UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 1-K

[X] ANNUAL REPORT PURSUANT TO REGULATION A

TV CHANNELS NETWORK INC.

(Exact Name of the Registrant as Specified in its Charter)

Nevada |

| 88-3851932 |

(State or Other Jurisdiction of Incorporation or Organization) |

| (IRS Employer Identification No.) |

7582 Law Vegas Blvd. South

Las Vegas, Nevada 89123

(Address of Principal Executive Offices and Zip Code)

702-721-9915

(Registrant's Telephone Number, Including Area Code)

ITEM 1.DESCRIPTION OF BUSINESS

Our Business

The Company was incorporated on August 12, 2022, in the State of Nevada. Since incorporation, the Company has not made any significant purchases or sales of assets. From inception until the date of this filing the Company has had limited operating activities, primarily consisting of (i) the incorporation of the company, (ii) the development of the business plan, (iii) initial equity funding, (iv) the performance of due diligence on potential suppliers of online content, and (v) beginning to develop strategic referral partnerships with investment newsletters and websites catering to our target market. Darryl Payne acquired 1,666,666 shares of our common stock with a par value of $0.001 per share in return for the Company’s initial funding, and goodwill consideration in the form of office space, access to internet and telephone service, access to its network of contacts and professional relationships.

TV Channels Network Inc. is a Nevada-based music and entertainment technology company whose primary business is the providing of streaming entertainment content. The Company goal is to become a major entertainment content provider.

The Company’s business plan is to seek to acquire many rights for ownership including:

·Streaming Services

·Movie and Film Libraries,

·Original and Exclusive Content

·Live Linear TV Network Licensing

·Streaming Exclusive Live Pay Per View Events

·Purchase of Music Rights

·Signing New Recording Artists

·TV Show Rights

·Professional Wrestling & Sports Companies

2

USA STREAMING RIGHTS LICENSED TO TV Channels Network Inc

1.The Legends of Classic Soul Concert Series, AS SEEN ON NATIONAL TV. The Legends of Classic Soul concert series features 20 soul groups on our own unique streaming video on demand pay per view platform. Featured artist includes The Four Tops, The Whispers, The Dells, Main Ingredient featuring Cuba Gooding Sr, Harold Melvin’s Blue Notes, Chi-lites, The Delfonics, Blue Magic, Ray, Goodman, & Brown, Enchantment, The Temptations Review featuring Dennis Edwards, The Dramatics, Confunkshun, Atlantic Starr, Slave, The Floaters, Coasters, and Melba Moore featuring Freddie Jackson.

3

2.The PBS On Tour Concert Series. These iconic performances aired fifty-two one hour shows in 1997. The PBS TV Show featured each artist performing 3 songs. Sting, Meatloaf, Ozzy Osbourne, Lenny Kravitz, Busta Rhymes, Lou Reed, The Cure, Devo, Hot Tuna, Dennis Brown, Freda Payne, Joan Osbourne, Goo Goo Dolls, Bruce Hornsby, Indigo Girls, Smashing Pumpkins, A Tribe Called Quest, Tears for Fears, The Fugees and Cypress Hill are some of the many artists in this iconic series.

All cleared content will be monetized on the Company’s HD Streaming platform which is already completed. Some of the concerts recorded used as many as 22 cameras for each show. Several of these performances were recorded in 3D. Many titles will be offered to worldwide fans.

Fifty-Two On Tour Shows can be made available for TV in their original show configuration. The Company intends to offer all the artists revenue-sharing deals if they sign a new current contract with our company. The goal is to also release separate full-length concerts of each artist. The Company has talked to many of these artists with positive feedback. These concerts were never commercially available or seen as full length shows from each separate artist.”

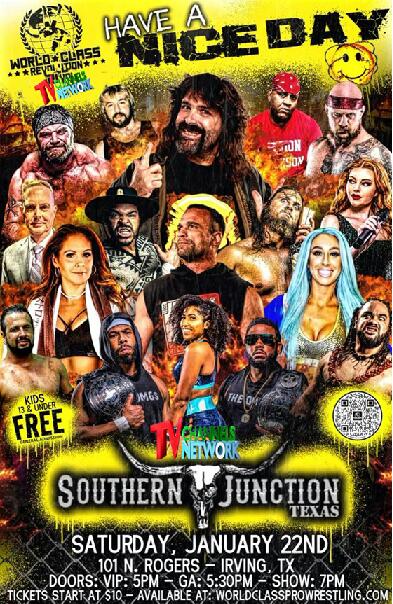

3.Wrestling. We are a financial partner in World Class Pro Wrestling and Lone Star Wrestling WAW. World Class Pro Wrestling and Lone Star Wrestling WAW have scheduled various live events this year. All the wresting events will be available streaming on TV Channels Network, Inc.’s streaming service.

4

5

6

The Company has rights to anywhere from 50 to 100 Radio Shows that were produced in conjunction of broadcast TV series. All the video concerts and radio shows will be made available for license to third-party companies.

1.10,000 Audio Songs of Various Artists. Including Pop, Dance, Jazz, Blues, Country, R & B, Classic Soul, and Rock & Roll. Many popular names complete this listing.

2.TV Channels Network Inc. has approximately 20 acquisition deals to close, upon the full completion of funding.

In addition, the Company intends to acquire additional rights to video and audio performances. The Company shall seek third party license deals whereas the Company will receive advance payments upfront upon signing a deal.

7

We are in an age where technology and entertainment merge to deliver the thrill of the front row seat to the hand-held device, or to the ultra-high-definition experience delivered from today’s television screen. Creation and distribution models struggle to adapt to the challenging global environment, and the complex interplay social media now has on the consuming public.

The Company intends to build upon its Officer’s direct relationships with legendary performers and event production partners, and through the bridge of technology, intends to deliver cross-platform interaction to expand reach while improving the creator and consumer value model.

Through a vision that respects the artist creation process and sees the growth of an engaged social audience, the Company intends to introduce new operations that build upon niche opportunities. Artistic relationships and media distribution acquisitions can broaden the company’s operations.

The Company recently completed its Streaming Media Pay Per View Platform. Through this platform, all the Company’s video content will be available for consumers to stream.

Event, Artist Production and Licensing.

The Company will seek to work with new artists and legendary artists at our recording facility. The goal is to invest in the development and promotion of live events, leveraging our strength in media distribution across all platforms. To become a premier management company. The Company intends to apply cutting edge video quality distribution methods and social media applications to expand market awareness. The Company will seek to introduce interactive marketing and grow strong continuous revenues.

Broadcast, Radio and Internet Media Operations.

Consistent with the Company’s mission to connect disparate distribution platforms. The Company with “Best of Breed’’ cloud infrastructure and software solutions intend to build upon broadcast partnerships and acquisitions to create a unified distribution business. Consumers will be given choices. Improving on the retail offerings of services like Spotify, YouTube, iTunes, Disney and Netflix, the Company’s platform provides owners and artists more transparent control over their intellectual property.

Rights Acquisition, Management, and Channel Integration.

The Company is committed to innovative Rights Management that recognizes the value of the artist and provides a preferred integrated channel distribution model for Creators in virtually all media and IP investors. Building upon a catalog of concerts, songs, and TV shows, the Company intends to manage around 5,000 titles by the end of 2024.

Capitalizing on the consolidation of extensive managed properties, the Company maintains a roster of legendary artist relationships. The Company is positioned to gain existing significant opportunities across the entertainment landscape. Our technology operations embrace cloud-based solutions for Audio/Video distribution and provide greater supply chain visibility and flexibility. The Company intends to seek to grow new fresh business units across numerous media channels.

Direct Response TV:

Unlimited channels will be created on our Pay Per View Subscription Platforms. The Company will advertise and buy media on TV to sell our content.

Legends of Classic Soul (www.LegendsOfClassicSoul.com). This series has generated substantial credit card sales on TV. The average consumer order for the DVD Box Sets is $199.00 per order. Legends of Classic Soul Concerts were all recorded in HD with great sound. Sadly, many of these legends have passed away since this series first started filming in 2005.

8

Live Video Concerts. The Company plans to offer its customers full-length, pre-recorded video of concerts by various artists in dance music, R&B/Urban, and other genres. These live concerts will be available through the Company’s video on-demand streaming channel via the Company’s website.

Business Model

The Company’s primary business is to develop and market world-class entertainment content, including but not limited to full-length concerts, movies, and television shows. This will be accomplished by aggressive deployment and branding of the Company’s state-of-the-art technologies to bring superior, cost-effective solutions to consumers in need of these services.

Through the Company’s web site, customers will be offered designated services. These services are transactional in nature with add-on options based on the sender’s requirements. Options are priced to increase the overall amount per transaction whereby the overall margin is significantly increased.

By being a web-based business, our business model is based on volume. Through automation of transactions inherent in the technologies employed, the low cost of transactions maintains a high gross margin. Our business can run 24 hours a day, seven days a week with the minimal staff needed to operate the business. Most business activities are automated, which greatly reduces the related overhead and staffing components associated with similar, conventional business formats.

The Company’s corporate development is focused on its core business and is structured to accomplish its initial business objectives over a three-year period. The Company has defined seven business divisions: systems operations and management; information technologies; sales and marketing; customer service; service development; business development; and general administration. Additional revenue streams will be added as new products and services are proven to be viable and are integrated into the network.

The Company also intends to devote resources to developing a consumer market with new specific services designed for the consumer, home-based businesses, and small business owners.

The key to the Company’s business growth strategy is customer acquisition. The Company’s initial operations are based in the United States. Being an Internet-based business, technical operations can be maintained separately from corporate operations. This will all be aligned with the Company’s basic financial philosophy of controlling costs as sales revenue grows through the expansion of the web site operations.

The Company will focus on the core business over the first three years to establish a significant market share in multiple industry segments. Other products and services may be implemented after proper feasibility, cost analysis and in-depth market and customer research.

Marketing

Marketing Strategy

The marketing strategy is simple and direct.

·Consumers will be marketed through the internet, magazines, and other electronic and print media.

·Targeted groups will be marketed by the branding of our name and logo through specific media channels focused on direct marketing campaigns, electronic media, trade shows, industry publications, newspapers, and other industry specific events, as well as traditional distribution channels.

9

Web Site and Internet Presence

The Company’s Web Sites https://tvchannelsnetwork.com/ will function as a main marketing tool (beyond its obvious function of conducting the business for products and services). These sites will act as a hub for the business and are international in scope. The sites will offer customers ease of use, clear and simple navigation, security, and prompt response to transactions.

The websites will also feature sections for promotions and joint venture and cross-branding marketing campaigns with partners. The web sites will function 24/7 and be a customer service portal. Being that the web site is the business, and customer impression is made through its pages, strict attention to detail, communicative proposition, and graphic design are critical. Additionally, drawing attention to the green benefits of the product will stimulate environmentally concerned consumers.

Smart Phone, Tablet, and Mobile Applications

These applications are critical to the future of the Company. There will be a large user base that will use our services strictly through their mobile devices. These applications are significant in that they fit with the growing trend of mobile users who demand synchronization of services (with their account) with multiple digital devices. This is especially true with business users who no longer work from physical offices and are part of the new virtual business economy.

Even more significant is we will be able to develop users and customers who use multiple communications platforms and networks outside of our web based and internet services.

Social Media and Business Networks

The impact of social networks (Instagram, Facebook, Snapchat, and Google) and business networks (LinkedIn, Salesforce) in today’s communications is huge. The Company’s ability as a communication utility to these networks represents hundreds of millions of users globally. Through the development of applications specifically for these networks, the Company will be able to cross platform its services into consumer and business user awareness.

The marketing on these networks is just one avenue to acquire users, but by combining the Company’s network specific applications to the process, this creates a whole new user dynamic. When you include components of music, media, and video to the delivery options of these users (private, secure, and verified delivery) by a “trusted third party” only goes to strengthen our brand recognition.

Direct Sales

The Company will engage industry specific national sales and marketing groups to promote its products and services. Corporate discounts and promotions will be instituted to target business customers and consumers.

Media Exposure

The Company will also develop national and international marketing campaigns through trade magazines, trade shows, articles, press releases, contracted public relations, a concise advertising campaign to generate brand awareness and impressions, electronic and print vehicles, and other media venues and events.

Our major competitors include such diverse companies as Amazon Prime, Hulu, DIRECTV Now, Live Nation, Clear Channel, and Netflix, among others. Many of our competitors have much larger customer bases and financial resources than TV Channels Network Inc.

10

Employees

As of the date of this offering circular, the Company has one (2) full-time employees and no (0) part-time employees, and approximately twenty (11) professionals on a contract basis. In order to manage the Company’s treasury, the Company does intend to pay full salaries to its executives and management as funding of this offering comes in. (See “Executive Compensation”).

Contact

The Company can be reached at 7582 Las Vegas Blvd. South, Las Vegas, Nevada 89123.

Legal Proceedings

The Company is not a party to any material legal proceedings and is not aware of any material threatened litigation.

Our corporate office is rented office space located at 7582 Law Vegas Blvd South, Las Vegas, NV 89123.

ITEM 2.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of our operations together with our consolidated financial statements and the notes thereto appearing elsewhere in this Offering Circular. This discussion contains forward-looking statements reflecting our current expectations, whose actual outcomes involve risks and uncertainties. Actual results and the timing of events may differ materially from those stated in or implied by these forward-looking statements due to a number of factors, including those discussed in the sections entitled “Risk Factors”, “Cautionary Statement Regarding Forward-Looking Statements” and elsewhere in this Offering Circular. Please see the notes to our Financial Statements for information about our Critical Accounting Policies and Recently Issued Accounting Pronouncements

Results of Operations

Revenues

As of December 31, 2023, the Company has no revenue.

Cost of Services

As of December 31, 2023, the Company has no revenue.

General and Administrative Expenses

Our operating expenses from inception on August 12, 2022, until December 31, 2023, has been $522.00.

Liquidity and Capital Resources

As of December 31, 2023, the Company had approximately $578.00 in total assets, of which $500.00 is in software under development.

11

The Company has enough capital to last up to and through the offering, to sustain its current operations. The Company has no bank lines or other financing arranged. We believe that the proceeds from the offering, together with our cash and cash equivalent balances will be adequate to meet our liquidity and capital expenditure requirements for the next 36 months. We anticipate that we will need at least $20,000,000 to attain significant business growth. In the future, we may need to seek additional capital, potentially through, bonds, or convertible notes to fund our plan of operations.

PLAN OF OPERATION FOR THE NEXT TWELVE MONTHS

See “DESCRIPTION OF BUSINESS” in Form 1-A:

Insurance

The Company does not currently have, nor does it contemplate purchasing any liability or other insurance in the near-term future.

Employee Benefit Plan and Medical and Health Insurance

Upon commencement of revenue-producing operations, or shortly thereafter, the Company expects to implement an Employee Benefit Plan and medical and health insurance for each officer that is competitive with industry standards.

Key Man Insurance

The Company does not hold “Key Man” life insurance on any of its officers and directors. However, the Company is currently considering key man life insurance on each of its officers upon the closing of the Offering Circular described herein or shortly thereafter.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, revenues, results of operations, liquidity, or capital expenditures.

CONTRACTUAL OBLIGATIONS

Quantitative and Qualitative Disclosures about Market Risk

In the ordinary course of our business, we are not exposed to market risk of the sort that may arise from changes in interest rates or foreign currency exchange rates, or that may otherwise arise from transactions in derivatives.

The preparation of financial statements in conformity with GAAP requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The Company’s significant estimates and assumptions include the fair value of the Company’s common stock, stock-based compensation, the recoverability and useful lives of long-lived assets, and the valuation allowance relating to the Company’s deferred tax assets.

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company, but which will only be resolved when one or more future events occur or fail to occur. The Company’s management, in consultation with its legal counsel as appropriate, assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company, in

12

consultation with legal counsel, evaluates the perceived merits of any legal proceedings or unasserted claims, as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates a potentially material loss contingency is not probable, but is reasonably possible, or is probable, but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss, if determinable and material, would be disclosed. Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

ITEM 3. DIRECTORS AND OFFICERS

The following sets forth certain information with respect to executive officers, directors, key employees and advisors of, TV Channels Network Inc. as of the date of this Offering Circular:

NAME |

| POSITION |

|

|

|

Darryl Payne |

| Chief Executive Officer and Director |

Steven George |

| CFO and Director |

Daryll Johnson |

| Director |

|

|

|

Significant employees: |

|

|

|

|

|

|

|

|

Biography of The Board Members

Darryl Payne – CEO

Multiple Billboard Number 1 Music Producer Darryl Payne has produced over 4000 separate releases, throughout his 46-year career. Dance Music & R&B/Urban Music is his favorite music to produce. Darryl started in the music business when he was 16 years old in 1976.

Warner Brothers, EMI, Sony/BMG, Universal, and Virgin are some of the music labels to have released his music. He has been awarded various Gold Records and Billboard Number One Producer Awards. Darryl Payne was also enshrined into The Legends Of Vinyl in 2019.

Darryl Payne has released over 500 albums on music labels he owns. He created and produced The Legends of Classic Soul features concerts by The Four Tops, The Chi-Lites, The Whispers, The Dells, The Dramatics, Harold Melvin’s Blue Notes, Temptations Review featuring Dennis Edwards, The Delfonics, and many more. Time Life sells the Legends of Soul on Home Video.

Darryl is pleased to have secured direct vending agreements with Disney, ABC, CBS/Viacom, E Entertainment, Fox, and others. TV Channels Network Inc, steaming service is his newest venture. Mr. Payne has accumulated an extensive library of more than 40,000 masters, live concerts, and television shows, featuring the world’s biggest entertainers. His catalogs are used by music companies and television networks that reach into millions of homes. Home – Darryl Payne Multiple Billboard number 1 Music Producer Awards DarrylPayneLegend.com

Steven George – Director

Mr. George has worked with CEO Darryl Payne in various companies. These companies include The Legends of Classic Soul & StreamWorld Entertainment. Award-winning, results driven, Senior Sales and Client Engagement Executive, Mr. George is known for driving business growth, and exceeding sales goals. He spent 20+ years of consultative sales and account management experience as an OnAir Radio Personality on IHeartMedia Radio.

13

Daryll Johnson - Director

Mr. Johnson has worked with CEO Darryl Payne for the StreamWorld Entertainment music label. Mr. Johnson has worked with various recording artists on the StreamWorld Entertainment Music label. He has also helped promote TV Channels Network wrestling brands to many people. His leadership skills are very good.

Family Relationships

None.

Involvement in Certain Legal Proceedings.

None of the following events have occurred during the past five years and which are material to an evaluation of the ability or integrity of any director or executive officer: (1) A petition under the federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing; or (2) Such person was convicted in a criminal proceeding (excluding traffic violations and other minor offenses).

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth all cash compensation to be paid by the Company as this offering is funded, and the activities of the Company grow:

Name of Individual |

| Position with Company |

| Annual Salary |

|

|

|

|

|

Darryl Payne |

| Chief Executive Officer |

| $3,000,000 |

Footnotes to Executive Compensation:

1.The salaries listed are estimates only. The listed salaries do not include annual bonuses to be paid based on the profitability and performance of the Company. These bonuses will be set, from time to time, by the Board of Directors. The annual salary for Darryl Payne does not include the $400,000 he will receive as deferred compensation from the offering proceeds for work performed since inception of the Company to the date of this offering.

2.Management’s salary will be based upon the performance of the Company. Management’s performance bonuses will be decided by a disinterested majority of the Board of Directors of the Company. In addition, management’s base salaries can be increased by the Board of Directors of the Company based on the attainment of financial and other performance guidelines set by the Company.

3.Members of the Company’s Board of Directors will serve until the next annual meeting of the stockholders and until their successors are duly elected and qualified unless earlier removed as provided in the Bylaws of the Company. Executive officers serve at the pleasure of the Board of Directors.

4.The above-named executives have agreed to defer partial payment of salaries based on the cash flow and financial performance of the Company. Salaries will not be paid until after funding of the Company is fully complete.

14

Board Leadership Structure and Risk Oversight

The Board of Directors oversees our business and considers the risks associated with our business strategy and decisions. The board currently implements its risk oversight function as a whole. Each of the board committees, when established, will also provide risk oversight in respect of its areas of concentration and reports material risks to the board for further consideration.

ITEM 4. SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS

The following table sets out, as of the date of this Offering Circular, the securities of the company that are owned by executive officers and directors, and other persons holding more than 10% of the company’s voting securities or having the right to acquire those securities.

Title of Class | Name of Beneficial Owner (1) | Amount and Nature of Beneficial Ownership | Amount and Nature of Beneficial Ownership Acquirable | Percent of Class |

Common Stock | Darryl Payne | 30,000,000 | N/A | 79% |

Notes to Principal Shareholders:

1.The post offer percentage of class is assuming that the maximum number of shares of common stock will be subscribed to. The total amount of shares outstanding after a maximum offering will be 52,880,000 shares of common stock.

2.Darryl Payne, Directors and Founder, controls 30,000,000 of the 37,880,000 (79.00%) issued and outstanding shares of common stock of the Company prior to the offering. After the maximum offering, Darryl Payne will control approximately 56.73%.

Stock Option Plan

The Company currently does not have a formal employee stock option plan. However, the Company’s Board of Directors may institute a formal stock option plan upon the successful conclusion of the offering. The Company will not grant options and warrants in excess of 15% of the total number of outstanding shares to officers, directors, employees or 5% shareholders for a one-year period following the offering. Furthermore, the Company will not issue options or warrants to the listed persons with an exercise price of less than 85% of the fair market value of the Common Stock on the date of the grant.

Legal Matters

There is no current or pending litigation, claims or counterclaims involving the Company as a Plaintiff or a Defendant.

ITEM 5 INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS

To the best of our knowledge, from, other than as set forth above, there were no material transactions, or series of similar transactions, or any currently proposed transactions, or series of similar transactions, to which we were or are to be a party, in which the amount involved exceeds $120,000, and in which any director or executive officer, or any security holder who is known by us to own of record or beneficially more than 5% of any class of our Common Stock, or any member of the immediate family of any of the foregoing persons, has an interest (other than compensation to our officers and directors in the ordinary course of business).

ITEM 6. OTHER INFORMATION

N/A

15

ITEM 7. FINANCIAL STATEMENTS

Report of Independent Registered Public Accounting Firm

To the members of TV Channels Network Inc.

Opinion on the Financial Statements

We have audited the accompanying Balance Sheet of TV Channels Network Inc (the “Company”) as of December 31, 2023, the related Statement of Operations and Comprehensive Income (Loss), Statement of Cash Flow and Statements of Shareholders’ Equity, for fiscal year in the period ended December 31, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023, and the results of its operations and its cash flows for the fiscal year in the period ended December 31, 2023, in conformity with Generally Accepted Accounting Principles of United States of America

(“US GAAP”).

The financials statements of the Company for the fiscal year ended December 31,2022 were audited by another auditor whose report dated May 3, 2023, expressed an unqualified opinion on those financial statements. The report stated is on the financials statement prior to the adjustments as discussed in Note 2.10 Restatement of previously issued Financial Statements. We audited the adjustments as described in Note 2.10 Restatement of previously issued Financial Statements that were applied to restate the 2022 financial statements. In our opinion such adjustments have been properly applied.

Matters related to Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, if the Company is unable to raise funds to alleviate liquidity needs, it may be required to reduce the scope of its planned development. The Company has a limited operating history, and its continued growth is dependent upon the start of selling its services; hence generating revenues and obtaining additional financing to fund future obligations and pay liabilities arising from normal business operations. These matters raise substantial doubt about the Company’s ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 3 to the Financial Statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Responsibilities of the Management for the Financial Statements

These financial Statements are the responsibility of the Company’s management. In preparing the financial Statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the applicable rules and regulations of the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The company is not required to have, nor we have engaged to perform, an audit of its internal control over financial reporting.

As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

16

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to those charged with governance and that:

(1) relate to accounts or disclosures that are material to the financial statements and

(2) involved our especially challenging, subjective, or complex judgments.

We determined that there are no critical audit matters.

/s/ Suri & Co., Chartered Accountants

Suri & Co., Chartered Accountants

Mumbai, India

29th April 2024

17

TV Channels Network Inc.

As of December 31, 2023 and restated 2022

|

|

|

|

| 2023 |

| 2022 | ||

ASSETS |

|

|

|

|

|

|

|

| |

CURRENT ASSETS |

|

|

|

|

|

|

|

| |

| Cash and cash equivalents |

|

|

| $ | 374 |

| $ | 78 |

TOTAL CURRENT ASSETS |

|

|

| $ | 374 |

| $ | 78 | |

|

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS |

|

|

|

|

|

|

|

| |

| Software (Under Development) |

|

|

| $ | - |

| $ | 500 |

TOTAL NON-CURRENT ASSETS |

|

|

| $ | - |

| $ | 500 | |

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

|

| $ | 374 |

| $ | 578 | |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

| |

LIABILITIES |

|

|

|

|

|

|

|

| |

CURRENT LIABILTITIES |

|

|

|

|

|

|

|

| |

| Accounts Payable |

|

|

| $ | 8,574 |

| $ | 1,025 |

TOTAL CURRENT LIABILITIES |

|

|

| $ | 8,574 |

| $ | 1,025 | |

|

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES |

|

|

|

| - |

|

| - | |

TOTAL LIABILITIES |

|

|

| $ | 8,574 |

| $ | 1,025 | |

|

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

| |

| Shareholders’ Contribution |

|

|

|

| - |

|

| - |

| Capital |

|

|

| $ | 1,100 |

| $ | 1,100 |

| Accumulated Surplus/(Deficit) |

|

|

|

| (9,300) |

|

| (1,547) |

TOTAL EQUITY |

|

|

| $ | (8,200) |

| $ | (447) | |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

|

| $ | 374 |

| $ | 578 | ||

THE ACCOMPANYING NOTES (1 TO 7) ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS

18

TV Channels Network Inc.

Statement of Operations and Comprehensive Income (Loss)

For the Years Ended December 31, 2023 and restated 2022

|

|

|

|

|

| 2023 |

| 2022 | ||

REVENUES |

|

|

|

|

|

|

|

| ||

TOTAL REVENUES |

|

|

| $ | - |

| $ | - | ||

|

|

|

|

|

|

|

|

|

|

|

GENERAL AND ADMINISTRATIVE EXPENSES |

| $ | 7,253 |

| $ | 1,547 | ||||

|

|

|

|

|

|

|

|

|

|

|

OPERATING LOSS |

|

|

| $ | (7,253) |

| $ | (1,547) | ||

|

|

|

|

|

|

|

|

|

|

|

OTHER EXPENSES |

|

|

|

|

|

|

|

| ||

| Impairment Loss |

|

|

| $ | 500 |

| $ | - | |

TOTAL OTHER EXPENSES |

|

| $ | 500 |

| $ | - | |||

|

|

|

|

|

|

|

|

|

|

|

NET LOSS |

|

|

|

| $ | (7,753) |

| $ | (1,547) | |

THE ACCOMPANYING NOTES (1 TO 7) ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS

19

TV Channels Network Inc.

Statement of Changes in Equity

As of December 31, 2023 and restated 2022

|

|

|

| Common Shares | Additional Paid In Capital | Accumulated Surplus/(Deficit) | Equity Balance |

Equity Opening Balance as of August 2022 | - | - | - | - | |||

Shares Issued During the Period |

| - | 1,100 | - | 1,100 | ||

Net Loss as of December 31, 2022 |

|

|

| (1,547) | (447) | ||

Equity Opening Balance as of January 1, 2023 | - | 1,100 | (1,547) | (447) | |||

Shares Issued During the Period |

| - | - | - | - | ||

Net Loss as of December 31, 2023 |

| - | - | (7,753) | (8,200) | ||

Equity Ending Balance as of December 31, 2023 | - | 1,100 | (9,300) | (8,200) | |||

THE ACCOMPANYING NOTES (1 TO 7) ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS

20

TV Channels Network Inc.

For the Years Ended December 31, 2023 and restated 2022

|

|

|

|

|

|

| 2023 |

| 2022 | ||

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

| ||

Net Income (Loss) |

|

|

|

|

| $ | (7,753) |

| $ | (1,547) | |

|

|

|

|

|

|

|

|

|

| ||

Impairment Loss |

|

|

|

|

|

| 500 |

|

| - | |

Changes in operating assets and liabilities |

|

|

|

| 7,549 |

|

| 1,025 | |||

Net cash (used in)/provided by operating activities |

|

|

|

| 296 |

|

| (522) | |||

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

| ||

Software (Under Development) |

|

|

|

|

| - |

|

| (500) | ||

Net cash used by investing activities |

|

|

|

| - |

|

| (500) | |||

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

| ||

Additional Paid In Capital |

|

|

|

|

| - |

|

| 1,100 | ||

Net cash provided by financing activities |

|

|

| - |

|

| 1,100 | ||||

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH INCREASE (DECREASE) FOR THE PERIOD |

|

| 296 |

|

| 78 | |||||

Cash at the beginning of the period |

|

|

|

| 78 |

|

| - | |||

CASH AT END OF PERIOD |

|

|

|

| $ | 374 |

| $ | 78 | ||

THE ACCOMPANYING NOTES (1 TO 7) ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS

21

TV Channels Network Inc.

Notes to the Financial Statements

As of December 31, 2023 and restated December 31, 2022

1.DESCRIPTION OF THE BUSINESS

TV Channels Network Inc. (The company) was established in August 2022 in Nevada.

TV Channels Network basic service is FREE. Users can sign up now to watch various movies. Agreements are currently signed to offer subscribers 350 National Live TV Cable Channels and around 40,000 movie titles once funding is completed. Live TV Channels will be offered as an up-sell to users. Top-tier films from major studios will be available on the platform once funding needs are met. Plus, TV Channels Network intends to become the first streaming service to offer subscribers 100 Video Music Concert Channels. The Video on Demand Pay Per View side of the streaming platform is already built out. The Legends of Classic Soul concerts will be available as Pay Per View events. The Legends of Classic Soul features concerts by The Four Tops, The Chi-Lites, The Dramatics, The Whispers, The Dells, The Manhattans, Harold Melvin’s Blue Notes, The Main Ingredient featuring Cuba Gooding, The Temptations Review featuring Dennis Edwards, and many more additional R&B groups.

TV Channels Network intends to feature many rock and rap legends from PBS On Tour Concert series. On Tour recorded an unprecedented historic 151 artists live in concert in 1997 on video. Full length concerts were recorded on Sting, Meatloaf, Ozzy Osbourne, Lenny Kravitz, Busta Rhymes, Lou Reed, The Cure, Devo, Hot Tuna, Dennis Brown, Bad Religion, Joan Osborne, Goo Goo Dolls, Bruce Hornsby, Indigo Girls, Smashing Pumpkins, No Doubt, Common Sense, Vic Chestnutt, White Zombie, Big Mountain, A Tribe Called Quest, Tears For Fears, The Fugees and Cypress Hill are some of the many artists in this legendary concert series. TV Channels Network’s goal is to enter new current revenue sharing agreements with every artist in this series once funding is completed.

TV Channels Network helps fund and is a partner of World Class Pro Wrestling. World Class Pro Wrestling promotes live monthly events which sometimes features various former and current WWE & AWE wrestlers. Subscribers have full access to watch all the exciting wrestling action right now on TV Channels Network - TV Channels Network.

TV Channels Network plans to compete with Amazon Prime Video, Apple’s Streaming Service, Disney+, HBO Max, Hulu, Peacock, Paramount Plus, Discovery, Netflix, YouTube, and others on the AVOD/TVOD (Streaming Video on Demand) market. In addition, the company intends to offer more affordable subscription prices. Access to Pay Per View Live Concert Events will be the first of its kind. TV Channels Network custom apps will be available on many devices.

TVCN service will include Dynamic Ad Insertion. This will allow our company to generate revenue by inserting ads into live linear programming and video on demand content. The plan is to gain viewers with various marketing and social media campaigns.

2.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

2.1.Basis of Presentation

The Company has earned no revenues from limited principal operations. Accordingly, the Company’s activities have been accounted for as those of a “Development Stage Enterprise” as set forth in Financial Accounting Standards Board Statement No. 7 (“SFAS 7”). Among the disclosures required by SFAS 7 are that the Company’s financial statements be identified as those of a development stage company and that the statements of operations, shareholders equity (deficit), and cash flows disclose activity since the date of the Company’s inception. The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States.

2.2.Use of Estimates

The preparation of financial statements in conformity with the U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure

22

of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Management evaluates the estimates and assumptions based on historical experience and believes those estimates and assumptions are reasonable based on the information available to them.

2.3.Reclassifications

Certain reclassifications have been made to the 2022 presentation to make them consistent with 2023.

2.4.Cash

The Company considers all short-term highly liquid investments with an original maturity date of purchase of three months or less to be cash equivalents.

2.5.Software

The Company is developing a website that manages the library of the movies and the customer subscriptions, any amount paid toward the development of the website is capitalized. During 2023, the software is tested for impairment and is carried at cost less impairment loss.

2.6.Fair value of financial instruments

We value our financial assets and liabilities on a recurring basis using the fair value hierarchy established in Accounting Standards Codification (“ASC”) 820, Fair Value Measurements and Disclosures.

ASC 820 describes three levels of inputs that may be used to measure fair value, as follows:

Level 1 input, which include quoted prices in active markets for identical assets or liabilities;

Level 2 inputs, which include observable inputs other than Level 1 inputs, such as quoted prices for similar assets or liabilities; quoted prices for identical or similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the asset or liability; and

Level 3 inputs, which include unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the underlying asset or liability. Level 3 assets and liabilities include those whose fair value measurements are determined using pricing models, discounted cash flow methodologies or similar valuation techniques, as well as significant management judgment or estimation.

2.7.Income Taxes

The Company’s income tax benefit differs from the expected income tax benefit by applying the U.S. Federal statutory rate of 21% to net income (loss) as follows:

Deferred Tax has not been recognized by the company since the company has not yet started operations and hence realizability is assessed as NIL.

2.8.Recently Issued and Adopted Accounting Standards

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board or other standard setting bodies that may have an impact on the Company’s accounting and reporting. The Company believes that such recently issued accounting pronouncements and other authoritative guidance for which the effective date is in the future either will not have an impact on its accounting or reporting or that such impact will not be material to its financial position, results of operations, and cash flows when implemented.

23

2.9.General and Administrative Expenses

The following table sets forth total operating expenses for the years ended December 31, 2023, and December 31, 2022:

|

| Years Ended December 31, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

Auditing Expense |

| $ | 5,000 |

|

| $ | - |

|

Insurance Expense |

|

| 1,122 |

|

|

| - |

|

Legal Fees |

|

| - |

|

|

| 63 |

|

Business Registration Fees |

|

| 922.50 |

|

|

| 1,025 |

|

Meals and Entertainment |

|

| 28 |

|

|

| - |

|

General and Administrative Fees |

|

| 180.50 |

|

|

| 459 |

|

Total General and Administrative Expenses |

| $ | 7,253 |

|

| $ | 1,547 |

|

2.10.Restatement of Previously Issued Financial Statements

During the course of the Independent Audit of the Company’s fiscal year December 31, 2023 along with already audited comparative figures of December 31, 2022, the financial statements, the Company’s Auditor identified errors that were determined to be material in the financial year ended December 31, 2022 financial statements which were required to be restated in the financial statements for the year ended December 31, 2022.

As a result, the Company has restated the balance as of December 31, 2022 and the corresponding opening reserves as at 1st January 2023, in accordance with ASC 250, Accounting Changes and Error Corrections (the “restated financial statements”).

Description of Restatement

a. Operating Expenses

Adjustments were required for operating expenses (business registration charges) for the fiscal year ended December 31, 2022 and the corresponding retained earnings as at January 1, 2023. The change addressed the identified under-reporting of expenses incurred but omitted to be accounted. The error understated the previously reported operating expenses by $1,025 for the year ended December 31, 2022.

TV Channels Network Inc

|

| As previously reported |

|

| Restatement |

|

| Ref No |

|

| Restated | ||||

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses |

| $ | 522 |

|

| $ | 1,025 |

|

|

| 2.10(a) |

|

| $ | 1,547 |

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained earnings |

| $ | (522) |

|

| $ | (1,025 | ) |

|

| 2.10(a) |

|

| $ | (1,547) |

Statements of Stockholders’ Equity |

| |||||||||||||||

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retained earnings |

| $ | (522) |

|

| $ | (1,025 | ) |

|

| 2.10(a) |

|

| $ | (1,547 | ) |

24

3.GOING CONCERN

The Company currently has limited operations. The financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates, among other things, the realization of assets and the satisfaction of liabilities in the normal course of business.

As reflected in the accompanying financial statements, the Company had an accumulated deficit of $7,753 as of December 31, 2023 and $1,547 as of December 31, 2022. The Company has a limited operating history, and its continued growth is dependent upon the start of selling its services; hence generating revenues and obtaining additional financing to fund future obligations and pay liabilities arising from normal business operations. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company’s ability to raise additional capital, implement its business plan, and generate significant revenues. There are no assurances that the Company will be successful in its efforts to generate significant revenues, maintain sufficient cash balance or report profitable operations or to continue as a going concern. The Company plans on raising capital through the sale of equity or debt instruments to implement its business plan. However, there is no assurance these plans will be realized and that any additional financings will be available to the Company on satisfactory terms and conditions, if any.

The accompanying financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

4.RELATED PARTY TRANSACTIONS

Related party loans and due to CEO were $3,574 and $1,025 as of December 31, 2023 and 2022. The related party amounts are funds borrowed to fund the Company’s daily operations. The loans are non-interest bearing with no maturity date, due on demand, and no covenants. The loans arose from a related party and member of management.

5.COMMON STOCK

The Company is authorized to issue 800,000,000 of common shares with no par value, and any amount paid is considered as Additional Paid In Capital. As of December 31, 2022, the company had issued 32,028,000 shares. During the current year 6,493,700 shares are fresh issued and as of December 31, 2023, the company had issued 38,521,700 shares.

6.COMMITMENTS AND CONTINGENCIES

There are no commitments and no contingent liabilities outstanding as at 31st December 2023 and 31st December 2022.

7.SUBSEQUENT EVENTS

The company has evaluated subsequent events for recognition and disclosure through April 29, 2024 which is the date the financial statements were available to be issued. No other matters were identified affecting the accompanying financial statements and related disclosures.

25

ITEM 4. EXHIBITS

None.

26

Pursuant to the requirements of Regulation A, the issuer certifies that it has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TV Channels Networks, Inc.

By: /s/ Darryl Payne

Name: Darryl Payne

Title: Chairman of the Board & CEO

Date: 4/29/2024

Pursuant to the requirements of Regulation A, this report has been signed by the following persons on behalf of the issuer and in the capacities and on the dates indicated.

TV Channels Networks, Inc.

By: /s/ Darryl Payne

Name: Darryl Payne

Title: Chairman of the Board & CEO

Date: 4/29/2024

27