- MTAL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

CORRESP Filing

MAC Copper (MTAL) CORRESPCorrespondence with SEC

Filed: 27 Apr 23, 12:00am

(713) 860-7352

willburns@paulhastings.com

April 27, 2023

VIA EDGAR AND OVERNIGHT DELIVERY

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Energy & Transportation

100 F Street, N.E.

Washington, D.C. 20549

| Attention: | Ms. Joanna Lam |

Mr. Raj Rajan Mr. John Coleman Ms. Anuja A. Majmudar Ms. Irene Barberena-Meissner |

| Re: | Metals Acquisition Limited Amendment No. 2 to Registration Statement on Form F-4 Filed April 18, 2023 File No. 333-269007 |

Ladies and Gentlemen:

On behalf of our client, Metals Acquisition Limited (the “Company”), we are submitting this letter in response to oral comments received during a phone call held on April 25, 2023, with Ms. Joanna Lam and Mr. Raj Rajan, members of the Division of Corporate Finance (the “Staff’) of the Securities and Exchange Commission (the “Commission”), with respect to the above-referenced Amendment No. 2 to the Registration Statement on Form F-4 (the “Registration Statement”).

We have included in Annex A to this letter the updated excerpts from the Registration Statement marked against the as-filed Registration Statement showing our proposed revised disclosure to afford the Staff the ability to review such proposed language as soon as possible. Assuming the Staff’s concurrence with the proposed revisions and the responses below, the Company would propose to file Amendment No. 3 to the Registration Statement (“Amendment No. 3”) reflecting those changes.

The Company’s responses to the oral comments are provided below. We have restated the substance of those comments to the best of our understanding.

Paul Hastings LLP | 600 Travis Street, Fifty-Eighth Floor | Houston, TX 77002

t: +1. 713.860.7300 | www.paulhastings.com

April 27, 2023

Page 2

| 1. | Comment: Please revise your disclosure to comply with Rule 11-02(a)(6)(i) of Regulation S-X or explain why it is appropriate to eliminate MAC historical operating and formation costs of $2,117 and acquisition costs relating to the due diligence costs incurred to consummate the proposed Business Combination of $7,625. |

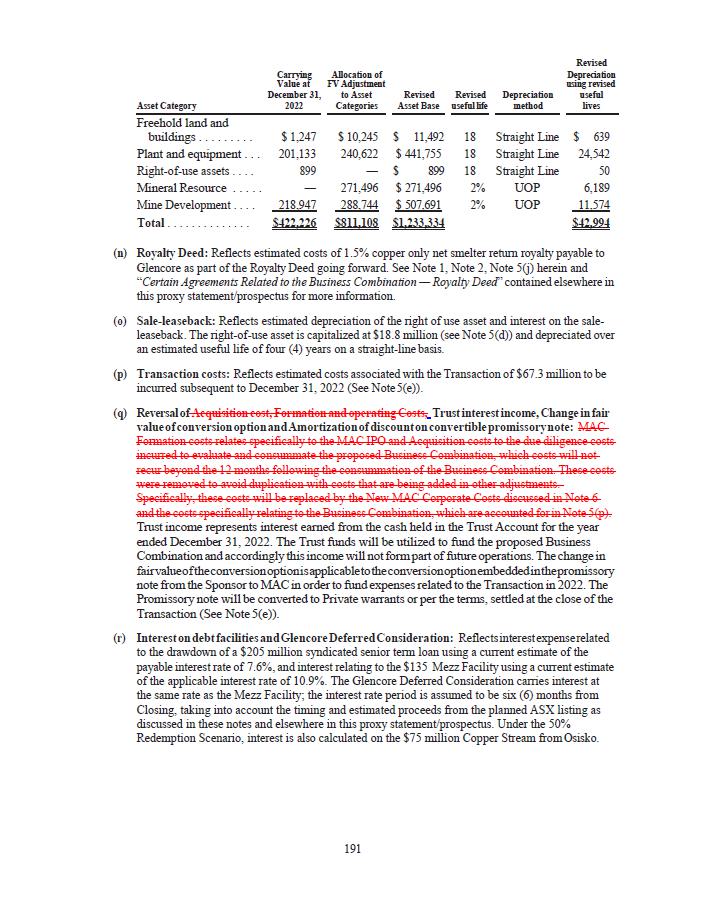

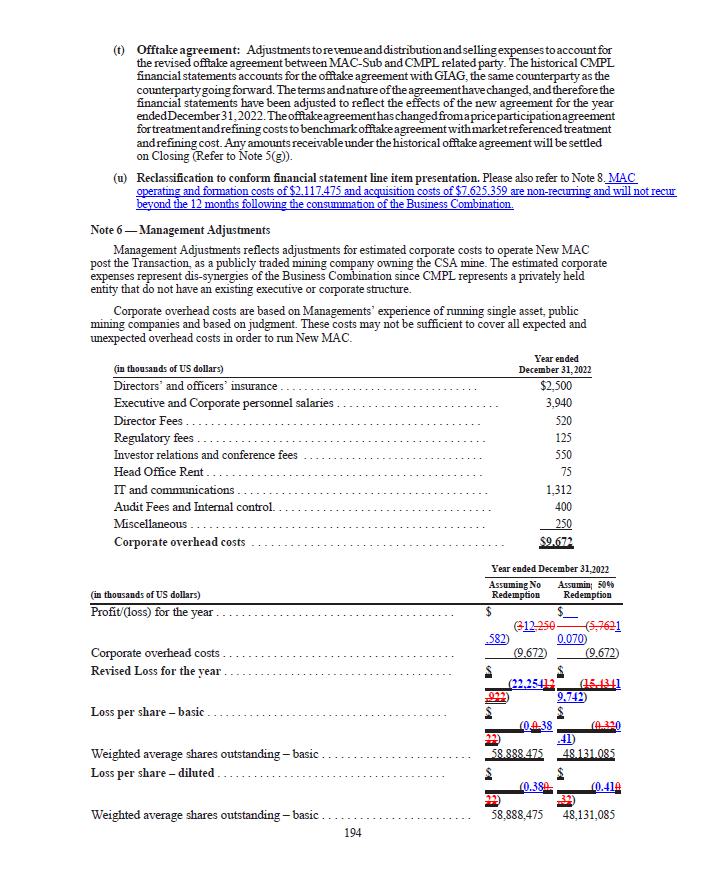

Response: The Company acknowledges the Staff’s comment and proposes to revise Amendment No. 3 as shown in Annex A by modifying Transaction Account Adjustment 5(q) to remove the elimination of the MAC historical operating and formation costs of $2,117 and acquisition costs relating to the due diligence costs incurred to consummate the proposed Business Combination of $7,625. To conform financial statement line item presentation, the Company further reclassified MAC’s operating and formation costs and acquisition costs to administrative expenses, as disclosed in note 5(u).

Corporate overhead costs (Directors’ and Officers’ insurance, Regulatory fees, Investor relations and conferences, Audit and internal control fees and Miscellaneous) that are of the same nature, yet not 100% identical to the historical MAC operating costs disclosed in Note 6, were left unchanged as Management Adjustments.

| 2. | Comment: With a view toward disclosure, please revise your disclosure or explain why adjustments for the equipment leases are included in the 50% redemption scenario and not the no redemption scenario. |

Response: The Company acknowledges the Staff’s comment and proposes to revise Amendment No. 3 as shown in Annex A by adding the interest on the finance leases in the no redemption scenario table under Note 5(r).

* * *

We hope the foregoing answers are responsive to your comments. Please do not hesitate to contact the undersigned at (713) 860-7352 (willburns@paulhastings.com) of this firm with any questions or comments regarding this correspondence.

April 27, 2023

Page 3

| Sincerely, | |

| /s/ R. William Burns | |

R. William Burns of PAUL HASTINGS LLP |

Enclosures

| cc: | (via e-mail) |

Michael James McMullen, Chief Executive Officer, Metals Acquisition Limited

Annex A