EXPLANATORY NOTE

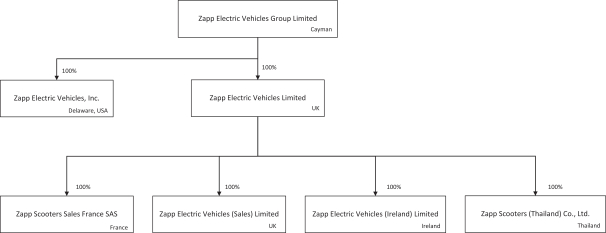

On April 28, 2023 (the “Closing Date”), Zapp Electric Vehicles Group Limited, an exempted company incorporated with limited liability under the laws of the Cayman Islands (“Pubco”), consummated the previously announced business combination pursuant to the Agreement and Plan of Merger, dated as of November 22, 2022 (the “Merger Agreement”), by and among Pubco, CIIG Capital Partners II, Inc. (“CIIG II”), Zapp Electric Vehicles Limited, a private company limited by shares registered in England and Wales (“Zapp”) and Zapp Electric Vehicles, Inc., a Delaware corporation and direct, wholly owned subsidiary of Pubco (“Merger Sub”).

The Merger Agreement provided that the parties thereto would enter into a business combination transaction (the “Business Combination”) pursuant to which, among other things, (i) the shareholders of Zapp transferred their respective ordinary shares of Zapp to Pubco in exchange for ordinary shares of Pubco (“Pubco Ordinary Shares”, and such exchange, the “Company Exchange”); and (ii) immediately following the Company Exchange, Merger Sub merged with and into CIIG II, with CIIG II being the surviving corporation in the merger (the “Merger”), and each outstanding share of common stock of CIIG II (other than certain excluded shares) would convert into the right to receive one Pubco Ordinary Share.

On April 26, 2023, CIIG II and Pubco entered into separate agreements (each a “Forward Purchase Agreement,” and together, the “Forward Purchase Agreements”) with each of ACM ARRT I LLC and CFPA Holdings LLC-Zapp RS (together, the “Sellers”) for OTC Equity Prepaid Forward Transactions, pursuant to which the Sellers may, but were not obligated to, purchase up to 10,000,000 shares of Class A common stock, par value $0.0001 per share, of CIIG II in the aggregate before the consummation of the Business Combination. The primary purpose of entering into the Forward Purchase Agreements was to help ensure the consummation of the Business Combination.

Upon the consummation of the Business Combination: (i) the shareholders of Zapp transferred their respective ordinary shares of Zapp to Pubco in exchange for 41,296,259 Pubco Ordinary Shares pursuant to the Company Exchange, (ii) $6.1 million in aggregate principal amount of Zapp’s senior unsecured convertible loan notes due 2025 (the “Zapp Convertible Loan Notes”) were automatically redeemed at the principal amount by conversion into ordinary shares of Zapp, which were then transferred to Pubco in exchange for 871,428 Pubco Ordinary Shares; (iii) all Zapp options, whether vested or unvested, were released and cancelled by holders of Zapp options in exchange for 4,410,844 options to purchase Pubco Ordinary Shares (“Pubco Exchange Options”), of which 4,082,240 Pubco Exchange Options were fully vested upon the consummation of the Business Combination; (iv) the 6,000,000 Zapp warrants issued to Michael Joseph to purchase 6,000,000 ordinary shares of Zapp ceased to be warrants with respect to ordinary shares of Zapp and were assumed by Pubco and converted into 3,412,469 fully vested warrants to purchase Pubco Ordinary Shares (“Pubco Exchange Warrants”); (v) all shares of CIIG II Class A common stock, par value $0.0001 per share, and CIIG II Class B common stock, par value $0.0001 per share, were cancelled and automatically deemed to represent the right to receive 28,750,000 Pubco Ordinary Shares and 7,187,500 Pubco Ordinary Shares (of which 754,687 Pubco Ordinary Shares are unvested and subject to certain vesting conditions), respectively; and (vi) each CIIG II warrant was modified to provide that such warrant no longer entitles the holder thereof to purchase the number of shares of CIIG II’s common stock set forth therein and in substitution thereof such warrant would entitle the holder to acquire the same number of Pubco Ordinary Shares per warrant on the same terms (“Pubco Public Warrants”).

The Business Combination was consummated on April 28, 2023. The transaction was unanimously approved by CIIG II’s board of directors and was approved at the special meeting of CIIG II’s stockholders held on April 14, 2023. As a result of the Business Combination, Zapp became a direct wholly-owned subsidiary of Pubco, and CIIG II became a direct wholly-owned subsidiary of Pubco. On May 1, 2023, Pubco Ordinary Shares and Pubco Public Warrants commenced trading on The Nasdaq Stock Market LLC, or “Nasdaq”, under the symbols “ZAPP” and “ZAPPW,” respectively.

Except as otherwise indicated or required by context, references in this shell company report on Form 20-F (including information incorporated by reference herein, the “Report”) to “we”, “us”, “our”, or “Pubco” refer to Zapp Electric Vehicles Group Limited, an exempted company incorporated with limited liability under the laws of the Cayman Islands, and its subsidiaries.

Capitalized terms used herein but not otherwise defined have the meaning set forth in the Proxy Statement and Prospectus (the “Proxy Statement/Prospectus”), forming part of Pubco’s Registration Statement on Form F-4, as amended (File No. 333-268857) (the “Form F-4”).

1