As filed with the U.S. Securities and Exchange Commission on August 17, 2023

1933 Act Registration No. 273036

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| | | | | |

| [X] | Pre-Effective Amendment No. 1 |

| [ ] | Post-Effective Amendment No. ____ |

|

| (Check appropriate box or boxes) |

ARISTOTLE FUNDS SERIES TRUST

(Exact name of registrant as specified in charter)

11100 Santa Monica Blvd., Suite 1700

Los Angeles, CA 90025

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (310) 478-4005

Richard Schweitzer

c/o Aristotle Investment Services, LLC

11100 Santa Monica Blvd., Suite 1700

Los Angeles, CA 90025

(Name and Address of Agent for Service)

With a copy to:

Elizabeth Reza, Esq.

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199

Title of Securities Being Registered: Class I-2 shares of Aristotle Core Equity Fund II, Class I-2 shares of Aristotle/Saul Global Equity Fund II, Class I-2 shares of Aristotle International Equity Fund II, Class I-2 shares of Aristotle Value Equity Fund II, and Class I-3 shares of Aristotle Small Cap Equity Fund II, each a series of the Registrant.

Approximate date of Proposed Offering: As soon as practicable after this Registration Statement becomes effective.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that the Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The Registrant has elected to register an indefinite amount of securities under the Securities Act of 1933 pursuant to Rule 24f-2 under the Investment Company Act of 1940. In reliance upon such Rule, no filing fee is paid at this time.

INVESTMENT MANAGERS SERIES TRUST

Aristotle Funds

235 West Galena Street

Milwaukee, Wisconsin 53212

August 21, 2023

Re: Proposed Reorganization of the Following Funds:

Aristotle Value Equity Fund

Aristotle/Saul Global Equity Fund

Aristotle International Equity Fund

Aristotle Core Equity Fund

Aristotle Small Cap Equity Fund

Dear Shareholder:

Our records indicate that as of the regular close of business of the New York Stock Exchange on July 17, 2023, you owned shares in one or more of the above-noted funds (each an “ Acquired Fund ” and together, the “ Acquired Funds ”), each a series (fund) of Investment Managers Series Trust (“ IMST ”). For each Acquired Fund in which you owned shares as of July 17, 2023, you are being asked to approve an Agreement and Plan of Reorganization (the “ Plan of Reorganization ”) pursuant to which such fund will be reorganized and merged in to the corresponding series (fund) (ea ch an “ Acquiring Fund ” and together, the “ Acquiring Funds ”) of the Aristotle Funds Series Trust (the “ Aristotle Funds Trust ”) noted below (each such reorganization, a “ Reorganization ”).

| | | | | | | | |

| Acquired Fund | | Acquiring Fund1 |

| Aristotle Value Equity Fund | Ø | Aristotle Value Equity Fund II |

| Aristotle/Saul Global Equity Fund | Ø | Aristotle/Saul Global Equity Fund II |

| Aristotle International Equity Fund | Ø | Aristotle International Equity Fund II |

| Aristotle Core Equity Fund | Ø | Aristotle Core Equity Fund II |

| Aristotle Small Cap Equity Fund | Ø | Aristotle Small Cap Equity Fund II |

1 Immediately after the closing of the applicable Reorganization, the names of the Acquiring Funds will be changed to remove the “II”.

On June 14, 2023, the Board of Trustees of IMST (the “ IMST Board ”), upon the recommendation of Aristotle Capital Management, LLC, the current investment adviser to Aristotle Value Equity Fund, Aristotle/Saul Global Equity Fund and Aristotle International Equity Fund; Aristotle Atlantic Partners, LLC, the current investment adviser to Aristotle Core Equity Fund; and Aristotle Capital Boston, LLC, the current investment adviser to Aristotle Small Cap Equity Fund, considered and approved each Plan of Reorganization, subject to shareholder approval. A Special Meeting of Shareholders of the Acquired Funds will be held on October 6, 2023, at 10:00 a.m., Pacific Time (1:00 p.m., Eastern Time) at the offices of IMST’s administrator, Mutual Fund Administration, LLC, located at 2220 E. Route 66, Suite 226, Glendora, CA 91740, to vote on each proposal.

If shareholders of an Acquired Fund approve its Plan of Reorganization, upon closing of the Reorganization, each shareholder of that Acquired Fund will receive a number of shares of the corresponding Acquiring Fund equal in value to the aggregate net asset value of the shares of the Acquired Fund held by the shareholder immediately prior to the Reorganization, and except for Aristotle Small Cap Equity Fund, they will become shareholders of Class I-2 shares of the corresponding Acquiring Fund upon closing of the Reorganization. Shareholders of Aristotle Small Cap Equity Fund will become shareholders of Class I-3 shares of the corresponding Acquiring Fund upon closing of the Reorganization. Each Acquiring Fund has an identical or substantially similar investment objective and the same or substantially similar investment strategies and policies to those of its corresponding Acquired Fund. The total expense ratio of each Acquiring Fund is expected to be the same as or lower than the total expense ratio of its corresponding Acquired Fund. Each Reorganization generally is not expected to result in the recognition of gain or loss by the applicable Acquired Fund or its shareholders for federal income tax purposes.

The Reorganizations are not expected or intended to result in any changes to the day-to-day management of any of the Acquired Funds. While the Reorganizations will shift primary management oversight responsibility for each Acquired Fund to Aristotle Investment Services, LLC (“AIS”), the investment adviser to the Aristotle Funds Trust, each Acquired Fund’s current investment adviser also serves as sub-adviser to the corresponding Acquiring Fund. Each Acquired Fund’s existing portfolio management team will serve as the portfolio management team for the corresponding Acquiring Fund.

Please note that with respect to Aristotle International Equity Fund and Aristotle Core Equity Fund, it is proposed that the Funds be merged into Aristotle International Equity Fund II and Aristotle Core Equity Fund II, respectively, each of which has recently commenced operations and has only had limited operations as an underlying fund in a “fund-of-funds” structure. With respect to Aristotle Small Cap Equity Fund, it is proposed that the Fund be merged into Aristotle Small Cap Equity Fund II, which recently commenced operations following the merger and reorganization of two separate series of another trust which had investment objectives and strategies similar to Aristotle Small Cap Equity Fund. With respect to Aristotle/Saul Global Equity Fund and Aristotle Value Equity Fund, it is proposed that the Funds be merged into Aristotle/Saul Global Equity Fund II and Aristotle Value Equity Fund II, respectively, each of which is a newly created “shell” fund that has not commenced operations and that has been registered with the U.S. Securities and Exchange Commission specifically for the purpose of acquiring the assets and liabilities of the corresponding Acquired Fund. The similarities and differences between each Acquired Fund and its corresponding Acquiring Fund, as well as other important information, are described in the combined Proxy Statement/Prospectus that is included with this letter.

The IMST Board unanimously recommends that you vote “FOR” the Plans of Reorganization. A summary of the Board’s considerations in approving the Plans of Reorganization is also included in the Proxy Statement/Prospectus.

The attached Prospectus/Proxy Statement is designed to give you more information about each proposal. Please read the Proxy Statement/Prospectus and consider the proposals to approve the Plans of Reorganization carefully before casting your vote.

Sincerely,

/s/ Maureen Quill

Maureen Quill, President, IMST

Aristotle Value Equity Fund

Aristotle Saul/Global Equity Fund

Aristotle International Equity Fund

Aristotle Core Equity Fund

Aristotle Small Cap Equity Fund

each, a series of Investment Managers Series Trust

235 W. Galena Street

Milwaukee, Wisconsin 53212

1-888-661-6691

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON October 6, 2023

NOTICE IS HEREBY GIVEN that Investment Managers Series Trust (“ IMST ”), a Delaware statutory trust, will hold a special meeting of shareholders (the “ Meeting ”) for the above-referenced series (each an “ Acquired Fund ” and together, the “ Acquired Funds ”) of IMST on October 6, 2023, at 10:00 a.m., Pacific Time (1:00 p.m., Eastern Time) at the offices of IMST’s administrator, Mutual Fund Administration, LLC, located at 2220 E. Route 66, Suite 226, Glendora, CA 91740. You are invited to attend the Meeting. To participate in the Meeting, you must email attendameeting@equiniti.com no later than 9:00 a.m., Pacific Time (12:00 p.m., Eastern Time) on October 5, 2023, and provide your full name, address and control number located on your proxy card.

The purpose of this Meeting is to consider and act upon an Agreement and Plan of Reorganization (the “Plan of Reorganization”) relating to the proposed reorganization of each Acquired Fund with and into a corresponding series (an “Acquiring Fund”) of Aristotle Funds Series Trust (the “Aristotle Funds Trust”) (each, a “Reorganization”) and vote upon any other business that may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

Each Plan of Reorganization provides for (i) the transfer of all of the assets, property and goodwill of the applicable Acquired Fund to the corresponding Acquiring Fund set forth in the chart below, in exchange solely for shares of the applicable class of the corresponding Acquiring Fund having a total dollar value equal to the value of the Acquired Fund’s assets less liabilities and the assumption by the Acquiring Fund of all the liabilities of the corresponding Acquired Fund; and (ii) the distribution of the Acquiring Fund shares to the shareholders of the Acquired Funds and the termination, dissolution and complete liquidation of the Acquired Fund, all upon the terms and conditions set forth in the Plan of Reorganization. Shareholders of each Acquired Fund will vote separately on the proposal to reorganize that Acquired Fund into its corresponding Acquiring Fund.

The Aristotle Funds Trust is organized as an open-end management investment company. The Acquired Funds and the corresponding Acquiring Funds (each, a “Fund,” and collectively, the “Funds”) are as follows:

| | | | | | | | | | | | | | | | | |

| Proposal | Acquired Fund | Acquired Fund Share Class | | Acquiring Fund Share Class | Acquiring Fund1 |

| 1 | Aristotle Value Equity Fund | Class I | Ø | Class I-2 | Aristotle Value Equity Fund II |

| 2 | Aristotle/Saul Global Equity Fund | Class I | Ø | Class I-2 | Aristotle/Saul Global Equity Fund II |

| 3 | Aristotle International Equity Fund | Class I | Ø | Class I-2 | Aristotle International Equity Fund II |

| 4 | Aristotle Core Equity Fund | Class I | Ø | Class I-2 | Aristotle Core Equity Fund II |

| 5 | Aristotle Small Cap Equity Fund | Class I | Ø | Class I-3 | Aristotle Small Cap Equity Fund II |

1 Immediately after the closing of the applicable Reorganization, the names of the Acquiring Funds will be changed to remove the “II” designation.

It is not anticipated that any matters other than the approval of the proposals will be brought before the Meeting. If, however, any other business is properly brought before the Meeting, proxies will be voted in accordance with the judgment of the persons designated as proxies or otherwise as described in the enclosed Proxy Statement/Prospectus.

Shareholders of record of each Acquired Fund at the regular close of business of the New York Stock Exchange on July 17, 2023 are entitled to notice of, and to vote at, such Meeting and any adjournment(s) or postponement(s) thereof. Each share of an Acquired Fund is entitled to one vote, and each fractional share held is entitled to a proportional fractional vote, with respect to its corresponding proposal.

The Board of Trustees of IMST unanimously recommends you vote FOR each proposal.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING ON October 6, 2023: This Notice and the Proxy Statement/Prospectus are available on the Internet free of charge at https://vote.proxyonline.com/aristotle/docs/proxy2023.pdf.

By order of the Board of Trustees of IMST

/s/ Diane Drake

Diane Drake

Secretary, IMST

August 21, 2023

Your vote is important, no matter how many shares you own. Please vote as soon as possible!

A Proxy Card covering your Acquired Fund is enclosed along with the Proxy Statement/Prospectus.

You may vote in any one of three ways:

•By mail with the enclosed proxy card. If you sign, date and return the proxy card but give no voting instructions, your shares will be voted “FOR” the proposals indicated on the card; or

•By Internet through the website listed on the enclosed proxy card; or

•By telephone using the toll-free number listed on the enclosed proxy card.

If you vote by mail, only votes received by 9:00 a.m., Eastern Time on October 6, 2023 at the address shown on the enclosed postage paid envelope will be counted. If you vote by telephone or Internet, only votes cast by 9:00 a.m., Eastern Time on October 6, 2023 will be counted. You may revoke your proxy at any time at, or before, the Meeting or vote at the Meeting if you attend the Meeting, as provided in the enclosed Proxy Statement/Prospectus.

You may receive one or more calls, letters, or other communications from our proxy solicitor, EQ Fund Solutions, reminding you to vote.

PROXY STATEMENT/PROSPECTUS

DATED August 21, 2023

Aristotle Value Equity Fund

Aristotle Saul/Global Equity Fund

Aristotle International Equity Fund

Aristotle Core Equity Fund

Aristotle Small Cap Equity Fund

each, a series of

INVESTMENT MANAGERS SERIES TRUST

235 W. Galena Street

Milwaukee, Wisconsin 53212

1-888-661-6691

AND

ARISTOTLE FUNDS SERIES TRUST

11100 Santa Monica Blvd., Suite 1700

Los Angeles, CA 90025

This Proxy Statement/Prospectus solicits proxies to be voted at a special meeting of the shareholders (the “ Meeting ”) of the funds identified above (each, an “ Acquired Fund ” and together, the “ Acquired Funds ”), each a series of Investment Managers Series Trust (“ IMST ”). The Meeting is scheduled to occur on October 6, 2023 at 10:00 a.m., Pacific Time (1:00 p.m., Eastern Time) at the offices of IMST’s administrator, Mutual Fund Administration, LLC, located at 2220 E. Route 66, Suite 226, Glendora, CA 91740. You are invited to attend the Meeting. T o participate in the Meeting, you must email attendameeting@equiniti.com no later than 9:00 a.m., Pacific Time (12:00 p.m., Eastern Time) on October 5, 2023, and provide your full name, address and control number located on your proxy card.

At the Meeting, shareholders of each Acquired Fund (the “Acquired Fund Shareholders”) will be asked to approve an Agreement and Plan of Reorganization (the “Plan of Reorganization”) relating to the proposed reorganization of their Acquired Fund with and into a corresponding series (an “Acquiring Fund” and together, the “Acquiring Funds”) of Aristotle Funds Series Trust (the “Aristotle Funds Trust”), as provided in the Plan of Reorganization (each, a “Reorganization”) and described below in this Proxy Statement/Prospectus. Each Acquired Fund’s existing portfolio management team serves as the portfolio management team for the corresponding Acquiring Fund.

The Aristotle Funds Trust is a recently created trust, and each Acquiring Fund is a recently created series of the Aristotle Funds Trust managed by Aristotle Investment Services, LLC (“AIS”), a recently organized and registered investment adviser. Aristotle Value Equity Fund II and Aristotle/Saul Global Equity Fund II (the “Shell Funds”) are “shell” funds that have not commenced operations and were created solely for the purpose of the acquiring the assets and liabilities of the corresponding Acquired Funds. Each Reorganization into a Shell Fund is referred to as a “Shell Reorganization.” Aristotle International Equity Fund II and Aristotle Core Equity Fund II (the “Underlying Funds”) commenced operations on April 17, 2023 and have had only limited operations serving as underlying funds in a “fund-of-funds” structure with a group of affiliated funds that are also advised by AIS. Aristotle Small Cap Equity Fund II commenced operations on April 17, 2023 as a result of the merger and reorganization of two unaffiliated funds with and into Aristotle Small Cap Equity Fund II. The Reorganizations of Aristotle International Equity Fund into Aristotle International Equity Fund II, Aristotle Core Equity Fund into Aristotle Core Equity Fund II, and Aristotle Small Cap Equity Fund into Aristotle Small Cap Equity Fund II are each referred to as a “non-Shell Reorganization.” The Aristotle Funds Trust has several additional series that are not part of these Reorganizations.

Each Plan of Reorganization provides for:

(i) the transfer of all of the assets, property and goodwill of the applicable above-noted Acquired Fund to the corresponding Acquiring Fund set forth in the chart below, in exchange solely for shares of the applicable class of the corresponding Acquiring Fund having a total dollar value equal to the value of the Acquired Fund's assets less liabilities, as set forth in the Plan of Reorganization, and the assumption by the Acquiring Fund of all the liabilities of the corresponding Acquired Fund; and

(ii) the distribution, after the closing date, of the Acquiring Fund shares to the Acquired Fund Shareholders in termination, dissolution and complete liquidation of the Acquired Fund as provided in the Plan of Reorganization, all upon the terms and conditions set forth in the Plan of Reorganization.

Acquired Fund Shareholders will vote separately on the proposal to reorganize that Acquired Fund into its corresponding Acquiring Fund as shown below:

| | | | | | | | | | | | | | | | | |

| Proposal | Acquired Fund | Acquired Fund Share Class | | Acquiring Fund Share Class | Acquiring Fund1 |

| 1 | Aristotle Value Equity Fund | Class I | Ø | Class I-2 | Aristotle Value Equity Fund II |

| 2 | Aristotle/Saul Global Equity Fund | Class I | Ø | Class I-2 | Aristotle/Saul Global Equity Fund II |

| 3 | Aristotle International Equity Fund | Class I | Ø | Class I-2 | Aristotle International Equity Fund II |

| 4 | Aristotle Core Equity Fund | Class I | Ø | Class I-2 | Aristotle Core Equity Fund II |

| 5 | Aristotle Small Cap Equity Fund | Class I | Ø | Class I-3 | Aristotle Small Cap Equity Fund II |

1 Immediately after the closing of the applicable Reorganization, the names of the Acquiring Funds will be changed to remove the “II” designation.

Each Plan of Reorganization is a separate agreement between the applicable Acquired Fund and its corresponding Acquiring Fund. Each Acquired Fund and IMST, acting for itself and on behalf of each Acquired Fund, and each Acquiring Fund and the Aristotle Funds Trust, acting for itself and on behalf of each Acquiring Fund, is acting separately from all other parties and their series, and not jointly or jointly and severally with any other party.

The Board of Trustees of IMST (the “ IMST Board ”) is soliciting these proxies on behalf of each Acquired Fund. The IMST Board believes that the proposed Reorganizations are in the best interests of each Acquired Fund and that the interests of the Acquired Fund Shareholders will not be diluted as a result of the Reorganizations. The IMST Board unanimously recommends that you vote FOR the proposed Reorganizations. The Reorganization of each Acquired Fund into the corresponding Acquiring Fund is not conditioned upon receipt of shareholder approval of, or the consummation of, the Reorganization relating to any other Acquired Fund. If a Reorganization is not approved by shareholders, the IMST Board will consider what further actions, if any, may be taken with respect to the applicable Acquired Fund, including liquidation of one or more Acquired Funds.

This Proxy Statement/Prospectus sets forth concisely the information about the Reorganizations and each Acquiring Fund that you should know before voting. Copies of the forms of the Plans of Reorganization, which more completely describe the proposed transaction, are attached as Appendix A (for Aristotle/Saul Global Equity Fund and Aristotle Value Equity Fund) and Appendix B (for Aristotle International Equity Fund, Aristotle Core Equity Fund and Aristotle Small Cap Equity Fund). This Proxy Statement/Prospectus is expected to first be sent to the Acquired Fund Shareholders on or about August 4, 2023.

You should retain this Proxy Statement/Prospectus for future reference. Additional information about the Acquired Funds and the Acquiring Funds can be found in the following documents, which have been filed with the U.S. Securities and Exchange Commission (“SEC”) and are incorporated by reference into this Proxy Statement/Prospectus:

• The prospectus and SAI of Aristotle Funds Trust on behalf of each Acquiring Fund, dated July 28, 2023 (File No. 333-269243); previously filed on the EDGAR Database and available on the SEC’s website at http://www.sec.gov, (Accession No. 0000894189-23-005144) (the “Acquiring Fund Prospectus”). The Acquiring Fund Prospectus does not include information about the Class I-3 shares of Aristotle Small Cap Equity Fund II. Please read the following paragraph for more informat ion about Class I-3 shares of Aristotle Small Cap Equity Fund II.

The Acquiring Fund Prospectus, which is incorporated by reference above and which accompanies this Proxy Statement/Prospectus, is intended to provide you with additional information about Aristotle Value Equity Fund II, Aristotle/Saul Global Equity Fund II, Aristotle International Equity Fund II and Aristotle Core Equity Fund II. While other classes of shares of Aristotle Small Cap Equity Fund II are currently offered in the Acquiring Funds Prospectus, Class I-3 shares of Aristotle Small Cap Equity Fund II are being registered with the SEC specifically for the purpose of acquiring the assets and liabilities of Aristotle Small Cap Equity Fund. As such, no prospectus or SAI is available for Class I-3 shares of Aristotle Small Cap Equity Fund II as of the date of this Proxy Statement/Prospectus. Information about Class I-3 shares of Aristotle Small Cap Equity Fund II that would otherwise be available in a prospectus can be found in this Proxy Statement/Prospectus.

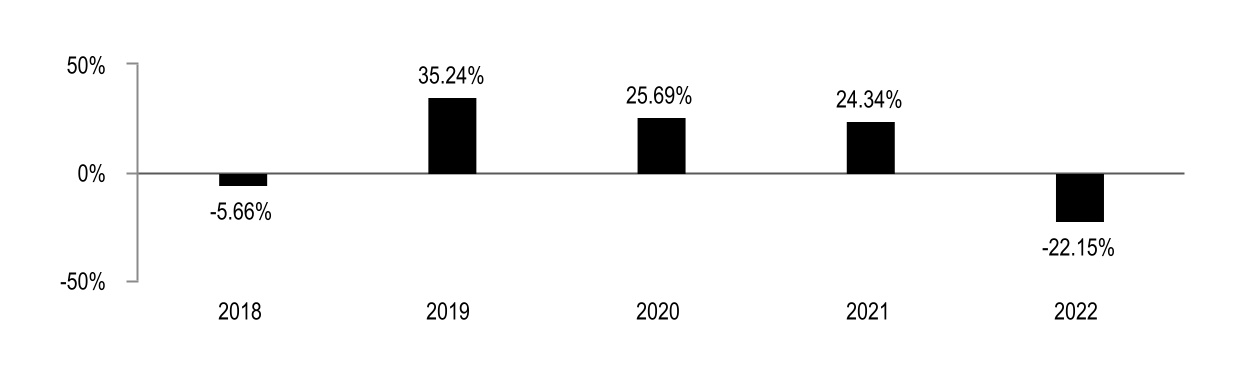

Because the Acquiring Funds have not, or have only recently, commenced operations, no annual reports or semi-annual reports for the Acquiring Funds are available as of the date of this Proxy Statement/Prospectus. Aristotle Small Cap Equity Fund II assumed the accounting history of a predecessor fund, Pacific Funds Small Cap (the “Predecessor Fund”) upon the closing of a reorganization on April 17, 2023. The Predecessor Fund’s financial statements is included in the Predecessor Fund’s most recent annual report to shareholders, which is available upon request.

You may request another copy of this Proxy Statement/Prospectus, a copy of the SAI relating to this Proxy Statement/Prospectus, the Acquired Fund Prospectus and the related SAI, the Acquiring Fund Prospectus and the related SAI, or the Predecessor Fund or Acquired Fund annual report, each without charge, by contacting the Aristotle Funds by mail, 11000 Santa Monica Blvd., Suite 1700, Los Angeles, CA 90025 or by calling 844-ARISTTL (844-274-7885) (toll free). You may also obtain Acquired Fund and Acquiring Fund filings by visiting https://www.aristotlefunds.com/ or on the EDGAR database by visiting the SEC’s website at http://www.sec.gov.

MUTUAL FUND SHARES ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, ANY BANK AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION, THE FEDERAL RESERVE BOARD, OR ANY OTHER U.S. GOVERNMENT AGENCY. MUTUAL FUND SHARES INVOLVE INVESTMENT RISKS, INCLUDING THE POSSIBLE LOSS OF YOUR INVESTMENT.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS COMBINED PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

OVERVIEW

The following is a brief overview of the proposed Reorganizations. Additional information is contained in the section titled Comparisons of the Acquired Funds and the Acquiring Funds and elsewhere in this Proxy Statement/Prospectus, as well as in each Plan of Reorganization, the Acquired Fund Prospectus, the Acquiring Fund Prospectus and the SAI for this Proxy Statement/Prospectus, all of which are incorporated herein.

You should read the entire Proxy Statement/Prospectus and the relevant Acquired Fund Prospectus carefully for more complete information. If you need another copy of the Proxy Statement/Prospectus, please call 844-ARISTTL (844-274-7885) (toll-free).

On what proposals am I being asked to vote?

You are being asked to vote on the approval of the Plan(s) of Reorganization with respect to the Acquired Fund(s) of which you were a shareholder on July 17, 2023. If you held shares of multiple Acquired Funds, you will be asked to vote separately on the approval of a Plan of Reorganization with respect to each Acquired Fund of which you held shares.

The Acquired Funds and their corresponding Acquiring Funds are as follows:

| | | | | | | | | | | |

| Proposal | Acquired Fund | | Acquiring Fund1 |

| 1 | Aristotle Value Equity Fund | Ø | Aristotle Value Equity Fund II |

| 2 | Aristotle/Saul Global Equity Fund | Ø | Aristotle/Saul Global Equity Fund II |

| 3 | Aristotle International Equity Fund | Ø | Aristotle International Equity Fund II |

| 4 | Aristotle Core Equity Fund | Ø | Aristotle Core Equity Fund II |

| 5 | Aristotle Small Cap Equity Fund | Ø | Aristotle Small Cap Equity Fund II |

1 Immediately after the closing of the applicable Reorganization, the names of the Acquiring Funds will be changed to remove the “II” designation. The “II” designation in each Acquiring Fund’s name had been included to differentiate the Acquiring Funds from the corresponding Acquired Funds during the period from the formation of the Acquiring Funds to the closing of the Reorganizations.

As a result of the proposed Reorganizations (if approved and consummated), the Acquired Fund Shareholders will become shareholders of the corresponding Acquiring Fund (the “Acquiring Fund Shareholders” and, together with the Acquired Fund Shareholders, the “Shareholders”) and will receive shares of the corresponding Acquiring Fund having a total dollar value equal to the total dollar value of the shares such shareholder held in that Acquired Fund immediately prior to the closing of the Reorganization, as determined pursuant to the Plan of Reorganization. Each Acquired Fund’s existing portfolio management team will serve as the portfolio management team for the corresponding Acquiring Fund.

The IMST Board and the Board of Trustees of the Aristotle Funds Trust (the “ Aristotle Funds Board ”) have approved the Reorganizations and each Plan of Reorganization. The IMST Board unanimously recommends that you vote FOR each proposed Reorganization. The Reorganization of each Acquired Fund into the corresponding Acquiring Fund is not conditioned upon receipt of shareholder approval of, or the consummation of, the Reorganization relating to any other Acquired Fund. If a Reorganization is not approved by its shareholders, the IMST Board will consider what further actions, if any, may be in the best interests of the relevant Acquired Fund and its shareholders, including liquidation of one or more Acquired Funds.

Each Plan of Reorganization is subject to certain customary closing conditions and may be terminated with respect to any Reorganization at any time by mutual consent of IMST and the Aristotle Funds Trust. More information about the Plan of Reorganization is included under Summary of the Plans of Reorganization. Forms of the Plans of Reorganization are attached hereto as Appendix A (for Aristotle/Saul Global Equity Fund and Aristotle Value Equity Fund) and Appendix B (for Aristotle International Equity Fund, Aristotle Core Equity Fund and Aristotle Small Cap Equity Fund).

Has the IMST Board approved the proposed Reorganizations?

The IMST Board has approved the Plans of Reorganization. The IMST Board believes that each proposed Reorganization is in the best interests of the relevant Acquired Fund, and that the interests of the Acquired Fund Shareholders will not be diluted as a result of the Reorganizations.

The Aristotle Funds Board has also approved the Plans of Reorganization.

Why are the Reorganizations being proposed?

In considering the proposed Reorganizations, the IMST Board reviewed, among other things, information provided by AIS detailing potential benefits of the Reorganizations to the Acquired Funds and their shareholders. This information included benefits resulting from making the Acquired Funds and their shareholders part of a proprietary fund platform where there is oversight by a board with responsibility for a smaller number of funds managed by a single investment advisory organization and its affiliates. IMST operates using a multiple series trust structure, whereby a common

board of trustees provides oversight to, and a common set of service providers provide non-investment management services to, a number of different funds managed by a number of different unaffiliated investment managers. The Acquired Funds are only several among other various series of IMST and a number of unaffiliated investment advisers provide investment management services to those various funds. This structure is in contrast to the Aristotle Funds complex recently organized by Aristotle Capital Management, LLC, in its role as the parent company (“ Aristotle Parent Company ” or “ Aristotle Capital ”) of AIS and the investment advisers to the Acquired Funds, in which Aristotle Parent Company has been able to develop a focused servicing and growth strategy for the Aristotle Funds. While Aristotle Parent Company believes the IMST Board has served the Acquired Funds and their shareholders well, Aristotle Parent Company has proposed, and the IMST Board has determined, that the Acquired Funds would benefit from being reorganized into the Aristotle Funds complex, whereby the Aristotle Funds Board can focus its attention solely on the Aristotle Funds. Detailed information about the IMST Board’s considerations in approving the Reorganizations is included below under Background and Trustees’ Considerations Relating to the Proposed Reorganization .

How do the fees and expenses of the Acquiring Funds compare to those of their corresponding Acquired Funds?

While the management fees of the Acquiring Funds are higher than the management fees of the Acquired Funds, it is expected that the total annual operating expenses, and the net annual operating expenses after waiver, of each Acquiring Fund will be the same as or lower th an the current total annual operating expenses , and the net annual operating expenses after waiver, respectively, of the corr esponding Acquired Fund. Detailed and pro forma information regarding the fees and expenses for each Fund is included below under Comparison of Current Fees and Expenses .

Different Fee Structure . Each Acquired Fund currently pays a management fee that consists solely of an advisory fee to its investment adviser and separately bears various other expenses incurred by the Acquired Fund, such as the cost of external audit, accounting, tax, custody, legal, and valuation services. In contrast, each Acquiring Fund pays AIS an annual combined management fee, consisting of an advisory fee and a supervision and administration fee, for services it receives from AIS under what is essentially an all-in fee structure. The advisory fee covers investment advisory services and payment for the services of the Acquiring Funds’ sub-advisers. The supervision and administration fee covers certain non-investment related expenses (i.e., most “other expenses” reflected in the Acquired Fund’s fee table, including audit, custodial, portfolio accounting, legal, transfer agency and printing costs), which are currently borne by the Acquired Funds. Thus, the Acquiring Funds’ management fees are higher because the supervision and administration fee includes these “other expenses” in addition to the advisory fee, and those additional fees are incorporated within the Acquiring Funds’ management fee. However, both the Acquiring Funds and the Acquired Funds ultimately bear these expenses, whether categorized as management fees (in the case of the Acquiring Funds) or management fees combined with “other expenses” (in the case of the Acquired Funds). Each Acquiring Fund will also continue to bear certain non-investment related expenses, such as distribution and service fees; organizational expenses; costs of borrowing money, including interest expenses; extraordinary expenses (such as litigation and indemnification expenses); and fees and expenses of trustees who are not deemed to be “interested persons” of the Aristotle Funds Trust (as defined in the Investment Company Act of 1940, as amended (“ 1940 Act ”)) (the “ Independent Trustees ”) and their counsel . AIS believes that the unitary fee structure provides shareholders with fees that are largely non-variable, simple, and predictable.

The basis for the Aristotle Funds Board’s approval of the Investment Advisory Agreement between the Aristotle Funds Trust and AIS will be provided in each Acquiring Fund’s first report to shareholders.

Fee Waivers. While the total annual operating expenses for each Acquiring Fund are expected to be the same as or lower than the corresponding Acquired Fund’s total annual operating expenses after waivers, even before the application of any Acquiring Fund fee waiver, AIS has entered into a contractual fee waiver through July 31, 2026, to waive its management fees to the extent that the total annual operating expenses (excluding interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, other expenditures which are capitalized in accordance with generally accepted accounting principles (other than offering costs), other extraordinary expenses not incurred in the ordinary course of such Acquiring Fund’s business and amounts payable pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act) of the applicable class of shares of an Acquiring Fund (Class I-2 shares, or Class I-3 shares for Aristotle Small Cap Equity Fund II) exceed the total annual operating expenses, after waivers, borne by Class I Shares of the corresponding Acquired Fund during the fiscal year ended December 31, 2022.

The Acquired Funds are currently subject to expense limitations as described under Comparison of Current Fees and Expenses below. While these expense limitations allow an Acquired Fund’s investment adviser under certain circumstances to seek reimbursement of fees waived or payments made to such Acquired Fund, following the Reorganizations, the Acquired Funds’ investment advisers will forgo the right to seek reimbursement of any such amounts that have not already been reimbursed prior to the Reorganizations. AIS may not seek reimbursement of amounts waived under its fee waiver, nor may AIS seek reimbursement of amounts previously reimbursed by an Acquired Fund’s investment adviser under such Acquired Fund’s expense limitation.

Distribution and Service Fees. Aristotle International Equity Fund, Aristotle Small Cap Equity Fund and Aristotle Core Equity Fund may pay a fee at an annual rate of up to 0.15% of its average daily net assets to shareholder servicing agents. The remaining Acquired Funds do not bear any distribution or service fees.

Class I-2 and Class I-3 shares of the Acquiring Funds, as applicable, do not bear any distribution or service fees.

How do the share purchase, redemption and exchange procedures of the Acquiring Funds compare to those of their corresponding Acquired Funds?

The share purchase, redemption, and exchange procedures, including the initial and subsequent investment minimums, of the Acquiring Funds are substantially similar to those of the Acquired Funds. For more information concerning the share purchase, redemption and exchange procedures of the Acquired Funds and the Acquiring Funds, please see the Other Information About the Funds section below.

Will the portfolio managers change in connection with the Reorganizations?

Same Portfolio Managers. Each Acquired Fund’s investment adviser will serve as sub-adviser to the corresponding Acquiring Fund. Each Acquired Fund's current portfolio managers will serve as the portfolio managers of the corresponding Acquiring Fund.

AIS as Investment Adviser. Currently, Aristotle Capital serves as the investment adviser to Aristotle/Saul Global Equity Fund, Aristotle International Equity Fund and Aristotle Value Equity Fund; Aristotle Capital Boston, LLC (“Aristotle Boston”) serves as the investment adviser to Aristotle Small Cap Equity Fund; and Aristotle Atlantic Partners, LLC (“Aristotle Atlantic”) serves as the investment adviser to Aristotle Core Equity Fund.

AIS serves as investment adviser to each of the Acquiring Funds; Aristotle Capital serves as the sub-adviser to Aristotle/Saul Global Equity Fund II, Aristotle International Equity Fund II and Aristotle Value Equity Fund II; Aristotle Boston serves as the sub-adviser to Aristotle Small Cap Equity Fund II; and Aristotle Atlantic serves as the sub-adviser to Aristotle Core Equity Fund II.

As investment adviser, AIS has overall responsibility to oversee the management of the investment of each Acquiring Fund’s assets and will supervise the daily business affairs of the Acquiring Funds, including the services provided by each Acquiring Fund’s sub-adviser, subject to the ultimate oversight of the Aristotle Funds Board. AIS will have the ultimate responsibility, subject to the review of the Aristotle Funds Board, to oversee and monitor the performance of the sub-advisers. AIS also will be responsible for performing compliance monitoring services to help maintain compliance with applicable laws and regulations. AIS also serves as the Acquiring Funds’ Administrator, and in such capacity performs certain administrative services for each of the Acquiring Funds pursuant to a supervision and administration agreement between AIS and the Acquiring Funds.

Comparable Services. AIS expects that the Acquiring Fund Shareholders will receive a comparable level and quality of services following the proposed Reorganizations compared to the services they currently receive as the Acquired Fund Shareholders.

Additional information about AIS, Aristotle Capital, Aristotle Boston, Aristotle Atlantic and the portfolio managers for each Acquiring Fund, is included in the Acquiring Funds Prospectus and SAI, which are incorporated herein by reference.

Are the investment objectives of the Acquired Funds different from the investment objectives of their corresponding Acquiring Funds?

Same or Substantially Similar Investment Objectives. The investment objective of each Acquiring Fund is identical or substantially similar to the investment objective of the corresponding Acquired Fund.

Each Acquired Fund’s and Acquiring Fund’s investment objective is included below under Comparison of Investment Objectives and Principal Investment Strategies.

Are the investment strategies of the Acquired Funds different from the investment strategies of their corresponding Acquiring Funds?

Same or Substantially Similar Investment Strategies. Each Acquiring Fund has the same or substantially similar investment strategies as the corresponding Acquired Fund.

Each Acquiring Fund’s principal investment strategies are included below under Comparison of Investment Objectives and Principal Investment Strategies. Additional information about the principal investment strategies of the Acquiring Funds is included in the Acquiring Funds Prospectus and SAI, which are incorporated herein by reference.

Do the principal risks associated with investments in the Acquired Funds differ from the principal risks associated with investments in their corresponding Acquiring Funds?

Substantially Similar Principal Risks. The Acquired Funds and the Acquiring Funds are subject to substantially similar principal risks. For additional information and comparisons regarding the principal risks of each Acquired Fund and each Acquiring Fund, please see Comparison of Principal Risks below. Summaries of the principal risks associated with investments in the Acquiring Funds can be found in the Acquiring Funds Prospectus and SAI, which are incorporated herein by reference.

Who will bear the expenses associated with the Reorganizations?

Solicitation and Transaction Costs. The costs of the solicitation related to each proposed Reorganization, including any costs directly associated with preparing, filing, printing and distributing to the Acquired Fund Shareholders all materials relating to this Proxy Statement/Prospectus and soliciting and tallying shareholder votes, will be borne by AIS.

The Acquiring Funds will bear any other direct or indirect transaction costs associated with the Reorganizations, such as brokerage commissions, costs (and, possibly, taxable gains or losses) from the sale of securities and market impact costs. Delays in opening foreign custody accounts may require Aristotle Capital Management, LLC, the sub-adviser to both Aristotle International Equity Fund and Aristotle/Saul Global Equity Fund, to sell a position in a single security held in both Funds. The commission rate to trade the security is 14 basis points per share, accounting for the sale and repurchase after the close of the applicable Fund reorganization. As such, it is estimated that the brokerage expenses and trade costs related to the transaction are de minimis and would have no impact on either Fund’s net asset value. For more detailed information about the tax consequences of the Reorganizations please refer to the Certain U.S. Federal Income Tax Consequences of the Reorganizations section below.

Shareholders should consult their tax advisors about possible state and local tax consequences of the Reorganizations, if any, because the information about tax consequences in the document relates to the federal income tax consequences of the Reorganizations only.

What appraisal rights do I have in connection with the Reorganizations?

Under the applicable legal and regulatory requirements, none of the Acquired Fund Shareholders will be entitled to dissenters’ rights (i.e., to demand the fair value of their shares in connection with a Reorganization). Therefore, the Acquired Fund Shareholders will be bound by the terms of the Plans of Reorganization. However, any Acquired Fund Shareholder may redeem their shares prior to the Reorganizations.

OTHER INFORMATION ABOUT THE FUNDS

The investment objective, policies, principal investment strategies and principal risks of the Acquired Fund of which you are a record owner can be found in the Acquired Fund Prospectus that you received upon purchasing shares in that Acquired Fund and any updated prospectuses that you may have subsequently received. The investment objective, policies, principal investment strategies and principal risks of the corresponding Acquiring Fund can be found in this Proxy Statement/Prospectus under Comparison of the Acquired Funds and the Acquiring Funds below and in the Acquiring Fund Prospectus.

Fundamental and Non-Fundamental Investment Policies

The 1940 Act requires, and each Acquiring Fund and Acquired Fund has, investment policies relating to investing in commodities, concentration in particular industries, making loans, investing in real estate, acting as an underwriter and issuing senior securities and borrowing money. For the Acquired Funds, these policies are fundamental, and may not be changed without shareholder approval. For the Acquiring Funds, the investment policies relating to concentration in particular industries, making loans, investing in real estate, acting as an underwriter and issuing senior securities and borrowing money are fundamental, and may not be changed without shareholder approval, and, as discussed below, the investment policy relating to investment in commodities is non-fundamental, and may be changed without shareholder approval. Each Acquired Fund describes its fundamental investment policies differently than its corresponding Acquiring Fund, as described in more detail in Appendix C.

Each Acquired Fund and each Acquiring Fund have also adopted certain non-fundamental policies that may be changed without shareholder approval. Each Acquired Fund has adopted a non-fundamental policy related to investments in illiquid securities. Each Acquiring Fund has adopted non-fundamental policies related to investments in illiquid securities, investments in commodities, providing shareholders advance notice of a change to a policy on investing at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in a manner consistent with its name (if applicable), and serving as an underlying fund for a fund-of-funds.

It is not expected that the differences in fundamental and non-fundamental investment policies will affect in any material respect the way any of the Acquiring Funds are managed after the Reorganizations. A comparison of the fundamental and non-fundamental investment policies of each Acquired Fund and its corresponding Acquiring Fund appears in Appendix C.

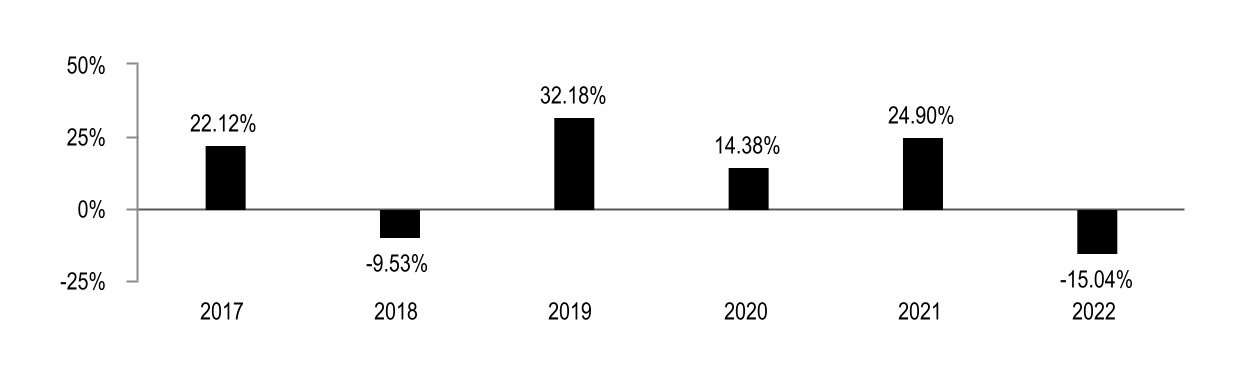

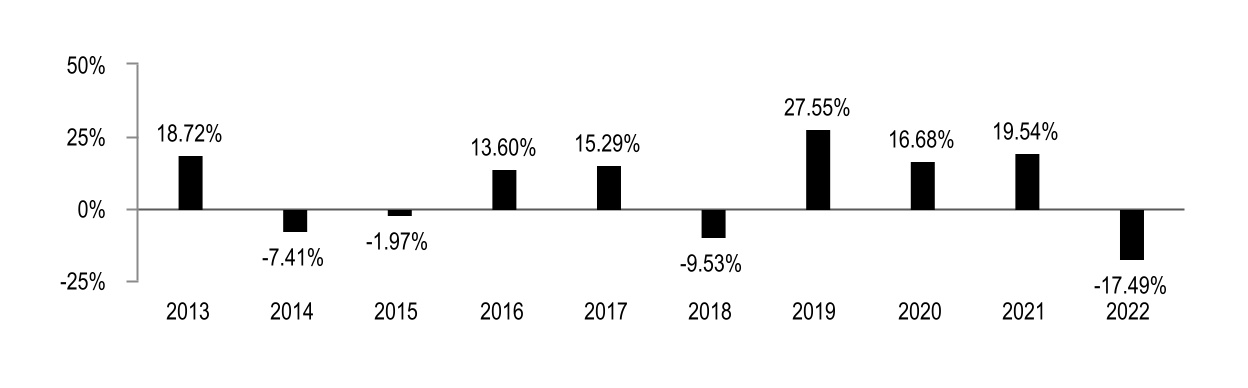

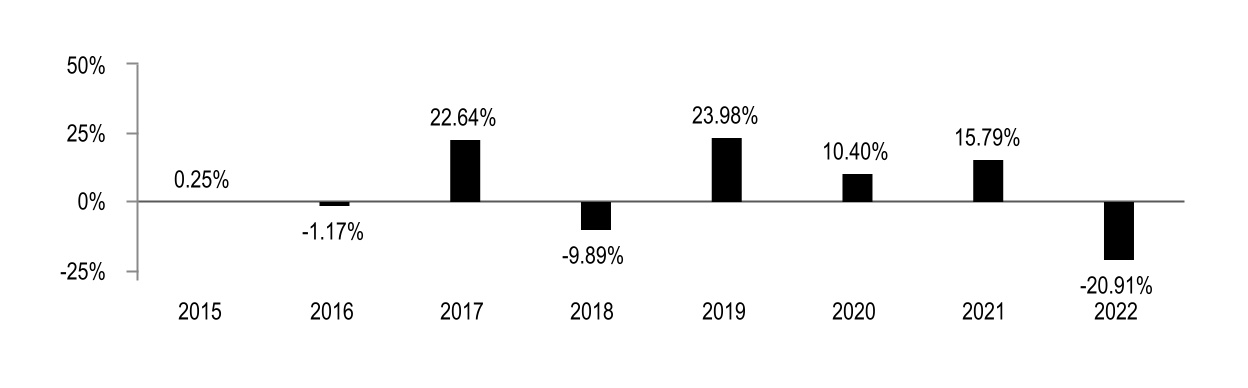

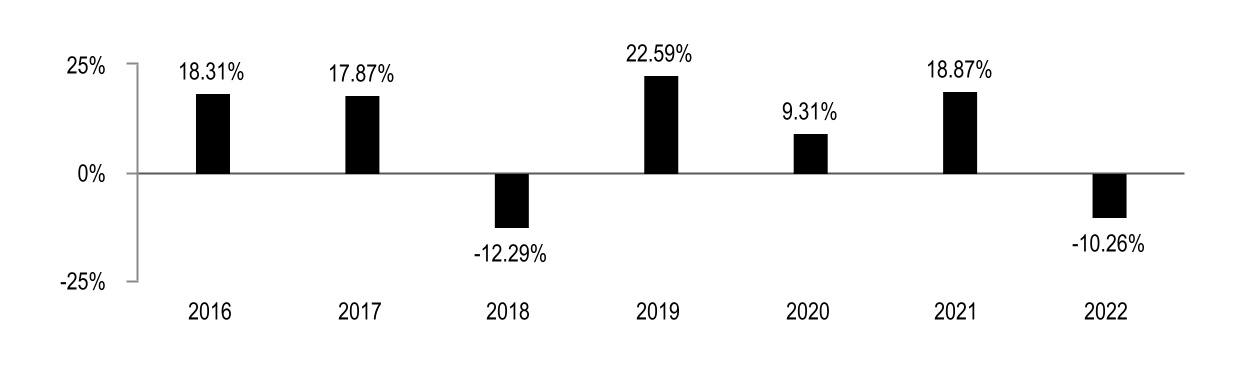

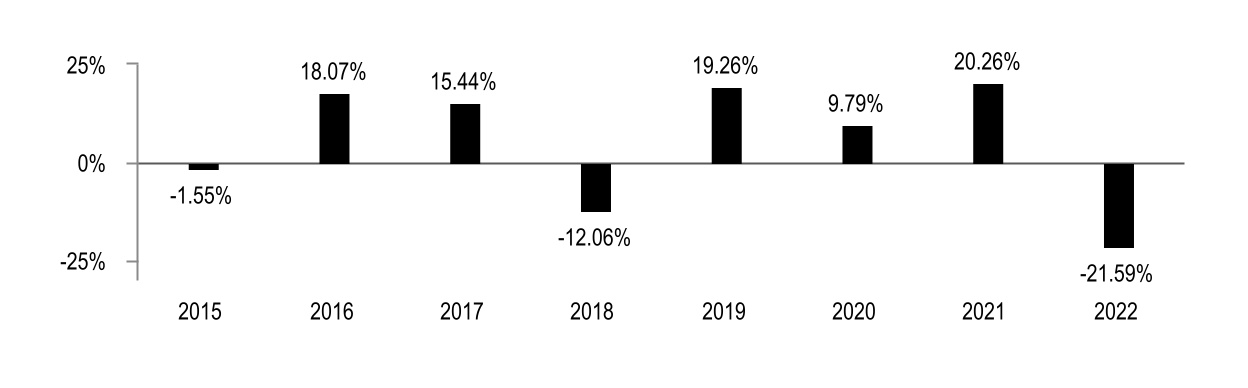

Performance

Performance information for each Acquired Fund is included in the Acquired Fund Prospectus and in this Proxy Statement/Prospectus under Comparison of Fund Performance. Performance information for Aristotle Small Cap Equity Fund II is included in the Acquiring Fund Prospectus and in this Proxy Statement/Prospectus under Comparison of Fund Performance. No performance information is presented for the other Acquiring Funds as they have yet to commence investment operations or do not have full calendar year returns. Each Acquired Fund is expected to be the accounting survivor in the Reorganization with the corresponding Acquiring Fund.

Distribution Arrangements

IMST Distributors, LLC (the “Acquired Fund Distributor”), a wholly-owned subsidiary of Foreside Financial Group, LLC, is the principal underwriter for the Acquired Funds. Foreside Financial Services, LLC (the “Acquiring Fund Distributor”) is the principal underwriter for the Acquiring Funds.

The Acquiring Fund Distributor is expected to provide substantially the same services to the Acquiring Funds after the Reorganizations as the Acquired Fund Distributor currently provides to the Acquired Funds.

Shares of each Acquired Fund and each Acquiring Fund are continuously offered through the Acquired Fund Distributor and Acquiring Fund Distributor, respectively. Shares of the Acquired Funds and the Acquiring Funds are generally purchased through broker-dealers, which may be affiliated with financial firms, such as banks and retirement plan administrators, and which have entered into selling group agreements with the Distributor (collectively, “selling group members”). Such selling group members and their financial intermediaries, as well as other service providers (such as registered investment advisers, banks, trust companies, certified financial planners, third party administrators, recordkeepers, trustees, custodians and financial consultants) may be referred to as a “financial intermediary” or “financial intermediaries.”

For more information about the distribution arrangements of the Acquiring Funds, see the Acquiring Fund Prospectus.

Purchase and Sale of Fund Shares

The Acquired Funds and the Acquiring Funds operate under substantially the same purchase and redemptions procedures. Shareholders may generally purchase or redeem (sell) shares of an Acquired Fund or Acquiring Fund on any business day. For accounts established through a broker-dealer or other financial intermediary, shareholders should contact their financial professional to purchase or redeem shares.

For Class I shares of the Acquired Funds, the minimum initial investment is $2,500, with a $100 minimum for subsequent investments. For the Acquiring Funds, Class I-2 and Class I-3 shares are only available to eligible investors for purchase or redemption through a financial intermediary. There is no minimum initial or subsequent investment for Class I-2 shares or Class I-3 shares of the Acquiring Funds because they are generally only available to investors in fee-based advisory programs. Each Acquired Fund and Acquiring Fund reserves the right to waive or change minimum investment amounts, including for certain types of retirement plans. Each Acquired Fund and each Acquiring Fund reserves the right to reject any request to buy shares.

Class I shares of the Acquired Funds and Class I-2 shares of the Acquiring Funds and Class I-3 shares of Aristotle Small Cap Equity Fund II are not subject to any sales charges or redemption fees.

Share Class Eligibility for the Acquiring Funds

Class I-2 shares of the Acquiring Funds and Class I-3 shares of Aristotle Small Cap Equity Fund II are generally only available to certain employer-sponsored retirement, savings or benefit plans held in plan level or omnibus accounts and managed account programs offered by broker-dealers, registered investment advisers, insurance companies, trust institutions and bank trust departments which charge an asset-based fee to their clients participating in those programs. In a managed account program, the financial intermediary typically charges each investor a single fee based on the value of the investor’s account in exchange for providing various services to that account (like management, brokerage and custody services). Class I-2 or Class I-3 shares may also be available on certain brokerage platforms. Investors buying or selling Class I-2 or Class I-3 shares through a broker acting as an agent for the investor may be required to pay commissions and/or other charges to the broker.

Exchange Privileges and Conversion Rights

Class I and Class I-2 shares of the Acquired Funds and Class I-3 of Small Cap Equity Fund II have substantially similar exchange privileges and conversion rights. Each Acquired Fund and Acquiring Fund affords shareholders the ability to exchange investments among the various Acquired Funds or Acquiring Funds, as applicable, if they satisfy eligibility requirements for that Fund. Exchanges are considered sales and may result in a gain or loss for federal and state income tax purposes. There are no additional sales charges or fees for exchanges with respect to any Acquired Fund or Acquiring Fund. Exchange and conversion rights are subject to change at any time.

For additional information on purchasing, redeeming, and exchanging shares of the Acquiring Funds, see the Acquiring Fund Prospectus.

COMPARISON OF THE ACQUIRED FUNDS AND THE ACQUIRING FUNDS

Summary Comparison

Below is a summary of the differences between the Acquired Funds and the Acquiring Funds, followed by more detailed comparisons of the Acquired Funds and the Acquiring Funds. As noted above, the Shell Funds have been registered with the SEC specifically for the purpose of acquiring the assets and liabilities of the corresponding Acquired Fund. The Underlying Funds are newly formed funds that commenced operations on April 17, 2023 and have had only limited operations serving as underlying funds in a “fund-of-funds” structure with a group of affiliated funds in the Aristotle Funds Trust, which are also advised by AIS. Aristotle Small Cap Equity Fund II commenced operations on April 17, 2023 as a result of the merger and reorganization of two series of a separate, unaffiliated trust into Aristotle Small Cap Equity Fund II.

Same Portfolio Management Team. Each Acquiring Fund will have the same portfolio management team as the corresponding Acquired Fund. The same individuals serve as portfolio managers of the Acquiring Funds.

New Investment Adviser. AIS serves as investment adviser to each of the Acquiring Funds, and the investment adviser to each Acquired Fund serves as the sub-adviser to the corresponding Acquiring Fund.

Same or Lower Fees and Expenses . While the management fees of the Acquiring Funds are higher than the management fees of the Acquired Funds, it is expected that the total annual operating expenses, and the net annual operating expenses after waiver, of each Acquiring Fund w ill be the same as or lower than the current total annual operating expenses, and the net annual operating expenses after waiver, of the corr esponding Acquired Fund because of the Acquiring Funds’ unitary fee structure. Each Acquired Fund currently pays a management fee that consists solely of an advisory fee to its investment adviser and separately bears various other expenses incurred by the Acquired Fund, such as the cost of external audit, accounting, tax, custody, legal, and valuation services. In contrast, each Acquiring Fund pays AIS an annual combined management fee, consisting of an advisory fee and a supervision and administration fee, for services it receives from AIS under what is essentially an all-in fee structure that covers certain non-investment related expenses (i.e., most “other expenses” reflected in each Acquired Fund’s fee table , including audit, custodial, portfolio accounting, legal, transfer agency and printing costs ), which are currently borne by the Acquired Funds. Thus, the Acquiring Funds’ management fees are higher because the supervision and administration fee includes these “other expenses” in addition to the advisory fee, and those additional fees are incorporated within the Acquiring Funds’ management fee. However, both the Acquiring Funds and the Acquired Funds ultimately bear these expenses, whether categorized as management fees (in the case of the Acquiring Funds) or management fees combined with “other expenses” (in the case of the Acquired Funds). T he Acquiring Funds will also continue to bear certain non-investment related expenses, such as distribution and service fees; organizational expenses; costs of borrowing money, including interest expenses; extraordinary expenses (such as litigation and indemnification expenses); and fees and expenses of the Independent Trustees and their counsel . AIS believes the unitary fee structure provides shareholders with fees that are largely non-variable, simple, and predictable.

Two-Year Fee Waiver. While the annual operating expenses for each Acquiring Fund are expected to be the same as or lower than the corresponding Acquired Fund's total annual operating expenses after waiver, even before the application of any Acquiring Fund waiver, AIS has entered into a contractual fee waiver through July 31, 2026, to waive its management fees to the extent that the total annual operating expenses (but excluding interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, other expenditures which are capitalized in accordance with generally accepted accounting principles (other than offering costs), other extraordinary expenses not incurred in the ordinary course of such Acquiring Fund’s business and amounts payable pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act) of the applicable class of shares of an Acquiring Fund exceed the total annual operating expenses, after waivers, borne by the Class I Shares of the corresponding Acquired Fund for the most recent fiscal year ended December 31, 2022. AIS may not seek reimbursement of any amounts waived in future periods, nor may AIS seek reimbursement of amounts previously reimbursed by an Acquired Fund’s investment adviser under such Acquired Fund’s current expense limitation.

Same Strategies and Risks. Each Acquiring Fund has the same or substantially similar investment objective, and substantially similar principal investment strategies and principal risks as the corresponding Acquired Fund.

Comparison of Investment Objectives and Principal Investment Strategies

The tables below include each Acquiring Fund’s investment objective and principal investment strategies, in each case marked to show any differences compared to the investment objective and principal investment strategies of the corresponding Acquired Fund. Deleted text is shown in red strikethrough and added text is shown in blue underline.

The investment objective of Aristotle Value Equity Fund is to maximize long-term capital appreciation, and Aristotle Value Equity Fund II has a substantially similar investment objective of seeking long-term growth of capital. Aristotle Value Equity Fund has principal investment strategies that are substantially similar to those of Aristotle Value Equity Fund II.

| | | | | |

| Acquiring Fund: Aristotle Value Equity Fund II |

| Investment Objective | The investment objective of the Aristotle Value Equity Fund (the “Value Equity Fund” or “Fund”) is to This Fund seeks long-term growth of capital appreciation. |

| Principal Investment Strategy of the Acquiring Fund | Under normal market conditions, the Value Equity Fund invests at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities. The Value Equity Fund’s investments in equity securities may include common stocks, depositorydepositary receipts, and exchange-traded funds (“ETFs”) that invest primarily in equity securities. Depositary receipts represent interests in foreign securities held on deposit by banks. ETFs are investment companies that invest in portfolios of securities designed to track particular market segments or indices, the shares of which are bought and sold on securities exchanges. The Value EquityFund seeks to meet its investment objectivegoal by investing primarily in equity securities of domestic and foreign issuers that are listed on a U.S. exchange or that are otherwise publicly traded in the United States but may invest up to 20% of its total assets in American DepositoryDepositary Receipts and Global DepositoryDepositary Receipts (“ADRs” and “GDRs”, respectively). ADRs are receipts that represent interests in foreign securities held on deposit by U.S. banks. GDRs have the same qualities as ADRs, except that they may be traded in several international trading markets. In selecting investments for the Value EquityFund, Aristotle Capital Management, LLC (the "Advisor" or "Aristotle Capital"), the Fund's investment advisor, employs a fundamental, bottom-up approach. The Advisorsub-adviser focuses on those companies that it believes have high-quality businesses that are undervalued by the market relative to what the Advisorsub-adviser believes to be their fair value and have a minimum market capitalization of $2 billion. The Advisorsub-adviser seeks to identify high-quality businesses by focusing on companies with the following attributes: attractive business fundamentals; experienced, motivated company management; pricing power; sustainable competitive advantages; financial strength; and/or high or consistently improving market position, return on invested capital and operating margins. The Value EquityFund generally seeks favorable performance relative to its benchmark,is benchmarked to the Russell 1000® Value Index and the S&P 500® Index. However, the Advisorsub-adviser is not constrained by the composition of either index the Russell 1000® Value Index in selecting investments for the Value EquityFund. |

Aristotle/Saul Global Equity Fund has an identical investment objective to that of Aristotle/Saul Global Equity Fund II and principal investment strategies that are substantially similar to those of Aristotle/Saul Global Equity Fund II.

| | | | | |

| Acquiring Fund: Aristotle/Saul Global Equity Fund II |

| Investment Objective | The investment objective of the Aristotle/Saul Global Equity Fund (the “Global Equity Fund” or “Fund”) is to This Fund seeks to maximize long-term capital appreciation and income. |

| Principal Investment Strategy of the Acquiring Fund | Under normal circumstances, the Global Equity Fund invests at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities. The Global Equity Fund primarily invests its assets in equity securities that are listed on an exchange or that are otherwise publicly traded in the United States or in a foreign country. The Global Equity Fund may also invest in exchange-traded funds (“ETFs”). ETFs are investment companies that invest in portfolios of securities designed to track particular market segments or indices, the shares of which are bought and sold on securities exchanges. Under normal market conditions, the Global Equity Fund invests in at least three different countries, including emerging market countries, with at least 40% of its net assets invested in securities of issuers located outside the United States. The Global Equity Fund’s investments in foreign securities may include investments through American, European and Global Depositary Receipts (“ADRs,” “EDRs,” and “GDRs,” respectively). Depositary receipts represent interests in foreign securities held on deposit by banks. The strategy seeks to maximize total return, which includes both long-term capital appreciation and income via equity dividends. In selecting investments for the Global Equity Fund, Aristotle Capital Management, LLC (the “Advisor” or “Aristotle Capital”), the Fund’s investment advisor, employs a fundamental, bottom-up approach. The Advisorsub-adviser focuses first on the quality of a company’s business and then considers whether the company’s securities are available at an attractive price relative to what the Advisorsub-adviser believes to be their fair value. The Advisorsub-adviser seeks to identify high-quality businesses by focusing on companies with all or most of the following attributes: attractive business fundamentals; experienced, motivated company management; pricing power; sustainable competitive advantages; financial strength; history of or prospects for paying dividends; and/or high or consistently improving market position, return on invested capital and operating margins. The Global Equity Fund may invest in companies of any market capitalizations, but typically invests in companies with a market capitalization above $2 billion at initial investment. The Global Equity Fund is benchmarked to generally seeks favorable performance relative to its benchmarks, the MSCI All Country World (ACWI) Index (net) and the MSCI World Index (net). However, the Advisorsub-adviser is not constrained by the composition of either index in selecting investments for the Global Equity Fund. |

Aristotle International Equity Fund has an identical investment objective to that of Aristotle International Equity Fund II and principal investment strategies that are substantially similar to those of Aristotle International Equity Fund II.

| | | | | |

| Acquiring Fund: Aristotle International Equity Fund II |

| Investment Objective | The investment objective of the Aristotle International Equity Fund (the “International Equity Fund” or “Fund”) is to This Fund seeks long-term capital appreciation. |

| Principal Investment Strategy of the Acquiring Fund | Under normal circumstances, the International Equity Fund invests at least 80% of its net assets (including amounts borrowed for investment purposes) in publicly traded equity securities or depositary receipts of companies organized, headquartered, or doing a substantial amount of business outside of the United States. Aristotle Capital Management, LLC, (the “Advisor” or “Aristotle Capital”), the Fund’s investment advisor, considers a company that has at least 50% of its assets located outside the United States or derives at least 50% of its revenue from business outside the United States as doing a substantial amount of business outside the United States. The International Equity Fund generally invests in securities of companies located in different regions and in at least three different countries. The International Equity Fund intends to invest no more than 20% of its total assets in companies organized, headquartered or doing a substantial amount of business in emerging market countries under normal market conditions. The International Equity Fund’s investments in equity securities may include common stocks, preferred stocks, warrants and rights. The International Equity Fund’s investments in depositary receipts may include American, European, and Global Depositary Receipts (“ADRs,” “EDRs,” and “GDRs,” respectively). ADRs are receipts that represent interests in foreign securities held on deposit by U.S. banks. EDRs and GDRs have the same qualities as ADRs, except that they may be traded in several international trading markets. The International Equity Fund may invest in companies of any market capitalization. In pursuing the International Equity Fund’s investment objectivegoal, the Advisorsub-adviser employs a fundamental, bottom-up research driven approach to identify companies for investment by the International Equity Fund. The Advisorsub-adviser focuses on those companies that it believes have high-quality businesses that are undervalued by the market relative to what the Advisorsub-adviser believes to be their fair value. The Advisorsub-adviser seeks to identify high-quality companies by focusing on the following attributes: attractive business fundamentals, strong financials, experienced, motivated company management, and high and/or consistently improving market position, return on invested capital or operating margins. The Fund is benchmarked to the MSCI Europe, Australasia and Far East (“EAFE”) Index (net) and the MSCI All Country World (“ACWI”) ex USA Index (net). However, the sub-adviser is not constrained by the composition of either index in selecting investments for the Fund. |

Aristotle Core Equity Fund has an identical investment objective to that of Aristotle Core Equity Fund II and principal investment strategies that are substantially similar to those of Aristotle Core Equity Fund II.

| | | | | |

| Acquiring Fund: Aristotle Core Equity Fund II |

| Investment Objective | The investment objective of the Aristotle Core Equity Fund (the “Core Equity Fund” or “Fund”) is to This Fund seeks long-term growth of capital. |

| Principal Investment Strategy of the Acquiring Fund | Under normal circumstances, the Core Equity Fund invests at least 80% of its assets in equity securities. The Core Equity Fund’s investments in equity securities may include common stocks, preferred stocks, convertible preferred stocks, depositary receipts, shares of publicly-tradedpublicly traded real estate investment trusts (“REITs”), warrants and rights. The Core Equity Fund’s investments in depositary receipts may include American, European, and Global Depositary Receipts (“ADRs,” “EDRs,” and “GDRs,” respectively). ADRs are receipts that represent interests in foreign securities held on deposit by U.S. banks. EDRs and GDRs have the same qualities as ADRs, except that they may be traded in several international trading markets. Although the Core Equity Fund may invest in companies of any market capitalization and from any country, it invests primarily in large U.S. companies. Aristotle Atlantic Partners, LLC (the “Advisor” or “Aristotle Atlantic”), the Fund’s investment advisor, the Core Equity Fund’s Advisor, applies itsthe sub-adviser’s investment process to a typically focuses on the universe of companies with market capitalizations in excess of $2 billion at initial investment. In pursuing the Core Equity Fund’s investment objectivegoal, the Advisorsub-adviser employs a fundamental, bottom-up research driven approach to identify companies for investment by the Core Equity Fund. The Advisorsub-adviser seeks to identify companies that it believes are positioned to benefit from one or more of the following: (i) shifts in industry spending, government spending and consumer trends; (ii) gains in market share from innovative products and strong intellectual property; and (iii) cyclical trends in the industry in which they operate and capable management that can take advantage of those trends. The investment process and allocation decisions result in a portfolio that blends both value and growth characteristics. At times, the Core Equity Fund’s assets may be invested in securities of relatively few industries or sectors. Currently, the Fund is significantly invested in the Information Technology Sector. The Fund is benchmarked to the S&P 500 Index. However, the sub-adviser is not constrained by the composition of the S&P 500® Index in selecting Investments for the Fund. |

Aristotle Small Cap Equity Fund has an identical investment objective to that of Aristotle Small Cap Equity Fund II and principal investment strategies that are substantially similar to those of Aristotle Small Cap Equity Fund II.

| | | | | |

| Acquiring Fund: Aristotle Small Cap Equity Fund II |

| Investment Objective | The investment objective of the Aristotle Small Cap Equity Fund (the “Small Cap Equity Fund” or “Fund”) is to This Fund seeks long-term capital appreciation. |

| Principal Investment Strategy of the Acquiring Fund | Under normal circumstances, the Small Cap Equity Fund invests at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities of small-capitalization companies. Aristotle Boston Capital Boston, LLC (the “Advisor” or “Aristotle Boston”), the Fund’s investment advisor, the Small Cap Equity Fund’s Advisor,considers small capitalization companies to be those companies that, at the time of initial purchase, have a market capitalization equal to or less than that of the largest company in the Russell 2000® Indexduring the most recent 12-month period (. The largest market capitalization of a company in the Russell 2000® Index was approximately $16.7 billion during the 12-month period ended December 31, 2022). The Russell 2000® Index is reconstituted annually. Because small capitalization companies are defined by reference to an index, the range of market capitalization of companies in which the Small Cap Equity Fund invests may vary with market conditions. Investments in companies that move above or below the capitalization range may continue to be held by the Small Cap Equity Fund in the Advisorsub-adviser’s sole discretion. As of December 31, 2022, the weighted average market capitalization of Predecessor Fund was approximately $3.2 billion. The Small Cap Equity Fund’s investments in equity securities may include common stocks, depositorydepositary receipts, and exchange traded-funds exchange-traded funds (“ETFs”) that invest primarily in equity securities of small capitalization companies. DepositoryDepositary receipts represent interests in foreign securities held on deposit by banks. ETFs are investment companies that invest in portfolios of securities designed to track particular market segments or indices, the shares of which are bought and sold on securities exchanges. The Small Cap Equity Fund seeks to meet its investment objectivegoal by investing primarily in equity securities of U.S. issuers but may invest up to 5% of its total assets in American DepositoryDepositary Receipts (“ADRs”). ADRs are receipts that represent interests in foreign securities held on deposit by U.S. banks. In pursuing the Small Cap Equity Fund’s investment objectivegoal, the Advisorsub-adviser employs a fundamental, bottom-up research driven approach to identify companies for investment by the Small Cap Equity Fund. The Advisorsub-adviser focuses on those companies that it believes have high-quality businesses that are undervalued by the market relative to what the Advisorsub-adviser believes to be their fair value. The Advisorsub-adviser seeks to identify high-quality businesses by focusing on companies with that it believes have the following attributes: disciplined business plans; attractive business fundamentals; sound balance sheets; financial strength; experienced, motivated company management; reasonable competition; and/or a record of long-term value creation. The Fund generally seeks favorable performance relative to its benchmark, the Russell 2000® Index. The Fund is benchmarked to the Russell 2000® Index. However, the Advisor is not constrained by the composition of the Russell 2000® Index in selecting investments for the Fund. |

Further information about each Acquiring Fund’s investment objective and principal investment strategies is contained in the Acquiring Funds’ Prospectuses, which are incorporated by reference into this Proxy Statement/Prospectus.

Further information about each Acquired Fund’s investment objectives and strategies is contained in the Acquired Funds’ prospectus and SAI. The Acquired Funds’ prospectus and SAI are on file with the SEC and are also incorporated herein by reference. For information regarding how to request copies of the Acquired Funds’ prospectus or SAI, please refer to Where to Find Additional Information below.

Comparison of Current Fees and Expenses

The tables below allow shareholders to compare the management fees and expense ratios of each Acquired Fund and each Acquiring Fund and to analyze the estimated expenses that each Acquiring Fund expects to bear following the Reorganizations. Each Acquiring Fund pays AIS an annual combined management fee, consisting of an advisory fee and supervision and administration fee, for services it receives from AIS under what is essentially an all-in fee structure that covers certain non-investment related expenses; (i.e., most “other expenses” reflected in each Acquired Fund’s fee table), which are currently borne by the Acquired Funds. The Acquiring Funds will continue to bear certain non-investment related expenses, such as distribution and service fees; organizational expenses; costs of borrowing money, including interest expenses; extraordinary expenses (such as litigation and indemnification expenses); and fees and expenses of the Independent Trustees and their counsel. AIS believes the unitary fee structure provides shareholders with management fees that are largely non-variable, simple, and predictable. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees (fees paid directly from your investment)

There are no sales charges on Class I shares of the Acquired Funds or Class I-2 shares or Class I-3 shares of the Acquiring Funds. Class I shares of the Acquired Funds are subject to the fees and expenses shown in the table below.

| | | | | |

Shareholder Fees (fees paid directly from your investment) | Class I Shares of the Acquired Funds |

| Redemption fee if redeemed within 30 days of purchase (as a percentage of amount redeemed) | 1.00% |

| Wire fee | $20 |

| Overnight check delivery fee | $25 |

| Retirement account fees (annual maintenance fee) | $15 |

Class I-2 and Class I-3 shares of the Acquiring Funds are subject to the fees and expenses shown in the table below. Class I-3 shares are only offered by Aristotle Small Cap Equity Fund II.

| | | | | |

Shareholder Fees (fees paid directly from your investment) | Class I-2 and Class I-3 Shares of the Acquiring Funds |

| Redemption fee if redeemed within 30 days of purchase (as a percentage of amount redeemed) | None |

| Wire fee | $15 |

| Overnight check delivery fee | $15 |

| Retirement account fees (annual maintenance fee) | $15, capped at $30/per Social Security Number |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

The fees and expenses for each Acquired Fund shown in the tables below reflect expenses for the most recent fiscal year ended December 31, 2022. The fee and expense figures shown below for each Acquiring Fund are pro forma estimates that assume the applicable Reorganization has been completed. It is expected that annual operating expenses of each Acquiring Fund will be the same as or lower than those of the corresponding Acquired Fund.

| | | | | | | | | | | |

| Aristotle Value Equity Fund (Acquired Fund) | Aristotle Value Equity Fund II (Acquiring Fund) |

| Class I | Class I-2 |

| Management Fee | 0.60% | 0.69%2 |

| Distribution (12b-1) and/or Service Fee | None | None |

| Other Expenses | 0.11% | None |

| Total Annual Fund Operating Expenses | 0.71% | 0.69% |

| Fees Waived and/or Expenses Reimbursed | (0.02)%1 | 0.00%3 |

| Total Annual Fund Operating Expenses after Waiving Fees and/or Reimbursing Expenses | 0.69% | 0.69% |