| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333--257737-06 |

| Dated November 15, 2022 | BBCMS 2022-C18 |

Free Writing Prospectus Structural and Collateral Term Sheet | ||

BBCMS Mortgage Trust 2022-C18 | ||

$808,180,236 (Approximate Mortgage Pool Balance) | ||

$709,178,000 (Approximate Offered Certificates) | ||

Barclays Commercial Mortgage Securities LLC Depositor | ||

Commercial Mortgage Pass-Through Certificates, Series 2022-C18 | ||

Barclays Capital Real Estate Inc. Argentic Real Estate Finance LLC LMF Commercial, LLC Starwood Mortgage Capital LLC UBS AG Bank of Montreal KeyBank National Association BSPRT CMBS Finance, LLC Societe Generale Financial Corporation Mortgage Loan Sellers

| ||

Barclays UBS Securities LLC | Société Générale | KeyBanc Capital Markets BMO Capital Markets |

| Co-Lead Managers and Joint Bookrunners | ||

| Academy Securities | Mischler Financial Group, Inc. | |

| Co-Manager | Co-Manager | |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| Dated November 15, 2022 | BBCMS 2022-C18 |

This material is for your information, and none of Barclays Capital Inc., SG Americas Securities, LLC, KeyBanc Capital Markets Inc., BMO Capital Markets Corp., UBS Securities LLC, Mischler Financial Group, Inc. and Academy Securities, Inc. (the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-257737) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Barclays Capital Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-888-603-5847. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2022-C18 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended or superseded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 2 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Indicative Capital Structure | ||

Publicly Offered Certificates

| Class | Expected Ratings (Moody’s / Fitch / KBRA) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) |

| A-1 | Aaa(sf) / AAAsf / AAA(sf) | $10,600,000 | 30.000% | 2.45 | 1/23-3/27 | 36.1% | 19.6% |

| A-2 | Aaa(sf) / AAAsf / AAA(sf) | $73,000,000 | 30.000% | 4.55 | 3/27-11/27 | 36.1% | 19.6% |

| A-3 | Aaa(sf) / AAAsf / AAA(sf) | $42,100,000 | 30.000% | 6.95 | 11/29-12/29 | 36.1% | 19.6% |

| A-4 | Aaa(sf) / AAAsf / AAA(sf) | (6) | 30.000% | (6) | (6) | 36.1% | 19.6% |

| A-5 | Aaa(sf) / AAAsf / AAA(sf) | (6) | 30.000% | (6) | (6) | 36.1% | 19.6% |

| A-SB | Aaa(sf) / AAAsf / AAA(sf) | $16,826,000 | 30.000% | 7.17 | 11/27-4/32 | 36.1% | 19.6% |

| X-A | Aa1(sf) / AAAsf / AAA(sf) | $636,441,000(7) | N/A | N/A | N/A | N/A | N/A |

| X-B | NR / A-sf / AAA(sf) | $72,737,000(8) | N/A | N/A | N/A | N/A | N/A |

| A-S | Aa1(sf) / AAAsf / AAA(sf) | $70,715,000 | 21.250% | 9.92 | 11/32-11/32 | 40.6% | 17.4% |

| B | NR / AA-sf / AA+(sf) | $34,348,000 | 17.000% | 9.92 | 11/32-11/32 | 42.8% | 16.5% |

| C | NR / A-sf / A(sf) | $38,389,000 | 12.250% | 9.92 | 11/32-11/32 | 45.3% | 15.6% |

Privately Offered Certificates(9)

| Class | Expected Ratings (Moody’s / Fitch / KBRA) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) |

| X-D | NR / BBBsf / AAA(sf) | $20,204,000(10) | N/A | N/A | N/A | N/A | N/A |

| D | NR / BBBsf / A-(sf) | $20,204,000 | 9.750% | 9.94 | 11/32-12/32 | 46.6% | 15.2% |

| E-RR | NR / BBB-sf / BBB(sf) | $19,194,000 | 7.375% | 10.00 | 12/32-12/32 | 47.8% | 14.8% |

| F-RR | NR / BB+sf / BBB-(sf) | $11,113,000 | 6.000% | 10.00 | 12/32-12/32 | 48.5% | 14.6% |

| G-RR | NR / BB-sf / BB(sf) | $10,102,000 | 4.750% | 10.00 | 12/32-12/32 | 49.1% | 14.4% |

| H-RR | NR / B-sf / B+(sf) | $9,092,000 | 3.625% | 10.00 | 12/32-12/32 | 49.7% | 14.2% |

| J-RR | NR / NR / NR | $29,297,236 | 0.000% | 10.00 | 12/32-12/32 | 51.6% | 13.7% |

| (1) | In the case of each such Class, subject to a permitted variance of plus or minus 5%. In addition, the notional amounts of the Class X-A, Class X-B and Class X-D Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates whose Certificate Balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any Class of the Class X-A, Class X-B or Class X-D Certificates, as applicable, would be equal to zero at all times, such Class of Certificates will not be issued on the closing date of this securitization. |

| (2) | The credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates represent the approximate initial credit support for the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates in the aggregate. |

| (3) | Assumes 0% CPR / 0% CPR and a December 14, 2022 closing date. Based on modeling assumptions as described in the Preliminary Prospectus dated November 15, 2022 (the “Preliminary Prospectus”). |

| (4) | The “Certificate Principal to Value Ratio” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans, and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (5) | The “Underwritten NOI Debt Yield” for any Class of Principal Balance Certificates (other than the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (6) | The exact initial certificate balances of the Class A-4 and Class A-5 Certificates are unknown and will be determined based on the final pricing of those Classes of Certificates. However, the respective initial certificate balances, expected weighted average lives and expected principal windows of the Class A-4 and Class A-5 Certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-4 and Class A-5 Certificates is expected to be approximately $423,200,000, subject to a variance of plus or minus 5%. |

| Class of Certificates | Expected Range of Approximate Initial Certificate Balance | Expected Range of Weighted Avg. Life (Yrs) | Expected Range of Principal Window | |||

| Class A-4 | $0 – $195,000,000 | N/A – 9.68 | N/A / 4/32-10/32 | |||

| Class A-5 | $228,200,000 – $423,200,000 | 9.90 – 9.80 | 10/32-11/32 / 4/32-11/32 |

| (7) | The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB and Class A-S Certificates outstanding from time to time. |

| (8) | The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class B and Class C Certificates outstanding from time to time. |

| (9) | The Class X-D, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR are not being offered by the Preliminary Prospectus and this Term Sheet. The Class R Certificates are not shown above. |

| (10) | The Notional Amount of the Class X-D Certificates will be equal to the Certificate Balance of the Class D Certificates outstanding from time to time. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 3 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Summary of Transaction Terms | ||

| Securities Offered: | $709,178,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | Barclays Capital Inc., SG Americas Securities, LLC, BMO Capital Markets Corp., UBS Securities LLC and KeyBanc Capital Markets Inc. |

| Co-Managers: | Mischler Financial Group, Inc. and Academy Securities, Inc. |

| Mortgage Loan Sellers: | Barclays Capital Real Estate Inc. (“Barclays”) (21.6%), Argentic Real Estate Finance LLC (“AREF”) (16.8%), LMF Commercial, LLC (“LMF”) (15.7%), Starwood Mortgage Capital LLC (“SMC”) (11.5%), UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG”) (10.5%), Bank of Montreal (“BMO”) (7.5%), KeyBank National Association (“KeyBank”) (7.0%), BSPRT CMBS Finance, LLC (“BSPRT”) (6.5%) and Societe Generale Financial Corporation (“SGFC”) (3.1%). |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association. |

| Special Servicer: | Rialto Capital Advisors, LLC. |

| Trustee: | Computershare Trust Company, National Association. |

| Certificate Administrator: | Computershare Trust Company, National Association. |

| Operating Advisor: | Park Bridge Lender Services LLC. |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC. |

| Rating Agencies: | Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, LLC (“KBRA”). |

| Initial Majority Controlling Class Certificateholder: | RREF IV-D AIV RR H, LLC, or another affiliate of Rialto Capital Advisors, LLC. |

| U.S. Credit Risk Retention: | For a discussion on the manner in which Barclays, as retaining sponsor, intends to satisfy the U.S. credit risk retention requirements, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Credit Risk Retention: | The transaction is not structured to satisfy the EU risk retention and due diligence requirements. |

| Closing Date: | On or about December 14, 2022. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in December 2022, or in the case of any mortgage loan that has its first due date after December 2022, the date that would have been its due date in December 2022 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in January 2023. |

| Determination Date: | 11th day of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in January 2023. |

| Assumed Final Distribution Date: | The Distribution Date in December 2032 which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in December 2055. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC “regular interests” for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB, Class X-A, Class X-B, Class A-S, Class B and Class C Certificates (the “Publicly Offered Certificates”) will be offered publicly. The Class X-D, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors (other than the Class R Certificates) and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | On any Distribution Date on which the aggregate principal balance of the pool of mortgage loans is less than 1% of the aggregate principal balance of the mortgage loans as of the Cut-off Date, certain entities specified in the Preliminary Prospectus will have the option to purchase all of the remaining mortgage loans (and all property acquired through exercise of remedies in respect of any mortgage loan) at the price specified in the Preliminary Prospectus. Refer to “Pooling and Servicing Agreement—Termination; Retirement of Certificates” in the Preliminary Prospectus. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 4 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Summary of Transaction Terms | ||

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., BlackRock Financial Management, Inc., Interactive Data Corp., CMBS.com, Inc., Markit Group Limited, Moody’s Analytics, MBS Data, LLC, RealInsight, Thomson Reuters Corporation, DealView Technologies Ltd., KBRA Analytics, LLC and CRED iQ. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. REFER TO THE “SUMMARY OF RISK FACTORS” AND “RISK FACTORS” SECTIONS OF THE PRELIMINARY PROSPECTUS. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 5 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

Mortgage Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate | % of IPB |

| Barclays | 10 | 12 | $174,474,464 | 21.6% |

| AREF | 6 | 6 | $135,703,125 | 16.8% |

| LMF | 3 | 14 | $126,500,000 | 15.7% |

| SMC | 2 | 15 | $92,900,000 | 11.5% |

| UBS AG | 4 | 51 | $84,574,228 | 10.5% |

| BMO | 3 | 3 | $60,400,000 | 7.5% |

| KeyBank | 4 | 4 | $56,197,097 | 7.0% |

| BSPRT | 4 | 7 | $52,471,322 | 6.5% |

| SGFC | 1 | 2 | $24,960,000 | 3.1% |

| Total: | 37 | 114 | $808,180,236 | 100.0% |

| Loan Pool | ||

| Initial Pool Balance (“IPB”): | $808,180,236 | |

| Number of Mortgage Loans: | 37 | |

| Number of Mortgaged Properties: | 114 | |

| Average Cut-off Date Balance per Mortgage Loan: | $21,842,709 | |

| Weighted Average Current Mortgage Rate: | 6.16454% | |

| 10 Largest Mortgage Loans as % of IPB: | 57.1% | |

| Weighted Average Remaining Term to Maturity: | 111 months | |

| Weighted Average Seasoning: | 3 months | |

| Credit Statistics(1) | ||

| Weighted Average UW NCF DSCR(1)(2): | 2.01x | |

| Weighted Average UW NOI Debt Yield(1)(3): | 13.7% | |

| Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(1)(4): | 51.6% | |

| Weighted Average Maturity Date LTV(1)(4): | 49.2% | |

| Other Statistics | ||

| % of Mortgage Loans with Additional Debt: | 5.4% | |

| % of Mortgage Loans with Single Tenants(5): | 17.5% | |

| % of Mortgage Loans secured by Multiple Properties: | 31.1% | |

| Amortization | ||

| Weighted Average Original Amortization Term(6): | 349 months | |

| Weighted Average Remaining Amortization Term(6): | 345 months | |

| % of Mortgage Loans with Interest-Only: | 65.9% | |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 19.0% | |

| % of Mortgage Loans with Amortizing Balloon: | 15.1% | |

| Lockboxes(7) | ||

| % of Mortgage Loans with Hard Lockboxes: | 74.2% | |

| % of Mortgage Loans with Springing Lockboxes: | 13.5% | |

| % of Mortgage Loans with Soft Lockboxes: | 12.3% | |

| Reserves | ||

| % of Mortgage Loans Requiring Monthly Tax Reserves: | 87.5% | |

| % of Mortgage Loans Requiring Monthly Insurance Reserves: | 57.1% | |

| % of Mortgage Loans Requiring Monthly CapEx Reserves: | 73.1% | |

| % of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 23.0% | |

| (1) | In the case of Loan Nos. 1, 3, 7, 8, 12, 15, 16, 17, 22, 24, 26 and 31, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 31, the Total Mortgage Loan Cut-off Date Balance and corresponding calculations exclude the related Subordinate Companion Loan(s) and/or mezzanine loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 7, the UW NOI Debt Yield is calculated based on the Cut-off Date Principal Balance after netting out a $5,000,000 holdback reserve. The UW NOI Debt Yield based on the Cut-off Date Principal Balance without netting out the holdback reserve is 9.8%. |

| (4) | In the case of Loan Nos. 3, 16 and 19, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “as-portfolio” or an “as-complete” assumption. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

| (6) | Excludes 24 mortgage loans that are interest-only for the entire term. |

| (7) | For a more detailed description of Lockboxes, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. In the case of Loan No. 31, the mortgage loan is structured with a soft lockbox for residential tenants and a hard lockbox for commercial tenants and is considered a Soft Lockbox in the calculations shown. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, mixed use, retail and industrial properties. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 6 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| Ten Largest Mortgage Loans |

| No. | Loan Name | City, State | Mortgage Loan Seller | No. of Prop. | Cut-off Date Balance | % of IPB | Square Feet / Pads / Units | Property Type | UW NCF DSCR(1) | UW NOI Debt Yield(1)(2) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) | ||

| 1 | Rialto Industrial | Rialto, CA | AREF | 1 | $68,000,000 | 8.4% | 1,106,124 | Industrial | 1.23x | 9.7% | 51.7% | 51.7% | ||

| 2 | Spartan Retail Portfolio | Various, Various | SMC | 14 | $65,500,000 | 8.1% | 844,888 | Retail | 1.30x | 10.3% | 69.7% | 62.3% | ||

| 3 | WRS Retail Portfolio | Various, Various | LMF | 12 | $60,000,000 | 7.4% | 549,973 | Retail | 1.39x | 11.5% | 57.8% | 56.4% | ||

| 4 | Hilton Columbus at Easton Town Center | Columbus, OH | LMF | 1 | $49,000,000 | 6.1% | 345 | Hospitality | 3.61x | 25.7% | 35.8% | 35.8% | ||

| 5 | Liberty Park at Tysons | Vienna, VA | Barclays | 1 | $45,000,000 | 5.6% | 225,038 | Mixed Use | 3.02x | 16.1% | 40.6% | 40.6% | ||

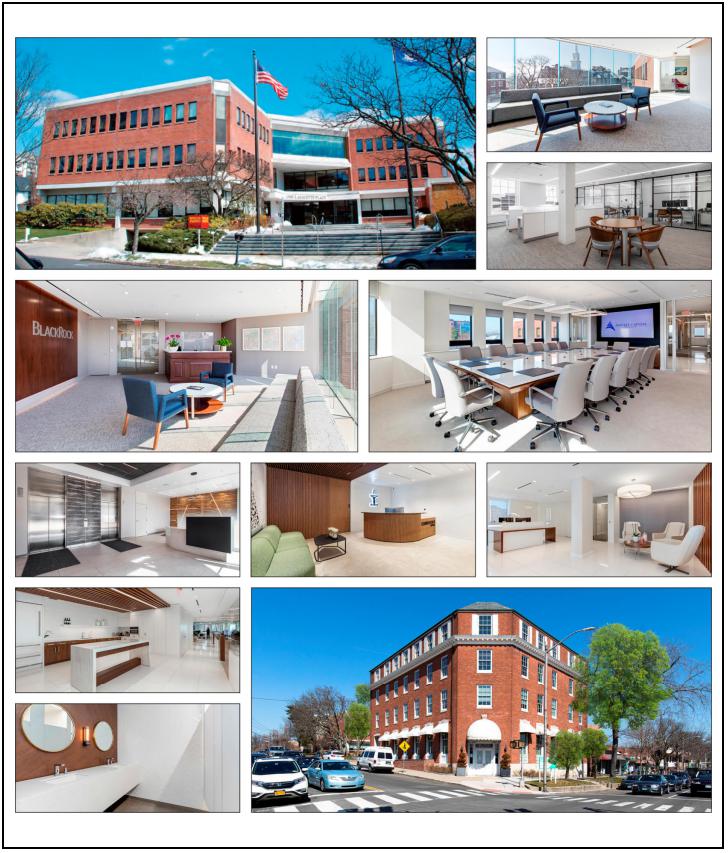

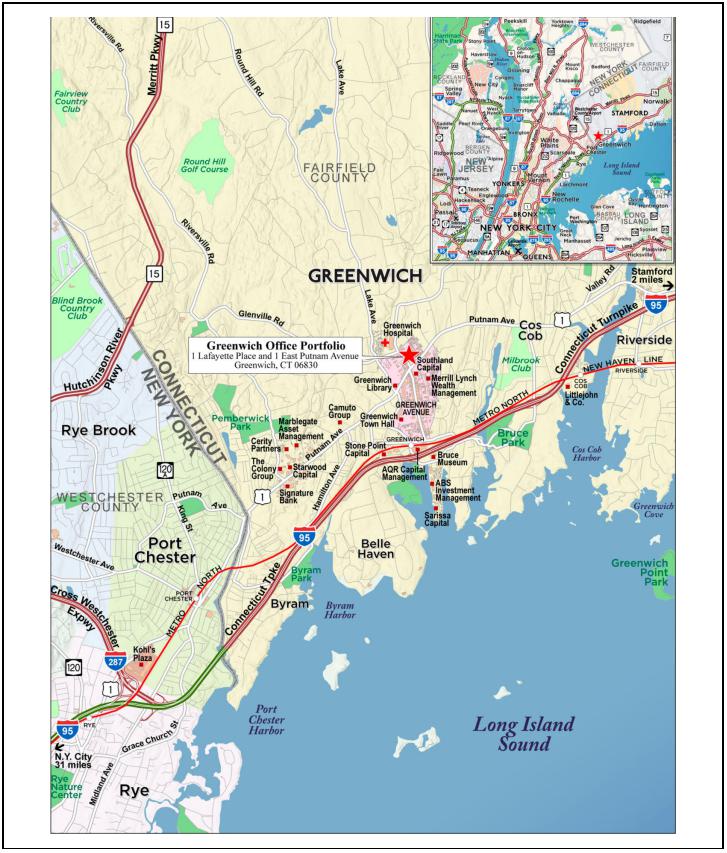

| 6 | Greenwich Office Portfolio | Greenwich, CT | BMO | 1 | $42,900,000 | 5.3% | 90,268 | Office | 1.84x | 11.4% | 54.5% | 54.5% | ||

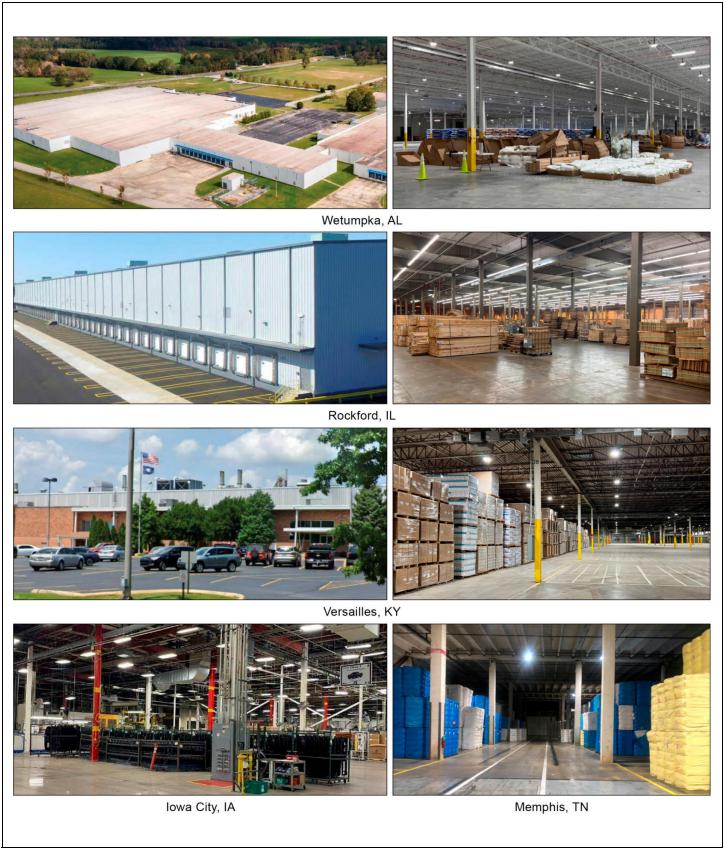

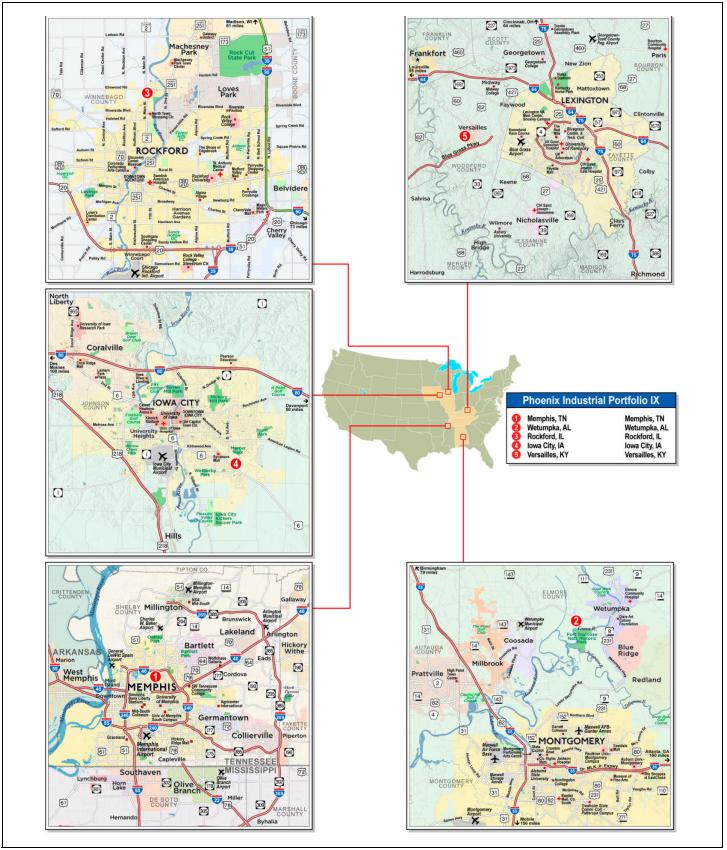

| 7 | Phoenix Industrial Portfolio IX | Various, Various | UBS AG | 5 | $38,000,000 | 4.7% | 3,760,303 | Industrial | 1.48x | 10.6% | 41.2% | 41.2% | ||

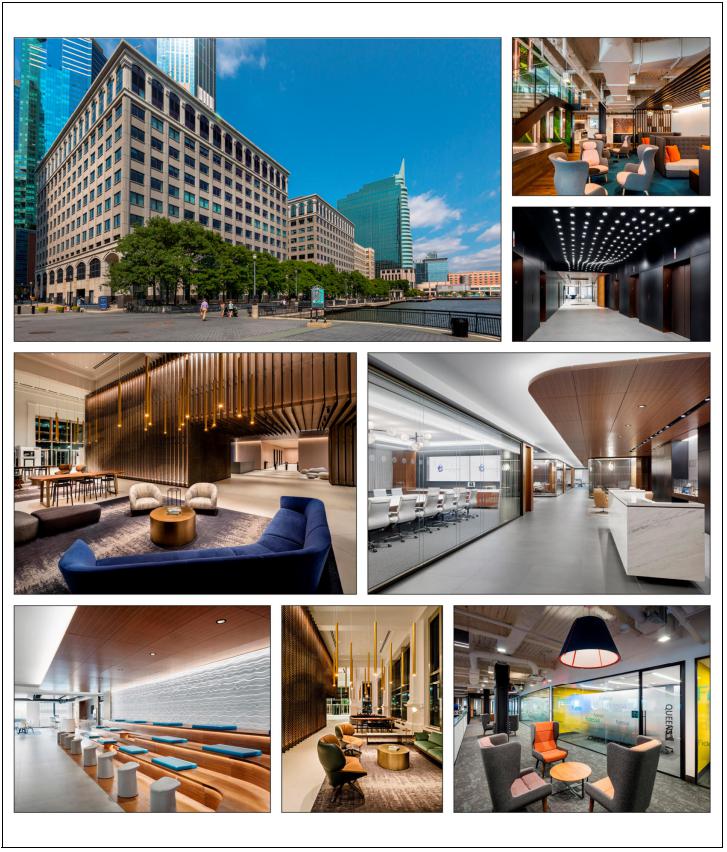

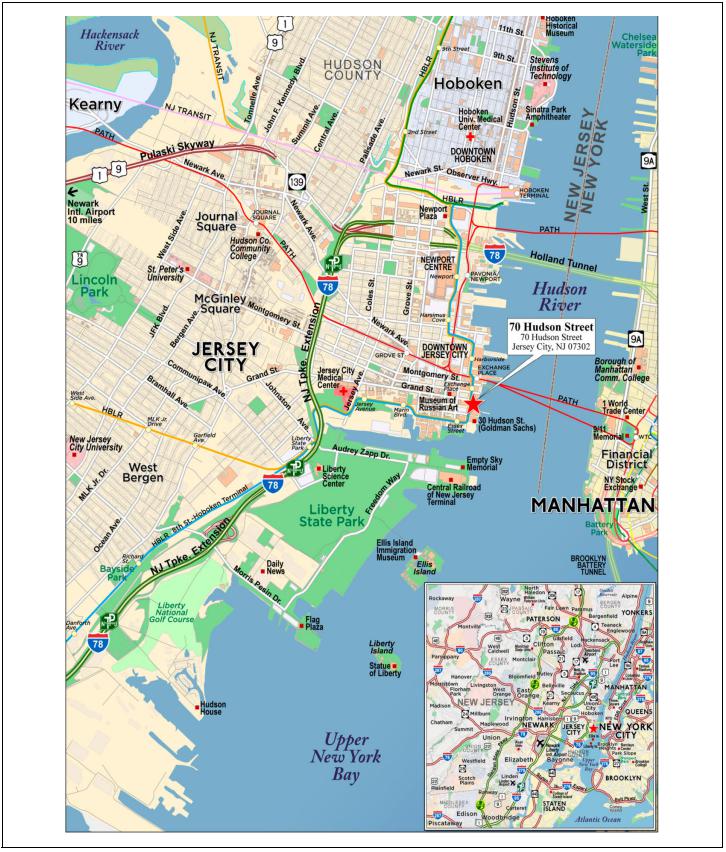

| 8 | 70 Hudson Street | Jersey City, NJ | Barclays | 1 | $36,000,000 | 4.5% | 431,281 | Office | 4.10x | 13.3% | 40.5% | 40.5% | ||

| 9 | Green Valley Corporate Center South | Henderson, NV | KeyBank | 1 | $29,425,000 | 3.6% | 163,356 | Office | 1.95x | 12.0% | 54.5% | 54.5% | ||

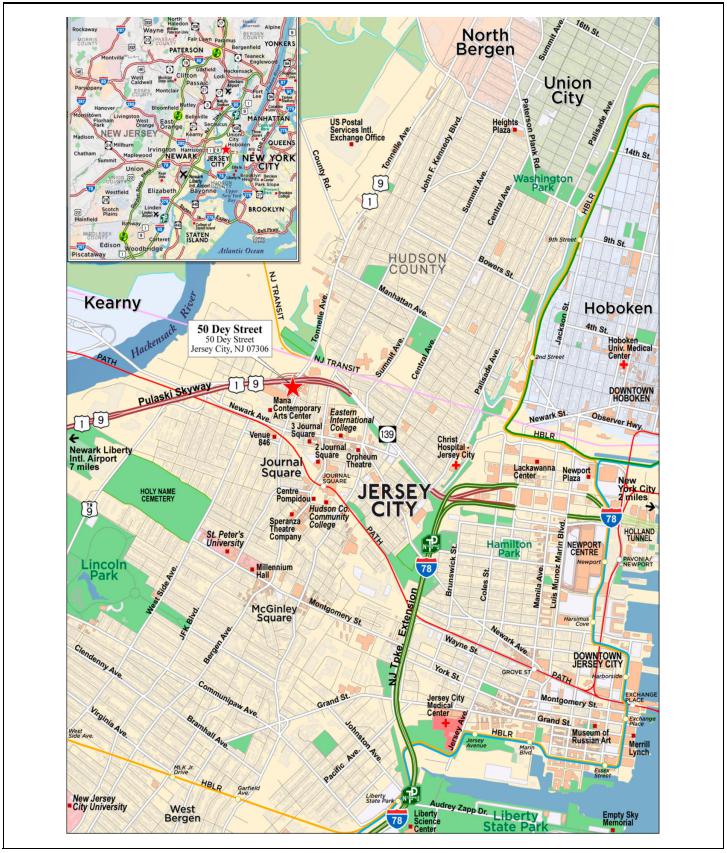

| 10 | 50 Dey Street | Jersey City, NJ | SMC | 1 | $27,400,000 | 3.4% | 363,500 | Industrial | 2.40x | 14.8% | 36.3% | 36.3% | ||

| Top 3 Total/Weighted Average | 27 | $193,500,000 | 23.9% | 1.30x | 10.5% | 59.7% | 56.7% | |||||||

| Top 5 Total/Weighted Average | 29 | $287,500,000 | 35.6% | 1.97x | 13.9% | 52.6% | 50.6% | |||||||

| Top 10 Total/Weighted Average | 38 | $461,225,000 | 57.1% | 2.11x | 13.3% | 50.1% | 48.8% | |||||||

| Non-Top 10 Total/Weighted Average | 76 | $346,955,236 | 42.9% | 1.89x | 14.1% | 53.6% | 49.8% | |||||||

| (1) | In the case of Loan Nos. 1, 3, 7 and 8, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 8, the Total Mortgage Loan Cut-off Date Balance and corresponding calculations exclude the related Subordinate Companion Loan(s) and/or mezzanine loan(s). |

| (2) | In the case of Loan No. 7, the UW NOI Debt Yield is calculated based on the Cut-off Date Principal Balance after netting out a $5,000,000 holdback reserve. The UW NOI Debt Yield based on the Cut-off Date Principal Balance without netting out the holdback reserve is 9.8%. |

| (3) | In the case of Loan Nos. 3, 16 and 19, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “as-portfolio” or an “as-complete” assumption. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 7 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| Pari Passu Companion Loan Summary |

No. | Loan Name | Mortgage Loan Seller | Trust Cut-off Date Balance | Total Mortgage Loan Cut-off Date Balance(1) | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Loan(s) Securitizations | Related Pari Passu Loan(s) Original Balance | |

| 1 | Rialto Industrial | AREF | $68,000,000 | $181,000,000 | (2) | (2) | (2) | Future Securitization(s) | $113,000,000 | |

| 3 | WRS Retail Portfolio | LMF | $60,000,000 | $84,000,000 | BBCMS 2022-C18 | Midland | Rialto | Future Securitization(s) | $24,000,000 | |

| 7 | Phoenix Industrial Portfolio IX | UBS AG | $38,000,000 | $75,000,000 | BMO 2022-C3 | Midland | Midland | BMO 2022-C3 | $37,000,000 | |

| 8 | 70 Hudson Street | Barclays | $36,000,000 | $120,000,000 | BBCMS 2022-C18(3) | Midland(3) | Rialto(3) | BBCMS 2022-C16 Future Securitization(s) | $48,000,000 $36,000,000 | |

| 12 | Hamilton Portfolio | BSPRT | $25,000,000 | $65,000,000 | BBCMS 2022-C17 | KeyBank | Argentic | BBCMS 2022-C17 | $40,000,000 | |

| 15 | The Showboat Hotel | Barclays | $24,732,690 | $48,466,079 | BBCMS 2022-C18 | Midland | Rialto | Future Securitization(s) | $23,750,000 | |

| 16 | Wyndham National Hotel Portfolio | UBS AG | $23,074,228 | $133,830,523 | UBS 2019-C18 | Wells | Rialto | UBS 2019-C18 BBCMS 2021-C10 BBCMS 2021-C11 WFCM 2021-C61 BMO 2022-C1 BMO 2022-C2 Future Securitization(s) | $35,000,000 $10,000,000 $20,000,000 $10,000,000 $20,000,000 $10,000,000 $15,000,000 | |

| 17 | 469 7th Avenue | UBS AG | $19,000,000 | $98,000,000 | BMARK 2022-B37 | Midland | Rialto | BMO 2022-C3 BMARK 2022-B37 | $30,000,000 $49,000,000 | |

| 22 | Autokiniton Industrial Portfolio | Barclays | $11,000,000 | $41,000,000 | BBCMS 2022-C17 | KeyBank | Argentic | BBCMS 2022-C17 | $30,000,000 | |

| 24 | Saks Fulfillment Center | BMO | $10,000,000 | $60,000,000 | BMO 2022-C3 | Midland | Midland | BMO 2022-C3 BBCMS 2022-C17 | $27,500,000 $22,500,000 | |

| 26 | Crossgates Commons | AREF | $9,929,121 | $31,773,187 | BBCMS 2022-C17 | KeyBank | Argentic | BBCMS 2022-C17 | $22,000,000 | |

| 31 | Park West Village | BMO | $7,500,000 | $187,500,000 | BBCMS 2022-C17 | KeyBank | KeyBank | BBCMS 2022-C17 BMO 2022-C3 BMARK 2022-B37 Future Securitization(s) | $47,500,000 $37,500,000 $62,500,000 $32,500,000 | |

| (1) | In the case of Loan Nos. 8 and 31, the Total Mortgage Loan Cut-off Date Balance excludes the related Subordinate Companion Loan(s) and/or mezzanine loan(s) and includes any related pari passu companion loans. |

| (2) | In the case of Loan No. 1, the related Whole Loan will be serviced under the BBCMS 2022-C18 pooling and servicing agreement until such time that the lead servicing pari passu companion loan is securitized, at which point the Whole Loan will be serviced under the related trust and servicing agreement or pooling and servicing agreement for such future securitization. The initial controlling noteholder is the loan seller or an affiliate of the loan seller as holder of the companion loans. |

| (3) | In the case of Loan No. 8, the control note is Note A-B, held by John Hancock Life Insurance Company (U.S.A.). Upon the occurrence of a control appraisal period, Note A-A-1 will be controlling note. The 70 Hudson Street Whole Loan will be serviced under the BBCMS 2022-C18 pooling and servicing agreement. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 8 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| Additional Debt Summary |

No. | Loan Name | Trust | Pari Passu Companion Loan(s) Cut-off Date Balance | Subordinate Debt Cut-off Date Balance(1) | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2) | Total Debt UW NCF DSCR | Mortgage Loan | Total Debt Cut-off Date LTV | Mortgage Loan UW NOI Debt Yield(2) | Total Debt UW NOI Debt Yield |

| 8 | 70 Hudson Street | $36,000,000 | $84,000,000 | $76,950,000 | $196,950,000 | 4.10x | 2.50x | 40.5% | 66.5% | 13.3% | 8.1% |

| 31 | Park West Village | $7,500,000 | $180,000,000 | $177,500,000 | $365,000,000 | 2.60x | 1.34x | 32.6% | 63.5% | 12.3% | 6.3% |

| (1) | In the case of Loan Nos. 8 and 31, Subordinate Debt Cut-off Date Balance represents one or more Subordinate Companion Loans. |

| (2) | Mortgage Loan UW NCF DSCR, Mortgage Loan Cut-off Date LTV and Mortgage Loan UW NOI Debt Yield calculations include any related Pari Passu Companion Loans (if applicable), but exclude the related Subordinate Companion Loans and/or mezzanine loan(s). |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 9 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| Mortgaged Properties by Type(1) |

Weighted Average | |||||||||

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2)(4) | Cut-off Date LTV(2)(5) | Maturity Date LTV(2)(5) | |

| Retail | Anchored | 17 | $106,907,774 | 13.2 | % | 1.39x | 11.0% | 65.4% | 58.3% |

| Shadow Anchored | 12 | 60,000,000 | 7.4 | 1.39x | 11.5% | 57.8% | 56.4% | ||

| Unanchored | 6 | 26,188,444 | 3.2 | 2.04x | 14.5% | 54.2% | 50.8% | ||

| Single Tenant | 2 | 24,960,000 | 3.1 | 1.73x | 9.6% | 59.6% | 59.6% | ||

| Subtotal: | 37 | $218,056,218 | 27.0 | % | 1.51x | 11.4% | 61.3% | 57.0% | |

| Office | Suburban | 4 | $112,412,969 | 13.9 | % | 1.88x | 12.2% | 54.7% | 53.8% |

| CBD | 2 | 55,000,000 | 6.8 | 3.17x | 12.0% | 44.6% | 44.6% | ||

| Subtotal: | 6 | $167,412,969 | 20.7 | % | 2.30x | 12.1% | 51.4% | 50.8% | |

| Industrial | Warehouse / Distribution | 5 | $94,093,333 | 11.6 | % | 1.30x | 9.9% | 48.8% | 48.8% |

| Flex | 2 | 33,940,000 | 4.2 | 2.21x | 13.7% | 41.5% | 41.5% | ||

| Manufacturing | 3 | 22,906,667 | 2.8 | 1.60x | 10.5% | 50.7% | 50.7% | ||

| Warehouse | 1 | 10,000,000 | 1.2 | 1.71x | 10.7% | 53.1% | 53.1% | ||

| Subtotal: | 11 | $160,940,000 | 19.9 | % | 1.56x | 10.9% | 47.8% | 47.8% | |

| Hospitality | Full Service | 4 | $95,415,436 | 11.8 | % | 3.12x | 24.7% | 41.4% | 37.6% |

| Limited Service | 46 | 38,700,613 | 4.8 | 1.76x | 15.8% | 62.8% | 50.2% | ||

| Select Service | 1 | 17,500,000 | 2.2 | 2.36x | 17.7% | 49.9% | 49.9% | ||

| Subtotal: | 51 | $151,616,049 | 18.8 | % | 2.69x | 21.6% | 47.9% | 42.3% | |

| Mixed Use | Office / Data Center / Warehouse | 1 | $45,000,000 | 5.6 | % | 3.02x | 16.1% | 40.6% | 40.6% |

| Retail / Office | 1 | 2,600,000 | 0.3 | 1.63x | 12.4% | 40.6% | 40.6% | ||

| Subtotal: | 2 | $47,600,000 | 5.9 | % | 2.94x | 15.9% | 40.6% | 40.6% | |

| Multifamily | Independent Living | 1 | $26,400,000 | 3.3 | % | 1.55x | 10.5% | 51.8% | 51.8% |

| High Rise | 1 | 7,500,000 | 0.9 | 2.60x | 12.3% | 32.6% | 32.6% | ||

| Subtotal: | 2 | $33,900,000 | 4.2 | % | 1.78x | 10.9% | 47.6% | 47.6% | |

| Self Storage | 4 | $18,655,000 | 2.3 | % | 1.67x | 11.8% | 47.5% | 46.4% | |

| Other | Sub-Leased Fee | 1 | $10,000,000 | 1.2 | % | 2.29x | 15.1% | 33.6% | 33.6% |

| Total / Weighted Average: | 114 | $808,180,236 | 100.0 | % | 2.01x | 13.7% | 51.6% | 49.2% | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 3, 7, 8, 12, 15, 16, 17, 22, 24, 26 and 31, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 31, the Total Mortgage Loan Cut-off Date Balance and corresponding calculations exclude the related Subordinate Companion Loan(s) and/or mezzanine loan(s). |

| (3) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 7, the UW NOI Debt Yield is calculated based on the Cut-off Date Principal Balance after netting out a $5,000,000 holdback reserve. The UW NOI Debt Yield based on the Cut-off Date Principal Balance without netting out the holdback reserve is 9.8%. |

| (5) | In the case of Loan Nos. 3, 16 and 19, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “as-portfolio” or an “as-complete” assumption. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 10 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| Mortgaged Properties by Location(1) |

Weighted Average | ||||||||

State | Number of Properties | Cut-off Date | % of IPB | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2)(4) | Cut-off Date LTV(2)(5) | Maturity Date LTV(2)(5) | |

| New Jersey | 4 | $98,887,690 | 12.2% | 3.05x | 17.0% | 38.6% | 37.7% | |

| California | 5 | 95,632,429 | 11.8% | 1.43x | 10.3% | 52.7% | 52.6% | |

| Ohio | 2 | 66,500,000 | 8.2% | 3.28x | 23.6% | 39.5% | 39.5% | |

| South Carolina | 12 | 60,278,343 | 7.5% | 1.32x | 10.5% | 67.4% | 61.2% | |

| New York | 6 | 54,739,976 | 6.8% | 1.67x | 12.2% | 53.4% | 48.8% | |

| Virginia | 3 | 52,077,361 | 6.4% | 2.80x | 15.2% | 43.7% | 43.5% | |

| North Carolina | 10 | 48,413,999 | 6.0% | 1.46x | 12.2% | 60.8% | 57.4% | |

| Connecticut | 1 | 42,900,000 | 5.3% | 1.84x | 11.4% | 54.5% | 54.5% | |

| Tennessee | 6 | 40,056,029 | 5.0% | 1.50x | 11.2% | 53.1% | 48.9% | |

| Nevada | 2 | 30,093,070 | 3.7% | 1.94x | 12.1% | 54.7% | 54.3% | |

| Florida | 6 | 28,321,277 | 3.5% | 1.94x | 13.0% | 49.3% | 46.9% | |

| Washington | 1 | 26,400,000 | 3.3% | 1.55x | 10.5% | 51.8% | 51.8% | |

| Michigan | 2 | 22,528,683 | 2.8% | 1.75x | 14.0% | 55.2% | 50.9% | |

| Louisiana | 3 | 17,900,923 | 2.2% | 2.74x | 21.8% | 56.6% | 45.5% | |

| Alabama | 2 | 16,993,369 | 2.1% | 1.43x | 10.5% | 49.7% | 47.5% | |

| Georgia | 2 | 14,535,714 | 1.8% | 1.39x | 11.5% | 57.8% | 56.4% | |

| Wisconsin | 1 | 13,582,050 | 1.7% | 1.73x | 9.6% | 59.6% | 59.6% | |

| Minnesota | 2 | 11,473,767 | 1.4% | 1.73x | 9.6% | 59.6% | 59.5% | |

| Texas | 4 | 10,192,167 | 1.3% | 1.94x | 17.2% | 62.5% | 52.7% | |

| Pennsylvania | 1 | 10,000,000 | 1.2% | 1.71x | 10.7% | 53.1% | 53.1% | |

| Indiana | 1 | 8,000,000 | 1.0% | 1.64x | 10.7% | 62.0% | 62.0% | |

| Illinois | 1 | 6,080,000 | 0.8% | 1.48x | 10.6% | 41.2% | 41.2% | |

| Kentucky | 2 | 5,583,287 | 0.7% | 1.64x | 10.5% | 54.5% | 54.5% | |

| Iowa | 3 | 4,742,621 | 0.6% | 1.51x | 11.4% | 45.0% | 42.2% | |

| Wyoming | 6 | 4,699,550 | 0.6% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Maryland | 2 | 4,577,306 | 0.6% | 2.23x | 15.1% | 31.8% | 31.3% | |

| Nebraska | 4 | 2,663,277 | 0.3% | 1.64x | 15.1% | 62.2% | 46.7% | |

| New Mexico | 3 | 2,481,409 | 0.3% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Kansas | 5 | 2,120,524 | 0.3% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Arizona | 2 | 1,406,319 | 0.2% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Missouri | 2 | 1,338,015 | 0.2% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Montana | 2 | 958,980 | 0.1% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Oregon | 1 | 647,798 | 0.1% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Utah | 1 | 384,735 | 0.0% | 1.64x | 15.1% | 62.2% | 46.7% | |

| South Dakota | 1 | 352,419 | 0.0% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Oklahoma | 1 | 340,649 | 0.0% | 1.64x | 15.1% | 62.2% | 46.7% | |

| North Dakota | 1 | 245,083 | 0.0% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Colorado | 1 | 51,419 | 0.0% | 1.64x | 15.1% | 62.2% | 46.7% | |

| Total / Weighted Average: | 114 | $808,180,236 | 100.0% | 2.01x | 13.7% | 51.6% | 49.2% | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 3, 7, 8, 12, 15, 16, 17, 22, 24, 26 and 31, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 31, the Total Mortgage Loan Cut-off Date Balance and corresponding calculations exclude the related Subordinate Companion Loan(s) and/or mezzanine loan(s). |

| (3) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 7, the UW NOI Debt Yield is calculated based on the Cut-off Date Principal Balance after netting out a $5,000,000 holdback reserve. The UW NOI Debt Yield based on the Cut-off Date Principal Balance without netting out the holdback reserve is 9.8%. |

| (5) | In the case of Loan Nos. 3, 16 and 19, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “as-portfolio” or an “as-complete” assumption. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 11 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| Cut-off Date Principal Balance |

Weighted Average | ||||||||||||

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |||

| $2,600,000 | - | $4,999,999 | 4 | $15,000,000 | 1.9% | 6.61796% | 119 | 2.31x | 16.9% | 44.5% | 43.2% | |

| $5,000,000 | - | $9,999,999 | 8 | 64,947,280 | 8.0% | 6.09487% | 110 | 1.92x | 13.9% | 57.7% | 52.6% | |

| $10,000,000 | - | $19,999,999 | 9 | 118,041,039 | 14.6% | 6.38658% | 117 | 1.85x | 13.8% | 52.0% | 48.9% | |

| $20,000,000 | - | $29,999,999 | 8 | 205,791,918 | 25.5% | 5.99388% | 101 | 1.95x | 14.0% | 51.7% | 48.7% | |

| $30,000,000 | - | $39,999,999 | 2 | 74,000,000 | 9.2% | 4.69403% | 85 | 2.75x | 11.9% | 40.9% | 40.9% | |

| $40,000,000 | - | $47,499,999 | 2 | 87,900,000 | 10.9% | 5.59068% | 119 | 2.44x | 13.8% | 47.4% | 47.4% | |

| $47,500,000 | - | $68,000,000 | 4 | 242,500,000 | 30.0% | 6.84864% | 119 | 1.77x | 13.5% | 54.9% | 52.5% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |||

| Mortgage Interest Rates |

Weighted Average | ||||||||||||

| Range of Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |||

| 3.19200 | - | 4.99000 | 3 | $66,574,228 | 8.2% | 3.93091% | 63 | 3.08x | 13.8% | 47.1% | 41.8% | |

| 5.00000 | - | 5.50000 | 3 | 82,890,972 | 10.3% | 5.23338% | 116 | 2.55x | 14.8% | 49.6% | 47.3% | |

| 5.50000 | - | 5.99999 | 8 | 179,054,121 | 22.2% | 5.85053% | 103 | 1.91x | 12.2% | 53.3% | 51.7% | |

| 6.00000 | - | 6.49999 | 9 | 209,291,774 | 25.9% | 6.27627% | 118 | 2.00x | 14.5% | 52.8% | 50.1% | |

| 6.50000 | - | 6.99999 | 9 | 148,181,385 | 18.3% | 6.77032% | 119 | 1.69x | 12.9% | 53.5% | 51.9% | |

| 7.00000 | - | 7.79500 | 5 | 122,187,756 | 15.1% | 7.54736% | 120 | 1.65x | 14.3% | 48.3% | 46.1% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |||

| Original Term to Maturity in Months |

Weighted Average | ||||||||||

| Original Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |

| 60 | 3 | $70,900,000 | 8.8% | 4.35025% | 55 | 3.28x | 13.8% | 38.0% | 38.0% | |

| 84 | 1 | 24,800,000 | 3.1% | 5.93000% | 83 | 1.94x | 11.8% | 56.5% | 56.5% | |

| 120 | 33 | 712,480,236 | 88.2% | 6.35325% | 117 | 1.89x | 13.7% | 52.7% | 50.1% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |

| Remaining Term to Maturity in Months |

| Weighted Average | ||||||||||||

| Range of Remaining Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |||

| 51 | - | 59 | 3 | $70,900,000 | 8.8% | 4.35025% | 55 | 3.28x | 13.8% | 38.0% | 38.0% | |

| 83 | - | 84 | 2 | 47,874,228 | 5.9% | 5.40947% | 83 | 1.80x | 13.4% | 59.2% | 51.8% | |

| 112 | - | 116 | 6 | 93,820,093 | 11.6% | 5.59819% | 114 | 1.76x | 12.2% | 60.1% | 55.1% | |

| 117 | - | 120 | 26 | 595,585,915 | 73.7% | 6.53043% | 119 | 1.92x | 13.9% | 51.2% | 49.4% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |||

| (1) | In the case of Loan Nos. 1, 3, 7, 8, 12, 15, 16, 17, 22, 24, 26 and 31, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 31, the Total Mortgage Loan Cut-off Date Balance and corresponding calculations exclude the related Subordinate Companion Loan(s) and/or mezzanine loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 7, the UW NOI Debt Yield is calculated based on the Cut-off Date Principal Balance after netting out a $5,000,000 holdback reserve. The UW NOI Debt Yield based on the Cut-off Date Principal Balance without netting out the holdback reserve is 9.8%. |

| (4) | In the case of Loan Nos. 3, 16 and 19, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “as-portfolio” or an “as-complete” assumption. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 12 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| Original Amortization Term in Months |

| Weighted Average | ||||||||||

| Original Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |

| Interest Only | 24 | $532,330,000 | 65.9% | 6.00563% | 108 | 2.20x | 13.4% | 47.3% | 47.3% | |

| 270 | 1 | 23,074,228 | 2.9% | 4.85000% | 84 | 1.64x | 15.1% | 62.2% | 46.7% | |

| 300 | 1 | 12,930,972 | 1.6% | 5.08000% | 112 | 2.50x | 20.5% | 61.6% | 46.8% | |

| 330 | 1 | 9,929,121 | 1.2% | 5.75000% | 114 | 1.60x | 12.9% | 66.8% | 54.4% | |

| 360 | 10 | 229,915,915 | 28.4% | 6.74329% | 118 | 1.62x | 13.8% | 59.1% | 53.8% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |

| Remaining Amortization Term in Months |

| Weighted Average | ||||||||||||

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |||

| Interest Only | 24 | $532,330,000 | 65.9% | 6.00563% | 108 | 2.20x | 13.4% | 47.3% | 47.3% | |||

| 234 | - | 324 | 3 | 45,934,321 | 5.7% | 5.10929% | 98 | 1.87x | 16.1% | 63.0% | 48.4% | |

| 357 | - | 360 | 10 | 229,915,915 | 28.4% | 6.74329% | 118 | 1.62x | 13.8% | 59.1% | 53.8% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |||

| Amortization Types |

Weighted Average | ||||||||||

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |

| Interest Only | 24 | $532,330,000 | 65.9% | 6.00563% | 108 | 2.20x | 13.4% | 47.3% | 47.3% | |

| Interest Only, Amortizing Balloon | 4 | 153,950,000 | 19.0% | 6.50806% | 118 | 1.37x | 11.0% | 63.4% | 58.6% | |

| Amortizing Balloon | 9 | 121,900,236 | 15.1% | 6.42464% | 111 | 2.03x | 18.2% | 55.1% | 45.7% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(1)(2) |

| Weighted Average | ||||||||||||

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |||

| 1.23x | - | 1.39x | 5 | $208,517,097 | 25.8% | 6.98526% | 119 | 1.30x | 10.6% | 59.5% | 56.3% | |

| 1.40x | - | 1.69x | 10 | 169,298,349 | 20.9% | 6.02058% | 113 | 1.53x | 11.3% | 53.4% | 49.6% | |

| 1.70x | - | 1.79x | 4 | 61,247,969 | 7.6% | 5.98252% | 116 | 1.73x | 11.4% | 57.0% | 55.4% | |

| 1.80x | 1.89x | 2 | 51,986,035 | 6.4% | 6.12458% | 119 | 1.84x | 12.2% | 56.6% | 55.1% | ||

| 1.90x | - | 1.99x | 3 | 62,976,774 | 7.8% | 5.90010% | 104 | 1.95x | 12.7% | 56.4% | 55.2% | |

| 2.00x | - | 2.49x | 6 | 74,490,350 | 9.2% | 6.27949% | 97 | 2.32x | 15.7% | 41.8% | 41.2% | |

| 2.50x | - | 2.99x | 3 | 45,163,662 | 5.6% | 6.49539% | 107 | 2.73x | 22.9% | 42.0% | 35.7% | |

| 3.00x | 4.10x | 4 | 134,500,000 | 16.6% | 5.12078% | 101 | 3.54x | 19.2% | 38.9% | 38.9% | ||

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |||

| (1) | In the case of Loan Nos. 1, 3, 7, 8, 12, 15, 16, 17, 22, 24, 26 and 31, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 31, the Total Mortgage Loan Cut-off Date Balance and corresponding calculations exclude the related Subordinate Companion Loan(s) and/or mezzanine loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 7, the UW NOI Debt Yield is calculated based on the Cut-off Date Principal Balance after netting out a $5,000,000 holdback reserve. The UW NOI Debt Yield based on the Cut-off Date Principal Balance without netting out the holdback reserve is 9.8%. |

| (4) | In the case of Loan Nos. 3, 16 and 19, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “as-portfolio” or an “as-complete” assumption. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 13 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| LTV Ratios as of the Cut-off Date(1)(3) |

| Weighted Average | ||||||||||||

| Range of Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |||

| 30.9% | - | 49.9% | 14 | $286,037,690 | 35.4% | 5.81747% | 103 | 2.81x | 17.3% | 39.3% | 38.9% | |

| 50.0% | - | 59.9% | 13 | 363,880,416 | 45.0% | 6.52032% | 116 | 1.57x | 11.2% | 55.0% | 53.7% | |

| 60.0% | - | 64.9% | 6 | 70,296,975 | 8.7% | 5.46321% | 105 | 1.83x | 14.6% | 62.0% | 53.1% | |

| 65.0% | - | 69.7% | 4 | 87,965,156 | 10.9% | 6.38185% | 118 | 1.39x | 11.2% | 69.0% | 61.0% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |||

| LTV Ratios as of the Maturity Date(1)(3) |

Weighted Average | ||||||||||||

| Range of Maturity Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |||

| 30.8% | - | 49.9% | 18 | $348,897,957 | 43.2% | 5.83334% | 103 | 2.63x | 17.1% | 42.7% | 40.3% | |

| 50.0% | - | 59.9% | 14 | 364,792,280 | 45.1% | 6.44974% | 115 | 1.59x | 11.3% | 55.9% | 54.4% | |

| 60.0% | - | 63.5% | 5 | 94,490,000 | 11.7% | 6.28641% | 118 | 1.39x | 10.3% | 67.6% | 62.2% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |||

| Prepayment Protection |

Weighted Average | ||||||||||

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |

| Defeasance | 26 | $507,970,036 | 62.9% | 6.48836% | 112 | 1.75x | 12.6% | 51.5% | 50.1% | |

| Yield Maintenance | 9 | 253,210,200 | 31.3% | 5.96511% | 115 | 2.27x | 16.0% | 52.9% | 48.2% | |

| Defeasance or Yield Maintenance | 2 | 47,000,000 | 5.8% | 3.73919% | 66 | 3.54x | 12.6% | 45.3% | 45.3% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |

| Loan Purpose |

Weighted Average | ||||||||||

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1)(3) | Cut-off Date LTV(1)(4) | Maturity Date LTV(1)(4) | |

| Refinance | 21 | $472,226,102 | 58.4% | 6.40708% | 114 | 2.07x | 14.9% | 48.7% | 46.2% | |

| Acquisition | 15 | 275,954,135 | 34.1% | 5.59393% | 103 | 2.05x | 12.0% | 55.1% | 52.9% | |

| Refinance and Acquisition | 1 | 60,000,000 | 7.4% | 6.88000% | 119 | 1.39x | 11.5% | 57.8% | 56.4% | |

| Total / Weighted Average: | 37 | $808,180,236 | 100.0% | 6.16454% | 111 | 2.01x | 13.7% | 51.6% | 49.2% | |

| (1) | In the case of Loan Nos. 1, 3, 7, 8, 12, 15, 16, 17, 22, 24, 26 and 31, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan Nos. 8 and 31, the Total Mortgage Loan Cut-off Date Balance and corresponding calculations exclude the related Subordinate Companion Loan(s) and/or mezzanine loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service Amount ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 7, the UW NOI Debt Yield is calculated based on the Cut-off Date Principal Balance after netting out a $5,000,000 holdback reserve. The UW NOI Debt Yield based on the Cut-off Date Principal Balance without netting out the holdback reserve is 9.8%. |

| (4) | In the case of Loan Nos. 3, 16 and 19, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “as-portfolio” or an “as-complete” assumption. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 14 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Collateral Characteristics | ||

| Previous Securitization History(1) |

| No. | Mortgage Loan Seller | Loan Name | Location | Property Type | Cut-off Date Principal Balance | % of IPB | Previous Securitization |

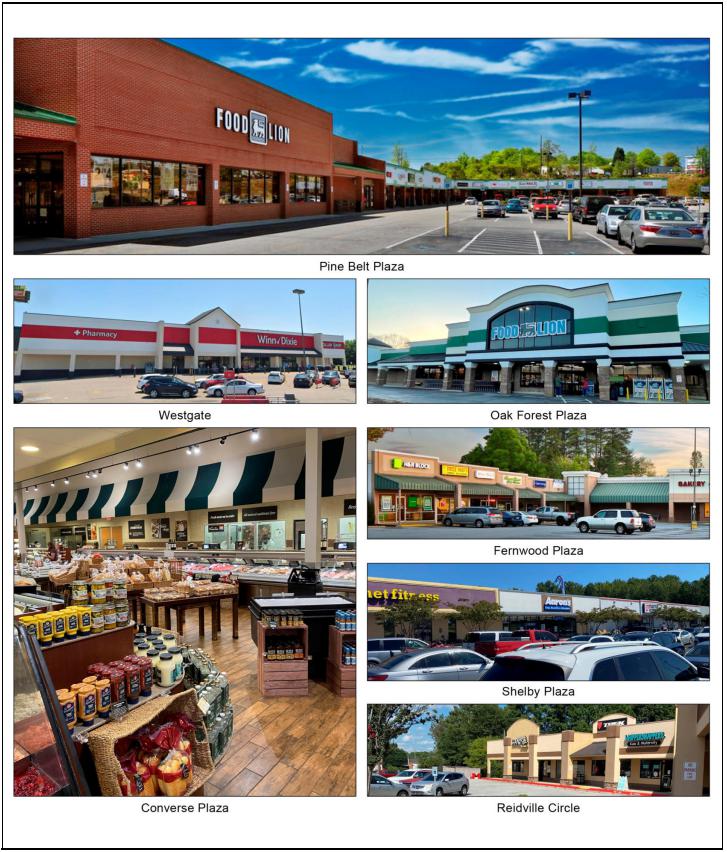

| 2.01 | SMC | Converse Plaza | Spartanburg, SC | Retail | $8,849,468 | 1.1% | JPMBB 2014-C18 |

| 2.02 | SMC | Oak Forest Plaza | Spartanburg, SC | Retail | $6,828,723 | 0.8% | JPMBB 2014-C18 |

| 2.03 | SMC | Pine Belt Plaza | Columbia, SC | Retail | $6,759,043 | 0.8% | JPMBB 2014-C18 |

| 2.04 | SMC | Spring Valley Commons | Columbia, SC | Retail | $6,340,957 | 0.8% | JPMBB 2014-C18 |

| 2.05 | SMC | Shelby Plaza | Shelby, NC | Retail | $5,435,106 | 0.7% | JPMBB 2014-C18 |

| 2.06 | SMC | Westgate Plaza | Mobile, AL | Retail | $5,086,702 | 0.6% | JPMBB 2014-C18 |

| 2.07 | SMC | Beaumont Plaza | Spartanburg, SC | Retail | $4,947,340 | 0.6% | JPMBB 2014-C18 |

| 2.08 | SMC | North Town Center | Spartanburg, SC | Retail | $4,250,532 | 0.5% | JPMBB 2014-C18 |

| 2.09 | SMC | Fernwood Plaza | Spartanburg, SC | Retail | $4,041,489 | 0.5% | JPMBB 2014-C18 |

| 2.10 | SMC | Parkmore Plaza | Milton, FL | Retail | $3,971,809 | 0.5% | JPMBB 2014-C18 |

| 2.11 | SMC | Reidville Circle | Spartanburg, SC | Retail | $3,553,723 | 0.4% | JPMBB 2014-C18 |

| 2.12 | SMC | Pensacola Plaza | Pensacola, FL | Retail | $2,299,468 | 0.3% | JPMBB 2014-C18 |

| 2.13 | SMC | Merchant's Plaza | Spartanburg, SC | Retail | $1,742,021 | 0.2% | JPMBB 2014-C18 |

| 2.14 | SMC | Cleveland Village | Spartanburg, SC | Retail | $1,393,617 | 0.2% | JPMBB 2014-C18 |

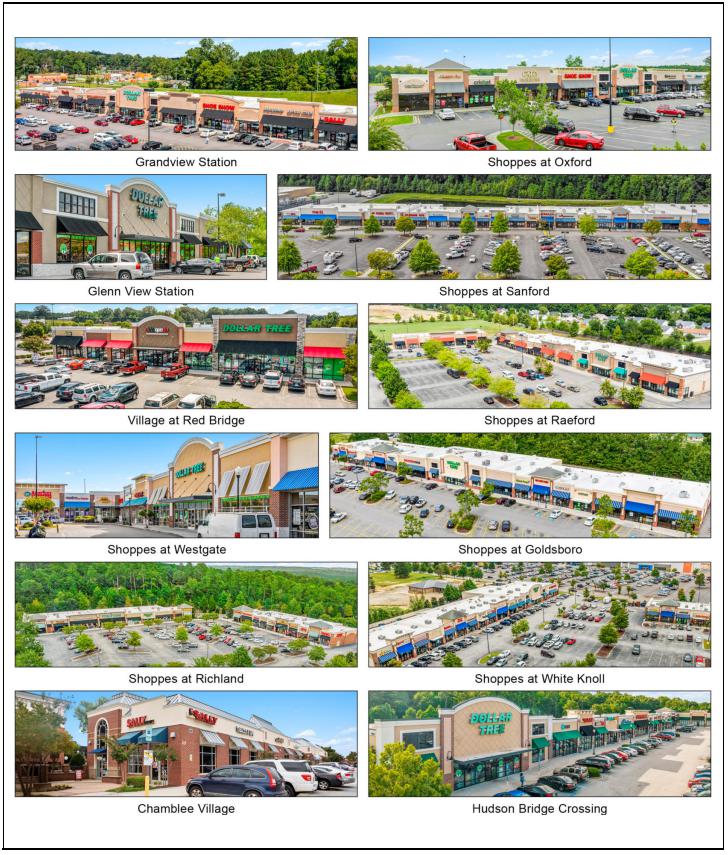

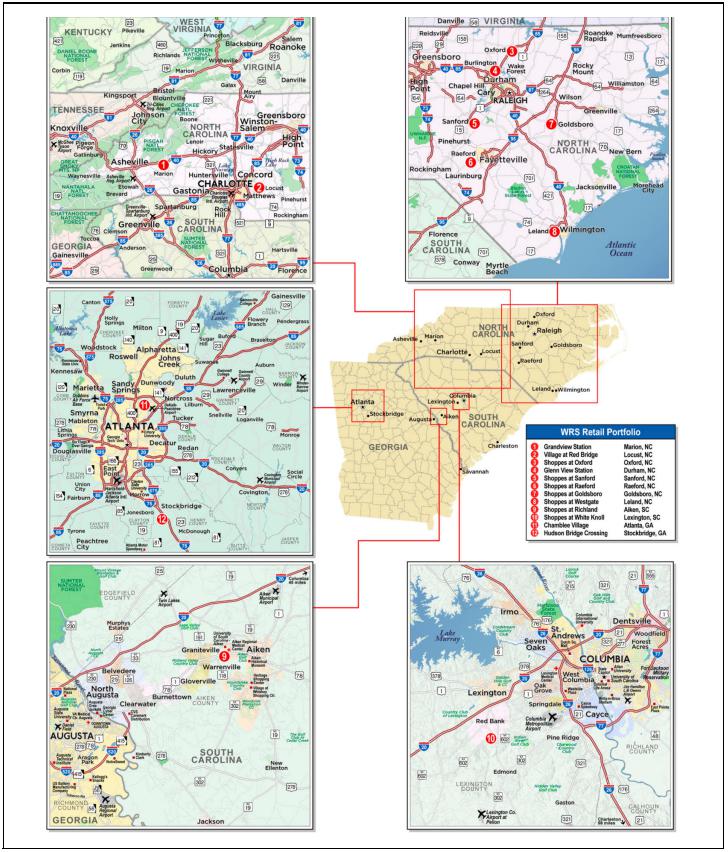

| 3.01 | LMF | Hudson Bridge Crossing | Stockbridge, GA | Retail | $9,500,000 | 1.2% | COMM 2014-LC15 |

| 3.02 | LMF | Shoppes at Westgate | Leland, NC | Retail | $6,928,571 | 0.9% | COMM 2014-LC15 |

| 3.03 | LMF | Shoppes at Richland | Aiken, SC | Retail | $6,107,143 | 0.8% | COMM 2014-LC15 |

| 3.04 | LMF | Shoppes at White Knoll | Lexington, SC | Retail | $5,464,286 | 0.7% | COMM 2014-LC15 |

| 3.05 | LMF | Chamblee Village | Atlanta, GA | Retail | $5,035,714 | 0.6% | COMM 2014-LC15 |

| 3.07 | LMF | Grandview Station | Marion, NC | Retail | $4,785,714 | 0.6% | COMM 2014-LC15 |

| 3.08 | LMF | Glenn View Station | Durham, NC | Retail | $4,642,857 | 0.6% | COMM 2014-LC15 |

| 3.09 | LMF | Shoppes at Raeford | Raeford, NC | Retail | $3,714,286 | 0.5% | COMM 2014-LC15 |

| 3.10 | LMF | Shoppes at Oxford | Oxford, NC | Retail | $3,642,857 | 0.5% | COMM 2014-LC15 |

| 3.11 | LMF | Shoppes at Goldsboro | Goldsboro, NC | Retail | $3,142,857 | 0.4% | COMM 2014-LC15 |

| 3.12 | LMF | Village at Red Bridge | Locust, NC | Retail | $2,214,286 | 0.3% | COMM 2014-LC15 |

| 4 | LMF | Hilton Columbus at Easton Town Center | Columbus, OH | Hospitality | $49,000,000 | 6.1% | UBSBB 2012-C4 |

| 9 | KeyBank | Green Valley Corporate Center South | Henderson, NV | Office | $29,425,000 | 3.6% | COMM 2015-CR27 |

| 10 | SMC | 50 Dey Street | Jersey City, NJ | Industrial | $27,400,000 | 3.4% | COMM 2013-CR7 |

| 12.04 | BSPRT | Hamilton Crossing | Chattanooga, TN | Retail | $4,495,413 | 0.6% | WFRBS 2011-C4 |

| 18 | LMF | Courtyard by Marriott Columbus Easton | Columbus, OH | Hospitality | $17,500,000 | 2.2% | UBSBB 2012-C4 |

| 20 | BSPRT | Sheraton Metairie | Metairie, LA | Hospitality | $12,930,972 | 1.6% | BSPRT 2017-FL1 |

| 21 | KeyBank | Webster Plaza | Webster, NY | Retail | $11,567,097 | 1.4% | COMM 2012-CR4 |

| 23 | KeyBank | Mini U Storage - Brick | Brick, NJ | Self Storage | $10,755,000 | 1.3% | UBS 2013-C6 |

| 26 | AREF | Crossgates Commons | Albany, NY | Retail | $9,929,121 | 1.2% | CGCMT 2017-B1; BANK 2017-BNK5 |

| 29 | AREF | Wynwood Retail | Miami, FL | Retail | $8,600,000 | 1.1% | COMM 2015-CR26 |

| 30 | BSPRT | Gateway Promenade | Hammond, IN | Retail | $8,000,000 | 1.0% | BSPRT 2018-FL4 |

| 31 | BMO | Park West Village | New York, NY | Multifamily | $7,500,000 | 0.9% | UBSCM 2017-C2; UBSCM 2017-C3; UBSCM 2017-C4 |

| 35 | KeyBank | Mini U Storage - Landover Hills | Landover Hills, MD | Self Storage | $4,450,000 | 0.6% | UBSBB 2013-C5 |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 15 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Class A-2(1) | ||

No. | Loan Name | Location | Cut-off Date Balance | % of IPB | Maturity Date Balance | % of Certificate Class(2) | Original Loan Term | Remaining Loan Term | UW NCF DSCR | UW NOI Debt Yield | Cut-off Date LTV | Maturity Date LTV |

| 8 | 70 Hudson Street | Jersey City, NJ | $36,000,000 | 4.5% | $36,000,000 | 49.3% | 60 | 51 | 4.10x | 13.3% | 40.5% | 40.5% |

| 10 | 50 Dey Street | Jersey City, NJ | 27,400,000 | 3.4% | 27,400,000 | 37.5% | 60 | 59 | 2.40x | 14.8% | 36.3% | 36.3% |

| 31 | Park West Village | New York, NY | 7,500,000 | 0.9% | 7,500,000 | 10.3% | 60 | 56 | 2.60x | 12.3% | 32.6% | 32.6% |

| Total / Weighted Average: | $70,900,000 | 8.8% | $70,900,000 | 97.1% | 60 | 55 | 3.28x | 13.8% | 38.0% | 38.0% | ||

| (1) | The table above presents the mortgage loans whose balloon payment would be applied to pay down the certificate balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Maturity Date Balance divided by the initial Class A-2 Certificate Balance. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 16 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Class A-3(1) | ||

No. | Loan Name | Location | Cut-off Date Balance | % of IPB | Maturity Date Balance | % of Certificate Class(2) | Original Loan Term | Remaining Loan Term | UW NCF DSCR | UW NOI Debt Yield | Cut-off Date LTV | Maturity Date LTV |

| 14 | HERE Campus | Laguna Hills, CA | $24,800,000 | 3.1% | $24,800,000 | 58.9% | 84 | 83 | 1.94x | 11.8% | 56.5% | 56.5% |

| 16 | Wyndham National Hotel Portfolio | Various, Various | 23,074,228 | 2.9% | 17,304,952 | 41.1% | 120 | 84 | 1.64x | 15.1% | 62.2% | 46.7% |

| Total / Weighted Average: | $47,874,228 | 5.9% | $42,104,952 | 100.0% | 101 | 83 | 1.80x | 13.4% | 59.2% | 51.8% | ||

| (1) | The table above presents the mortgage loans whose balloon payment would be applied to pay down the certificate balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates, including the Class A-3 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Maturity Date Balance divided by the initial Class A-3 Certificate Balance. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 17 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Structural Overview | ||

| ■ Assets: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB, Class X-A, Class X-B, Class X-D, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR and Class R Certificates (collectively, the “Certificates”) will be entitled to distributions solely with respect to the mortgage loans. | |

| ■ Accrual: | Each Class of Certificates (other than the Class R Certificates) will accrue interest on a 30/360 basis. The Class R Certificates will not accrue interest. | |

| ■ Distribution of Interest: | On each Distribution Date, accrued interest for each Class of Certificates (other than the Class R Certificates) at the applicable pass-through rate will be distributed in the following order of priority to the extent of available funds: first, to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB, Class X-A, Class X-B and Class X-D Certificates (the “Senior Certificates”), on a pro rata basis, based on the interest entitlement for each such Class on such date, and then to the Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR Certificates, in that order, in each case until the interest entitlement for such date payable to each such Class is paid in full. The pass-through rate applicable to each of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR Certificates (collectively, the “Principal Balance Certificates”) on each Distribution Date, will be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), (iii) the lesser of a specified fixed pass-through rate and the rate described in clause (ii) above or (iv) the rate described in clause (ii) above less a specified percentage. The pass-through rate for the Class X-A Certificates for any Distribution Date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-SB and Class A-S Certificates for the related Distribution Date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that Distribution Date. The pass-through rate for the Class X-B Certificates for any Distribution Date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class B and Class C Certificates for the related Distribution Date, weighted on the basis of their respective Certificate Balances immediately prior to that Distribution Date. The pass-through rate for the Class X-D Certificates for any Distribution Date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate on the Class D Certificates for the related Distribution Date. See “Description of the Certificates—Distributions” in the Preliminary Prospectus. | |

■ Distribution of Principal:

| On any Distribution Date prior to the Cross-Over Date, payments in respect of principal will be distributed: first, to the Class A-SB Certificates until the Certificate Balance of the Class A-SB Certificates is reduced to the Class A-SB planned principal balance for the related Distribution Date set forth in Annex E to the Preliminary Prospectus, second, to the Class A-1 Certificates, until the Certificate Balance of such Class is reduced to zero, third, to the Class A-2 Certificates, until the Certificate Balance of such Class is reduced to zero, fourth, to the Class A-3 Certificates, until the Certificate Balance of such Class is reduced to zero, fifth, to the Class A-4 Certificates, until the Certificate Balance of such Class is reduced to zero, sixth, to the Class A-5 Certificates, until the Certificate Balance of such Class is reduced to zero and seventh to the Class A-SB Certificates, until the Certificate Balance of such Class is reduced to zero and then to the Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 18 | ||

| Structural and Collateral Term Sheet | BBCMS 2022-C18 | |

| Structural Overview | ||