2018 First Quarter Earnings Release David T. Provost Chief Executive Officer Thomas C. Shafer Vice Chairman, Chief Executive Officer of Chemical Bank Dennis L. Klaeser EVP and Chief Financial Officer April 25, 2018

This presentation and the accompanying presentation by management may contain forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about the financial services industry, the economy and Chemical Financial Corporation ("Chemical"). Words and phrases such as "anticipates," "believes," "continue," "estimates," "expects," "forecasts," "future," "intends," "is likely," "judgment," "look ahead," "look forward," "on schedule," "on track," "opinion," "opportunity," "plans," "potential," "predicts," "probable," "projects," "should," "strategic," "trend," "will," and variations of such words and phrases or similar expressions are intended to identify such forward-looking statements. All statements referencing future time periods are forward-looking. Management's determination of the provision and allowance for loan losses; the carrying value of acquired loans, goodwill and mortgage servicing rights; the fair value of investment securities (including whether any impairment on any investment security is temporary or other- than-temporary and the amount of any impairment); and management's assumptions concerning pension and other postretirement benefit plans involve judgments that are inherently forward-looking. There can be no assurance that future loan losses will be limited to the amounts estimated. All of the information concerning interest rate sensitivity is forward-looking. The future effect of changes in the financial and credit markets and the national and regional economies on the banking industry, generally, and on Chemical, specifically, are also inherently uncertain. Forward-looking are based upon current beliefs and expectations and involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Accordingly, such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions ("risk factors") that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. Chemical undertakes no obligation to update, amend or clarify forward-looking statements, whether as a result of new information, future events or otherwise. Forward-Looking Statements & Other Information 2

Risk factors include, without limitation: • Chemical's ability to attract and retain new commercial lenders and other bankers as well as key operations staff in light of competition for experienced employees in the banking industry; • Operational and regulatory challenges associated with our information technology systems and policies and procedures in light of our rapid growth and pending systems conversion in 2018; • Chemical's ability to grow its deposits while reducing the number of physical branches that it operates; • Negative reactions to the branch closures by Chemical Bank's customers, employees and other counterparties; • Economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a reduction in demand for credit and a decline in real estate values; • A general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results; • Increased cybersecurity risk, including potential network breaches, business disruptions, or financial losses; • Restrictions or condition imposed by our regulators on our operations may make it more difficult for us to achieve our goals; • Legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; • Changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; and • Economic, governmental, or other factors may prevent the projected population, residential, and commercial growth in the markets in which we operate. In addition, risk factors include, but are not limited to, the risk factors described in Item 1A of Chemical’s most recent Annual Report on Form 10-K or disclosed in documents filed or furnished by the Company with or to the SEC after the filing of such Annual Report on Form 10-K. These and other factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a preceding forward-looking statement. Forward-Looking Statements & Other Information (continued) 3

Non-GAAP Financial Measures This presentation and the accompanying presentation by management contain certain non-GAAP financial disclosures that are not in accordance with U.S. generally accepted accounting principles ("GAAP"). Such non-GAAP financial measures include Chemical’s tangible shareholders' equity to tangible assets ratio, tangible book value per share, presentation of net interest income and net interest margin on a fully taxable equivalent basis, operating expenses-core (which excludes merger and restructuring expenses and impairment of income tax credits), operating expenses-efficiency ratio (which excludes merger and restructuring expenses, impairment of income tax credits and amortization of intangibles), the adjusted efficiency ratio (which excludes significant items, merger and restructuring expenses, impairment of income tax credits, loan servicing rights change in fair value gains (losses), amortization of intangibles, net interest income FTE adjustments, (losses) gains from sale of investment securities and closed branch locations) and other information presented excluding significant items, including net income, diluted earnings per share, return on average assets and return on average shareholders' equity. Chemical uses non-GAAP financial measures to provide meaningful, supplemental information regarding its operational results and to enhance investors’ overall understanding of Chemical’s financial performance. The limitations associated with non-GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. These disclosures should not be considered an alternative to Chemical’s GAAP results. See the Appendix included with this presentation for a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Forward-Looking Statements & Other Information (continued) 4

First Quarter 2018 Highlights q Diluted earnings per share of $0.97, compared to $0.13 in the 4th qtr. 2017 and $0.67 in the 1st qtr. 2017 q Diluted earnings per share, excluding significant items,(1)(2) of $0.97; up 11% from 4th qtr. 2017 and up 39% from 1st qtr. 2017 q Return on average assets and return on average shareholders' equity of 1.44% and 10.5%, respectively, in 1st qtr. 2018 q Return on average tangible shareholders' equity(2) of 18.6% in 1st qtr. 2018 q Net interest margin (GAAP) of 3.51%, compared to 3.39% in 4th qtr. 2017 and 3.41% in 1st qtr. 2017. Net interest margin (fully tax equivalent basis)(2) up 9 basis points to 3.56% compared to 4th qtr. 2017, and up 7 basis points from 1st qtr. 2017 q Asset quality ratios ▪ Nonperforming loans/total loans of 0.43% at March 31, 2018; decreased from 0.45% at December 31, 2017, and increased from 0.36% at March 31, 2017 ▪ Net loan charge-offs/average loans of 0.10% (1) "Significant items" include the fourth and first quarters of 2017 merger and restructuring expenses, the fourth quarter of 2017 charge to income tax expense as a result of the revaluation of the net deferred tax assets and the fourth quarter of 2017 losses on sales of investment securities. (2) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. 5

2018 2017 2017 (in thousands except per share data) 1st Qtr. 4th Qtr. 1st Qtr. Net interest income $ 151,863 $ 145,905 $ 130,097 Provision for loan losses 6,256 7,522 4,050 Noninterest income 40,554 32,319 38,010 Operating expenses 103,358 100,022 104,196 Operating expenses, core(1) 101,724 91,298 100,029 Merger expenses — 1,511 4,167 Restructuring expenses — 1,056 — Impairment of income tax credits 1,634 6,157 — Net income 70,170 9,446 47,604 Net income, excl. significant items(1) 70,170 62,686 50,313 Diluted EPS 0.97 0.13 0.67 Diluted EPS, excl. significant items(1) 0.97 0.87 0.70 Return on Avg. Assets 1.44% 0.20% 1.09% Return on Avg. Shareholders’ Equity 10.5% 1.4% 7.4% Return on Avg. Tangible Shareholders’ Equity, excluding significant items(1) 18.6% 16.5% 14.1% Efficiency Ratio 53.7% 56.1% 62.0% Efficiency Ratio - Adjusted(1) 52.5% 47.4% 57.4% Equity/Total Assets 13.7% 13.8% 14.7% Tangible Shareholders' Equity/Tangible Assets(1) 8.3% 8.3% 8.8% Book Value/Share $ 37.89 $ 37.48 $ 36.56 Tangible Book Value/Share(1) $ 21.66 $ 21.21 $ 20.32 Prior Quarter Comparison ▪ Higher net interest income in Q1 compared to Q4, due to higher yields earned and average balances on loans and investment securities − partially offset by two less days in the first quarter ▪ Increase in noninterest income primarily due to the Q4 losses on the sale of investment securities and the benefit from a $3.8 million change in fair value in loan servicing rights ▪ Operating expenses increased primarily due to an increase in salaries, wages and benefits expense ▪ Decrease in provision for loan losses, primarily due to lower net organic loan growth Prior-Year Quarter Comparison ▪ Increase in net interest income, attributable to organic growth in total loans and and increase in investment securities during the twelve months ended March 31, 2018 (1) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. Financial Highlights Income Statement Highlights 6 Financial Highlights

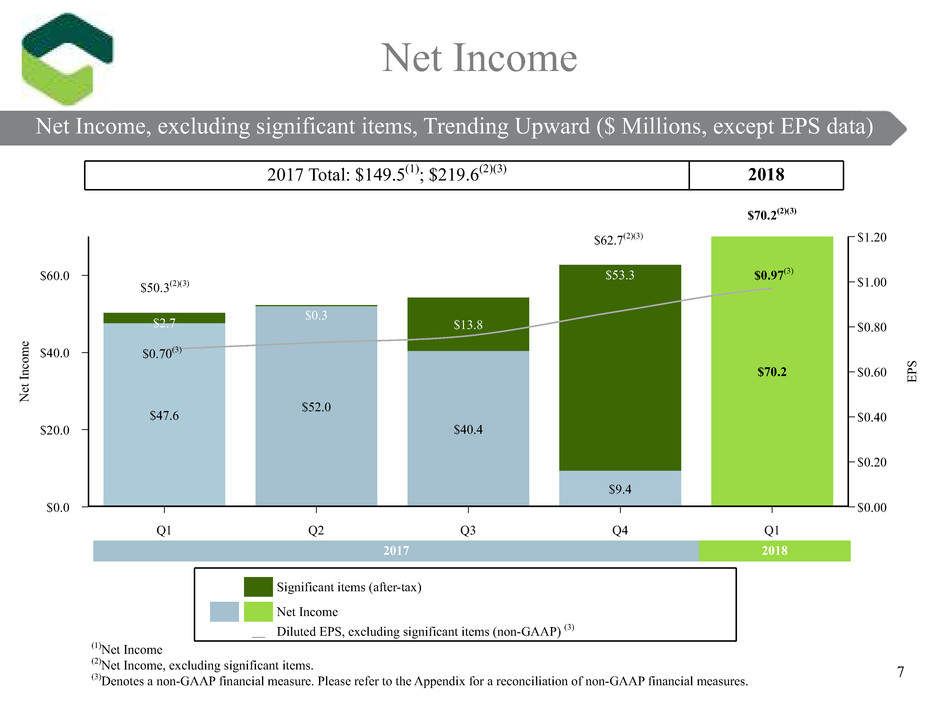

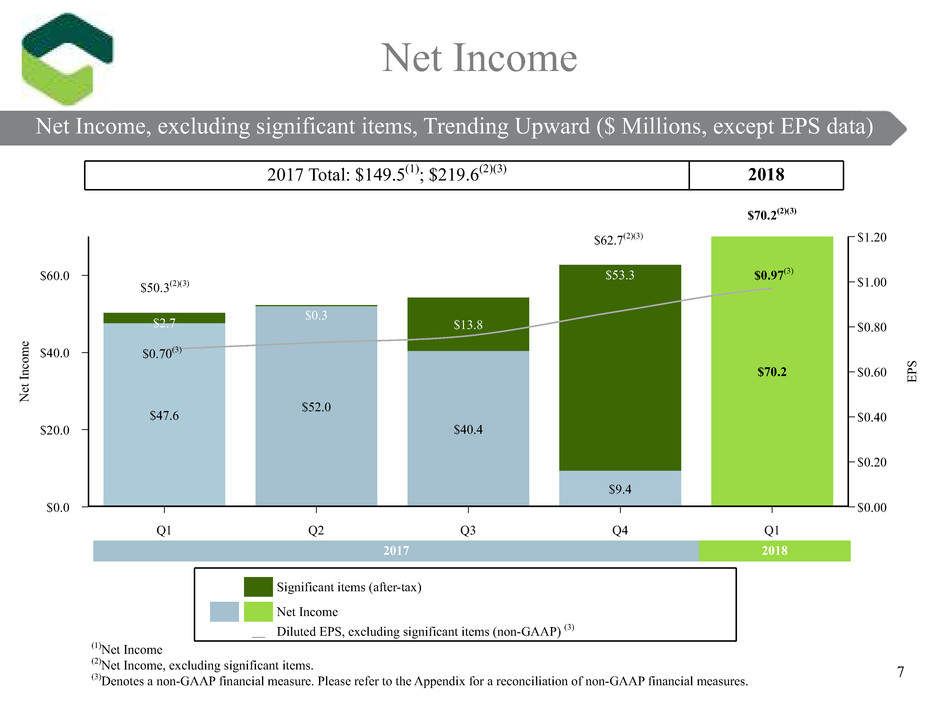

2017 Total: $149.5(1); $219.6(2)(3) 2018 (1)Net Income (2)Net Income, excluding significant items. (3)Denotes a non-GAAP financial measure. Please refer to the Appendix for a reconciliation of non-GAAP financial measures. $70.2(2)(3) Net Income Trending Upward ($ Millions, except EPS data) Net Income $0.65(3) Net Income, excluding significant items, Trending Upward ($ Millions, except EPS data) $60.0 $40.0 $20.0 $0.0 N et In co m e $1.20 $1.00 $0.80 $0.60 $0.40 $0.20 $0.00 EP S Q1 Q2 Q3 Q4 Q1 $47.6 $52.0 $40.4 $9.4 $70.2 $2.7 $0.3 $13.8 $53.3 2017 2018 $62.7(2)(3) 7 $50.3(2)(3) Significant items (after-tax) Net Income __ Diluted EPS, excluding significant items (non-GAAP) (3) $0.97(3) $0.70(3)

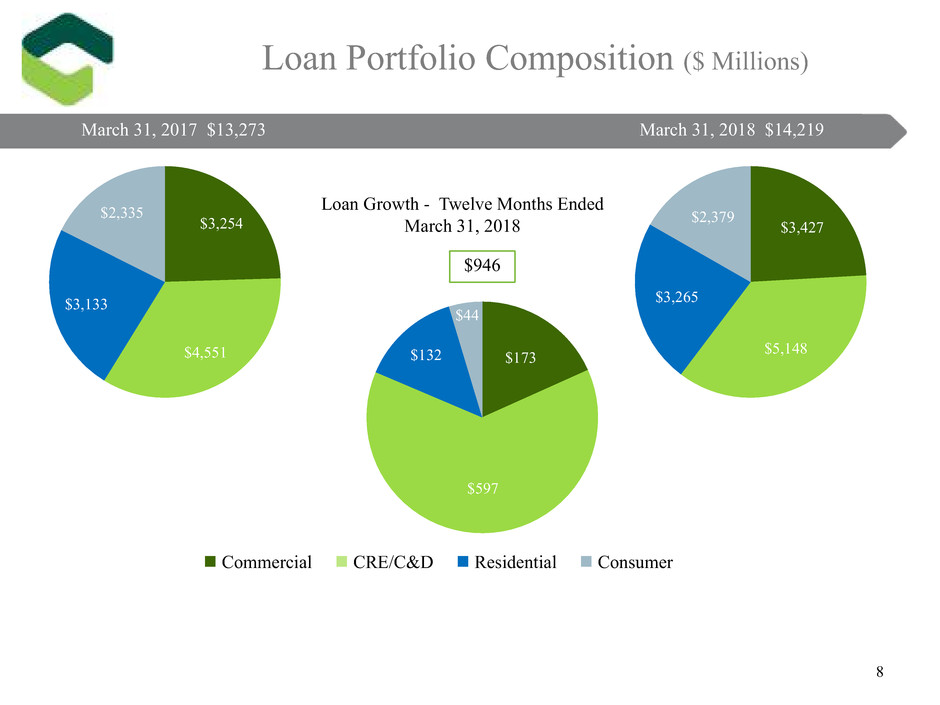

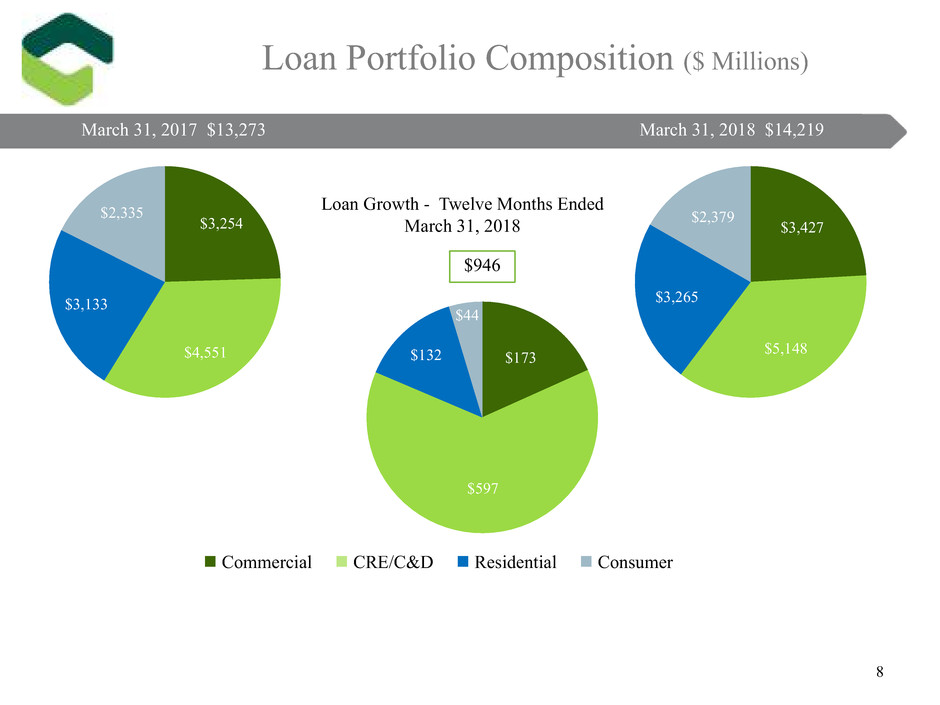

Loan Portfolio Composition ($ Millions) 8 March 31, 2017 $13,273 March 31, 2018 $14,219 $3,254 $4,551 $3,133 $2,335 $3,427 $5,148 $3,265 $2,379 $173 $597 $132 $44 n Commercial n CRE/C&D n Residential n Consumer Loan Growth - Twelve Months Ended March 31, 2018 $946

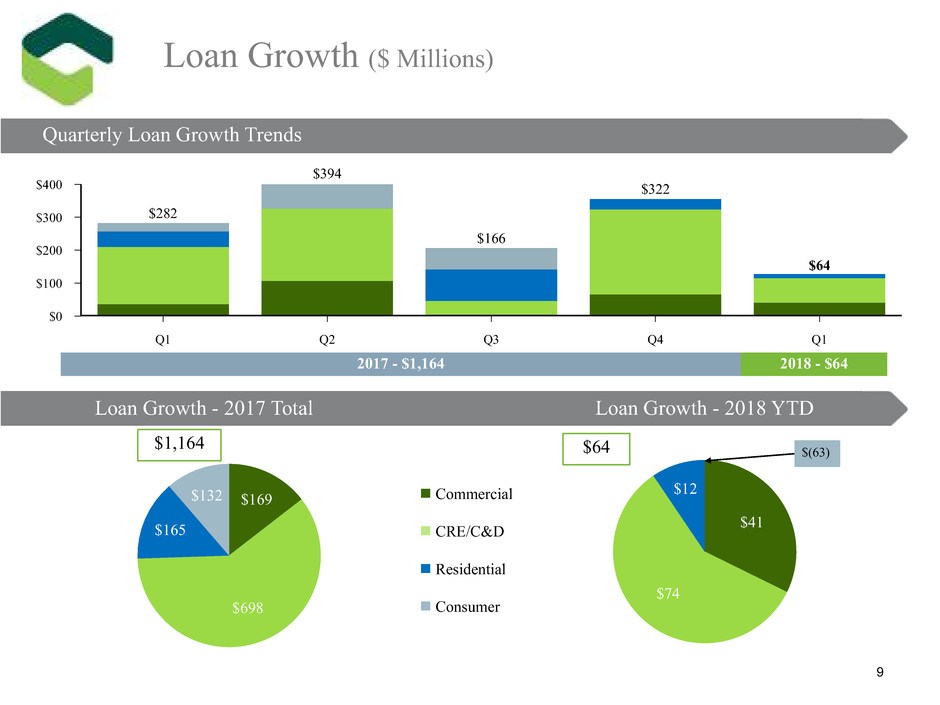

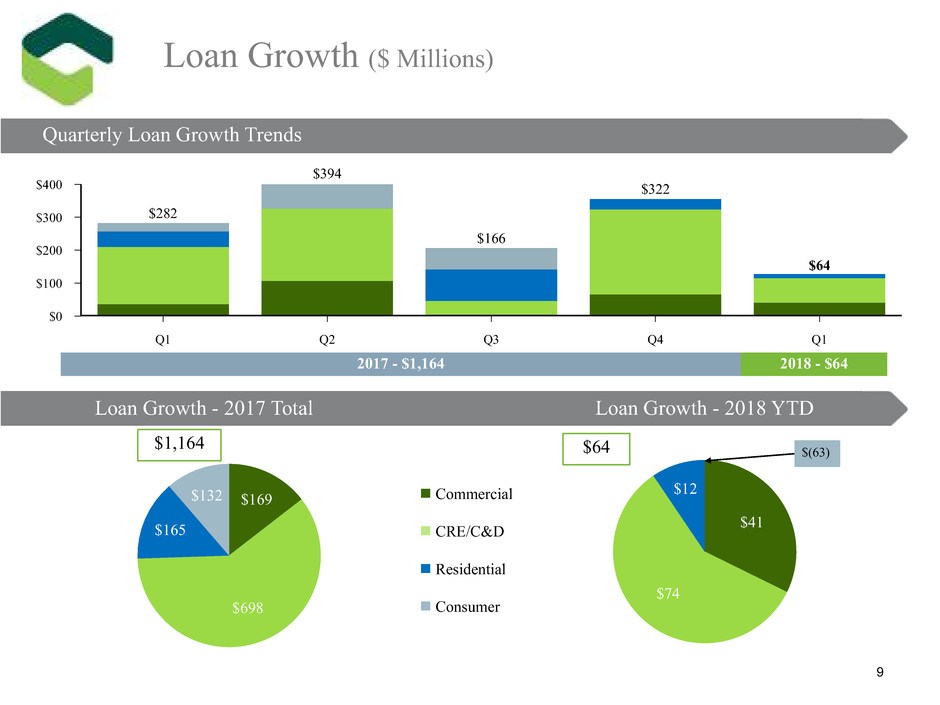

2017 - $1,164 2018 - $64 $64$1,164 Quarterly Loan Growth Trends Loan Growth ($ Millions) 9 n Commercial n CRE/C&D n Residential n Consumer $400 $300 $200 $100 $0 Q1 Q2 Q3 Q4 Q1 $322 $64 $282 $394 $166 Loan Growth - 2017 Total Loan Growth - 2018 YTD $41 $74 $12 $169 $698 $165 $132 Quarterly Loan Growth Trends $(63)

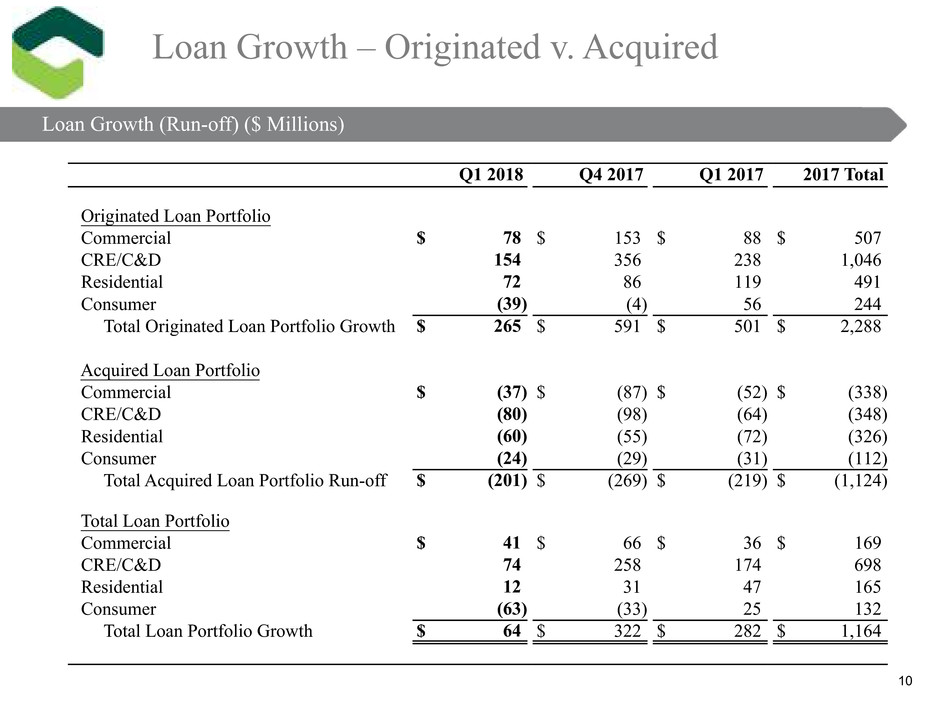

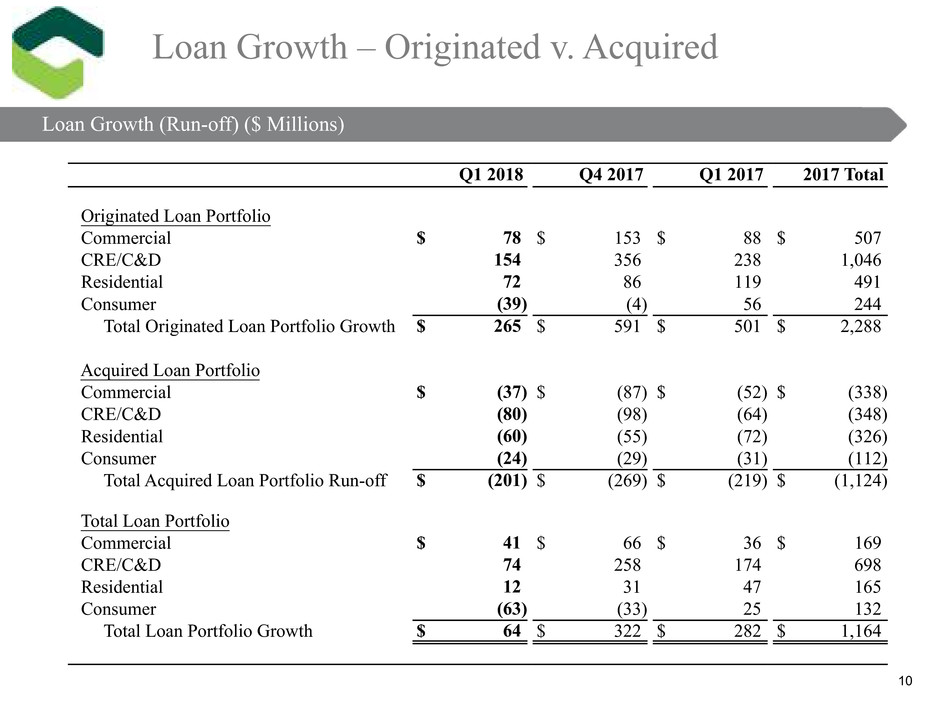

Q1 2018 Q4 2017 Q1 2017 2017 Total Originated Loan Portfolio Commercial $ 78 $ 153 $ 88 $ 507 CRE/C&D 154 356 238 1,046 Residential 72 86 119 491 Consumer (39) (4) 56 244 Total Originated Loan Portfolio Growth $ 265 $ 591 $ 501 $ 2,288 Acquired Loan Portfolio Commercial $ (37) $ (87) $ (52) $ (338) CRE/C&D (80) (98) (64) (348) Residential (60) (55) (72) (326) Consumer (24) (29) (31) (112) Total Acquired Loan Portfolio Run-off $ (201) $ (269) $ (219) $ (1,124) Total Loan Portfolio Commercial $ 41 $ 66 $ 36 $ 169 CRE/C&D 74 258 174 698 Residential 12 31 47 165 Consumer (63) (33) 25 132 Total Loan Portfolio Growth $ 64 $ 322 $ 282 $ 1,164 Loan Growth (Run-off) ($ Millions) Loan Growth – Originated v. Acquired 10 Loan Growth (Run-off) ($ Millions)

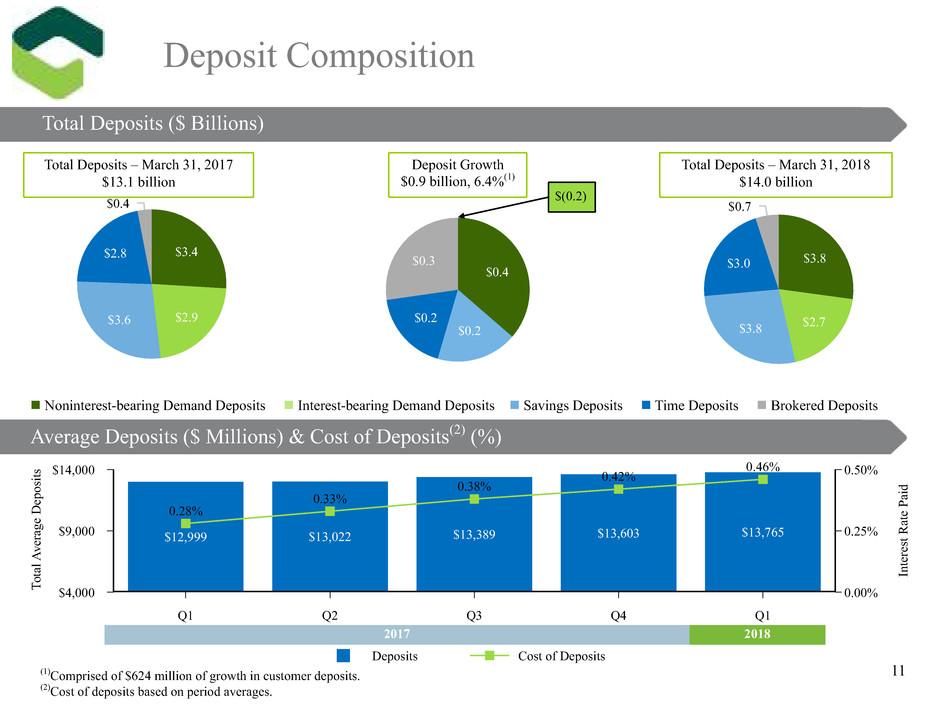

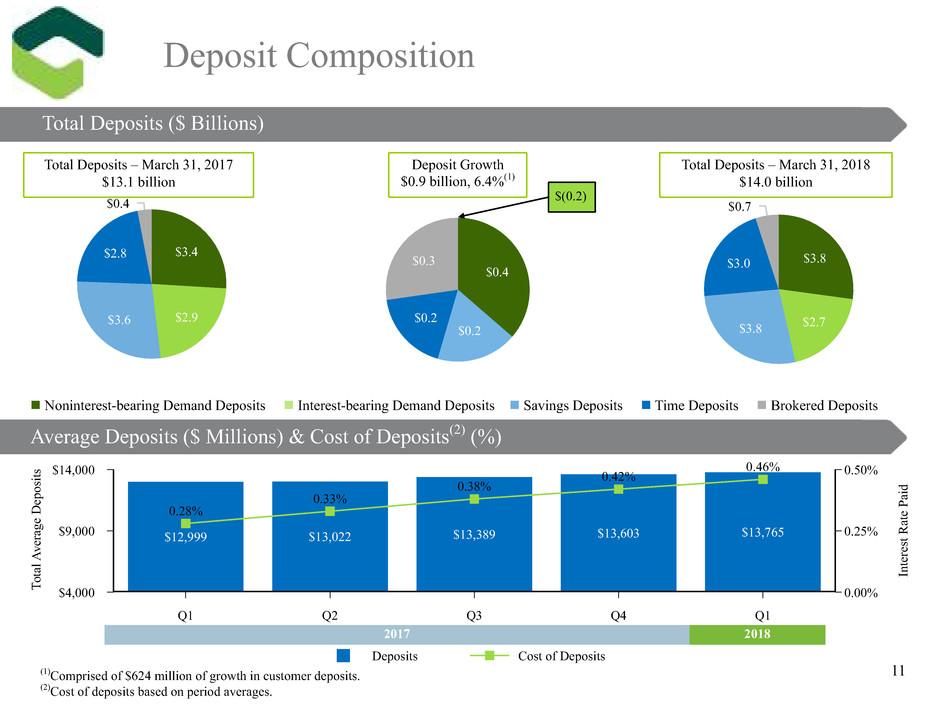

(1)Comprised of $624 million of growth in customer deposits. (2)Cost of deposits based on period averages. Total Deposits – March 31, 2017 $13.1 billion Total Deposits – March 31, 2018 $14.0 billion Deposit Growth $0.9 billion, 6.4%(1) Total Deposits ($ Billions) Deposit Composition 2017 2018 11 otal Deposits ($ Billions) Average Deposits ($ Millions) & Cost of Deposits(2) (%) $3.8 $2.7$3.8 $3.0 $0.7 n Noninterest-bearing Demand Deposits n Interest-bearing Demand Deposits n Savings Deposits n Time Deposits n Brokered Deposits $0.4 $0.2 $0.2 $0.3 $3.4 $2.9$3.6 $2.8 $0.4 Deposits Cost of Deposits $14,000 $9,000 $4,000T ot al Av er ag e D ep os its 0.50% 0.25% 0.00% In te re st R at e Pa id Q1 Q2 Q3 Q4 Q1 $12,999 $13,022 $13,389 $13,603 $13,765 0.28% 0.33% 0.38% 0.42% 0.46% $(0.2)

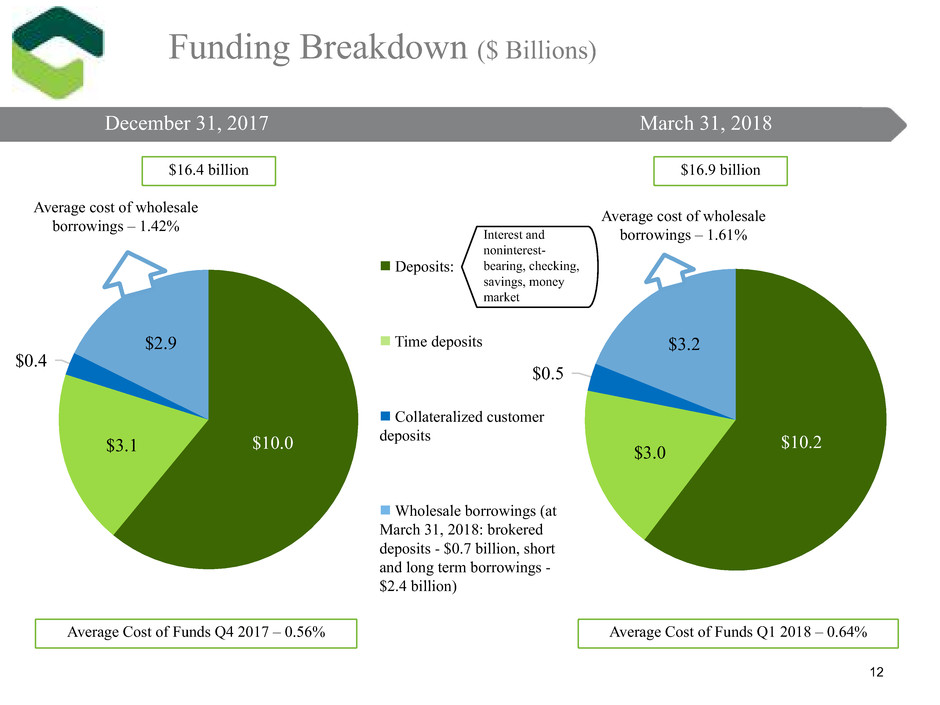

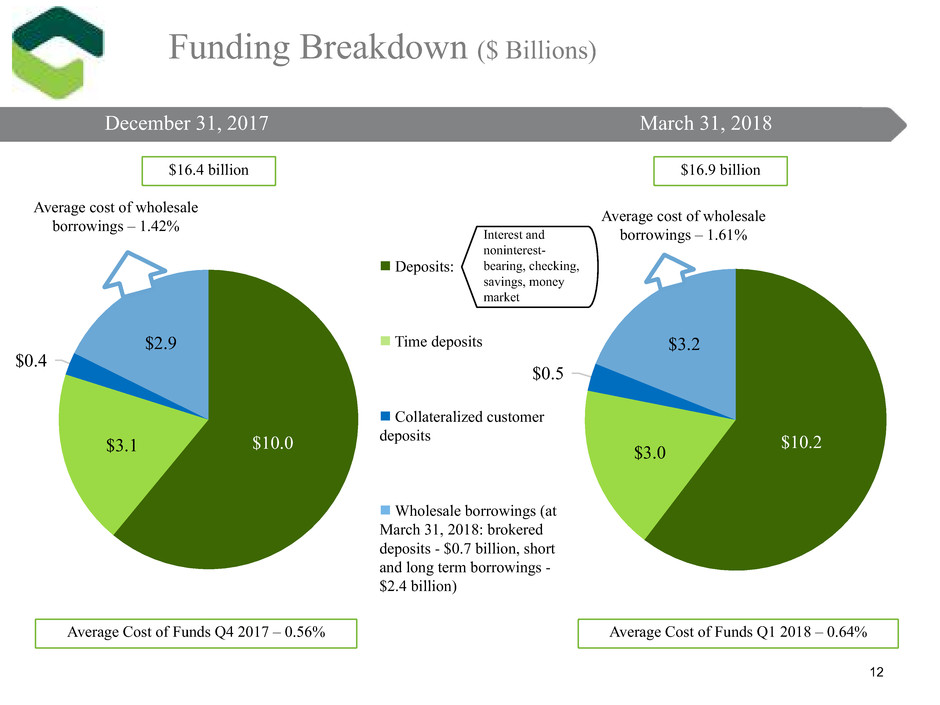

Average Cost of Funds Q1 2018 – 0.64% Average Cost of Funds Q4 2017 – 0.56% $16.4 billion $16.9 billion Average cost of wholesale borrowings – 1.61% Average cost of wholesale borrowings – 1.42% Funding Breakdown ($ Billions) 12 December 31, 2017 March 31, 2018 n Deposits: n Time deposits n Collateralized customer deposits n Wholesale borrowings (at March 31, 2018: brokered deposits - $0.7 billion, short and long term borrowings - $2.4 billion) $10.0$3.1 $0.4 $2.9 $10.2$3.0 $0.5 $3.2 Interest and noninterest- bearing, checking, savings, money market

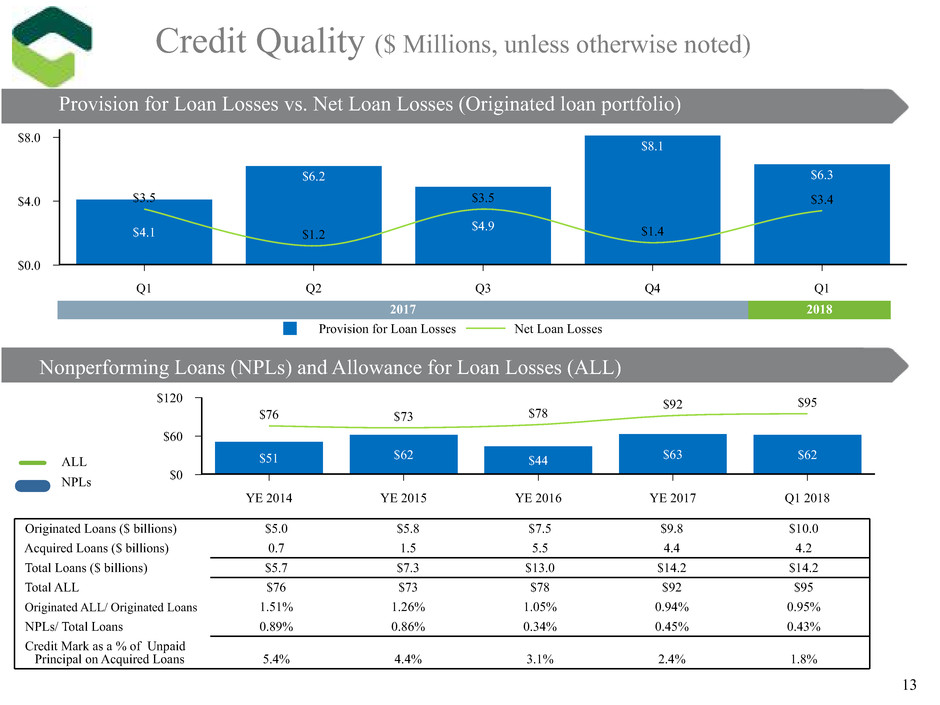

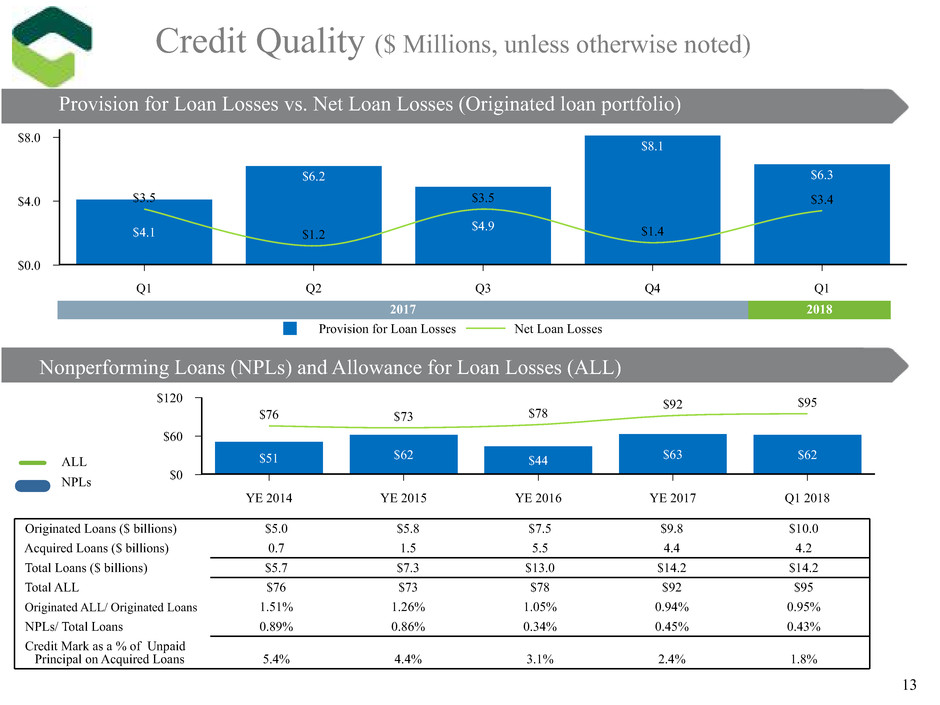

ALL NPLs 2017 2018 Originated Loans ($ billions) $5.0 $5.8 $7.5 $9.8 $10.0 Acquired Loans ($ billions) 0.7 1.5 5.5 4.4 4.2 Total Loans ($ billions) $5.7 $7.3 $13.0 $14.2 $14.2 Total ALL $76 $73 $78 $92 $95 Originated ALL/ Originated Loans 1.51% 1.26% 1.05% 0.94% 0.95% NPLs/ Total Loans 0.89% 0.86% 0.34% 0.45% 0.43% Credit Mark as a % of Unpaid Principal on Acquired Loans 5.4% 4.4% 3.1% 2.4% 1.8% Credit Quality ($ Millions, unless otherwise noted) Provision for Loan Losses vs. Net Loan Losses (Originated loan portfolio) Nonperforming Loans (NPLs) and Allowance for Loan Losses (ALL) Provision for Loan Losses Net Loan Losses $8.0 $4.0 $0.0 Q1 Q2 Q3 Q4 Q1 $4.1 $6.2 $4.9 $8.1 $6.3 $3.5 $1.2 $3.5 $1.4 $3.4 $120 $60 $0 YE 2014 YE 2015 YE 2016 YE 2017 Q1 2018 $51 $62 $44 $63 $62 $76 $73 $78 $92 $95 13

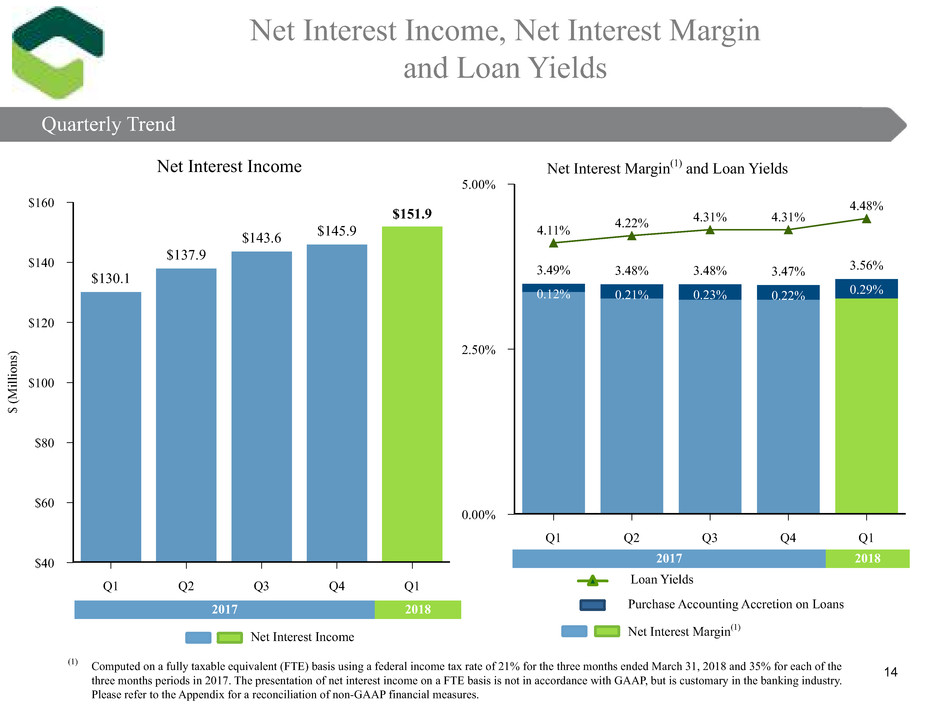

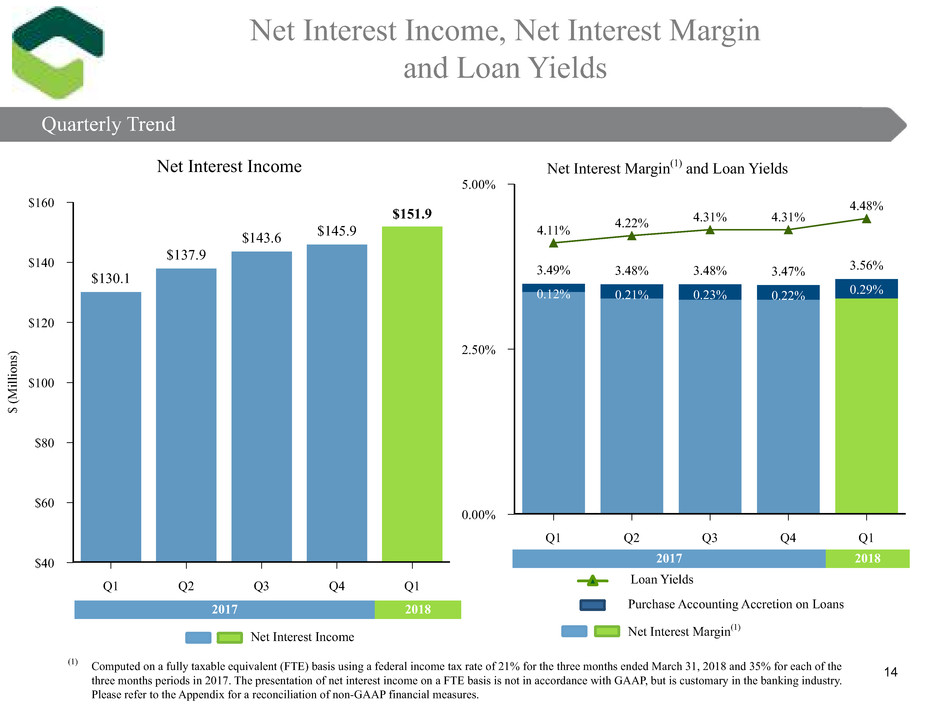

Net Interest Margin(1) and Loan Yields Net Interest Margin(1) Purchase Accounting Accretion on Loans Loan Yields Net Interest Income (Quarterly Trend) Net Interest Income, Net Interest Margin and Loan Yields (1) Computed on a fully taxable equivalent (FTE) basis using a federal income tax rate of 21% for the three months ended March 31, 2018 and 35% for each of the three months periods in 2017. The presentation of net interest income on a FTE basis is not in accordance with GAAP, but is customary in the banking industry. Please refer to the Appendix for a reconciliation of non-GAAP financial measures. 14 Quarterly Trend 2017 2018 Net Interest Income $160 $140 $120 $100 $80 $60 $40 $ (M ill io ns ) Q1 Q2 Q3 Q4 Q1 $130.1 $137.9 $143.6 $145.9 $151.9 2017 2018 5.00% 2.50% 0.00% Q1 Q2 Q3 Q4 Q1 4.11% 4.22% 4.31% 4.31% 4.48% 3.49% 3.48% 3.48% 3.47% 3.56% 0.12% 0.21% 0.23% 0.22% 0.29%

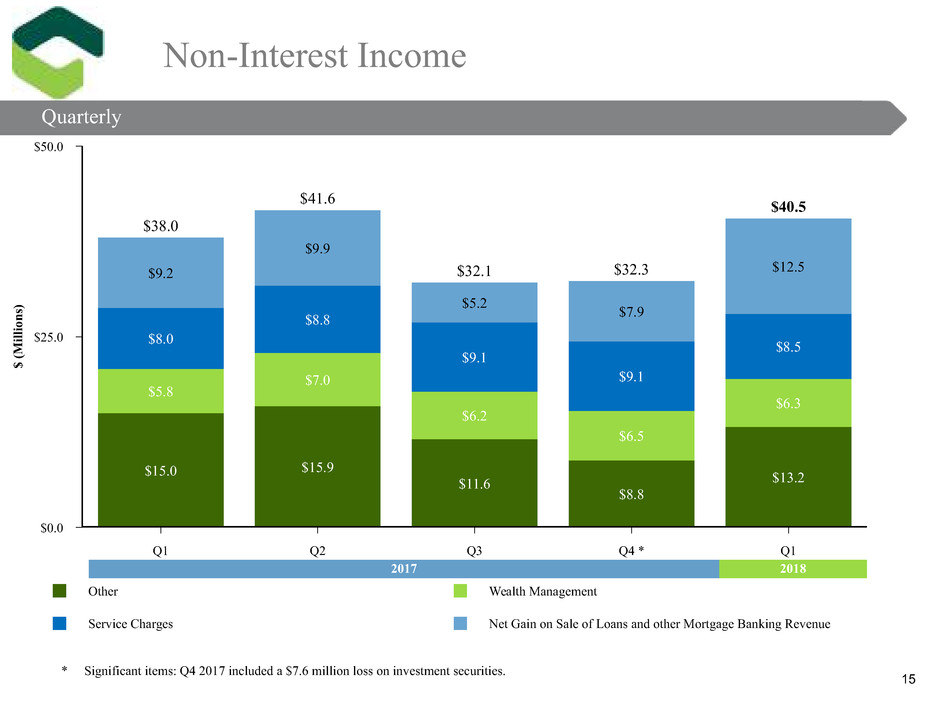

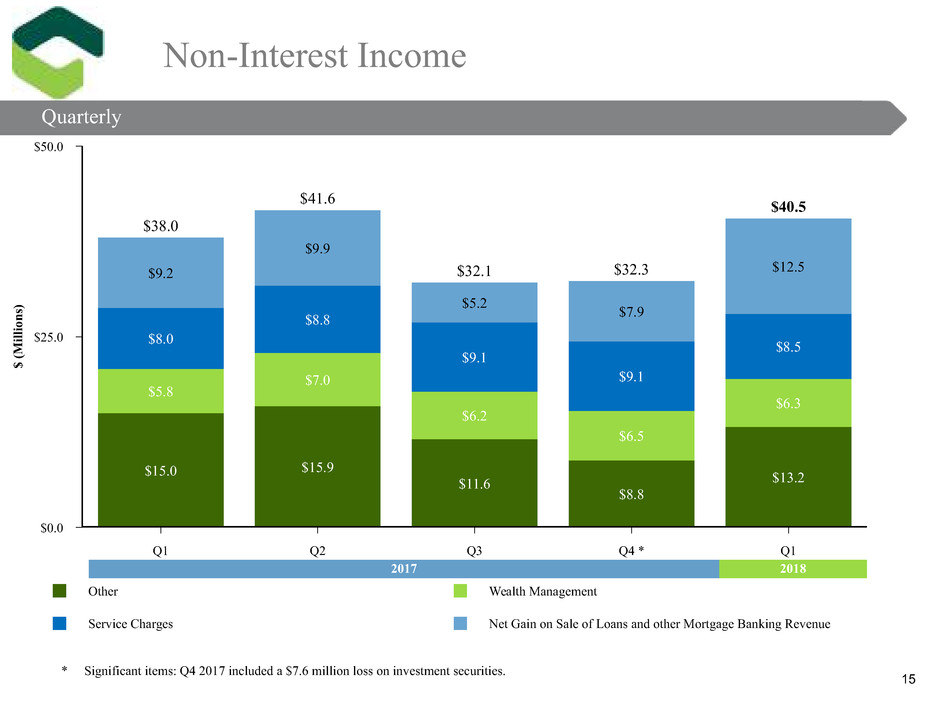

Non-Interest Income * Significant items: Q4 2017 included a $7.6 million loss on investment securities. 15 Quarterly 2017 2018 Other Wealth Management Service Charges Net Gain on Sale of Loans and other Mortgage Banking Revenue $50.0 $25.0 $0.0 $ (M ill io ns ) Q1 Q2 Q3 Q4 * Q1 $15.0 $15.9 $11.6 $8.8 $13.2 $5.8 $7.0 $6.2 $6.5 $6.3 $8.0 $8.8 $9.1 $9.1 $8.5 $9.2 $38.0 $9.9 $41.6 $5.2 $32.1 $7.9 $32.3 $12.5 $40.5

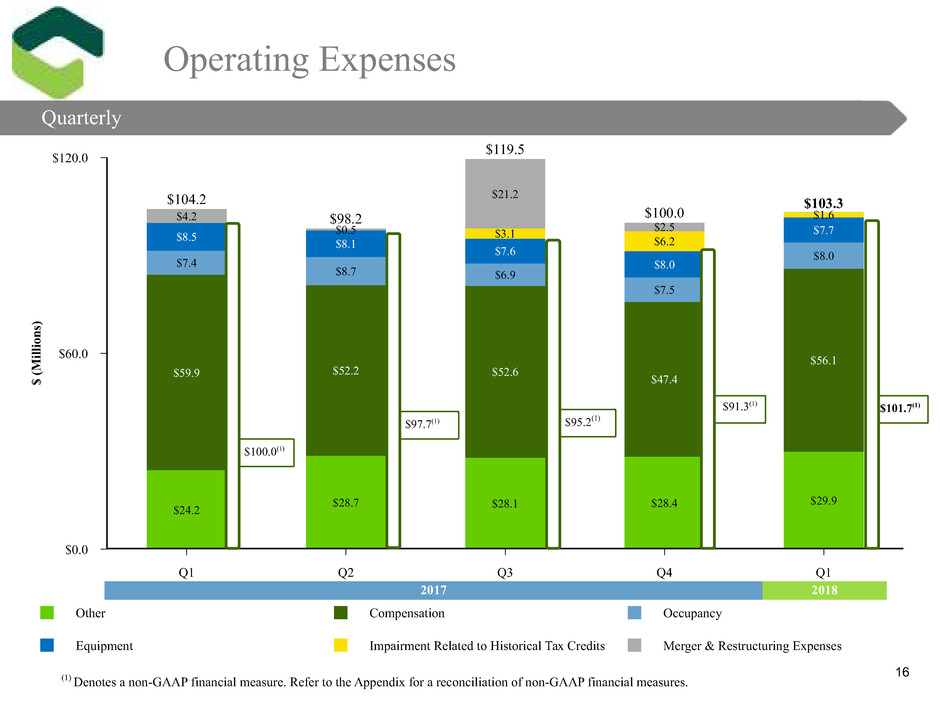

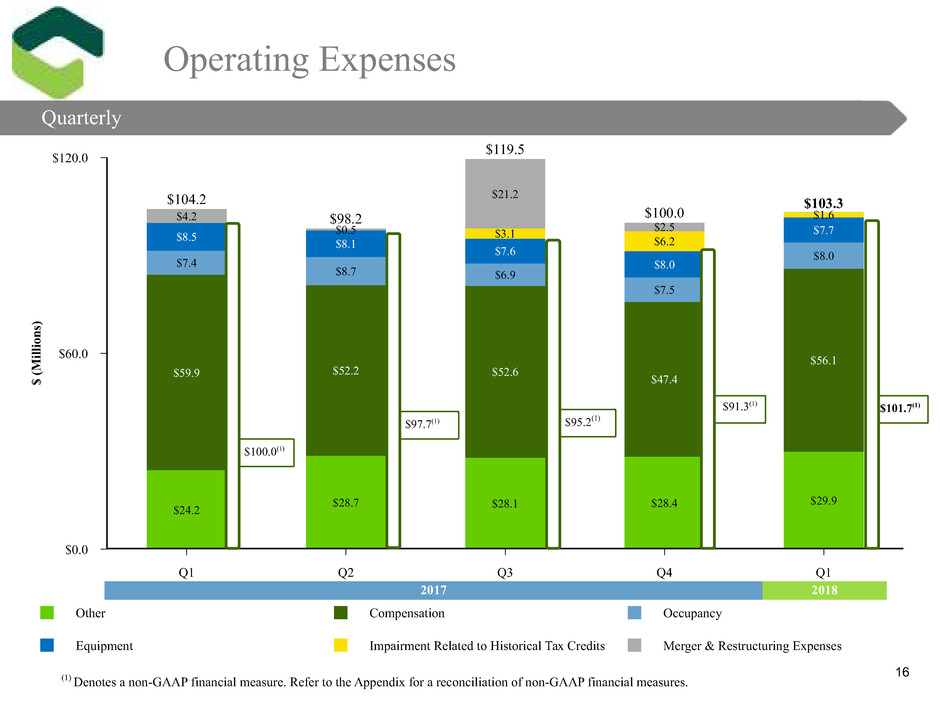

$100.0(1) $97.7(1) Operating Expenses $95.2(1) 16 Quarterly 2017 2018 Other Compensation Occupancy Equipment Impairment Related to Historical Tax Credits Merger & Restructuring Expenses $120.0 $60.0 $0.0 $ (M ill io ns ) Q1 Q2 Q3 Q4 Q1 $24.2 $28.7 $28.1 $28.4 $29.9 $59.9 $52.2 $52.6 $47.4 $56.1 $7.4 $8.7 $6.9 $7.5 $8.0 $8.5 $8.1 $7.6 $8.0 $7.7$3.1 $6.2 $1.6 $103.3 $4.2 $104.2 $0.5 $98.2 $21.2 $119.5 $2.5 $100.0 $91.3(1) $101.7(1) (1) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

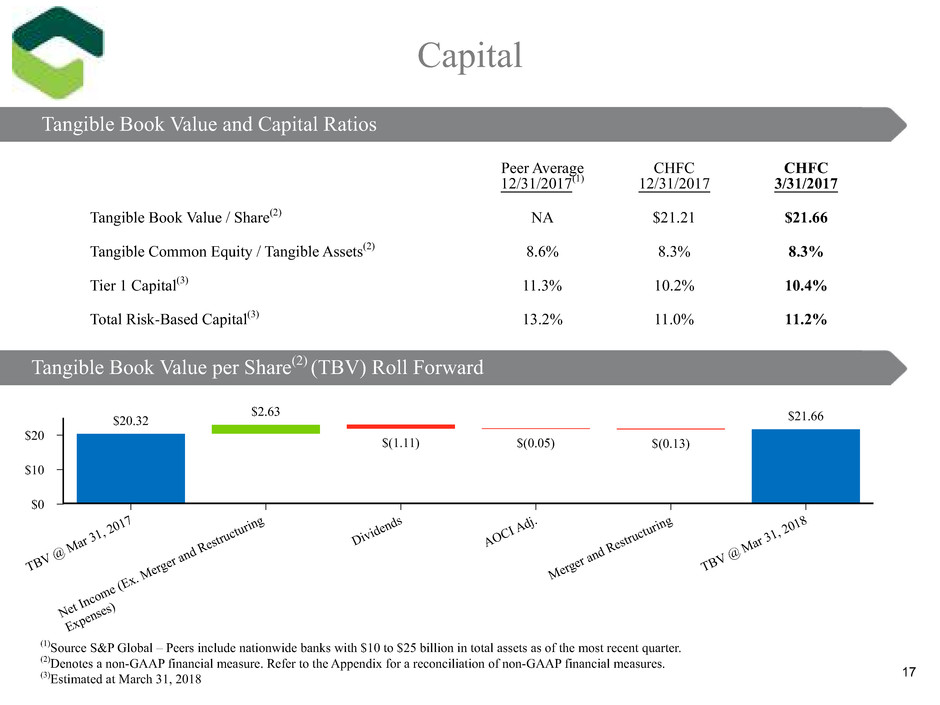

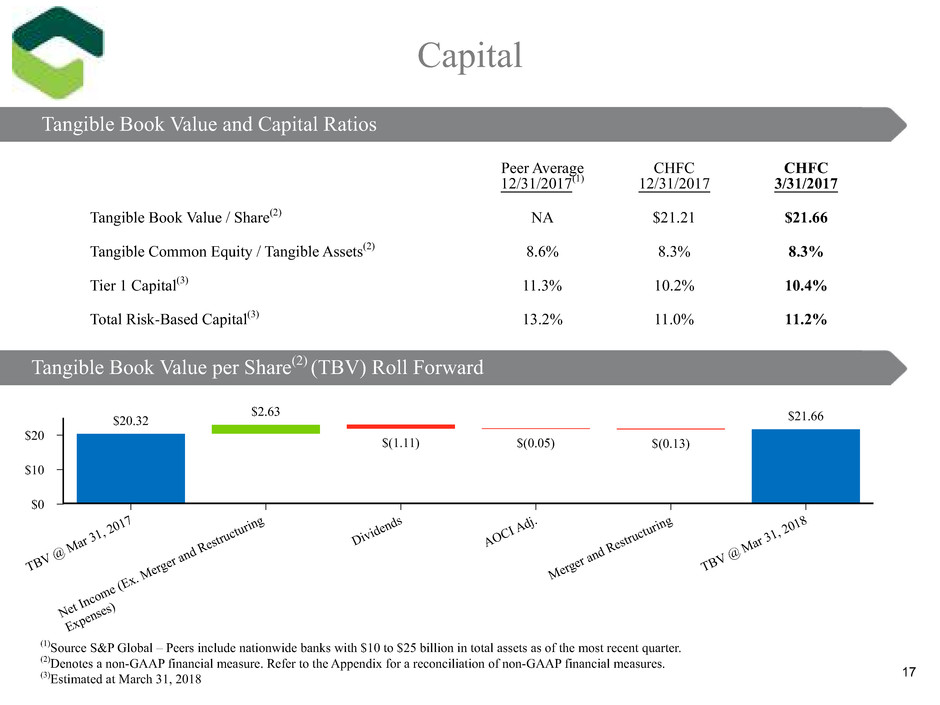

Peer Average 12/31/2017(1) CHFC 12/31/2017 CHFC 3/31/2017 Tangible Book Value / Share(2) NA $21.21 $21.66 Tangible Common Equity / Tangible Assets(2) 8.6% 8.3% 8.3% Tier 1 Capital(3) 11.3% 10.2% 10.4% Total Risk-Based Capital(3) 13.2% 11.0% 11.2% Capital (1)Source S&P Global – Peers include nationwide banks with $10 to $25 billion in total assets as of the most recent quarter. (2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. (3)Estimated at March 31, 2018 Tangible Book Value and Capital Ratios Tangible Book Value per Share(2) (TBV) Roll Forward $20 $10 $0 TBV @ M ar 31 , 201 7 Net Inco me ( Ex. Mer ger a nd R estru cturi ng Exp ense s) Divi dend s AOC I Ad j. Mer ger a nd R estru cturi ng TBV @ M ar 31 , 201 8 $20.32 $2.63 $(1.11) $(0.05) $(0.13) $21.66 17

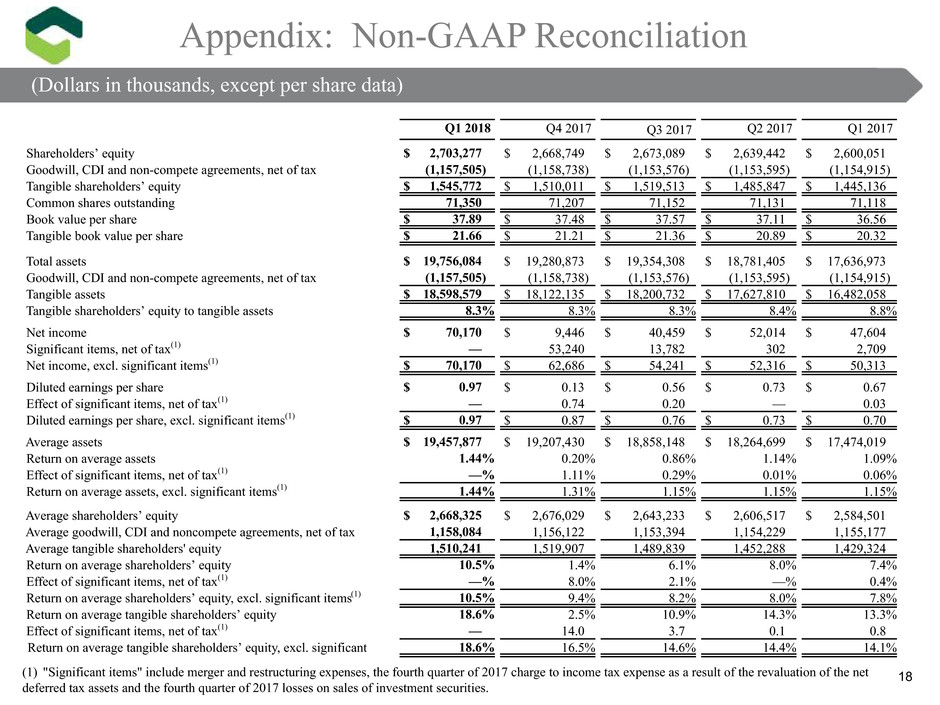

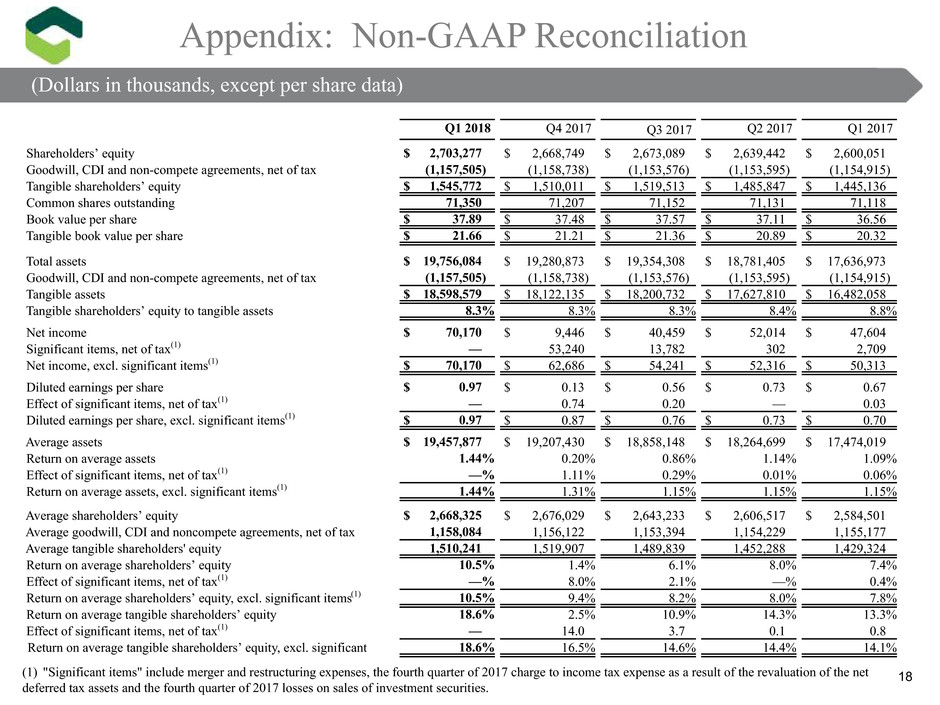

Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Shareholders’ equity $ 2,703,277 $ 2,668,749 $ 2,673,089 $ 2,639,442 $ 2,600,051 Goodwill, CDI and non-compete agreements, net of tax (1,157,505) (1,158,738) (1,153,576) (1,153,595) (1,154,915) Tangible shareholders’ equity $ 1,545,772 $ 1,510,011 $ 1,519,513 $ 1,485,847 $ 1,445,136 Common shares outstanding 71,350 71,207 71,152 71,131 71,118 Book value per share $ 37.89 $ 37.48 $ 37.57 $ 37.11 $ 36.56 Tangible book value per share $ 21.66 $ 21.21 $ 21.36 $ 20.89 $ 20.32 Total assets $ 19,756,084 $ 19,280,873 $ 19,354,308 $ 18,781,405 $ 17,636,973 Goodwill, CDI and non-compete agreements, net of tax (1,157,505) (1,158,738) (1,153,576) (1,153,595) (1,154,915) Tangible assets $ 18,598,579 $ 18,122,135 $ 18,200,732 $ 17,627,810 $ 16,482,058 Tangible shareholders’ equity to tangible assets 8.3% 8.3% 8.3% 8.4% 8.8% Net income $ 70,170 $ 9,446 $ 40,459 $ 52,014 $ 47,604 Significant items, net of tax(1) — 53,240 13,782 302 2,709 Net income, excl. significant items(1) $ 70,170 $ 62,686 $ 54,241 $ 52,316 $ 50,313 Diluted earnings per share $ 0.97 $ 0.13 $ 0.56 $ 0.73 $ 0.67 Effect of significant items, net of tax(1) — 0.74 0.20 — 0.03 Diluted earnings per share, excl. significant items(1) $ 0.97 $ 0.87 $ 0.76 $ 0.73 $ 0.70 Average assets $ 19,457,877 $ 19,207,430 $ 18,858,148 $ 18,264,699 $ 17,474,019 Return on average assets 1.44% 0.20% 0.86% 1.14% 1.09% Effect of significant items, net of tax(1) —% 1.11% 0.29% 0.01% 0.06% Return on average assets, excl. significant items(1) 1.44% 1.31% 1.15% 1.15% 1.15% Average shareholders’ equity $ 2,668,325 $ 2,676,029 $ 2,643,233 $ 2,606,517 $ 2,584,501 Average goodwill, CDI and noncompete agreements, net of tax 1,158,084 1,156,122 1,153,394 1,154,229 1,155,177 Average tangible shareholders' equity 1,510,241 1,519,907 1,489,839 1,452,288 1,429,324 Return on average shareholders’ equity 10.5% 1.4% 6.1% 8.0% 7.4% Effect of significant items, net of tax(1) —% 8.0% 2.1% —% 0.4% Return on average shareholders’ equity, excl. significant items(1) 10.5% 9.4% 8.2% 8.0% 7.8% Return on average tangible shareholders’ equity 18.6% 2.5% 10.9% 14.3% 13.3% Effect of significant items, net of tax(1) — 14.0 3.7 0.1 0.8 Return on average tangible shareholders’ equity, excl. significant 18.6% 16.5% 14.6% 14.4% 14.1% Appendix: Non-GAAP Reconciliation 18 (Dollars in thousands, except per share data) (1) "Significant items" include merger and restructuring expenses, the fourth quarter of 2017 charge to income tax expense as a result of the revaluation of the net deferred tax assets and the fourth quarter of 2017 losses on sales of investment securities.

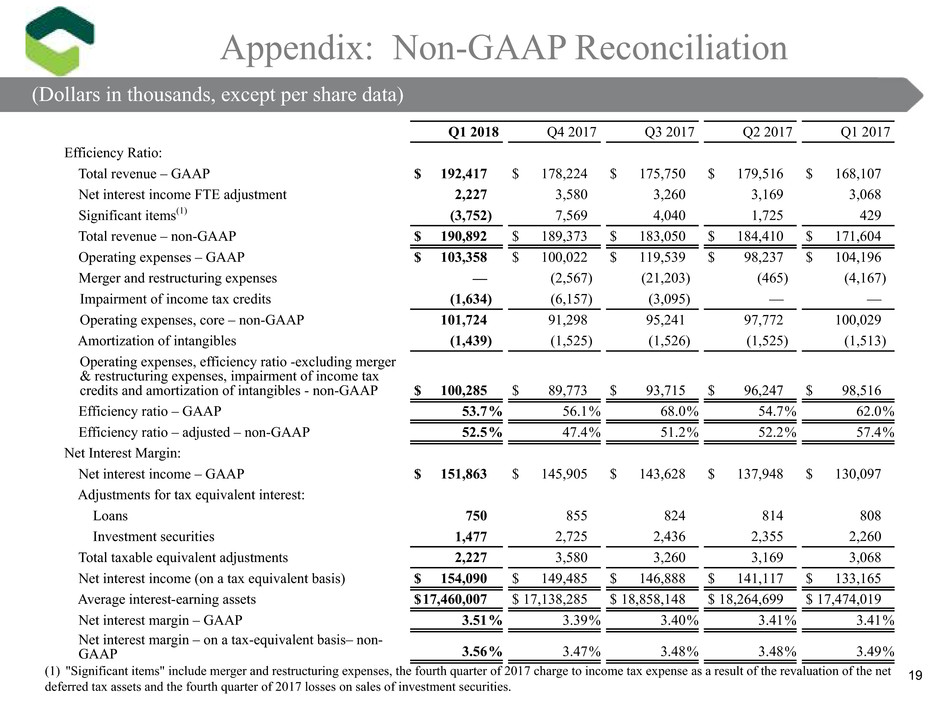

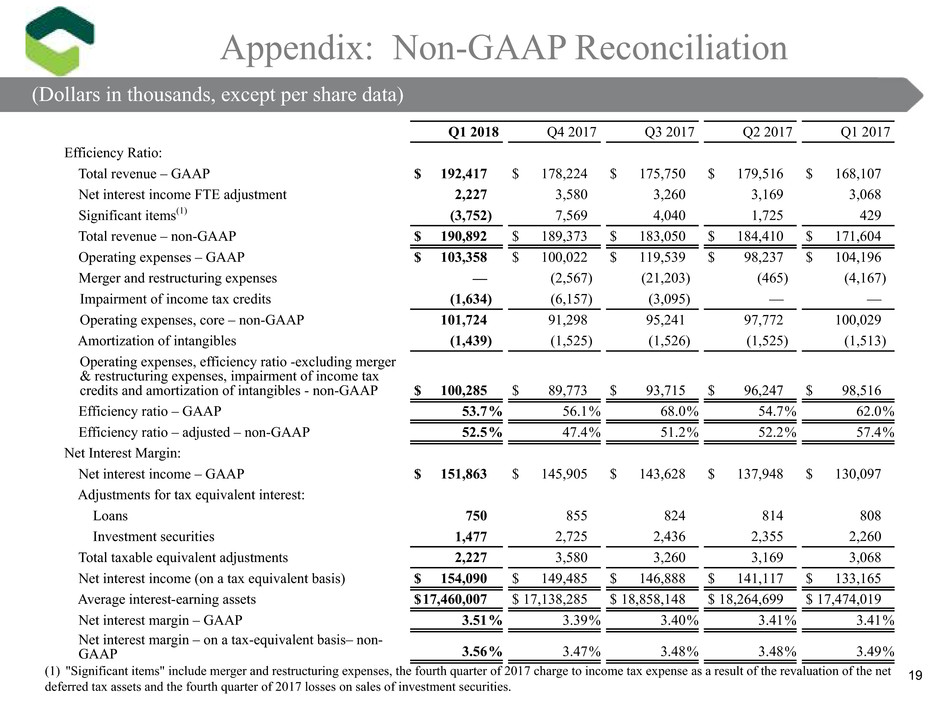

Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Efficiency Ratio: Total revenue – GAAP $ 192,417 $ 178,224 $ 175,750 $ 179,516 $ 168,107 Net interest income FTE adjustment 2,227 3,580 3,260 3,169 3,068 Significant items(1) (3,752) 7,569 4,040 1,725 429 Total revenue – non-GAAP $ 190,892 $ 189,373 $ 183,050 $ 184,410 $ 171,604 Operating expenses – GAAP $ 103,358 $ 100,022 $ 119,539 $ 98,237 $ 104,196 Merger and restructuring expenses — (2,567) (21,203) (465) (4,167) Impairment of income tax credits (1,634) (6,157) (3,095) — — Operating expenses, core – non-GAAP 101,724 91,298 95,241 97,772 100,029 Amortization of intangibles (1,439) (1,525) (1,526) (1,525) (1,513) Operating expenses, efficiency ratio -excluding merger & restructuring expenses, impairment of income tax credits and amortization of intangibles - non-GAAP $ 100,285 $ 89,773 $ 93,715 $ 96,247 $ 98,516 Efficiency ratio – GAAP 53.7% 56.1% 68.0% 54.7% 62.0% Efficiency ratio – adjusted – non-GAAP 52.5% 47.4% 51.2% 52.2% 57.4% Net Interest Margin: Net interest income – GAAP $ 151,863 $ 145,905 $ 143,628 $ 137,948 $ 130,097 Adjustments for tax equivalent interest: Loans 750 855 824 814 808 Investment securities 1,477 2,725 2,436 2,355 2,260 Total taxable equivalent adjustments 2,227 3,580 3,260 3,169 3,068 Net interest income (on a tax equivalent basis) $ 154,090 $ 149,485 $ 146,888 $ 141,117 $ 133,165 Average interest-earning assets $17,460,007 $ 17,138,285 $ 18,858,148 $ 18,264,699 $ 17,474,019 Net interest margin – GAAP 3.51% 3.39% 3.40% 3.41% 3.41% Net interest margin – on a tax-equivalent basis– non- GAAP 3.56% 3.47% 3.48% 3.48% 3.49% Appendix: Non-GAAP Reconciliation 19 (Dollars in thousands, except per share data) (1) "Significant items" include merger and restructuring expenses, the fourth quarter of 2017 charge to income tax expense as a result of the revaluation of the net deferred tax assets and the fourth quarter of 2017 losses on sales of investment securities.