UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or §240.14a-12 |

WK KELLOGG CO

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ý | No fee required |

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | |

| | |

| | |

| 2024 Proxy Statement and Notice of the Annual Meeting of Shareowners | |

| | |

Message from the Chairman and

Chief Executive Officer

WK KELLOGG CO

BATTLE CREEK,

MICHIGAN 49017-3534

Dear Fellow Shareowners,

On behalf of the Board of Directors, it is my pleasure to invite you to attend the first ever Annual Meeting of Shareowners of WK Kellogg Co. This inaugural meeting marks another exciting ‘first’ in our journey as an independent public company. Our meeting will take place at 1:00 p.m. Eastern Time on Thursday, May 2, 2024, and will be available exclusively online via live webcast at www.virtualshareholdermeeting.com/KLG2024.

2023 was a transformational year for WK Kellogg Co as we began to write the next chapter of our founder W.K. Kellogg’s original story. On October 2, 2023, our spin off from Kellanova was successfully completed, and we introduced ourselves to the world as a leading food company in the U.S., Canada, and Caribbean positioned to build on our strong foundation in cereal and fulfill our purpose to create joy and connection to inspire Gr-r-reat days. We are indeed a 118-year-old start-up, with the legacy and attitude to match.

We have already started to make steady progress executing on each of our strategic priorities – driving an integrated commercial plan to win, modernizing our supply chain, and unleashing an energized and winning culture. In 2023, we delivered standalone adjusted net sales growth of 2.8% and a standalone adjusted EBITDA margin of 9.4%, a 290-basis point improvement.

Our many accomplishments in 2023 were only possible because of the hard work and dedication of the WK Kellogg Co team. I want to thank our dedicated 3,000+ employees for the tremendous effort that went into supporting WK Kellogg Co as an independent public company. I could not be prouder of how our team is operating and the passion they show every day to drive our business forward.

And we are just getting started …

Looking ahead, we remain focused on winning in cereal, integrating end-to-end to drive better execution, and investing in capabilities, technology, and infrastructure. We will be making it better every day, the WK Way.

Taken together, this combination of focused priorities, integrated teams, intentional investment, and an energized and winning culture is creating a more dynamic, efficient, and profitable organization. We are positioned to deliver our financial objectives, including driving stable top line and share growth, unlocking EBITDA growth and margin expansion, and creating long-term value for our Shareowners.

I am truly excited about the singular opportunity ahead of us and proud of the company we are building. Our foundation is strong, and we have charted our path to long-term value creation. Thank you for your continued investment in WK Kellogg Co as we shape our next chapter of success in 2024 and beyond.

Sincerely,

| | | | | |

| |

Gary Pilnick Chairman and Chief Executive Officer March 21, 2024 |

One Kellogg Square

Battle Creek, Michigan 49017-3534

Notice of the Annual Meeting of Shareowners

Background

| | | | | | | | |

| | |

| Date and Time | Virtual Meeting | Record Date |

| | |

| | |

May 2, 2024 at 1:00 p.m. Eastern Time | Live webcast at www.virtualshareholdermeeting.com/KLG2024 | Only Shareowners of record at the close of business on March 4, 2024 will receive notice of and be entitled to vote at the meeting or any adjournments or postponements. |

| | |

Voting Items

| | | | | | | | | | | |

| Proposal | Board Voting Recommendation |

| | | |

| 1 | To elect two Directors for a two-year term to expire at the 2026 Annual Meeting of Shareowners | | FOR each director nominee |

| | | |

| | | |

| 2 | To vote on an advisory resolution to approve the executive compensation of our named executive officers | | FOR |

| | | |

| | | |

| 3 | To vote on an advisory basis on the frequency of future advisory votes on executive compensation | | ONE YEAR |

| | | |

| | | |

| 4 | To ratify the Audit Committee's appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our 2024 fiscal year | | FOR |

| | | |

| | | |

| 5 | To approve an amendment to the WK Kellogg Co 2023 Long-Term Incentive Plan | | FOR |

| | | |

Shareowners will also take action upon any other matters that may properly come before the meeting, or any adjournments or postponements thereof.

The Annual Meeting will be virtual and will be held entirely online via live webcast at www.virtualshareholdermeeting.com/KLG2024. There will not be an option to attend the meeting in person.

Important Notice Regarding the Availability of Proxy Materials for the Shareowner Meeting to be held on May 2, 2024: The Proxy Statement and 2023 Annual Report on Form 10-K are available at https://investor.wkellogg.com/overview. Beginning on or about March 21, 2024, we are mailing either a Notice of Internet Availability of Proxy Materials containing instructions on how to vote your shares and how to access the accompanying Proxy Statement and our 2023 Annual Report on Form 10-K online (or request a paper or e-mail copy of these proxy materials), or a printed copy of these proxy materials, as required by the rules of the Securities and Exchange Commission.

We look forward to the meeting.

By Order of the Board of Directors,

Norma Barnes-Euresti

Chief Legal Officer and Secretary

March 21, 2024

Forward-Looking Statements and Non-GAAP Financial Measures

Forward-Looking Statements

This Proxy Statement contains a number of forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include predictions of future results or activities and may contain the words “expect,” “believe,” “will,” “can,” “anticipate,” “estimate,” “project,” “should,” "would," or words or phrases of similar meaning. You are cautioned not to rely on these forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and are subject to risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved.

Our future results could be affected by a variety of other factors, including a decline in demand for ready-to-eat cereals; supply chain disruptions and increases in costs and/or shortages of raw materials, labor, fuels and utilities as a result of geopolitical, economic and market conditions; consumers’ perception of our brands or company; business disruptions; our ability to drive our growth targets to increase revenue and profit; our failure to achieve our targeted cost savings and efficiencies from cost reduction initiatives; strategic acquisitions, alliances, divestitures or joint ventures or organic growth opportunities we may pursue in the future; material disruptions at one of our facilities; our ability to attract, develop and retain the skilled people we need to support our business; a shortage of labor, our failure to successfully negotiate collectively bargained agreements, or other general inflationary pressures or changes in applicable laws and regulations that could increase labor costs; an increase in our post-retirement benefit-related costs and funding requirements caused by, among other things, volatility in the financial markets, changes in interest rates and actuarial assumptions; our inability to obtain sufficient capital to grow our business and to increase our revenues; an impairment of the carrying value of goodwill or other acquired intangibles; increases in the price of raw materials, including agricultural commodities, packaging, fuel and labor; increases in transportation costs and reduced availability of, or increases in, the price of oil or other fuels; competition, including with respect to retail and shelf space; the changing retail environment and the growing presence of alternative retail channels; the successful development of new products and processes; adverse changes in the global climate or extreme weather conditions; and other risks and uncertainties detailed from time to time in our reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including our Registration Statement on Form 10, Quarterly Reports on Form 10-Q, Annual Report on Form 10-K, Current Reports on Form 8-K and other documents filed with the SEC. Forward-looking statements speak only as of the date of this Proxy Statement, and we undertake no obligation to publicly update them except as required by law.

Non-GAAP Financial Measures

The non-GAAP financial measures in this Proxy Statement are supplemental measures of our Company’s performance. These non-GAAP financial measures that we provide to management and investors exclude certain items that we do not consider part of on-going operations. Our management team utilizes a combination of GAAP and non-GAAP financial measures to evaluate business results, to make decisions regarding the future direction of the business, and for resource allocation decisions, including incentive compensation. As a result, we believe the presentation of both GAAP and non-GAAP financial measures provides investors with increased transparency into financial measures used by the management team and improves investors’ understanding our underlying operating performance, which is useful in the analysis of ongoing operating trends. All historical non-GAAP financial measures have been reconciled from the most directly comparable U.S. Generally Accepted Accounting Principles (GAAP) financial measures.

Because non-GAAP financial measures are not standardized, they may not be comparable to financial measures used by other companies or to non-GAAP financial measures having the same or similar names. In order to compensate for such limitations of non-GAAP measures, readers should review the reconciliations and should not consider these measures in isolation from, or as alternatives to, the comparable financial measures determined in accordance with GAAP.

Non-GAAP financial measures should not be used exclusively in evaluating our business and operations. Please see Appendix A of this Proxy Statement for additional detail regarding these non-GAAP financial measures and a reconciliation between each non-GAAP financial measure and the most directly comparable GAAP financial measure.

Contents

| | | | | |

| Board Voting Recommendation "FOR" | |

| |

| |

Proxy Voting Summary

You have received this proxy Statement because the WK Kellogg Co Board of Directors (the "Board") is soliciting your proxy to vote your shares at the 2024 Annual Meeting of Shareowners of WK Kellogg ("Annual Meeting") to be held at 1:00 p.m. Eastern Time on Thursday, May 2, 2024, or any adjournments or postponements thereof. The following proxy voting summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

References in this Proxy Statement to “WK Kellogg,” the “Company,” “we,” “us,” or “our” refer to WK Kellogg Co, which was formed to hold the assets, liabilities and operations associated with the North American cereal business and operations previously conducted by Kellogg Company (which is now known as Kellanova). On October 2, 2023, WK Kellogg became a standalone public company after being spun off by Kellanova (referred to herein as the "Spin" or “Spin Off”).

| | | | | | | | |

| |

PROPOSAL 1 Election of Directors | See further information beginning on page 3 |

| |

| |

| The Board recommends a vote FOR the re-election of each of Zack Gund and Gary Pilnick. |

| |

| | | | | | | | |

| |

PROPOSAL 2 Advisory Resolution on Executive Compensation | See further information beginning on page 27 |

| |

| |

| The Board recommends a vote FOR the advisory resolution approving the compensation of our named executive officers as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC. |

| |

| | | | | | | | |

| |

PROPOSAL 3 Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation | See further information beginning on page 61 |

| |

| |

| The Board recommends a vote FOR the option of one year as the frequency with which Shareowners are provided advisory votes on executive compensation. |

| |

| | | | | | | | |

| |

PROPOSAL 4 Ratification of PricewaterhouseCoopers LLP as Our Independent Registered Public Accounting Firm | See further information beginning on page 62 |

| |

| |

| The Board recommends a vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm |

| |

| | | | | | | | |

| |

PROPOSAL 5 Approval of an amendment to the WK Kellogg Co 2023 Long-Term Incentive Plan | See further information beginning on page 66 |

| |

| |

| The Board recommends a vote FOR the approval of an amendment to the WK Kellogg Co 2023 Long-Term Incentive Plan |

| |

Board and Corporate Governance

| | | | | | | | |

|

| | |

PROPOSAL 1 Election of Directors |

|

| |

| The Board recommends a vote FOR each director nominee. | |

| |

For more than 118 years, consumers have counted on WK Kellogg's business to offer them great-tasting, high-quality and nutritious ready-to-eat cereals. In order for the Board to effectively guide WK Kellogg to long-term sustainable, dependable performance, we believe it should be composed of individuals with sophistication and experience in the key disciplines that impact our business. To best serve WK Kellogg and our Shareowners, we seek to have a board of directors that, as a whole, possesses experience in key corporate disciplines, including public company leadership, accounting and financial acumen, people management, risk management, spin off experience and sustainability and corporate responsibility. We also seek expertise related to WK Kellogg’s industry, such as branded consumer products and consumer dynamics, health and nutrition, innovation, marketing, brand building, manufacturing and supply chain, regulatory and government affairs, the retail environment, and sales and distribution.

The Nominating and Governance ("N&G") Committee will consider a slate of candidates from a variety of different backgrounds when filling Board vacancies. The N&G Committee believes that all Directors must, at a minimum, meet the criteria outlined in the WK Kellogg Co Board of Directors' Code of Conduct and our publicly available Corporate Governance Guidelines, which specify, among other things, that the N&G Committee will consider criteria such as independence, diversity, age, skills and experience in the context of the needs of the Board. The N&G Committee also considers a nominee’s differences in viewpoint, professional experience, background, education, and skill. The N&G Committee believes that diversity of backgrounds and viewpoints is a key attribute for a director nominee. The N&G Committee seeks to have a Board that is representative of our business, Shareowners, consumers, customers, and employees. While different backgrounds and perspectives are critical in Board composition (as demonstrated by the variety of backgrounds of our Directors) and the Board's consideration of diversity when evaluating Board members is included in our Corporate Governance Guidelines, the Board has otherwise not established a formal policy regarding diversity. In evaluating Board members, the N&G Committee considers a combination of factors for each Director nominee, including whether the nominee (1) has the ability to represent all Shareowners without a conflict of interest; (2) has the ability to work in and promote a productive environment; (3) has sufficient time and willingness to fulfill the substantial duties and responsibilities of a Director; (4) has demonstrated the high level of character and integrity that we expect; (5) possesses the broad professional and leadership experience and skills necessary to effectively respond to the complex issues encountered by a publicly-traded company; (6) has the ability to apply sound and independent business judgment; and (7) has diverse attributes such as background, qualifications and personal characteristics.

Moreover, each of our Directors is expected to possess the following critical personal qualities and attributes that we believe are essential for the proper functioning of the Board to allow it to fulfill its duties for our Shareowners: accountability, ethical leadership, integrity, and sound business judgment. In addition, our Directors have the mature confidence to assess and challenge the way things are done and recommend constructive solutions, a keen awareness of the business and social realities of the business environment in which WK Kellogg operates, the independence and high-performance standards necessary to fulfill the Board’s oversight function, and the humility, professional maturity, and style to interface openly and constructively with other Directors. The N&G Committee conducts an annual review of our Directors and at this time affirms that all of our Directors meet the criteria and qualifications set forth in our Board of Directors Code of Conduct, our Corporate Governance Guidelines and the criteria set forth above for director nominees. Finally, while our Directors possess numerous qualities and experiences that make them effective fiduciaries for the Company, the Director biographies below include a non-exclusive list of other key experiences and qualifications that further qualify the individual to serve on the Board. These collective qualities, skills, experiences and attributes are essential to the Board’s ability to exercise its oversight function for WK Kellogg and its Shareowners, and guide the long-term sustainable, dependable performance of WK Kellogg.

Board and Corporate Governance

Our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) and our Amended and Restated Bylaws (the “Bylaws”) provide that the Board shall be composed of not less than six and no more than fifteen Directors. The Board is currently comprised of eight members. From time to time, the size of the Board may be expanded to add outstanding candidates or to prepare for an orderly transition with respect to departures of Directors.

The Board is currently divided into three classes, with the classes as nearly equal in number as possible. Our Certificate of Incorporation provides that this classified structure will no longer exist and “sunset” beginning at our 2026 Annual Meeting, meaning that all of our Director nominees will stand for election at the 2026 Annual Meeting for one-year terms and all of our Directors will thereafter be subject to annual re-election.

Based upon the recommendation of the N&G Committee, the Board has nominated the two Directors nominees named herein for election at the Annual Meeting each to serve for a two-year term ending at the 2026 Annual Meeting and until their respective successors are duly elected and qualified, or until their earlier of death, resignation or removal. Proxies cannot be voted for a greater number of persons than the number of nominees named. Biographical information for each of the Director nominees is set forth below. Also set forth below is a non-exhaustive description of the specific skills and experience of each nominee that were considered by the N&G Committee, in the context of the needs of the Board as a whole, in determining that these individuals were qualified to serve on the Board.

The Board recommends that the Shareowners vote “FOR” each of the following nominees: Zack Gund and Gary Pilnick. If, before the Annual Meeting, any nominee becomes unable to serve, or chooses not to serve, the Board may nominate a substitute. If that happens, the persons named as proxies on the proxy card will vote for the substitute. Alternatively, the Board may either let the vacancy stay unfilled until an appropriate candidate is identified or reduce the size of the Board to eliminate the unfilled seat.

| | | | | | | | |

| Skills and Experience of our Directors |

| The Board is comprised of individuals with experience in key areas relevant to WK Kellogg and collectively possesses the mix of skills and experience necessary to provide appropriate oversight of a company the size and complexity of WK Kellogg. Each director was recruited based on the unique experience, qualifications and skills that they bring to the Board. This blend of diverse backgrounds provides the Board with the benefit of a broad array of perspectives. The following skills and areas of expertise have been identified by the Board as core competencies: |

| | |

| Public Company Leadership | Directors who have served as chief executive officers / senior executives in public companies bring valuable experience and practical insight to assist management and in formulating and executing effective company strategy. They also challenge and motivate management to align resources with strategic objectives and take the necessary actions to achieve desired results. Further more, they were able to identify, develop and manage leadership potential within the organization. | P |

| Manufacturing and Supply Chain | Directors who have experience managing / overseeing supply chain strategy across a large, complex enterprise provide valuable insights into supply chain strategy and provide guidance to assist the Company in executing its strategic priorities. | P |

| Marketing, Innovation, and Brand Building | Directors who have experience with relevant and modern marketing approaches provide meaningful perspective to assist management to effectively communicate the story of a consumer products company; develop innovation strategies; and develop the strategies to help our brands attract and retain consumers and customers and stand out from competitor offerings. | P |

| Sales | Directors who have sales expertise in a wide variety of sales channels, including new and evolving consumer channels in e-commerce, omni-channel and digital businesses. | P |

| Accounting and Financial Acumen | Directors with a strong understanding of accounting and finance is important to ensure the integrity of our financial reporting and critically evaluate our performance as a company. | P |

| People Management | Directors with experience in setting the strategy for and otherwise managing people and teams, including recruitment, retention, development and compensation. | P |

Board and Corporate Governance

| | | | | | | | |

| Risk Management | Directors with experience managing various enterprise risks at companies in industries with similar risks and addressing issues when they arise to provide oversight, managing risk, and continuously improving our risk management processes. | P |

| Spin off Experience | Directors who have managed through recent spin off or similar transactions provide us guidance and practical insights as our company stands-up functions and processes needed as a standalone public company established from a spin off of a well-established, larger global public company. | P |

| Sustainable Business Practices and Corporate Responsibility | Directors with experience and exposure in identifying the risks and opportunities in sustainable business practices and corporate responsibility can help the Company identify value-creation strategies and goals that will have the most positive impact on our business. | P |

Each of our Directors possesses many of these competencies. For purposes of this Proxy Statement, the Director biographies provide a non-exhaustive list of the key competencies for each Director.

Nominees for Election for a Two-Year Term Expiring at the 2026 Annual Meeting

| | | | | | | | |

| | |

| | ZACK GUND | LEAD DIRECTOR | 53 Managing Partner of Coppermine Capital, LLC Mr. Gund is currently a Managing Partner of Coppermine Capital, LLC, a private investment firm he founded in 2001. In this role, Mr. Gund makes investment decisions and oversees several portfolio companies across many different sectors. His work has spanned both the manufacturing and service industries, including food manufacturing. Mr. Gund has served as a member board of directors of Kellanova (formerly Kellogg Company), a global consumer products company, since December 2014, where he chairs the Manufacturing Committee and also serves on its Compensation & Talent Management Committee and Nominating & Governance Committee. |

|

Director since October 2023 Committees •Nominating & Governance (Chair) •Compensation and Talent Management |

Director Qualifications As a result of these professional and other experiences, Mr. Gund brings particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to), Public Company Leadership, Manufacturing and Supply Chain and Sales, and Marketing and Innovation. Additionally, he brings the perspective of an investor who is focused on the long-term health and vitality of the Company and establishing a solid foundation for future growth and profitability. Mr. Gund has significant public company board experience (including specific experience in auditing, manufacturing, and marketing oversight), which strongly positions him to serve as the Lead Director of WK Kellogg. |

Board and Corporate Governance

| | | | | | | | |

| | |

| | GARY PILNICK | 59 Chairman and Chief Executive Officer of WK Kellogg Co Mr. Pilnick was appointed as Chairman and Chief Executive Officer of WK Kellogg effective upon the completion of the Spin Off. Prior to his current role, he served as Vice Chairman, Corporate Development and Chief Legal Officer of Kellogg Company (now Kellanova), a global consumer products company, since January 2016. In August 2003, he was appointed Senior Vice President, General Counsel and Secretary, and had been a member of Kellogg Company's Executive Committee for over 20 years, and assumed responsibility for the global Corporate Development function in June 2004. He joined Kellogg Company as Vice President, Deputy General Counsel and Assistant Secretary in September 2000 and served in that position until August 2003. Before joining Kellogg Company, he served as Vice President and Chief Counsel of Sara Lee Branded Apparel (now Hanesbrands) an apparel company, and as Vice President and Chief Counsel, Corporate Development and Finance at Sara Lee Corporation, formerly a consumer goods corporation now held by Kohlberg & Company after being acquired by Tyson Foods. |

|

Director since November 2022 Committees None |

Director Qualifications As a result of these professional and other experiences, Mr. Pilnick possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to), Public Company Leadership, People Management, and Marketing, Innovation and Brand Building experience. Additionally, drawing on his 23-year senior leadership tenure at Kellogg Company prior to the Spin Off, Mr. Pilnick has an in-depth knowledge of, and passion for, our business and people, which positions him well to serve as our Chairman. |

Continuing Directors to Serve Until the 2025 Annual Meeting

| | | | | | | | |

| | |

| | MICHAEL CORBO | 64 Former Chief Supply Chain Officer of Colgate-Palmolive Company Mr. Corbo retired from Colgate-Palmolive Company, a consumer products company, where he served as its Chief Supply Chain Officer from April 2011 to January 2023. Prior to January 2023, he served in various roles with Colgate-Palmolive, including, Vice President, Global Oral Care, Supply Chain from April 2005 to April 2011 and Vice President, Manufacturing Operations, Latin America from April 2001 to April 2005. |

|

| |

Director since October 2023 Committees •Audit •Nominating & Governance | |

Director Qualifications As a result of these professional and other experiences, Mr. Corbo possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) Manufacturing and Supply Chain, Financial Acumen, and Marketing, Innovation and Brand Building. Mr. Corbo experience leading supply chain for a global consumer products company makes him well positioned to critically and thoughtfully review and participate in the Board's oversight of the Company’s supply chain strategic initiatives. |

Board and Corporate Governance

| | | | | | | | |

| | |

| | RAMÓN MURGUÍA | 65 Owner of Murguía Law Firm Mr. Murguía has been owner of Murguía Law Firm since he established the firm in September 1991 and has served as a trustee of the W.K. Kellogg Foundation, an independent, private foundation (and one of the largest philanthropic foundations in the U.S.), since April 2007. Mr. Murguĺa has also served as a director of Country Club Bank for nearly 20 years and serves on the non-profit boards of the Wyandotte Health Foundation, Union Station Kansas City, Kansas University Endowment Association, the Wildflowers Institute and the Nelson-Atkins Museum of Art. |

| |

Director since October 2023 Committees •Compensation and Talent Management •Nominating & Governance | Director Qualifications As a result of these professional and other experiences, Mr. Murguía possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) Risk Management, Sustainable Business Practices and People Management. Based upon his legal career and service as a director on for-profit and non-profit boards, he brings valuable insights on public policy and community relations to the Board. |

| |

| | | | | | | | |

| | |

| | MINDY SHERWOOD | 57 President, Global Walmart and Chief Sales Officer of The Procter & Gamble Company Ms. Sherwood has served as the President, Global Walmart and Chief Sales Officer of the Procter & Gamble Company, a consumer goods company, since July 2021 and leads strategy and capability for Procter & Gamble sales across all categories and regions as well as the global Walmart business, Procter & Gamble's largest customer. During her over 30-year career at Procter & Gamble and prior to her current role at that company, Ms. Sherwood served as its President, Global Walmart from July 2019 to July 2021, Vice President, Global Walmart from January 2015 to July 2019; Vice President, Sales, Beauty Care, Walmart from September 2014 to January 2015; and Vice President, Nordics, Europe Region from October 2012 to September 2014. |

|

Director since October 2023 Committees •Compensation and Talent Management •Nominating & Governance |

Director Qualifications As a result of these professional and other experiences, Ms. Sherwood possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to), Sales, Marketing, Innovation and Brand Building, Public Company Leadership and People Management. Specifically, drawing on her 30-year career covering all aspects of sales, she brings a unique perspective on sales strategy and building relationships with our customers to the Board. |

Board and Corporate Governance

Continuing Directors to Serve Until the 2026 Annual Meeting

| | | | | | | | |

| | |

| | WENDY ARLIN | 53 Former Chief Financial Officer of Bath & Body Works, Inc. Ms. Arlin served as Chief Financial Officer of Bath & Body Works, Inc. (“BBWI”), a home fragrance, body care and soaps and sanitizer products retailer, from August 2021 through July 2023. Prior to serving in that role and prior to the spin off of BBWI, Ms. Arlin served as Senior Vice President, Finance and Corporate Controller of L Brands, Inc. (now Bath & Body Works, Inc.), a specialty retailer, leading the corporate finance, financial reporting, accounting, and financial shared services functions from 2005 to 2021. Prior to joining L Brands in 2005, Ms. Arlin spent 12 years at KPMG LLP, a global professional services firm, in the audit practice and ultimately held the position of partner in charge of the central Ohio consumer and industrial/information, communications and entertainment businesses practices. Ms. Arlin also serves as a director of Kohl's Corporation and The Wendy's Company. |

|

Director since September 2023 Committees •Audit (Chair) •Compensation and Talent Management |

Director Qualifications As a result of these and other experiences, Ms. Arlin has been determined by the Board to be an “audit committee financial expert” as defined under Securities and Exchange Commission ("SEC") regulations, and brings significant accounting, auditing and financial reporting expertise to the Board. Additionally, she brings and possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) Spin Experience, Risk Management Experience and Public Company Leadership. Additionally, Ms. Arlin's service on other public company boards allows her to provide insight into oversight and corporate governance matters for the Board. |

| | | | | | | | |

| | |

| | R. DAVID BANYARD, JR. | 55 President and Chief Executive Officer of MasterBrand, Inc. Mr. Banyard is the President and Chief Executive Officer of MasterBrand, Inc., the largest manufacturer of residential cabinets in North America, and has served in that role since December 2022, when Fortune Brands Innovations, Inc. spun off MasterBrand, Inc. Prior to his current role, Mr. Banyard served as President of MasterBrand Cabinets, Inc., the cabinets segment of Fortune Brands Home and Security, Inc., from 2019 to 2022. Mr. Banyard previously served as President and Chief Executive Officer of Myers Industries, Inc., an international manufacturer of packaging, storage and safety products and specialty molding, from 2015 to 2019. Prior to that role, Mr. Banyard was Group President, Fluid Handling Technologies at Roper Technologies, Inc., a diversified technology company, from 2010 to 2015. Mr. Banyard began his business career at Danaher Corporation, a science and technology company, where he held a variety of management roles from 2004 to 2010, including Vice President and General Manager of Kollmorgen’s Vehicle Systems business. Mr. Banyard also completed an 11-year career in the U.S. Navy as a fighter pilot. |

|

Director since October 2023 Committees •Compensation and Talent Management (Chair) •Audit |

Director Qualifications As a result of these professional and other experiences, Mr. Banyard possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) Spin Experience, People Management, Financial Acumen and Risk Management Experience. In addition, given his experience leading MasterBrand, Inc. as a new public company following its spin-off from Fortune Brands, Home and Security, Inc. Mr. Banyard brings a unique insight on managing and implementing new public company functions to the Board. |

Board and Corporate Governance

| | | | | | | | |

| | |

| | JULIO NEMETH | 63 Former Chief Product Supply Officer of The Procter & Gamble Company Mr. Nemeth served as the Chief Product Supply Officer at the Procter & Gamble Company, a consumer goods company, from May 2019 to May 2023. In this role, Mr. Nemeth led Procter & Gamble’s global product supply organization, which includes over 100 manufacturing plants and roughly 200 distribution centers around the world. Prior to this role, Mr. Nemeth held numerous senior roles with Procter & Gamble since 1990, including President, Global Business Services from January 2015 to April 2019 and Senior Vice President, Product Supply, Global Operations from July 2013 to December 2014. Mr. Nemeth has served on the board of directors of The Boston Beer Company, Inc. since January 2020. |

|

Director since October 2023 Committees •Audit •Nominating & Governance |

Director Qualifications As a result of these professional and other experiences, Mr. Nemeth possesses particular knowledge and experience in a variety of the identified core competencies and other areas that strengthens the Board’s collective knowledge, capabilities and experience, including (but not limited to) Manufacturing and Supply Chain, Public Company Leadership, and Accounting and Financial Acumen. Mr. Nemeth's experience leading supply chain for a global consumer products company makes him well positioned to critically and thoughtfully review and guide the Company’s supply chain strategic initiatives for the Board. Additionally, Mr. Nemeth also has other public company board experience, which allows him to provide insight into risk oversight and corporate governance matters for the Board. |

Board and Corporate Governance

Corporate Governance

Board-Adopted Corporate Governance Guidelines

We operate under corporate governance principles and practices (“Corporate Governance Guidelines”) that are designed to maximize long-term Shareowner value, align the interests of the Board and management with those of our Shareowners and promote high ethical conduct among our Directors and employees. Our Corporate Governance Guidelines include the following:

| | | | | |

| |

| Board Independence | •A majority of the Directors, and all of the members of the Audit Committee, Compensation and Talent Management Committee (the "Compensation Committee") and N&G Committee, are required to meet the applicable independence requirements of the New York Stock Exchange and the SEC. •One Director is designated a Lead Director, who, among other things, chairs executive session meetings of the independent, non-employee Directors, and may call any such meetings at any time, approves proposed meeting agendas and schedules, and establishes a method for Shareowners and other interested parties to communicate with the Board. See also "Board and Corporate Governance - Corporate Governance - Lead Director." •The Board and each Board Committee have the authority to hire independent legal, financial or other advisors as they may deem necessary, at the Company's expense. •The Corporate Governance Guidelines provide that non-employee Directors meet in executive session at least three times annually. As a general practice, the non-employee Directors are scheduled to meet in executive session at every Board meeting. •No Director may serve as a director, officer or employee of a competitor. |

| |

| |

| Strategic Oversight | •Directors review the Company's strategy periodically during the year and dedicate at least one meeting per year to focus on a comprehensive strategic review, including the key elements of the Company's strategy. •Directors have direct and regular access to officers, employees, facilities, books and records of the Company and can initiate contact or meetings directly or through the Chief Executive Officer ("CEO") or the Secretary. |

| |

| |

| Performance Assessments | •The Board and Board Committees conduct annual performance evaluations to assess whether the Board and its Committees are functioning effectively. •The independent Directors use the recommendations from the N&G Committee and Compensation Committee to conduct an annual review of the CEO’s performance and determine the CEO’s compensation. |

| |

| |

| |

| Succession Planning | •The Board reviews CEO succession planning at least once per year. |

| |

| |

| |

| Restrictions and Rules | •Non-employee Directors who change their principal responsibility or occupation from that held when they were elected shall offer their resignation for the Board to consider the continued appropriateness of Board membership under the circumstances. •No Director may be nominated for a new term if he or she would attain the age limit of seventy-five or older at the time of election, unless the Board otherwise determines that it is in the best interest of WK Kellogg due to his or her unique capabilities or special circumstances. •No Director may serve on more than three other public company boards, in addition to WK Kellogg (with consideration given to public company leadership roles and outside commitments). •All Directors are expected to comply with stock ownership guidelines for Directors. •Continuing education is provided to Directors consistent with our Board education policy. |

| |

Board and Corporate Governance

Board Structure; Communication with the Board

We believe the current mix of experienced independent and management Directors that make up our Board, along with the independent role of our Lead Director and our independent Board Committee composition, is in the best interests of WK Kellogg and our Shareowners. The following section describes the Board leadership structure, the reasons why the structure is in place at this time, the roles of various positions, and our related key governance practices.

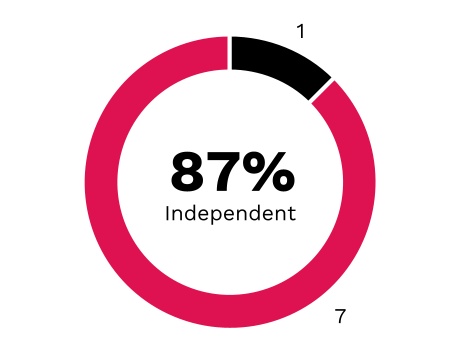

Independence; Board Mix

Our Board has an effective mix of independent and management Directors. It is composed of seven independent Directors (including a Lead Director) and Mr. Pilnick, our CEO who also serves as Chairman.

Board Independence

| | | | | |

| n | Management Director |

| n | Independent Directors |

Board Demographics

| | | | | | | | |

| Board Demographics-Gender |

| Total Numbers of Directors | 8 | |

| Did Not Disclose Gender | 1 | |

| Part I: Gender | Female | Male |

| Directors | 2 | 5 |

| | | | | |

| Board Demographics-Demographic Background |

| Total Numbers of Directors | 8 |

| Part II: Demographic Background |

| Hispanic or Latinx | 2 |

| White | 5 |

| Did Not Disclose Demographic Background | 1 |

Board and Corporate Governance

Board Committee Structure and Independence

The Board has three standing Committees: (i) Audit Committee, (ii) the Compensation and Talent Management Committee ("Compensation Committee"), and (iii) N&G Committee. Each of the Audit Committee, Compensation Committee, and N&G Committee is composed solely of independent Directors, each with a different independent Director serving as chair of the respective Committee.

Board Leadership Structure

With respect to the roles of Chairman and CEO, the Corporate Governance Guidelines provide that the roles may be separated or combined, and the Board exercises its discretion in combining or separating these positions as it deems appropriate in light of prevailing circumstances. At this time, the Board believes that combining the roles of Chairman and CEO, together with the separate, independent role of our Lead Director, is the most effective leadership structure for WK Kellogg for many reasons. In particular, the Board believes the combined role is appropriate because of the following:

•As a result of his professional experience, Mr. Pilnick has acquired extensive knowledge and expertise in a variety of areas, including public company leadership; marketing, innovation and brand building; accounting and financial acumen; people management; risk management and spin experience. This background gives him the insight necessary to combine the responsibilities of strategic development and execution along with management of day-to-day operations, and

•Mr. Pilnick’s deep understanding of, and passion for, WK Kellogg's business, people, operations and risks acquired in his previous role at the executive level for the Kellogg Company for over two decades gives him the insight to combine the responsibilities of strategic development along with management of day-to-day operations and execution.

We believe Mr. Gund, an independent director fulfilling the Company's robust Lead Director role (as described below), provides an effective independent voice on issues facing the company, ensures that key issues are brought to the Board's attention and that effective corporate governance is maintained.

Board and Corporate Governance

| | | | | | | | |

| | |

| LEAD DIRECTOR Zack Gund, an independent Director and the Chair of the N&G Committee, currently serves as our Lead Director. Mr. Gund is an effective Lead Director for WK Kellogg due to, among other things •independence; •strong strategic and financial acumen; •commitment to ethics; •effective leadership skills; •extensive knowledge of the retail environment and branded consumer products; and •deep understanding of WK Kellogg's business obtained while serving on the board of directors of Kellanova (formerly Kellogg Company) for more than nine years. The independent Lead Director serves a variety of roles, including •for every meeting, reviewing and approving Board agendas, meeting materials and schedules to confirm the appropriate Board and committee topics are reviewed and sufficient time is allocated to each; •liaising between the Chairman and CEO and non-management Directors if and when necessary and appropriate (that said, each Director has direct and regular access to the Chairman and CEO); •presiding at the executive sessions of independent Directors and at all other meetings of the Board at which the Chairman is not present; •chairing an executive session of independent Directors at every meeting consistent with the Corporate Governance Guidelines; •leading the Board's annual evaluation process, including conducting private, individual reviews with each Director; and •facilitating succession planning for the Board, including by having the N&G Committee and the independent Directors regularly discuss and evaluate CEO succession plans. Mr. Gund may be contacted at zack.gund@wkkellogg.com. Any communications which Shareowners or other interested parties may wish to send to the Board may also be directly sent to Mr. Gund at zack.gund@wkkellogg.com. | |

| | |

Our Corporate Governance Guidelines provide the flexibility for the Board to modify our leadership structure as appropriate. We believe that WK Kellogg, like many U.S.-based companies, is well-served by this flexible leadership structure.

Board and Corporate Governance

Board Self-Evaluation

Our Lead Director leads our annual Board self-evaluation process whereby the Board conducts an annual performance evaluation to assess the performance of the Board and its Committees to determine how to make the Board even more effective. The process includes detailed written survey materials as well as individual, private meetings between each Director and the Lead Director. As a newly public company, the annual performance evaluation began in December 2023 to ensure the self-evaluation process and opportunity for continuous improvement occurs promptly to evaluate and establish our own Board practices and processes.

Board Self-Evaluation / Continuous Improvement Program

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | u | | | | | | | u | | | | | | | u | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | December - February

Overall Program Assessment | | | | February - April

Action Plan Development | | | | April - December

Action Plan Progress Review | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | •Board conducts in-depth evaluation to determine whether the Board, its Committees, and its Directors are functioning effectively •Lead Director conducts private one-on-one meetings with each Director | | | | •Program assessed for enhancements that would improve Board effectiveness •Targeted Action Plan developed to address key focus areas identified | | | | •Action Plan is executed throughout the year •The N&G Committee formally monitors progress against the Action Plan annually | | | | |

| p | | | | | | | | | | | q |

| | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | t | | Ongoing Action Plan Execution | | t | | | | | |

| | | | | | | | | | | |

Company Strategy

Strategic planning and oversight of the Company’s business strategy are key responsibilities of the Board, and the Board has deep experience and expertise in the areas of strategy and strategic development. The Board believes that overseeing and monitoring strategy is a continuous process and takes a multi-step approach to exercising its responsibilities. Our entire Board discusses the strategic priorities of the Company, taking into consideration economic, industry, consumer, environmental, social, governance, and other significant trends, as well as changes in the food industry and regulatory initiatives. The Board reviews the Company’s strategy periodically during the year and will dedicate at least one meeting each year to focus on a strategic review, including key elements of our strategy. Relevant strategic topics are also embedded in the work of Committees. The Board is uniquely positioned to provide the oversight required for the Company's strategy given the specific and diverse mix of skills, capabilities and core competencies relating to our long-term strategy and business model as well as their diverse perspectives, experiences and backgrounds (see “Board and Corporate Governance – Election of Directors”).

While the Board and its Committees oversee strategy and strategic planning, management is charged with executing the business strategy. To monitor performance against the Company’s strategic goals, the Board receives regular updates and actively engages in dialogue with our Company’s senior leaders.

The Board’s oversight and management’s execution of business strategy are intended to help promote the creation of long-term Shareowner value in a sustainable manner, with a focus on assessing both opportunities available to us and risks that we may encounter.

Board and Corporate Governance

Board Oversight of Enterprise Risk

The Board, directly and indirectly through its Committees, utilizes our Enterprise Risk Management (“ERM”) process to assist in fulfilling its oversight of the Company's risks. While risk oversight is a full Board responsibility, the responsibility for monitoring the ERM process has been delegated to the Audit Committee. As such, one of the leaders of the ERM process is the Senior Director, Internal Audit and Controls, who reports to the Chair of the Audit Committee.

Annually, the Audit Committee reviews an assessment of the Company’s enterprise risks and the allocation of risk oversight among the Board and its Committees. Due to the dynamic nature of risk and the business environment generally, at every Audit Committee meeting, the Company provides a status report on key enterprise risks where responsible senior leaders provide in-depth reviews. Key enterprise risks are also reviewed with and discussed in other relevant Committee meetings. Board and Committee agendas are updated throughout the year so that emerging enterprise risks may be reviewed and discussed at the relevant times. This process facilitates the Board’s ability to fulfill its oversight responsibilities of WK Kellogg’s risks in a timely and effective manner.

| | | | | | | | | | | | | | |

| | | | |

| | RISK ASSESSMENT | | |

| | | | |

| | | | |

| The risk assessment process has been developed to identify and assess WK Kellogg’s current and emerging risks, including the nature, probability and implications of the risk, as well as to identify steps to mitigate and manage each risk (including how ERM is integrated into the Company’s internal audit plan). Many of our key business leaders, functional heads and other managers from across the Company provide perspective and input in a targeted and strategic manner to develop the Company’s holistic views on enterprise risks. The centerpiece of the enterprise risk assessment is the distillation of this review into key enterprise risks which includes the potential magnitude, likelihood and velocity of each risk. As part of the process for assessing each risk, management identifies the following: •the nature of the risk •the senior executive responsible for managing the risk •the potential impact of the risk •management’s approach to manage the risk •Board or Committee accountability The results of the risk assessment are then integrated into the Board’s processes. | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

| | BOARD OF DIRECTORS | | |

| | | | |

| | | | |

| •Receives updates on business operations, financial results, strategic priorities, long-range plans, employee safety and other key enterprise risks, including current status and action items, during regularly scheduled meetings •Advises management on shaping corporate purpose, values and strategy •The full Board reviews the results of the annual enterprise risk assessment and periodic updates on status of key risks, which includes consideration of potential impacts •Oversight responsibility for each risk is allocated among the full Board and its Committees, and specific Board and Committee agendas are developed accordingly | |

| | | | |

Board and Corporate Governance

| | | | | | | | | | | | | | |

| | | | |

| | KEY AUDIT COMMITTEE RESPONSIBILITIES | | |

| | | | |

| | | | |

| •Reviews and considers the annual audit risk assessment, which identifies risks related to our internal control over financial reporting and informs our internal and external audit plans •Receives updates on the key enterprise risks •Reviews the ERM process and results of the annual risk assessment •Monitors independence of our independent auditor, including establishing policies for hiring of any current or former employees of our independent auditor •Reviews the use of new accounting principles •Reviews the use of non-GAAP measures in our earnings releases and SEC filings •Considers the impact of risk on our financial position and the adequacy of our risk-related internal controls •Oversees cybersecurity and receives regular updates on cybersecurity matters, which includes a review of potential digital threats and vulnerabilities, cybersecurity priorities, and our cybersecurity framework •Receives quarterly updates on litigation and regulatory matters and developments •Reviews the ethics and compliance and litigation management programs | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

| | KEY N&G COMMITTEE RESPONSIBILITIES | | |

| | | | |

| | | | |

| •Conducts an annual review of our corporate governance policies and practices •Oversees corporate governance, receiving regular updates on emerging corporate governance issues and trends •Oversees annual self-evaluation process for the Board and each of its committees •Oversees succession planning and refreshment efforts for the Board •Reviews, approves and oversees any proposed transactions involving a related party | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

| | KEY COMPENSATION COMMITTEE RESPONSIBILITIES | | |

| | | | |

| | | | |

| •Assesses annually whether our compensation plans, policies and practices encourage excessive or inappropriate risk taking by employees •Evaluates our executive compensation programs to ensure they adequately tie to company performance •Reviews risks related to talent acquisition, retention and development | |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

| | KEY MANAGEMENT RESPONSIBILITIES | | |

| | | | |

| | | | |

| •Conducts a formal risk assessment of WK Kellogg's business annually, including assessing probability, magnitude, potential economic and reputational impacts, and developing mitigation actions and monitoring plans •Evaluates the completeness of the identified enterprise risks •Key risks are reviewed and monitored and mitigation plans developed by designated senior leaders responsible for day-to-day risk management | |

| | | | |

Board and Corporate Governance

Majority Voting for Directors; Director Resignation Policy

Our Bylaws contain a majority voting standard for the election of Directors in an uncontested election (that is, an election where the number of nominees is equal to the number of seats open). In an uncontested election, each nominee must be elected by the vote of a majority of the votes cast. A “majority of the votes cast” means the number of votes cast “for” a Director’s election must exceed the number of votes cast “against” (excluding abstentions). No Director will be nominated for election or otherwise be eligible for service on the Board unless and until such candidate has delivered an irrevocable resignation to the N&G Committee that would be effective upon (i) such Director’s failure to receive the required vote in an election of Directors and (ii) the Board’s acceptance of the resignation. If a Director fails to achieve the required vote in an uncontested election, the N&G Committee would promptly consider the resignation and recommend to the Board the action to be taken on the offered resignation. The Board would act on the N&G Committee’s recommendation no later than 90 days following the date of the certification of the election results of the Shareowners’ meeting where the election occurred. The Director whose resignation is under consideration shall not participate in the recommendation of the N&G Committee or deliberations of the Board with respect to his or her nomination. Following the Board’s decision, WK Kellogg would promptly disclose in a current report on Form 8-K the decision whether to accept the resignation as tendered. To the extent that a resignation is accepted, the N&G Committee would recommend to the Board whether to fill such vacancy or vacancies or to reduce the size of the Board.

Director Independence

The Board has determined that all current Directors (other than Mr. Pilnick) are independent based on the following standards: (a) no entity (other than a charitable entity) of which such a Director is an employee in any position or any immediate family member (as defined) is an executive officer, made payments to, or received payments from, WK Kellogg and its subsidiaries in the 2023 fiscal year in excess of the greater of (1) $1,000,000 or (2) two percent of that entity’s annual consolidated gross revenues; (b) no such Director, or any immediate family member employed as an executive officer of WK Kellogg or its subsidiaries, received in any twelve month period within the last three years more than $120,000 per year in direct compensation from WK Kellogg or its subsidiaries, other than Director and Committee fees and pension or other forms of deferred compensation for prior service not contingent in any way on continued service; (c) WK Kellogg did not employ such Director in any position, or any immediate family member as an executive officer, during the past three years; (d) no such Director was a current partner or employee of a firm that is WK Kellogg’s internal or external auditor (“Auditor”), no immediate family member of such Director was a current partner of the Auditor or an employee of the Auditor who personally worked on our audit, and no Director or immediate family member of such Director was during the past three years a partner or employee of the Auditor and personally worked on our audit within that time; (e) no such Director or immediate family member served as an executive officer of another company during the past three years at the same time as a current executive officer of WK Kellogg served on the compensation committee of such company; and (f) no other material relationship exists between any such Director and WK Kellogg or our subsidiaries.

The Board also considers from time to time commercial ordinary-course transactions as it assesses independence status. The Board has concluded that any such transaction did not impair Director independence for a variety of reasons including that the amounts in question were considerably under the thresholds set forth in our independence standards and the relationships were not deemed material.

Related Person Transactions

The Board has adopted a written policy relating to the N&G Committee’s review and approval of transactions with related persons that are required to be disclosed in proxy statements by SEC regulations, which are commonly referred to as “related person transactions.” A “related person” is defined under the applicable SEC regulation and includes our Directors, executive officers and 5% or more beneficial owners of our common stock. The Secretary administers procedures adopted by the Board with respect to related person transactions and the N&G Committee reviews and approves all such transactions. Approval of a related person transaction requires the affirmative vote of the majority of disinterested Directors on the N&G Committee. Prior to approving any related person transaction, the N&G Committee must determine that the transaction is fair and reasonable to WK Kellogg. The N&G Committee regularly reports on its activities to the Board. The written policy relating to the N&G Committee’s review and approval of related person transactions is available on our investor relations website, at https://investor.wkkellogg.com/governance/governance-documents.

Board and Corporate Governance

Agreements with Kellanova

In connection with the Spin Off, we entered into a Separation and Distribution Agreement and certain other agreements with Kellanova that provide a framework for our relationship with Kellanova after the Spin Off. The following summarizes the terms of these agreements, forms of which are filed with the SEC as exhibits to the our Annual Report on Form 10-K for the year ended December 30, 2023, which was filed with the SEC on March 8, 2024. The summaries of each of these agreements set forth below are qualified in their entirety by reference to the full text of the applicable agreements.

Separation and Distribution Agreement

In connection with the Spin Off, we entered into a Separation and Distribution Agreement with Kellanova that outlined the terms and conditions of the Spin Off. The Separation and Distribution Agreement provides for the principal actions taken in connection with the Spin Off, identified the assets transferred to, and the liabilities to be assumed by, WK Kellogg associated with the Spin.

WK Kellogg and Kellanova have agreed to indemnify the other and each of the other’s current, former and future directors, officers, employees and agents, and each of the heirs, executors, successors and assigns of any of them, against certain liabilities incurred in connection with the Spin Off and our and Kellanova’s respective businesses. The amount of either Kellanova’s or our indemnification obligations will be reduced by any insurance proceeds the party being indemnified receives. The Separation and Distribution Agreement specifies procedures regarding claims subject to indemnification and related matters. Indemnification with respect to taxes, and the procedures related thereto, are governed by the Tax Matters Agreement, which is described separately below.

The Separation and Distribution Agreement also governs the allocation, transfer and leasing of certain real estate between WK Kellogg and Kellanova following the Spin Off, including the corporate headquarters building located in Battle Creek, Michigan and manufacturing plants related to our business that were transferred to us.

Other matters governed by the Separation and Distribution Agreement include, among others, approvals and notifications of transfer, termination of intercompany agreements and outstanding guarantees, treatment of shared contracts, non-competition obligations, confidentiality, access to and provision of records, privacy and data protection, production of witnesses, privileged matters, financing arrangements, dispute resolution, release of claims and liabilities, and treatment of and access to insurance policies.

During the year ended December 30, 2023, no indemnification or other payments were made by either party to the other under the Separation and Distribution Agreement.

Transition Services Agreement

We entered into a Transition Services Agreement with Kellanova, on customary terms and conditions, pursuant to which Kellanova provides specified services to WK Kellogg and its subsidiaries, and WK Kellogg provides certain limited services to Kellanova, on a transitional basis to help ensure an orderly transition following the Spin Off. These services include information technology, procurement, distribution, logistics, order to delivery, research and development, accounting, finance, compliance and administrative activities.

During the year ended December 30, 2023, we made payments totaling approximately $48.1 million to Kellanova, and Kellanova paid us $156,616, under the Transition Services Agreement.

Supply Agreement

WK Kellogg entered into a Supply Agreement with Kellanova pursuant to which Kellanova will manufacture and supply to WK Kellogg certain cereal products that were manufactured at Kellanova facilities that were not transferred to WK Kellogg pursuant to the terms of the Separation and Distribution Agreement. The Supply Agreement has a three-year term expiring on October 2, 2026, though products may be supplied for a shorter period. Either party may terminate the Supply Agreement following a material breach of the Supply Agreement by the other party, which breach is not cured within 30 days of notice of such breach. In addition, either party may terminate the manufacture and purchase of specified products without cause upon six or twelve months’ notice, depending on the product being supplied.

During the year ended December 30, 2023, we made payments totaling approximately $13.8 million to Kellanova under the Supply Agreement.

Board and Corporate Governance

Management Services Agreement

WK Kellogg entered into a Management Services Agreement with Kellanova pursuant to which Kellanova has granted WK Kellogg and its subsidiaries the right to use Kellanova's pilot plant located in Battle Creek, Michigan for a specified number of days throughout the years in order for WK Kellogg to conduct research and development and product trials on specified equipment.

During the year ended December 30, 2023, we made payments totaling approximately $678,243 to Kellanova under the Management Services Agreement.

Tax Matters Agreement

The Tax Matters Agreement between WK Kellogg and Kellanova governs the respective rights, responsibilities and obligations of Kellanova and WK Kellogg after the Spin Off with respect to tax liabilities and benefits, tax attributes, tax contests and other tax sharing regarding U.S. federal, state, local and foreign income taxes, other tax matters and related tax returns. WK Kellogg and certain of its subsidiaries have (and will continue to have following the Spin Off) joint and several liability with Kellanova to the IRS for the combined U.S. federal income taxes of the Kellanova combined group relating to the taxable periods in which we and our applicable subsidiaries were part of that group. The Tax Matters Agreement also provides special rules for allocating tax liabilities in the event that the Spin Off is not tax-free. In general, if a party’s actions cause the Spin Off not to be tax-free, that party will be responsible for the payment of any resulting tax liabilities (and will indemnify the other party with respect thereto). The Tax Matters Agreement provides certain covenants that may restrict our ability to pursue strategic or other transactions.

During the year ended December 30, 2023, no indemnification or other payments were made by either party to the other under the Tax Matters Agreement.

Employee Matters Agreement

The Employee Matters Agreement between WK Kellogg and Kellanova addresses certain post-Spin Off employee matters issues between Kellanova and WK Kellogg Co, including transitions of employment for employees; allocation of, and reimbursement and indemnification for, employment-related liabilities; collective bargaining agreement matters; termination and severance benefits; employee benefits matters, including participation in benefit plans, assumption of certain employee benefit plans by WK Kellogg Co, service recognition, health and welfare and retirement plan matters; employee compensation matters, including equity and cash-based incentive compensation, retention and nonqualified deferred compensation matters; payroll reporting and withholding; access to employees; employee records; employment transition matters; mutual one-year salaried employee no-hire and two-year employee non-solicitation provisions (with customary exceptions); and other related employee matters.

During the year ended December 30, 2023, no indemnification or other payments were made by either party to the other under the Employee Matters Agreement.

Intellectual Property Agreements

In connection with the Spin Off, we entered into the following Intellectual Property Agreements with Kellanova that provide for intellectual property use and selling rights: (A) Master Ownership and License Agreement Regarding Trademarks and Certain Related Intellectual Property and (B) Master Ownership and License Agreement Regarding Patents, Trade Secrets and Certain Related Intellectual Property.

The Master Ownership and License Agreement Regarding Trademarks and Certain Related Intellectual Property allocates ownership, use and selling rights between Kellanova and us of all trademarks, domain names and certain copyrights that Kellanova or we owned immediately prior to the Spin Off. Under this agreement, Kellanova and WK Kellogg will each grant the other party various perpetual, irrevocable, exclusive, and royalty-free licenses to use certain of its and our respective trademarks in connection with specific food and beverage categories in specified jurisdictions. The agreement contains usage guidelines, quality control, enforcement and maintenance provisions governing the trademarks that Kellanova and WK Kellogg will license to each other. In addition, the agreement includes diversion provisions under which Kellanova and we agree that neither we nor any of our affiliates will authorize or encourage the sale of branded products in jurisdictions where trademark ownership or license rights do not extend.

In addition, the Master Ownership and License Agreement Regarding Patents, Trade Secrets and Certain Related Intellectual Property allocates ownership of patents, trade secrets and know-how to Kellanova. Under this agreement, Kellanova granted to WK Kellogg a perpetual, irrevocable, exclusive and royalty-free license to use

Board and Corporate Governance

certain food-related patents, trade secrets and know-how in specific categories in North America. Kellanova also granted us a perpetual, irrevocable, and royalty-free license to use certain non-food related patents, trade secrets and know-how, and other intellectual property rights applicable generally to business process and information technology systems, in our business.

During the year ended December 30, 2023, neither party made any payments to the other party under these Intellectual Property Agreements.

Other than the Agreements with Kellanova described above and the compensation arrangements for our Directors and named executive officers, there were no related person transactions since January 1, 2023 that require reporting under the SEC’s disclosure rules.

Shareowner Recommendations for Director Nominees

The N&G Committee will consider Shareowner nominations for Director. Nominations may may be submitted to the Office of the Secretary, WK Kellogg Co, North Tower, One Kellogg Square, Battle Creek, Michigan 49017-3534 which will forward them to the Chair of the N&G Committee. Recommendations must be in writing and we must receive the recommendation not earlier than January 2, 2025 and not later than February 1, 2025. Recommendations must also meet certain other requirements specified in our Bylaws.

When filling a vacancy on the Board, the N&G Committee identifies the desired skills and experience of a new Director and nominates individuals who it believes can strengthen the Board’s capabilities and further diversify the collective experience represented by the then-current Directors. The N&G Committee may engage third parties to assist in the search and provide recommendations. Also, current Directors may be asked to recommend candidates for Director. The candidates are evaluated based on the process outlined in the Corporate Governance Guidelines and the N&G Committee Charter, and the same process is used for all candidates, including candidates recommended by Shareowners. For more information, see “Board and Committee Membership-Nominating and Governance Committee.”

Attendance at Annual Meetings

All of our Directors are expected to attend the Annual Meetings of our Shareowners.

Code of Conduct/Code of Ethics

We have adopted the Board of Directors Code of Conduct and a Code of Ethics, which applies to all employees of WK Kellogg Co and its subsidiaries (including executives, corporate officers and members of the Board). We intend to post any amendments to the Code of Ethics, or waivers by the Board of its requirements for any of our Directors or executive officers, on our website at www.wkkellogg.com to the extent required by SEC and/or New York Stock Exchange rules.

Availability of Corporate Governance Documents

Copies of the Corporate Governance Guidelines, the Charters of each of the Audit Committee, the Compensation Committee, and the N&G Committee, the Board of Directors Code of Conduct, and our Code of Ethics can be found under the “Investors” tab of the WK Kellogg Co website at https://investor.wkkellogg.com/governance/governance-documents. Shareowners may also request a free copy of these documents from WK Kellogg Co, Investor Relations, North Tower, One Kellogg Square, Battle Creek, Michigan 49017-3534 or by sending an email to investorrelations@wkkellogg.com.

Board and Corporate Governance

Board and Committee Membership

The Board currently has the following standing Committees: (i) Audit Committee; (ii) Compensation Committee; and (iii) N&G Committee.

The Board held two Board meetings and six Committee meetings in 2023 following the completion of the Spin Off on October 2, 2023. Each of our Directors attended at least 75% of the meetings of the Board and those Board committees of which he or she served.

The composition of each standing Board committee is set forth below:

| | | | | | | | | | | |

| Name | Audit | Compensation and

Talent Management | Nominating &

Governance |

| Wendy Arlin | Chair | | |

| R. David Banyard, Jr. | | Chair | |

| Michael Corbo | | | |

| Zack Gund | | | Chair |

| Ramón Murguía | | | |

| Julio Nemeth | | | |

| Gary Pilnick(1) | | | |

| Mindy Sherwood | | | |

| 2023 Meetings Held | 2 | 2 | 2 |

(1)Mr. Pilnick is not a member of any of the standing Board Committees, but attends meetings for each Committee, as appropriate.

As provided in their respective Charters, each of the Board Committees may form and delegate authority to subcommittees when it deems appropriate.

Audit Committee

| | | | | | | | | | | | | | | | | |

| | | | | |

| Wendy Arlin (Chair) Julio Nemeth | R. David Banyard, Jr. | Michael Corbo | 2023 Meetings (held on or after October 2, 2023): 2 | |

| | | | | |

Pursuant to a written charter, the Audit Committee’s responsibilities include the following:

•The Audit Committee assists the Board in monitoring the following:

•the integrity of the financial statements of the Company;

•the independence and performance of the Company’s independent registered public accounting firm;