UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-01911 |

|

Schroder Capital Funds (Delaware) |

(Exact name of registrant as specified in charter) |

|

875 Third Avenue, 22nd Floor New York, NY | | 10022 |

(Address of principal executive offices) | | (Zip code) |

|

Schroder Capital Funds (Delaware) P.O. Box 8507 Boston, MA 02266 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-800-464-3108 | |

|

Date of fiscal year end: | October 31, 2010 | |

|

Date of reporting period: | October 31, 2010 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Schroder Mutual Funds

October 31, 2010 | Annual Report |

| |

| Schroder International Alpha Fund |

| Schroder International Multi-Cap Value Fund |

| Schroder Emerging Market Equity Fund |

| Schroder U.S. Opportunities Fund |

| Schroder U.S. Small and Mid Cap Opportunities Fund |

| Schroder North American Equity Fund |

| Schroder Total Return Fixed Income Fund |

| Schroder Multi-Asset Growth Portfolio |

Table of Contents

Letter to Shareholders | 1 |

| |

Management Discussion and Analysis | 3 |

| |

Schedules of Investments | |

| |

International Alpha Fund | 26 |

| |

International Multi-Cap Value Fund | 29 |

| |

Emerging Market Equity Fund | 39 |

| |

U.S. Opportunities Fund | 43 |

| |

U.S. Small and Mid Cap Opportunities Fund | 46 |

| |

North American Equity Fund | 49 |

| |

Total Return Fixed Income Fund | 56 |

| |

Multi-Asset Growth Portfolio | 62 |

| |

Statements of Assets and Liabilities | 66 |

| |

Statements of Operations | 70 |

| |

Statements of Changes in Net Assets | 72 |

| |

Financial Highlights | 76 |

| |

Notes to Financial Statements | 80 |

| |

Report of Independent Registered Public Accounting Firm | 95 |

| |

Information Regarding Review and Approval of Investment Advisory Contracts | 96 |

| |

Disclosure of Fund Expenses | 100 |

| |

Trustees and Officers | 104 |

| |

Notice to Shareholders | 108 |

Proxy Voting (Unaudited)

A description of the Funds’ proxy voting policies and procedures is available upon request, without charge, by visiting the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov, or by calling 1-800-464-3108 and requesting a copy of the applicable Fund’s Statement of Additional Information or on the Schroder Funds website at http://www.schroderfunds.com, by downloading the Funds’ Statement of Additional Information. Information regarding how the Funds voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request by calling 1-800-464-3108 and on the SEC’s website at http://www.sec.gov.

Form N-Q (Unaudited)

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available on the SEC’s website at http://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

December 9, 2010

Dear Shareholder:

We are pleased to provide the Annual Report to shareholders of the Schroder Mutual Funds, which covers the twelve months ended October 31, 2010. The Report includes information designed to help you understand the status of your investment — the Management Discussion and Analysis prepared by portfolio managers explains how they put your money to work in various markets; the Schedules of Investments give you a point-in-time picture of the holdings in your fund; and additional information includes a detailed breakdown of other financial information. We encourage you to read the Report and thank you for making Schroders part of your financial plan.

The twelve months under review were extremely volatile for investors. The reporting period can be viewed as a time of transition, as the developed world painfully rebounds from the abyss and starts to settle into a ‘new normal’ environment. This is a world in which the developed market continues to slowly deleverage, bringing fiscal discipline into an economy with high unemployment and low-trend growth. The ‘new normal’ is also a bipolar world where emerging markets continue to take an increasingly large role in the global economy, supported by global demographic trends.

It is important to note that the global economy still remains fragile. As we move into 2011, sources of risk include the unraveling of the structural issues in peripheral Europe as those countries deal with the past excesses of the EU integration process. At this writing, Ireland is going through a painful adjustment and more countries might follow during 2011. Investors see a developed world weighed down by debt, struggling to recover from the financial crisis of the past two plus years, while the relatively unencumbered emerging economies continue to enjoy growth. Such a scenario might be seen as a healthy re-allocation of capital from the developed world to the developing, helping to raise global living standards. However, as can be seen from recent International Monetary Fund (IMF) meetings in Washington, developments have exacerbated tensions between the developed and emerging economies with talk of c urrency wars and fear of protectionism.

The move toward additional quantitative easing in the US has only exacerbated the problem by driving down the US dollar and Treasury yields, sending investors into higher-yielding assets. Increased capital flows to the emerging economies have been one consequence. In turn, central banks in the emerging world are resisting the upward pressure on their currencies by intervening heavily in the foreign exchange market, or trying to slow the flow by raising taxes on foreign purchases of assets. The divergence between the US dollar-trade-weighted exchange rate for the major currencies and the emerging markets (described here as other important trading partners) highlights the uneven distribution of dollar weakness, with the developed economies taking the bulk of the adjustment.

The focus of the currency war has really been on the fall in the dollar, but against that we’ve seen a rise in the euro, the yen and the Australian dollar. That increase in currencies is going to squeeze growth in the Eurozone, Japan and Australia, so there’s a real battle going on where everybody is trying to devalue their currency in order to get a bigger share of a shrinking pie. So far it seems the US is winning, while Europe, where there is a desperate need for growth, is fast becoming the biggest casualty. It is only recently with the crisis in Ireland that the euro has begun to fall again, providing some relief to the embattled region. China is benefiting from the fall in the U.S. dollar with a currency that is becoming cheaper against the euro and the yen. But the benefits are not without problems. Big capital inflows are creating liquidity problems and asset bubbles, not to mention infl ation — and that’s something the Chinese authorities have to deal with in 2011.

Looking back, the emerging economies effectively locked in the fall in their currencies following the crisis of 1997-98. Today, after the financial crisis, it is a different story. Western consumers are de-leveraging, spending is weak and with fiscal and monetary policy reaching its limits, the governments of developed countries are looking overseas for demand to support their economies. Hence the desire for a weaker currency to boost overseas market share and export growth. However, despite accusations of currency protectionism by the advanced countries, the emerging economies continue to follow the same economic path of export-led growth underpinned by a competitive currency, otherwise known as mercantilism.

The policies of West and East are now at odds with one another: the willingness of the West to tolerate the undervaluation of Eastern currencies has been considerably reduced by the financial crisis.

Recognizing that currency wars are likely to continue suggests that we could be in for a turbulent time. The US is already preparing protectionist measures that will be winding their way through Congress. Countries that are seen to deliberately run a policy of keeping their exchange rate undervalued are likely to be targeted. Rhetoric could turn ugly and tensions are likely to mount as countries pursue beggar-thy-neighbor policies.

1

Meanwhile, we are likely to see continued capital flows to the emerging markets as interest rates in the West remain close to zero and the US restarts quantitative easing. In the absence of a shift in policy, the outcome will be more intervention and a recycling of the capital flows back into the US Treasury market. This in turn depresses long-term rates and forces more capital outflows as investors seek yield. The result could be a simultaneous bubble in both Treasury bonds and emerging market equities.

Going into 2011, we expect to see the recovery continue globally, but especially in the US, which has been boosted by strong profits and healthy balance sheets in the corporate sector. We should see increased capital expenditure and employment, raising growth in the world economy as confidence returns to US consumers. In emerging markets, an enviable fiscal position capable of increasing expenditure in infrastructure will likely continue to boost growth. Nevertheless, we believe the Federal Reserve will be on hold through 2011 with regards to raising rates.

We are expecting a slowdown in Europe and in the UK, mainly because of the spending cuts and tax increases, which will begin to impact markets there in 2011. Given the fragility of the European periphery, we do not expect any increases in euro policy rates until 2012. This continued recovery in growth is important for supporting real assets, but it’s not a strong recovery so we believe that interest rates are going to stay very low as we go through 2011. That means investors are still going to be searching for yield. Following the rally in bonds we expect investors to rotate out of credit and move into equities and commodities. Emerging markets are likely to continue to attract funds given their growth prospects.

As we stated in the Funds’ Semi-Annual Report, in this type of environment, we believe that the investor who maintains a diversified portfolio — both across asset classes and geographic borders — should be able to weather the bumpy periods better than those who have high concentrations in one or two sectors or regions. We encourage you to consult with your financial advisor to ascertain whether your current mix of investments is suitable for your long-term objectives.

Again, we thank you for including Schroders in your financial plan and we look forward to our continued relationship.

| Sincerely, |

| |

|

|

| |

| Mark A. Hemenetz, CFA |

| President |

The views expressed in the following report were those of each respective Fund’s portfolio management team as of the date specified, and may not reflect the views of the portfolio managers on the date this Annual Report is published or any time thereafter. These views are intended to assist shareholders of the Funds in understanding their investment in the Funds and do not constitute investment advice; investors should consult their own investment professionals as to their individual investment programs. Certain securities described in these reports may no longer be held by the Funds and therefore may no longer appear in the Schedules of Investments as of October 31, 2010.

2

Schroder International Alpha Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 9, 2010)

Performance

In the 12 months ended October 31, 2010, the Schroder International Alpha Fund (the “Fund”) gained 18.90% (Investor Shares) and 18.61% (Advisor Shares) compared to the Morgan Stanley Capital International EAFE Index (the “Index”), a broad-based basket of international stocks, which rose 8.36%.

Market Background

Following the extraordinary rebound in financial markets since the March 2009 lows, investors paused for breath over the first six months of the period as questions about the true strength of the world economy emerged.

Both corporate and macro news was generally supportive of a recovery in the first half of the year, with many companies beating earnings forecasts and all the major economies exiting recession.

In the early months of 2010, concerns about fiscal problems in Greece and some other Eurozone countries had a negative impact. Following a rebound in investor confidence later in the year (against a background of generally favorable economic data and the agreement of a support plan for Greece), risk aversion returned. In particular, uncertainties over fiscal difficulties in the Eurozone resurfaced, with rating agency Standard & Poor’s downgrading the sovereign credit ratings of Greece, Portugal and Spain.

Despite equities having a mid-summer rally on strong company earnings and the relative success of the European banks’ stress tests, August was a volatile month. Economic data from the US left equities down on renewed fears of its economy double-dipping. However, speculation that the Fed would begin a second round of quantitative easing increased throughout the last two months of the period under review. This, combined with US dollar weakness, meant equities ended the 12 months on a strong note.

Portfolio Review

The Fund outperformed the Index over the 12-month period.

From a total portfolio standpoint, the regions with the strongest positive contribution during the period were emerging mrkets, Japan and the United Kingdom. Continental Europe was a very small detractor overall. From a sector basis the portfolio benefitted most from our exposure to financials, energy and industrials while consumer staples detracted most.

In emerging markets, the strongest sectors in relative terms were financials and industrials. Indian financial Shriram Transport led returns. This well capitalized company has shown impressive year on year growth while its new initiatives — facilitating commercial vehicle purchases and refurbishing vehicles to sell for a profit — are looking promising. In industrials, Tata Motors and Dongfang Electric were particularly strong. The Indian truck maker Tata Motors is benefiting from a rebound in domestic consumption amid India’s buoyant economic growth. It has a dominant position in the country’s truck market and will profit from a healthy global demand for Jaguar and Land Rover vehicles.

In Japan, the Fund largely benefited from good stock selection; its underweight position in the region was also beneficial. Financials and consumer discretionary added the most value compared to the benchmark and the top stocks in the region were Mitsubishi and Unicharm. Paper nappies are one of the latter company’s products with growth supported by increasingly widespread use. It is expanding its sales routes to not only China but also other emerging markets, and we believe ongoing profit growth warrants a premium valuation for its shares.

In continental Europe, while financials, materials and utilities have all performed very well over the period, this was offset by the consumer discretionary and staples sectors, which detracted. In consumer discretionary, relative returns were hurt by the Fund’s significantly underweight exposure and Unilever held back performance in consumer staples. However, long-term prospects remain good for Unilever, with management taking a more pro-active stance and investing in greater spending on advertising and promotion.

3

On a sector basis, financials and energy were the strongest sectors relative to the benchmark and consumer staples detracted. Stock selection was strong in financials, led by Shriram Transport and Itau Unibanco. The Sao Paulo-based lender was created in November 2008 when Itau took over smaller rival Unibanco at the height of the global financial crisis. This Brazilian bank is growing market share in areas such as pension retirement plans, auto loans and credit card lending and it has a strong capital base, diversified earnings stream and strong management. Stock selection was also positive in energy. Cairn Energy and AMEC contributed the most in this sector. AMEC continues to be an attractive holding with strong long-term growth in its core markets.

Outlook

The Fed showed it is focused on supporting consumer sentiment and the economy with a new round of quantitative easing, including a buy program of $600bn in longer-term Treasury securities by the middle of next year. Japan also took steps to increase quantitative easing, although to a lesser extent than the US. Interest rates in Japan are now close to zero and the scope for further fiscal measures seems limited. In the medium term, an increase in available cash to purchase equities should have a positive impact on stocks. Meanwhile, better-than-expected growth figures in the UK have reduced the likelihood of central bank intervention. We remain aware that, although ample liquidity is supportive of equity markets overall, the potential impact of the new US quantitative easing program on emerging markets and Asian ex Japan economies might be inflationary and create short-term volatility as those countr ies adjust interest rates. We continue to find opportunities there as growth continues to be supportive of earnings growth and valuations appear attractive.

There are several factors supporting international equities over the next 12 to 18 months. First, company shares appear attractively priced. For global equities, we are expecting earnings growth of over 16% over the next 12 months and a valuation, as measured by the PE 12 months forward, of only 13x.

Second, the combination of low interest rates and high liquidity levels means that the case for investors to increase their exposure to equities is compelling. In fact, when considering various asset classes, investors are currently underweight in equities overall, while they have a high exposure to bonds compared to historical norms. We therefore believe that there is room for increased asset allocation into equities.

Third, companies are generally in good shape. Survivors of the crisis are leaner thanks to cost-cutting measures. Many have shed risk-prone management teams, leading to a renewed, cautious management style. Overall with profits to GDP at high levels and investment to GDP at low levels, the corporate world is ready to embrace a new wave of growth. This growth will be financed differently than in the past given the reluctance of developed market banks to lend in an evolving regulatory framework; companies with strong cash flows will be advantaged.

We remain cautious about the outlook for the Eurozone. Business sentiment in Europe’s powerhouse Germany remains upbeat as its recovery is supported by strong export growth, benefitting from emerging market demand. Sources of risk in 2011 include the possible unraveling of the structural issues in ‘peripheral’ Europe and how it deals with the past excesses of the EU integration process. As we speak, Ireland is going through a painful adjustment and more countries might follow during 2011.

China announced its new five-year plan and it was in line with our expectations. The plan focused on domestic consumption (and wage growth), increasing the added value of production, further developing the inland provinces, energy savings and climate change and supporting public housing programs. It also released its figures showing a modest slowdown in the GDP growth rate YoY from Q3 2009. However, its underlying growth rate is still strong relative to the global economy and we still expect China to be an engine of world growth in 2011.

We continue to find attractively priced growth companies in quality names with strong competitive advantage. As the world adjusts to the new environment where global economic growth is driven by the large emerging markets such as China, India and Brazil, while developed market consumers deleverage and the western financial system settles to function under new rules, competitive companies with strong balance sheets will find attractive growth opportunities.

4

Comparison of Change in the Value of a $10,000 Investment in the Schroder International Alpha Fund

Investor and Advisor Shares vs. the Morgan Stanley Capital International (MSCI) EAFE Index

The MSCI EAFE Index is a market weighted index composed of companies representative of the market structure of certain developed market countries in Europe, Australia, Asia and the Far East, and reflects dividends reinvested net of non-recoverable withholding tax.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2010 | | Five Years Ended

October 31, 2010 (b) | | Ten Years Ended

October 31, 2010 (b) | |

Schroder International Alpha Fund (a) — | | | | | | | |

Investor Shares | | 18.90 | % | 6.32 | % | 3.43 | % |

Advisor Shares | | 18.61 | % | 6.05 | %(c) | 3.17 | %(c) |

(a) Effective April 1, 2006, the advisory fee of the Fund increased to 0.975% per annum. If the Fund had paid such higher fees during prior periods, the returns of the Fund would have been lower.

(b) Average annual total return.

(c) The Advisor Shares commenced operations on May 15, 2006. The performance information provided in the above table for periods prior to May 15, 2006 reflects the performance of the Investor Shares of the Fund, adjusted to reflect the distribution fees paid by Advisor Shares.

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security | | % of Investments | |

Novartis | | 3.2 | % |

BG Group | | 2.8 | |

Honda Motor | | 2.7 | |

Rio Tinto | | 2.6 | |

Vodafone Group | | 2.6 | |

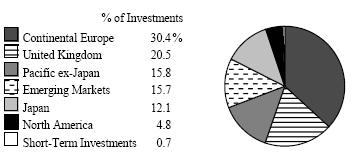

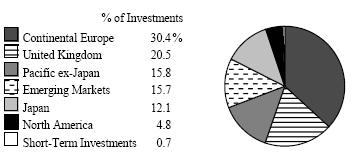

Geographic Allocation

5

Schroder International Multi-Cap Value Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 9, 2010)

Performance

In the 12 months ended October 31, 2010, the Schroder International Multi-Cap Value Fund (the “Fund”) gained 16.96% (Investor Shares) and 16.64% (Advisor Shares) compared to the Morgan Stanley Capital International EAFE Index (the “Index”), a broad-based basket of international stocks, which rose 8.36% during this same period.

Market Background

Global equities continued to make progress in the final months of 2009, albeit at a slower pace than earlier in the year. Notably, we began to see signs of market gains broadening beyond a narrow band of cyclical stocks, which staged the strongest recovery through the earlier risk trading, to also include traditionally defensive areas of the market.

After pausing for breath in late January - when sentiment was adversely affected by concerns over the tightening of monetary policy in China and sovereign default risk in Europe - global equity markets resumed their upward climb. Economic data has been broadly supportive since the start of this year, helping to fuel a revival in many of the risk trades that characterized the earlier stages of the market recovery in 2009.

After peaking in mid-April, global equity markets retreated throughout the second quarter of 2010 as investor sentiment deteriorated and volatility returned. Concerns about the credit worthiness of the peripheral European countries (most notably Greece) and a run of weaker macro economic data in both the US and China dented confidence.

Unsurprisingly, the defensive parts of the market declined by less, particularly telecoms and consumer staples — with food retailers being one of the better performing industries — while resources and financials bore the brunt of the selling. Sentiment towards the energy sector in particular was adversely affected by BP’s leaking oil well in the Gulf of Mexico, while financials were weighed down by continued uncertainty about the increasing prospect of a global banking-levy and new regulatory pressures. Regionally, emerging markets, especially Asia, outperformed. Against this more volatile backdrop, the primary beneficiaries were sovereign bonds, particularly US treasuries, safe haven currencies such as the Japanese yen and US dollar, as well as gold.

As we closed the reporting period, equity markets rose strongly. September was a particularly strong month as fears of a double-dip recession, which had been depressing market sentiment during August, receded. The main catalyst to the recovery in investor confidence was the announcement from the US Federal Reserve that it was willing to bolster growth by embarking on a second round of quantitative easing.

Regionally, the Pacific ex Japan was the second best performing equity region behind emerging markets, while Japan was by far the worst, as political uncertainty and the strength of the yen weighed on sentiment.

Portfolio Review

The Fund is managed using a bottom-up, unconstrained approach. It aims to capture as many different value themes as possible, and seeks to benefit from these over the longer term as markets recognize this value.

Despite large swings in sentiment, risk appetite drove equity market gains over the period as a whole. Cyclical sectors such as materials, industrials and consumer discretionary outperformed, with the more defensive utilities and healthcare sectors lagging the wider market. Interestingly, financials continued to lag the Index despite a decline in risk aversion in the third quarter, although there was reasonable variation within the sector with higher quality companies tending to perform better. Emerging Markets and Pacific ex Japan equities were stand-out performers on a regional basis.

The Fund has performed extremely well over the past year, outperforming the Index by a substantial margin. Positive stock selection was broadly diversified across all sectors and regions, and accounted for much of the excess performance. In particular, our allocation to Canada and emerging Asia added value. At a sector level, leading positive contributions came from both cyclical and defensive securities held by the Fund. Financials stocks led the relative gains, and the Fund’s energy and industrials stocks also outperformed. The Fund’s defensive positioning also came to the fore, with consumer staples and utilities holdings contributing to performance.

A good portion of the value opportunity that emerged during 2008 and early 2009, when investors became very pessimistic, may now have played out. However, we have started to see a value opportunity among defensives that appear undervalued, which is reflected in the more defensive composition of the Fund — with significantly higher allocation to telecoms, healthcare and consumer staples; as compared to the Fund’s more cyclical composition at the very beginning of the period.

6

More generally, the transition from cyclical to defensives and the corresponding reduction in the market sensitivity of the Fund in the recent past highlights the necessity for a dynamic approach to capturing the best value opportunities, particularly during volatile market environments.

Outlook

Despite the Fund’s strong returns over the past year, we continue to identify what we believe to be many attractively-valued companies globally on both a relative and an absolute basis. While the huge breadth of our 10,000-stock universe is a key factor, it also reflects the much changed nature of the value opportunity over this period. At the start of the market recovery in March 2009, the most attractive prospects were predominantly within the cyclical parts of the market that had lagged behind in the economic downturn. The strong returns to cyclical companies since then has provided an opportunity within the higher quality and more defensive parts of the market, which means that the Fund today is somewhat more defensive than is usually the case:

· The Fund has an overweight position in telecoms, where we are attracted to high dividend yields, while consumer discretionary is one of the largest underweight positions.

· Within resources, we have increased the Fund’s exposure to materials, partly funded by reducing holdings in utilities.

· Although the strategy is underweight cyclical sectors on aggregate, the Fund has selectively built some positions here.

· As for financials, we have retained our preference for insurers over banks.

· Regionally, allocations remain broadly unchanged in that the Fund has underweighted continental Europe and the UK, while having a slightly higher allocation in most other regions.

Given its current positioning, the Fund appears relatively well-placed to withstand deterioration in market sentiment although the fact that it has also kept pace over the past quarter when markets were very strong is also encouraging. As of this Report, the Fund has diversified exposure across both stocks and value “themes”; and a high dividend yield. Given the low level of sovereign bond yields around the world at the moment (itself a manifestation of central bank action), we believe that sustainable dividend income may increasingly become a highly prized feature by investors.

7

Comparison of Change in the Value of a $10,000 Investment in the Schroder International Multi-Cap Value Fund Investor and Advisor Shares vs. the Morgan Stanley Capital International (MSCI) EAFE Index

The MSCI EAFE Index is a market weighted index composed of companies representative of the market structure of certain developed market countries in Europe, Australia, Asia and the Far East, and reflects dividends reinvested net of non-recoverable withholding tax.

PERFORMANCE INFORMATION

| | | | Annualized | |

| | One Year Ended | | Since | |

| | October 31, 2010 | | Inception (a) | |

Schroder International Multi-Cap Value Fund — | | | | | |

Investor Shares | | 16.96 | % | 4.24 | % |

Advisor Shares | | 16.64 | % | 4.01 | % |

(a) From commencement of Fund operations on August 30, 2006.

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Investments | |

Recordati | | 0.5 | % |

Credit Agricole | | 0.5 | |

SembCorp Industries | | 0.5 | |

Kumba Iron Ore | | 0.5 | |

WM Morrison Supermarkets | | 0.4 | |

* Excludes any Short-Term Investments.

Geographic Allocation

8

Schroder Emerging Market Equity Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 14, 2010)

Performance

In the 12 months ending October 31, 2010, the Schroder Emerging Market Equity Fund (the “Fund”) rose 18.97% (Investor Shares) and 18.60% (Advisor Shares), compared to the Morgan Stanley Capital International Emerging Markets Index (the “Index”), a broad-based basket of international stocks, which rose 23.56% during the same period.

Market Background

Global equities produced a gain in USD terms over the year. In the last months of 2009, global equities benefited from improved risk appetite and confirmation that the ‘worst-case’ economic scenario of a depression had been avoided. However, developed equity markets fell in the first quarter of 2010 as investors moved their focus from the economic recovery in the US to the worsening fiscal crisis in the peripheral European Union (EU) economies. A joint EU/International Monetary Fund package was subsequently negotiated to support the peripheral nations but markets continued to view fiscal deficits in a number of EU states as being unsustainable. Meanwhile slowing growth in the US in the second quarter of 2010 raised fears of a ‘double dip’ recession. Toward the end of the period, risk appetite increased and equities rallied on hopes that further policy stimulus would be implemented in the US. In early November, the US Federal Reserve confirmed it would re-start quantitative easing, purchasing a further $600 billion of US Treasury bonds by the end of June 2011. In contrast to the developed world, emerging markets continued to exhibit strong rates of GDP growth without the consumer de-leveraging and government retrenchment that was evident elsewhere. As a result, the Index strongly outperformed the MSCI World Index over the 12-month period.

At the country level, the vast majority of emerging markets produced positive returns over the 12-month period. In Asia, Thailand was the best performing emerging market, delivering over 60% return in USD terms. Despite ongoing political uncertainty, the Thai economy produced good rates of growth with year-on-year GDP for the second quarter of 2010 reported at 9.1%. Indonesia outperformed, as the economy benefited from strong foreign direct investment flows. The Philippines also outperformed, driven by high levels of liquidity and strong economic growth, which in turn helped to lift consumer confidence to an all-time high. Malaysia produced a strong return, with the market benefiting from a recovery in growth as well as the rally in the oil price. India continued to exhibit strong domestic economic growth during the year, and this helped its equity market to outperform broader emerging markets. South Korea outp erformed as the global economic outlook started to improve toward the end of the period while the central bank started to normalize interest rates. China was the weakest Asian market over the period due to the tightening of policy in response to heightened inflation. This followed the implementation of a large stimulus program during the crisis, raising concerns over a ‘hard landing’. Taiwan rose over the year but underperformed broader emerging markets, as doubts over the outlook for its key export markets continued to weigh on returns.

In Latin America, Colombia strongly outperformed over the year, benefiting from a stronger-than-expected economic recovery amid a low interest rate environment. Chile delivered strong gains as the resurgence in commodities — most notably copper — buoyed the market. Peru outperformed, driven by a better-than-expected domestic economic recovery and the rebound in mineral prices. Mexico also produced a strong double-digit return on hopes that a second round of quantitative easing would improve economic conditions in the US, its key trading partner. Brazil underperformed early in the period on rising interest rates due to heightened inflationary pressure. The market was also negatively impacted by a poorly managed share offering by Index heavyweight Petrobras. Brazilian authorities also increased the existing IOF tax on foreign investments into local fixed-interest securities, raising fears that su ch measures could be extended to other asset classes.

In the EMEA markets, Turkey was by far the strongest performer. The Turkish equity market benefited from a benign global liquidity environment and strong economic growth. South Africa also outperformed, helped by strength in the gold price. Russia underperformed as the severe drought and wildfires over the summer of 2010 resulted in renewed inflation pressures and fears that the government could be forced to introduce price controls on food. Meanwhile, the Czech Republic and Hungary, both highly open economies, suffered from concerns of a ‘double dip’ in global growth and were also negatively affected by sovereign risk contagion fears. Poland also underperformed but still registered a double-digit positive return over the year, benefitting from its status as a relatively closed economy.

Portfolio Review

Over the 12-month period ended October 31, 2010, the Fund underperformed the Index. Country selection and stock selection detracted from returns over the year, with stock selection providing the largest drag on returns relative to the Index. In terms of country selection, the Fund benefited from being overweight Thailand and Turkey, as both of these markets strongly outperformed over the period. However, these positives were outweighed by the Fund’s overweight to China earlier in the period, which underperformed, and underweight positions in Chile, Mexico and Colombia, which outperformed over the year. Unfavourable

9

stock selection in South Korea (overweight Megastudy, GS Engineering & Construction, Hana Financial and Hyundai Engineering and Construction) provided the largest drag on returns over the year, more than offsetting positive stock selection in India (overweight HDFC Bank, Infosys Technologies, Larsen & Toubro) and Turkey (overweight Turkiye Halk Bankasi, Turkiye Garanti Bankasi and Efes Beverage Group later in the period). Our choice of stocks in Taiwan (zero weight HTC, overweight Cathay Financial Holding), South Africa (overweight Impala Platinum Holdings and Aveng) and Indonesia (zero weight PT Astra) also detracted from returns.

12-month returns for the Fund’s fiscal year have been dominated by weak 2010 performance. Year to date we have witnessed an exceptional market environment characterized by significant stock rotation within a directionless, range-bound market that has resulted in investors pursuing an extreme theme driven and/or trading approach. Weak performance over the year has been entirely attributable to stock selection with price reversal driving stocks rather than fundamentals such as attractive growth and valuation. In fact, those stocks that appear ‘expensive’ on a 12 month forward P/E basis and those stocks with the lowest expected growth generally performed the best year to date. Furthermore, one of the reasons for value and growth failing to be market drivers is that many global emerging market investors have been investing in the theme of domestic consumption and consumer plays in emergin g markets, regardless of valuation or growth fundamentals. Whilst we agree with the thesis that emerging consumers will be a key driver for economic growth going forward, we are not prepared to pay what we believe to be an unreasonable price for stocks assumed to be involved in this theme. We believe a continued increase in clarity regarding the global economic outlook will see a reduction in the extraordinary stock rotation and narrow market focus. We believe this will cause investors’ attention to return to those stocks displaying the strongest fundamentals, a trend the Fund is well placed to exploit. Currently the portfolio has a lower PE than the market but a higher ROE and earnings growth. The five largest stocks in the portfolio as at end October were Samsung Electronics (Korean technology), Vale (Brazilian materials), Itau Unibanco Holding (Brazilian financials), Petroleo Brasileiro (Brazilian energy) and Gazprom (Russian energy).

Outlook

The situation faced by emerging markets is very different to that of the developed world owing to their strong fundamentals and healthier public, private and corporate finances. Inflationary pressures have increased in some emerging markets, leading to policy normalisation and tightening measures in some cases. Whilst policy makers will certainly be keen to avoid the build up of asset ‘bubbles’, they will not allow tightening policy to destabilise a sustainable recovery in the economy. The risk of elevated inflationary pressure and a ‘bubble’ developing in the emerging world has heightened on further quantitative easing being implemented in the US and the prospect of further policy stimulus amongst other economies. Policy stimulus will likely continue to lead to emerging markets receiving a disproportionate amount of capital flows in search of higher yielding opportunities. Whilst supportive for stock market returns, the prospect of strong, including speculative, capital inflows, with investors can have a destabilizing effect on domestic assets and currencies. Furthermore, in reaction to such strong flows, some emerging economies, including Brazil and Thailand, have already imposed capital controls to deter excessive foreign money. Whilst government intervention can provoke short-term market volatility, the longer-term impact of such measures tends to be somewhat limited.

The Fund remains fully invested reflecting our positive view of the short- to medium-term outlook. Even with recent strong market performance, valuations remain attractive with the global emerging markets P/E around 11, which is in line with its long-term average, and earnings growth expected by us to be approximately 20% over the next 12 months. If, as expected, US growth only moderates but avoids a double-dip and concerns over sovereign risk contagion abate, investors are likely to focus on the stronger fundamentals and growth potential of the emerging world.

10

Comparison of Change in the Value of a $10,000 Investment in the Schroder Emerging Market Equity Fund

Investor and Advisor Shares vs. the Morgan Stanley Capital International (MSCI) Emerging Markets Index

The MSCI Emerging Markets Index is an unmanaged market capitalization index of companies representative of the market structure of emerging countries in Europe, the Middle East, Africa, Latin America and Asia. The Index reflects actual buyable opportunities for the non-domestic investor by taking into account local market restrictions on share ownership by foreigners.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2010 | | Annualized

Since

Inception (a) | |

Schroder Emerging Market Equity Fund — | | | | | |

Investor Shares | | 18.97 | % | 10.15 | % |

Advisor Shares | | 18.60 | % | 9.94 | % |

(a) From commencement of Fund operations on March 31, 2006.

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security | | % of Investments | |

Samsung Electronics | | 3.2 | % |

Vale | | 3.0 | |

Itau Unibanco Holding ADR | | 2.7 | |

Petroleo Brasileiro | | 2.7 | |

Gazprom ADR | | 2.6 | |

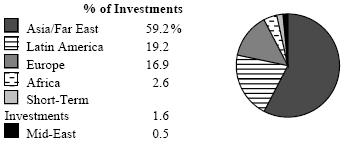

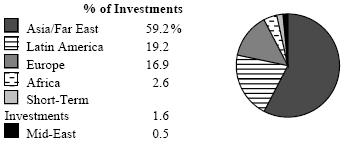

Geographic Allocation

11

Schroder U.S. Opportunities Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 12, 2010)

Performance

In the 12 months ended October 31, 2010, the Schroder U.S. Opportunities Fund (the “Fund”) rose 20.88% (Investor Shares) and 20.66% (Advisor Shares) compared to the Russell 2000 Index (the “Index”), a broad-based basket of stocks with characteristics similar to the Fund’s portfolio, which rose 26.58%.

Market Background

The fiscal year began as the small cap market was in a powerful rally that began on March 9, 2009 when the market hit bottom (post-Lehman Brothers). In November the Index rose by over 3% and in December it was up over 8%, giving a strong finish to the year.

The mood changed quickly in January as the Index dropped 3.7%, but negative thoughts dissapated in early February and the market began a run that lasted until late April. When the Index of Leading Economic Indicators began to decline on a year over year basis in late April, the rally came to a screeching halt and the Fund’s Index dropped by more than 7% in both May and June. We had a brief 6.8% rally in July but in August the market was again off, this time by over 7.4%. The fiscal year ended strongly in the last two months, particularly September (+12.5%) followed by a calmer but still solid October (+4.1%).

Throughout the year there have been crosscurrents at work, as economic data at times suggested strength and at other times weakness. Closely watched indicators such as the unemployment rate and new jobs created, at times seemed to support the argument of pessimists, and at other times the position of the optimists. The feared double dip did not occur, but as we drew to the end of the Fund’s fiscal year there remains considerable uncertainty in the housing market.

Official economic releases this year have created a mixed picture at best. The unemployment rate and housing market are still below average levels, and valuations are not as attractive on a year-over-year basis. In general, sectors such as autos, consumer staples (surprisingly), large cap banks and home builders, which lagged in 2009, have been leading the way this year. Smaller companies, high beta and price momentum stocks are also ahead in the market.

The end of the reporting period saw the Index end on a high note, rising 26.58% for the year ended October 31, 2010. This strong return obscures the performance pattern of the past 12 months. We have been in a “risk on/risk off” environment, where the market has fluctuated between very strong or negative monthly returns. There has been no moderation in this market. The market has seen four months of negative returns and eight months of strong positive returns, ranging between +3.19% and +12.49%. This return pattern has been in place essentially since the fall of Lehman Brothers in September 2008, with investors alternating between despair and euphoria.

Portfolio Review

The Fund underperformed the Index during the 12 months ending October 31, 2010 due to weak stock selection and our average cash position. On the stock selection front we have subtracted the most value in the energy and financial services sectors.

The Fund has become more underweight in the energy sector over the period. Although pricing in the oil and natural gas industries have become attractive, we believe that the oil spill in the Gulf of Mexico may have continuing negative repercussions to the industry. Stock selection has also suffered as a consequence: for example, the Fund’s position in Goodrich Petroleum detracted from performance.

At the sector level, an underweight position in financial services added to returns but was overwhelmed by weak stock selection in the sector. We have had a bias towards higher quality banks and financials and this has been a disadvantage this quarter. Finally, the Fund’s average cash position detracted in what was otherwise a very strong quarter.

On the positive side, stock selection in the consumer staples and technology sectors contributed to relative returns. Within consumer staples, the Fund benefited from owning NBTY, which was acquired by the Carlyle Group in a $4 billion transaction. The stock has since been removed from the Index.

In the technology sector, the Fund’s holdings in Atmel benefited as the company gained market share from its touch screen solutions business (i.e., Samsung recently selected Atmel to power its Galaxy Tab product). Informatica, Netscout Systems and Digital River from the technology sector added value.

12

Outlook

The US economy still hangs over a difficult environment. We see particular headwinds from weak consumer market, government budgets, weak dollar and uncertainty over 2011 earnings. On the consumer front, we are worried about high unemployment rates, sluggish new job creations and a seemingly moribund housing market. As the consumer market makes up approximately 71% of US GDP, our expectations for overall economic growth are modest.

One additional factor we are watching is state budgets. As states finalize their budgets, we anticipate a further drag on employment in the public sector. As states are not allowed to run on deficits, they will probably look to increase taxes, which may have a negative impact on consumers. Lastly, valuations for small caps (i.e., absolute forecast P/E) have come down below their long-term average. However, compared to large caps, small caps look less attractive and earnings estimates from some sell-side analysts appear to be still too high.

As a final note we have commented on a number of gloomy factors above. However, we do see the US entering a third year of recovery and we expect that recovery to continue. We do not expect high levels of equity returns this year, but we are anticipating a positive market. This would follow the normal pattern of equity returns in a recovery.

13

Comparison of Change in the Value of a $10,000 Investment in the Schroder U.S. Opportunities Fund

Investor and Advisor Shares vs. the Russell 2000 Index

The Russell 2000 Index is a market capitalization weighted broad based index of 2,000 small capitalization U.S. companies.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2010 | | Five Years Ended

October 31, 2010 (c) | | Ten Years Ended

October 31, 2010 (c) | |

Schroder U.S. Opportunities Fund (a) (b) — | | | | | | | |

Investor Shares | | 20.88 | % | 6.94 | % | 8.76 | % |

Advisor Shares | | 20.66 | % | 6.69 | %(d) | 8.50 | %(d) |

(a) The portfolio manager primarily responsible for making investment decisions for the Fund assumed this responsibility effective January 2, 2003. The performance results for periods prior to January 2, 2003 were achieved by the Fund under a different portfolio manager.

(b) Effective May 1, 2006, the combined advisory and administrative fees of the Fund increased to 1.00% per annum. If the Fund had paid such higher fees during prior periods, the returns of the Fund would have been lower.

(c) Average annual total return.

(d) The Advisor Shares commenced operations on May 15, 2006. The performance information provided in the above table for periods prior to May 15, 2006 reflects the performance of the Investor Shares of the Fund, adjusted to reflect the distribution fees paid by Advisor Shares.

“Total Return” is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Investments | |

SM Energy | | 1.7 | % |

Waste Connections | | 1.5 | |

iShares Russell 2000 Index Fund | | 1.5 | |

Arbitron | | 1.3 | |

Atmel | | 1.3 | |

* Excludes any Short-Term Investments.

Sector Allocation

Sector | | % of Investments | |

Technology | | 16.9 | % |

Consumer Discretionary | | 15.6 | |

Health Care | | 12.7 | |

Financial Services | | 11.6 | |

Producer Durables | | 9.4 | |

Materials & Processing | | 7.4 | |

Other Energy | | 5.2 | |

Utilities | | 4.1 | |

Consumer Staples | | 2.4 | |

Auto & Transportation | | 1.8 | |

Short-Term Investment | | 12.9 | |

14

Schroder U.S. Small and Mid Cap Opportunities Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 9, 2010)

Performance

In the 12 months ended October 31, 2010, the Schroder U.S. Small and Mid Cap Opportunities Fund (the “Fund”) rose 19.85% (Investor Shares) and 19.59% (Advisor Shares) compared to the Russell 2500 Index (the “Index”), a broad-based basket of stocks with characteristics similar to the Fund’s portfolio, which rose 27.76%.

Market Background

The fiscal year began with the market in high gear, having begun a powerful rally off of the market bottom in March 2009. The Index rose by 4% in November 2009 and finished the year with a flourish in December, rising by 7.2%. The new year began on a sour note with equities delivering negative returns in January 2010 as investors fretted about sovereign debt in Europe and weaker economic numbers from China. But the mood changed in February and the market rose strongly through late April when US leading economic indicators began to lose steam. Two months of sharply negative returns ensued, followed by a tug of war between the bulls and bears through July and August. September set the tone for the balance of the year as many indices delivered record or near record returns that month. The Index, for example, had its best September on record with a 12.2% return. The positiv e advance continued into October, although at a less frenetic pace.

Throughout the year there have been crosscurrents at work, as economic data at times suggested strength and at other times weakness. Closely watched indicators, such as the unemployment rate and new jobs created at times seemed to support the argument of pessimists, and at other times the position of the optimists. The feared double dip did not occur, but as we drew to the end of the fiscal year there remains considerably uncertainty in the housing market.

Official economic releases this year have created a mixed picture at best. The unemployment rate and housing market are still below average levels, and valuations are not as attractive on a year-over-year basis. In general, sectors such as autos, consumer staples (surprisingly), large cap banks and home builders, which lagged in 2009, have been leading the way this year. Smaller companies, high beta and price momentum stocks are also ahead in the market.

The end of the reporting period saw the Index end on a high note, up over 27%. This strong return obscures the performance pattern of the past 12 months. We have been in a “risk on/risk off” environment, where the market has fluctuated between very strong or negative monthly returns. There has been no moderation in this market. This return pattern has been in place essentially since the fall of Lehman Brothers in September 2008, with investors alternating between despair and euphoria.

Portfolio Review

As symptomatic of the performance pattern of its strategy, the Fund lagged the benchmark on a net-of-fees basis during the period. We have lagged in the strongly positive months and outperformed in the negative months. The Fund’s performance lag has been a combination of not making up enough excess return in negative months, higher cash positions, and weak stock selection, particularly in our “steady eddie” category of stocks.

From a sector point of view, our weakest stock selection was in financials. Our focus on higher quality banks (such as Peoples Bank of Connecticut, Bank of Hawaii and West America Bancorp) detracted from returns. Lower quality banks rallied in part because of efforts by the Obama Administration to minimize bank failures. In producer durables we also had weak stock selection. One example is Republic Services, a waste management company (essentially a trash collection firm). The stock had a decent year, rising by 18%, but the overall sector was up by 30% so this detracted value. This was a case of a “steady eddie” stock doing what we expected fundamentally but the market was more focused on higher growth companies.

On the positive side, stock selection in the materials & processing, energy and consumer staples sectors contributed to relative returns. In materials & processing, Molycorp (no longer a Fund holding), a rare earths producer performed well for the Fund. The Fund purchased the stock as an IPO in July and the upside has been rewarding as pricing of rare earth elements has risen sharply on concerns over Chinese export controls. Rare earths are used in high-growth-end-market products such as hybrid vehicles, wind turbines and hi-tech consumer electronics.

In the energy sector, the Fund benefitted by not owning stocks from either the offshore drilling or energy equipment industries, which have been negatively impacted by the Gulf of Mexico oil spill. The Fund instead held stocks such as Cimarex Energy, Concho Resources and SM Energy, which have outperformed over the reporting period. Finally, within consumer staples, the Fund benefited from owning NBTY, which was acquired by the Carlyle Group in a $4 billion transaction. The stock has since been removed from the Index.

15

At the sector level, an underweight position in financial services added to relative performance but was offset by the Fund’s average cash position in what otherwise was a very strong one-year period.

Outlook

The US economy still hangs over a difficult environment. We see particular headwinds from a weak consumer market, government budgets, a weak dollar and uncertainty over 2011 earnings. On the consumer front, we are worried about high unemployment rates, sluggish new job creations and a seemingly moribund housing market. Because the consumer market makes up approximately 71% of US GDP, our expectations for overall economic growth are modest.

One additional factor we are watching is state budgets. As states finalize their budgets, we anticipate a further drag on employment in the public sector. As states are not allowed to run on deficits, they will probably look to reduce expenses, likely at the expense of jobs, and increase taxes, which may have a negative impact on consumers. Lastly, valuations for SMID caps (i.e., absolute forecast P/E) have come down below their long-term average. However, compared to large caps, SMID caps look less attractive and earnings estimates from some sell-side analysts appear to be still too high.

As a final note we have commented on a number of gloomy factors above. However, we do see the US entering a third year of recovery and we expect that recovery to continue. We do not expect high levels of equity returns this year, but we are anticipating a positive market. This would follow the normal pattern of equity returns in a recovery.

16

Comparison of Change in the Value of a $10,000 Investment in the Schroder U.S. Small and Mid Cap Opportunities Fund

Investor and Advisor Shares vs. the Russell 2500 Index

The Russell 2500 Index is a market capitalization weighted broad based index measuring the performance of the 2500 smallest companies in the Russell 3000 Index, which represents approximately 20% of the total market capitalization of the Russell 3000 Index.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2010 | | Annualized

Since

Inception (a) | |

Schroder U.S. Small and Mid Cap Opportunities Fund — | | | | | |

Investor Shares | | 19.85 | % | 4.06 | % |

Advisor Shares | | 19.59 | % | 3.81 | % |

(a) From commencement of Fund operations on March 31, 2006.

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Investments | |

iShares Russell Midcap Index Fund | | 2.6 | % |

Crown Holdings | | 2.4 | |

Amdocs | | 2.3 | |

Pactiv | | 1.9 | |

Republic Services | | 1.9 | |

* Excludes any Short-Term Investments.

Sector Allocation

Sector | | % of Investments | |

Health Care | | 14.2 | % |

Consumer Discretionary | | 14.0 | |

Financial Services | | 13.8 | |

Technology | | 12.4 | |

Materials & Processing | | 10.5 | |

Producer Durables | | 7.0 | |

Utilities | | 5.0 | |

Other Energy | | 2.2 | |

Telecommunication Services | | 1.3 | |

Auto & Transportation | | 1.1 | |

Consumer Staples | | 1.0 | |

Short-Term Investment | | 17.5 | |

17

Schroder North American Equity Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 9, 2010)

Performance

In the 12 months ended October 31, 2010, the Schroder North American Equity Fund (the “Fund”) rose 15.68% (Investor Shares) and 15.27% (Advisor Shares). For the same period, the S&P 500 Index (the “Index”) rose by 16.52%.

Market Background

The US equity market continued to rise in the final months of 2009, extending the strong rebound from the lows of early March 2009, fueled by highly accommodative fiscal and monetary policy.

After peaking in mid-April, North American markets retreated in the second quarter of 2010 as investor sentiment deteriorated and volatility returned. Concerns about the credit worthiness of the peripheral European countries (most notably Greece) and a run of weaker macro-economic data in both the US and China dented confidence.

Unsurprisingly, the defensive parts of the market declined by less during the middle of the reporting period, particularly telecoms and consumer staples — with food retailers being one of the better performing industries — while resources and financials bore the brunt of the selling.

During the period ended October 31, 2010, sentiment towards the energy sector in particular was adversely affected by BP’s leaking oil well in the Gulf of Mexico, while financials were weighed down by continued uncertainty about the increasing prospect of a global banking-levy and new regulatory pressures. Against this more volatile backdrop, the primary beneficiaries were sovereign bonds, particularly US treasuries, as well as gold.

As we closed the reporting period, North American equities rose strongly. September was a particularly strong month as fears of a double-dip recession, which had been depressing market sentiment during August, receded. This continued in October as the Dow Jones Industrials, S&P 500 and NASDAQ 100 all registered gains. US stock markets were boosted by improving risk appetite and continued signs that corporate America is in good health. The main catalyst to the recovery in investor confidence was the announcement from the US Federal Reserve that it was willing to bolster growth by embarking on a second round of quantitative easing.

Economic data remained mixed, with unemployment rates remaining stuck at 9.6%. By contrast, data at the end of the reporting period showed that the economy grew at an annualized rate of 2%, between July and September, in line with Wall Street’s expectations — helping to ease fears of a ‘double-dip’ recession. The dollar lost value against most major currencies toward the latter part of the period, reflecting the US’s large trade deficit and fears that any recommencement of quantitative easing by the US Federal Reserve could deal a further blow to the currency. International political tensions were also evident, with Treasury Secretary Tim Geithner suggesting that the G20 nations should cap their trade surpluses in order to promote a more balanced global economy.

Portfolio Review

The Fund proved quite robust to changes in market direction and volatility, however the fund underperformed over this particular 12-month period. As would be expected, for a risk-controlled approach, stock selection was the main source of performance, especially within the financials, resources and industrials sectors whilst underperformance came from cyclical sectors such as Consumer discretionary and technology.

Outlook

As a matter of course, the Fund is structured in an attempt to perform well across a broad range of market environments. Multiple investment strategies are spread across a large number of small stock positions with the goal of capturing broad themes and limiting stock-specific risk, while top down risks (such as those arising from sector positions) are carefully managed.

We are increasingly finding attractively-priced, high quality opportunities within healthcare and consumer staples. These are “balanced” by also being overweight higher beta technology companies, where we have a slight preference for technology and semiconductors.

While the Fund remains underweight lower quality consumer discretionary stocks, such as autos, we have taken advantage of recent market volatility to reduce this underweight position slightly.

Within resources we have a preference for energy companies over materials. Within financials, the Fund remains focused on high-quality insurers over real estate and banks.

18

Comparison of Change in the Value of a $10,000 Investment in the Schroder North American Equity Fund

Investor and Advisor Shares vs. the Standard & Poor’s (S&P) 500 Index

The S&P 500 Index is a market capitalization value weighted composite index of 500 large capitalization U.S. companies and reflects the reinvestment of dividends.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2010 | | Five Years Ended

October 31, 2010 (c) | | Annualized

Since

Inception | |

Schroder North American Equity Fund — | | | | | | | |

Investor Shares | | 15.68 | % | 2.18 | % | 4.80 | %(a) |

Advisor Shares | | 15.27 | % | 1.82 | %(b) | 4.45 | %(b) |

(a) The Investor Shares commenced operations on September 17, 2003.

(b)��The Advisor Shares commenced operations on March 31, 2006. The performance information provided in the above table for periods prior to March 31, 2006 reflects the performance of the Investor Shares of the Fund, adjusted to reflect the distribution fees paid by Advisor Shares.

(c) Average annual total return.

“Total Return” shown above is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security* | | % of Investments | |

Exxon Mobil | | 2.7 | % |

Apple | | 2.4 | |

Microsoft | | 1.9 | |

International Business Machines | | 1.7 | |

Johnson & Johnson | | 1.6 | |

* Excludes any Short-Term Investments.

Sector Allocation

Sector | | % of Investments | |

Information Technology | | 17.0 | % |

Financials | | 14.9 | |

Energy | | 11.5 | |

Health Care | | 10.5 | |

Consumer Staples | | 9.7 | |

Industrials | | 9.5 | |

Consumer Discretionary | | 9.2 | |

Materials | | 4.2 | |

Telecommunication Services | | 3.2 | |

Utilities | | 2.5 | |

Short-Term Investment | | 7.8 | |

19

Schroder Total Return Fixed Income Fund

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 9, 2010)

Performance

During the 12 months ended October 31, 2010, the Schroder Total Return Fixed Income Fund (the “Fund”) returned 9.09% (Investor Shares) and 8.82% (Advisor Shares), compared to the Barclays Capital U.S. Aggregate Bond Index (the “Index”), a broad-based basket of U.S. debt securities, which rose 8.01%.

Market Background

U.S. debt markets moved towards normalization during the first few months of the reporting period with growth running above trend. The Fed started to unwind its remaining emergency liquidity facilities and the market shifted its focus on the timing and methodology of the Fed’s exit strategy and rising rates. However, escalating sovereign risk in Greece and to a lesser extent, Spain and Portugal, changed all that, erasing all talk of the removal of monetary stimulus and severely curtailing investor risk appetites. Debates around financial regulatory reform in the US and the SEC’s lawsuit against Goldman Sachs further escalated uncertainty, driving interest rates lower.

By mid year, economic conditions weakened as investors became increasingly worried about the prospects of a double-dip recession and deflation. Negative impacts from the Gulf oil spill, implementation of budget cuts and tax hikes in Europe, and a slowing Chinese economy further reinforced the notion of slowing growth. Job growth and payroll numbers turned weaker as companies continued to be concerned about the pace of the recovery. Housing data also struggled following the end of home buyer subsidies. This below-trend growth, falling inflation expectations and a very low probability for additional fiscal stimulus prompted the Fed to discuss another program of asset purchases. This caused the bond and equity markets to rally substantially in the third quarter, partly on the expectation that this quantitative easing would be good for growth, and partly as investors sought to lock-in higher yields.

Treasury rates declined over the period with the ten-year Treasury yield declining from 3.20% on November 1, 2009 to 2.60% on October 31, 2010. The decline was somewhat erratic though as rates peaked at a high of 3.99% in April (pre-sovereign crisis) to its lowest point of 2.39% in the beginning of October. The Treasury yield curve flattened slightly over the period, with the spread between two and ten-year maturities narrowing 27 basis points, as short rates remained anchored by the Fed’s low rate policy.

All sectors of the US fixed income market performed well as investors sought higher yields than those offered by money markets. Treasuries returned 7.20% over the period. Despite a challenging property market, commercial mortgage-backed securities (“CMBS”) were the best performing sector, returning 21.58% — more than three times the 5.99% return of the residential MBS sector. Investment grade corporate spreads declined 38 basis points over the period, generating 11.61% return led by the financial sector. Lower-rated credits significantly outperformed higher-rated credits as bonds rated BBB returned 14.79%, while AAA-rated bonds produced a 6.80% total returns.

Portfolio Review

The Fund outperformed the Index. The largest contributor to returns was the Fund’s corporate bond overweight versus a similar underweight in Treasuries. The overweight was reduced at end of April due to European sovereign distress and looming financial industry reform but remained intact at this lower level until July when it was increased again as conditions improved. Throughout the period, the Fund’s investment grade corporate security selection was biased toward BBB rated companies.

Similar to investment grade corporate strategy, the Fund’s high yield exposure was increased in late 2009 and early 2010 to reflect our view that these companies would benefit most from improving credit trends. Exposure to high yield ranged between 7%-15% for most of the period, and was a positive contributor to return.

The Fund’s securitized allocation focused on selecting well-structured agency Collateralized Mortgage Obligations (CMOs) to complement the portfolio of agency pass-through securities. Throughout the period, we varied these exposures to manage the Fund’s sensitivity to prepayments and spread widening. The Fund also maintained a small overweight to CMBS, comprised of shorter-maturity bonds comprised of loans originated in 2000-2004 with strong underwriting characteristics as well as recently issued securities with superior structures and collateralization. The securitized allocations positively contributed to performance.

20

The Fund’s duration and yield curve positioning slightly added to returns. The Fund’s duration was slightly shorter than the benchmark until the first week of April, when ten-year Treasuries reached a yield of 4.0%. At this point, the Fund’s duration was increased, bringing duration to a slight long of +0.25 year relative to the benchmark. This contributed a small amount to returns and the position was closed out when the ten-year yield fell to 3.68%. During the third quarter, yield curve positioning detracted slightly as our 10-year underweight vs. 30-year overweight strategy underperformed when intermediate maturities outpaced all others. This underperformance was offset by gains from our long duration positioning after yields rose in September.

Outlook

The Federal Reserve is sending very clear signals that it will maintain a very accommodative monetary policy for the foreseeable future, and this will continue to force investors out of cash and similar low risk securities and into higher yielding investments. Quantitative easing, which would target longer-term interest rates, would be further impetus for investors to rotate out of Treasuries and into sectors with better total return prospects. However, the key to implementation will be adding yield without taking on too much exposure to issuers that could be under pressure if growth were to slow materially.

We believe that economic growth will gradually recover though the large debt balances restraining consumer and government spending will likewise hold back overall growth and keep interest rates relatively low. Monetary policy is decidedly accommodative and, without a change in the debt reduction attitude in Washington, will remain accommodative to offset the fiscal stimulus. While the overall pressure for yields to stay low should persist, we recognize that yields are near generational lows and the risk of a negative surprise will increase.

Based on our outlook for moderate growth, we have a bias toward owning higher yielding securities through moderate overweights to corporate and mortgage securities and underweights to Treasury and agency sectors. As in 2010, corporate deleveraging is a trend that remains firmly in place. However, we expect to see greater distinction between higher credit quality issuers with large cash reserves that will be tempted to pursue shareholder friendly transactions and high yield companies that are keen to reduce leverage and increase financial flexibility. As a result, we prefer to continue to overweight corporate bonds with a bias toward lower rated issuers that are paring leverage. That being said, following on a year when corporate bonds have performed well, in 2011 we believe that investors will need to be more discriminatory in issuer selection.

21

Comparison of Change in the Value of a $10,000 Investment in the Schroder Total Return Fixed Income Fund

Investor and Advisor Shares vs. the Barclays Capital U.S. Aggregate Bond Index

The Barclays Capital U.S. Aggregate Bond Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have a least 1 year remaining to maturity. It is not managed.

PERFORMANCE INFORMATION

| | One Year Ended

October 31, 2010 | | Five Years Ended

October 31, 2010 (a) | | Annualized

Since

Inception (b) | |

Schroder Total Return Fixed Income Fund — | | | | | | | |

Investor Shares | | 9.09 | % | 7.03 | % | 6.27 | % |

Advisor Shares | | 8.82 | % | 6.75 | % | 5.99 | % |

(a) Average annual total return.

(b) From commencement of Fund operations on December 31, 2004.

“Total Return” is calculated including reinvestment of all dividends and distributions. Results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. Results represent past performance and do not indicate future results. The value of an investment in the Fund and the return on investment both will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

Top 5 Holdings

Security | | % of Investments | |

U.S. Treasury Bill 0.093%, 12/02/10 | | 6.3 | % |

U.S. Treasury Note 1.250%, 9/30/15 | | 5.9 | |

U.S. Treasury Note 2.625%, 8/15/20 | | 4.5 | |

FHLMC 4.000%, 11/15/40 | | 3.7 | |

U.S. Treasury Bond 4.375%, 5/15/40 | | 3.6 | |

Sector Allocation

Sector | | % of Investments | |

Corporate Obligation | | 33.7 | % |

U.S. Government Mortgage-Backed Obligation | | 30.6 | |

U.S. Treasury Obligation | | 27.4 | |

Commercial Mortgage-Backed Obligation | | 7.0 | |

Municipal Bond | | 0.6 | |

Collateralized Mortgage Obligation | | 0.2 | |

Short-Term Investment | | 0.5 | |

22

Schroder Multi-Asset Growth Portfolio

MANAGEMENT DISCUSSION AND ANALYSIS (As of December 9, 2010)

Performance