THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (“SEC”) DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THIS INVESTMENT INVOLVES A DEGREE OF RISK THAT MAY NOT BE SUITABLE FOR ALL PERSONS. ONLY THOSE INVESTORS WHO CAN BEAR THE LOSS OF A SIGNIFICANT PORTION OF THEIR INVESTMENT SHOULD PARTICIPATE IN THE INVESTMENT. (SEE “RISK FACTORS” BELOW.)

Offering Circular

For

Starpax Biopharma Inc.

A Canadian Corporation

February 8, 2023

SECURITIES OFFERED : Equity in the form of 4,000,000 Common Shares

PRICE PER SHARE : $6.25 per Common Share

MAXIMUM OFFERING AMOUNT : $25,000,000.00

MINIMUM OFFERING AMOUNT : Not Applicable (No Minimum Offering Amount)

MINIMUM INVESTMENT : $500.00

CONTACT INFORMATION :

2500-1000 boul. René-Lévesque West

Montréal, Québec, Canada H3B 5C9

PHONE (514) 427-3004

Starpaxbiopharma.com

(Please request President and CEO, Michael Gareau)

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than ten (10%) percent of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, Investors are encouraged to review rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, Investors are encouraged to refer to www.investor.gov.

Starpax Biopharma Inc. (the “Company” or the “Issuer”), a biopharmaceutical research and development company, has conceived an unprecedented platform technology intended to treat cancer using its living self-propelled Starpax Magnetodrones that are sensitive to magnetic fields and transport anticancer drugs attached to their surface. The Magnetodrones are injected directly into the tumor. The trajectory is controlled by the Starpax PolarTrak that generates precision 3D guidance monopole magnetic field vectors in order to keep them captive in a tumor and force them to spread and release the anticancer drug throughout the volume of the tumor without circulating in the blood system, avoiding side effects usually resulting from systemic cancer treatments.

The Company was founded as Starpax Medical Inc. on December 19, 2017, under the laws of Québec, Canada. The Company changed its name to Starpax Biopharma Inc. on June 9, 2022 (See Exhibit 2A “Articles of Consolidation and Other Corporate Documents”).

The Company is run by a board of directors, comprised of seven (7) directors (the “Board” collectively, “Director” when referring to a director). The day-to-day management of the Company is vested in the officers of the Company (the “Officers”). The Board of Directors oversees the corporate conduct and represents the interests of the Company’s shareholders. It provides guidance and advice to the CEO and the executive team.

The share capital of the Company is made up of an unlimited number of common shares (the “Common Shares” or the “Shares”). The minimum investment amount per Investor is Five Hundred Dollars ($500.00), representing 80 Common Shares at Six Dollars and Twenty-Five Cents ($6.25) per Share.

Sales of the Shares pursuant to the Offering will commence immediately upon qualification of the Offering by the Securities and Exchange Commission (the “Effective Date”) and will terminate at the discretion of the Board or twelve (12) months following the Effective Date, whichever is earlier. The maximum amount of the Offering shall not exceed Twenty-Five Million Dollars ($25,000,000) in any twelve (12) month period (“Maximum Offering Amount”) in accordance with Tier II of Regulation A as set forth under the Securities Act of 1933, as amended, (“Reg A Tier II” or “Tier II”). The Company intends to offer the Shares described herein on a continuous and ongoing basis pursuant to Rule 251(d)(3)(i)(F). Further, the acceptance of Investor subscriptions, may be briefly paused at times to allow the Company to effectively and accurately process and settle subscriptions that have been received. (See “Summary of the Offering” below.) The Company may increase the Maximum Offering Amount at its sole and absolute discretion, subject to qualification by the SEC of a post-qualification amendment.

Prior to this Offering, there has been no public market for the Shares, and none is expected to develop for the foreseeable future, however, the Company reserves the right to list the Shares on an exchange in the future. The Offering price does not bear any relationship to the value of the assets of the Company. Investing in the Company through the purchase of Shares involves risks, some of which are set forth below. See the section titled “Risk Factors” to read about the factors an Investor should consider prior to purchasing Shares.

Investors who purchase Shares will become shareholders of the Company (“Investors” or “Shareholders” subject to the terms of the Articles of Consolidation and the Bylaws of the Company (see Exhibit 2A Articles of Consolidation and Other Corporate Documents” and Exhibit 2B “Bylaws”) once the Company deposits the Investor’s investment into the Company’s main

operating account and the Investor is properly registered in the share register held on its behalf by its registrar and transfer agent.

The Directors and Officers will receive compensation from the Company (see “Risk Factors” below starting on Page 4, and “Compensation of Directors and Officers” below). Investing in the Shares is speculative and involves substantial risks, including the risk of complete loss. Prospective Investors should purchase these securities only if they can afford a complete loss of their investment (see “Risk Factors” below).

As of the date of this Offering Circular, the Company has engaged KoreConX as registrar and transfer agent in relation to this Offering. The Company has engaged North Capital as escrow agent for this Offering.

NO PERSON HAS BEEN AUTHORIZED IN CONNECTION WITH THIS OFFERING TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THAT INFORMATION AND THOSE REPRESENTATIONS SPECIFICALLY CONTAINED IN THIS OFFERING CIRCULAR; ANY OTHER INFORMATION OR REPRESENTATIONS SHOULD NOT BE RELIED UPON. ANY PROSPECTIVE PURCHASER OF THE SECURITIES WHO RECEIVES ANY OTHER INFORMATION OR REPRESENTATIONS SHOULD CONTACT THE COMPANY IMMEDIATELY TO DETERMINE THE ACCURACY OF SUCH INFORMATION AND REPRESENTATIONS. NEITHER THE DELIVERY OF THIS OFFERING CIRCULAR NOR ANY SALES HEREUNDER SHALL, UNDER ANY CIRCUMSTANCES, CREATE AN IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY OR IN THE INFORMATION SET FORTH HEREIN SINCE THE DATE OF THIS OFFERING CIRCULAR SET FORTH ABOVE.

THE INFORMATION CONTAINED IN THIS OFFERING CIRCULAR HAS BEEN SUPPLIED BY THE COMPANY. THIS OFFERING CIRCULAR CONTAINS SUMMARIES OF DOCUMENTS NOT CONTAINED IN THIS OFFERING CIRCULAR, BUT ALL SUCH SUMMARIES ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCES TO THE ACTUAL DOCUMENTS. COPIES OF DOCUMENTS REFERRED TO IN THIS OFFERING CIRCULAR, BUT NOT INCLUDED AS AN EXHIBIT, WILL BE MADE AVAILABLE TO QUALIFIED PROSPECTIVE INVESTORS UPON REQUEST.

RULE 251(D)(3)(I)(F) DISCLOSURE. RULE 251(D)(3)(I)(F) PERMITS REGULATION A OFFERINGS TO CONDUCT ONGOING CONTINUOUS OFFERINGS OF SECURITIES FOR MORE THAN THIRTY (30) DAYS AFTER THE QUALIFICATION DATE IF: (1) THE OFFERING WILL COMMENCE WITHIN TWO (2) DAYS AFTER THE QUALIFICATION DATE; (2) THE OFFERING WILL BE MADE ON A CONTINUOUS AND ONGOING BASIS FOR A PERIOD THAT MAY BE IN EXCESS OF THIRTY (30) DAYS OF THE INITIAL QUALIFICATION DATE; (3) THE OFFERING WILL BE IN AN AMOUNT THAT, AT THE TIME THE OFFERING CIRCULAR IS QUALIFIED, IS REASONABLY EXPECTED TO BE OFFERED AND SOLD WITHIN ONE (1) YEAR FROM THE INITIAL QUALIFICATION DATE; AND (4) THE SECURITIES MAY BE OFFERED AND SOLD ONLY IF NOT MORE THAN THREE (3) YEARS HAVE ELAPSED SINCE THE INITIAL QUALIFICATION DATE OF THE OFFERING, UNLESS A NEW OFFERING CIRCULAR IS SUBMITTED AND FILED BY THE COMPANY PURSUANT TO RULE 251(D)(3)(I)(F) WITH THE SEC COVERING THE REMAINING SECURITIES OFFERED UNDER THE PREVIOUS OFFERING; THEN THE SECURITIES MAY CONTINUE TO BE OFFERED AND SOLD UNTIL THE EARLIER OF THE QUALIFICATION DATE OF THE NEW OFFERING CIRCULAR OR THE ONE HUNDRED EIGHTY (180) CALENDAR DAYS AFTER THE THIRD ANNIVERSARY OF THE INITIAL QUALIFICATION DATE OF THE PRIOR OFFERING CIRCULAR. THE COMPANY INTENDS TO OFFER THE SHARES DESCRIBED HEREIN ON A CONTINUOUS AND ONGOING BASIS PURSUANT TO RULE 251(D)(3)(I)(F). THE COMPANY INTENDS TO COMMENCE THE OFFERING IMMEDIATELY AND NO LATER THAN TWO (2) DAYS FROM THE INITIAL QUALIFICATION DATE. THE COMPANY REASONABLY EXPECTS TO OFFER AND SELL THE SECURITIES STATED IN THIS OFFERING CIRCULAR WITHIN ONE (1) YEAR FROM THE INITIAL QUALIFICATION DATE.

There are no selling shareholders within this Offering.

The Company will commence sales of the Shares immediately upon qualification of the Offering by the SEC. The Company approximates that sales will commence during Q1 – 2023.

| | | Price to Public* | | Commissions** | | Proceeds to Other Persons | | Proceeds to the Company |

| Amount to be Raised per Share | | $ | 6.25 | | | $ | 0.1875 | | | $ | 0.00 | | | $ | 6.0625 | |

Minimum Investment

Amount | | $ | 500.00 | | | $ | 15.00 | | | $ | 0.00 | | | $ | 485.00 | |

| Minimum Offering Amount | | | Not Applicable | | | | Not Applicable | | | | Not Applicable | | | | Not Applicable | |

| Maximum Offering Amount | | $ | 25,000,000 | | | $ | 750,000 | | | $ | 0.00 | | | $ | 24,250,000 | |

*The Board of Directors and management set the Share price based on public market data, Company forecasts, valuation of comparable pre-revenue pharmaceutical companies in preclinical stage, consultations with experts, as well as the price per Share of recent private offerings from the Company.

** The Company is not using an underwriter for the sale of Shares. These commissions listed are those for Justly Markets, a FINRA broker-dealer. Justly Markets is entitled to 1% on all passive sales of securities as placement agent. If securities are sold through the efforts of Justly Markets, 5% will be due to Justly Markets (instead of 1%) up to a maximum of $500,000– for potential maximum commissions of $750,000. The commissions due to Justly Markets are conditional on the services provided by Justly Markets with respect to any one sale. See “Plan of Distribution” below.

FORWARD LOOKING STATEMENTS

Investors should not rely on forward-looking statements in this Offering Circular because they are inherently uncertain. This Offering Circular contains forward-looking statements that involve risks and uncertainties. The use of words such as “anticipated”, “projected”, “forecasted”, “estimated”, “prospective”, “believes”, “expects,” “plans”, “future”, “intends”, “by design”, “designed”, “should”, “can”, “could”, “might”, “potential”, “continue”, “may”, “will”, and similar expressions identify these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which may apply only as of the date of this Offering Circular, and the Company undertakes no obligation to publicly update or revise any forward-looking information, other than as required by applicable law.

TABLE OF CONTENTS

SUMMARY OF THE OFFERING

The following information is only a brief summary of, and is qualified in its entirety by, the detailed information appearing elsewhere in this Offering Circular. This Offering Circular, together with the exhibits attached including, but not limited to, the Amended Articles of Incorporation and Company Bylaws, copies of which are attached hereto as Exhibit 2A and Exhibit 2B, respectively, and should be carefully read in their entirety before any investment decision is made. If there is a conflict between the terms contained in this Offering Circular and these documents, Amended Articles of Incorporation and Bylaws shall prevail and control, and no Investor should rely on any reference herein to the Amended Articles of Incorporation or Bylaws without consulting the actual underlying documents.

| COMPANY INFORMATION | | Starpax Biopharma Inc. has a principal place of business located at 6615 Abrams Street,

Montréal, Québec, Canada H4S 1V9. |

| MANAGEMENT | | The Company is managed by a Board of Directors. The Board is comprised of seven (7) Directors. The Company has five (5) Officers who manage the day-to-day operations. See “Risk Factors” and “Directors, Officers, and Significant Employees” below. |

| THE OFFERING | | This Offering is the first capital raise by the Issuer under Regulation A. The Company is selling Company equity in the form of Common Shares through this Offering. The Company will use the Proceeds of this Offering to execute Phase I and Phase II clinical trials regarding the Starpax Technology. See “Use of Proceeds” below. |

| SECURITIES BEING OFFERED | | The Shares are being offered at a purchase price of $6.25 per Share. The Minimum Investment Amount for any Investor is $500.00. Upon purchase of the Shares and becoming a Shareholder of the Company, a Shareholder is granted the right to vote, receive all dividends declared, and share the remaining property of the Company upon its liquidation. See “Description of the Securities” below. |

| COMPENSATION TO DIRECTORS | | The Company compensates the Directors and Officers with salaries and/or stock options for their roles as Directors and Officers. For more information on this compensation see “Compensation of the Director and Officers” section below. The Directors, Officers, and employees of the Company will not be compensated through commissions for the sale of the Shares through this Offering. |

| PRIOR EXPERIENCE OF COMPANY MANAGEMENT | | The Company is overseen by a seven-person, highly experienced Board of Directors, which includes three retired presidents of divisions of large pharmaceutical companies (Johnson & Johnson France, Pfizer Canada, Eli Lilly Canada), a retired managing director and chief operating officer of J.P. Morgan, EMEA Investment Bank (London, UK), and the former president and managing director of a high-performing private equity fund. |

| INVESTOR SUITABILITY STANDARDS | | The Shares will not be sold to any person unless they are a “Qualified Purchaser”. A Qualified Purchaser includes: (1) an “Accredited Investor” as that term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act of 1933 (the “Securities Act”); or (2) all other Investors who meet the investment limitations set forth in Rule 251(d)(2)(i)(C) of Regulation A. Such persons as stated in (2) above must conform with the “Limitations on Investment Amount” as described in this Summary below. Each person acquiring Shares may be required to represent that he, she, or it is purchasing the Shares for his, her, or its own account for investment purposes and not with a view to resell or distribute the securities.

Each prospective purchaser of Shares may be required to furnish such information or certification as the Company may require in order to determine whether any person or entity purchasing Shares is an Accredited Investor if such is claimed by the Investor. |

| LIMITATIONS ON INVESTMENT AMOUNT | | For Qualified Purchasers who are Accredited Investors, there is no limitation as to the amount invested through the purchase of Shares. For non-Accredited Investors, the aggregate purchase price paid to the Company for the purchase of the Shares cannot be more than 10% of the greater of the purchaser’s (1) annual income or net worth as determined under Rule 501(a) of Regulation D, if purchaser is a natural person; or (2) revenue or net assets for the purchaser’s most recently completed fiscal year if purchaser is a non- natural person. Different rules apply to Accredited Investors and non-natural persons. Each Investor should review Rule 251(d)(2)(i)(C) of Regulation A as determined under Rule 501(a) of Regulation D before purchasing the Shares. |

| NON-FOREIGN SALES OF SECURITIES | | The Company will only sell the Shares offered through this Offering to United States investors. |

| COMMISSIONS FOR SELLING SHARES | | The Shares will be offered and sold directly by the Company, the Board, the Officers, and Company’s employees. No commissions for selling the Shares will be paid to the Company, the Board, the Officers, or the Company’s employees. The Company is not using an underwriter for the sale of Shares. These commissions listed are those for Justly Markets, a FINRA broker- dealer. Justly Markets is entitled to 1% on all passive sales of securities as placement agent. If securities are sold through the efforts of Justly Markets, 5% will be due to Justly Markets (instead of 1%) up to a maximum of$500,000 – for potential maximum commissions of $750,000. The commissions due to Justly Markets are conditional on the services provided by Justly Markets with respect to any one sale. See “Plan of Distribution” below. |

| NO LIQUIDITY | | The Company does not currently have plans to list any Shares on any securities market or exchange, however, the Company reserves the right to list the Shares on an exchange in the future. Additionally, the Shares will be transferable, in accordance with Federal and state securities laws, and Canadian law. However, the Shares will not be listed for trading on any exchange or automated quotation system. (See “Description of the Securities” below.) Prospective Investors are urged to consult their own legal advisors with respect to secondary trading of the Shares. See “Risk Factors” below. |

| COMPANY EXPENSES | | Except as otherwise provided herein, the Company shall bear all costs and expenses associated with the Offering, the operation of the Company, including, but not limited to, the annual preparation of the Company's tax returns, any state and federal income tax due, accounting fees, filing fees, independent audit reports, other costs and expenses, and other advisory fees. |

The Company currently develops several technologies, the purposes of which are to treat cancers in humans.

Defined terms used in this Offering Circular:

The Starpax cancer treatment technology consists of two major elements that cannot be dissociated:

1) The first element consists of living self-moving Magnetodrones sensitive to magnetic fields swimming in the tumor without circulating in the blood system and transporting the therapeutic anticancer agent attached to their surface. The Magnetodrones are injected directly into the tumor. This element will be referred to throughout this Offering Circular as “Magnetodrones” without notification to the reader that Magnetodrones is a trademark of the Company by use of the “TM” symbol.

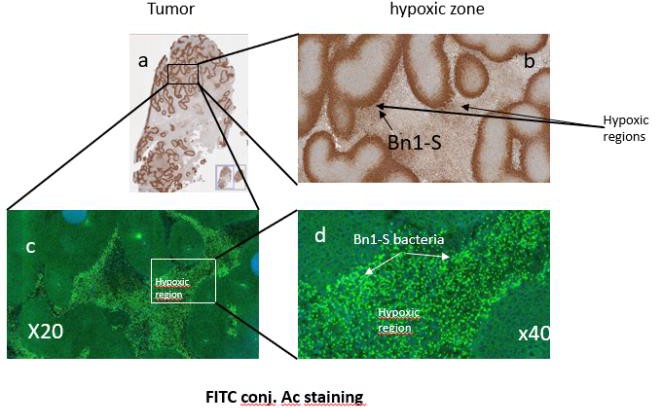

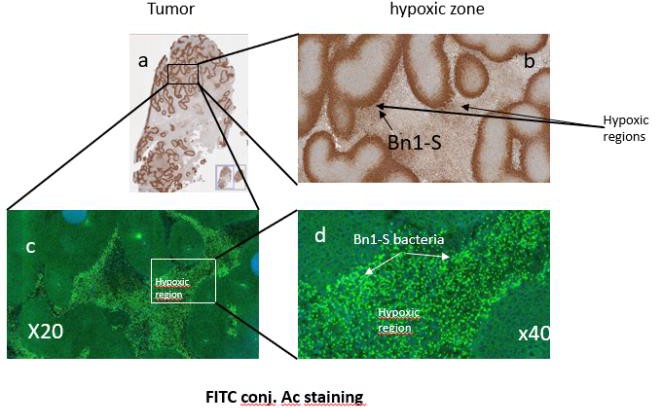

2) The second element is a medical device in which the patient is installed (the Starpax PolarTrak) that generates precision 3D guidance monopole magnetic field vectors in order to keep the Magnetodrones captive inside the tumor in order for the Magnetodrones not to escape to the rest of the body and forces them to distribute in three dimensions throughout the tumor volume including hypoxic zones where the stem cells are located. This element will be referred to throughout this Offering Circular as “PolarTrak” without notification to the reader that PolarTrak is a trademark of the Company by use of the “TM” symbol.

This Offering Circular will refer to “anti-cancer drug”, therapeutic agent”, “drug”, “therapeutic anti-cancer drug”, or some derivation or combination of these terms to mean the pharmaceutical attached to the Magnetodrones whose sole purpose is to kill the cancerous cells in a tumor.

“Starpax Dose” refers to the dose given to patients containing the Magnetodrones already combined with a therapeutic agent.

“GMP” refers to Good Manufacturing Practices. GMP are a set of regulations set by the relevant authorities, in this case Health Canada and/or the FDA, that regulate manufacturers, packagers, labelers, testers, distributors, importers, wholesalers of drugs. These regulations dictate the standards and processes required for facilities that handle drugs in this way. The Company and its facilities are currently regulated by GMP.

“NDA refers to a New Drug Application with the Food and Drug Administration.

“IND” refers to an Investigational New Device with the Food and Drug Administration.

“BLA” refers to Biologics License Applications and the associated process with the Food and Drug Administration.

“CDER” refers to Center for Drug Evaluation and Research at the Food and Drug Administration.

“PMA” refers to the Premarket Approval which is the FDA process of scientific and regulatory review to evaluate the safety and effectiveness of Class III medical devices

“De Novo” refers to De Novo request to the FDA providing a marketing pathway to classify novel medical devices for which general controls alone, or general and special controls, provide reasonable assurance of safety and effectiveness for the intended use, but for which there is no legally marketed predicate device.

“510k” refers to the 510(k) process with the FDA which is a premarket submission made to FDA to demonstrate that the device to be marketed is as safe and effective, that is, substantially equivalent, to a legally marketed device (section 513(i)(1)(A) FD&C Act) that is not subject to premarket approval.

“product candidate(s)” refers to the Company products that have applications with the Food and Drug Administration, which require clinical trials for ultimate approval or clearance by the Food and Drug Administration. Current product candidates of the Company include the Magnetodrones combined with SN38. See below.

“Starpax Care Center(s)” or “Starpax Cancer Center(s)” refers to the Company-owned centers where the Starpax Treatments will be administered.

“3D” refers to three dimensions in space.

Collectively, the Magnetodrones and PolarTrak, and other associated technologies will be referred to as the “Starpax Technology” or “Technology.”

“Starpax Treatment” and “Starpax Cancer Treatment” – refers to the utilization of the Starpax Technology, including the Magnetodrones and PolarTrak to treat cancers in humans. These terms may be used to refer to a single treatment or the collective treatments over a given time period.

On January 19, 2023, the Company amended its Articles of Incorporation to consolidate Class A and B Common Shares into a single class of common stock. Throughout this document, any reference to “Class A Common Shares” or “Class B Common Shares” is referring to shares of the Company’s common stock prior to January 19, 2023. “Common Shares” or the “Shares” will refer to the Shares of common stock after January 19, 2023, as being offered through this Offering.

All results, assertions, deductions, technical, and/or scientific or medical forward-looking claims by Starpax in this document are based either on independent 3rd party preclinical work conducted at reputable Canadian 1st-tier research institutions, good laboratory practice (“GLP”) certified labs, clinical research organization, papers from the scientific literature or by design intended use of the technology on humans.

The Starpax Technology is currently an investigational product and is not yet approved for commercial use.

RISK FACTORS

IN INVESTING IN STARPAX, INVESTORS FACE RISKS THAT ARE SIMILAR TO ANY OTHER INVESTMENT IN A BIOPHARMACEUTICAL, BIOTHECHNOLOGY, OR ANY OTHER KIND OF MANUFACTURING COMPANIES. THE RISK FACTORS LISTED IN THIS SECTION MAY NOT BE EXHAUSTIVE AS MANY RISKS MAY STILL BE UNKNOWN AS OF THE DATE OF THIS OFFERING CIRCULAR. THE COMPANY MAKES NO REPRESENTATION AS TO THE RELEVANCY OR COMPLETENESS OF THESE RISK FACTORS AND INVESTORS SHOULD CONSULT WITH INVESTOR’S LEGAL, ACCOUNTING, AND OTHER ADVISORS WHEN MAKING AN INVESTMENT DECISION.

The Company may continue to be impacted by the COVID-19 pandemic.

As a result of the pandemic, the Company has at times experienced delays in reception of manufacturing equipment, shortage of qualified workers, reduced access to essential workers at expected clinical sites and costs increases for raw material, wages or other purchases. The Company might be affected by shortages of raw materials, parts and other supplies and there can be no assurance that the Company will be able to avoid supply chain shortages in the future. The risk exists that further COVID-19 developments may negatively impact operations if the Company should suffer supply chain shortages, absenteeism of workers or facility shutdowns due to the pandemic or clinical site and external laboratories access restrictions. Governmental restrictions, including travel restrictions, quarantines, shelter-in-place orders, business closures, new safety requirements or regulations, or restrictions on the import or export of certain materials, or other operational issues related to the COVID-19 pandemic may have an adverse effect on business and results of operations. The evolving nature of the circumstances is such that it is impossible, at this stage, to determine the full and overall impact the COVID-19 pandemic may have, but it could further disrupt production and cause delays in the supply and delivery of investigational products used in clinical trials, adversely affect employees and disrupt operations and manufacturing activities, interrupt clinical trials, all of which may have a material adverse effect on business. The Company has ascertained that certain risks associated with further COVID-19 developments may adversely impact operations and liquidity, and business and share price may also be affected by the COVID-19 pandemic. Due to the general unknown nature surrounding the pandemic, the Company cannot reasonably estimate the potential for any future impacts on operations or liquidity.

Risks related to Operations

The Company’s past experience may not be indicative of future performance.

The Company faces many risks. Past experience may not be indicative of future performance, and the Company has included forward-looking statements about business, plans and prospects that are subject to change. Forward-looking statements are particularly located in, but not limited to, the sections “Description of the Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In addition to the other risks or uncertainties, the risks described below may affect operating results, financial condition, and cash flows. If any of these risks occur, either alone or in combination with other factors, the business, financial condition, or operating results could be adversely affected, and the fair market value of the Shares may decline. The Company has limited operating history and future results are uncertain. Moreover, readers should note that this is not an exhaustive list of the risks the Company faces; some risks are unknown or not quantifiable, and other risks that the Company currently perceives as immaterial may ultimately prove more significant than expected. Statements about plans, predictions or expectations should not be construed to be assurances of performance or promises to take a given course of action.

The Company is in its research and development phase and has never generated profits.

Since the Company’s formation in 2017, the Company has incurred operating losses and negative cash flows from operations. The Company’s net loss was approximately $4.5 million and $3 million for 2021 and 2020, respectively. As of June 30, 2022, the Company had an accumulated deficit of approximately $14 million. As of the Date of this Offering Circular, the Company has never been profitable.

To date, the Company has financed operations primarily through the sale of Common Shares. The Company has devoted substantially all efforts to research and development, including the development and validation of the Starpax Technology, development of the “Good Manufacturing Practices” (“GMP”) compliant manufacturing plant, research and development (“R&D”) and quality control (“QC”) laboratories. The Company has not completed development of or commercialized the Starpax Technology nor any product candidate or medical device. The Company expects to continue to incur significant expenses and incur operating losses for at least the next 3 years. The Company anticipates that expenses and losses will increase substantially when the Company:

| • | initiates Phase I and Phase II clinical trials of its product candidates; |

| • | continues the R&D of product candidates; |

| • | seeks to discover additional product candidates; and |

| • | adds operational, financial and management information systems, and personnel, including personnel to support product development and manufacturing efforts. |

Profitability in large part depends on (1) the success of the planned clinical trials; (2) receiving NDA or BLA from the FDA for its product candidates or market approval for its medical device from the FDA; (3) and the execution of the Company’s business plan by opening Starpax Care Centers. This will require the Company, alone or with collaborators, to be successful in a range of challenging activities, including completing preclinical testing, Phase I and Phase II clinical trials of the Company’s product candidates, obtaining regulatory approval for the Starpax Technology (product candidates and medical devices) and manufacturing, marketing, and offering the Starpax Treatment for which regulatory approval is to be obtained. The Company may never succeed in these activities and the Company may never generate revenues that are significant or large enough to achieve profitability.

Even if the Company does achieve profitability, the Company may not be able to sustain or increase profitability on a periodic or annual basis. Failure to become and remain profitable would diminish the value of the Company and could impair the ability to raise capital, expand business, diversify product offerings, or continue operations. A decline in the value of the Company may also cause Investors to lose all or part of their investment.

The Company may require additional funding to develop and commercialize the products past the Clinical Trial phase.

The Company expects expenses to increase significantly as the product candidates advance in clinical development, and as the Company expands operations. As part of the regulatory process, the Company must conduct clinical trials for each product candidate to demonstrate safety and efficacy to the satisfaction of the FDA and other regulatory authorities. The number and design of the required clinical trials varies depending upon the product candidate, the condition being evaluated, and the trial results themselves. Therefore, it is difficult to accurately estimate the cost of the clinical trials. Clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. The clinical trial process is also time consuming. The Company estimates that clinical trials of product candidates will take at least several years to complete. Because of numerous risks and uncertainties involved in business, the timing or amount of increased development expenses cannot be accurately predicted, and expenses could increase beyond expectations if the Company is required by the FDA, or comparable non- U.S. regulatory authorities, to perform studies or clinical trials in addition to those the Company currently anticipates. Furthermore, failure can occur at any stage of the trials, and the Company could encounter problems that cause the Company to abandon or repeat clinical trials.

After the planned clinical trials and commercialization of the Starpax Technology, as the Company expands its business, the Company will need to retain additional employees with the necessary skills including employees for planned establishment of Starpax Care Centers across the United States and later Europe and Canada.

Even if the Company’s product candidates and medical devices are approved for commercial sale, the Company anticipates incurring significant costs associated with the commercial launch of, and the related commercial-scale manufacturing requirements for, the product candidate. As a result, the Company expects to continue to incur significant and increasing operating losses and negative cash flows for the foreseeable future. Because of the numerous risks and uncertainties associated with biopharmaceutical product development and medical device development and commercialization, the Company is unable to accurately predict the timing or amount of future expenses or when, or if, the Company will be able to achieve or maintain profitability. These losses have had and will continue to have an adverse effect on the financial position and working capital.

The Company currently has no committed sources of funding. If the Company is unable to raise capital in sufficient amounts when needed or on attractive terms, it would be forced to delay development programs.

The Company may experience delays before initiating clinical trials.

Before initiating clinical trials, the Company could be affected by various circumstances that could result in additional delays and costs. This includes but is not limited to, obtaining authorization from governmental health agencies and ethical review boards of the hospital to start the clinical trials, obtaining compliance certifications for operating the medical device and GMP manufacturing equipment, securing adequate insurance coverage for the clinical trials, contracting a competent Contract Research Organization (“CRO”), securing access to essential and qualified workers at expected clinical sites. With respect to the GMP plant and the commissioning of its production equipment, the Company could experience delays in receiving (or shortages of) equipment, parts, tools, raw materials and consumables. It could face technical issues related to the installation, validation, and commissioning of equipment, and in the development and validation of methods, scale-up process, operations, as well as experiencing broken parts, engineering design errors or other type of delays, including from its general contractor. The auditing of the manufacturing plant by Health Canada or FDA may require some changes to be a GMP compliant facility for biopharmaceutical manufacturing. Although the occurrence of one or more of these circumstances could cause business, financial performance, and cash position to be negatively impacted, the Company cannot reasonably estimate the potential for any future impacts on operations or liquidity due to the general unknown nature surrounding these risks.

The Company’s future products may not be commercially successful.

Even if the Company is successful in further validating the Starpax Technology and continuing to build a Company pipeline, the potential product candidates that the Company identifies may not be suitable for clinical development for many possible reasons, including harmful side effects, limited efficacy or other characteristics that indicate that such product candidates or medical devices are unlikely to be products that will receive marketing approval and achieve market acceptance, even if the Company uses already-approved drugs in its Technology. If the Company does not successfully develop and commercialize product candidates and medical devices based upon the Starpax Technology, the Company will not obtain product revenues in future periods, which likely would result in significant harm to financial position and adversely affect the fair market value of the Shares.

A failure by Starpax to hire and retain an appropriately skilled and adequate workforce could adversely impact the ability of the facility to operate and function efficiently.

The Company’s operations will depend, in part, on its ability to attract and retain an appropriately skilled and sufficient workforce to operate its development and manufacturing facility as well as its R&D facility. These employees may voluntarily terminate their employment with the Company at any time. Laboratories and manufacturing plants are located in a growing biotechnology and medical device hub and competition for skilled workers will continue to increase as the industry undergoes further growth in the area. There can be no assurance that the Company will be able to retain key personnel, or to attract and retain additional qualified employees. The Company’s inability to attract and retain key personnel as the Company grows may have a material adverse effect on the business.

The Company may be unable to manage future growth effectively, which could make it difficult to execute business strategy.

The Company intends to grow business operations as regulatory approvals of the product candidates and medical devices are granted by regulatory authorities This will increase demand and increase the number of employees to accommodate such potential growth, which may cause the Company to experience periods of rapid growth and expansion. This potential future growth could create a strain on organizational, administrative and operational infrastructure, including manufacturing operations, quality control, technical support and other administrative functions. The Company’s ability to manage growth properly will require the Company to continue to improve operational, financial and management controls.

As the commercial operations and opening of Starpax Care Centers grows, the Company will need to continue to increase capacity for manufacturing, billing, reimbursement and general process improvements, and expand internal quality assurance program, among other things. The Company may also need to purchase additional equipment, some of which can take several months or more to procure, set up and validate, and increase the Company’s manufacturing, maintenance, software and computing capacity to meet increased demand. These increases in scale, expansion of personnel, purchase of equipment or process enhancements may not be successfully implemented.

The Company may be subject to various litigation claims and legal proceedings.

The Company, as well as certain of its Directors and Officers, may be subject to claims or lawsuits during the ordinary course of business. Regardless of the outcome, these lawsuits may result in significant legal fees and expenses and could divert management’s time and other resources. If the claims contained in these lawsuits are successfully asserted against the Company, the Company could be liable for damages and be required to alter or cease certain of business practices. Any of these outcomes could cause business, financial performance and cash position to be negatively impacted.

The Company relies extensively on information technology systems that are vulnerable to damage and interruption.

The Company relies on information technology systems and infrastructure to process transactions, summarize results and manage business, including maintaining client and supplier information. Additionally, the Company utilizes third parties, including cloud providers, to store, transfer and process data. Information technology systems, as well as the systems of suppliers and other partners, whose systems the Company does not control, are vulnerable to outages and an increasing risk of continually evolving deliberate intrusions to gain access to Company sensitive information. Likewise, data security incidents and breaches by employees and others with or without permitted access to systems pose a risk that sensitive data may be exposed to unauthorized persons or to the public. A cyber-attack or other significant disruption involving Company information technology systems, or those of vendors, suppliers and other partners, could also result in disruptions in critical systems, corruption or loss of data and theft of data, funds or intellectual property. A security breach of any kind, including physical or electronic break-ins, computer viruses and attacks by hackers, employees or others, could expose the Company to risks of data loss, litigation, government enforcement actions, regulatory penalties and costly response measures, and could seriously disrupt Company operations. The Company may be unable to prevent outages or security breaches in Company systems. The Company remains potentially vulnerable to additional known or yet unknown threats as, in some instances, the Company, suppliers and other partners may be unaware of an incident or its magnitude and effects. The Company also faces the risk that the Company exposes the vendors or partners to cybersecurity attacks. Any or all of the foregoing could harm the Company’s reputation and adversely affect the results of operations and business reputation.

Future financing may result in ownership dilution to the Company’s existing Shareholders and may not be on terms similar to past financings, including this Offering.

The sale of a substantial number of Common Shares to future investors, or anticipation of such sales, could make it more difficult for the Company to sell equity or equity-related securities in the future at a time and at a price that might otherwise wish to effect sales. Until such time as the Company can generate substantial development, the Company expects to finance cash needs through a combination of equity offerings and other arrangements. Sources of funds may not be available or, if available, may not be available on terms satisfactory to the Company.

If the Company raises additional funds by issuing equity securities, existing Shareholders may, subject to the Anti-Dilution Agreement, experience dilution. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting the Company’s ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Any debt financing or additional equity that the Company raises may contain terms, such as liquidation and other preferences, which are not favorable to Shareholders. If the Company raises additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable. Should the financing the Company requires to sustain working capital needs be unavailable or prohibitively expensive when the Company requires it, the business, operating results, financial condition, and prospects could be materially and adversely affected, and the Company may be unable to continue operations.

To the extent the Company raises additional capital through a public or private offering and sale of equity securities, but subject to the provisions of the anti-dilution agreement (see “Dilution” below), Investors’ ownership interest may be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect an Investor’s rights as a Shareholder. Sales of Common Shares offered through current or future equity offerings may result in substantial dilution to the Shareholders.

Any government funding programs may impose requirements that could affect the Company’s business, financial condition, and results of operations.

The Company has applied for government grants to support some of the clinical development activities for the product candidates. Often government grants include provisions that reflect the government’s substantial rights and remedies, many of which are not typically found in commercial contracts, including powers of the government to potentially require repayment of all or a portion of the grant award proceeds, in certain cases with interest, in the event the Company violates certain covenants pertaining to various matters.

The Company is currently eligible for certain tax credits that may no longer be available in the future.

The Company currently has access to certain tax credits to fund some of its R&D expenses and investments. In the future, the governments may eliminate those tax credits or change the eligibility criteria, therefore negatively affecting the Company’s access to this type of funding. Should the Company lose access to current or future tax credits or is eligible to less, the business, operating results, financial condition, and prospects could be materially and adversely affected.

Risks Related to Intellectual Property

If the Company is unable to obtain and maintain intellectual property protection for the Starpax Technology and products, the ability to successfully commercialize the Starpax Technology and products may be impaired.

The Company currently owns 31 patents or pending patents, therefore success depends in part on the Company’s ability to maintain and obtain patent and other intellectual property protections in the United States and other countries with respect to the Starpax Technology and products. The Company seeks to protect its proprietary position by filing patent applications in the United States and abroad related to the Starpax Technology and product candidates, and by maintenance of trade secrets and copyrights through proper procedures.

The patent prosecution process is expensive and time-consuming, and the Company may not be able to file and prosecute all necessary or desirable patent applications at a reasonable cost, in a timely manner, or in all jurisdictions. It is also possible that the Company will fail to identify patentable aspects of R&D output before it is too late to obtain patent protection.

The patent position of biotechnology and pharmaceutical and medical device companies generally is highly uncertain, involves complex legal and factual questions and has in recent years been the subject of much litigation. In addition, the laws of foreign countries may not protect Company rights to the same extent as the laws of the United States and the Company may fail to seek or obtain patent protection in all major markets. Even if, to the Company’s knowledge, the Company were the first to file patent on the underlying inventions of the Starpax Technology, the Company cannot know with certainty whether the Company was the first to make the inventions claimed in the Company’s owned patents or pending patent applications, or that the Company was the first to file for patent protection of such inventions. Nor can the Company know whether those from whom the Company licenses patents were the first to make the inventions claimed or were the first to file. As a result, the issuance, scope, validity, enforceability and commercial value of patent rights are uncertain. Pending and future patent applications may not result in patents being issued which protect the Company’s Technology or products, in whole or in part, or which effectively prevent others from commercializing competitive technologies and products. Changes in either the patent laws or interpretation of the patent laws in the United States and other countries may diminish the value of patents or narrow the scope of the Company’s patent protection. Even if the Company’s pending or future patent applications issue as patents, they may not issue in a form that will provide the Company with any meaningful protection, prevent competitors from competing with the Company or otherwise provide the Company with any competitive advantage. Competitors may be able to circumvent patents by developing similar or alternative technologies or products in a non-infringing manner.

The Company may become involved in lawsuits to protect or enforce patents or other intellectual property.

Commercial success depends upon the Company’s ability, and the ability of the collaborators, to develop, manufacture, market and sell product candidates and use proprietary technologies without infringing the proprietary rights of third parties. There is considerable intellectual property litigation in the biotechnology and pharmaceutical and medical device industry. Competitors may infringe the Company’s issued patents or other intellectual property. To counter infringement or unauthorized use, the Company may be required to file infringement claims, which can be expensive and time-consuming. Any claims the Company asserts against perceived infringers could provoke these parties to assert counterclaims against the Company alleging that the Company infringes their intellectual property. In addition, in a patent infringement proceeding, a court may decide that a patent of the Company is invalid or unenforceable, in whole or in part, construe the patent’s claims narrowly or refuse to stop the other party from using the technology at issue on the grounds that the Company’s patents do not cover the technology in question. An adverse result in any litigation proceeding could put one or more of the Company’s patents at risk of being invalidated or interpreted narrowly, which could adversely affect the Company and its collaborators.

The Company may become party to, or threatened with, future adversarial proceedings or litigation regarding intellectual property rights with respect to the Company’s products and technology, including interference or derivation proceedings before the United States Patent and Trademark Office (“USPTO”) and similar bodies in other countries. Third parties may assert infringement claims against the Company based on existing intellectual property rights and intellectual property rights that may be granted in the future.

If the Company is found to infringe on a third party’s intellectual property rights, the Company could be required to obtain a license from such third party to continue developing and marketing the products and Starpax Technology. However, the Company may not be able to obtain any required license on commercially reasonable terms or at all. Even if the Company were able to obtain a license, it could be non-exclusive, thereby giving potential competitors access to the same technologies licensed to the Company. The Company could be forced, including by court order, to cease commercializing the infringing technology or product. In addition, the Company could be found liable for monetary damages. A finding of infringement could prevent the Company from commercializing product candidates or force the Company to cease some of the business operations, which could materially harm the business. Claims that the Company has misappropriated the confidential information or trade secrets of third parties could have a similar negative impact on the business.

In addition, the uncertainties associated with litigation could have a material adverse effect on the Company’s ability to raise the funds necessary to continue clinical trials, continue research programs, license necessary technology from third parties, or enter into development partnerships that would help the Company bring product candidates to market. Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of the Company’s confidential information could be compromised by disclosure during this type of litigation.

If the Company is unable to protect trade secrets, business and competitive position would be harmed.

The Company also seeks to enter into confidentiality and invention or patent assignment agreements with the employees, consultants, corporate collaborators, outside scientific collaborators, contract manufacturers, consultants, advisors and other third parties. The Company has implemented procedural and physical mechanisms to deter external intrusions and violation from inside the Company’s organization. Despite these efforts, any of these parties may breach the agreements and disclose proprietary information, including trade secrets, and the Company may not be able to obtain adequate remedies for such breaches.

Trade secrets may also be obtained by third parties by other means, such as breaches of the Company’s physical or computer security systems. Enforcing a claim that a party illegally disclosed or misappropriated a trade secret is difficult, expensive and time-consuming, and the outcome is unpredictable. In addition, some courts inside and outside the United States are less willing or unwilling to protect trade secrets. If any of the Company’s trade secrets were to be lawfully obtained or independently developed by a competitor, the Company would have no right to prevent them, or those to whom they communicate it, from using that technology or information to compete with the Company. If any of the Company’s trade secrets were to be disclosed to or independently developed by a competitor, competitive position would be harmed.

Risks related to Regulations

The Company currently is dependent on the success of product candidates and medical devices in the clinical trial process. If product candidates or medical devices do not receive regulatory approval or are not successfully commercialized, the business may be harmed.

The Company expects that a substantial portion of efforts and expenditures over the next few years will be devoted to its product candidates and medical devices. Accordingly, business currently depends heavily on the successful development, regulatory approval, and commercialization of these product candidates and medical devices, which may not receive regulatory approval or be successfully commercialized even if regulatory approval is received. After approval, the research, testing, manufacturing, labeling, approval, sale, marketing and commercial use of product candidates and medical devices are and will remain subject to extensive regulation by the FDA and other regulatory authorities in the United States and other countries that each have differing regulations. The Company is not permitted to market any product in the United States unless and until the Company receives approval from the FDA, or in any foreign countries unless and until the Company receives the requisite approval from regulatory authorities in such countries. The Company has never submitted a NDA, BLA, PMA, de Novo, or 510k applications to the FDA or comparable applications to other regulatory authorities and does not expect to be in a position to do so for the foreseeable future. Obtaining approval of an NDA, BLA PMA, de Novo, or 510k applications is an extensive, lengthy, expensive, and inherently uncertain process, and the FDA may delay, limit or deny approval of Company products for many reasons.

Because the Company has limited financial and managerial resources, focus is limited to the development of current product candidates. As a result, the Company may forego or delay pursuit of opportunities with other technologies or product candidates that later prove to have greater commercial potential. Resource allocation decisions may cause the Company to fail to capitalize on viable commercial products or profitable market opportunities. Spending may not yield any commercially viable products.

The Company has based the R&D efforts largely on technologies and product candidates and medical devices derived from such technologies. Notwithstanding large investment to date and anticipated future expenditures in these technologies, the Company has not yet developed, and may never successfully develop, any marketed products using these technologies. As a result, the Company may fail to address or develop product candidates and medical devices based on other scientific approaches that may offer greater commercial potential or for which there is a greater likelihood of success.

The Company also may not be successful in efforts to identify or discover additional product candidates and medical devices using the Starpax Technology. Research programs to identify new product candidates and medical devices require substantial technical, financial, and human resources. These research programs may initially show promise in identifying potential product candidates and medical devices yet fail to yield product candidates for clinical development.

There may be risks of failure proceeding through clinical trials.

Starpax product candidates and medical devices are not yet in clinical development. The Company’s ability to generate product sales revenues for the Company’s own products, which the Company does not expect will occur for several years, will depend heavily on the successful development and eventual commercialization of product candidates and medical devices.

Clinical trials are expensive, time consuming, uncertain and susceptible to change, delay or termination.

Preclinical and clinical testing is expensive, difficult to design and implement, can take many years to complete and has an uncertain outcome. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and interim results of a clinical trial do not necessarily predict final results. The Company may experience numerous unforeseen events during, or as a result of, preclinical testing and the clinical trial process that could delay or prevent the commercialization of product candidates.

Significant clinical trial delays could allow competitors to bring products to market before the Company and impair the ability to commercialize the Starpax Technology and product candidates and medical devices based on the Starpax Technology. Poor clinical trial results or delays may make it impossible to license a product candidate, or reduce its attractiveness to prospective licensees, so that the Company will be unable to successfully develop and commercialize such a product candidate

After the completion of clinical trials, and the Company’s products are commercialized, failure to comply with regulatory requirements could adversely affect business and results of operations.

Manufacturing operations will be regulated, and the Company must comply with the regulatory requirements of various local, state, provincial, national and international regulatory bodies having jurisdiction in the locality in which the Company manufactures products. In particular, the Company is subject to laws and regulations concerning development, testing, manufacturing processes, equipment and facilities, including compliance with GMPs or ISO13485 import and export, and product registration and listing, among other things. As a result, the facility is subject to regulation by the FDA, Health Canada, as well as regulatory bodies of other jurisdictions. As the Company progresses in pharmaceutical development, the Company may be exposed to more complex and newer regulatory and administrative requirements and legal risks, any of which may require expertise in which the Company has little or no experience. It is possible that compliance with new regulatory requirements could impose significant compliance costs. Such costs could have a material adverse effect on the business, financial condition and results of operations.

The Company’s operations are also subject to a variety of environmental, health and safety laws and regulations, including those of the local, provincial, state, and federal agencies. These laws and regulations govern, among other things, air emissions, wastewater discharges, the use, handling and disposal of hazardous substances and wastes, soil and groundwater contamination, and employee health and safety. Any failure to comply with environmental, health and safety requirements could result in the limitation or suspension of production or monetary fines or civil or criminal sanctions, or other future liabilities. The Company is also subject to laws and regulations governing the destruction and disposal of raw materials and the handling and disposal of regulated material.

Product candidates will be subject to the regulatory approvals discussed above, but the facility is subject to governmental approval for the testing or manufacturing of products. If the manufacturing facility or medical devices are not able to demonstrate compliance with GMPs or ISO13485 and other related industry requirements, pass other aspects of pre-approval inspections or properly scale up to produce commercial supplies, the FDA or other regulatory agencies can delay approval of product candidate(s).

In addition, if new legislation or regulations are enacted or existing legislation or regulations are amended or are interpreted or enforced differently, the Company may be required to obtain additional approvals or operate according to different manufacturing or operating standards. This may require a change in development and manufacturing techniques or additional capital investments in the facility. Any related costs may be significant. If the Company fails to comply with applicable regulatory requirements in the future, then the Company may be subject to warning letters and/or civil or criminal penalties and fines, suspension or withdrawal of regulatory approvals, product recalls, seizure of products, restrictions on the import and export of the products, debarment, exclusion, disgorgement of profits, operating restrictions and criminal prosecution and the loss of contracts and resulting revenue losses. Inspections by regulatory authorities that identify any deficiencies could result in remedial actions, production stoppages or facility closure, which would disrupt the manufacturing process and supply of product to the customers. In addition, such failure to comply could expose the Company to contractual and product liability claims, including claims for reimbursement for lost or damaged active pharmaceutical ingredients or recall or other corrective actions, the cost of which could be significant.

The FDA and comparable government authorities having jurisdiction in the countries in which the Company intends to market its products have the authority to withdraw product approval or suspend manufacture if there are significant problems with raw materials, parts or supplies, quality control and assurance or the product the Company manufactures is adulterated or misbranded. If manufacturing facilities, medical device and services are not in compliance with the FDA and comparable government authorities, the Company may be unable to obtain or maintain the necessary approvals to continue manufacturing products, which would materially adversely affect the financial condition and results of operations.

Environmental Regulations.

The Company’s GMP manufacturing plant, Starpax Cancer Care Centers, and other facilities are or will be subject to various federal, state/province, and local and laws and regulations to protect the environment. Various states and governmental agencies are considering, and some have adopted, laws and regulations regarding environmental control which could adversely affect our business. Compliance with such legislation and regulations, together with any penalties resulting from noncompliance therewith, will increase the Company’s operating costs.

Government Regulations.

In addition to the regulation of the Company’s manufacturing plant and R&D facilities, the Company’s anticipated business of operating the Starpax Cancer Centers will be subject to extensive governmental regulation under which, among other things, will regulate the practice of medicine within the Starpax Cancer Centers. Governmental regulation also may limit or otherwise affect the market for the Starpax Cancer Centers and the manner in which the Company develops and deploys the commercialization strategy. Governmental regulations relating to environmental matters could also affect our operations. The nature and extent of various regulations, the nature of other political developments and their overall effect upon the Company are not predictable.

Included in these government regulations will be import/export laws and controls. The Company’s main manufacturing plant is located in Canada, for use in Starpax Cancer Centers to be located throughout the United States. This will require the Company to comply with import and export laws of at least these two jurisdictions. Any changes in these import and export laws could result in difficulties or inability of the Company to get the Starpax Technology to the Starpax Cancer Centers once commercialization of the Starpax Technology has begun.

Risks related to commercialization of the Starpax Technology

If the market chooses to buy competing products, the Company may fail.

The manufacture of biologics, drugs, medical devices and the methods of such manufacture are intensely competitive fields. Each of these fields is characterized by extensive research efforts, which result in rapid technological progress that can render existing technologies obsolete or economically non-competitive. If competitors succeed in developing more effective technologies or render technologies obsolete or non-competitive, business will suffer. Many universities, public agencies and established pharmaceutical, biotechnology, and other life sciences companies with substantially greater resources than the Company has are developing and using technologies and are actively engaging in the development of products competitive with Company technologies and products. To remain competitive, the Company must continue to invest in new technologies and improve existing technologies. To make such renewing investment the Company will need to obtain additional financing. If the Company is unable to secure such financing, the Company will not have sufficient resources to continue such investment. In addition, competitors may also have significantly greater experience in the discovery and development of products, as well as in obtaining regulatory approvals of those products in the United States and in foreign countries. Current and potential future competitors also have significantly more experience in commercially deploy technologies or therapeutics that have been approved for marketing. Mergers and acquisitions in the pharmaceutical and biotechnology industries could result in even more resources being concentrated among a small number of competitors.

For cancer product candidates, not only does the Company compete with companies engaged in various cancer treatments including surgery, thermal, radiotherapy, hormonotherapy and chemotherapy, but the Company also competes with various companies that have developed or are trying to develop different technologies such as but not limited to nanocarriers, precision medicine, immune check points inhibitors, oncolytic virus, immunology treatment in oncology. Certain of the Company’s competitors have substantially greater capital resources, large customer bases, broader product lines, sales forces, greater marketing and management resources, larger research and development staffs with extensive facilities and equipment than the Company does and have more established reputations as well as global distribution channels.

The availability of competitors’ products could limit the demand, and the price the Company is able to charge, for any product candidate the Company develops. The inability to compete with existing or subsequently introduced therapies would have an adverse impact on the business, financial condition and prospects.

Established pharmaceutical companies may invest heavily to accelerate discovery and development of novel compounds or to in-license novel compounds that could make product candidates less competitive. In addition, any new products that compete with an approved product must demonstrate compelling advantages in efficacy, convenience, tolerability and safety in order to overcome price competition and to be commercially successful.

Product liability lawsuits against the Company could cause the Company to incur substantial liabilities and to limit commercialization of any products that the Company may develop.

The Company faces the risk of product liability exposure in connection with the testing of the product candidates and medical devices in human clinical trials and will face an even greater risk if the Company commercially sells any products that the Company may develop. If the Company cannot successfully defend itself against claims that the Company’s product candidates, medical device or products caused injuries, the Company will incur substantial liabilities.

Prior to commencing human clinical trials and after regulatory approval, the Company will seek to obtain insurance coverage. Such insurance coverage is expensive and may not be available in coverage amounts the Company seeks or at all. If the Company obtains such coverage, the Company may in the future be unable to maintain such coverage at a reasonable cost or in an amount adequate to satisfy any liability that may arise.

The Company intends to use its own manufacturing facility. Any manufacturing problems experienced by the Company could result in a delay or interruption in the supply of the Company’s products.

The Company is preparing to manufacture clinical product candidates in its own facilities. It currently does not have any alternative manufacturer. If the Company experiences disruption in distribution, considering the short shelf-life of the product candidate(s), the Company could be forced to interrupt supply for the patient treatments, negatively impacting timelines, and clinical trials or commercialization costs. If the Company changes manufacturers at any point during the development process or after approval of a product candidate or medical device, the Company will be required to demonstrate comparability between the product manufactured by the old manufacturer and the product manufactured by the new manufacturer. If the Company is unable to do so the Company may need to conduct additional clinical trials with product manufactured by the new manufacturer.

The Company may not be able to manufacture products at the scale required for commercial success.

If the Company is not able to manufacture sufficient quantities of clinical product candidate(s), or fails to develop product candidate(s) with specifications or quality attributes adequate for the clinical trials or the commercialization of the Company’s clinical product candidate(s), development or commercial activities would be impaired. In addition, the manufacturing facility where clinical product candidates are manufactured is subject to ongoing, periodic inspection by the FDA or other comparable regulatory agencies (including Health Canada) to ensure compliance with current Good Manufacturing Practice regulations. Any failure to follow and document the manufacturer’s adherence to such GMP regulations or other regulatory requirements may lead to significant delays in the availability of investigational product substance for clinical trials, which may result in the termination of or a hold on a clinical trial or may delay or prevent filing or approval of marketing applications for the Company’s clinical product candidates.

Reliance on third-party manufacturers and suppliers entails risks to which the Company would not be subject if the Company manufactures the clinical product candidates itself, including:

| • | reliance on the third parties for regulatory compliance and quality assurance; |

| • | the possible breach of the manufacturing agreements by the third parties because of factors beyond Company control or the insolvency of any of these third parties or other financial difficulties, labor unrest, natural disasters or other factors adversely affecting their ability to conduct their business; and |

| • | possibility of termination or non-renewal of the agreements by the third parties, at a time that is costly or inconvenient for the Company, because of breach of the manufacturing agreement or based on their own business priorities. |

The Company currently leases the space where the R&D laboratories and GMP manufacturing plant are located.

The Company currently leases the space where the R&D laboratories and GMP plant are located. The lease is for a term of 5 years. The Company currently has an option to extend the lease for an additional 5 years after the expiration of the primary term. In the event the lease expires, or if the lessor of the space does not wish to extend the lease past the option period, the Company could incur delays in manufacturing and R&D which may render the products unavailable for the clinical trials or to patients if commercialization of the Starpax Technology has already begun. This could result in significant losses which may cause the Company to (1) seek future financings to remedy; (2) lose market share and customer confidence; (3) utilize a third-party manufacturer for the manufacturing of the Company’s products; (4) incur significant costs in developing a second manufacturing plant, subject to GMP.

Risks Relating to Common Shares

Provisions of the Articles of Consolidation, bylaws and provisions of applicable Québec law may discourage, delay or prevent a merger, or other change in control.

The Board of Directors is authorized to issue additional Common Shares and, if the Company were to amend its Articles, the Board of directors could be authorized to issue preferred Shares. Any additional issuance of Common Shares could have the effect of impeding or discouraging the acquisition of control of the Company by means of a merger, tender offer, proxy contest or otherwise, including a transaction in which Shareholders would receive a premium over the market price for their Shares, and thereby protect the continuity of management. Specifically, if in the due exercise of its fiduciary obligations, the Board of Directors were to determine that a takeover proposal was not in the Company’s best interest, Common Shares could be issued by the Board of Directors without Shareholder approval in one or more transactions that might prevent or render more difficult or costly the completion of the takeover that a Shareholder may determine to be in his, her or its best interest, including attempts that might result in a premium over the market price for the Shares held by the Shareholders, by:

| • | diluting the voting or other rights of the proposed acquirer or insurgent Shareholder group, |

| • | putting a substantial voting bloc in institutional or other hands that might undertake to support the incumbent Board of Directors, or |

| • | effecting an acquisition that might complicate or preclude the takeover. |

The Company does not anticipate paying cash dividends for the foreseeable future.

The Company has never declared or paid any cash dividends or distributions on the Company’s Share capital. The Company currently intends to retain future earnings to support operations and to finance expansion and therefore the Company does not anticipate paying any cash dividends on Common Shares in the foreseeable future.

There is no current public market for the Shares.

Despite the possibility of individual transfer transactions between an Investor and a buyer allowing resale of the Shares, there is no public market for the resale of Company Shares and none is expected to arise for the foreseeable future, however, the Company reserves the right list the Shares on an exchange in the future.

The value of the Shares through this Offering may fluctuate after investment and may vary in the future.

The Board of Directors and management set the Share price based on public market data, Company forecasts, valuation of comparable pre-revenue pharmaceutical companies in preclinical stage, consultations with experts, as well as the price per Share of recent private offerings from the Company. However, the price per Share in this Offering bears no relationship to the book or asset values or to any other criteria for valuing Shares and may not be indicative of the proceeds that an Investor would receive upon liquidation. Further, the price at which the Shares would trade if they were to be listed on an exchange or actively traded by broker-dealers may be different than the Offering price per Share.

There is limited liquidity for the Shares

The Shares have no redemption rights and limited transferability rights, therefore impacting liquidity for the Shares. As of the date of this Offering Circular, the Company does not currently have plans to list any Shares on any securities market or exchange, however, the Company reserves the right to list the Shares on an exchange in the future.

DILUTION

Except for one Officer of the Company (Jean-Francois Pruneau, Executive Vice President and Chief Financial Officer), none of the Directors, Officers, or affiliated persons have received Shares within the past calendar year from the date of this Offering Circular.

These Shares were purchased by Jean-Francois Pruneau through the exercise of stock options. Jean-Francois Pruneau was granted 15,000 stock options on February 15, 2022, as a result of his position as an Officer. Jean-Francois Pruneau exercised one third of his options on December 20, 2022 (5,000 options). After the stock split on January 19, 2023, Jean-Francois Pruneau had 50,000 remaining options. After the stock split executed on January 19, 2023, the effective cash cost per Share was $0.0005 per Share. This represents a material disparity of approximately $6.2495 per Share as is being offered to Investors through this Offering.

Anti-Dilution Agreement

On November 23, 2022, the Company entered into an anti-dilution agreement between the Company and Ipax 2 llp. Subject to certain terms, this anti-dilution agreement avoids the dilution of the percentage of Shares that investors, excluding Ipax 2 llp, own in the Company when new Shares are issued from treasury. The anti-dilution agreement is provided hereto as Exhibit 3.

This agreement includes a forced redemption option granted to the Company. Ipax 2 granted the Company an option (the “Forced Redemption Option”) allowing the Company to redeem one share held by Ipax 2 in its share capital, for a price of $0.02 CAD per Share (approximately $0.014), upon each and every issue of a treasury share by the Corporation. Conversely, the Corporation undertakes to exercise the Forced Redemption Option upon each new issue of treasury shares, thus to buying back a number of shares held by Ipax 2 equal to the number of shares so issued.