UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23850

Aristotle Funds Series Trust

(Exact name of registrant as specified in charter)

11100 Santa Monica Blvd., Suite 1700

Los Angeles, CA 90025

(Address of principal executive offices) (Zip code)

Richard Schweitzer

11100 Santa Monica Blvd., Suite 1700

Los Angeles, CA 90025

(Name and address of agent for service)

(844-274-7885)

Registrant’s telephone number, including area code

Date of fiscal year end: March 31, 2024

Date of reporting period: April 1, 2023 through March 31, 2024

Item 1. Reports to Stockholders.

(a)

Back to Table of Contents

Aristotle Funds Series Trust

Shareholder Letter

March 31, 2024 (Unaudited)

We close this fiscal year with a deep sense of gratitude for the trust you have given us and are proud of the milestones that were crossed in 2023. With the completed reorganization of certain of the former series of Pacific Funds and Investment Managers trusts with the funds of Aristotle Funds Series Trust, we can now look to the future and focus on growing our mutual fund platform and working hard every day to deliver investment results for you, our valued shareholders.

Market volatility was a recurring theme for most of 2023 and leading into 2024. For the year ended March 31, 2024, the MSCI ACWI Index (net), a representation of equity markets around the world, posted a full-year return of 23.22%. Domestically, large-cap U.S. equity, as depicted by the S&P 500 Index, rose 29.88%, as large technology companies regained their lead in the first quarter of 2024 after showing more modest performance in the second half of 2023. The U.S. small-cap equity market rallied in 2023 and finished the fiscal year on a strong note with the Russell 2000 Index posting a trailing 12-month return of 19.71%.

Fixed income markets also finished in positive territory. Ending March 31, 2024, trailing one-year returns for the Bloomberg Global Aggregate Bond Index and Bloomberg U.S Aggregate Bond Index were 0.49% and 1.70%, respectively. On the credit side, the Bloomberg U.S. Credit Bond Index posted a 4.15% return for the year, while the Bloomberg U.S. Corporate Bond Index was slightly above that with a return of 4.43%. In general, below investment-grade outperformed investment-grade debt given the supportive economy and elevated inflation. Representing high yield bonds, the Bloomberg U.S. High Yield 2% Issuer Capped Bond Index returned 11.15%. The Credit Suisse Leveraged Loan Index was a top performer, ending the year up 12.40%. Elevated inflation has resulted in higher interest rates at the short end of the yield curve, providing a tailwind for floating rate instruments. The loan asset class continues to perform exceptionally well in this prolonged higher rate environment.

In comparison to late 2022, when markets were bracing for a recession, the end of 2023 and start of 2024 seem to indicate a more optimistic tone. A resilient U.S. economy coupled with a strong employment backdrop have provided enough support through a minor banking crisis and geopolitical conflicts in Europe and the Middle East. The result has been elevated inflation, corresponding central bank policies, strong equity returns and more attractive fixed income yields. Add to this the economic recovery in Europe and Asia. Investors’ rate-cut expectations now tend to be more aligned with the Federal Reserve’s forecasts for a continued “higher for longer” environment.

You may reach out to the Aristotle Funds team via email at funds@aristotlecap.com, via phone at (844) 274-7885 to speak with an Investor Services Representative, or by visiting our website at www.aristotlefunds.com. Our website provides additional information on the funds through fund-specific market commentaries and fact sheets and lets you hear from our portfolio management teams through insight pieces, charts library and podcasts. As always, we welcome your questions and comments.

Sincerely,

| | | | |

| | | |

| | | |

Richard Schweitzer, CFA

President and Trustee

Aristotle Funds Series Trust | | | Dominic Nolan, CFA

Chief Executive Officer

Aristotle Investment Services, LLC |

| | | | |

Back to Table of Contents

Aristotle Funds Series Trust

Shareholder Letter

March 31, 2024 (Unaudited) (Continued)

Disclosures:

| • | The Bloomberg Global Aggregate Bond Index is a flagship measure of global investment grade debt from 28 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. |

| • | The Bloomberg U.S. Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. |

| • | The Bloomberg US Corporate Bond Index includes publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. |

| • | The Bloomberg US Credit Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate and government-related bond markets. It is composed of the US Corporate Index and a non-corporate component that includes non-US agencies, sovereigns, supranationals and local authorities. |

| • | The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index measures the performance of high-yield bonds with a 2% maximum allocation to any one issuer. |

| • | The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. senior secure-credit (leveraged-loan) market. |

| • | The S&P 500® Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. |

| • | The Russell 2000® Index measures the performance of the small-capitalization segment of the U.S. equity universe. It includes approximately 2,000 of the smallest securities based on a combination of their market capitalization and current index membership. |

| • | The MSCI All Country World (“ACWI”) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of December 31, 2023, the MSCI ACWI Index consists of the following developed market country indices—Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States—and of the following emerging market country indices—Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. |

For the domestic indices, results include the reinvestment of all dividends. For the foreign indices, results include the reinvestment of dividends after the deduction of withholding tax, applying the tax rate to non-resident individuals who do not benefit from double taxation treaties. It is not possible to invest directly in these indices.

Past Performance is not a guarantee of future results. Fund investing involves risk. Principal loss is possible. Diversification does not assure a profit or protect against loss in a declining market.

Opinions expressed herein are as of March 31 2024, and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus. Additional information may be obtained by calling 844-ARISTTL (844-274-7885), or visiting www.aristotlefunds.com.

Back to Table of Contents

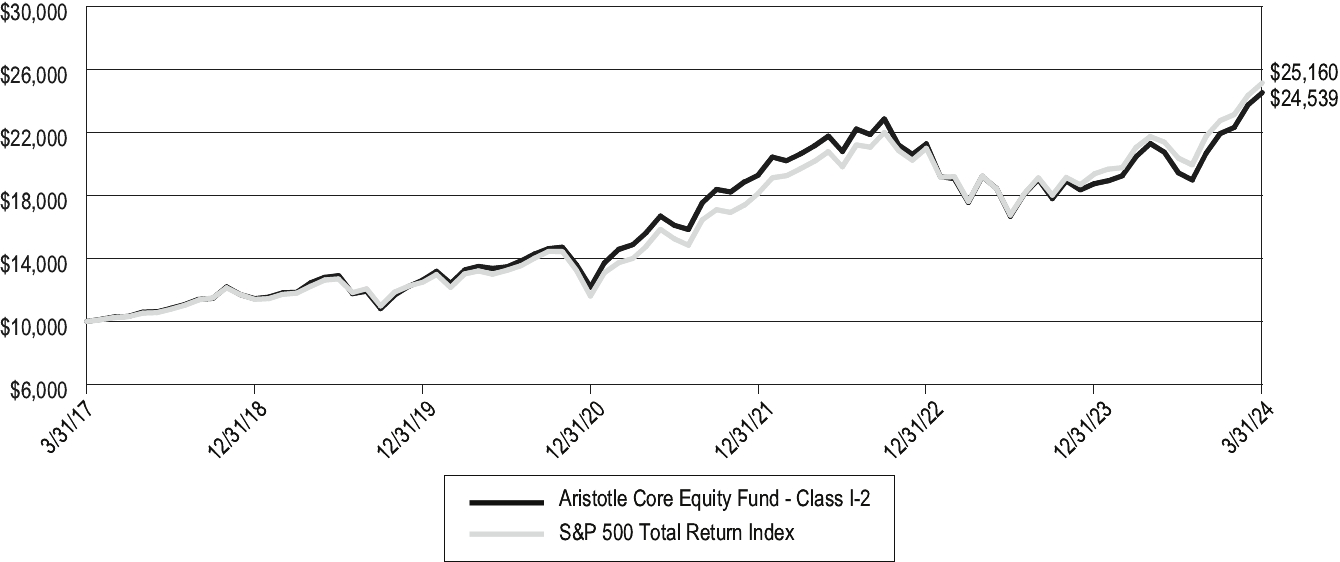

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited)

Aristotle Core Income Fund

Growth of $10,000

The Fund performance shown in the chart above includes the performance of Pacific Funds Core Income (the “Predecessor Fund”), a series of Pacific Funds Series Trust, as a result of a reorganization of the Predecessor Fund into the Fund on April 17, 2023. The Predecessor Fund was managed by the same portfolio management team using investment policies, objectives, guidelines and restrictions that were substantially similar to those of the Fund. The chart above assumes an initial gross investment of $10,000 made on March 31, 2014 into Class I Shares of the Predecessor Fund. The Fund’s performance figures in table below are for the periods ended March 31, 2024.

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month end may be obtained by calling 844-274-7885. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

The Fund’s gross expense ratios are 0.85%, 1.60%, 0.45%, and 0.55% for Class A, Class C, Class I, and I-2 as of the most recent prospectus dated October 19, 2023, as supplemented on April 1, 2024.

| | | | | | | | | | |

Aristotle Core Income Fund - Class A(1) | | | 3.87% | | | 1.63% | | | 2.12% |

Aristotle Core Income Fund - Class C(1) | | | 3.19% | | | 0.88% | | | 1.37% |

Aristotle Core Income Fund - Class I(1) | | | 4.15% | | | 1.93% | | | 2.43% |

Aristotle Core Income Fund - Class I-2(1) | | | 4.27% | | | 1.95% | | | 2.42% |

Bloomberg US Aggregate Bond Index | | | 1.70% | | | 0.36% | | | 1.54% |

| | | | | | | | | | |

(1)

| The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

Bloomberg US Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. Results include the reinvestment of all distributions.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Aristotle Core Income Fund

Market Overview

After an impressive rally in late 2023, bond market performance was mixed in early 2024 as investors adjusted their expectations of interest rate cuts. The Federal Reserve (the Fed) dashed investor hopes of an early year rate cut as strong job growth continued, and inflation remained persistently above the Fed’s target of 2%. At both its January and March meetings the Federal Open Market Committee left the fed funds rate range unchanged at 5.25% to 5.50%, a 23-year high. The Fed’s Summary of Economic Projections (SEP) released In March Indicates three rate cuts in 2024. The recent inflation Consumer Price Index and Producer Price Index releases in March may temper both the expected start date of rate cuts as well as their magnitude. The SEP also forecast three cuts in both 2025 and 2026.

The total return for investment-grade bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, was 1.70% for the year ended March 31, 2024. While the picture is not perfect in all segments of credit markets, fundamentals remain in a largely positive position. Dispersion among sectors remains present, but overall we retain a favorable view of corporate fundamentals. Additionally, credit sectors performed relatively well in the short to intermediate sections of the curve versus longer-dated portions of the curve.

The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index returned 11.15% for the year. The high yield sector outperformed the investment-grade bond market over the period as investors favored the combination of attractive yields and credit exposure in a largely supportive economy. While elevated financing rates of high yield companies created potential for increase default activity, many borrowers extended out maturities. We are not anticipating a high level of bonds to reach maturity this year or next year. Many companies are expecting the Fed to be well into a rate-cut campaign before bond maturities spike. Default rates have been rising, but remain low.

The Credit Suisse Leveraged Loan Index (CSLL Index) returned 12.40% for the year ended March 31, 2024. A potential knock down effect of the elevated inflationary estimates seen in March is that the loan asset class is seeing increased investor interest. The loan asset class continues to perform exceptionally well in what may be a “higher for longer” rate environment. As measured by the four-year effective yield, the CSLL Index currently offers investors a yield of over 10% with a coupon of 9.24%—both of which remain supported by an elevated Secured Overnight Financing Rate (SOFR), a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Performance Summary and Portfolio Positioning

Past Performance is not a guarantee of future results. Fund investing involves risk. Principal loss is possible. Diversification does not assure a profit or protect against loss in a declining market. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

For the year ended March 31, 2024, Aristotle Core Income Fund – Class I-2 posted a return of 4.27%, outperforming its benchmark, the Bloomberg U.S. Aggregate Bond Index, which posted a return of 1.70%.

The Fund’s emphasis on corporate credit and sector allocation positioning contributed to relative outperformance. Floating rate holdings across bank loans and investment-grade collateralized loan obligation (CLO) debt was beneficial. The Fund’s duration remains below benchmark; however, the range has narrowed over the reporting period. Shorter-than-benchmark duration contributed to relative performance. The Fund has upgraded the quality of the portfolio over the last few quarters, adding exposure to credits within more resilient, less cyclical sectors. Corporate fundamentals have held up reasonably well and leverage remains broadly manageable. However, we still view an economic slowdown with higher levels of volatility and greater sector and credit dispersion as a possibility. Combining floating rate securities with intermediate and longer duration fixed rate securities in a barbell structure we believe positions the Fund to withstand a continued high level of interest rate uncertainty.

On a sector basis, we continue to find value in Banking, Technology and Utilities. Within the Fund’s asset-backed securities (ABS) allocation, we have maintained exposure to high grade (AAA/AA) CLO debt securities which we believe to be attractive on a risk-adjusted basis. Student Loan and Auto ABS positions are high quality and primarily AAA-rated. We continue to like larger, liquid bank loans that offer attractive, low duration yield with stable credit profiles.

The Fund’s allocations to floating rate bank loans (12.0%) and high yield bonds (4.5%) contributed to relative outperformance. The allocation to ABS/CLO was also a positive return contributor led by floating rate, senior CLO debt securities (6.0%). The Fund’s focus on corporate credit and relative underweight to U.S. Treasuries and agency mortgage-backed securities (MBS) was beneficial. On a sector basis, Capital Goods, Consumer Cyclicals and Technology contributed to relative returns. A lack of exposure to commercial mortgage-backed securities (CMBS), agency debt and municipal debt detracted.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

As of March 31, 2024, the Fund’s allocation was as follows: investment grade corporate bonds (38.7%), bank loans (14.4%), government bonds (21.7%), ABS (14.4%), and high yield (2.7%). The Fund’s cash position was 1.3%.

Outlook

The economic back drop, especially in the U.S., remains to be a positive for Corporate fundamentals. While there remains to be dispersion across sectors (semis troughing, leisure cresting, and commercial real estate in freefall), overall corporate fundamentals are still solid. Many sectors are performing well, such as utilities, consumer staples, manufacturing, and travel-related industries, and we do not expect that to change in the near term. The U.S. consumer has been a stabilizing force despite tighter monetary policy.

However, one area we are becoming more concerned with is intentional leveraging. Management teams are more comfortable with growth outlooks and balance sheets. They are using the liquidity in the debt markets to repurchase shares, payout dividends, and acquisitions. This is a modest negative for fundamentals thus far and we continue to monitor. Also, we expect economic slowing going forward. The slowing will weigh on ratings, as well on those sectors already struggling (mostly in well-known areas such as property-related sectors).

Investment-grade corporate technicals benefited from the move higher in interest rates over the course in early 2024. 10-year Treasury yields rose by over 30 basis points in the first quarter of 2024. This helped move Investment-grade corporate yields to 5.3% as of March 31, 2024. Retail flows into fixed income continued to be strong as a result. Institutional demand remained strong as clients were able to get another bite at higher back-end rates. While U.S. Government budget funding and higher near-term inflation could keep pressure on rates, we could see technical pressure in MBS and Treasuries subside a bit with the Fed’s recalibration of their quantitative tightening (QT) efforts. A reduction in the roll-off of those securities could be another positive technical for broader fixed income.

Stable fundamentals and strong technicals continue to benefit corporate spreads. Corporate spreads are now within shouting distance (about 10 basis points) of the post Great Financial Crisis tights seen in 2021. All-in yields are still attractive at 5.3%, but spread cushion is less robust. Corporate yields and spreads are in the 90th and 8th percentiles over the past 10 years. While index level spreads are at the tighter end of their historical range, we continue to find attractive opportunities within certain sectors as well as at the individual corporate level.

We are finding value in industries that are seeing stability in the top line and/or cash flows, including lodging/leisure, airline related (AEETCs and aircraft lessors), utilities, U.S. global systemically important banks (G-SIBs), and food and beverage. Sectors we remain wary of include metals & mining, retail, office and retail REITS, regional banks, and chemicals. Merger and acquisition activity may pick up in 2024, especially in the tech and healthcare sectors. Those activities pose both risk and potential investment opportunities. Inflation, geopolitical conflicts, and the U.S. elections late this year all pose risks the market must contend with. Inflation has been resilient, which pushes potential Fed cuts further into the horizon. This leaves us favoring certain floating-rate asset classes (high-quality bank loans and senior CLOs) given the attractive spread/yield profiles, which help absorb rate volatility.

Disclosures:

| • | The Bloomberg U.S. Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. |

| • | The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index measures the performance of high-yield bonds with a 2% maximum allocation to any one issuer. |

| • | The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. senior secure-credit (leveraged-loan) market. |

Results include the reinvestment of dividends and distributions. It is not possible to invest directly in these indices.

Opinions expressed herein are as of March 31, 2024, and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus. Additional information may be obtained by calling 844-ARISTTL (844-274-7885), or visiting www.aristotlefunds.com.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Aristotle ESG Core Bond Fund

Growth of $10,000

The Fund performance shown in the chart above includes the performance of Pacific Funds ESG Core Bond (the “Predecessor Fund”), a series of Pacific Funds Series Trust, as a result of a reorganization of the Predecessor Fund into the Fund on April 17, 2023. The Predecessor Fund was managed by the same portfolio management team using investment policies, objectives, guidelines and restrictions that were substantially similar to those of the Fund. The chart above assumes an initial gross investment of $10,000 made on December 14, 2020 into Class I Shares of the Predecessor Fund. The Fund’s performance figures in table below are for the periods ended March 31, 2024.

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month end may be obtained by calling 844-274-7885. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

The Fund’s gross expense ratios are 0.48% and 0.48% for Class I and Class I-2 as of the most recent prospectus dated October 19, 2023, as supplemented on April 1, 2024.

| | | | | | | |

Aristotle ESG Core Bond Fund - Class I(2) | | | 3.23% | | | -2.48% |

Aristotle ESG Core Bond Fund - Class I-2(2) | | | 3.23% | | | -2.48% |

Bloomberg US Aggregate Bond Index | | | 1.70% | | | -3.18% |

| | | | | | | |

(1)

| Commencement date is December 14, 2020 for Class I and Class I-2 Shares. |

(2)

| The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

Bloomberg US Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. Results include the reinvestment of all distributions.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Aristotle ESG Core Bond Fund

Market Overview

After an impressive rally in late 2023, bond market performance was mixed in early 2024 as investors adjusted their expectations of interest rate cuts. The Federal Reserve (the Fed) dashed investor hopes of an early year rate cut as strong job growth continued, and inflation remained persistently above the Fed’s target of 2%. At both its January and March meetings the Federal Open Market Committee left the fed funds rate range unchanged at 5.25% to 5.50%, a 23-year high. The Fed’s Summary of Economic Projections (SEP) released In March Indicates three rate cuts in 2024. The recent inflation Consumer Price Index and Producer Price Index releases in March may temper both the expected start date of rate cuts as well as their magnitude. The SEP also forecast three cuts in both 2025 and 2026.

The total return for investment-grade bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, was 1.70% for the year ended March 31, 2024. While the picture is not perfect in all segments of credit markets, fundamentals remain in a largely positive position. Dispersion among sectors remains present, but overall we retain a favorable view of corporate fundamentals. Additionally, credit sectors performed relatively well in the short to intermediate sections of the curve versus longer-dated portions of the curve.

The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index returned 11.15% for the year. The high yield sector outperformed the investment-grade bond market over the period as investors favored the combination of attractive yields and credit exposure in a largely supportive economy. While elevated financing rates of high yield companies created potential for increase default activity, many borrowers extended out maturities. We are not anticipating a high level of bonds to reach maturity this year or next year. Many companies are expecting the Fed to be well into a rate-cut campaign before bond maturities spike. Default rates have been rising, but remain low.

Performance Summary and Portfolio Positioning

Past Performance is not a guarantee of future results. Fund investing involves risk. Principal loss is possible. Diversification does not assure a profit or protect against loss in a declining market. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

For the year ended March 31, 2024, Aristotle ESG Core Bond Fund – Class I-2 posted a return of 3.23%, outperforming its benchmark, the Bloomberg U.S. Aggregate Bond Index, which posted a return of 1.70%.

Given the environmental, social and governance (ESG) mandate of this Fund, factors related to credit fundamentals and the ESG ratings of the Fund’s holdings were assessed, with a focus on ESG risk (ranging from negligible to severe) and ESG quality (ranging from industry best-in-class, leader, average, laggard, or worst-in-class). At the end of the reporting period, the Fund held corporates considered to have overall slightly lower ESG risk associated with them, compared to the benchmark. In addition, the Fund held no corporates considered to have high or severe risk associated with ESG factors, while the benchmark held 15.47%. The Fund also had a higher percentage of corporates considered best-in-class and leaders for ESG (48.02%) compared to those in the benchmark (35.84%). The Fund held no companies deemed worst-in-class, while the benchmark held 0.32%.

The Fund had no exposure to corporate bonds, asset-backed securities (ABS) and mortgage-related securities directly involved in: (i) the extraction of thermal coal, coal power generation and providing tailor-made products and services that support thermal coal extraction that contribute materially to company revenue (over 9.99%); (ii) the production of tobacco; or (iii) the production of controversial military weapons (i.e., weapons that have a disproportionate and indiscriminate impact on civilian populations, sometimes even years after a conflict has ended); and (iv) serious financial crime1.

The Fund’s significant average underweight to Agency mortgage-backed securities (MBS) versus the benchmark (2.42% versus 27.49%) and average overweight to ABS (16.18% versus 1.35%) were strong contributors to relative performance. While economic data coupled with supportive employment data remained in place, persistent and elevated inflation has led to expectations of interest rate policy remaining higher for longer. This revision in rate expectations has led to higher Treasury rates throughout the yield curve. As a result, exposure to ABS, most notably to CLOs, contributed to relative performance due to their relatively short duration.

An overweight exposure to corporate bonds versus the benchmark (average 56.63% versus average 24.76%) also contributed positively to relative performance. Within corporate sectors, an overweight and security selection in Financials, Capital Goods, Consumer Cyclicals and Technology contributed to relative performance.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

While the Fund’s underweight to U.S. Treasuries compared to the benchmark (20.36% versus 41.40%) was modestly positive, the selection of longer-term Treasuries versus shorter-term ones more than offset this gain and became an overall detractor to relative performance.

The corporate sectors that were the most significant detractors to relative performance were Electric Utilities, Insurance and real estate investment trusts (REITs).

As of March 31, 2024, the Fund’s carbon intensity (measured as tons of carbon dioxide equivalent per million (USD) of revenue) was 77% lower than that of the benchmark. Five green bonds from companies Eversource Energy, Healthpeak Properties, NiSource, Sumitomo Mitsui Financial and American Homes 4 Rent made up 3.09% of the Fund.

Outlook

The economic back drop, especially in the U.S., remains to be a positive for Corporate fundamentals. While there remains to be dispersion across sectors (semis troughing, leisure cresting, and commercial real estate in freefall), overall corporate fundamentals are still solid. Many sectors are performing well, such as utilities, consumer staples, manufacturing, and travel-related industries, and we do not expect that to change in the near term. The U.S. consumer has been a stabilizing force despite tighter monetary policy.

However, one area we are becoming more concerned with is intentional leveraging. Management teams are more comfortable with growth outlooks and balance sheets. They are using the liquidity in the debt markets to repurchase shares, payout dividends, and acquisitions. This is a modest negative for fundamentals thus far and we continue to monitor. Also, we expect economic slowing going forward. The slowing will weigh on ratings, as well on those sectors already struggling (mostly in well-known areas such as property-related sectors).

Investment-grade corporate technicals benefited from the move higher in interest rates over the course in early 2024. 10-year Treasury yields rose by over 30 basis points in the first quarter of 2024. This helped move Investment-grade corporate yields to 5.3% as of March 31, 2024. Retail flows into fixed income continued to be strong as a result. Institutional demand remained strong as clients were able to get another bite at higher back-end rates. While U.S. Government budget funding and higher near-term inflation could keep pressure on rates, we could see technical pressure in mortgage-backed securities (MBS) and Treasuries subside a bit with the Fed’s recalibration of their quantitative tightening (QT) efforts. A reduction in the roll-off of those securities could be another positive technical for broader fixed income.

Stable fundamentals and strong technicals continue to benefit corporate spreads. Corporate spreads are now within shouting distance (about 10 basis points) of the post Great Financial Crisis tights seen in 2021. All-in yields are still attractive at 5.3%, but spread cushion is less robust. Corporate yields and spreads are in the 90th and 8th percentiles over the past 10 years. While index level spreads are at the tighter end of their historical range, we continue to find attractive opportunities within certain sectors as well as at the individual corporate level.

We are finding value in industries that are seeing stability in the top line and/or cash flows, including lodging/leisure, airline related (AEETCs and aircraft lessors), utilities, U.S. global systemically important banks (G-SIBs), and food and beverage. Sectors we remain wary of include metals & mining, retail, office and retail REITS, regional banks, and chemicals. Merger and acquisition activity may pick up in 2024, especially in the tech and healthcare sectors. Those activities pose both risk and potential investment opportunities. Inflation, geopolitical conflicts, and the U.S. elections late this year all pose risks the market must contend with. Inflation has been resilient, which pushes potential Fed cuts further into the horizon. This leaves us favoring certain floating-rate asset classes (high-quality bank loans and senior CLOs) given the attractive spread/yield profiles, which help absorb rate volatility.

Disclosures:

| • | The Bloomberg U.S. Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. |

| • | The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index measures the performance of high-yield bonds with a 2% maximum allocation to any one issuer. |

| • | The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. senior secure-credit (leveraged-loan) market. |

Results include the reinvestment of dividends and distributions. It is not possible to invest directly in these indices.

Opinions expressed herein are as of March 31, 2024, and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus. Additional information may be obtained by calling 844-ARISTTL (844-274-7885), or visiting www.aristotlefunds.com.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Aristotle Floating Rate Income Fund

Growth of $10,000

The Fund performance shown in the chart above includes the performance of Pacific Funds Floating Rate Income (the “Predecessor Fund”), a series of Pacific Funds Series Trust, as a result of a reorganization of the Predecessor Fund into the Fund on April 17, 2023. The Predecessor Fund was managed by the same portfolio management team using investment policies, objectives, guidelines and restrictions that were substantially similar to those of the Fund. The chart above assumes an initial gross investment of $10,000 made on March 31, 2014 into Class I Shares of the Predecessor Fund. The Fund’s performance figures in table below are for the periods ended March 31, 2024.

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month end may be obtained by calling 844-274-7885. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

The Fund’s gross expense ratios are 1.03%, 1.78%, 0.70%, and 0.78% for Class A, Class C, Class I, and I-2 as of the most recent prospectus dated October 19, 2023, as supplemented on April 1, 2024.

| | | | | | | | | | |

Aristotle Floating Rate Income Fund - Class A(1) | | | 12.50% | | | 4.86% | | | 3.99% |

Aristotle Floating Rate Income Fund - Class C(1) | | | 11.67% | | | 4.12% | | | 3.24% |

Aristotle Floating Rate Income Fund - Class I(1) | | | 12.88% | | | 5.16% | | | 4.29% |

Aristotle Floating Rate Income Fund - Class I-2(1) | | | 12.76% | | | 5.10% | | | 4.24% |

Credit Suisse Leveraged Loan Index | | | 12.40% | | | 5.30% | | | 4.56% |

| | | | | | | | | | |

(1)

| The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar-denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest-rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenure of at least one year and are made by issuers domiciled in developed countries. Results include the reinvestment of all distributions.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Aristotle Floating Rate Income Fund

Market Overview

After an impressive rally in late 2023, bond market performance was mixed in early 2024 as investors adjusted their expectations of interest rate cuts. The Federal Reserve (the Fed) dashed investor hopes of an early year rate cut as strong job growth continued, and inflation remained persistently above the Fed’s target of 2%. At both its January and March meetings the Federal Open Market Committee left the fed funds rate range unchanged at 5.25% to 5.50%, a 23-year high. The Fed’s Summary of Economic Projections (SEP) released In March Indicates three rate cuts in 2024. The recent inflation Consumer Price Index and Producer Price Index releases in March may temper both the expected start date of rate cuts as well as their magnitude. The SEP also forecast three cuts in both 2025 and 2026.

Short-duration investment-grade bonds, as represented by the Bloomberg 1-3 Year U.S. Government/Credit Bond Index, returned 3.49% for the year ended March 31, 2024. The short end of the curve tended to fare better than the long end in early 2024, as hopes were dashed of a rate cut by the Fed. The Fed’s dot plot in March indicated three rate cuts, though some investors expect only one or two cuts following the strong jobs report in late March. This has allowed the front end of the curve to remain more attractively elevated than was anticipated to start the year.

The total return for investment-grade bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, was 1.70% for the year ended March 31, 2024. While the picture is not perfect in all segments of credit markets, fundamentals remain in a largely positive position. Dispersion among sectors remains present, but overall we retain a favorable view of corporate fundamentals. Additionally, credit sectors performed relatively well in the short to intermediate sections of the curve versus longer-dated portions of the curve.

The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index returned 11.15% for the year. The high yield sector outperformed the investment-grade bond market over the period as investors favored the combination of attractive yields and credit exposure in a largely supportive economy. While elevated financing rates of high yield companies created potential for increase default activity, many borrowers extended out maturities. We are not anticipating a high level of bonds to reach maturity this year or next year. Many companies are expecting the Fed to be well into a rate-cut campaign before bond maturities spike. Default rates have been rising, but remain low.

The Credit Suisse Leveraged Loan Index (CSLL Index) returned 12.40% for the year ended March 31, 2024. A potential knock down effect of the elevated inflationary estimates seen in March is that the loan asset class is seeing increased investor interest. The loan asset class continues to perform exceptionally well in what may be a “higher for longer” rate environment. As measured by the four-year effective yield, the CSLL Index currently offers investors a yield of over 10% with a coupon of 9.24%—both of which remain supported by an elevated Secured Overnight Financing Rate (SOFR), a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Performance Summary and Portfolio Positioning

Past Performance is not a guarantee of future results. Fund investing involves risk. Principal loss is possible. Diversification does not assure a profit or protect against loss in a declining market. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

For the year ended March 31, 2024, Aristotle Floating Rate Income Fund – Class I-2 posted a return of 12.76%, outperforming its benchmark, the Credit Suisse Leveraged Loan Index (CSLLI), which posted a return of 12.40%.

With economic indicators consistently surpassing expectations and a renewed outlook for higher interest rates, the Fund was well positioned to capitalize on conditions during the reporting period. With approximately 90% of the Fund invested in floating rate loans, the impact of interest rates drifting higher has improved yields, without the expense of price erosion. The strong economic and technical environment facilitated material price appreciation, in addition to an already elevated coupon return. The Fund carried a coupon advantage over the index, contributing to its outperformance in this environment, which was achieved by maintaining an underweight position in lower spread BB-rated loans and favoring single B-rated and CCC-rated loans. Aware of the potential pressures on leveraged loan issuers, the Fund remained underweight to stressed loans priced below $90, thus providing a buffer against potential adverse economic scenarios. Additionally, we maintain an overweight to second lien loans, which underscores our conviction in their relative value.

The Fund’s underweight to loans BB-rated and above, as well as an overweight to second lien loans, contributed to performance. Security selection in Healthcare, Chemicals, and Utilities detracted from performance. An underweight to, and selection within, Media/Telecom contributed to performance. The Fund’s selection within higher priced loans above par ($100) also contributed to performance.

As of March 31, 2024, the Fund’s allocation was as follows: investment grade corporate bonds (56.6%), bank loans (7.7%), government bonds (4.2%) and asset-backed securities (28.9%). The Fund’s cash position was 2.6%.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Outlook

Loans continue to outperform in fixed income. Amidst the backdrop of a resilient U.S. economy, the market has dialed back its expectation for rate cuts this year – with consensus currently calling for two cuts in 2024 (compared to six at the start of the year). We believe the mantra of “higher for longer” provides a meaningful tailwind for loans, as investors can continue to clip an outsized coupon. Notably, we would highlight that the coupon of the CSLLI ended at 9.24% on March 31, 2024, well above its 30-year average of 6.06%.

By sector, we remain overweight financials, information technology and aerospace and defense, while being underweight media/telecom, chemicals and retail. We continue to favor financials (insurance brokers) and information technology (software) given their subscription-based business models, which provide strong revenue and cash flow visibility. We view these credits as more resilient in a downturn. We are underweight media/telecom due to secular concerns and chemicals due to the sector’s high degree of cyclicality. We remain underweight distressed CCC-rated loans, with our CCC exposure largely concentrated in performing second-lien loans.

Disclosures:

| • | The Bloomberg 1-3 Year U.S. Government/Credit Bond Index is a performance benchmark of U.S. investment-grade government and corporate bonds with maturities of one to three years. |

| • | The Bloomberg U.S. Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. |

| • | The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index measures the performance of high-yield bonds with a 2% maximum allocation to any one issuer. |

| • | The Credit Suisse Leveraged Loan Indexis designed to mirror the investable universe of the U.S. senior secure-credit (leveraged-loan) market. |

Results include the reinvestment of dividends and distributions. It is not possible to invest directly in these indices.

Opinions expressed herein are as of March 31, 2024, and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus. Additional information may be obtained by calling 844-ARISTTL (844-274-7885), or visiting www.aristotlefunds.com.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

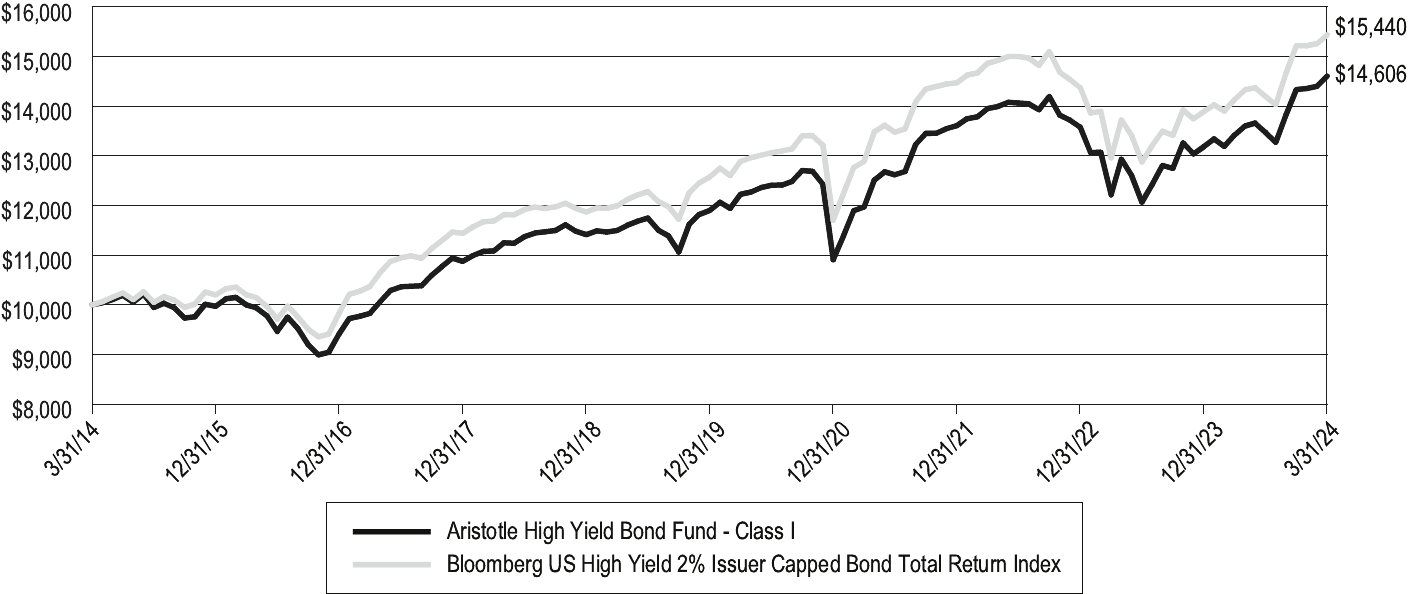

Aristotle High Yield Bond Fund

Growth of $10,000

The Fund performance shown in the chart above includes the performance of Pacific Funds High Income (the “Predecessor Fund”), a series of Pacific Funds Series Trust, as a result of a reorganization of the Predecessor Fund into the Fund on April 17, 2023. The Predecessor Fund was managed by the same portfolio management team using investment policies, objectives, guidelines and restrictions that were substantially similar to those of the Fund. The chart above assumes an initial gross investment of $10,000 made on March 31, 2014 into Class I Shares of the Predecessor Fund. The Fund’s performance figures in table below are for the periods ended March 31, 2024.

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month end may be obtained by calling 844-274-7885. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

The Fund’s gross expense ratios are 0.95%, 1.70%, 0.55%, and 0.65% for Class A, Class C, Class I, and I-2 as of the most recent prospectus dated October 19, 2023, as supplemented on April 1, 2024.

| | | | | | | | | | |

Aristotle High Yield Bond Fund - Class A(1) | | | 10.45% | | | 3.94% | | | 3.60% |

Aristotle High Yield Bond Fund - Class C(1) | | | 9.69% | | | 3.18% | | | 2.86% |

Aristotle High Yield Bond Fund - Class I(1) | | | 10.78% | | | 4.18% | | | 3.86% |

Aristotle High Yield Bond Fund - Class I-2(1) | | | 10.67% | | | 4.21% | | | 3.87% |

Bloomberg US High-Yield 2% Issuer Capped Bond Total Return Index | | | 11.15% | | | 4.19% | | | 4.44% |

| | | | | | | | | | |

(1)

| The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

Bloomberg US High-Yield 2% Issuer Capped Bond Total Return Index is an issuer-constrained version of the Bloomberg US Corporate High-Yield Bond Total Return Index that covers the U.S. dollar-denominated, high yield, fixed-rate corporate bond market and limits issuer exposures to a maximum of 2% and redistributes the excess market value index-wide on a pro-rata basis. Results include the reinvestment of all distributions.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Aristotle High Yield Bond Fund

Market Overview

After an impressive rally in late 2023, bond market performance was mixed in early 2024 as investors adjusted their expectations of interest rate cuts. The Federal Reserve (the Fed) dashed investor hopes of an early year rate cut as strong job growth continued, and inflation remained persistently above the Fed’s target of 2%. At both its January and March meetings the Federal Open Market Committee left the fed funds rate range unchanged at 5.25% to 5.50%, a 23-year high. The Fed’s Summary of Economic Projections (SEP) released In March Indicates three rate cuts in 2024. The recent inflation Consumer Price Index and Producer Price Index releases in March may temper both the expected start date of rate cuts as well as their magnitude. The SEP also forecast three cuts in both 2025 and 2026.

The total return for investment-grade bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, was 1.70% for the year ended March 31, 2024. While the picture is not perfect in all segments of credit markets, fundamentals remain in a largely positive position. Dispersion among sectors remains present, but overall we retain a favorable view of corporate fundamentals. Additionally, credit sectors performed relatively well in the short to intermediate sections of the curve versus longer-dated portions of the curve.

The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index returned 11.15% for the year. The high yield sector outperformed the investment-grade bond market over the period as investors favored the combination of attractive yields and credit exposure in a largely supportive economy. While elevated financing rates of high yield companies created potential for increase default activity, many borrowers extended out maturities. We are not anticipating a high level of bonds to reach maturity this year or next year. Many companies are expecting the Fed to be well into a rate-cut campaign before bond maturities spike. Default rates have been rising, but remain low.

The Credit Suisse Leveraged Loan Index (CSLL Index) returned 12.40% for the year ended March 31, 2024. A potential knock down effect of the elevated inflationary estimates seen in March is that the loan asset class is seeing increased investor interest. The loan asset class continues to perform exceptionally well in what may be a “higher for longer” rate environment. As measured by the four-year effective yield, the CSLL Index currently offers investors a yield of over 10% with a coupon of 9.24%—both of which remain supported by an elevated Secured Overnight Financing Rate (SOFR), a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Performance Summary and Portfolio Positioning

Past Performance is not a guarantee of future results. Fund investing involves risk. Principal loss is possible. Diversification does not assure a profit or protect against loss in a declining market. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

For the year ended March 31, 2024, Aristotle High Yield Bond Fund – Class I-2 posted a return of 10.67%, underperforming its benchmark, the Bloomberg U.S. High Yield 2% Issuer Capped Bond Index, which posted a return of 11.15%.

Increasingly optimistic market sentiment and continued economic resilience provided a backdrop for positive high yield performance during the reporting period. Credit selection was the primary contributor to the Fund’s relative underperformance versus the benchmark. Portfolio positioning included an above index option adjusted spread positioning. Contributing to this was a modest overweight to select CCC-rated credits. The overweight to CCC was beneficial as lower rated/higher spread credits outperformed. Strong balance sheet positioning continues to be a positive factor for the broad high yield asset class. However, industry and individual credit selection are becoming increasingly important as credit spreads have tightened and a slowdown in economic activity remains a possibility. We continue to find opportunities in sectors that benefit from broad secular themes such as infrastructure spending. There remains attractive relative value in floating rate bank loans and high yield collateralized loan obligation (CLO) debt securities, and we have largely maintained those exposures. Duration positioning was neutral to slightly shorter than benchmark throughout the reporting period.

Credit selection contributed to relative returns, most notably in the CCC-rated area. The Fund’s allocation to floating rate CLO debt securities and bank loans was also a positive return factor. Investment grade corporate bond exposure of approximately 5.7% detracted. On a sector basis, Capital Goods, Basic Industry and Electric Utilities were notable relative return contributors. Consumer Cyclicals, Technology and Finance companies were among sectors that detracted.

As of March 31, 2024, the Fund’s allocation was as follows: high yield bonds (80.4%), bank loans (6.6%), investment grade corporate bonds (4.8%) and CLO debt securities (5.6%). The ending cash position was 2.2%.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Outlook

The high-yield market rally that began in 2023 continued into the first quarter of 2024. Inflation and expectations for future inflation continued to fall as investors priced in significant Fed interest rate cuts. However, it remains unclear as to whether the economy – still flush with liquidity driven by unprecedented levels of fiscal stimulus created during the pandemic – will slow sufficiently to return inflation to the targeted 2% level. That said, the near- to intermediate-term economic outlook in the U.S. remains positive and resilient. While some consumers are showing early signs of slowing spending, economic growth coming from business investment led by $1 trillion in government stimulus targeting infrastructure, clean energy and critical industries such as semiconductor manufacturing are helping fuel growing business investment and strong labor markets.

The risks around a ballooning federal budget, the ever-evolving geopolitical backdrop in an election year in the U.S. and the feeling that an economic downturn has to occur at some point after several years of rampant growth, remain concerns we will be actively monitoring. However, borrower credit profiles are much stronger relative to previous cycles, thereby in our view improving the ability for the asset class to withstand an economic downturn aligned with a historically more normalized default rate. We believe this affords us a margin of safety in the event of more negative economic scenarios.

Disclosures:

| • | The Bloomberg U.S. Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. |

| • | The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index measures the performance of high-yield bonds with a 2% maximum allocation to any one issuer. |

| • | The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. senior secure-credit (leveraged-loan) market. |

Results include the reinvestment of dividends and distributions. It is not possible to invest directly in these indices.

Opinions expressed herein are as of March 31, 2024, and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus. Additional information may be obtained by calling 844-ARISTTL (844-274-7885), or visiting www.aristotlefunds.com.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

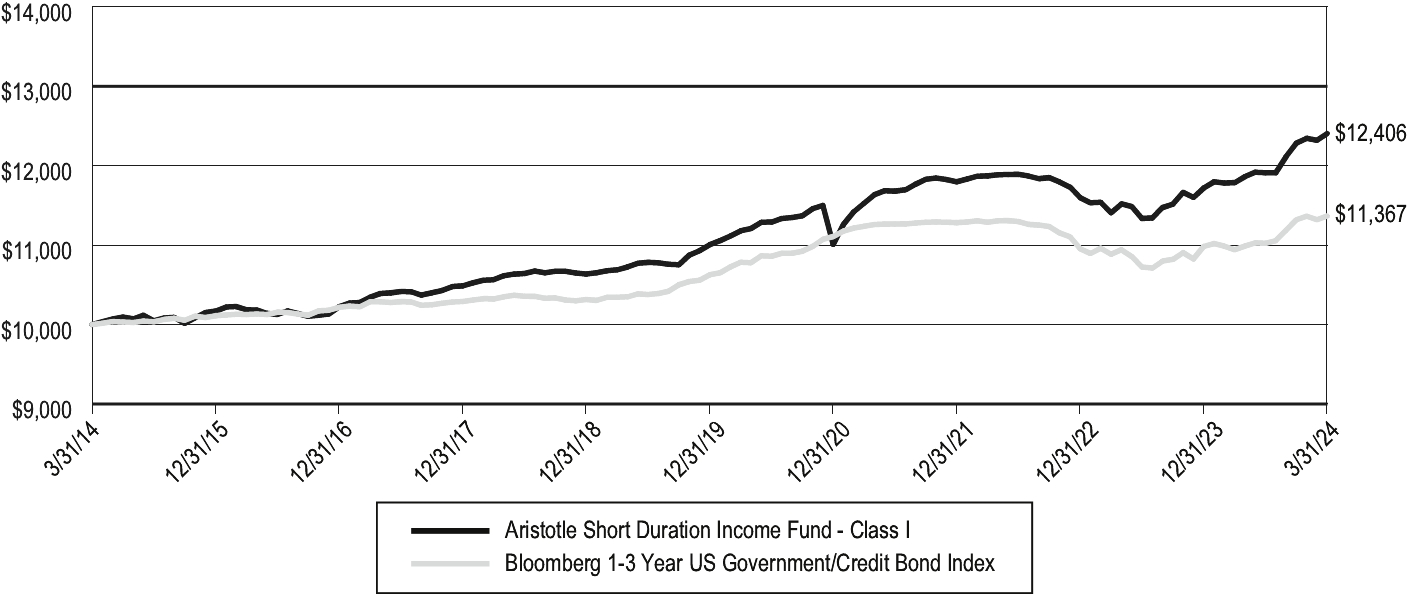

Aristotle Short Duration Income Fund

Growth of $10,000

The Fund performance shown in the chart above includes the performance of Pacific Funds Short Duration Income (the “Predecessor Fund”), a series of Pacific Funds Series Trust, as a result of a reorganization of the Predecessor Fund into the Fund on April 17, 2023. The Predecessor Fund was managed by the same portfolio management team using investment policies, objectives, guidelines and restrictions that were substantially similar to those of the Fund. The chart above assumes an initial gross investment of $10,000 made on March 31, 2014 into Class I Shares of the Predecessor Fund. The Fund’s performance figures in table below are for the periods ended March 31, 2024.

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month end may be obtained by calling 844-274-7885. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

The Fund’s gross expense ratios are 0.75%, 1.50%, 0.39%, and 0.49% for Class A, Class C, Class I, and I-2 as of the most recent prospectus dated October 19, 2023, as supplemented on April 1, 2024.

| | | | | | | | | | |

Aristotle Short Duration Income Fund - Class A(1) | | | 5.43% | | | 2.14% | | | 1.90% |

Aristotle Short Duration Income Fund - Class C(1) | | | 4.63% | | | 1.38% | | | 1.13% |

Aristotle Short Duration Income Fund - Class I(1) | | | 5.84% | | | 2.42% | | | 2.18% |

Aristotle Short Duration Income Fund - Class I-2(1) | | | 5.77% | | | 2.39% | | | 2.16% |

Bloomberg US 1-3 Year Government/Credit Bond Index | | | 3.49% | | | 1.36% | | | 1.29% |

| | | | | | | | | | |

(1)

| The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

Bloomberg US 1-3 Year Government/Credit Bond Index measures the performance of a subset of the Bloomberg US Aggregate Bond Index and includes investment grade U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities with maturities of one to three years. Results include the reinvestment of all distributions.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Aristotle Short Duration Income Fund

Market Overview

After an impressive rally in late 2023, bond market performance was mixed in early 2024 as investors adjusted their expectations of interest rate cuts. The Federal Reserve (the Fed) dashed investor hopes of an early year rate cut as strong job growth continued, and inflation remained persistently above the Fed’s target of 2%. At both its January and March meetings the Federal Open Market Committee left the fed funds rate range unchanged at 5.25% to 5.50%, a 23-year high. The Fed’s Summary of Economic Projections (SEP) released In March Indicates three rate cuts in 2024. The recent inflation Consumer Price Index and Producer Price Index releases in March may temper both the expected start date of rate cuts as well as their magnitude. The SEP also forecast three cuts in both 2025 and 2026.

Short-duration investment-grade bonds, as represented by the Bloomberg 1-3 Year U.S. Government/Credit Bond Index, returned 3.49% for the year ended March 31, 2024. The short end of the curve tended to fare better than the long end in early 2024, as hopes were dashed of a rate cut by the Fed. The Fed’s dot plot in March indicated three rate cuts, though some investors expect only one or two cuts following the strong jobs report in late March. This has allowed the front end of the curve to remain more attractively elevated than was anticipated to start the year.

The total return for investment-grade bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, was 1.70% for the year ended March 31, 2024. While the picture is not perfect in all segments of credit markets, fundamentals remain in a largely positive position. Dispersion among sectors remains present, but overall we retain a favorable view of corporate fundamentals. Additionally, credit sectors performed relatively well in the short to intermediate sections of the curve versus longer-dated portions of the curve.

The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index returned 11.15% for the year. The high yield sector outperformed the investment-grade bond market over the period as investors favored the combination of attractive yields and credit exposure in a largely supportive economy. While elevated financing rates of high yield companies created potential for increase default activity, many borrowers extended out maturities. We are not anticipating a high level of bonds to reach maturity this year or next year. Many companies are expecting the Fed to be well into a rate-cut campaign before bond maturities spike. Default rates have been rising, but remain low.

The Credit Suisse Leveraged Loan Index (CSLL Index) returned 12.40% for the year ended March 31, 2024. A potential knock down effect of the elevated inflationary estimates seen in March is that the loan asset class is seeing increased investor interest. The loan asset class continues to perform exceptionally well in what may be a “higher for longer” rate environment. As measured by the four-year effective yield, the CSLL Index currently offers investors a yield of over 10% with a coupon of 9.24%—both of which remain supported by an elevated Secured Overnight Financing Rate (SOFR), a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Performance Summary and Portfolio Positioning

Past Performance is not a guarantee of future results. Fund investing involves risk. Principal loss is possible. Diversification does not assure a profit or protect against loss in a declining market. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

For the year ended March 31, 2024, Aristotle Short Duration Income Fund – Class I-2 posted a return of 5.77%, outperforming its benchmark, the Bloomberg 1-3 Year U.S. Government/Credit Bond Index, which posted a return of 3.49%.

Within the Fund, credit outperformed government exposure over the quarter due to credit spread tightening and income advantage. While economic data coupled with supportive employment data remained in place, persistent and elevated inflation has led to expectations of interest rate policy remaining higher for longer. This change in outlook proved to be a positive for the Fund given its focus on the front end of the curve, shorter duration assets and floating rate exposures. Going forward, we expect the elevated yields in corporate credit to provide a buffer from anticipated rate and spread volatility that may occur.

On a total return basis by asset class, the Fund’s exposures to floating rate loans, asset-backed securities (ABS) and collateralized loan obligation (CLO) exposures were the most positive contributors to total return. U.S. government exposures detracted on a total return basis due to higher duration positioning, but the Fund’s overall underweight to U.S. government securities proved to be a positive for relative performance versus the benchmark. By credit quality, a barbell-like approach performed best over the reporting period with AAA-, BBB-, and B-rated exposures being the strongest contributors to return. Securitized assets (ABS/CLOs), Consumer Cyclicals and Capital Goods sectors contributed most to return.

As of March 31, 2024, the Fund’s allocation was as follows: investment-grade bonds (42.4%), ABS (23.6%), floating-rate loans (18.7%), government bonds (13.3%), and high-yield bonds (1.3%). The ending cash position was 0.7%.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Outlook

The economic back drop, especially in the U.S., remains to be a positive for Corporate fundamentals. While there remains to be dispersion across sectors (semis troughing, leisure cresting, and commercial real estate in freefall), overall corporate fundamentals are still solid. Many sectors are performing well, such as utilities, consumer staples, manufacturing, and travel-related industries, and we do not expect that to change in the near term. The U.S. consumer has been a stabilizing force despite tighter monetary policy.

However, one area we are becoming more concerned with is intentional leveraging. Management teams are more comfortable with growth outlooks and balance sheets. They are using the liquidity in the debt markets to repurchase shares, payout dividends, and acquisitions. This is a modest negative for fundamentals thus far and we continue to monitor. Also, we expect economic slowing going forward. The slowing will weigh on ratings, as well on those sectors already struggling (mostly in well-known areas such as property-related sectors).

Investment-grade corporate technical benefited from the move higher in interest rates over the course in early 2024. 10-year Treasury yields rose by over 30 basis points in the first quarter of 2024. This helped move Investment-grade corporate yields to 5.3% as of March 31, 2024. Retail flows into fixed income continued to be strong as a result. Institutional demand remained strong as clients were able to get another bite at higher back-end rates. While U.S. Government budget funding and higher near-term inflation could keep pressure on rates, we could see technical pressure in mortgage-backed securities (MBS) and Treasuries subside a bit with the Fed’s recalibration of their quantitative tightening (QT) efforts. A reduction in the roll-off of those securities could be another positive technical for broader fixed income.

Stable fundamentals and strong technicals continue to benefit corporate spreads. Corporate spreads are now within shouting distance (about 10 basis points) of the post Great Financial Crisis tights seen in 2021. All-in yields are still attractive at 5.3%, but spread cushion is less robust. Corporate yields and spreads are in the 90th and 8th percentiles over the past 10 years. While index level spreads are at the tighter end of their historical range, we continue to find attractive opportunities within certain sectors as well as at the individual corporate level.

We are finding value in industries that are seeing stability in the top line and/or cash flows, including lodging/leisure, airline related (AEETCs and aircraft lessors), utilities, U.S. global systemically important banks (G-SIBs), and food and beverage. Sectors we remain wary of include metals & mining, retail, office and retail REITS, regional banks, and chemicals. Merger and acquisition activity may pick up in 2024, especially in the tech and healthcare sectors. Those activities pose both risk and potential investment opportunities. Inflation, geopolitical conflicts, and the U.S. elections late this year all pose risks the market must contend with. Inflation has been resilient, which pushes potential Fed cuts further into the horizon. This leaves us favoring certain floating-rate asset classes (high-quality bank loans and senior CLOs) given the attractive spread/yield profiles, which help absorb rate volatility.

Disclosures:

| • | The Bloomberg 1-3 Year U.S. Government/Credit Bond Index is a performance benchmark of U.S. investment-grade government and corporate bonds with maturities of one to three years. |

| • | The Bloomberg U.S. Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. |

| • | The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index measures the performance of high-yield bonds with a 2% maximum allocation to any one issuer. |

| • | The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the U.S. senior secure-credit (leveraged-loan) market. |

Results include the reinvestment of dividends and distributions. It is not possible to invest directly in these indices.

Opinions expressed herein are as of March 31, 2024, and are subject to change at any time, are not guaranteed and should not be considered investment advice. This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus. Additional information may be obtained by calling 844-ARISTTL (844-274-7885), or visiting www.aristotlefunds.com.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

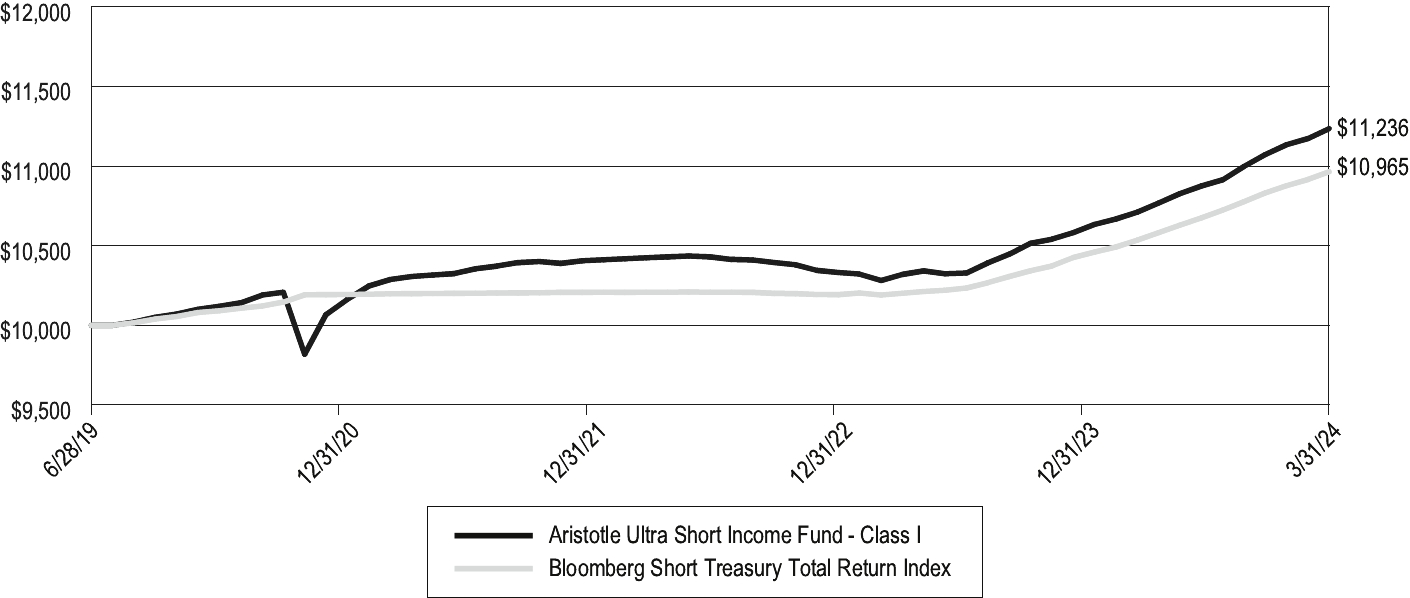

Aristotle Strategic Income Fund

Growth of $10,000

The Fund performance shown in the chart above includes the performance of Pacific Funds Strategic Income (the “Predecessor Fund”), a series of Pacific Funds Series Trust, as a result of a reorganization of the Predecessor Fund into the Fund on April 17, 2023. The Predecessor Fund was managed by the same portfolio management team using investment policies, objectives, guidelines and restrictions that were substantially similar to those of the Fund. The chart above assumes an initial gross investment of $10,000 made on March 31, 2014 into Class I Shares of the Predecessor Fund. The Fund’s performance figures in table below are for the periods ended March 31, 2024.

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month end may be obtained by calling 844-274-7885. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Performance figures for periods greater than one year are annualized.

The Fund’s gross expense ratios are 0.94%, 1.69%, 0.59%, and 0.69% for Class A, Class C, Class I, and I-2 as of the most recent prospectus dated October 19, 2023, as supplemented on April 1, 2024.

| | | | | | | | | | |

Aristotle Strategic Income Fund - Class A(1) | | | 8.33% | | | 4.10% | | | 3.60% |

Aristotle Strategic Income Fund - Class C(1) | | | 7.43% | | | 3.35% | | | 2.85% |

Aristotle Strategic Income Fund - Class I(1) | | | 8.49% | | | 4.40% | | | 3.90% |

Aristotle Strategic Income Fund - Class I-2(1) | | | 8.46% | | | 4.36% | | | 3.86% |

Bloomberg US Aggregate Bond Index | | | 1.70% | | | 0.36% | | | 1.54% |

| | | | | | | | | | |

(1)

| The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

Bloomberg US Aggregate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, which includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. Results include the reinvestment of all distributions.

Back to Table of Contents

Aristotle Funds Series Trust

Fund Performance

March 31, 2024 (Unaudited) (Continued)

Aristotle Strategic Income Fund

Market Overview

After an impressive rally in late 2023, bond market performance was mixed in early 2024 as investors adjusted their expectations of interest rate cuts. The Federal Reserve (the Fed) dashed investor hopes of an early year rate cut as strong job growth continued and inflation remained persistently above the Fed’s target of 2%. At both its January and March meetings, the Federal Open Market Committee left the fed funds rate range unchanged at 5.25% to 5.50%, a 23-year high. The Fed’s Summary of Economic Projections (SEP) released In March Indicates three rate cuts in 2024. The recent inflation Consumer Price Index and Producer Price Index releases in March may temper both the expected start date of rate cuts as well as their magnitude. The SEP also forecast three cuts in both 2025 and 2026.

The total return for investment-grade bonds, as represented by the Bloomberg U.S. Aggregate Bond Index, was 1.70% for the year ended March 31, 2024. While the picture is not perfect in all segments of credit markets, fundamentals remain in a largely positive position. Dispersion among sectors remains present, but overall we retain a favorable view of corporate fundamentals. Additionally, credit sectors performed relatively well in the short to intermediate sections of the curve versus longer-dated portions of the curve.

The Bloomberg U.S. High Yield 2% Issuer Capped Bond Index returned 11.15% for the year. The high yield sector outperformed the investment-grade bond market over the period as investors favored the combination of attractive yields and credit exposure in a largely supportive economy. While elevated financing rates of high yield companies created potential for increase default activity, many borrowers extended out maturities. We are not anticipating a high level of bonds to reach maturity this year or next year. Many companies are expecting the Fed to be well into a rate-cut campaign before bond maturities spike. Default rates have been rising, but remain low.

The Credit Suisse Leveraged Loan Index (CSLL Index) returned 12.40% for the year ended March 31, 2024. A potential knock down effect of the elevated inflationary estimates seen in March is that the loan asset class is seeing increased investor interest. The loan asset class continues to perform exceptionally well in what may be a “higher for longer” rate environment. As measured by the four-year effective yield, the CSLL Index currently offers investors a yield of over 10% with a coupon of 9.24%—both of which remain supported by an elevated Secured Overnight Financing Rate (SOFR), a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Performance Summary and Portfolio Positioning

Past Performance is not a guarantee of future results. Fund investing involves risk. Principal loss is possible. Diversification does not assure a profit or protect against loss in a declining market. The investment return and principal value of an investment in the Fund will fluctuate, so that an investor’s shares in the Fund, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

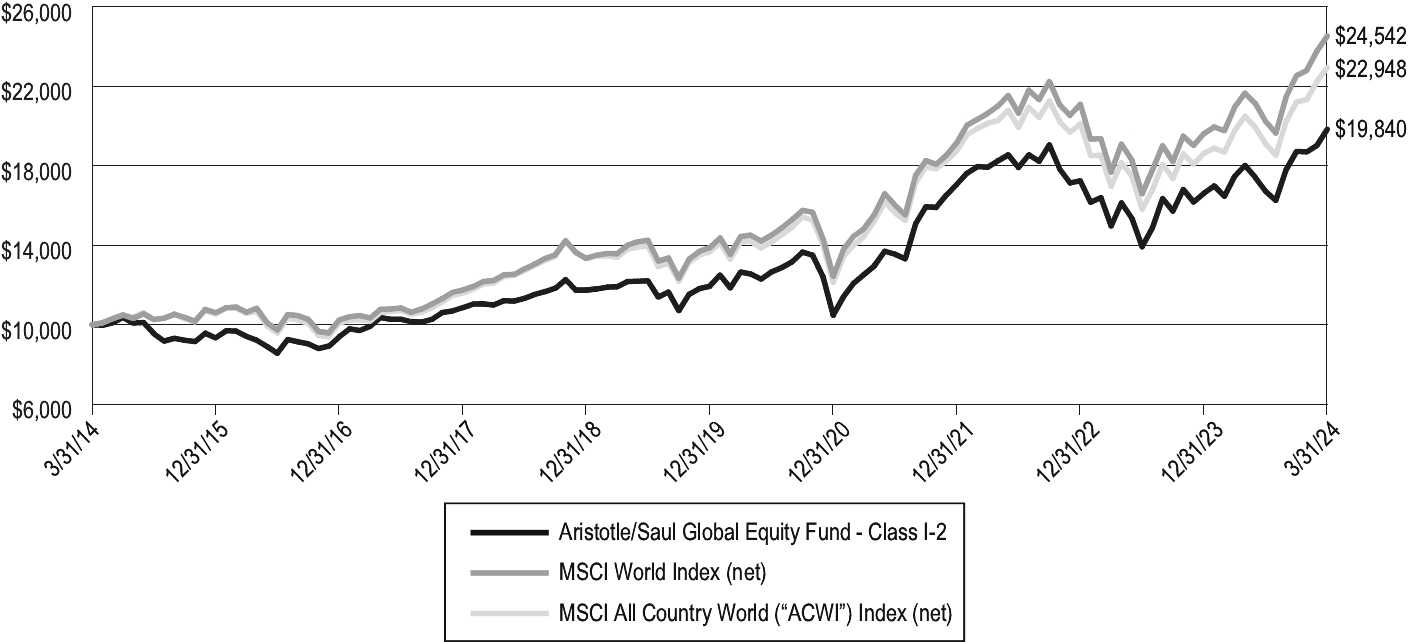

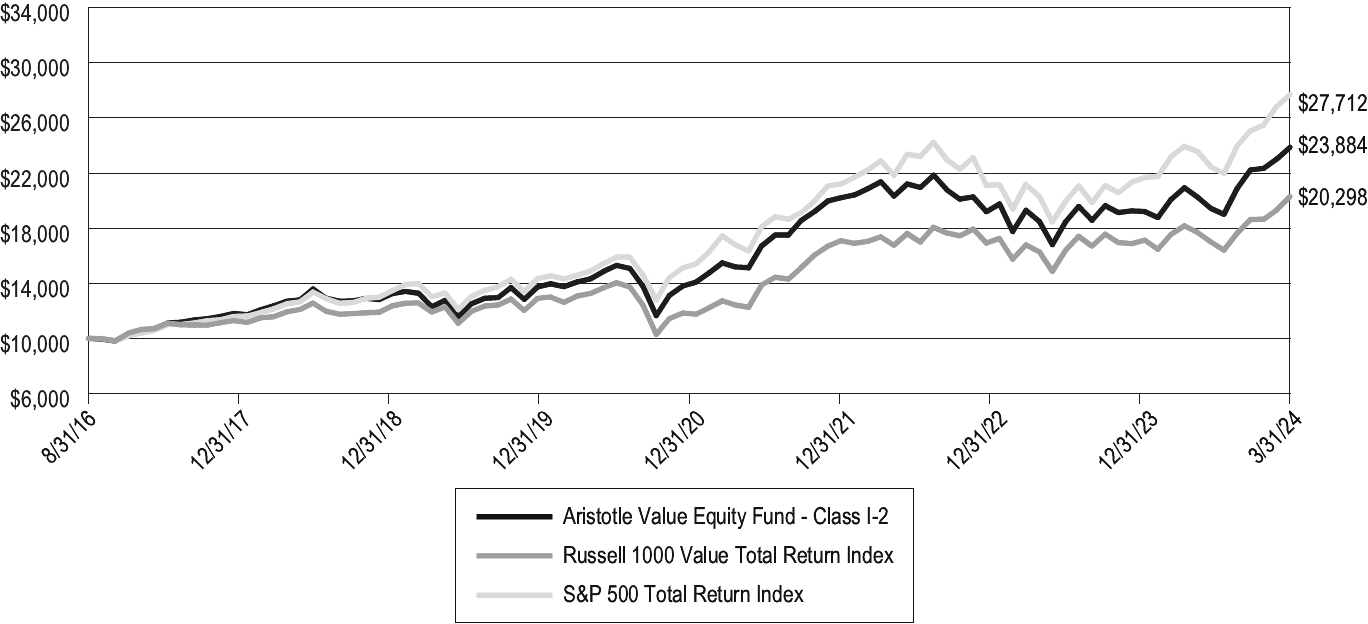

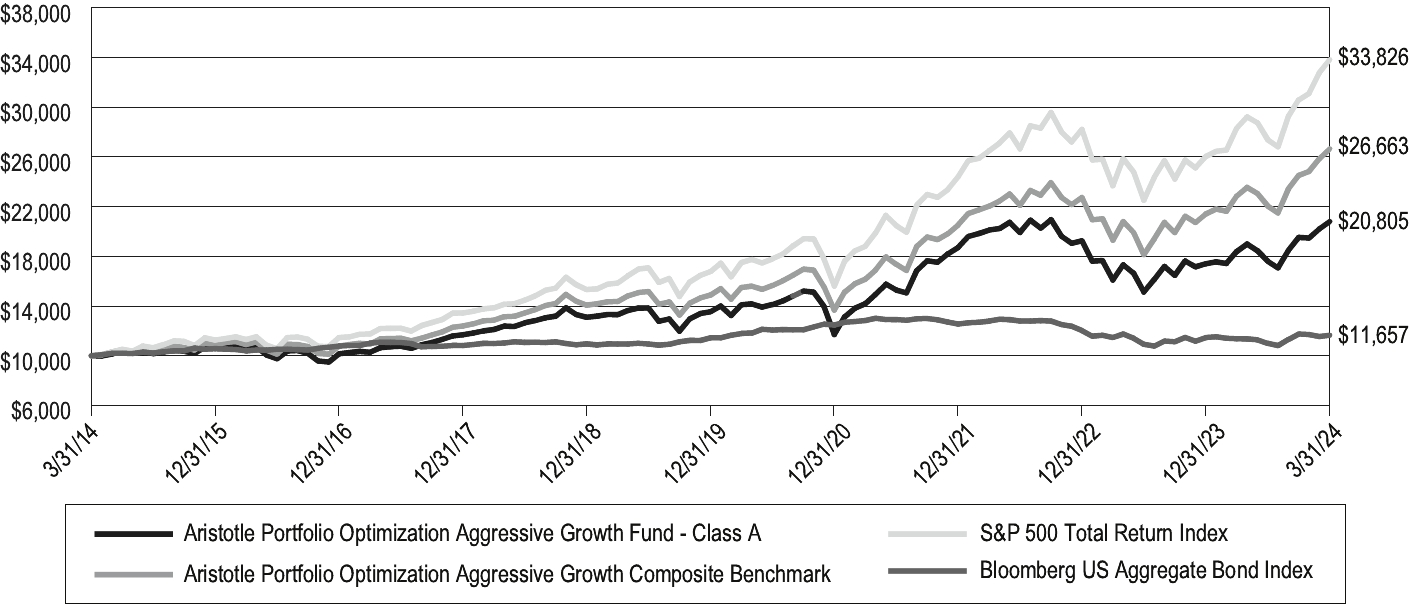

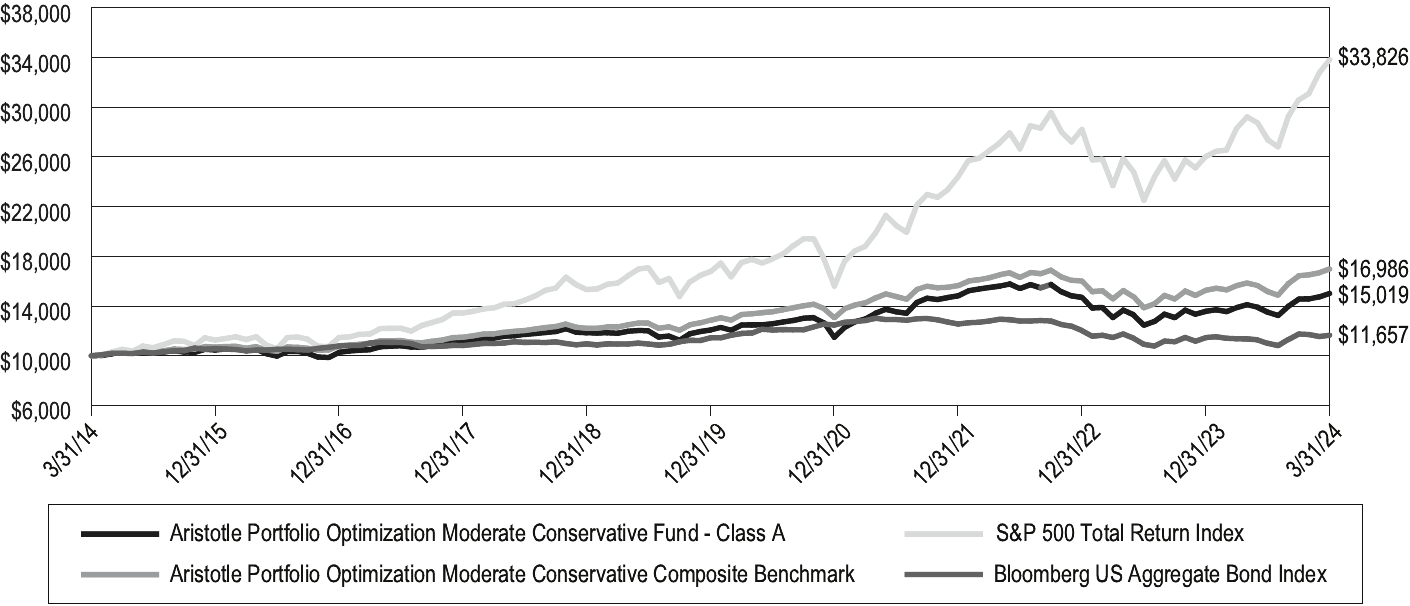

For the year ended March 31, 2024, Aristotle Strategic Income Fund – Class I-2 posted a return of 8.46%, outperforming its benchmark, the Bloomberg U.S. Aggregate Bond Index, which posted a return of 1.70%.