2018 Second Quarter Earnings Release David T. Provost Chief Executive Officer July 25, 2018 Thomas C. Shafer Vice Chairman, Chief Executive Officer of Chemical Bank Dennis L. Klaeser EVP and Chief Financial Officer

Forward-Looking Statements & Other Information This presentation and the accompanying presentation by management may contain forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about the financial services industry, the economy and Chemical Financial Corporation ("Chemical"). Words and phrases such as "anticipates," "believes," "continue," "estimates," "expects," "forecasts," "future," "intends," "is likely," "judgment," "look ahead," "look forward," "on schedule," "on track," "opinion," "opportunity," "plans," "potential," "predicts," "probable," "projects," "should," "strategic," "trend," "will," and variations of such words and phrases or similar expressions are intended to identify such forward-looking statements. All statements referencing future time periods are forward-looking. Management's determination of the provision and allowance for loan losses; the carrying value of acquired loans, goodwill and mortgage servicing rights; the fair value of investment securities (including whether any impairment on any investment security is temporary or other- than-temporary and the amount of any impairment); and management's assumptions concerning pension and other postretirement benefit plans involve judgments that are inherently forward-looking. There can be no assurance that future loan losses will be limited to the amounts estimated. All of the information concerning interest rate sensitivity is forward-looking. The future effect of changes in the financial and credit markets and the national and regional economies on the banking industry, generally, and on Chemical, specifically, are also inherently uncertain. Forward-looking are based upon current beliefs and expectations and involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Accordingly, such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions ("risk factors") that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. Chemical undertakes no obligation to update, amend or clarify forward-looking statements, whether as a result of new information, future events or otherwise. 2

Forward-Looking Statements & Other Information (continued) Risk factors include, without limitation: • Chemical's ability to attract and retain new commercial lenders and other bankers as well as key operations staff in light of competition for experienced employees in the banking industry; • Operational and regulatory challenges associated with our information technology systems and policies and procedures in light of our rapid growth and systems conversion in 2018; • Chemical's ability to grow its deposits while reducing the number of physical branches that it operates; • Negative reactions to the branch closures by Chemical Bank's customers, employees and other counterparties; • Economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a deterioration in credit quality, a reduction in demand for credit and a decline in real estate values; • A general decline in the real estate and lending markets, particularly in our market areas, could negatively affect our financial results; • Increased cybersecurity risk, including potential network breaches, business disruptions, or financial losses; • The timing of when historic tax credits are placed into service could impact our operating expenses; • Restrictions or condition imposed by our regulators on our operations may make it more difficult for us to achieve our goals; • Legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; • Changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; and • Economic, governmental, or other factors may prevent the projected population, residential, and commercial growth in the markets in which we operate. In addition, risk factors include, but are not limited to, the risk factors described in Item 1A of Chemical’s most recent Annual Report on Form 10-K or disclosed in documents filed or furnished by the Company with or to the SEC after the filing of such Annual Report on Form 10-K. These and other factors are representative of the risk factors that may emerge and could cause a difference between an ultimate actual outcome and a preceding forward-looking statement. 3

Forward-Looking Statements & Other Information (continued) Non-GAAP Financial Measures This presentation and the accompanying presentation by management contain certain non-GAAP financial disclosures that are not in accordance with U.S. generally accepted accounting principles ("GAAP"). Such non-GAAP financial measures include Chemical’s tangible shareholders' equity to tangible assets ratio, tangible book value per share, presentation of net interest income and net interest margin on a fully taxable equivalent basis, operating expenses-core (which excludes merger and restructuring expenses and impairment of income tax credits), operating expenses-efficiency ratio (which excludes merger and restructuring expenses, impairment of income tax credits and amortization of intangibles), the adjusted efficiency ratio (which excludes significant items, merger and restructuring expenses, impairment of income tax credits, loan servicing rights change in fair value gains (losses), amortization of intangibles, net interest income FTE adjustments and (losses) gains from sale of investment securities and other information presented excluding significant items, including net income, diluted earnings per share, return on average assets and return on average shareholders' equity. Chemical uses non-GAAP financial measures to provide meaningful, supplemental information regarding its operational results and to enhance investors’ overall understanding of Chemical’s financial performance. The limitations associated with non-GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might calculate these measures differently. These disclosures should not be considered an alternative to Chemical’s GAAP results. See the Appendix included with this presentation for a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. 4

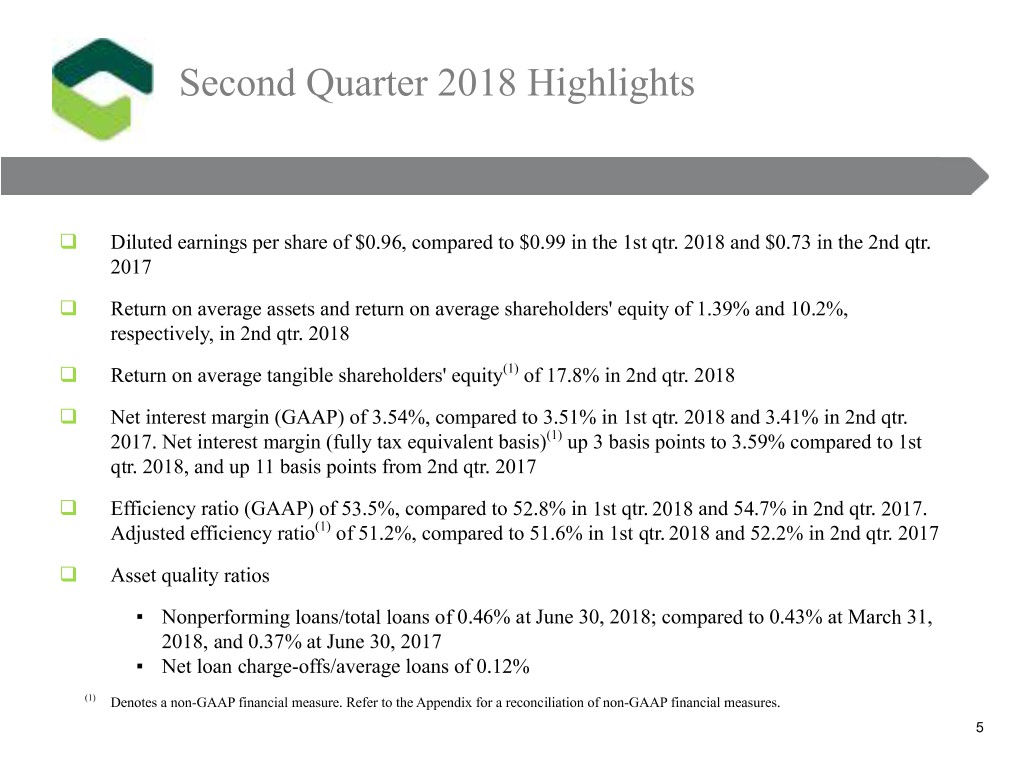

Second Quarter 2018 Highlights q Diluted earnings per share of $0.96, compared to $0.99 in the 1st qtr. 2018 and $0.73 in the 2nd qtr. 2017 q Return on average assets and return on average shareholders' equity of 1.39% and 10.2%, respectively, in 2nd qtr. 2018 q Return on average tangible shareholders' equity(1) of 17.8% in 2nd qtr. 2018 q Net interest margin (GAAP) of 3.54%, compared to 3.51% in 1st qtr. 2018 and 3.41% in 2nd qtr. 2017. Net interest margin (fully tax equivalent basis)(1) up 3 basis points to 3.59% compared to 1st qtr. 2018, and up 11 basis points from 2nd qtr. 2017 q Efficiency ratio (GAAP) of 53.5%, compared to 52.8% in 1st qtr. 2018 and 54.7% in 2nd qtr. 2017. (1) Adjusted efficiency ratio of 51.2%, compared to 51.6% in 1st qtr. 2018 and 52.2% in 2nd qtr. 2017 q Asset quality ratios ▪ Nonperforming loans/total loans of 0.46% at June 30, 2018; compared to 0.43% at March 31, 2018, and 0.37% at June 30, 2017 ▪ Net loan charge-offs/average loans of 0.12% (1) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. 5

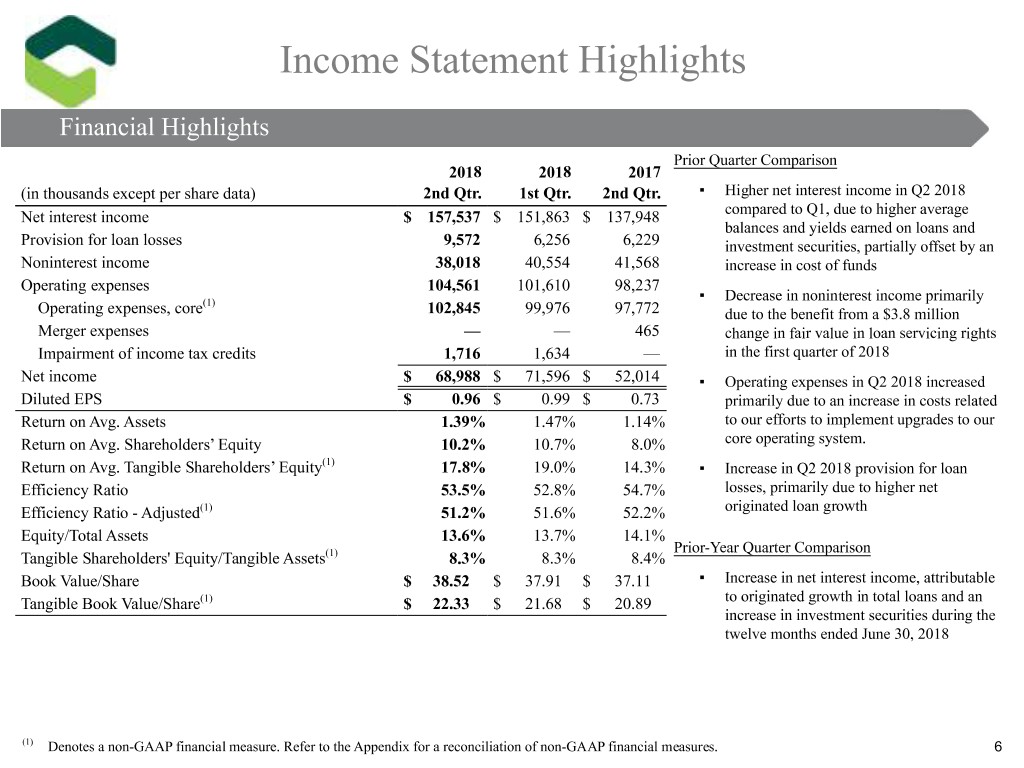

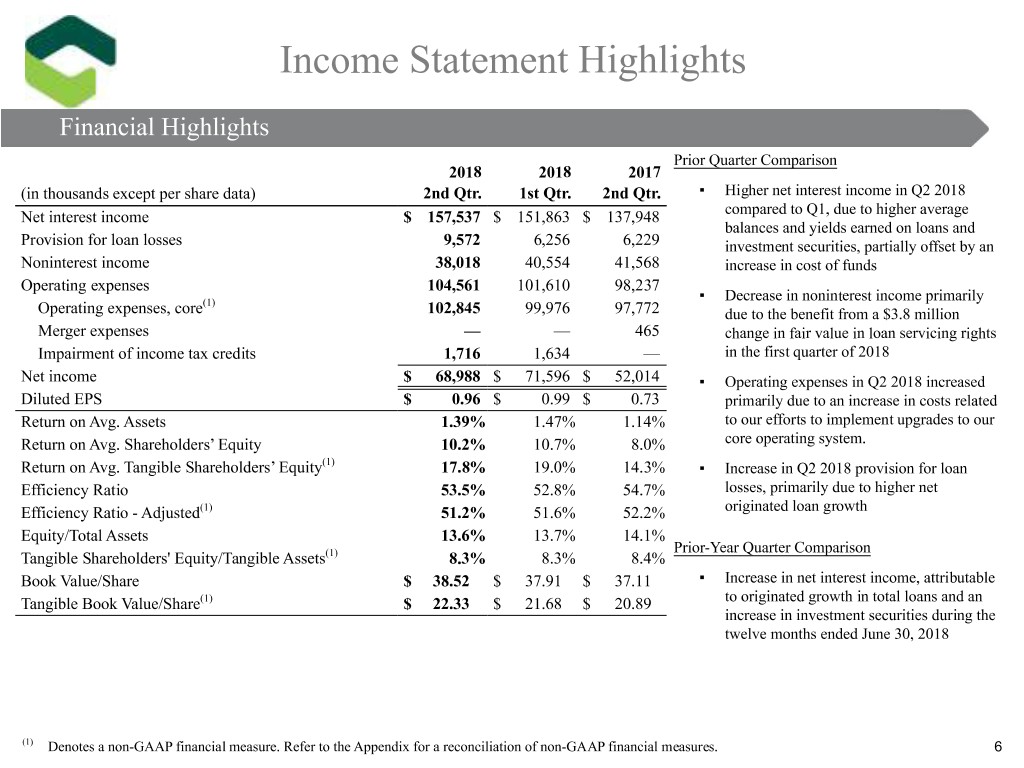

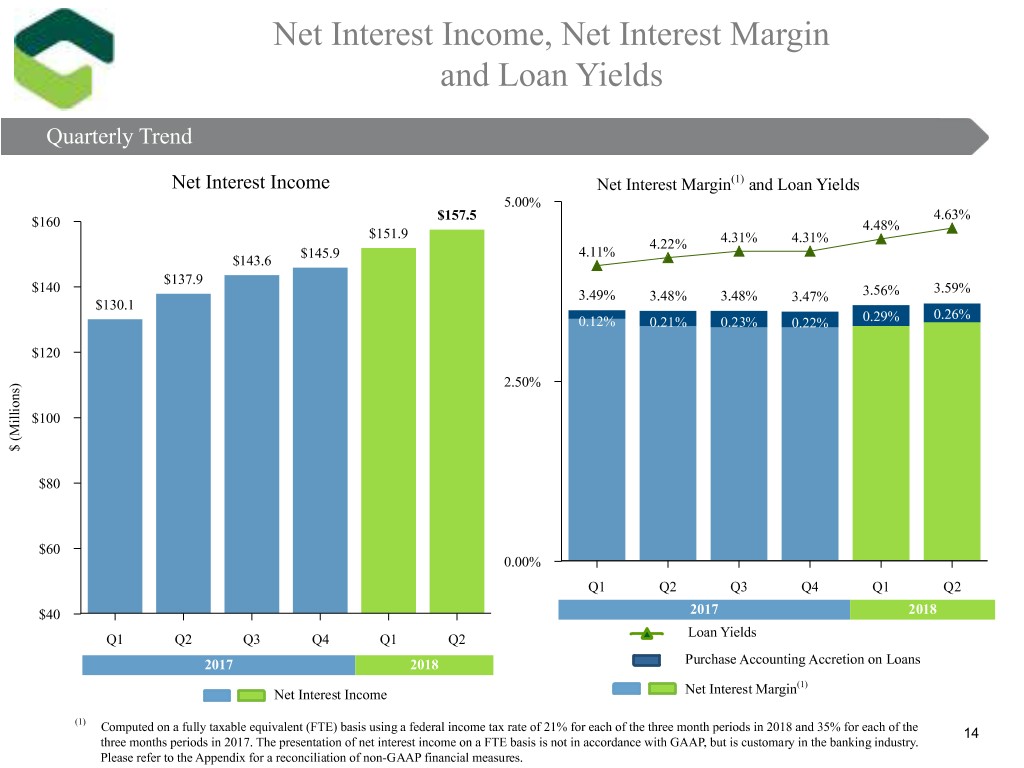

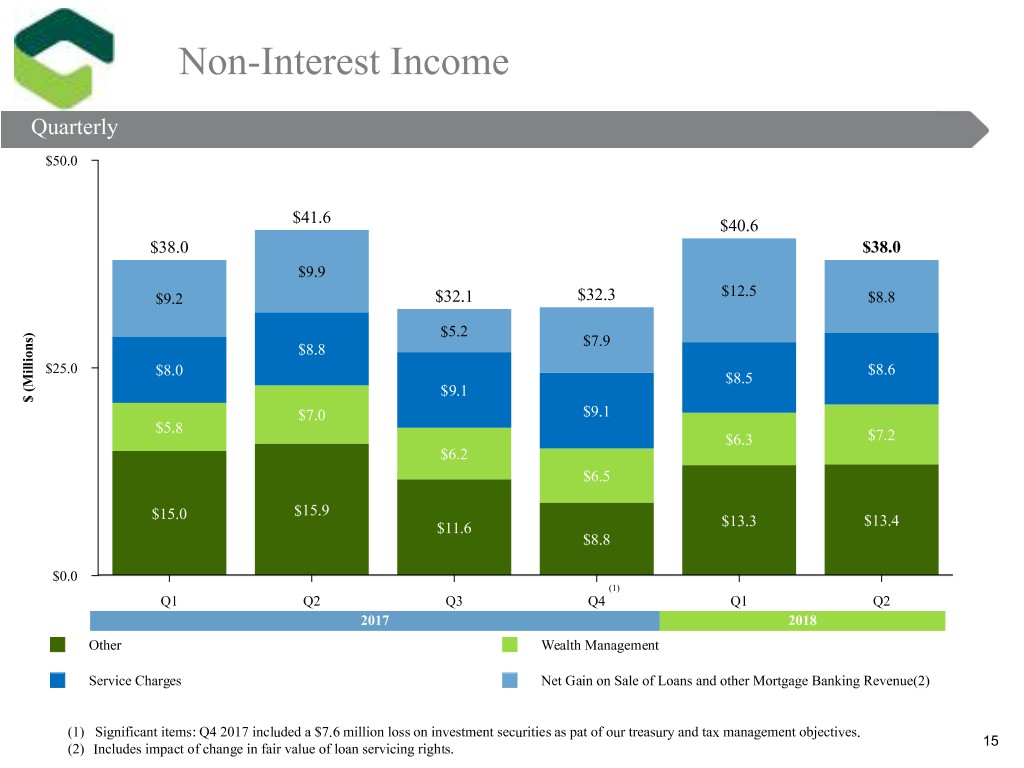

Income Statement Highlights FinancialFinancial Highlights Highlights Prior Quarter Comparison 2018 2018 2017 (in thousands except per share data) 2nd Qtr. 1st Qtr. 2nd Qtr. ▪ Higher net interest income in Q2 2018 Net interest income $ 157,537 $ 151,863 $ 137,948 compared to Q1, due to higher average balances and yields earned on loans and Provision for loan losses 9,572 6,256 6,229 investment securities, partially offset by an Noninterest income 38,018 40,554 41,568 increase in cost of funds Operating expenses 104,561 101,610 98,237 (1) ▪ Decrease in noninterest income primarily Operating expenses, core 102,845 99,976 97,772 due to the benefit from a $3.8 million Merger expenses — — 465 change in fair value in loan servicing rights Impairment of income tax credits 1,716 1,634 — in the first quarter of 2018 Net income $ 68,988 $ 71,596 $ 52,014 ▪ Operating expenses in Q2 2018 increased Diluted EPS $ 0.96 $ 0.99 $ 0.73 primarily due to an increase in costs related Return on Avg. Assets 1.39% 1.47% 1.14% to our efforts to implement upgrades to our Return on Avg. Shareholders’ Equity 10.2% 10.7% 8.0% core operating system. Return on Avg. Tangible Shareholders’ Equity(1) 17.8% 19.0% 14.3% ▪ Increase in Q2 2018 provision for loan Efficiency Ratio 53.5% 52.8% 54.7% losses, primarily due to higher net Efficiency Ratio - Adjusted(1) 51.2% 51.6% 52.2% originated loan growth Equity/Total Assets 13.6% 13.7% 14.1% Prior-Year Quarter Comparison Tangible Shareholders' Equity/Tangible Assets(1) 8.3% 8.3% 8.4% Book Value/Share $ 38.52 $ 37.91 $ 37.11 ▪ Increase in net interest income, attributable Tangible Book Value/Share(1) $ 22.33 $ 21.68 $ 20.89 to originated growth in total loans and an increase in investment securities during the twelve months ended June 30, 2018 (1) Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. 6

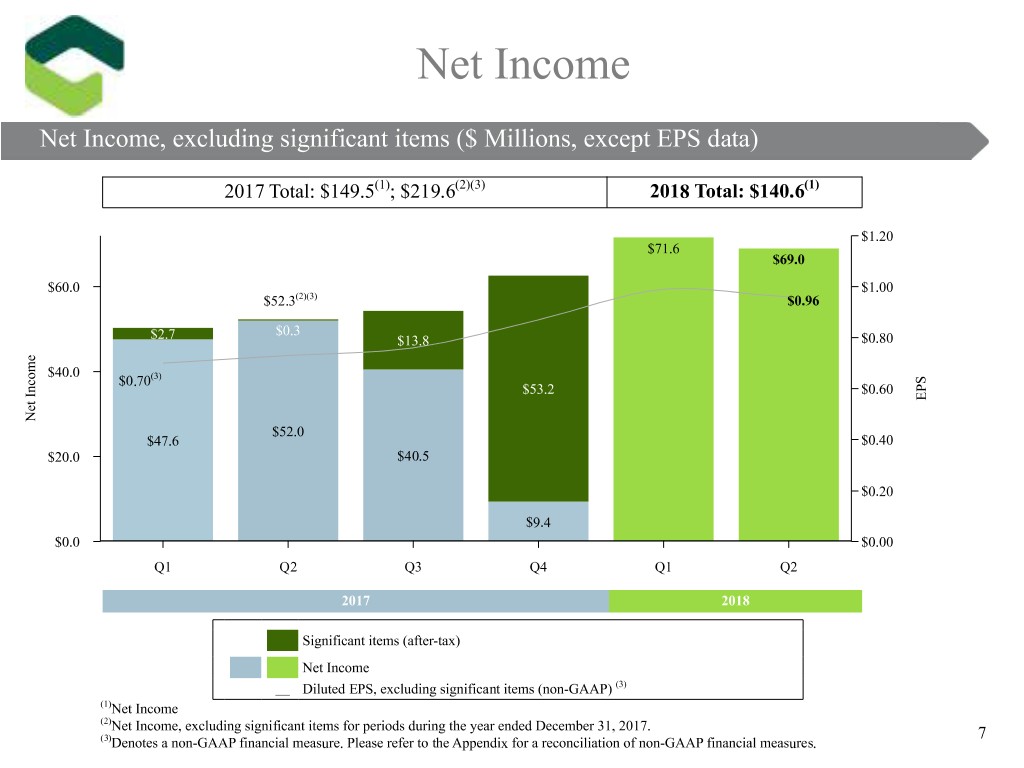

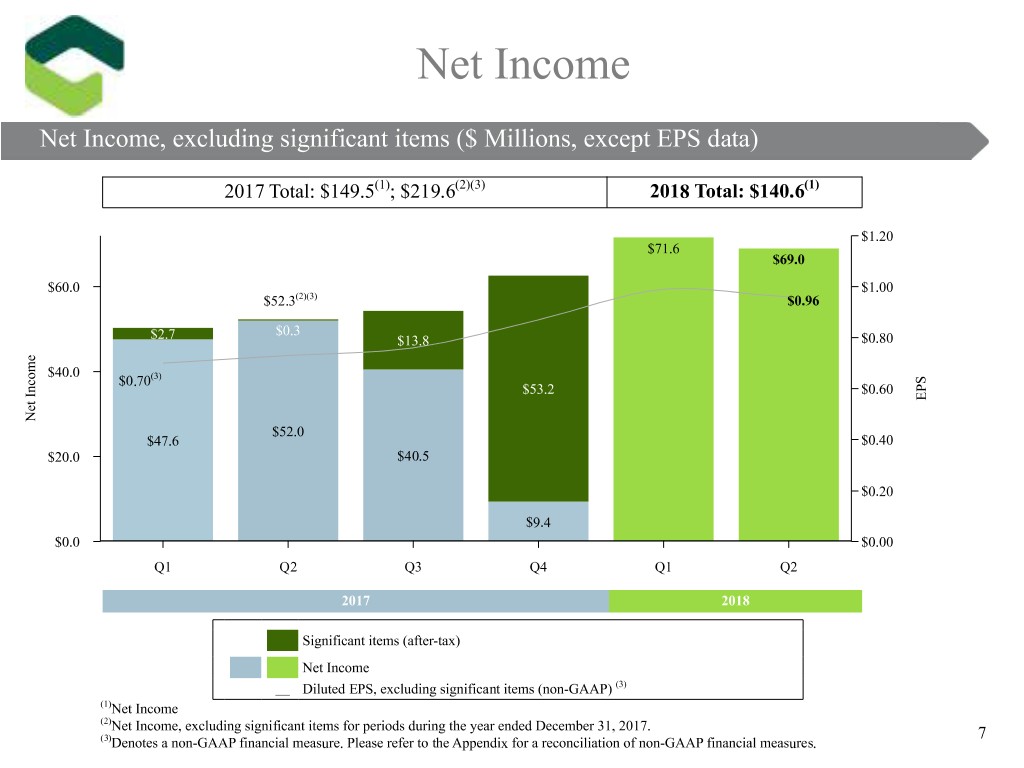

Net Income NetNet IncomeIncome, Trending excluding Upward significant ($ Millions, items except ($ EPS Millions, data) except EPS data) 2017 Total: $149.5(1); $219.6(2)(3) 2018 Total: $140.6(1) $1.20 $71.6 $69.0 $60.0 $1.00 $52.3(2)(3) $0.96 $0.3 $2.7 $13.8 $0.80 e m o $40.0 (3) S c $0.70 P n $53.2 $0.60 I E t e N $52.0 $47.6 $0.40 $20.0 $40.5 $0.20 $9.4 $0.0 $0.00 Q1 Q2 Q3 Q4 Q1 Q2 2017 2018 Significant items (after-tax) Net Income __ Diluted EPS, excluding significant items (non-GAAP) (3) (1)Net Income (2) Net Income, excluding significant items for periods during the year ended December 31, 2017. 7 (3)Denotes a non-GAAP financial measure. Please refer to the Appendix for a reconciliation of non-GAAP financial measures.

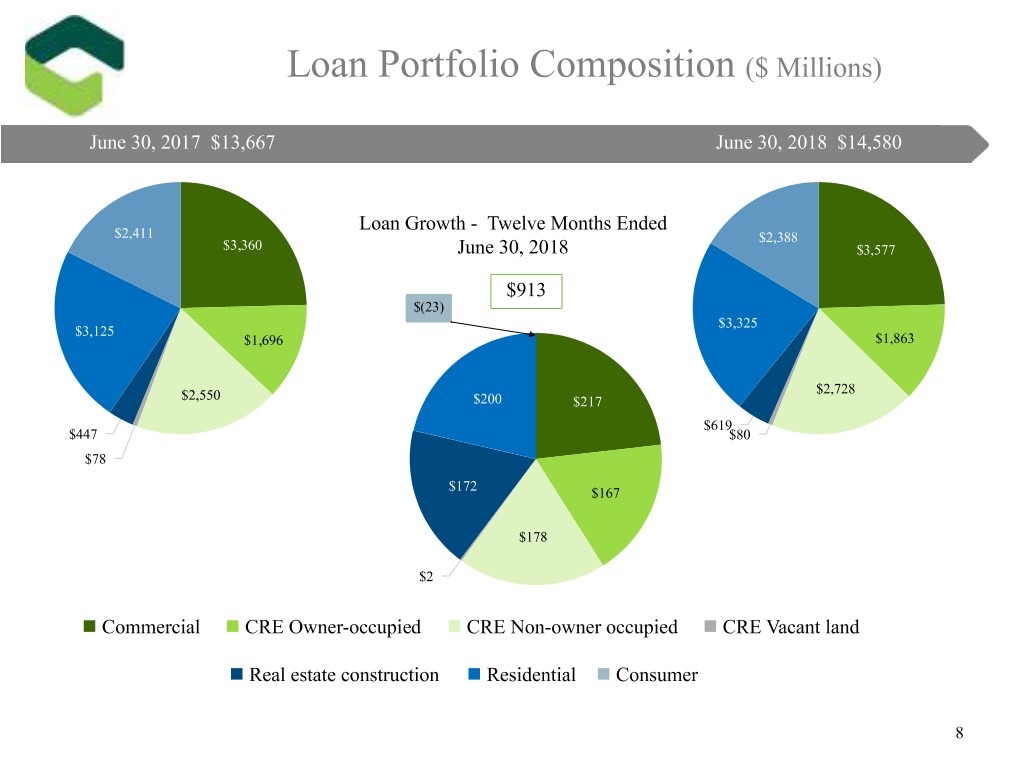

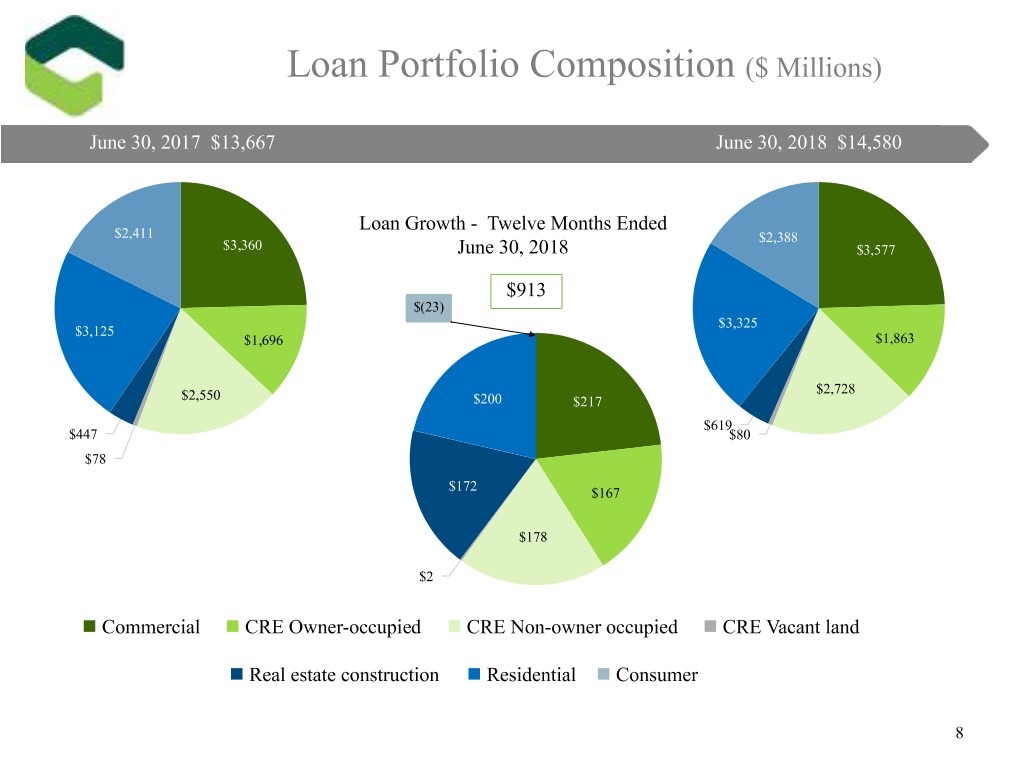

Loan Portfolio Composition ($ Millions) June 30, 2017 $13,667 June 30, 2018 $14,580 Loan Growth - Twelve Months Ended $2,411 $2,388 $3,360 June 30, 2018 $3,577 $913 $(23) $3,325 $3,125 $1,696 $1,863 $2,728 $2,550 $200 $217 $619 $447 $80 $78 $172 $167 $178 $2 n Commercial n CRE Owner-occupied n CRE Non-owner occupied n CRE Vacant land n Real estate construction n Residential n Consumer 8

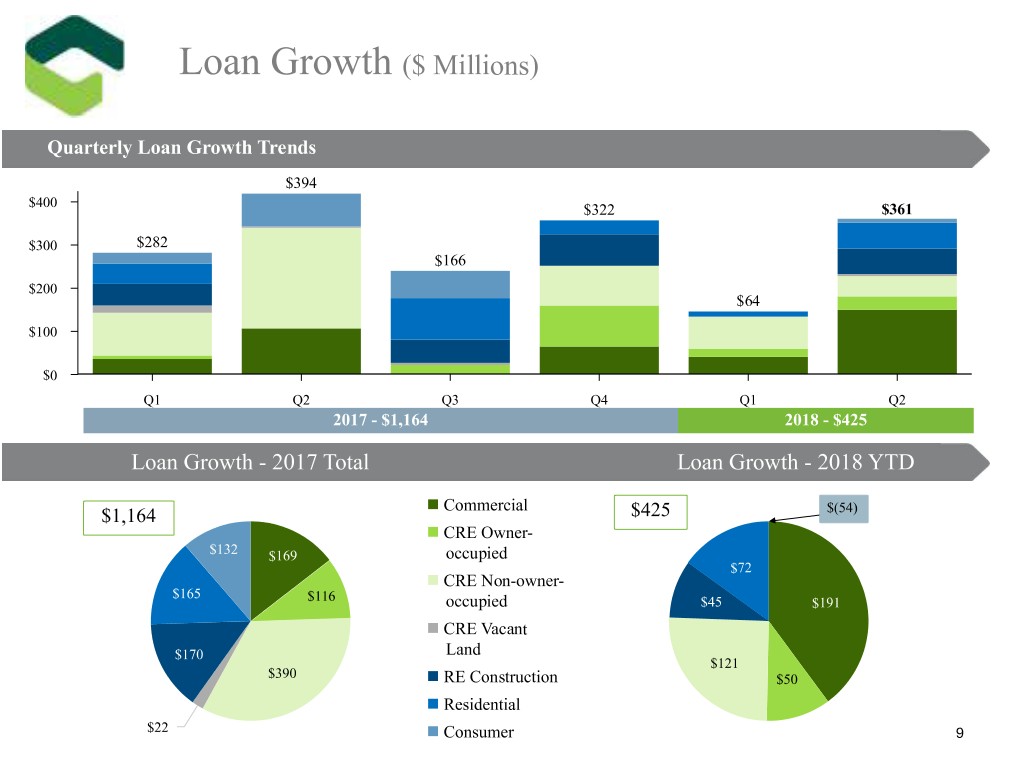

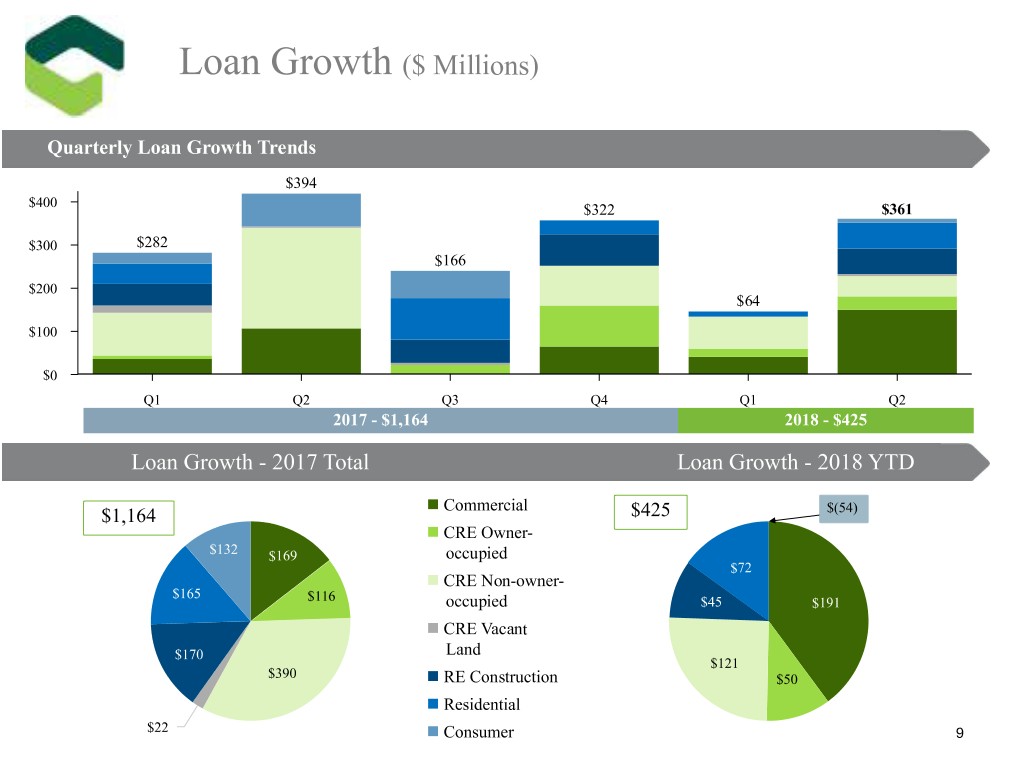

Loan Growth ($ Millions) Quarterly Loan Growth Trends $394 $400 $322 $361 $300 $282 $166 $200 $64 $100 $0 Q1 Q2 Q3 Q4 Q1 Q2 2017 - $1,164 2018 - $425 Loan Growth - 2017 Total Loan Growth - 2018 YTD n Commercial $1,164 $425 $(54) n CRE Owner- $132 $169 occupied $72 n CRE Non-owner- $165 $116 occupied $45 $191 n CRE Vacant $170 Land n $121 $390 RE Construction $50 n Residential $22 n Consumer 9

Loan Growth – Originated v. Acquired LoanLoan GrowthGrowth (Run-off) (Run-off) ($ ($Millions) Millions) Q2 2018 Q1 2018 Q2 2017 2017 Total Originated Loan Portfolio Commercial $ 268 $ 78 $ 195 $ 507 CRE/RE Construction 265 155 313 1,046 Residential 122 72 89 491 Consumer 29 (39) 103 244 Total Originated Loan Portfolio Growth $ 684 $ 266 $ 700 $ 2,288 Acquired Loan Portfolio Commercial $ (118) $ (37) $ (88) $ (338) CRE/RE Construction (123) (81) (93) (348) Residential (62) (60) (98) (326) Consumer (20) (24) (27) (112) Total Acquired Loan Portfolio Run-off $ (323) $ (202) $ (306) $ (1,124) Total Loan Portfolio Commercial $ 150 $ 41 $ 107 $ 169 CRE/RE Construction 142 74 220 698 Residential 60 12 (9) 165 Consumer 9 (63) 76 132 Total Loan Portfolio Growth $ 361 $ 64 $ 394 $ 1,164 10

Deposit Composition TotalTotal DepositsDeposits ($ ($ Billions) Billions) Total Deposits – June 30, 2017 Deposit Growth Total Deposits – June 30, 2018 $13.2 billion $1.4 billion, 10.2%(1) $14.6 billion $0.4 $1.1 $2.9 $3.6 $0.3 $3.9 $3.2 $0.7 $(0.1) $0.2 $3.7 $2.6 $2.5 $0.3 $3.9 n Noninterest-bearing Demand n Interest-bearing Checking n Savings and Money Market n Other Time Deposits n Brokered Deposits Average Deposits ($ Millions) & Cost of Deposits(2) (%) s $14,000 t i s $13,765 $13,603 d o $13,389 $12,999 $13,022 0.56% 0.50% i p a e P D 0.46% e t e 0.42% a g 0.38% R a $9,000 $13,975 r 0.33% t s e 0.25% e v 0.28% r A e t l n a I t o T $4,000 0.00% Q1 Q2 Q3 Q4 Q1 Q2 2017 2018 Deposits Cost of Deposits (1)Comprised of $382 million of growth in customer deposits. 11 (2)Cost of deposits based on period averages.

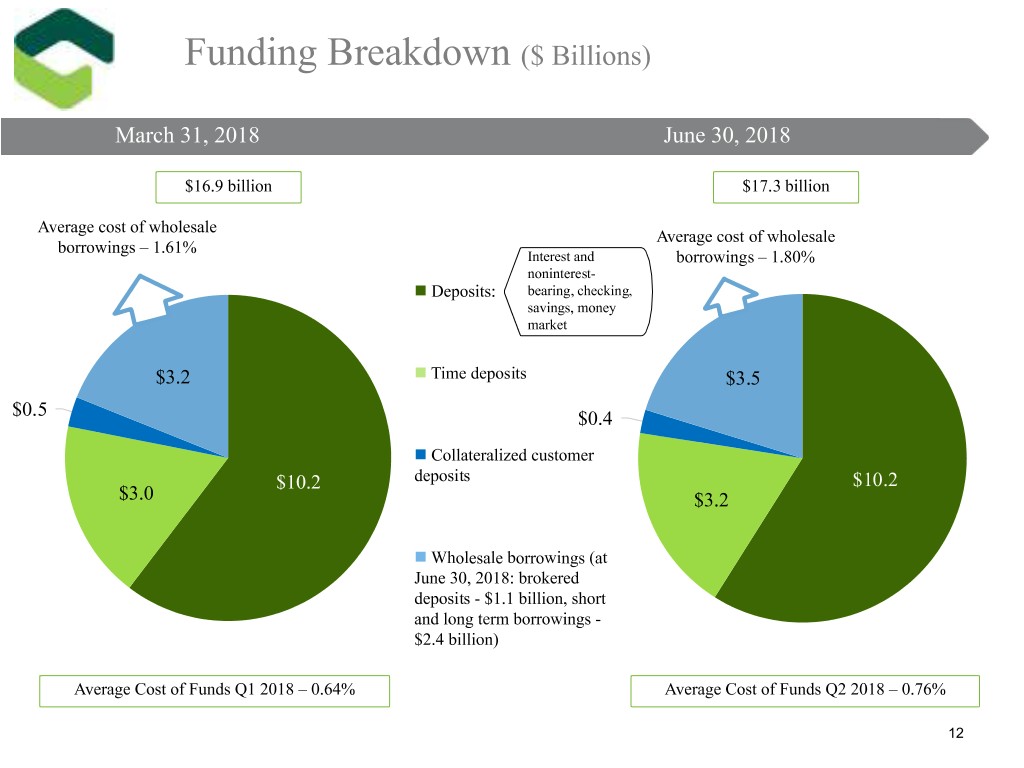

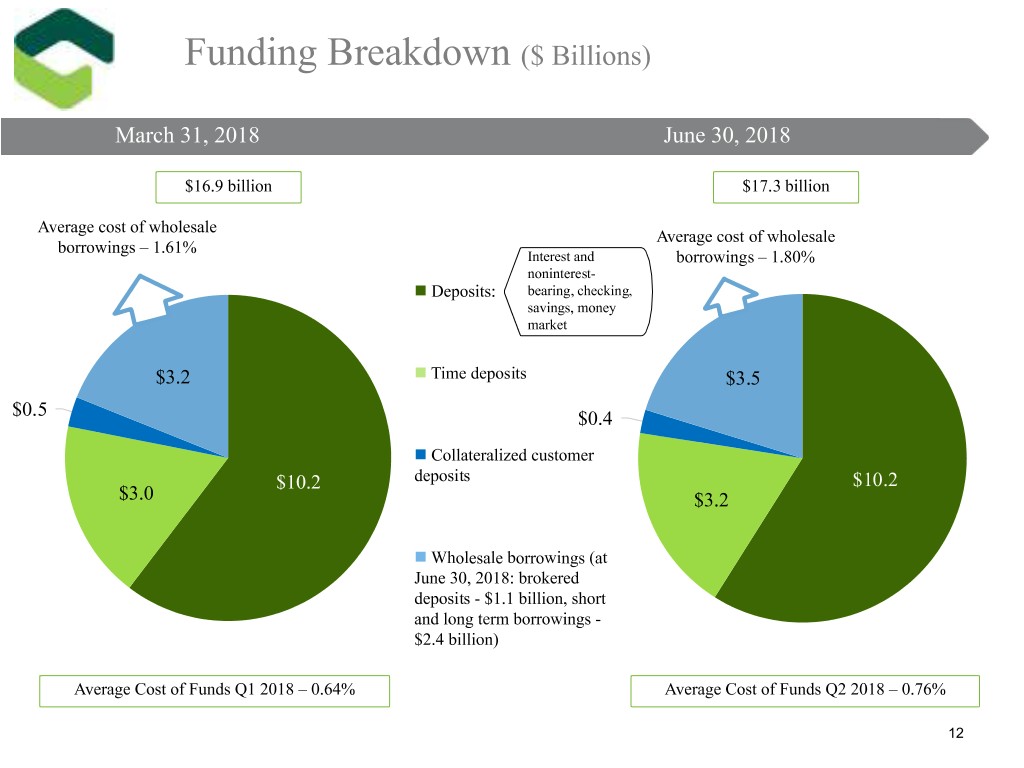

Funding Breakdown ($ Billions) March 31, 2018 June 30, 2018 $16.9 billion $17.3 billion Average cost of wholesale Average cost of wholesale borrowings – 1.61% Interest and borrowings – 1.80% noninterest- n Deposits: bearing, checking, savings, money market n Time deposits $3.2 $3.5 $0.5 $0.4 n Collateralized customer deposits $10.2 $10.2 $3.0 $3.2 n Wholesale borrowings (at June 30, 2018: brokered deposits - $1.1 billion, short and long term borrowings - $2.4 billion) Average Cost of Funds Q1 2018 – 0.64% Average Cost of Funds Q2 2018 – 0.76% 12

Credit Quality ($ Millions, unless otherwise noted) Provision for Loan Losses vs. Net Loan Losses (Originated loan portfolio) $10.0 $9.6 $8.1 $6.3 $5.0 $6.2 $4.3 $3.5 $4.9 $3.4 $3.5 $4.1 $1.2 $1.4 $0.0 Q1 Q2 Q3 Q4 Q1 Q2 2017 2018 Provision for Loan Losses Net Loan Losses Nonperforming Loans (NPLs) and Allowance for Loan Losses (ALL) $120 $92 $100 $76 $73 $78 $60 $62 $63 $67 ALL $51 $44 $0 NPLs YE 2014 YE 2015 YE 2016 YE 2017 Q2 2018 Originated Loans ($ billions) $5.0 $5.8 $7.5 $9.8 $10.7 Acquired Loans ($ billions) 0.7 1.5 5.5 4.4 3.9 Total Loans ($ billions) $5.7 $7.3 $13.0 $14.2 $14.6 Total ALL $76 $73 $78 $92 $100 Originated ALL/ Originated Loans 1.51% 1.26% 1.05% 0.94% 0.94% NPLs/ Total Loans 0.89% 0.86% 0.34% 0.45% 0.46% Credit Mark as a % of Unpaid Principal on Acquired Loans 5.4% 4.4% 3.1% 2.4% 1.8% 13

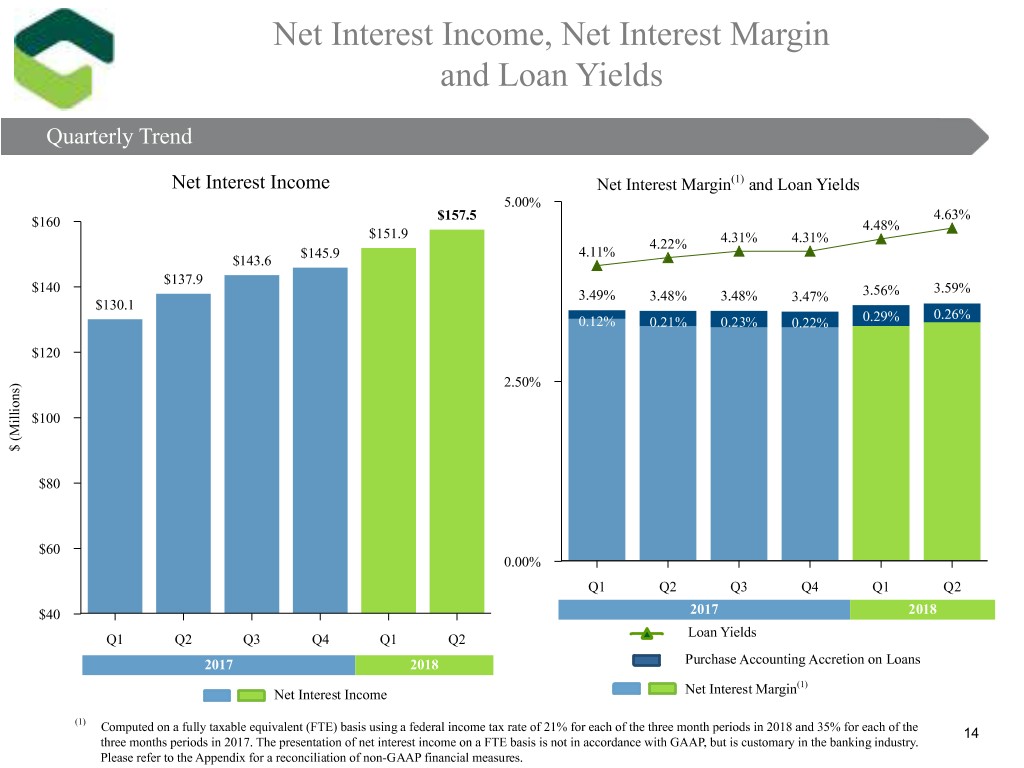

Net Interest Income, Net Interest Margin and Loan Yields Quarterly(Quarterly Trend Trend) Net Interest Income Net Interest Margin(1) and Loan Yields 5.00% $157.5 4.63% $160 4.48% $151.9 4.22% 4.31% 4.31% $145.9 4.11% $143.6 $137.9 $140 3.59% 3.49% 3.48% 3.48% 3.47% 3.56% $130.1 0.26% 0.12% 0.21% 0.23% 0.22% 0.29% $120 ) 2.50% s n o i l l i $100 M ( $ $80 $60 0.00% Q1 Q2 Q3 Q4 Q1 Q2 $40 2017 2018 Loan Yields Q1 Q2 Q3 Q4 Q1 Q2 2017 2018 Purchase Accounting Accretion on Loans (1) Net Interest Income Net Interest Margin (1) Computed on a fully taxable equivalent (FTE) basis using a federal income tax rate of 21% for each of the three month periods in 2018 and 35% for each of the 14 three months periods in 2017. The presentation of net interest income on a FTE basis is not in accordance with GAAP, but is customary in the banking industry. Please refer to the Appendix for a reconciliation of non-GAAP financial measures.

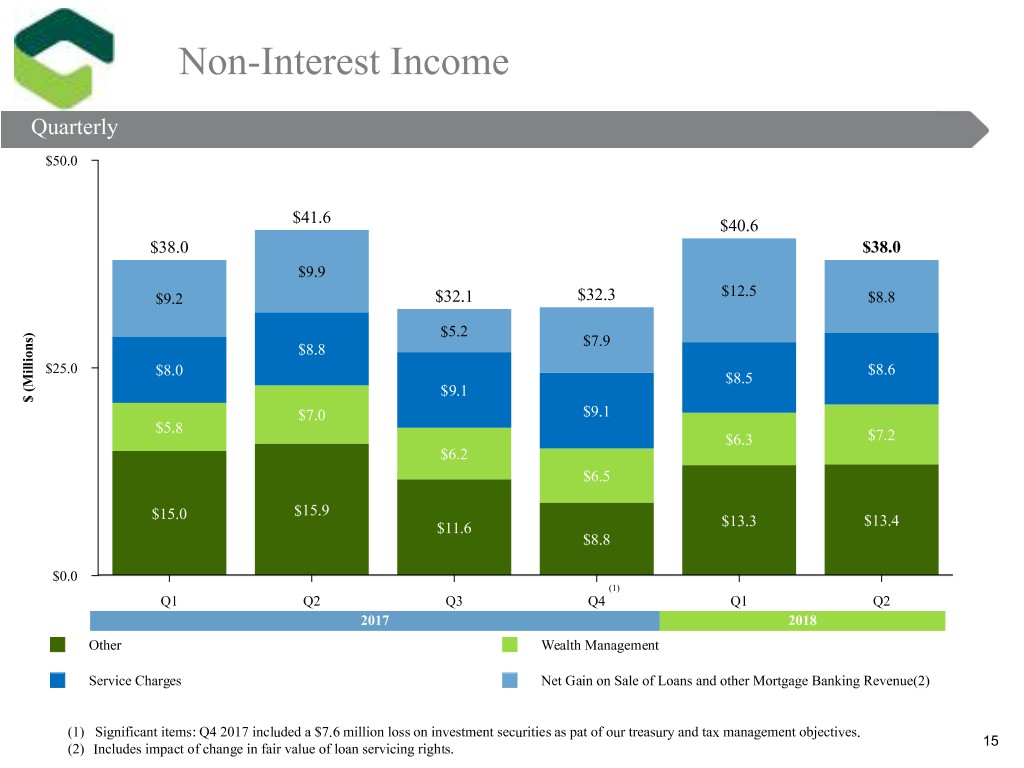

Non-Interest Income Quarterly $50.0 $41.6 $40.6 $38.0 $38.0 $9.9 $12.5 $9.2 $32.1 $32.3 $8.8 ) $5.2 s $7.9 n $8.8 o i l l i $25.0 $8.0 $8.6 $8.5 M ( $9.1 $ $7.0 $9.1 $5.8 $6.3 $7.2 $6.2 $6.5 $15.0 $15.9 $11.6 $13.3 $13.4 $8.8 $0.0 (1) Q1 Q2 Q3 Q4 Q1 Q2 2017 2018 Other Wealth Management Service Charges Net Gain on Sale of Loans and other Mortgage Banking Revenue(2) (1) Significant items: Q4 2017 included a $7.6 million loss on investment securities as pat of our treasury and tax management objectives. 15 (2) Includes impact of change in fair value of loan servicing rights.

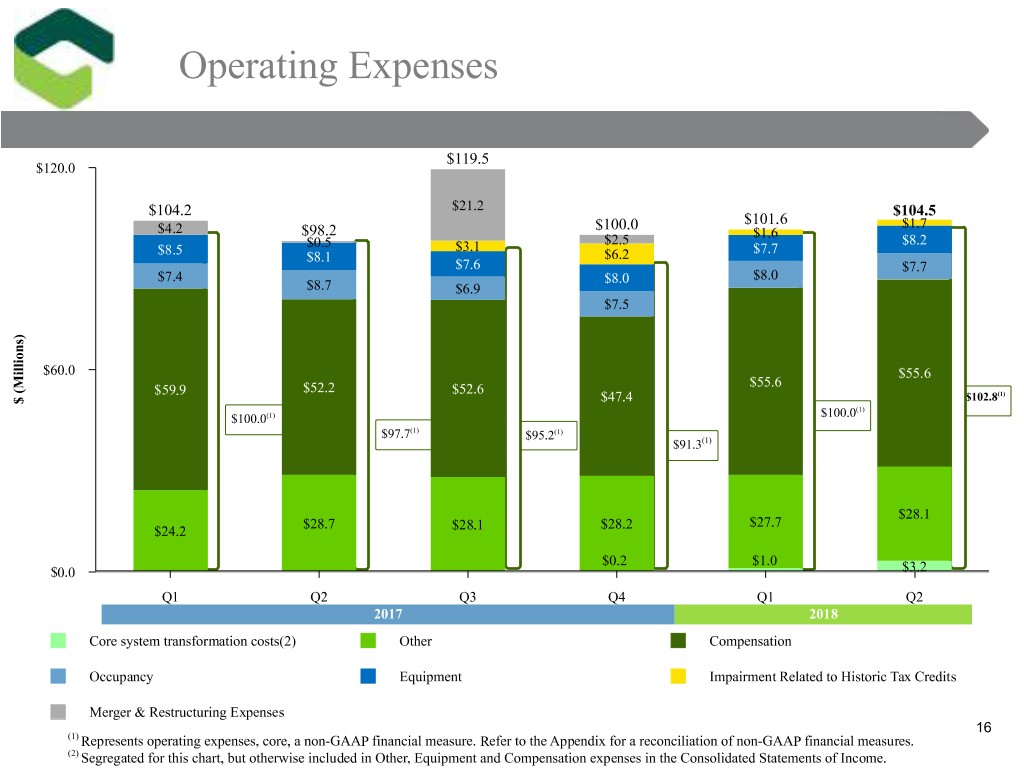

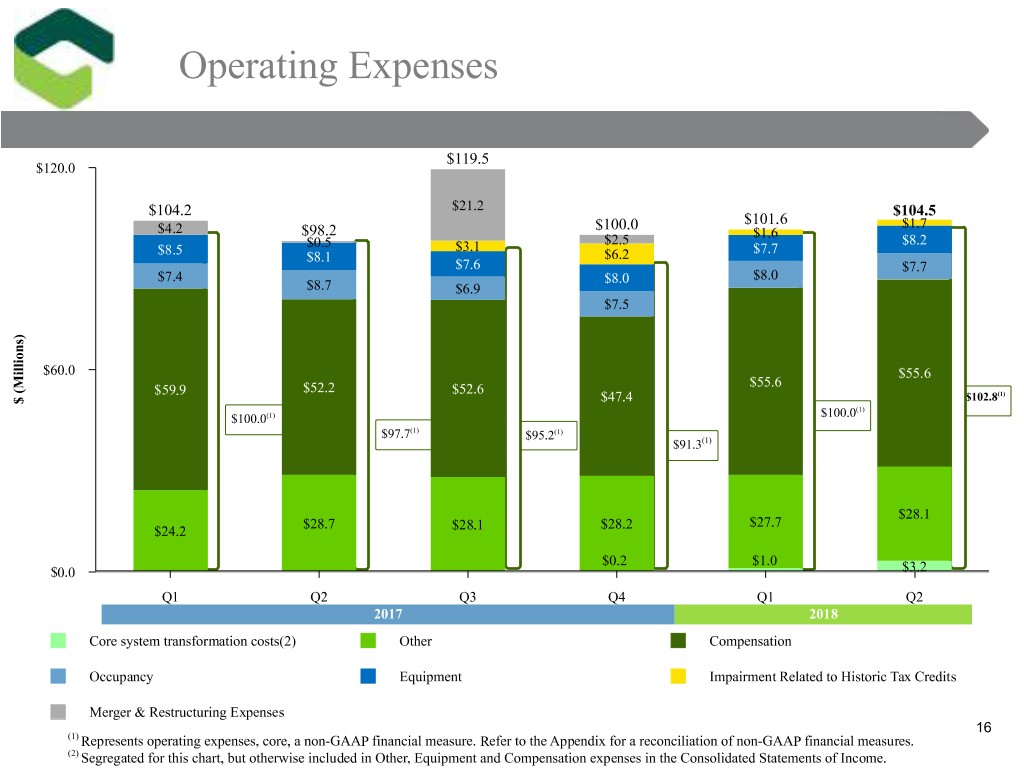

Operating Expenses Quarterly $119.5 $120.0 $104.2 $21.2 $104.5 $101.6 $4.2 $98.2 $100.0 $1.7 $2.5 $1.6 $8.2 $0.5 $3.1 $7.7 $8.5 $8.1 $6.2 $7.6 $7.7 $7.4 $8.0 $8.0 $8.7 $6.9 $7.5 ) s n o i l l i $60.0 $55.6 M $55.6 ( $59.9 $52.2 $52.6 (1) $102.8 $ $47.4 (1) $100.0(1) $100.0 $97.7(1) $95.2(1) $91.3(1) $28.1 $28.7 $28.2 $27.7 $24.2 $28.1 $0.2 $1.0 $0.0 $3.2 Q1 Q2 Q3 Q4 Q1 Q2 2017 2018 Core system transformation costs(2) Other Compensation Occupancy Equipment Impairment Related to Historic Tax Credits Merger & Restructuring Expenses 16 (1) Represents operating expenses, core, a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. (2) Segregated for this chart, but otherwise included in Other, Equipment and Compensation expenses in the Consolidated Statements of Income.

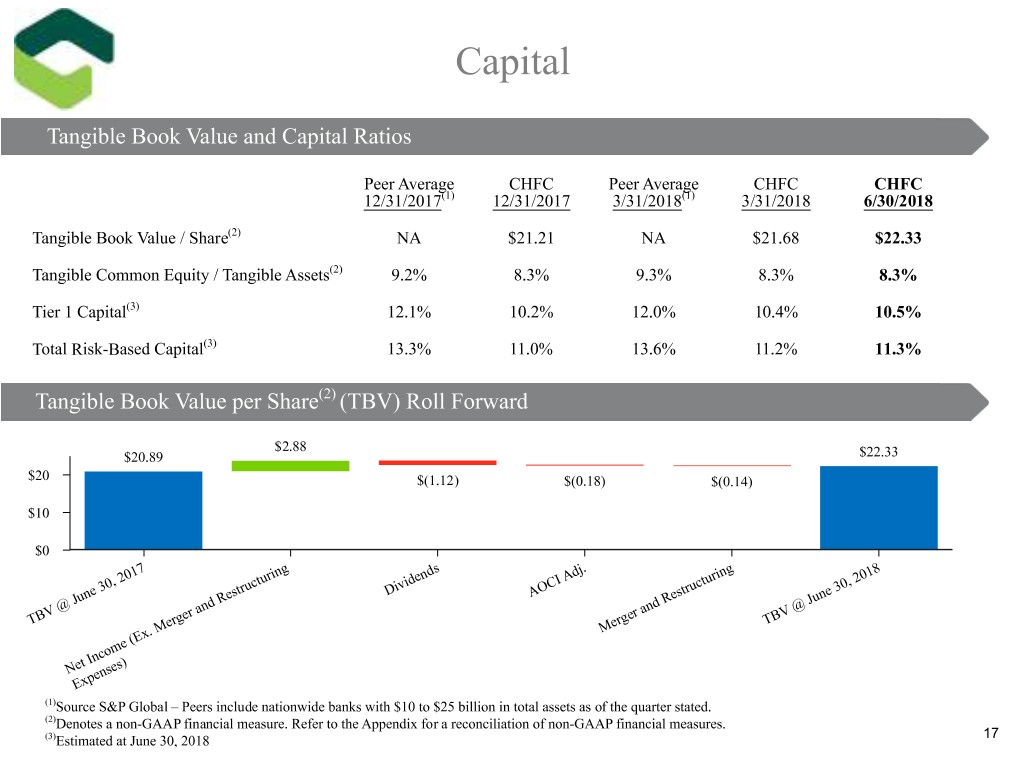

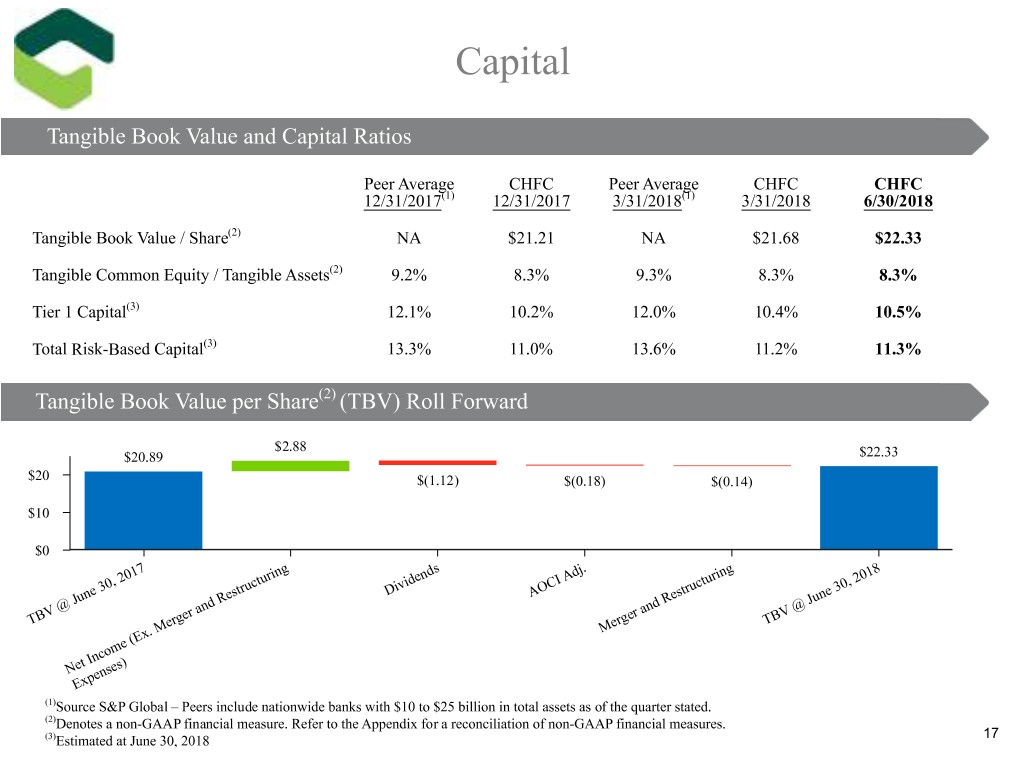

Capital Tangible Book Value and Capital Ratios Peer Average CHFC Peer Average CHFC CHFC 12/31/2017(1) 12/31/2017 3/31/2018(1) 3/31/2018 6/30/2018 Tangible Book Value / Share(2) NA $21.21 NA $21.68 $22.33 Tangible Common Equity / Tangible Assets(2) 9.2% 8.3% 9.3% 8.3% 8.3% Tier 1 Capital(3) 12.1% 10.2% 12.0% 10.4% 10.5% Total Risk-Based Capital(3) 13.3% 11.0% 13.6% 11.2% 11.3% Tangible Book Value per Share(2) (TBV) Roll Forward $2.88 $20.89 $22.33 $20 $(1.12) $(0.18) $(0.14) $10 $0 7 g ds j. g 8 201 rin en Ad rin 201 0, ctu vid CI ctu 0, e 3 stru Di AO stru e 3 Jun Re Re Jun @ nd nd @ V er a er a V TB erg erg TB x. M M e (E com t In ) Ne ses pen Ex (1)Source S&P Global – Peers include nationwide banks with $10 to $25 billion in total assets as of the quarter stated. (2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures. 17 (3)Estimated at June 30, 2018

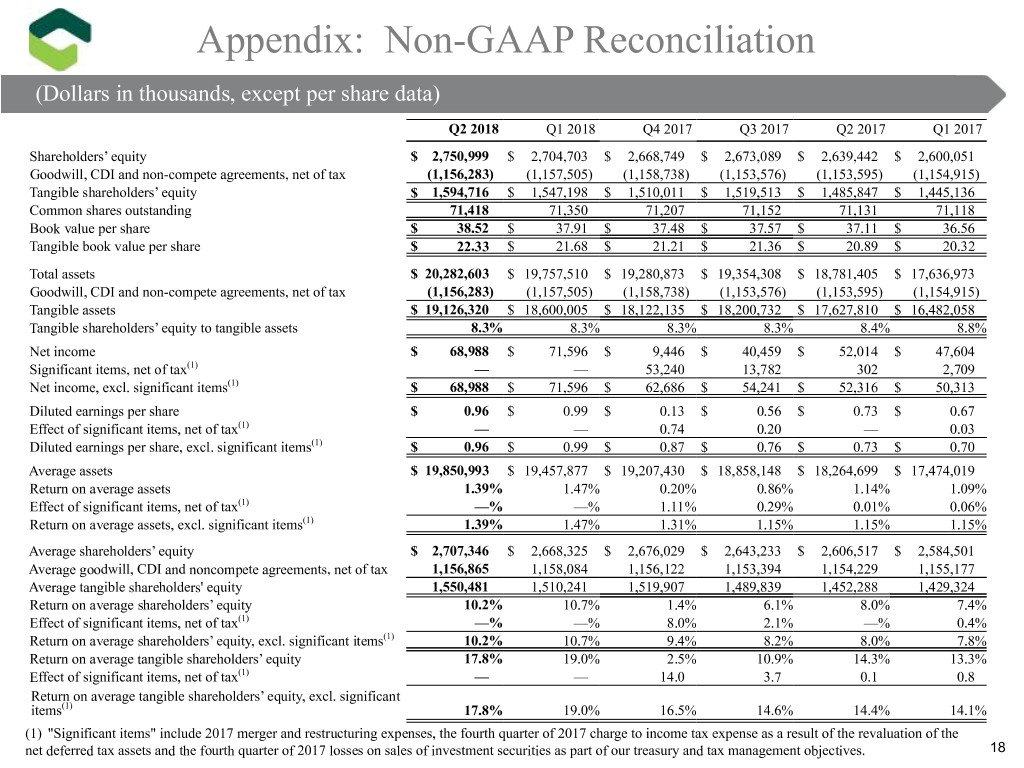

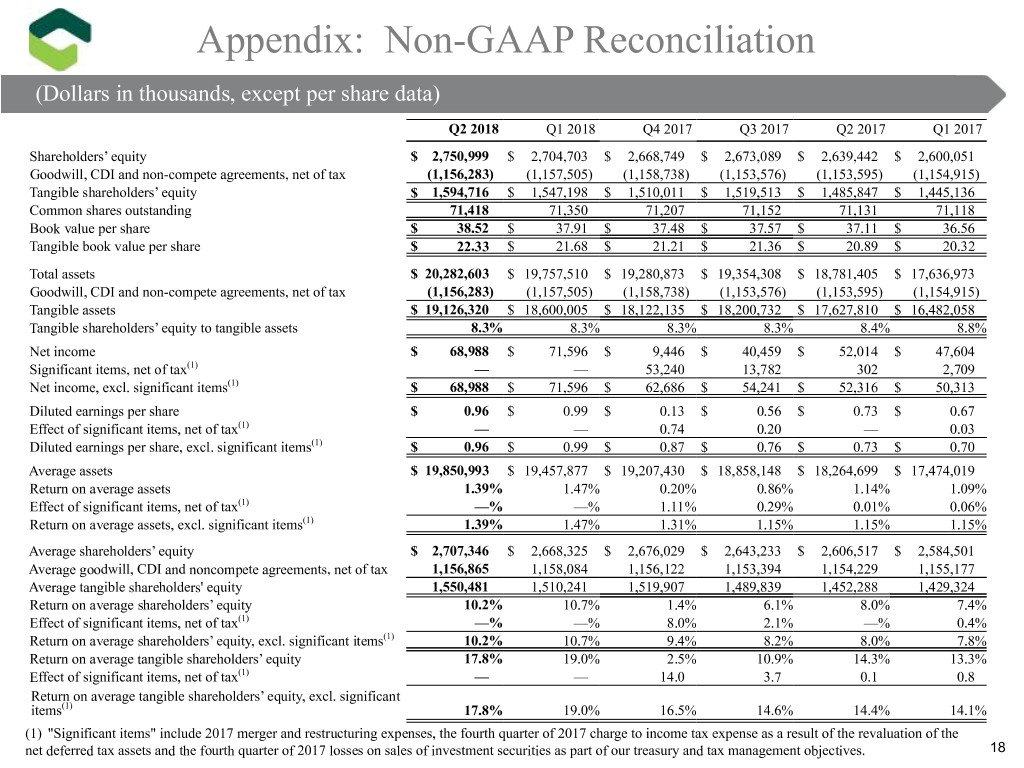

Appendix: Non-GAAP Reconciliation (Dollars in thousands, except per share data) Q2 2018 Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Shareholders’ equity $ 2,750,999 $ 2,704,703 $ 2,668,749 $ 2,673,089 $ 2,639,442 $ 2,600,051 Goodwill, CDI and non-compete agreements, net of tax (1,156,283) (1,157,505) (1,158,738) (1,153,576) (1,153,595) (1,154,915) Tangible shareholders’ equity $ 1,594,716 $ 1,547,198 $ 1,510,011 $ 1,519,513 $ 1,485,847 $ 1,445,136 Common shares outstanding 71,418 71,350 71,207 71,152 71,131 71,118 Book value per share $ 38.52 $ 37.91 $ 37.48 $ 37.57 $ 37.11 $ 36.56 Tangible book value per share $ 22.33 $ 21.68 $ 21.21 $ 21.36 $ 20.89 $ 20.32 Total assets $ 20,282,603 $ 19,757,510 $ 19,280,873 $ 19,354,308 $ 18,781,405 $ 17,636,973 Goodwill, CDI and non-compete agreements, net of tax (1,156,283) (1,157,505) (1,158,738) (1,153,576) (1,153,595) (1,154,915) Tangible assets $ 19,126,320 $ 18,600,005 $ 18,122,135 $ 18,200,732 $ 17,627,810 $ 16,482,058 Tangible shareholders’ equity to tangible assets 8.3% 8.3% 8.3% 8.3% 8.4% 8.8% Net income $ 68,988 $ 71,596 $ 9,446 $ 40,459 $ 52,014 $ 47,604 Significant items, net of tax(1) — — 53,240 13,782 302 2,709 Net income, excl. significant items(1) $ 68,988 $ 71,596 $ 62,686 $ 54,241 $ 52,316 $ 50,313 Diluted earnings per share $ 0.96 $ 0.99 $ 0.13 $ 0.56 $ 0.73 $ 0.67 Effect of significant items, net of tax(1) — — 0.74 0.20 — 0.03 Diluted earnings per share, excl. significant items(1) $ 0.96 $ 0.99 $ 0.87 $ 0.76 $ 0.73 $ 0.70 Average assets $ 19,850,993 $ 19,457,877 $ 19,207,430 $ 18,858,148 $ 18,264,699 $ 17,474,019 Return on average assets 1.39% 1.47% 0.20% 0.86% 1.14% 1.09% Effect of significant items, net of tax(1) —% —% 1.11% 0.29% 0.01% 0.06% Return on average assets, excl. significant items(1) 1.39% 1.47% 1.31% 1.15% 1.15% 1.15% Average shareholders’ equity $ 2,707,346 $ 2,668,325 $ 2,676,029 $ 2,643,233 $ 2,606,517 $ 2,584,501 Average goodwill, CDI and noncompete agreements, net of tax 1,156,865 1,158,084 1,156,122 1,153,394 1,154,229 1,155,177 Average tangible shareholders' equity 1,550,481 1,510,241 1,519,907 1,489,839 1,452,288 1,429,324 Return on average shareholders’ equity 10.2% 10.7% 1.4% 6.1% 8.0% 7.4% Effect of significant items, net of tax(1) —% —% 8.0% 2.1% —% 0.4% Return on average shareholders’ equity, excl. significant items(1) 10.2% 10.7% 9.4% 8.2% 8.0% 7.8% Return on average tangible shareholders’ equity 17.8% 19.0% 2.5% 10.9% 14.3% 13.3% Effect of significant items, net of tax(1) — — 14.0 3.7 0.1 0.8 Return on average tangible shareholders’ equity, excl. significant items(1) 17.8% 19.0% 16.5% 14.6% 14.4% 14.1% (1) "Significant items" include 2017 merger and restructuring expenses, the fourth quarter of 2017 charge to income tax expense as a result of the revaluation of the net deferred tax assets and the fourth quarter of 2017 losses on sales of investment securities as part of our treasury and tax management objectives. 18

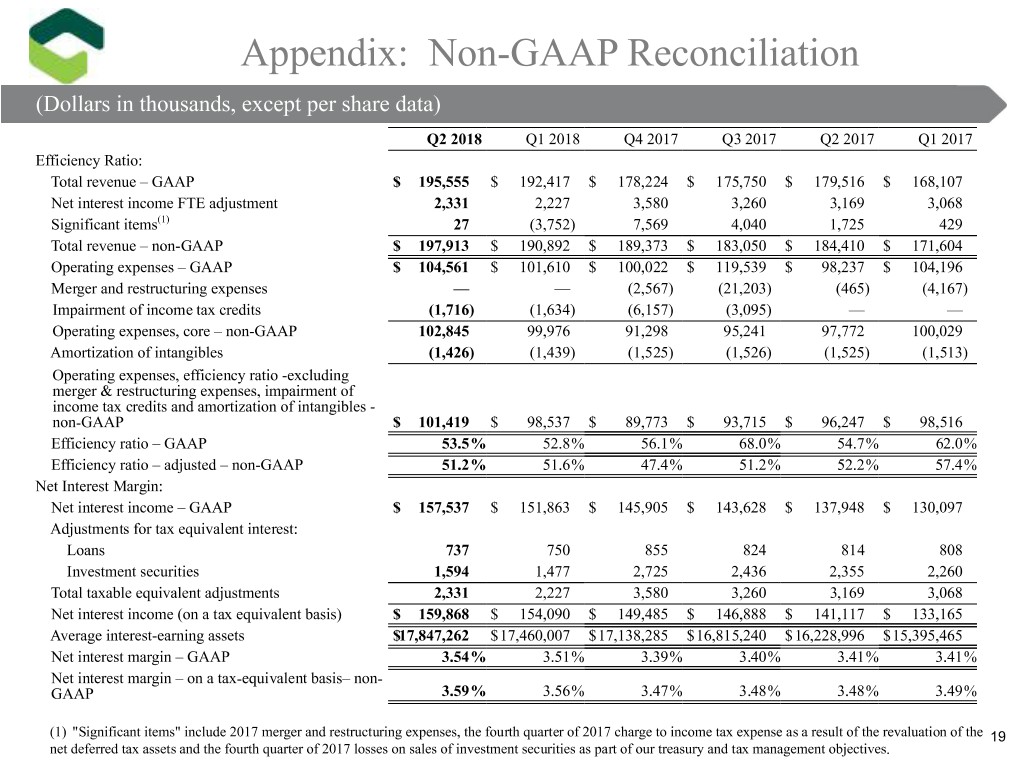

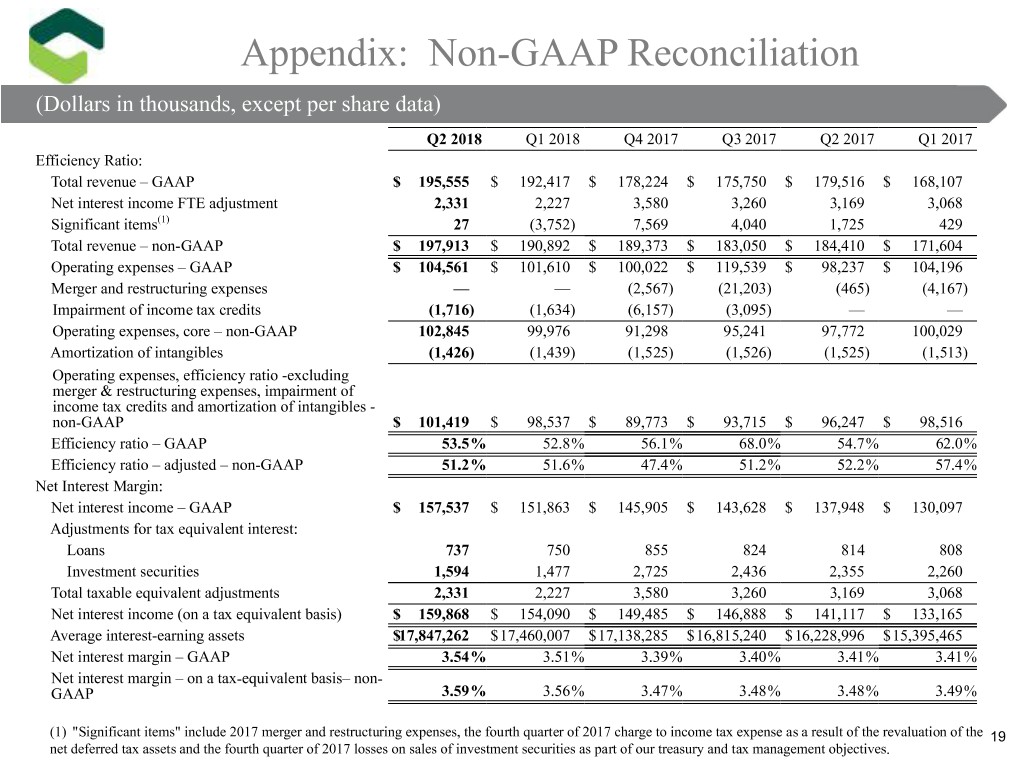

Appendix: Non-GAAP Reconciliation (Dollars in thousands, except per share data) Q2 2018 Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Efficiency Ratio: Total revenue – GAAP $ 195,555 $ 192,417 $ 178,224 $ 175,750 $ 179,516 $ 168,107 Net interest income FTE adjustment 2,331 2,227 3,580 3,260 3,169 3,068 Significant items(1) 27 (3,752) 7,569 4,040 1,725 429 Total revenue – non-GAAP $ 197,913 $ 190,892 $ 189,373 $ 183,050 $ 184,410 $ 171,604 Operating expenses – GAAP $ 104,561 $ 101,610 $ 100,022 $ 119,539 $ 98,237 $ 104,196 Merger and restructuring expenses — — (2,567) (21,203) (465) (4,167) Impairment of income tax credits (1,716) (1,634) (6,157) (3,095) — — Operating expenses, core – non-GAAP 102,845 99,976 91,298 95,241 97,772 100,029 Amortization of intangibles (1,426) (1,439) (1,525) (1,526) (1,525) (1,513) Operating expenses, efficiency ratio -excluding merger & restructuring expenses, impairment of income tax credits and amortization of intangibles - non-GAAP $ 101,419 $ 98,537 $ 89,773 $ 93,715 $ 96,247 $ 98,516 Efficiency ratio – GAAP 53.5% 52.8% 56.1% 68.0% 54.7% 62.0% Efficiency ratio – adjusted – non-GAAP 51.2% 51.6% 47.4% 51.2% 52.2% 57.4% Net Interest Margin: Net interest income – GAAP $ 157,537 $ 151,863 $ 145,905 $ 143,628 $ 137,948 $ 130,097 Adjustments for tax equivalent interest: Loans 737 750 855 824 814 808 Investment securities 1,594 1,477 2,725 2,436 2,355 2,260 Total taxable equivalent adjustments 2,331 2,227 3,580 3,260 3,169 3,068 Net interest income (on a tax equivalent basis) $ 159,868 $ 154,090 $ 149,485 $ 146,888 $ 141,117 $ 133,165 Average interest-earning assets $17,847,262 $17,460,007 $17,138,285 $16,815,240 $16,228,996 $15,395,465 Net interest margin – GAAP 3.54% 3.51% 3.39% 3.40% 3.41% 3.41% Net interest margin – on a tax-equivalent basis– non- GAAP 3.59% 3.56% 3.47% 3.48% 3.48% 3.49% (1) "Significant items" include 2017 merger and restructuring expenses, the fourth quarter of 2017 charge to income tax expense as a result of the revaluation of the 19 net deferred tax assets and the fourth quarter of 2017 losses on sales of investment securities as part of our treasury and tax management objectives.