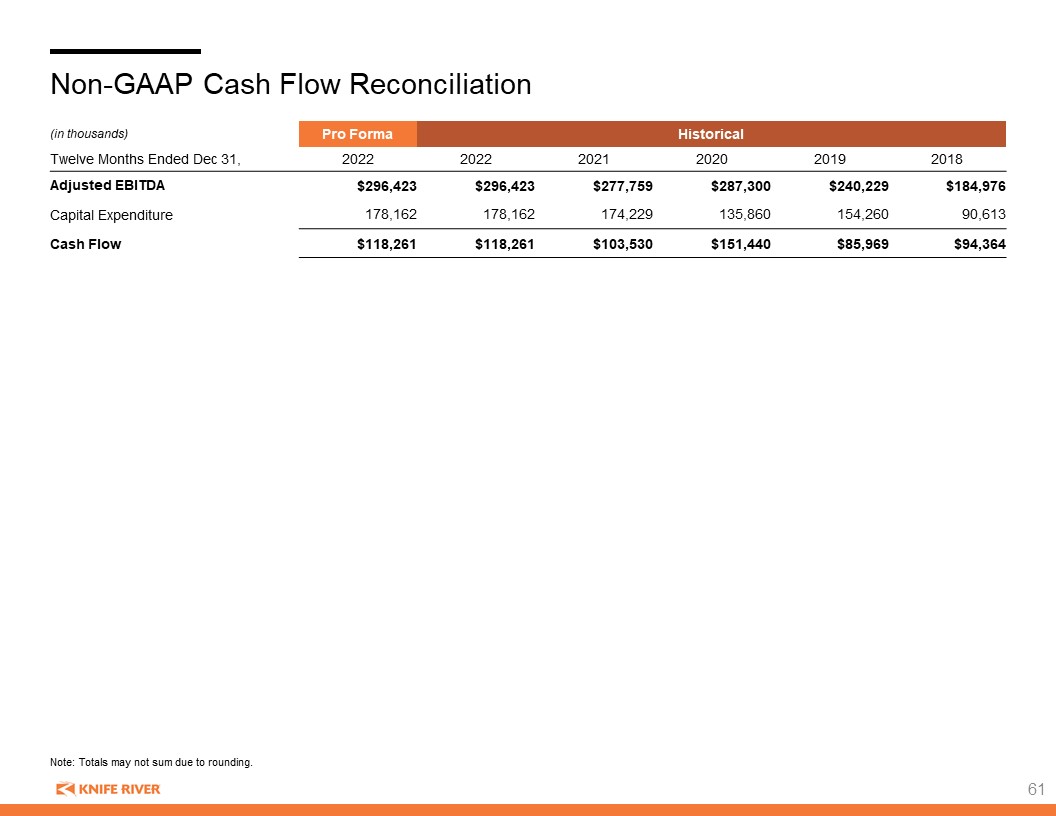

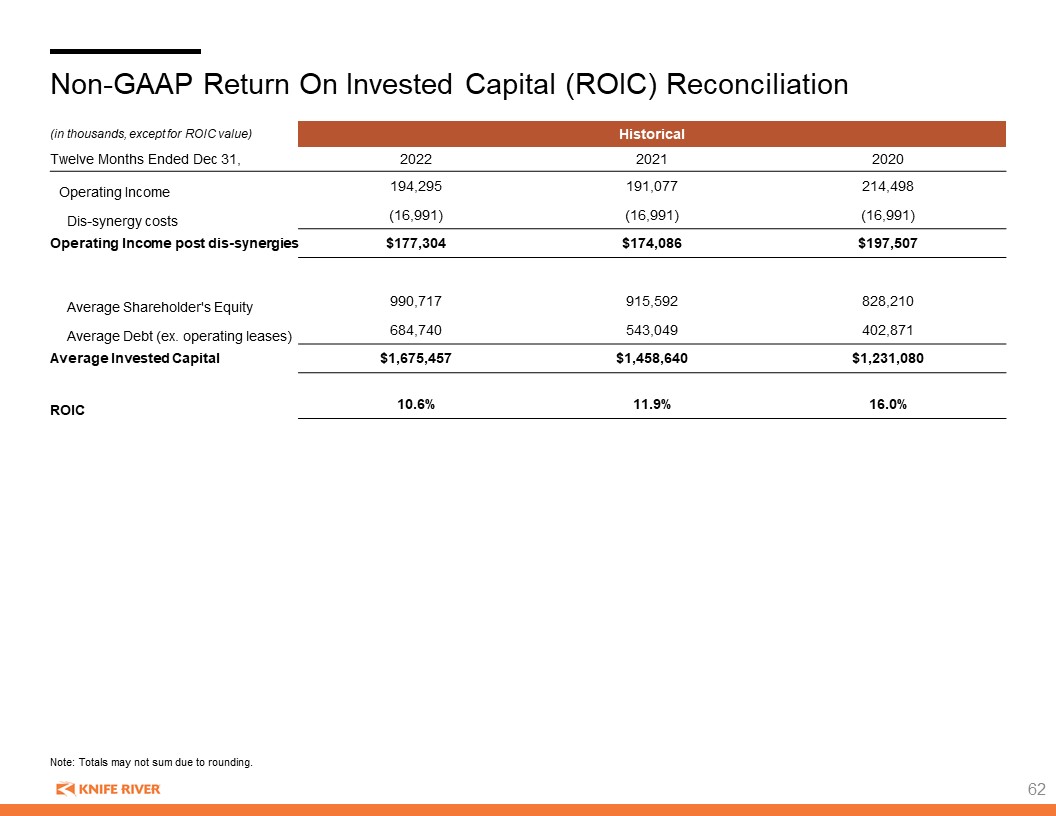

Forward Looking Statements Certain statements and information in this presentation may constitute forward-looking statements. These forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “intends,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “propose,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, risks associated with the impact, timing or terms of the spinoff; risks associated with the expected benefits and costs of the spinoff, including the risk that the expected benefits of the spinoff will not be realized within the expected time frame, in full or at all, and the risk that conditions to the spinoff will not be satisfied and/or that the spinoff will not be completed within the expected timeframe, on the expected terms or at all; the expected qualification of the spinoff as a tax-free transaction for U.S. federal income tax purposes, including whether or not an IRS ruling will be sought or obtained; the risk that any consents or approvals required in connection with the spinoff will not be received or obtained within the expected timeframe, on the expected terms or at all; risks associated with expected financing transactions undertaken in connection with the spinoff and risks associated with indebtedness incurred in connection with the spinoff; the risk that dis-synergy costs, costs of restructuring transactions and other costs incurred in connection with the spinoff will exceed estimates; and the impact of the spinoff on the businesses and the risk that the spinoff may be more difficult, time consuming or costly than expected, including the impact on resources, systems, procedures and controls, diversion of management's attention and the impact on relationships with customers, suppliers, employees and other business counterparties, general economic and business conditions, which will, among other things, affect demand for new residential and commercial construction; our inability to close the proposed acquisitions described in this presentation; our inability to achieve benefits from the acquisitions described in this presentation to offset the significant costs associated with the acquisitions; our ability to successfully identify, manage, and integrate additional acquisitions; the cyclical nature of, and changes in, the real estate and construction markets, including pricing changes by our competitors; governmental requirements and initiatives, including those related to mortgage lending or mortgage financing, funding for public or infrastructure construction, land usage, and environmental, health, and safety matters; disruptions, uncertainties or volatility in the credit markets that may limit our, our suppliers’ and our customers’ access to capital; our ability to successfully implement our operating strategy; weather conditions; our substantial indebtedness and the restrictions imposed on us by the terms of our indebtedness; the degree to which a pandemic will impact Knife River Holding Company which depends on future developments, including the resurgence of COVID-19 and its variants, federal and state mandates, actions taken by governmental authorities, effectiveness of vaccines being administered, and the pace and extent to which the economy recovers and remains under relatively normal operating conditions; our ability to implement cost containment strategies and the adverse effects of COVID-19 on our business, the economy and the markets we serve; our ability to maintain favorable relationships with third parties who supply us with equipment and essential supplies; our ability to retain key personnel and maintain satisfactory labor relations; and product liability, property damage, results of litigation, and other claims and insurance coverage issues. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except as required by federal securities laws. This presentation should be read along with the historical financial statements of Knife River Holding Company, including the most recent audited financial statements. Historical results may not be indicative of future results. This presentation contains certain financial information defined as “non-GAAP financial measures” by the Securities and Exchange Commission. These measures may be different from non-GAAP financial measures used by other companies and should not be considered in isolation or as a substitute for revenue, net income, operating income, cash flows from operating, investing or financing activities, or any other measure calculated in accordance with U.S. GAAP. Management believes these non-GAAP financial measures are useful to investors by providing meaningful information about operational efficiency compared to Knife River Holding Company's peers by excluding the impacts of differences in tax jurisdictions and structures, debt levels and capital investment. Knife River Holding Company's management uses the non-GAAP financial measures in conjunction with GAAP results when evaluating the company's operating results internally and calculating compensation packages. Non-GAAP financial measures are not standardized; therefore, it may not be possible to compare such financial measures with other companies' non-GAAP financial measures having the same or similar names. Knife River Holding Company strongly encourages investors to review the consolidated financial statements in their entirety and to not rely on any single financial measure.