CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Draft Registration Statement as confidentially submitted to the Securities and Exchange Commission on

January 23, 2023. This draft registration statement has not been publicly filed with the Securities and

Exchange Commission and all information herein remains strictly confidential.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☒ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number:

Almacenes Éxito S.A.

(Exact Name of Registrant as Specified in Its Charter)

| N/A | | Colombia |

(Translation of Registrant’s

name into English) | | (Jurisdiction of incorporation

or organization) |

Carrera 48 No. 32B Sur - 139

Avenida Las Vegas

Envigado, Colombia

(Address of Principal Executive Offices)

Ivonne Windmuller Palacio, Chief Financial Officer

Carrera 48 No. 32B Sur - 139

Avenida Las Vegas

Envigado, Colombia

Telephone: +(57 604) 604 9696

Email: iwindmuller@grupo-exito.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Era Anagnosti, Esq.

Karen Katri, Esq.

White & Case LLP

1221 Avenue of the Americas

New York, NY 10020

Telephone: +1 (212) 819-8200

Securities registered or to be registered pursuant to section 12(b) of the Act:

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on which Registered |

Common Shares, par value of COP 3.33 per

common share | | -- | | New York Stock Exchange1 |

American Depositary Share, each

representing eight common shares | | | | New York Stock Exchange |

| 1 | Not for trading, but only in connection with the listing of the American Depositary Shares on the New York Stock Exchange. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close

of the period covered by the annual report.

Not applicable

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☐ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | U.S. GAAP ☐ | International Financial Reporting | Other ☐ | |

| | | Standards as issued by the International | | |

| | | Accounting Standards Board ☒ | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☐ No

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

TABLE OF CONTENTS

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

INTRODUCTION

Except where the context otherwise requires, in this registration statement, “Éxito” refers to Almacenes Éxito S.A., a corporation (sociedad anónima) incorporated under the laws of Colombia, and “Éxito Group,” the “Company,” “we,” “our,” “us” or like terms refer to Éxito and its consolidated subsidiaries.

We have prepared this registration statement to register the common shares of Éxito (the “Éxito common shares”), each represented by American Depositary Shares (“ADSs”), under the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with the trading of the Éxito ADSs on the New York Stock Exchange (“NYSE”) as a result of the Spin-Off (as defined below).

In addition, unless otherwise indicated or the context otherwise requires, all references to:

| ● | “ADSs” are to American Depositary Shares. |

| ● | “Argentine Central Bank” are to Banco Central de la República Argentina. |

| ● | “B3” or “São Paulo Stock Exchange” are to B3 S.A. – Brasil, Bolsa, Balcão. |

| ● | “BDRs” are to Brazilian Depositary Shares. |

| ● | “Brazil” are to the Federative Republic of Brazil. |

| ● | “Brazilian Central Bank” are to Banco Central do Brasil. |

| ● | “Brazilian Corporation Law” are to Brazilian Law No. 6,404/76, as amended. |

| ● | “Brazilian real,” “Brazilian reais” or “R$” are to the Brazilian real, the official currency of Brazil. |

| ● | “BVC” or “Colombian Stock Exchange” are to the Colombian Stock Exchange (Bolsa de Valores de Colombia). |

| ● | “Casino” are to Casino, Guichard-Perrachon S.A., a French corporation (société anonyme). Casino is our indirect controlling shareholder. For more information about our direct and indirect shareholders, see Item 9. The Offer and Listing”—D. Selling Shareholders.” |

| ● | “Casino Group” are to Casino and its subsidiaries. |

| ● | “CBD” are to Companhia Brasileira de Distribuição, a corporation (sociedad anónima) incorporated under the laws of Brazil. As of the date of this registration statement, CBD owns 91.52% of the issued and outstanding Éxito common shares. For more information about the principal shareholders of Éxito, see “Item 7. Major Shareholder and Related Party Transactions”—A. Major Shareholders.” |

| ● | “CBD ADSs” are to ADSs, each representing one common share of CBD. |

| ● | “CBD ADS Custodian” are to Banco Itaú Corretora de Valores S.A., the Brazilian custodian of the CBD common shares underlying the CBD ADSs. |

| ● | “CBD common shares” are to common shares of CBD. |

| ● | “CBD Deposit Agreement” are to the Fourth Amended and Restated Deposit Agreement, dated as of December 7, 2021, between CBD and the CBD Depositary and the owners and holders from time to time of CBD ADSs issued thereunder. |

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

| ● | “CBD Depositary” are to JPMorgan Chase Bank N.A., the depositary for the CBD ADSs. |

| ● | “Colombia” are to the Republic of Colombia. |

| ● | “Colombian Central Bank” are to Banco de la República de Colombia. |

| ● | “Colombian Government” are to the central government of Colombia. |

| ● | “Colombian Stock Exchange” or “BVC” are to the Colombian Stock Exchange (Bolsa de Valores de Colombia). |

| ● | “COP” or “Colombian pesos” are to Colombian pesos, the official currency of Colombia. |

| ● | “CVM” are to the Brazilian Securities Commission (Comissão de Valores Mobiliários). |

| ● | “DANE” are to the Colombia’s National Administrative Department of Statistics (Departamento Administrativo Nacional de Estadística). |

| ● | “DIAN” are to the National Directorate of Taxes and Customs of Colombia (Dirección de Impuestos y Aduanas Nacionales). |

| ● | “Exchange Act” are to the U.S. Securities Exchange Act of 1934, as amended. |

| ● | “Éxito ADSs” are to ADS, each representing eight Éxito common shares. |

| ● | “Éxito ADS Custodian” are to BNP Paribas Securities Services, the Colombian custodian of the Éxito common shares underlying the Éxito ADSs. |

| ● | “Éxito ADS Depositary” are to JPMorgan Chase Bank N.A., the depositary for the Éxito ADSs; |

| ● | “Éxito ADS Deposit Agreement” are to the deposit agreement to be entered into between Éxito and the Éxito ADS Depositary and the holders and beneficial owners from time to time of Éxito ADSs issued thereunder. |

| ● | “Éxito BDRs” are to BDRs, each representing four Éxito common shares. |

| ● | “Éxito BDR Custodian” are to BNP Paribas Securities Services, the Colombian custodian of the Éxito common shares underlying the Éxito BDRs. |

| ● | “Éxito BDR Depositary” are to Itaú Unibanco S.A., the depositary for the Éxito BDRs. |

| ● | “Éxito BDR Deposit Agreement” are to the BDR Issuance and Registration Service Agreement, dated December 16, 2022, between Éxito and the Éxito BDR Depositary, with respect to the Éxito BDRs issued thereunder. |

| ● | “GPA2” are to GPA2 Empreendimentos e Participações Ltda., a limited liability company (sociedade limitada) organized under the laws of Brazil, is a wholly-owned subsidiary of CBD. As of the date of this registration statement, GPA2 owns 5.00% of the issued and outstanding Éxito common shares. For more information about the principal shareholders of Éxito, see “Item 7. Major Shareholder and Related Party Transactions”—A. Major Shareholders.” |

| ● | “ICONTEC” are to the Colombian Technical Standards and Certification Institute (Instituto Colombiano de Normas Técnicas y Certificación). |

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

| ● | “INDEC” are to the National Institute of Statistics and Census of Argentina (Instituto Nacional de Estadística y Censos de la República Argentina). |

| ● | “INE” are to the National Institute of Statistics of Uruguay (Instituto Nacional de Estadistica de Uruguay). |

| ● | “NYSE” are to the New York Stock Exchange. |

| ● | “SEC” or the “Commission” are to the United States Securities and Exchange Commission. |

| ● | “Securities Act” are to the U.S. Securities Act of 1933, as amended. |

| ● | “Separation” refers to our separation from CBD. Prior to the completion of the Spin-Off, we intend to enter into a Separation Agreement with CBD to provide a framework for our relationship with CBD following the Separation and Spin-Off. For more information about the Separation Agreement, see “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Separation Agreement.” |

| ● | “SFC” are to the Colombian Superintendency of Finance (Superintendencia Financiera de Colombia). |

| ● | “Spin-Off” are to the proposed distribution of 86.26% of the issued and outstanding Éxito common shares held by CBD (directly and indirectly through GPA2), representing 83.26% of the issued and outstanding Éxito common shares, to holders of CBD common shares, including the CBD ADS Custodian, on a pro rata basis for no consideration. For more information about the Spin-Off, see “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off.” |

| ● | “Tuya” are to Compañia de Financiamiento Tuya S.A. |

| ● | “Uruguay” are to the Oriental Republic of Uruguay. |

| ● | “Uruguayan Central Bank” are to Banco Central del Uruguay. |

| ● | “U.S. dollars,” “dollars” or “US$” are to United States dollars. |

We are furnishing this registration statement solely to provide information to holders of CBD common shares and CBD ADSs who will receive Éxito common shares (including in the form of Éxito ADSs or Éxito BDRs) in the Spin-Off. You should not construe this registration statement as an inducement or encouragement to buy, hold or sell any of our securities or any securities of CBD. We believe that the information contained in this registration statement is accurate as of the date set forth on the cover. Changes to the information contained in this registration statement may occur after that date, and neither we nor CBD undertakes any obligation to update the information except in the normal course of our respective public disclosure obligations and practices.

This registration statement does not constitute a proxy statement. Neither CBD nor Éxito is asking you for a proxy, and you are requested not to send CBD or Éxito a proxy.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Financial Statements

This registration statement includes financial information derived from the Éxito Group’s audited historical consolidated financial statements as of December 31, 2021 and 2020 and for the years then ended, and the related notes thereto, which are included in this registration statement. We refer to these financial statements and the related notes thereto collectively as our “audited consolidated financial statements.”

We have prepared our audited consolidated financial statements in accordance with the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB.

Éxito maintains its books and records in Colombian pesos, which is its functional currency, as well as its presentation currency. The Éxito Group’s consolidated financial statements included in this registration statement are presented in Colombian pesos. For each entity, we determine its functional currency and items included in its financial statements are measured using that functional currency. The financial statements of subsidiaries that are carried in a functional currency other than the Colombian peso are translated into Colombian pesos. Results of operations and balances are translated as follows, except for subsidiaries located in hyperinflationary economies, in which case all balances and transactions are translated at closing rates:

| ● | assets and liabilities are translated into Colombian pesos at the period closing exchange rate; |

| ● | income and expenses are translated into Colombian pesos using the period’s average exchange rate; and |

| ● | equity accounts in foreign currency are translated into Colombian pesos at the exchange rate on the date of each transaction. |

Exchange differences arising from the translation are directly recognized in a separate component of equity and are reclassified to the statement of profit or loss upon loss of control in the subsidiary.

Argentina’s accumulated inflation rate over the past three years at December 31, 2021 calculated using different consumer price index combinations has exceeded 100%, and therefore is considered to be hyperinflationary. Financial statements related to Éxito’s subsidiary in Argentina have been adjusted for hyperinflation pursuant to IAS 29 – Financial Reporting in Hyperinflationary Economies.

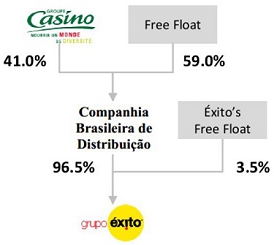

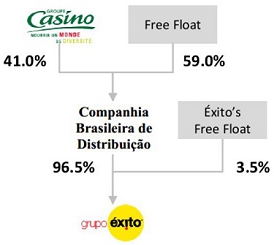

The Spin-Off

As of the date of this registration statement, CBD, our direct controlling shareholder, holds (directly and indirectly through GPA2) 96.52% of our issued and outstanding share capital. CBD is controlled by the Casino Group, which beneficially owns approximately 41% of the total capital stock of CBD.

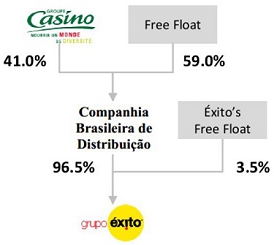

We have prepared this registration statement to register the Éxito common shares, each represented by ADSs, under the Exchange Act, in connection with the trading of the Éxito ADSs on the NYSE as a result of the Spin-Off. In connection with the Spin-Off, 86.26% of the issued and outstanding Éxito common shares held by CBD (directly and indirectly through GPA2), representing 83.26% of the issued and outstanding Éxito common shares, will be distributed to holders of CBD common shares, including the CBD ADS Custodian, on a pro rata basis for no consideration. Following the Spin-Off, we will no longer be a subsidiary of CBD, which will hold approximately 13.26% of our issued and outstanding share capital. Although CBD will no longer be our direct controlling shareholder, Casino Group will remain our ultimate controlling shareholder, controlling approximately 47% of the Éxito common shares (34% directly and 13% through CBD). For more information about the Spin-Off, see “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off.”

In addition, prior to the completion of the Spin-Off, we intend to enter into a Separation Agreement with CBD to effect our separation from CBD, which we refer to as the “Separation,” and provide a framework for our relationship with CBD following the Separation and the Spin-Off. For more information about the Separation Agreement, see “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Separation Agreement.”

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Key Operating Performance Indicators

Throughout this registration statement we provide a number of key operating performance indicators used by our management and often used by competitors in our industry. We define certain terms used in this registration statement as follows:

Retail and Other Complimentary Businesses

| ● | “Average ticket” means the average amount per revenue from retail sales per customer. |

| ● | “Net sales per full time employee” means revenue from retail sales divided by end of year full time employees. |

| ● | “Number of stores” means number of physical stores. |

| ● | “Number of tickets” means the total number of tickets per annum. |

| ● | “Omnichannel share” means sales made through the channels: .com, marketplace, home delivery, Shop&Go, Click&Collect, digital catalogues and B2B virtual, as percentage of the total sales. |

| ● | “Sales per square meter” means revenue from retail sales divided by total square meters of store area. |

| ● | “Same store sales” means sales made in stores open for at least 12 consecutive months and that did not close nor remain closed for a period of seven or more consecutive days. |

| ● | “Sales area” means total square meters of physical stores. |

| ● | “Total number of active credit cards” means number of credit cards issued by Tuya per annum. |

| ● | “Total number of loyalty program members” means number of members of Puntos Colombia by year end. |

Real Estate

| ● | “Gross leasable area” means the total area of a building that can be used by tenants. |

| ● | “Occupancy rate” means the ratio of rented or used space to the total amount of available space. |

Translation of Colombian Pesos into U.S. Dollars

Unless otherwise stated, we have translated certain amounts included in this registration statement from Colombian pesos into U.S. dollars. The exchange rate used to translate such amounts was COP 3,891.16 to US$1.00, which was the commercial selling rate at closing for the purchase of U.S. dollars on December 31, 2021, as reported by the Colombian Central Bank. The U.S. dollar equivalent information included in registration statement is provided solely for convenience of investors and should not be construed as implying that the Colombian peso amounts represent, or could have been or could be converted into, U.S. dollars at such rates or at any other rate.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Market and Industry Data

We obtained the statistical data and information relating to the markets where we operate from reports prepared by government agencies and other publicly-available sources, including, but not limited, from Euromonitor, Nielsen, IDRetail, DANE, the SFC, the Colombian Central Bank, INDEC, the Argentine Central Bank, the INE and the Uruguayan Central Bank. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under “Cautionary Statement with Respect to Forward-Looking Statements” and “Item 3. Key Information—D. Risk Factors.”

Trademarks, Service Marks and Trade Names

We have proprietary rights to trademarks used in this registration statement that are important to our business, many of which are registered under applicable intellectual property laws.

Solely for convenience, the trademarks, service marks, logos and trade names referred to in this registration statement are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This registration statement contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing in this registration statement are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Rounding Adjustments

Certain figures included in this registration statement have been subject to rounding adjustments. Accordingly, the figures shown for the same item presented in different tables may vary slightly and figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING STATEMENTS

This registration statement includes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, principally in “Item 3. Key Information—D. Risk Factors,” “Item 4. Information on the Company—B. Business Overview” and “Item 5. Operating and Financial Review and Prospects.” Forward looking terms such as “may,” “will,” “could,” “should,” “would,” “plan,” “potential,” “intend,” “anticipate,” “project,” “target,” “believe,” “estimate” or “expect” and other words, terms and phrases of similar nature are often intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are statements which are not historical fact and involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. Such forward-looking statements may include, but are not limited to, statements related to:

| ● | competition and pressure to adapt to changing consumer habits and preferences; |

| ● | competition from internet sales; |

| ● | economic slowdowns in the food retail industry; |

| ● | changes in merchant policies on credit card sales; |

| ● | our ability to maintain and enhance our brands; |

| ● | the impact of the global COVID-19 pandemic; |

| ● | our ability to protect our intellectual property rights; |

| ● | our reliance on our advertisement and marketing campaigns; |

| ● | our ability to maintain and renew our stores’ lease agreements and operational licenses; |

| ● | our reliance on the Colombian transportation systems and infrastructure; |

| ● | the potential of cyberattacks and security and privacy breaches; |

| ● | our ability to protect our database and security in accordance with privacy laws; |

| ● | the effects of unfavorable legal or administrative proceeding decisions; |

| ● | the inability to attract or retain personnel; |

| ● | violations of anti-corruption laws; |

| ● | our service providers or suppliers engaging in irregular practices; |

| ● | the concentration of products in few suppliers; |

| ● | compliance with environmental laws and regulations; |

| ● | political and economic conditions in our countries of operations; |

| ● | economic and political conditions in Colombia; |

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

| ● | developments and perception of risks in other countries; |

| ● | exchange rate volatility in Colombia; |

| ● | the influence of the Colombian Government and Colombian Central Bank over the Colombian economy; |

| ● | potential sanctions imposed by the United States; |

| ● | developments and political conditions in other emerging markets; |

| ● | the enforcement of court judgments in the United States; |

| ● | violence and instability in Colombia; |

| ● | impacts of the armed rebel groups in Colombia’s laws and regulations; |

| ● | expropriation by the Colombian Government; |

| ● | changes in tax laws in Colombia; |

| ● | influence and differing interest of the Selling Shareholder; |

| ● | ability to trade and maintain our listing on the NYSE; |

| ● | research publications by securities or industry analysts; |

| ● | the perception of future sales on the NYSE; |

| ● | voting rights of Éxito ADS shares; |

| ● | the right to a jury trial of holders of Éxito ADSs; |

| ● | the ability of holders of Éxito ADSs to receive dividends; |

| ● | the ability of holders of Éxito ADSs to participate in tender offers in Colombia; |

| ● | our status as a foreign private issuer; |

| ● | the ability of holders of Éxito ADSs to serve process; |

| ● | U.S. tax liabilities and consequences; and |

| ● | other risk factors as set forth under “Item 3. Key Information—D. Risk Factors.” |

The list above is not intended to be exhaustive, and there may be other key risks that are not listed above that are not presently known to us or that we currently deem immaterial. Should one or more of these or other risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by the forward-looking statements made by us contained in this registration statement. As a result of the foregoing, readers should not place undue reliance on the forward-looking statements contained in this registration statement. The forward-looking statements contained in this registration statement are expressly qualified in their entirety by the foregoing cautionary statements. All such forward-looking statements are based upon information available as of the date of this registration statement or other specified date and speak only as of such date. We disclaim any intention or obligation to update or revise any forward-looking statements in this registration statement as a result of new information or future events, except as may be required under applicable securities law.

Forward-looking statements in this registration statement are based on current expectations and assumptions made by our management. Although our management believes that the expectations and assumptions on which such forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements. We can give no assurance that they will prove to be correct. Additionally, forward-looking statements are subject to various risks and uncertainties which could cause actual results and experience to differ materially from the anticipated results or expectations expressed in this registration statement. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements, or that could contribute to such differences, include, without limitation, the risks and uncertainties set forth under the section “Item 3. Key Information – D. Risk Factors.”

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

THE SPIN-OFF

The following provides only a summary of the Spin-Off and certain questions relating to the terms of the Spin-Off. You should read the section entitled “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off” in this registration statement for a more detailed description of the matters identified below.

Overview

We are the sixth largest food retailer in South America, and the largest in Colombia and Uruguay based on public information of our main competitors in the region, in terms of net revenue, with a presence in Colombia, Uruguay and Argentina. With over 70 years of retail experience in Colombia, we operate under a multi-format and omni-channel strategy with a portfolio of recognized brands targeting a customer base across all income levels. We offer a broad variety of products through our physical and online stores, including perishable and packaged food products, and non-food products, including appliances, apparel, among others. We believe our multi-format, omni-channel and multi-brand strategy has allowed us to overcome the economic effects of the COVID-19 pandemic and will potentially let us to benefit from the economic growth and rising purchasing power of consumers in our target markets in the future.

As of the date of this registration statement, CBD, our direct controlling shareholder, holds (directly and indirectly through GPA2) 96.52% of our issued and outstanding share capital. CBD is controlled by the Casino Group, which beneficially owns approximately 41% of the total capital stock of CBD.

On January 9, 2023, the board of directors of CBD approved their management’s proposal for the Spin-Off of Éxito. Consummation of the Spin-Off requires, among other conditions, a quorum of at least two-thirds (2/3) of CBD’s outstanding shares and the affirmative vote of at least 50% plus one of CBD’s outstanding shares present at the CBD extraordinary general shareholders’ meeting. The CBD extraordinary general shareholders’ meeting to approve the Spin-Off is expected to be held on February 14, 2023.

Upon receiving the necessary creditor, regulatory and stock exchange approvals, CBD expects to complete the Spin-Off, pursuant to which 86.26% of the issued and outstanding Éxito common shares held by CBD (directly and indirectly through GPA2), representing 83.26% of the issued and outstanding Éxito common shares, will be distributed to holders of CBD common shares, including the CBD ADS Custodian, on a pro rata basis for no consideration. Following the Spin-Off, we will no longer be a subsidiary of CBD, which will hold approximately 13.26% of our issued and outstanding share capital. Although CBD will no longer be our direct controlling shareholder, Casino Group will remain our ultimate controlling shareholder, controlling approximately 47% of the Éxito common shares (34% directly and 13% through CBD).

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Set forth below are structure charts showing CBD and Éxito immediately prior to and immediately following the Spin-Off:

Pre Spin-Off

Post Spin-Off

For additional information on the share capital of Éxito following the Spin-Off, see “Item 7. Major Shareholders and Related Party Transactions—A. Major Shareholders” and “Item 10. Additional Information—A. Share Capital.”

Questions and Answers about the Spin-Off

Q: What is the Spin-Off?

A: The Spin-Off refers to the proposed distribution of 86.26% of the issued and outstanding Éxito common shares held by CBD (directly and indirectly through GPA2), representing 83.26% of the issued and outstanding Éxito common shares, to holders of CBD common shares, including the CBD ADS Custodian, on a pro rata basis for no consideration. Following the Spin-Off, we will no longer be a subsidiary of CBD, which will hold approximately 13.26% of our issued and outstanding share capital. Although CBD will no longer be our direct controlling shareholder, Casino Group will remain our ultimate controlling shareholder, controlling approximately 47% of the Éxito common shares (34% directly and 13% through CBD). See “Item 10. Additional Information—A. Share Capital.” For more information about the expected principal shareholders of CBD immediately following the Spin-Off, see “Item 7. Major Shareholders and Related Party Transactions—A. Major Shareholders.” Éxito’s common shares are listed on the Colombian Stock Exchange, and we intend to apply to list the Éxito ADSs on the NYSE and Éxito BDRs on the B3.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Q: Who is entitled to receive Éxito common shares in the Spin-Off?

A: Holders of CBD common shares at the close of trading on the B3 on , 2023 (the “Brazilian Record Date”) will be entitled to receive one Éxito BDR for every one CBD common share held. Each Éxito BDR will represent four Éxito common shares.

Holders of CBD ADSs at the close of trading on the NYSE on , 2023 (the “ADS Record Date” and, together with the Brazilian Record Date, the “Record Dates”) will be entitled to receive one Éxito ADS for every two CBD ADS held. Each Éxito ADS will represent eight Éxito common shares.

Q: May I choose to receive Éxito common shares, Éxito ADSs or Éxito BDRs in the Spin-Off?

A: Except as described below, holders of CBD common shares on the Brazilian Record Date shall receive Éxito BDRs only in connection with the Spin-Off and may not elect to receive Éxito common shares or Éxito ADSs. Such holders will be entitled to receive one Éxito BDR for every one CBD common share held. Each Éxito BDR will represent four Éxito common shares. Following the Spin-Off, holders of Éxito BDRs may choose to cancel all or a portion of their Éxito BDRs and receive the underlying Éxito common shares, provided that all applicable fees, charges and taxes due in connection with this service are duly paid in accordance with the Éxito BDR Deposit Agreement.

Holders of CBD common shares that are not domiciled in Brazil for tax purposes who have registered their investment in CBD as a foreign direct investment under Law No. 4,131/62 are not eligible to receive BDRs in connection with the Spin-Off and may instead elect to receive Éxito common shares or Éxito ADSs. Such holders may elect to receive four Éxito common shares for every one CBD common share held or one Éxito ADS for every two CBD common shares held. Each Éxito ADS will represent eight Éxito common shares.

Holders of CBD ADSs on the ADS Record Date will be entitled to receive Éxito ADSs only in connection with the Spin-Off and may not elect to receive Éxito common shares or Éxito BDRs. Such holders will be entitled to receive one Éxito ADS for every two CBD ADS held. Each Éxito ADS will represent eight Éxito common shares. Following the Spin-Off, holders of Éxito ADSs may choose to cancel all or a portion of their Éxito ADSs and receive the underlying Éxito common shares, provided that all applicable fees, charges and taxes due in connection with this service are duly paid in accordance with the Éxito ADS Deposit Agreement.

Q: What is the expected date of completion of the Spin-Off?

A: The distribution of Éxito ADSs is expected to occur on or about , 2023 (the “ADS Distribution Date”). The distribution of Éxito BDRs is expected to occur on or about , 2023 (the “BDR Distribution Date” and, together with the ADS Distribution Date, the “Distribution Dates”).

See “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off—” for more information.

Q: How will fractional shares and fractional ADSs and BDRs be treated in the Spin-Off?

A: The Spin-Off will not result in fractional entitlements of Éxito common shares or Éxito BDRs.

With respect Éxito ADSs, following the ADS Distribution Date, any fractional Éxito ADSs resulting from the Spin-Off will be grouped into whole numbers and sold on the open market by the CBD Depositary. The net proceeds from the sale of the fractional Éxito ADSs will be distributed on a pro rata basis to the Éxito ADS holders who received fractional entitlements to Éxito ADSs.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Q: What do I have to do to participate in the Spin-Off?

A: Except as described below, if you hold CBD common shares or CBD ADSs as of the applicable Record Dates, you will not be required to take any action, pay any cash, deliver any other consideration, or surrender any existing CBD common shares or CBD ADSs in order to receive Éxito BDRs or Éxito ADSs, respectively, in the Spin-Off.

Holders of CBD common shares that are not domiciled in Brazil for tax purposes who have registered their investment in CBD as a foreign direct investment under Law No. 4,131/62 are not eligible to receive BDRs in connection with the Spin-Off and may instead elect to receive Éxito common shares or Éxito ADSs.

In addition, for the first 30 days after the applicable Distribution Dates, the Éxito ADS Depositary and the Éxito BDR Depositary will waive the Éxito ADS and Éxito BDR issuance and cancellation fees, respectively. This means that during this time, holders of Éxito ADSs will be able to convert their Éxito ADSs into Éxito common shares or Éxito BDRs and holders of Éxito BDRs will be able to convert their Éxito BDRs into Éxito common shares or Éxito ADRs without paying issuance or cancellation fees to the respective depositaries.

See “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off—” for more information.

This registration statement does not constitute a proxy statement. Neither CBD nor Éxito is asking you for a proxy, and you are requested not to send CBD or Éxito a proxy.

The Spin-Off will not affect the number of outstanding CBD common shares or CBD ADSs or any rights of CBD shareholders, although it may affect the market value of each outstanding CBD common share and CBD ADS. See “—Will the Spin-Off affect the trading price of my CBD common shares or CBD ADSs?” below.

We expect that the Spin-Off will be completed on or about , 2023, provided that certain conditions shall have been satisfied. For more information, see “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off—Conditions to the Spin-Off.”

Q: If I sell my CBD common shares or CBD ADSs on or before the Brazilian Distribution Date or the ADS Distribution Date, as the case may be, will I still be entitled to receive Éxito securities in the Spin-Off with respect to the sold shares or ADSs?

A: To receive Éxito BDRs in connection with the Spin-Off, you must hold CBD common shares on the Brazilian Record Date. Immediately following the Brazilian Record Date, the CBD common shares will trade “ex-distribution” on the B3. This means that if you purchase CBD common shares following the Brazilian Record Date, you will not receive Éxito BDRs in connection with the Spin-Off. Similarly, if you hold CBD common shares as of the Brazilian Record Date and you subsequently sell or otherwise dispose of your CBD common shares, up to and including through the Brazilian Distribution Date, you will still receive the Éxito BDRs that you would be entitled to receive in respect of your ownership, as of the Brazilian Record Date, of the CBD common shares that you sold.

With respect to CBD ADSs, beginning on the day prior to the ADS Record Date, and continuing up to and including the ADS Distribution Date, we expect that there will be two markets in CBD ADSs: a “regular-way” market and an “ex-distribution” market. CBD ADSs that trade on the “regular-way” market will trade with the entitlement to receive Éxito ADSs in connection with the Spin-Off. CBD ADSs that trade on the “ex-distribution” market will trade without the entitlement to receive Éxito ADSs in connection with the Spin-Off. Therefore, if you sell CBD ADSs on the “regular-way” market, you will also be selling your right to receive Éxito ADSs in connection with the Spin-Off. If you own CBD ADSs as of the ADS Record Date and sell or otherwise dispose of these shares on the “ex-distribution” market, up to and including through the ADS Distribution Date, you will still receive the Éxito ADSs that you would be entitled to receive in respect of your ownership, as of the ADS Record Date, of the CBD ADSs that you sold. You are encouraged to consult with your financial advisor regarding the specific implications of selling your CBD ADSs prior to or on the ADS Distribution Date.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Q: When will Éxito common shares, Éxito ADSs and Éxito BDRs begin to trade on a standalone basis?

A: Éxito common shares already trade on a standalone basis on the BVC under the ticker symbol “EXITO.”

We expect that Éxito ADSs will commence “regular-way” trading on a standalone basis on the NYSE at market open on , 2023. In addition, we expect that Éxito ADSs will begin trading on a “when-issued” basis on the NYSE from market open on , 2023 and continue up to and including the ADS Distribution Date, which we expect to be on or about , 2023.

We expect that Éxito BDRs will commence trading on a standalone basis on the B3 at market open on , 2023.

See also “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off— Listing and Trading of Éxito Common Shares, Éxito ADSs and Éxito BDRs.”

Q: What will be the ticker symbol of the Éxito ADSs and Éxito BDRs?

A: We intend to apply to list the Éxito ADSs on the NYSE under the ticker symbol “ .” We intend to apply to list the Éxito BDRs on the B3 under the ticker symbol “ .”

Q: Will the CBD Depositary suspend the issuance and cancellation of CBD ADSs in connection with the Spin-Off?

A: Yes. The CBD Depositary will suspend the issuance and cancellation of CBD ADSs from , 2023, until , 2023. This means that during this time, you will not be able to convert your CBD ADSs into CBD common shares or vice-versa, surrender your CBD ADSs and receive underlying CBD common shares, or deposit your CBD common shares and receive CBD ADSs. However, the closing of the issuance and cancellation books does not impact trading, and you may continue to trade your CBD ADSs during this period.

Q: How many Éxito common shares are expected to be outstanding immediately following the Spin-Off?

A: Éxito will have 1,297,864,359 common shares issued and outstanding immediately following the Spin-Off. For additional information on the share capital of Éxito following the Spin-Off, see “Item 7. Major Shareholders and Related Party Transactions—A. Major Shareholders” and “Item 10. Additional Information—A. Share Capital.”

Q: What will happen to the listing of CBD common shares and CBD ADSs?

A: After the Spin-Off, CBD common shares will continue to trade on the B3 under the symbol “PCAR3” and CBD ADSs will continue to trade on the NYSE under the symbol “CBD.”

Q: Will the number of CBD common shares or CBD ADSs I own change as a result of the Spin-Off?

A: No, the number of CBD common shares or CBD ADSs you own will not change as a result of the Spin-Off.

Q: Will the spin-off affect the trading price of my CBD common shares or CBD ADSs?

A: Yes. The trading price of the CBD common shares and the CBD ADSs immediately following the Spin-Off could be lower than immediately prior to the Spin-Off because the trading price will no longer reflect the value of Éxito and its subsidiaries. We cannot provide you with any assurance regarding the price at which the CBD common shares and CBD ADSs will trade following the Spin-Off. See “Item 3. Key Information—D. Risk Factors—Risks Relating to the Spin-Off—Éxito and CBD’s equity values after the Spin-Off may not accurately reflect the value of the underlying entities, and equity values may fluctuate significantly” for more detail.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Q: What are the conditions to the Spin-Off?

A. We expect that the Spin-Off will be completed on or about , 2023, provided that the following corporate conditions shall have been satisfied:

| ● | the Spin-Off having been approved by a quorum of at least two-thirds (2/3) of CBD’s outstanding shares and the affirmative vote of at least 50% plus one of CBD’s outstanding shares present at the CBD extraordinary general shareholders’ meeting. The CBD extraordinary general shareholders’ meeting to approve the Spin-Off is expected to be held on February 14, 2023; |

| ● | the expiration of the 60-day creditor opposition period following the date of publication of the minutes of the CBD extraordinary general shareholders’ meeting that approves the Spin-Off; |

| ● | the SEC declaring effective, under the Exchange Act, this registration statement, with no stop order in effect or pending before or threatened by the SEC with respect to this registration statement; |

| ● | the NYSE approving the listing of the Éxito ADSs; |

| ● | the CVM approving the registration of Éxito as a foreign issuer; |

| ● | the B3 approving the listing of the Éxito BDRs; and |

| ● | no order, injunction or decree issued by any governmental authority of competent jurisdiction or other legal or administrative restraint or prohibition preventing consummation of the Spin-Off being in effect, and no other event outside the control of CBD having occurred or failed to occur that prevents the consummation of the Spin-Off. |

CBD and Éxito cannot assure you that any or all of the conditions to the Spin-Off will be met. See also “—Can CBD decide to cancel the Spin-Off of Éxito common shares even if all the conditions are met?” below and “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off—Conditions to the Spin-Off.”

Q: Can CBD decide to cancel the Spin-Off even if all the conditions are met?

A: No. The Spin-Off is subject to the satisfaction of certain conditions. However, if all such conditions have been satisfied in a timely manner, CBD will not have the right to subsequently terminate the planned distribution without the approval of its shareholders. See also “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off—Conditions to the Spin-Off.”

Q: What are the tax consequences to me of the Spin-Off?

A: See “Item 10. Additional Information—E. Taxation—Material U.S. Federal Income Tax Consequences.” “—Material Brazilian Tax Consequences” and “— Material Colombian Tax Consequences” for more information regarding the material tax consequences of the Spin-Off.

Q: What will the relationship between CBD and Éxito be following the Spin-Off?

A: Prior to the completion of the Spin-Off, we intend to enter into a Separation Agreement with CBD related to the Separation and the Spin-Off. The Separation Agreement will provide a framework for our relationship with CBD following the Separation and the Spin-Off. Following the Spin-Off, we will no longer be a subsidiary of CBD, which will hold approximately 13.26% of our issued and outstanding share capital. Although CBD will no longer be our direct controlling shareholder, Casino Group will remain our ultimate controlling shareholder, controlling approximately 47% of the Éxito common shares (34% directly and 13% through CBD). See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Separation Agreement” for more detail.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Q: Are there risks associated with owning Éxito securities?

A: Yes. Ownership of Éxito securities is subject to both general and specific risks relating to our business, the industry in which we operate and our status as a separate, publicly traded company. Ownership of Éxito securities is also subject to risks relating to the Spin-Off. Accordingly, you should carefully read the information set forth under “Item 3. Key Information—D. Risk Factors” in this registration statement.

Q: Where can I get more information?

A: Before the Spin-Off, if you have any questions relating to the business performance of CBD or Éxito or the Spin-Off, you may contact the investor relations departments of CBD or Éxito at:

Almacenes Éxito S.A.

Investor Relations Department

Carrera 48 No. 32B Sur – 139

Envigado, Colombia

Telephone: +57 312 796-2298

Email: mmorenor@grupo-exito.com

Companhia Brasileira de Distribuição

Investor Relations Department

Avenida Brigadeiro Luiz Antonio, No. 3142

01402-901 São Paulo, SP, Brazil

Telephone: +55 11 3886-0421

Email: gpa.ri@gpabr.com

After the Spin-Off, if you have any questions relating to Éxito’s business performance, you may contact the investor relations department of Éxito at:

Almacenes Éxito S.A.

Investor Relations Department

Carrera 48 No. 32B Sur – 139

Envigado, Colombia

Telephone: +57 312 796-2298

Email: mmorenor@grupo-exito.com

If you hold CBD ADSs and have any questions with respect to the mechanics of the Spin-Off as they relate to your CBD ADSs, you may contact the CBD Depositary’s transfer agent, EQ, at:

JPMC Call Center at EQ

Telephone: +1 800 990 1135 (from inside the U.S.) / +1 651 453 2128 (from outside the U.S.)

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

For information regarding our directors and senior management, see “Item 6. Directors, Senior Management and Employees—A. Directors and Senior Management.”

B. Advisers

Our Colombian legal counsel is Brigard & Urrutia Abogados S.A.S., Calle 70Bis No. 4 - 41, Bogotá, Colombia. Our U.S. legal counsel is White & Case LLP, 1221 Avenue of the Americas, New York, New York 10020. Our Brazilian legal counsel is Machado, Meyer, Sendacz & Opice Advogados, Avenida Brigadeiro Faria Lima, 3144, 11th floor, 01451-000, São Paulo, SP, Brazil.

C. Auditors

Ernst & Young Audit S.A.S. (“EY”), an independent registered public accounting firm, has acted as auditor with respect to the consolidated financial statements of Éxito as of December 31, 2021 and 2020 and for the years then ended included in this registration statement. The address for EY is Edificio Milla de Oro, Av. Cra. 43A No. 3 Sur 130 Torre 1 Piso 14, El Poblado, Medellín, Colombia.

Deloitte S.C. (“Deloitte Uruguay”), an independent registered public accounting firm, has acted as auditor with respect to the consolidated financial statements of Grupo Disco Uruguay S.A. and the financial statements of Devoto Hnos. S.A. as of December 31, 2021 and 2020 and for each of the two years in the period ended December 31, 2021 (prepared in Uruguayan pesos and before its translation into Colombian pesos), respectively, consolidated with those of Éxito, but not presented separately in this registration statement. The address for Deloitte Uruguay is Juncal 1385 Piso 11, Montevideo, Uruguay, 11000.

Deloitte & Co. S.A. (“Deloitte Argentina”), an independent registered public accounting firm, has acted as auditor with respect to the financial statements of Libertad S.A. as of December 31, 2021 and 2020 and for each of the two years in the period ended December 31, 2021 (prepared in Argentine pesos and before its translation into Colombian pesos), consolidated with those of Éxito, but not presented separately in this registration statement. The address for Deloitte Argentina is Florida 234 - 5th floor, Ciudad Autonoma de Buenos Aires, Argentina, C1005AAF.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

B. Capitalization and Indebtedness

The following table sets forth our consolidated capitalization and indebtedness as of December 31, 2021 on an actual historical basis. Investors should read the information in this table together with our audited consolidated financial statements appearing elsewhere in this registration statement, as well as the sections of this registration statement captioned “Presentation of Financial and Other Information” and “Item 5. Operating and Financial Review and Prospects.” The Spin-Off will not have any effect on our capitalization.

| | | As of December 31, 2021 | |

| | | (in millions of US$)(1) | | | (in millions of COP) | |

| | | | | | | |

| Current loans and borrowings(2) | | | 170 | | | | 674,927 | |

| Non-current loans and borrowings(2) | | | 186 | | | | 742,084 | |

| Total loans and borrowings | | | 356 | | | | 1,417,011 | |

| Total shareholders’ equity | | | 2,017 | | | | 8,028,477 | |

| Total capitalization(3) | | | 2,373 | | | | 9,445,488 | |

| (1) | Solely for the convenience of the reader, Colombian peso amounts as of December 31, 2021 have been translated into U.S. dollars at the selling rate as of December 31, 2021 of COP 3,981.16 to US$1.00 for liabilities. |

| (2) | All our current and non-current loans and borrowing were unsecured as of December 31, 2021. |

| (3) | Total capitalization is defined as the sum of our total loans and borrowings plus total shareholders’ equity. |

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

You should carefully consider the risks described below, together with all of the other information included in this registration statement, in evaluating us, the Éxito common shares, Éxito ADSs and Éxito BDRs. The following risk factors could adversely affect our business, financial condition, results of operations and the price of the Éxito common shares, Éxito ADSs and Éxito BDRs.

Risks Relating to the Spin-Off

The Spin-Off may not be successful, and we may not enjoy the same benefits that we did as a subsidiary of CBD.

As of the date of this registration statement, CBD holds (directly and indirectly through GPA2) 96.52% of our issued and outstanding share capital. Upon completion of the Spin-Off, we will no longer be a subsidiary of CBD, which will hold approximately 13.26% of our issued and outstanding share capital. Although CBD will no longer be our direct controlling shareholder, Casino Group will remain our ultimate controlling shareholder, controlling approximately 47% of the Éxito common shares (34% directly and 13% through CBD). The process of becoming a standalone public company independent of CBD may distract our management from focusing on our business and strategic priorities. We also may not fully realize the anticipated benefits of the Separation, or the realization of such benefits may be delayed, if any of the risks identified in this “Risk Factors” section, or other events, were to occur.

We may not achieve some or all of the expected benefits of the Spin-Off, and the Spin-Off may adversely affect our business.

We may not be able to achieve the full strategic and financial benefits expected to result from the Spin-Off, or such benefits may be delayed or not occur at all. The Spin-Off is expected to provide the following benefits, among others:

| ● | permit each of the separate companies to increase their strategic focus on their businesses as each company operates in a different market with different client profiles, opportunities and business models; |

| ● | improve the operational efficiencies of each of the separate companies by eliminating the inefficiencies of the current holding company structure; |

| ● | improve the resource allocation by the separate companies and permit each company to achieve more attractive financing terms as investors are better able to understand each stand-alone business; and |

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

| ● | create value for stakeholders based on Éxito’s greater liquidity, its listing in key markets in the region (United States and Brazil) and the increased market visibility of each separate company, allowing investors to recognize the intrinsic value of each company, based on the attributes and performance of the separate companies. |

We may not achieve these and other anticipated benefits for a variety of reasons, including, among others:

| ● | the listing of securities issued by Éxito in the Brazilian and U.S. markets will require significant amounts of management’s time and effort, which may divert management’s attention from our commercial strategies; and |

| ● | following the Separation and the Spin-Off, we may be more susceptible to market fluctuations and other adverse events than if we were still a part of CBD. In addition, CBD and Éxito have expended and will continue to expend significant management time and resources and have incurred and will continue to incur significant expenses due to legal and financial advisory and accounting services fees related to the Spin-Off. These expenses must be paid regardless of whether the Spin-Off is completed. Any such conditions or changes could have the effect of delaying completion of the Spin-Off and otherwise reduce the anticipated benefits of the Spin-Off. |

If we fail to achieve some or all of the benefits expected to result from the Spin-Off, or if such benefits are delayed, our business, financial conditions and results of operations could be adversely affected.

The Spin-Off may not be completed on the terms or timeline currently contemplated, or at all.

The completion of the Spin-Off is subject to numerous conditions, including obtaining the necessary regulatory and stock exchange approvals. See “Item 4. Information on the Company—A. History and Development of the Company—The Spin-Off—Conditions to the Spin-Off.” There is no assurance that the Spin-Off will be completed on the terms or timeline currently contemplated, or at all.

We will be required by comply with various rules and regulations as a public company listed on the Colombian Stock Exchange, the NYSE and the B3.

As a public company listed in Colombia, the United States and Brazil, we will be subject to various corporate governance and compliance rules and regulations. Accordingly, we will incur significant legal, accounting and other expenses that we did not incur as a subsidiary of CBD. The Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”), as well as rules subsequently adopted by the SEC and the NYSE, have imposed various requirements on public companies, including setting forth rules regarding corporate governance practices. For example, Sarbanes-Oxley requires, among other things, that we maintain and periodically evaluate our internal control over financial reporting and disclosure controls and procedures. In particular, we and our managers will have to perform system and process evaluation and testing of our and their internal control over financial reporting to allow management and our independent registered public accounting firm to report on the effectiveness of our internal control over financial reporting, as required by Section 404 of Sarbanes-Oxley. We currently test our internal controls over financial reporting on a regular basis, in accordance with the financial reporting practices and policies of CBD. In conjunction with the audit of CBD’s consolidated financial statements in 2021, we reported to CBD deficiencies in our internal control over financial reporting which we classified as material weaknesses as of December 31, 2021, which CBD reported in their annual report on Form 20-F for the year ended December 31, 2021. These material weaknesses are described below under “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Internal Controls over Financial Reporting.” A mitigation plan is currently ongoing. If we are unable to successfully remediate these material weaknesses, they may be reported at the time we are required, on a standalone basis, to report on the effectiveness of our internal control over financial reporting, as required by Section 404 of Sarbanes-Oxley. In addition, testing our internal controls as a standalone entity may require our management and other personnel to devote a substantial amount of time to comply with these requirements and also increase our legal and financial compliance costs. Compliance with Section 404 of Sarbanes-Oxley as a standalone entity will require a substantial accounting expense and significant management efforts. We cannot be certain at this time that all of our controls will be considered effective and our internal control over financial reporting may not satisfy the regulatory requirements when they become applicable to us.

Furthermore, the listing of our securities on the BVC, the NYSE and the B3 will require us to comply with the listing, reporting and other regulations for each exchange. Compliance with two sets of regulations, which may have different standards and requirements, will require more time and effort from management.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

The transitional services CBD has agreed to provide us may not be sufficient for our needs. In addition, we or CBD may fail to perform under various transaction agreements that will be executed as part of the Separation or we may fail to have necessary systems and services in place when certain of the transaction agreements expire.

In connection with the Spin-Off, we will enter into a Separation Agreement with CBD. See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Separation Agreement.” The Separation Agreement will provide for the performance of key business services by CBD for our benefit for a period of time after the Spin-Off, including services performed by the following departments: human resources, information technology and investor relations, among others. All expenses and costs incurred by the parties in relation to the shared resources, including full labor costs and social security charges, depreciation charges for fixed assets and general expenses will be periodically allocated between the parties in proportion to the shared resources effectively used according to the criteria agreed between the parties. The costs and expenses are calculated, approved and charged on a quarterly basis. These services may not be sufficient to meet our needs and the terms of such services may not be equal to or better than the terms we may have received from unaffiliated third parties, including our ability to obtain redress.

We will rely on CBD to satisfy its performance and payment obligations under the Separation Agreement and related agreements. If CBD is unable to satisfy its obligations under these agreements, including its indemnification obligations, we could incur operational difficulties or losses. If we do not have in place our own systems and services, or if we do not have agreements with other providers of these services, we may not be able to operate our business effectively and this may have an adverse effect on our business, financial condition and results of operations. In addition, after our agreements with CBD expire, we may not be able to obtain these services at as favorable prices or on as favorable terms.

Éxito and CBD’s equity values after the Spin-Off may not accurately reflect the value of the underlying entities, and equity values may fluctuate significantly.

The trading price of the CBD common shares and the CBD ADSs immediately following the Spin-Off could be lower than immediately prior to the Spin-Off because the trading price will no longer reflect the value of Éxito and its subsidiaries. Furthermore, until the market has fully analyzed the value of CBD without all of its historical businesses, the trading price of the CBD common shares and the CBD ADSs may fluctuate significantly. We cannot assure you that, following the Spin-Off, the combined trading prices of the CBD common shares and the Éxito common shares will equal or exceed what the trading price of CBD common shares would have been in the absence of the Spin-Off or that the combined trading prices of the CBD ADSs and the Éxito ADSs will equal or exceed what the trading price of the CBD ADSs would have been in the absence of the Spin-Off. It is possible that after the Spin-Off, CBD’s and Éxito’s combined equity value will be less than CBD’s equity value before the Spin-Off.

The Spin-Off could result in substantial U.S. tax liability for you.

We intend to take the position that for U.S. federal income tax purposes, the Spin-Off (the distribution of Éxito common shares or Éxito ADSs to U.S. Holders of CBD common shares or CBD ADSs) will be a taxable distribution. The U.S. federal income tax treatment of the Spin-Off is discussed below at “Item 10. Additional Information—E. Taxation—Material U.S. Federal Income Tax Consequences— U.S. Federal Income Tax Consequences of the Spin-Off.”

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Risks Relating to Our Industry and Us

Our traditional supermarkets and retail stores face increasing competition from internet sales, which may negatively affect sales of traditional channels, and our digital transformation strategy might not be an effective response to this emerging competition.

In recent years, retail sales of food, clothing and home appliances products over the internet have increased significantly in Colombia and in other Latin American countries where we have operations. We expect this trend to continue as more traditional retailers enter into the online retail field or expand their existing infrastructure related to internet sales. Growth in the internet retail business of our competitors would likely harm not only our retail operations but also our internet retail operations. Internet retailers are able to sell directly to consumers, reducing the importance of traditional distribution channels such as supermarkets and retail stores. Certain internet food retailers have significantly lower operating costs than traditional hypermarkets and supermarkets because they do not rely on an expensive network of retail points of sale or a large workforce. As a result, internet food retailers are able to offer their products at lower costs than we do and in certain cases are able to bypass retailing intermediaries and deliver particularly high-quality, fresh products to consumers. We believe that our customers are increasingly using the internet to shop electronically for food and other retail goods, and that this trend is likely to continue, especially as a result of the COVID-19 pandemic.

Additionally, technology employed in retail sales of food and home appliances evolves constantly as part of a modern digital culture. We may not be able to adapt to these changes quickly enough to meet our customers’ demands and preferences, as well as standards of the industry in which we operate.

If internet sales in our countries of operation continue to grow, consumers’ reliance on traditional distribution channels such as our supermarkets and retail stores could be materially diminished, which could have a material adverse effect on our financial condition and results of operations.

We are increasingly dependent on credit card sales. Any changes in the policies of merchant acquirers may adversely affect us.

We are increasingly dependent on credit card sales. In our Colombia segment, sales to customers using credit cards, including Tuya credit card, accounted for 32.2% and 29.7% of our consolidated revenue from contracts with customers in the years ended December 31, 2021 and 2020, respectively. In our Uruguay segment, customers using credit cards accounted for 29.1% and 28.3% of our consolidated revenue from contracts with customers in the years ended December 31, 2021 and 2020, respectively. In our Argentina segment, credit card sales accounted for 40.1%, and 41.8% of our consolidated revenue from contracts with customers in the years ended December 31, 2021 and 2020, respectively. In order to offer credit card sales to our customers, we depend on the policies of merchant acquirers, including fees charged by acquirers. Any change in the policies of acquirers, including, for example, their merchant discount rate, may adversely affect us.

Our business depends on strong brands. We may not be able to maintain and enhance our brands, or we may receive unfavorable customer complaints or negative publicity, which could adversely affect our brands.

We believe that our Éxito, Carulla, Surtimax, Super Inter, Surtimayorista, Devoto, Disco, Geant and Libertad brands contribute significantly to the success of our business. We also believe that maintaining and enhancing those brands is critical to expanding our base of customers, which depends largely on our ability to continue to create the best customer experience, based on our competitive pricing and our large assortment of products.

Customer complaints or negative publicity about our product offerings or services could harm our reputation and diminish consumer confidence in us. A reduction in the strength of our brands and reputation could adversely affect our business, financial condition and operating results.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

The global outbreak of the novel coronavirus disease (COVID-19) could affect our operations and could have an adverse impact on our business, financial condition, results of operations or prospects.

Since December 2019, a novel strain of coronavirus known as COVID-19 has spread in China and other countries. In 2020, the COVID-19 outbreak compelled governments around the world, including in Colombia, Uruguay and Argentina, to adopt temporary measures to contain the spread of COVID-19, such as lockdowns of cities, restrictions on travel and public transportation, business and store closures, and emergency quarantines, among others, all of which have caused significant disruptions to the global economy and normal business operations across a growing list of sectors and countries. The measures adopted to combat the COVID-19 outbreak have adversely affected and will continue to adversely affect business confidence and consumer sentiment, and have been, and may continue to be, accompanied by significant volatility in financial and commodity markets as well as stock exchanges worldwide.

While we have not experienced significant disruptions from the COVID-19 outbreak, we are unable to accurately predict the future impact that COVID-19 will have due to numerous uncertainties, including: (i) the severity and duration of the pandemic, including whether there are new waves caused by additional periods of increases or spikes in the number of COVID-19 cases, future mutations or related strains of the virus in areas in which we operate; (ii) evolving macroeconomic factors, including general economic uncertainty, unemployment rates, and recessionary pressures; (iii) unknown consequences on our business performance and initiatives stemming from the substantial investment of time and other resources to the pandemic response; and (iv) the long-term impact of the pandemic on our business, including consumer behaviors. Accordingly, our business may be adversely impacted by the fear of exposure to uncertainties related to or actual effects of COVID-19 or similar disease outbreak.

In addition, the COVID-19 pandemic may negatively impact our business by causing or contributing to, among other things, the following, each of which could adversely affect our business, results of operations, financial condition and cash flows:

| ● | We cannot assure you that the emergency health measures we adopted will be effective or that we will not have to adopt new protective measures, including work from home policies, which may divert our management’s attention and increase our operating costs; |

| ● | If individual states and municipalities implement different COVID-19 preventative measures, we may be required to expend additional time to implement them, which may increase our operating costs. In addition, we cannot assure you that we will be able to fully comply with these measures, which may negatively impact the way we operate our stores; and |

| ● | In case we face a worsening in the pandemic situation in the future, which will require some investments with additional temporary workers or new adaptations in our stores, which may increase our operating costs. |

If new restrictions are imposed that again impact the production capacity of some of our suppliers, we might face new shortages in the future, in which case we may have to seek alternate sources of supply which may be more expensive, may not be available or may result in delays in shipments to us and subsequently to our customers.

We may not be able to protect our intellectual property rights.

Our future success depends significantly on our ability to protect our current and future brands and to defend our intellectual property rights, including trademarks, patents, domain names, trade secrets and know-how. We have been granted numerous trademark registrations covering our brands and products and have filed, and expect to continue to file, trademark and patent applications seeking to protect newly developed brands and products. We cannot assure that trademark and patent registrations will be issued with respect to any of our applications. There is also a risk that we could inadvertently fail to renew a trademark or patent on a timely basis or that our competitors will challenge, invalidate or circumvent any existing or future trademarks and patents issued to, or licensed by, us. We cannot be certain that the steps we have taken to protect our portfolio of intellectual property rights (including trademark registration and domain names) will be sufficient or that third parties will not infringe upon or misappropriate our proprietary rights. Any failure in our ability to protect our proprietary rights against infringement or misappropriation could adversely affect our business, results of operations, cash flows or financial condition, and in particular, on our ability to develop our business.

CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

Our sales depend on the effectiveness of our advertisement and marketing campaigns, which may adversely affect our revenues and profitability.

To promote increased traffic of customers and attract them to our stores, we dedicate substantial resources to our advertisement and marketing campaigns. Our revenues and profitability depend on our ability to, among other things, identify our target consumers and decide on the marketing message and communication method to reach them most effectively. If we do not conceive, plan or execute our advertisement and marketing activities in order to successfully and efficiently increase revenues and market share, our profitability and financial position may be adversely affected.

We may not be able to renew or maintain our stores’ lease agreements on acceptable terms, or at all, and we may be unable to obtain or renew the operational licenses of our stores or distribution centers in a timely manner.

Most of our stores are leased. The strategic location of our stores is key to the development of our business strategy and, as a result, we may be adversely affected in the event that a significant number of our lease agreements is terminated and we fail to renew these lease agreements on acceptable terms, or at all. In addition, in accordance with applicable laws, landlords may increase rent periodically, usually every year. A significant increase in the rent of our leased properties may adversely affect our financial position and results of operations.

Our stores and distribution centers are also subject to certain operational licenses. Our inability to obtain or renew these operational licenses may result in the imposition of fines and, as the case may be, in the closing of stores or distribution centers. Given that smooth and uninterrupted operations in our stores and distribution centers are a critical factor for the success of our business strategy, we may be negatively affected in the case of their closing as a result of our inability to obtain or renew the necessary operational licenses.

Our product distribution is dependent on a limited number of distribution centers and we depend on the transportation systems and infrastructure in the geographies where we operate to deliver our products, and any disruption at one of our distribution centers or delay related to transportation and infrastructure could adversely affect our supply needs and our ability to distribute products to our stores and customers.