UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| [ ] | Preliminary Proxy Statement. |

| [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| [ ] | Definitive Proxy Statement. |

| [X] | Definitive Additional Materials. |

| [ ] | Soliciting Material Pursuant to § 240.14a-12. |

ARISTOTLE FUNDS SERIES TRUST

| | |

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

o Fee paid previously with preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

March 10, 2023

Pacific Funds Small/Mid-Cap

Pacific Funds Small-Cap

Pacific Funds Small-Cap Value

Dear Shareholder,

As a shareholder in one or more of the above Pacific Funds Series Trust (“Pacific Funds”) funds (“PF Funds”), you recently received a proxy communication via e-mail or a proxy statement and proxy card(s) in the mail in connection with the Special Meeting of Shareholders to be held on April 10, 2023.

Shareholders are being asked to consider and approve a Plan of Reorganization (“Plan”) between Aristotle Funds Series Trust (“Aristotle Trust”) and Pacific Funds. If shareholder approval is obtained for each PF Fund, your PF Funds will be merged into the Aristotle Trust.

After careful consideration, your Pacific Funds’ Board recommends shareholders vote FOR the Plan proposal. It is important that you exercise your right to vote. Please take a moment to sign, date and mail the enclosed proxy card in the pre-paid envelope or follow the instructions below to vote by internet or telephone.

How will the acquisition affect my investment?

Your PF Fund(s) will become part of the Aristotle Trust, and we expect shareholders will receive comparable service to what they are accustomed to. It is also important for you to know:

There will be NO increase in your management fees and expenses.

The Trust will be advised by Aristotle Investment Services, LLC. Your investment will be managed by Aristotle Capital Boston, LLC.

Your investment will continue with an identical investment objective and similar investment strategies.

Your PF Funds investment has a unique shareholder base. You and your fellow shareholders will have a substantial impact on the vote if you act early. Please see voting instructions below:

| | | | | |

| Vote by Phone by calling 1-833-290-2607 and speaking with a proxy voting specialist today. Our representatives are available weekdays from 10 a.m. to 11 p.m. Eastern time. You may also call the toll-free number on the enclosed card and follow the prompts. |

| : | Vote by Internet by visiting the internet address on the enclosed card and following the instructions. |

| * | Vote by Mail by completing, signing, and dating the enclosed card and returning it in the enclosed prepaid return envelope. |

If you have any questions or need assistance in voting, please contact our proxy solicitor, Di Costa Partners ("DCP") at 1 (833) 290-2607. Please note that a DCP representative may call you to assist in voting.

Thank you,

/s/ Adrian S. Griggs

Adrian S. Griggs

President, Pacific Funds Series Trust

Hello, my name is (CSR FULL NAME).

May I please speak with (SHAREHOLDER’S FULL NAME)?

(Repeat the greeting if necessary)

I am calling on a recorded line regarding your current investment in the Pacific Funds. Materials were recently sent to you for the upcoming Special Meeting of Shareholders scheduled to take place on April 10th, 2023, and at this time we have not yet received your vote. The Fund’s Board of Trustees is recommending a vote in favor of the proposal. Would you like to vote along with its recommendation?

(Pause for shareholder’s response)

| | |

If YES or a positive response from the shareholder: (Proceed to confirmation) |

| | |

If NO or a shareholder hasn’t received information: The purpose of the Meeting is to seek shareholder approval of the Reorganization of the Pacific Funds into corresponding new Aristotle Funds.

If shareholders of the Pacific Funds approve the Plan of Reorganization, they will become shareholders of the corresponding new Aristotle Fund upon closing of the Reorganization.

The investment objectives of each new Aristotle Fund are identical to the investment objectives of the corresponding Pacific Fund acquired in the mergers.

The total expense ratios of each new Aristotle Fund are expected to be the same or less than the total expense ratios of its corresponding Pacific Fund acquired in the mergers.

After careful consideration your Board of Trustees is recommending shareholders vote in favor. Would you like to vote along with the recommendation?

(If Shareholder wants to vote proceed to confirmation.) (If Shareholder has questions refer to factsheet) If shareholder still chooses not to vote: I understand you do not wish to vote at this time thank you and have a great day. |

| | |

Shareholder Not Available: We can be reached toll-free at 1-833-290-2607, Monday through Friday between the hours of 10:00AM and 10:00PM Eastern time. Your time today is appreciated. Thank you and have a good day. |

Confirming the vote with the shareholder:

I am recording your vote (RECAP VOTING INSTRUCTIONS FOR ALL PROPOSALS) on all accounts.

For confirmation purposes please state your full name.

(Pause for shareholder’s response)

According to our records, you reside in (city, state, zip code).

(Pause for shareholder’s response)

To ensure that we have the correct address for the letter confirming your vote, please state your street address.

(Pause for shareholder’s response)

Thank you. You will receive written confirmation of this vote within 3 to 5 business days. Upon receipt, please review and retain for your records. If you should have any questions, please call the toll-free number listed in the letter. Mr./Mrs./Ms. (SHAREHOLDER’S LAST NAME), your vote is important, and your time today is appreciated. Thank you and have a good (MORNING, AFTERNOON, EVENING).

FOR DCP and DA PURPOSES ONLY Updated: 3/9/2023

FOR DCP and DA PURPOSES ONLY Updated: 3/9/2023

| | | | | | | | | | | | | | |

| Special Meeting IMPORTANT DATES | | Special Meeting LOCATION |

| Meeting Date | April 10, 2023 | Virtual Meeting Format 9:00 AM Pacific Time/12:00 PM Eastern Time |

| Record Date | February 10, 2023 | |

| Mail Date | March 2, 2023 | |

| ADDITIONAL INFORMATION | CONTACT INFORMATION |

| Trades | NSCC | Inbound Line | 833-290-2607 |

| Cusips | See Page 5 | | ADVISOR | Pacific Life Fund Advisors LLC |

Proposal:

1.To approve an Agreement and Plan of Reorganization (the “Plan of Reorganization”) relating to the proposed reorganization of their PF Acquired Fund with and into a corresponding series (an “Aristotle Acquiring Fund”) of Aristotle Funds Series Trust (the “Aristotle Funds Trust”) (each, a “Reorganization”) and vote upon any other business that may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. Each Plan of Reorganization provides for: (i) the transfer of all of the assets, property and goodwill of each PF Acquired Fund (exclusive of any rights to the “Pacific Funds” name) to the corresponding Aristotle Acquiring Fund set forth in the proxy statement/prospectus, in exchange solely for shares of the corresponding class of the Aristotle Acquiring Fund having a total dollar value equivalent to the total dollar value of their investment in the relevant PF Acquired Fund, as set forth in the Plan of Reorganization; (ii) the assumption by each Aristotle Acquiring Fund of all the liabilities of the corresponding PF Acquired Fund; and (iii) the distribution, after the closing date, of the Aristotle Acquiring Fund shares to the PF Acquired Fund Shareholders and the termination, dissolution and complete liquidation of the PF Acquired Fund as provided in the Plan of Reorganization, all upon the terms and conditions set forth in the Plan of Reorganization. PF Acquired Fund Shareholders will vote separately on the proposal to reorganize that PF Acquired Fund into its corresponding Aristotle Acquiring Fund.

| | |

| FOR DCP and DA PURPOSES ONLY |

Why are the Reorganizations being proposed?

Aristotle Parent Company and Pacific Life have entered into an agreement pursuant to which Pacific Life will sell its subsidiary, Pacific Asset Management LLC (“PAM”), to Aristotle Capital Management (“Aristotle Parent Company”), (the “Parent Company Transaction”) Aristotle Parent Company is purchasing PAM, and substantially all of PAM’s investment and support personnel are expected to remain with PAM. PAM will be renamed Aristotle Pacific Capital, LLC (“Aristotle Pacific”), and will be a subsidiary of Aristotle Parent Company. The Parent Company Transaction will allow Aristotle Parent Company to integrate PAM into its advisory business. PAM currently serves as sub-adviser to seven series of the Pacific Funds Trust. Those series sub-advised by PAM constitute a majority of the assets within the Pacific Funds Trust, and, therefore, Pacific Life has made the determination to no longer support the Pacific Funds Trust following the closing of the Parent Company Transaction. As a result, the Pacific Funds Board determined that it was necessary and appropriate to consider alternative arrangements for the future of the Pacific Funds Trust.

Pacific Life and Aristotle Parent Company have proposed, and PLFA recommends, the reorganization of 16 series of the Pacific Funds Trust, including the PF Acquired Funds, into the Aristotle Funds Trust, a newly created registered investment company organized and managed by Aristotle. Since the series of the Pacific Funds Trust sub-advised by PAM constituted a majority of the assets of the Pacific Funds Trust and because PAM would be acquired by Aristotle Parent Company, the reorganization of the 16 series of the Pacific Funds Trust into the Aristotle Funds Trust would be less disruptive to shareholders than other alternatives, such as the liquidation of all the PF Acquired Funds or other alternatives.

If the proposed Reorganizations are approved, each of PLFA, Aristotle and the Pacific Funds Board expects that the Aristotle Acquiring Fund Shareholders will receive a comparable level and quality of services following the proposed Reorganizations compared to the services they currently receive as the PF Acquired Fund Shareholders.

Has the Pacific Funds Board approved the proposed Reorganizations?

The Pacific Funds Board has approved the Plans of Reorganization. The Pacific Funds Board believes that each proposed Reorganization is in the best interests of the relevant PF Acquired Fund, and that the interests of the PF Acquired Fund Shareholders will not be diluted as a result of the Reorganizations.

The Aristotle Funds Board has also approved the Plans of Reorganization.

Are the investment strategies of the PF Acquired Funds different from the investment strategies of their corresponding Aristotle Acquiring Funds?

Similar Investment Strategies.

While each Aristotle Acquiring Fund will pursue similar investment strategies and seek to obtain similar asset class exposures as the corresponding PF Acquired Fund, they are sub-advised by different portfolio management teams. As a result, the investment strategies are similar but will differ in certain respects. In particular, following the Reorganization, Aristotle Small Cap Equity Fund II, like Pacific Funds Small-Cap, will consider small-capitalization companies by reference to the Russell 2000® Index, which includes both value and growth stocks. By contrast, Pacific Funds Small-Cap Value focused on investments in value stocks and considered small-capitalization companies by reference to the Russell 2000® Value Index, which includes predominantly value stocks.

| | |

| FOR DCP and DA PURPOSES ONLY |

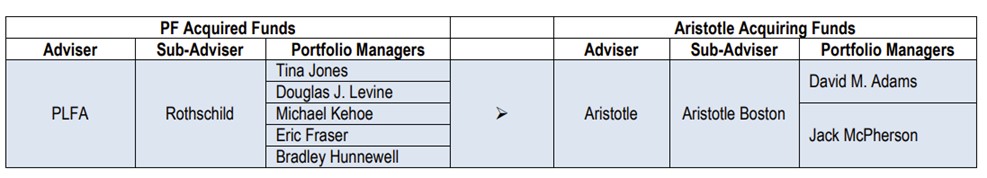

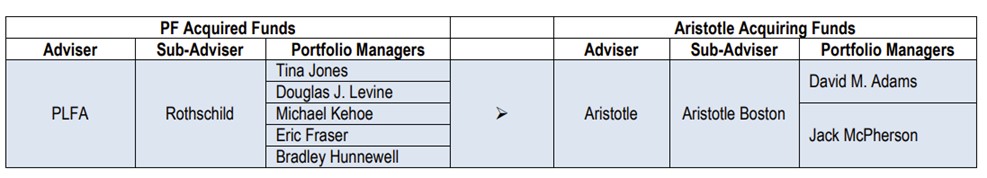

Will the portfolio managers change in connection with the Reorganizations?

Different Sub-Advisers and Portfolio Managers.

The PF Acquired Funds are as of the date of the Proxy Statement/Prospectus sub-advised by Rothschild & Co Asset Management US Inc. (“Rothschild”). During the first quarter of 2023, Rothschild is expected to be acquired by Great Lakes Advisors, LLC (“Great Lakes”). The Pacific Funds Board has approved Great Lakes to serve as sub-adviser to each PF Acquired Fund following the acquisition of Rothschild. Following that acquisition, the PF Acquired Funds are expected to continue to be managed pursuant to the same investment objective and strategies. Other than Tina Jones, the same portfolio management team will continue to have responsibility for the day-to-day management of the PF Acquired Funds following the acquisition of Rothschild by Great Lakes. Following the Reorganizations, each Aristotle Acquiring Fund will be sub-advised by Aristotle Capital Boston, LLC (“Aristotle Boston”), an affiliate of Aristotle. Accordingly, the Aristotle Acquiring Funds will be sub-advised by different portfolio managers than the corresponding PF Acquired Fund. The portfolio managers to each Aristotle Acquiring Fund are experienced investment professionals. The portfolio managers have experience managing, and currently manage, assets on behalf of other registered investment companies. The Pacific Funds Board expects that the Aristotle Acquiring Fund Shareholders will receive a comparable level and quality of services following the proposed Reorganizations compared to the services they currently receive as PF Acquired Fund Shareholders and that the change in investment managers may provide an opportunity to enhance the investment performance of the Funds.

Will the Investment Adviser Change?

Following the proposed Reorganizations, Aristotle Investment Services, LLC (“Aristotle”) will serve as investment adviser to the Aristotle Acquiring Funds. Aristotle is a subsidiary of Aristotle Parent Company. While Aristotle Parent Company and certain of its affiliates currently serve as investment adviser or sub-adviser to other registered investment companies, Aristotle is newly organized and recently registered with the SEC as an investment adviser. As investment adviser, Aristotle will assume overall responsibility to oversee the management of the investment of each Aristotle Acquiring Fund’s assets and will supervise the daily business affairs of the Aristotle Acquiring Funds, including the services provided by Aristotle Boston, subject to the ultimate oversight of the Aristotle Board. Aristotle will have the ultimate responsibility, subject to the review of the Aristotle Board, to oversee and monitor the performance of Aristotle Boston. Aristotle also will be responsible for performing compliance monitoring services to help maintain compliance with applicable laws and regulations.

Are the investment objectives of the PF Acquired Funds different from the investment objectives of their corresponding Aristotle Acquiring Funds?

Identical Investment Objectives.

| | |

| FOR DCP and DA PURPOSES ONLY |

The investment objective of each Aristotle Acquiring Fund is identical to the investment objective of the corresponding PF Acquired Fund.

Are the investment strategies of the PF Acquired Funds different from the investment strategies of their corresponding Aristotle Acquiring Funds?

Similar Investment Strategies.

While each Aristotle Acquiring Fund will pursue similar investment strategies and asset class exposures as the corresponding PF Acquired Fund, they are managed by different portfolio management teams. As a result, the investment strategies are similar but will differ in certain respects. In particular, following the Reorganization, Aristotle Small Cap Equity Fund II, like Pacific Funds Small-Cap, will consider small-capitalization companies by reference to the Russell 2000® Index, which includes both value and growth stocks. By contrast, Pacific Funds Small-Cap Value focused on investments in value stocks and considered small-capitalization companies by reference to the Russell 2000® Value Index, which includes predominantly value stocks.

Do the principal risks associated with investments in the PF Acquired Funds differ from the principal risks associated with investments in their corresponding Aristotle Acquiring Funds?

Same or Similar Principal Risks.

Pacific Funds Small/Mid-Cap and Aristotle Small/Mid Cap Equity Fund are subject to the same principal risks. Aristotle Small Cap Equity Fund II is subject to similar risks compared to Pacific Funds Small-Cap and Pacific Funds Small-Cap Value, but there are certain differences that reflect the anticipated combined portfolio managed by the new sub-adviser.

Who will bear the expenses associated with the Reorganizations?

Solicitation and Transaction Costs.

The costs of the solicitation related to each proposed Reorganization, including any costs directly associated with preparing, filing, printing, and distributing to the PF Acquired Fund Shareholders all materials relating to this Proxy Statement/Prospectus and soliciting and tallying shareholder votes, as well as the brokerage commission costs associated with the proposed Reorganizations, will be borne by Aristotle Parent Company and/or Pacific Life. None of the PF Acquired Funds nor any of the Aristotle Acquiring Funds will bear any brokerage commission costs in connection with the proposed Reorganizations.

| | |

| FOR DCP and DA PURPOSES ONLY |

Will the Reorganizations be Tax Free?

Each Reorganization is intended to be a tax-free “reorganization” within the meaning of Section 368 of the Code for federal income tax purposes.

How can I attend the meeting?

In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic we will be hosting the Meeting virtually. There is no physical location for the Meeting. To participate in the Meeting, you must email meetinginfo@dicostapartners.com no later than 11:00 a.m. Pacific Time (2:00 p.m. Eastern Time) on April 7, 2023, and provide your full name, address and control number located on your proxy card. You will then receive an email from Di Costa Partners LLC (the “Solicitor”) containing the conference call dial-in information and instructions for participating in the Meeting.

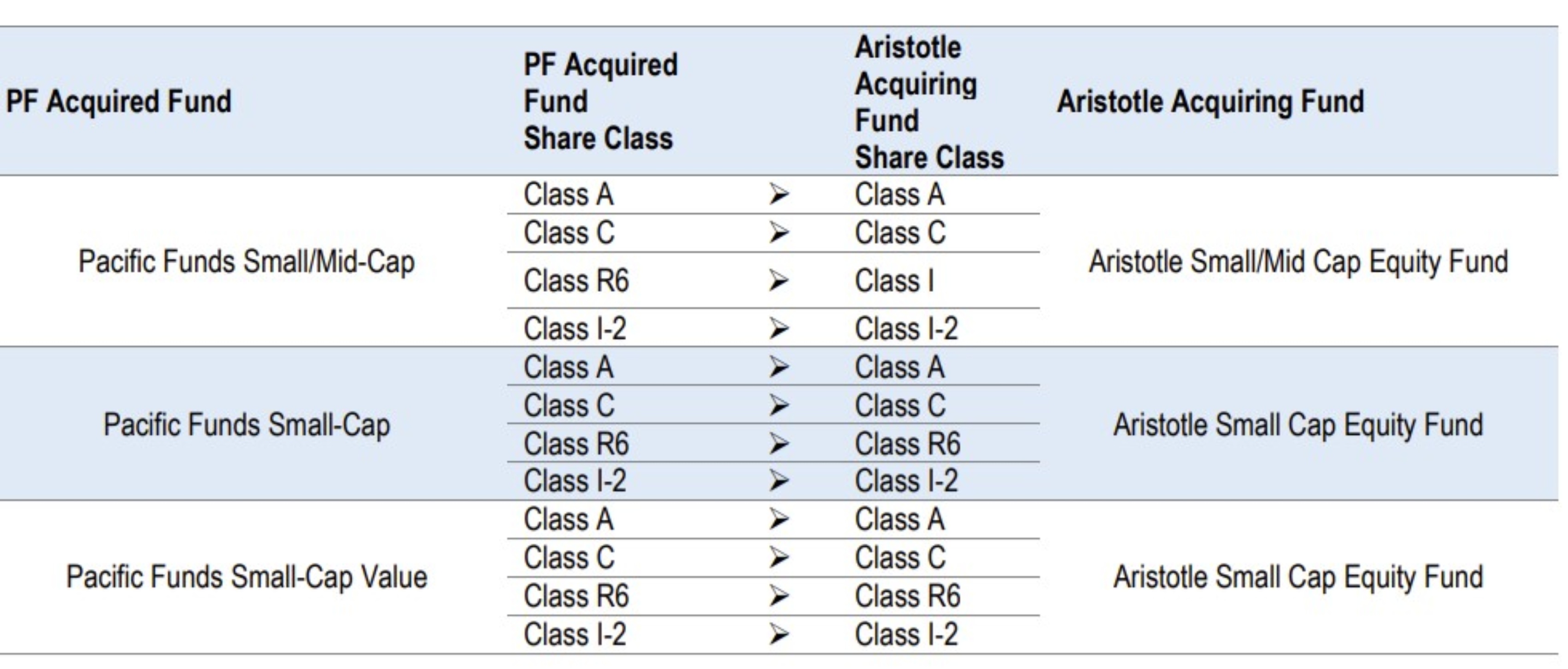

Share Class and Name Changes.

| | |

| FOR DCP and DA PURPOSES ONLY |

| | | | | | | | |

| Fund Name | Cusip | Class |

| PACIFIC FUNDS SMALL/MID-CAP | 69448A482 | I-2 |

| PACIFIC FUNDS SMALL/MID-CAP | 69448A524 | A |

| PACIFIC FUNDS SMALL/MID-CAP | 69448A516 | C |

| PACIFIC FUNDS SMALL/MID-CAP | 69448A268 | R6 |

| PACIFIC FUNDS SMALL-CAP | 69448A433 | I-2 |

| PACIFIC FUNDS SMALL-CAP | 69448A466 | A |

| PACIFIC FUNDS SMALL-CAP | 69448A458 | C |

| PACIFIC FUNDS SMALL-CAP | 69448A417 | R6 |

| PACIFIC FUNDS SMALL-CAP VALUE | 69448A367 | I-2 |

| PACIFIC FUNDS SMALL-CAP VALUE | 69448A391 | A |

| PACIFIC FUNDS SMALL-CAP VALUE | 69448A383 | C |

| PACIFIC FUNDS SMALL-CAP VALUE | 69448A342 | R6 |

| | |

| FOR DCP and DA PURPOSES ONLY |

| | | | | |

| TELEPHONE, WITH A LIVE AGENT: | Call 1-833-290-2607 Monday through Friday, between the hours of 10:00AM and 10:00PM Eastern time to cast your vote by telephone with a live proxy specialist. Only votes cast by 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time) on April 10, 2023 will be counted. |

| TOUCH-TONE TELEPHONE VOTING: | To vote via touch-tone, call the toll-free number on your card and follow the instructions provided. |

| MAIL YOUR CARD: | To vote by mail, check )the appropriate voting boxes on the card, sign and date the card, and return it in the postage-paid envelope. It is important that votes be received no later than 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time) on April 10, 2023. |

| ONLINE VOTING: | To vote via the Internet, go to the website on your card and follow the instructions provided. Only votes cast by 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time) on April 10, 2023 will be counted. |

ATTEND VIRTUAL MEETING: | Email meetinginfo@dicostapartners.com no later than 11:00 a.m. Pacific Time (2:00 p.m. Eastern time) on April 7, 2023, and provide your full name and address. You will then receive an email from Di Costa Partners LLC containing the conference call dial-in information and instructions for participating in the Meeting. |

| | |

| FOR DCP and DA PURPOSES ONLY |

FOR DCP and DA PURPOSES ONLY Updated: 3/9/2023

FOR DCP and DA PURPOSES ONLY Updated: 3/9/2023