share (the “Class C common stock,” and, together with the Class A common stock, the “common stock”) as of the close of business on March 22, 2024 are entitled to receive notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

Table of Contents

Information About the Proxy Process and Voting

How many shares can be voted and what is a quorum?

You are entitled to one vote for each share of Sitio’s common stock (a “share”) that you owned as of the close of business on March 22, 2024, and you may vote all of those shares. Only our common stock has voting rights. On the Record Date, there were [●] shares of our common stock outstanding and entitled to vote at the Annual Meeting and approximately [●] holders of record and approximately [●] beneficial owners holding shares in “street name.”

A quorum is the minimum number of shares that must be represented online or by proxy for us to conduct the Annual Meeting. The attendance online or by proxy of holders of a majority of the shares of common stock entitled to vote at the Annual Meeting, or [●] shares of our common stock based on the Record Date of March 22, 2024, will constitute a quorum to hold the Annual Meeting. If you grant your proxy over the Internet, by telephone or by your proxy/voting instruction card, your shares will be considered present at the Annual Meeting and counted toward the quorum.

What different methods can I use to vote my shares?

You have a choice of voting your shares:

| ■ | Over the Internet |

| ■ | By telephone |

| ■ | By mail |

| ■ | Via smartphone or computer during the virtual Annual Meeting |

Even if you plan to attend the Annual Meeting, we encourage you to vote your shares beforehand over the Internet, by telephone or by mail. Please carefully read the instructions below on how to vote your shares. Because the instructions vary depending on how you own your shares and the method you use to vote your shares, it is important that you follow the instructions that apply to your situation.

If you vote your shares over the Internet or by telephone, you should not return a proxy/voting instruction card.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, Continental Stock & Trust Company, you are considered the stockholder of record with respect to those shares, and the proxy materials were sent directly to you by the Company.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a broker, bank, broker-dealer, custodian or other similar organization, then you are the beneficial owner of shares held in “street name,” and the proxy materials were forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting during the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account, but you must follow the “vote instruction form” that organization has provided to you to vote or attend the Annual Meeting.

How do I vote my shares if I am a “stockholder of record” (shares registered in my name)?

Voting over the Internet. Voting over the Internet is easy, fast and available 24 hours a day. If you receive a Notice of Internet Availability of Proxy Materials by mail, you may submit your proxy/voting instruction over the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials. If you receive notice of the availability of our proxy materials by e-mail, you may submit your proxy/voting instruction over the Internet by following the instructions included in that e-mail. If you receive a proxy/voting instruction card by mail, you may submit your proxy/voting instruction over the Internet by following the instructions on the proxy/ voting instruction card. You will be able to confirm that the Internet voting system has properly recorded your vote, which will be counted immediately, and there is no need to return a proxy/voting instruction card.

Voting by telephone. Voting by telephone also is easy, fast and available 24 hours a day. If you live in the United States or Canada, you may vote by telephone by calling toll-free 1-800-690-6903. If you receive a Notice of Internet Availability of Proxy Materials by mail, you must have the control number that appears on the notice when voting. If you receive notice of the availability of our proxy materials by e-mail, you must have the control number included in that e-mail when voting. If you receive a proxy/voting instruction

Table of Contents

Information About the Proxy Process and Voting

card by mail, you must have the control number that appears on the proxy/voting instruction card when voting. You will be able to confirm that the telephone voting system has properly recorded your vote, which will be counted immediately, and there is no need to return a proxy/voting instruction card.

Voting by mail. You can save us expense by voting over the Internet or by telephone. Alternatively, if you received a proxy/voting instruction card by mail, you may vote by mail by completing, signing, dating and promptly mailing your proxy/voting instruction card in the accompanying postage-paid return envelope.

Voting at the meeting. The Annual Meeting will be held online. Please have your 16-digit control number on your Notice of Internet Availability, proxy card or in the voting instructions that accompanied your proxy materials to participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/STR2024. You will be able to vote your shares electronically during the Annual Meeting.

How do I vote my shares if I am a “beneficial owner” (shares held in “street name”)?

Voting over the Internet, by telephone or by mail. If your shares are registered or held in the name of your broker, bank, or other nominee (“street name”), you have the right to direct your broker, bank, or other nominee on how to vote your shares by using the method specified by your broker, bank, or other nominee. In addition to voting by mail, most brokerage firms and banks participate in Internet or telephone voting programs. These programs provide eligible “street name” stockholders the opportunity to vote over the Internet or by telephone. Voting forms will provide instructions for stockholders whose brokerage firms or banks participate in these programs.

Voting at the meeting. If your shares are registered or held in the name of your broker, bank, or other nominee and you plan to attend and participate in the Annual Meeting, you should contact your broker, bank, or other nominee (preferably at least five days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in or vote at the Annual Meeting.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) whether made via the Internet, by telephone or by mail, by attending the Annual Meeting virtually and voting online during the meeting or by filing a revocation with the Company’s Corporate Secretary, at 1401 Lawrence Street, Suite 1750, Denver, CO 80202.

If you hold your shares in street name, you may change your vote by contacting your broker or other nominee and following their instructions. Please note, however, that if your shares of record are held by a broker, bank, broker-dealer, custodian, or other similar organization, you must instruct your broker, bank, broker-dealer, custodian, or other similar organization that you wish to change your vote by following the procedures on the voting instruction form provided to you by such organization.

What happens if I do not indicate how to vote my proxy?

If you sign your proxy card without providing further instructions, your shares will be voted:

| ■ | “FOR” the election of each of the director nominees named in this Proxy Statement to hold office until our 2025 Annual Meeting or until their respective successors are duly elected and qualified; |

| ■ | “FOR” the approval, on a non-binding, advisory basis, of the Company’s compensation of its named executive officers; and |

| ■ | “FOR” the approval of the amendment to the Restated Certificate of Incorporation to eliminate the supermajority voting provision. |

In addition, you are entitled to vote on any other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof.

How will my shares be voted if I do not provide instructions to my broker?

It is possible for a proxy to indicate that some of the shares represented are not being voted with respect to certain proposals. This occurs, for example, when a broker, bank, or other nominee does not have discretion under New York Stock Exchange (“NYSE”) rules to vote on a matter without instructions from the beneficial owner of the shares and has not received such instructions. In these cases, non-voted shares will not be considered present and entitled to vote with respect to that matter, although they may be considered present and entitled to vote for other purposes and will be counted in determining the presence of a quorum. Under NYSE rules, brokers, banks and other nominees have discretionary voting power to vote without receiving voting instructions from the beneficial owner on “routine” matters, but not on “non-routine” matters. Under NYSE rules, none of the matters to be considered at the Annual Meeting are considered “routine” and, therefore, your broker, bank, or other nominee will not have the discretion to vote your shares on Proposals 1, 2 or 3.

Table of Contents

Information About the Proxy Process and Voting

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials or more than one proxy/voting instruction card?

If you receive more than one Notice of Internet Availability of Proxy Materials or more than one proxy/voting instruction card, you own shares of Sitio’s common stock in multiple accounts with your brokers(s) and/or our transfer agent. Please vote all of these shares. We recommend that you contact your broker(s) and/or our transfer agent to consolidate as many accounts as possible under the same name and address. Our transfer agent is Continental Stock Transfer & Trust Company, which may be reached by telephone at 1-212-509-4000, by e-mail at cstmail@continentalstock.com or over the Internet at https://www.continentalstock.com/shareholders.

How does the Board recommend that I vote my shares?

A proxy that is properly completed and returned will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and return a proxy, but do not provide any voting instructions, your shares will be voted in accordance with the Board’s recommendations. The Board’s recommendations can be found with the description of each proposal in this Proxy Statement. In summary, the Board recommends a vote:

| ■ | Proposal 1 — FOR the election of each of the director nominees named in this Proxy Statement to hold office until our 2025 Annual Meeting or until their respective successors are duly elected and qualified; |

| ■ | Proposal 2 — FOR the approval, on a non-binding, advisory basis, of the Company’s compensation of its named executive officers; and |

| ■ | Proposal 3 — FOR the approval of the amendment to the Restated Certificate of Incorporation to eliminate the supermajority voting provision. |

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted at the discretion of the holders of the proxy. At the date of this Proxy Statement, the Board knows of no matters, other than those stated immediately above, to be presented for consideration at the Annual Meeting.

Who may vote during the Annual Meeting?

Stockholders who owned shares of the Company’s common stock as of the close of business on March 22, 2024 are entitled to vote during the Annual Meeting. As of the Record Date, there were [●] shares of our common stock issued and outstanding.

How many votes must be present to hold the Annual Meeting?

Your shares are counted as present at the Annual Meeting if (a) you attend the Annual Meeting and vote during the Annual Meeting or (b) you vote (either by mail, telephone or online) in advance of the Annual Meeting (even if you abstain from voting on one proposal or all three proposals). On March 22, 2024, there were [●] shares of the Company’s common stock outstanding and entitled to vote. In order for us to conduct the Annual Meeting, a majority of our outstanding shares of common stock entitled to vote during the Annual Meeting must be present at the beginning of the Annual Meeting. This is referred to as a quorum. Consequently, [●] shares of common stock must be present or represented at the beginning of the Annual Meeting to constitute a quorum.

How many votes do I have?

Each share of common stock is entitled to one vote on each matter that comes before the Annual Meeting. Information about the stock holdings of our directors and executive officers is contained in the section of this Proxy Statement entitled “Security Ownership of Certain Beneficial Owners and Management.”

What is the proxy card?

The proxy card enables you to appoint Christopher L. Conoscenti, the Company’s Chief Executive Officer, and Brett S. Riesenfeld, the Company’s Executive Vice President, General Counsel and Corporate Secretary, each as your representative at the Annual Meeting. By completing and returning the proxy card, you are authorizing Messrs. Conoscenti and Riesenfeld to vote your shares during the Annual Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, it is strongly recommended that you complete and return your proxy card or vote via telephone or online before the Annual Meeting date to ensure your vote is counted in case your plans change. If a proposal comes up for vote during the Annual Meeting that is not on the proxy card, the representatives you have appointed as proxies will vote your shares, under your proxy, according to their best judgment.

Table of Contents

Information About the Proxy Process and Voting

Is my vote kept confidential?

To the extent possible, proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.

Who will tabulate and oversee the vote?

Representatives of Broadridge Investor Communication Solutions, Inc. will tabulate and oversee the vote.

How can I attend the Annual Meeting?

All stockholders are welcome to attend the Annual Meeting. If you were a stockholder as of the Record Date, or if you hold a valid proxy, you will be able to participate in the Annual Meeting online and submit questions during the meeting by visiting www. virtualshareholdermeeting.com/STR2024. You also will be able to vote your shares electronically during the Annual Meeting.

To participate in the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability, on your proxy card or in the voting instructions that accompanied your proxy materials. If your shares are held in street name and your voting instruction form indicates that you may vote those shares through the http://www.proxyvote.com website, then you may access and participate in the Annual Meeting with the 16-digit access code indicated on that voting instruction form. Otherwise, stockholders who hold their shares in street name should contact their bank, broker or other nominee (preferably at least five days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in or vote at the Annual Meeting.

The Annual Meeting webcast will begin promptly at 11:00 AM Central Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:30 AM Central Time and you should allow ample time for the check-in procedures.

What if I have technical difficulties during check-in or the meeting?

We will have technicians ready to assist you if you have any technical difficulties during check-in or the meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log in page.

How can I ask questions during the Annual Meeting?

As part of the Annual Meeting, we will hold a live question and answer session, during which we intend, time permitting, to answer all written questions pertinent to Sitio and meeting matters that are submitted before or during the meeting in accordance with the Annual Meeting’s Rules of Conduct, which will be posted on the Annual Meeting website. Questions may be submitted the day of or during the Annual Meeting through www.virtualshareholdermeeting.com/STR2024. Answers to any such questions that are not addressed during the meeting will be published on the Investor Relations section of our website at https://investors.sitio.com shortly after the meeting. Questions and answers may be grouped by topic and substantially similar questions will be grouped and answered once. We reserve the right to edit or reject questions we deem inappropriate.

Where can I find the voting results of the Annual Meeting?

We intend to announce the preliminary voting results at the Annual Meeting and to disclose detailed, final voting results in a Current Report on Form 8-K, which we will file with the SEC and make available on the Investor Relations section of our website at https:// investors.sitio.com/financials/sec-filings within four business days of the Annual Meeting (or, if final results are not available at that time, within four business days of the date on which final results become available).

Who can help answer my questions?

Stockholders who have questions about the proposals described in this Proxy Statement, how to execute your vote, or need assistance in completing or submitting their proxy cards should contact Brett S. Riesenfeld, Sitio’s Executive Vice President, General Counsel and Corporate Secretary at 1-720-640-7620 or by sending a letter to Mr. Riesenfeld at the offices of the Company at 1401 Lawrence Street, Suite 1750, Denver, CO 80202.

Table of Contents

Annual Meeting Information

Date, Time, Place and Purpose of the Annual Meeting

The Annual Meeting will be held on Tuesday, May 14, 2024, at 11:00 AM Central Time, at www.virtualshareholdermeeting.com/ STR2024. You are cordially invited to attend the Annual Meeting, at which stockholders will be asked to consider and vote upon the following proposals, which are more fully described in this Proxy Statement:

| ■ | Proposal 1 — the election of the director nominees named in this Proxy Statement to hold office until our 2025 Annual Meeting or until their respective successors are duly elected and qualified; |

| ■ | Proposal 2 — the approval, on a non-binding, advisory basis, of the Say-on-Pay Vote; and |

| ■ | Proposal 3 — the approval of the amendment to the Restated Certificate of Incorporation to eliminate the supermajority voting provision. |

| ■ | In addition, you are entitled to vote on any other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Annual Meeting will be conducted via live webcast. The Annual Meeting will be virtual only and stockholders will not be able to attend the Annual Meeting in person this year. Stockholders will be able to submit questions via the online platform before and during a portion of the Annual Meeting. You may submit questions prior to the Annual Meeting by logging onto www.proxyvote. com with your 16-digit control number. You will be able to participate in the Annual Meeting online and submit questions during the Annual Meeting at www.virtualshareholdermeeting.com/STR2024. You will also be able to vote your shares electronically. This Proxy Statement provides information on how to join the Annual Meeting online and about the business we plan to conduct.

It is important that you retain a copy of the control number found on the proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials, as such number will be required in order for stockholders to gain access to any meeting held partially or solely by means of remote communication.

Matters to be Decided at the Annual Meeting

At the date of this Proxy Statement, our Board was not aware of any business to be acted upon or matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement and does not intend to bring before the Annual Meeting any matter other than the proposals described in this Proxy Statement.

The proxy card accompanying this Proxy Statement confers discretionary authority upon the named proxy holders with respect to amendments or variations to the matters identified in the accompanying Notice of Annual Meeting and with respect to any other matters which may properly come before the Annual Meeting. If other matters do properly come before the Annual Meeting, or at any adjournment(s) or postponement(s) of the Annual Meeting, we expect that shares of our common stock, represented by properly submitted proxies will be voted by the proxy holders in accordance with the recommendations of our Board.

Solicitation of Proxies

We will pay for the cost of preparing, assembling, printing and mailing this Proxy Statement and the accompanying proxy card and the cost of soliciting proxies relating to the Annual Meeting. Some banks and brokers have customers who beneficially own common stock listed of record in the names of nominees. We intend to request banks and brokers to solicit such customers and will reimburse them for their reasonable out-of-pocket expenses for such solicitations. If any additional solicitation of the holders of our outstanding shares of common stock is deemed necessary, we anticipate making such solicitation directly. The solicitation of proxies may be supplemented by telephone, telegram and personal solicitation by officers, directors and other employees of the Company, but no additional compensation will be paid to such individuals.

Table of Contents

Miscellaneous Matters

Annual Report on Form 10-K — Our Annual Report on Form 10-K for our fiscal year ended December 31, 2023 has been filed with the SEC and is available on the Investor Relations section of our website at https://investors.sitio.com/financials/sec-filings or on the SEC’s website at https://www.sec.gov/. We will gladly furnish to any stockholder, without charge, a copy of our most recent Annual Report on Form 10-K (including the financial statements and schedules thereto) upon written request from the stockholder addressed to: ir@sitio.com or by writing to Ross Wong, Vice President of Finance and Investor Relations, at 1401 Lawrence Street, Suite 1750, Denver, CO 80202.

Stockholder List — A list of our stockholders of record as of the Record Date of March 22, 2024 will be available for examination for any purpose germane to the Annual Meeting during normal business hours at Sitio, 1401 Lawrence Street, Suite 1750, Denver, CO 80202, at least 10 calendar days prior to the Annual Meeting. The list will also be available virtually for inspection by any stockholder present at the Annual Meeting.

Principal Offices — Our principal executive offices are located at 1401 Lawrence Street, Suite 1750, Denver, CO 80202. Our telephone number is 1-720-640-7620.

Table of Contents

PROPOSAL 1

Election of Directors |

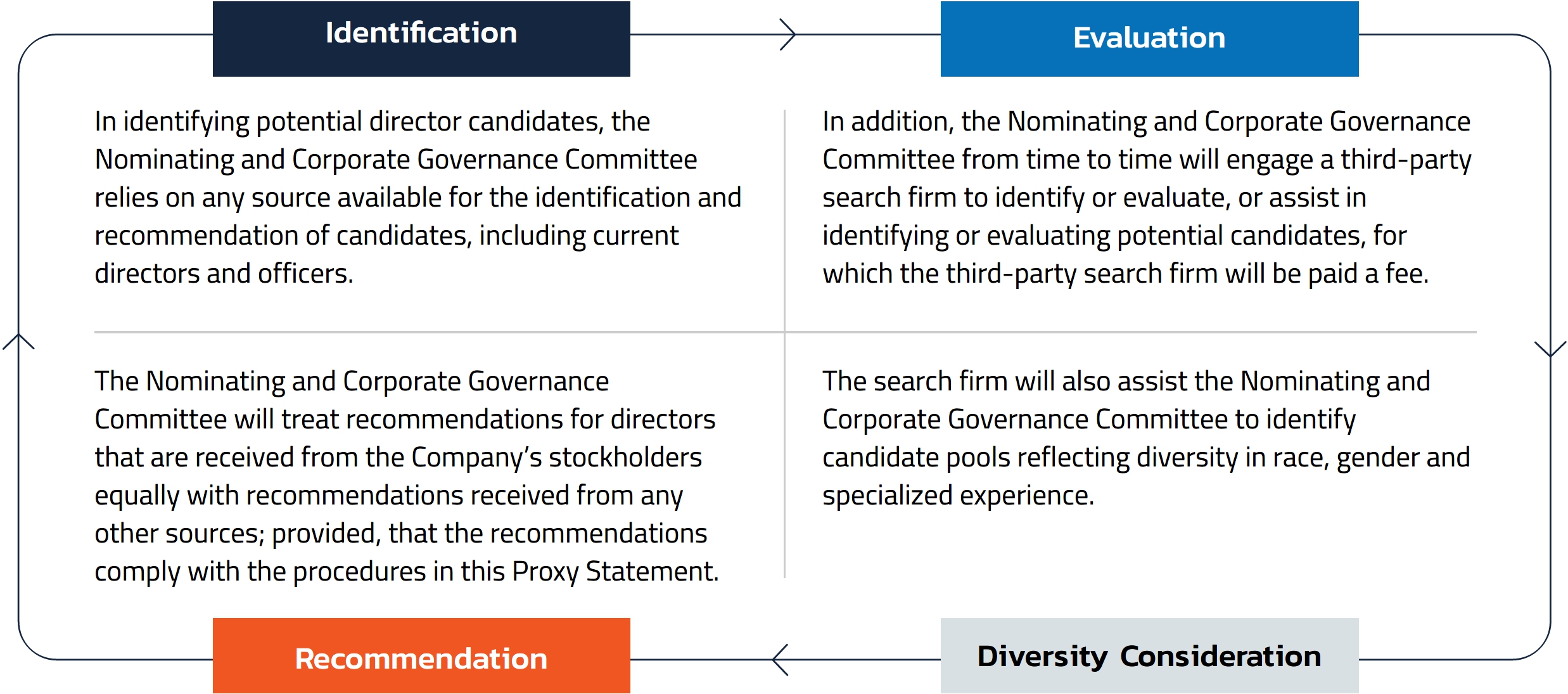

| The Board currently consists of nine directors. Our amended and restated bylaws (the “Bylaws”) provide that the number of directors will be determined by the Board, and the number of directors is currently set at nine. At the recommendation of Sitio’s Nominating and Corporate Governance Committee (the “Nominating and Corporate Governance Committee”), the Board has nominated: |

| |

■Noam Lockshin ■Christopher L. Conoscenti ■Morris R. Clark | ■Alice E. Gould ■Claire R. Harvey ■Gayle L. Burleson | ■Jon-Al Duplantier ■Richard K. Stoneburner ■John R. (“J.R.“) Sult |

| |

For election as directors to serve until our 2025 Annual Meeting or until their successors are elected and qualified.

All such nominees named above have indicated a willingness to serve as directors but should any of them decline or be unable to serve, proxies may be voted for another person nominated as a substitute by the Board. There are no family relationships, of first cousins or closer, among the Company’s directors and executive officers, by blood, marriage, or adoption.

The following information is furnished with respect to each of the nominees of the Board, including information regarding their business experience, director positions held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes, or skills that caused the Nominating and Corporate Governance Committee and the Board to determine that the nominees should serve as our directors.

Biographical information for each nominee is contained in the “Board of Directors’ Nominees” section below.

Vote Required

The election of directors in this proposal requires the affirmative vote of a plurality of the votes cast by stockholders entitled to vote on the election of directors. Neither abstentions nor broker non-votes will have any effect on the outcome of voting on director elections. Therefore, it is important that you vote your shares by proxy or online at the Annual Meeting.

|

| Recommendation of the Board

The Board recommends that stockholders vote FOR the election of each of the nominees. |

Table of Contents

Board of Directors’ Nominees

The following table provides summary information about each of the director nominees standing for election to the Board for a one-year term expiring on the date of our 2025 Annual Meeting. The nominees for director, each of whom has consented to serve, if elected, are as follows:

| | | | Committee Memberships |

| Name | Age | Independence | AC | CC | NCGC |

Noam Lockshin

Chairman of the Board | 39 |  | |  | |

Christopher L. Conoscenti

Chief Executive Officer and Director | 48 | | | | |

Morris R. Clark

Independent Board Member | 56 |  |  | | |

Alice E. Gould

Independent Board Member | 62 |  | |  | |

Claire R. Harvey

Independent Board Member | 44 |  |  | |  |

Gayle L. Burleson

Independent Board Member | 58 |  | |  | |

Jon-Al Duplantier

Independent Board Member | 56 |  | |  | |

Richard K. Stoneburner

Independent Board Member | 70 |  | | |  |

John R. (“J.R.”) Sult

Independent Board Member | 64 |  |  | |  |

| | | | |

| AC – Audit Committee NCGC – Nominating and Corporate Governance Committee | |  – Member – Member |  – Chair – Chair |

| | | | |

| CC – Compensation Committee | | | |

Board Snapshot

Table of Contents

Board of Directors’ Nominees

Board Matrix

|  |  |  |  |  |  |  |  |  |

| Personal Demographic / Board Information |

| Age | 39 | 48 | 56 | 62 | 44 | 58 | 56 | 70 | 64 |

| Gender | M | M | M | F | F | F | M | M | M |

| Number of Current Public Boards(1) | 1 | 1 | 2 | 1 | 1 | 3 | 4 | 2 | 2 |

| Sitio Director Since | 2022 | 2022 | 2022 | 2022 | 2020(2) | 2022 | 2022 | 2022 | 2022 |

| Industry Experience |

| Upstream Energy |  |  |  | |  |  |  |  |  |

| Mineral Rights |  |  | | |  | | | | |

| Acquisitive Companies |  |  |  | |  |  | |  |  |

| Equities Portfolio Management |  | | |  |  | | |  | |

| Business Competencies |

| Public Company Executive | |  |  | | |  |  |  |  |

| M&A |  |  |  |  |  |  |  |  |  |

| Capital Markets | |  |  | |  | | | |  |

| Operations | |  | |  |  |  |  |  | |

| Corporate Responsibility(3) |  |  |  |  |  |  |  |  |  |

| (1) | Numbers include Sitio for each director. |

| (2) | Because the seven-year term limit for non-management directors was implemented alongside the Falcon Merger (as defined below), Ms. Harvey’s term on the Company’s Board is deemed to have begun in June 2022 for purposes of the term limit policy. |

| (3) | Includes expertise or experience in matters relating to environmental, social or corporate governance, cybersecurity or human capital management. |

Table of Contents

Board of Directors’ Nominees

Director Biographies

| | Noam Lockshin Chairman of the Board Chairman of the Board Director since: 2022

Age: 39 | |

| | |

Director Qualifications

Mr. Lockshin’s experience covering the E&P industry, his specialized knowledge of the minerals and royalty interests business, history of building successful working relationships with landowners in the Delaware Basin to acquire land, and mineral and royalty interests, and leading the Kimmeridge team that manages those assets, uniquely qualify him to serve as a member of the Board. |

|

■Joined our Board in June 2022 and serves as the Chairman of the Board. ■Appointed to the Desert Peak Minerals Inc. board of directors in April 2019. ■Partner of Kimmeridge Energy Management Company, LLC (“Kimmeridge”) and has been with the firm since its founding in May 2012. ■Member of the firm’s investment team, and serves in various capacities including research, analysis and diligence of investment opportunities as well as the negotiation and execution of investment strategies. ■Most recently, Mr. Lockshin led the firm’s investment efforts in the mineral and royalty interests business focused on the Delaware Basin in Texas and New Mexico. ■Served as a Vice President, Energy Investing for AllianceBernstein Holding L.P., a leading global asset management firm, from July 2010 to May 2012, prior to joining Kimmeridge. ■Equity Research Associate for E&P at Sanford C. Bernstein & Co. LLC from July 2007 to July 2010. ■Holds a Bachelor of Arts degree in Mathematics from York University. | |

| | Christopher L. Conoscenti

Chief Executive Officer and Director Director since: 2022

Age: 48 | |

| | |

Director Qualifications

Mr. Conoscenti’s significant experience in the oil and gas industry and financial expertise makes him well qualified to serve as a member of the Board. | |

■Joined our Board in June 2022. ■Joined Kimmeridge as the Chief Executive Officer of its mineral and royalty interest business in March 2019 following an 18 year career in oil and gas investment banking, most recently as a Managing Director in the Oil & Gas Investment Banking and Capital Markets Group at Credit Suisse Securities (USA) LLC (“Credit Suisse”) from July 2014 to March 2019. ■Previously, Mr. Conoscenti worked in Oil & Gas Investment Banking at J.P. Morgan Securities LLC beginning in January 2001 where he served as a Managing Director from May 2012 until his departure in April 2014. ■His clients at Credit Suisse included large and mid-cap upstream E&P operators and minerals companies. ■Advised on numerous mergers and acquisition transactions and served as an active bookrunner on equity, equity-linked and debt transactions during his investment banking career. ■Holds a Bachelor of Arts degree from the University of Notre Dame and a Juris Doctor and a Master of Business Administration from Tulane University. | |

Table of Contents

Board of Directors’ Nominees

| | Morris R. Clark

Director since: 2022

Age: 56 | |

| | |

Director Qualifications

Mr. Clark’s significant experience in the oil and gas industry with multiple public companies will bring extensive financial expertise and proven leadership to the Board. Furthermore, Mr. Clark’s leadership with multiple community based and educational organizations will provide the Board with a welcomed perspective. For example, Mr. Clark has served on the University of St. Thomas Board of Trustees since 2017 (having previously served as Vice-Chair of the Audit & Finance Committee of the University of St. Thomas Board of Trustees). | |

■Joined our Board in June 2022. ■Served as Vice President and Treasurer of Marathon Oil Corporation (“Marathon Oil”) from January 2014 to July 2019. ■Served as Assistant Treasurer of Marathon Oil from 2007 until January 2014. ■Responsible for managing all treasury related matters, including corporate finance, cash and banking/operations, insurance, pensions, enterprise risk management and credit and counterparty risk. ■Led financing transactions, including bond and equity issuances, revolving credit and receivables facilities, merger and acquisition financings and major corporate restructurings (public spin-offs) during his tenure. ■Served as Senior Tax Counsel at Enron North America Corporation, a Tax Attorney at Bracewell LLP in Houston and a Senior Accountant with Touche Ross & Company (Deloitte & Touche) in Los Angeles, prior to joining Marathon Oil. ■Currently serves as a Director and Chair of the Audit Committee of the Board of Directors of Civitas Resources, Inc. (NYSE: CIVI), a position he has held since January 2021. ■Previously served as a director and Chair of the Audit Committee of Extraction Oil & Gas (NYSE: XOG) prior to its amalgamation with multiple companies resulting in the formation of Civitas Resources, Inc. ■Involved with several non-profit and educational boards. ■Holds a Bachelor of Science degree in Accounting from Southern University, a Juris Doctor from Tulane Law School and a Master of Laws degree (LL.M.) from New York University School of Law. | |

| | Alice E. Gould

Director since: 2022

Age: 62 | |

| | |

Director Qualifications

Ms. Gould’s leadership skills and experience, including serving on another corporate board of directors and its key committees, as well as her asset allocation expertise and significant experience evaluating and monitoring energy and natural resource investments qualify her to serve as a member of the Board. | |

■Joined our Board in June 2022. ■Joined the Board of Directors of CorePoint Lodging Inc., a publicly-traded select service lodging real estate investment trust (NYSE: CPLG) spun off from La Quinta Franchising LLC, in 2018 and served on its Compensation and Nominating and Corporate Governance Committees until the sale of the company in May 2022. ■Former Investment Manager at DUMAC Inc. (“DUMAC”), a professionally staffed investment office controlled by Duke University that managed over $18 billion of endowment and other Duke-related assets, where she worked from 2004 to 2018 and had responsibility for the evaluation, selection and monitoring of energy and natural resources investments. ■Management consultant assisting senior executives in the technology, pharmaceutical, media and financial industries with strategic initiatives, prior to her role at DUMAC. ■Worked for ten years at International Business Machines Corporation (NYSE: IBM) (“IBM”) where she managed product development, marketing and business planning. ■Served on the advisory board of over 20 private equity and real assets partnerships in the U.S. and abroad. ■Received a Bachelor of Science degree in Engineering from Duke University (magna cum laude) and Master of Business Administration from The Fuqua School of Business at Duke University, where she was a Fuqua Scholar. | |

Table of Contents

Board of Directors’ Nominees

| | Claire R. Harvey

Director since: 2020

Age: 44 | |

| | |

Director Qualifications

Ms. Harvey’s current role as partner of an energy focused private equity firm as well as her background in non-operated working interest companies, finance and oil and gas mergers and acquisitions makes her well qualified to serve as a member of the Board. | |

■Joined our Board in May 2020.(4) ■Served as a member of and as Chairman of the Falcon Minerals Corporation (“Falcon”) Board from May 2020 through the closing of the business combination with Sitio. ■Partner of EIV Capital and serves as the CEO of EIV Resources and as the President of ARM Resource Partners. ■Led Gryphon Oil and Gas, LLC (“Gryphon”), a Blackstone-sponsored company focused on acquiring non-operated interests in the Permian Basin, from May 2019 to August 2020. ■Made upstream oil and gas investments on behalf of two private equity funds, Pine Brook Partners, LLC from March 2014 to May 2019, and TPH Partners LLC from May 2010 to February 2014, prior to Gryphon. ■Worked as an investment banker at Lehman Brothers and Barclays plc, primarily focused on corporate finance and mergers and acquisitions for oil and gas companies. ■Served as a director for Tellurian Inc. (NYSE American: TELL), a global LNG company based in Houston, from December 2021 to January 2023. ■Earned a Bachelor of Business Administration degree in Finance at Texas A&M University, where she was also a four-year letterman and co-captain for the Texas Aggie Volleyball Team. ■Earned a Master of Business Administration from the Jones Graduate School of Business at Rice University where she was the Jones Scholar and M.A. Wright Award winner. | |

| | Gayle L. Burleson

Director since: 2022

Age: 58 | |

| | |

Director Qualifications

Ms. Burleson’s knowledge of the industry, as well as her experience with oil and gas operations, company growth and scaling and mergers and acquisitions, qualify her to serve as a member of the Board. | |

■Joined our Board in December 2022. ■Served as a director of Brigham Minerals Inc. (“Brigham”) from January 2022 until our merger with Brigham in December 2022. ■Serves on the board and on the audit committee and compensation committee of each of Select Energy Services, Inc. (NYSE: WTTR) and Atlas Energy Solutions, Inc. (NYSE: AESI).Ms. Burleson previously served on the audit committee of privately held Chisholm Energy Holdings, LLC. ■Most recently with Concho Resources Inc. (“Concho”) (NYSE: CXO) as the Senior Vice President of Business Development and Land and held that position until Concho’s acquisition by ConocoPhillips (NYSE: COP) in January 2021. ■Employed at Concho in various roles and capacities with ever increasing leadership responsibilities for 15 years. ■Served in a number of engineering and operations positions with BTA Oil Producers, Mobil Oil Corporation, Parker & Parsley Petroleum Company and Exxon Corporation, prior to joining Concho. ■Received her B.S. in Chemical Engineering from Texas Tech University. | |

| (4) | Because the seven-year term limit for non-management directors was implemented alongside the Falcon Merger, Ms. Harvey’s term on the Company’s Board is deemed to have begun in June 2022 for purposes of the term limit policy. |

Table of Contents

Board of Directors’ Nominees

| | Jon-Al Duplantier

Director since: 2022

Age: 56 | |

| | |

Director Qualifications

Mr. Duplantier’s broad experience across commercial, governance, compliance, human resources and legal aspects of business, along with his professional and leadership experience, qualify him to serve as a member of the Board. | |

■Joined our Board in December 2022. ■Served as a director of Brigham from February 2021 until our merger with Brigham in December 2022. ■Enjoyed a 25-year career in the oil and gas industry with Conoco Inc., ConocoPhillips and Parker Drilling Company (“Parker Drilling”). ■Most recently served as Parker Drilling’s President, Rental Tools and Well Services, a position he held from April 2018 until his departure in July 2020. ■Held a series of executive positions at Parker Drilling where he had responsibility across more than a dozen countries, and his roles included management and oversight of legal affairs, corporate compliance and governance, human resources, environmental, safety and procurement from 2009 to 2018 prior to that role. ■Parker filed for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code in December 2018. ■Worked for ConocoPhillips from 2002 to 2009, where he held legal and management roles, prior to joining Parker Drilling. ■Served in multiple roles of increasing responsibility at Conoco Inc., from 1995 to 2002. ■Holds a Juris Doctorate from Louisiana State University and a Bachelor of Science degree from Grambling State University. ■Director of AltaGas Ltd. (TSX: ALA), where he serves on the Governance Committee and the Human Resources and Compensation Committee. ■Director and member of the Audit Committee and Compensation Committee of Stellar Bancorp, Inc. (NASDAQ: STEL). ■Director of Kodiak Gas Services, Inc. (NYSE: KGS), where he chairs the Nominating, Governance and Sustainability Committee and serves as a member of the Personnel and Compensation Committee. | |

Table of Contents

Board of Directors’ Nominees

| | Richard K. Stoneburner

Director since: 2022

Age: 70 | |

| | |

Director Qualifications

Mr. Stoneburner’s management and geologic experience in the energy industry qualify him to serve as a member of the Board. | |

■Joined our Board in December 2022. ■Served as a director of Brigham from May 2018 until our merger with Brigham in December 2022. ■Has over 45 years of experience in the oil and gas industry. He currently is owner of Stoneburner Consulting Services. ■Served as Senior Advisor and Partner with Pine Brook Partners from April 2013 through December 2022. ■Served as president of the North America Shale Production Division for BHP Billiton Petroleum from 2011 to 2012. ■Served as president and chief operating officer of Petrohawk Energy Corporation, from 2009 to 2011. He was the company’s chief operating officer from 2007 to 2009 and led their exploration activities as executive vice president of exploration from 2003 to 2007. ■Began his career as a geologist in 1977 and held positions at Texas Oil and Gas Corp., Weber Energy Corp., Hugoton Energy Corp. and 3TEC Energy Corp. Mr. Stoneburner is non-Executive chairman for Tamboran Resources (ASX: TBN), as well as a director for private upstream companies Pursuit Oil and Gas and Elevation Resources. ■Formerly served as a director for private upstream companies Saguaro Resources, Accelerate Resources and Serafina Oil and Gas. ■Formerly served as non-Executive Chairman of Yuma Energy (NYSE: YUMAQ) until 2020. He is an advisor to Ayata, a private company developing oil and gas related AI. ■Serves on the advisory council of The Jackson School of Geosciences at the University of Texas at Austin, on the visiting committee of the Bureau of Economic Geology at the University of Texas at Austin and is a board member of not-for-profit Switch Energy Alliance. ■Former board member for not-for-profit Memorial Assistance Ministries and past President and former board member of the Houston Producers Forum. ■Holds a B.S. in Geological Sciences from the University of Texas at Austin, an M.S. in Geological Sciences from Wichita State University, was a member of the American Association of Petroleum Geologists (“AAPG”) Foundation’s Distinguished Lecturer Series in 2012-2013 and was awarded the Norman Foster Outstanding Explorer of the Year award by the AAPG in 2016. | |

Table of Contents

Board of Directors’ Nominees

| | John R. (“J.R.”) Sult

Director since: 2022

Age: 64 | |

| | |

Director Qualifications

Mr. Sult’s experience in executive financial positions with large public companies, service on numerous public company boards and significant knowledge of board governance, finance, accounting and financial reporting, capital structures, capital allocation, strategic planning and forecasting qualify him to serve as a member of the Board. | |

■Joined our Board in December 2022. ■Served as a director of Brigham from May 2018 until our merger with Brigham in December 2022. ■Served as Executive Vice President and Chief Financial Officer of Marathon Oil Corporation from September 2013 until August 2016. ■Executive Vice President and Chief Financial Officer of El Paso Corporation (“El Paso”) from March 2010 until May 2012 where he previously served as Senior Vice President and Chief Financial Officer from November 2009 until March 2010, and as Senior Vice President and Controller from November 2005 until November 2009. ■Served as Executive Vice President, Chief Financial Officer and director of El Paso Pipeline GP Company, L.L.C., the general partner of El Paso Pipeline Partners, L.P., from July 2010 until May 2012, where he previously served as Senior Vice President and Chief Financial Officer from November 2009 until July 2010, and as Senior Vice President, Chief Financial Officer and Controller from August 2007 until November 2009. ■Served as Chief Accounting Officer of El Paso and as Senior Vice President, Chief Financial Officer and Controller of El Paso’s Pipeline Group from November 2005 to November 2009. ■Served as Vice President and Controller of Halliburton Energy Services, Inc. from August 2004 to October 2005. ■Managed an independent consulting practice that provided a broad range of finance and accounting advisory services and assistance to public companies in the energy industry. ■Prior to private practice, was an audit partner with Arthur Andersen LLP. ■Graduated from Washington & Lee University with a Bachelor of Science with Special Attainments in Commerce. ■Served on the board of directors of Dynegy, Inc., where he served as the chairman of its audit committee, from October 2012 to April 2018, and joined the board of directors of Vistra Corp. (NYSE: VST), where he currently serves as the chairman of its audit committee, in April 2018 in connection with its acquisition of Dynegy, Inc. ■Served on the board of directors of Jagged Peak Energy Inc. (NYSE: JAG), from January 2017 until its merger with Parsley Energy Inc. in January 2020, serving as the chairman of its audit committee. ■Serves on the Advisory Board of Boys and Girls Country of Houston, Inc. | |

Table of Contents

Executive Officers

The following persons are the executive officers of the Company.

| Name | Age | Position |

| Christopher L. Conoscenti | 48 | Chief Executive Officer |

| Carrie L. Osicka | 46 | Chief Financial Officer |

| Jarret J. Marcoux | 42 | Executive Vice President, Operations |

| Britton L. James | 41 | Executive Vice President of Land |

| A. Dax McDavid | 43 | Executive Vice President of Corporate Development |

| Brett S. Riesenfeld | 39 | Executive Vice President, General Counsel and Secretary |

| | Christopher L. Conoscenti

Chief Executive Officer and Director Age: 48 | |

| | |

| |

■Serves as Chief Executive Officer of Sitio. ■Joined Kimmeridge as the Chief Executive Officer of its mineral and royalty interest business in March 2019 following an 18-year career in oil and gas investment banking, most recently as a Managing Director in the Oil & Gas Investment Banking and Capital Markets Group at Credit Suisse from July 2014 to March 2019. ■Previously, Mr. Conoscenti worked in Oil & Gas Investment Banking at J.P. Morgan Securities LLC beginning in January 2001 where he served as a Managing Director from May 2012 until his departure in April 2014. ■His clients at Credit Suisse included large and mid-cap upstream E&P operators and minerals companies. ■Advised on numerous mergers and acquisition transactions and served as an active bookrunner on equity, equity-linked and debt transactions during his investment banking career. ■Holds a Bachelor of Arts degree from the University of Notre Dame and a Juris Doctor and a Master of Business Administration from Tulane University. | |

| | Carrie L. Osicka

Chief Financial Officer Age: 46 | |

| | |

| |

■Serves as Chief Financial Officer of Sitio. ■Joined Kimmeridge as the Chief Financial Officer of its mineral and royalty interest business in April 2019 following a ten year career at Resolute Energy Corporation, where she served as the Senior Director of Finance from November 2017 to February 2019 and previously as Manager of Business Analytics from November 2010 to October 2017. ■Focused on strategy, financial planning, analysis and mergers and acquisition transactions while at Resolute Energy Corporation. ■Holds a Master of Business Administration from the Kellogg School of Management at Northwestern University and Bachelor of Science degree in Accounting from Metropolitan State University. | |

Table of Contents

Executive Officers

| | Jarret J. Marcoux

Executive Vice President, Operations Age: 42 | |

| | |

| | |

■Serves as Executive Vice President, Operations of Sitio. ■Joined Kimmeridge in January 2015 as Reservoir Engineer, became Vice President of Reservoir Engineering in September 2015 and Vice President of Engineering and Acquisitions of its mineral and royalty interest business in May 2019. Mr. Marcoux was involved in Kimmeridge’s investments in Arris Petroleum and 299 Resources and the subsequent sale of Kimmeridge’s ownership interests in those companies to PDC Energy. ■Spent two years at Baker Hughes Company, first consulting on various unconventional plays as a Reservoir Engineer from May 2013 until May 2014, and later held the title of Product Line Manager, overseeing subsurface consulting in the Permian Basin from June 2014 until December 2014. ■Has eight years of engineering experience working for IBM, Samsung Electronics Co., Ltd. and Advanced Micro Devices, Inc. within the electronics industry. ■Holds a Master of Engineering from Texas A&M University in Petroleum Engineering as well as a Bachelor of Science degree from the University of Massachusetts Amherst in Chemical Engineering with a secondary major in Economics. | |

| | Britton L. James

Executive Vice President of Land Age: 41 | |

| | |

| |

■Serves as Executive Vice President of Land of Sitio. ■Joined Kimmeridge as Vice President of Land of its mineral and royalty interest business in December 2018 following a 12 year career in land management as part of teams covering the Bakken, Delaware Basin, Powder River Basin and several other basins throughout the United States, most recently as a Land Manager for Rockies Resources LLC from June 2018 until November 2018. ■Previously, an independent land consultant for multiple upstream companies from March 2018 until June 2018, and a Managing Partner, Vice President-Land and member of the Board of Directors for Clear Creek E&P, LLC from January 2017 until its sale in February 2018. ■Land Manager for Arris Petroleum Corporation from May 2015 until its sale to PDC Energy, Inc. in December 2016, Senior Landman for American Eagle Energy Corporation from January 2012 until May 2015, and Senior Landman for Whiting Petroleum Corporation for over five years. ■Involved in Kimmeridge’s investment in 299 Resources LLC until its sale to PDC Energy. ■Advised on acquisitions/divestitures, grassroots leasing, managing drilling programs and all other facets of land management during his career. ■Served as a Non-Commissioned Officer in the Colorado Army National Guard for six years in addition to his career in oil and gas. ■Holds a Bachelor of Science degree in Business from the University of Montana. | |

Table of Contents

Executive Officers

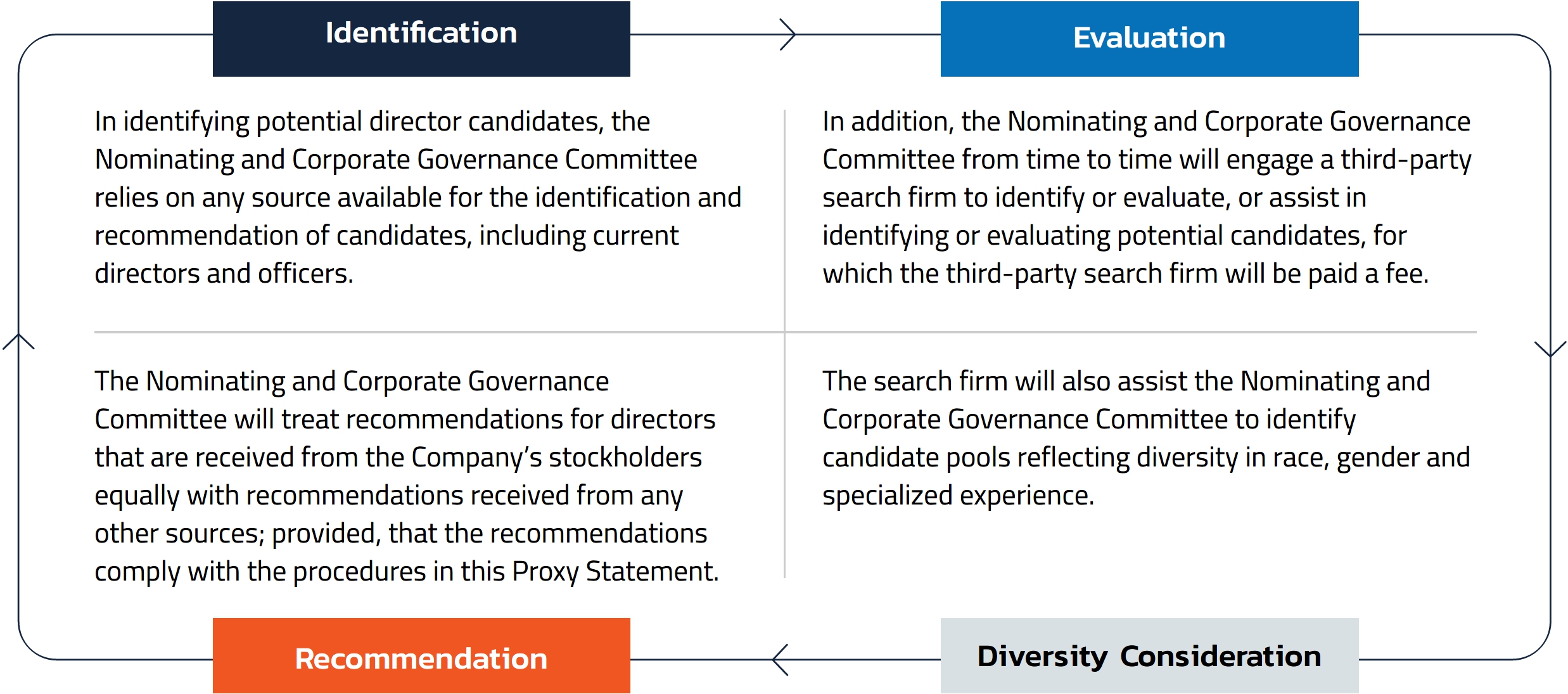

| | A. Dax McDavid