UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ |

| | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

(Exact Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| | |

| ☒ | No fee required. |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

225 Liberty Street, 35th Floor

New York, New York 10281

NOTICE OF 2024 SPECIAL MEETING OF STOCKHOLDERS

May 28, 2024

To the Stockholders:

Notice is hereby given that the 2024 Special Meeting of Stockholders (the "Meeting") of Brookfield Infrastructure Income Fund Inc., a Maryland corporation (the "Fund"), will be held on Thursday, June 20, 2024, at 8:15 a.m., Eastern Time, for the following purposes:

1. To elect two (2) Directors to the Board of Directors.

2. To transact any other business that may properly come before the Meeting or any adjournment or postponement thereof.

The Board of Directors recommends that you vote "FOR" the nominees named in the proxy statement.

The Meeting will be held in a virtual meeting format only. Stockholders will not be able to attend the Meeting in person. In order to participate in and vote at the Meeting, stockholders of record as of the close of business on April 12, 2024 (the "Record Date") need to register for the Meeting.

If you are a registered holder, and wish to attend and vote at the Meeting, please send an email including your full name and address to the Fund's proxy solicitor, Equiniti Trust Company, LLC ("Equiniti") at attendameeting@equiniti.com with "Brookfield Infrastructure Income Fund Inc. virtual meeting" in the subject line. After receiving this information, Equiniti will then email you the virtual meeting access information and instructions for voting during the Meeting. If you hold common shares of stock ("Shares") beneficially through a bank or broker, you will receive information regarding how to instruct your bank or broker to cast your vote. If you wish to attend and vote at the Meeting, you must first obtain a legal proxy from your financial intermediary reflecting the Fund's name, the number of Shares you held as of the Record Date, as well as your name and address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy via email to attendameeting@equiniti.com with "Legal Proxy" in the subject line. After receiving this information, Equiniti will then email you the virtual meeting access information and instructions for voting during the Meeting.

Stockholders of record as of the close of the Record Date are entitled to notice of, and to vote at, the Meeting or any adjournment or postponement thereof. You are being asked to participate at the Meeting either virtually or by proxy. If you attend the Meeting and are a stockholder of record as of the close

of business on the Record Date, you may vote your Shares at the Meeting. Regardless of whether you plan to attend the Meeting, please complete, date, sign and return promptly in the enclosed envelope the accompanying proxy. This is important to ensure a quorum at the Meeting.

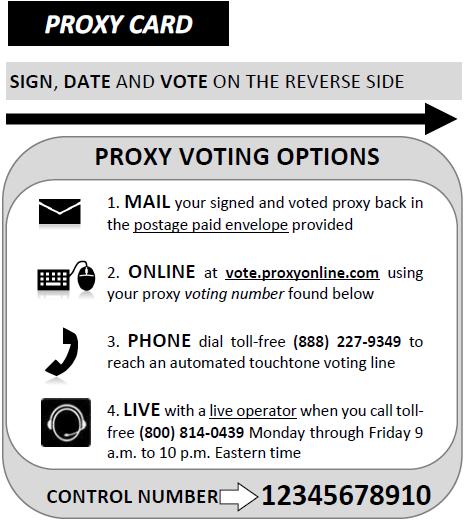

In addition to authorizing a proxy to vote by mail, you may also authorize a proxy to vote your Shares via the internet or telephone, as follows:

To vote by the internet:

(1) Read the Proxy Statement and have the enclosed proxy card at hand.

(2) Go to the website that appears on the enclosed proxy card.

(3) Enter the control number set forth on the enclosed proxy card and follow the simple instructions.

To vote by telephone:

(1) Read the Proxy Statement and have the enclosed proxy card at hand.

(2) Refer to the toll-free number that appears on the enclosed proxy card.

(3) Follow the instructions.

We encourage you to authorize a proxy to vote your Shares via the Internet using the control number that appears on your enclosed proxy card. Use of internet voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote. If you should have any questions about this Notice or the proxy materials, we encourage you to call us at (800) 814-0439.

By Order of the Board of Directors,

/s/ Craig Ruckman

Craig Ruckman

Assistant Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 20, 2024

The Fund's Notice of 2024 Special Meeting of Stockholders, Proxy Statement and Form of Proxy are available on the Internet at https://vote.proxyonline.com/brookfield/docs/bii.pdf.

WE NEED YOUR PROXY VOTE IMMEDIATELY.

YOU MAY THINK YOUR VOTE IS NOT IMPORTANT, BUT IT IS VITAL. AT THE MEETING OF STOCKHOLDERS, THE FUND WILL BE UNABLE TO CONDUCT ANY BUSINESS IF LESS THAN A MAJORITY OF THE VOTES ENTITLED TO BE CAST ARE REPRESENTED. IN THAT EVENT, THE MEETING MAY BE ADJOURNED AND THE FUND, AT THE STOCKHOLDERS' EXPENSE, WOULD CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO ACHIEVE A QUORUM. CLEARLY, YOUR VOTE COULD BE CRITICAL TO ENABLE THE FUND TO HOLD THE MEETING AS SCHEDULED, SO PLEASE RETURN YOUR PROXY CARD IMMEDIATELY. YOU AND ALL OTHER STOCKHOLDERS WILL BENEFIT FROM YOUR COOPERATION.

Instructions for Signing Proxy Cards

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts. Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts. Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration.

3. All Other Accounts. The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

Registration | | Valid Signature | |

Corporate Accounts

(1) ABC Corp.

| | ABC Corp. (by John Doe,

Treasurer) | |

| (2) ABC Corp. | | John Doe, Treasurer | |

| (3) ABC Corp. c/o John Doe, Treasurer | | John Doe | |

| (4) ABC Corp. Profit Sharing Plan | | John Doe, Director | |

Trust Accounts

| (1) ABC Trust | | Jane B. Doe, Director | |

| (2) Jane B. Doe, Director u/t/d 12/28/78 | | Jane B. Doe | |

Custodial or Estate Accounts

(1) John B. Smith, Cust.

f/b/o John B. Smith, Jr.

UGMA | | John B. Smith | |

| (2) John B. Smith | | John B. Smith, Jr., Executor | |

YOUR VOTE IS IMPORTANT. PLEASE AUTHORIZE A PROXY TO VOTE YOUR SHARES PROMPTLY, NO MATTER HOW MANY SHARES YOU OWN.

1

QUESTIONS AND ANSWERS

Why am I receiving this Proxy Statement?

Stockholders of the Fund are being asked to consider and vote on a proposal to elect two (2) Directors to the Board of Directors (the "Board" or the "Directors") of the Fund (the "Proposal"). The current Directors, a majority of whom are not "interested persons" (as defined in the Investment Company Act of 1940, as amended (the "1940 Act")), have unanimously recommended that each proposed individual be submitted to the Fund's stockholders for election at the special meeting of stockholders (the "Meeting"). The 1940 Act requires a certain percentage of the directors of the Fund to have been elected by stockholders and that such elections occur before the Board can appoint any new Director to fill vacancies or expand the Board. The Board recommends that you vote for the Proposal in order to elect two (2) Directors to the Fund's Board that were recently appointed to the Board and to facilitate future compliance with the requirements of the 1940 Act. On April 12, 2024, you owned shares of common stock ("Shares") of the Fund and, as a result, have a right to vote on the Proposal.

What proposals am I being asked to vote on?

You are being asked to vote on the Proposal to elect two (2) Directors, Mr. Brian F. Hurley and Ms. Betty A. Whelchel (the "Director Nominees" or "Nominees"), to the Board of Directors. The Proxy Statement describes the Proposal in more detail.

Why am I being asked to elect Directors?

The Fund is governed by the Board. Although the Board can ordinarily appoint new directors without a stockholder vote, the 1940 Act requires a certain percentage of the directors to have been elected by stockholders and that such elections occur before the Board can appoint any new director to fill vacancies or expand the Board. To facilitate future appointments to the Board to fill vacancies or expand the Board, the Board is recommending that stockholders of the Fund elect to the Board: (i) Mr. Hurley, who is an "interested person" (as such term is defined in the 1940 Act) of the Fund (an "Interested Director"); and (ii) Ms. Whelchel, who is not an "interested person" (as such term is defined in the 1940 Act) of the Fund (an "Independent Director"). Mr. Hurley currently serves on the Board as an "Interested Director," and Ms. Whelchel currently serves on the Board as an "Independent Director" under the 1940 Act.

When will the new Directors take office?

Mr. Hurley and Ms. Whelchel are currently serving as Directors on the Board and are expected to continue serving as Directors regardless of whether they are elected by stockholders at the Meeting.

2

What role does the Board play?

The Directors serve as your representatives. They are fiduciaries and have an obligation to serve the best interests of stockholders. The Directors review the Fund's performance, oversee the Fund and the Fund's activities, and review contractual arrangements with companies that provide services to the Fund.

Do Directors receive compensation for their services?

Each Independent Director receives compensation for his or her service on the Board. The Interested Directors do not receive compensation for their service on the Board. The Proxy Statement provides details about each Nominee and compensation to be paid to the Independent Directors.

Who is paying for my stockholder meeting and Proxy Statement?

The Fund will bear the costs, fees and expenses incurred in connection with the Proxy Statement. Brookfield Asset Management Private Institutional Capital Adviser (Canada), L.P. (the "Adviser" or "BAM PIC"), the investment adviser to the Fund has contractually agreed to limit certain expenses of the Fund as part of operating expense limitation agreements and to the extent that such an agreement applies to the Fund, the Adviser will indirectly pay the proxy costs incurred by the Fund.

Who is eligible to vote?

Any person who owned shares of the Fund on the "Record Date," which was April 12, 2024.

What is the required vote?

If a quorum is present, a plurality of all the votes cast shall be sufficient to approve the Proposal. A "plurality of votes cast" means that those Nominees receiving the two highest numbers of affirmative votes cast, whether or not such votes constitute a majority, will be elected at the Meeting. For purposes of electing Directors, not voting or withholding your vote by voting "abstain" (or a direction to your broker, bank or other nominee to withhold your vote, called a "broker non-vote") is not counted as a vote cast, and therefore will have no effect on the outcome of the election of Directors.

I have only a few shares – does my vote matter?

Your vote is important. If many stockholders choose not to vote, the Fund might not receive enough votes to reach a quorum to hold the Meeting. If it appears that there will not be a quorum, the Fund would have to send additional mailings or otherwise solicit stockholders to try to obtain more votes.

How does the Board suggest I vote in connection with the Proposal?

The current members of the Board, including all of the Independent Directors, recommend that you vote in favor of the Proposal.

3

How do I vote my Shares?

You can vote in any of the following ways:

Internet: Have your proxy card available. Vote on the internet by accessing the website address on your proxy card. Enter your control number from your proxy card. Follow the instructions found on the website;

Telephone: Have your proxy card available. You may vote by telephone by calling the number on your proxy card. Enter the control number on the proxy card and follow the instructions provided (A confirmation of your telephone vote will be mailed to you.);

Mail: Vote, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope.

When and where will the Meeting be held?

The Meeting will be held on June 20, 2024, at 8:15 a.m. Eastern Time. The Meeting will be held in a virtual meeting format only. Stockholders will not be able to attend the Meeting in person. If you owned shares as of the Record Date and wish to participate in the Meeting, you must email Equiniti Trust Company, LLC ("Equiniti") at attendameeting@equiniti.com, in order to register to attend the Meeting, obtain the credentials to access the Meeting, and verify that you were a stockholder on the Record Date. If you are a record owner of shares, please have your 15-digit control number on your proxy card available when you call or include it in your email. You may vote during the Meeting by following the instructions that will be available on the Meeting website during the Meeting.

If you hold your shares through an intermediary, such as a bank or broker, as of the Record Date, you must provide a legal proxy from that institution in order to vote your shares at the Meeting. You may forward an email from your intermediary or attach an image of your legal proxy and transmit it via email to Equiniti at attendameeting@equiniti.com and you should label the email "Legal Proxy" in the subject line. If you hold your shares through an intermediary as of the Record Date and wish to attend, but not vote at, the Meeting, you must verify to Equiniti that you owned shares as of the Record Date through an account statement or some other similar means.

Requests for registration must be received by Equiniti no later than 5:00 p.m., Eastern Time, on June 19, 2024. You will then receive a confirmation email from Equiniti of your registration and a control number that will allow you to vote at the Meeting.

Whom should I call for more information about the Proxy Statement?

For more information regarding the Proxy Statement for the Meeting, please call (800) 814-0439.

4

BROOKFIELD INFRASTRUCTURE INCOME FUND INC.

225 Liberty Street, 35th Floor

New York, New York 10281-1023

PROXY STATEMENT

This Proxy Statement is furnished to the holders of common shares of stock, par value of $0.001 per share ("Shares"), of Brookfield Infrastructure Income Fund Inc., a Maryland corporation (the "Fund"), of proxies to be exercised at the 2024 Special Meeting of Stockholders (the "Meeting") of the Fund to be held on Thursday, June 20, 2024 at 8:15 a.m., Eastern Time (and at any adjournment or postponements thereof) for the purposes set forth in the accompanying Notice of Special Meeting of Stockholders. This Proxy Statement and the accompanying form of proxy are first being sent to stockholders on or about May 28, 2024.

The Meeting has been called for the following purposes:

1. To elect two (2) Directors to the Board of Directors.

2. To transact any other business that may properly come before the Meeting or any adjournment or postponement thereof.

The Meeting will be held solely on the internet by virtual means. You will not be able to attend the Meeting in person.

The persons named as proxy holders on the proxy card will vote in accordance with your instructions and, unless specified to the contrary, will vote "FOR" the election of the Director Nominees. The close of business on April 12, 2024, has been fixed as the record date (the "Record Date") for the determination of stockholders entitled to receive notice of, and to vote at, the Meeting. Each outstanding full share of common stock of the Fund is entitled to one vote for as many individuals as there are directors to be elected at the Meeting, and one vote for each other matter properly presented at the Meeting. Votes may not be cumulated. At the close of business on the Record Date, the Fund had 200,803,489.914 Shares.

Under the Amended and Restated Bylaws of the Fund, the presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast constitutes a quorum. In the event that a quorum is not present at the Meeting or otherwise, the chairperson of the Meeting has the power to adjourn the Meeting from time to time, to a date not more than 120 days after the Record Date without notice other than announcement at the Meeting.

For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and broker "non-votes" (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other persons entitled to vote Shares

5

on a particular matter with respect to which the brokers or nominees do not have discretionary power), if any, will be treated as Shares that are present for quorum purposes but not "entitled to vote." Abstentions will have the same effect as votes against the proposal to elect two (2) Directors to the Board of Directors (the "Board" or the "Directors") of the Fund (the "Proposal"). Broker "non-votes" will have no effect on the outcome of the vote on the Proposal. Since banks and brokers will have discretionary authority to vote Shares in the absence of voting instructions from stockholders with respect to the Proposal, we expect that there will be no broker "non-votes."

Stockholders who execute proxies retain the right to revoke them by: (a) written notice received by the Secretary of the Fund at any time before that proxy is exercised; (b) signing a proxy bearing a later date or; (c) attending the Meeting and voting in person (attendance at the Meeting will not, by itself, revoke a properly executed proxy). If you hold your Shares in "street name" (that is, through a broker or other nominee), you should instruct your broker or nominee how to vote your Shares by following the voting instructions provided by your broker or nominee.

In order to participate in and vote your Shares at the Meeting, stockholders as of the Record Date need to register for the Meeting.

If you are a registered holder, and wish to attend and vote at the Meeting, you must:

• Send an email including your full name and address to the Fund's proxy solicitor, Equiniti Trust Company, LLC ("Equiniti"), at attendameeting@equiniti.com with "Brookfield Infrastructure Income Fund Inc. virtual meeting" in the subject line. After receiving this information, Equiniti will then email you the virtual meeting access information and instructions for voting during the Meeting. You will need the control number found on your proxy card as part of the registration process.

If your Shares are registered in the name of your broker, bank, or other agent, you are the "beneficial owner" of those Shares and those Shares are considered as held in "street name." If you hold your Shares in "street name" and wish to attend and vote at the Meeting, you must:

• Obtain a legal proxy from your broker, bank or other nominee reflecting the Fund's name, the number of Shares you held as of the Record Date, as well as your name and address. You may forward an email from your intermediary containing the legal proxy or attach an image of the legal proxy via email to Equiniti at attendameeting@equiniti.com with "Legal Proxy" in the subject line. After receiving this information, Equiniti will then email you the virtual meeting access information and instructions for voting during the Meeting.

6

You will receive a confirmation of your registration by email after Equiniti receives your registration materials. If you wish to vote your Shares electronically at the Meeting, please follow the instructions provided by Equiniti in its confirmation email. On the day of the Meeting, we encourage you to access the Meeting prior to start time leaving ample time to check in.

Stockholders may request copies of the Fund's most recent annual report, including the financial statements, without charge, by writing to Investor Relations, Brookfield Infrastructure Income Fund Inc., 225 Liberty Street, 35th Floor, New York, New York 10281. These reports also are available on the Fund's website at https://www.brookfieldoaktree.com/. These documents have been filed with the Securities and Exchange Commission and are available at www.sec.gov.

PROPOSAL: ELECTION OF DIRECTORS

Stockholders of the Fund are being asked to consider and vote on a proposal to elect two (2) Directors to the Board of Directors (the "Board" or the "Directors") of the Fund (the "Proposal"). The proposed individuals standing for election at the Meeting, Mr. Brian F. Hurley and Ms. Betty Whelchel (the "Director Nominees" or "Nominees"), currently serve as Directors of the Fund.

At a meeting of the Board of Directors held on February 21-22, 2024 (the "February Board Meeting"), Mr. David W. Levi resigned as a Director of the Fund, effective March 29, 2024. Mr. Levi served as a Director of the Fund since its inception in 2023, and was an "interested person" (as such term is defined in the Investment Company Act of 1940, as amended (the "1940 Act")) of the Fund (an "Interested Director"). At the February Board Meeting, the Board considered and approved the appointment of Mr. Brian F. Hurley to serve as an Interested Director of the Fund, effective March 29, 2024, filling the vacancy created by Mr. Levi's resignation. Mr. Hurley has served as Secretary of the Fund since its inception in 2023. In addition, the Board previously approved the appointment of Ms. Betty A. Whelchel, who is not considered an "interested person" (as such term is defined in the 1940 Act) of the Fund (an "Independent Director"), to serve as an Independent Director of the Fund, effective January 1, 2024. Since her appointment, Ms. Whelchel has served as an Independent Director of the Fund, and a member of the Audit and Nominating and Compensation Committees.

The Director Nominees have consented to stand for election and to continue to serve if elected. If elected, the Director Nominees will each hold office until his or her resignation, retirement, death or removal or until his or her respective successor is duly elected and qualified.

* * *

7

As described above, there are two (2) Director Nominees for election to the Board at this time. The affirmative vote of a plurality of all the votes cast at the Meeting, if a quorum is present, is sufficient to elect a director.

The Board of Directors recommends that the stockholders vote "FOR" the election of each Director Nominee in the Proposal.

Information Concerning Nominees and Directors

The following table provides information concerning each of the Directors and the Director Nominees of the Board as of the date of this Proxy Statement. The Nominee for Interested Director is listed under "Interested Director Nominee." The Nominee for Independent Director is listed under "Independent Director Nominee." The Fund has a retirement policy, which sets a mandatory retirement age of 78 for the Directors. However, two additional one-year extensions up to the age of 80 may be implemented on an annual basis pending the unanimous vote by the other Directors.

Name, Address(*)

and Year of Birth | | Position(s)

Held with Fund,

Length of

Time Served and

Term of Office(1) | | Principal Occupation(s)

During Past 5 Years and

Other Directorships

Held by Director | | Number of

Portfolios in

Fund Complex

Overseen

by Director(**) | |

Interested Director Nominee | |

Brian F. Hurley(***)

Born: 1977 | | Secretary since 2023 and Director since March 29, 2024(2) | | President of several investment companies advised or administered by the Adviser (2014-Present); General Counsel of the Adviser (2017-Present); General Counsel of Brookfield Oaktree Wealth Solutions (2021-Present); Managing Partner of Brookfield Asset Management Inc. (2016-Present). | | 8 | |

8

Name, Address(*)

and Year of Birth | | Position(s)

Held with Fund,

Length of

Time Served and

Term of Office(1) | | Principal Occupation(s)

During Past 5 Years and

Other Directorships

Held by Director | | Number of

Portfolios in

Fund Complex

Overseen

by Director(**) | |

Independent Director Nominee | |

Betty A. Whelchel

Born: 1956 | | Director, Member of the Audit Committee, Member of the Nominating and Compensation Committee

Served since January 1, 2024(3) | | Director/Trustee of several investment companies advised by PSG (2024-Present). US Head of Public Policy: Regulatory Affairs of BNP Paribas (2016-2019). | | 8 | |

(*) Address: Brookfield Place, 225 Liberty Street, 35th Floor, New York, New York 10281, unless otherwise noted.

(**) The Fund Complex is comprised of the Fund, Brookfield Investment Funds (5 series of underlying portfolios), Brookfield Real Assets Income Fund Inc. and Oaktree Diversified Income Fund Inc.

(***) Directors who are considered to be "interested persons" of the Fund as defined in the Investment Company Act of 1940, as amended (the "1940 Act"), are considered to be "Interested Directors."

(1) Each Director will hold office for an indefinite term until the earliest of (i) the next meeting of stockholders if any, called for the purpose of considering the election or re-election of such Director and until the election and qualification of his or her successor, if any, elected at such meeting, or (ii) the date a Director resigns or retires, or a Director is removed by the Board or stockholders, in accordance with the Fund's Charter and Bylaws. Each officer will hold office for an indefinite term or until the date he resigns or retires or until his successor is elected and qualified.

(2) Mr. Brian F. Hurley was appointed as an interested director/trustee of the Fund Complex effective March 29, 2024.

(3) Ms. Betty Whelchel was appointed as an independent director/trustee of the Fund Complex effective January 1, 2024.

9

Officers of the Fund

The officers of the Fund are elected by the Board either at its annual meeting, or at any subsequent regular or special meeting of the Board. The Board of the Fund has appointed five officers, each to hold office at the discretion of the Board until his successor is elected and qualifies or until his resignation or removal. Except where dates of service are noted, all officers listed below served the Fund as such throughout the fiscal year ended December 31, 2023. The following table sets forth information concerning each officer of the Fund as of the date of this Proxy Statement:

Name, Address(*)

and Year of Birth | | Position(s)

Held with

Fund | | Length of

Time Served(1) | | Principal Occupation(s)

During Past 5 Years | |

Brian F. Hurley(**)

Born: 1977 | | Secretary and Director | | Secretary since 2023; Director since March 29, 2024(2) | | President of several investment companies advised or administered by the Adviser (2014-Present); General Counsel of the Adviser (2017-Present); General Counsel of Brookfield Oaktree Wealth Solutions (2021-Present); Managing Partner of Brookfield Asset Management Inc. (2016-Present). | |

Chloe Berry

Born: 1984 | | President | | Since 2023 | | Managing Director of Brookfield Asset Management Private Institutional Capital Adviser (Canada), L.P. (the "Adviser" or "BAM PIC") (2022-Present); Senior Vice President of the Adviser (2017-2022). | |

Casey Tushaus

Born: 1982 | | Treasurer | | Since 2023 | | Treasurer of several investment companies advised by PSG (2021-Present); Assistant Treasurer of several investment companies advised by PSG (2016-2021); Director of PSG (2021-Present); Vice President of PSG (2014-2021). | |

10

Name, Address(*)

and Year of Birth | | Position(s)

Held with

Fund | | Length of

Time Served(1) | | Principal Occupation(s)

During Past 5 Years | |

Craig Ruckman

Born: 1977 | | Assistant Secretary | | Since 2023 | | Secretary of several investment companies advised by PSG (2022-Present); Managing Director of PSG (October 2022-Present); Director of Allianz Global Investors U.S. Holdings LLC (2016-2022); Assistant Secretary of 63 funds in the Allianz Global Investors Fund Complex (2017-2020); and Chief Legal Officer of Allianz Global Investors Distributors LLC (2019-2022). | |

Adam R. Sachs

Born: 1984 | | Chief Compliance Officer ("CCO") | | Since 2023 | | CCO of several investment companies advised by PSG (2017-Present); Director of PSG (2017-Present); CCO of Brookfield Investment Management (Canada) Inc. (2017-2023). | |

Mohamed Rasul

Born: 1981 | | Assistant Treasurer | | Since 2023 | | Assistant Treasurer of several investment companies advised by PSG (2016-Present); Vice President of PSG (2019-Present); Assistant Vice President of PSG (2014-2019). | |

(*) Address: Brookfield Place, 225 Liberty Street, 35th Floor, New York, New York 10281, unless otherwise noted.

(**) Directors who are considered to be "interested persons" of the Fund as defined in the Investment Company Act of 1940, as amended, (the "1940 Act"), are considered to be "Interested Directors."

(1) Mr. Hurley will hold office as Director for an indefinite term until the earliest of: (i) the next meeting of stockholders, if any, called for the purpose of considering the election or re-election of Mr. Hurley and until the election and qualification of his successor, if any, elected at such meeting; or (ii) the date Mr. Hurley resigns or retires, or is removed by the Board or stockholders, in accordance with the Fund's Charter and Bylaws. Each officer will hold office for an indefinite term or until the date he resigns or retires until his successor is elected and qualified.

(2) Mr. Brian F. Hurley was appointed as an interested director/trustee of the Fund Complex effective March 29, 2024.

11

Share Ownership

As of the Record Date, the Director Nominees, Directors, and officers of the Fund beneficially owned individually and collectively as a group less than 1% of the outstanding shares of the Fund.

The following table sets forth the aggregate dollar range of equity securities owned by each Director of the Fund and of all funds overseen by each Director in the Adviser's family of investment companies, the Fund Complex, as of December 31, 2023. As of the date of this Proxy Statement, the Fund Complex is comprised of the Fund, Brookfield Real Assets Income Fund Inc., Oaktree Diversified Income Fund Inc., and Brookfield Investment Funds and its five series of underlying portfolios: Brookfield Global Listed Real Estate Fund, Brookfield Global Listed Infrastructure Fund, Brookfield Global Renewables & Sustainable Infrastructure Fund, Center Coast Brookfield Midstream Focus Fund, and Oaktree Emerging Markets Equity Fund. The cost of each Director's investment in the Fund Complex may vary from the current dollar range of equity securities shown below, which is calculated on a market value basis as of December 31, 2023. The information as to beneficial ownership is based on statements furnished to the Fund by each Director.

Name of

Nominees/Directors | | Dollar Range of

Equity Securities

Held in the Fund(1) | | Aggregate

Dollar Range of

Equity Securities

Held in the Family

of Investment

Companies*(1)(2) | |

Interested Director Nominee | | | | | |

Brian F. Hurley(3) | | A | | C | |

Independent Director Nominee | | | | | |

Betty A. Whelchel(4) | | A | | A | |

Independent Directors | | | | | |

Edward A. Kuczmarski | | A | | D | |

Stuart A. McFarland | | A | | E | |

Heather S. Goldman | | A | | D | |

William H. Wright II | | A | | A | |

* Key to Dollar Ranges:

A. None

B. $1 – $10,000

C. $10,001 – $50,000

D. $50,001 – $100,000

E. Over $100,000

(1) "Beneficial Ownership" is determined in accordance with Rule 16a-1(a)(2) of the Securities Exchange Act of 1934, as amended (the "Exchange Act").

12

(2) The aggregate dollar range of equity securities owned by each Director of all funds overseen by each Director in the Adviser's family of investment companies (the "Fund Complex") as of December 31, 2023.

(3) Mr. Brian F. Hurley was appointed as an interested director/trustee of the Fund Complex effective March 29, 2024.

(4) Ms. Betty A. Whelchel was appointed as an independent director/trustee of the Fund Complex effective January 1, 2024.

Information Regarding the Board and its Committees

The Role of the Board

The business and affairs of the Fund are managed under the direction of the Board. The Board provides oversight of the management and operations of the Fund. As is the case with virtually all investment companies (as distinguished from operating companies), the day-to-day management and operation of the Fund is the responsibility of various service providers to the Fund, such as the Fund's investment adviser and administrator, custodian, and transfer agent, each of whom are discussed in greater detail in the Fund's Statement of Additional Information (the "SAI"). The Board approves all significant agreements between the Fund and its service providers. The Board has appointed senior employees of the Administrator (as defined below) as officers of the Fund, with responsibility to monitor and report to the Board on the Fund's day-to-day operations. In conducting this oversight, the Board receives regular reports from these officers and service providers regarding the Fund's operations. The Board has appointed a Chief Compliance Officer who administers the Fund's compliance program and regularly reports to the Board as to compliance matters. Some of these reports are provided as part of formal "Board meetings" which are typically held quarterly, in person, and involve the Board's review of recent Fund operations. From time to time, one or more members of the Board may also meet with management in less formal settings, between scheduled "Board meetings," to discuss various topics. In all cases, however, the role of the Board and of any individual Director is one of oversight and not of management of the day-to-day affairs of the Fund and its oversight role does not make the Board a guarantor of the Fund's investments, operations, or activities.

Board Leadership Structure

The Board has structured itself in a manner that it believes allows it to perform its oversight function effectively. It has established three standing committees, an Audit Committee (the "Audit Committee"), a Nominating and Compensation Committee (the "Nominating and Compensation Committee"), and a Qualified Legal Compliance Committee (the "QLCC") (collectively, the "Committees" and each defined below), which are discussed in greater detail below. Currently, five of the six members of the Board, including the Chair of the Board, are Independent Directors, which are Directors that are not affiliated with the Adviser, Administrator, or their affiliates, and each of the Audit

13

Committee, Nominating and Compensation Committee, and QLCC are comprised entirely of Independent Directors. Each of the Independent Directors helps identify matters for consideration by the Board and the Chair has an active role in the agenda-setting process for Board meetings. The Audit Committee Chair also has an active role in the agenda-setting process for the Audit Committee meetings.

The Board has adopted Fund Governance Policies and Procedures to ensure that the Board is properly constituted in accordance with the 1940 Act and to set forth examples of certain of the significant matters for consideration by the Board and/or its Committees in order to facilitate the Board's oversight function.

The Board has determined that its leadership structure is appropriate. In addition, the Board also has determined that the structure, function, and composition of the Committees are appropriate means to provide effective oversight on behalf of Fund stockholders. The Independent Directors have engaged their own independent counsel to advise them on matters relating to their responsibilities to the Fund.

Board Oversight of Risk Management

As part of its oversight function, the Board receives and reviews various risk management reports and assessments and discusses these matters with appropriate management and other personnel. Because risk management is a broad concept comprised of many elements, Board oversight of different types of risks is handled in different ways. For example, the full Board receives and reviews reports from senior personnel of the Adviser and Administrator (including senior compliance, financial reporting, and investment personnel) or their affiliates regarding various types of risks, including, but not limited to, operational, compliance, investment, and business continuity risks, and how they are being managed. From time to time, the full Board meets with the Fund's Chief Compliance Officer to discuss compliance risks relating to the Fund, the Adviser, and the Fund's other service providers. The Audit Committee supports the Board's oversight of risk management in a variety of ways, including meeting regularly with the Fund's Treasurer and with the Fund's independent registered public accounting firm and, when appropriate, with other personnel employed by the Adviser to discuss, among other things, the internal control structure of the Fund's financial reporting function and compliance with the requirements of the Sarbanes-Oxley Act of 2002. The Audit Committee also meets regularly with the Fund's Chief Compliance Officer to discuss compliance and operational risks and receives reports from the Adviser's internal audit group as to these and other matters.

14

Information about Each Director's Qualification, Experience, Attributes or Skills

The Board believes that each of the Directors has the qualifications, experience, attributes, and skills ("Director Attributes") appropriate to serve as a Director of the Fund in light of the Fund's business and structure. Certain of these business and professional experiences are set forth in detail in the table above. The Directors have substantial board experience or other professional experience and have demonstrated a commitment to discharging their oversight responsibilities as Directors. The Board, with the assistance of the Nominating and Compensation Committee, annually conducts a "self-assessment" wherein the performance and effectiveness of the Board and the Committees are reviewed.

In addition to the information provided in the table above, below is certain additional information regarding each particular Director and certain of their Director Attributes. The information provided below, and in the table above, is not all-inclusive. Many Director Attributes involve intangible elements, such as intelligence, integrity and work ethic, the ability to work together, the ability to communicate effectively, the ability to exercise judgment, the ability to ask incisive questions, and commitment to stockholder interests. In conducting its self-assessment, the Board has determined that the Directors have the appropriate attributes and experience to serve effectively as Directors of the Fund.

• Heather S. Goldman – In addition to her tenure as a Director of the Fund, Ms. Goldman has extensive experience in executive leadership, business development and marketing of investment vehicles similar to those managed by PSG. Ms. Goldman is a capital markets financial services and tech executive, who over a twenty-plus year career has worked in a senior capacity across a diverse array of firms in the private equity, investment management and commercial banking industries. She previously served as head of global marketing for PSG, and as such has extensive knowledge of PSG, its operations, and personnel. She also has experience working in other roles for the parent company of PSG. Prior to working with PSG, and for nearly five years, she acted as CEO and Chair, co-founding and managing Capital Thinking, a financial services risk-management technology company in New York. Ms. Goldman is a member of the Audit Committee and is Chair of the Nominating and Compensation Committee.

• Brian F. Hurley – Mr. Hurley has 22 years of industry experience and is General Counsel for PSG as well as a Managing Partner of Brookfield Asset Management. In this role he oversees the legal and regulatory functions and is also actively involved in PSG's investment

15

funds business, including product and business development. Prior to joining the firm in 2010, Mr. Hurley was an attorney at Paul Hastings LLP and a member of the Investment Management Practice Group, where he focused his practice on representing investment advisers and various forms of investment companies. Mr. Hurley earned a Juris Doctor degree from Columbia University and a Bachelor of Arts degree from the College of the Holy Cross.

• Edward A. Kuczmarski – In addition to his tenure as a Director of the Fund, Mr. Kuczmarski has financial accounting experience as a Certified Public Accountant. He also has served on the board of directors/trustees for several other investment management companies. In serving on these boards, Mr. Kuczmarski has come to understand and appreciate the role of a director and has been exposed to many of the challenges facing a board and the appropriate ways of dealing with those challenges. Mr. Kuczmarski serves as Chair of the Board of Directors, and is a member of the Nominating and Compensation Committee and the Audit Committee.

• Stuart A. McFarland – In addition to his tenure as a Director of the Fund, Mr. McFarland has extensive experience in executive leadership, business development and operations, corporate restructuring, and corporate finance. He previously served in senior executive management roles in the private sector, including serving as the Executive Vice President and Chief Financial Officer of Fannie Mae and as the Executive Vice President and General Manager of GE Capital Mortgage Services, Corp. Mr. McFarland currently serves on the board of directors/trustees for various other investment management companies and non-profit entities, and was the Managing Partner of Federal City Capital Advisors. Mr. McFarland is a member of the Audit Committee and the Nominating and Compensation Committee.

• William H. Wright II – In addition to his tenure as a Director of the Fund, Mr. Wright has extensive experience in executive leadership, investment banking and corporate finance. He previously served as a Managing Director of Morgan Stanley until his retirement in 2010, having joined the firm in 1982. During his career in investment banking at Morgan Stanley, Mr. Wright headed the corporate finance execution group, where he was responsible for leading and coordinating teams in the execution of complex equity offerings for multinational corporations. Following his career in investment banking, Mr. Wright served on the board of directors/trustees for various other investment management companies and non-profit entities. Mr. Wright serves as Chair of the Audit Committee and is a member of the Nominating and Compensation Committee.

16

• Betty Whelchel – Ms. Whelchel has extensive experience in financial services law and regulation, international finance and public policy. She has held a number of senior management positions at international financial institutions, including serving as U.S. Head of Public Policy and Regulatory Affairs and U.S. General Counsel for BNP Paribas, Global General Counsel for Deutsche Asset Management and U.S. Deputy General Counsel for Deutsche Bank AG. She started her career in the General Counsel's office of the U.S. Treasury Department, and worked as a lawyer with Shearman & Sterling in its New York and Tokyo offices, specializing in bank finance, mergers and acquisitions and joint ventures. Throughout her forty-two year career, Ms. Whelchel has been active in industry initiatives related to financial regulation and corporate governance, including the Committee on Capital Markets Regulation, the Executive Committee of the Institute of International Bankers Board of Trustees, and the Association of the Bar of the City of New York's Special Task Force on the Lawyer's Role in Corporate Governance. She has received numerous awards, including 2015 Legal 500 Individual of the Year in Financial Services and the 2013 Burton "Legend in the Law" Award. Ms. Whelchel is a member of the Audit Committee and the Nominating and Compensation Committee.

Nominating and Compensation Committee Considerations for Independent Directors

The Nominating and Compensation Committee evaluates candidates' qualifications for Board membership. When evaluating candidates, the Nominating and Compensation Committee considers a number of attributes including leadership, independence, interpersonal skills, financial acumen, integrity and professional ethics, educational and professional background, prior director or executive experience, industry knowledge, business judgment and specific experiences or expertise that would complement or benefit the Board as a whole. The Nominating and Compensation Committee also may consider other factors/attributes as it may determine appropriate in its own judgment. The Nominating and Compensation Committee believes that the significance of each nominee's background, experience, qualifications, attributes, or skills must be considered in the context of the Board as a whole. As a result, the Nominating and Compensation Committee has not established a litmus test or quota relating to these matters that must be satisfied before an individual may serve as a Director. The Nominating and Compensation Committee believes that board effectiveness is best evaluated at a group level, through the annual self-assessment process. Through this process, the Nominating and Compensation Committee considers whether the Board as a whole has an appropriate level of sophistication, skill, and business acumen

17

and the appropriate range of experience and background. The diversity of a candidate's background or experiences, when considered in comparison to the background and experiences of other members of the Board, may or may not impact the Nominating and Compensation Committee's view as to the candidate. In evaluating these matters, the Nominating and Compensation Committee typically considers the following minimum criteria:

• With respect to nominations for Independent Directors, nominees shall be independent of the Adviser and other principal service providers. The Nominating and Compensation Committee of the Fund shall also consider the effect of any relationship beyond those delineated in the 1940 Act that might impair independence, such as business, financial or family relationships with the investment adviser or its affiliates.

• Independent Director nominees must qualify for service on the Fund's Audit Committee under the rules of the New York Stock Exchange (including financial literacy requirements) or of another applicable securities exchange.

• With respect to all Directors, a proposed nominee must qualify under all applicable laws and regulations.

• The Nominating and Compensation Committee of the Fund also may consider such other factors as it may determine to be relevant.

Board Meetings

During the Fund's fiscal year ended December 31, 2023, the Board held four regular meetings, and each Director attended at least 75% of the meetings of the Fund's Board of Directors and of the Committees on which he or she served. The Chair of the Board of Directors, who is elected by the Independent Directors, will preside at each executive session of the Board, or if one has not been designated, the Chair of the Nominating and Compensation Committee shall serve as such.

Audit Committee

The Fund has a standing Audit Committee that was established in accordance with Section 3(a)(58)(A) of the Exchange Act, which currently consists of Messrs. Wright, Kuczmarski, and McFarland, and Mses. Goldman and Whelchel, all of whom are Independent Directors. The principal functions of the Audit Committee are to review the Fund's audited financial statements, to select the Fund's independent auditors, to review with the Fund's auditors the scope and anticipated costs of their audit and to receive and consider a report from the auditors concerning their conduct of the audit, including any comments or recommendations they might want to make in connection therewith. During the Fund's fiscal year ended December 31, 2023, the Audit

18

Committee held two Committee meetings. Mr. Wright serves as Chair of the Audit Committee, and the Board has determined that Messrs. Wright, McFarland and Kuczmarski and Ms. Goldman each qualify and are designated as an "audit committee financial expert," as defined in Item 401(h) of Regulation S-K promulgated by the Securities and Exchange Commission.

The Fund's Board of Directors has adopted a written charter for its Audit Committee, which is available on the Fund's website at https://www.brookfieldoaktree.com/fund/brookfield-infrastructure-income-fund-inc. A copy of the Fund's Audit Committee Charter is also available free of charge, upon request directed to Investor Relations, Brookfield Infrastructure Income Fund Inc., 225 Liberty Street, 35th Floor, New York, New York 10281.

Nominating and Compensation Committee

The Fund has a Nominating and Compensation Committee, which currently consists of Mses. Goldman and Whelchel and Messrs. Kuczmarski, McFarland and Wright, all of whom are Independent Directors and independent as independence is defined in New York Stock Exchange, Inc.'s listing standards. The Nominating and Compensation Committee of the Fund met one time during the Fund's fiscal year ended December 31, 2023. Ms. Goldman serves as Chair of the Nominating and Compensation Committee. The function of the Fund's Nominating and Compensation Committee is to recommend candidates for election to its Board as Independent Directors. The Fund's Nominating and Compensation Committee evaluates each candidate's qualifications for Board membership and their independence from the Adviser and other principal service providers.

The Nominating and Compensation Committee will consider nominees recommended by stockholders who, separately or as a group, own at least one percent of the Fund's shares. For a list of the minimum criteria used by the Nominating and Compensation to assess a candidate's qualifications, please see "Nominating and Compensation Committee Considerations for Independent Directors" above.

When identifying and evaluating prospective nominees, the Nominating and Compensation Committee reviews all recommendations in the same manner, including those received by stockholders. The Nominating and Compensation Committee first determines if the prospective nominee(s) meets the minimum qualifications set forth above. Those proposed nominees meeting the minimum qualifications as set forth above are then to be considered by the Nominating and Compensation Committee with respect to any other qualifications deemed to be important. Those proposed nominees meeting the minimum and other qualifications and determined by the Nominating and Compensation Committee as suitable are nominated for election by the Committee.

19

Stockholder recommendations should be addressed to the Nominating and Compensation Committee in care of the Secretary of the Fund and sent to 225 Liberty Street, 35th Floor, New York, New York 10281. Stockholder recommendations should include biographical information, including business experience for the past nine years and a description of the qualifications of the proposed nominee, along with a statement from the nominee that he or she is willing to serve and meets the requirements to be an Independent Director, if applicable. The Fund's Nominating and Compensation Committee also determines the compensation paid to the Independent Directors. The Board has adopted a written charter for its Nominating and Compensation Committee, which is available on the Fund's website at https://www.brookfieldoaktree.com/fund/brookfield-infrastructure-income-fund-inc. A copy of the Fund's Nominating and Compensation Committee Charter is also available free of charge, upon request directed to Investor Relations, Brookfield Infrastructure Income Fund Inc., 225 Liberty Street, 35th Floor, New York, New York 10281.

The Fund's Nominating and Compensation Committee has recommended Ms. Whelchel as a Nominee for election as an Independent Director. The Fund's Board of Directors has approved and appointed Mr. Hurley and Ms. Whelchel to serve as Interested Director and Independent Director, respectively.

Qualified Legal Compliance Committee

The Fund has a standing Qualified Legal Compliance Committee ("QLCC"). The QLCC was formed for the purpose of compliance with Rules 205.2(k) and 205.3(c) of the Code of Federal Regulations, regarding alternative reporting procedures for attorneys retained or employed by an issuer who appear and practice before the Securities and Exchange Commission on behalf of the issuer (the "issuer attorneys"). An issuer attorney who becomes aware of evidence of a material violation by the Fund, or by any officer, Director, employee, or agent of the Fund, may report evidence of such material violation to the QLCC as an alternative to the reporting requirements of Rule 205.3(b) (which requires reporting to the chief legal officer and potentially "up the ladder" to other entities). The QLCC meets as needed. During the fiscal year ended December 31, 2023, the Fund's QLCC did not meet. The QLCC currently consists of Messrs. Kuczmarski, McFarland, and Wright, and Mses. Goldman and Whelchel.

Code of Ethics

Code of Ethics. The Fund has adopted a code of ethics that applies to all of its Directors and officers and any employees of the Fund's external manager or its affiliates who are involved in the Fund's business and affairs. The code of

20

ethics is designed to comply with the SEC regulations and New York Stock Exchange listing standards related to codes of conduct and ethics and is available on the Fund's website at https://www.brookfieldoaktree.com/fund/brookfield-infrastructure-income-fund-inc. A copy of the Fund's code of ethics also is available free of charge, upon request directed to Investor Relations, Brookfield Infrastructure Income Fund Inc., 225 Liberty Street, 35th Floor, New York, New York 10281.

There is no family relationship between any of the Fund's current officers or Directors. There are no orders, judgments, or decrees of any governmental agency or administrator, or of any court of competent jurisdiction, revoking or suspending for cause any license, permit or other authority to engage in the securities business or in the sale of a particular security or temporarily or permanently restraining any of the Fund's officers or Directors from engaging in or continuing any conduct, practice or employment in connection with the purchase or sale of securities, or convicting such person of any felony or misdemeanor involving a security, or any aspect of the securities business or of theft or of any felony, nor are any of the officers or Directors of any corporation or entity affiliated with the Fund so enjoined.

Compensation of Directors and Executive Officers

No remuneration was paid by the Fund to persons who were directors, officers or employees of the Adviser or any affiliate thereof for their services as Directors or officers of the Fund. Each Director of the Fund, other than those who are officers or employees of the Adviser or any affiliate thereof, was entitled to receive from the Fund a Fund Complex fee. For the fiscal year ended December 31, 2023, the aggregate annual retainer paid to each Independent Director of the Board for the Fund Complex was $225,000. Effective January 1, 2024, the aggregate annual retainer paid to each Independent Director of the Board for the Fund Complex is $250,000. The Independent Chair of the Fund Complex receives an additional payment of $55,000 per year. The Chair of the Audit Committee receives an additional payment of $50,000 per year. The Chair of the Nominating & Compensation Committee receives an additional payment of $15,000 per year. The Independent Directors also receive reimbursement from the Fund for expenses incurred in connection with attendance at regular meetings. The Fund does not have a pension or retirement plan. No other entity affiliated with the Fund pays any compensation to the Independent Directors.

21

The following table sets forth information concerning the compensation received by Directors for the fiscal year ended December 31, 2023.

Name of Person

and Position | | Directors'

Aggregate

Compensation

from the Fund(1) | | Total Directors'

Compensation

from the Fund

and the

Fund Complex(2) | |

Interested Director Nominee | | | | | | | |

Brian F. Hurley | | | N/A | | | | N/A | | |

Independent Director Nominee | |

Betty A. Whelchel(3) | | $ | — | | | $ | — | | |

Independent Directors | |

Edward A. Kuczmarski | | $ | 20,063 | | | $ | 270,000 | | |

Stuart A. McFarland | | $ | 16,719 | | | $ | 225,000 | | |

Heather S. Goldman | | $ | 17,462 | | | $ | 235,000 | | |

William H. Wright II | | $ | 19,692 | | | $ | 265,000 | | |

(1) The Fund commenced operations November 1, 2023.

(2) Represents the total compensation paid to such persons for the fiscal year ended December 31, 2023. This total does not include, among other things, out-of-pocket Director expenses. As of December 31, 2023, there were 9 investment companies (including the Fund) or portfolios thereof from which such person received compensation and which were considered part of the Fund Complex.

(3) Ms. Betty A. Whelchel was appointed as an independent director/trustee of the Fund Complex effective January 1, 2024. As a result, she received no compensation from the Fund Complex for the fiscal year ended December 31, 2023.

Stockholder Communications with Board of Directors and Board Attendance at Special Meetings

The Fund's Board of Directors provides a process for stockholders to send communications to the Board. Any stockholder who wishes to send a communication to the Board of Directors of the Fund should send the communication to the attention of the Fund's Secretary at 225 Liberty Street, 35th Floor, New York, New York 10281. If a stockholder wishes to send a communication directly to an individual Director or to a Committee of the Fund's Board of Directors, then the communication should be specifically addressed to such individual Director or Committee and sent in care of the Fund's Secretary at the same address. All communications will be immediately forwarded to the appropriate individual(s).

The Fund's policy with respect to Directors' attendance at special meetings of stockholders is to encourage such attendance.

22

Audit Committee Report

On February 21, 2024, the Audit Committee of the Board of Directors of the Fund reviewed and discussed with management the Fund's audited financial statements as of and for the fiscal year ended December 31, 2023. The Audit Committee discussed with Deloitte & Touche LLP ("Deloitte"), the Fund's independent registered public accounting firm, the matters required to be discussed by Rule 3526 of the Public Company Accounting Oversight Board ("PCAOB"), Communication with Audit Committees Concerning Independence.

The Audit Committee received and reviewed the written disclosures and the letter from Deloitte required by Rule 3520 of the PCAOB, Auditor Independence, and discussed with Deloitte, its independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements referred to above be included in the Fund's Annual Report to Stockholders, as required by Section 30(e) of the 1940 Act and Rule 30d-1 promulgated thereunder, for the fiscal year ended December 31, 2023.

William H. Wright II – Audit Committee Chair

Edward A. Kuczmarski – Audit Committee Member

Stuart A. McFarland – Audit Committee Member

Heather S. Goldman – Audit Committee Member

Betty A. Whelchel – Audit Committee Member

Required Vote

The election of the listed Nominees for Director requires the approval of a plurality of all the votes cast at the Meeting, in person or by proxy, at which a quorum is present. The Board of Directors of the Fund recommends a vote "FOR" the election of the Nominees to the Fund's Board of Directors.

23

GENERAL INFORMATION

MANAGEMENT AND SERVICE PROVIDERS

The Adviser/The Sub-Advisers

Brookfield Asset Management Private Institutional Capital Adviser (Canada), L.P., a Manitoba limited partnership ("BAM PIC Canada," or the "Adviser"), provides investment advisory services to the Fund and certain public and private investment vehicles and programs that Brookfield currently manages and participates in, and may in the future manage and participate in, including co-investment vehicles, sidecar vehicles, separate accounts, region-specific vehicles, strategy-specific vehicles, sector-specific vehicles and Brookfield proprietary accounts (collectively, "Brookfield Accounts"). BAM PIC Canada is an indirect wholly-owned subsidiary of Brookfield Asset Management ULC, an unlimited liability company formed under the laws of British Columbia, Canada ("BAM ULC"). Brookfield Corporation, a publicly traded company (NYSE: BN; TSX: BN), holds a 75% interest in BAM ULC, while Brookfield Asset Management Ltd. (NYSE: BAM; TSX: BAMA) ("Brookfield Asset Management" or "BAM") holds a 25% interest in BAM ULC. Brookfield Asset Management is a leading global alternative asset manager focused on real estate, renewable power, infrastructure and private equity, with assets under management of approximately $900 billion as of March 31, 2024.

The Adviser has entered into an investment sub-advisory agreement (the "Sub-Advisory Agreement") with Brookfield Public Securities Group LLC ("PSG," or the "Sub-Adviser"), a Delaware limited liability company and a registered investment adviser under the Investment Advisers Act of 1940, as amended. Founded in 1989, the Sub-Adviser is an indirect wholly-owned subsidiary of BAM ULC. In addition to the Fund, the Sub-Adviser's clients include financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net-worth investors. The Sub-Adviser specializes in global listed real assets strategies and its investment philosophy incorporates a value-based approach towards investment. The Sub-Adviser also provides advisory services to several other registered investment companies. As of March 31, 2024, the Sub-Adviser had approximately $25 billion in assets under management. The Sub-Adviser's principal offices are located at Brookfield Place, 225 Liberty Street, New York, New York 10281.

Ms. Chloe Berry is the President of the Fund and an employee of the Adviser, and may be entitled, in addition to receiving a salary from the Adviser, to receive a bonus based upon a portion of the Adviser's profits. Mr. Brian F. Hurley, the Interested Director Nominee, is the Secretary of the Fund and an employee of the Sub-Adviser, and may be entitled, in addition to receiving a salary from the Sub-Adviser, to receive a bonus based upon a portion of the

24

Sub-Adviser's profits. Mr. Casey Tushaus, the Treasurer of the Fund; Mr. Adam Sachs, the CCO of the Fund; Mr. Craig Ruckman, the Assistant Secretary of the Fund; and Mr. Mohamed Rasul, Assistant Treasurer of the Fund, are all employees of PSG.

A team of investment professionals at the Adviser are jointly and primarily responsible for the day-to-day management and operations of the Fund. The portfolio managers who comprise this team, and their professional backgrounds, are set forth below:

Sam Pollock, Portfolio Manager. Mr. Pollock is Chief Executive Officer of Brookfield's Infrastructure business and Brookfield Infrastructure Partners. In this role, he is responsible for investments, operations and the expansion of the Infrastructure business. Since joining Brookfield in 1994, Mr. Pollock has held a number of senior positions across the organization, including leading Brookfield's corporate investment group and its private equity business. Mr. Pollock holds a Bachelor of Commerce degree from Queen's University and is a Chartered Professional Accountant.

Chloe Berry, Portfolio Manager. Ms. Berry is a Managing Director in Brookfield's Infrastructure Group. In this role, Ms. Berry is the Head of Brookfield Infrastructure Income and is also responsible for the global capital markets and treasury function. She has held a number of roles within Brookfield, including recently leading the finance and operations of Brookfield's private infrastructure funds. Prior to joining Brookfield, Ms. Berry worked in corporate finance and M&A at large multinational corporations and a global investment bank. Ms. Berry holds a Bachelor of Science degree from McGill University.

Sam Garetano, Portfolio Manager. Mr. Garetano is a Senior Vice President in Brookfield's Infrastructure Group. In this role, Mr. Garetano is responsible for the portfolio management of Brookfield Infrastructure Income and is also involved in strategic initiatives for Brookfield's infrastructure platform. Prior to joining Brookfield, Mr. Garetano held similar roles at Waud Capital Partners, Adams Street Partners and BlackRock, where he was responsible for delivering alternative investment solutions to clients globally. Mr. Garetano holds a Bachelor of Science degree from Syracuse University.

Caroline Rouse, Portfolio Manager. Ms. Rouse is a Senior Vice President in Brookfield's Infrastructure Group. In this role, Ms. Rouse is responsible for portfolio management initiatives for the Brookfield Infrastructure Income fund including asset allocation and portfolio construction. Ms. Rouse is also responsible for origination and execution of infrastructure investments for the broader platform. Prior to joining Brookfield, Ms. Rouse was a Vice President in the Project, Infrastructure, and Principal Finance group at Goldman Sachs and held various roles in infrastructure finance and debt capital markets at J.P. Morgan. Ms. Rouse graduated summa cum laude with a BA from Yale

25

University and holds an MPhil with distinction from the University of Cambridge.

Hrishikesh Balaji, Portfolio Manager. Mr. Balaji is a Director in Brookfield's Infrastructure Group. In this role, Mr. Balaji is responsible for portfolio management initiatives for the Brookfield Infrastructure Income fund including asset allocation and portfolio construction. Prior to this role, Mr. Balaji was responsible for investor relations, capital raising, co-investments, and other strategic initiatives for Brookfield's private infrastructure funds. Prior to Brookfield, Mr. Balaji worked in the assurance practice at Ernst & Young LLP. Mr. Balaji holds a Bachelor of Arts degree from the Ivey Business School at Western University, is a Chartered Professional Accountant and a CFA Charter holder.

A team of investment professionals at the Sub-Adviser are jointly and primarily responsible for the day-to-day management of the Fund's public securities portfolio, consisting of publicly traded equity and debt securities of infrastructure companies, subject to overall supervision of the Adviser. The portfolio managers who comprise this team, and their professional backgrounds, are set forth below:

Christopher Janus, Portfolio Manager. Mr. Janus has 16 years of industry experience and is a Director on Brookfield's Corporate Credit team. He is responsible for portfolio manager duties that span all real asset sectors, the largest of which is infrastructure. Previously, he was a Director on Brookfield's Structured Products team focused on CMBS, CRE CLOs (Commercial Real Estate Collateralized Loan Obligations) and direct lending. Prior to joining the firm in 2009, Chris began his career at SunTrust Robinson Humphrey within the Real Estate Investment Banking group. Chris earned a Bachelor of Science degree in Mechanical Engineering from Miami University.

Christopher Langs, Portfolio Manager. Mr. Langs is a Managing Director and Portfolio Manager on the Global Credit team for Brookfield's Public Securities Group. In this role, he oversees and contributes to the portfolio construction process, including execution of buy/sell decisions. Prior to joining Brookfield in 2022, Mr. Langs was Co-Chief Investment Officer of fixed income at Mesirow Financial. He previously held portfolio management and credit research roles at Calamos Investments, Aviva Investors, and Standish, Ayer & Wood. Mr. Langs holds a Master of Business Administration degree from the University of Chicago and a Bachelor of Arts degree from Purdue University. He is a CFA charterholder and a member of the CFA Society of Boston.

Daniel Parker, CFA, Portfolio Manager. Mr. Parker has over 20 years of industry experience and is a Portfolio Manager and Managing Director on the Public Securities Group's Global Credit team. In addition, Mr. Parker supports the Global Infrastructure Equities team with a focus on utilities. Prior to joining

26

the firm in 2006, Mr. Parker spent four years at Standard & Poor's where he covered the utilities and natural resources sectors. He started his career in international trade finance as a credit analyst at Canada's Export Credit Agency, EDC. Mr. Parker holds the Chartered Financial Analyst® designation and is a member of the CFA Society Chicago, Inc. He earned an Honours Bachelor of Commerce degree from Lakehead University.

The Administrator

Pursuant to an administration agreement (the "Administration Agreement"), PSG also performs various administrative services to the Fund, including, among other responsibilities, the preparation and coordination of reports and other materials to be supplied to the Board of Directors; prepare and/or supervise the preparation and filing with the applicable regulatory authority of all securities filings, periodic financial reports, prospectuses, statements of additional information, marketing materials, tax returns, stockholder reports and other regulatory reports and filings required of the Fund; supervise and monitor the preparation of all required filings necessary to maintain the Fund's qualification and/or registration to sell Shares in all states where the Fund currently does, or intends to do, business; coordinate the preparation, printing and mailing of all materials required to be sent to stockholders; coordinate the preparation and payment of Fund-related expenses; monitor and oversee the activities of the Fund's other service providers; review and adjust as necessary the Fund's daily expense accruals; monitor daily, monthly and periodic compliance with respect to the federal and state securities laws; and send periodic information (i.e., performance figures) to service organizations that track investment company information.

The Sub-Administrator

J.P. Morgan Chase Bank, N.A. (in such capacity, the "Sub-Administrator") provides certain administrative and fund accounting services pursuant to a fund services agreement with the Fund (the "Fund Services Agreement"). Pursuant to the Fund Services Agreement, and subject to the supervision of the Administrator, the Sub-Administrator provides certain administrative services to the Fund that are not otherwise provided by the Administrator, which include, but are not limited to: assisting in securities valuation; performing portfolio accounting services; and assisting in the preparation of financial reports.

The Fund's Auditor

At a meeting held on February 21, 2024, the Audit Committee of the Fund unanimously recommended the selection of, and the Directors unanimously approved, Deloitte as the Fund's independent registered public accounting firm for the current fiscal year ending December 31, 2024. The Fund is not submitting the Audit Committee's selection of Deloitte as the Fund's independent registered public accounting firm for ratification by its stockholders because doing so is not required by law. Although representatives

27

of Deloitte are not expected to be present at the Meeting, they are expected to be available to respond to appropriate questions.

The following table sets forth the aggregate fees billed or to be billed to the Fund for services performed for the fiscal years ended December 31, 2023, 2022 and 2021 by Deloitte.

| | | 2023 | |

Audit fees | | $ | 205,000 | | |

Audit-related fees | | $ | 0 | | |

Tax fees(1) | | $ | 0 | | |

All other fees | | $ | 0 | | |

(1) Tax fees consist of fees for review of tax returns and distribution requirements.

As indicated above, the Board has adopted a written charter for the Audit Committee (the "Charter"), which is available on the Fund's website at https://www.brookfieldoaktree.com/fund/brookfield-infrastructure-income-fund-inc. The Fund's Audit Committee reviews the Charter at least annually and may recommend changes to the Board. Each member of the Audit Committee of the Fund is independent as independence is defined in the listing standards of the New York Stock Exchange. The Audit Committee has adopted policies and procedures for pre-approval of the engagement of the Fund's auditors. The Audit Committee evaluates the auditor's qualifications, performance, and independence at least annually by reviewing, among other things, the relationship between the auditor and the Fund, as well as the Adviser or any control affiliate of the Adviser, any material issues raised by the most recent internal quality control review and the auditor's internal quality control procedures.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Fund's directors and executive officers, and persons who own more than ten percent of a registered class of the Fund's equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Fund. Officers, directors and greater than ten percent stockholders are required by Securities and Exchange Commission regulation to furnish the Fund with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such reports furnished to the Fund and written representations that no other reports were required, all Section 16(a) filing requirements were complied with during the Fund's fiscal year ended December 31, 2023.

28

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

A principal shareholder is any person who owns of record or beneficially 5% or more of any class of the outstanding shares of the Fund. A control person is one who owns beneficially or through controlled companies more than 25% of the voting securities of a company or acknowledges the existence of control. A controlling stockholder's vote could have a more significant effect on matters presented to stockholders for approval than for other Fund stockholders.

As of March 31, 2024, the officers and Directors, as a group, did not own any shares of the Fund.

As of March 31, 2024, the following persons were known to own of record or beneficially 5% or more of the outstanding shares of the Fund, and beneficially 25% or more of the outstanding shares of the Fund, where applicable, as indicated:

Name and Address | | % of Shares | | Nature of

Ownership | |

Brookfield Infrastructure Income Fund FCP-RAIF

26A Boulevard Royal

Luxembourg L-2449

Luxembourg | | | 73.99167 | % | | Record | |

Brookfield BRP Holdings (US) Inc.

41 Victoria Street

Gatineau

QC J8X 2A1

Canada | | | 8.41065 | % | | Record | |

BII BIP Holdings LP

PO Box 309 Ugland House

Grand Cayman, KY1-1104

Cayman Islands | | | 5.83354 | % | | Record | |

OTHER BUSINESS

The Board of Directors of the Fund does not know of any other matter, which may come before the Meeting or any postponement or adjournment thereof. If any other matter properly comes before the Meeting or any postponement or adjournment thereof, it is the intention of the persons named in the proxy to vote the proxies in accordance with their discretion on that matter.

PROPOSALS TO BE SUBMITTED BY STOCKHOLDERS

The Fund is not required to hold annual meetings of stockholders but will hold special meetings of stockholders when, in the judgment of the Directors, it is necessary or desirable to submit matters for a stockholder vote. Any stockholder who wishes to submit proposals to be considered at a special

29