UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23846

Redwood Real Estate Income Fund

(Exact name of registrant as specified in charter)

c/o UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

(Address of Principal Executive Offices)

Ann Maurer

235 West Galena Street

Milwaukee, WI 53212

(Name and Address of Agent for Service)

Copies to:

Joshua B. Deringer, Esq.

Faegre Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, PA 19103-6996

215-988-2700

Registrant's telephone number, including area code: (414) 299-2270

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”).

REDWOOD REAL ESTATE INCOME FUND

Shareholder Letter December 31, 2023 (Unaudited) |

Dear Shareholders,

We are pleased to provide you with the 2023 annual report for the Redwood Real Estate Income Fund (CREMX or the Fund). CREMX is a continuously-offered, closed-end, management investment company registered under the Investment Company Act of 1940, as amended (1940 Act). The Fund operates as an interval fund pursuant to Rule 23c-3 of the 1940 Act. The Fund primarily invests in short duration, low loan to value (LTV) private bridge loans backed by commercial real estate assets in the top 30 metropolitan statistical areas (MSAs) in the United States.

The Fund’s innovative structure allows it to directly invest in private real estate debt rather than in private funds of other managers, thereby avoiding multiple layers of fees. Through valued relationships of the Fund’s officers, the Fund seeks to provide investors with exposure to proprietary transactions, alongside other large, sophisticated institutional investors, that otherwise may not be available to retail investors that do not meet higher investment minimums or other investor requirements such as accreditation or qualified purchaser status.

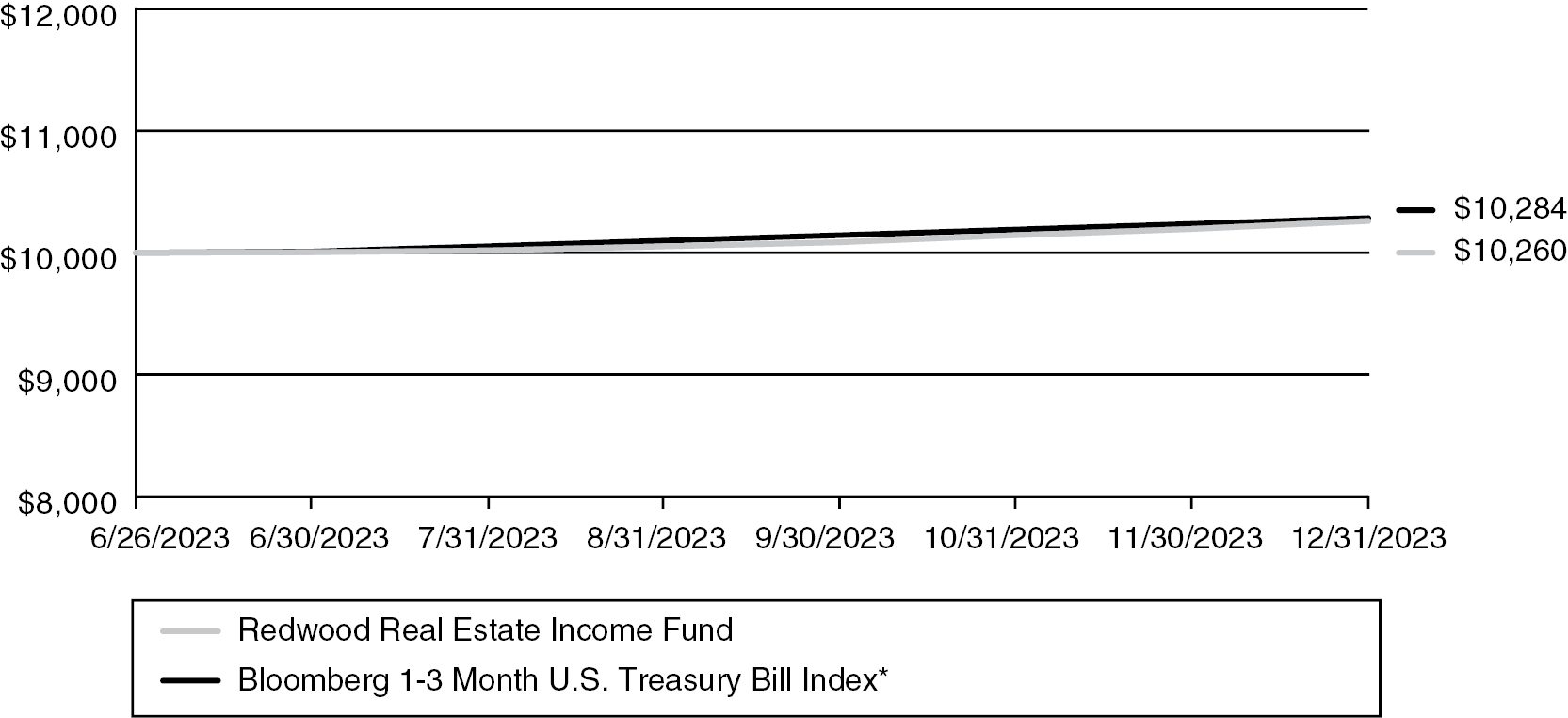

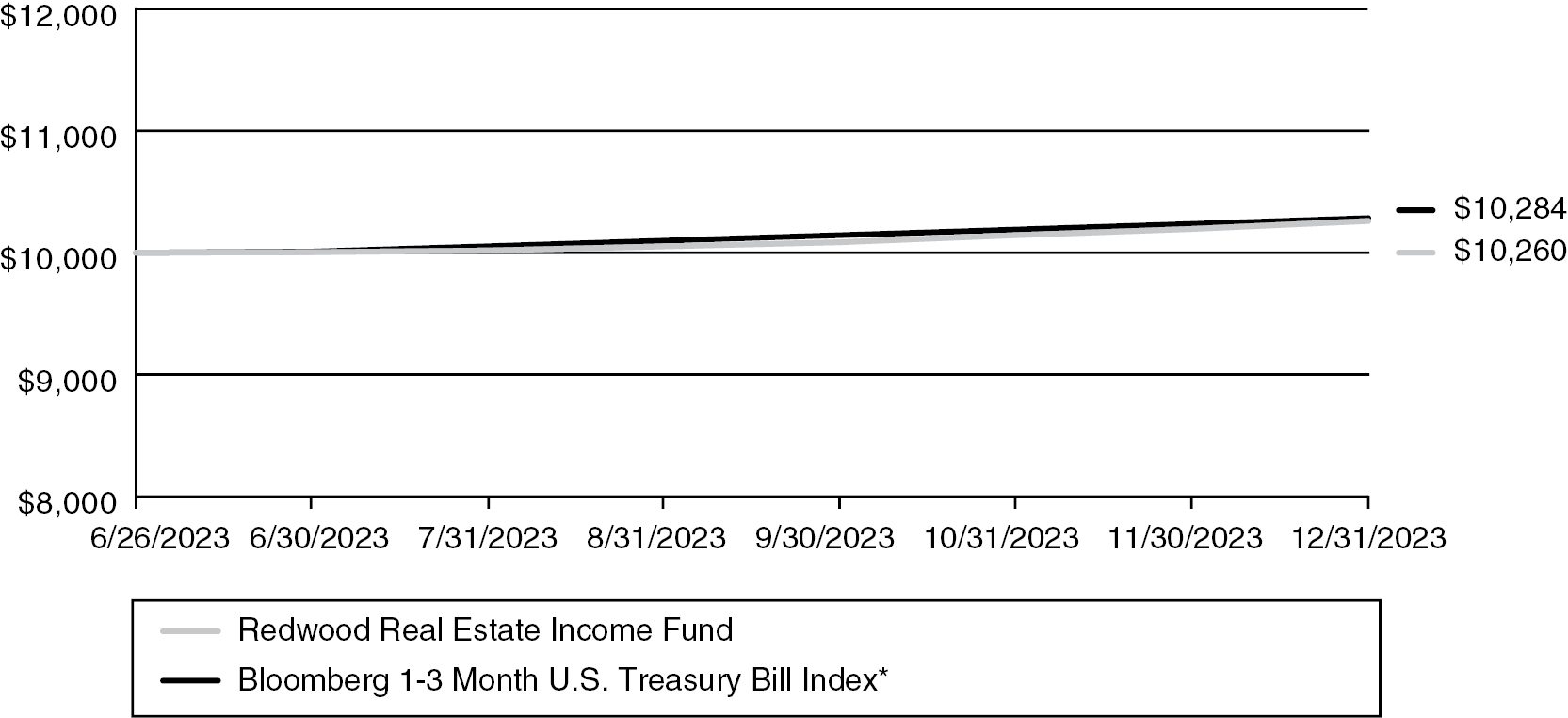

Since the Fund launched at the end of June of 2023, it has returned 2.60% as of December 31, 2023 (Source: UMB Fund Services). This positive return is attributable to the Fund getting invested in its initial private debt positions. Fund performance during the period from the Fund’s launch to December 31, 2023 was in line with its benchmark at 2.84% for the Bloomberg U.S. Treasury Bills: 1-3 Months Index** (Source: UMB Fund Services); and compared favorably to other public fixed income indices such as the Bloomberg U.S. Aggregate Index*** which returned 0.72% for the same period (Source: Bloomberg).

The regional banking crisis of early 2023 that saw the failure of banks such as Silicon Valley Bank and First Republic created and continues to create incremental opportunities for private lenders and for the types of loans CREMX makes and participates in. This is due to regional banks being a significant source of commercial real estate financing historically and those lenders pulling back from new lending activities. This trend presents potentially attractive incremental opportunities for CREMX to continue to deploy more capital.

Thank you for your investment in CREMX. If you have any questions, please contact the Redwood Team at 1 888.570.0805. We look forward to continuing our relationship for years to come.

Sincerely,

Michael T. Messinger

President

Richard M. Duff

Treasurer

1

REDWOOD REAL ESTATE INCOME FUND

Fund Performance December 31, 2023 (Unaudited) |

Performance of a $10,000 Investment

This graph compares a hypothetical $10,000 investment in the Fund’s shares, made at its inception, June 26, 2023, with a similar investment in the Index. Results include the reinvestment of all dividends and capital gains.

Cumulative Returns as of December 31, 2023 | | Since

Inception |

Redwood Real Estate Income Fund (Inception Date 6/26/2023) | | 2.60 | % |

Bloomberg 1-3 Month U.S. Treasury Bill Index | | 2.84 | %* |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 888-988-9882.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

For the Fund’s current expense ratio, please refer to the Financial Highlights Section of this report.

2

REDWOOD REAL ESTATE INCOME FUND

Schedule of Investments December 31, 2023 |

Principal

Amount

($) | | | | Spread | | Coupon

Rate

(%) | | Maturity | | Fair Value |

| | | Commercial Real Estate — 71.9%1,2 | | | | | | | | | |

| | | Participation Notes — 71.9% | | | | | | | | | |

| | | Condominium Development — 1.2% | | | | | | | | | |

2,087,271 | | 3323 – 44 W 8 Capital, LLC & 44 W 8 SME, LLC3 | | SOFR1M + 5.00%; floor 10.00% | | 10.38 | | 04/07/2025 | | $ | 2,087,271 |

229,743 | | 3343 – 502 East 81st Street Development, LLC3 | | SOFR1M + 5.25%; floor 10.25% | | 10.61 | | 06/22/2025 | | | 229,743 |

| | | | | | | | | | | | 2,317,014 |

| | | | | | | | | | | | |

| | | Early Stage Construction — 12.7% | | | | | | | | | |

25,000,000 | | 3321 – Queens Plaza North New York, LLC3 | | SOFR1M + 5.50%; floor 10.83% | | 10.86 | | 10/22/2024 | | | 25,000,000 |

| | | | | | | | | | | | |

| | | Hospitality — 8.3% | | | | | | | | | |

4,019,257 | | 3330 – 3601 Parking, LLC & N Ocean Blvd, LLC3 | | SOFR1M + 5.10%; floor 10.25% | | 10.50 | | 10/31/2025 | | | 4,019,257 |

12,500,000 | | 3333 – McRopp New York Royal44, LLC3 | | SOFR1M + 5.25%; floor 10.50% | | 10.63 | | 11/28/2025 | | | 12,500,000 |

| | | | | | | | | | | | 16,519,257 |

| | | | | | | | | | | | |

| | | Industrial — 7.7% | | | | | | | | | |

14,000,000 | | 3320 – Howell Lendco, LLC3 | | SOFR1M + 5.21%; floor 10.51% | | 10.55 | | 03/24/2025 | | | 14,000,000 |

1,300,000 | | 3335 – Cromwell Inwood, LLC3 | | SOFR1M + 5.50%; floor 10.83% | | 10.88 | | 11/27/2025 | | | 1,300,000 |

| | | | | | | | | | | | 15,300,000 |

| | | | | | | | | | | | |

| | | Mixed Use Development — 1.3% | | | | | | | | | |

2,618,182 | | 3340 – San Antonio Palo Alto, LLC3 | | SOFR1M + 6.20%; floor 11.50% | | 11.55 | | 12/15/2025 | | | 2,618,182 |

| | | | | | | | | | | | |

| | | Multifamily — 21.0% | | | | | | | | | |

3,470,000 | | 3303 – 150 Lefferts Ave./55 East 21st Street3 | | SOFR1M + 5.20%; floor 10.00% | | 10.53 | | 04/28/2024 | | | 3,470,000 |

3,439,153 | | 3316 – Spring Rock Bridge/428 Williams3 | | SOFR1M + 5.00%; floor 9.50% | | 10.38 | | 05/18/2024 | | | 3,439,153 |

5,500,000 | | 3336 – Blue Spruce Lendco, LLC3 | | SOFR1M + 5.00%; floor 10.25% | | 10.34 | | 05/30/2025 | | | 5,500,000 |

28,930,784 | | Tryperion TL Los Altos, LLC3 | | SOFR1M + 8.36% | | 13.68 | | 02/01/2024 | | | 28,930,784 |

| | | | | | | | | | | | 41,339,937 |

| | | | | | | | | | | | |

| | | Office — 2.0% | | | | | | | | | |

4,000,000 | | 3341 – Ferncroft, LLC3 | | SOFR1M + 5.25%; floor 10.50% | | 10.61 | | 12/19/2025 | | | 4,000,000 |

| | | | | | | | | | | | |

| | | Predevelopment — 15.3% | | | | | | | | | |

12,000,000 | | 3317 – 24 – 02 Queens Plaza South, Queens3 | | SOFR1M + 5.15%; floor 10.25% | | 10.50 | | 08/25/2025 | | | 12,000,000 |

8,000,000 | | 3318 – 125 3rd Street Brooklyn, NY3 | | SOFR1M + 5.25%; floor 10.25% | | 10.58 | | 09/12/2024 | | | 8,000,000 |

10,377,692 | | 3324 – Sarasota3 | | SOFR1M + 5.68%; floor 10.53% | | 11.01 | | 09/23/2025 | | | 10,377,692 |

| | | | | | | | | | | | 30,377,692 |

| | | | | | | | | | | | |

| | | Single Family — 0.5% | | | | | | | | | |

1,000,000 | | 3326 – Elgny, LLC3 | | SOFR1M + 5.00%; floor 10.25% | | 10.38 | | 10/07/2025 | | | 1,000,000 |

| | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

3

REDWOOD REAL ESTATE INCOME FUND

Schedule of Investments (Continued) December 31, 2023 |

Principal

Amount

($) | | | | Spread | | Coupon

Rate

(%) | | Maturity | | Fair Value |

| | | Single Family/Condominium — 1.2% | | | | | | | | | |

2,451,862 | | 3313 – First Lien Portfolio #33 | | SOFR1M + 5.25%; floor 10.35% | | 10.63 | | 07/25/2025 | | $ | 2,451,862 |

| | | | | | | | | | | | |

| | | Single Family/Multifamily — 0.7% | | | | | | | | | |

1,427,220 | | 3314 – VM Equities #33 | | SOFR1M + 5.25%; floor 9.75% | | 10.63 | | 07/28/2025 | | | 1,427,220 |

| | | Total Participation Notes

(Cost $142,348,344) | | | | | | | | | 142,351,164 |

| | | | | | | | | | | | |

| | | Total Commercial Real Estate

(Cost $142,348,344) | | | | | | | | | 142,351,164 |

| | | | | | | | | | | | |

| | | Short-term Investments — 20.2% | | | | | | | | | |

| | | Money Market Funds — 20.2% | | | | | | | | | |

39,992,059 | | Fidelity US Government Fund, 5.16%4 | | | | | | | | | 39,992,059 |

| | | Total Short-term Investments

(Cost $39,992,059) | | | | | | | | | 39,992,059 |

| | | | | | | | | | | | |

| | | Total Investments

(Cost $182,340,403) — 92.1% | | | | | | | | $ | 182,343,223 |

| | | Other assets in excess of liabilities – 7.9% | | | | | | | | | 15,610,518 |

| | | Net Assets — 100.0% | | | | | | | | $ | 197,953,741 |

See accompanying Notes to Financial Statements.

4

REDWOOD REAL ESTATE INCOME FUND

Summary of Investments (Unaudited) December 31, 2023 |

Security Type | | Percent of

Total

Net Assets |

Commercial Real Estate | | | |

Participation Notes | | 71.9 | % |

Total Commercial Real Estate | | 71.9 | % |

Short-term Investments | | 20.2 | % |

Total Investments | | 92.1 | % |

Other assets in excess of liabilities | | 7.9 | % |

Net Assets | | 100.0 | % |

| | | | |

Property Type | | Percent of

Total

Net Assets |

Participation Notes | | | |

Condominium Development | | 1.2 | % |

Early Stage Construction | | 12.7 | % |

Hospitality | | 8.3 | % |

Industrial | | 7.7 | % |

Mixed Use Development | | 1.3 | % |

Multifamily | | 21.0 | % |

Office | | 2.0 | % |

Predevelopment | | 15.3 | % |

Single Family | | 0.5 | % |

Single Family/Condominium | | 1.2 | % |

Single Family/Multifamily | | 0.7 | % |

Total Participation Notes | | 71.9 | % |

Total Short-term Investments | | 20.2 | % |

Total Investments | | 92.1 | % |

Other assets in excess of liabilities | | 7.9 | % |

Net Assets | | 100.0 | % |

See accompanying Notes to Financial Statements.

5

REDWOOD REAL ESTATE INCOME FUND

Statement of Assets and Liabilities As of December 31, 2023 |

Assets: | | | |

Unaffiliated investments, at fair value (cost $142,348,344) | | $ | 142,351,164 |

Short-term investments, at fair value (cost $39,992,059) | | | 39,992,059 |

Receivables: | | | |

Fund shares sold | | | 94,352 |

Interest receivable | | | 2,155,884 |

Prepaid expenses | | | 122,306 |

Prefunded commitments | | | 13,800,000 |

Total assets | | | 198,515,765 |

| | | | |

Liabilities: | | | |

Payable for investment management fees | | | 286,222 |

Payable for legal fees | | | 30,388 |

Payable for audit and tax fees | | | 175,000 |

Payable for fund accounting and administration fees | | | 33,476 |

Payable for transfer agent fees | | | 24,000 |

Payable for custody fees | | | 1,000 |

Payable for Trustees’ fees | | | 3,000 |

Payable for other accrued expenses | | | 8,938 |

Total liabilities | | | 562,024 |

Commitments and contingencies (Note 10) | | | |

| | | | |

Net Assets | | $ | 197,953,741 |

| | | | |

Components of Net Assets: | | | |

Paid-in capital (unlimited shares authorized, no par value) | | $ | 197,950,203 |

Total distributable earnings | | | 3,538 |

Net Assets | | $ | 197,953,741 |

| | | | |

Shares of beneficial interest issued and outstanding | | | 7,908,144 |

Net asset value per share | | $ | 25.03 |

See accompanying Notes to Financial Statements.

6

REDWOOD REAL ESTATE INCOME FUND

Statement of Operations For the Period Ended December 31, 2023(1) |

Investment income: | | | | |

Interest | | $ | 6,113,971 | |

Total investment income | | | 6,113,971 | |

| | | | | |

Expenses: | | | | |

Advisory fees (Note 4) | | | 1,313,243 | |

Audit and tax fees | | | 175,000 | |

Fund accounting and administration fees | | | 84,548 | |

Brokerage fees | | | 75,890 | |

Transfer agent fees | | | 62,228 | |

Legal fees | | | 59,423 | |

Trustees’ fees | | | 21,000 | |

Chief Compliance Officer fees | | | 17,986 | |

Insurance fees | | | 10,082 | |

Miscellaneous fees | | | 8,626 | |

Shareholder reporting fees | | | 3,863 | |

Custody fees (Note 5) | | | 7,730 | |

Registration fees | | | 1,804 | |

Total expenses | | | 1,841,423 | |

Expense reductions (Note 5) | | | (4,015 | ) |

Net expenses | | | 1,837,408 | |

Net investment income | | | 4,276,563 | |

Net change in unrealized appreciation on investments | | | 2,820 | |

Net Increase in Net Assets from Operations | | $ | 4,279,383 | |

See accompanying Notes to Financial Statements.

7

REDWOOD REAL ESTATE INCOME FUND

Statements of Changes in Net Assets |

| | For the

Period Ended

December 31,

2023(1) |

Increase (Decrease) in Net Assets from: | | | | |

Operations: | | | | |

Net investment income | | $ | 4,276,563 | |

Net change in unrealized appreciation on investments | | | 2,820 | |

Net increase in net assets resulting from operations | | | 4,279,383 | |

| | | | | |

Distributions to Shareholders: | | | | |

From net investment income | | | (4,275,845 | ) |

Total distributions to shareholders | | | (4,275,845 | ) |

| | | | | |

Capital Transactions: | | | | |

Net proceeds from shares sold | | | 208,435,994 | |

Reinvestment of distributions | | | 1,686,088 | |

Cost of shares redeemed | | | (12,271,879 | ) |

Net increase in net assets from capital transactions | | | 197,850,203 | |

| | | | | |

Total increase in net assets | | | 197,853,741 | |

| | | | | |

Net Assets: | | | | |

Beginning of period | | | 100,000 | (2) |

End of period | | $ | 197,953,741 | |

| | | | | |

Capital Share Transactions: | | | | |

Shares sold | | | 8,325,511 | |

Shares reinvested | | | 67,358 | |

Shares redeemed | | | (488,725 | ) |

Net increase in capital share transactions | | | 7,904,144 | |

See accompanying Notes to Financial Statements.

8

REDWOOD REAL ESTATE INCOME FUND

Statement of Cash Flows For the Period Ended December 31, 2023(1) |

Cash flows provided by operating activities: | | | | |

Net increase in net assets from operations | | $ | 4,279,383 | |

| | | | | |

Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | | | | |

Purchases of investments | | | (172,684,963 | ) |

Sales of investments | | | 16,533,799 | |

Return of capital dividends received | | | 2,820 | |

Net change in unrealized (appreciation) on investments | | | (2,820 | ) |

Change in short-term investments, net | | | (39,992,059 | ) |

| | | | | |

Changes in assets and liabilities | | | | |

(Increase) in assets: | | | | |

Interest | | | (2,155,884 | ) |

Prepaid expenses | | | (122,306 | ) |

Increase in liabilities: | | | | |

Investment management fees | | | 286,222 | |

Audit and tax fees | | | 175,000 | |

Custody fees | | | 1,000 | |

Transfer agent fees | | | 24,000 | |

Fund accounting and administration fees | | | 33,476 | |

Trustees’ fees | | | 3,000 | |

Other accrued expenses | | | 8,938 | |

Legal fees | | | 30,388 | |

Net cash used in operating activities | | | (193,580,006 | ) |

| | | | | |

Cash flows provided by financing activities: | | | | |

Proceeds from shares sold, net of receivable for fund shares sold | | | 208,341,642 | |

Cost of shares repurchased, net of redemption fees | | | (12,271,879 | ) |

Distributions paid to shareholders, net of reinvestments | | | (2,589,757 | ) |

Net cash provided by financing activities | | | 193,480,006 | |

| | | | | |

Net Decrease in Cash | | | (100,000 | ) |

| | | | | |

Cash, beginning of period | | | 100,000 | |

Cash, end of period | | $ | — | |

| | | | | |

Supplemental disclosure of non-cash activity: | | | | |

Reinvestment of distributions | | $ | 1,686,088 | |

See accompanying Notes to Financial Statements.

9

REDWOOD REAL ESTATE INCOME FUND

Financial Highlights |

Per share operating performance.

For a capital share outstanding throughout the period.

| | For the Period

Ended

December 31,

2023(1) |

Net asset value, beginning of period | | $ | 25.00 | (2) |

| | | | | |

Income from Investment Operations: | | | | |

Net investment income(3) | | | 0.73 | |

Net realized and unrealized (loss) | | | (0.09 | ) |

Total from investment operations | | | 0.64 | |

| | | | | |

Less Distributions: | | | | |

From net investment income | | | (0.61 | ) |

Total distributions | | | (0.61 | ) |

Net asset value, end of period | | $ | 25.03 | |

| | | | | |

Total return(4),(5) | | | 2.60 | % |

| | | | | |

Ratios and Supplemental Data: | | | | |

Net assets, end of period (in thousands) | | $ | 197,954 | |

| | | | | |

Ratio of expenses to average net assets before expense reductions(6) | | | 2.43 | % |

Ratio of expenses to average net assets after expense reductions(6) | | | 2.42 | % |

Ratio of net investment income to average net assets before expense reductions(6) | | | 5.64 | % |

Ratio of net investment income to average net assets after expense reductions(6) | | | 5.64 | % |

| | | | | |

Portfolio turnover rate(5) | | | 18 | % |

See accompanying Notes to Financial Statements.

10

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements December 31, 2023 |

1. Organization

Redwood Real Estate Income Fund (the “Fund”) was established as a Delaware statutory trust (the “Trust”) on December 19, 2022. The Fund is registered with the Securities and Exchange Commission (the “SEC”) as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund operates as an interval fund pursuant to Rule 23c-3 of the 1940 Act, and has adopted a fundamental policy to conduct quarterly repurchase offers at net asset value (“NAV”). The Fund currently offers one share class, Class I Shares, and is authorized to offer an unlimited number of shares. On April 21, 2023, Redwood Investment Management, LLC (the “Investment Manager”) made an initial purchase of 4,000 shares for $100,000 at a $25.00 net asset value per share. The Fund commenced investment operations on June 26, 2023. The period covered by these Notes to Financial Statements is the period from the Fund’s commencement of investment operations on June 26, 2023 through December 31, 2023 (the “Reporting Period”).

The Fund’s investment objective is to provide current income and preserve shareholders’ capital. The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in U.S. commercial real estate-related income investments. For this purpose, commercial real estate-related income investments include U.S.-based (i.e., backed by real estate based in one of the fifty U.S. states): (i) real estate mortgages, (ii) participation notes of real estate mortgages, (iii) mezzanine debt, and (iv) lines of credit for commercial real estate-related investments and real estate-related investment entities, such as REITs. These investments may include but are not limited to senior mortgage loans, second lien mortgages, also known as junior or sub-ordinated debt, mezzanine loans, and participation interests in such mortgages or debt.

The Investment Manager serves as the Fund’s investment adviser and is registered with the SEC under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Fund’s Board of Trustees (the “Board” or “Trustees”) has the overall responsibility for the management and supervision of the business operations of the Fund.

2. Significant accounting policies

Basis of presentation

The following is a summary of significant accounting policies followed by the Fund in the preparation of the financial statement. The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services — Investment Companies.

Use of estimates

The preparation of the financial statement in accordance with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statement, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

11

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

2. Significant accounting policies – (Continued) |

Income recognition and expenses

Interest income is recognized on an accrual basis as earned. Dividend income is recorded on the ex-dividend date. Expenses are recognized on an accrual basis as incurred. The Fund bears all expenses incurred in the course of its operations, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Fund’s account; professional fees; costs of insurance; registration expenses; and expenses of meetings of the Board.

Investment transactions

Investment transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the highest cost method for financial reporting.

Federal income taxes

The Fund has elected to be taxed as a real estate investment trust (“REIT”). The Fund’s qualification and taxation as a REIT depend upon the Fund’s ability to meet on a continuing basis, through actual operating results, certain qualification tests set forth in the U.S. federal tax laws. Those qualification tests involve the percentage of income that the Fund earns from specified sources, the percentage of the Fund’s assets that falls within specified categories, the diversity of the ownership of the Fund’s shares, and the percentage of the Fund’s taxable income that the Fund distributes. No assurance can be given that the Fund will in fact satisfy such requirements for any taxable year. Provided that the Fund qualifies as a REIT, generally the Fund will be entitled to a deduction for dividends that the Fund pays and therefore will not be subject to U.S. federal corporate income tax on the Fund’s net taxable income that is currently distributed to the Fund’s shareholders. In general, the income that the Fund generates, to the extent declared as a dividend and subsequently paid to its shareholders, is taxed only at the shareholder level.

Distribution to shareholders

Distributions from net investment income of the Fund, if any, are declared and paid on a monthly basis. Distributions of net realized gains, if any, are declared annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP. For tax purposes, a distribution that for purposes of GAAP is composed of return of capital and net investment income may be subsequently re-characterized to also include capital gains. Shareholders will be informed of the tax characteristics of the distributions after the close of the 2023 fiscal year.

Investment valuation

The Fund’s net asset value (“NAV”) is calculated following the close of regular trading on the NYSE, generally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading, which does not include weekends and customary holidays, and at such other times as the Board may determine, including in connection with repurchases of Shares, in accordance with the procedures described below or as may be determined from time to time in accordance with policies established by the Board. NAV per share is calculated by dividing the value of all of the securities and other assets of the Fund, less the liabilities (including accrued expenses and indebtedness), and the aggregate liquidation value of any outstanding preferred stock, by the total number of common shares outstanding.

12

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

2. Significant accounting policies – (Continued) |

The Fund’s Board oversees the valuation of the Fund’s investments on behalf of the Fund. The Board has approved valuation procedures for the Fund (the “Valuation Procedures”) and designated the Fund’s Investment Manager as its valuation designee (“Valuation Designee”). The Valuation Procedures provide that the Fund will value its investments at fair value.

The Valuation Procedures provide that the Fund will value its investments at fair value. The Board has delegated the day to day responsibility for determining these fair values in accordance with the policies it has approved to the Investment Manager. The Investment Manager’s Valuation Committee (the “Valuation Committee”) will oversee the valuation of the Fund’s investments on behalf of the Fund. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly.

Short-term securities, including bonds, notes, debentures and other debt securities, and money market instruments such as certificates of deposit, commercial paper, bankers’ acceptances and obligations of domestic and foreign banks, with maturities of 60 days or less, for which reliable market quotations are readily available shall each be valued at current market quotations as provided by an independent pricing service or principal market maker.

Fixed income securities (other than the short-term securities as described above) shall be valued by (a) using readily available market quotations based upon the last updated sale price or a market value from an approved pricing service generated by a pricing matrix based upon yield data for securities with similar characteristics or (b) by obtaining a direct written broker-dealer quotation from a dealer who has made a market in the security. If no price is obtained for a security in accordance with the foregoing, because either an external price is not readily available or such external price is believed by the Valuation Designee not to reflect the market value, the Valuation Committee will make a determination in good faith of the fair value of the security in accordance with the Valuation Procedures. In general, fair value represents a good faith approximation of the current value of an asset and will be used when there is no public market or possibly no market at all for the asset. The fair values of one or more assets may not be the prices at which those assets are ultimately sold and the differences may be significant.

In circumstances in which market quotations are not readily available or are deemed unreliable, or in the case of the valuation of private, direct investments, such investments may be valued as determined in good faith using methodologies approved by the Board. In these circumstances, the Valuation Designee determines fair value in a manner that seeks to reflect the market value of the security on the valuation date based on consideration by the Valuation Committee of any information or factors deemed appropriate. The Valuation Committee may engage third party valuation consultants on an as-needed basis to assist in determining fair value.

Fair valuation involves subjective judgments, and there is no single standard for determining the fair value of an investment. The fair value determined for an investment may differ materially from the value that could be realized upon the sale of the investment. Fair values used to determine the Fund’s NAV may differ from quoted or published prices, or from prices that are used by others, for the same investment. Thus, fair valuation may have an unintended dilutive or accretive effect on the value of shareholders’ investments in the Fund. Non-material information that becomes known to the Fund or its agents after the NAV has been calculated on a particular day will not be used to retroactively adjust the price of a security or the NAV determined earlier.

13

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

3. Fair value disclosures

The Fund uses a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

• Level 1 — Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Fund is able to access.

• Level 2 — Valuations based on inputs, other than quoted prices included in Level 1 that are observable either directly or indirectly.

• Level 3 — Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

The availability of valuation techniques and observable inputs can vary from investment to investment and are affected by a wide variety of factors, including type of investment, whether the investment is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, determining fair value requires more judgment. Because of the inherent uncertainly of valuation, estimated values may be materially higher or lower than the values that would have been used had a ready market for the investments existed. Accordingly, the degree of judgment exercised by the Valuation Designee in determining fair value is greatest for investments categorized in Level 3.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to determine fair value of the Fund’s investments as of December 31, 2023:

Investments | | Practical

Expedient | | Fair Value Measurements at the End of the

Reporting Period Using | | Total |

Level 1

Quoted

Prices | | Level 2

Other

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | |

Security Type | | | | | | | | | | | | | | | |

Participation Notes | | $ | — | | $ | — | | $ | — | | $ | 142,351,164 | | $ | 142,351,164 |

Short-Term Investments | | | — | | | 39,992,059 | | | — | | | — | | | 39,992,059 |

Total | | $ | — | | $ | 39,992,059 | | $ | — | | $ | 142,351,164 | | $ | 182,343,223 |

14

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

3. Fair value disclosures – (Continued) |

The following table presents the changes in assets and transfers in and out which are classified in Level 3 of the fair value hierarchy for the Reporting Period:

| | Beginning

Balance

as of

June 26,

2023 | | Transfers

into

Level 3

during

the period | | Transfers

out of

Level 3

during

the period | | Purchases or

Conversions | | Sales or

Distributions | | Net

Realized

Gain

(Loss) | | Return of

Capital | | Distributions | | Change in

net

unrealized

appreciation | | Ending

Balance

as of

December 31,

2023 |

Participation

Notes | | $ | — | | $ | — | | $ | — | | $ | 158,884,963 | | $ | (16,533,799 | ) | | $ | — | | $ | (2,820 | ) | | $ | — | | $ | 2,820 | | $ | 142,351,164 |

| | | $ | — | | $ | — | | $ | — | | $ | 158,884,963 | | $ | (16,533,799 | ) | | $ | — | | $ | (2,820 | ) | | $ | — | | $ | 2,820 | | $ | 142,351,164 |

The change in net unrealized appreciation (depreciation) included in the Statement of Operations attributable to Level 3 investments that were held as of December 31, 2023 is $2,820.

The following table summarizes the valuation techniques and significant unobservable inputs used for the Fund’s investments that are categorized in Level 3 of the fair value hierarchy as of December 31, 2023.

Type of Level 3 Investment | | Fair Value

as of

December 31,

2023 | | Valuation

Technique | | Unobservable

Inputs | | Range of

Inputs/(weighted

average) | | Impact to Valuation

from an Increase

in Input |

Participation Notes | | $ | 142,351,164 | | Cost | | Transaction Price | | Not Applicable | | Not Applicable |

Total Level 3 Investments | | $ | 142,351,164 | | | | | | | | |

4. Management and other agreements

The Fund has entered into an investment management agreement with the Investment Manager (the “Management Agreement”), pursuant to which the Investment Manager provides advisory and other services to the Fund. For its provision of advisory services to the Fund, the Fund pays the Investment Manager an investment management fee at an annual rate of 1.75% payable monthly in arrears, accrued daily based upon the Fund’s average daily Managed Assets. “Managed Assets” means the total assets of the Fund, including leverage, minus liabilities (other than debt representing leverage and any preferred stock that may be outstanding). The Fund did not engage in leverage or have any outstanding preferred stock during the Reporting Period; therefore, the management fee based on net assets and Managed Assets was the same during this Reporting Period. For the Reporting Period, fees in the amount of $1,313,243 were incurred pursuant to the terms of the Management Agreement.

Certain officers and Trustees of the Trust are also officers of the Investment Manager.

PINE Advisors LLC provides Chief Compliance Officer (“CCO”) services to the Fund. UMB Distribution Services, LLC serves as the Fund’s distributor (also known as the principal underwriter); UMB Fund Services, Inc. (“UMBFS”) serves as the Fund’s fund accountant, transfer agent and administrator.

5. Custody credits

Under an agreement with the Fund’s custodian bank, $4,015 of custodian fees were paid by credits for cash balances during the Reporting Period. If not for the offset agreement, the assets could have been employed to produce income.

15

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

6. Capital share transactions

The Fund is authorized as a Delaware statutory trust to issue an unlimited number of shares (“Shares”). The minimum initial investment in Class I Shares by any investor is $1,000. However, the Fund, in its sole discretion, may accept investments below this minimum with respect to Class I Shares.

Class I Shares are not subject to a sales charge. Shares will generally be offered for purchase on each business day at NAV per share, except that Shares may be offered more or less frequently as determined by the Board in its sole discretion. The Board may also suspend or terminate offerings of Shares at any time.

Pursuant to Rule 23c-3 under the 1940 Act, on a quarterly basis, the Fund will offer shareholders the option of redeeming Shares at NAV. The Board determines the quarterly repurchase offer amount (“Repurchase Offer Amount”), which can be no less than 5% and no more than 25% of all shares outstanding on the repurchase request deadline. If shareholders tender more than the Repurchase Offer Amount, the Fund may, but is not required to, repurchase an additional amount of Shares not to exceed 2% of outstanding Shares of the Fund on the repurchase request deadline. If the Fund determines not to repurchase more than the Repurchase Offer Amount, or if shareholders tender Shares in an amount exceeding the Repurchase Offer Amount plus 2% of the outstanding Shares on the repurchase request deadline, the Fund will repurchase the Shares on a pro rata basis. However, the Fund may accept all shares tendered for repurchase by shareholders who own less than 100 shares and who tender all of their shares, before prorating other amounts tendered. In addition, the Fund may accept the total number of shares tendered in connection with required minimum distributions from an IRA or other qualified retirement plan. It is the shareholder’s obligation to both notify and provide the Fund supporting documentation of a required minimum distribution from an IRA or other qualified retirement plan.

During the Reporting Period, the Fund had the following repurchase offer:

Repurchase

Offer Notice | |

Repurchase Request

Deadline

| |

Repurchase Pricing

Date

| |

Repurchase

Offer Amount

| | % of Shares

Repurchased | | Number

of Shares

Repurchased |

October 10, 2023 | | November 13, 2023 | | November 13, 2023 | | 7.0% | | 6.1% | | 488,725 |

7. Investment transactions

Purchases and sales of investments, excluding short-term investments, for the Reporting Period were $158,884,963 and $16,533,799, respectively.

8. Beneficial ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of the Fund creates a presumption of control under Section 2(a)(9) of the 1940 Act. The following table lists the significant Fund account holders as of December 31, 2023. Each company listed is an open-end management investment company and each is a series of the Two Roads Shared Trust. The Investment Manager provides investment management services for each series of the Two Roads Shared Trust.

Redwood Managed Volatility Fund | | 7.08 | % |

Redwood Managed Municipal Income Fund | | 9.01 | % |

Redwood AlphaFactor Tactical International Fund | | 13.29 | % |

Redwood Systematic Macro Trend Fund | | 14.43 | % |

16

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

| |

9. Restricted securities

Restricted securities include securities that have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and securities that are subject to restrictions on resale. The Fund may invest in restricted securities that are consistent with the Fund’s investment objectives and investment strategies. Investments in restricted securities are valued at fair value as determined in good faith in accordance with procedures adopted by the Board. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material.

Additional information on each restricted security held by the Fund on December 31, 2023 is as follows:

Security | | Initial

Acquisition Date | | Principal

Amount | | Cost | | Fair Value | | % of

Net

Assets |

Participation Notes: | | | | | | | | | | | | | |

3303 – 150 Lefferts Ave./55 East 21st Street | | July 28, 2023 | | 3,470,000 | | $ | 3,470,000 | | $ | 3,470,000 | | 1.8 | % |

3323 – 44 W 8 Capital, LLC & 44 W 8 SME, LLC | | October 6, 2023 | | 2,087,271 | | | 2,087,271 | | | 2,087,271 | | 1.1 | % |

3326 – Elgny, LLC | | October 6, 2023 | | 1,000,000 | | | 1,000,000 | | | 1,000,000 | | 0.5 | % |

3330 – 3601 Parking, LLC & N Ocean Blvd, LLC | | October 31, 2023 | | 4,019,257 | | | 4,019,257 | | | 4,019,257 | | 2.0 | % |

3333 – McRopp New York Royal44, LLC | | November 17, 2023 | | 12,500,000 | | | 12,500,000 | | | 12,500,000 | | 6.3 | % |

3335 – Cromwell Inwood, LLC | | November 27, 2023 | | 1,300,000 | | | 1,300,000 | | | 1,300,000 | | 0.7 | % |

3336 – Blue Spruce Lendco, LLC | | November 28, 2023 | | 5,500,000 | | | 5,500,000 | | | 5,500,000 | | 2.8 | % |

3340 – San Antonio Palo Alto, LLC | | December 15, 2023 | | 2,618,182 | | | 2,618,182 | | | 2,618,182 | | 1.3 | % |

3341 – Ferncroft, LLC | | December 19, 2023 | | 4,000,000 | | | 4,000,000 | | | 4,000,000 | | 2.0 | % |

3343 – 502 East 81st Street Development, LLC | | December 22, 2023 | | 229,743 | | | 229,743 | | | 229,743 | | 0.1 | % |

3313 – First Lien Portfolio #3 | | July 25, 2023 | | 2,451,862 | | | 2,451,862 | | | 2,451,862 | | 1.2 | % |

3314 – VM Equities #3 | | July 28, 2023 | | 1,427,220 | | | 1,427,220 | | | 1,427,220 | | 0.7 | % |

3316 – Spring Rock Bridge/428 Williams | | August 11, 2023 | | 3,439,153 | | | 3,439,153 | | | 3,439,153 | | 1.7 | % |

3317 – 24-02 Queens Plaza South, Queens | | August 22, 2023 | | 12,000,000 | | | 12,000,000 | | | 12,000,000 | | 6.1 | % |

3318 – 125 3rd Street Brooklyn, NY | | September 12, 2023 | | 8,000,000 | | | 8,000,000 | | | 8,000,000 | | 4.0 | % |

3320 – Howell Lendco, LLC | | September 19, 2023 | | 14,000,000 | | | 14,000,000 | | | 14,000,000 | | 7.1 | % |

3321 – Queens Plaza North New York, LLC | | September 26, 2023 | | 25,000,000 | | | 25,000,000 | | | 25,000,000 | | 12.6 | % |

3324 – Sarasota | | September 29, 2023 | | 10,377,692 | | | 10,377,692 | | | 10,377,692 | | 5.3 | % |

Tryperion TL Los Altos, LLC | | September 26, 2023 | | 28,930,784 | | | 28,927,964 | | | 28,930,784 | | 14.6 | % |

| | | | | | | $ | 142,348,344 | | $ | 142,351,164 | | | |

10. Contingencies and commitments

In the normal course of business, the Fund will enter into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

17

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

10. Contingencies and commitments – (Continued)

The Fund is required to provide financial support in the form of investment commitments to certain investees as part of the conditions for entering into such investments. At December 31, 2023, the Fund reasonably believes its assets will provide adequate cover to satisfy all its unfunded commitments. The Fund’s unfunded commitments as of December 31, 2023 are as follows:

Participation Notes | | Unfunded

Commitments | | Fair Value |

3316 – Spring Rock Bridge/428 Williams | | $ | 11,560,847 | | $ | 11,560,847 |

3323 – 44 W 8 Capital, LLC & 44 W 8 SME, LLC | | | 912,729 | | | 912,729 |

3330 – 3601 Parking, LLC & N Ocean Blvd, LLC | | | 6,809,759 | | | 6,809,759 |

3340 – San Antonio Palo Alto, LLC | | | 581,818 | | | 581,818 |

3343 – 502 East 81st Street Development, LLC | | | 1,970,257 | | | 1,970,257 |

Tryperion TL Los Altos, LLC | | | 4,069,216 | | | 4,069,216 |

| | | $ | 25,904,626 | | $ | 25,904,626 |

11. Federal Tax Information

For the tax year ended December 31, 2023, gross unrealized appreciation/(depreciation) of investments, based on cost for federal income tax purposes were as follows:

Cost of investments | | $ | 182,340,403 |

Gross unrealized appreciation | | | 2,820 |

Gross unrealized depreciation | | | — |

Net unrealized appreciation (depreciation) | | $ | 2,820 |

For the tax year ended December 31, 2023, there were no permanent book to tax reclassifications.

The tax character of distributions paid during the tax year ended December 31, 2023 were as follows:

Distributions paid from: | | | |

Ordinary income | | $ | 4,275,845 |

Total distributions paid | | $ | 4,275,845 |

For the tax year ended December 31, 2023, the components of accumulated earnings on a tax basis for the Fund were as follows:

Undistributed Ordinary Income | | $ | 718 |

Undistributed Long-Term Capital Gains | | | — |

Accumulated Capital and Other Losses | | | — |

Unrealized Appreciation (Depreciation) | | | 2,820 |

Total | | $ | 3,538 |

18

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

12. Risk factors

NEW FUND RISK. The Fund is a newly organized, non-diversified, closed-end interval fund with limited operating history.

REPURCHASE OFFERS; LIMITED LIQUIDITY. Although the Fund intends to implement a quarterly Share repurchase program, there is no guarantee that an investor will be able to sell all of the Shares he or she desires to sell. Accordingly, the Fund should be considered an illiquid investment.

NON-DIVERSIFIED STATUS. The Fund is classified as “non-diversified” under the 1940 Act. As a result, it can invest a greater portion of its assets in obligations of a single issuer than a “diversified” fund. The Fund may therefore be more susceptible than a diversified fund to being adversely affected by a single corporate, economic, political or regulatory occurrence.

SOURCING INVESTMENT OPPORTUNITIES RISK. The Investment Manager may not be able to locate a sufficient number of suitable investment opportunities or finalize investments at a pace that allows the Fund to fully implement its investment strategy. Therefore, the Fund’s operations will likely be materially adversely affected to the extent the Fund’s capital is not fully deployed.

MORTGAGE LOAN RISK. The Fund will invest in commercial mortgage loans, which are subject to risks of delinquency, foreclosure, and risk of loss. In the event of a commercial borrower’s default, the Fund’s profitability will suffer a material adverse effect to the extent of any deficiency between the value of the collateral and the principal and accrued interest of the mortgage loan.

MORTGAGE PARTICIPATION RISK. The Fund’s investments in commercial real estate loans will include holding a participation interest in such loans. The Fund generally will not have a right to enforce the borrower’s compliance with the terms of any loan agreement, so any such enforcement would require cooperation of other participation interests’ holders in the same underlying loan. The inability to enforce borrower’s compliance could have a material adverse effect on the Fund’s profitability.

MEZZANINE DEBT. Mezzanine investments share all of the risks of other high yield securities and are subject to greater risk of loss of principal and interest than higher-rated securities. High yield securities are below investment grade debt securities and are commonly referred to as “junk bonds.” They are also generally considered to be subject to greater risk than securities with higher ratings in the case of deterioration of general economic conditions. Because investors generally perceive that there are greater risks associated with the lower-rated securities, the yields and prices of those securities may tend to fluctuate more than those for higher-rated securities.

FIXED INCOME SECURITIES RISK. A rise in interest rates typically causes bond prices to fall. The longer the duration of bonds held by the Fund, the more sensitive it will likely be to interest fluctuations.

SECURED OVERNIGHT FINANCING RATE (“SOFR”) RISK. SOFR is intended to be a broad measure of the cost of borrowing funds overnight in transactions that are collateralized by U.S. Treasury securities. Because SOFR is a financing rate based on overnight secured funding transactions, it differs fundamentally from the London Inter-Bank Offered Rate (“LIBOR”), so there is no assurance that SOFR, or rates derived from SOFR, will perform in the same or similar way as LIBOR would have performed at any time, and there is no assurance that SOFR-based rates will be a suitable substitute for LIBOR.

DEPENDENCE ON KEY PERSONNEL RISK. The Fund’s performance may depend on the Investment Manager’s ability to attract and retain certain key personnel in providing services with respect to the Fund’s investments, as well as such key personnel’s performance in selecting securities or investment techniques for the Fund’s portfolio.

19

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

12. Risk factors – (Continued) |

SECURED DEBT. Although secured debt in most circumstances is fully collateralized by the borrower’s assets and holds a senior position in the borrower’s capital structure, there is a risk that the collateral may decrease in value over time, and may be difficult to apprise or sell in a timely manner. Therefore, the Fund’s ability to fully collect on the investment in the event of a default, is not guaranteed.

SECOND LIEN AND SUBORDINATED LOANS. The Fund may invest in secured subordinated loans, which rank below senior secured loans in the priority of collateral claims. Consequently, such loans involve a higher degree of overall risk than senior loans of the same borrower due to the possible unsecured or partially secured status. Further, certain actions to enforce the Fund’s rights with respect to the collateral will be subject to senior loan holder’s directions.

DEFAULT RISK. The ability of the Fund to generate income through its loan investments is dependent upon payments being made by the borrower underlying such loan investments. If a borrower is unable to make its payments on a loan, the Fund may be greatly limited in its ability to recover any outstanding principal and interest under such loan.

ILLIQUID PORTFOLIO INVESTMENTS. The Fund’s investments may include loans that are not registered under the Securities Act, and are not listed on any securities exchange, and lack a reliable secondary market. As such, these investments should be considered illiquid. The Fund’s overall returns may be adversely affected by the illiquid status of such investments.

LENDER LIABILITY CONSIDERATIONS AND EQUITABLE SUBORDINATION. The Fund may be subject to allegations of lender liability due to alleged duty violations (e.g. good faith, commercial reasonableness and fair dealing). In addition, under “equitable subordination,” a court may elect to subordinate the Fund’s claim as a lender, to the claims of other creditors, under certain common law principles.

VALUATION RISK. Unlike publicly traded common stock which trades on national exchanges, there is no central place or exchange for many of the Fund’s investments to trade. Due to the lack of centralized information and trading, the valuation of loans or fixed-income instruments may result in more risk than that of common stock. Uncertainties in the conditions of the financial market, unreliable reference data, lack of transparency and inconsistency of valuation models and processes may lead to inaccurate asset pricing. In addition, other market participants may value securities differently than the Fund. As a result, the Fund may be subject to the risk that when an instrument is sold in the market, the amount received by the Fund is less than the value of such loans or fixed-income instruments carried on the Fund’s books.

Shareholders should recognize that valuations of illiquid assets involve various judgments and consideration of factors that may be subjective. As a result, the NAV of the Fund, as determined based on the fair value of its investments, may vary from the amount ultimately received by the Fund from its investments. This could adversely affect Shareholders whose Shares are repurchased as well as new Shareholders and remaining Shareholders.

REAL ESTATE INDUSTRY CONCENTRATION. The Fund will concentrate (i.e., invest more than 25% of its assets) its investments in securities of real estate industry issuers. As such, its portfolio will be significantly impacted by the performance of the real estate market and may experience more volatility and be exposed to greater risk than a more diversified portfolio.

20

REDWOOD REAL ESTATE INCOME FUND

Notes to the Financial Statements (Continued) December 31, 2023 |

12. Risk factors – (Continued) |

CONFLICTS OF INTEREST. The Fund may be subject to a number of actual and potential conflicts of interest, resulting from the use of leverage, the Investment Manager’s other financial advisory activities that are similar to (or different than) those of the Fund, and personal trading of the directors, partners, trustees, managers, members, officers and employees of the Investment Manager and its affiliates.

CASH CONCENTRATION RISK. The Fund may hold varying concentrations of cash and cash equivalents periodically which may consist primarily of cash, deposits in money market accounts and other short-term investments which are readily convertible into cash and have an original maturity of three months or less. Cash and cash equivalents are subject to credit risk to the extent those balances exceed applicable Securities Investor Protection Corporations (“SIPC”) or Federal Deposit Insurance Corporation (“FDIC”) limitations.

13. Subsequent events

Management of the Fund has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

21

REDWOOD REAL ESTATE INCOME FUND

Report of Independent Registered Public Accounting Firm December 31, 2023 |

|

| | Board of Trustees and Shareholders Redwood Real Estate Income Fund Opinion on the financial statements We have audited the accompanying statement of assets and liabilities of Redwood Real Estate Income Fund (the “Fund”), including the schedule of investments, as of December 31, 2023, the related statements of operations, changes in net assets, and cash flows for the period from June 26, 2023 (commencement of operations) through December 31, 2023, and the related notes (collectively referred to as the “financial statements”), and the financial highlights for the period from June 26, 2023 (commencement of operations) through December 31, 2023. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2023, the results of its operations, and its cash flows for the period from June 26, 2023 (commencement of operations) through December 31, 2023, and the financial highlights of the period from June 26, 2023 (commencement of operations) through December 31, 2023, in conformity with accounting principles generally accepted in the United States of America. Basis for opinion These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. |

22

REDWOOD REAL ESTATE INCOME FUND

Report of Independent Registered Public Accounting Firm (Continued) December 31, 2023 |

| | Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of investments owned as of December 31 2023, by correspondence with the custodian and loan servicers. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audit provides a reasonable basis for our opinion. /s/ GRANT THORNTON LLP We have served as the Fund’s auditor since 2023. Chicago, Illinois February 29, 2024 |

23

REDWOOD REAL ESTATE INCOME FUND

Other Information December 31, 2023 (Unaudited) |

Proxy Voting

The Fund is required to file Form N-PX, with its complete proxy voting record for the twelve months ended June 30, no later than August 31. The Fund’s Form N-PX filing is available: (i) without charge, upon request, by calling the Fund c/o UMB Fund Services, by telephone at 1-888-988-9882 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Form N-PORT filings are available, without charge and upon request, on the SEC’s website at www.sec.gov.

24

REDWOOD REAL ESTATE INCOME FUND

Fund Management December 31, 2023 (Unaudited) |

NAME, ADDRESS AND

YEAR OF BIRTH | |

POSITION(S)

HELD WITH

THE FUND

| | LENGTH OF

TIME

SERVED | | PRINCIPAL

OCCUPATION(S) DURING

PAST 5 YEARS | | NUMBER OF

PORTFOLIOS

IN FUND

COMPLEX

OVERSEEN BY

TRUSTEES | |

OTHER

DIRECTORSHIPS

HELD BY TRUSTEES

|

J. Michael Fields

Year of Birth: 1973

c/o UMB Fund Services, Inc.

235 W. Galena St.

Milwaukee, WI 53212 | | Trustee | | Since Inception | | Independent Consultant, (June 2023 – present); Chief Operating Officer, The Strategic Group (financial consulting firm) (2017 – May 2023); Secretary, Hatteras Master Fund Complex (2009 – 2016); Chief Financial Officer, Hatteras Master Fund Complex (2004 – 2009) | | 1 | | Independent Board Member, Constitution Capital Access Fund, LLC (2022 – Present) |

Stephen A. Mace

Year of Birth: 1957

c/o UMB Fund Services, Inc. 235 W. Galena St. Milwaukee, WI 53212 | | Trustee | | Since Inception | | General Counsel, Midwest Holding Inc. (a Delaware insurance holding company), and its subsidiaries (2020 – Present); President, Alpine Capital Research, LLC (a SEC-

registered investment adviser) (2016 – 2020) | | 1 | | Board of Directors, Centurion Alliance, Inc. (2000 – Present) |

Stacy Roode

Year of Birth: 1968

c/o UMB Fund Services, Inc. 235 W. Galena St. Milwaukee, WI 53212 | | Trustee | | Since Inception | | Senior Vice President, Fidelity Investments (2018 – 2020); Global Transfer Agent Manager, Shareholder Services Inc. (2009 – 2018); President, Oppenheimer Funds (1992 – 2018) | | 1 | | Independent Board of Trustee, XD Fund Trust (2023 – Present) |

Amy Small*

Year of Birth: 1982

c/o UMB Fund Services, Inc. 235 W. Galena St. Milwaukee, WI 53212 | | Trustee | | Since Inception | | Executive Vice President, Executive Director — Institutional Custody Business Line, Director of Institutional Banking Operations, UMB Bank, n.a; (2018 – present); Director of Finance (2016 – 2018), Director of Financial Control, Operations, and Business Development, DST Systems, Inc. (advisory, technology and operations outsourcing service provider) (2000 – 2018) | | 1 | | None |

25

REDWOOD REAL ESTATE INCOME FUND

Fund Management (Continued) December 31, 2023 (Unaudited) |

NAME, ADDRESS AND

YEAR OF BIRTH | |

POSITION(S)

HELD WITH

THE FUND

| | LENGTH OF

TIME

SERVED | | PRINCIPAL

OCCUPATION(S) DURING

PAST 5 YEARS | | NUMBER OF

PORTFOLIOS

IN FUND

COMPLEX

OVERSEEN BY

TRUSTEES | |

OTHER

DIRECTORSHIPS

HELD BY TRUSTEES

|

Michael T. Messinger

Year of Birth: 1978

c/o UMB Fund Services, Inc. 235 W. Galena St. Milwaukee, WI 53212 | | President | | Since Inception | | Founding Partner & Money Manager, Redwood Investment Management, LLC (2010 – present) | | N/A | | N/A |

Ann Maurer

Year of Birth: 1972

c/o UMB Fund Services, Inc. 235 W. Galena St. Milwaukee, WI 53212 | | Secretary | | Since Inception | | Senior Vice President, Client Services (2017 – Present); Vice President, Senior Client Service Manager (2013 – 2017); Assistant Vice President, Client Relations Manager (2002 – 2013), each with UMB Fund Services, Inc. | | N/A | | N/A |

Richard M. Duff

Year of Birth: 1966

c/o UMB Fund Services, Inc. 235 W. Galena St. Milwaukee, WI 53212 | | Treasurer | | Since Inception | | Managing Partner & Portfolio Manager & Money Manager, Redwood Investment Management, LLC (2015 – present) | | N/A | | N/A |

Alexander Woodcock

Year of Birth: 1989

c/o UMB Fund Services, Inc. 235 W. Galena St. Milwaukee, WI 53212 | | Chief Compliance Officer | | Since Inception | | Director, PINE Advisor Solutions (2022 – Present); Chief Executive Officer and Chief Compliance Officer, PINE Distributors LLC (2022 – Present); Vice President of Compliance Services, SS&C ALPS Advisors (2019 – 2022); Manager of Global Operations Oversight, Oppenheimer Funds (2014 – 2019) | | N/A | | N/A |

26

REDWOOD REAL ESTATE INCOME FUND

Privacy Notice (Unaudited) |

The Redwood Real Estate Income Fund (the “Fund”, “we”. “our”, “us”) respects your right to privacy. We are committed to maintaining the confidentiality and integrity of nonpublic personal information. We want our investors and prospective investors to understand what information we collect and how we use it. “Nonpublic personal information” is defined as personally identifiable information about you. We do not sell your personal information, and we do not disclose it to anyone except as permitted or required by law or as described in this notice.

CONFIDENTIALITY & SECURITY

We take our responsibility to protect the privacy and confidentiality of investors’ and prospective investors’ information very seriously. We maintain appropriate physical, electronic, and procedural safeguards to guard nonpublic personal information. Our network is protected by firewall barriers, encryption techniques, and authentication procedures, among other safeguards, to maintain the security of your information. We provide this Privacy Notice to investors at the start of new relationships and annually after that. We continue to adhere to the practices described herein after investors’ accounts close. Furthermore, vendors with access to nonpublic personal information undergo an annual due diligence verification process to ensure their informational safeguards adhere to our strict standards.

WHY WE COLLECT YOUR INFORMATION

The Redwood Real Estate Income Fund gathers information about our investors and their accounts to (1) know investors’ identities and thereby prevent unauthorized access to confidential information; (2) design and improve the products and services we offer to investors; and (3) comply with the laws and regulations that govern us.

HOW WE PROTECT YOUR INFORMATION

To fulfill our privacy commitment for prospective, current, and former investors, the Redwood Real Estate Income Fund has safeguards in place to protect nonpublic personal information. Safeguards include, but are not limited to:

• Policies and procedures to protect your nonpublic information and comply with federal and state regulations; and

• Contractual agreements with third-party service providers to protect your nonpublic personal information.

INFORMATION WE COLLECT

The Redwood Real Estate Income Fund is required by industry guidelines to obtain personal information about you in providing investment management services to you. We use this information to manage your account, direct your financial transactions, and provide you with valuable information about the assets we manage for you. We gather information from documents you provide to us, forms that you complete, and personal interviews. This information may include:

• Your name, address, and social security number;

• Proprietary information regarding your beneficiaries;

• Information regarding your earned wages and other sources of income;

27

REDWOOD REAL ESTATE INCOME FUND

Privacy Notice (Unaudited) (Continued) |

• The composition and value of your managed portfolio;

• Historical information we receive and maintain relating to transactions made on your behalf by the Redwood Real Estate Income Fund, your custodian, or others;

• Information we receive from your institutional financial advisor, investment consultant, or other financial institutions with whom the Redwood Real Estate Income Fund has a relationship and/or with whom you may be authorized us to gather and maintain such information.

SHARING INFORMATION WITH NON-AFFILIATED THIRD PARTIES

We only disclose nonpublic investor information to non-affiliated third parties (e.g. investor’s custodian or broker) without prior investor consent when we believe it necessary to conduct our business or as required or permitted by law such as:

• If you request or authorize the disclosure of the information;

• To provide investor account services or account maintenance;

• To respond to regulatory authorities, a subpoena or court order, judicial process, or law enforcement;

• To perform services for the Fund, or on its behalf, to maintain business operations and services;

• To help us to prevent fraud;

• With attorneys, accountants, and auditors of the Fund;

• To comply with federal, state, or local laws, rules, and other applicable legal requirements.

We do not sell your information and do not make any disclosure of investor nonpublic personal information to other companies who may want to sell their products or services to you.

OPT-OUT NOTICE

If, at any time in the future, it is necessary to disclose any investor personal information in a way that is inconsistent with this notice, the Redwood Real Estate Income Fund will provide you with proper advanced notice of the proposed disclosure so that you will have the opportunity to either opt-in or opt-out of such disclosure, as required by applicable law.

If you have any questions about this Privacy Notice, please contact the Redwood Real Estate Income Fund at 888-988-9882

The identity of the members of the Board and the Fund’s officers and brief biographical information is set forth below. The Fund’s Statement of Additional Information includes additional information about the membership of the Board and is available without charge, upon request, by calling the Fund at 888-988-9882.

28

Investment Manager

Redwood Investment Management, LLC

4110 N. Scottsdale Rd, Suite 125

Scottsdale, AZ 85251 | | Transfer Agent/Administrator

UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212 |

Custodian Bank

UMB Bank, N.A.

1010 Grand Boulevard

Kansas City, MO 64106 | | Distributor

UMB Distribution Services, LLC

235 West Galena Street

Milwaukee, WI 53212 |

Independent Registered Public Accounting Firm

Grant Thornton LLP

171 N. Clark Street, Suite 200

Chicago, IL 60601 | | Fund Counsel

Faegre Drinker Biddle & Reath LLP

One Logan Square, Suite 2000

Philadelphia, PA 19103-6996 |

(b) There were no notices transmitted to stockholders in reliance on Rule 30e-3 under the 1940 Act that contained disclosures specified by paragraph (c)(3) of that rule.

Item 2. Code of Ethics.

The Redwood Real Estate Fund (the “Registrant”) has a code of ethics (the “Code”) that applies to the Registrant’s principal executive officer and principal financial officer. During the period covered by this report, there were no material amendments to the provisions of the Code, nor were there any implicit or explicit waivers to the provisions of the Code. The Code is included as Exhibit 13(a)(1).

Item 3. Audit Committee Financial Expert.

As of the end of the period covered by the report, the registrant’s Board of Trustees has determined that J. Michael Fields and Stephen Mace are qualified to serve as the audit committee financial experts serving on its Audit Committee and that they are “independent,” as defined by Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The aggregate fees for professional services by the principal accountant during the fiscal period ended December 31, 2023 were as follows:

(a) Audit Fees.

Fiscal period ended December 31, 2023: $ 128,100

(b) Audit-Related Fees. These are fees by the Registrant’s independent auditors for assurance and related services that were reasonably related to the performance of the audit of the Registrant’s financial statements that are not reported under “Audit Fees.”

Fiscal period ended December 31, 2023: $ 0

(c) Tax Fees. These are fees billed for professional services rendered by the Registrant’s independent auditors for tax compliance, tax advice, and tax planning.

Fiscal period ended December 31, 2023: $ 0

(d) All Other Fees. These are aggregate fees billed for the fiscal period ended December 31, 2023 for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item.

Fiscal period ended December 31, 2023: $ 0

(e) Audit Committee’s pre-approval policies and procedures.

(1) The Audit Committee has adopted pre-approval policies and procedures that require the Audit Committee to pre-approve all audit and non-audit services of the Registrant, including services provided to the Registrant’s investment adviser or any entity controlling, controlled by or under common control with the Registrant’s investment adviser that provides ongoing services to the Registrant with respect to any engagement that directly relates to the operations and financial reporting of the Registrant.

(2) The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

(b) 0%

(c) 0%

(d) 0%

(f) The percentage of hours expended on the principal accountant's engagement to audit the Registrant's financial statements for the fiscal period ended December 31, 2023 that were attributed to work performed by persons other than the principal accountant's full-time, permanent employees was less than fifty percent.

(g) The aggregate non-audit fees billed by the Registrant's accountant for services rendered to the Registrant, and rendered to the Registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the fiscal period ended December 31, 2023, of the Registrant was $0.

(h) The Registrant's audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the Registrant's investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant's independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

(a) Included as part of the report to shareholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Proxy Voting Policy and Procedures

The Redwood Real Estate Income Fund (the “Fund”) has adopted the following Proxy Voting Policy and Procedures (the “Fund’s Policy”), as set forth below, in recognition of the fact that proxy voting is an important component of investment management and must be performed in a dutiful and purposeful fashion in order to advance the best interests of the Fund’s shareholders.

Shareholders of the Fund expect the Fund to vote proxies received from issuers whose voting securities are held by the Fund. The Fund exercises its voting responsibilities as a fiduciary, with the goal of maximizing the value of the Fund and its shareholder’s investments. Redwood Investment Management, LLC (the “Adviser” or “Redwood”) will seek to ensure that proxies are voted in the best interests of the Fund and its shareholders except where the Fund may be required by law to vote proxies in the same proportion as the vote of all other shareholders (i.e., “echo vote”).

Delegation of Proxy Voting to the Adviser

The Adviser shall vote all proxies relating to securities held by the Fund and, in that connection subject to any further policies and procedures contained herein, shall use proxy voting policies and procedures (“Proxy Policy”) adopted by the Adviser conformance with Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended (“Advisers Act”).

Disclosure of Proxy Voting Policy and Procedure in the Fund’s Statement of Additional Information (“SAI”) and Annual Report to Shareholders

The Fund shall include in annual report to shareholders on Form N-CSR, and in any SAI filed with the Securities and Exchange Commission (“SEC”) a summary of the Proxy Policy. In lieu of including a summary of policy, the Fund may include the policy in full.

Material Conflicts of Interest

If (i) the Adviser knows that a vote presents a material conflict between the interests of: (a) shareholders of the Fund, and (b) the Adviser or any of its affiliated persons; and (ii) the Adviser proposes to vote on the particular issue in the manner not prescribed by its Proxy Policy, then the Adviser will follow the material conflict of interest procedures set forth in the Adviser’s Proxy Policy when voting such proxies.

Adviser and Fund CCO Responsibilities

The Fund has delegated proxy voting authority with respect to the Fund’s portfolio securities to the Adviser, as set forth above. Consistent with this delegation, the Adviser is responsible for the following:

| ● | The Adviser must implement written policies and procedures, in compliance with Rule 206(4)-6 under the Advisers Act, reasonably designed to ensure that the voting of portfolio securities is in the best interest of shareholders of the Fund. |

| ● | At least annually, the Adviser will provide a summary of the material changes made to their Proxy Policies. These changes, and a redlined copy of such Proxy Policies, as applicable, shall be provided to the Board and to the Fund CCO. |

| ● | At least annually, the Adviser will present to the Board a record of each proxy voted by the Adviser on behalf of the Fund, including a report on the resolution of all proxies identified by the Adviser involving a conflict of interest. |

| ● | The Adviser CCO shall review all Proxy Policies at least annually to ensure that they are in compliance with Rule 206(4)-6 under the Advisers Act and confirm that it appears reasonably designed to ensure that the Adviser votes portfolio securities in the best interest of shareholders of the Funds owning the portfolio securities voted. |

| ● | Quarterly, the Fund CCO will request confirmation from the Adviser that any proxy votes for the Fund were handled in compliance with the Proxy Policies. |

Review Responsibilities

The Adviser may retain a proxy-voting service to coordinate, collect, and maintain all proxy-related information.