UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-56540

KKR Private Equity Conglomerate LLC

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 88-4368033 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

| 30 Hudson Yards, New York, NY | 10001 |

| (Address of principal executive offices) | (Zip Code) |

(212) 750-8300

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| None. | None. | None. |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | o | |

| Non-accelerated filer | ☒ | | Smaller reporting company | o | |

| | | | Emerging growth company | ☒ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ☒

As of August 6, 2024, the registrant had 13,123 Class I Shares, 112,564 Class U Shares, 5,413,776 Class R-D Shares, 35,735,918 Class R-I Shares, 68,479,227 Class R-U Shares, 10,163 Class F Shares, 40 Class G Shares and 40 Class H Shares outstanding. The number of Shares outstanding excludes August 1, 2024 subscriptions since the issuance price is not yet finalized as of the date of this filing.

Table of Contents

| | | | | |

| Page |

Part I - Financial Information | |

| Item 1. Financial Statements | |

| Consolidated Statements of Assets and Liabilities as of June 30, 2024 (Unaudited) and December 31, 2023 | |

| Consolidated Statements of Operations for the Three and Six Months Ended June 30, 2024 and 2023 (Unaudited) | |

| Consolidated Statements of Changes in Net Assets for the Three and Six Months Ended June 30, 2024 (Unaudited) | |

| Consolidated Statement of Cash Flows for the Six Months Ended June 30, 2024 (Unaudited) | |

| Condensed Consolidated Schedule of Investments as of June 30, 2024 (Unaudited) and December 31, 2023 | |

| Notes to Consolidated Financial Statements (Unaudited) | |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. Quantitative and Qualitative Disclosures about Market Risk | |

| Item 4. Controls and Procedures | |

| |

| |

| Item 1. Legal Proceedings | |

| Item 1A. Risk Factors | |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

| Item 3. Defaults Upon Senior Securities | |

| Item 4. Mine Safety Disclosures | |

| Item 5. Other Information | |

| Item 6. Exhibits | |

| |

| Signatures | |

| |

Special Note Regarding Forward-Looking Statements

Some of the statements in this Quarterly Report on Form 10-Q constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this Quarterly Report on Form 10-Q may include statements as to:

•our future operating results;

•our business prospects and the prospects of the portfolio companies we own and control;

•the impact of the acquisitions that we expect to make;

•our ability to raise sufficient capital to execute our acquisition strategies;

•the ability of the Manager (as defined herein) to source adequate acquisition opportunities to efficiently deploy capital;

•the ability of our portfolio companies to achieve their objectives;

•our current and expected financing arrangements;

•changes in the general interest rate environment;

•the adequacy of our cash resources, financing sources and working capital;

•the timing and amount of cash flows, distributions and dividends, if any, from our portfolio companies;

•our contractual arrangements and relationships with third parties;

•actual and potential conflicts of interest with the Manager or any of its affiliates;

•the dependence of our future success on the general economy and its effect on the industries in which we own and control portfolio companies;

•our use of financial leverage;

•the ability of the Manager to identify, acquire and support our portfolio companies;

•the ability of the Manager or its affiliates to attract and retain highly talented professionals;

•our ability to structure acquisitions and joint ventures in a tax-efficient manner and the effect of changes to tax legislation and our tax position; and

•the tax status of the enterprises through which we own and control portfolio companies.

In addition, words such as “anticipate,” “believe,” “expect” and “intend” indicate a forward-looking statement, although not all forward-looking statements include these words. The forward-looking statements contained in this Quarterly Report on Form 10-Q involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth elsewhere in this Quarterly Report on Form 10-Q, our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”). Other factors that could cause actual results to differ materially include:

•changes in the economy;

•risks associated with possible disruption in our operations or the economy generally due to terrorism, natural disasters, epidemics or other events having a broad impact on the economy; and

•future changes in laws or regulations and conditions in our operating areas.

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Quarterly Report on Form 10-Q should not be regarded as a representation by us that our plans and objectives will be achieved. These forward-looking statements apply only as of the date of this Quarterly Report on Form 10-Q. Moreover, we assume no duty and do not undertake to update the forward-looking statements, except as required by law.

Part I. Financial Information

Item 1. Financial Statements

KKR PRIVATE EQUITY CONGLOMERATE LLC

CONSOLIDATED STATEMENTS OF ASSETS AND LIABILITIES (UNAUDITED)

(Amounts in Thousands, Except Share and Per Share Data)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Investments at fair value (cost of $2,309,019 and $703,790, respectively) | $ | 2,444,343 | | | $ | 713,610 | |

| Cash and cash equivalents | 309,135 | | | 18,007 | |

| Prepaids and other assets | — | | | 243 | |

| Deferred offering costs | 116 | | | 815 | |

| Due from Manager | 2,332 | | | 13,451 | |

| Dividends receivable | 3,984 | | | 307 | |

| Unrealized appreciation on foreign currency forward contracts | 568 | | | 103 | |

| Total assets | 2,760,478 | | | 746,536 | |

| | | |

| Liabilities | | | |

| Line of Credit | — | | | 19,200 | |

| Accrued performance participation allocation | 22,997 | | | 1,508 | |

| Accrued shareholder servicing fees and distribution fees | 113,543 | | | 40,309 | |

| Directors’ fees and expenses payable | 151 | | | 137 | |

| Other accrued expenses and liabilities | 7,257 | | | 2,133 | |

| Unrealized depreciation on foreign currency forward contracts | 79 | | | 742 | |

| Due to Manager | 6,911 | | | 14,471 | |

| Total liabilities | 150,938 | | | 78,500 | |

| | | |

| Commitments and contingencies (Note 8) | | | |

| | | |

| Net assets | $ | 2,609,540 | | | $ | 668,036 | |

| | | |

| Net assets are comprised of | | | |

| Class I Shares, 12,209 and 69,695 shares authorized, issued and outstanding, respectively | $ | 334 | | | $ | 1,804 | |

| Class U Shares, 110,734 and — shares authorized, issued and outstanding, | 2,825 | | | — | |

| Class R-D Shares, 2,796,988 and — shares authorized, issued and outstanding, respectively | 74,791 | | | — | |

| Class R-I Shares, 33,302,088 and 4,452,158 shares authorized, issued and outstanding, respectively | 909,397 | | | 115,196 | |

| Class R-U Shares, 63,960,210 and 22,941,060 shares authorized, issued and outstanding, respectively | 1,622,034 | | | 550,983 | |

| Class F Shares, 5,657 and 1,967 shares authorized, issued and outstanding, respectively | 157 | | | 51 | |

| Class G Shares, 40 and 40 shares authorized, issued and outstanding, respectively | 1 | | | 1 | |

| Class H Shares, 40 and 40 shares authorized, issued and outstanding, respectively | 1 | | | 1 | |

| Net assets | $ | 2,609,540 | | | $ | 668,036 | |

See notes to consolidated financial statements.

KKR PRIVATE EQUITY CONGLOMERATE LLC

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Investment income | | | | | | | |

| Dividend income | $ | 12,837 | | | $ | — | | | $ | 16,688 | | | $ | — | |

| Total investment income | 12,837 | | | — | | | 16,688 | | | — | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Performance participation allocation | 21,490 | | | — | | | 21,490 | | | — | |

| General and administration expenses | 4,355 | | | 22 | | | 7,942 | | | 22 | |

| Management fee expense | 5,968 | | | — | | | 8,621 | | | — | |

| Deferred offering costs amortization | 349 | | | — | | | 698 | | | — | |

| Directors’ fees and expenses | 152 | | | — | | | 306 | | | — | |

| Interest expense | — | | | — | | | 14 | | | — | |

| Organization costs | — | | | 1,916 | | | — | | | 3,706 | |

| Total operating expenses | 32,314 | | | 1,938 | | | 39,071 | | | 3,728 | |

| Less: Expenses reimbursed by Manager | (959) | | | (1,938) | | | (3,170) | | | (3,728) | |

| Less: Management fee and expense credits | (7,342) | | | — | | | (9,995) | | | — | |

| Less: Interest expense waived by Lender | — | | | — | | | (14) | | | — | |

| Net operating expenses | 24,013 | | | — | | | 25,892 | | | — | |

| Net investment loss | (11,176) | | | — | | | (9,204) | | | — | |

| | | | | | | |

| Net realized gain (loss) on investments, foreign currency and foreign currency forward contracts | | | | | | | |

| Net realized gain (loss) on: | | | | | | | |

| Foreign currency forward contracts | 2,874 | | | — | | | 3,142 | | | — | |

| Foreign currency | — | | | — | | | (54) | | | — | |

| Total net realized gain | 2,874 | | | — | | | 3,088 | | | — | |

| | | | | | | |

| Net change in unrealized appreciation (depreciation) on investments, foreign currency translation and foreign currency forward contracts | | | | | | | |

| Net change in unrealized appreciation (depreciation) before income taxes on: | | | | | | | |

| Investments | 119,550 | | | — | | | 130,529 | | | — | |

| Foreign currency translation | (2,584) | | | — | | | (5,026) | | | — | |

| Foreign currency forward contracts | (601) | | | — | | | 1,128 | | | — | |

| Total net change in unrealized appreciation (depreciation) before income taxes | 116,365 | | | — | | | 126,631 | | | — | |

| Provision for income taxes | 1,333 | | | — | | | 2,634 | | | — | |

| Total net change in unrealized appreciation (depreciation) after income taxes | 115,032 | | | — | | | 123,997 | | | — | |

| | | | | | | |

| Net increase in net assets resulting from operations | $ | 106,730 | | | $ | — | | | $ | 117,881 | | | $ | — | |

See notes to consolidated financial statements.

KKR PRIVATE EQUITY CONGLOMERATE LLC

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS (UNAUDITED)

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I Shares | | Class U Shares | | Class R-D Shares | | Class R-I Shares | | Class R-U Shares | | Class F Shares | | Class G Shares | | Class H Shares | | Total Shareholders' Equity (Net Assets) |

| Balance at March 31, 2024 | $ | 10 | | | $ | — | | | $ | 10,292 | | | $ | 248,196 | | | $ | 964,490 | | | $ | 98 | | | $ | 1 | | | $ | 1 | | | $ | 1,223,088 | |

| Consideration from the issuance of shares | 329 | | | 2,975 | | | 63,068 | | | 622,616 | | | 637,051 | | | 52 | | | — | | | — | | | 1,326,091 | |

| Repurchase of shares | — | | | — | | | — | | | (75) | | | (281) | | | — | | | — | | | — | | | (356) | |

| Early repurchase fee | — | | | — | | | — | | | 6 | | | 11 | | | — | | | — | | | — | | | 17 | |

| Transfers in | — | | | — | | | — | | | 1,589 | | | — | | | — | | | — | | | — | | | 1,589 | |

| Transfers out | (14) | | | — | | | (101) | | | — | | | (1,474) | | | — | | | — | | | — | | | (1,589) | |

| Accrued shareholder servicing fees and distribution fees | — | | | (203) | | | (1,285) | | | — | | | (44,542) | | | — | | | — | | | — | | | (46,030) | |

| Net investment loss | (1) | | | (7) | | | (253) | | | (3,394) | | | (7,522) | | | 1 | | | — | | | — | | | (11,176) | |

| Net realized gain | — | | | 4 | | | 81 | | | 960 | | | 1,829 | | | — | | | — | | | — | | | 2,874 | |

| Net change in unrealized appreciation | 10 | | | 56 | | | 2,989 | | | 39,499 | | | 72,472 | | | 6 | | | — | | | — | | | 115,032 | |

| Balance at June 30, 2024 | $ | 334 | | | $ | 2,825 | | | $ | 74,791 | | | $ | 909,397 | | | $ | 1,622,034 | | | $ | 157 | | | $ | 1 | | | $ | 1 | | | $ | 2,609,540 | |

| | | | | | | | | | | | | | | | | |

| Balance at December 31, 2023 | $ | 1,804 | | | $ | — | | | $ | — | | | $ | 115,196 | | | $ | 550,983 | | | $ | 51 | | | $ | 1 | | | $ | 1 | | | $ | 668,036 | |

| Consideration from the issuance of shares | 339 | | | 2,975 | | | 73,587 | | | 750,695 | | | 1,072,964 | | | 97 | | | — | | | — | | | 1,900,657 | |

| Repurchase of shares | — | | | — | | | — | | | (75) | | | (281) | | | — | | | — | | | — | | | (356) | |

| Early repurchase fee | — | | | — | | | — | | | 6 | | | 11 | | | — | | | — | | | — | | | 17 | |

| Transfers in | — | | | — | | | — | | | 4,691 | | | — | | | — | | | — | | | — | | | 4,691 | |

| Transfers out | (1,818) | | | — | | | (151) | | | — | | | (2,722) | | | — | | | — | | | — | | | (4,691) | |

| Accrued shareholder servicing fees and distribution fees | — | | | (203) | | | (1,501) | | | — | | | (74,991) | | | — | | | — | | | — | | | (76,695) | |

| Net investment loss | (1) | | | (7) | | | (239) | | | (3,243) | | | (5,715) | | | 1 | | | — | | | — | | | (9,204) | |

| Net realized gain | — | | | 4 | | | 83 | | | 1,002 | | | 1,999 | | | — | | | — | | | — | | | 3,088 | |

| Net change in unrealized appreciation | 10 | | | 56 | | | 3,012 | | | 41,125 | | | 79,786 | | | 8 | | | — | | | — | | | 123,997 | |

| Balance at June 30, 2024 | $ | 334 | | | $ | 2,825 | | | $ | 74,791 | | | $ | 909,397 | | | $ | 1,622,034 | | | $ | 157 | | | $ | 1 | | | $ | 1 | | | $ | 2,609,540 | |

See notes to consolidated financial statements.

KKR PRIVATE EQUITY CONGLOMERATE LLC

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

(Amounts in Thousands)

| | | | | | | | |

| | Six Months Ended June 30, 2024 |

| Operating activities | | |

| Net increase in net assets from operations | | $ | 117,881 | |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | |

| Net change in unrealized appreciation on investments | | (130,529) | |

| Net change in unrealized depreciation on foreign currency translation | | 5,026 | |

| Net change in unrealized appreciation on foreign currency forward contracts | | (1,128) | |

| Deferred offering costs amortization | | 698 | |

| Class F Shares issued as payment of directors’ fees and expenses | | 97 | |

| Acquisition of portfolio companies | | (1,605,230) | |

| Changes in operating assets and liabilities: | | |

| Decrease in prepaids and other assets | | 243 | |

| Increase in accrued performance participation allocation | | 21,488 | |

| Decrease in due from Manager | | 11,119 | |

| Increase in dividends receivable | | (3,677) | |

| Increase in other accrued expenses and liabilities | | 5,124 | |

| Increase in directors’ fees and expenses payable | | 14 | |

| Decrease in due to Manager | | (7,700) | |

| Net cash used in operating activities | | (1,586,574) | |

| Financing activities | | |

| Proceeds from issuance of shares | | 1,900,560 | |

| Repayment on Line of Credit | | (19,200) | |

| Payment of offering costs | | (1,397) | |

| Payments of shareholder servicing fees and distribution fees | | (1,922) | |

| Repurchase of shares | | (339) | |

| Net cash provided by financing activities | | 1,877,702 | |

| Net increase in cash and cash equivalents | | 291,128 | |

| Cash and cash equivalents, beginning of period | | 18,007 | |

| Cash and cash equivalents, end of period | | $ | 309,135 | |

| | | | | | | | |

| | Six Months Ended June 30, 2024 |

| Supplemental Disclosure of Non-Cash Financing Activities | | |

| Change in shareholder servicing fees and distribution fees payable | | $ | 76,695 | |

See notes to consolidated financial statements.

KKR PRIVATE EQUITY CONGLOMERATE LLC

CONDENSED CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF JUNE 30, 2024 (UNAUDITED)

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | | Asset | | Industry | | Geography(1) | | Valuation Level | | Currency | | Settlement Date | | Notional | | Estimated Fair Value | | Estimated Fair Value as a Percentage of Net Assets |

| Portfolio Companies | | | | | | | | | | | | | | | | | | |

| Industrials - 14.2% | | | | | | | | | | | | | | | | | | |

| CIRCOR International, Inc. | | Equity interest held through KKR Cube Aggregator L.P. | | Industrials | | Americas | | Level III | | USD | | N/A | | N/A | | $132,500 | | 5.1% |

Other investments in portfolio companies(2) | | | | Industrials | | Americas | | Level III | | USD | | N/A | | N/A | | 227,396 | | 8.7% |

| Other investment in portfolio company | | | | Industrials | | EMEA | | Level III | | EUR | | N/A | | N/A | | 10,162 | | 0.4% |

| Health Care - 32.6% | | | | | | | | | | | | | | | | | | |

| Cotiviti Holdings, Inc. | | Equity interest held through KKR Compass Aggregator L.P. | | Health Care | | Americas | | Level III | | USD | | N/A | | N/A | | 480,000 | | 18.4% |

Other investments in portfolio companies(2) | | | | Health Care | | Americas | | Level III | | USD | | N/A | | N/A | | 225,528 | | 8.6% |

Other investments in portfolio companies(2) | | | | Health Care | | EMEA | | Level III | | Various | | N/A | | N/A | | 120,376 | | 4.6% |

| Other investment in portfolio company | | | | Health Care | | Asia Pacific | | Level III | | CNY | | N/A | | N/A | | 25,731 | | 1.0% |

| Financials - 8.3% | | | | | | | | | | | | | | | | | | |

| USI Insurance Services LLC | | Equity interest held through Uno Aggregator L.P. | | Financials | | Americas | | Level III | | USD | | N/A | | N/A | | 156,750 | | 6.0% |

| Other investment in portfolio company | | | | Financials | | EMEA | | Level III | | EUR | | N/A | | N/A | | 50,979 | | 2.0% |

| Other investment in portfolio company | | | | Financials | | Americas | | Level III | | USD | | N/A | | N/A | | 8,165 | | 0.3% |

| Consumer Discretionary - 9.8% | | | | | | | | | | | | | | | | | | |

Other investments in portfolio companies(2) | | | | Consumer Discretionary | | Americas | | Level III | | USD | | N/A | | N/A | | 212,624 | | 8.1% |

| Other investment in portfolio company | | | | Consumer Discretionary | | EMEA | | Level III | | EUR | | N/A | | N/A | | 29,496 | | 1.1% |

| Other investment in portfolio company | | | | Consumer Discretionary | | Asia Pacific | | Level III | | VND | | N/A | | N/A | | 16,075 | | 0.6% |

| Materials - 1.2% | | | | | | | | | | | | | | | | | | |

| Other investment in portfolio company | | | | Materials | | Americas | | Level III | | USD | | N/A | | N/A | | 30,400 | | 1.2% |

| Communication Services - 2.4% | | | | | | | | | | | | | | | | | | |

Other investments in portfolio companies(2) | | | | Communication Services | | Americas | | Level III | | USD | | N/A | | N/A | | 32,462 | | 1.2% |

| Other investment in portfolio company | | | | Communication Services | | EMEA | | Level III | | EUR | | N/A | | N/A | | 29,634 | | 1.1% |

| Information Technology - 24.2% | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

N/A(3) | | Equity interest held through KKR Modena Aggregator L.P. | | Information Technology | | Americas | | N/A | | USD | | N/A | | N/A | | 320,000 | | 12.3% |

| BMC Software Finance Inc. | | Equity interest held through KKR Banff Aggregator L.P. | | Information Technology | | Americas | | Level III | | USD | | N/A | | N/A | | 184,000 | | 7.1% |

Other investments in portfolio companies(2) | | | | Information Technology | | Americas | | Level III | | USD | | N/A | | N/A | | 92,923 | | 3.6% |

Other investments in portfolio companies(2) | | | | Information Technology | | Asia Pacific | | Level III | | Various | | N/A | | N/A | | 34,196 | | 1.3% |

| Consumer Staples - 1.0% | | | | | | | | | | | | | | | | | | |

| Other investment in portfolio company | | | | Consumer Staples | | EMEA | | Level III | | USD | | N/A | | N/A | | 24,946 | | 1.0% |

| Total Portfolio Companies (cost of $2,309,019) | | | | | | | | | | | | | | | | $2,444,343 | | 93.7% |

| | | | | | | | | | | | | | | | | | |

| Foreign Currency Forward Contracts | | | | | | | | | | | | | | | | | | |

| Nomura International plc | | Sell JPY/USD | | N/A | | N/A | | Level II | | JPY | | October 4, 2024 | | 2,100,000 | | 279 | | —% |

| Goldman Sachs | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | October 4, 2024 | | 97,300 | | 142 | | —% |

| Goldman Sachs | | Sell AUD/USD | | N/A | | N/A | | Level II | | AUD | | October 4, 2024 | | 11,300 | | (79) | | —% |

| Barclays Bank PLC | | Sell CNH/USD | | N/A | | N/A | | Level II | | CNH | | October 8, 2024 | | 140,000 | | 79 | | —% |

| Nomura International plc | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | October 4, 2024 | | 19,200 | | 46 | | —% |

| Barclays Bank PLC | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | October 4, 2024 | | 17,200 | | 22 | | —% |

| Total Foreign Currency Forward Contracts | | | | | | | | | | | | | | | | $489 | | —% |

| | | | | | | | | | | | | | | | | | |

| Investments in Money Market Funds | | | | | | | | | | | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds Government Portfolio | | | | N/A | | N/A | | Level I | | USD | | N/A | | N/A | | $308,646 | | 11.8% |

| Total Investments in Money Market Funds (cost of $308,646) | | | | | | | | | | | | | | | | $308,646 | | 11.8% |

| | | | | | | | | | | | | | | | | | |

| Total Investments and Cash Equivalents (cost of $2,617,665) | | | | | | | | | | | | | | | | $2,753,478 | | 105.5% |

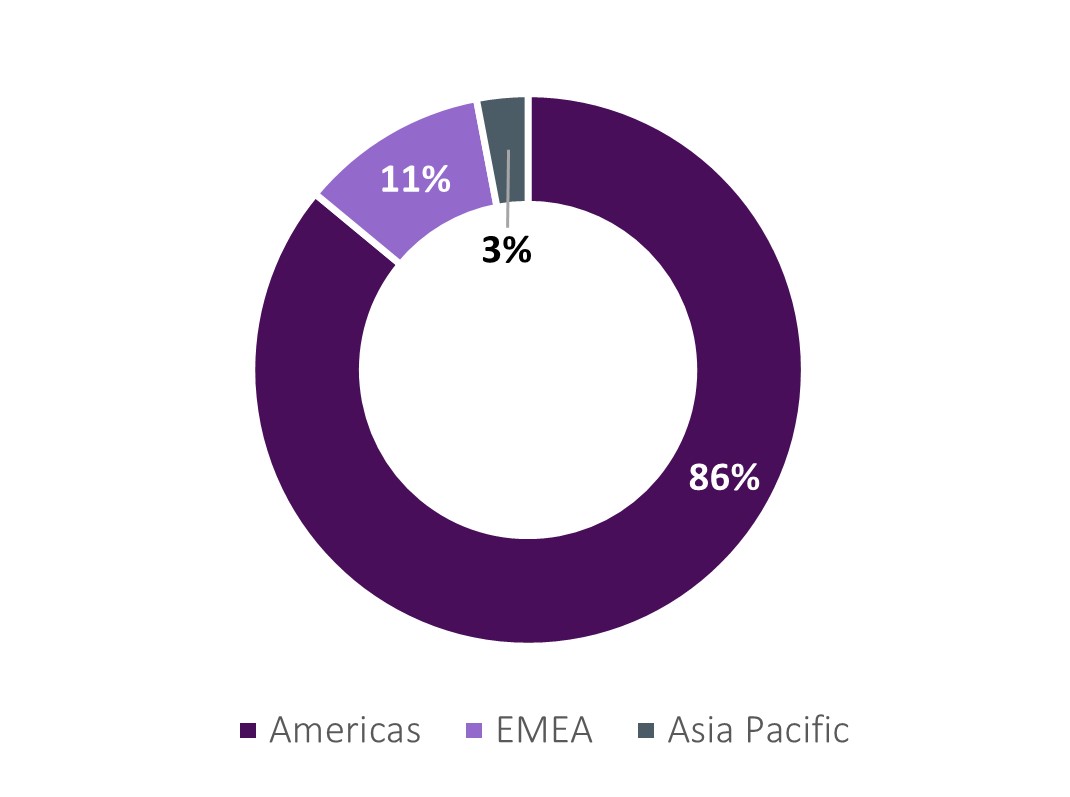

(1) The estimated fair value of our portfolio companies in the Americas, EMEA and Asia Pacific as a percentage of net assets was approximately 80.6%, 10.2% and 2.9%, respectively, as of June 30, 2024. The cost basis of portfolio companies in Americas, EMEA and Asia Pacific were $1,994,843, $241,942 and $72,233, respectively. The fair value of portfolio companies in Americas, EMEA and Asia Pacific were $2,102,747, $265,593 and $76,003, respectively.

(2) There were no single investments included in this category that exceeded 5% of net assets.

(3) As of June 30, 2024, the Company had funded cash into KKR Modena Aggregator L.P. in connection with acquiring an indirect interest in Omnissa on July 1, 2024. This investment is measured at fair value using the net asset value practical expedient under Accounting Standards Codification (“ASC”) 820, Fair Value Measurements and Disclosure (“ASC 820”).

KKR PRIVATE EQUITY CONGLOMERATE LLC

CONDENSED CONSOLIDATED SCHEDULE OF INVESTMENTS AS OF DECEMBER 31, 2023

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | | Asset | | Industry | | Geography | | Valuation Level | | Currency | | Settlement Date | | Notional | | Estimated Fair Value | | Estimated Fair Value as a Percentage of Net Assets |

| Portfolio Companies | | | | | | | | | | | | | | | | | | |

| Industrials - 37.6% | | | | | | | | | | | | | | | | | | |

| CIRCOR International, Inc. | | Equity interest held through KKR Cube Aggregator L.P. | | Industrials | | Americas | | Level III | | USD | | N/A | | N/A | | $132,500 | | 19.8% |

| Potter Electrical Signal Company, LLC | | Equity interest held through KKR Phoenix 1 Aggregator L.P. | | Industrials | | Americas | | Level III | | USD | | N/A | | N/A | | 85,500 | | 12.8% |

Other investments in portfolio companies(1) | | | | Industrials | | Americas | | Level III | | USD | | N/A | | N/A | | 33,660 | | 5.0% |

| Health Care - 28.7% | | | | | | | | | | | | | | | | | | |

| PetVet Care Centers, LLC | | Equity interest held through KKR Romulus Aggregator L.P. | | Health Care | | Americas | | Level III | | USD | | N/A | | N/A | | 127,453 | | 19.1% |

| IVI Rma Global SL | | Equity interest held through KKR Inception Aggregator L.P. | | Health Care | | EMEA | | Level III | | EUR | | N/A | | N/A | | 58,877 | | 8.8% |

| Other investment in portfolio company | | | | Health Care | | EMEA | | Level III | | USD | | N/A | | N/A | | 3,542 | | 0.5% |

| Other investment in portfolio company | | | | Health Care | | Americas | | Level III | | USD | | N/A | | N/A | | 1,770 | | 0.3% |

| Financials - 28.6% | | | | | | | | | | | | | | | | | | |

| USI Insurance Services LLC | | Equity interest held through Uno Aggregator L.P. | | Financials | | Americas | | Level III | | USD | | N/A | | N/A | | 142,500 | | 21.3% |

| April SAS | | Equity interest held through KKR Athena Aggregator L.P. | | Financials | | EMEA | | Level III | | EUR | | N/A | | N/A | | 48,508 | | 7.3% |

| Consumer Discretionary - 5.1% | | | | | | | | | | | | | | | | | | |

| Groundworks, LLC | | Equity interest held through KKR Proof Aggregator A L.P. and KKR Proof Aggregator B L.P. | | Consumer Discretionary | | Americas | | Level III | | USD | | N/A | | N/A | | 34,000 | | 5.1% |

| Materials - 4.6% | | | | | | | | | | | | | | | | | | |

| Other investment in portfolio company | | | | Materials | | Americas | | Level III | | USD | | N/A | | N/A | | 30,400 | | 4.6% |

| Communication Services - 1.9% | | | | | | | | | | | | | | | | | | |

| Other investment in portfolio company | | | | Communication Services | | Americas | | Level III | | USD | | N/A | | N/A | | 13,000 | | 1.9% |

| Information Technology - 0.3% | | | | | | | | | | | | | | | | | | |

| Other investment in portfolio company | | | | Information Technology | | Americas | | Level III | | USD | | N/A | | N/A | | 1,900 | | 0.3% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Portfolio Companies (cost of $703,790) | | | | | | | | | | | | | | | | $713,610 | | 106.8% |

| | | | | | | | | | | | | | | | | | |

| Foreign Currency Forward Contracts | | | | | | | | | | | | | | | | | | |

| Goldman Sachs | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | June 28, 2024 | | 35,700 | | $(652) | | (0.1)% |

| Barclays Bank PLC | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | June 28, 2024 | | 32,900 | | 103 | | —% |

| Nomura International plc | | Sell EUR/USD | | N/A | | N/A | | Level II | | EUR | | June 28, 2024 | | 1,700 | | (90) | | —% |

| Total Foreign Currency Forward Contracts | | | | | | | | | | | | | | | | $(639) | | (0.1)% |

| | | | | | | | | | | | | | | | | | |

| Investments in Money Market Funds | | | | | | | | | | | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds Government Portfolio | | | | N/A | | N/A | | Level I | | USD | | N/A | | N/A | | $18,007 | | 2.7% |

| Total Investments in Money Market Funds (cost of $18,007) | | | | | | | | | | | | | | | | $18,007 | | 2.7% |

| | | | | | | | | | | | | | | | | | |

| Total Investments and Cash Equivalents (cost of $721,797) | | | | | | | | | | | | | | | | $730,978 | | 109.4% |

(1) There were no single investments included in this category that exceeded 5% of net assets.

See notes to consolidated financial statements.

KKR PRIVATE EQUITY CONGLOMERATE LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(All Amounts in Thousands, Except Share and Per Share Data)

1.Organization

KKR Private Equity Conglomerate LLC (“K-PEC” and the “Company”) was formed on December 6, 2022 as a limited liability company under the laws of the state of Delaware and the Company operates its business in a manner permitting it to be excluded from the definition of an “investment company” under the Investment Company Act of 1940, as amended. The Company is a holding company that primarily seeks to acquire, own and control portfolio companies with the objective of generating attractive risk-adjusted returns and achieving medium-to-long-term capital appreciation through joint ventures (“Joint Ventures”). The Company expects that its portfolio companies will operate principally in the following business lines: Business & Financial Services; Consumer & Retail; Healthcare; Impact; Industrials; and Technology, Media & Telecommunications. The Company commenced principal operations on August 1, 2023.

K-PEC conducts a continuous private offering of its investor shares on a monthly basis: Class S Shares, Class D Shares, Class U Shares, Class I Shares, Class R-S Shares, Class R-D Shares, Class R-U Shares and Class R-I Shares (collectively, the “Investor Shares” and, collectively with the Class E Shares, Class F Shares, Class G Shares and Class H Shares, the “Shares”) in reliance on exemptions from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), including under Regulation D and Regulation S, (i) to accredited investors (as defined in Regulation D under the Securities Act) and (ii) in the case of shares sold outside of the United States, to persons that are not “U.S. persons” (as defined in Regulation S under the Securities Act).

Holders of Investor Shares have equal rights and privileges with each other, except that Class D Shares, Class U Shares, Class I Shares, Class R-D Shares, Class R-U Shares and Class R-I Shares do not pay a sales load or dealer-manager fees and the Company does not pay any servicing or distribution fees with respect to Class I Shares or Class R-I Shares or any distribution fees with respect to the Class D Shares or Class R-D Shares.

Holders of Class E Shares, Class F Shares, Class G Shares and Class H Shares (collectively, the “KKR Shares”) have equal rights and privileges with each other and, except for the Class G Shares, no class of shares will have any rights, powers or preferences with respect to determining the number of directors constituting the entire Board of Directors the (“Board”) or the appointment, election, or removal of any directors of officers of the Company. Kohlberg Kravis Roberts & Co. L.P. (together with its subsidiaries, “KKR”), through its ownership of all of the Company’s outstanding Class G Shares, hold, directly and indirectly, all of the voting power of the Company. The KKR Shares are not subject to the Management Fee (defined herein) or the Performance Participation Allocation (defined herein), and are not subject to any servicing or distribution fees.

The Company is sponsored by KKR and benefits from its industry leading institutional private equity sourcing and portfolio management platform pursuant to a management agreement entered into with KKR DAV Manager LLC (the “Manager”) to support the Company in managing its portfolio companies with the objective of generating attractive risk-adjusted returns and achieving medium-to-long-term capital appreciation by owning and controlling portfolio companies diversified by strategy, sector and geography for shareholders (the “Shareholders”).

2.Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and are stated in United States (“U.S.”) dollars. The preparation of consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in these consolidated financial statements. Actual results could differ from those estimates.

The Company’s consolidated financial statements are prepared using the accounting and reporting guidance under Accounting Standards Codification (“ASC”) ASC 946, Financial Services—Investment Companies (“ASC 946”).

Basis of Consolidation

As provided under Regulation S-X and ASC 946, the Company will generally not consolidate its investment in a company other than a wholly owned investment company or controlled operating company whose business consists of providing services to the Company. Accordingly, the Company consolidates in its consolidated financial statements the accounts of certain wholly owned subsidiaries that meet the criteria. All significant intercompany balances and transactions have been eliminated in consolidation.

Adoption of New and Revised Accounting Standards

The Company has reviewed recently issued accounting pronouncements and concluded that such pronouncements are either not applicable to the Company or no material impact is expected in the consolidated financial statements as a result of future adoption.

For a detailed discussion about K-PEC’s significant accounting policies, see Note 2 to the audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023. During the six months ended June 30, 2024, there were no significant updates to K-PEC’s significant accounting policies.

3.Investments

Summarized Portfolio Company Financial Information

The following table presents unaudited summarized financial information for the portfolio companies in the aggregate in which the Company has an indirect equity interest for the three and six months ended June 30, 2024. Amounts provided do not represent the Company’s proportionate share:

| | | | | | | | | | | |

| Three Months Ended June 30, 2024 | | Six Months Ended June 30, 2024 |

| Revenues | $ | 1,933,505 | | | $ | 4,600,377 | |

| Expenses | 2,120,872 | | | 4,937,485 | |

| Loss before taxes | (187,367) | | | (337,108) | |

| Income tax (benefit) expense | 18,159 | | | 15,595 | |

| Consolidated net loss | (205,526) | | | (352,703) | |

| Net (income) loss attributable to non-controlling interests | (92) | | | 72 | |

| Net loss | $ | (205,618) | | | $ | (352,631) | |

The net loss above represents the aggregated net loss attributable to the controlling interests in each of the Company’s portfolio companies and does not represent the Company’s proportionate share of loss.

Acquisition of Interest in Portfolio Company through Secondary Transaction

During the three and six months ended June 30, 2024, the Company purchased an interest in a portfolio company from a third-party seller for $149,691 and recorded unrealized appreciation of $34,309 in connection with the investment acquired.

4.Fair Value Measurements - Investments

The following tables present fair value measurements of investments, by major class, according to the fair value hierarchy:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 |

| Investments | Level I | | Level II | | Level III | | Investments Measured at Net Asset Value | | Fair Value |

| Portfolio companies | $ | — | | | $ | — | | | $ | 2,124,343 | | | $ | 320,000 | | | $ | 2,444,343 | |

| Unrealized depreciation on foreign currency forward contracts | — | | | (79) | | | — | | | — | | | (79) | |

| Unrealized appreciation on foreign currency forward contracts | — | | | 568 | | | — | | | — | | | 568 | |

| Investments in Money Market Funds | 308,646 | | | — | | | — | | | — | | | 308,646 | |

| Total | $ | 308,646 | | | $ | 489 | | | $ | 2,124,343 | | | $ | 320,000 | | | $ | 2,753,478 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| Investments | Level I | | Level II | | Level III | | Fair Value |

| Portfolio companies | $ | — | | | $ | — | | | $ | 713,610 | | | $ | 713,610 | |

| Unrealized depreciation on foreign currency forward contracts | — | | | (742) | | | — | | | (742) | |

| Unrealized appreciation on foreign currency forward contracts | — | | | 103 | | | — | | | 103 | |

| Investments in Money Market Funds | 18,007 | | | — | | | — | | | 18,007 | |

| Total | $ | 18,007 | | | $ | (639) | | | $ | 713,610 | | | $ | 730,978 | |

The following tables provide a reconciliation of the beginning and ending balances for investments that use Level III inputs for the six months ended June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2024 |

| Investments | | Balance as of December 31, 2023 | | Purchases | | Net change in unrealized appreciation on investments | | Net change in unrealized depreciation on foreign currency translation | | Balance as of June 30, 2024 |

| Portfolio companies | | $ | 713,610 | | | $ | 1,285,230 | | | $ | 130,529 | | | $ | (5,026) | | | $ | 2,124,343 | |

| Total | | $ | 713,610 | | | $ | 1,285,230 | | | $ | 130,529 | | | $ | (5,026) | | | $ | 2,124,343 | |

The total change in unrealized appreciation (depreciation) included in the Consolidated Statements of Operations within net change in unrealized appreciation (depreciation) for the six months ended June 30, 2024 attributable to Level III investments and foreign currency translation still held at June 30, 2024 was $130,529 and $(5,026), respectively.

The following tables present the quantitative information about Level III fair value measurements of the Company’s portfolio companies as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Level III Assets | | Fair Value June 30, 2024 | | Valuation Methodology and Inputs | | Unobservable Input(s) (1) | | Weighted Average (2) | | Range | | Impact to Valuation from an Increase in Input (3) |

| Portfolio companies | | $2,124,343 | | Inputs to market comparables, discounted cash flow and transaction price/other | | Illiquidity Discount | | 9.2% | | 5.0% - 15.0% | | Decrease |

| | | | | | Weight Ascribed to Market Comparables | | 36.1% | | 0.0% - 100.0% | | (4) |

| | | | | | Weight Ascribed to Discounted Cash Flow | | 43.1% | | 0.0% - 75.0% | | (5) |

| | | | | | Weight Ascribed to Transaction Price/Other | | 20.8% | | 0.0% - 100.0% | | (6) |

| | | | | | | | | | | | |

| | | | Market Comparables | | Enterprise Value / Forward EBITDA Multiple | | 13.7x | | 6.9x - 24.6x | | Increase |

| | | | | | | | | | | | |

| | | | Discounted Cash Flow | | Weighted Average Cost of Capital | | 12.2% | | 6.5% - 18.2% | | Decrease |

| | | | | | Enterprise Value / LTM EBITDA Exit Multiple | | 13.8x | | 8.5x - 23.0x | | Increase |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Level III Assets | | Fair Value December 31, 2023 | | Valuation Methodology and Inputs | | Unobservable Input(s) (1) | | Weighted Average (2) | | Range | | Impact to Valuation from an Increase in Input (3) |

| Portfolio companies | | $713,610 | | Inputs to market comparables, discounted cash flow and transaction price/other | | Illiquidity Discount | | 7.4% | | 5.0% - 15.0% | | Decrease |

| | | | | | Weight Ascribed to Market Comparables | | 25.0% | | 0.0% - 50.0% | | (4) |

| | | | | | Weight Ascribed to Discounted Cash Flow | | 40.2% | | 0.0% - 75.0% | | (5) |

| | | | | | Weight Ascribed to Transaction Price/Other | | 34.8% | | 0.0%- 100.0% | | (6) |

| | | | | | | | | | | | |

| | | | Market Comparables | | Enterprise Value / Forward EBITDA Multiple | | 14.6x | | 7.5x - 17.8x | | Increase |

| | | | | | | | | | | | |

| | | | Discounted Cash Flow | | Weighted Average Cost of Capital | | 11.6% | | 8.5% - 18.2% | | Decrease |

| | | | | | Enterprise Value / LTM EBITDA Exit Multiple | | 14.9x | | 8.5x - 17.5x | | Increase |

(1) In determining the inputs, management evaluates a variety of factors including economic conditions, industry and market developments, market valuations of comparable companies, and company-specific developments including exit strategies and realization opportunities. The Manager has determined that market participants would take these inputs into account when valuing the investments. “LTM” means Last Twelve Months.

(2) Inputs are weighted based on fair value of the investments included in the range.

(3) Unless otherwise noted, this column represents the directional change in the fair value of the Level III investments that would result from an increase to the corresponding unobservable input. A decrease to the unobservable input would have the opposite effect. Significant increases and decreases in these inputs in isolation could result in significantly higher or lower fair value measurements.

(4) The directional change from an increase in the weight ascribed to the market comparables approach would increase the fair value of the Level III investments if the market comparables approach results in a higher valuation than the discounted cash flow approach and transaction price approach. The opposite would be true if the market comparables approach results in a lower valuation than the discounted cash flow approach and transaction price approach.

(5) The directional change from an increase in the weight ascribed to the discounted cash flow approach would increase the fair value of the Level III investments if the discounted cash flow approach results in a higher valuation than the market comparables approach and transaction price approach. The opposite would be true if the discounted cash flow approach results in a lower valuation than the market comparables approach and transaction price approach.

(6) The directional change from an increase in the weight ascribed to the transaction price would increase the fair value of the Level III investments if the transaction price results in a higher valuation than the market comparables approach and discounted cash flow approach. The opposite would be true if the transaction price results in a lower valuation than the market comparables approach and discounted cash flow approach.

Valuations involve subjective judgments and may not accurately reflect realizable value. The assumptions above are determined by the Manager and reviewed by the Manager’s independent valuation advisor. A change in these assumptions or factors would impact the calculation of the value of our assets.

5.Related Party Transactions

Management Agreement

On July 27, 2023, the Company entered into a management agreement with the Manager, which was further amended on May 30, 2024 (“Management Agreement”). Pursuant to the Management Agreement, the Manager is responsible for sourcing, evaluating and monitoring the Company’s acquisition opportunities and making recommendations to the Company’s executive committee related to the acquisition, management, financing and disposition of the Company’s assets, in accordance with the Company’s objectives, guidelines, policies and limitations, subject to oversight by the Board.

Pursuant to the Management Agreement, the Manager is entitled to receive a management fee (the “Management Fee”) from the Company in an amount equal to (i) 1.25% per annum of the month-end Net Asset Value (“NAV”) attributable to Class S Shares, Class D Shares, Class U Shares and Class I Shares and (ii) 1.00% per annum of the month-end NAV for a 60-month period following August 1, 2023 (the “Initial Offering”) attributable to Class R-S Shares, Class R-D Shares, Class R-U Shares and Class R-I Shares (provided that for Class R-S Shares, Class R-U Shares and Class R-I Shares, such shares are purchased by an investor as part of an intermediary’s direct or indirect aggregate subscription for at least $100,000 in Shares and shares of any class of KKR Private Markets Equity Fund SICAV SA, a multi-compartment Luxembourg investment company with variable capital, and KKR Private Markets Equity Fund (Master) FCP, a Luxembourg mutual fund (together, with any parallel vehicles formed to invest alongside the aforementioned entities and that are direct or indirect parent companies of K-PRIME Aggregator L.P., “K-PRIME”) during the 18-month period following the Initial Offering) and 1.25% per annum of the month-end NAV attributable to Class R-S Shares, Class R-D Shares, Class R-U Shares and Class R-I Shares after the 60-month period following the Initial Offering, each before giving effect to accruals for the Management Fee, the Distribution Fee (as defined herein), the Servicing Fee (as defined herein), the Performance Participation Allocation (as defined herein), share repurchases for that month, any distributions and without taking into account any taxes (whether paid, payable, accrued or otherwise) of any intermediate entity through which the Company indirectly acquires and holds a portfolio company, as determined in the good faith judgment of the Manager. Such Management Fee is calculated based on the Company’s transactional net asset value (“Transactional Net Asset Value”), which is used to determine the price at which the Company sells and repurchases its Shares.

KKR or its affiliates (and in the case of directors’ fees, KKR executives) are expected to be paid transaction fees and monitoring fees in connection with the acquisition, ownership, control and exit of portfolio companies, and KKR or its affiliates are expected to be entitled to receive “break-up” or similar fees in connection with unconsummated transactions (“Other Fees”). The Management Fee payable in any monthly period is subject to reduction, but not below zero, by an amount equal to any Other Fees allocable to Investor Shares pursuant to the terms of the Management Agreement. The Manager, in its sole discretion, may forgo reimbursement by the Company of certain expenses incurred by the Manager or its affiliates (other than the Company and its subsidiaries) on behalf of the Company in each calendar month to the extent there remains any Other Fees that are not used to offset the Management Fee. Any Other Fees used to offset such expenses will not be applied again to offset future Management Fees.

For the three and six months ended June 30, 2024, the Manager earned $5,968 and $8,621 in gross Management Fees, respectively. For the three and six months ended June 30, 2024, the Company offset Management fees and certain operating expenses of $7,342 and $9,995, respectively.

As of June 30, 2024 and December 31, 2023, there were unapplied credits of $14,615 and $12,403, respectively, to be carried forward that relate to Other Fees earned.

As of June 30, 2024 and December 31, 2023, the Company did not owe a net Management Fee to the Manager. Pursuant to the Management Agreement, such amounts earned may be offset by the Manager against amounts due to the Company from the Manager.

Performance Participation Allocation

KKR is allocated a “Performance Participation Allocation” equal to 15.0% of the Total Return attributable to Investor Shares subject to a 5.0% annual Hurdle Amount and a High Water Mark, with a 100% Catch-Up (each as defined in the LLC Agreement). Such allocation will be measured and allocated or paid annually and accrued monthly (subject to pro-rating for partial periods). KKR may elect to receive the Performance Participation Allocation in cash and/or Class F Shares. Specifically, promptly following the end of each Reference Period (and at other times as described below), KKR is allocated a Performance Participation Allocation in an amount equal to:

•First, if the Total Return for the applicable period exceeds the sum of (i) the Hurdle Amount for that period and (ii) the Loss Carryforward Amount (as defined in the LLC Agreement) (any such excess, “Excess Profits”), 100% of such Excess Profits until the total amount allocated to KKR equals 15.0% of the sum of (x) the Hurdle Amount for that period and (y) any amount allocated to KKR pursuant to this clause (any such amount, the “Catch-Up”); and

•Second, to the extent there are remaining Excess Profits, 15.0% of such remaining Excess Profits.

KKR will also be allocated a Performance Participation Allocation with respect to all Investor Shares that are repurchased in connection with repurchases of Shares in an amount calculated as described above with the relevant period being the portion of the Reference Period (which is the applicable year beginning on October 1 and ending on September 30 of the next succeeding year, with the initial Reference Period being the period from August 1, 2023 to September 30, 2024) for which such Shares were outstanding, and proceeds for any such Share repurchases will be reduced by the amount of any such Performance Participation Allocation. Such Performance Participation Allocation is calculated based on the Transactional Net Asset Value.

If the Performance Participation Allocation is paid in Class F Shares, such Shares may be repurchased at KKR’s request and are subject to the repurchase limitations of our share repurchase plan.

A Performance Participation Allocation accrual of $22,997 and $1,508 was recorded as of June 30, 2024 and December 31, 2023, respectively, in the Consolidated Statements of Assets and Liabilities. During both the three and six months ended June 30, 2024, we recognized Performance Participation Allocation of $21,490 in the Consolidated Statements of Operations. No such Performance Participation Allocation was recognized during the three and six months ended June 30, 2023. During the three and six months ended June 30, 2024, we issued 48 Class F Shares to an affiliate of KKR totaling $1 with respect to Performance Participation Allocation resulting from repurchases of Investor Shares by the Company during the second quarter of 2024.

Distribution Fees and Servicing Fees

The Company will pay KKR Capital Markets LLC ongoing distribution and servicing fees (a) of 0.85% of NAV per annum for Class S Shares, Class U Shares, Class R-S Shares and Class R-U Shares only (consisting of a 0.60% distribution fee (the “Distribution Fee”) and a 0.25% shareholder servicing fee (the “Servicing Fee”)), accrued and payable monthly and (b) of 0.25% for Class D Shares and Class R-D Shares only (all of which constitutes payment for shareholder services, with no payment for distribution services) in each case as accrued, and payable monthly. Such Distribution Fee and Servicing Fee are calculated based on the Transactional Net Asset Value. None of the Class I Shares, Class R-I Shares, Class E Shares, Class F Shares, Class G Shares or Class H Shares incur the Distribution Fee or the Servicing Fee. The Dealer Manager (defined below) generally expects to reallow the Distribution Fee and the Servicing Fee to participating broker dealers or other intermediaries. The Company may also pay for certain sub-transfer agency, platform, sub-accounting and administrative services outside of the Distribution Fee and the Servicing Fee.

Under GAAP, the Company accrues the cost of the Servicing Fees and Distribution Fees, as applicable, for the estimated life of the shares as an offering cost at the time the Company sells Class S Shares, Class U Shares, Class D Shares, Class R-S Shares, Class R-U Shares and Class R-D Shares. As of June 30, 2024 and December 31, 2023, the Company has accrued $113,543 and $40,309, respectively, of Servicing Fees and Distribution Fees payable to the Dealer Manager (as defined below) related to the Class R-U Shares and Class R-D Shares sold.

Expense Limitation and Reimbursement Agreement

On December 6, 2022, the Company entered into an Expense Limitation and Reimbursement Agreement, which was further amended on May 10, 2024 (the “Expense Limitation Agreement”), with the Manager. Pursuant to the Expense Limitation Agreement, the Manager will forgo an amount of its monthly management fee and/or pay, absorb or reimburse certain expenses of the Company, to the extent necessary so that, for any fiscal year, the Company’s annual Specified Expenses (as defined below) do not exceed 0.60% of the Company’s net assets as of the end of each calendar month. “Specified Expenses” is defined to include all expenses incurred in the business of the Company, including organizational and offering costs, with the exception of (i) the management fee, (ii) the Performance Participation Allocation, (iii) the Servicing Fee, (iv) the Distribution Fee, (v) portfolio company level expenses, (vi) brokerage costs or other investment-related out-of-pocket expenses, including with respect to unconsummated transactions, (vii) dividend/interest payments (including any dividend payments, interest expenses, commitment fees, or other expenses related to any leverage incurred by the Company), (viii) taxes, (ix) ordinary corporate operating expenses (including costs and expenses related to hiring,

retaining, and compensating employees and officers of the Company), (x) certain insurance costs and (xi) extraordinary expenses (as determined in the sole discretion of the Manager).

The Expense Limitation Agreement remains in effect through and including June 30, 2025, but may be renewed by the mutual agreement of the Manager and the Company for successive terms. Under the Expense Limitation Agreement, the Company has agreed to carry forward the amount of the foregone management fees and/or expenses paid, absorbed or reimbursed by the Manager for a period not to exceed three years from the end of the month in which the Manager waived or reimbursed such fees or expenses and to reimburse the Manager for such fees or expenses in accordance with the Expense Limitation Agreement.

As of June 30, 2024, the Manager agreed to reimburse expenses of $959 and $3,170 incurred by the Company for the three and six months ended June 30, 2024, respectively, pursuant to the Expense Limitation Agreement. The amounts are subject to recoupment within a three year period.

As of June 30, 2024 and December 31, 2023, the Company recorded $2,332 and $13,451, respectively, as Due from Manager related to amounts waived under the Expense Limitation Agreement to date and $6,911 and $14,471, respectively, as Due to Manager related to amounts paid by the Manager on behalf of the Company.

The following table reflects the amounts incurred by the Company and subject to recoupment pursuant to the Expense Limitation Agreement and the expiration for future possible recoupments by the Company:

| | | | | | | | | | | | | | |

| Three Months Ended | | Amount | | Last Expiration Date |

| December 31, 2022 | | $ | 3,635 | | | December 31, 2025 |

| March 31, 2023 | | 1,838 | | | March 31, 2026 |

| June 30, 2023 | | 1,938 | | | June 30, 2026 |

| September 30, 2023 | | 3,269 | | | September 30, 2026 |

| December 31, 2023 | | 2,771 | | | December 31, 2026 |

| March 31, 2024 | | 2,211 | | | March 31, 2027 |

| June 30, 2024 | | 959 | | | June 30, 2027 |

| Total | | $ | 16,621 | | | |

As of June 30, 2024 and December 31, 2023, management believes that it was not probable for the Company to be required to reimburse the expenses waived by the Manager.

Acquisition of Interests in Portfolio Companies through Secondary Transaction with Related Party

During the three and six months ended June 30, 2024, the Company purchased interests in portfolio companies from an investment vehicle that is managed by an affiliate of the Manager for $348,432 and recorded unrealized appreciation of $33,046 in connection with the investments acquired.

Dealer-Manager Agreement

On July 27, 2023, the Company entered into a Dealer-Manager Agreement (as amended from time to time, the “Dealer-Manager Agreement”) with KKR Capital Markets LLC (the “Dealer Manager”).

Pursuant to the Dealer-Manager Agreement, the Dealer Manager solicits sales of the Company’s Shares authorized for issue in accordance with the Company’s confidential Private Placement Memorandum (the “PPM”) and provides certain administrative and shareholder services to the Company, subject to the terms and conditions set forth in the Dealer-Manager Agreement. The Dealer Manager receives certain front-end sales charges, Distribution Fees, Servicing Fees and certain other fees as described in the PPM.

Line of Credit

On December 20, 2023, certain wholly-owned subsidiaries of the Company, as may be added and removed from time to time (the “Borrowers”), entered into an unsecured, uncommitted line of credit, which was further amended on March 21,

2024 (the “Line of Credit”) to provide for up to a maximum aggregate principal amount of $300,000 with KKR Alternative Assets LLC (the “Lender”), an affiliate of the Company.

Each loan under the Line of Credit will (i) be subject to an interest rate per annum as set forth in the applicable loan request up to the then-current rate offered by a third party lender or, if no such rate is available, up to Secured Overnight Financing Rate applicable to such loan plus 3.50% and (ii) in the event that the interest rate is zero percent such loan will have a maximum maturity of 364 days following the borrowing of such loan (unless otherwise consented to by the Lender in its sole discretion). The Line of Credit expires on December 20, 2024, subject to six-month extension options requiring the Lender’s approval. Each advance under the Line of Credit is repayable on the earlier of the (i) 180th day following the earlier of (x) the Lender’s demand and (y) the expiration of the line of credit and (ii) if specified, the scheduled date of repayment for each such loan as set forth in the relevant loan request (the “Scheduled Repayment Date”), which date shall in no case be later than 364 days following the borrowing of such loan (unless the Lender, in its sole discretion, consents to a Scheduled Repayment Date that is later than 364 days following the borrowing of such loan). To the extent the Company has not repaid all loans and other obligations under the Line of Credit after a repayment event has occurred, the Company is obligated to apply excess available cash proceeds to the repayment of such loans and other obligations; provided that the Borrowers will be permitted to (w) make payments to fulfill any repurchase requests pursuant to the Company’s share repurchase plan or any excess tender offer on the terms described in the Company’s private placement memorandum, (x) use funds to close any acquisition of a portfolio company which the Company committed to prior to receiving a demand notice, (y) make elective distributions of an amount not to exceed amounts paid in the immediately preceding fiscal quarter and (z) pay any taxes when due. The Line of Credit also permits voluntary prepayment of principal and accrued interest without any penalty other than customary breakage costs subject to the Lender’s discretion. Each Borrower may withdraw from the Line of Credit at the time all such obligations held by such Borrower to the Lender under the Line of Credit have been repaid to the Lender in full. The Line of Credit contains customary events of default. As is customary in such financings, if an event of default occurs under the Line of Credit, the Lender may accelerate the repayment of amounts outstanding under the Line of Credit and exercise other remedies subject, in certain instances, to the expiration of an applicable cure period.

The Lender and its assignees shall not have any recourse to any entities with interests in the Borrowers such as a general partner or investor, including the Company, or any of their respective assets for any indebtedness or other monetary obligation incurred under the Line of Credit.

As of December 31, 2023, the outstanding balance on the Line of Credit was $19,200, all of which was subsequently repaid on January 4, 2024. No balance was outstanding on the Line of Credit as of June 30, 2024. For the period from January 1, 2024 to January 4, 2024, the Company incurred interest expense of $14, which was waived by the Lender.

6.Shareholders’ Equity

The following table is a summary of share activity during the three months ended June 30, 2024 and shares outstanding as of June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares Outstanding as of March 31, 2024 | | Shares Issued During the Period | | Shares Repurchased During the Period | Transfers In During the Period | | Transfers Out During the Period | | Shares Outstanding as of June 30, 2024 |

| Class I Shares | | 386 | | | 12,353 | | | — | | — | | | (530) | | | 12,209 | |

| Class U Shares | | — | | | 110,734 | | | — | | — | | | — | | | 110,734 | |

| Class R-D Shares | | 402,685 | | | 2,398,137 | | | — | | — | | | (3,834) | | | 2,796,988 | |

| Class R-I Shares | | 9,502,499 | | | 23,742,542 | | | (2,871) | | 59,918 | | | — | | | 33,302,088 | |

| Class R-U Shares | | 39,756,187 | | | 24,270,806 | | | (10,837) | | — | | | (55,946) | | | 63,960,210 | |

| Class F Shares | | 3,710 | | | 1,947 | | | — | | — | | | — | | | 5,657 | |

| Class G Shares | | 40 | | | — | | | — | | — | | | — | | | 40 | |

| Class H Shares | | 40 | | | — | | | — | | — | | | — | | | 40 | |

| Total | | 49,665,547 | | | 50,536,519 | | | (13,708) | | 59,918 | | | (60,310) | | | 100,187,966 | |

The following table is a summary of share activity during the six months ended June 30, 2024 and shares outstanding as of June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares Outstanding as of December 31, 2023 | | Shares Issued During the Period | | Shares Repurchased During the Period | Transfers In During the Period | | Transfers Out During the Period | | Shares Outstanding as of June 30, 2024 |

| Class I Shares | | 69,695 | | | 12,739 | | | — | | — | | | (70,225) | | | 12,209 | |

| Class U Shares | | — | | | 110,734 | | | — | | — | | | — | | | 110,734 | |

| Class R-D Shares | | — | | | 2,802,745 | | | — | | — | | | (5,757) | | | 2,796,988 | |

| Class R-I Shares | | 4,452,158 | | | 28,673,012 | | | (2,871) | | 179,789 | | | — | | | 33,302,088 | |

| Class R-U Shares | | 22,941,060 | | | 41,134,422 | | | (10,837) | | — | | | (104,435) | | | 63,960,210 | |

| Class F Shares | | 1,967 | | | 3,690 | | | — | | — | | | — | | | 5,657 | |

| Class G Shares | | 40 | | | — | | | — | | — | | | — | | | 40 | |

| Class H Shares | | 40 | | | — | | | — | | — | | | — | | | 40 | |

| Total | | 27,464,960 | | | 72,737,342 | | | (13,708) | | 179,789 | | | (180,417) | | | 100,187,966 | |

Distribution Reinvestment Plan

The Company adopted a Distribution Reinvestment Plan (the “DRIP”) in which cash distributions to holders of our Shares will automatically be reinvested in additional whole and fractional Shares attributable to the class of Shares that a Shareholder owns unless such holders elect to receive distributions in cash. Shareholders may terminate their participation in the DRIP with prior written notice to us. Under the DRIP, Shareholders’ distributions are reinvested in Shares of the same class owned by the Shareholder for a purchase price equal to the most recently available Transactional Net Asset Value per Share. Shareholders will not pay a sales load when purchasing Shares under our DRIP; however, Class S Shares, Class D Shares, Class U Shares, Class R-S Shares, Class R-D Shares and Class R-U Shares, including those purchased under our DRIP, will be subject to applicable ongoing distribution and/or shareholder servicing fees.

As of June 30, 2024 and December 31, 2023, the Company has not issued any Shares under the DRIP.

Share Repurchases

The Company offers a share repurchase plan pursuant to which, on a quarterly basis, Shareholders may request that we repurchase all or any portion of their Shares. The Company may repurchase fewer Shares than have been requested in any particular quarter to be repurchased under our share repurchase plan, or none at all, in our discretion at any time. In addition, the aggregate NAV of total repurchases of Class S Shares, Class D Shares, Class U Shares, Class I Shares, Class R-S Shares, Class R-D Shares, Class R-U Shares, Class R-I Shares or Class F Shares under our share repurchase plan will be limited to no more than 5% of our aggregate NAV per calendar quarter (measured using the average aggregate NAV attributable to Shareholders as of the end of the immediately preceding calendar quarter).

On May 6, 2024, the Company repurchased approximately $356 of Shares. The following table summarizes the Shares repurchased during the six months ended June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | Repurchase Price per Share | | Number of Shares Repurchased | | Gross Consideration | | 5% Early Repurchase Fee | | Net Consideration |

| Class R-I Shares | | $ | 26.12 | | | 2,871 | | | $ | 75 | | | $ | (6) | | | $ | 69 | |

| Class R-U Shares | | 25.97 | | | 10,837 | | | 281 | | | (11) | | | 270 | |

| Total | | | | 13,708 | | | $ | 356 | | | $ | (17) | | | $ | 339 | |

Repurchase Arrangement for Class E Shares held by KKR

No shares were repurchased by the Company, pursuant to the KKR Share Repurchase Arrangement, effective July 27, 2023 (“KKR Share Repurchase Arrangement”), during the three and six months ended June 30, 2024.

For a description of the KKR Share Repurchase Arrangement, please see our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

7.Distributions

The Company did not declare or pay any distributions during the three and six months ended June 30, 2024.

8.Commitments and Contingencies

Litigation

The Company was not subject to any material litigation nor was the Company aware of any material litigation threatened against it.

Funding Commitments and Others

The Company had $8,833 of unfunded commitments in portfolio companies as of both June 30, 2024 and December 31, 2023.

Indemnification

Under the LLC Agreement and organizational documents, the members of the Board, officers of the Company, the Manager, KKR, and their respective affiliates, directors, officers, representatives, agents and employees are indemnified against certain liabilities arising out of the performance of their duties to the Company. In the normal course of business, the Company enters into contracts that contain a variety of representations and that provide general indemnifications. The Company’s maximum liability exposure under these arrangements is unknown, as future claims that have not yet occurred may be made against the Company.

9.Financial Highlights

The following is a schedule of the financial highlights of the Company attributed to each class of Shares for the six months ended June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I Shares | | Class U Shares | | Class R-D Shares | | Class R-I Shares | | Class R-U Shares | | Class F Shares | | Class G Shares | | Class H Shares |

Per share data attributed to shares (1) | | | | | | | | | | | | | | | |

| Net asset value per share at beginning of period (January 1, 2024) | $ | 25.88 | | | $ | — | | | $ | — | | | $ | 25.87 | | | $ | 24.08 | | | $ | 26.02 | | | $ | 26.02 | | | $ | 26.02 | |

| Consideration from the issuance of shares, net | — | | | 26.87 | | | 26.65 | | | — | | | 1.58 | | | — | | | — | | | — | |

| Repurchase of shares | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Early repurchase fee | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Transfers in | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Transfers out | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Accrued shareholder servicing fees and distribution fees (2) | — | | | (1.83) | | | (0.99) | | | — | | | (1.68) | | | — | | | — | | | — | |

Net investment (loss) income (2) | (0.26) | | | (0.06) | | | (0.16) | | | (0.17) | | | (0.13) | | | 0.18 | | | 0.16 | | | 0.16 | |

Net realized gain (loss) and change in unrealized appreciation (depreciation)(2) | 1.72 | | | 0.53 | | | 1.24 | | | 1.61 | | | 1.51 | | | 1.54 | | | 1.57 | | | 1.57 | |

| Net increase (decrease) in net assets attributed to shareholders | 1.46 | | | (1.36) | | | 0.09 | | | 1.44 | | | 1.28 | | | 1.72 | | | 1.73 | | | 1.73 | |

| Net asset value per share at the end of period (June 30, 2024) | $ | 27.34 | | | $ | 25.51 | | | $ | 26.74 | | | $ | 27.31 | | | $ | 25.36 | | | $ | 27.74 | | | $ | 27.75 | | | $ | 27.75 | |

| Net assets at end of period (June 30, 2024) | $ | 334 | | | $ | 2,825 | | | $ | 74,791 | | | $ | 909,397 | | | $ | 1,622,034 | | | $ | 157 | | | $ | 1 | | | $ | 1 | |

| Shares outstanding at end of period (June 30, 2024) | 12,209 | | | 110,734 | | | 2,796,988 | | | 33,302,088 | | | 63,960,210 | | | 5,657 | | | 40 | | | 40 | |

| Weighted average shares outstanding at end of period (June 30, 2024) | 3,581 | | | 110,734 | | | 1,516,561 | | | 19,167,111 | | | 44,621,484 | | | 4,668 | | | 40 | | | 40 | |

| | | | | | | | | | | | | | | |

| Ratio/Supplemental data for Shares (not annualized): | | | | | | | | | | | | | | | |

Ratios to net asset value (3): | | | | | | | | | | | | | | | |

Operating expenses before Performance Participation Allocation (4) | 0.24 | % | | 0.05 | % | | 0.19 | % | | 0.24 | % | | 0.28 | % | | 0.27 | % | | 0.28 | % | | 0.28 | % |

Operating expenses before expenses reimbursed by Manager (4) (5) | 2.04 | % | | 0.39 | % | | 1.57 | % | | 1.80 | % | | 1.75 | % | | 0.49 | % | | 0.54 | % | | 0.54 | % |

Operating expenses after expenses reimbursed by Manager (4) (5) | 1.94 | % | | 0.38 | % | | 1.48 | % | | 1.66 | % | | 1.53 | % | | 0.27 | % | | 0.28 | % | | 0.28 | % |

Operating expenses after Performance Participation Allocation (4) (6) | 1.94 | % | | 0.38 | % | | 1.48 | % | | 1.66 | % | | 1.53 | % | | 0.27 | % | | 0.28 | % | | 0.28 | % |

Net investment (loss) income(4) | (0.95) | % | | (0.23) | % | | (0.60) | % | | (0.64) | % | | (0.52) | % | | 0.67 | % | | 0.62 | % | | 0.62 | % |

Total GAAP return attributed to Shares based on net asset value (7) | 5.64 | % | | (5.06) | % | | 2.85 | % | | 5.57 | % | | 5.32 | % | | 6.61 | % | | 6.65 | % | | 6.65 | % |

(1) Per share data may be rounded in order to recompute the ending net asset value per share.

(2) The per share data was derived by using the weighted average shares outstanding during the applicable period.

(3) Actual results may not be indicative of future results. Additionally, an individual Shareholder’s ratios may vary from the ratios presented for a share class as a whole.

(4) Weighted average net assets during the applicable period are used for this calculation.

(5) Ratios presented after accounting for the accrual of the Performance Participation Allocation.

(6) Ratios presented after expenses reimbursed by Manager.

(7) The Total return is calculated for each share class as the change in the net asset value for such share class during the period plus any distributions per share declared in the period, and assumes any distributions are reinvested in accordance with our distribution reinvestment plan. Amounts are not annualized and are not representative of total return as calculated for purposes of the Performance Participation Allocation as described in Note 5. Related Party Transactions. The Company’s performance changes over time and currently may be different than that shown above. Past performance is no guarantee of future results. Investment performance is presented without regard to sales load that may be incurred by Shareholders in the purchase of the Company’s Shares. The Company did not declare or pay any distributions during the six months ended June 30, 2024.

10. Income Taxes

The Company operates so that it will qualify to be treated as a partnership for U.S. federal income tax purposes under the Internal Revenue Code of 1986, as amended, and not as a publicly traded partnership taxable as a corporation. As such, it will not be subject to any U.S. federal and state income taxes. In any year, it is possible that the Company will be considered a publicly traded partnership and will not meet the qualifying income exception, which would result in the Company being treated as a publicly traded partnership and taxed as a corporation, rather than as a partnership. In such case, the members would then be treated as shareholders in a corporation, and the Company would become taxable as a corporation for U.S. federal, state and/or local income tax purposes. The Company would be required to pay income tax at corporate rates on its net taxable income.

In addition, the Company operates, in part, through subsidiaries that may be treated as corporations for U.S. and non-U.S. tax purposes and therefore may be subject to current and deferred U.S. federal, state and/or local income taxes at the subsidiary level.

For the three months ended June 30, 2024 and 2023, the effective tax rates were 1.2% and 0.0%, respectively, and for the six months ended June 30, 2024 and 2023, the effective tax rates were 2.2% and 0.0%, respectively. For the three and six months ended June 30, 2024, the primary items giving rise to the difference between the 0.0% federal statutory rate applicable to partnerships and the effective tax rate is due to U.S. federal, state and local taxes on income from the Company’s subsidiaries that are treated as corporations for U.S. federal, state or local purposes. For the three and six months ended June 30, 2023, the effective tax rates did not differ from the 0.0% federal statutory rate applicable to partnerships as the Company did not have any income from subsidiaries that are treated as corporations for U.S. federal, state or local purposes.

11. Subsequent Events

Unregistered Sale of Equity Securities

On July 1, 2024, the Company sold the following Investor Shares of the Company (with the final number of shares determined on July 19, 2024) to investors for cash:

| | | | | | | | | | | | | | |

| Class | | Number of Shares Sold | | Net Consideration |

| Class I Shares | | 914 | | | $ | 25 | |

| Class U Shares | | 1,830 | | | 50 | |

| Class R-D Shares | | 2,617,161 | | | 71,348 | |

| Class R-I Shares | | 2,422,106 | | | 66,142 | |

| Class R-U Shares | | 4,555,712 | | | 123,336 | |

Share Repurchases

The following table summarizes the Shares repurchased on August 5, 2024 by the Company in connection with the Company’s share repurchase plan:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class | Repurchase Price per Share | | Number of Shares Repurchased | | Gross Consideration | | 5% Early Repurchase Fee | | Net Consideration |

| Class R-U Shares | $ | 27.07 | | | 25,246 | | | $ | 683 | | | $ | (34) | | | $ | 649 | |