UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

CHATTEM, INC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

CHATTEM, INC.

1715 West 38th Street

Chattanooga, Tennessee 37409

March 5, 2004

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Chattem, Inc., scheduled for Wednesday, April 14, 2004, at 1:00 p.m., in the Company’s executive offices located in Chattanooga, Tennessee. The matters expected to be acted upon at the meeting are described in detail in the attached Notice of Annual Meeting and Proxy Statement.

I hope that you will be able to attend the Annual Meeting on April 14, 2004.

| | |

| | | Sincerely, |

| |

| | |  |

| | | Zan Guerry Chairman of the Board and Chief Executive Officer |

Enclosures

CHATTEM, INC.

1715 West 38th Street

Chattanooga, Tennessee 37409

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

APRIL 14, 2004

To the Shareholders of Chattem, Inc.:

Notice is hereby given that the Annual Meeting of Shareholders (the “Annual Meeting”) of Chattem, Inc., a Tennessee corporation (the “Company”), will be held on Wednesday, April 14, 2004, at 1:00 p.m. local time, at the Company’s executive offices, 1715 West 38th Street, Chattanooga, Tennessee 37409, for the following purposes:

| | (1) | To elect two members to the Board of Directors, each to serve for a three year term; |

| | (2) | To ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for fiscal 2004; and |

| | (3) | To transact such other business as may properly come before the Annual Meeting or any adjournment(s) thereof. |

Information regarding the matters to be acted upon at the Annual Meeting is contained in the Proxy Statement attached to this Notice.

Only shareholders of record at the close of business on February 20, 2004 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment(s) thereof.

You are encouraged to attend the Annual Meeting in person. IF YOU ARE UNABLE TO ATTEND THE ANNUAL MEETING, THE BOARD OF DIRECTORS REQUESTS THAT, AT YOUR EARLIEST CONVENIENCE, YOU PLEASE COMPLETE, DATE, SIGN AND RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED REPLY ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES.

| | |

| | | |

| |

| | |  |

| | | Zan Guerry Chairman of the Board and Chief Executive Officer |

Chattanooga, Tennessee

March 5, 2004

TABLE OF CONTENTS

CHATTEM, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

APRIL 14, 2004

GENERAL INFORMATION

The accompanying proxy is solicited by the Board of Directors of Chattem, Inc., a Tennessee corporation (the “Company”), for use at the Company’s Annual Meeting of Shareholders (the “Annual Meeting”), and at any adjournment(s) thereof, to be held at the Company’s executive offices, 1715 West 38th Street, Chattanooga, Tennessee 37409, on Wednesday, April 14, 2004, at 1:00 p.m. local time, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. Solicitations of proxies may be made in person or by mail, telephone or telegram by directors, officers and regular employees of the Company. The Company will also request banking institutions, brokerage firms, custodians, trustees, nominees and fiduciaries to forward solicitation material to the beneficial owners of the Company’s shares held of record by such persons, will furnish at its expense the number of copies thereof necessary to supply such material to all such beneficial owners and will reimburse the reasonable forwarding expenses incurred by such record owners. All costs of preparing, printing, assembling and mailing the form of proxy and the material used in the solicitation will be paid by the Company. This Proxy Statement is first being mailed to shareholders on or about March 5, 2004.

VOTING INFORMATION

Record Date

The Board of Directors has fixed the close of business on February 20, 2004 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. Each share of the Company’s common stock without par value (“Common Stock”) is entitled to one vote. As of February 20, 2004, there were issued and outstanding 19,458,473 shares of Common Stock.

Revocability of Proxy

Granting a proxy does not preclude the right of the person giving the proxy to vote in person, and a person may revoke his or her proxy at any time before it has been exercised, by giving written notice to the Secretary of the Company, by delivering a later dated proxy or by voting in person at the Annual Meeting.

Quorum; Voting

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock which are entitled to vote is necessary to constitute a quorum at the Annual Meeting. If a quorum is not present or represented at the Annual Meeting, the shareholders entitled to vote, whether present in person or represented by proxy, have the power to adjourn the Annual Meeting from time to time, without notice other than announcement at the Annual Meeting, until a quorum is present or represented. At any such adjourned Annual Meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the Annual Meeting as originally noticed.

On all matters submitted to a vote of the shareholders at the Annual Meeting or any adjournment(s) thereof, each shareholder will be entitled to one vote for each share of Common Stock owned of record at the close of business on February 20, 2004. There will be no cumulative voting. Abstentions and broker non-votes will count for determining whether a quorum exists, but will not be included in vote totals and will not affect the outcome of the vote.

1

OWNERSHIP OF COMMON STOCK

Set forth below is information, as of February 20, 2004, with respect to beneficial ownership by (a) each person who is known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock, (b) each director and nominee, (c) the chief executive officer and the four other most highly compensated executive officers for the previous fiscal year, and (d) all directors and executive officers of the Company as a group:

| | | | | |

Name of Beneficial Owner

| | Amount and Nature of Beneficial Ownership (1)

| | | Percent of Class (2)

|

Peter R. Kellogg 120 Broadway New York, NY 10274 | | 2,774,000 | (3) | | 14.26 |

| | |

EARNEST Partners, LLC 75 Fourteenth Street, Suite 2300 Atlanta, GA 30309 | | 1,799,945 | (4) | | 9.25 |

| | |

Zan Guerry 1715 W, 38th St. Chattanooga, TN 37409 | | 1,315,164 | (5)(6) | | 6.76 |

| | |

Barclays Global Investors, N.A. 45 Fremont Street San Francisco, CA 94105 | | 1,272,653 | (7) | | 6.54 |

| | |

Robert E. Bosworth One Union Square Suite 300 Chattanooga, TN 37402 | | 979,141 | (6)(8) | | 5.03 |

| | |

A. Alexander Taylor II | | 253,160 | (9) | | 1.30 |

Samuel E. Allen | | 47,100 | | | * |

Richard E. Cheney | | 34,520 | | | * |

Philip H. Sanford | | 43,912 | | | * |

Bill W. Stacy | | 13,648 | | | * |

B. Derrill Pitts | | 5,500 | | | * |

Donald K. Riker | | 12,600 | (10) | | * |

Richard W. Kornhauser | | 13,798 | (11) | | * |

Directors and Executive Officers as a Group (16 persons) | | 1,892,015 | | | 9.61 |

| (1) | Except as otherwise indicated, beneficial ownership refers to either shared or sole voting and investment power. The amounts include the following numbers of shares subject to purchase pursuant to options that are exercisable within 60 days of February 20, 2004 under the Company’s Non-Statutory Stock Option Plan—1993 (the “1993 Stock Option Plan”), the Company’s Non-Statutory Stock Option Plan—1994 (the “1994 Stock Option Plan”), the Company’s Non-Statutory Stock Option Plan—1998 (the “1998 Stock Option Plan”), the Company’s Non-Statutory Stock Option Plan—2000 (the “2000 Stock Option Plan”), the Company’s Stock Incentive Plan—2003 (the “2003 Stock Incentive Plan”), the Company’s Non-Statutory Stock Option Plan for Non-Employee Directors (the “Director Plan”) or the 1999 Stock Plan for Non-Employee Directors (the “1999 Director Plan”): Mr. Bosworth—8,000 shares, Mr. Taylor—46,952 shares, Mr. Allen—2,500 shares, Mr. Cheney—20,000 shares, Mr. Sanford—16,000 shares, Dr. Stacy—3,000 shares, Mr. Pitts—5,500 shares, Dr. Riker—12,500 shares, Mr. Kornhauser—12,500 shares, and all directors and executive officers as a group-230,952 shares. |

2

| (2) | For the purpose of computing the percentage of outstanding shares owned by each beneficial owner, the shares issuable pursuant to stock options held by such beneficial owner that are exercisable within 60 days of February 20, 2004 are deemed to be outstanding. Such shares are not deemed to be outstanding for the purpose of computing the percentage owned by any other person. |

| (3) | This information is based solely upon a Schedule 13G filed by Mr. Kellogg on February 9, 2001. |

| (4) | This information is based solely upon a Schedule 13G filed by EARNEST Partners, LLC on February 17, 2004. |

| (5) | Includes 12,000 shares held in trust for Mr. Guerry pursuant to the terms of the Company’s Savings and Investment Plan and 120 shares which Mr. Guerry holds as custodian for his children. Mr. Guerry disclaims beneficial ownership of the custodial shares. |

| (6) | Includes 938,228 shares owned by Hamico, Inc., a charitable foundation for which Messrs. Guerry and Bosworth serve as directors and executive officers. Messrs. Guerry and Bosworth disclaim beneficial ownership of all such shares. |

| (7) | Includes 129,787 shares held by Barclays Global Fund Advisors and 18,800 shares held by Barclays Bank PLC. This information is based solely upon a Schedule 13G filed by Barclays Global Investors, N.A. on February 17, 2004. |

| (8) | Includes 1,200 shares held in trust for the benefit of one of Mr. Bosworth’s children. Mr. Bosworth disclaims beneficial ownership of these shares. |

| (9) | Includes 2,608 shares held in trust for Mr. Taylor pursuant to the terms of the Company’s Savings and Investment Plan, 3,000 shares held by Mr. Taylor’s spouse and 2,250 shares which Mr. Taylor holds as custodian for his children. Mr. Taylor disclaims beneficial ownership of the shares held by his spouse and the custodial shares. |

| (10) | Includes 100 shares held in trust for Dr. Riker pursuant to the terms of the Company’s Savings and Investment Plan. |

| (11) | Includes 698 shares held in trust for Mr. Kornhauser pursuant to the terms of the Company’s Savings and Investment Plan. |

3

ITEMS TO BE VOTED ON BY SHAREHOLDERS

Item 1—Election of Directors

Each director elected at the Annual Meeting will serve for a three year term expiring at the Annual Meeting of Shareholders in 2007 and until his successor has been elected and qualified or until his earlier resignation or removal. Messrs. Bill W. Stacy and Zan Guerry are the Board of Directors’ nominees for election.

Proxies in the accompanying form that are properly executed and returned will be voted at the Annual Meeting and any adjournment(s) thereof in accordance with the directions on such proxies. If no directions are specified, such proxies will be voted “FOR” the election of the two persons specified as nominees for directors of the Company, each of whom will serve for a three year term. The Company has no reason to believe that either of the nominees will be unable or unwilling to serve if elected. However, should any director nominee named herein become unable or unwilling to serve if elected, it is intended that the proxies will be voted for the election, in his stead, of such other person as the Board of Directors of the Company may recommend.

Voting For Directors

Directors will be elected by a plurality of the votes cast.The Board of Directors recommends a vote FOR each of the nominees.

Information About Nominees and Continuing Directors

The following information is furnished with respect to the nominees and continuing directors:

| | | | |

Name

| | Age

| | Principal Occupation

|

|

Nominees for Terms of Office to Expire in 2007 |

| | |

Bill W. Stacy | | 65 | | Chancellor of the University of Tennessee at Chattanooga since 1997. Member of the Company’s Audit Committee. First elected a director of the Company in 2002. |

| | |

Zan Guerry | | 55 | | Chairman of the Board of the Company since June 1990 and Chief Executive Officer of the Company since January 1998. Previously served as President of the Company from 1990 to 1998. Director of SunTrust Bank, Chattanooga, N.A. First elected a director of the Company in 1981. |

|

Directors Whose Terms of Office to Expire in 2005 |

| | |

Samuel E. Allen | | 67 | | Chief Executive Officer of Globalt, Inc. (investment management) since 1990. Member of the Company’s Audit Committee. First elected a director of the Company in 1993. |

| | |

Philip H. Sanford | | 50 | | Independent business consultant since August 2003. Chairman and Chief Executive Officer of The Krystal Company (restaurants) from September 1997 to August 2003. Director of The Krystal Company since 1997. Director and Member of the Executive Committee of SunTrust Bank, Chattanooga, N.A. Member of the Company’s Compensation Committee. First elected a director of the Company in 1999. |

| | |

A. Alexander Taylor II | | 50 | | President and Chief Operating Officer of the Company since 1998. Director of Constar International Inc. (packaging) and The Krystal Company (restaurants). First elected a director of the Company in 1993. |

4

| | | | |

Name

| | Age

| | Principal Occupation

|

|

Directors Whose Terms of Office Expire in 2006 |

| | |

Robert E. Bosworth | | 56 | | Vice President-Corporate Finance of Livingston Company (merchant banking) since February 2001. Independent business consultant from January 1998 to February 2001. Director of Covenant Transport, Inc. (transportation). Member of the Company’s Audit Committee and Compensation Committee. First elected a director of the Company in 1986. |

| | |

Richard E. Cheney | | 82 | | Former Chairman Emeritus, director and member of the executive committee of Hill & Knowlton, Inc. (international public relations and public affairs consulting). Director of Stoneridge, Inc. (engineered electrical vehicle components) and The Rowe Companies (home furnishings). Member of the Company’s Compensation Committee. First elected a director of the Company in 1984. |

Director Compensation

In fiscal 2003, all directors received annual compensation of $9,000 and supplemental life insurance coverage in varying amounts. In addition, directors who are not officers of the Company receive $1,000 for each meeting attended. Beginning in fiscal 2004, directors will receive annual compensation of $12,000 and the chair of the Audit Committee and Compensation Committee will receive additional annual compensation of $5,000 and $3,000, respectively. The outside directors of the Company are also eligible for the grant of stock options and the award of Common Stock in lieu of cash fees under the terms of the 1999 Director Plan.

Item 2—Selection of Auditors for Fiscal 2004

The Audit Committee of the Board of Directors has appointed Ernst & Young LLP to serve as the Company’s independent auditors for fiscal 2004. The Company is asking shareholders to ratify the Committee’s selection. In the event the shareholders fail to ratify the appointment, the Audit Committee will consider it a direction to consider other auditors for the subsequent year. If the accompanying proxy is duly executed and received in time for the Annual Meeting, and if no contrary specification is made as provided therein, it is the intention of the persons named in the proxy to vote the shares represented thereby for the ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for fiscal 2004. Representatives of Ernst & Young LLP will be present at the meeting. They will be given the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for fiscal 2004.

Audit and Non-Audit Fees

The following table presents fees for professional audit services rendered by Ernst & Young LLP for the audit of the Company’s annual financial statements for the fiscal years ended November 30, 2002 and November 30, 2003, and fees billed for other services rendered by Ernst & Young LLP during those periods. Certain amounts for 2002 have been reclassified to conform to 2003 presentation.

| | | | | | |

Type of Fees

| | 2002

| | 2003

|

Audit Fees (1) | | $ | 356,700 | | $ | 342,000 |

Audit Related Fees (2) | | | — | | | 8,500 |

Tax Fees (3) | | | 118,600 | | | 347,800 |

All Other Fees (4) | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 475,300 | | $ | 698,300 |

| | |

|

| |

|

|

5

| (1) | Audit fees consist of services rendered for the audit of the annual financial statements, including required quarterly reviews, statutory and regulatory filings or engagements and services that generally only the auditor can reasonably be expected to provide. |

| (2) | Audit related fees are for assurance and related services that are reasonably related to the performance of the audit or review of the financial statements or that are traditionally performed by the independent auditor. |

| (3) | Tax fees are for professional services rendered for tax compliance, tax advice and tax planning. |

| (4) | All other fees are for services other than those in the previous categories such as permitted corporate finance assistance and permitted advisory services. |

CORPORATE GOVERNANCE

The Company’s business is managed by its employees under the direction and oversight of the Board of Directors. Except for Messrs. Guerry and Taylor, all of the Company’s Board members are “independent” as defined by rules of the National Association of Securities Dealers, Inc. (“NASD”). The Board limits membership of the Audit Committee and Compensation Committee to independent directors as defined by rules of the NASD and the Securities and Exchange Commission. Board members are kept informed of the Company’s business through discussions with management, materials provided to them by management and their participation in Board and Board Committee meetings.

The Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all of the Company’s directors, officers and employees, a copy of which may be found on the Company’s website at www.chattem.com.

Board of Directors

Composition of Board

The Company’s Board of Directors is separated into three classes having staggered terms of three years. At present, two classes consist of two directors each and one class consists of three directors. The Board of Directors has determined that as of January 27, 2004, five of the Company’s seven incumbent directors are “independent” as defined by rules of the NASD: Messrs. Allen, Bosworth, Cheney, Sanford and Stacy. No member of the Board of Directors serves on more than two other boards of directors of publicly-traded companies.

Board Meetings

The Board of Directors meets quarterly and may convene for special meetings when necessary. During the fiscal year ended November 30, 2003, the Board of Directors conducted a total of four regularly scheduled meetings. Each director attended 75% or more of the meetings of the Board of Directors and of any committees on which he served during this period. The Company has no established policy regarding board members’ attendance at the annual meeting of shareholders. Five of the Company’s then eight directors were present at the Company’s 2003 annual meeting of shareholders.

Director Nomination Procedure

The Company seeks to attract and retain highly qualified directors who are willing to commit the time and effort necessary to fulfill their duties and responsibilities as a director of the Company. The Board of Directors desires to maintain flexibility in choosing appropriate board candidates, and, therefore, has not adopted specific, minimum qualifications that must be met by a recommended nominee for a position on the Company’s Board of Directors. Board candidates are generally considered based on various criteria, including their business and professional skills and experiences, business and social perspective, personal integrity and judgment, and other factors the Board of Directors may deem relevant under the circumstances.

6

Director nominees are selected by a majority vote of the independent directors as defined by NASD rules, all of whom participate in the consideration of director nominees. The Board of Directors has adopted a resolution addressing the nominations process and such related matters as required under the federal securities laws. Given the size and composition of the Company’s Board of Directors, the Company does not have a separate nominating committee or a nominating committee charter.

The Board of Directors does not have a specific policy with regard to the consideration of director nominees submitted by a shareholder. The Board of Directors will evaluate nominees for directors submitted by a shareholder on the same basis as other nominees and does not believe a specific policy is appropriate or necessary given the size and composition of the Company’s Board and the infrequency with which director nominees have been submitted in the past.

Compensation Committee

The Compensation Committee is composed of three independent, non-employee directors who currently have no interlocking relationships as defined by the Securities and Exchange Commission. The Compensation Committee reviews and approves the salary arrangements, including annual and long-term incentive awards and other remuneration, for the chief executive officer and the president and chief operating officer, and the long-term incentive awards for all officers of the Company. Beginning in fiscal 2004, the Compensation Committee will review and determine the compensation for all officers of the Company as required by NASD rules. The Compensation Committee also is responsible for administration of the Company’s stock option plans (except for the Director Plan and the 1999 Director Plan), the annual incentive plan and certain other plans. The Compensation Committee met two times in fiscal 2003.

Compensation Committee Interlocks and Insider Participation

Mr. Taylor, a Director, President and Chief Operating Officer of the Company, served on the compensation committee of The Krystal Company until October 2003. Mr. Sanford, a Director of the Company and a member of the Company’s Compensation Committee, served as the Chairman and Chief Executive Officer of The Krystal Company from September 1997 until August 2003.

Audit Committee

The responsibilities of the Audit Committee are described in the Amended and Restated Audit Committee Charter attached hereto as Exhibit A and in the following Audit Committee Report.

Audit Committee Report

Identification of Members and Functions of Committee

The Audit Committee of the Company’s Board of Directors is currently composed of three non-employee directors, Samuel E. Allen, Robert E. Bosworth and Bill W. Stacy. Each member of the Audit Committee (i) is “independent” as defined by Rule 4200(a)(15) of the National Association of Securities Dealer Inc.’s listing standards, (ii) meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, (iii) has not participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years, and (iv) is able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. Additionally, the Company has and will continue to have, at least one member of the Audit Committee who has past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. The Board of Directors has determined that Mr. Bosworth is an “audit committee financial expert” as defined in applicable Securities and Exchange Commission rules.

7

Committee Charter

The Board of Directors has adopted a written charter for the Audit Committee. The Audit Committee Charter has been reviewed, reassessed and amended by the Board of Directors, and the Amended and Restated Audit Committee Charter is attached hereto as Exhibit A. In accordance with its written charter, the Audit Committee assists the Board in fulfilling its responsibility for overseeing the accounting, auditing and financial reporting processes of the Company. In addition, the Audit Committee selects the independent auditors of the Company for each fiscal year. The Audit Committee met two times in person in fiscal year 2003. Prior to the release of quarterly earnings announcements in fiscal year 2003, the Audit Committee or a member of the Committee also reviewed and discussed the interim financial information contained therein with the Company’s independent auditors, and with the Company’s President and Chief Financial Officer.

Termination of Arthur Andersen LLP; Engagement of Ernst & Young LLP

On May 7, 2002, the Board of Directors, upon the recommendation of the Audit Committee, decided not to renew its engagement of Arthur Andersen LLP as the Company’s independent auditors and engaged Ernst & Young LLP to serve as the Company’s auditors for fiscal year 2002. The decision to change auditors was not the result of any disagreement between the Company and Arthur Andersen LLP on any matter of accounting principles, practices or financial disclosure.

Auditor Independence

The Audit Committee received from Ernst & Young LLP written disclosures and a letter regarding its independence as required by Independence Standards Board Standard No. 1, describing all relationships between the auditors and the Company that might bear on the auditors’ independence, and discussed this information with Ernst & Young LLP. The Audit Committee specifically considered the provision of non-audit services by Ernst & Young LLP and concluded that the nature and scope of such services provided to the Company did not compromise Ernst & Young LLP’s independence. The Audit Committee also reviewed and discussed with management and with Ernst & Young LLP the quality and adequacy of the Company’s internal controls. The Audit Committee also reviewed with Ernst & Young LLP and financial management of the Company the audit plans, audit scope and audit procedures. The discussions with Ernst & Young LLP also included the matters required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended.

Review of Audited Financial Statements

The Audit Committee has reviewed the audited financial statements of the Company and its consolidated subsidiaries as of and for the fiscal year ended November 30, 2003, and has discussed the audited financial statements with management and with Ernst & Young LLP. Based on all of the foregoing reviews and discussions with management and Ernst & Young LLP, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended November 30, 2003, to be filed with the Securities and Exchange Commission.

The foregoing report is submitted by the Audit Committee, consisting of Samuel E. Allen, Robert E. Bosworth and Bill W. Stacy.

8

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Compensation Committee Report on Executive Compensation

Principles of Executive Compensation

The Company’s executive compensation program is designed to help the Company attract, motivate and retain the executive talent that the Company needs in order to maximize its return to shareholders. Toward that end, the Company’s executive compensation program attempts to provide strongly competitive compensation levels and incentive pay that varies based on corporate and individual performance.

The Company attempts to provide its executives with a total compensation package that, at expected levels of performance, is competitive with average market rates for executives who hold comparable positions or have similar qualifications in companies the Company’s size. Total compensation is defined to include base salary, annual incentives and long-term incentives. The Company determines competitive levels of compensation for executive positions based on information drawn from compensation surveys and compensation consultants. The Company does not necessarily consider pay levels for the peer companies included in the shareholder return graph, since these companies, in some cases, vary in size significantly from the Company.

The Company targets its base salary program at slightly below competitive market norms while placing more emphasis on long-term incentive compensation that is common in the market for comparable sized companies. Thus, the Company’s executive salaries tend to be slightly below the market average while its long-term incentive award opportunities are at or above average rates.

The Company’s incentive plans are designed to ensure that incentive compensation varies based upon the financial performance of the Company. However, some of the Company’s incentive payouts are based on annual performance while other incentive values are based on long-term (i.e., multi-year) performance. Also, the Company considers individual performance in its incentive plan. As a result, the total compensation levels for an executive in any given year may not reflect the Company’s overall bottom-line financial performance in that year.

Base Salary Program

The Company’s base salary program is based on a philosophy of providing salaries that are competitive with, but slightly below, market rates for companies of similar size. The Company believes that offering competitive rates of base pay plays an important role in its ability to attract and retain executive talent. Base salary levels are also based on each individual employee’s performance over time. Consequently, employees with higher levels of sustained performance over time will be paid correspondingly higher salaries. Salaries for executives are reviewed and revised annually based on a variety of factors, including individual performance (assessed in a qualitative fashion), general levels of market salary increases and the Company’s overall financial results. All salary increases are granted within a pay-for-performance framework.

Annual Incentive Plan

The Company’s annual incentive plan is intended to assist the Company in rewarding and motivating key employees, focuses strongly on Company and individual performance, and provides a fully competitive compensation package to plan participants. As a pay-for-performance plan, incentive awards are paid annually based on the achievement of performance objectives for the year. Under the plan, each plan participant is provided a range of potential annual incentive awards based on competitive award levels in the marketplace. The incentive award ranges are consistent with those provided by other companies similar in size to the Company. Actual awards paid under the plan are based on the Company’s corporate performance. Individual performance is also considered in determining actual award levels for each year, but is assessed in a non-formula fashion. The corporate annual incentive plan objective usually is earnings per share performance against plan. The specific objectives and standards under the plan are reviewed annually by the Company in order to ensure consistency with the Company’s business strategy and prevailing market conditions.

9

An annual incentive funding pool is created to pay awards achieved under the annual incentive plan. At targeted performance, the plan provides sufficient funding to pay competitive annual incentives to all plan eligible positions. However, the actual size of the annual incentive funding pool will vary based on corporate earnings per share performance. Aggregate payments under the annual incentive plan are generally limited by the size of the funding pool. Actual awards made to participants under the annual incentive plan are based on a combination of corporate and individual performance. Individual performance is assessed relative to various qualitative objectives and criteria, such as overall contribution to the Company’s success and successful implementation of business strategy.

Long-Term Incentives

The Company believes that its key employees should have an ongoing interest in the long-term success of the business. To accomplish this objective, the Company has historically provided long-term incentives to executives in the form of non-qualified stock options and grants of restricted stock.

The Company’s existing stock option plans are intended to reward participants for generating appreciation in the Company’s stock price. Stock options granted to the executive officers named in the Summary Compensation Table and certain other executives were awarded at 100% of the fair market value of the stock on the date of grant. All stock options have a term of ten years. Generally, stock option grants vest at a rate of 25% per year beginning one year after the date of grant. The exercise price is payable in cash, shares of the Company stock or some combination thereof. No option holder has any rights as a shareholder for any shares subject to an option until the exercise price has been paid and the shares are issued to the employee.

Restricted stock granted by the Compensation Committee is subject to restrictions as to transferability and conditions of forfeiture as determined by the Committee. Each grant of restricted stock is made pursuant to an agreement which specifies the restrictions thereon and the terms and conditions governing the termination of such restrictions. Shares of restricted stock granted to the chief executive officer and the president and chief operating officer as reflected in the Summary Compensation Table vest in equal one-fourth increments beginning on the first anniversary of the grant.

The Company’s overall stock option and restricted stock grant levels are established by considering market data for the Company’s stock and the number of shares reserved under the plan for grants. Individual stock option and restricted stock grants are based on the job level of each participant in the Company and individual performance. The Committee also considers the size of past stock option and restricted stock grants in determining the size of new grants.

The Compensation Committee believes that while options provide a strong alliance of the interests of management and shareholders generally, options have a limited effect in retaining qualified management personnel in periods in which market prices for publicly-traded stocks are generally volatile or decreasing. Consistent with this philosophy, the 2003 Stock Incentive Plan, an omnibus plan, provides the Compensation Committee the discretion and flexibility to customize equity-based grants in light of changing circumstances or unique situations.

The Company’s compensation plans will continue to be periodically reviewed to ensure an appropriate mix of base salary, annual incentive and long-term incentive within the philosophy of providing strongly competitive total direct compensation opportunities.

2003 Chief Executive Officer Compensation

In accordance with rules of the NASD, the compensation of the chief executive officer is determined by the Compensation Committee. Beginning in fiscal 2004, the chief executive officer will not be present during voting or deliberations with respect to his compensation. As described above, the Company compensates all executives, including the chief executive officer, based upon both a pay-for-performance philosophy and consideration of market rates of compensation for each executive position. Specific actions taken by the Compensation Committee regarding the chief executive officer’s compensation are summarized below.

10

Base Salary

Consistent with the philosophy outlined above, the base annual salary for the Company’s chief executive officer was increased to $435,000 from $410,000 effective June 1, 2003.

Annual Incentive

The annual incentive earned by the Company’s chief executive officer for 2003 performance was $340,000. This annual incentive award was based on competitive market annual incentive awards for chief executive officers in companies comparable in size to the Company, and adjusted to reflect both the chief executive officer’s performance and the Company’s growth in earnings per share against plan.

Long-Term Incentive

In fiscal 2003, the Company’s chief executive officer received an award of options to acquire 125,000 shares of stock at an exercise price of $14.50. In fiscal 2003, the Company’s chief executive officer received a grant of 69,000 shares of restricted stock.

The foregoing report is submitted by the Compensation Committee, consisting of Richard E. Cheney, Robert E. Bosworth and Philip H. Sanford.

Summary of Cash and Certain Other Compensation

The following table sets forth information for the past three fiscal years concerning compensation paid or accrued by the Company to or on behalf of the Company’s chief executive officer and the four other most highly compensated executive officers of the Company during the fiscal year ended November 30, 2003:

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | Long-Term

Compensation

| | |

Name and Principal Position

| | Fiscal Year

| | Salary

| | Bonus

| | Other Annual Compensation

| | | Restricted Stock Awards(2)

| | Securities Underlying Options Awarded

| | All Other Compensation(3)

|

| | | | | | | |

Zan Guerry Chairman of the Board and Chief Executive Officer | | 2003

2002

2001 | | $

| 418,441

400,000

382,377 | | $

| 340,000

390,000

368,607 | | $

| 668,391

—

345,913 | (1)

(1) | | $

| 1,000,500

—

496,750 | | 125,000

—

400,000 | | $

| 21,975

17,471

17,293 |

| | | | | | | |

A. Alexander Taylor II President and Chief Operating Officer | | 2003

2002

2001 | | $

| 368,441

350,000

332,055 | | $

| 300,000

340,000

313,600 | |

| —

752,065

345,913 |

(1)

(1) | |

| —

1,125,750

496,750 | | 125,000

—

260,000 | | $

| 21,486

16,986

16,093 |

| | | | | | | |

B. Derrill Pitts Vice President— Operations | | 2003

2002

2001 | | $

| 168,937

162,638

157,368 | | $

| 81,000

95,700

92,568 | |

| —

—

— |

| |

| —

—

— | | 40,000

22,000

110,000 | | $

| 8,793

7,114

6,314 |

| | | | | | | |

Donald K. Riker(4) Vice President—Research and Development and Chief Scientific Officer | | 2003

2002

2001 | | $

| 167,969

162,291

9,202 | | $

| 81,000

101,523

52,269 | |

| —

—

— |

| |

| —

—

— | | 25,000

20,000

30,000 | | $

| 9,348

1,905

— |

| | | | | | | |

Richard W. Kornhauser Vice President—Brand Management | | 2003

2002

2001 | | $

| 164,682

158,738

153,776 | | $

| 79,000

93,375

110,700 | |

| —

—

— |

| |

| —

—

— | | 40,000

36,000

30,000 | | $

| 8,049

7,140

5,956 |

11

| (1) | Represents amount reimbursed to the named executive for the payment of federal income taxes resulting from executive’s receipt of restricted stock. |

| (2) | At November 30, 2003, a total of 319,000 shares of restricted stock had been granted with an aggregate value of $5,110,380. Shares of restricted stock vest in equal one-fourth increments beginning on the first anniversary of the grant. If declared by the Board of Directors, dividends will be paid on the restricted stock, unless and until such stock is forfeited to the Company. |

| (3) | Represents annual compensation of $9,000 paid to Messrs. Guerry and Taylor for service on the Board of Directors for the 2003 fiscal year; premiums paid by the Company under life insurance policies with respect to which the named executive is entitled to a death benefit of up to $450,000 as follows for the 2003 fiscal year: Mr. Guerry—$1,042; Mr. Taylor—$837; Mr. Pitts—$975; Dr. Riker—$714; and Mr. Kornhauser—$249; and the Company’s contributions with respect to the Company’s Savings and Investment Plan for the named executive as follows for the 2003 fiscal year: Mr. Guerry—$11,933; Mr. Taylor—$11,649; Mr. Pitts—$7,818; Dr. Riker—$8,634; and Mr. Kornhauser—$7,800. |

| (4) | Dr. Riker joined the Company on November 5, 2001 as Vice President-Research and Development and Chief Scientific Officer. |

Stock Option Grants in Last Fiscal Year

The following table contains information concerning the grant of stock options to the named executive officers during the fiscal year ended November 30, 2003:

Option Grants in Last Fiscal Year

| | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable

Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

Name

| | Options Granted(1)(#)

| | Percentage of Total

Options Granted to

Employees in Fiscal Year

| | Exercise or Base Price ($/sh)

| | Expiration Date

| |

| | | | | | 5%($)

| | 10%($)

|

Zan Guerry | | 125,000 | | 15.71 | | 14.50 | | 06-29-13 | | 2,952,372 | | 4,701,158 |

A. Alexander Taylor II | | 125,000 | | 15.71 | | 14.50 | | 06-29-13 | | 2,952,372 | | 4,701,158 |

B. Derrill Pitts | | 40,000 | | 5.03 | | 14.50 | | 06-29-13 | | 944,759 | | 1,504,371 |

Donald K. Riker | | 25,000 | | 3.14 | | 14.50 | | 06-29-13 | | 590,474 | | 940,232 |

Richard W. Kornhauser | | 40,000 | | 5.03 | | 14.50 | | 06-29-13 | | 944,759 | | 1,504,371 |

| (1) | The options vest with respect to 25% of the shares subject to the options on each of the four succeeding anniversaries of the date of grant. |

12

Option Exercises and Holdings

The option exercises by the Company’s chief executive officer and the other named executive officers during the fiscal year ended November 30, 2003, as well as the number and total value of unexercised in-the-money options at November 30, 2003, are shown in the following table:

Aggregated Option Exercises in Last Fiscal Year

and Option Values at November 30, 2003

| | | | | | | | | | |

Name

| | Number of Shares Acquired On Exercise

| | Value Realized

| | Number of Unexercised Options at Nov. 30, 2003(1) Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at Nov. 30, 2003 Exercisable/Unexercisable

|

Zan Guerry | | 100,000 | | $ | 1,478,500 | | 146,000/325,000 | | $ | 1,424,410/$2,407,000 |

A. Alexander Taylor II | | 2,400 | | | 34,020 | | 87,600/255,000 | | | 971,046/1,631,050 |

B. Derrill Pitts | | 27,500 | | | 380,187 | | 5,500/111,500 | | | 8,635/696,380 |

Donald K. Riker | | 7,500 | | | 82,230 | | 12,500/55,000 | | | 69,425/184,700 |

Richard W. Kornhauser | | 12,500 | | | 175,737 | | 9,000/87,000 | | | 35,182/378,972 |

Equity Compensation Plan Information

The following table provides information about the Company’s existing equity compensation plans as of November 30, 2003:

| | | | | | | |

Plan Category

| | (A) Number of Securities

to Be Issued Upon

Exercise Of

Outstanding Options, Warrants and Rights

| | (B) Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights

| | (C) Number of Securities Remaining Available

for Future Issuance

Under Equity

Compensation Plans

(Excluding Securities

Reflected in Column (A))

|

Equity Compensation Plans Approved by Shareholders(1) | | 2,443,850 | | $ | 9.72 | | 745,166 |

Equity Compensation Plans Not Approved by Shareholders(2) | | 56,000 | | $ | 17.28 | | — |

| | |

| | | | |

|

Total | | 2,499,850 | | | | | 745,166 |

| (1) | These plans consist of (i) the 1993 Stock Option Plan, (ii) the 1994 Stock Option Plan, (iii) the 1998 Stock Option Plan, (iv) the 2000 Stock Option Plan, (v) the 2003 Stock Incentive Plan, (vi) the Director Plan, and (vii) the 1999 Director Plan. |

| (2) | The Company has granted options to purchase an aggregate of 56,000 shares of Common Stock to three employees of the Company who were hired in fiscal 2002 under stock option agreements which were not approved by the shareholders of the Company. These shares have been subtracted from the number of shares otherwise available for issuance under the 2003 Stock Incentive Plan. The stock option agreements and the options granted thereunder shall be interpreted consistent with the terms and conditions of the Company’s 2000 Stock Option Plan. The options have an exercise price equal to the closing sale price on the last business day prior to the date of grant. The options vest with respect to 25% of the shares on each of the four succeeding anniversaries of the date of grant. The options must be exercised not later than ten years from the date of grant. All options not exercised shall immediately cease and terminate 30 days after the optionee’s employment with the Company or any of its subsidiaries is terminated for any reason other than death, disability or retirement. |

13

Pension Plan

In October 2000, the Company’s Board of Directors adopted an amendment to freeze the Chattem, Inc. Pension Plan effective December 31, 2000. No new participants will be allowed to enter the Pension Plan, and current participants will not be allowed to accrue further benefits after that date.

The frozen monthly accrued benefit payable at age 65 for each of the named executive officers as of December 31, 2000 was:

| | | |

Zan Guerry | | $ | 3,429/mo. |

A. Alexander Taylor II | | $ | 889/mo. |

B. Derrill Pitts | | $ | 4,745/mo. |

Donald K. Riker | | $ | 0/mo. |

Richard W. Kornhauser | | $ | 0/mo. |

Upon retirement, benefits are calculated on the basis of a normal retirement pension to be paid during the lifetime of the participant. Benefits will be paid in the form of a Qualified Joint and Survivor Annuity or Qualified Preretirement Survivor Annuity, unless one of the following options is appropriately elected:

| | (i) | A reduced annuity benefit to be paid monthly over 5, 10 or 15 years and thereafter for the participant’s life; |

| | (ii) | A reduced annuity benefit to be paid during the participant’s life with one-half of the reduced benefit to be continued to the spouse for the spouse’s life; |

| | (iii) | A reduced annuity benefit to be paid during the participant’s life with either three-fourths of or the full-reduced benefit to be continued to the spouse for the spouse’s life; |

| | (iv) | A single lump sum payment; or |

| | (v) | A single life annuity. |

14

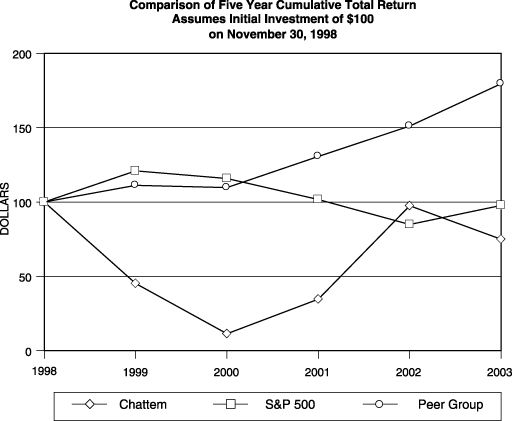

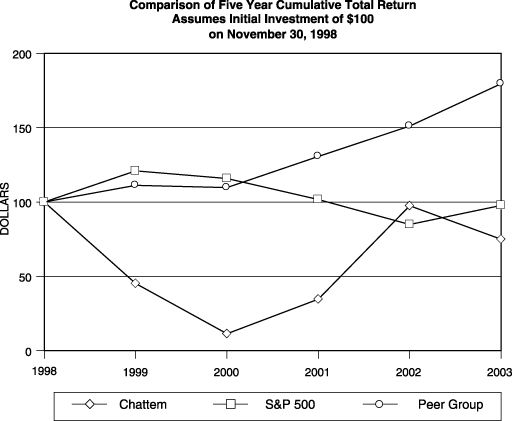

Comparative Performance by the Company

The following is a chart comparing the cumulative total return to shareholders of the Company, assuming reinvestment of dividends, for the five-year period ending at the end of the 2003 fiscal year with the return from: (i) the S&P 500 Index and (ii) a peer group of public companies engaged in either the functional toiletries, cosmetics or non-prescription drug business, for the same period. The peer group consists of the following selected comparable companies: Playtex Products Inc., Church & Dwight, Inc., Columbia Laboratories, Inc., Del Laboratories, Inc. and Alberto Culver Co. (Class B common stock).

| | | | | | | | | | | | | | | | | | |

| | | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

|

Chattem Inc. | | $ | 100 | | $ | 45.18 | | $ | 11.40 | | $ | 34.62 | | $ | 97.45 | | $ | 74.95 |

S&P 500 | | $ | 100 | | $ | 120.90 | | $ | 115.80 | | $ | 101.64 | | $ | 84.86 | | $ | 97.67 |

Peer Group | | $ | 100 | | $ | 111.18 | | $ | 109.67 | | $ | 130.61 | | $ | 151.06 | | $ | 179.52 |

Agreements With Executive Officers

The Company has entered into employment agreements with Messrs. Guerry and Taylor. Each of the employment agreements has a rolling three-year term which renews automatically each year for a new three-year term absent the election of either party to terminate the employment agreement at the end of the current three-year term. The employment agreements provide for a base salary as adjusted from time to time by the

15

Compensation Committee of the Board of Directors and the executives’ participation in the annual bonus plan and stock option plans of the Company as determined from time to time by the Compensation Committee of the Board of Directors. The employment agreements are intended to secure the long-term commitment of Messrs. Guerry and Taylor to remain in the Company’s employ and impose restrictions on competitive employment should they leave the Company’s employment for any reason. The employment agreements prohibit Messrs. Guerry and Taylor from competing with the Company with respect to existing Company brands or using confidential information for a period of 18 months after termination of employment in exchange for a monthly noncompetition payment equal to 75% of their then established base salary. Upon the early termination of the employment agreement by the Company without cause, Messrs. Guerry and Taylor would also be entitled to a liquidated damages payment in a lump sum equal to 25% of their base salary that would have been payable over the remainder of the term subject to an obligation to repay a pro rated portion of the amount if they are able to secure comparable employment during the remaining period of the term.

The Company has also entered into separate severance agreements with Messrs. Guerry and Taylor and the other executive officers of the Company, including Messrs. Pitts, Riker and Kornhauser. These severance agreements are operative only upon the occurrence of a change in control of the Company and are intended to secure continuity of management during, and an unbiased review of, any offer to acquire control of the Company and, in the case of Messrs. Pitts, Riker and Kornhauser, impose various restrictions on competitive employment should they leave the Company’s employment. Absent a change in control of the Company, the severance agreements do not require the Company to retain any executive or to pay him any specified level of compensation.

The severance agreements become operative if the employment with the Company of one of these officers is terminated or constructively discharged within two years of the occurrence of a change in control of the Company, or if the officer elects to terminate his employment during a period of 60 days following the initial six-month period after the occurrence of a change of control of the Company. If the severance agreement becomes operative, the officer will be entitled to receive a termination payment equal to 299 percent of his average annualized includable compensation from the Company, in the case of Messrs. Guerry and Taylor, and 200 percent of his average annualized includable compensation from the Company, in the case of Messrs. Pitts, Riker and Kornhauser, during the five most recently completed fiscal years and the continuation of certain Company-provided benefits. Includable compensation for purposes of calculating the severance benefit generally includes all compensation paid to the officer by the Company and will be calculated in accordance with the applicable provisions of the Internal Revenue Code.

A change of control of the Company will be deemed to occur if (i) there is a change of one-third or more of the directors of the Company within any 12-month period; (ii) there is a change of one-half or more of the directors of the Company within any 24-month period; or (iii) any person acquires ownership or the right to vote 35% or more of the Company’s outstanding voting shares.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under federal securities laws, the Company’s directors, executive officers and holders of 10% or more of the Company’s Common Stock are required to report, within specified due dates, their initial ownership in the Company’s Common Stock and all subsequent acquisitions, dispositions or other transfers of beneficial interests therein, if and to the extent reportable events occur which require reporting by such due dates. Based solely on representations and information provided to the Company by the persons required to make such filings, the Company believes that all filing requirements were complied with during the last fiscal year.

16

SHAREHOLDER COMMUNICATIONS

General

Shareholders of the Company may send communications to the Company’s Board of Directors by writing to the Board of Directors in care of the Company’s Secretary at the Company’s principal executive office address.

Shareholder Proposals

Under SEC rules, proposals from the Company’s eligible shareholders for presentation for action at the 2005 Annual Meeting of Shareholders must be received by the Company no later than November 18, 2004, in order to be considered for inclusion in the Proxy Statement and Proxy for that Annual Meeting. Any such proposals, as well as any questions relating thereto, should be directed to the Secretary of the Company at the Company’s principal executive offices.

Under the Company’s By-Laws, and as SEC rules permit, shareholders must follow certain procedures to nominate a person for election as a director at an annual or special meeting, or to introduce an item of business at an annual meeting. Under these procedures, shareholders must submit the proposed nominee or item of business by delivering a notice to the Secretary of the Company at the Company’s principal executive offices. The Company must receive notice as follows:

| | • | Normally, the Company must receive notice of a shareholder’s intention to introduce a nomination or proposed item of business for an annual meeting not less than 90 days prior to the anniversary date of the immediately preceding annual meeting of shareholders. Assuming that the Company’s 2004 Annual Meeting is held on schedule, the Company must receive notice pertaining to the 2005 Annual Meeting no later than January 14, 2005. |

| | • | However, if the Company holds the annual meeting on a date that is not within 30 days before or after such anniversary date, the Company must receive the notice no later than the close of business on the tenth day following the day on which notice of the date of the annual meeting was mailed or public disclosure of the date of the annual meeting was made, whichever first occurs. |

| | • | If the Company holds a special meeting to elect directors, the Company must receive a shareholder’s notice of intention to introduce a nomination no later than the close of business on the tenth day following the day on which notice of the date of the special meeting was mailed or public disclosure of the date of the special meeting was made, whichever first occurs. |

A notice of a proposed nomination must include certain information about the shareholder and nominee. A notice of a proposed item of business must include a description of and the reasons for bringing the proposed business to the meeting, any material interest of the shareholder in the business, and certain other information about the shareholder.

The Board and the Company’s management know of no other matters or business to be presented for consideration at the Annual Meeting. If, however, any other matters properly come before the Annual Meeting or any adjournment(s) thereof, it is the intention of the persons named in the enclosed proxy to vote such proxy in accordance with their best judgment on any such matters. The persons named in the enclosed proxy may also, if they deem it advisable, vote such proxy to adjourn the Annual Meeting from time to time.

Zan Guerry

Chairman of the Board and

Chief Executive Officer

March 5, 2004

17

EXHIBIT A

CHATTEM, INC.

AMENDED AND RESTATED AUDIT COMMITTEE CHARTER

I. PURPOSE

The primary purpose of the Audit Committee is to represent and assist the Board of Directors in fulfilling its oversight responsibility relating to: (i) the integrity of the Company’s financial statements; (ii) the financial reporting process; (iii) the Company’s systems of internal accounting and financial controls; (iv) the performance of the Company’s independent auditors and their qualifications and independence; and (v) the Company’s compliance with ethics policies and legal and regulatory requirements.

It shall be the responsibility of the Audit Committee to maintain free and open communication between the Audit Committee, the Board of Directors, the independent auditor and management of the Company. In discharging its oversight role, the Audit Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company and to engage independent counsel and other advisers as it determines necessary to carry out its duties.

II. COMPOSITION

The Audit Committee shall be comprised of three or more directors as appointed by the Board of Directors, each of whom shall be “independent”. Members of the Committee shall be considered independent as long as they (i) do not directly or indirectly accept any consulting, advisory or other compensatory fee from the Company, (ii) are not an affiliated person of the Company or any of its subsidiaries, other than in their capacity as a member of the Audit Committee, the Board of Directors, or any other Board committee, (iii) meet the independence requirements of the Nasdaq Stock Market, Inc. (“NASDAQ”), and (iv) do not own or control 20% or more of the Company’s voting securities. Furthermore, no member of the Audit Committee shall have participated in the preparation of the financial statements of the Company at any time during the three years prior to his service on the Audit Committee.

All members of the Audit Committee must have a working familiarity with basic finance and accounting practices and be able to read and understand fundamental financial statements, and the Committee shall have at least one member who has past experience in finance or accounting, requisite professional certification in accounting or other comparable experience or background which results in the member’s financial sophistication. The Board of Directors shall determine annually whether at least one member of the Audit Committee is an “audit committee financial expert,” as defined by the regulations promulgated by the Securities and Exchange Commission (“SEC”).

Audit Committee members and the Committee Chairman shall be appointed by a committee of the Board of Directors comprised solely of independent directors or a majority of independent directors of the Board of Directors meeting in executive session and shall serve at the pleasure of the Board.

III. MEETINGS

The Audit Committee shall meet at least two times annually, or more frequently as circumstances dictate. In addition, the Audit Committee shall have discussions with the independent auditor and management quarterly to review the Company’s financial statements in advance of the Company’s earnings releases. As part of its job to foster open communication, the Audit Committee shall meet at least twice a year with management and the independent auditor in separate executive sessions to discuss any matters that the Audit Committee or either of these groups believe should be discussed privately.

A-1

IV. RESPONSIBILITIES AND DUTIES

The primary responsibility of the Audit Committee is to oversee the Company’s financial reporting process on behalf of the Board of Directors and report the results of their activities to the Board. Management is responsible for the preparation, presentation, and integrity of the Company’s financial statements and for the appropriateness of the accounting principles and reporting policies that are used by the Company. The independent auditors are responsible for auditing the Company’s financial statements and for reviewing the Company’s unaudited interim financial statements.

In carrying out its responsibilities, the Audit Committee believes its policies and procedures should remain flexible, in order to best react to changing conditions and circumstances and to ensure to the Board and shareholders of the Company that the accounting and reporting practices of the Company are in accordance with all requirements and are of a high quality.

The following shall be the principal duties and responsibilities of the Audit Committee. These are set forth as a guide with the understanding that the Audit Committee may supplement them as appropriate.

(a) Oversight of Audit Process

| | 1. | The Audit Committee shall be directly responsible for the appointment, retention and termination (subject, if applicable, to shareholder ratification), compensation, and oversight of the work of the independent auditor, including resolution of disagreements between management and the auditor regarding financial reporting. |

| | 2. | The Audit Committee shall pre-approve all audit and permissible non-audit services provided by the independent auditor and shall not engage the independent auditors to perform the specific non-audit services proscribed by law or regulation. The Audit Committee may delegate pre-approval authority to a member of the Audit Committee or establish appropriate procedures to pre-approve all audit and non-audit services to be provided by the independent auditor. The decisions of any Audit Committee member to whom pre-approval authority is delegated must be presented to the full Audit Committee at its next scheduled meeting. |

| | 3. | The Audit Committee shall ensure that the independent auditor submits annually a formal written statement regarding relationships and services which may impact the objectivity and independence of the independent auditor; discuss with the independent auditor any disclosed relationships or services that may impact the objectivity and independence of the independent auditor; and take appropriate action to oversee the independence of the independent auditor. |

| | 4. | At least annually, the Audit Committee shall obtain and review a report by the independent auditors describing the firm’s internal quality control procedures and any material issues raised by the most recent internal quality control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues. |

| | 5. | The Audit Committee shall meet with the independent auditor and financial management of the Company to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof, to review such audit, including any comments or recommendations of the independent auditor. |

| | 6. | The Audit Committee shall review the internal audit function of the Company including the independence and authority of its reporting obligations, the proposed audit plans for the coming year and the coordination of such plans with the independent auditor. |

A-2

| | 7. | The Audit Committee shall provide sufficient opportunity for the independent auditor to meet with the members of the Audit Committee without members of management present. Among the items to be discussed in these meetings are the independent auditor’s evaluation of the Company’s financial and accounting personnel. |

| | 8. | Following completion of the annual audit, the Audit Committee shall review separately with management and the independent auditor any significant difficulties encountered during the course of the audit, including any restrictions on the scope of work or access to required information and the cooperation that the independent auditors received during the course of the audit. |

| | 9. | The Audit Committee shall set clear hiring policies for employees or former employees of the independent auditors that meet SEC regulations and NASDAQ listing standards. |

| | 10. | The Audit Committee shall discuss with management, the internal auditors, and the independent auditors the adequacy and effectiveness of Company’s accounting and financial controls, including the Company’s policies and procedures to assess, monitor and manage business risks, and legal and ethical compliance programs. |

| | 11. | The Audit Committee shall oversee the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit at least once every five years, and oversee the rotation of other audit partners, in accordance with the rules of the SEC. |

(b) Financial Reporting

| | 1. | The Audit Committee shall review the interim financial statements and disclosures under Management’s Discussion and Analysis of the Financial Condition and Results of Operations (“M,D&A”) with management and the independent auditors prior to the filing of the Company’s Quarterly Reports on Form 10-Q. Also, the Audit Committee shall discuss the results of the quarterly review and any other matters required to be communicated to the Audit Committee by the independent auditors under generally accepted auditing standards. The Chairman of the Committee may represent the entire Committee for purposes of this review. |

| | 2. | The Audit Committee shall review with management and the independent auditors the financial statements and disclosures under M,D&A to be included in the Company’s Annual Report on Form 10-K. Also, the Audit Committee shall discuss the results of the annual audit and any other matters required to be communicated to the Audit Committee by the independent auditors under generally accepted auditing standards. |

| | 3. | The Audit Committee shall review and discuss the type and presentation of information to be included in earnings press releases as well as financial information and earnings guidance provided to analysts and rating agencies. |

| | 4. | The Audit Committee shall discuss guidelines and policies governing the process by which management assesses and manages the integrity of the Company’s financial reporting processes, both internal and external, and disclosure controls and procedures. |

| | 5. | The Audit Committee shall inquire of management as to its assessment of the effectiveness of internal controls as of the end of the most recent fiscal year and the independent auditor’s attestation of management’s assessment (effective beginning fiscal year 2004). |

A-3

| | 6. | The Audit Committee shall: |

| | (i) | consider the independent auditor’s judgments about the quality and appropriateness (and not just acceptability) of the Company’s accounting principles and judgments as applied in its financial reporting, on both an annual and quarterly basis. |

| | (ii) | consider and recommend to the Board, if appropriate, changes to the Company’s auditing and accounting principles and practices as suggested by the independent auditor or management. |

| | (iii) | establish regular and separate systems of reporting to the Audit Committee by management and the independent auditor regarding any significant judgments made in management’s preparation of the financial statements and the view of each as to the appropriateness of such judgments. |

| | (iv) | receive regular reports from the independent auditor on the critical policies and practices of the Company, and all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management. |

| | 7. | The Audit Committee shall review with the independent auditor and the Company’s legal counsel, compliance matters and any legal or regulatory matter that could have a significant impact on the Company’s financial statements. |

| | 8. | The Audit Committee shall establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| | 9. | The Audit Committee shall report Committee actions to the Board of Directors with such recommendations as the Committee may deem appropriate. |

| | 10. | The Audit Committee shall prepare a report for inclusion in the Company’s annual proxy statement. |

| | 11. | The Audit Committee shall review and approve all transactions between the Company and officers and directors, or affiliates of officers or directors, that are not a normal part of the Company’s business. |

(c) Process Improvement

| | 1. | The Audit Committee shall inquire of the independent auditor and the Company’s financial and accounting personnel regarding the adequacy and effectiveness of the accounting and financial controls of the Company, and elicit any recommendations for the improvement of such internal control procedures for particular areas where new or more detailed controls or procedures are desirable. |

| | 2. | The Audit Committee shall review with the independent auditor and management the extent to which changes or improvements in financial or accounting practices, as approved by the Audit Committee, have been implemented. |

| | 3. | The Audit Committee shall investigate any matter brought to its attention within the scope of its duties, with the power to retain independent counsel for this purpose if, in its judgment, that is appropriate. |

A-4

| | 4. | The Audit Committee shall review activities, organizational structure and qualifications of the financial and accounting personnel of the Company. |

| | 5. | The Audit Committee shall oversee the conduct of appropriate review of all related party transactions (as defined in NASDAQ listing standards) for potential conflicts of interest situations on an ongoing basis. All such related party transactions must be approved by the Audit Committee. |

| | 6. | The Audit Committee shall annually review and assess the adequacy of this Charter, amend it as appropriate, and seek and receive Board approval of the proposed changes. |

| | 7. | The Audit Committee shall provide members of the Audit Committee with appropriate educational opportunities to assure an understanding of the business and environment in which the Company operates. |

A-5

CHATTEM, INC.

PROXY SOLICITED BY THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF SHAREHOLDERS

APRIL 14, 2004

The undersigned, having received the Notice of Annual Meeting and the Proxy Statement dated March 5, 2004, appoints ZAN GUERRY and A. ALEXANDER TAYLOR II, and each of them proxies, with full power of substitution and revocation, to represent the undersigned and to vote all shares of Chattem, Inc., which the undersigned is entitled to vote at the Annual Meeting of Shareholders to be held on April 14, 2004, at the principal executive offices, 1715 West 38th Street, Chattanooga, Tennessee 37409, at one o’clock p.m. local time, and any adjournment(s) thereof, as specified in this Proxy:

| | |

¨ FOR all nominees (exceptas marked to the contrary below) | | ¨ WITHHOLD AUTHORITY (to vote for all nominees listed below) |

INSTRUCTION: TO WITHHOLD AUTHORITY TO VOTE FOR ONE OR MORE OF THE NOMINEES, STRIKE A LINE THROUGH HIS NAME IN THE LIST BELOW:

BILL W. STACY and ZAN GUERRY

| | 2. | Ratification of Independent Auditors | |

¨ FOR ¨ AGAINST ¨ ABSTAIN

| | 3. | In their discretion the proxies are authorized to vote upon such other matters as may property come before the meeting. | |

(CONTINUED AND TO BE SIGNED ON THE OTHER SIDE)

(Continued from reverse side.)

The Board of Directors recommends affirmative votes for Items 1 and 2, andIF NO CONTRARY SPECIFICATION IS MADE, THIS PROXY WILL BE VOTED FOR ITEMS 1 AND 2.

The Board of Directors knows of no other matters that may properly be or which are likely to come or be brought before the meeting. However, if any other matters are properly brought before the meeting, the persons named in this proxy or their substitutes will vote in accordance with their best judgment on such matters.THIS PROXY SHOULD BE DATED, SIGNED BY THE SHAREHOLDER AS THE NAME APPEARS BELOW AND RETURNED PROMPTLY IN THE ENCLOSED ENVELOPE. JOINT OWNERS SHOULD EACH SIGN PERSONALLY, AND TRUSTEES AND OTHERS SIGNING IN A REPRESENTATIVE CAPACITY SHOULD INDICATE THE CAPACITY IN WHICH THEY SIGN.

| | |

| | | Dated:__________________________________________ |

| |

| | |

Signature of Shareholder |

| |

| | |

Signature of Shareholder |

| |

| | | PLEASE SIGN, DATE AND AND PROMPTLY RETURN IN THE ACCOMPANYING ENVELOPE—NO POSTAGE REQUIRED. |