AS FILED WITH THE U. S. SECURITIES AND EXCHANGE COMMISSION ON ______________________

REGISTRATION NO. ______________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_________________

TV Channels Network Inc.

(Exact name of registrant as specified in its charter)

_________________

Nevada | 7370 | 88-3851932 |

(State or Other Jurisdiction | (Primary Standard Industrial | (I.R.S. Employer |

of Incorporation or Organization) | Classification Number) | Identification No.) |

7582 Las Vegas Blvd. South

Las Vegas, Nevada 89123

(Address of Principal Executive Offices) (Zip Code)

(702) 721-9915

(Registrant’s telephone number, including area code)

Darryl Payne

7582 Las Vegas Blvd. South

Las Vegas, Nevada 89123

Phone: (702) 721-9915

E-mail: TVChannelsNetwork1@gmail.com

(Name, Address, Including Zip Code and Telephone Number,

Including Area Code, of Agent for Service)

WITH COPIES OF ALL CORRESPONDENCE TO:

Thomas C. Cook, Esq.

The Law Offices of Thomas C. Cook

10470 W. Cheyenne Avenue Suite 115, PMB 303

Las Vegas, Nevada 89129

Phone: (702) 524-9151

E-mail: tccesq@aol.com

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

i

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

ii

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

·Public Offering Prospectus. A prospectus to be used for the public offering of 1,250,000 shares of common stock of the registrant (the “Public Offering Prospectus”) through the underwriter named on the cover page of the Public Offering Prospectus.

·Resale Prospectus. A prospectus to be used for the resale by the selling stockholders set forth therein of 2,516,550 shares of common stock of the Registrant (the “Resale Prospectus”)

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

·they contain different front covers;

·they contain different Offering sections in the Prospectus Summary;

·they contain different Use of Proceeds sections;

·the Capitalization and Dilution sections are deleted from the Resale Prospectus;

·a Selling Stockholders section is included in the Resale Prospectus;

·the Underwriting section from the Public Offering Prospectus is deleted from the Resale Prospectus and a Plan of Distribution section is inserted in its place; and

·the Legal Matters section in the Resale Prospectus deletes the reference to counsel for the underwriter.

The registrant has included in this registration statement a set of alternate pages after the back cover page of the Public Offering Prospectus, which we refer to as the Alternate Pages, to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the selling stockholders.

iii

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U. S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED _______________, 2025

PROSPECTUS

TV Channels Network Inc.

This is an initial public offering of our common stock. We are offering 1,250,000 shares of our common stock, assuming a public offering price of $5.00 per share (which is the midpoint of the estimated range of the public offering price). We currently estimate that the public offering price will be between $4.00 and $6.00 per share..

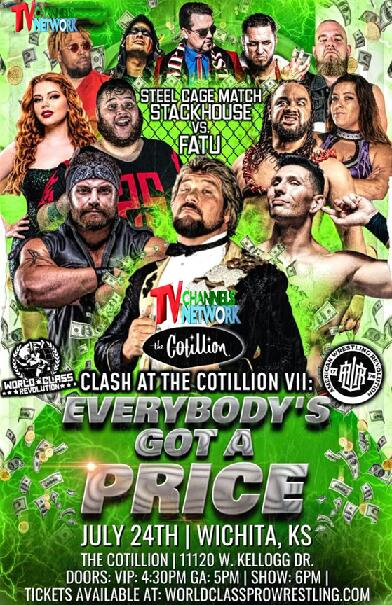

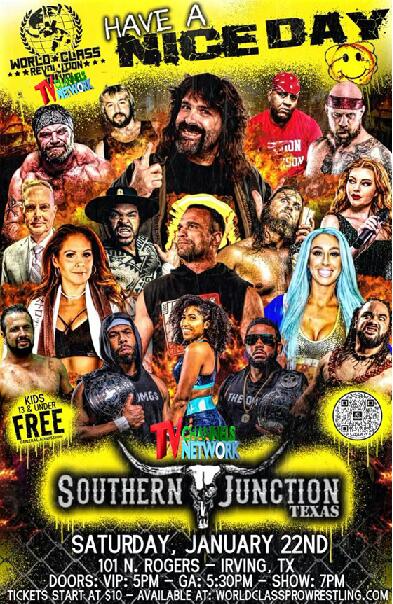

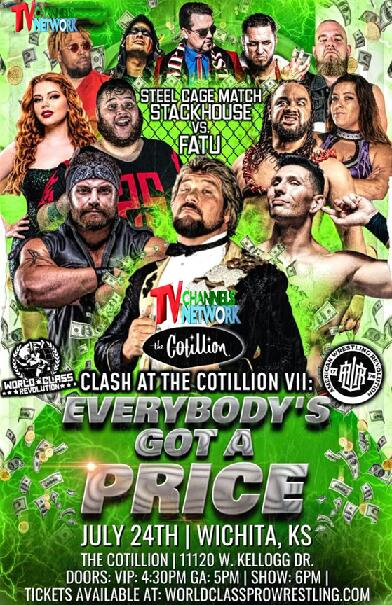

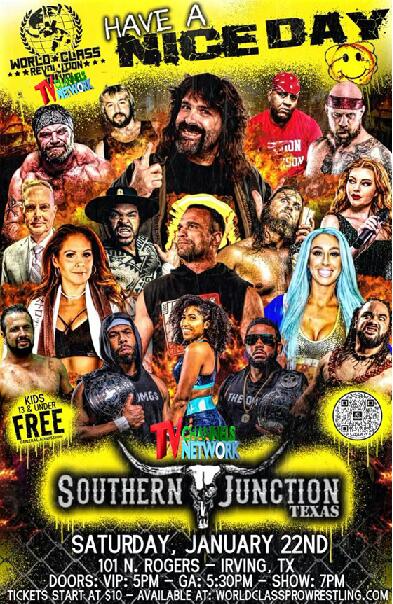

TV Channels Network Inc. is a Nevada based music and entertainment technology company whose primary business is providing Streaming services to subscribers. We intend to offer 100 Live Linear Concert Channels, Video on Demand, and various Live TV Channels as an AVOD/TVOD Service. TV Channels Network Inc. is preparing to become the next major entertainment content provider. Our goal is to create a conglomerate in many facets. Being a diversified entertainment business with multiple sources of income should allow us to earn positive returns. Moreover, TVCN, having already secured quality live concert titles, has a solid base for future profits to the benefit of our partners and investors. TV Channels Network - TV Channels Network.

Currently, there is no public market for our common stock. We have applied to list our common stock on the Nasdaq Capital Market, under the symbol “TVCN.” We cannot guarantee that our common stock will be approved for listing on the Nasdaq Capital Market, and if our application is not approved, this offering cannot be completed.

After completion of this offering, public investors in the public offering will own approximately 3.2% of our outstanding shares of common stock, other investors will own approximately 12.6% of our outstanding shares of common stock, and approximately 84.6% of our outstanding common stock will be deemed to be owned by Darryl Payne. Accordingly, we are a “controlled company” under Nasdaq corporate governance rules and are eligible for certain exemptions from these rules, though we do not intend to rely on any such exemptions. See “Risk Factors - We will be a ‘controlled company’ within the meaning of the listing rules of Nasdaq and, as a result, can rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies” on page 25 for more information.

Investing in our common stock involves a high degree of risk. See the section of this prospectus entitled “Risk Factors” beginning on page 15 for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the United States Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | PER SHARE | | TOTAL (4) |

Initial public offering price(1) | | $ | | | $ | |

Underwriting discounts and commissions(2) | | $ | | | $ | |

Proceeds, before expenses, to us(3) | | $ | | | $ | |

(1)The initial public offering price per share is assumed as $5.00 per share, which is the midpoint of the range set forth on the cover page of this prospectus.

(2)We have agreed to pay the underwriter a discount equal to 7.5% of the gross proceeds of the offering. We have agreed to sell to the Representative, on the applicable closing date of this offering, warrants in an amount equal to 6% of the aggregate number of shares of common stock sold by us in this offering (the “Representative’s Warrants”) (not including over-allotment shares). For a description of other terms of the Representative’s Warrants and a description of the other compensation to be received by the Underwriter, see “Underwriting” beginning on page 79.

iv

(3)Excludes fees and expenses payable to the Underwriter. The total amount of Underwriter’s expenses related to this offering is set forth in the section entitled “Underwriting.”

(4)Assumes that the Underwriter does not exercise any portion of their over-allotment option.

We expect our total cash expenses for this offering (including cash expenses payable to our Underwriter for its out-of-pocket expenses) to be approximately $200,000, exclusive of the above discounts. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting” beginning on page __.

This offering is being conducted on a firm commitment basis. The underwriter, Craft Capital Management, LLC (the “Underwriter”), is obligated to take and pay for all of the shares of common stock if any such shares of common stock are taken. We have granted the Underwriter an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of our shares of common stock to be offered by us pursuant to this offering (excluding shares of common stock subject to this option), solely for the purpose of covering over-allotments, at the initial public offering price less the underwriting discounts and commissions. If the underwriters exercise their option in full, the total underwriting discounts and commissions payable will be $[ ] based on the estimated offering price of $5.00 per share, and the total gross proceeds to us, before underwriting discounts and commissions expenses, will be $[ ]. If we complete this offering, net proceeds will be delivered to us on the applicable closing date.

The Underwriter expects to deliver the shares of common stock against payment as set forth under “Underwriting”, on or about [ ], 2025.

Neither the U. S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

CRAFT CAPITAL MANAGEMENT, LLC

The date of this prospectus is __________________, 2025

v

Table of Contents

vi

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this Prospectus. This summary does not contain all the information that may be important to you. You should read the more detailed information contained in this prospectus, including but not limited to, the risk factors beginning on page 3. References to “we,” “us,” “our,” “TV Channels Network Inc.,” or the “Company” mean TV Channels Network Inc.

Forward-Looking Statements

This Prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend, and similar expressions to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in the “Risk Factors” section and elsewhere in this Prospectus.

Our Company

TV Channels Network Inc. is a Nevada based music and entertainment technology company whose primary business is providing Streaming services to subscribers. We intend to offer 100 Live Linear Concert Channels, Video on Demand, and various Live TV Channels as an AVOD/TVOD Service. TV Channels Network Inc. is preparing to become the next major entertainment content provider. Our goal is to create a conglomerate in many facets. Being a diversified entertainment business with multiple sources of income should allow us to earn positive returns. Moreover, TVCN, having already secured quality live concert titles, has a solid base for future profits to the benefit of our partners and investors. TV Channels Network - TV Channels Network.

Public Market

TV Channels Network Inc. common shares are not currently traded on any recognized stock exchange or trading platform. We intend to list our common stock on NASDAQ. There is no assurance that our listing application will be approved by Nasdaq. The approval of our listing on Nasdaq is a condition of closing. If our application to Nasdaq is not approved or we otherwise determine that we will not be able to secure the listing of the common stock on Nasdaq, we will not complete the offering.

Common Stock Outstanding. 37,880,000 shares of common stock, par value $0.001.

Preferred Stock Outstanding. To date, there have been no issuances of the preferred stock of the Company.

Risks. The purchase of the common stock in this offering hereby involves a high degree of risk. The securities offered hereby are for investment purposes only and currently no market for the common shares exists. (See “Risk Factors”).

Use of Proceeds. The net proceeds of this offering will be used primarily for the following purposes: operations, software development, computer equipment, intellectual property, legal and accounting fees, offering expenses, marketing, and advertising and general working capital. (See “Use of Proceeds”).

Implications of Being an “Emerging Growth Company

As a public reporting company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

·are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

·are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis);

1

·are not required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes);

·are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure;

·may present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations, or MD&A;

·are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and

·are exempt from any PCAOB rules relating to mandatory audit firm rotation and any requirement to include an auditor discussion and analysis narrative in our audit report.

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding management’s assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

Under the JOBS Act, we may take advantage of these reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, or such earlier time that we no longer meet the definition of an emerging growth company. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period. Furthermore, under current SEC rules we will continue to qualify as a “smaller reporting company” for so long as we (1) have a public float (i.e., the market value of common equity held by non-affiliates) of less than $75 million as of the last business day of our most recently completed second fiscal quarter; or (2) for so long as we have a public float of zero, have annual revenues of less than $50 million during our most recently completed fiscal year.

Investors should be aware that we will be subject to the “Penny Stock” rules adopted by the Securities and Exchange Commission, which regulate broker-dealer practices in connection with transactions in Penny Stocks. These regulations may have the effect of reducing the level of trading activity, if any, in the secondary market for our stock, and investors in our common stock may find it difficult to sell their shares. Please see the disclosures under “Penny Stock Regulations” on Page 28 of this Prospectus for more information.

Our principal offices are located at 7582 Las Vegas Blvd. South, Las Vegas, Nevada 89123. Our telephone number is: (702) 721-9915.

2

The Offering

Securities Offered: | | |

| | |

Offering Price | | We currently estimate that the public offering price will be between $[ ] and $[ ] per share. For purposes of this prospectus, the assumed public offering price per share is $[ ], the midpoint of the anticipated price range. The actual offering price per share will be as determined between the underwriter and us based on market conditions at the time of pricing. Therefore, the assumed offering price used throughout this prospectus may not be indicative of the final offering price. |

| | |

Shares Offered | | 1,250,000 shares of common stock (or 1,437,500 shares if the underwriter exercises the over-allotment option in full). |

| | |

Shares Outstanding Before the Offering: | | 37,880,000 shares of common stock. |

| | |

Shares Outstanding After the Offering: | | 39,130,000 shares of common stock (or 39,317,500 shares if the underwriter exercises the over-allotment option in full). |

| | |

Over-allotment option: | | We have granted to the underwriter a 45-day option to purchase from us up to an additional 15% of the shares sold in the offering (187,500 additional shares) at the initial public offering price, less the underwriting discounts and commissions. |

| | |

Use of Proceeds | | We expect to receive net proceeds of approximately $[ ] from this offering (or approximately $[ ] if the underwriters exercise their over-allotment option in full), assuming an initial public offering price of $[ ] per share (which is the midpoint of the estimated range of the initial public offering price shown on the cover page of this prospectus) and no exercise of the underwriters’ over-allotment option, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to purchase advertisement, develop our website, and purchase further equipment needed for operations, expenses associated with becoming a public company; and general corporate and working capital purposes. See “Use of Proceeds” section for more information on the use of proceeds. |

| | |

Lock-up | | We, all of our directors and officers, our majority shareholder, and other shareholders holding over 5% of our common stock, have agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our common stock or securities convertible into or exercisable or exchangeable for our common stock for a period of twelve months after the closing of this offering. The underwriters have agreed to waive the lock-up requirement for shares of common stock being sold by the selling stockholders named in the Resale Prospectus. See “Underwriting” for more information. |

| | |

Proposed trading market and symbol | | We have applied to list our common stock on the Nasdaq Capital Market under the symbol “TVCN.” We believe that upon the completion of this offering, we will meet the standards for listing on Nasdaq. The closing of this offering is contingent upon the successful listing of our common stock on the Nasdaq Capital Market. |

3

Selected Financial Data

The following financial information summarizes the more complete historical financial information at the end of this Prospectus.

The summary information below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the December 31, 2023 audited financial statements and notes and the unaudited September 30, 2024 financial statements and notes thereto included elsewhere in this Prospectus.

Balance Sheet Data | | | | |

| | December 31, 2023 (audited) | | From Inception (August 12, 2022) to September 30, 2024 (unaudited) |

| | | | |

Total cash and equivalents | | $374 | | $244 |

Total current assets | | $374 | | $244 |

Total other assets | | $0 | | $0 |

| | | | |

| | | | |

Total Assets | | $374 | | $244 |

| | | | |

Total current liabilities | | $8,574 | | $9,534 |

Total liabilities | | $8,574 | | $9,534 |

| | | | |

Income Statement Data | | | | |

| | For the three months ended September 30, 2024 (unaudited) | | From Inception (August 12, 2022) to September 30, 2024 (unaudited) |

Revenues | | $- | | $- |

| | | | |

General & Administrative Expenses | | 1,090 | | 1,036 |

| | | | |

Net loss from Operations | | $(1,090) | | $(1,036) |

| | | | |

Net income (loss) applicable to common shareholders | | $(1,090) | | $(1,036) |

SUMMARY OF RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk Factors” section immediately following this Prospectus Summary. These risks include, but are not limited to, the following:

·We have a limited operating history.

·We have limited revenue-producing operations and may need additional capital.

·The internet-based entertainment business is highly competitive, and many of our competitors have greater resources than we do.

·Significant expansion will be required to address potential growth in our customer base.

·Dependence on management and key personnel.

·Possible inability to find suitable employees.

4

·It is likely that we will need to conduct further nonpublic sales of our securities.

·The offering price of the common shares offered hereunder has been arbitrariliy determined and bears no relationship to any objective criterion of value.

·We may experience significant losses from operations.

·There has been no public market for our common stock prior to this offering, and an active market in which investors can resell their shares of our common stock may not develop.

·We may not be able to satisfy listing requirements of Nasdaq or obtain or maintain listing of our common stock on Nasdaq.

·Listing our common stock on a securities exchange will likely increase our regulatory burden.

·The market price of our common stock may fluctuate, and you could lose all or part of your investment.

·We do not anticipate paying cash dividends in the foreseeable future.

·The application of the net proceeds of this offering is substantially within the discretion of management.

·There has been no independent valuation of our stock, which means that our common stock may be worth less than the offering price in the offering..

·The offering price of the primary offering and the resale offering could differ.

·The resale by the selling stockholders may cause the market price of our common stock to decline.

·The Company is entirely dependent on its internet content for digital broadcast for use by television, computers and mobile devises, and our future revenue depends on its commercial success.

·Any fasilure of our telecommunications providers to provide required transmission capacity to us could result in interruptions in our service.

·Our business will suffer if the business is not able to scale its network as demand increases.

·Our business may suffer if we do not respond to technological changes.

·If we fail to promote and maintain its brand in the market, our business, operating results, financial condition, and our ability to attract customers will be materially adversely affected.

·If studios, content providers or other rights holders refuse to license streaming content or other rights upon terms acceptable to us, our business could be adversely affected.

·If our efforts to attract and retain members are not successful, our business will be adversely affected

·If we are unable to compete effectively, our business will be adversely affected.

·The long-term and fixed cost nature of our content licenses may limit our operating flexibility and could adversely affect our liquidity and results of operation.

·If our efforts to build a strong brand identity and improve member satisfaction and loyalty are not successful, we may not be able to attract or retain members, and our operating results may be adversely affected..

·We face risks, such as unforeseen costs and potential liability in connection with content we produce, license and/or distribute through our service.

5

·If studios, content providers or other rights holders refuse to license streaming content or other rights upon terms acceptable to us, our business could be adversely affected.

·If governmet regulations relating to the Internet or other areas of our business change, we may need to alter the way we conduct our business or incur greater operating expenses.

·Changes in how network operators handle and charge for access to data that travel across their networks could adversely impact on our business.

·Increases in payment processing fees, changes in operating rules, the acceptance of new types of payment methods or payment fraud could increase our operating expenses and adversely affect our business and results of operations.

·If the market segment for online entertainment video saturates, our business will be adversely affected.

·Intellectual property claims against us could be costly and result in the loss of significant rights related to, among other things, our website, streaming technology, our recommendations, and merchandising technology, title selection processes and marketing activities.

·We may issue shares of preferred stock in the future that may adversely impact your rights as holders of our common stock..

·We may be exposed to potential risks resulting from requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

·Purchasers of our common shares will experience immediate and substantial dilution.

·Our projections are hypothetical and based upon the presumed financial performance of the Company.

6

RISK FACTORS

Please consider the following risk factors before deciding to invest in our preferred and common stock.

This offering and any investment in our preferred and common stock involves a high degree of risk. You should carefully consider the risks discussed in this section and all of the information contained in this Prospectus before deciding whether to purchase our preferred or common stock.

If any of the following risks actually occur, our business, financial condition, and results of operations could be harmed. An investment in our common and preferred stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this Prospectus before investing in our preferred and common stock. If any of the following risks occur, our business, operating results, and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We Have a Limited Operating History

The Company has a limited operating history on which to base an evaluation of its business and prospects. The Company is subject to all the risks inherent in a small company seeking to develop, market and distribute new services, particularly companies in evolving markets such as the Internet. The likelihood of the Company’s success must be considered, in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the development, introduction, marketing and distribution of new products and services in a competitive environment.

Such risks for the Company include, but are not limited to, dependence on the success and acceptance of the Company’s services, the ability to attract and retain a suitable client base, and the management of growth. To address these risksIn view of the rapidly evolving nature of the Company’s business and its limited operating history, the Company believes that period-to-period comparisons of its operating results are not necessarily meaningful and should not be relied upon as an indication of future performance.

We have limited revenue-producing operations and may ned additional capital

The Company has limited revenue-producing operations and will require the proceeds from this offering to execute its full business plan. The Company believes the proceeds from this offering will be sufficient to develop its initial plans. However, the Company can give no assurance that all, or even a significant portion of these shares will be sold or that the money raised will be sufficient to execute the entire business plan of the Company. Further, no assurance can be given if additional capital is needed as to how much additional capital will be required or that additional financing can be obtained, or if obtainable, that the terms will be satisfactory to the Company, or that such financing would not result in a substantial dilution of shareholder’s interest.

Competition

The internet-based entertainment business is highly competitive, and the Company competes with many different types of companies that offer some form of streaming entertainment content. Certain of these competitors may have greater industry experience or financial and other resources than the Company.

Growth Strategy Implementation: Ability to Manage Growth

The Company anticipates that significant expansion will be required to address potential growth in its customer base and market opportunities. The Company’s expansion is expected to place a significant strain on the Company’s management, operational and financial resources. To manage any material growth of its operations and personnel, the Company may be required to improve existing operational and financial systems, procedures, and controls and to expand, train and manage its employee base. There can be no assurance that the Company’s planned personnel, systems, procedures, and controls will be adequate to support the Company’s future operations, that management will be able to hire, train, retain, motivate, and manage required personnel or that the Company’s management will be able to successfully identify, manage and exploit existing and potential market opportunities. If the Company is unable to manage growth effectively, its business, prospects, financial condition, and results of operations may be materially adversely affected.

7

Dependence upon Management and Key Personnel

The Company is and will be heavily dependent on the skill, acumen, and services of the management of the Company. The loss of the services of these key individuals, and certain others, for any substantial length of time, would materially and adversely affect the Company’s results of operation and financial position. (See “Management”).

Possible Inability to Find Suitable Employees

The Company’s success depends significantly on its ability to attract and retain highly qualified personnel, including retaining the services of full-time employees, part-time employees, and managers to assist the Company in the conduct and management of the Company’s business. Competition for such personnel is intense. There can be no assurance that the Company will be able to find these suitable employees or personnel, or if found, that these employees or personnel can be hired on terms favorable to the Company.

Other Nonpublic Sales of Securities Likely

As part of the Company’s plan to raise additional capital and because of the capital-intensive nature to establish a brand name on the Internet, the Company will likely make offers and sales of its common stock and/or preferred stock to qualified investors in transactions which are exempt from registration under the 1933 Act, as amended, in the future. Other offers and sales of common stock or preferred stock may be at prices per share that are higher or lower than the price per share in this offering or higher or lower than the conversion rate of the share of this offering. The Company reserves the right to set prices at its discretion, which prices need not relate to any ascertainable criterion of value. There can be no assurance the Company will not make other offers at lower prices per share, when, at the Company’s discretion, such price is deemed by the Company to be reasonable under the circumstances.

Arbitrary Offering Price

The offering price of the common shares offered hereunder has been arbitrarily determined and bears no relationship to any objective criterion of value. The price does not bear any relationship to the assets, book value, historical earnings, or net worth of the Company. In determining the offering price, the Company considered such factors as the prospects, if any, for similar companies, the previous experience of management, the Company’s anticipated results of operations, the present financial resources of the Company and the likelihood of acceptance of this offering. Please review any financial or other information contained in this Offering Circular with qualified people to determine its suitability as an investment before purchasing any shares in this offering.

We may experience significant losses from operations.

Even if we do generate operating income in one or more quarters in the future, subsequent developments in our industry, customer base, business or cost structure or an event such as significant litigation or a significant transaction may cause us to again experience operating losses. We may not become profitable in the long- term, or even for any.

There has been no public market for our common stock prior to this offering, and an active market in which investors can resell their shares of our common stock may not develop.

Prior to this offering, there has been no public market for our common stock. We have applied to list of our common stock on Nasdaq under the symbol “TVCNTVCN.” The closing of this offering is contingent upon the successful listing of our common stock on the Nasdaq Capital Market. There is no guarantee that Nasdaq, or any other exchange or quotation system, will permit our common stock to be listed and traded. If we fail to obtain a listing on Nasdaq, we may seek quotation on the OTCQX Best Market or OTCQB Venture Market of the OTC Link ATS (alternative trading system) operated by OTC Markets Group, Inc. These markets are inter-dealer, over-the-counter markets that provide significantly less liquidity than Nasdaq.

Even if our common stock is approved for listing on Nasdaq, a liquid public market for our common stock may not develop. The initial public offering price for our common stock has been determined by negotiation between us and the underwriters based upon several factors, including prevailing market conditions, our historical performance, estimates of our business potential and earnings prospects, and the market valuations of similar companies. The price at which the common stock is traded after this offering may decline below the initial public offering price, meaning

8

that you may experience a decrease in the value of your common stock regardless of our operating performance or prospects.

We may not be able to satisfy listing requirements of Nasdaq or obtain or maintain a listing of our common stock on Nasdaq.

If our common stock is listed on Nasdaq, we must meet certain financial and liquidity criteria to maintain such listing. If we violate Nasdaq’s listing requirements, or if we fail to meet any of Nasdaq’s listing standards, our common stock may be delisted. In addition, our board of directors may determine that the cost of maintaining our listing on a national securities exchange outweighs the benefits of such listing. A delisting of our common stock from Nasdaq may materially impair our shareholders’ ability to buy and sell our common stock and could have an adverse effect on the market price of, and the efficiency of the trading market for, our common stock. The delisting of our common stock could significantly impair our ability to raise capital and the value of your investment.

Listing our common stock on a securities exchange will likely increase our regulatory burden.

We have applied for the listing of our common stock under the symbol “TVCN” on the Nasdaq Capital Market. Our application has not yet been approved by Nasdaq, and there is no guarantee that our application will be approved in connection with this offering. Although to date we have not been subject to the continuous and timely disclosure requirements of exchange rules, regulations and policies of Nasdaq, we are working with our legal, accounting and financial advisors to identify those areas in which changes should be made to our financial management control systems to manage our obligations as a public company listed on Nasdaq. These areas include corporate governance, corporate controls, disclosure controls and procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas, including our internal controls over financial reporting. However, we cannot assure holders of our shares that these and other measures that we might take will be sufficient to allow us to satisfy our obligations as a public company listed on Nasdaq on a timely basis and that we will be able to achieve and maintain compliance with applicable listing requirements. In addition, compliance with reporting and other requirements applicable to public companies listed on Nasdaq will create additional costs for us and will require the time and attention of management. We cannot predict the amount of the additional costs that we might incur, the timing of such costs or the effects that management’s attention to these matters will have on our business.

The market price of our common stock may fluctuate, and you could lose all or part of your investment.

After this offering, the market price for our common stock is likely to be volatile, in part because our shares have not been traded publicly. In addition, the market price of our common stock may fluctuate significantly in response to several factors, most of which we cannot control, including:

·actual or anticipated variations in our periodic operating results;

·increases in market interest rates that lead investors of our common stock to demand a higher investment return;

·changes in earnings estimates;

·changes in market valuations of similar companies;

·actions or announcements by our competitors;

·adverse market reaction to any increased indebtedness we may incur in the future;

·additions or departures of key personnel;

·actions by shareholders;

·speculation in the media, online forums, or investment community; and

·our intentions and ability to list our common stock on Nasdaq and our subsequent ability to maintain such listing.

The public offering price of our common stock has been determined by negotiations between us and the underwriters based upon many factors and may not be indicative of prices that will prevail following the closing of this offering. Volatility in the market price of our common stock may prevent investors from being able to sell their common stock at or above the initial public offering price. As a result, you may suffer a loss on your investment.

9

We do not anticipate paying cash dividends in the foreseeable future.

To date, the Company has not declared or paid any cash dividends on its stock and does not anticipate paying cash dividends in the foreseeable future. The payment of cash dividends, if any, in the future will be at the sole discretion of the Board of Directors.

We will be a “controlled company” within the meaning of the listing rules of Nasdaq and, as a result, can rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies.

Because Darryl Payne owns a majority of our common stock and will own a majority of our common stock after this offering, we will be a “controlled company” as defined under the listing rules of Nasdaq. Under Nasdaq listing rules, controlled companies are companies of which more than 50% of the voting power for the election of directors is held by an individual, a group, or another company. For as long as we remain a controlled company, we are permitted to elect to rely on certain exemptions from Nasdaq’s corporate governance rules, including the following:

·an exemption from the rule that a majority of our board of directors must be independent directors;

·an exemption from the rule that our compensation committee be composed entirely of independent directors;

·an exemption from the rule that our director nominees must be selected or recommended solely by independent directors or a nominating committee composed solely of independent directors;

Although we do not intend to rely on the “controlled company” exemptions to Nasdaq’s corporate governance rules, we could elect to rely on these exemptions in the future. If we elected to rely on the “controlled company” exemptions, a majority of the members of our board of directors might not be independent directors, our nominating and corporate governance and compensation committees might not consist entirely of independent directors upon closing of the offering, and you would not have the same protection afforded to shareholders of companies that are subject to Nasdaq’s corporate governance rules.

The application of the net proceeds of this offering is substantially within the discretion of the management.

Although a majority portion of the net proceeds of this Offering Circular is for specific uses, the balance will be available for working capital and general corporate purposes. Therefore, the application of the net proceeds of this offering is substantially within the discretion of the management. Investors will be relying on the Company’s management and business judgment based solely on limited information. No assurance can be given that the application of the net proceeds of this Offering Circular will result in the Company achieving its financial and strategic objectives.

There has been no independent valuation of our stock, which means that our common stock may be worth less than the offering price in the offering.

The per share purchase price in the offering has been determined by us without independent valuation of our shares of common stock. The initial public offering price for our common stock has been determined by negotiation between us and the underwriters based upon several factors, including prevailing market conditions, our historical performance, estimates of our business potential and earnings prospects, and the market valuations of similar companies. There is no relation to the market value, book value, or any other established criteria. We did not obtain an independent appraisal opinion on the valuation of our shares. Our shares of common stock may have a value significantly less than the offering price, and the shares may never obtain a value equal to or greater than the offering price.

The offering price of the primary offering and resale offering could differ.

The offering price of our common stock in the primary offering (the initial public offering) has been determined by negotiations between the Company and the underwriter based upon several factors, including prevailing market conditions, our historical performance, estimates of our business potential and earnings prospects, and the market valuations of similar companies. The offering price in the primary offering bears no relationship to our assets, earnings or book value, or any other objective standard of value. Additionally, the estimated offering price in the primary offering of $[ ] per share is substantially higher than the prices at which the selling stockholders acquired their shares ($1.00 and $2.00 per share), and we recently sold stock at prices ($1.00 and $2.00 per share) substantially less than the primary offering price. Our recent share issuances at prices substantially less than the primary offering price

10

occurred while we were a non-public company, and the shares we issued were subject to transfer restrictions imposed by the Securities Act of 1933, as amended, and by lock-up restrictions, whereas shares issued in the primary offering will be issued after we are a public company and will be issued without restriction.

The selling stockholders may sell the resale shares at prevailing market prices or privately negotiated prices after close of the primary offering and listing of our common stock on the Nasdaq Capital Market. Therefore, the offering prices of our common stock in the primary offering and the resale offering could differ. As a result, purchasers in the resale offering could pay more or less than the offering price in the primary offering.

The resale by the selling stockholders may cause the market price of our common stock to decline.

The resale of shares of our common stock by the selling stockholders in the resale offering could result in resales of our common stock by our other shareholders concerned about selling volume. In addition, the resale by the selling stockholders after expiration of the lock-up period could have the effect of depressing the market price for our common stock.

If securities industry analysts do not publish research reports on us, or publish unfavorable reports on us, then the market price and market trading volume of our common stock could be negatively affected.

Any trading market for our common stock may be influenced in part by any research reports that securities industry analysts publish about us. We do not currently have and may never obtain research coverage by securities industry analysts. If no securities industry analysts commence coverage of us, the market price and market trading volume of our common stock could be negatively affected. In the event we are covered by analysts, and one or more of such analysts downgrade our securities, or otherwise reports on us unfavorably, or discontinues coverage of us, the market price and market trading volume of our common stock could be negatively affected.

The Company is Entirely Dependent on its Internet Content for Digital Broadcast for use by Televisions, Computers and Mobile Devices, and the Company’s Future Revenue Depends on Its Commercial Success

The Company’s future development and growth depends on the commercial success of the Company’s Internet Broadcast content delivery service. The Company’s streaming service, or other services under development, may not achieve widespread market acceptance. The Company has recently begun to commercially introduce its service for the delivery of digital video (with audio), and the Company’s future growth will depend, in part, on customer acceptance of this service. Failure of the Company’s current and planned services to operate as expected could delay or prevent their adoption. If the Company’s targeted customers do not purchase and successfully deploy the Company’s planned services, the Company’s revenue will not grow significantly the Company’s business, results of operations and financial condition will be seriously harmed. In addition, to the extent that the Company promotes any portion of its streaming technology as an industry standard by making it readily available to users for little or no charge, the Company may not receive revenue that might otherwise have been received by the Company.

The Internet Content Delivery Market for Television, Computer and Mobile Devices is Relatively New, and the Company’s Business will Suffer if it Does Not Continue to Develop as the Company Expects

The market for Internet content delivery services to televisions, computers and mobile devices is relatively new. The Company cannot be certain that a viable market for the Company’s Broadcast technology service will emerge or be sustainable. If this market does not develop or develops more slowly than the Company expects, the Company’s business, results of operations and financial condition will be seriously harmed.

ANY FAILURE OF THE COMPANY’S INTERNET BROADCAST NETWORK INFRASTRUCTURE COULD LEAD TO SIGNIFICANT COSTS AND DISRUPTIONS WHICH COULD REDUCE THE COMPANY’S REVENUE AND HARM THE COMPANY’S BUSINESS, FINANCIAL RESULTS, AND REPUTATION.

The Company’s business is dependent on providing its customers with fast, efficient and reliable Internet Broadcasted content. To meet these customer requirements, the Company must protect its network infrastructure against damage from:

·Human Error;

·Physical and Electronic Security Breaches;

·Fire, Earthquake, Flood, and other Natural Disasters;

11

·Power Loss;

·Sabotage and Vandalism; and

·Similar Events.

Any Failure of the Company’s Telecommunications Providers to Provide Required Transmission Capacity to the Company Could Result in Interruptions in the Company’s Service

The Company’s operations are dependent upon transmission capacity provided by third-party telecommunications providers. Any failure of such telecommunications providers to provide the capacity that the Company requires may result in a reduction in, or termination of, service to the Company’s customers. This failure may be a result of the telecommunications providers or Internet service providers choosing services that are competitive with the Company’s service, failing to comply with or terminating their agreements with the Company, or otherwise not entering relationships with the Company at all, or on terms commercially acceptable to the Company. If the Company does not have access to third-party transmission capacity, the Company could lose customers or fees charged to such customers, and the Company’s business and financial results could suffer.

The Markets in Which the Company Operates are Highly Competitive and the Company may be unable to Compete Successfully against New Entrants and Established Companies with Greater Resources.

The Company competes in markets that are new, intensely competitive, highly fragmented and rapidly changing. Many of the Company’s current competitors, as well as a few of the Company’s potential competitors, have longer operating histories, greater name recognition, and substantially greater financial, technical and marketing resources than the Company does. Some of the Company’s current or potential competitors have the financial resources to withstand substantial price competition. Moreover, many of the Company’s competitors have more extensive customer bases, broader customer relationships and broader industry alliances that they could use to their advantage in competitive situations, including relationships with many of the Company’s potential customers. The Company’s competitors may be able to respond more quickly than the Company can to new or emerging technologies and changes in customer requirements.

As competition in the Internet content delivery market continues to intensify, new solutions will come to market. The Company is aware that other companies will in the future focus significant resources on developing and marketing digital broadcast products and services that will compete with the Company’s products and services.

Increased competition could result in:

·Price and Revenue Reductions and Lower Profit Margins;

·Increased Cost of Service from Telecommunications Providers;

·Loss of Customers; and

·Loss of Market Share

Anyone of these could materially and adversely affect the Company’s business, financial condition, and results of operations.

The Company’s Business will suffer if the Business is Not Able to Scale Its Network as Demand Increases

The Company has had only limited deployment of its Internet Broadcast content delivery service to date, and the Company cannot be certain that its network can connect and manage a substantially larger number of customers at high transmission speeds. The Company’s network may not be scalable to expected customer levels while maintaining superior performance. In addition, as customers’ usage of bandwidth increases, the Company will need to make additional investments in its infrastructure to maintain adequate downstream data transmission speeds. The Company cannot assure you that it will be able to make these investments successfully or at an acceptable cost. Upgrading the Company’s infrastructure may cause delays or failures in the Company’s network. As a result, in the future, the Company’s network may be unable to achieve or maintain a sufficiently high transmission capacity. The Company’s failure to achieve or maintain high-capacity data transmission could significantly reduce demand for the Company’s service, reducing the Company’s revenue and causing the Company’s business and financial results to suffer.

12

The Company’s Business may suffer if the Company Does Not Respond to Technological Changes

The market for Internet content delivery services is likely to be characterized by rapid technological change, frequent new product and service introductions and changes in customer requirements. The Company may be unable to respond quickly or effectively to these developments. If competitors introduce products, services or technologies that are better than that of the Company, or that gain greater market acceptance, or if new industry standards emerge, our Internet-based broadcast technology may become obsolete, which would materially and adversely affect the Company’s business, results of operations and financial condition.

In developing the Company’s Internet-based broadcast service, the Company has made and will continue to make assumptions about the standards that the Company’s customers and competitors may adopt. If the standards adopted are different from those which the Company may now or in the future promote or support, market acceptance of the Company’s service may be significantly reduced or delayed, and the Company’s business will be seriously harmed. In addition, the introduction of services or products incorporating new technologies and the emergence of new industry standards could render the Company’s existing services obsolete.

If the Company Fails to Promote and Maintain Its Brand in the Market, the Company’s Business, Operating Results, Financial Condition, and Its Ability to Attract Customers will be Materially Adversely Affected

The Company’s success depends on the Company’s ability to create and maintain brand awareness for its Internet Broadcasting Products and Services. This may require a significant amount of capital to allow the Company to market the Company’s Internet Broadcasting products and services and to establish brand recognition and customer loyalty. Many of the Company’s competitors in this market are larger than the Company and have substantially greater financial resources than those of the Company. Additionally, many of the companies offering similar products have already established their brand identity within the marketplace. The Company can offer no assurances that it will be successful in establishing awareness of the Company’s brand, allowing the Company to compete in this market. The importance of brand recognition will continue to increase because of low barriers of entry to the industries in which the Company operates and may result in an increased number of direct competitors. To promote the Company’s brands, the Company may be required to continue to increase its financial commitment to creating and maintaining brand awareness. The Company may not generate a corresponding increase in revenue to justify these costs.

If Studios, Content Providers or Other Rights Holders Refuse to License Streaming Content or Other Rights Upon Terms Acceptable to the Company, the Company’s Business Could be Adversely Affected

The Company’s ability to provide its members with content they can watch and/or listen to instantly depends on studios, content providers and other rights holders licensing rights to distribute such content and certain related elements thereof, such as the public performance of music contained within the content that the Company distributes. The license periods and the terms and conditions of such licenses vary. If the studios, content providers and other rights holders are not, or are no longer willing, or are unable to license to the Company upon terms that are acceptable to the Company, the Company’s ability to stream content to the Company’s Members will be adversely affected and/or the Company’s costs could increase. Many of the licenses for content provide for the studios or other content providers to withdraw content from the Company’s service relatively quickly. Because of these provisions, as well as other actions the Company may take, content available through the Company’s streaming service can be withdrawn on short notice. As competition increases, the Company may see the cost of programming increase. As the Company seeks to differentiate its service, the Company is increasingly focused on securing certain exclusive rights when obtaining content, including original content. The Company is also focused on programming an overall mix of content that delights the Company’s members in a cost-efficient manner. Within this context, the Company will be selective about the titles that it adds and renews to its service. If the Company does not maintain a compelling mix of content, the Company’s member acquisition and retention numbers may be adversely affected.

Music contained within content that it distributes may require the Company to obtain licenses for such distribution. In this regard, the Company will engage in negotiations with performing rights organizations and collection societies (“PROs”) that hold certain rights to music interests when “publicly performed” or “communicated to the public” in connection with streaming content into various territories. If the Company is unable to reach mutually acceptable terms with these organizations, the Company could become involved in litigation and/or could be enjoined from distributing certain content, which could adversely impact the Company’s business. Additionally, pending and ongoing litigation, as well as negotiations between certain PROs and other third parties in various territories could adversely impact the Company’s negotiations with PROs or result in music publishers represented by certain PROs to unilaterally withdraw rights, and thereby adversely impact the Company’s ability to reach licensing agreements

13

acceptable to the Company. Failure to reach such licensing agreements could expose the Company to potential liability for copyright infringement or otherwise increase the Company’s cost(s).

If our efforts to attract and retain members are not successful, our business will be adversely affected.

Our ability to attract members will depend in part on our ability to consistently provide our members with valuable and quality experience for selecting and viewing audio and video content. Furthermore, the relative service levels, content offerings, pricing, and related features of competitors to our service may adversely impact our ability to attract and retain members. Competitors include multichannel video programming distributors providing free on-demand content through authenticated Internet applications, Internet-based movie, and TV content providers, including both those that provide legal and illegal (or pirated) entertainment video content, DVD rental outlets and kiosk services and entertainment video retail stores. If consumers do not perceive our service offering to be of value, or if we introduce new or adjust existing features or change the mix of content in a manner that is not favorably received by them, we may not be able to attract and retain members. If our efforts to satisfy our existing members are not successful, we may not be able to attract members, and as a result, our ability to maintain and/or grow our business will be adversely affected. Members cancel our service for many reasons, including a perception that they do not use the service sufficiently, the need to cut household expenses, availability of content is unsatisfactory, competitive services provide a better value or experience and customer service issues are not satisfactorily resolved. We must continually add new members both to replace members who cancel and to grow our business beyond our current member base. If too many of our members cancel our service, or if we are unable to attract new members in numbers sufficient to grow our business, our operating results will be adversely affected. If we are unable to successfully compete with current and new competitors in both retaining our existing members and attracting new members, our business will be adversely affected. Further, if excessive numbers of members cancel our service, we may be required to incur significantly higher marketing expenditures than we currently anticipate replacing these members with new members.

If we are unable to compete effectively, our business will be adversely affected.

The market for entertainment audio and video is intensely competitive and subject to rapid change. New technologies and evolving business models for delivery of entertainment videos continue to develop at a fast pace. The growth of Internet-connected devices, including TVs, computers and mobile devices has increased the consumer acceptance of Internet delivery of entertainment video. Through these new and existing distribution channels, consumers are afforded various means for consuming entertainment audio and video. The various economic models underlying these different means of entertainment video delivery include subscription, transactional, ad-supported, and piracy-based models. All of these have the potential to capture meaningful segments of the entertainment audio and video market. Several competitors have longer operating histories, large customer bases, strong brand recognition, and significant financial, marketing, and other resources. They may secure better terms from suppliers, adopt more aggressive pricing, and devote more resources to technology, fulfillment, and marketing. New entrants may enter the market with unique service offerings or approaches to providing entertainment videos, and other companies also may enter business combinations or alliances that strengthen their competitive positions. If we are unable to compete with current and new competitors, programs, and technologies successfully or profitably, our business will be adversely affected, and we may not be able to increase or maintain market share, revenues or profitability.

The long-term and fixed cost nature of our content licenses may limit our operating flexibility and could adversely affect our liquidity and results of operation.

In connection with obtaining streaming content, we plan to enter into multi-year licenses with studios and other content providers, the payment terms of which are not tied to member usage or the size of our member base (“fixed cost”), but which may be tied to such factors as titles licensed and/or theatrical exhibition receipts. Given the multiple-year duration and largely fixed cost nature of content licenses, if member acquisition and retention do not meet our expectations, our margins may be adversely impacted. Payment terms for streaming licenses, especially programming that is initially available in the applicable territory on our service (“original programming”), or that is considered output content, will typically require more up-front cash payments than other licensing agreements. To the extent member and/or revenue growth do not meet our expectations, our liquidity and results of operations could be adversely affected because of content licensing commitments and accelerated payment requirements of certain licenses. In addition, the long-term and fixed cost nature of our content licenses may limit our flexibility in planning for or reacting to changes in our business and the market segments in which we operate. As we expand internationally, we must license content in advance of entering a new geographical market. If we license content that is not favorably received by consumers in the applicable territory, acquisition, and retention may be adversely impacted and given the

14

long-term and fixed cost nature of our content licenses, we may not be able to adjust our content offering quickly, and our results of operation may be adversely impacted.

If our efforts to build a strong brand identity and improve member satisfaction and loyalty are not successful, we may not be able to attract or retain members, and our operating results may be adversely affected.

We must build and maintain a strong brand identity. We believe that strong brand identity will be important in attracting and retaining members who have a few choices from which to obtain entertainment video. To build a strong brand, we believe we must offer content and service features that our members value and enjoy. We also believe that these must be coupled with effective consumer communications, such as marketing, customer service and public relations. If our efforts to promote and maintain our brand are not successful, our ability to attract and retain members may be adversely affected. Such a result, coupled with the increasingly long-term and fixed cost nature of our content acquisition licenses, may adversely affect our operating results.

We face risks, such as unforeseen costs and potential liability in connection with content we produce, license and/or distribute through our service.

As a distributor of content, we face potential liability for negligence, copyright, or trademark infringement or other claims based on the nature and content of materials that we produce, license and/or distribute. We also may face potential liability for content used in promoting our service, including marketing materials and features on our website. As we expand our original programming, we will become responsible for production costs and other expenses, such as ongoing guild payments. We will also take on risks associated with the production, such as completion and key talent risk. To the extent we do not accurately anticipate costs or mitigate risks, or if we become liable for the content we produce, license and/or distribute, our business may suffer. Litigation to defend these claims could be costly and the expenses and damages arising from any liability or unforeseen production risks could harm the results of operations. We cannot assure that we are indemnified to cover claims or costs of these types and we may not have insurance coverage for these types of claims.

If studios, content providers or other rights holders refuse to license streaming content or other rights upon terms acceptable to us, our business could be adversely affected.

Our ability to provide our members with content they can watch or listen to instantly depends on studios, content providers and other rights holders licensing rights to distribute such content and certain related elements thereof, such as the public performance of music contained within the content we distribute. The license periods and the terms and conditions of such licenses vary. If the studios, content providers and other rights holders are not or are no longer willing or able to license our content upon terms acceptable to us, our ability to stream content to our members will be adversely affected and/, or our costs could increase. Many of the licenses for content provide for the studios or other content providers to withdraw content from our service relatively quickly. Because of these provisions as well as other actions we may take, content available through our service can be withdrawn on short notice. As competition increases, we may see the cost of programming increase. As we seek to differentiate our service, we are increasingly focused on securing certain exclusive rights when obtaining content, including original content. We are also focused on programming an overall mix of content that delights our members in a cost-efficient manner. Within this context, we are selective about the titles we add and renew to our service. If we do not maintain a compelling mix of content, our member acquisition and retention may be adversely affected.

Music contained within content we distribute may require us to obtain licenses for such distribution. In this regard, we will engage in negotiations with performing rights organizations and collection societies (“PROs”) that hold certain rights to music interests when “publicly performed” or “communicated to the public” in connection with streaming content into various territories. If we are unable to reach mutually acceptable terms with these organizations, we could become involved in litigation and/or could be prevented from distributing certain content, which could adversely impact our business. Additionally, pending and ongoing litigation as well as negotiations between certain PROs and other third parties in various territories could adversely impact our negotiations with PROs or result in music publishers represented by certain PROs to unilaterally withdraw rights, and thereby adversely impact our ability to reach licensing agreements reasonably acceptable to us. Failure to reach such licensing agreements could expose us to potential liability for copyright infringement or otherwise increase our costs.

15

If government regulations relating to the Internet or other areas of our business change, we may need to alter the way we conduct our business or incur greater operating expenses.

The adoption or modification of laws or regulations relating to the Internet or other areas of our business could limit or otherwise adversely affect the way we currently conduct our business. In addition, the continued growth and development of the market for online commerce may lead to more stringent consumer protection laws, which may impose additional burdens on us. If we are required to comply with new regulations or legislation or new interpretations of existing regulations or legislation, this compliance could cause us to incur additional expenses or alter our business model.

The adoption of any laws or regulations that adversely affect the growth, popularity, or use of the Internet, including laws impacting Internet neutrality, could decrease the demand for our service and increase our cost of doing business. For example, in late 2010, the Federal Communications Commission (FCC) adopted so-called net neutrality rules intended, in part, to prevent network operators from discriminating against legal traffic that transverse their networks. Recently, the U.S. Court of Appeals for the District of Columbia struck down the FCC’s net neutrality rules, and it is currently uncertain how the FCC will respond to this decision. To the extent network operators attempt to use this ruling to extract fees from us to deliver our traffic or otherwise engage in discriminatory practices, our business could be adversely impacted. As we expand internationally, government regulation concerning the Internet, and in particular, network neutrality, may be nascent or non-existent. Within such a regulatory environment, coupled with the potentially significant political and economic power of local network operators, we could experience discriminatory or anti-competitive practices that could impede our growth, cause us to incur additional expense or otherwise negatively affect our business.

Changes in how network operators handle and charge for access to data that travel across their networks could adversely impact on our business.

We rely upon the ability of consumers to access our service through the Internet. To the extent that network operators implement usage-based pricing, including meaningful bandwidth caps, or otherwise try to monetize access to their networks by data providers, we could incur greater operating expenses and our member acquisition and retention could be negatively impacted. Furthermore, to the extent network operators were to create tiers of Internet access service and either charge us for or prohibit us from being available through these tiers, our business could be negatively impacted.

Most network operators that provide consumers with access to the Internet also provide these consumers with multichannel video programming. As such, many network operators have an incentive to use their network infrastructure in a manner adverse to our continued growth and success. For example, Comcast exempted certain of its own Internet video traffic (e.g., Streampix videos to the Xbox 360) from a bandwidth cap that applies to all unaffiliated Internet video traffic (e.g., Netflix videos to the Xbox 360). While we believe that consumer demand, regulatory oversight, and competition will help check these incentives, to the extent that network operators are able to provide preferential treatment to their data as opposed to ours or otherwise implement discriminatory network management practices, our business could be negatively impacted.

Increases in payment processing fees, changes to operating rules, the acceptance of new types of payment methods or payment fraud could increase our operating expenses and adversely affect our business and results of operations.

Our customers may pay for our membership services predominantly using credit and debit cards (together, “payment cards”). Our acceptance of these payment methods requires our payment of certain fees. From time to time, these fees may increase, either because of rate changes by the payment processing companies or as a result of a change in our business practices which increase the fees on a cost-per-transaction basis. Such increases may adversely affect the results of operations.

We are subject to rules, regulations, and practices governing our accepted payment methods. These rules, regulations, and practices could change or be reinterpreted to make it difficult or impossible for us to comply. If we fail to comply with these rules or requirements, we may be subject to fines and higher transaction fees and lose our ability to accept these payment methods, and our business and results of operations would be adversely affected.

We accept payment methods other than payment cards. As our service continues to evolve and expand internationally, we will likely continue to explore accepting various forms of payment, which may have higher fees

16

and costs than our currently accepted payment methods. If more consumers utilize higher cost payment methods, our payment costs could increase, and our results of operations could be adversely impacted.