UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 1-A

#3

TV CHANNELS NETWORK INC.

(Exact Name of the Registrant as Specified in its Charter)

Nevada |

| 88-3851932 |

(State or Other Jurisdiction of Incorporation or Organization) |

| (IRS Employer Identification No.) |

7582 Law Vegas Blvd. South

Las Vegas, Nevada 89123

(Address of Principal Executive Offices and Zip Code)

702-721-9915

(Registrant's Telephone Number, Including Area Code)

i

OFFERING CIRCULAR

TV Channels Network Inc.

______________________________________________________

15,000,000 Shares of Common Stock

$4.00 Per Share

No Minimum Investment

Pursuant to this Offering Circular, TV Channels Network Inc. is offering up to 15,000,000 shares of common stock at a price of $4.00 per common share. (See “Description of Securities”). Each share of common stock – par value $0.001 per share – will be sold on a “best efforts” basis. The entire purchase is payable in cash at the time of subscription by each purchaser. THE SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECUTRITES LAWS UNDER THE STATE OF NEVADA OR ANY OTHER STATE SECURITIES OR JURISDICTION IN RELIANCE UPON THE EXEMPTIONS FROM REGISTRATION PROVIDED BY THE ACT AND REGULATION A+ PROMULGATED THEREUNDER AND THE COMPARABLE EXEMPTIONS FROM REGISTRATION PROVIDED BY OTHER APPLICABLE SECURITIES LAWS.

All subscriptions will be in whole shares. The offering will terminate on the earlier of (i) the sale of all 15,000,000 common shares; (ii) July 31, 2024, unless extended by the Company, without further notice, for an additional ninety (90) days; or (iii) the Company decides to terminate the offering, in its sole discretion at any time without notice. The proceeds from the sale of the shares will be payable directly to the Company after payment of all applicable commissions, and the Company will deliver stock certificates attributable to shares purchased directly to the Purchasers within ninety (90) days of the closing of this offering. Broker and finder fees, if any, in addition to expenses of the offering, may be deducted from the proceeds as the offering progresses.

THE SECURITIES OFFERED HEREBY ENTAIL A SUBSTANTIAL DEGREE OF RISK AND SHOULD BE CONSIDERED SPECULATIVE. (SEE “RISK FACTORS”). THIS TIER TWO REGULATION A OFFERING DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY STATE OR OTHER JURISDICTION WHEN NOT AUTHORIZED.

| Sale Price To Public | Offering Expenses Per Share (3) | Commission to Brokers | Proceeds To Company (2) |

Per Share (1) | $4.00 | $0.3367 | $0.32 | $3.34 |

Total Maximum: | $60,000,000 | $5,050,500 | $4,800,000 | $50,149,500 |

1.The maximum number of shares to be sold in this offering is 15,000,000 shares at an offering price of $4.00 per share which, assuming all the shares are sold, will yield $60,000,000.

2.The Company plans to sell this offering of shares through its officers and directors and will pay no commissions, sales representative, or placement fees for the placement of its securities to officers and directors of the Company.

3.Proceeds are estimated before deducting expenses of the offering, which are estimated to be $5,050,500. These expenses include, but are not limited to, printing, advertising, accounting, and other miscellaneous items. The expenses of this offering shall not exceed a maximum of ten percent (10%) of the aggregate offering.

ii

TV Channels Network Inc.

7582 Las Vegas Blvd. South

Las Vegas, Nevada 89123

Phone: (702) 721-9915

The securities offered hereby entail a substantial degree of risk and should be considered speculative. (See “Risk Factors”).

We are a private company not listed with any U.S. or foreign exchange including OTC Markets.

This Offering will be conducted on a “best-efforts” basis, which means our Officers will use their commercially reasonable best efforts in an attempt to offer and sell the Shares. Our Officers will not receive any commission or any other remuneration for these sales. In offering the securities on our behalf, the Officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

Our Board of Directors used its business judgment in setting a value of $4,00 per share to the Company as consideration for the stock to be issued under the Offering. The sales price per share bears no relationship to our book value or any other measure of our current value or worth.

No agent or person other than a Director or Officer of the Company has been authorized to give any information or to make any representation, other than those contained in this Offering Circular and, if given or made, such information or representation must not be relied upon as having been authorized by the Company. Authorized representatives of the Company will, if such is reasonably available, provide additional information, which an offeree or his/her professional adviser may request for the purpose of evaluating the merits and risks of this offering, and prospective purchasers may ask questions of, and receive answers from, Officers and Directors of the Company. Questions, inquiries, and requests for information may be sent to the Company by mail at 7582 Las Vegas Blvd. South, Las Vegas, Nevada 89123.

Sale of these shares will commence within two calendar days of the qualification date and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This Offer is irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. All proceeds received by the Company from subscribers for this Offering will be available for use by the Company upon acceptance of subscriptions for Securities by the Company.

Certain securities offering guidelines, codes, regulations, and other “Blue Sky Laws” for various states are included herein. (See “State Blue Sky Information”).

iii

TABLE OF CONTENTS

| PAGE |

|

|

1 | |

|

|

1 | |

|

|

2 | |

|

|

13 | |

|

|

14 | |

|

|

15 | |

|

|

15 | |

|

|

24 | |

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 24 |

|

|

25 | |

|

|

27 | |

|

|

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITYHOLDERS | 27 |

|

|

28 | |

|

|

28 | |

|

|

30 | |

|

|

32 | |

|

|

32 | |

|

|

33 |

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

In this Offering Circular, unless the context indicates otherwise, references to “we”, the “Company”, “our” and “us” refer to the activities of and the assets and liabilities of the business and operations of TV Channels Network, Inc.

iv

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary”, “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Our Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “potential”, “should”, “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward-looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

·The speculative nature of the business we intend to develop.

·Our reliance on suppliers and customers;

·Our ability to effectively execute our business plan;

·Our ability to manage our expansion, growth, and operating expenses;

·Our ability to finance our businesses;

·Our ability to promote our businesses;

·Our ability to compete and succeed in highly competitive and evolving businesses;

·Our ability to respond and adapt to changes in technology and customer behavior; and

·Our ability to protect our intellectual property and to develop, maintain and enhance strong brands.

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as maybe be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

The following Summary of the Offering Circular does not purport to be complete and is qualified in its entirety by reference to the more detailed information contained in other parts of this Offering Circular. Please pay special attention to the “Risk Factors” before making any decision on the suitability of this investment.

The Company

TV Channels Network Inc. is a Nevada based music and entertainment technology company whose primary business is providing Streaming services to subscribers. We intend to offer 100 Live Linear Concert Channels, Video on Demand, and various Live TV Channels as an AVOD/TVOD Service. TV Channels Network Inc. is preparing to become the next major entertainment content provider. Our goal is to create a conglomerate in many facets. Being a diversified entertainment business with multiple sources of income should allow us to earn positive returns. Moreover, TVCN, having already secured quality live concert titles, has a solid base for future profits to the benefit of our partners and investors. TV Channels Network - TV Channels Network.

1

Public Market

TV Channels Network Inc. common shares are not currently traded on any recognized stock exchange or trading platform. Management intends to register the shares of common stock sold in this offering with the United States Securities and Exchange Commission on Form S-1.

The Offering

Securities Authorized. The Company is authorized to issue 800,000,000 shares of common stock with a par value of $0.001 per share.

Securities Offered. The Company is offering up to 15,000,000 shares of common stock of the Company at an offering price of $4.00 per common share. Should the offering yield less than the maximum of $60,000,000 the Company may nonetheless utilize the proceeds for the business operations of the company.

Common Stock Outstanding. 37,880,000 shares of common stock, par value $0.001.

Preferred Stock Outstanding. To date, there have been no issuances of the preferred stock of the Company.

Investor Suitability. Subscriptions will only be accepted from “accredited investors” as defined in Regulation D under the Securities Act of 1933 as amended (the “Act”) and up to a maximum of 35 unaccredited purchasers. (See “Investor Suitability Standards”).

Risks. The purchase of the common stock in this offering hereby involves a high degree of risk. The securities offered hereby are for investment purposes only and currently no market for the common shares exists. (See “Risk Factors”).

Use of Proceeds. The net proceeds of this offering will be used primarily for the following purposes: operations, software development, computer equipment, intellectual property, legal and accounting fees, offering expenses, marketing, and advertising and general working capital. (See “Use of Proceeds”).

An investment in our Common Stock involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this Offering Circular, before purchasing our Common Stock. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Statement Regarding Forward-Looking Statements”.

Limited Operating History

The Company has a limited operating history on which to base an evaluation of its business and prospects. The Company is subject to all the risks inherent in a small company seeking to develop, market and distribute new services, particularly companies in evolving markets such as the Internet. The likelihood of the Company’s success must be considered, in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the development, introduction, marketing and distribution of new products and services in a competitive environment.

Such risks for the Company include, but are not limited to, dependence on the success and acceptance of the Company’s services, the ability to attract and retain a suitable client base, and the management of growth. To address these risks, the Company must, among other things, generate increased demand, attract a sufficient clientele base, respond to competitive developments, increase the “RegEx” brand name visibility, successfully introduce new services, attract, retain, and motivate qualified personnel and upgrade and enhance the Company’s technologies to accommodate expanded service offerings. In view of the rapidly evolving nature of the Company’s business and its limited operating history, the Company believes that period-to-period comparisons of its operating results are not necessarily meaningful and should not be relied upon as an indication of future performance.

2

Need for Additional Capital

The Company has limited revenue-producing operations and will require the proceeds from this offering to execute its full business plan. The Company believes the proceeds from this offering will be sufficient to develop its initial plans. However, the Company can give no assurance that all, or even a significant portion of these shares will be sold or that the money raised will be sufficient to execute the entire business plan of the Company. Further, no assurance can be given if additional capital is needed as to how much additional capital will be required or that additional financing can be obtained, or if obtainable, that the terms will be satisfactory to the Company, or that such financing would not result in a substantial dilution of shareholder’s interest.

Competition

The internet-based entertainment business is highly competitive, and the Company competes with many different types of companies that offer some form of streaming entertainment content. Certain of these competitors may have greater industry experience or financial and other resources than the Company.

Growth Strategy Implementation: Ability to Manage Growth

The Company anticipates that significant expansion will be required to address potential growth in its customer base and market opportunities. The Company’s expansion is expected to place a significant strain on the Company’s management, operational and financial resources. To manage any material growth of its operations and personnel, the Company may be required to improve existing operational and financial systems, procedures, and controls and to expand, train and manage its employee base. There can be no assurance that the Company’s planned personnel, systems, procedures, and controls will be adequate to support the Company’s future operations, that management will be able to hire, train, retain, motivate, and manage required personnel or that the Company’s management will be able to successfully identify, manage and exploit existing and potential market opportunities. If the Company is unable to manage growth effectively, its business, prospects, financial condition, and results of operations may be materially adversely affected.

Dependence upon Management and Key Personnel

The Company is and will be heavily dependent on the skill, acumen, and services of the management of the Company. The loss of the services of these key individuals, and certain others, for any substantial length of time, would materially and adversely affect the Company’s results of operation and financial position. (See “Management”).

Possible Inability to Find Suitable Employees

The Company’s success depends significantly on its ability to attract and retain highly qualified personnel, including retaining the services of full-time employees, part-time employees, and managers to assist the Company in the conduct and management of the Company’s business. Competition for such personnel is intense. There can be no assurance that the Company will be able to find these suitable employees or personnel, or if found, that these employees or personnel can be hired on terms favorable to the Company.

Other Nonpublic Sales of Securities Likely

As part of the Company’s plan to raise additional capital and because of the capital-intensive nature to establish a brand name on the Internet, the Company will likely make offers and sales of its common stock and/or preferred stock to qualified investors in transactions which are exempt from registration under the 1933 Act, as amended, in the future. Other offers and sales of common stock or preferred stock may be at prices per share that are higher or lower than the price per share in this offering or higher or lower than the conversion rate of the share of this offering. The Company reserves the right to set prices at its discretion, which prices need not relate to any ascertainable criterion of value. There can be no assurance the Company will not make other offers at lower prices per share, when, at the Company’s discretion, such price is deemed by the Company to be reasonable under the circumstances.

3

Arbitrary Offering Price

The offering price of the common shares offered hereunder has been arbitrarily determined by the Company and bears no relationship to any objective criterion of value. The price does not bear any relationship to the assets, book value, historical earnings, or net worth of the Company. In determining the offering price, the Company considered such factors as the prospects, if any, for similar companies, the previous experience of management, the Company’s anticipated results of operations, the present financial resources of the Company and the likelihood of acceptance of this offering. Please review any financial or other information contained in this Offering Circular with qualified people to determine its suitability as an investment before purchasing any shares in this offering.

We may experience significant losses from operations.

Even if we do generate operating income in one or more quarters in the future, subsequent developments in our industry, customer base, business or cost structure or an event such as significant litigation or a significant transaction may cause us to again experience operating losses. We may not become profitable in the long- term, or even for any.

Limited Market for Securities

The Company’s securities are not currently quoted on any recognized stock exchange or trading platform. Therefore, there is currently no market for the Company’s common stock is limited. There can be no assurance that a meaningful trading market will develop.

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure related to the market for penny stocks and for trades in any stock defined as a penny stock. The Commission has recently adopted regulations under this Act, which defines penny stock to be any non-NASDAQ equity security that has a market price of less than $4.00 per share (as defined). Unless exempt, for any transaction in a penny stock, the new rules require the delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the Commission explaining important concepts involving the penny stock market, the nature of such market, terms used in such market, the broker/dealer’s duties to the customer, a toll-free telephone number for inquiries about the broker/dealer’s disciplinary history and the customer’s rights and remedies in case of fraud or abuse in the sale. Disclosure must be made about commissions payable to both the broker/dealer and the registered representative and current quotations of securities. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Non-NASDAQ stocks would not be covered by the definition of penny stock for (i) issuers who have $3,000,000 in tangible assets ($5,000,000 if the issuer has not been in continuous operation for three years); (ii) transactions in which the customer is an institutional accredited investor; and (iii) transactions that are not recommended by the broker/dealer.

Dividend Policy

To date, the Company has not declared or paid any cash dividends on its stock and does not anticipate paying cash dividends in the foreseeable future. The payment of cash dividends, if any, in the future will be at the sole discretion of the Board of Directors.

Control by Existing Management

Under the terms of the Company’s Articles of Incorporation filed with the Secretary of State of Nevada with respect to the rights, preferences, and limitations of the common shares, each common shareholder is entitled to vote on any matters presented to stockholders of the Company. Given the maximum number of common shares offered hereunder may be sold, of which there is no assurance, the present officers and directors of the Company will own approximately 78.82% of the issued and outstanding common shares. As a result, purchasers of the common shares will have only a limited voice in the Company’s management, which is likely to be controlled by the present officers and directors of the Company. As a result, the current management will retain voting control of the Company. (See “Principal Shareholders” and “Description of Securities”).

Proceeds Applied to General Corporate Purposes - Management Discretion

Although a majority portion of the net proceeds of this Offering Circular is for specific uses, the balance will be available for working capital and general corporate purposes. Therefore, the application of the net proceeds of this

4

offering is substantially within the discretion of the management. Investors will be relying on the Company’s management and business judgment based solely on limited information. No assurance can be given that the application of the net proceeds of this Offering Circular will result in the Company achieving its financial and strategic objectives.

No Commitment to Purchase; Best Efforts Offering

The offering of these securities is being done on a “best efforts” basis. However, there is no assurance that all, or any, of the shares offered hereby will be sold. No individual firm or corporation has agreed to purchase any of the shares offered herein. The shares are being offered on a best-efforts basis.

The Company is Entirely Dependent on its Internet Content for Digital Broadcast for use by Televisions, Computers and Mobile Devices, and the Company’s Future Revenue Depends on Its Commercial Success

The Company’s future development and growth depends on the commercial success of the Company’s Internet Broadcast content delivery service. The Company’s streaming service, or other services under development, may not achieve widespread market acceptance. The Company has recently begun to commercially introduce its service for the delivery of digital video (with audio), and the Company’s future growth will depend, in part, on customer acceptance of this service. Failure of the Company’s current and planned services to operate as expected could delay or prevent their adoption. If the Company’s targeted customers do not purchase and successfully deploy the Company’s planned services, the Company’s revenue will not grow significantly the Company’s business, results of operations and financial condition will be seriously harmed. In addition, to the extent that the Company promotes any portion of its streaming technology as an industry standard by making it readily available to users for little or no charge, the Company may not receive revenue that might otherwise have been received by the Company.

The Internet Content Delivery Market for Television, Computer and Mobile Devices is Relatively New, and the Company’s Business will Suffer if it Does Not Continue to Develop as the Company Expects

The market for Internet content delivery services to televisions, computers and mobile devices is relatively new. The Company cannot be certain that a viable market for the Company’s Broadcast technology service will emerge or be sustainable. If this market does not develop or develops more slowly than the Company expects, the Company’s business, results of operations and financial condition will be seriously harmed.

ANY FAILURE OF THE COMPANY’S INTERNET BROADCAST NETWORK INFRASTRUCTURE COULD LEAD TO SIGNIFICANT COSTS AND DISRUPTIONS WHICH COULD REDUCE THE COMPANY’S REVENUE AND HARM THE COMPANY’S BUSINESS, FINANCIAL RESULTS, AND REPUTATION.

The Company’s business is dependent on providing its customers with fast, efficient and reliable Internet Broadcasted content. To meet these customer requirements, the Company must protect its network infrastructure against damage from:

·Human Error;

·Physical and Electronic Security Breaches;

·Fire, Earthquake, Flood, and other Natural Disasters;

·Power Loss;

·Sabotage and Vandalism; and

·Similar Events.

Any Failure of the Company’s Telecommunications Providers to Provide Required Transmission Capacity to the Company Could Result in Interruptions in the Company’s Service

The Company’s operations are dependent upon transmission capacity provided by third-party telecommunications providers. Any failure of such telecommunications providers to provide the capacity that the Company requires may result in a reduction in, or termination of, service to the Company’s customers. This failure may be a result of the telecommunications providers or Internet service providers choosing services that are competitive with the Company’s service, failing to comply with or terminating their agreements with the Company, or otherwise not entering relationships with the Company at all, or on terms commercially acceptable to the Company. If the Company does not have access to third-party transmission capacity, the Company could lose customers or fees charged to such customers, and the Company’s business and financial results could suffer.

5

THE MARKETS IN WHICH THE COMPANY OPERATES ARE HIGHLY COMPETITIVE AND THE COMPANY MAY BE UNABLE TO COMPETE SUCCESSFULLY AGAINST NEW ENTRANTS AND ESTABLISHED COMPANIES WITH GREATER RESOURCES.

The Company competes in markets that are new, intensely competitive, highly fragmented and rapidly changing. Many of the Company’s current competitors, as well as a few of the Company’s potential competitors, have longer operating histories, greater name recognition, and substantially greater financial, technical and marketing resources than the Company does. Some of the Company’s current or potential competitors have the financial resources to withstand substantial price competition. Moreover, many of the Company’s competitors have more extensive customer bases, broader customer relationships and broader industry alliances that they could use to their advantage in competitive situations, including relationships with many of the Company’s potential customers. The Company’s competitors may be able to respond more quickly than the Company can to new or emerging technologies and changes in customer requirements.

As competition in the Internet content delivery market continues to intensify, new solutions will come to market. The Company is aware that other companies will in the future focus significant resources on developing and marketing digital broadcast products and services that will compete with the Company’s products and services.

Increased competition could result in:

·Price and Revenue Reductions and Lower Profit Margins;

·Increased Cost of Service from Telecommunications Providers;

·Loss of Customers; and

·Loss of Market Share

Anyone of these could materially and adversely affect the Company’s business, financial condition, and results of operations.

The Company’s Business will suffer if the Business is Not Able to Scale Its Network as Demand Increases

The Company has had only limited deployment of its Internet Broadcast content delivery service to date, and the Company cannot be certain that its network can connect and manage a substantially larger number of customers at high transmission speeds. The Company’s network may not be scalable to expected customer levels while maintaining superior performance. In addition, as customers’ usage of bandwidth increases, the Company will need to make additional investments in its infrastructure to maintain adequate downstream data transmission speeds. The Company cannot assure you that it will be able to make these investments successfully or at an acceptable cost. Upgrading the Company’s infrastructure may cause delays or failures in the Company’s network. As a result, in the future, the Company’s network may be unable to achieve or maintain a sufficiently high transmission capacity. The Company’s failure to achieve or maintain high-capacity data transmission could significantly reduce demand for the Company’s service, reducing the Company’s revenue and causing the Company’s business and financial results to suffer.

The Company’s Business may suffer if the Company Does Not Respond to Technological Changes

The market for Internet content delivery services is likely to be characterized by rapid technological change, frequent new product and service introductions and changes in customer requirements. The Company may be unable to respond quickly or effectively to these developments. If competitors introduce products, services or technologies that are better than that of the Company, or that gain greater market acceptance, or if new industry standards emerge, our Internet-based broadcast technology may become obsolete, which would materially and adversely affect the Company’s business, results of operations and financial condition.

In developing the Company’s Internet-based broadcast service, the Company has made and will continue to make assumptions about the standards that the Company’s customers and competitors may adopt. If the standards adopted are different from those which the Company may now or in the future promote or support, market acceptance of the Company’s service may be significantly reduced or delayed, and the Company’s business will be seriously harmed. In addition, the introduction of services or products incorporating new technologies and the emergence of new industry standards could render the Company’s existing services obsolete.

6

If the Company Fails to Promote and Maintain Its Brand in the Market, the Company’s Business, Operating Results, Financial Condition, and Its Ability to Attract Customers will be Materially Adversely Affected

The Company’s success depends on the Company’s ability to create and maintain brand awareness for its Internet Broadcasting Products and Services. This may require a significant amount of capital to allow the Company to market the Company’s Internet Broadcasting products and services and to establish brand recognition and customer loyalty. Many of the Company’s competitors in this market are larger than the Company and have substantially greater financial resources than those of the Company. Additionally, many of the companies offering similar products have already established their brand identity within the marketplace. The Company can offer no assurances that it will be successful in establishing awareness of the Company’s brand, allowing the Company to compete in this market. The importance of brand recognition will continue to increase because of low barriers of entry to the industries in which the Company operates and may result in an increased number of direct competitors. To promote the Company’s brands, the Company may be required to continue to increase its financial commitment to creating and maintaining brand awareness. The Company may not generate a corresponding increase in revenue to justify these costs.

If Studios, Content Providers or Other Rights Holders Refuse to License Streaming Content or Other Rights Upon Terms Acceptable to the Company, the Company’s Business Could be Adversely Affected

The Company’s ability to provide its members with content they can watch and/or listen to instantly depends on studios, content providers and other rights holders licensing rights to distribute such content and certain related elements thereof, such as the public performance of music contained within the content that the Company distributes. The license periods and the terms and conditions of such licenses vary. If the studios, content providers and other rights holders are not, or are no longer willing, or are unable to license to the Company upon terms that are acceptable to the Company, the Company’s ability to stream content to the Company’s Members will be adversely affected and/or the Company’s costs could increase. Many of the licenses for content provide for the studios or other content providers to withdraw content from the Company’s service relatively quickly. Because of these provisions, as well as other actions the Company may take, content available through the Company’s streaming service can be withdrawn on short notice. As competition increases, the Company may see the cost of programming increase. As the Company seeks to differentiate its service, the Company is increasingly focused on securing certain exclusive rights when obtaining content, including original content. The Company is also focused on programming an overall mix of content that delights the Company’s members in a cost-efficient manner. Within this context, the Company will be selective about the titles that it adds and renews to its service. If the Company does not maintain a compelling mix of content, the Company’s member acquisition and retention numbers may be adversely affected.

Music contained within content that it distributes may require the Company to obtain licenses for such distribution. In this regard, the Company will engage in negotiations with performing rights organizations and collection societies (“PROs”) that hold certain rights to music interests when “publicly performed” or “communicated to the public” in connection with streaming content into various territories. If the Company is unable to reach mutually acceptable terms with these organizations, the Company could become involved in litigation and/or could be enjoined from distributing certain content, which could adversely impact the Company’s business. Additionally, pending and ongoing litigation, as well as negotiations between certain PROs and other third parties in various territories could adversely impact the Company’s negotiations with PROs or result in music publishers represented by certain PROs to unilaterally withdraw rights, and thereby adversely impact the Company’s ability to reach licensing agreements acceptable to the Company. Failure to reach such licensing agreements could expose the Company to potential liability for copyright infringement or otherwise increase the Company’s cost(s).

If our efforts to attract and retain members are not successful, our business will be adversely affected.

Our ability to attract members will depend in part on our ability to consistently provide our members with valuable and quality experience for selecting and viewing audio and video content. Furthermore, the relative service levels, content offerings, pricing, and related features of competitors to our service may adversely impact our ability to attract and retain members. Competitors include multichannel video programming distributors providing free on-demand content through authenticated Internet applications, Internet-based movie, and TV content providers, including both those that provide legal and illegal (or pirated) entertainment video content, DVD rental outlets and kiosk services and entertainment video retail stores. If consumers do not perceive our service offering to be of value, or if we introduce new or adjust existing features or change the mix of content in a manner that is not favorably received by them, we may not be able to attract and retain members. If our efforts to satisfy our existing members are not successful, we may not be able to attract members, and as a result, our ability to maintain and/or grow our business will be adversely affected. Members cancel our service for many reasons, including a perception that they do not use

7

the service sufficiently, the need to cut household expenses, availability of content is unsatisfactory, competitive services provide a better value or experience and customer service issues are not satisfactorily resolved. We must continually add new members both to replace members who cancel and to grow our business beyond our current member base. If too many of our members cancel our service, or if we are unable to attract new members in numbers sufficient to grow our business, our operating results will be adversely affected. If we are unable to successfully compete with current and new competitors in both retaining our existing members and attracting new members, our business will be adversely affected. Further, if excessive numbers of members cancel our service, we may be required to incur significantly higher marketing expenditures than we currently anticipate replacing these members with new members.

If we are unable to compete effectively, our business will be adversely affected.

The market for entertainment audio and video is intensely competitive and subject to rapid change. New technologies and evolving business models for delivery of entertainment videos continue to develop at a fast pace. The growth of Internet-connected devices, including TVs, computers and mobile devices has increased the consumer acceptance of Internet delivery of entertainment video. Through these new and existing distribution channels, consumers are afforded various means for consuming entertainment audio and video. The various economic models underlying these different means of entertainment video delivery include subscription, transactional, ad-supported, and piracy-based models. All of these have the potential to capture meaningful segments of the entertainment audio and video market. Several competitors have longer operating histories, large customer bases, strong brand recognition, and significant financial, marketing, and other resources. They may secure better terms from suppliers, adopt more aggressive pricing, and devote more resources to technology, fulfillment, and marketing. New entrants may enter the market with unique service offerings or approaches to providing entertainment videos, and other companies also may enter business combinations or alliances that strengthen their competitive positions. If we are unable to compete with current and new competitors, programs, and technologies successfully or profitably, our business will be adversely affected, and we may not be able to increase or maintain market share, revenues or profitability.

The long-term and fixed cost nature of our content licenses may limit our operating flexibility and could adversely affect our liquidity and results of operation.

In connection with obtaining streaming content, we plan to enter into multi-year licenses with studios and other content providers, the payment terms of which are not tied to member usage or the size of our member base (“fixed cost”), but which may be tied to such factors as titles licensed and/or theatrical exhibition receipts. Given the multiple-year duration and largely fixed cost nature of content licenses, if member acquisition and retention do not meet our expectations, our margins may be adversely impacted. Payment terms for streaming licenses, especially programming that is initially available in the applicable territory on our service (“original programming”), or that is considered output content, will typically require more up-front cash payments than other licensing agreements. To the extent member and/or revenue growth do not meet our expectations, our liquidity and results of operations could be adversely affected because of content licensing commitments and accelerated payment requirements of certain licenses. In addition, the long-term and fixed cost nature of our content licenses may limit our flexibility in planning for or reacting to changes in our business and the market segments in which we operate. As we expand internationally, we must license content in advance of entering a new geographical market. If we license content that is not favorably received by consumers in the applicable territory, acquisition, and retention may be adversely impacted and given the long-term and fixed cost nature of our content licenses, we may not be able to adjust our content offering quickly, and our results of operation may be adversely impacted.

If our efforts to build a strong brand identity and improve member satisfaction and loyalty are not successful, we may not be able to attract or retain members, and our operating results may be adversely affected.

We must build and maintain a strong brand identity. We believe that strong brand identity will be important in attracting and retaining members who have a few choices from which to obtain entertainment video. To build a strong brand, we believe we must offer content and service features that our members value and enjoy. We also believe that these must be coupled with effective consumer communications, such as marketing, customer service and public relations. If our efforts to promote and maintain our brand are not successful, our ability to attract and retain members may be adversely affected. Such a result, coupled with the increasingly long-term and fixed cost nature of our content acquisition licenses, may adversely affect our operating results.

8

We face risks, such as unforeseen costs and potential liability in connection with content we produce, license and/or distribute through our service.

As a distributor of content, we face potential liability for negligence, copyright, or trademark infringement or other claims based on the nature and content of materials that we produce, license and/or distribute. We also may face potential liability for content used in promoting our service, including marketing materials and features on our website. As we expand our original programming, we will become responsible for production costs and other expenses, such as ongoing guild payments. We will also take on risks associated with the production, such as completion and key talent risk. To the extent we do not accurately anticipate costs or mitigate risks, or if we become liable for the content we produce, license and/or distribute, our business may suffer. Litigation to defend these claims could be costly and the expenses and damages arising from any liability or unforeseen production risks could harm the results of operations. We cannot assure that we are indemnified to cover claims or costs of these types and we may not have insurance coverage for these types of claims.

If studios, content providers or other rights holders refuse to license streaming content or other rights upon terms acceptable to us, our business could be adversely affected.

Our ability to provide our members with content they can watch or listen to instantly depends on studios, content providers and other rights holders licensing rights to distribute such content and certain related elements thereof, such as the public performance of music contained within the content we distribute. The license periods and the terms and conditions of such licenses vary. If the studios, content providers and other rights holders are not or are no longer willing or able to license our content upon terms acceptable to us, our ability to stream content to our members will be adversely affected and/, or our costs could increase. Many of the licenses for content provide for the studios or other content providers to withdraw content from our service relatively quickly. Because of these provisions as well as other actions we may take, content available through our service can be withdrawn on short notice. As competition increases, we may see the cost of programming increase. As we seek to differentiate our service, we are increasingly focused on securing certain exclusive rights when obtaining content, including original content. We are also focused on programming an overall mix of content that delights our members in a cost-efficient manner. Within this context, we are selective about the titles we add and renew to our service. If we do not maintain a compelling mix of content, our member acquisition and retention may be adversely affected.

Music contained within content we distribute may require us to obtain licenses for such distribution. In this regard, we will engage in negotiations with performing rights organizations and collection societies (“PROs”) that hold certain rights to music interests when “publicly performed” or “communicated to the public” in connection with streaming content into various territories. If we are unable to reach mutually acceptable terms with these organizations, we could become involved in litigation and/or could be prevented from distributing certain content, which could adversely impact our business. Additionally, pending and ongoing litigation as well as negotiations between certain PROs and other third parties in various territories could adversely impact our negotiations with PROs or result in music publishers represented by certain PROs to unilaterally withdraw rights, and thereby adversely impact our ability to reach licensing agreements reasonably acceptable to us. Failure to reach such licensing agreements could expose us to potential liability for copyright infringement or otherwise increase our costs.

If government regulations relating to the Internet or other areas of our business change, we may need to alter the way we conduct our business or incur greater operating expenses.

The adoption or modification of laws or regulations relating to the Internet or other areas of our business could limit or otherwise adversely affect the way we currently conduct our business. In addition, the continued growth and development of the market for online commerce may lead to more stringent consumer protection laws, which may impose additional burdens on us. If we are required to comply with new regulations or legislation or new interpretations of existing regulations or legislation, this compliance could cause us to incur additional expenses or alter our business model.

The adoption of any laws or regulations that adversely affect the growth, popularity, or use of the Internet, including laws impacting Internet neutrality, could decrease the demand for our service and increase our cost of doing business. For example, in late 2010, the Federal Communications Commission (FCC) adopted so-called net neutrality rules intended, in part, to prevent network operators from discriminating against legal traffic that transverse their networks. Recently, the U.S. Court of Appeals for the District of Columbia struck down the FCC’s net neutrality rules, and it is currently uncertain how the FCC will respond to this decision. To the extent network operators attempt to use this ruling to extract fees from us to deliver our traffic or otherwise engage in discriminatory practices, our business

9

could be adversely impacted. As we expand internationally, government regulation concerning the Internet, and in particular, network neutrality, may be nascent or non-existent. Within such a regulatory environment, coupled with the potentially significant political and economic power of local network operators, we could experience discriminatory or anti-competitive practices that could impede our growth, cause us to incur additional expense or otherwise negatively affect our business.

Changes in how network operators handle and charge for access to data that travel across their networks could adversely impact on our business.

We rely upon the ability of consumers to access our service through the Internet. To the extent that network operators implement usage-based pricing, including meaningful bandwidth caps, or otherwise try to monetize access to their networks by data providers, we could incur greater operating expenses and our member acquisition and retention could be negatively impacted. Furthermore, to the extent network operators were to create tiers of Internet access service and either charge us for or prohibit us from being available through these tiers, our business could be negatively impacted.

Most network operators that provide consumers with access to the Internet also provide these consumers with multichannel video programming. As such, many network operators have an incentive to use their network infrastructure in a manner adverse to our continued growth and success. For example, Comcast exempted certain of its own Internet video traffic (e.g., Streampix videos to the Xbox 360) from a bandwidth cap that applies to all unaffiliated Internet video traffic (e.g., Netflix videos to the Xbox 360). While we believe that consumer demand, regulatory oversight, and competition will help check these incentives, to the extent that network operators are able to provide preferential treatment to their data as opposed to ours or otherwise implement discriminatory network management practices, our business could be negatively impacted.

Increases in payment processing fees, changes to operating rules, the acceptance of new types of payment methods or payment fraud could increase our operating expenses and adversely affect our business and results of operations.

Our customers may pay for our membership services predominantly using credit and debit cards (together, “payment cards”). Our acceptance of these payment methods requires our payment of certain fees. From time to time, these fees may increase, either because of rate changes by the payment processing companies or as a result of a change in our business practices which increase the fees on a cost-per-transaction basis. Such increases may adversely affect the results of operations.

We are subject to rules, regulations, and practices governing our accepted payment methods. These rules, regulations, and practices could change or be reinterpreted to make it difficult or impossible for us to comply. If we fail to comply with these rules or requirements, we may be subject to fines and higher transaction fees and lose our ability to accept these payment methods, and our business and results of operations would be adversely affected.

We accept payment methods other than payment cards. As our service continues to evolve and expand internationally, we will likely continue to explore accepting various forms of payment, which may have higher fees and costs than our currently accepted payment methods. If more consumers utilize higher cost payment methods, our payment costs could increase, and our results of operations could be adversely impacted.

In addition, we do not obtain signatures from customers in connection with their use of payment methods. To the extent we do not obtain customers’ signatures, we may be liable for fraudulent payment transactions, even when the associated financial institution approves payment of the orders. From time to time, fraudulent payment methods are used to obtain service. While we do have certain safeguards in place, we nonetheless experience some fraudulent transactions. We do not currently carry insurance against the risk of fraudulent payment transactions. A failure to adequately control fraudulent payment transactions would harm our business and the results of operations.

If the market segment for online entertainment video saturates, our business will be adversely affected.

The market segment for online entertainment video has grown significantly. Much of the increasing growth can be attributed to the ability of our customers to stream TV shows and movies on their TVs, computers, and mobile devices. As we face more competition in our market segment, our rate of growth relative to overall growth in the segment may decline. Further, a decline in our rate of growth could indicate that the market segment for online

10

subscription-based entertainment video is beginning to saturate. While we believe that this segment will continue to grow in the foreseeable future, if this market segment were to saturate, our business would be adversely affected.

Intellectual property claims against us could be costly and result in the loss of significant rights related to, among other things, our website, streaming technology, our recommendation, and merchandising technology, title selection processes and marketing activities.

Trademark, copyright, patent, and other intellectual property rights are important to us and other companies. Our intellectual property rights extend to our technology, business processes and the content on our website. We use the intellectual property of third parties in merchandising our products and marketing our service through contractual and other rights. From time to time, third parties may allege that we have violated their intellectual property rights. If we are unable to obtain sufficient rights, successfully defend our use, or develop non-infringing technology or otherwise alter our business practices on a timely basis in response to claims against us for infringement, misappropriation, misuse or other violation of third-party intellectual property rights, our business and competitive position may be adversely affected. Many companies are devoting significant resources to developing patents that could potentially affect many aspects of our business. There are numerous patents that broadly claim means and methods of conducting business on the Internet. We have not searched for patents related to our technology. Defending ourselves against intellectual property claims, whether they are with or without merit or are determined in our favor, results in costly litigation and diversion of technical and management personnel. It also may result in our inability to use our current Web site, streaming technology, our recommendation and merchandising technology or inability to market our service or merchandise our products. As a result of a dispute, we may have to develop non-infringing technology, enter into royalty or licensing agreements, adjust our merchandising or marketing activities, or take other actions to resolve the claims. These actions, if required, may be costly or unavailable on terms acceptable to us.

We do not expect to declare or pay dividends in the foreseeable future.

We do not expect to declare or pay dividends in the foreseeable future, as we anticipate that we will invest future earnings in the development and growth of our business. Therefore, holders of our Common Stock will not receive any return on their investment unless they sell their securities, and holders may be unable to sell their securities on favorable terms or at all.

We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 800,000,000 shares of preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval. Currently there are no shares of Preferred stock issued and outstanding. We have not yet determined how many votes each share of preferred stock will be designated to a security holder of our Preferred Stock at stockholders’ meetings, for all purposes, including election of directors.

Our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

If we become a reporting company we will be required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting. We do not have a sufficient number of employees to segregate responsibilities and may be unable to afford to increase our staff or engage outside consultants or professionals to overcome our lack of employees.

11

We do not currently have independent audit or compensation committees. As a result, our directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

As a Regulation A, Tier 2 issuer, we will be subject to the periodic and current reporting requirements under Rule 257(b) of Regulation A.

Dilution.

Purchasers of Shares will experience immediate and substantial dilution of $2.67 per share in net tangible book value, or approximately 67% of the assumed offering price of $4.00 per share (assuming maximum offering proceeds are achieved). Additional Shares issued by the Company in the future will also dilute a purchaser’s investment in the Shares.

Limited Transferability and Liquidity

To satisfy the requirements of certain exemptions from registration under the Securities Act, and to conform with applicable state securities laws, each investor must acquire his Shares for investment purposes only and not with a view towards distribution. Consequently, certain conditions of the Securities Act may need to be satisfied prior to any sale, transfer, or other disposition of the Shares. Some of these conditions may include a minimum holding period, availability of certain reports, including financial statements from TV Channels Network, Inc, limitations on the percentage of Shares sold and the way they are sold. TV Channels Network, Inc can prohibit any sale, transfer, or disposition unless it receives an opinion of counsel provided at the holder’s expense, in a form satisfactory to TV Channels Network, Inc, stating that the proposed sale, transfer or other disposition will not result in a violation of applicable federal or state securities laws and regulations. No public market exists for the Shares and no market is expected to develop. Consequently, owners of the Shares may have to hold their investment indefinitely and may not be able to liquidate their investments in TV Channels Network, Inc or pledge them as collateral for a loan in the event of an emergency.

Broker/Dealer Sales of Shares

The Company’s Common Stock Shares are not presently included for trading on any exchange, and there can be no assurances that the Company will ultimately be registered on any exchange. The NASDAQ Stock Market, Inc. has recently enacted certain changes to the entry and maintenance criteria for listing eligibility on the NASDAQ SmallCap Market. The entry standards require at least $4 million in net tangible assets or $750,000 net income in two of the last three years. The proposed entry standards would also require a public float of at least $1 million shares, $5 million value of public float, a minimum bid price of $2.00 per share, at least three market makers, and at least 300 shareholders. The maintenance standards (as opposed to entry standards) require at least $2 million in net tangible assets or $500,000 in net income in two of the last three years, a public float of at least 500,000 shares, a $1 million market value of public float, a minimum bid price of $1.00 per share, at least two market makers, and at least 300 shareholders.

No assurance can be given that the Common Stock Share of the Company will ever qualify for inclusion on the NASDAQ System or any other trading market until such time as the Management deem it necessary. As a result, the Company’s Common Stock Shares are covered by a Securities and Exchange Commission rule that opposes additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors. For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell the Company’s securities and will also affect the ability of shareholders to sell their Shares in the secondary market.

No Current Market For Shares

There is no current market for the Shares offered in this offering and no market is expected to develop in the near future.

12

Compliance with Securities Laws

The Shares are being offered for sale in reliance upon certain exemptions from the registration requirements of the Securities Act, applicable Nevada Securities Laws, and other applicable state securities laws. If the sale of Shares were to fail to qualify for these exemptions, purchasers may seek rescission of their purchases of Shares. If several purchasers were to obtain rescission, TV Channels Network, Inc would face significant financial demands, which could adversely affect TV Channels Network, Inc as a whole, as well as any non-rescinding purchasers.

Offering Price

The price of the Shares offered has been arbitrarily established by TV Channels Network, Inc, considering such matters as the state of the Company’s business development and the general condition of the industry in which it operates. The Offering price bears little relationship to the assets, net worth, or any other objective criteria of value applicable to TV Channels Network, Inc.

Lack of Firm Underwriter

The Shares are offered on a “best efforts” basis by the Management of TV Channels Network, Inc without compensation and on a “best efforts” basis through certain FINRA registered broker-dealers, which enter into Participating Broker-Dealer Agreements with the Company. Accordingly, there is no assurance that the Company, or any FINRA broker-dealer, will sell the maximum Shares offered or any lesser amount.

Projections: Forward Looking Information

Management has prepared projections regarding TV Channels Network, Inc’ anticipated financial performance. The Company’s projections are hypothetical and based upon the presumed financial performance of the Company, the addition of a sophisticated and well-funded marketing plan, and other factors influencing the business of TV Channels Network, Inc. The projections are based on Management’s best estimate of the probable results of operations of the Company, based on present circumstances, and have not been reviewed by TV Channels Network, Inc’ independent accountants. These projections are based on several assumptions, set forth therein, which Management believes are reasonable. Some assumptions upon which the projections are based, however, invariably will not materialize due the inevitable occurrence of unanticipated events and circumstances beyond Management’s control. Therefore, actual results of operations will vary from the projections, and such variances may be material. Assumptions regarding future changes in sales and revenues are necessarily speculative in nature. In addition, projections do not and cannot consider such factors as general economic conditions, unforeseen regulatory changes, the entry into TV Channels Network, Inc’ market of additional competitors, the terms and conditions of future capitalization, and other risks inherent to the Company’s business. While Management believes that the projections accurately reflect possible future results of TV Channels Network, Inc’ operations, those results cannot be guaranteed.

If you purchase shares in this Offering, your ownership interest in our Common Stock will be diluted immediately, to the extent of the difference between the price to the public charged for each share in this Offering and the net tangible book value per share of our Common Stock after this Offering.

Future Dilution

Dilution may also result from future actions by our Company, and specifically from any increase in the number of shares of the Company’s capital stock outstanding resulting from a stock offering (such as a public offering, a crowdfunding round, a venture capital round, or an angel investment), employees exercising stock options, or conversion of certain instruments (such as convertible bonds, preferred shares, or warrants) into stock.

If we decide to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though this typically occurs only if we offer dividends, and most early-stage companies are unlikely to offer dividends, preferring to invest any earnings into the Company).

13

Dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round” the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money. Investors should pay careful attention to the number of convertible notes that the company has issued (and may issue in the future), and the terms of those notes.

If you are making an investment expecting to own a certain percentage of our Company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those shares can decrease by actions taken by us. Dilution can make drastic changes to the value of each share, ownership percentage, voting control, and earnings per share.

No Selling Security holders

There are no selling security holders in this Offering.

Terms of the Offering

Securities Authorized. The Company is authorized to issue 800,000,000 shares of common stock with a par value of $0.001 per share.

Securities Offered. The Company is offering up to 15,000,000 shares of common stock of the Company at an offering price of $4.00 per common share.

Common Stock Outstanding. 37,880,000 shares of common stock, par value $0.001.

Preferred Stock Outstanding. To date, there have been no issuances of the preferred stock of the Company.

Risks. The purchase of the common stock in this offering hereby involves a high degree of risk. The securities offered hereby are for investment purposes only, and currently, no market for the common shares exists. (See “Risk Factors”).

Use of Proceeds. The net proceeds of this offering will be used primarily for the following purposes: service development, web site designing and hosting, corporate consulting, organizational fees, legal and accounting fees, offering expenses, computer equipment, and software, marketing and advertising and general working capital. (See “Use of Proceeds”).

Pursuant to this Offering Circular, the Company is offering up to 15,000,000 shares of common stock (par value $0.001) at a price of $4.00 per share on a best effort basis. The entire purchase price is payable in cash at the time of subscription by each purchaser. All subscriptions will be in whole shares unless the Company, in its sole discretion, allows for the sale of fewer shares. The offering will terminate on the earlier of (i) the sale of all 15,000,000 shares, (ii) one hundred and eighty (180) days from the date of this Offering Circular, unless extended by the Company, without further notice, for an additional ninety (90) days, or (iii) the Company decides to terminate the offering in its sole discretion at any time without notice. Broker and finders’ fees (if any), in addition to expenses of the offering, may be deducted from the proceeds as the offering progresses.

The Company is offering its securities in all states.

Transfer Agent

The Company’s current transfer agent is currently Empire Stock Transfer.

14

The allocations set forth below are the estimates of management as to how the net proceeds of this public offering will be generally allocated. Pending use of the net proceeds for the following purposes, the Company intends to invest such funds in short-term, interest-bearing, investment-grade securities. There are no assurances that the estimates set forth below will correspond with the actual expenditures of the Company during the next twelve (12) months or thereafter or that the results of this public offering and the allocations set forth below will be sufficient to maintain the Company’s operations following this public offering.

Use of Proceeds |

| Allocation(1) (000) | |

Operations |

| $ | 11,675 |

Real Estate Acquisition |

|

| 3,720 |

Software Development |

|

| 1,517 |

Advertising & Marketing |

|

| 19,313 |

General & Administration |

|

| 2,335 |

Equipment & Working Capital |

|

| 3,972 |

Legal & Accounting |

|

| 2,218 |

Transaction Fees and Expenses |

|

| 5,050 |

Intellectual Property |

|

| 10,200 |

|

|

|

|

Total Use of Proceeds |

| $ | 60,000 |

Notes to Use of Proceeds:

1.These figures are estimates only, account for the first twelve (12) months of operations and are subject to revision from time to time to meet the Company’s requirements. Pending such uses, in management’s discretion, the Company may make temporary investments in U.S. Government obligations. Maximum Use Allocation represents the sale of all 15,000,000 shares of common stock of the Company or approximately $60,000,000. (See “Plan of Distribution”).

The expected use of net proceeds from this Offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve and change. The amounts and timing of our actual expenditures, specifically with respect to working capital, may vary significantly depending on numerous factors. The precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this Offering.

In the event we do not sell all of the shares being offered, we may seek additional financing from other sources in order to support the intended use of the proceeds indicated above. If we secure additional equity funding, investors in this Offering would be diluted. In all events, there can be no assurance that additional financing would be available to us when wanted or needed and, if available, on terms acceptable to us.

Our Business

The Company was incorporated on August 12, 2022, in the State of Nevada. Since incorporation, the Company has not made any significant purchases or sales of assets. From inception until the date of this filing the Company has had limited operating activities, primarily consisting of (i) the incorporation of the company, (ii) the development of the business plan, (iii) initial equity funding, (iv) the performance of due diligence on potential suppliers of online content, and (v) beginning to develop strategic referral partnerships with investment newsletters and websites catering to our target market. Darryl Payne acquired 1,666,666 shares of our common stock with a par value of $0.001 per share in return for the Company’s initial funding, and goodwill consideration in the form of office space, access to internet and telephone service, access to its network of contacts and professional relationships.

TV Channels Network Inc. is a Nevada-based music and entertainment technology company whose primary business is the providing of streaming entertainment content. The Company goal is to become a major entertainment content provider.

15

The Company’s business plan is to seek to acquire many rights for ownership including:

·Streaming Services

·Movie and Film Libraries,

·Original and Exclusive Content

·Live Linear TV Network Licensing

·Streaming Exclusive Live Pay Per View Events

·Purchase of Music Rights

·Signing New Recording Artists

·TV Show Rights

·Professional Wrestling & Sports Companies

USA STREAMING RIGHTS LICENSED TO TV Channels Network Inc

1.The Legends of Classic Soul Concert Series, AS SEEN ON NATIONAL TV. The Legends of Classic Soul concert series features 20 soul groups on our own unique streaming video on demand pay per view platform. Featured artist includes The Four Tops, The Whispers, The Dells, Main Ingredient featuring Cuba Gooding Sr, Harold Melvin’s Blue Notes, Chi-lites, The Delfonics, Blue Magic, Ray, Goodman, & Brown, Enchantment, The Temptations Review featuring Dennis Edwards, The Dramatics, Confunkshun, Atlantic Starr, Slave, The Floaters, Coasters, and Melba Moore featuring Freddie Jackson.

16

2.The PBS On Tour Concert Series. These iconic performances aired fifty-two one hour shows in 1997. The PBS TV Show featured each artist performing 3 songs. Sting, Meatloaf, Ozzy Osbourne, Lenny Kravitz, Busta Rhymes, Lou Reed, The Cure, Devo, Hot Tuna, Dennis Brown, Freda Payne, Joan Osbourne, Goo Goo Dolls, Bruce Hornsby, Indigo Girls, Smashing Pumpkins, A Tribe Called Quest, Tears for Fears, The Fugees and Cypress Hill are some of the many artists in this iconic series.

All cleared content will be monetized on the Company’s HD Streaming platform which is already completed. Some of the concerts recorded used as many as 22 cameras for each show. Several of these performances were recorded in 3D. Many titles will be offered to worldwide fans.

Fifty-Two On Tour Shows can be made available for TV in their original show configuration. The Company intends to offer all the artists revenue-sharing deals if they sign a new current contract with our company. The goal is to also release separate full-length concerts of each artist. The Company has talked to many of these artists with positive feedback. These concerts were never commercially available or seen as full length shows from each separate artist.”

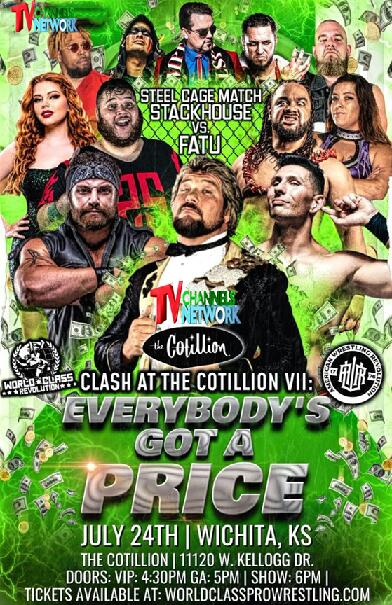

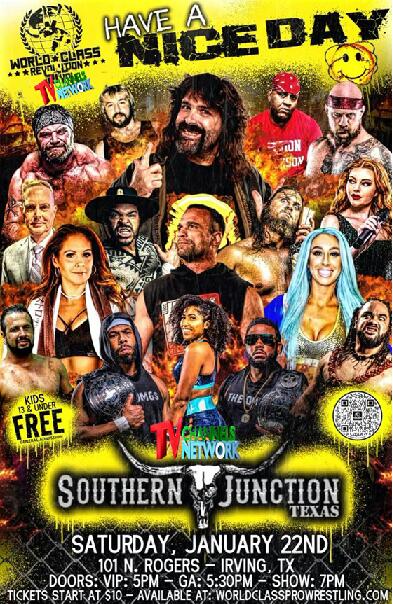

3.Wrestling. We are a financial partner in World Class Pro Wrestling and Lone Star Wrestling WAW. World Class Pro Wrestling and Lone Star Wrestling WAW have scheduled various live events this year. All the wresting events will be available streaming on TV Channels Network, Inc.’s streaming service.

17

18

19