In connection with the Subscription Agreements, Green Mountain Metals, LLC, the Company’s sponsor, agreed to transfer an aggregate of 517,500 shares of Class B common stock (Founder Shares converted to ordinary common stock on closing of the Proposed Business Combination) of the Company that it currently holds to certain investors who agreed to subscribe for a significant number of Subscribed Shares.

Going Concern and Management’s Plan

As of March 31, 2023, the Company had $35,075 of cash and a working capital deficit of $22,808,456.

The Company has incurred and expects to continue to incur significant costs in pursuit of its acquisition plans. The Company will need to raise additional capital through loans or additional investments from its Sponsor, stockholders, officers, directors, or third parties. The Company’s officers, directors and Sponsor may, but are not obligated to, loan the Company funds, from time to time or at any time, in whatever amount they deem reasonable in their sole discretion, to meet the Company’s working capital needs. Until the consummation of the Business Combination, the Company will be using the funds not held in the Trust Account.

On April 13, 2022, the Company issued an unsecured promissory note (the “2022 Sponsor Convertible Note”) to the Sponsor pursuant to which the Company could borrow up to $1,200,000 from the Sponsor for working capital needs, including transaction costs reasonably related to the consummation of the Proposed Business Combination (Refer to Note 5). On May 6, 2022, the Company borrowed $1,200,000 under the 2022 Sponsor Convertible Note. On May 24, 2022, the Sponsor exercised its option to convert the issued and outstanding loan amount of $1,200,000 under the 2022 Sponsor Convertible Note resulting in the issuance of 800,000 private placement warrants to the Sponsor, fully satisfying the Company’s obligation under the 2022 Sponsor Convertible Note.

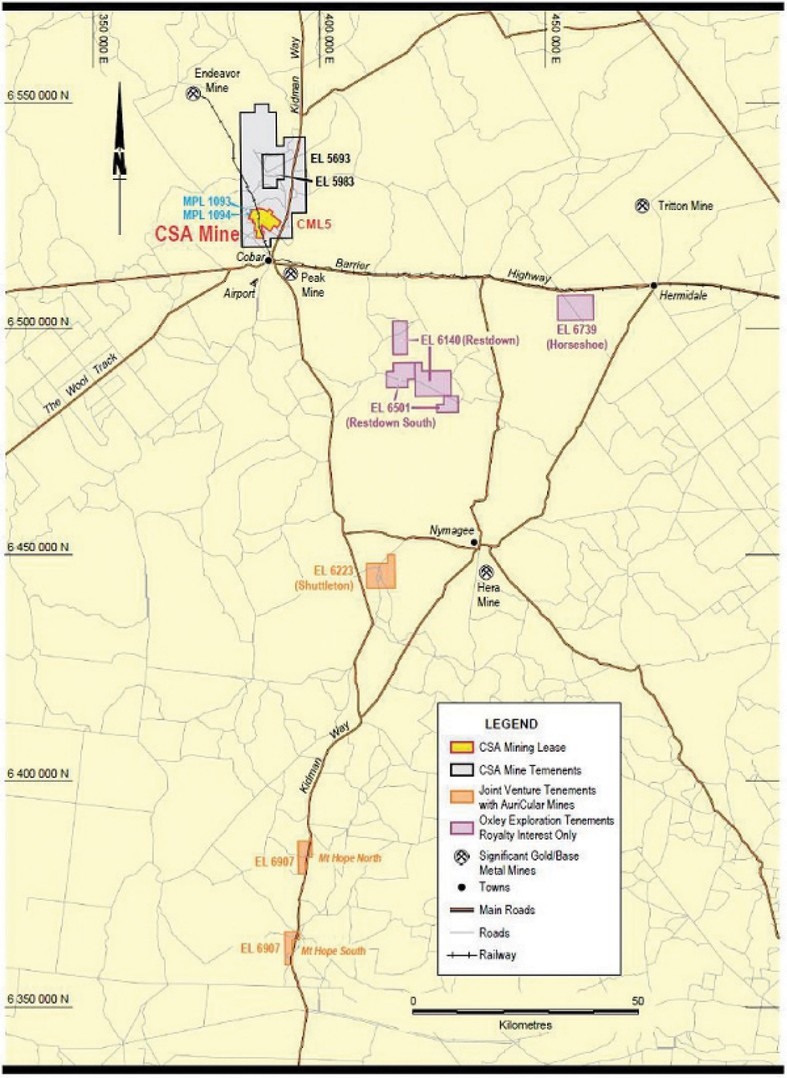

On October 25, 2022, the Company issued an unsecured non-convertible promissory note (the “October 2022 Note”) to the Sponsor pursuant to which the Company may borrow up to $300,000 from the Sponsor for transaction costs reasonably related to the consummation of the Business Combination. The October 2022 Note bears no interest and all unpaid principal under the note will be due and payable in full up to the earlier of (1) August 2, 2023 and (ii) the acquisition of the Cornish, Scottish and Australian Mine in the Company’s Proposed Business Combination. As of March 31, 2023, $300,000 was outstanding under the October 2022 Note.

On December 21, 2022, the Company issued an unsecured non-convertible promissory note (the “December 2022 Note”) to the Sponsor pursuant to which the Company may borrow up to $1,254,533 from the Sponsor for transaction costs reasonably related to the consummation of the Business Combination. The December Note bears no interest and all unpaid principal under the Note will be due and payable in full up the earlier of (i) August 2, 2023, and (ii) the acquisition of the Cornish, Scottish and Australian Mine in the Company’s Proposed Business Combination. As of March 31, 2023, $1,187,496 was outstanding under the December 2022 Note.

On January 9, 2023, the Company issued an unsecured promissory note (the “2023 Sponsor Convertible Note”) to the Sponsor pursuant to which the Company borrowed $300,000 from the Sponsor for transaction costs reasonably related to the consummation of the Proposed Business Combination. Concurrently upon the issuance of the 2023 Sponsor Convertible Note, the Sponsor exercised its option to convert the issued and outstanding loan amount of $300,000 resulting in the issuance of 200,000 private placement warrants to the Sponsor, fully satisfying the Company’s obligation under the 2023 Sponsor Convertible Note.

On March 31, 2023, the Company issued an unsecured non-convertible promissory note (the “March 2023 Note”) to the Sponsor pursuant to which the Company may borrow up to $339,877 from the Sponsor for transaction costs reasonably related to the consummation of the Business Combination. The March 2023 Note bears no interest and all unpaid principal under the Note will be due and payable in full up the earlier of (i) August 2, 2023 and (ii) the acquisition of the Cornish, Scottish and Australian Mine (“CSA Mine”) in the Company’s business combination. As of March 31, 2023 there was no balance outstanding under the March 31, 2023 Note.

In connection with the Company’s assessment of going concern considerations in accordance with the Financial Accounting Standards Board’s (“FASB’s”) Accounting Standards Update (“ASU”) 2014-15, “Disclosures of Uncertainties about an Entity’s Ability to Continue as a Going Concern,” the Company has until August 2, 2023 to consummate a Business Combination. It is uncertain that the Company will be able to consummate a Business Combination by this time. If a Business Combination is not consummated by this date and the Company’s stockholders have not approved an extension by this date, there will be a mandatory liquidation and subsequent dissolution of the Company. Management has determined that, should a Business Combination not occur, and an extension not be approved by the stockholders of the Company, the potential for mandatory liquidation and dissolution raises