2016 Third Quarter Earnings Release David B. Ramaker Chief Executive Officer Dennis L. Klaeser Chief Financial Officer October 26, 2016

2016 Q3 Earnings Release Supplemental Information David B. Ramaker Chief Executive Officer Dennis L. Klaeser Chief Financial Officer October 26, 2016 2

This presentation and the accompanying presentation by management may contain forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about the financial services industry, the economy and Chemical Financial Corporation ("Chemical"). Words and phrases such as "anticipates," "believes," "continue," "estimates," "expects," "forecasts," "future," "intends," "is likely," "judgment," "look ahead," "look forward," "on schedule," "opinion," "opportunity," "plans," "potential," "predicts," "probable," "projects," "should," "strategic," "trend," "will," and variations of such words and phrases or similar expressions are intended to identify such forward-looking statements. Such statements are based upon current beliefs and expectations and involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These statements include, among others, statements related to future levels of loan charge-offs, future levels of provisions for loan losses, real estate valuation, future levels of nonperforming assets, the rate of asset dispositions, future capital levels, future dividends, future growth and funding sources, future liquidity levels, future profitability levels, future deposit insurance premiums, future asset levels, the effects on earnings of future changes in interest rates, the future level of other revenue sources, future economic trends and conditions, future initiatives to expand Chemical’s market share, expected performance and cash flows from acquired loans, future effects of new or changed accounting standards, future opportunities for acquisitions, opportunities to increase top line revenues, Chemical’s ability to grow its core franchise, future cost savings and Chemical’s ability to maintain adequate liquidity and capital based on the requirements adopted by the Basel Committee on Banking Supervision and U.S. regulators. All statements referencing future time periods are forward- looking. Management's determination of the provision and allowance for loan losses; the carrying value of acquired loans, goodwill and mortgage servicing rights; the fair value of investment securities (including whether any impairment on any investment security is temporary or other-than-temporary and the amount of any impairment); and management's assumptions concerning pension and other postretirement benefit plans involve judgments that are inherently forward-looking. There can be no assurance that future loan losses will be limited to the amounts estimated. All of the information concerning interest rate sensitivity is forward-looking. The future effect of changes in the financial and credit markets and the national and regional economies on the banking industry, generally, and on Chemical, specifically, are also inherently uncertain. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions ("risk factors") that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. Chemical undertakes no obligation to update, amend or clarify forward-looking statements, whether as a result of new information, future events or otherwise. Forward-Looking Statements & Other Information 3

This presentation and the accompanying presentation by management also contain forward-looking statements regarding Chemical's outlook or expectations with respect to its merger with Talmer Bancorp, Inc. ("Talmer"), including the benefits of the transaction, the expected costs to be incurred and cost savings to be realized in connection with the transaction, the expected impact of the merger on Chemical's future financial performance and consequences of the integration of Talmer into Chemical. Risk factors relating both to the merger and the integration of Talmer into Chemical after closing include, without limitation: The anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events. The integration of Talmer’s business and operations into Chemical, which will include conversion of Talmer’s operating systems and procedures, may take longer than anticipated or be more costly than anticipated or have unanticipated adverse results relating to Chemical's or Talmer’s existing businesses. Chemical’s ability to achieve anticipated results from the merger is dependent on the state of the economic and financial markets going forward. Specifically, Chemical may incur more credit losses than expected and customer and employee attrition may be greater than expected. The outcome of pending or threatened litigation, whether currently existing or commencing in the future, including litigation related to the merger. The challenges of integrating, retaining and hiring key personnel. Failure to attract new customers and retain existing customers in the manner anticipated. In addition, risk factors include, but are not limited to, the risk factors described in Item 1A of Chemical’s Annual Report on Form 10-K for the year ended December 31, 2015. These and other factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a preceding forward-looking statement. Forward-Looking Statements & Other Information (continued) 4

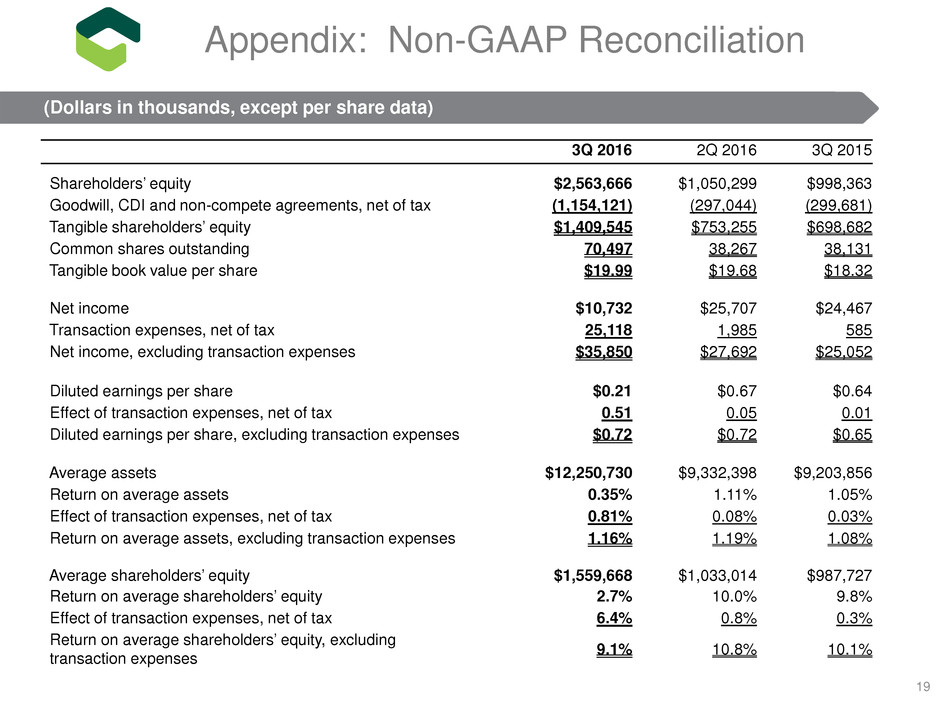

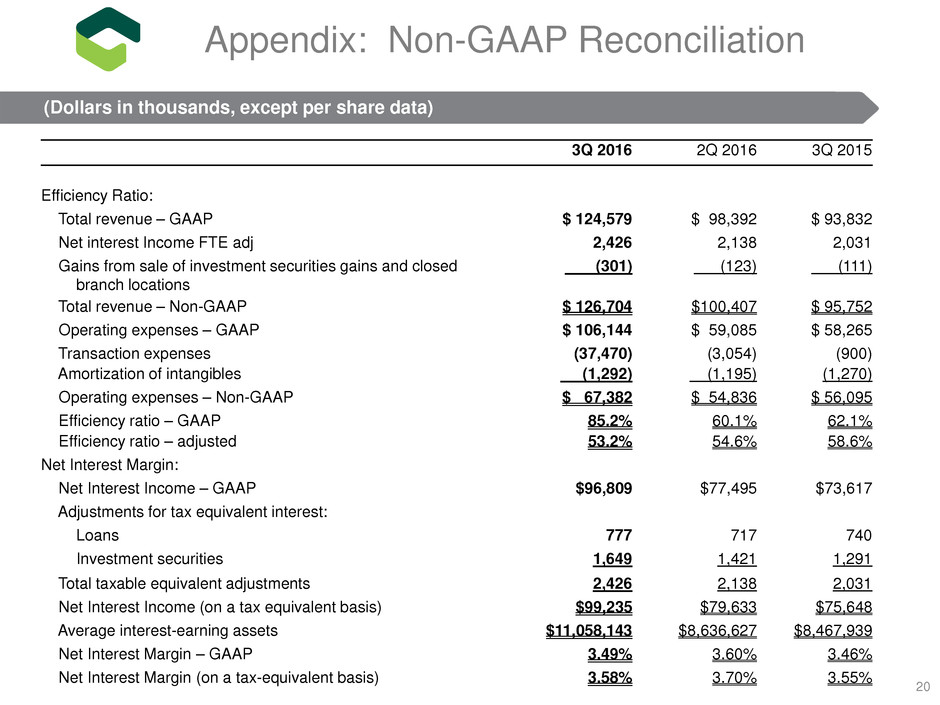

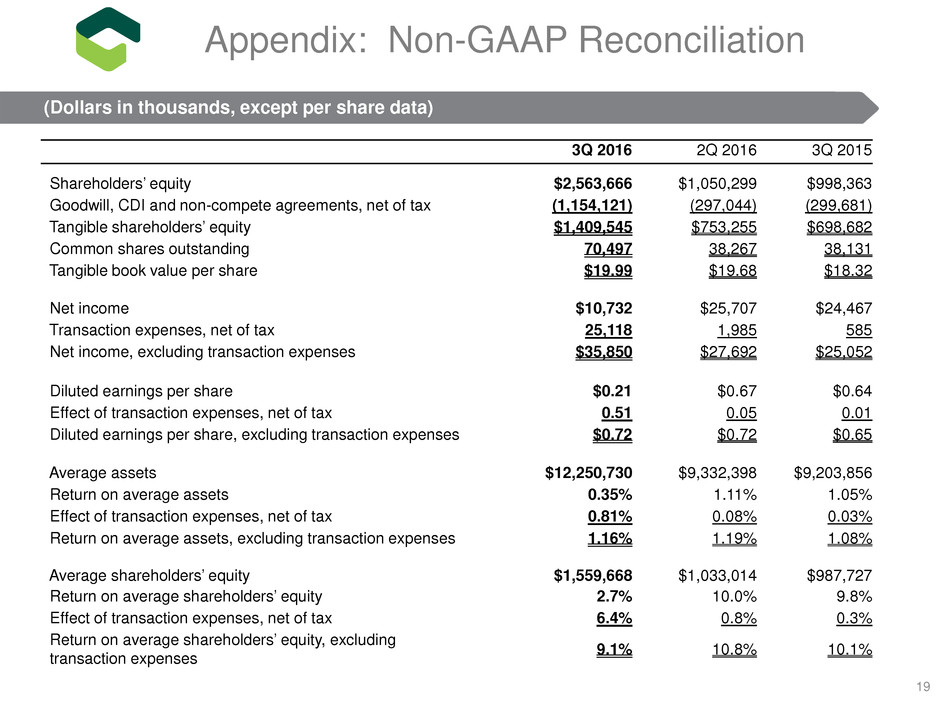

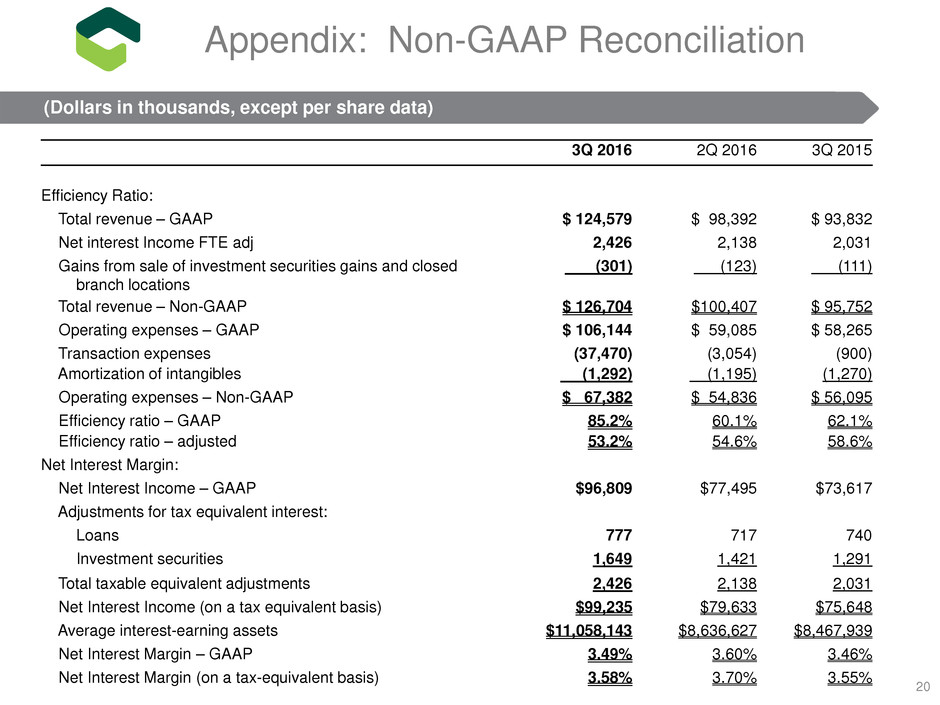

Non-GAAP Financial Measures This presentation and the accompanying presentation by management contain certain non-GAAP financial disclosures that are not in accordance with U.S. generally accepted accounting principles ("GAAP"). Such non-GAAP financial measures include Chemical’s tangible equity to tangible assets ratio, tangible book value per share, presentation of net interest income and net interest margin on a fully taxable equivalent basis, and information presented excluding merger and acquisition-related transaction expenses, including net income, diluted earnings per share, return on average assets, return on average shareholders’ equity, operating expenses and efficiency ratio. Chemical uses non-GAAP financial measures to provide meaningful, supplemental information regarding its operational results and to enhance investors’ overall understanding of Chemical’s financial performance. The limitations associated with non-GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. These disclosures should not be considered an alternative to Chemical’s GAAP results. See the Appendix hereto for a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Forward-Looking Statements & Other Information (continued) 5

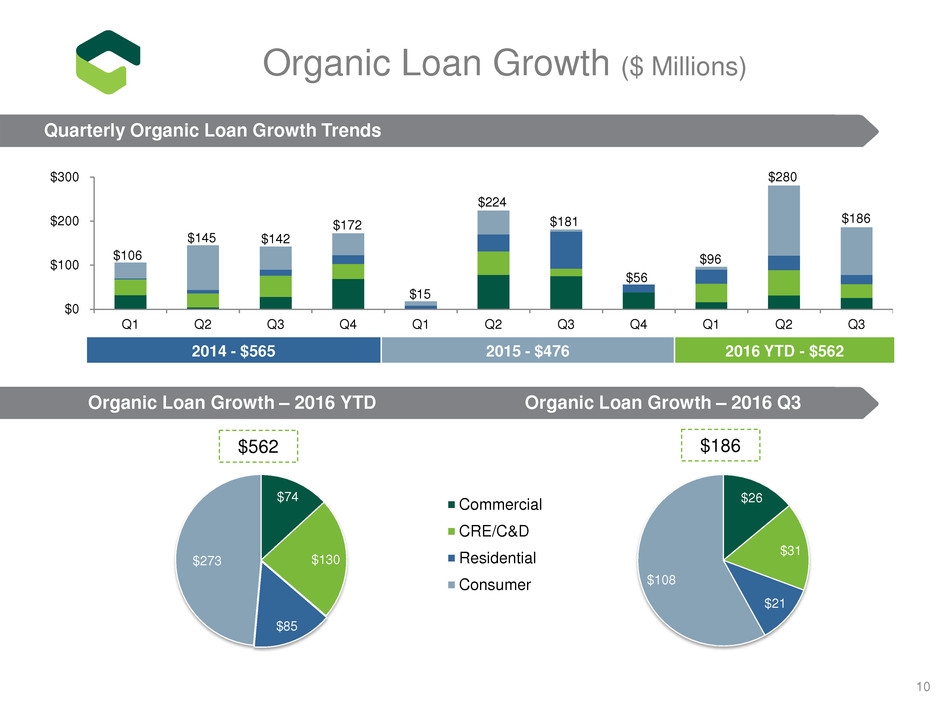

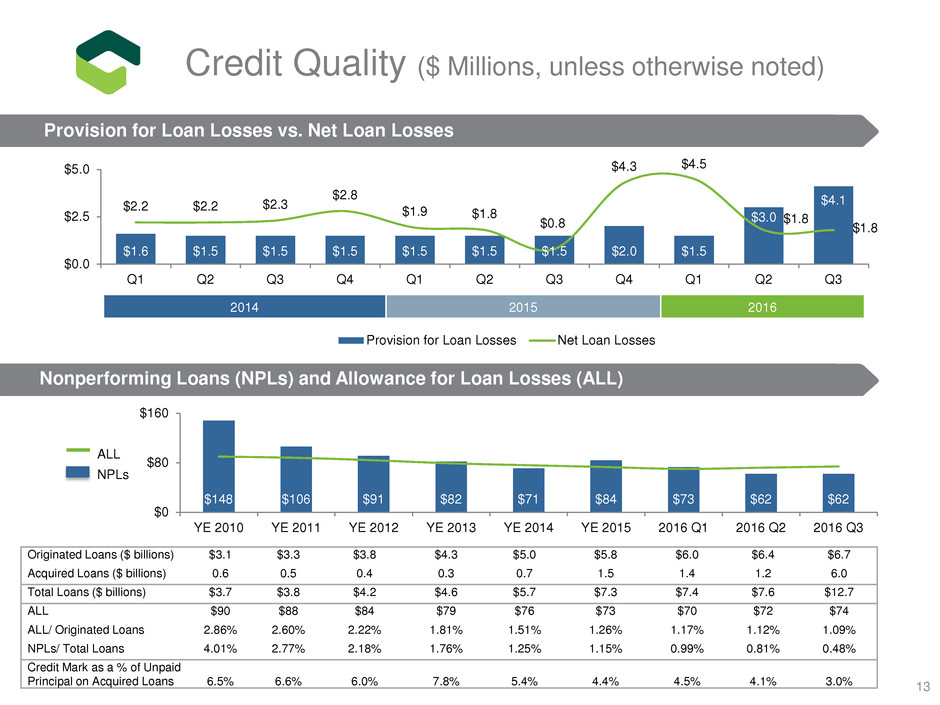

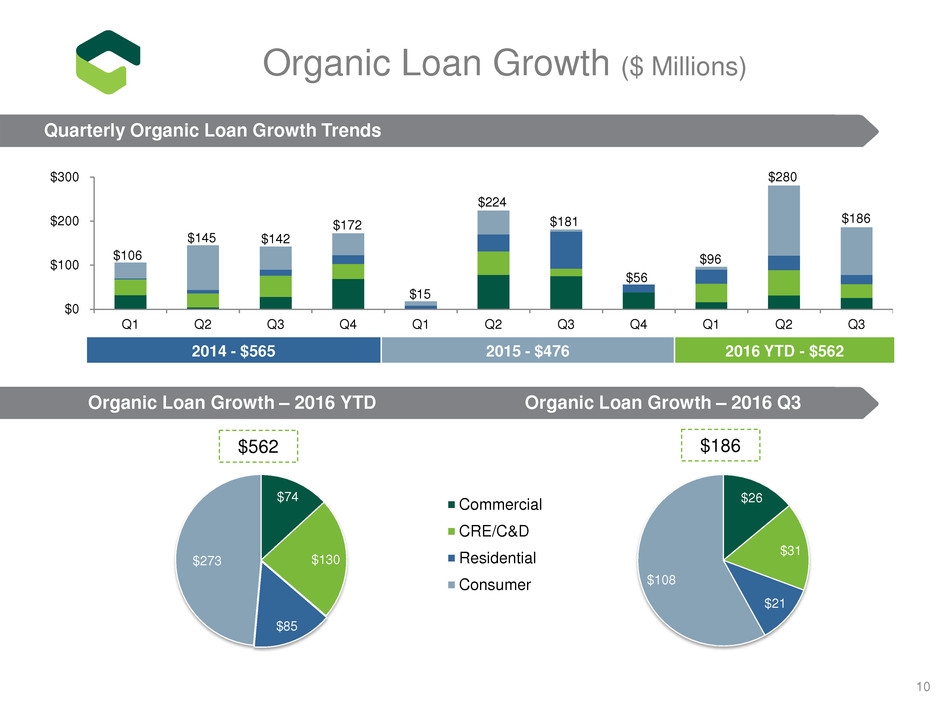

Q3 2016 Highlights Diluted earnings per share of $0.21, compared to $0.67 in the 2nd qtr. 2016 and $0.64 in the 3rd qtr. 2015 Diluted earnings per share, excluding merger and acquisition-related transaction expenses (“transaction expenses”), of $0.72(1); the same as 2nd qtr. 2016, while up 11% over 3rd qtr. 2015 Return on average assets and return on average equity of 0.35% and 2.7%, respectively, in 3rd qtr. 2016 (1.16% and 9.1%, respectively, excluding transaction expenses(1)) Loan Growth Organic: $186 million in 3rd qtr. 2016 (14% commercial, 17% commercial real estate, 11% residential mortgage and 58% consumer loans) Asset quality ratios Slight decrease in nonperforming loans Net loan charge-offs/total loans of 0.08% Nonperforming loans/total loans of 0.48% at 9/30/2016; down from 0.81% at 6/30/2016 (1)Non-GAAP. Refer to the Appendix for a reconciliation of non-GAAP financial measures 6

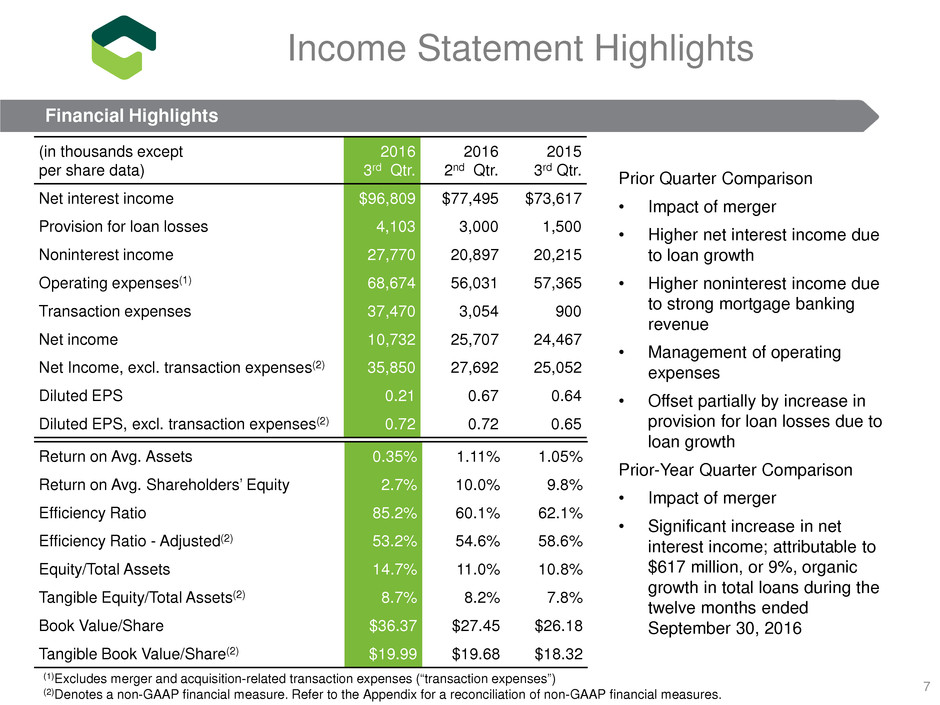

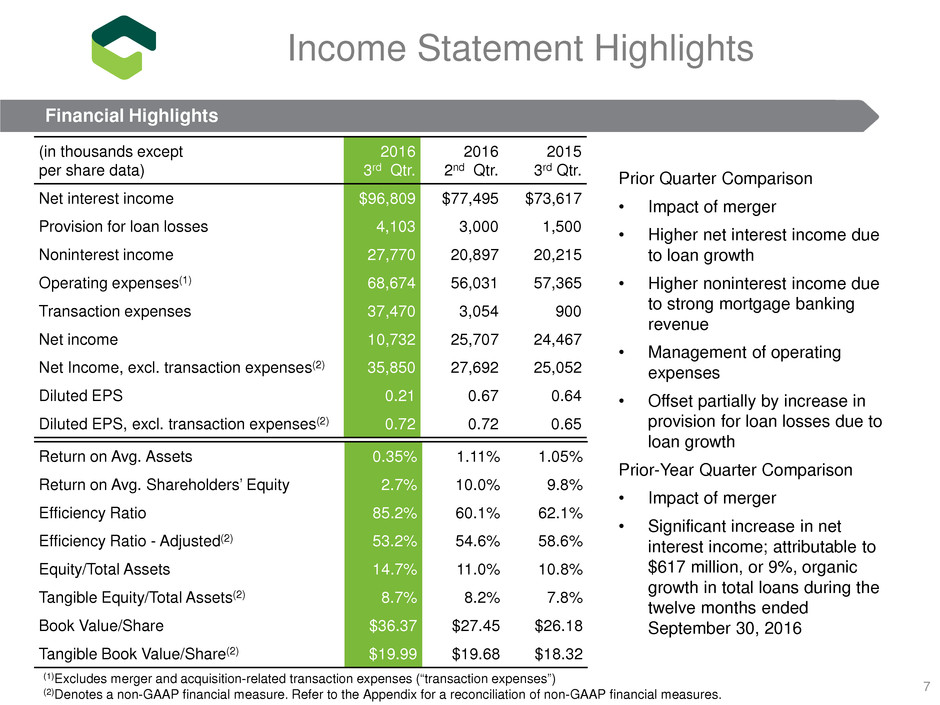

(in thousands except per share data) 2016 3rd Qtr. 2016 2nd Qtr. 2015 3rd Qtr. Net interest income $96,809 $77,495 $73,617 Provision for loan losses 4,103 3,000 1,500 Noninterest income 27,770 20,897 20,215 Operating expenses(1) 68,674 56,031 57,365 Transaction expenses 37,470 3,054 900 Net income 10,732 25,707 24,467 Net Income, excl. transaction expenses(2) 35,850 27,692 25,052 Diluted EPS 0.21 0.67 0.64 Diluted EPS, excl. transaction expenses(2) 0.72 0.72 0.65 Return on Avg. Assets 0.35% 1.11% 1.05% Return on Avg. Shareholders’ Equity 2.7% 10.0% 9.8% Efficiency Ratio 85.2% 60.1% 62.1% Efficiency Ratio - Adjusted(2) 53.2% 54.6% 58.6% Equity/Total Assets 14.7% 11.0% 10.8% Tangible Equity/Total Assets(2) 8.7% 8.2% 7.8% Book Value/Share $36.37 $27.45 $26.18 Tangible Book Value/Share(2) $19.99 $19.68 $18.32 7 Prior Quarter Comparison • Impact of merger • Higher net interest income due to loan growth • Higher noninterest income due to strong mortgage banking revenue • Management of operating expenses • Offset partially by increase in provision for loan losses due to loan growth Prior-Year Quarter Comparison • Impact of merger • Significant increase in net interest income; attributable to $617 million, or 9%, organic growth in total loans during the twelve months ended September 30, 2016 (1)Excludes merger and acquisition-related transaction expenses (“transaction expenses”) (2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. Income Statement Highlights Financial Highlights

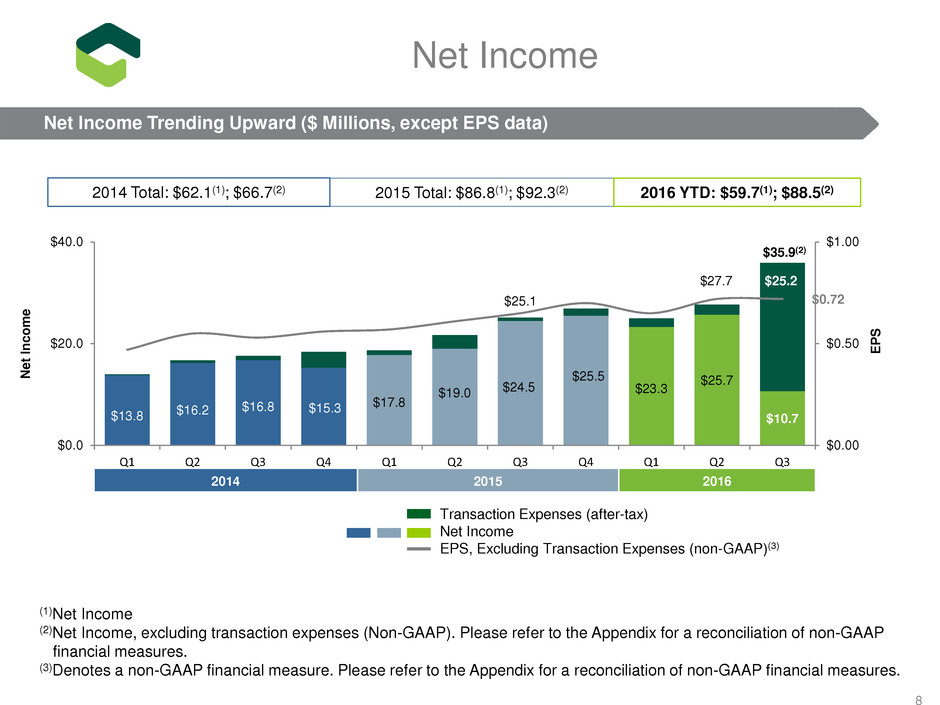

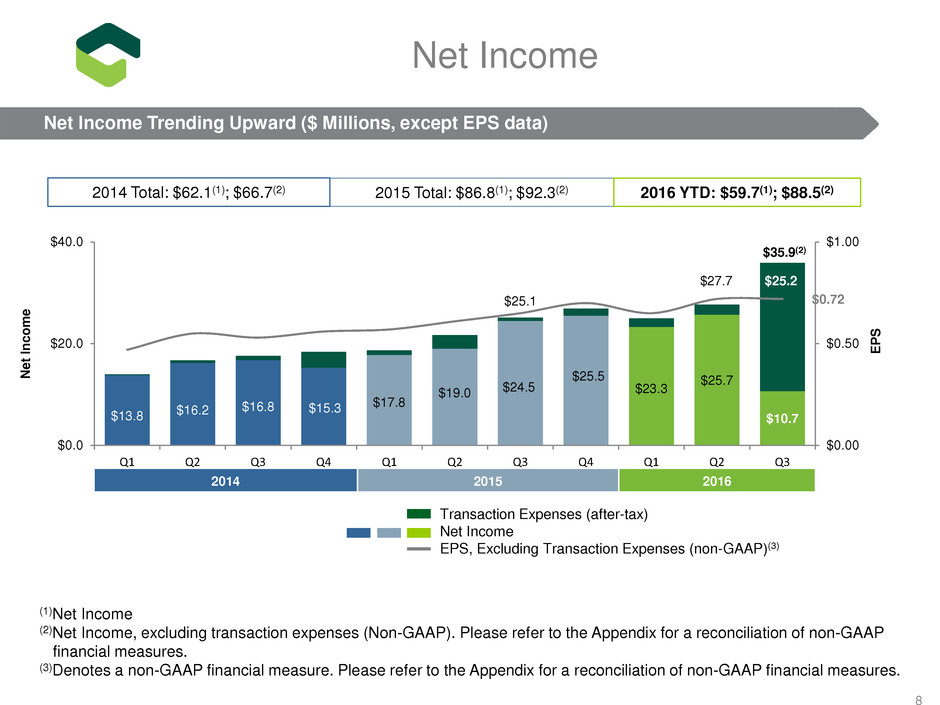

$13.8 $16.2 $16.8 $15.3 $17.8 $19.0 $24.5 $25.5 $23.3 $25.7 $10.7 $0.47 $0.72 $0.00 $0.50 $1.00 $0.0 $20.0 $40.0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 E P S N et In co m e Transaction Expenses (after-tax) Net Income EPS, Excluding Transaction Expenses (non-GAAP)(3) 2014 2015 2016 8 (1)Net Income (2)Net Income, excluding transaction expenses (Non-GAAP). Please refer to the Appendix for a reconciliation of non-GAAP financial measures. (3)Denotes a non-GAAP financial measure. Please refer to the Appendix for a reconciliation of non-GAAP financial measures. 2015 Total: $86.8(1); $92.3(2)2014 Total: $62.1(1); $66.7(2) 2016 YTD: $59.7(1); $88.5(2) $25.1 $35.9(2) $25.2 Net Income Net Income Trending Upward ($ Millions, except EPS data) $27.7

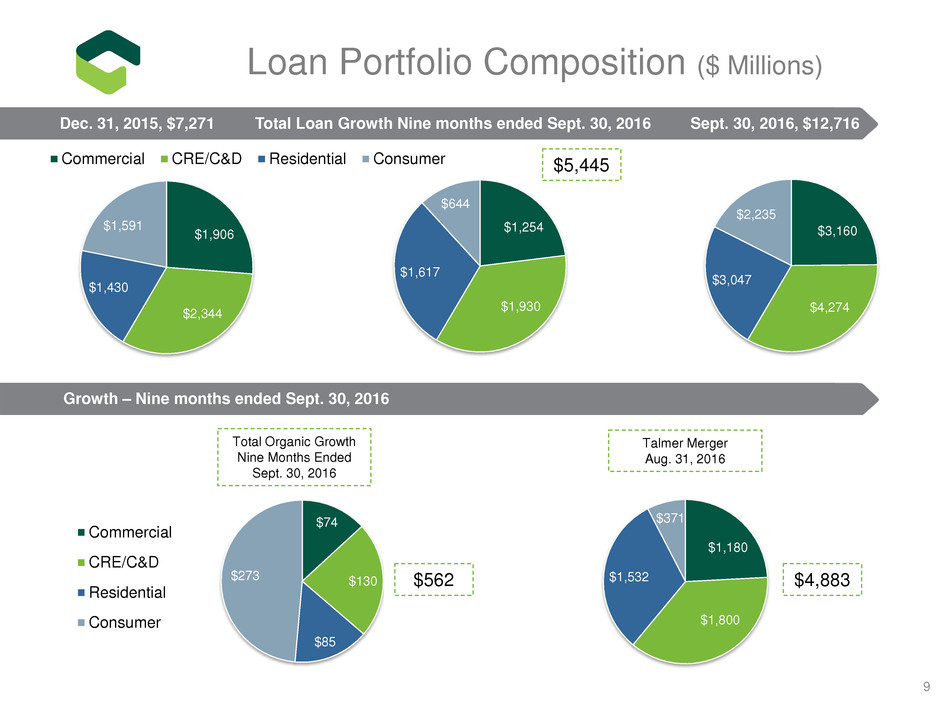

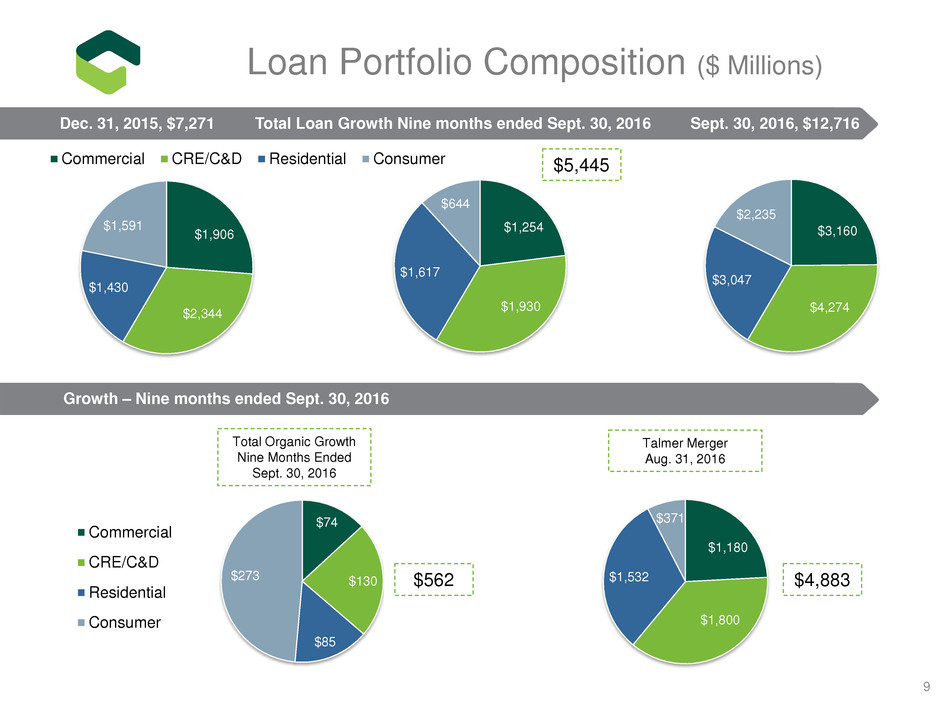

$3,160 $4,274 $3,047 $2,235 $1,254 $1,930 $1,617 $644 $1,906 $2,344 $1,430 $1,591 Commercial CRE/C&D Residential Consumer Loan Portfolio Composition ($ Millions) 9 $74 $130 $85 $273 Commercial CRE/C&D Residential Consumer $1,180 $1,800 $1,532 $371 Talmer Merger Aug. 31, 2016 $562 $4,883 $5,445 Total Organic Growth Nine Months Ended Sept. 30, 2016 Growth – Nine months ended Sept. 30, 2016 Dec. 31, 2015, $7,271 Total Loan Growth Nine months ended Sept. 30, 2016 Sept. 30, 2016, $12,716

$74 $130 $85 $273 $26 $31 $21 $108 Commercial CRE/C&D Residential Consumer $0 $100 $200 $300 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 10 2014 - $565 2015 - $476 2016 YTD - $562 $106 $145 $142 $15 $172 $224 $181 $280 $56 $186$562 $96 $186 Organic Loan Growth ($ Millions) Quarterly Organic Loan Growth Trends Organic Loan Growth – 2016 YTD Organic Loan Growth – 2016 Q3

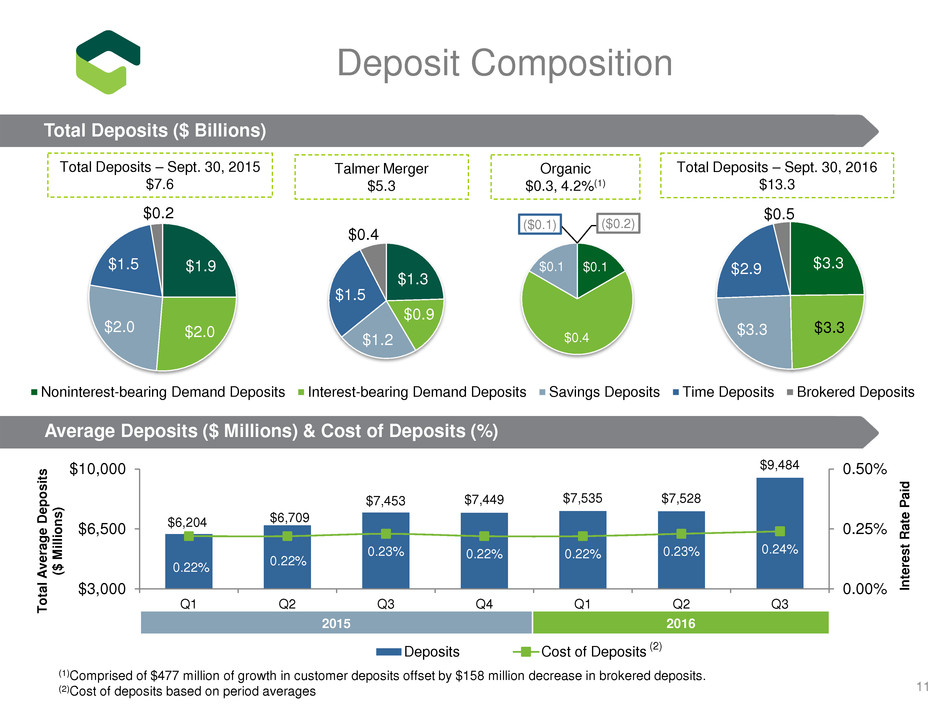

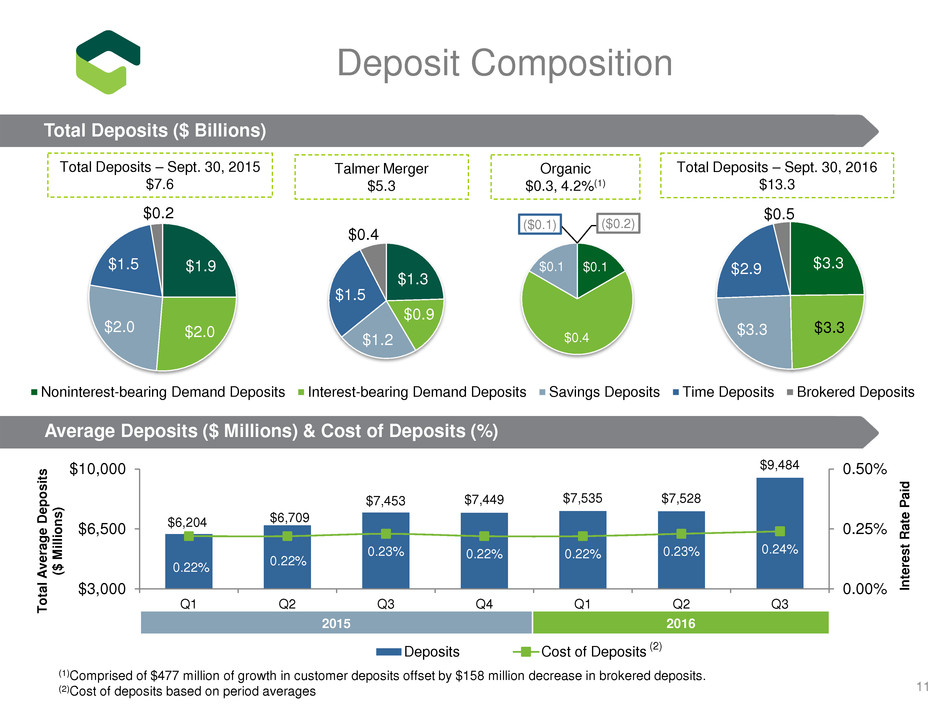

$3.3 $3.3 $3.3 $2.9 $0.5 Noninterest-bearing Demand Deposits Interest-bearing Demand Deposits Savings Deposits Time Deposits Brokered Deposits $1.9 $2.0 $2.0 $1.5 $0.2 11 (1)Comprised of $477 million of growth in customer deposits offset by $158 million decrease in brokered deposits. (2)Cost of deposits based on period averages 2015 2016 Total Deposits – Sept. 30, 2015 $7.6 Total Deposits – Sept. 30, 2016 $13.3 Organic $0.3, 4.2%(1) $1.3 $0.9 $1.2 $1.5 $0.4 Talmer Merger $5.3 $0.1 $0.4 $0.1 ($0.1) ($0.2) Deposit Composition Total Deposits ($ Billions) Average Deposits ($ Millions) & Cost of Deposits (%) $6,204 $6,709 $7,453 $7,449 $7,535 $7,528 $9,484 0.22% 0.22% 0.23% 0.22% 0.22% 0.23% 0.24% 0.00% 0.25% 0.50% $3,000 $6,500 $10,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 In te re st R at e P ai d T ot al A ve ra ge D ep os its ($ M ill io ns ) Deposits Cost of Deposits (2)

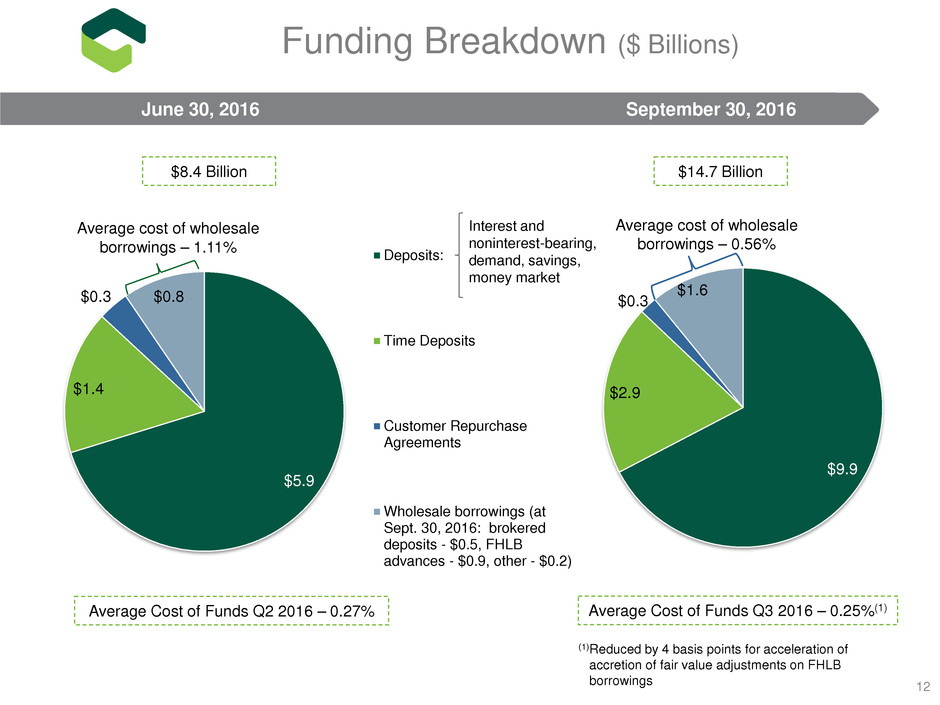

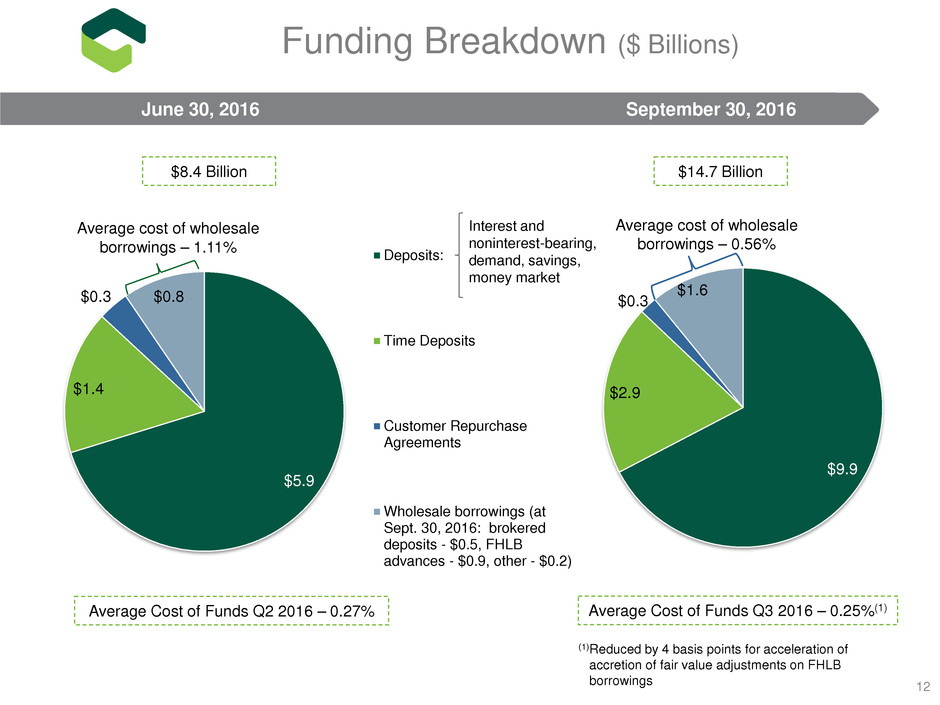

$9.9 $2.9 $0.3 $1.6 Deposits: Time Deposits Customer Repurchase Agreements Wholesale borrowings (at Sept. 30, 2016: brokered deposits - $0.5, FHLB advances - $0.9, other - $0.2) 12 Average Cost of Funds Q3 2016 – 0.25%(1)Average Cost of Funds Q2 2016 – 0.27% $8.4 Billion $14.7 Billion $5.9 $1.4 $0.3 $0.8 Interest and noninterest-bearing, demand, savings, money market Average cost of wholesale borrowings – 0.56% Average cost of wholesale borrowings – 1.11% Funding Breakdown ($ Billions) (1)Reduced by 4 basis points for acceleration of accretion of fair value adjustments on FHLB borrowings June 30, 2016 September 30, 2016

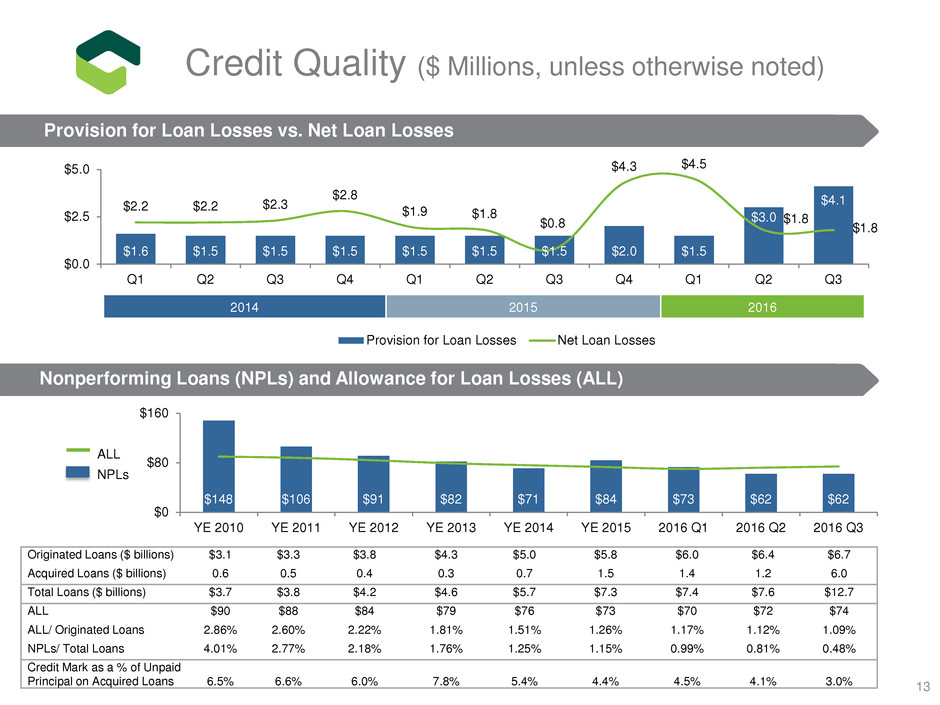

$1.6 $1.5 $1.5 $1.5 $1.5 $1.5 $1.5 $2.0 $1.5 $3.0 $4.1$2.2 $2.2 $2.3 $2.8 $1.9 $1.8 $0.8 $4.3 $4.5 $1.8 $1.8 $0.0 $2.5 $5.0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Provision for Loan Losses Net Loan Losses $148 $106 $91 $82 $71 $84 $73 $62 $62 $0 $80 $160 YE 2010 YE 2011 YE 2012 YE 2013 YE 2014 YE 2015 2016 Q1 2016 Q2 2016 Q3 13 ALL NPLs 2014 2015 2016 Originated Loans ($ billions) $3.1 $3.3 $3.8 $4.3 $5.0 $5.8 $6.0 $6.4 $6.7 Acquired Loans ($ billions) 0.6 0.5 0.4 0.3 0.7 1.5 1.4 1.2 6.0 Total Loans ($ billions) $3.7 $3.8 $4.2 $4.6 $5.7 $7.3 $7.4 $7.6 $12.7 ALL $90 $88 $84 $79 $76 $73 $70 $72 $74 ALL/ Originated Loans 2.86% 2.60% 2.22% 1.81% 1.51% 1.26% 1.17% 1.12% 1.09% NPLs/ Total Loans 4.01% 2.77% 2.18% 1.76% 1.25% 1.15% 0.99% 0.81% 0.48% Credit Mark as a % of Unpaid Principal on Acquired Loans 6.5% 6.6% 6.0% 7.8% 5.4% 4.4% 4.5% 4.1% 3.0% Credit Quality ($ Millions, unless otherwise noted) Provision for Loan Losses vs. Net Loan Losses Nonperforming Loans (NPLs) and Allowance for Loan Losses (ALL)

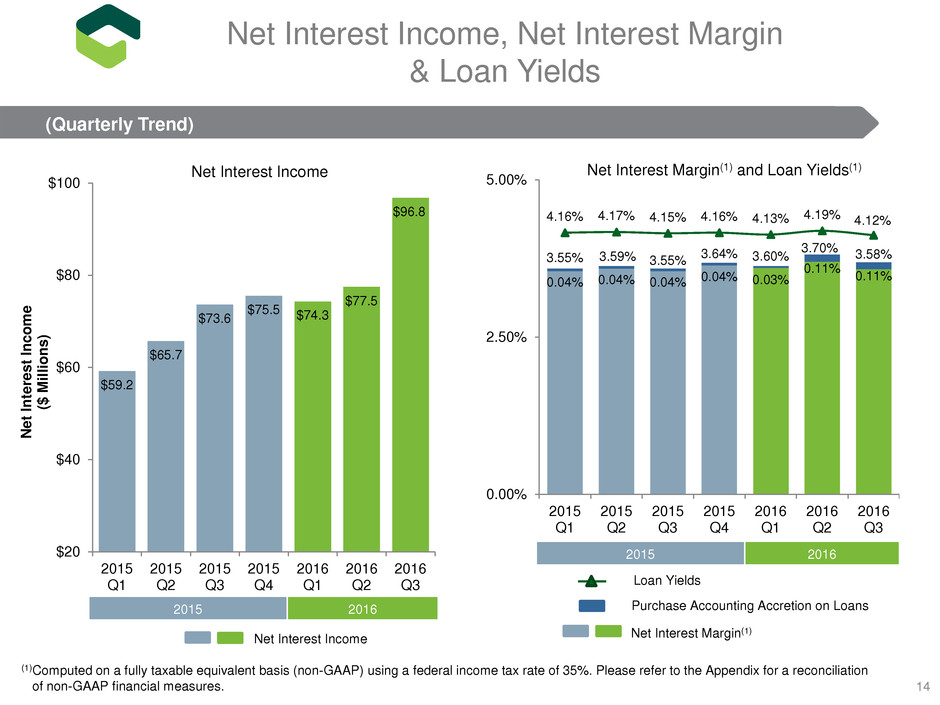

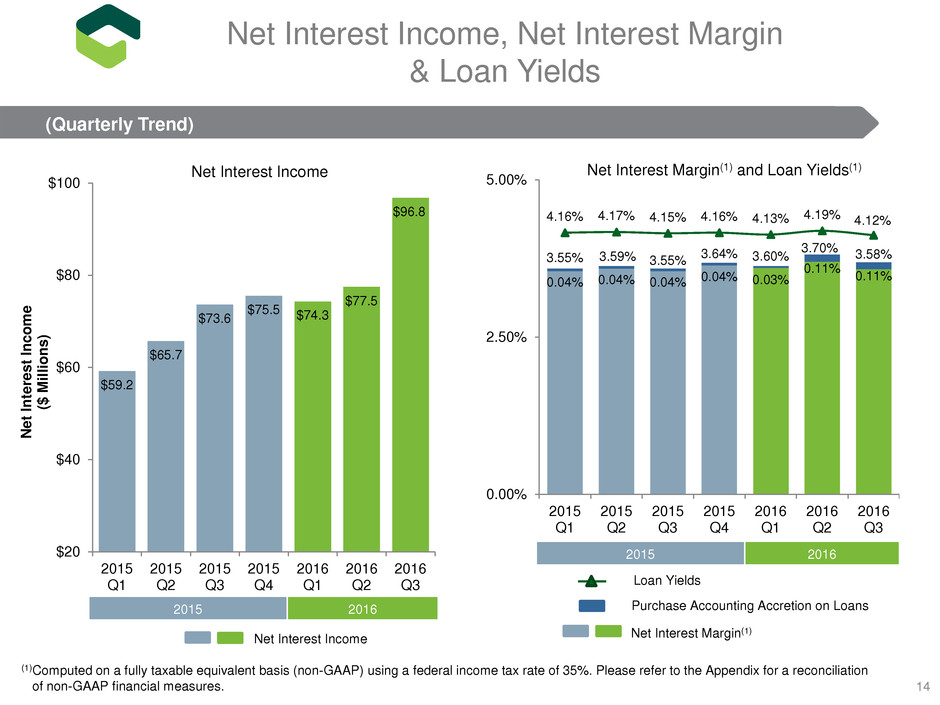

$59.2 $65.7 $73.6 $75.5 $74.3 $77.5 $96.8 $20 $40 $60 $80 $100 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2016 Q1 2016 Q2 2016 Q3 N et In te re st In co m e ($ M ill io ns ) Net Interest Income 14 3.55% 3.59% 3.55% 3.64% 3.60% 3.70% 3.58% 0.04% 0.04% 0.04% 0.04% 0.03% 0.11% 0.11% 4.16% 4.17% 4.15% 4.16% 4.13% 4.19% 4.12% 0.00% 2.50% 5.00% 2015 Q1 2015 Q2 2015 Q3 2015 Q4 2016 Q1 2016 Q2 2016 Q3 Net Interest Margin(1) and Loan Yields(1) Net Interest Margin(1) Purchase Accounting Accretion on Loans Loan Yields 2015 2016 2015 2016 Net Interest Income Net Interest Income, Net Interest Margin & Loan Yields (Quarterly Trend) (1)Computed on a fully taxable equivalent basis (non-GAAP) using a federal income tax rate of 35%. Please refer to the Appendix for a reconciliation of non-GAAP financial measures.

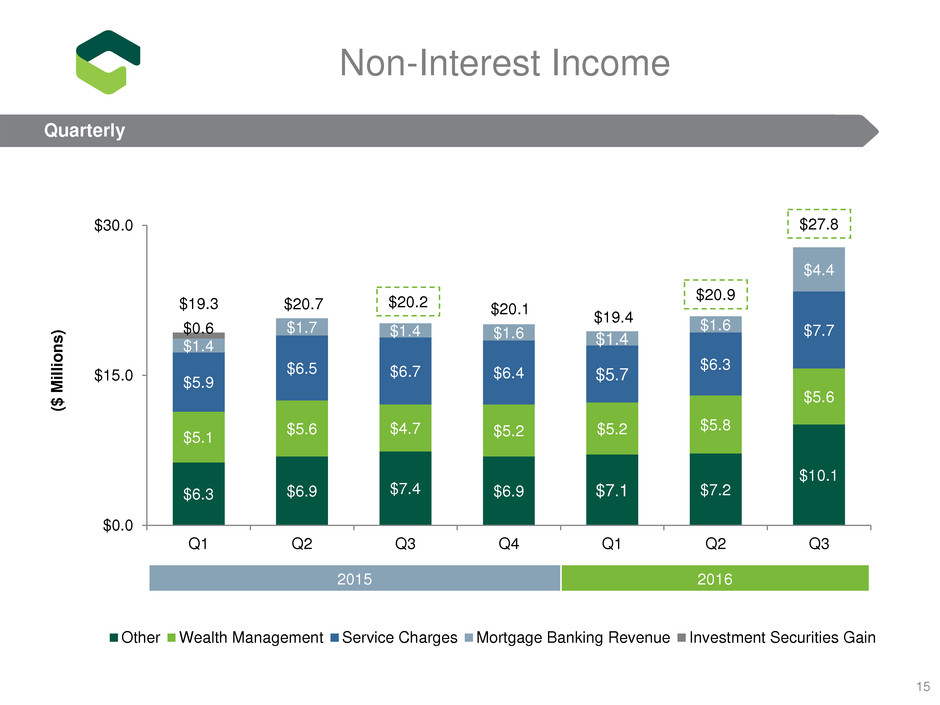

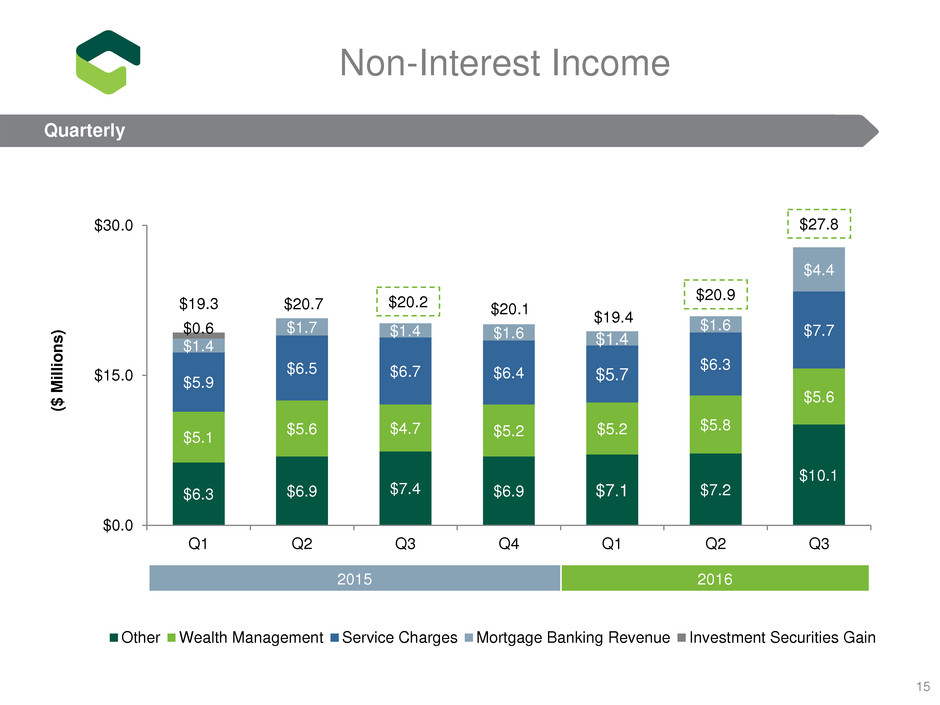

$6.3 $6.9 $7.4 $6.9 $7.1 $7.2 $10.1 $5.1 $5.6 $4.7 $5.2 $5.2 $5.8 $5.6 $5.9 $6.5 $6.7 $6.4 $5.7 $6.3 $7.7 $1.4 $1.7 $1.4 $1.6 $1.4 $1.6 $4.4 $0.6 $0.0 $15.0 $30.0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Other Wealth Management Service Charges Mortgage Banking Revenue Investment Securities Gain 2015 2016 ($ M ill io ns ) 15 $20.7$19.3 $19.4$20.1 $20.2 $27.8 $20.9 Non-Interest Income Quarterly

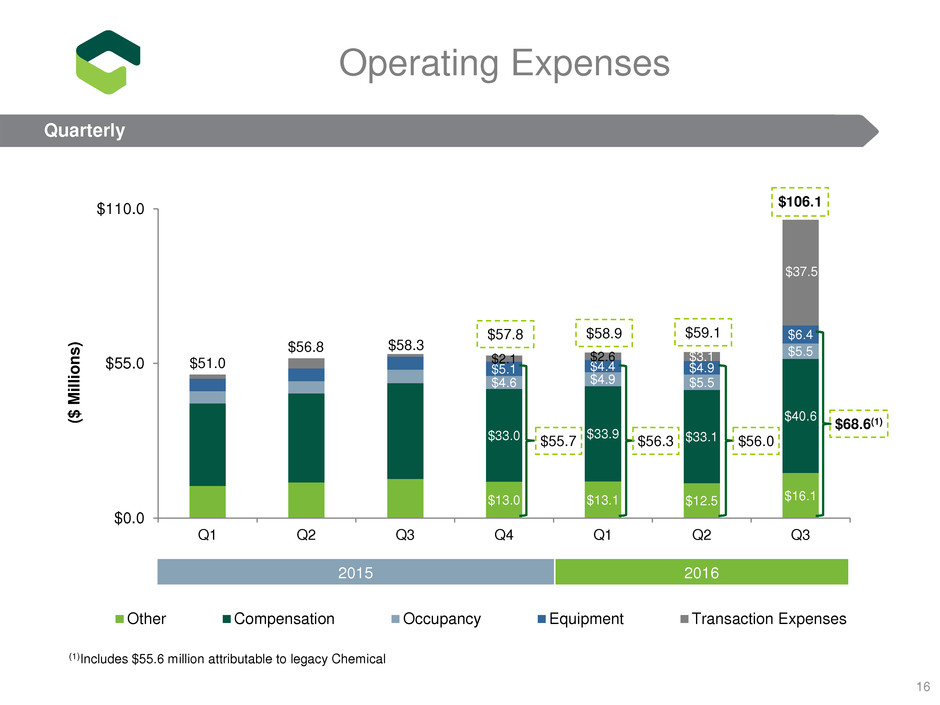

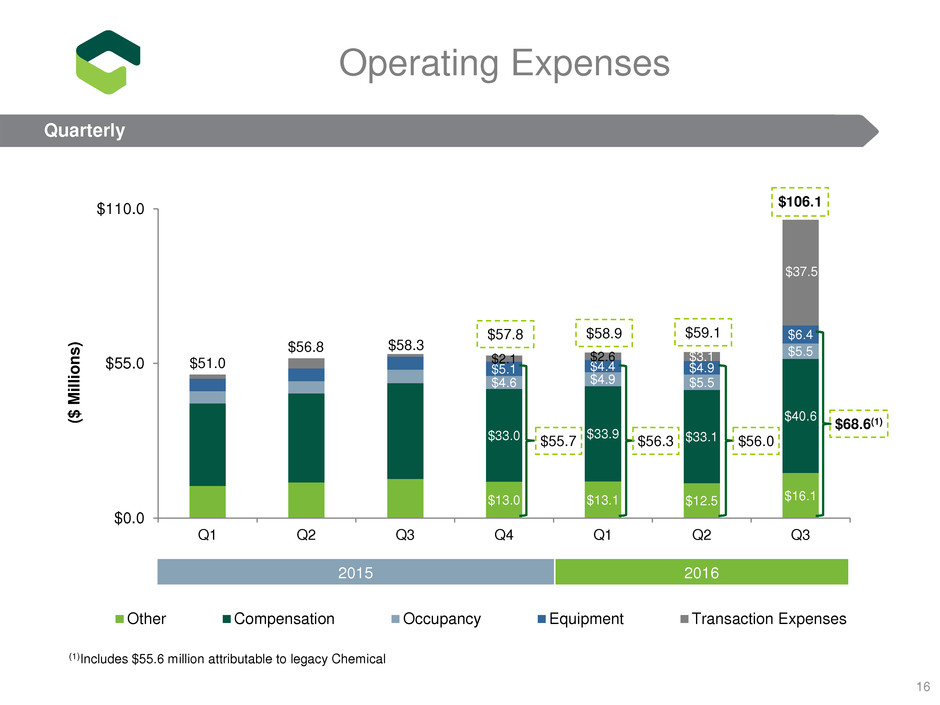

$13.0 $13.1 $12.5 $16.1 $33.0 $33.9 $33.1 $40.6 $4.6 $4.9 $5.5 $5.5 $5.1 $4.4 $4.9 $6.4 $2.1 $2.6 $3.1 $37.5 $0.0 $55.0 $110.0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Other Compensation Occupancy Equipment Transaction Expenses 2015 2016 16 ($ M ill io ns ) $56.8 $51.0 $58.3 $56.0 $57.8 $59.1 $56.3 $58.9 $55.7 $68.6(1) $106.1 Operating Expenses Quarterly (1)Includes $55.6 million attributable to legacy Chemical

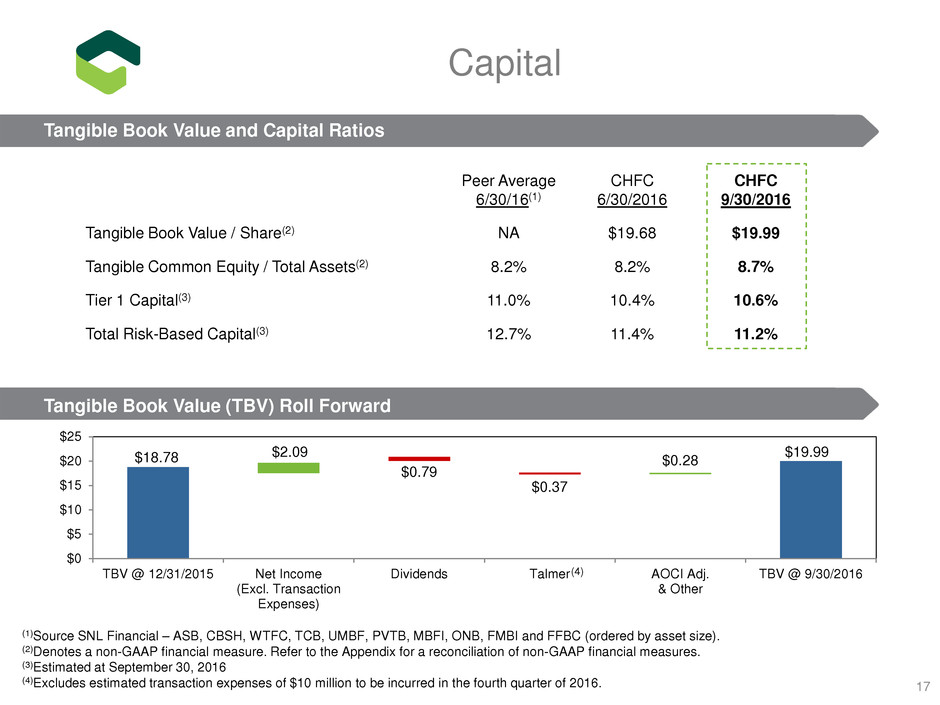

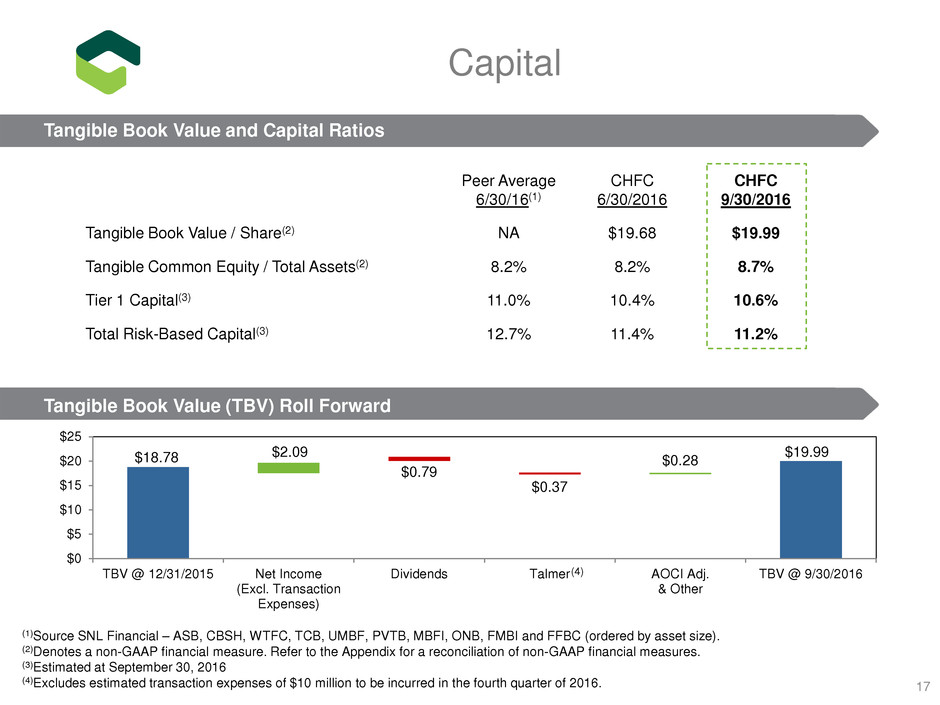

Peer Average 6/30/16(1) CHFC 6/30/2016 CHFC 9/30/2016 Tangible Book Value / Share(2) NA $19.68 $19.99 Tangible Common Equity / Total Assets(2) 8.2% 8.2% 8.7% Tier 1 Capital(3) 11.0% 10.4% 10.6% Total Risk-Based Capital(3) 12.7% 11.4% 11.2% $19.99 $0.79 $0.37 $18.78 $2.09 $0.28 $0 $5 $10 $15 $20 $25 TBV @ 12/31/2015 Net Income (Excl. Transaction Expenses) Dividends Talmer AOCI Adj. & Other TBV @ 9/30/2016 17 Capital Tangible Book Value and Capital Ratios Tangible Book Value (TBV) Roll Forward (1)Source SNL Financial – ASB, CBSH, WTFC, TCB, UMBF, PVTB, MBFI, ONB, FMBI and FFBC (ordered by asset size). (2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. (3)Estimated at September 30, 2016 (4)Excludes estimated transaction expenses of $10 million to be incurred in the fourth quarter of 2016. (4)

Concentrate on completing the integration of Chemical and Talmer, achieving cost savings and exploiting business synergy opportunities Maintain and enhance preparedness for acquisitive growth Emphasize our strategy of being the Preeminent Midwest Community Bank Focus on what we can control 18 Closing Comments

3Q 2016 2Q 2016 3Q 2015 Shareholders’ equity $2,563,666 $1,050,299 $998,363 Goodwill, CDI and non-compete agreements, net of tax (1,154,121) (297,044) (299,681) Tangible shareholders’ equity $1,409,545 $753,255 $698,682 Common shares outstanding 70,497 38,267 38,131 Tangible book value per share $19.99 $19.68 $18.32 Net income $10,732 $25,707 $24,467 Transaction expenses, net of tax 25,118 1,985 585 Net income, excluding transaction expenses $35,850 $27,692 $25,052 Diluted earnings per share $0.21 $0.67 $0.64 Effect of transaction expenses, net of tax 0.51 0.05 0.01 Diluted earnings per share, excluding transaction expenses $0.72 $0.72 $0.65 Average assets $12,250,730 $9,332,398 $9,203,856 Return on average assets 0.35% 1.11% 1.05% Effect of transaction expenses, net of tax 0.81% 0.08% 0.03% Return on average assets, excluding transaction expenses 1.16% 1.19% 1.08% Average shareholders’ equity $1,559,668 $1,033,014 $987,727 Return on average shareholders’ equity 2.7% 10.0% 9.8% Effect of transaction expenses, net of tax 6.4% 0.8% 0.3% Return on average shareholders’ equity, excluding transaction expenses 9.1% 10.8% 10.1% 19 Appendix: Non-GAAP Reconciliation (Dollars in thousands, except per share data)

3Q 2016 2Q 2016 3Q 2015 Efficiency Ratio: Total revenue – GAAP $ 124,579 $ 98,392 $ 93,832 Net interest Income FTE adj 2,426 2,138 2,031 Gains from sale of investment securities gains and closed branch locations (301) (123) (111) Total revenue – Non-GAAP $ 126,704 $100,407 $ 95,752 Operating expenses – GAAP $ 106,144 $ 59,085 $ 58,265 Transaction expenses (37,470) (3,054) (900) Amortization of intangibles (1,292) (1,195) (1,270) Operating expenses – Non-GAAP $ 67,382 $ 54,836 $ 56,095 Efficiency ratio – GAAP 85.2% 60.1% 62.1% Efficiency ratio – adjusted 53.2% 54.6% 58.6% Net Interest Margin: Net Interest Income – GAAP $96,809 $77,495 $73,617 Adjustments for tax equivalent interest: Loans 777 717 740 Investment securities 1,649 1,421 1,291 Total taxable equivalent adjustments 2,426 2,138 2,031 Net Interest Income (on a tax equivalent basis) $99,235 $79,633 $75,648 Average interest-earning assets $11,058,143 $8,636,627 $8,467,939 Net Interest Margin – GAAP 3.49% 3.60% 3.46% Net Interest Margin (on a tax-equivalent basis) 3.58% 3.70% 3.55% 20 Appendix: Non-GAAP Reconciliation (Dollars in thousands, except per share data)