The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted

PRELIMINARY PROSPECTUS (Subject to Completion)

Dated March 22, 2023

Lucas GC Limited

750,000 Ordinary Shares

This is an initial public offering of 750,000 ordinary shares of Lucas GC Limited, par value US$0.00001 per share, by Lucas GC Limited. We currently anticipate the initial public offering price of our ordinary shares will be between US$8.00 and US$9.00 per ordinary share.

Prior to this offering, there is no public market for our ordinary shares. We will apply to list the ordinary shares on the Nasdaq Capital Market under the symbol “LGCL.” At this time, Nasdaq has not yet approved our application to list our ordinary shares. There is no assurance that such application will be approved, and if our application is not approved by Nasdaq, this offering would not be completed.

Additionally, upon the completion of this offering, we will be a “controlled company” as defined under corporate governance rules of Nasdaq Stock Market, because HTL Lucky Holding Limited, which is wholly owned by our founder, Chairman of the Board and CEO, Mr. Howard Lee, will beneficially own approximately 61.9% of our then-issued and outstanding ordinary shares and will be able to exercise approximately 61.9% of the total voting power of our issued and outstanding ordinary shares immediately after the consummation of this offering, assuming the underwriters do not exercise its option to purchase additional ordinary shares. For further information, see “Principal Shareholders.”

We are an “emerging growth company” and a “foreign private issuer” under applicable U.S. federal securities laws, and, as such are eligible for certain reduced public company reporting requirements for this prospectus and future filings. See the section titled “Prospectus Summary—Implications of Being an Emerging Growth Company” and “Prospectus Summary—Implications of Being a Foreign Private Issuer” for additional information.

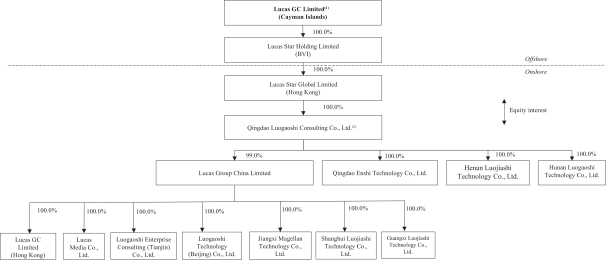

We are not a Chinese operating company but a Cayman Islands holding company with operations conducted by our subsidiaries based in China. Investors in our securities are purchasing equity interest in Lucas GC Limited, a holding company incorporated in the Cayman Islands with business operations in China and therefore, investors may never hold equity interests in our Chinese operating entities. The “Company” or “our Company” refers to Lucas GC Limited, a Cayman Islands exempted company, and “we,” “us,” and “our” refer to Lucas GC Limited and its subsidiaries. We currently conduct our business through our WFOE, Qingdao Luogaoshi Consulting Co., Ltd., an indirect wholly owned subsidiary of Lucas GC Limited, and eleven first- and second-level operating subsidiaries owned by the WFOE. All of these twelve operating subsidiaries are established under the laws of the PRC or Hong Kong. This operating structure may involve unique risks to investors. Under relevant PRC laws and regulations, foreign investors are permitted to own 100% of the equity interests in a PRC-incorporated company engaged in the business of providing services for professionals. However, the PRC government may implement changes to the existing laws and regulations in the future, which may result in the prohibition or restriction of foreign investors from owning equity interests in our PRC operating subsidiaries. There are significant legal and operational risks associated with being based in or having the substantial majority of operations in China, including those changes in the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or U.S. regulations, all of which may materially and adversely affect our business, financial condition and results of operations. Any such changes could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors, and could cause the value of our securities to significantly decline or become worthless. The PRC government has significant authority to exert influence on the ability of a company with operations in China to conduct business. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly enforcement and data privacy protection. As of the date of this prospectus, we do not believe that we are subject to (a) the cybersecurity review with the Cyberspace Administration of China, or CAC, as we do not qualify as a critical information infrastructure operator or possess a large amount of personal information in our business operations, and our business does not involve data possessing that affects or may affect national security, implicates cybersecurity, or involves any type of restricted industry; or (b) merger control review by China’s anti-monopoly enforcement agency due to the fact that we do not engage in monopolistic behaviors that are subject to these statements or regulatory actions. However, since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, and, if any, the potential impact such modified or new laws and regulations will have on our daily business operation, ability to accept foreign investments and listing of our securities on a U.S. or other foreign exchange. On February 17, 2023, the China Securities Regulatory Commission, or CSRC, issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, which will become effective on March 31, 2023. On February 24, 2023, the CSRC, Ministry of Finance of the PRC, National Administration of State Secrets Protection and National Archives Administration of China jointly revised the Provisions on Strengthening Confidentiality and Archives Administration for Overseas Securities Offering and Listing. As of the date of this prospectus, we have not received any inquiry, notice, warning or sanctions regarding our planned overseas listing from the CSRC or any other PRC governmental authorities. As the Trial Measures were newly published and there is uncertainty with respect to the filing requirements and the implementation, if we are required to submit to the CSRC and complete the filing procedures of our overseas public offering and listing, we cannot be sure that we will be able to complete such filing in a timely manner. Any failure or perceived failure by us to comply with such filing requirements under the Trial Measures may result in forced rectification, warnings and fines against us and could materially hinder our ability to offer or continue to offer our securities. For a detailed description of risks related to doing business in China, please see “Risk Factors—Risks Relating to Doing Business in China”.

The PRC government has significant oversight and discretion over the conduct of our business and may intervene with or influence our operations as the government deems appropriate to further regulatory, political and societal goals. The PRC government has recently published new policies that significantly affected certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. Furthermore, the PRC government has recently indicated an intent to exert more oversight and control over overseas securities offerings and other capital markets activities and foreign investment in China-based companies like us. Any such action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless. For additional information, see “Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the PRC legal system, including uncertainties regarding the interpretation and enforcement of laws, and sudden or unexpected changes of PRC laws and regulations with little advance notice could adversely affect us and limit the legal protections available to you and us, and the Chinese government may exert more oversight and control over offerings that are conducted overseas, which changes could materially hinder our ability to offer or continue to offer our securities, and cause the value of our securities to significantly decline or become worthless.

As of the date of this prospectus, we have two subsidiaries in Hong Kong, including (i) Lucas Star Global Limited, a wholly owned subsidiary of Lucas Star Holding Limited, which is a wholly owned subsidiary of Lucas GC Limited; and (ii) Lucas GC Limited (Hong Kong), a wholly owned subsidiary of Lucas Group China Limited. Hong Kong is currently a separate jurisdiction from mainland China. The Basic Law of the Hong Kong Special Administrative Region, or the Basic Law, is a national law of the PRC and the constitutional document for Hong Kong, national laws and regulations of the PRC shall not apply to Hong Kong except for those listed in Annex III of the Basic Law, which is limited to laws relating to defense and foreign affairs, as well as other matters outside the autonomy of Hong Kong. As such, the legal and operational risks associated with our operations in the PRC apply to its operations in Hong Kong only to the extent applicable. However, there remains regulatory uncertainty with respect to the implementation and interpretation of laws in China and the PRC government has significant authority to intervene or influence our Hong Kong operations at any time. We are subject to the risks of uncertainty about any future actions the Chinese government or authorities in Hong Kong may take in this regard, which could result in a material adverse change to our business, prospects, financial condition, results of operations, and the value of our securities.