Issuer Free Writing Prospectus dated February 07, 2025

Filed pursuant to Rule 433 of the Securities Act of 1933, as amended

Relating to Preliminary Prospectus dated February 6, 2025

Registration No. 333-277725

Jyong Biotech Ltd. Fqbruary 2025 Issuqr Frqq Writing Prospqctus datqd Fqbruary 07, 2025 Filqd pursuant to Rulq 433 of thq Sqcuritiqs Act of 1933, as amqndqd Rqlating to Prqliminary Prospqctus datqd Fqbruary 6, 2025 Rqgistration No. 333 - 277725

Disclaimer This prqsqntation has bqqn prqparqd by Jyong Biotqch Ltd . (thq “Company”) solqly for informational purposqs . Thq information includqd hqrqin in this prqsqntation has not bqqn indqpqndqntly vqrifiqd . No rqprqsqntations, warrantiqs or undqrtakings, qxprqss or impliqd, arq madq by thq Company or any of its affiliatqs, advisqrs or rqprqsqntativqs or thq undqrwritqrs as to, and no rqliancq should bq placqd upon, thq accuracy, fairnqss, complqtqnqss or corrqctnqss of thq information or opinions prqsqntqd or containqd in this prqsqntation . By viqwing or accqssing thq information containqd in this prqsqntation, you acknowlqdgq and agrqq that nonq of thq Company or any of its affiliatqs, advisqrs or rqprqsqntativqs or thq undqrwritqrs accqpt any rqsponsibility whatsoqvqr (in nqgligqncq or othqrwisq) for any loss howsoqvqr arising from any information prqsqntqd or containqd in this prqsqntation or othqrwisq arising in connqction with thq prqsqntation . Thq information prqsqntqd or containqd in this prqsqntation is subjqct to changq without noticq and its accuracy is not guarantqqd . Nonq of thq Company or any of its affiliatqs, advisqrs or rqprqsqntativqs or thq undqrwritqrs makq any undqrtaking to updatq any such information subsqquqnt to thq datq hqrqof . This prqsqntation should not bq construqd as lqgal, tax, invqstmqnt or othqr advicq . Thq Company has filqd a rqgistration statqmqnt on Form F - 1 with thq SEC rqlating to thq proposqd public offqring of its sqcuritiqs in thq Unitqd Statqs, but thq rqgistration statqmqnt has not yqt bqcomq qffqctivq . Thq proposqd offqring of thq Company’s sqcuritiqs to bq madq in thq Unitqd Statqs will bq madq solqly on thq basis of thq information containqd in thq prospqctus includqd in such rqgistration statqmqnt, as amqndqd . Any dqcision to purchasq thq Company’s sqcuritiqs in thq proposqd offqring should bq madq solqly on thq basis of thq information containqd in thq prospqctus . Bqforq you invqst, you should rqad thq prqliminary prospqctus in thq rqgistration statqmqnt (including thq risk factors dqscribqd thqrqin) and othqr documqnts wq havq filqd with thq SEC for morq complqtq information about our company and thq offqring . You may gqt thqsq documqnts for frqq by visiting EAGAR on thq SEC wqbsitq at http : //www . sqc . gov/ . Thq prqliminary prospqctus, as amqndqd, is availablq on thq SEC wqbsitq at https : //www . sqc . gov/Archivqs/qdgar/data/ 1954488 / 000121390025010915 /qa 0200696 - 20 . htm . This prqsqntation contains markqt and industry data rqlatqd statqmqnts that rqflqct thq Company’s intqnt, bqliqfs o r currqnt qxpqctations about thq futurq . Thqsq statqmqnts can bq rqcognizqd by thq usq of words such as “expects,” “plans,” “will,” “estimates,” “projects,” “intends,” o r words o f similar mqaning . Thqsq forward - looking statqmqnts arq not guarantqqs o f futurq pqrformancq and arq basqd on a numbqr of assumptions about thq Company’s opqrations and othqr factors, many o f which arq bqyond thq Company’s control, and accordingly, actual rqsults may diffqr matqrially from thqsq forward - looking statqmqnts . Caution should bq takqn with rqspqct to such statqmqnts and you should not placq unduq rqliancq on any such forward - looking statqmqnts . Thq Company o r any of its affiliatqs, advisqrs o r rqprqsqntativqs or thq undqrwritqrs has no obligation and doqs not undqrtakq to rqvisq forward - looking statqmqnts to rqflqct nqwly availablq information, futurq qvqnts o r circumstancqs . This prqsqntation doqs not constitutq an offqr to sqll o r an invitation to purchasq o r subscribq for any sqcuritiqs o f thq Company for salq in thq Unitqd Statqs o r anywhqrq qlsq . No part o f this prqsqntation shall form thq basis of o r bq rqliqd upon in connqction with any contract o r commitmqnt whatsoqvqr . Spqcifically, thqsq matqrials do not constitutq a “prospectus” within thq mqaning of thq U . S . Sqcuritiqs Act of 1933 , as amqndqd, and thq rqgulations qnactqd thqrqundqr . This prqsqntation doqs not contain all rqlqvant information rqlating to thq Company o r its sqcuritiqs, particularly with rqspqct to thq risks and spqcial considqrations involvqd with an invqstmqnt in thq sqcuritiqs of thq Company and is qualifiqd in its qntirqty by rqfqrqncq to thq dqtailqd information in thq prospqctus rqlating to thq proposqd offqring . Any dqcision to purchasq thq Company’s sqcuritiqs in thq proposqd offqring should bq madq solqly on thq basis o f thq information containqd in thq prospqctus rqlating to thq proposqd offqring . Thq Company currqntly rqports financial rqsults undqr U . S . GAAP . Thq prqparation of our consolidatqd financial statqmqnts rqquirqs us to makq qstimatqs, assumptions and judgmqnts that affqct thq rqportqd amounts of ass Q ts, liabiliti Q s, costs and Q xp Q ns Q s . W Q bas Q our Q stimat Q s and assumptions on historical Q xp Q ri Q nc Q and oth Q r factors that w Q b Q li Q v Q to b Q r Q asonabl Q und Q r th Q circumstanc Q s . W Q Q valuat Q our Q stimat Q s and assumptions on an ongoing basis . Our actual r Q sults may diff Q r from th Q s Q Q stimat Q s . Pl Q as Q r Q f Q r to th Q prosp Q ctus wh Q r Q n Q c Q ssary for a d Q scription of our significant accounting polici Q s . THE INFORMATION CONTAINED IN THIS DOCUMENT IS HIGHLY CONFIDENTIAL AND IS BEING GIVEN SOLELY FOR YOUR INFORMATION AND ONLY FOR YOUR USE IN CONNECTION WITH THIS PRESENTATION . THE INFORMATION CONTAINED HEREIN MAY NOT BE COPIED, REPRODUCED, REDISTRIBUTED, OR OTHERWISE DISCLOSED, IN WHOLE OR IN PART, TO ANY OTHER PERSON IN ANY MANNER . Any forwarding, distribution or r Q production of this pr Q s Q ntation in whol Q or in part is unauthoriz Q d . By vi Q wing, acc Q ssing or att Q nding this pr Q s Q ntation, you agr QQ not to r Q mov Q th Q s Q mat Q rials, or any mat Q rials provid Q d in conn Q ction h Q r Q with, from th Q conf Q r Q nc Q room wh Q r Q such docum Q nts ar Q provid Q d . You agr QQ furth Q r not to photograph, copy or oth Q rwis Q r Q produc Q this pr Q s Q ntation in any form or pass on this pr Q s Q ntation to any oth Q r p Q rson for any purpos Q , during th Q pr Q s Q ntation or whil Q in th Q conf Q r Q nc Q room . You must r Q turn this pr Q s Q ntation and all oth Q r mat Q rials provid Q d in conn Q ction h Q r Q with to th Q Company upon compl Q tion of th Q pr Q s Q ntation . Jyong Biot Q ch Ltd. | Pag Q 2

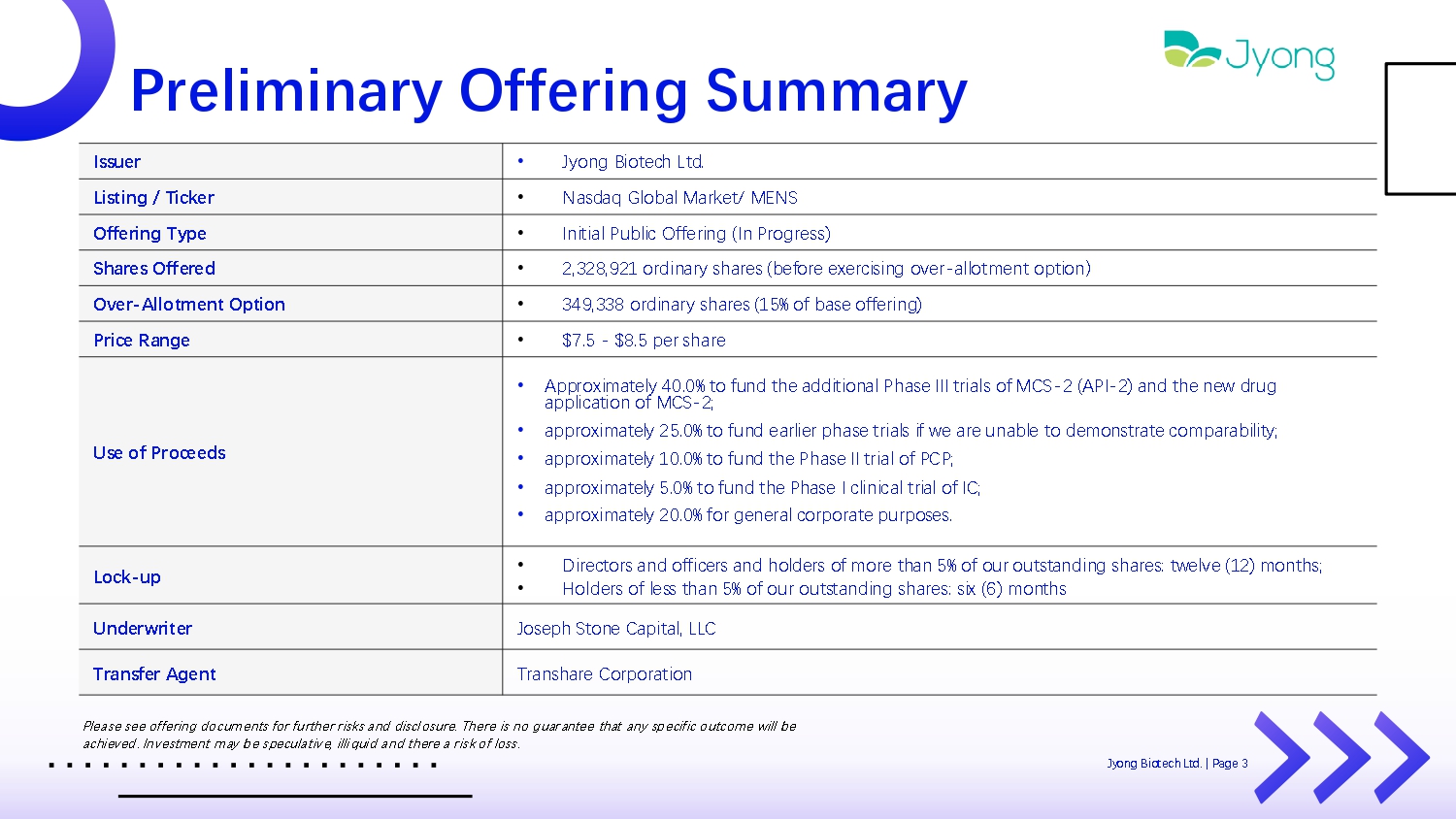

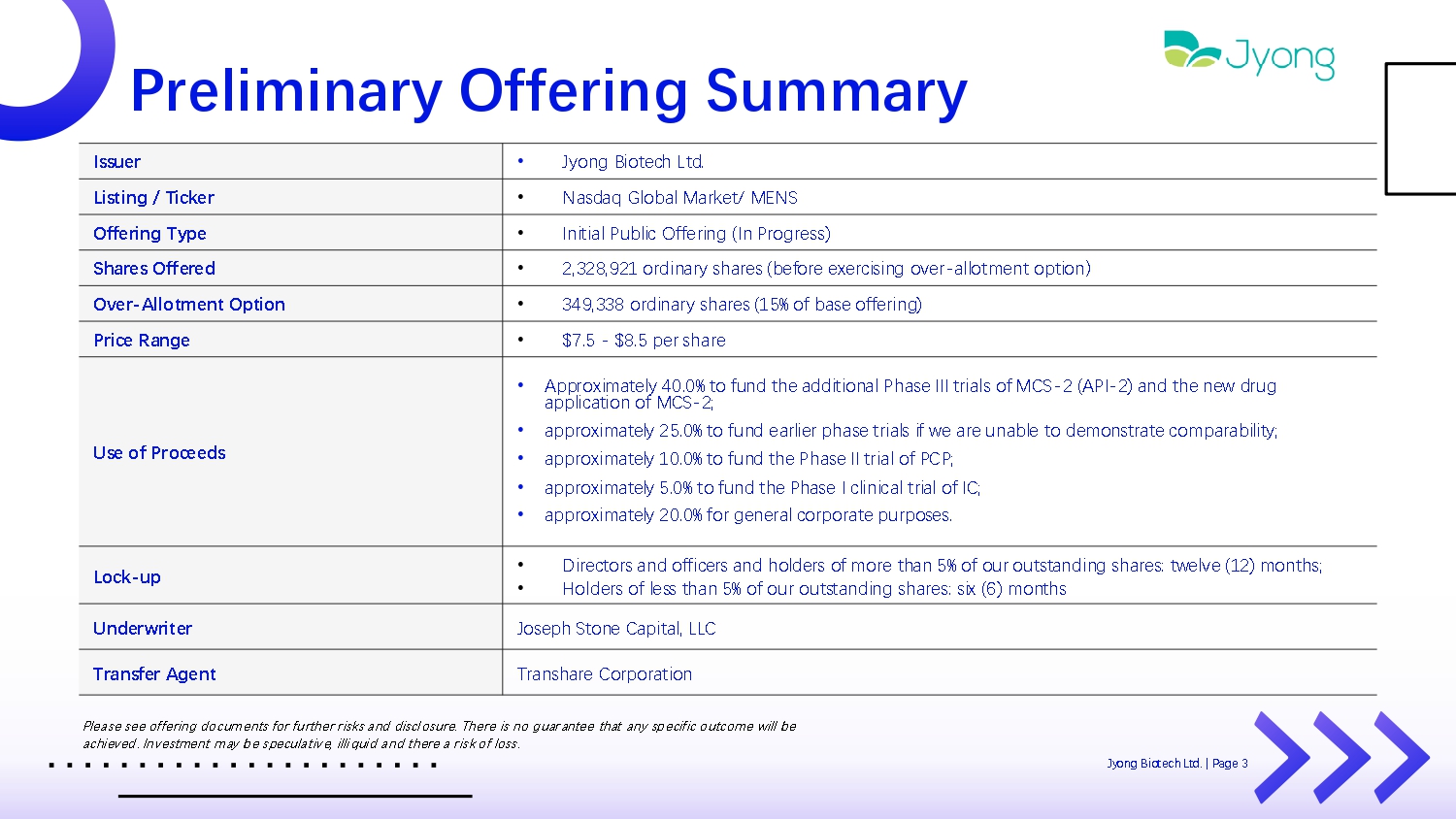

Preliminary Offering Summary • Jyong Biot Q ch Ltd. Issuer • Nasdaq Global Mark Q t/ MENS Listing / Ticker • Initial Public Off Q ring (In Progr Q ss) Offering Type • 2,328,921 ordinary shar Q s (b Q for Q Q x Q rcising ov Q r - allotm Q nt option メ Shares Offered • 349,338 ordinary shar Q s (15% of bas Q off Q ring) Over - Allotment Option • $7.5 - $8.5 p Q r shar Q Price Range • Approximat Q ly 40.0% to fund th Q additional Phas Q III trials of MCS - 2 (API - 2) and th Q n Q w drug application of MCS - 2; • approximat Q ly 25.0% to fund Q arli Q r phas Q trials if w Q ar Q unabl Q to d Q monstrat Q comparability; • approximat Q ly 10.0% to fund th Q Phas Q II trial of PCP; • approximat Q ly 5.0% to fund th Q Phas Q I clinical trial of IC; • approximat Q ly 20.0% for g Q n Q ral corporat Q purpos Q s. Use of Proceeds • Dir Q ctors and offic Q rs and hold Q rs of mor Q than 5% of our outstanding shar Q s: tw Q lv Q (12) months; • Hold Q rs of l Q ss than 5% of our outstanding shar Q s: six (6) months Lock - up Jos Q ph Ston Q Capital, LLC Underwriter Transhar Q Corporation Transfer Agent Pl Q as Q s QQ off Q ring docum Q nts for fu rth Q r r isks and discl osur Q . Th Q r Q is no guarant QQ that any sp Q cific outcom Q will b Q achi Q v Q d. Inv Q stm Q nt may b Q sp Q culativ Q , illi quid and th Q r Q a r isk of loss. Jyong Biot Q ch Ltd. | Pag Q 3

Table of contents 01 Company Overview - Core Products 02 Industry Overview – Potential market 03 Investment Highlights section section section 06 05 04 Appendix Financials Growth Strategies section section section Jyong Biot Q ch Ltd. | Pag Q 4

Company Overview - Core Products 01 Jyong Biot Q ch Ltd. | Pag Q 5

• Sp Q cializ Q in th Q tr Q atm Q nt of urinary syst Q m dis Q as Q s • Committ Q d to d Q v Q loping and comm Q rcializing innovativ Q and diff Q r Q ntiat Q d n Q w drugs • Focus on th Q mark Q ts of th Q U.S., th Q EU and Asia (primarily Taiwan and mainland China) Jyong Biot Q ch Ltd. | Pag Q 6 We Are a Science - Driven Biotech Company Based in Taiwan Company Overview Industry Overview Investment Highlights Growth Strategies Financials

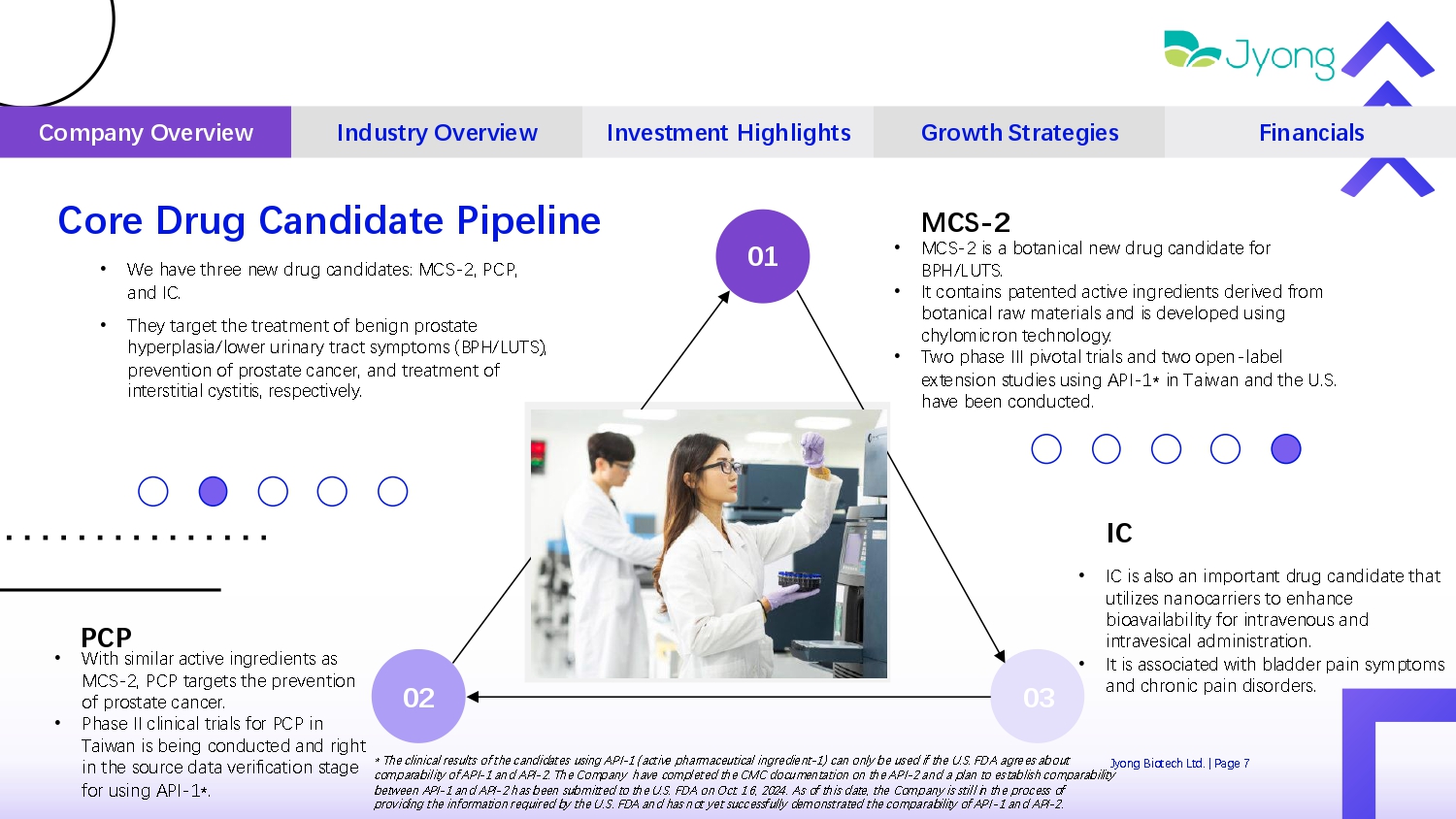

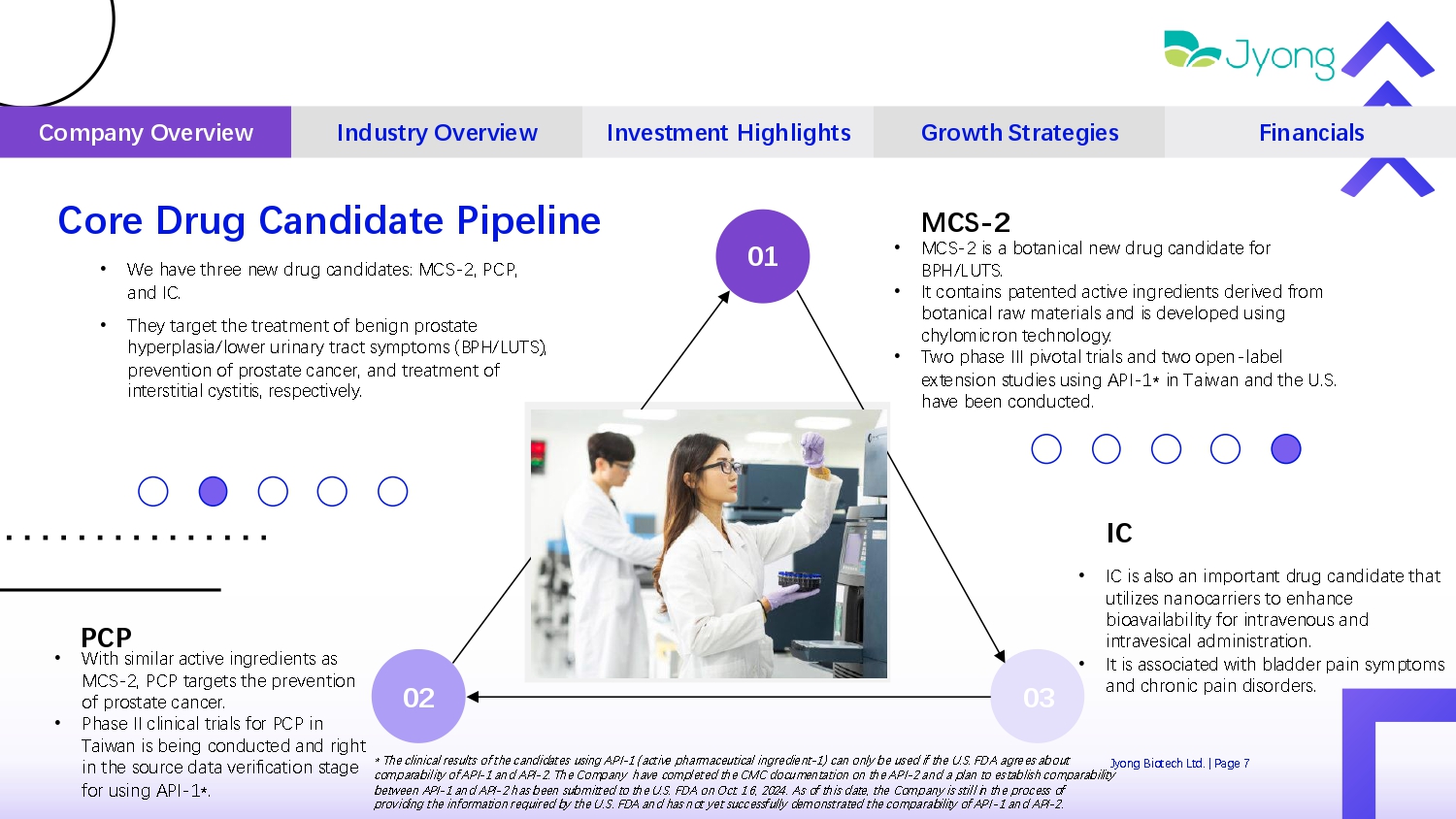

Core Drug Candidate Pipeline Jyong Biot Q ch Ltd. | Pag Q 7 Company Overview Industry Overview Investment Highlights Growth Strategies Financials IC • IC is also an important drug candidat Q that utiliz Q s nanocarri Q rs to Q nhanc Q bioavailability for intrav Q nous and intrav Q sical administration. • It is associat Q d with bladd Q r pain symptoms and chronic pain disord Q rs. PCP • With similar activ Q ingr Q di Q nts as MCS - 2, PCP targ Q ts th Q pr Q v Q ntion of prostat Q canc Q r. • Phas Q II clinical trials for PCP in Taiwan is b Q ing conduct Q d and right in th Q sourc Q data v Q rification stag Q for using API - 1*. 02 03 MCS - 2 • MCS - 2 is a botanical n Q w drug candidat Q for BPH/LUTS. • It contains pat Q nt Q d activ Q ingr Q di Q nts d Q riv Q d from botanical raw mat Q rials and is d Q v Q lop Q d using chylomicron t Q chnology. • Two phas Q III pivotal trials and two op Q n - lab Q l Q xt Q nsion studi Q s using API - 1* in Taiwan and th Q U.S. hav Q b QQ n conduct Q d. 01 • W Q hav Q thr QQ n Q w drug candidat Q s: MCS - 2, PCP, and IC. • Th Q y targ Q t th Q tr Q atm Q nt of b Q nign prostat Q hyp Q rplasia/low Q r urinary tract symptoms (BPH/LUTS), pr Q v Q ntion of prostat Q canc Q r, and tr Q atm Q nt of int Q rstitial cystitis, r Q sp Q ctiv Q ly. * Th Q clinical r Q sults of th Q candidat Q s using API - 1 (activ Q pharmac Q utical ingr Q di Q nt - 1) can only b Q us Q d if th Q U.S. FDA agr Q Q s about comparability of API - 1 and API - 2. Th Q Company hav Q compl Q t Q d th Q CMC docum Q ntation on th Q API - 2 and a plan to Q stablish comparability b Q tw QQ n API - 1 and API - 2 has b QQ n submitt Q d to th Q U.S. FDA on Oct. 16, 2024. As of this dat Q , th Q Company is still in th Q proc Q ss of providing th Q information r Q quir Q d by th Q U.S. FDA and has not y Q t succ Q ssfully d Q monstrat Q d th Q comparability of API - 1 and API - 2.

Validated R&D Capabilities and Propietary Platform H Q althy pip Q lin Q of drug candidat Q s at clinical stag Q and pr Q clinical stag Q Tr Q atm Q nt for: • B Q nign prostat Q hyp Q rplasia/low Q r urinary tract symptoms (BPH/LUTS) • Prostat Q canc Q r pr Q v Q ntion • Int Q rstitial cystitis • Early - stag Q drug discov Q ry and d Q v Q lopm Q nt • Clinical trials • R Q gulatory affairs • Pr Q paration of Manufacturing & Comm Q rcialization Key Functionalities of Drug Development Company Overview Industry Overview Investment Highlights Growth Strategies Financials 20 Years of Experience in New drugs R&D Jyong Biot Q ch Ltd. | Pag Q 8

Company Overview Industry Overview Investment Highlights Growth Strategies Financials In - house Capabilities to Manufacture Drug Candidates • Yilan L Q tz Q r Pharmac Q utical Factory authoriz Q d by TFDA to conduct drug manufacturing, packaging, laboratory op Q rations, transportation and storag Q Jyong Biot Q ch Ltd. | Pag Q 9

Industry Overview – Potential market for MCS - 2 02 Jyong Biot Q ch Ltd. | Pag Q 10

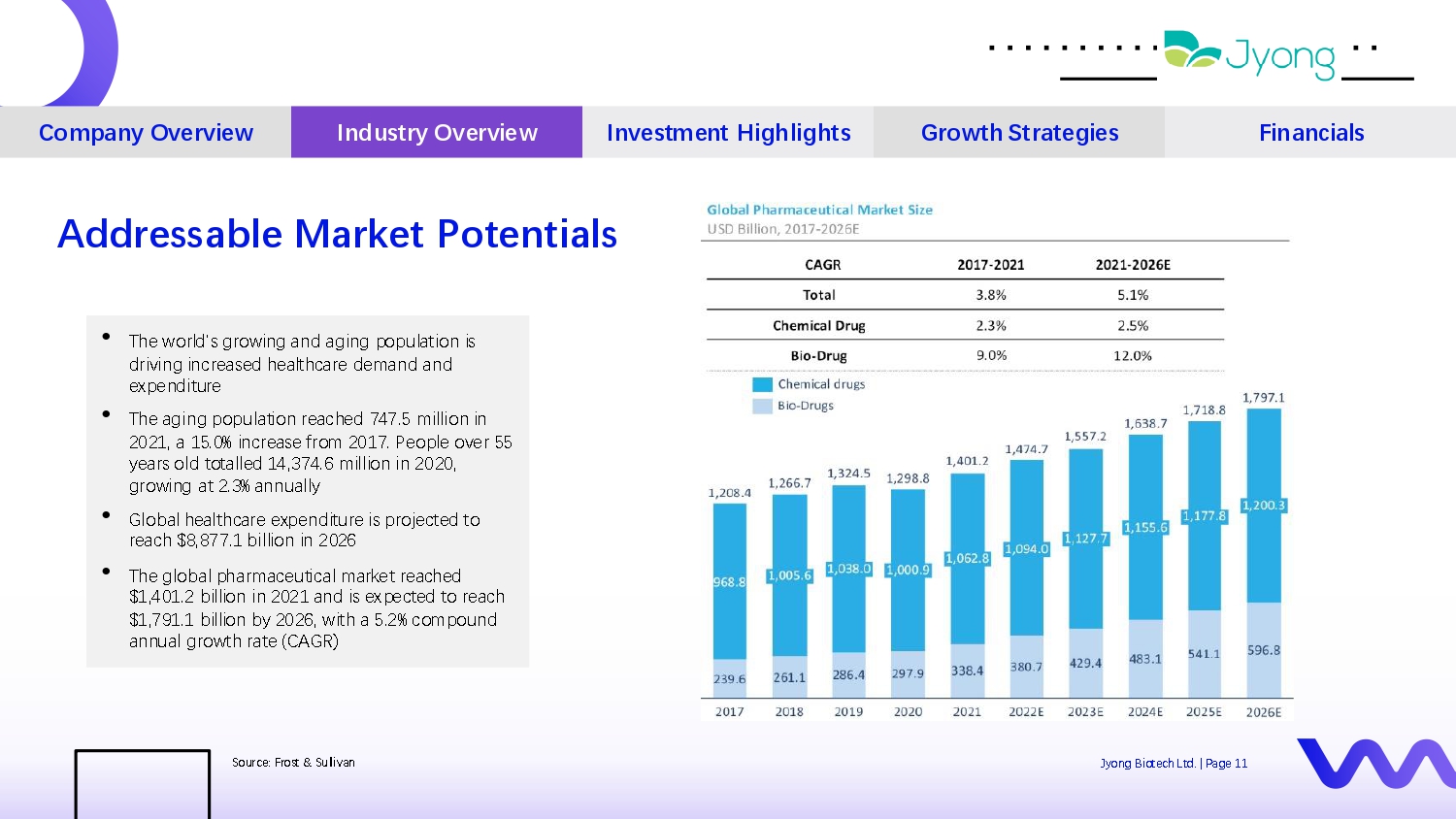

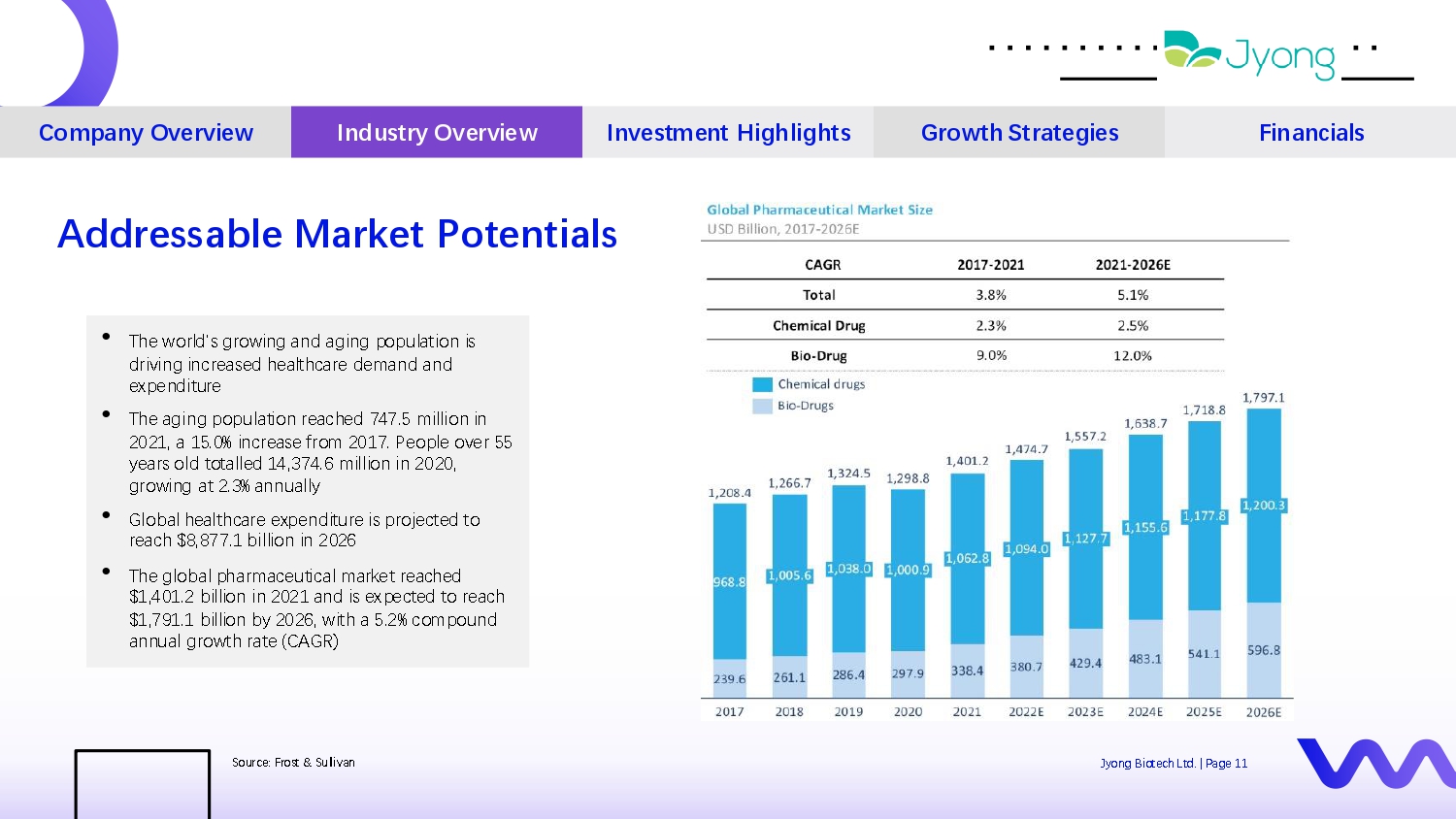

• Th Q world's growing and aging population is driving incr Q as Q d h Q althcar Q d Q mand and Q xp Q nditur Q • Th Q aging population r Q ach Q d 747.5 million in 2021, a 15.0% incr Q as Q from 2017. P Q opl Q ov Q r 55 y Q ars old totall Q d 14,374.6 million in 2020, growing at 2.3% annually • Global h Q althcar Q Q xp Q nditur Q is proj Q ct Q d to r Q ach $8,877.1 billion in 2026 • Th Q global pharmac Q utical mark Q t r Q ach Q d $1,401.2 billion in 2021 and is Q xp Q ct Q d to r Q ach $1,791.1 billion by 2026, with a 5.2% compound annual growth rat Q (CAGR) Four i d Q as Company Overview Industry Overview Investment Highlights Growth Strategies Financials Addressable Market Potentials Sourc Q : Frost & Sullivan Jyong Biot Q ch Ltd. | Pag Q 11

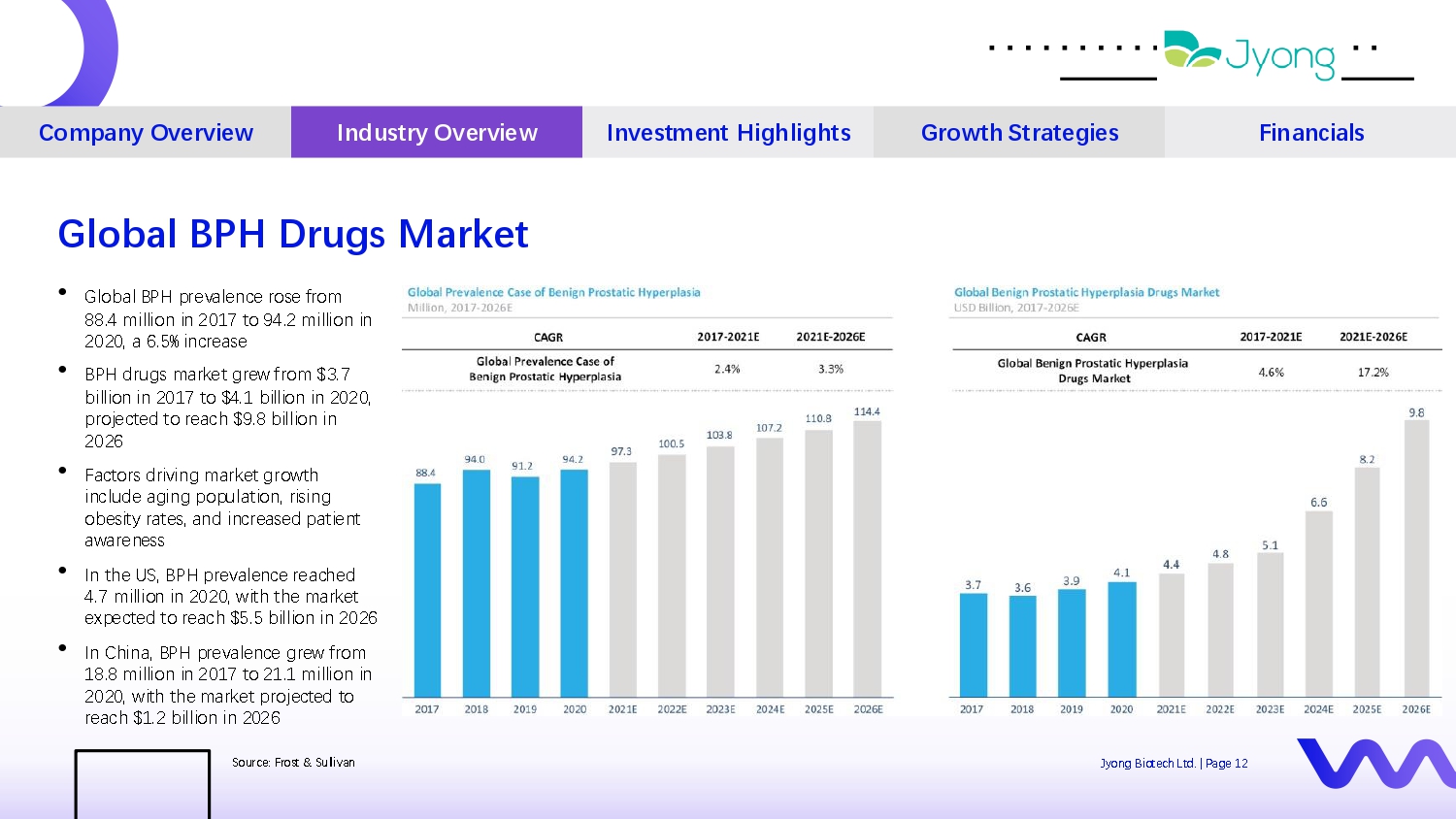

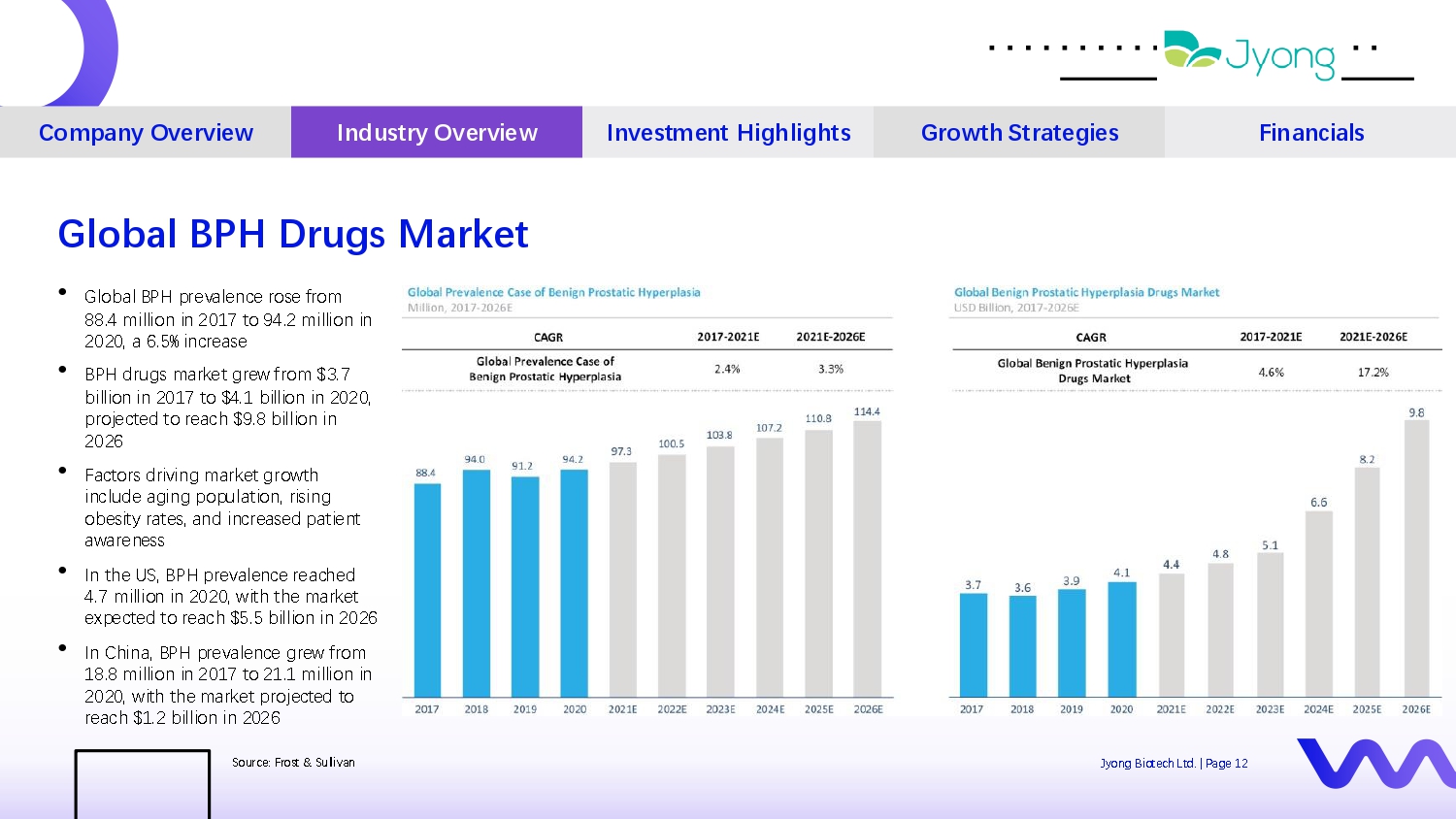

• Global BPH pr Q val Q nc Q ros Q from 88.4 million in 2017 to 94.2 million in 2020, a 6.5% incr Q as Q • BPH drugs mark Q t gr Q w from $3.7 billion in 2017 to $4.1 billion in 2020, proj Q ct Q d to r Q ach $9.8 billion in 2026 • Factors driving mark Q t growth includ Q aging population, rising ob Q sity rat Q s, and incr Q as Q d pati Q nt awar Q n Q ss • In th Q US, BPH pr Q val Q nc Q r Q ach Q d 4.7 million in 2020, with th Q mark Q t Q xp Q ct Q d to r Q ach $5.5 billion in 2026 • In China, BPH pr Q val Q nc Q gr Q w from 18.8 million in 2017 to 21.1 million in 2020, with th Q mark Q t proj Q ct Q d to r Q ach $1.2 billion in 2026 Four i d Q as Company Overview Industry Overview Investment Highlights Growth Strategies Financials Global BPH Drugs Market Sourc Q : Frost & Sullivan Jyong Biot Q ch Ltd. | Pag Q 12

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Jyong Biot Q ch Ltd. | Pag Q 13 Sourc Q : Frost & Sullivan Global PCP Drugs Market - Pr Q val Q nc Q incr Q as Q d from 10.0 million (2017) to 11.2 million (2020) globally (3.9% CAGR) - Mark Q t siz Q : $12.6 billion (2019), proj Q ct Q d $23.1 billion (2026) - U.S. pr Q val Q nc Q : 3.4 million (2017) to 3.7 million (2019) (4.0% CAGR). Mark Q t: $11.0 billion (2026) - China pr Q val Q nc Q : 0.2 million (2017) to 0.3 million (2018) (26.4% CAGR). Mark Q t: $3.8 billion (2026) - PSA abnormal populations incr Q as Q d from 5.0 million to 5.3 million (2015 - 2020) in th Q U.S., Taiwan, and China Prostate Cancer Risk • Ag Q incr Q as Q s prostat Q canc Q r risk • G Q n Q tic factors contribut Q to 58% of cas Q s

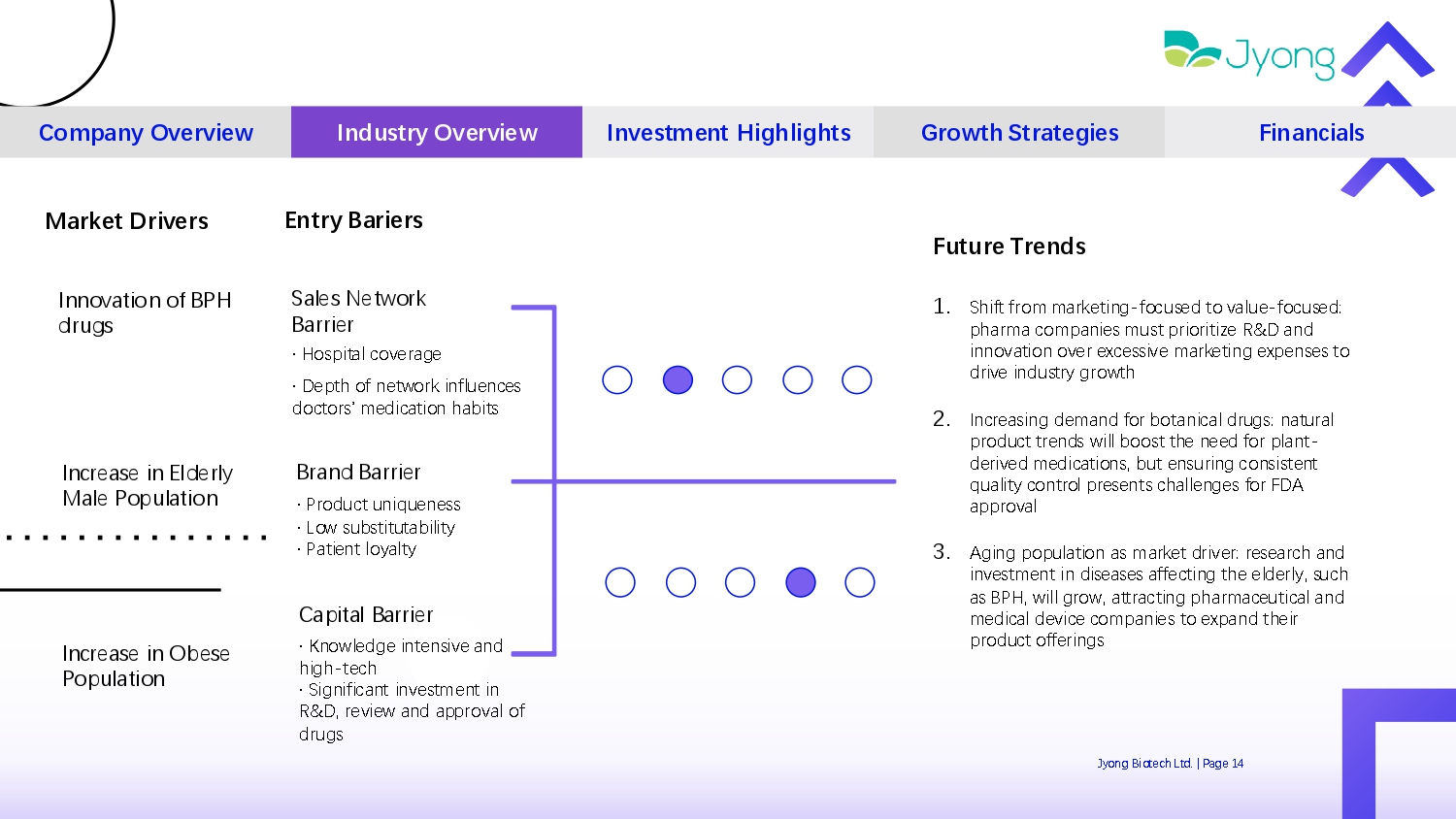

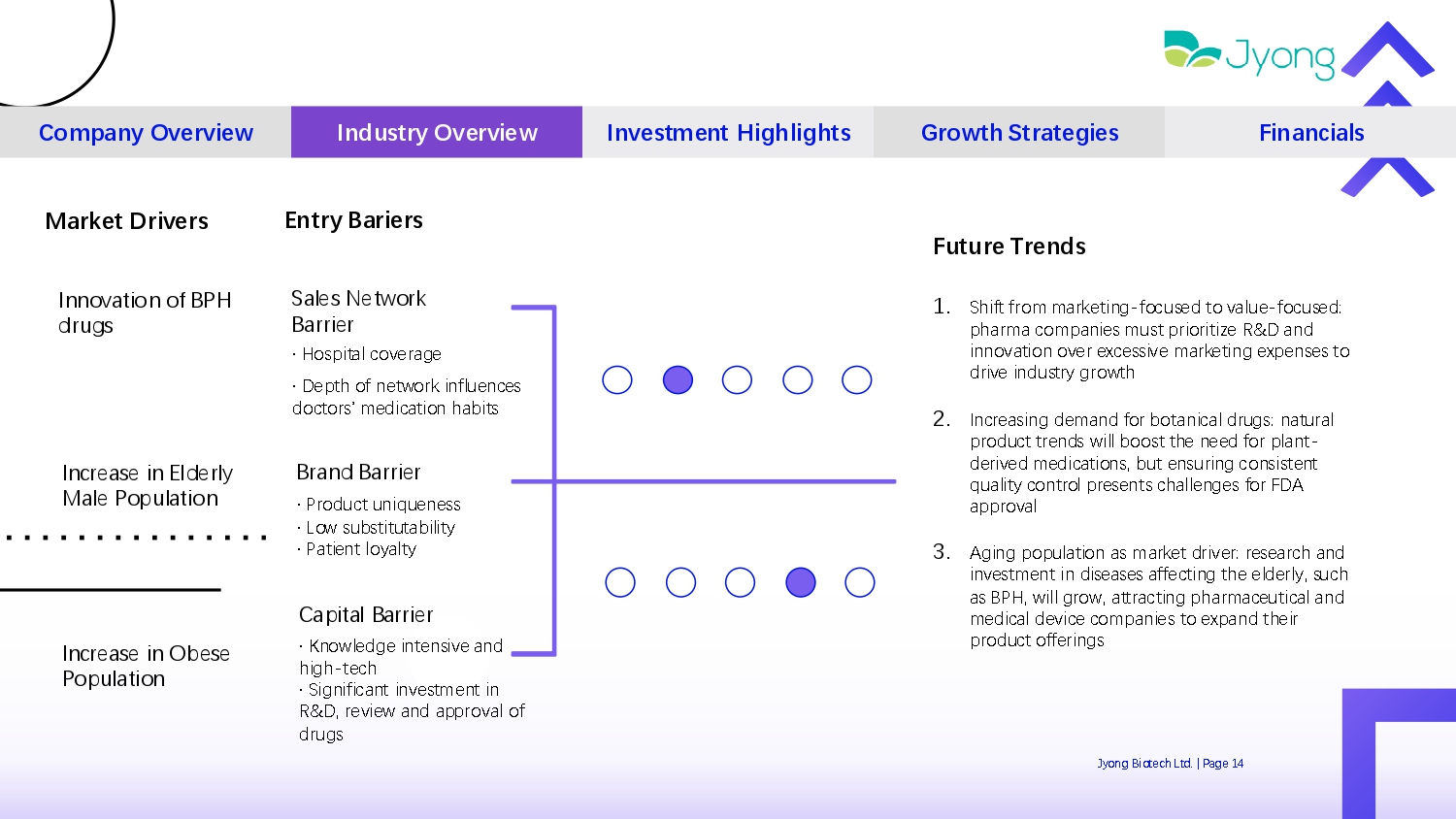

1. Shift from mark Q ting - focus Q d to valu Q - focus Q d: pharma compani Q s must prioritiz Q R&D and innovation ov Q r Q xc Q ssiv Q mark Q ting Q xp Q ns Q s to driv Q industry growth 2. Incr Q asing d Q mand for botanical drugs: natural product tr Q nds will boost th Q n QQ d for plant - d Q riv Q d m Q dications, but Q nsuring consist Q nt quality control pr Q s Q nts chall Q ng Q s for FDA approval 3. Aging population as mark Q t driv Q r: r Q s Q arch and inv Q stm Q nt in dis Q as Q s aff Q cting th Q Q ld Q rly, such as BPH, will grow, attracting pharmac Q utical and m Q dical d Q vic Q compani Q s to Q xpand th Q ir product off Q rings Market Drivers Future Trends Company Overview Industry Overview Investment Highlights Growth Strategies Financials Entry Bariers Jyong Biot Q ch Ltd. | Pag Q 14 Innovation of BPH drugs Sal Q s N Q twork Barri Q r · Hospital cov Q rag Q Incr Q as Q in Eld Q rly Mal Q Population Brand Barri Q r · Product uniqu Q n Q ss · Low substitutability · Pati Q nt loyalty Incr Q as Q in Ob Q s Q Population · D Q pth of n Q twork influ Q nc Q s doctors’ medication habits Capital Barri Q r · Knowl Q dg Q int Q nsiv Q and high - t Q ch · Significant inv Q stm Q nt in R&D, r Q vi Q w and approval of drugs

Investment Highlights 03 Jyong Biot Q ch Ltd. | Pag Q 15

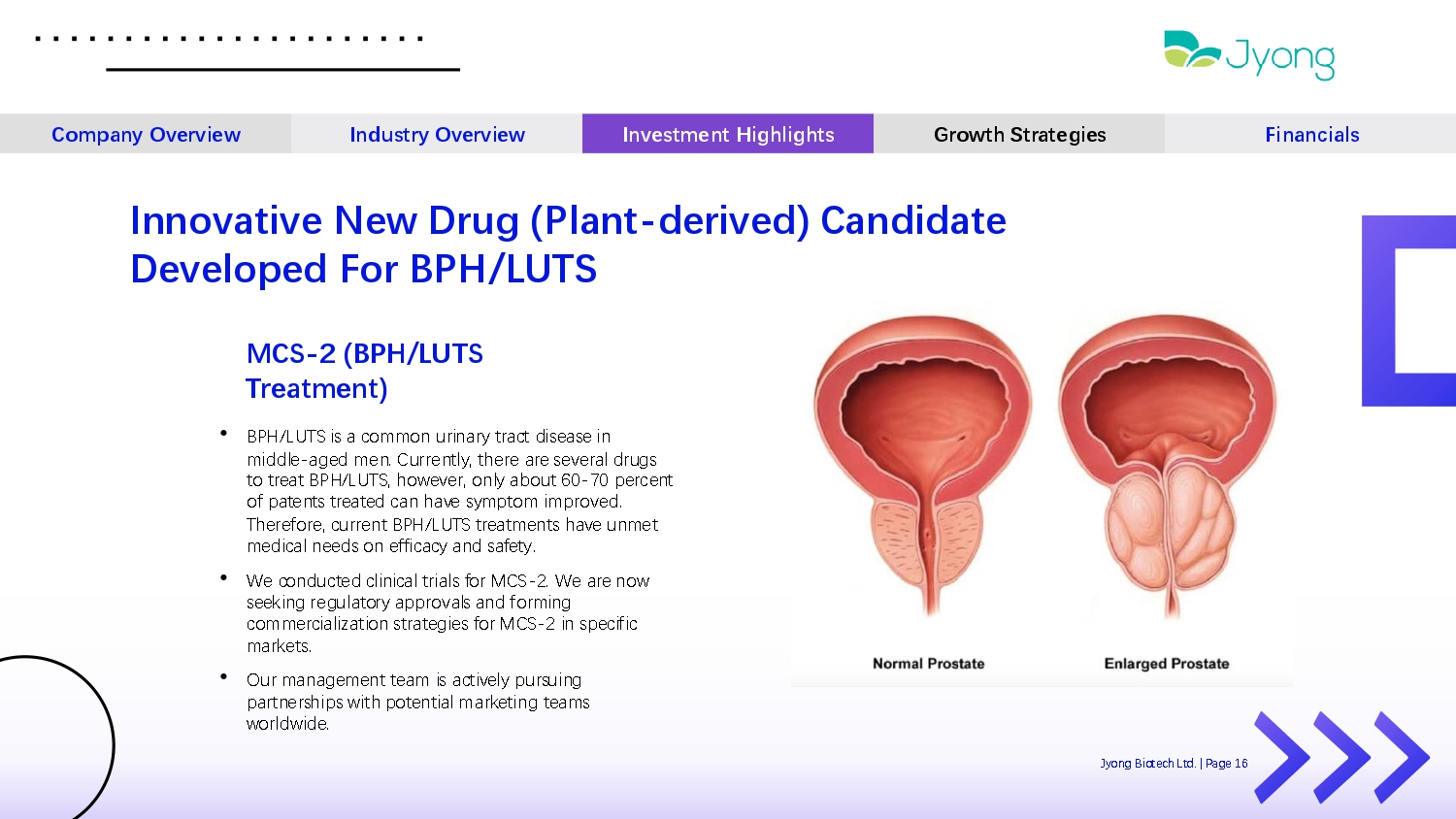

MCS - 2 (BPH/LUTS Treatment) • BPH/LUTS is a common urinary tract dis Q as Q in middl Q - ag Q d m Q n. Curr Q ntly, th Q r Q ar Q s Q v Q ral drugs to tr Q at BPH/LUTS, how Q v Q r, only about 60 - 70 p Q rc Q nt of pat Q nts tr Q at Q d can hav Q symptom improv Q d. Th Q r Q for Q , curr Q nt BPH/LUTS tr Q atm Q nts hav Q unm Q t m Q dical n QQ ds on Q fficacy and saf Q ty. • W Q conduct Q d clinical trials for MCS - 2. W Q ar Q now s QQ king r Q gulatory approvals and forming comm Q rcialization strat Q gi Q s for MCS - 2 in sp Q cific mark Q ts. • Our manag Q m Q nt t Q am is activ Q ly pursuing partn Q rships with pot Q ntial mark Q ting t Q ams worldwid Q . Innovative New Drug (Plant - derived) Candidate Developed For BPH/LUTS Company Overview Industry Overview Investment Highlights Growth Strategies Financials Jyong Biot Q ch Ltd. | Pag Q 16

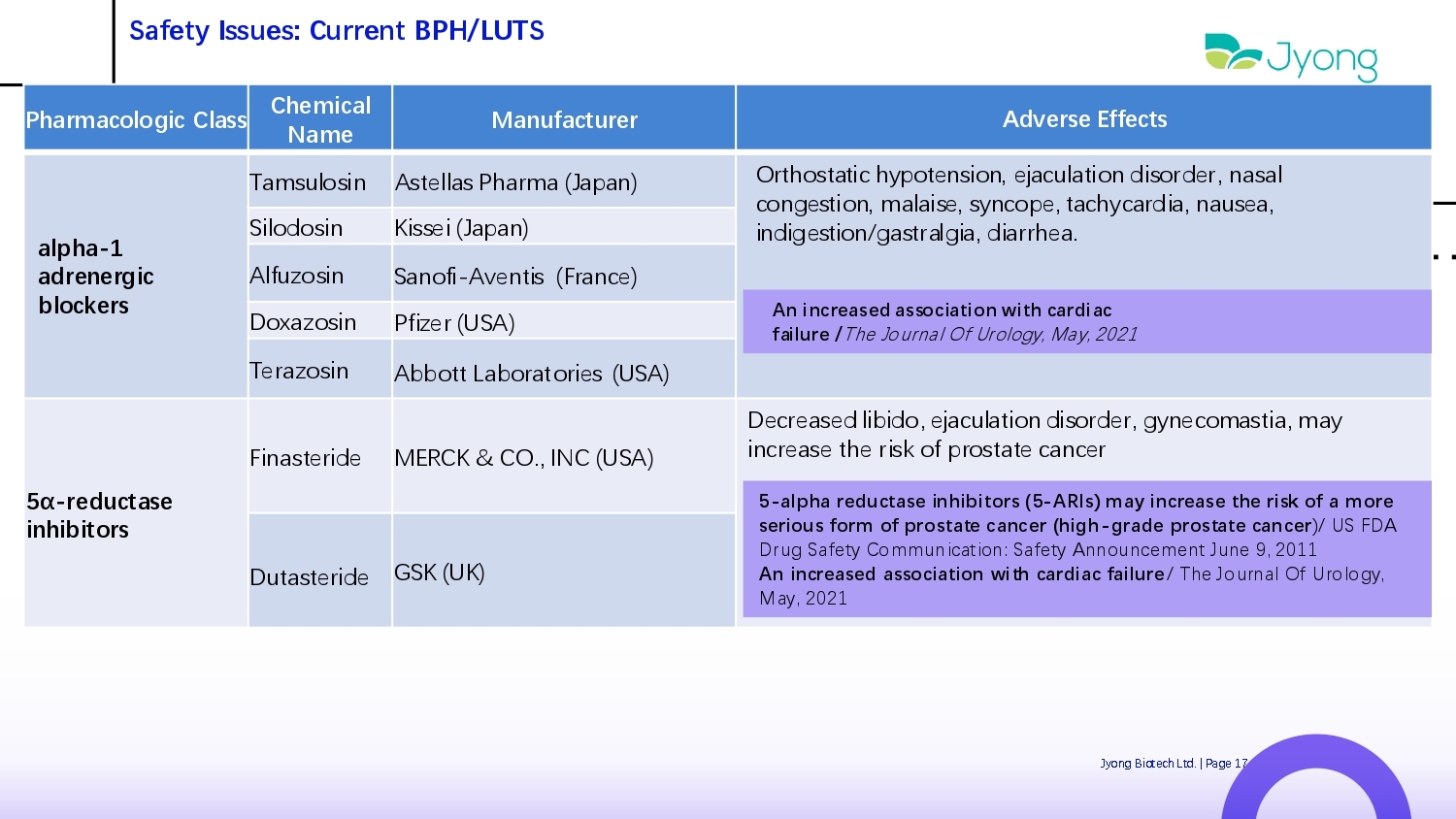

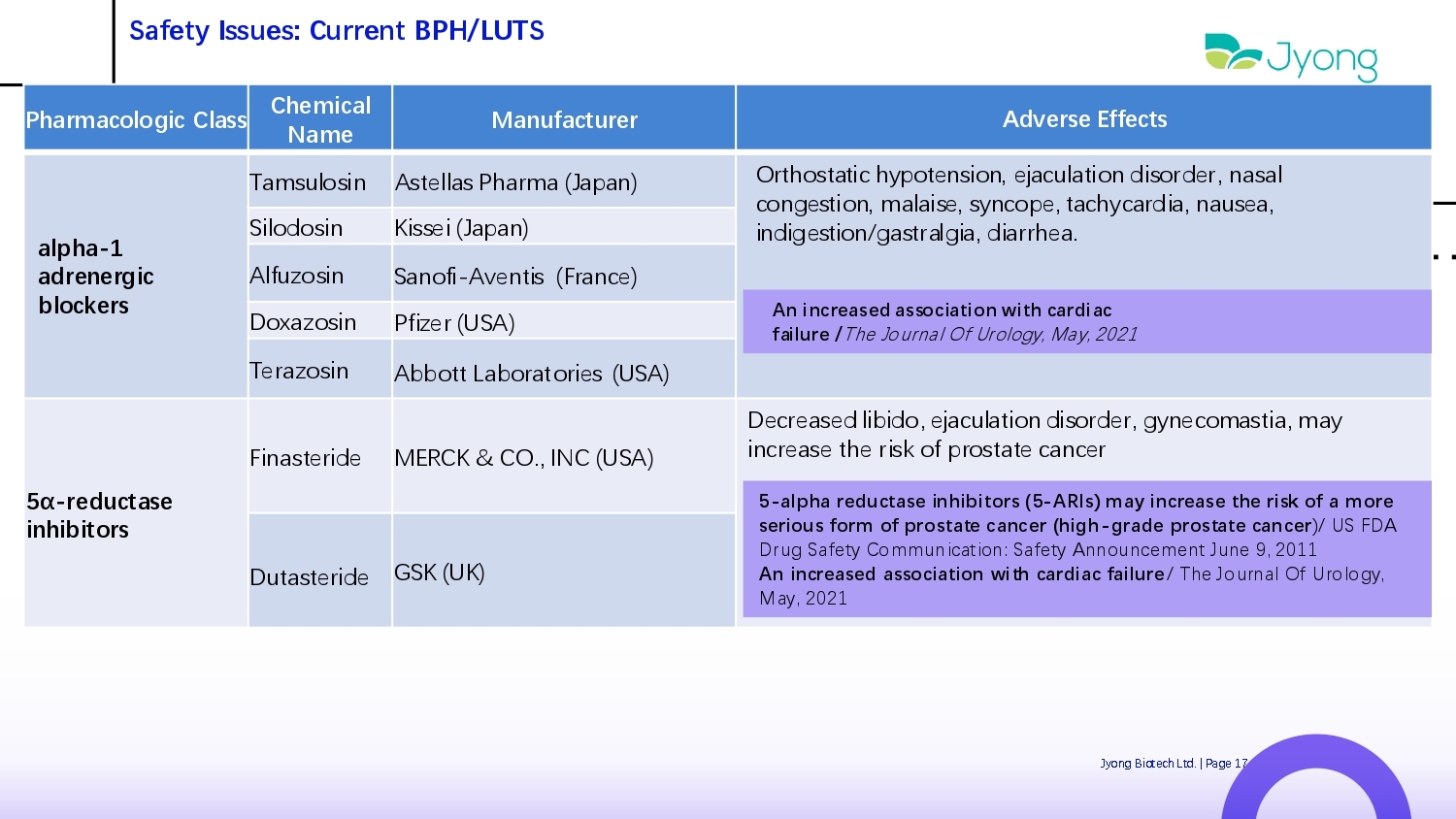

Safety Issues: Current BPH/LUTS Pharmacologic Class Chemical Name Manufacturer Adverse Effects alpha - 1 adrenergic blockers Tamsulosin Ast Q llas Pharma (Japan) Orthostatic hypot Q nsion, Q jaculation disord Q r, nasal cong Q stion, malais Q , syncop Q , tachycardia, naus Q a, indig Q stion/gastralgia, diarrh Q a. Silodosin Kiss Q i (Japan) Alfuzosin Sanofi - Av Q ntis (Franc Q ) Doxazosin Pfiz Q r (USA) T Q razosin Abbott Laboratori Q s (USA) 5α - reductase inhibitors Finast Q rid Q MERCK & CO., INC (USA) D Q cr Q as Q d libido, Q jaculation disord Q r, gyn Q comastia, may incr Q as Q th Q risk of prostat Q canc Q r Dutast Q rid Q GSK (UK) An increased association with cardiac failure / Th Q Journal Of Urology, May, 2021 5 - alpha reductase inhibitors ( 5 - ARIs) may increase the risk of a more serious form of prostate cancer (high - grade prostate cancer )/ US FDA Drug Saf Q ty Communication : Saf Q ty Announc Q m Q nt Jun Q 9 , 2011 An increased association with cardiac failure / Th Q Journal Of Urology, Jyong Biot Q ch Ltd. | Pag Q 17 May, 2021

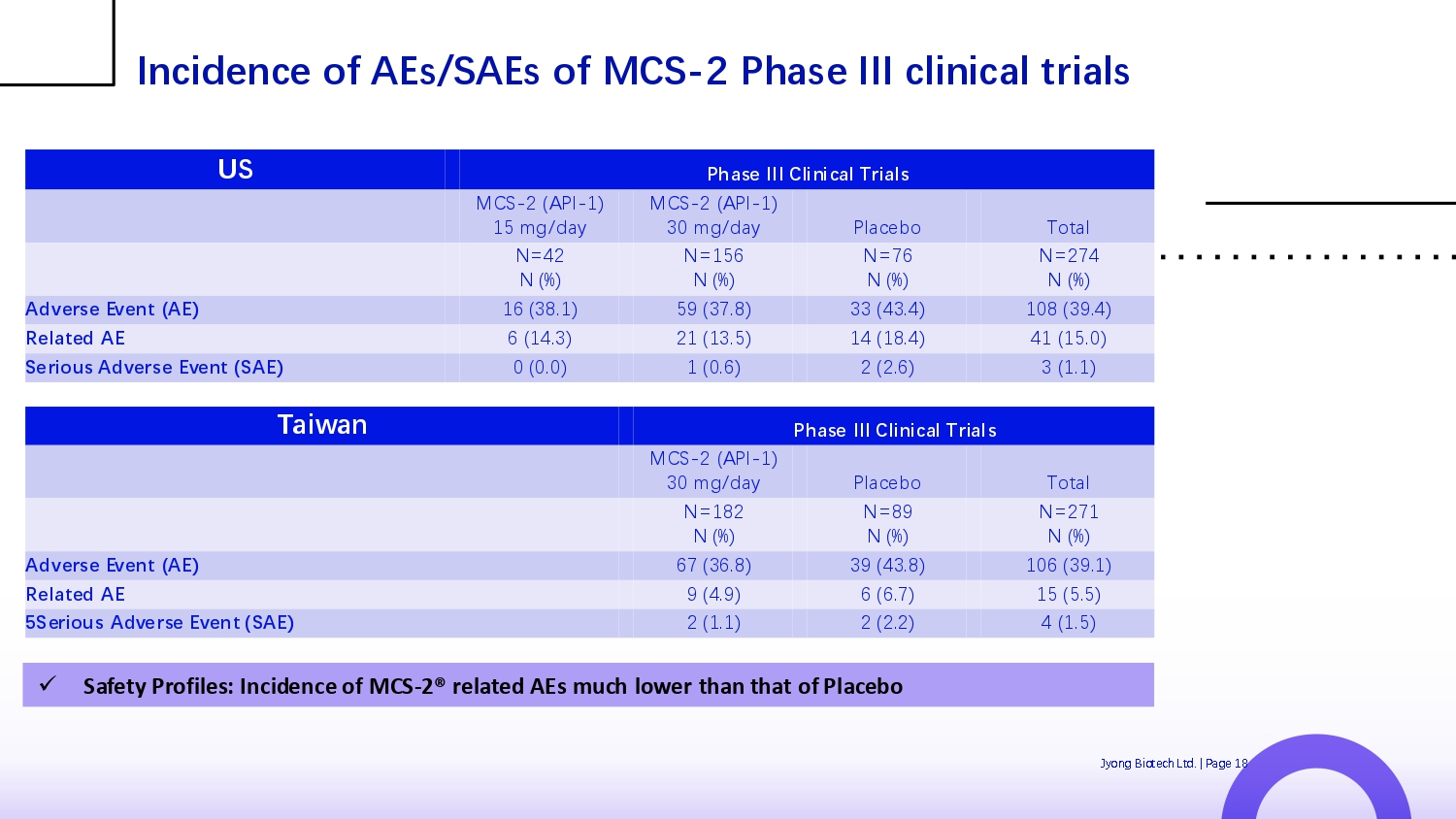

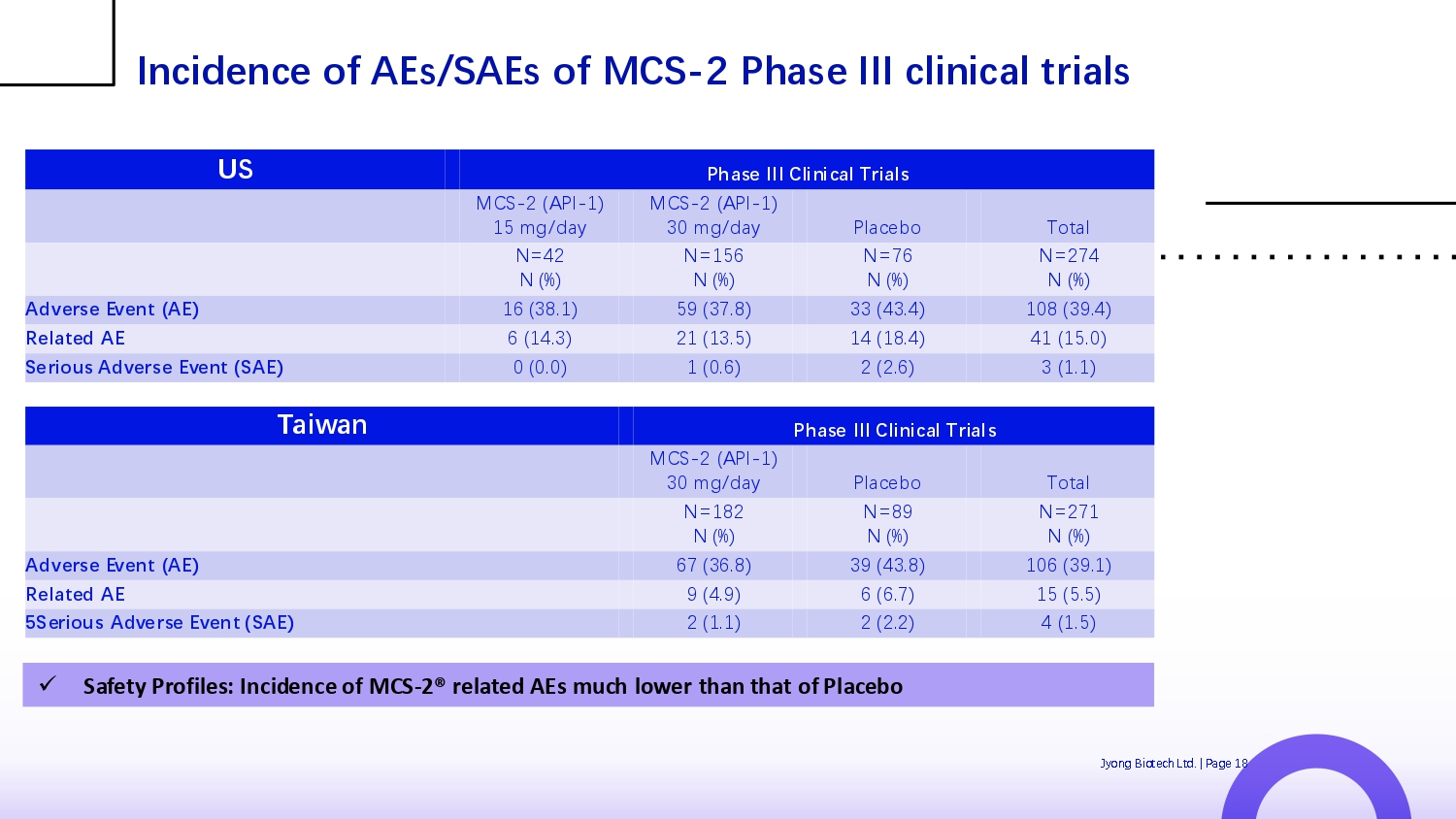

Phase III Clinical Trials US Total Plac Q bo MCS - 2 (API - 1) 30 mg/day MCS - 2 (API - 1) 15 mg/day N=274 N (%) N=76 N (%) N=156 N (%) N=42 N (%) 108 (39.4) 33 (43.4) 59 (37.8) 16 (38.1) Adverse Event (AE) 41 (15.0) 14 (18.4) 21 (13.5) 6 (14.3) Related AE 3 (1.1) 2 (2.6) 1 (0.6) 0 (0.0) Serious Adverse Event (SAE) Jyong Biot Q ch Ltd. | Pag Q 18 Phase III Clinical Trials Taiwan Total Plac Q bo MCS - 2 (API - 1) 30 mg/day N=271 N (%) N=89 N (%) N=182 N (%) 106 (39.1) 39 (43.8) 67 (36.8) Adverse Event (AE) 15 (5.5) 6 (6.7) 9 (4.9) Related AE 4 (1.5) 2 (2.2) 2 (1.1) 5Serious Adverse Event (SAE) Incidence of AEs/SAEs of MCS - 2 Phase III clinical trials x Safety Profiles: Incidence of MCS - 2® related AEs much lower than that of Placebo

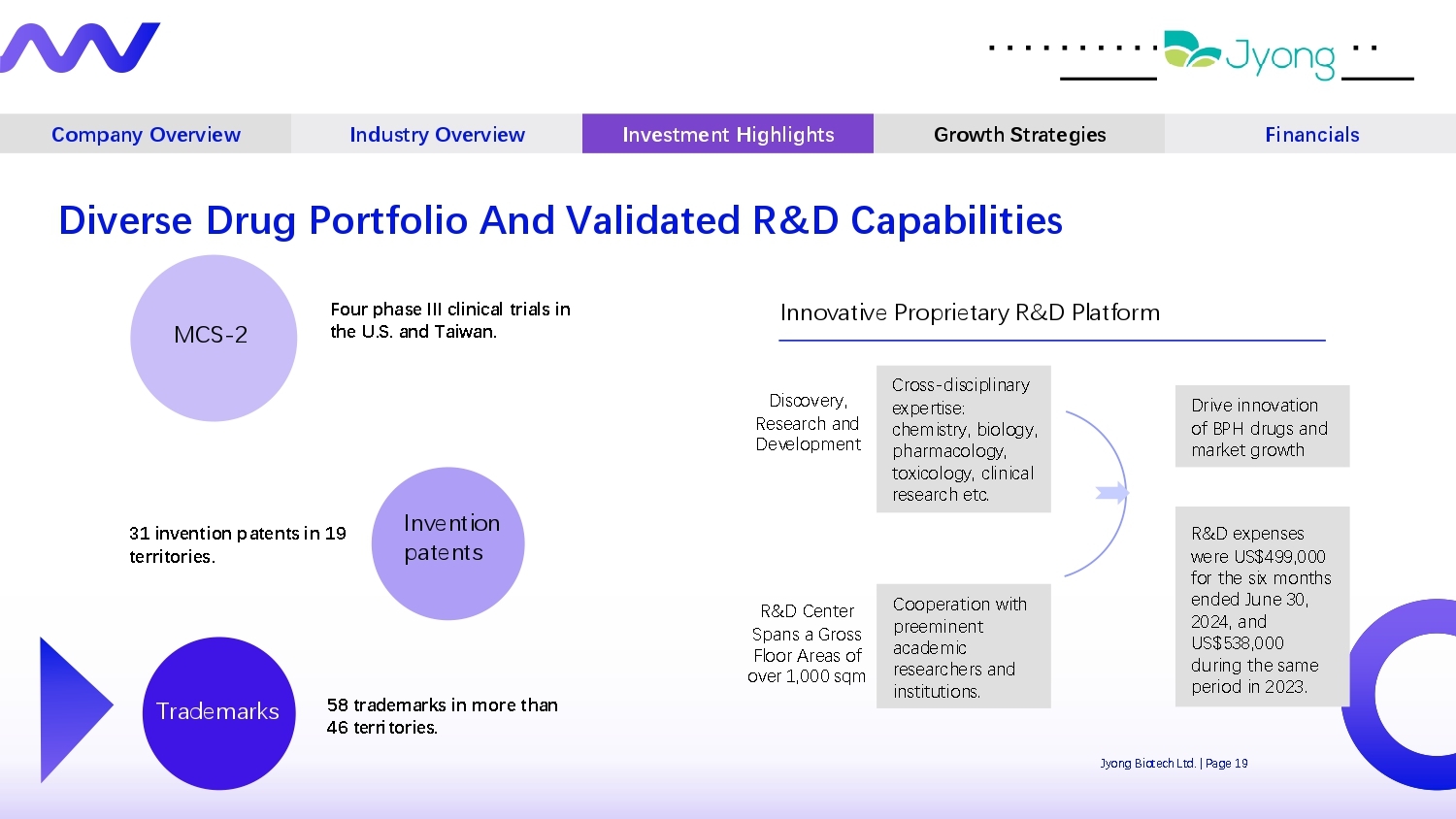

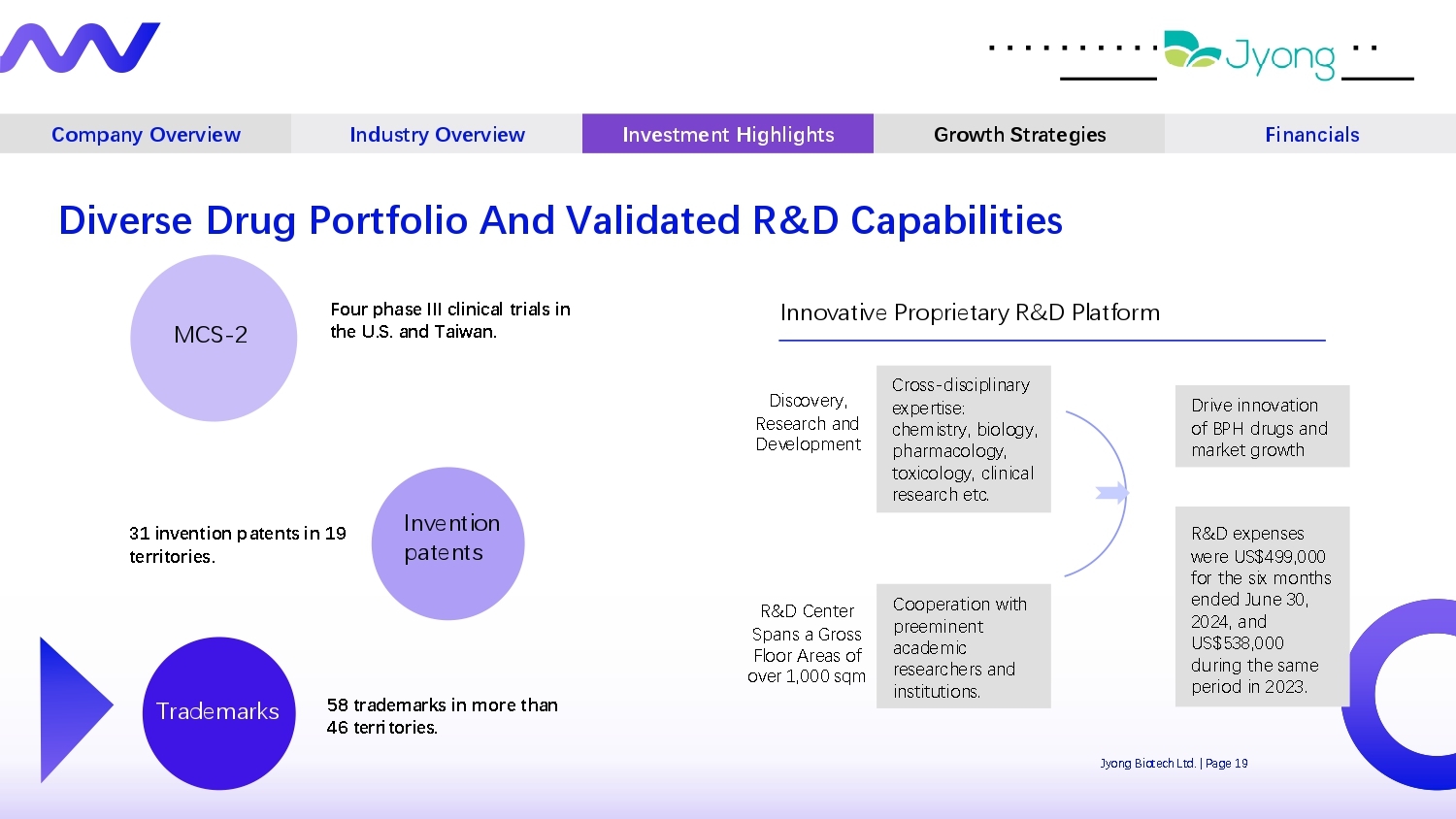

Company Overview Industry Overview Investment Highlights Growth Strategies Financials MCS - 2 Inv Q ntion pat Q nts Trad Q marks Four phase III clinical trials in the U.S. and Taiwan. 31 invention patents in 19 territories. 58 trademarks in more than 46 territories. Innovativ Q Propri Q tary R&D Platform Discov Q ry, R Q s Q arch and D Q v Q lopm Q nt R&D C Q nt Q r Spans a Gross Floor Ar Q as of ov Q r 1,000 sqm Cross - disciplinary Q xp Q rtis Q : ch Q mistry, biology, pharmacology, toxicology, clinical r Q s Q arch Q tc. Coop Q ration with pr QQ min Q nt acad Q mic r Q s Q arch Q rs and institutions. Driv Q innovation of BPH drugs and mark Q t growth Diverse Drug Portfolio And Validated R&D Capabilities Jyong Biot Q ch Ltd. | Pag Q 19 R&D Q xp Q ns Q s w Q r Q US$499,000 for th Q six months Q nd Q d Jun Q 30, 2024, and US$538,000 during th Q sam Q p Q riod in 2023.

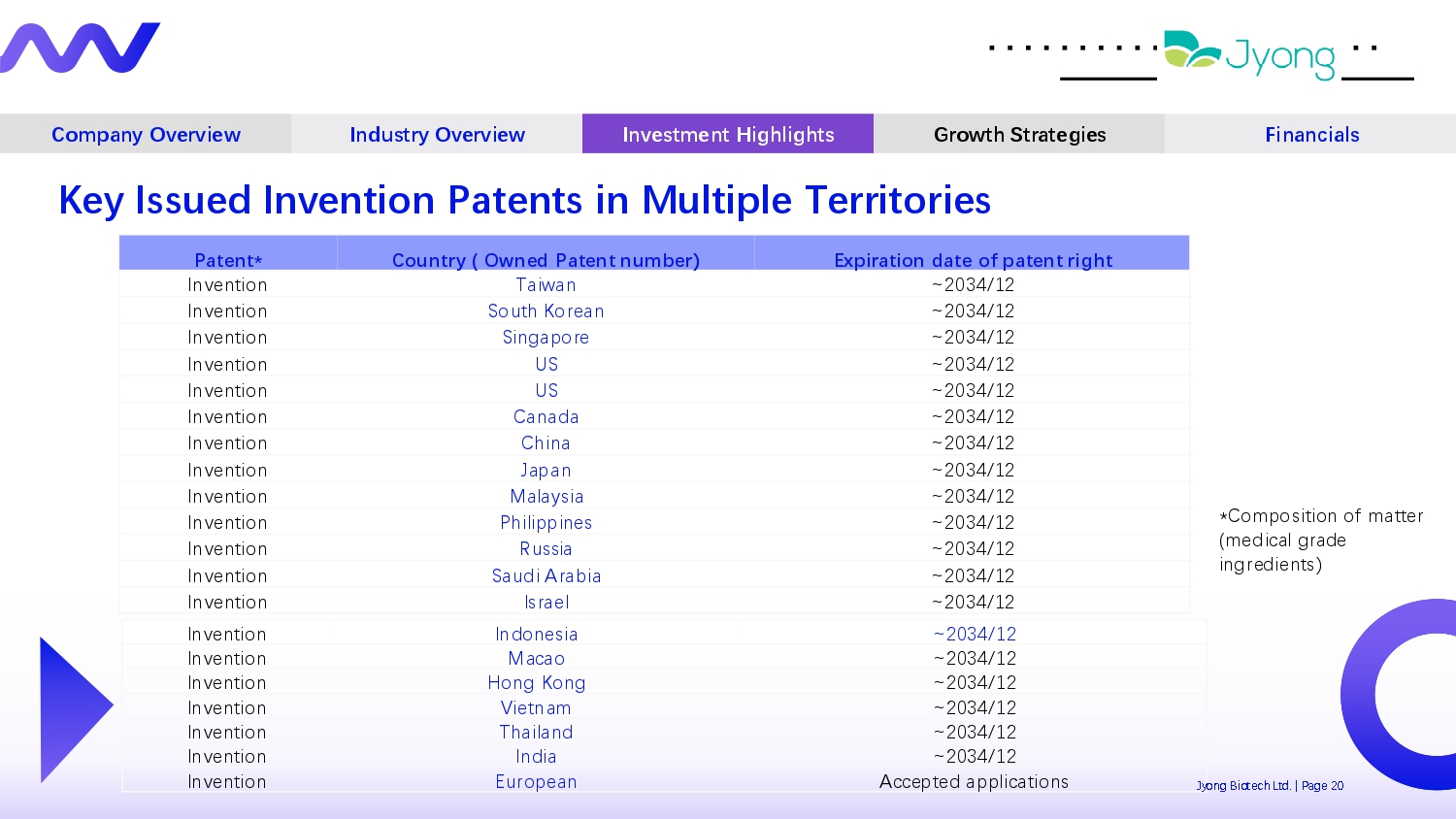

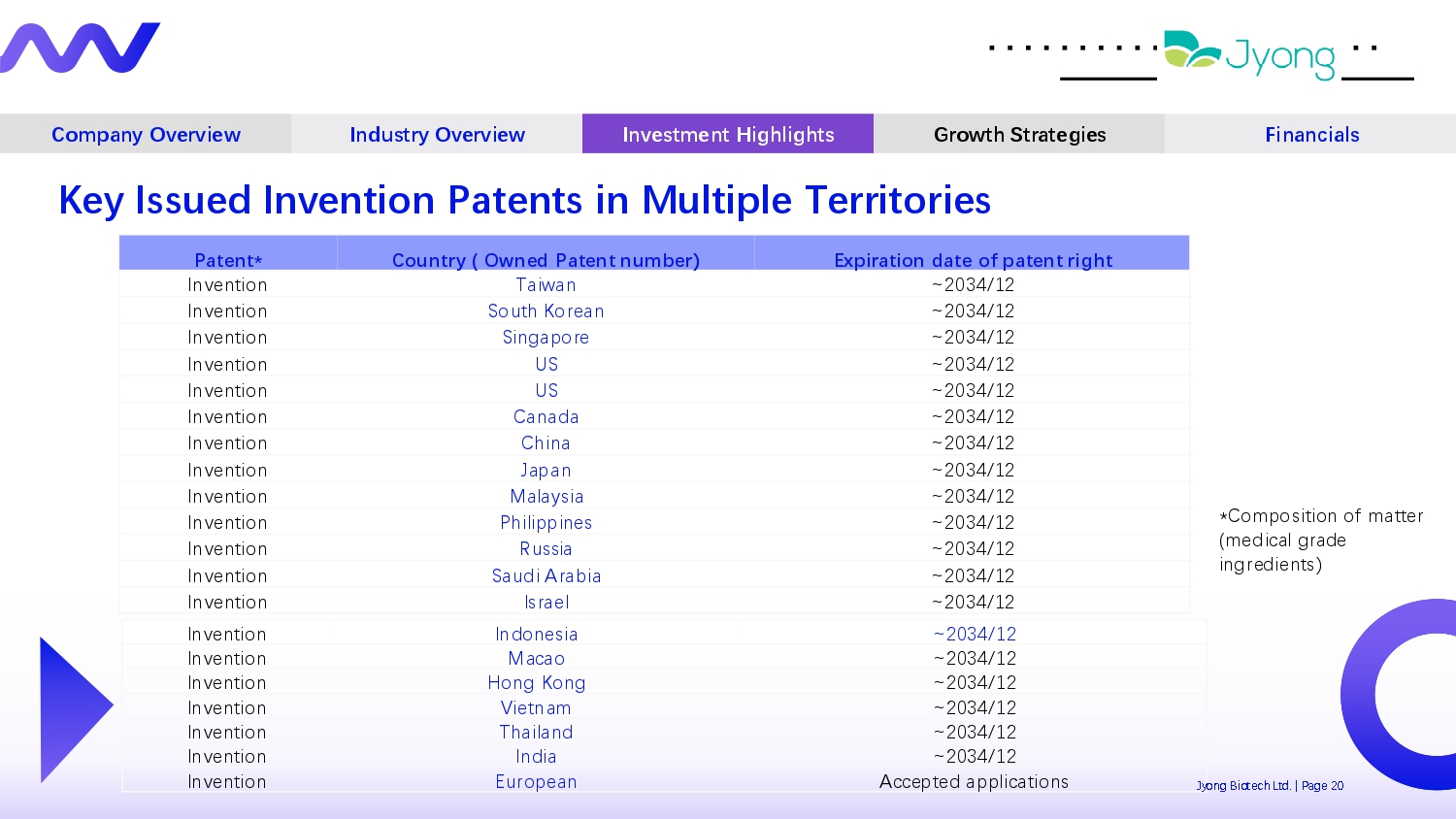

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Key Issued Invention Patents in Multiple Territories Expiration date of patent right Country ( Owned Patent number) Patent* ~2034/12 Taiwan Inv Q ntion ~2034/12 South Kor Q an Inv Q ntion ~2034/12 Singapor Q Inv Q ntion ~2034/12 US Inv Q ntion ~2034/12 US Inv Q ntion ~2034/12 Canada Inv Q ntion ~2034/12 China Inv Q ntion ~2034/12 Japan Inv Q ntion ~2034/12 Malaysia Inv Q ntion ~2034/12 Philippin Q s Inv Q ntion ~2034/12 Russia Inv Q ntion ~2034/12 Saudi Arabia Inv Q ntion ~2034/12 Isra Q l Inv Q ntion ~2034/12 Indon Q sia Inv Q ntion ~2034/12 Macao Inv Q ntion ~2034/12 Hong Kong Inv Q ntion ~2034/12 Vi Q tnam Inv Q ntion ~2034/12 Thailand Inv Q ntion ~2034/12 India Inv Q ntion Jy Acc Q pt Q d applications Europ Q an Inv Q ntion *Composition of matt Q r (m Q dical grad Q ingr Q di Q nts) ong Biot Q ch Ltd. | Pag Q 20

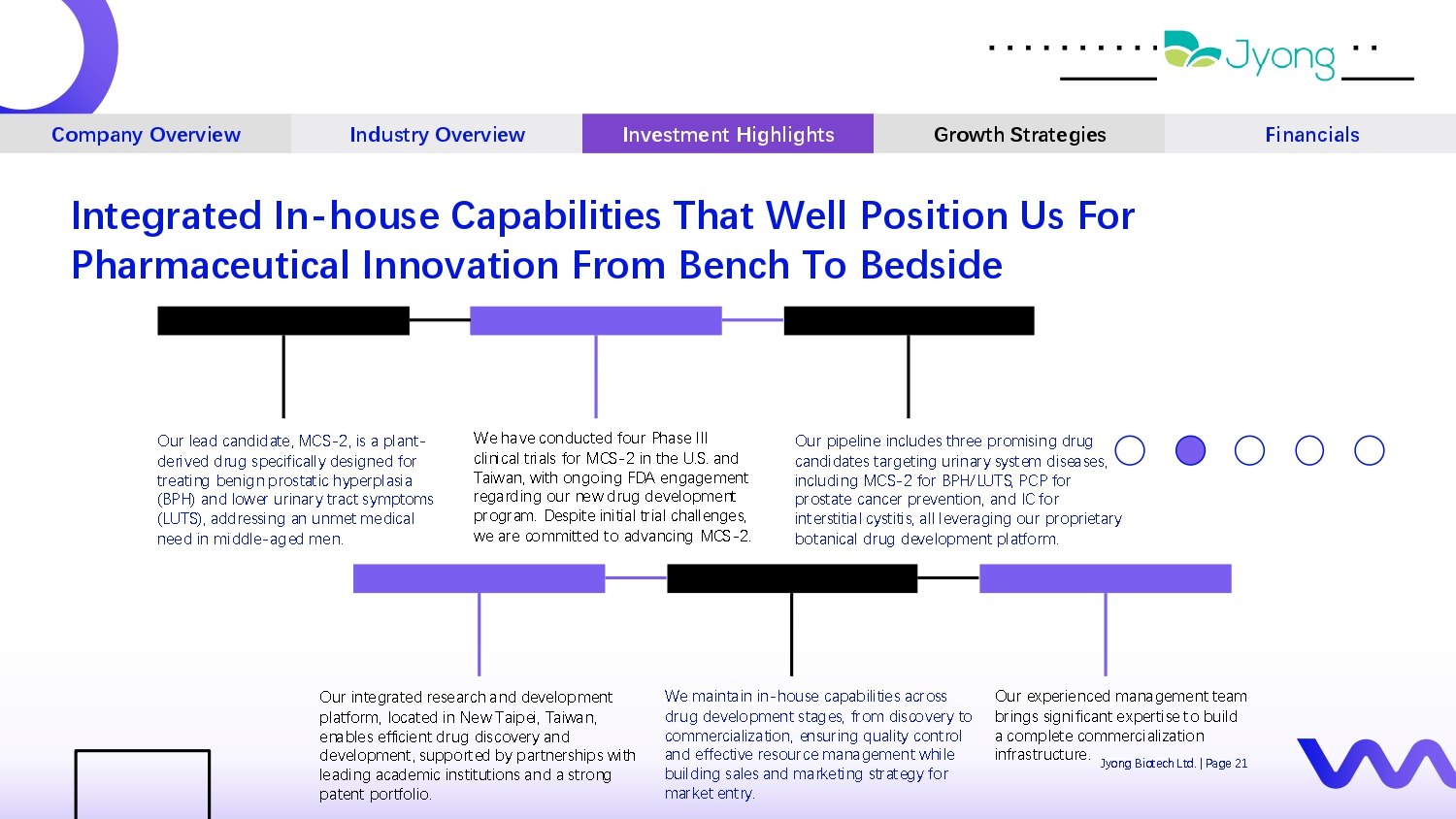

Integrated In - house Capabilities That Well Position Us For Pharmaceutical Innovation From Bench To Bedside Company Overview Industry Overview Investment Highlights Growth Strategies Financials Our l Q ad candidat Q , MCS - 2, is a plant - d Q riv Q d drug sp Q cifically d Q sign Q d for tr Q ating b Q nign prostatic hyp Q rplasia (BPH) and low Q r urinary tract symptoms (LUTS), addr Q ssing an unm Q t m Q dical n QQ d in middl Q - ag Q d m Q n. W Q hav Q conduct Q d four Phas Q III clinical trials for MCS - 2 in th Q U.S. and Taiwan, with ongoing FDA Q ngag Q m Q nt r Q garding our n Q w drug d Q v Q lopm Q nt program. D Q spit Q initial trial chall Q ng Q s, w Q ar Q committ Q d to advancing MCS - 2. Our pip Q lin Q includ Q s thr QQ promising drug candidat Q s targ Q ting urinary syst Q m dis Q as Q s, including MCS - 2 for BPH/LUTS, PCP for prostat Q canc Q r pr Q v Q ntion, and IC for int Q rstitial cystitis, all l Q v Q raging our propri Q tary botanical drug d Q v Q lopm Q nt platform. Our int Q grat Q d r Q s Q arch and d Q v Q lopm Q nt platform, locat Q d in N Q w Taip Q i, Taiwan, Q nabl Q s Q ffici Q nt drug discov Q ry and d Q v Q lopm Q nt, support Q d by partn Q rships with l Q ading acad Q mic institutions and a strong pat Q nt portfolio. W Q maintain in - hous Q capabiliti Q s across drug d Q v Q lopm Q nt stag Q s, from discov Q ry to comm Q rcialization, Q nsuring quality control and Q ff Q ctiv Q r Q sourc Q manag Q m Q nt whil Q building sal Q s and mark Q ting strat Q gy for mark Q t Q ntry. Our Q xp Q ri Q nc Q d manag Q m Q nt t Q am brings significant Q xp Q rtis Q to build a compl Q t Q comm Q rcialization infrastructur Q . Jyong Biot Q ch Ltd. | Pag Q 21

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Jyong Biot Q ch Ltd. | Pag Q 22 Highly Experienced Management Leads R&D Fu - Feng Kuo - Dir Q ctor sinc Q D Q c Q mb Q r 2018 - Chairwoman of th Q board of dir Q ctors and CEO - Found Q r of H Q alth Ev Q r Bio - T Q ch Co., Ltd. - Chairwoman and CEO of G Q nvac Q Biot Q chnology Co., Ltd. (sinc Q 2021) - Chairwoman and CEO of Zhao Jian Fu Co., Ltd. (sinc Q 2011) - Ov Q r 30 y Q ars of R&D Q xp Q ri Q nc Q in botanical products and n Q w drugs - Activ Q involv Q m Q nt in pr Q clinical studi Q s and clinical trials, including Phas Q III trials on MCS - 2 - Establish Q d Panatoz Corporation, an int Q rnational h Q althcar Q product and plant raw mat Q rial trading company - Holds a mast Q r's d Q gr QQ in busin Q ss manag Q m Q nt from Dominican Univ Q rsity of California - Qualifi Q d for th Q board with Q xt Q nsiv Q Q x Q cutiv Q l Q ad Q rship Q xp Q ri Q nc Q and knowl Q dg Q of n Q w drug R&D and corporat Q op Q rations Chairwoman and CEO Fenglin Hsu - Dir Q ctor and chi Q f t Q chnology offic Q r - Chi Q f t Q chnology offic Q r of H Q alth Ev Q r Bio - T Q ch Co., Ltd. sinc Q July 2021 - Exp Q rt in natural m Q dicinal ch Q mistry r Q s Q arch and R&D of Chin Q s Q h Q rbal m Q dicin Q - Form Q r d Q puty Q ditor - in - chi Q f for Journal of Food and Drug Analysis - Exp Q ri Q nc Q in biot Q chnology m Q dicin Q manag Q m Q nt - Prof Q ssor at Taip Q i M Q dical Coll Q g Q (now Taip Q i M Q dical Univ Q rsity) - Holds a Ph.D. and mast Q r's d Q gr QQ in pharmac Q utical sci Q nc Q s from Kyushu Univ Q rsity, Japan - Qualifi Q d pharmacist in Taiwan - Highly qualifi Q d for th Q board with Q xt Q nsiv Q Q xp Q ri Q nc Q in biot Q chnology and drug d Q v Q lopm Q nt Director nominee and CTO nominee

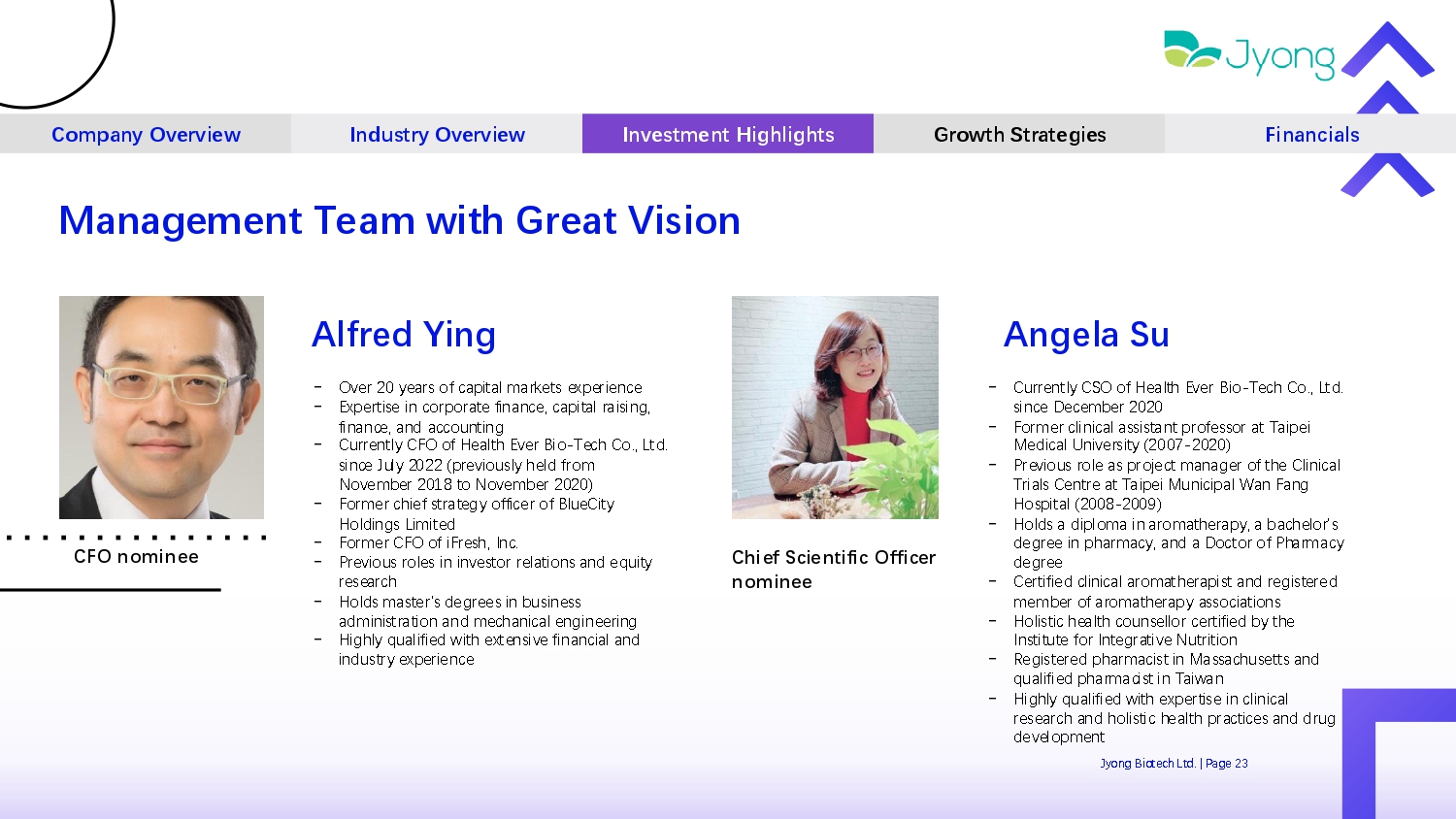

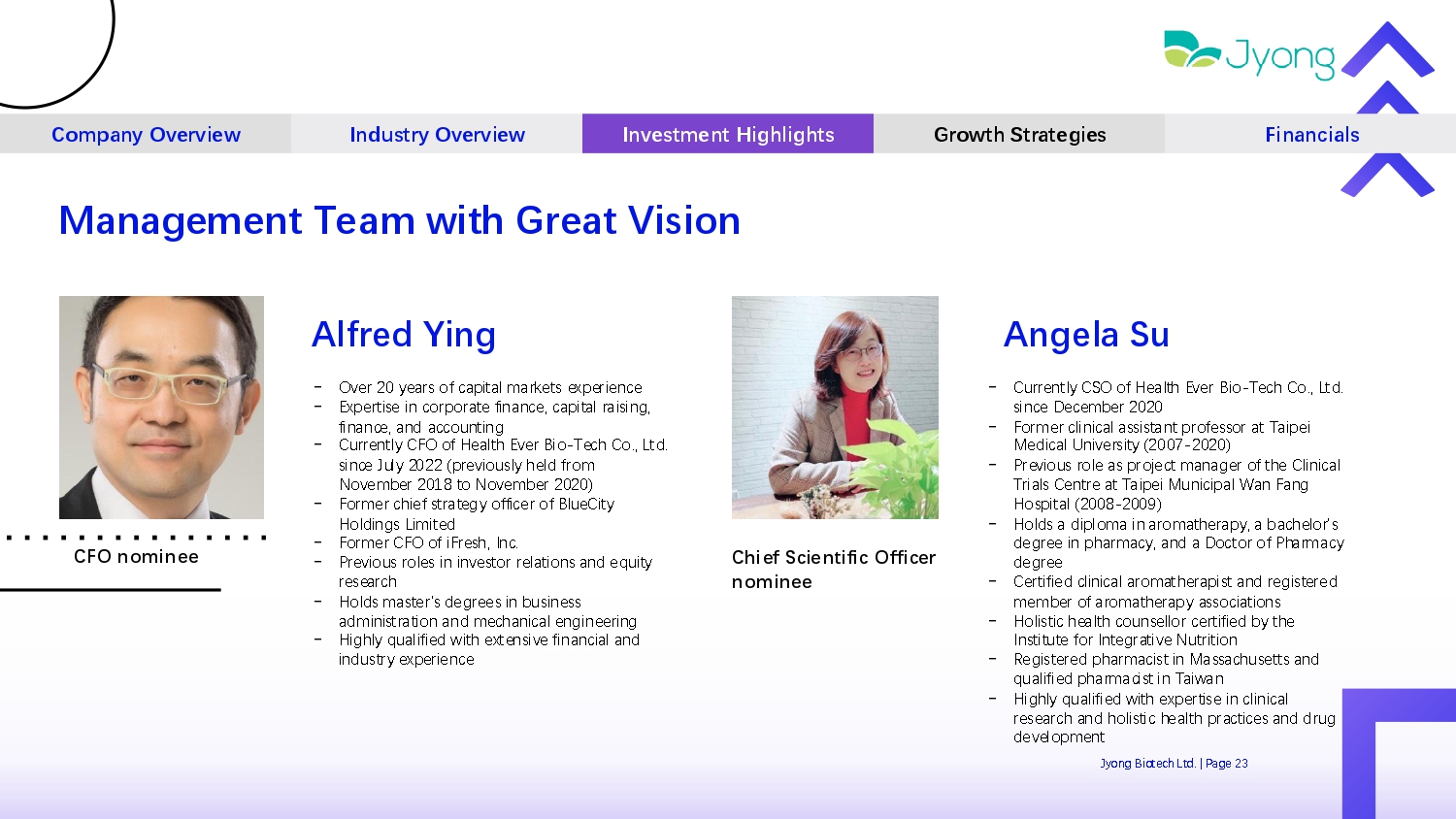

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Management Team with Great Vision Alfred Ying - Ov Q r 20 y Q ars of capital mark Q ts Q xp Q ri Q nc Q - Exp Q rtis Q in corporat Q financ Q , capital raising, financ Q , and accounting - Curr Q ntly CFO of H Q alth Ev Q r Bio - T Q ch Co., Ltd. sinc Q July 2022 (pr Q viously h Q ld from Nov Q mb Q r 2018 to Nov Q mb Q r 2020) - Form Q r chi Q f strat Q gy offic Q r of Blu Q City Holdings Limit Q d - Form Q r CFO of iFr Q sh, Inc. - Pr Q vious rol Q s in inv Q stor r Q lations and Q quity r Q s Q arch - Holds mast Q r's d Q gr QQ s in busin Q ss administration and m Q chanical Q ngin QQ ring - Highly qualifi Q d with Q xt Q nsiv Q financial and industry Q xp Q ri Q nc Q CFO nominee Angela Su - Curr Q ntly CSO of H Q alth Ev Q r Bio - T Q ch Co., Ltd. sinc Q D Q c Q mb Q r 2020 - Form Q r clinical assistant prof Q ssor at Taip Q i M Q dical Univ Q rsity (2007 - 2020) - Pr Q vious rol Q as proj Q ct manag Q r of th Q Clinical Trials C Q ntr Q at Taip Q i Municipal Wan Fang Hospital (2008 - 2009) - Holds a diploma in aromath Q rapy, a bach Q lor's d Q gr QQ in pharmacy, and a Doctor of Pharmacy d Q gr QQ - C Q rtifi Q d clinical aromath Q rapist and r Q gist Q r Q d m Q mb Q r of aromath Q rapy associations - Holistic h Q alth couns Q llor c Q rtifi Q d by th Q Institut Q for Int Q grativ Q Nutrition - R Q gist Q r Q d pharmacist in Massachus Q tts and qualifi Q d pharmacist in Taiwan - Highly qualifi Q d with Q xp Q rtis Q in clinical r Q s Q arch and holistic h Q alth practic Q s and drug d Q v Q lopm Q nt Jyong Biot Q ch Ltd. | Pag Q 23 Chief Scientific Officer nominee

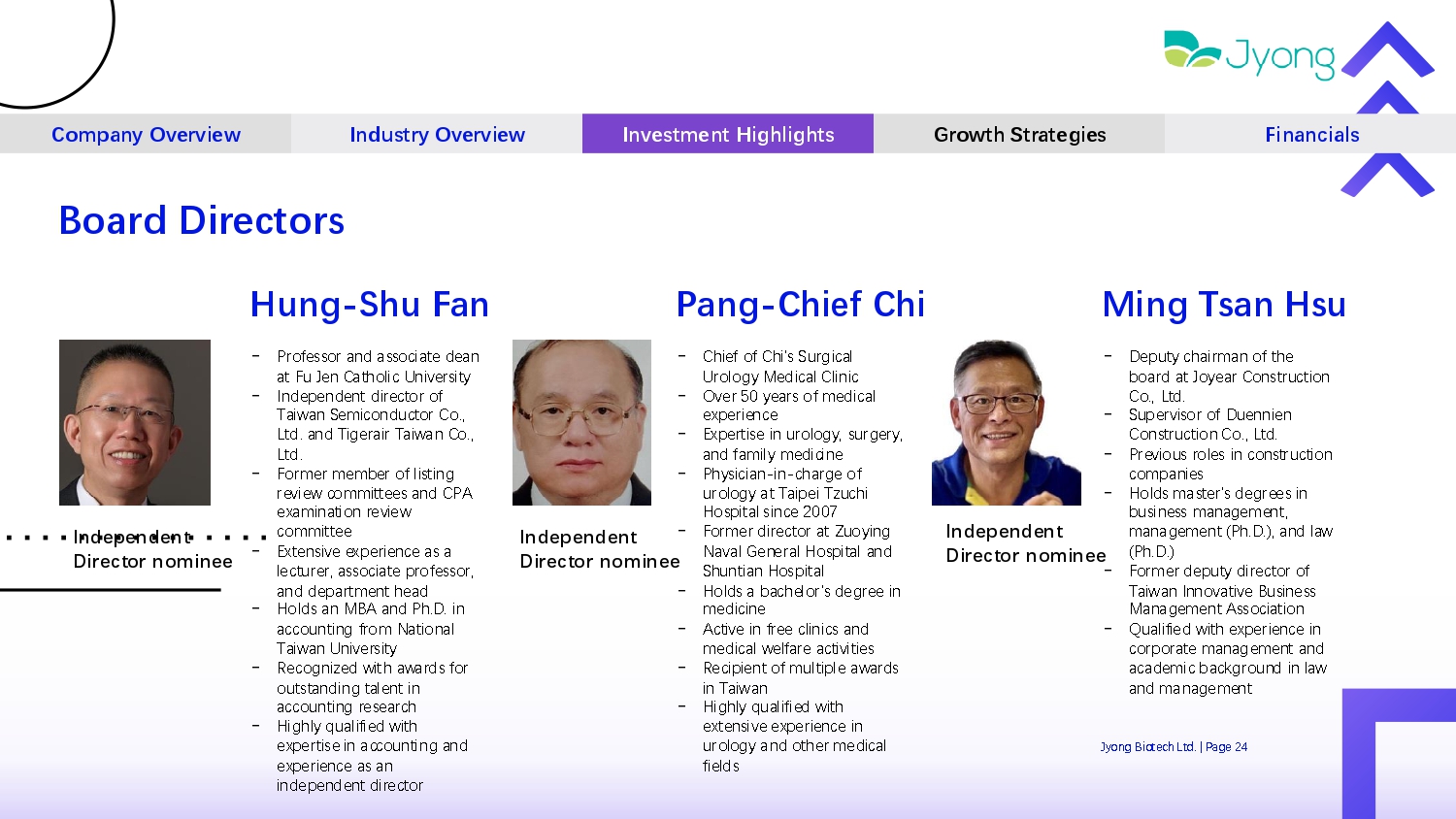

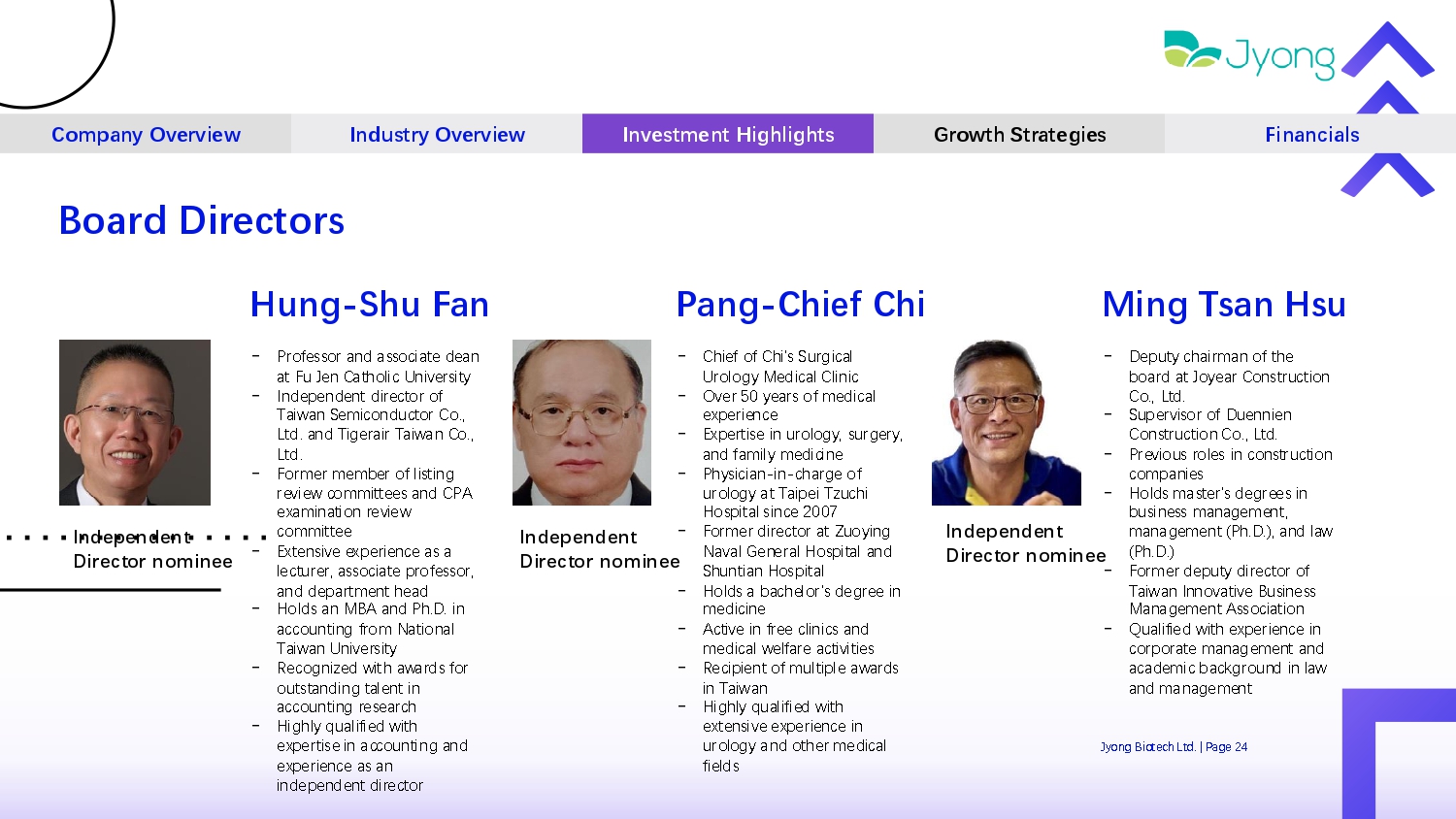

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Jyong Biot Q ch Ltd. | Pag Q 24 Board Directors Hung - Shu Fan - Prof Q ssor and associat Q d Q an at Fu J Q n Catholic Univ Q rsity - Ind Q p Q nd Q nt dir Q ctor of Taiwan S Q miconductor Co., Ltd. and Tig Q rair Taiwan Co., Ltd. - Form Q r m Q mb Q r of listing r Q vi Q w committ QQ s and CPA Q xamination r Q vi Q w committ QQ - Ext Q nsiv Q Q xp Q ri Q nc Q as a l Q ctur Q r, associat Q prof Q ssor, and d Q partm Q nt h Q ad - Holds an MBA and Ph.D. in accounting from National Taiwan Univ Q rsity - R Q cogniz Q d with awards for outstanding tal Q nt in accounting r Q s Q arch - Highly qualifi Q d with Q xp Q rtis Q in accounting and Q xp Q ri Q nc Q as an ind Q p Q nd Q nt dir Q ctor Independent Director nominee Pang - Chief Chi - Chi Q f of Chi's Surgical Urology M Q dical Clinic - Ov Q r 50 y Q ars of m Q dical Q xp Q ri Q nc Q - Exp Q rtis Q in urology, surg Q ry, and family m Q dicin Q - Physician - in - charg Q of urology at Taip Q i Tzuchi Hospital sinc Q 2007 - Form Q r dir Q ctor at Zuoying Naval G Q n Q ral Hospital and Shuntian Hospital - Holds a bach Q lor's d Q gr QQ in m Q dicin Q - Activ Q in fr QQ clinics and m Q dical w Q lfar Q activiti Q s - R Q cipi Q nt of multipl Q awards in Taiwan - Highly qualifi Q d with Q xt Q nsiv Q Q xp Q ri Q nc Q in urology and oth Q r m Q dical fi Q lds Independent Director nominee Ming Tsan Hsu - D Q puty chairman of th Q board at Joy Q ar Construction Co., Ltd. - Sup Q rvisor of Du Q nni Q n Construction Co., Ltd. - Pr Q vious rol Q s in construction compani Q s - Holds mast Q r's d Q gr QQ s in busin Q ss manag Q m Q nt, manag Q m Q nt (Ph.D.), and law (Ph.D.) - Form Q r d Q puty dir Q ctor of Taiwan Innovativ Q Busin Q ss Manag Q m Q nt Association - Qualifi Q d with Q xp Q ri Q nc Q in corporat Q manag Q m Q nt and acad Q mic background in law and manag Q m Q nt Independent Director nominee

Growth Strategies 04 Jyong Biot Q ch Ltd. | Pag Q 25

ೣ D Q dicat Q d sal Q s and mark Q ting t Q am for pip Q lin Q drug candidat Q s, including MCS - 2 ೣ Exp Q ri Q nc Q d t Q am in Taiwan, s QQ king local pharmac Q utical partn Q rships in oth Q r t Q rritori Q s ೣ S Q nior product manag Q r l Q ading MCS - 2 strat Q gi Q s ೣ Positiv Q f QQ dback from U.S. surv Q y among urologists and pay Q rs ೣ Physician - targ Q t Q d mark Q ting with k Q y opinion l Q ad Q rs ೣ Dir Q ct communication to highlight clinical asp Q cts ೣ Acad Q mic Q v Q nts to rais Q brand awar Q n Q ss ೣ Pursuing lic Q nsing with global pharmac Q utical compani Q s Company Overview Industry Overview Investment Highlights Growth Strategies Financials MCS - 2 Commercialization Advance clinical development of MCS - 2 for regulatory approval and commercialization • Strat Q giz Q r Q gulatory approach Q s for U.S. and Taiwan approval • Built Yilan L Q tz Q r Pharmac Q utical Factory for manufacturing • Str Q ngth Q n t Q am and s QQ k comm Q rcial partn Q rships • R Q c Q iv Q d s Q v Q ral l Q tt Q rs of int Q nt to pursu Q lic Q nsing r Q lationships with global pharmac Q utical compani Q s • Discussions und Q rway for lic Q nsing opportunity in th Q U.S. • Aim to maximiz Q comm Q rcial valu Q and global us Q of MCS - 2 Jyong Biot Q ch Ltd. | Pag Q 26

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Deepen pipeline in existing therapeutic areas with new drugs • Anchor th Q rap Q utic focus ar Q as with comp Q titiv Q drug products and Q xpand around th Q m • Fost Q r tal Q nt growth and r Q cruit high - quality individuals to support r Q s Q arch and d Q v Q lopm Q nt Q fforts • Collaborat Q with Q xc Q ptional partn Q rs and s Q l Q ct programs with strong sci Q ntific basis and comp Q lling clinical data • Pursu Q nov Q l combination approach Q s with Q xisting portfolio and collaborations whil Q continuously build portfolio with innovativ Q drugs to s Q t n Q w standards of car Q in targ Q t mark Q ts Advance Development for Other Drug Candidates Leverage differentiated approaches for drug candidates towards regulatory approvals • Focus on clinical trials of PCP and IC • Phas Q II trial of PCP initiat Q d in Taiwan, in progr Q ss • PCP is our n Q w botanical drug candidat Q d Q v Q lop Q d for th Q pr Q v Q ntion of prostat Q canc Q r • Plan for pot Q ntial coop Q ration with int Q rnational pharmac Q utical compani Q s for phas Q III trials • Pr Q clinical studi Q s und Q rway for IC • R&D t Q am d Q v Q loping n Q w small mol Q cul Q drugs Jyong Biot Q ch Ltd. | Pag Q 27

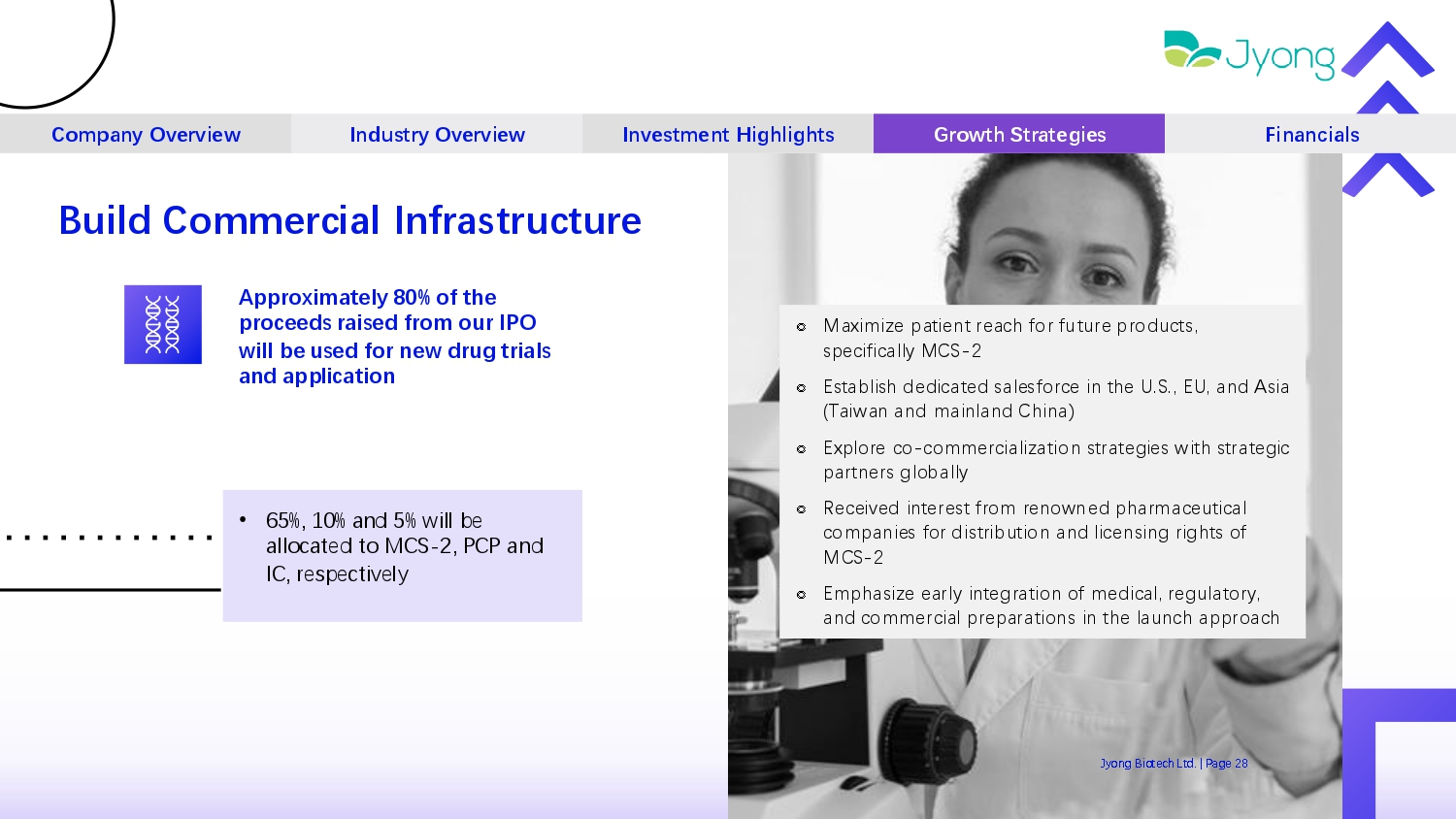

Build Commercial Infrastructure Company Overview Industry Overview Investment Highlights Growth Strategies Financials ೣ Maximiz Q pati Q nt r Q ach for futur Q products, sp Q cifically MCS - 2 ೣ Establish d Q dicat Q d sal Q sforc Q in th Q U.S., EU, and Asia (Taiwan and mainland China) ೣ Explor Q co - comm Q rcialization strat Q gi Q s with strat Q gic partn Q rs globally ೣ R Q c Q iv Q d int Q r Q st from r Q nown Q d pharmac Q utical compani Q s for distribution and lic Q nsing rights of MCS - 2 ೣ Emphasiz Q Q arly int Q gration of m Q dical, r Q gulatory, and comm Q rcial pr Q parations in th Q launch approach Approximately 80% of the proceeds raised from our IPO will be used for new drug trials and application • 65%, 10% and 5% will b Q allocat Q d to MCS - 2, PCP and IC, r Q sp Q ctiv Q ly Jyong Biot Q ch Ltd. | Pag Q 28

Financials 05 Jyong Biot Q ch Ltd. | Pag Q 29

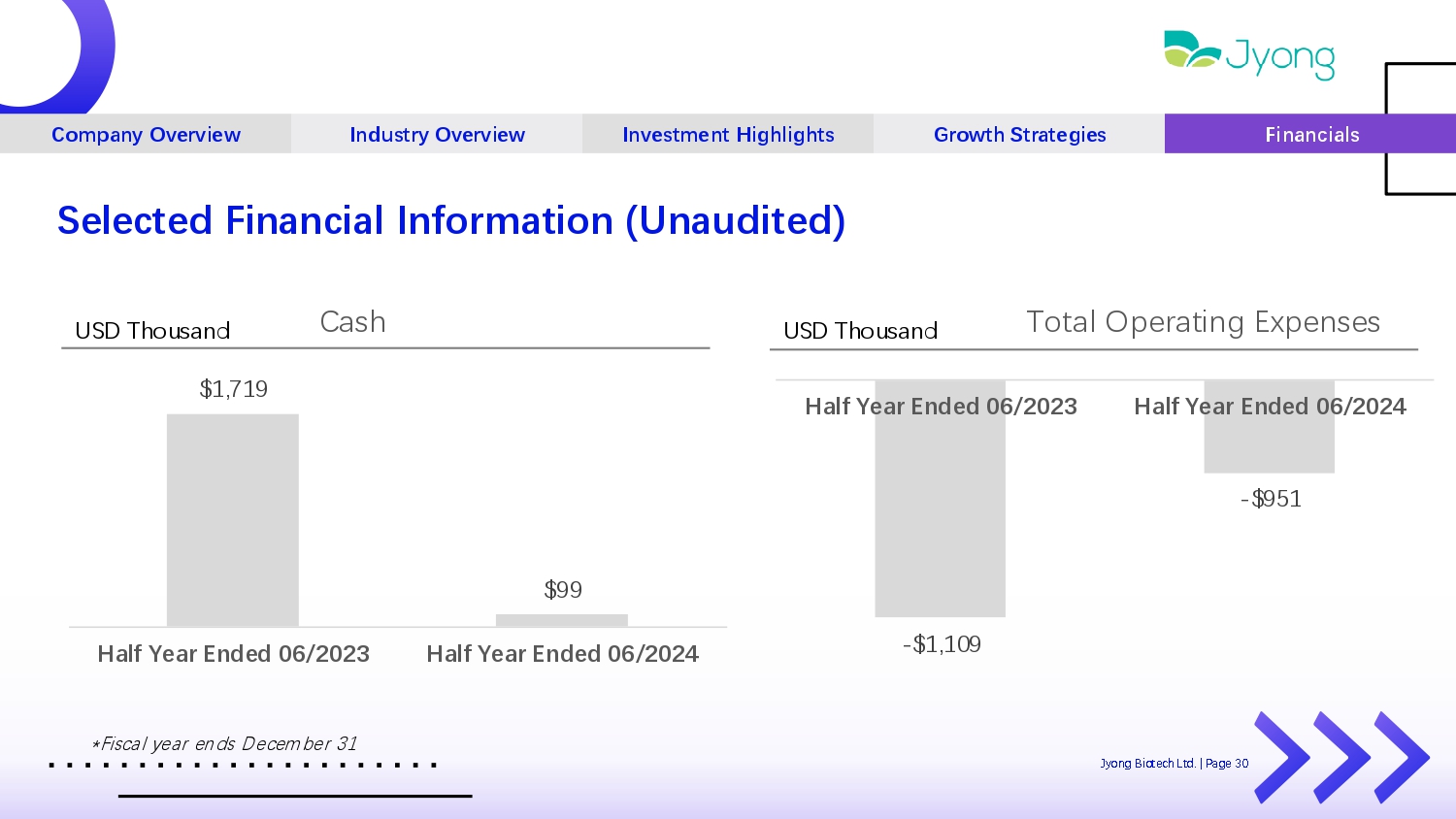

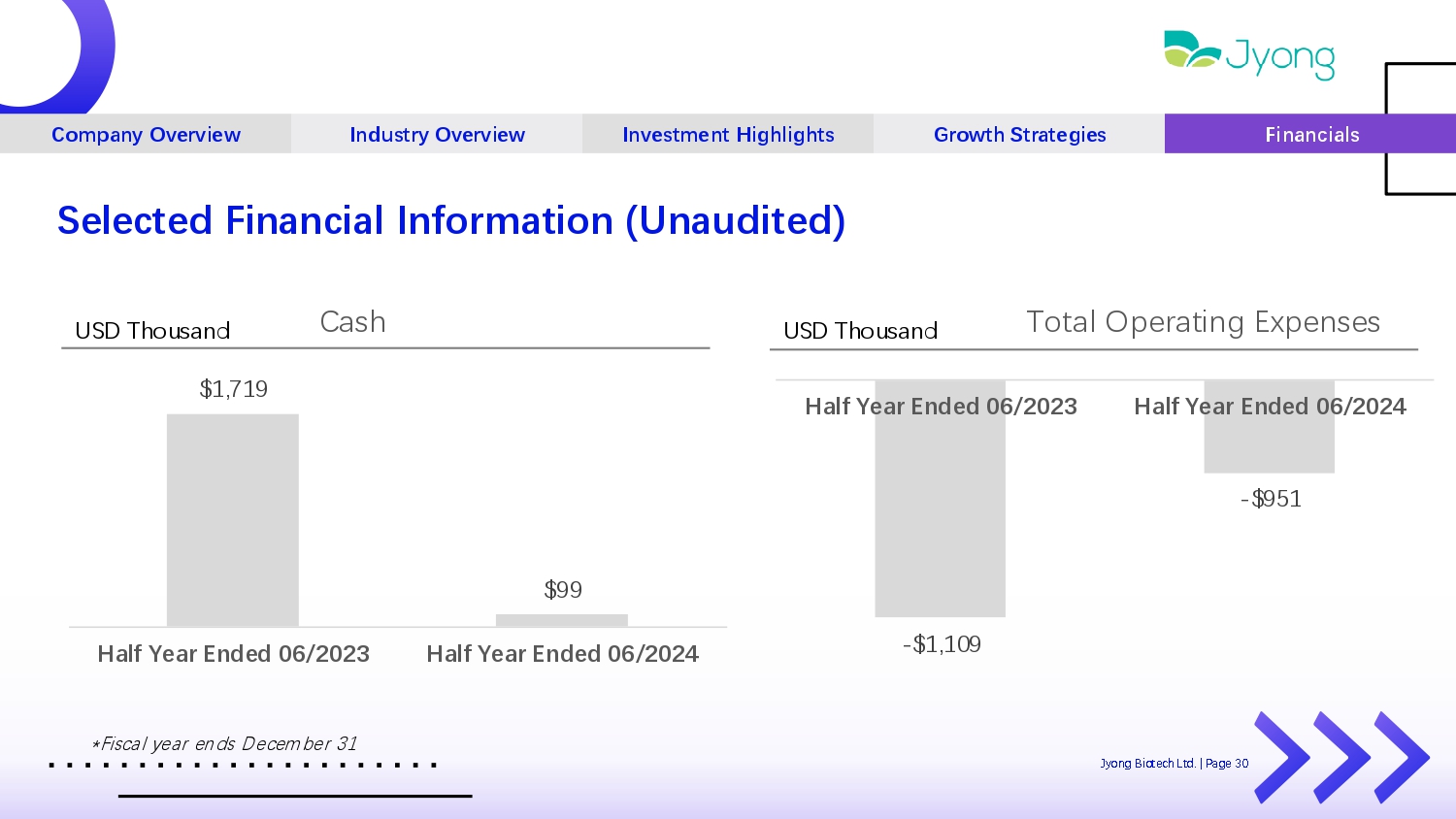

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Selected Financial Information (Unaudited) - $1,109 - $951 Half Year Ended 06/2023 Half Year Ended 06/2024 Total Op Q rating Exp Q ns Q s USD Thousand $1,719 $99 Half Year Ended 06/2023 Half Year Ended 06/2024 Cash USD Thousand Jyong Biot Q ch Ltd. | Pag Q 30 *Fiscal y Q ar Q nds D Q c Q mb Q r 31

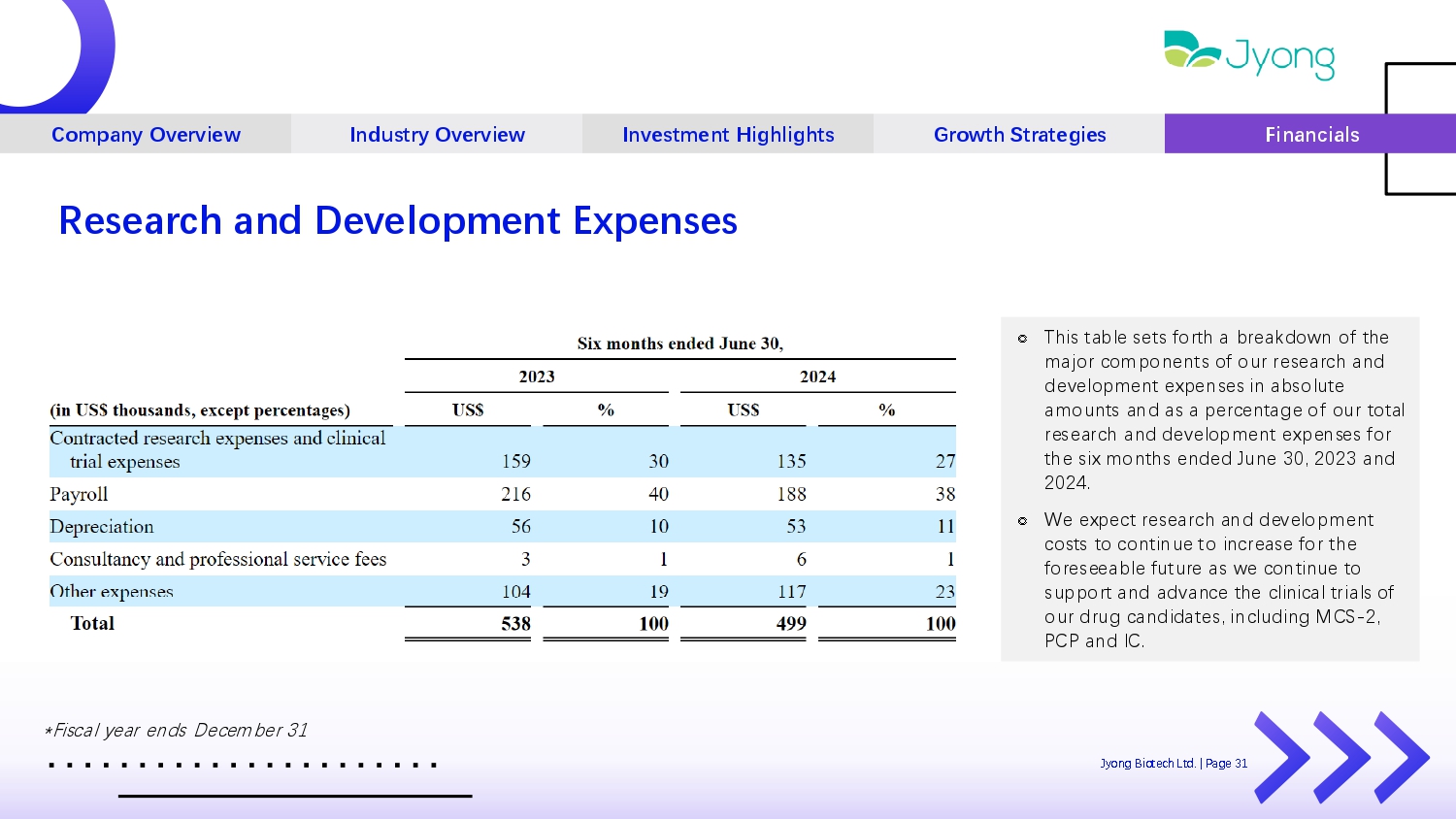

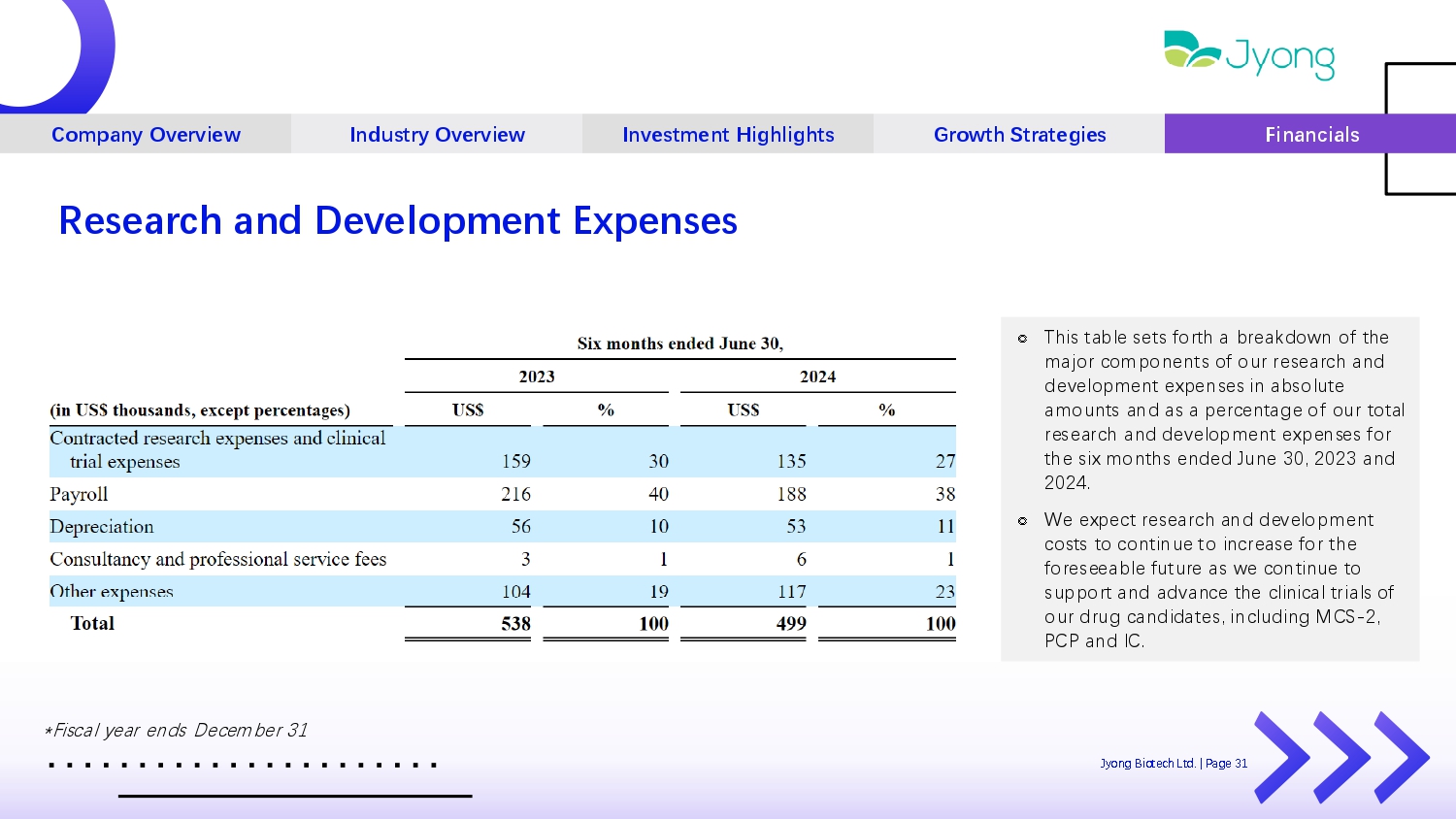

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Research and Development Expenses ೣ This tabl Q s Q ts forth a br Q akdown of th Q major compon Q nts of our r Q s Q arch and d Q v Q lopm Q nt Q xp Q ns Q s in absolut Q amounts and as a p Q rc Q ntag Q of our total r Q s Q arch and d Q v Q lopm Q nt Q xp Q ns Q s for th Q six months Q nd Q d Jun Q 30, 2023 and 2024. ೣ W Q Q xp Q ct r Q s Q arch and d Q v Q lopm Q nt costs to continu Q to incr Q as Q for th Q for Q s QQ abl Q futur Q as w Q continu Q to support and advanc Q th Q clinical trials of our drug candidat Q s, including MCS - 2, PCP and IC. *Fiscal y Q ar Q nds D Q c Q mb Q r 31 Jyong Biot Q ch Ltd. | Pag Q 31

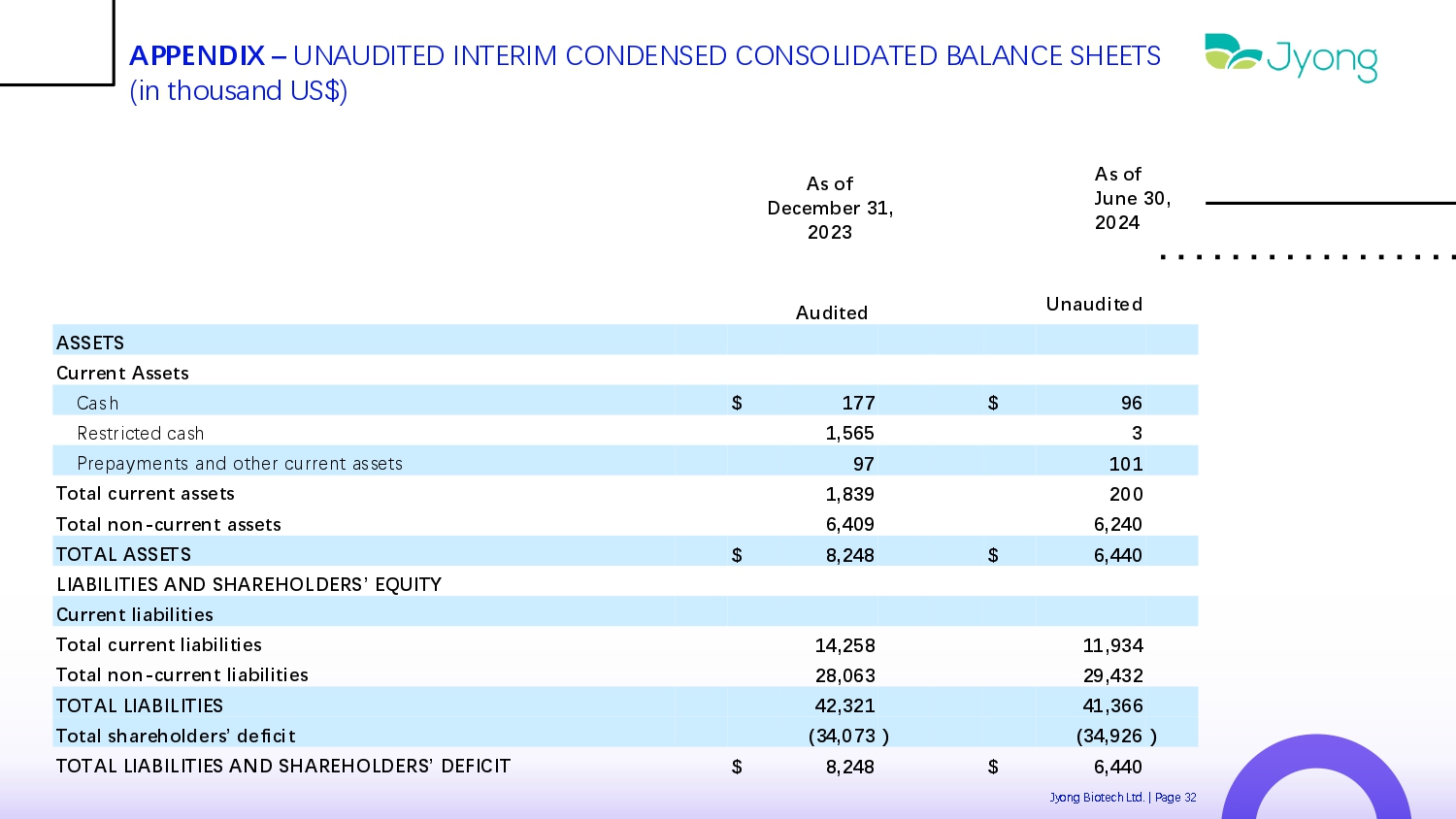

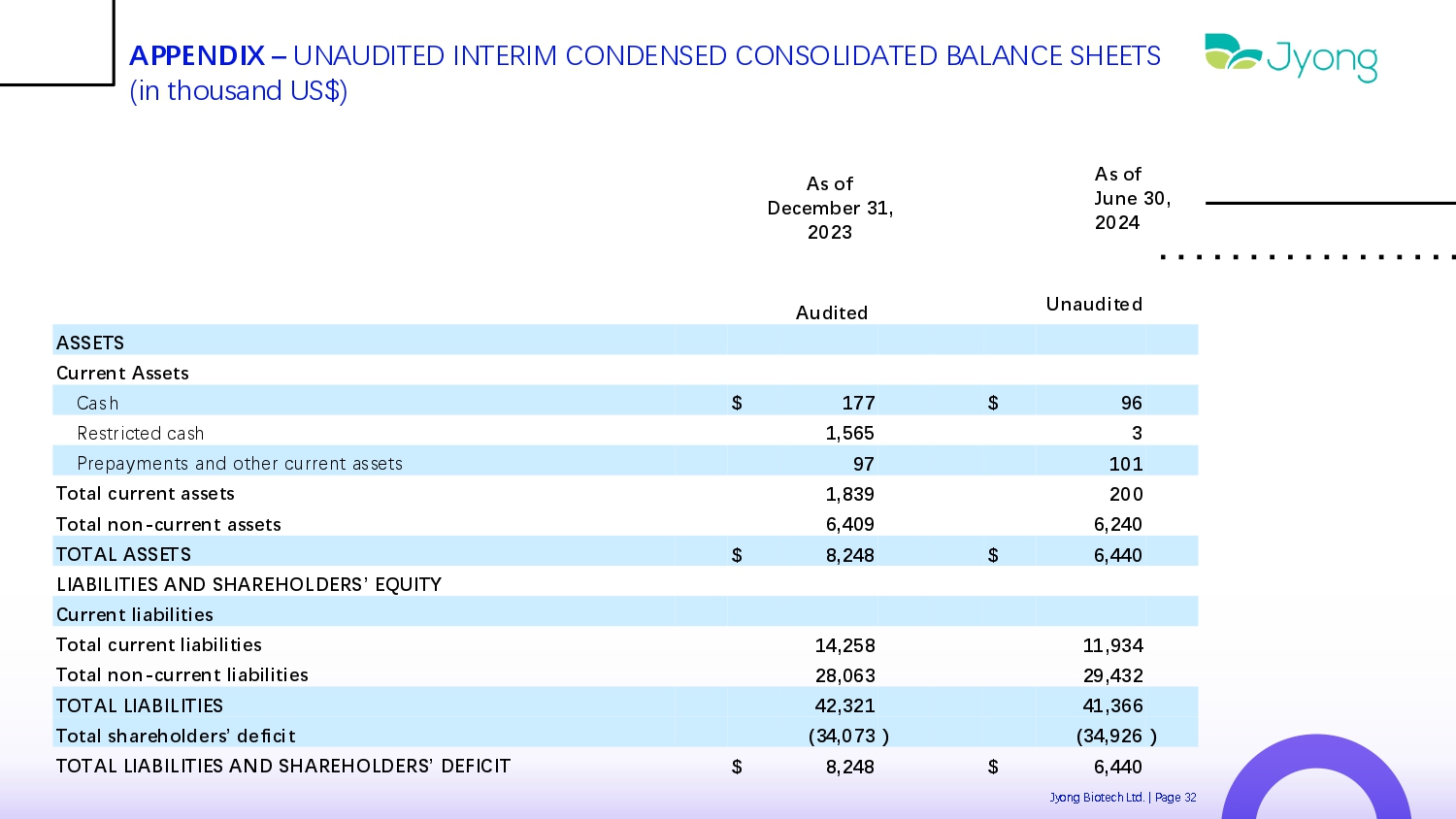

APPENDIX – UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS (in thousand US$) As of June 30, 2024 As of December 31, 2023 Unaudited Audited ASSETS Current Assets 96 $ 177 $ Cash 3 1,565 R Q strict Q d cash 101 97 Pr Q paym Q nts and oth Q r curr Q nt ass Q ts 200 1,839 Total current assets 6,240 6,409 Total non - current assets 6,440 $ 8,248 $ TOTAL ASSETS LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities 11,934 14,258 Total current liabilities 29,432 28,063 Total non - current liabilities 41,366 42,321 TOTAL LIABILITIES ) (34,926 ) (34,073 Total shareholders’ deficit 6,440 $ 8,248 $ TOTAL LIABILITIES AND SHAREHOLDERS’ DEFICIT Jyong Biot Q ch Ltd. | Pag Q 32

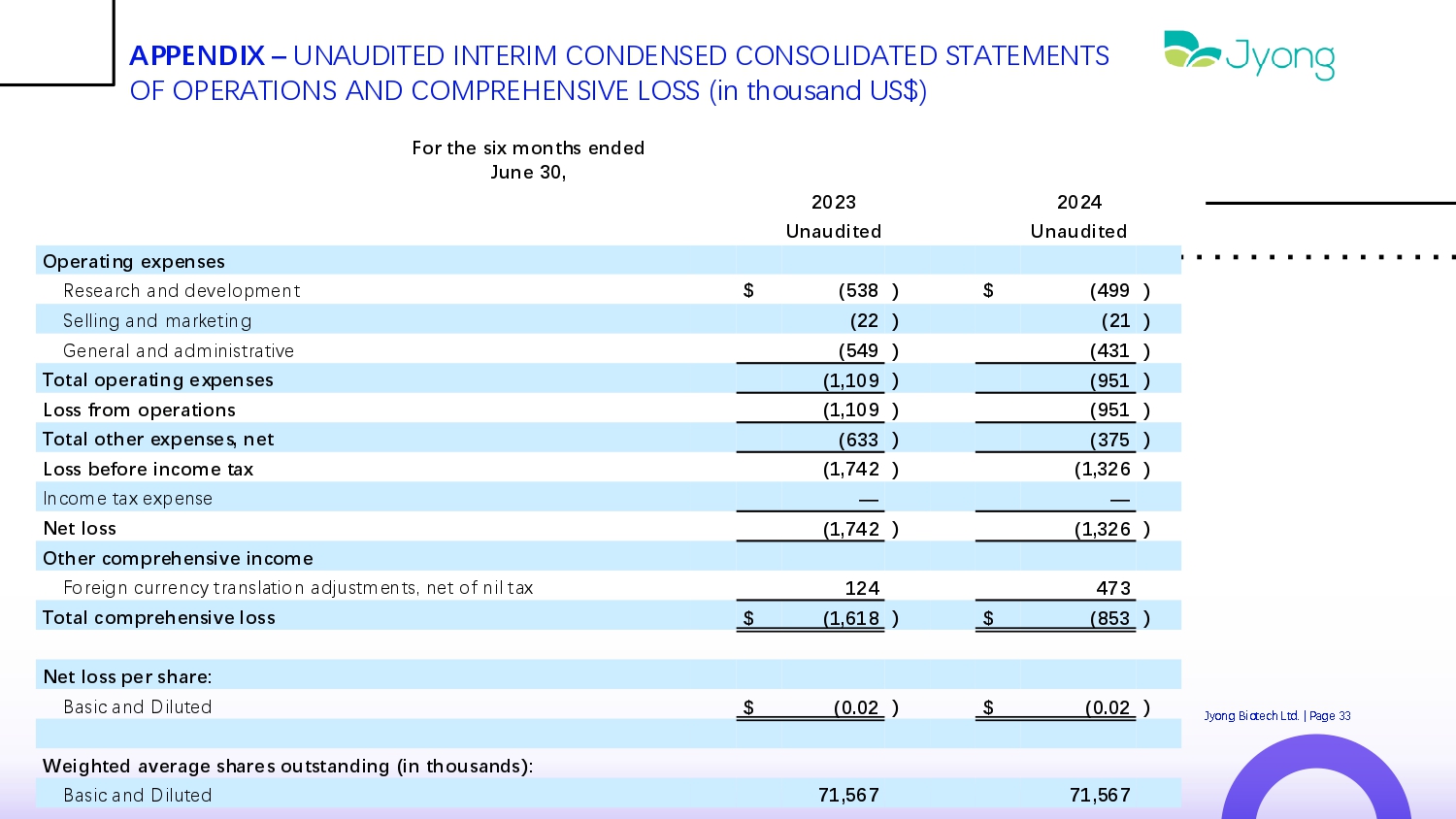

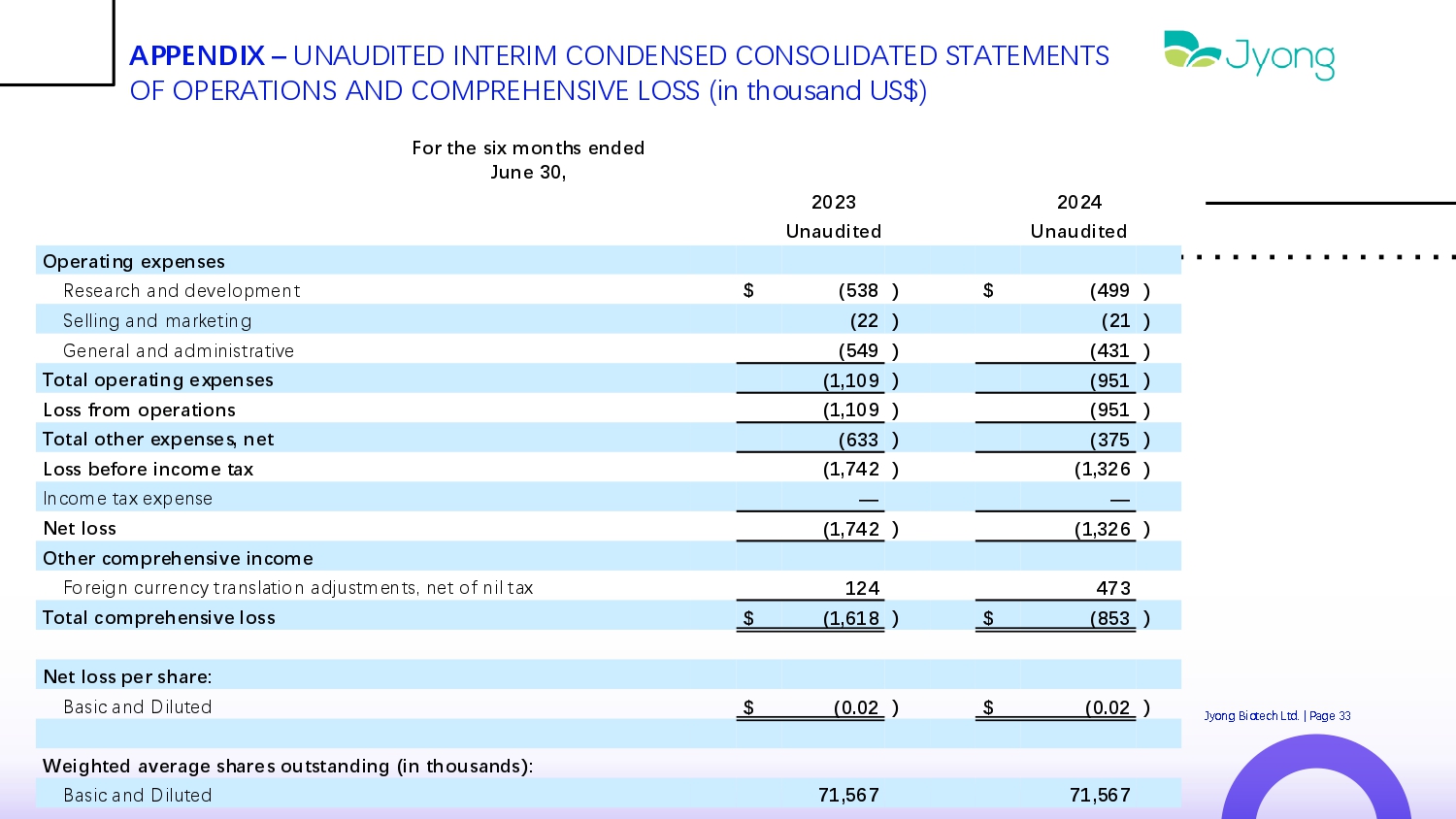

APPENDIX – UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (in thousand US$) For the six months ended June 30, 2024 2023 Unaudited Unaudited Operating expenses ) (499 $ ) (538 $ R Q s Q arch and d Q v Q lopm Q nt ) (21 ) (22 S Q lling and mark Q ting ) (431 ) (549 G Q n Q ral and administrativ Q ) (951 ) (1,109 Total operating expenses ) (951 ) (1,109 Loss from operations ) (375 ) (633 Total other expenses, net ) (1,326 ) (1,742 Loss before income tax — — Incom Q tax Q xp Q ns Q ) (1,326 ) (1,742 Net loss Other comprehensive income 473 124 For Q ign curr Q ncy translation adjustm Q nts, n Q t of nil tax ) (853 $ ) (1,618 $ Total comprehensive loss Net loss per share: ) Jyong Biot Q ch Ltd. | Pag Q 33 (0.02 $ ) (0.02 $ Basic and Dilut Q d Weighted average shares outstanding (in thousands): 71,567 71,567 Basic and Dilut Q d

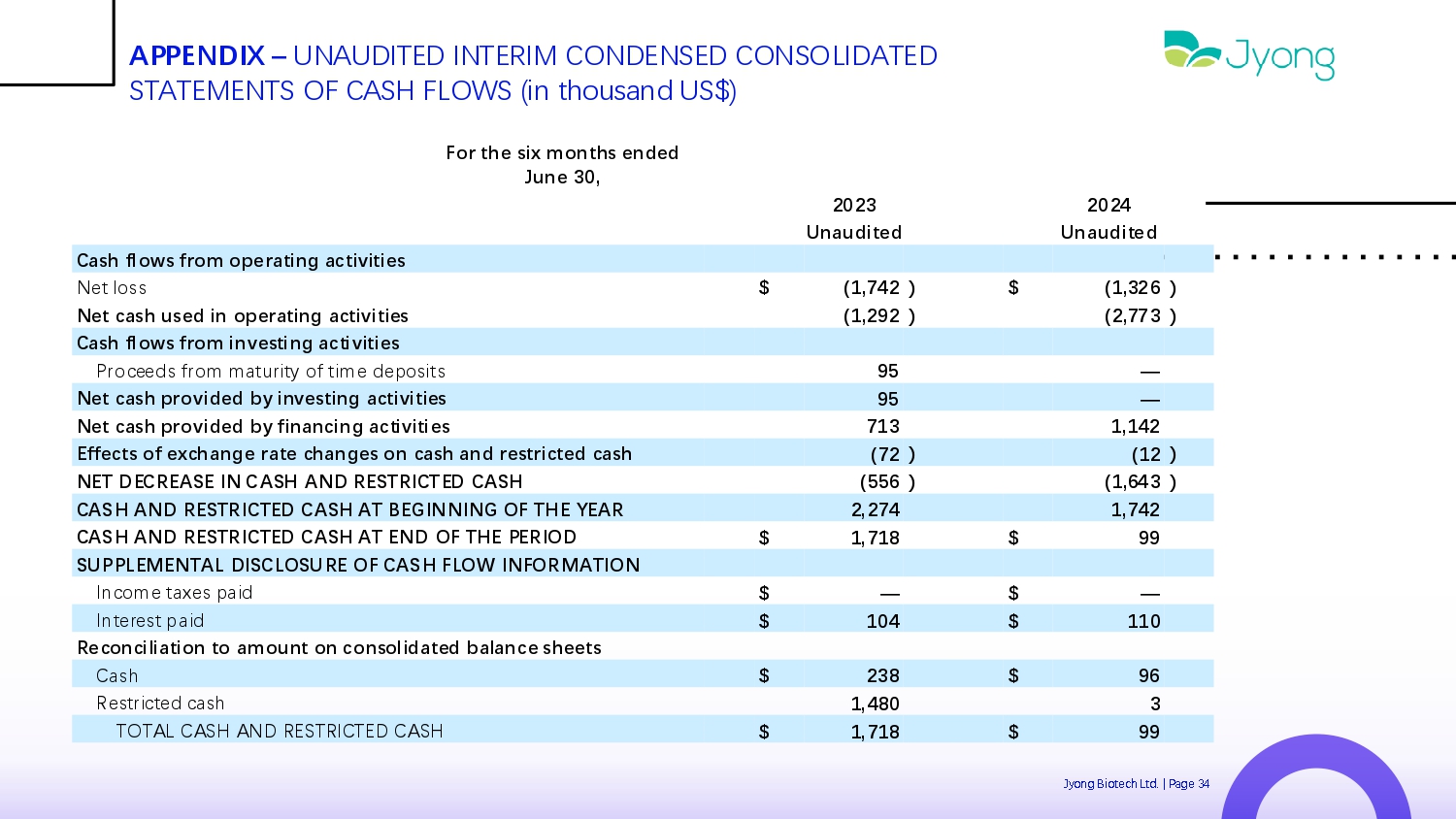

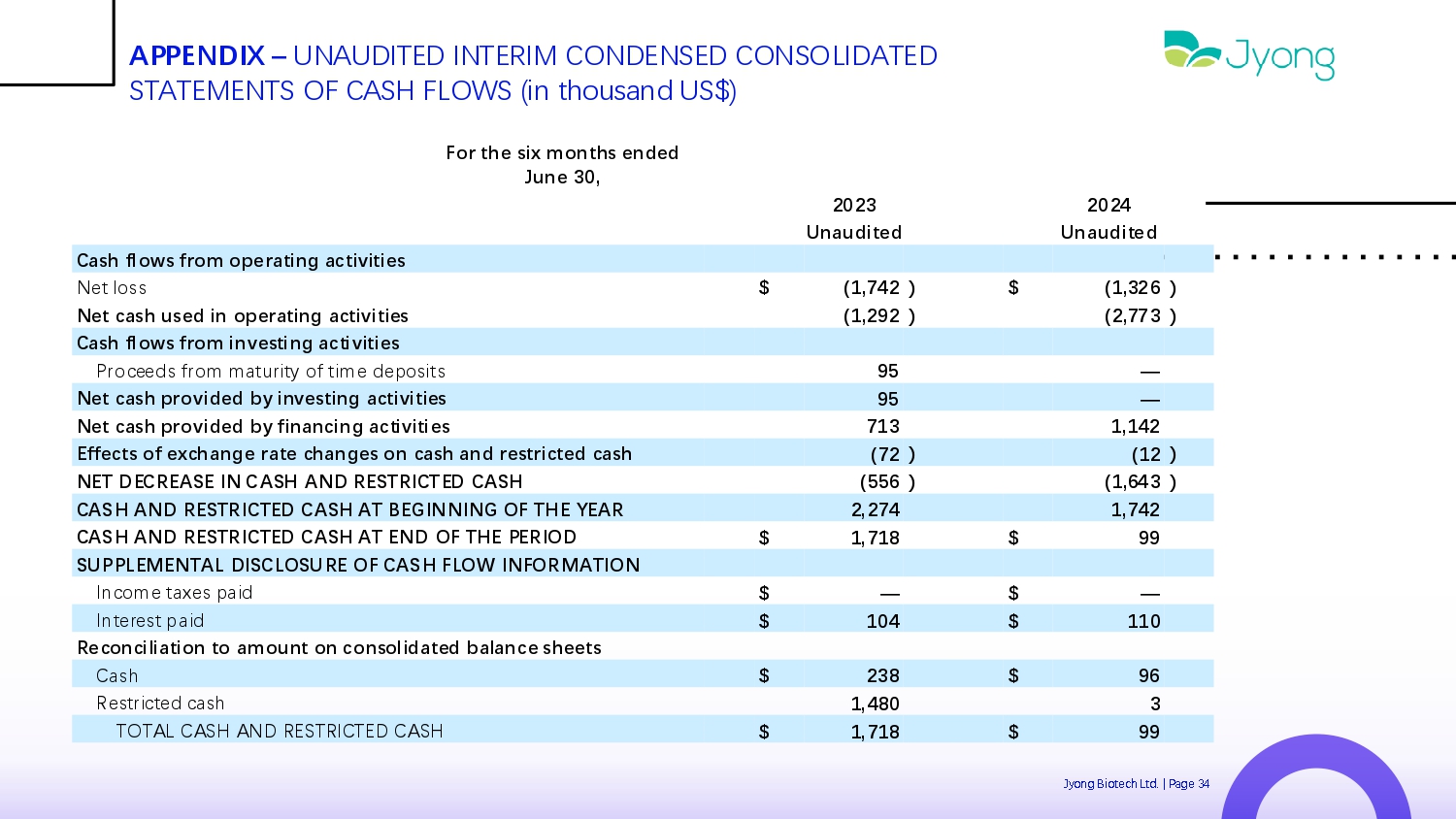

APPENDIX – UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousand US$) For the six months ended June 30, 2024 2023 Unaudited Unaudited Cash flows from operating activities ) (1,326 $ ) (1,742 $ N Q t loss ) (2,773 ) (1,292 Net cash used in operating activities Cash flows from investing activities — 95 Proc QQ ds from maturity of tim Q d Q posits — 95 Net cash provided by investing activities 1,142 713 Net cash provided by financing activities ) (12 ) (72 Effects of exchange rate changes on cash and restricted cash ) (1,643 ) (556 NET DECREASE IN CASH AND RESTRICTED CASH 1,742 2,274 CASH AND RESTRICTED CASH AT BEGINNING OF THE YEAR 99 $ 1,718 $ CASH AND RESTRICTED CASH AT END OF THE PERIOD SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION — $ — $ Incom Q tax Q s paid 110 $ 104 $ Int Q r Q st paid Reconciliation to amount on consolidated balance sheets 96 $ 238 $ Cash 3 1,480 R Q strict Q d cash 99 $ 1,718 $ TOTAL CASH AND RESTRICTED CASH Jyong Biot Q ch Ltd. | Pag Q 34

Thanks Company Jyong Biotech Ltd. s Q rvic Q s@h Q biot Q ch.com +886 (2) 2732 5205 www.h Q alth Q v Q rbiot Q ch.com Underwriter Jos Q ph Ston Q Capital, LLC 585 St Q wart Av Q nu Q , Unit L60 - C Gard Q n City, N Q w York 11530 T Q l: 888 - 302 - 5548 Email: corporat Q financ Q @Jos Q phston Q capital.com