BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements

December 31, 2023

1. ORGANIZATION & INVESTMENT OBJECTIVES

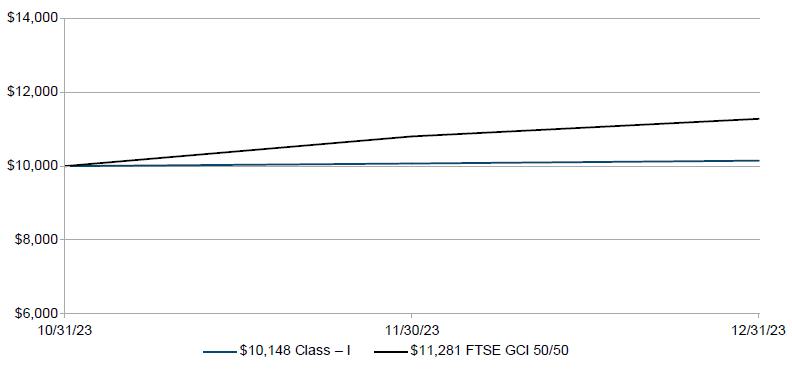

Brookfield Infrastructure Income Fund Inc. (the “Fund”) is a newly organized Maryland corporation registered under the Investment Company Act of 1940, as amended (the “1940 Act” or the “Investment Company Act”), as a non-diversified, closed-end management investment company with no operating history. The Fund continuously offers its shares of common stock, as well as periodic liquidity to investors. The Fund's Class I Shares and Class S Shares commenced operations on November 1, 2023 and December 1, 2023, respectively.

The Fund currently offers shares of four classes of common stock on a continuous basis: Class I Common Shares (“Class I Shares”), Class D Common Shares (“Class D Shares”), Class S Common Shares (“Class S Shares”), and Class T Common Shares (“Class T Shares” and, together with the Class I Shares, the Class D Shares, and the Class S Shares, the “Shares”). The Fund was granted exemptive relief (the “Multi-Class Exemptive Relief”) by the U.S. Securities and Exchange Commission (the “SEC”) that permits the Fund to issue multiple classes of shares and to impose asset-based distribution fees and early-withdrawal fees. In addition to the Class I Shares, Class D Shares, Class S Shares, and Class T Shares, the Fund may offer additional classes of shares in the future.

Brookfield Asset Management Private Institutional Capital Adviser (Canada), L.P. (the “Adviser”) serves as the investment adviser to the Fund pursuant to the terms of an investment advisory agreement with the Fund (the “Advisory Agreement”). The Adviser is an indirect wholly-owned subsidiary of Brookfield Asset Management ULC (“BAM ULC”). Brookfield Public Securities Group LLC (the “Administrator”), an indirect-wholly-owned subsidiary of BAM ULC, is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and serves as Administrator to the Fund. Brookfield Corporation, a publicly traded company (NYSE: BN; TSX: BN), holds a 75% interest in BAM ULC, while Brookfield Asset Management Ltd. (NYSE: BAM; TSX: BAMA) (“Brookfield Asset Management”) holds a 25% interest in BAM ULC. Brookfield Asset Management is a leading global alternative asset manager.

The Fund’s investment objective is to maximize total returns through growth of capital and current income. There can be no assurance that the Fund will achieve its investment objective.

BII launched on November 1, 2023, as a regulated investment company, structured as a "tender offer fund." At the time of launch, a predecessor fund based in Luxembourg, Brookfield Infrastructure Income Fund SCSp (the "Predecessor Fund"), was reorganized into the Fund (the "Reorganization") and as a result, the Fund adopted all of the assets and liabilities of the Predecessor Fund, including its portfolio of private infrastructure investments. The Fund maintains an investment objective and investment strategies, policies, guidelines and restrictions that are, in all material respects, equivalent to those of the Predecessor Fund. Further, the Reorganization did not result in (1) a material change in the Predecessor Fund’s investment portfolio due to investment restrictions; or (2) a change in accounting policies. Additionally, the investment advisers and portfolio managers did not change as a result of the Reorganization. The net asset value of the Fund’s shares as of close of business on October 31, 2023, after the Reorganization, was $10.00 for Class I Shares and the Fund received in-kind capital contributions of net assets valued at $1,548,637,987 in exchange for 154,863,799 Class I Shares.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company within the scope of Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2013-08 and follows accounting and reporting guidance under FASB Accounting Standards Codification (“ASC”) Topic 946 Financial Services-Investment Companies.

2023 Annual Report 17

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Reporting entity and principles of consolidation

The entities listed below are wholly-owned subsidiaries (each a “Subsidiary”, or together “Subsidiaries”) of the Fund. The financial results of these Subsidiaries are included in the consolidated financial statements and financial highlights of the Fund. All investments held by the Subsidiaries are disclosed in the Consolidated Schedule of Investments. The accompanying consolidated financial statements include the accounts of the Subsidiaries. All intercompany accounts and transactions have been eliminated on consolidation.

Subsidiaries

Enercare BII ULC, an Alberta corporation was formed on September 23, 2022.

IPL BII ULC, an Alberta corporation was formed on September 23, 2022.

Ontario Wind BII ULC, an Alberta corporation was formed on September 23, 2022.

Intermediate Holdings US LLC was formed as a limited liability company under the Delaware Limited Liability Company Act on September 30, 2022.

BII BID Europe Holdings (UK) Limited was formed as a private limited company under the United Kingdom Companies Act 2006 on November 28, 2022.

BII Foundry Holdings LLC, was formed as a limited liability company under the Delaware Limited Liability Company Act on December 22, 2022.

BII Smoky Holdings LLC, was formed as a limited liability company under the Delaware Limited Liability Company Act on February 16, 2023.

BII Finco (Cayman) 2 LP was formed as an Exempted Limited Partnership registered in the Cayman Islands on Oct 10th, 2023. The sole general partner of this Limited Partnership is BII Finco GP LLC which was formed in Delaware on the same date.

Cash

Cash represents funds held in bank accounts with reputable international financial institutions. To the extent that such deposits exceed federally insured limits, the excess over such limits will be uninsured.

Valuation of investments

The Board has designated the Adviser as the valuation designee pursuant to Rule 2a-5 under the 1940 Act to perform fair value determination relating to any or all fund investments. The Board oversees the Adviser in its role as the valuation designee in accordance with the requirements of Rule 2a-5 under the 1940 Act

The Fund values its Private Investments on at least a monthly basis. The Fund carries its private investments at their estimated fair value as determined by the Adviser. A number of valuation methodologies are considered in arriving at fair value of unquoted investments, including internal or external valuation models, which may include discounted cash flow analysis. The most appropriate methodology to determine fair value is chosen on an investment by investment basis. Any control, size, liquidity or other discounts or premiums on the investment are considered by the Adviser in their determination of fair value. During the initial period after an investment has been made, cost may represent the most reasonable estimate of fair value. Intra-quarter month-end values will reflect the latest quarterly valuation, as adjusted based on the total return that the investment is expected to generate, the impact of foreign exchange rates, and any adjustments the Adviser deems appropriate.

18 Brookfield

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Investments in equity securities listed or traded on any securities exchange or traded in the over-the-counter market are valued at the last trade price as of the close of business on the valuation date. If the relevant exchange closes early, then the equity security will be valued at the last traded price before the relevant exchange close. Prices of foreign equities that are principally traded on certain foreign markets will generally be adjusted daily pursuant to a fair value pricing service approved by the Board in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE close. When fair value pricing is employed, the value of the portfolio securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or official closing prices. Investments in open-end registered investment companies, if any, are valued at the NAV as reported by those investment companies.

Debt securities, including U S. government securities, listed corporate bonds, other fixed income and asset-backed securities, and unlisted securities and private placement securities, are generally valued at the bid prices furnished by an independent pricing service or, if not valued by an independent pricing service, using bid prices obtained from active and reliable market makers in any such security or a broker-dealer. Valuations from broker-dealers or pricing services consider appropriate factors such as market activity, market activity of comparable securities, yield, estimated default rates, timing of payments, underlying collateral, coupon rate, maturity date, and other factors. Short-term debt securities with remaining maturities of sixty days or less are valued at amortized cost of discount or premium to maturity, unless such valuation, in the judgment of the Adviser's Valuation Committee, does not represent fair value.

Over-the-counter financial derivative instruments, such as forward currency contracts, options contracts, or swap agreements, derive their values from underlying asset prices, indices, reference rates, other inputs or a combination of these factors. These instruments are normally valued on the basis of evaluations provided by independent pricing services or broker dealer quotations. Depending on the instrument and the terms of the transaction, the value of the derivative instruments can be estimated by a pricing service provider using a series of techniques, such as simulation pricing models. The pricing models use issuer details and other inputs that are observed from actively quoted markets such as indices, spreads, interest rates, curves, dividends and exchange rates. Derivatives that use similar valuation techniques and inputs as described above are normally categorized as Level 2 of the fair value hierarchy.

The fair value of financial instruments that are traded in active markets at each reporting date is determined by reference to quoted market prices or dealer price quotation, without any deduction for transaction costs. For financial instruments not traded in an active market, the fair value is determined using appropriate valuation techniques. Such techniques may include using recent arm’s length market transactions, reference to the current fair value or another instrument that is substantially the same, a discounted cash flow analysis, or other valuation models.

Securities for which market prices are not readily available, cannot be determined using the sources described above, or the Adviser’s Valuation Committee determines that the quotation or price for a portfolio security provided by a broker-dealer or an independent pricing service is inaccurate will be valued at a fair value determined by the Adviser’s Valuation Committee following the procedures adopted by the Adviser under the supervision of the Board.

The Adviser’s valuation policy establishes parameters for the sources, methodologies, and inputs the Adviser’s Valuation Committee uses in determining fair value. Non-publicly traded debt and equity securities and other securities or instruments for which reliable market quotations are not available are valued by the Adviser using valuation methodologies applied on a consistent basis. These securities may initially be valued at the acquisition price as the best indicator of fair value. The Adviser reviews the significant unobservable inputs, valuations of comparable investments and other similar transactions for investments valued at acquisition price to determine whether another valuation methodology should be utilized. Subsequent valuations will depend on facts and circumstances known as of the valuation date and the application of valuation methodologies further described below. The fair value may also be based on a pending transaction expected to close after the valuation date. These valuation methodologies involve a significant degree of management judgment. Accordingly, valuations do not necessarily represent the amounts which may eventually be realized from sales or other dispositions of investments in the future. Fair values may differ from the values that would have been used had a ready market for the investment existed, and the differences could be material to the consolidated financial statements.

2023 Annual Report 19

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality. The fair value may be difficult to determine and thus judgment plays a greater role in the valuation process. Imprecision in estimating fair value can also impact the amount of unrealized appreciation or depreciation recorded for a particular portfolio security and differences in the assumptions used could result in a different determination of fair value, and those differences could be material. For those securities valued by fair valuations, the Adviser’s Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available. There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV.

Foreign Currency Transactions

Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate the portion of gains or losses resulting from changes in foreign exchange rates on securities from the fluctuations arising from changes in market prices.

Reported net realized foreign exchange gains or losses arise from sales of securities, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid.

Investment Transactions and Investment Income

Public portfolio company investments are recorded on trade date. Realized gains and losses from securities transactions are calculated on the identified cost basis. Discounts and premiums on securities are accreted and amortized on a daily basis using the effective yield to maturity and yield to next methods, respectively, and might be adjusted based on management’s assessment of the collectability of such interest. Dividend income is recorded on the ex-dividend date. Income from distributions is limited to the amount of earnings and profits, generated by each portfolio company. Distributions from these portfolio companies in excess of earnings and profits are recorded as a return of capital. Interest income is recorded on the accrual basis, if applicable.

Expenses

Expenses directly attributable to the Fund are charged directly to the Fund, while expenses that are attributable to the Fund and other investment companies advised by the Adviser or its affiliates are allocated among the respective investment companies, including the Fund, based either upon relative average net assets, evenly, or a combination of average net assets and evenly.

Income Taxes

The Fund is a regulated investment company that benefits from flow-through tax treatment as it expects to distribute substantially all of its taxable income to its shareholders. However, income taxes are recognized for the amount of taxes payable by the Fund’s corporate subsidiaries and for the impact of deferred tax assets and liabilities related to such subsidiaries.

20 Brookfield

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Current income taxes: Current income tax assets and liabilities are measured at the amount expected to be paid to tax authorities, net of recoveries based on the tax rates and laws enacted or substantively enacted at the reporting date.

Deferred income taxes: Deferred income tax liabilities are provided for using the liability method on temporary differences between the tax bases used in the computation of taxable income and carrying amounts of assets and liabilities in the consolidated financial statements. Deferred income tax assets are recognized for all deductible temporary differences, carry forward of unused tax credits and unused tax losses, to the extent that it is probable that deductions, tax credits and tax losses can be utilized. The carrying amount of deferred income tax assets are reviewed at each reporting date and reduced to the extent it is no longer probable that the income tax asset will be recovered.

Deferred income tax assets and liabilities are measured at the tax rates that are expected to apply in the period in which the liability is settled or the asset realized, based on tax rates and tax laws that have been enacted or substantively enacted by the end of the reporting period. The measurement of deferred income tax liabilities and assets reflect the tax consequences that would follow from the manner in which the Fund expects, at the end of the reporting period, to recover or settle the carrying amount of its assets and liabilities.

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when they relate to income taxes levied by the same taxation authority within a single taxable entity or the Fund intends to settle its current tax assets and liabilities on a net basis in the case where there exist different taxable entities in the same taxation authority and when there is a legally enforceable right to set off current tax assets against current tax liabilities.

Organizational Expenses and Offering Costs

Organizational costs are expensed as incurred and consist of costs to establish the Fund and enable it legally to do business. Offering costs from the initial launch of the Fund were deferred and will be amortized over the first twelve months after the commencement of operations in accordance with FASB ASC 946-20-25-5 and ASC 946-20-35-5, respectively. Offering costs consist primarily of registration fees and legal fees for the preparation of the Fund’s initial Registration Statement on Form N-2. Organizational costs were reimbursed by the Adviser, subject to potential recoupment as described in Note 7.

New Accounting Pronouncements

In June 2022, FASB issued ASU No. 2022-03, Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions. The amendments in this update clarify the guidance in Topic 820 when measuring the fair value of an equity security subject to contractual sale restrictions and introduce new disclosure requirements related to such equity securities. The amendments are effective for fiscal years beginning after December 15, 2023, with early adoption permitted. Management is currently evaluating the impact of this guidance on the Funds’ financial statements.

In December 2022, the Financial Accounting Standards Board issued an Accounting Standards Update, ASU 2022-06, Reference Rate Reform (Topic 848)—Deferral of the Sunset Date of Topic 848 (“ASU 2022-06”). ASU 2022-06 is an amendment to ASU 2020-04, which provided optional guidance to ease the potential accounting burden due to the discontinuation of the LIBOR and other interbank-offered based reference rates and which was effective as of March 12, 2020 through December 31, 2022. ASU 2022-06 extends the effective period through December 31, 2024. Management is currently evaluating the impact, if any, of applying ASU 2022-06.

2023 Annual Report 21

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Derivative Financial Instruments

The Fund may purchase and sell derivative instruments such as swaps, including credit default and total return swaps, and other over-the-counter derivative instruments or participations. The Fund may invest in, or enter into, derivatives for a variety of reasons, including to hedge certain market risks, to provide a substitute for purchasing or selling particular securities or to increase potential income gain.

Forward Currency Contracts: A forward currency contract (“forward contract”) is an agreement between two parties to buy or sell a currency at an agreed upon price for settlement at a future date. During the period the forward contract is in existence, changes in the value of the forward contract will fluctuate with changes in the currency exchange rates. The forward contract is marked to market daily and these changes are recorded as an unrealized gain or loss. Gain or loss on the purchase or sale of a forward contract is realized on the settlement date.

The Fund invests in forward contracts to hedge against fluctuations in the value of foreign currencies caused by changes in the prevailing currency exchange rates. The use of forward contracts involves the risk that the counterparties may be unable to meet the terms of their contracts and may be negatively impacted from unanticipated movements in the value of a foreign currency relative to the U.S. dollar.

The average U.S. dollar value of forward currency contracts to be delivered or received during the period ended December 31, 2023 was $841,586,201.

Interest Rate Swaps: An interest rate swap is an agreement between the Fund and a counterparty to exchange cash flows based on the difference between two interest rates, applied to a notional amount. These agreements may be privately negotiated in the over-the-counter market (OTC interest rate swaps) or may be executed on a registered exchange (centrally cleared interest rate swaps). Over the term of the contract, contractually required payments to be paid and to be received are accrued daily and recorded as unrealized appreciation or depreciation until the payments are made, at which time they are realized.

The Fund invests in interest rate swap contracts primarily to manage interest rate risk.

For the period ended December 31, 2023, the average month end notional amount of swap contracts was $44,857,124.

The following table sets forth the fair value of the Fund’s derivative instruments:

| | | Consolidated Statement of Assets | | Value as of | |

| Derivatives | | and Liabilities Location | | December 31, 2023 | |

| Assets | | | | | | |

| Foreign currency contracts | | Foreign currency forward contracts | | $ | 269,689 | |

| Interest rate contracts | | Interest rate swap contracts | | $ | 628,647 | |

| | | | | | | |

| Liabilities | | | | | | |

| Foreign currency contracts | | Foreign currency forward contracts | | $ | (59,030,874 | ) |

22 Brookfield

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

The following table sets forth the effect of derivative instruments on the Consolidated Statement of Operations for the period ended December 31, 2023:

| | | | | | | | Net Change in | |

| | | | | | | | Unrealized | |

| | | Consolidated Statement of | | Net Realized | | | Appreciation | |

| Derivatives | | Operations Location | | Loss | | | (Depreciation) | |

| Foreign currency contracts | | Foreign currency forward contracts | | $ | (35,172 | ) | | $ | (38,741,205 | ) |

| Interest rate contracts | | Interest rate swap contracts | | | — | | | | 708,564 | |

| | | | | $ | (35,172 | ) | | $ | (38,032,641 | ) |

The Fund has elected to not offset derivative assets and liabilities or financial assets, including cash, that may be received or paid as part of collateral arrangements, even when an enforceable master netting agreement is in place that provides the Fund, in the event of counterparty default, the right to liquidate collateral and the right to offset a counterparty’s rights and obligations.

| | | | | | Gross | | | Net Amounts | | | | | | | | | | |

| | | | | | Amounts | | | Presented | | | | | | | | | | |

| | | | | | Offset in the | | | in the | | | Non-Cash | | | | | | | |

| | | | | | Statement | | | Statement of | | | Collateral | | | Collateral | | | | |

| | | Gross | | | Assets and | | | Assets and | | | (Pledged) | | | Pledged | | | | |

| | | Amounts | | | Liabilities | | | Liabilities | | | Received1 | | | (Received)1 | | | Net Amount | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Forward currency contracts | | $ | 269,689 | | | $ | — | | | $ | 269,689 | | | $ | — | | | $ | — | | | $ | 269,689 | |

| Swap contracts | | $ | 628,647 | | | $ | — | | | $ | 628,647 | | | $ | — | | | $ | — | | | $ | 628,647 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Forward currency contracts | | $ | (59,030,874 | ) | | $ | — | | | $ | (59,030,874 | ) | | $ | — | | | $ | — | | | $ | (59,030,874 | ) |

1 Excess of collateral pledged to the individual counterparty is not shown for financial statement purposes.

3. FAIR VALUE MEASUREMENTS

A three-tier hierarchy has been established to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

2023 Annual Report 23

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

3. FAIR VALUE MEASUREMENTS (continued)

The three-tier hierarchy of inputs is summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets or liabilities

Level 2 — quoted prices in markets that are not active or other significant observable inputs (including, but not limited to: quoted prices for similar assets or liabilities, quoted prices based on recently executed transactions, interest rates, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of assets or liabilities)

The following table summarizes the Fund’s investments valuation inputs categorized in the disclosure hierarchy as of December 31, 2023:

| | | FAIR VALUE MEASUREMENTS | |

| | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | | | TOTAL | |

| Investments accounted for at fair value: | | | | | | | | | | | | | | | | |

| Private investments | | $ | — | | | $ | — | | | $ | 1,728,989,209 | | | $ | 1,728,989,209 | |

| Public securities | | | — | | | | 299,660,404 | | | | — | | | | 299,660,404 | |

| Short Term Investments | | | 48,715,465 | | | | — | | | | — | | | | 48,715,465 | |

| Total Investments at Fair Value | | $ | 48,715,465 | | | $ | 299,660,404 | | | $ | 1,728,989,209 | | | $ | 2,077,365,078 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments (Assets) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Foreign currency forward contracts | | $ | — | | | $ | 269,689 | | | $ | — | | | $ | 269,689 | |

| Interest rate swaps | | | — | | | | 628,647 | | | | — | | | | 628,647 | |

| Total Other Financial Instruments (Assets) | | $ | — | | | $ | 898,336 | | | $ | — | | | $ | 898,336 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments (Liabilities) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Foreign currency forward contracts | | $ | — | | | $ | 59,030,874 | | | $ | — | | | $ | 59,030,874 | |

| Total Other Financial Instruments (Liabilities) | | $ | — | | | $ | 59,030,874 | | | $ | — | | | $ | 59,030,874 | |

The fair value of the Fund’s loan payable, credit facility and reverse repurchase agreements, which qualify as financial instruments under ASC Topic 825, Disclosures about Fair Values of Financial Instruments, approximates the carrying amounts of $174,000,000, $97,902,000 and $84,537,000, respectively. As of December 31, 2023, these financial instruments are categorized as Level 2 within the disclosure hierarchy.

24 Brookfield

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

3. FAIR VALUE MEASUREMENTS (continued)

The table below shows the significant unobservable valuation inputs that were used by the Adviser to fair value the Level 3 investments as of December 31, 2023.

| | | | Quantitative Information about Level 3 Fair Value Measurements |

| | | | | | | | | | | | | | | Impact to |

| | | | | | | | | | | | | | | Valuation |

| | | | | | | | | | | | | | | from an |

| | | Value as of | | | Valuation | | | | Unobservable | | Amount or | | Increase |

| | | December 31, 2023 | | | Approach | | Valuation Technique | | Input | | Range | | in Input(1) |

| Private equity Investments | | $ | 1,521,538,907 | | | Income Approach | | Discounted Cash Flow | | Discount Rate | | 6.5% to 17.9%

(11.5%) | | Decrease |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | Terminal Value | | 4.2x to 23.5x | | Increase |

| | | | | | | | | | | Multiple | | (11.9x) | | |

| | | | | | | | | | | | | | | |

| Private debt Investments | | $ | 207,450,302 | | | Income Approach | | Discounted Cash Flow | | Discount Rate | | 8% to 12%

(9.5%) | | Decrease |

| 1 | The impact represents the expected directional change in the fair value of Level 3 investments that would result from an increase in the corresponding input. A decrease to the unobservable input would have the opposite effect. Significant changes in these inputs could result in significantly higher or lower fair value measurements. |

The following is a reconciliation of the assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | Private Equity | | | Private Debt | | | Total | |

| Balance as of November 1, 2023 (commencement of Operations) | | $ | — | | | $ | — | | | $ | — | |

| Transfer of Assets from Predecessor Fund | | | 1,321,261,610 | | | | 199,230,778 | | | | 1,520,492,388 | |

| Purchases of investments | | | 167,234,313 | | | | 3,282,185 | | | | 170,516,498 | |

| Return of capital | | | (17,883,619 | ) | | | — | | | | (17,883,619 | ) |

| Sales proceeds | | | — | | | | — | | | | — | |

| Accrued discounts (premiums) | | | — | | | | — | | | | — | |

| Realized gain (loss) | | | — | | | | — | | | | — | |

| Net change in unrealized appreciation | | | 50,926,603 | | | | 4,937,339 | | | | 55,863,942 | |

| Balance as of December 31, 2023 | | $ | 1,521,538,907 | | | $ | 207,450,302 | | | $ | 1,728,989,209 | |

| Change in unrealized appreciation for Level 3 assets still held at the reporting date | | $ | 50,926,603 | | | $ | 4,937,339 | | | $ | 55,863,942 | |

4. CAPITAL SHARES

The Fund currently offers its Shares on a continuous basis and was granted Multi-Class Exemptive Relief by the SEC that permits the Fund to issue multiple classes of shares and to impose asset-based distribution fees and early-withdrawal fees. In addition to the Class I Shares, Class D Shares, Class S Shares, and Class T Shares, the Fund may offer additional classes of shares in the future.

The Shares are continuously offered each month at an offering price equal to NAV per share (plus an applicable front-end sales load, where relevant), which is calculated: (i) as of the close of business on the last business day of each month; (ii) on each date that Shares are to be repurchased in connection with the Fund's offer to purchase Shares; and (iii) at such other times as the Board shall determine. The differences among the Shares relate to front-end sales loads and ongoing distribution and shareholder servicing fees. No front-end sales load or distribution and shareholder servicing fees are paid with respect to Class I Shares. The Class D Shares and the Class S Shares are each subject to a front-end sales load of up to 2.00% and 3.50%, respectively. Investors purchasing Class T Shares may be charged a sales load of up to 3.00% and a maximum dealer fee of 0.50% of the investment amount, for a total front-end sales load of up to 3.50%. Holders of the Shares have equal rights and privileges with each other, except with respect to front-end sales loads and certain ongoing distribution and shareholder servicing fees.

2023 Annual Report 25

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

4. CAPITAL SHARES (continued)

At December 31, 2023, 18.07% of the shares of the Fund were owned by Brookfield and its affiliates.

Share transactions in the Fund’s shares were as follows:

| | | Period Ended | |

| | | December 31, 2023 | |

| | | Shares | | | Amount | |

| Class I Shares:1 | | | | | | | | |

| Shares issued in Reorganization (Note 1) | | | 154,863,799 | | | | 1,548,637,987 | |

| Subscriptions | | | 2,845,947 | | | $ | 28,471,530 | |

| Reinvestment of distributions | | | 196,998 | | | | 1,975,890 | |

| Net increase | | | 157,906,744 | | | $ | 1,579,085,407 | |

| Class S Shares:2 | | | | | | | | |

| Subscriptions | | | 700,900 | | | $ | 7,009,000 | |

| Net increase | | | 700,900 | | | $ | 7,009,000 | |

| 1 | For the Period November 1, 2023 (Commencement of Operations) through December 31, 2023. |

| 2 | For the Period December 1, 2023 (Commencement of Operations) through December 31, 2023. |

5. REPURCHASES

The Fund intends, but is not obligated, to conduct quarterly tender offers of its outstanding Shares at the applicable NAV per share as of the applicable valuation date. Repurchases will be made at such times and on such terms as may be determined by the Board of Directors, in its sole discretion. However, no assurance can be given that repurchases will occur or that any Shares properly tendered will be repurchased by the Fund. Any repurchase of Shares from a stockholder that were held for less than one year (on a first-in, first-out basis) will be subject to an “Early Repurchase Fee” equal to 2% of the NAV (measured as of the repurchase date) of any Shares repurchased by the Fund. If an Early Repurchase Fee is charged to a stockholder, the amount of such fee will be retained by the Fund. Following the commencement of an offer to repurchase Shares, the Fund may suspend, postpone or terminate such offer in certain circumstances upon the determination of a majority of the Board, including a majority of the independent directors, that such suspension, postponement or termination is advisable for the Fund and its stockholders, including, without limitation, circumstances as a result of which it is not reasonably practicable for the Fund to dispose of its investments or to determine its net asset value, and other unusual circumstances. In the event of termination, however, the Fund may terminate an offer only upon the occurrence of conditions as specified at the outset of the offer that are objectively verifiable and outside of the control of the Fund or its agents or affiliates. Stockholders may withdraw their written tenders after the expiration of 40 business days from the commencement of the offer if the Board provides consent and the tender has not yet been accepted by the Fund for payment. Once the tender has been accepted for payment, the Fund will repurchase the Shares and remit the repurchase price to stockholders, less any applicable Early Repurchase Fee, within 5 business days after the applicable expiration date in all instances.

6. DISTRIBUTIONS

The Fund intends to distribute substantially all of its net investment income to common stockholders in the form of distributions. Under normal market conditions, the Fund intends to declare and pay distributions monthly to common stockholders of record. In addition, the Fund intends to distribute any net capital gains earned from the sale of portfolio securities to common stockholders no less frequently than annually, although net short-term capital gains may be paid more frequently. However, the Fund cannot guarantee that it will make distributions and the amount of distributions that the Fund may pay, if any, is uncertain.

26 Brookfield

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

6. DISTRIBUTIONS (continued)

The Fund intends to pay common stockholders annually all, or at least 90%, of its investment company taxable income. Various factors will affect the level of the Fund’s investment company taxable income, such as its asset mix. Distributions may be paid to the holders of the Fund’s Shares if, as and when authorized by the Board of Directors and declared by the Fund out of assets legally available therefor. To permit the Fund to pay monthly distributions, it may from time to time distribute less than the entire amount of income earned in a particular period, with the undistributed amount being available to supplement future distributions. As a result, the distributions paid by the Fund for any particular monthly period may be more or less than the amount of income actually earned during that period. Because the Fund’s income will fluctuate and the Fund’s distribution policy may be changed by the Board of Directors at any time, there can be no assurance that the Fund will pay distributions or dividends. Distributions are subject to re-characterization for federal income tax purposes after the end of the fiscal year.

A notice disclosing the source(s) of a distribution is provided after a payment is made from any source other than net investment income. This notice is available on the Adviser’s website at https://www.brookfieldoaktree.com/fund/brookfield-infrastructure-income-fund-inc. Any such notice is provided only for informational purposes in order to comply with the requirements of Section 19(a) of the 1940 Act and not for tax reporting purposes. The tax composition of the Fund’s distributions for each calendar year is reported on IRS Form 1099-DIV.

7. INVESTMENT ADVISORY & ADMINISTRATIVE AGREEMENTS AND TRANSACTIONS WITH RELATED PARTIES

The Fund and the Adviser have entered into the Advisory Agreement pursuant to which the Adviser is entitled to receive a base management fee and an incentive fee.

The base management fee (the “Management Fee”) is accrued monthly and payable quarterly in arrears at the annual rate of 1.25% of the value of the Fund’s net assets before any management and incentive fees, which is calculated as of the close of business on the last business day of each month.

The incentive fee (the “Incentive Fee”) is accrued monthly and payable annually in arrears at an amount equal to 12.5% of the Fund Income for the applicable year. The Fund looks through any total return swap contracts and counts the underlying reference assets as investments for purposes of calculating the Incentive Fee.

“Fund Income” means (1) distributions received by the Fund from the Fund’s private portfolio investments; plus (2) distributions received by the Fund of net investment income (or loss) from debt, preferred equity investments and traded securities; minus (3) the Fund’s expenses (excluding the Incentive Fee and distribution and servicing fees). The distributions received by the Fund from the Fund’s private portfolio investments, including the distributions received by the Fund of net investment income (or loss) from debt, preferred equity investments and traded securities, are treated as cash from operations (or income) received by the Fund without regard to the tax characteristics (e.g., income vs. return of capital) of the distributions received. The annual payment of the Incentive Fee will reflect all such distributions received by the Fund, except returns of invested capital that are not derived from the operations of the issuer based on a review by the Fund’s portfolio management team of the issuer’s financial statements and results from business operations.

Fund Income does not include any component of capital gains or capital appreciation. The Adviser is not entitled to any incentive fee based on the capital gains or capital appreciation of the Fund or its investments.

On December 8, 2023, the Fund established a $300 million loan facility with BII BIG Holdings L.P., an indirect wholly-owned subsidiary of BAM ULC. Each loan advanced under the facility incurs interest at a rate of 8% per annum and is repayable no later than two years following the date of advance. As of December 31, 2023, $174 million was advanced on the facility and $762,740 of interest was incurred. From December 12, 2023 (the initial draw date) to December 31, 2023, the Fund borrowed an average daily balance of $174 million at a weighted average borrowing cost of 8.00%. Subsequent to year-end, $25 million of the outstanding loan was converted to equity and the residual balance was repaid in cash, including accrued interest of $1,324,276.

2023 Annual Report 27

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

7. INVESTMENT ADVISORY & ADMINISTRATIVE AGREEMENTS AND TRANSACTIONS WITH RELATED PARTIES (continued)

On November 1, 2023, the Fund commenced operations and the Adviser waived and/or reimbursed certain expenses related to organizational costs and income taxes in the amount of $11,325,213 and $6,774,268, respectively, of which $450,000 was recouped prior to December 31, 2023. The Fund will reimburse these remaining expenses, subject to a specified expense cap and reimbursement limitations (as detailed below).

Pursuant to an Expense Limitation and Reimbursement Agreement (the “Expense Limitation and Reimbursement Agreement”), through November 30, 2024, the Adviser has contractually agreed to waive and/or reimburse expenses of the Fund so that certain of the Fund’s expenses (“Specified Expenses,” as defined below) will not exceed 0.70% of the Fund’s net assets (annualized). The Fund has agreed to repay these amounts, when and if requested by the Adviser, but only if and to the extent that Specified Expenses are less than 0.70% of net assets (annualized) (or, if a lower expense limit under the Expense Limitation and Reimbursement Agreement is then in effect, such lower limit) within three years after the date the Adviser waived or reimbursed such fees or expenses. This arrangement cannot be terminated prior to November 30, 2024 without the Board’s consent. “Specified Expenses” is defined to include all expenses incurred in the business of the Fund, including, among other things, organizational and offering costs, professional fees, and fees and expenses of the Administrator, Transfer Agent and Custodian, with the exception of (i) the Management Fee, (ii) the Incentive Fee, (iii) distribution and shareholder servicing fees, (iv) portfolio level expenses, (v) brokerage costs or other investment-related out-of-pocket expenses, including costs incurred with respect to unconsummated investments, (vi) dividend/interest payments (including any dividend payments, interest expenses, commitment fees, or other expenses related to any leverage incurred by the Fund), (vii) taxes, and (viii) extraordinary expenses (such as litigation and other expenses not incurred in the ordinary course of the Fund’s business).

The Adviser has entered into an investment sub-advisory agreement with Brookfield Public Securities Group LLC (PSG, or the “Sub-Adviser”), a Delaware limited liability company and a registered investment adviser under the Advisers Act. The Sub-Adviser is an indirect wholly-owned subsidiary of BAM ULC. In addition to the Fund, the Sub-Adviser’s clients include financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net-worth investors. The Sub-Adviser specializes in global listed real assets strategies and its investment philosophy incorporates a value-based approach towards investment. PSG also serves as the Fund’s administrator (the “Administrator”) and accounting agent pursuant to an administration agreement. The Administrator will provide, or oversee the performance of, administrative and compliance services, including, but not limited to, maintaining financial records, overseeing the calculation of NAV, compliance monitoring (including diligence and oversight of our other service providers), preparing reports to stockholders and reports filed with the SEC, preparing materials and coordinating meetings of the Board, managing the payment of expenses and the performance of administrative and professional services rendered by others and providing office space, equipment and office services. For its services under the administration agreement, PSG receives an annual fee from the Fund equal to 0.03% of the Fund's net asset value.

J.P. Morgan Chase Bank, N.A. (in such capacity, the “Sub-Administrator”) will provide certain administrative and fund accounting services pursuant to a fund services agreement with the Fund (the “Fund Services Agreement”). Pursuant to the Fund Services Agreement, and subject to the supervision of the Administrator, the Sub-Administrator will provide certain administrative services to the Fund that are not otherwise provided by the Administrator, which include, but are not limited to: assisting in securities valuation; performing portfolio accounting services; and assisting in the preparation of financial reports.

The Fund is responsible for any fees due to the Sub-Administrator.

Certain officers and/or directors of the Fund are officers and/or employees of the Administrator or the Adviser.

28 Brookfield

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

8. PURCHASES AND SALES OF INVESTMENTS

For the period ended December 31, 2023, purchases and sales of investments excluding short-term securities were $390,745,807 and $419,784, respectively during the period ended December 31, 2023. There were no transactions in U.S. Government securities during the period ended December 31, 2023. The Fund acquired investments valued at $1,595,932,382 as a result of the Reorganization which are excluded from the amounts above.

9. BORROWINGS

Credit facility: The Predecessor Fund established a line of credit with Mizuho Bank, Ltd. on April 19, 2023. This facility was transferred to the Fund as part of the Reorganization that occurred on October 31, 2023. The Fund pays interest in the amount of SOFR plus 2.65% on the amount borrowed; 0.30% on the amount unused if the aggregate outstanding amount of the loan is less than 50% of the commitment (0.25% on the amount unused if otherwise). The Fund paid commitment fees of $27,618 during the period.

As of December 31, 2023, the Fund had $97,902,000 of outstanding borrowings on the credit facility. For the period ended December 31, 2023, the Fund borrowed an average daily balance of $87,158,492 at a weighted average borrowing cost of 8.08%. Subsequent to year-end, the Fund repaid the outstanding balance in full, including accrued interest of $705,160.

For the period ended December 31, 2023, the Fund amortized $103,562 in deferred financing costs which is included in interest expense and other financing costs on the Consolidated Statement of Operations. As of December 31, 2023, the Fund had $818,136 in unamortized deferred financing costs reported on the Consolidated Statement of Assets and Liabilities. The remaining portion is being amortized over the life of the agreement which matures on April 18, 2025.

In addition, as of December 31, 2023, $74,041,228 of the credit facility was committed for letters of credit in conjunction with our investments in Canadian Wind Portfolio (Ontario Wind), U.S. Hydro (Smoky Mountain), North American Residential Infrastructure (Enercare) and U.S. Semiconductor Foundry (Intel Partnership).

Reverse Repurchase Agreements: In a reverse repurchase agreement, the Fund delivers a security to a financial institution, the counterparty, in exchange for cash with a simultaneous agreement to repurchase the same or substantially the same security at an agreed upon price and date. The Fund is entitled to receive principal and interest payments, if any, made on the security delivered to the counterparty during the term of the agreement. Cash received in exchange for securities delivered plus accrued interest payments to be made by the Fund to counterparties are reflected as a liability on the Consolidated Statement of Assets and Liabilities. Interest payments made by the Fund to counterparties are recorded as a component of interest expense on the Consolidated Statement of Operations. The Fund will segregate assets delivered as collateral under reverse repurchase agreements.

Reverse repurchase agreements involve the risk that the market value of the securities retained in lieu of sale by the Fund may decline below the price of the securities the Fund has sold but is obligated to repurchase. In the event the buyer of securities under a reverse repurchase agreement files for bankruptcy or becomes insolvent, such buyer or its trustee or receiver may receive an extension of time to determine whether to enforce the Fund’s obligation to repurchase the securities, and the Fund’s use of the proceeds of the reverse repurchase agreement may effectively be restricted pending such decision. Also, the Fund would bear the risk of loss to the extent that the proceeds of the reverse repurchase agreement are less than the value of the securities subject to such agreements.

2023 Annual Report 29

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

9. BORROWINGS (continued)

At December 31, 2023, the Fund had the following reverse repurchase agreements outstanding:

| | | | | | | | | | | | | | | Payable For | |

| | | | | | | | | | | | | | | Reverse | |

| | | Borrowing | | | Borrowing | | | Maturity | | | Amount | | | Repurchase | |

| Counterparty | | Rate | | | Date | | | Date | | | Borrowed1 | | | Agreements | |

| RBC Capital Markets | | | 5.97 | % | | | 11/08/23 | | | | 02/08/24 | | | $ | 9,917,000 | | | $ | 10,000,865 | |

| RBC Capital Markets | | | 5.97 | % | | | 11/14/23 | | | | 02/14/24 | | | | 24,922,000 | | | | 25,107,960 | |

| RBC Capital Markets | | | 5.96 | % | | | 12/14/23 | | | | 03/14/24 | | | | 31,896,000 | | | | 31,975,270 | |

| RBC Capital Markets | | | 5.96 | % | | | 12/18/23 | | | | 03/18/24 | | | | 17,802,000 | | | | 17,834,454 | |

| Total | | | | | | | | | | | | | | $ | 84,537,000 | | | $ | 84,918,549 | |

| 1 | The average daily balance of reverse repurchase agreements outstanding for the Fund during the period ended December 31, 2023 was $47,317,222 at a weighted average daily interest rate of 5.97% and the interest expense amounted to $381,549. As of December 31, 2023, the total value of the collateral was $96,521,772. |

The following is a summary of the reverse repurchase agreements by the type of collateral and the remaining contractual maturity of the agreements:

| | | Overnight | | | | | | | | | | | | | |

| | | and | | | | | | | | | Greater Than 90 | | | | |

| Counterparty | | Continuous | | | Up to 30 Days | | | 30 to 90 Days | | | Days | | | Total | |

| Corporate Credit | | $ | — | | | $ | — | | | $ | 84,918,549 | | | $ | — | | | $ | 84,918,549 | |

The Fund has elected to not offset derivative assets and liabilities or financial assets, including cash, that may be received or paid as part of collateral arrangements, even when an enforceable master netting agreement is in place that provides the Fund, in the event of counterparty default, the right to liquidate collateral and the right to offset a counterparty’s rights and obligations.

Below is the gross and net information about instruments and transactions eligible for offset in the Statement of Assets and Liabilities as well as instruments and transactions subject to an agreement similar to a master netting arrangement:

| | | | | | Gross | | Net Amounts | | | | | | | | | |

| | | | | | Amounts | | Presented | | | | | | | | | |

| | | Gross | | | Offset in the | | in the | | Non-Cash | | | | | | | |

| | | Amounts of | | | Statement | | Statement of | | Collateral | | | Collateral | | | | |

| | | Recognized | | | Assets and | | Assets and | | (Pledged) | | | Pledged | | | | |

| | | Liabilities | | | Liabilities | | Liabilities | | Received1 | | | (Received)1 | | | Net Amount | |

| Reverse Repurchase Agreement | | $ | 84,537,000 | | | $ | — | | $ | 84,537,000 | | $ | (84,537,000 | ) | | $ | — | | | $ | — | |

1 Excess of collateral pledged to the individual counterparty is not shown for financial statement purposes.

Reverse repurchase transactions are entered into by the Fund under Master Repurchase Agreements (“MRA”) which permit the Fund, under certain circumstances, including an event of default of the Fund (such as bankruptcy or insolvency), to offset payables under the MRA with collateral held with the counterparty and create one single net payment from the Fund. Upon a bankruptcy or insolvency of the MRA counterparty, the Fund is considered an unsecured creditor with respect to excess collateral and, as such, the return of excess collateral may be delayed. In the event the buyer of securities (i.e. the MRA counterparty) under a MRA files for bankruptcy or becomes insolvent, the Fund’s use of the proceeds of the agreement may be restricted while the other party, or its trustee or receiver, determines whether or not to enforce the Fund’s obligation to repurchase the securities.

30 Brookfield

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

10. FEDERAL INCOME TAX INFORMATION

The Fund intends to continue to meet the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute substantially all of its investment company taxable income and net capital gain, if any, for the taxable year to its shareholders. Therefore, no associated federal income or excise tax provision is required. The Fund may incur an excise tax to the extent it has not distributed all of its taxable income on a calendar year basis, however, no such tax has been incurred for the period ended December 31, 2023. Income taxes recognized relate to the amount of taxes payable by the Fund’s corporate subsidiaries and the deferred tax assets and liabilities of such subsidiaries.

GAAP provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. An evaluation of tax positions taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the taxing authority is required. Tax benefits of positions not deemed to meet the more-likely-than-not threshold would be booked as a tax expense in the current year and recognized as: a liability for unrecognized tax benefits; a reduction of an income tax refund receivable; a reduction of a deferred tax asset; an increase in a deferred tax liability; or a combination thereof.

The Fund has reviewed all taxable years that are open for examination (i.e., not barred by the applicable statute of limitations) by taxing authorities of all major jurisdictions, including the Internal Revenue Service. As of December 31, 2023, the open taxable year consisted of the period from November 1, 2023 (commencement of operations), to December 31, 2023. No examination of the Fund’s tax returns is currently in progress.

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

The Fund’s income tax provision consists of the following for the fiscal year ended December 31, 2023:

| | | Period Ended | |

| | | December 31, 2023 | |

| Current tax expense: | | | | |

| Federal | | $ | — | |

| State | | | — | |

| Foreign | | | 880,287 | |

| Total current tax expense | | $ | 880,287 | |

| Deferred tax expense | | | | |

| Federal | | $ | 3,806,772 | |

| State | | | 755,312 | |

| Foreign | | | 5,475,763 | |

| Total deferred tax expense | | $ | 10,037,847 | |

| Total estimated provisions for income taxes | | $ | 10,918,134 | |

The tax character of the distributions paid for the periods shown below were as follows:

| | | Period Ended | |

| | | December 31, 2023 | |

| Ordinary income | | $ | 9,370,735 | |

| Return of capital | | | 2,816,897 | |

| Total | | $ | 12,187,632 | |

2023 Annual Report 31

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

10. FEDERAL INCOME TAX INFORMATION (continued)

At December 31, 2023, the Fund’s most recently completed tax year-end, the components of distributable earnings on a tax basis were as follows:

| Undistributed ordinary income | | $ | — | |

| Undistributed long-term capital gains | | $ | — | |

| Capital loss carryforwards | | $ | — | |

| Net unrealized appreciation | | $ | 54,981,551 | |

| Other timing differences | | $ | (445,000 | ) |

Federal Income Tax Basis: The federal income tax basis of the Fund’s investments at December 31, 2023 was as follows:

| Cost of investments | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized Appreciation | |

| $ | 1,984,350,885 | | | $ | 96,253,263 | | | $ | (41,271,712 | ) | | $ | 54,981,551 | |

The Fund deferred, on a tax basis, late year ordinary losses of $28,353,791 and post-October capital losses of $21,904. The Fund had no capital loss carryforwards as at December 31, 2023.

Capital Account Reclassifications: Because federal income tax regulations differ in certain respects from GAAP, income and capital gain distributions, if any, determined in accordance with tax regulations may differ in amount, timing, and character from net investment income and realized gains recognized for financial reporting purposes. These differences are primarily due to differing treatments for Section 988 currency, partnership income/expense and nondeductible expenses. Permanent book and tax differences, if any, will result in reclassifications among the components of the Fund's net assets. These reclassifications have no effect on net assets or NAV per share. Any undistributed net income and realized gain remaining at fiscal year end is distributed in the following year.

At December 31, 2023, the Fund’s most recently completed tax year-end, the Fund’s components of net assets were increased or (decreased) by the amounts shown in the table below:

| Paid-in capital | | | Distributable earnings | |

| $ | (12,682,433 | ) | | $ | 12,682,433 | |

32 Brookfield

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

Notes to Consolidated Financial Statements (continued)

December 31, 2023

11. INVESTMENTS IN AFFILIATED ISSUERS

The table below reflects transactions during the period with entities that are affiliates as of December 31, 2023.

| | | | | | Purchases, net | | | | | | Unrealized | | | | | | Dividend and | |

| | | | | | of returns of | | | | | | Appreciation | | | | | | Distributions | |

| | | Opening Value | | | capital1 | | | Sales | | | (Depreciation) | | | End Value | | | Income2 | |

| Australian Utility (AusNet Services) | | $ | — | | | $ | 92,214,111 | | | $ | — | | | $ | 6,853,069 | | | $ | 99,067,180 | | | $ | 878,222 | |

| BII BID Aggregator A L.P. | | | — | | | | 112,978,516 | | | | — | | | | 1,750,934 | | | | 114,729,450 | | | | — | |

| BII BID Aggregator B L.P. | | | — | | | | 89,534,448 | | | | — | | | | 3,186,404 | | | | 92,720,852 | | | | — | |

| Canadian Midstream (Inter Pipeline) | | | — | | | | 164,782,277 | | | | — | | | | 9,075,313 | | | | 173,857,590 | | | | 3,174,584 | |

| Canadian Wind Portfolio (Ontario Wind) | | | — | | | | 107,792,812 | | | | — | | | | 5,806,291 | | | | 113,599,103 | | | | — | |

| Colombian Renewable Power (Isagen) | | | — | | | | 102,221,233 | | | | — | | | | (1,244,901 | ) | | | 100,976,332 | | | | 735,523 | |

| European LNG Vessels (Knutsen LNG) | | | — | | | | 37,420,208 | | | | — | | | | (175,200 | ) | | | 37,245,008 | | | | 866,361 | |

| European Telecom Towers (GD Towers) | | | — | | | | 90,091,508 | | | | — | | | | 5,552,329 | | | | 95,643,837 | | | | — | |

| Global Container Network (Triton International) | | | — | | | | 91,275,740 | | | | — | | | | 2,534,749 | | | | 93,810,489 | | | | — | |

| North American Residential Infrastructure (Enercare) | | | — | | | | 111,558,937 | | | | — | | | | 12,899,133 | | | | 124,458,070 | | | | — | |

| North American Residential Infrastructure (Homeserve) | | | — | | | | 94,949,534 | | | | — | | | | 1,534,664 | | | | 96,484,198 | | | | 1,133,204 | |

| Nuclear Services (Westinghouse) | | | — | | | | 115,000,000 | | | | — | | | | 2,835,993 | | | | 117,835,993 | | | | — | |

| Terraform Renewable Power (TERP) | | | — | | | | 195,081,059 | | | | — | | | | 2,529,216 | | | | 197,610,275 | | | | 340,000 | |

| U.K. Utility (SGN) | | | — | | | | 51,268,087 | | | | — | | | | 2,676,980 | | | | 53,945,067 | | | | 864,899 | |

| U.K. Wind & Solar Portfolio (OnPath) | | | — | | | | 18,506,334 | | | | — | | | | 173,662 | | | | 18,679,996 | | | | — | |

| U.S. Hydro (Smoky Mountain) | | | — | | | | 142,417,323 | | | | — | | | | (1,065,889 | ) | | | 141,351,434 | | | | 5,139,704 | |

| U.S. Semiconductor Foundry (Intel Partnership) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| U.S. Utility (FirstEnergy Transmission) | | | — | | | | 56,033,140 | | | | — | | | | 941,195 | | | | 56,974,335 | | | | 33,179 | |

| | | $ | — | | | $ | 1,673,125,267 | | | $ | — | | | $ | 55,863,942 | | | $ | 1,728,989,209 | | | $ | 13,165,676 | |

| 1 | Reflects the market value of investments held by the Predecessor Fund on the date of Reorganization, as applicable, adjusted for subsequent purchases and returns of capital. |

| 2 | Dividend and distributions income is shown gross of foreign withholding taxes. |

12. INDEMNIFICATIONS, COMMITMENTS AND CONTINGENCIES

Under the Fund’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for indemnification. The Fund’s maximum exposure under these arrangements is unknown, since this would involve the resolution of certain claims, as well as future claims that may be made, against the Fund. Thus, an estimate of the financial impact, if any, of these arrangements cannot be made at this time. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be unlikely.

13. SUBSEQUENT EVENTS

GAAP requires recognition in the financial statements of the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made.

Management has evaluated subsequent events in the preparation of the Fund’s financial statements and has determined that there are no additional events that require recognition or disclosure in the financial statements.

2023 Annual Report 33