Agenda Page

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2013, which has been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.’s website (http://investor.shareholder.com/jpmorganchase) and on the Securities and Exchange Commission's website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements.

February 25, 2014 F I R M O V E R V I E W Marianne Lake, Chief Financial Officer

Agenda Page F I R M O V E R V I E W 1 JPMorgan Chase overview 1 New financial architecture 6 Balance sheet/NII and credit update 15 Expense, investments and outlook 21 Appendix – investor topics 27 Appendix – other 32

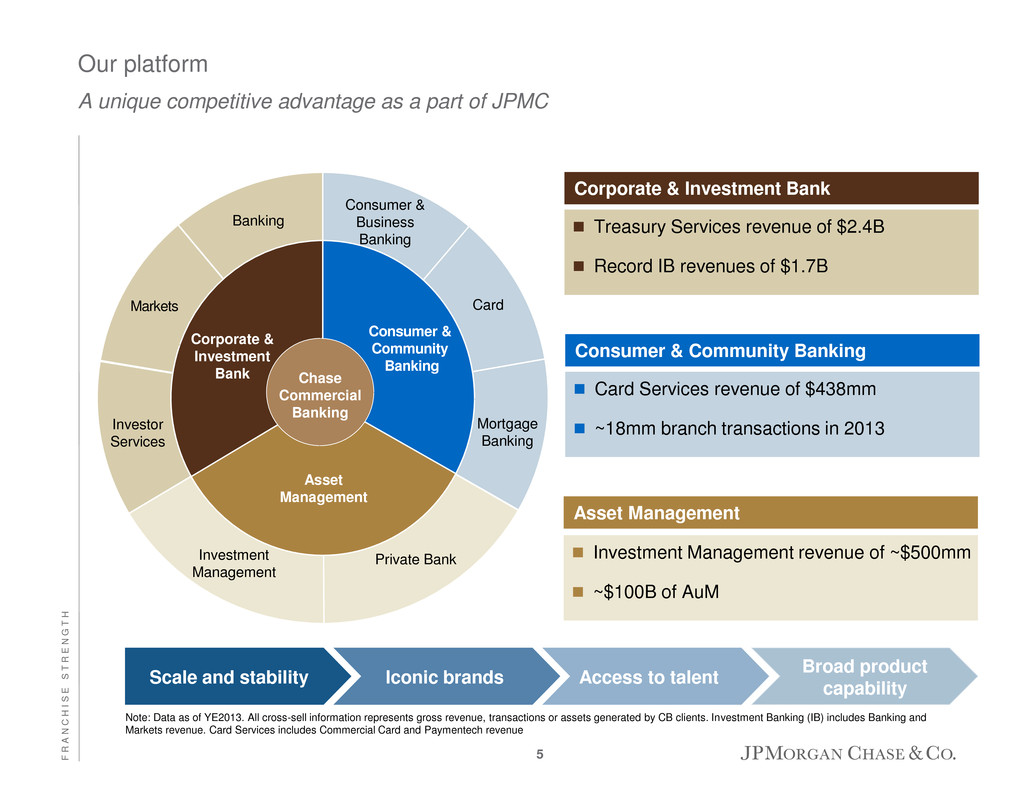

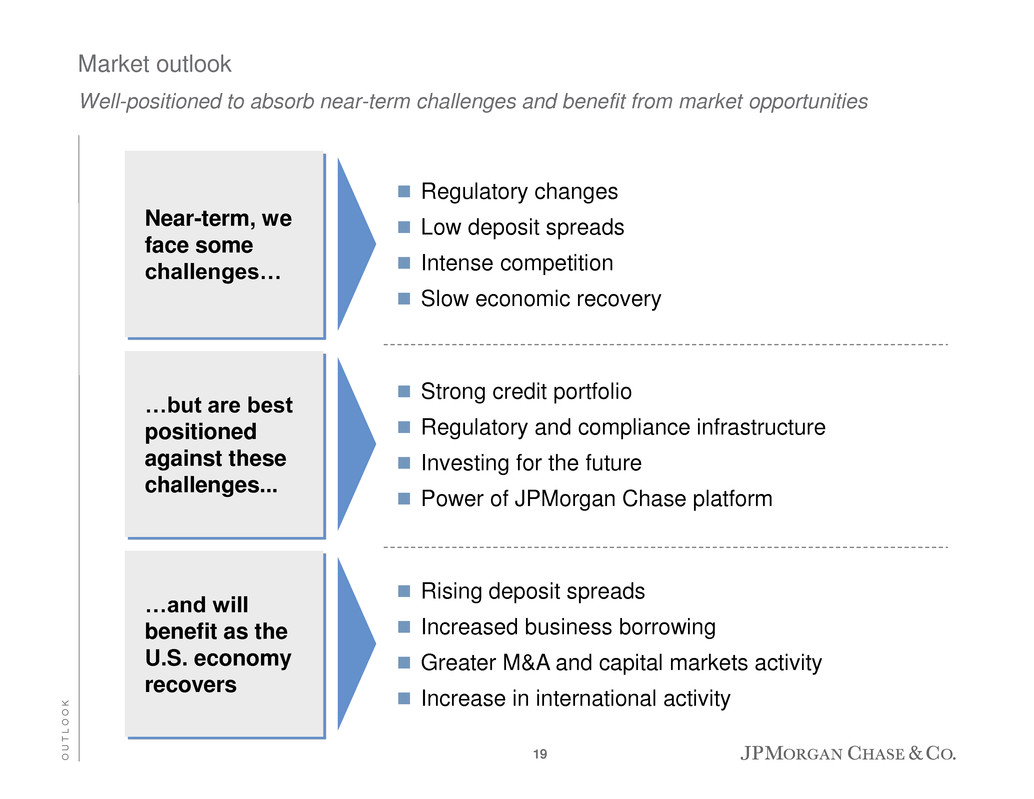

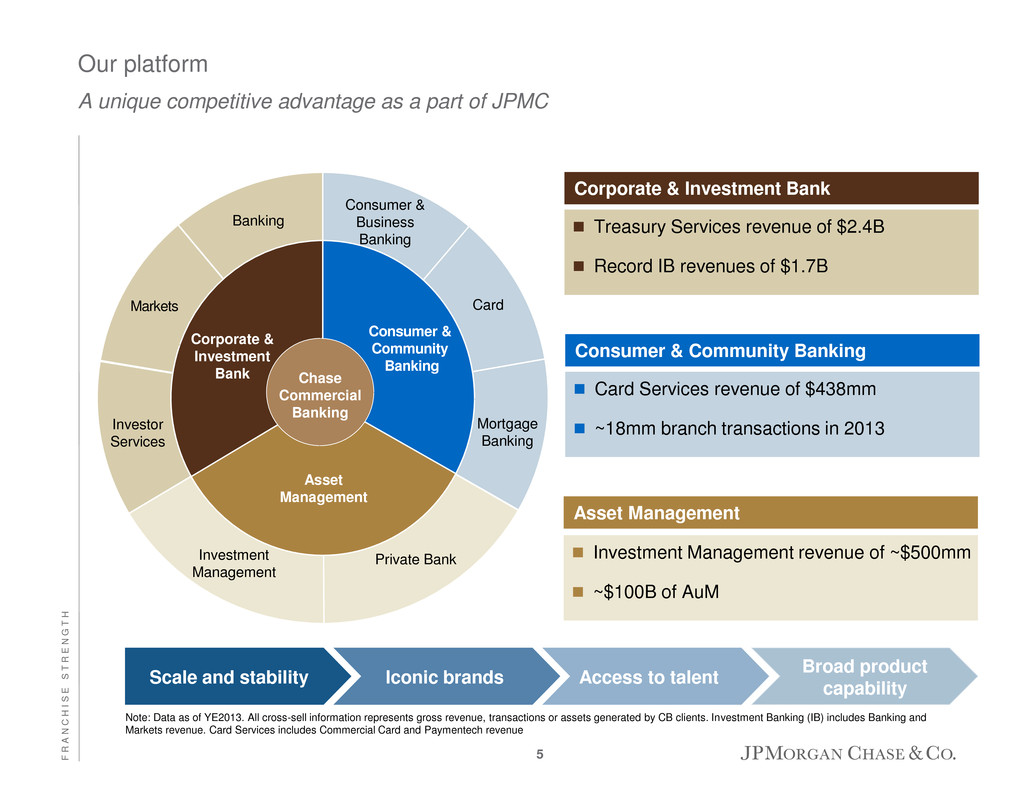

J P M O R G A N C H A S E O V E R V I E W JPMorgan Chase – extremely strong fundamentals and well positioned to adapt JPMorgan Chase overview Four best-in-class client franchises – each performing strongly Together driving significant synergies – diversification, complete platform, scale and efficiencies Demonstrated earnings capacity, resilience and superior returns Maintain best-in-class margins and improve operating leverage Experienced management teams with deep talent Excellent client franchises Regulatory, control and simplification agendas Executing on our regulatory and control agendas Significant effort – will make us a better company Business simplification agenda – reduce complexity and focus on core competencies New financial architecture Optimize returns against capital targets Manage at granular level – legal entity, sub-LOB, product and client level Focus on impact to broader franchise and client relationships Continue progress towards Firm’s capital targets while balancing capital returns Transition year – protect franchise value and future earnings power 2

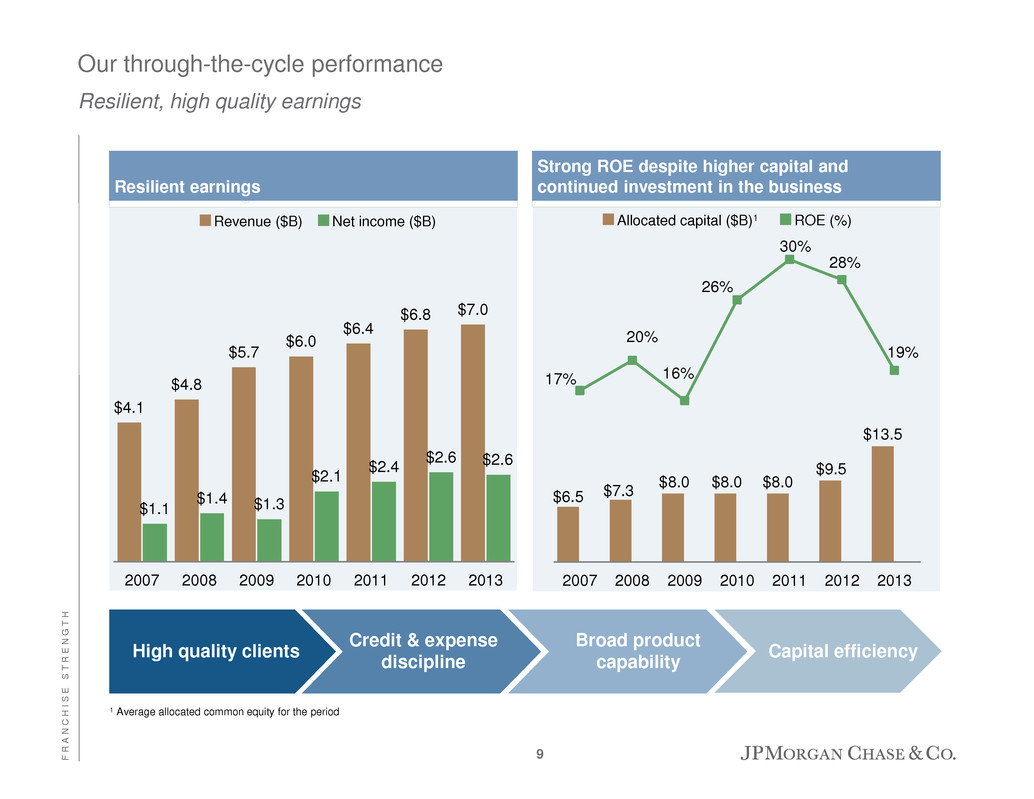

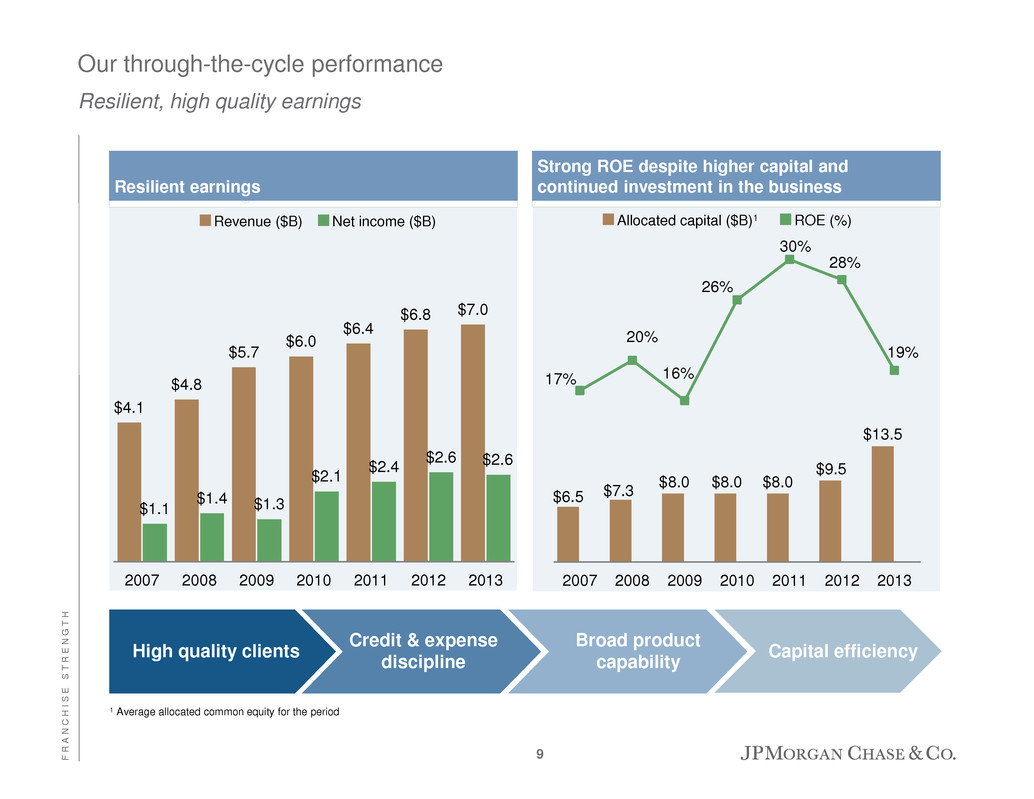

J P M O R G A N C H A S E O V E R V I E W Performance summary JPMorgan Chase overview Note: Totals may not sum due to rounding 1 See note 1 on slide 48 2 See note 2 on slide 48 3 See note 4 on slide 49 4 Estimated impact of final Basel 2.5 Rules and Basel III Advanced NPR reflected in 2012, but not in 2010 and 2011 5 See note 3 on slide 49 Comments Diversification of our business has enabled us to invest through-the-cycle and maintain strong returns on increasing levels of capital Despite significant items, the rate environment and mortgage volatility – stable revenue for the last 3 years – NIR >50% of total revenue, across a broad set of categories and growing strongly Expense – maintained adjusted overhead ratio of ~58-59% over last 3 years $mm, excluding EPS Excl. total legal expense & FRM5 FY2010 FY2011 FY2012 FY2013 Revenue (FTE) 1 $104,842 $99,767 $99,890 $99,798 Credit costs 16,639 7,574 3,385 225 Expense 61,196 62,911 64,729 70,467 Reported – net income $17,370 $18,976 $21,284 $17,923 Reported EPS $3.96 $4.48 $5.20 $4.35 ROTCE 3 15% 15% 15% 11% Ba el III Tier 1 common ratio 3,4 7.0 7.9 8.7 9.5 Memo: Adjusted expense 5 $53,440 $57,401 $59,742 $59,031 ROE by LOB Consumer & Community Banking 11% 15% 25% 23% Corporate & Investment Bank 17 17 18 15 Commercial Banking 26 30 28 19 Asset Management 26 25 24 23 3

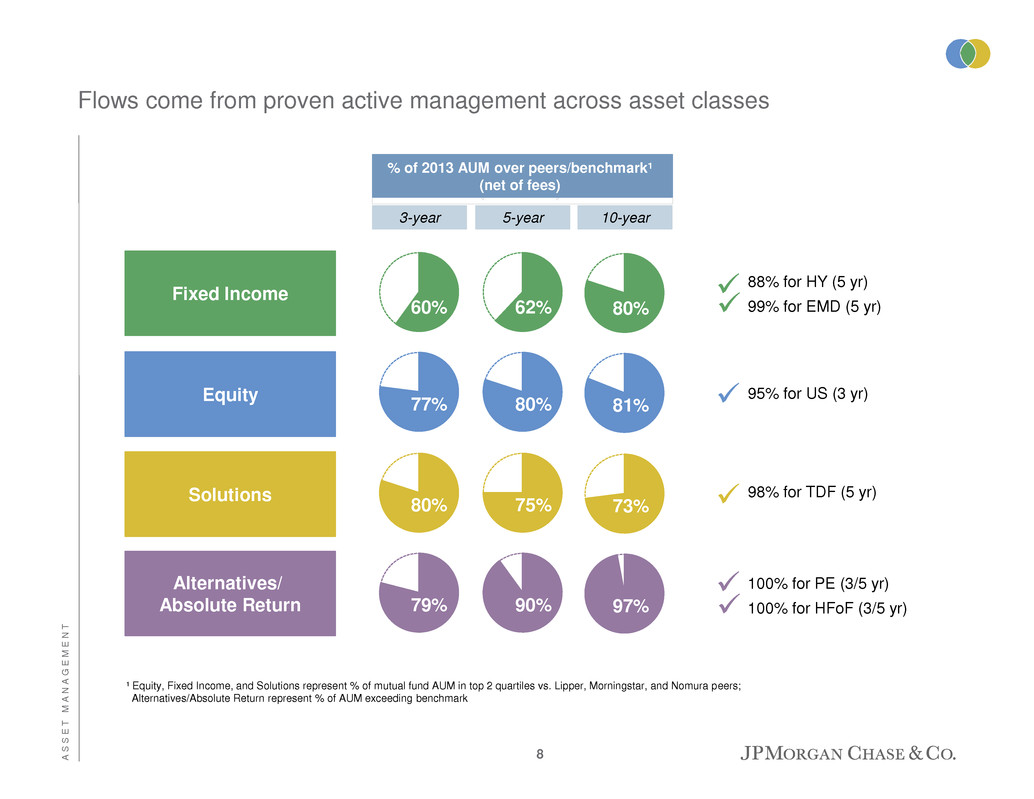

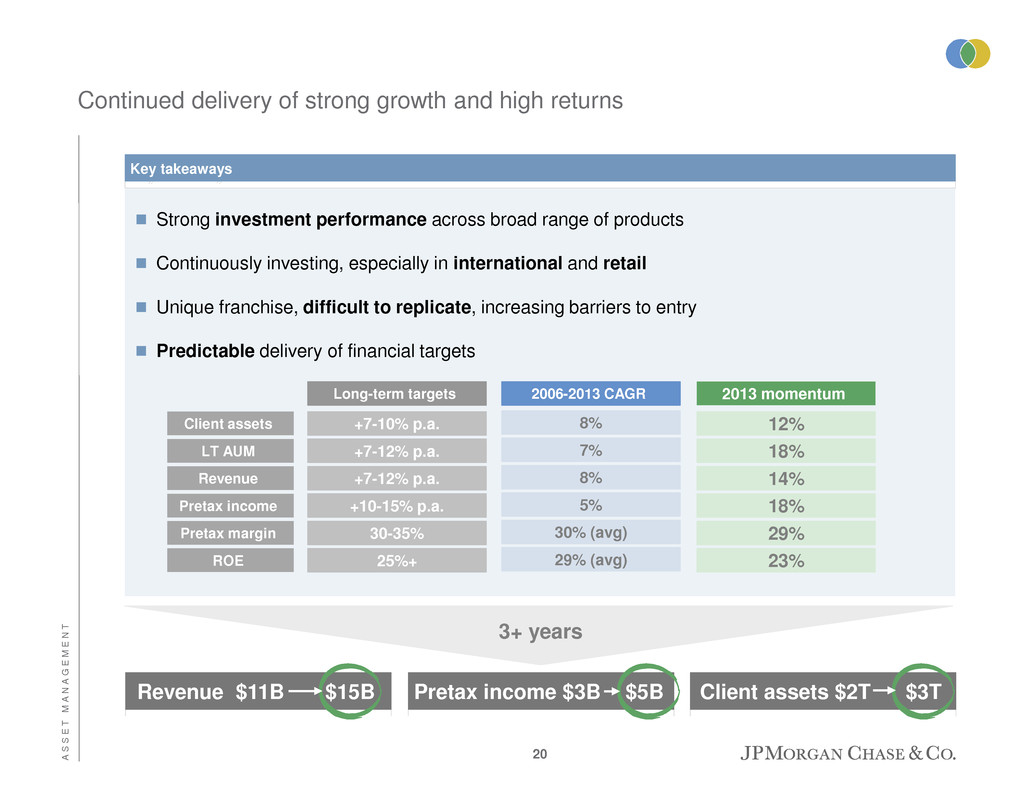

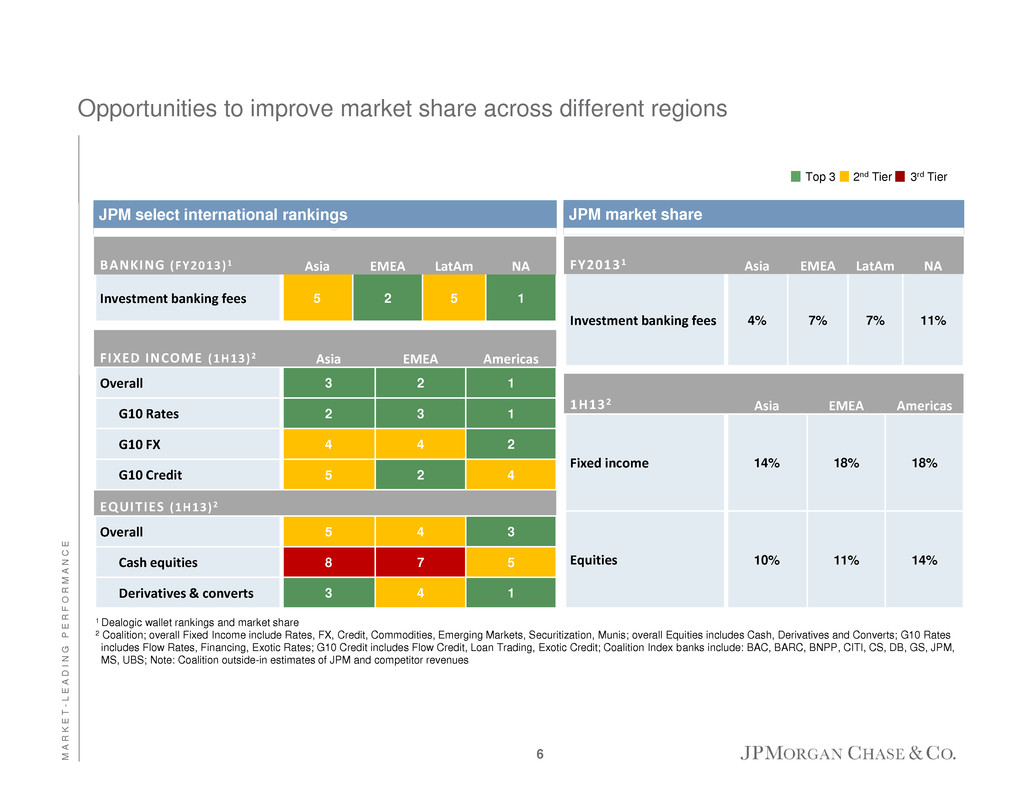

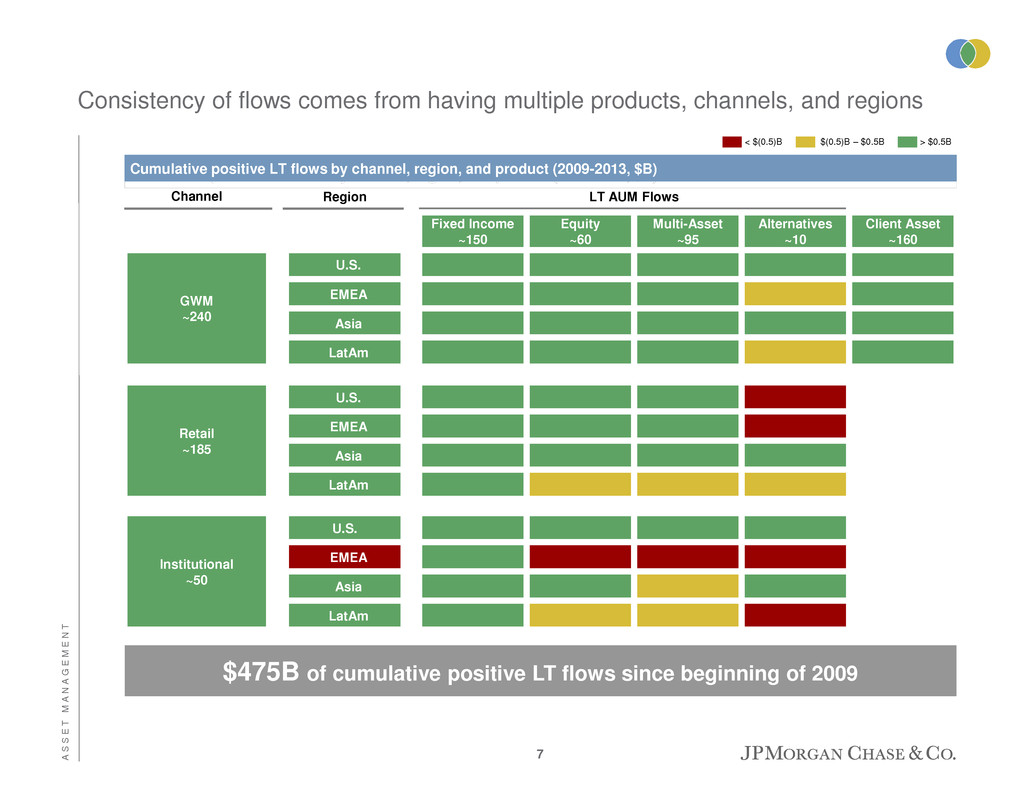

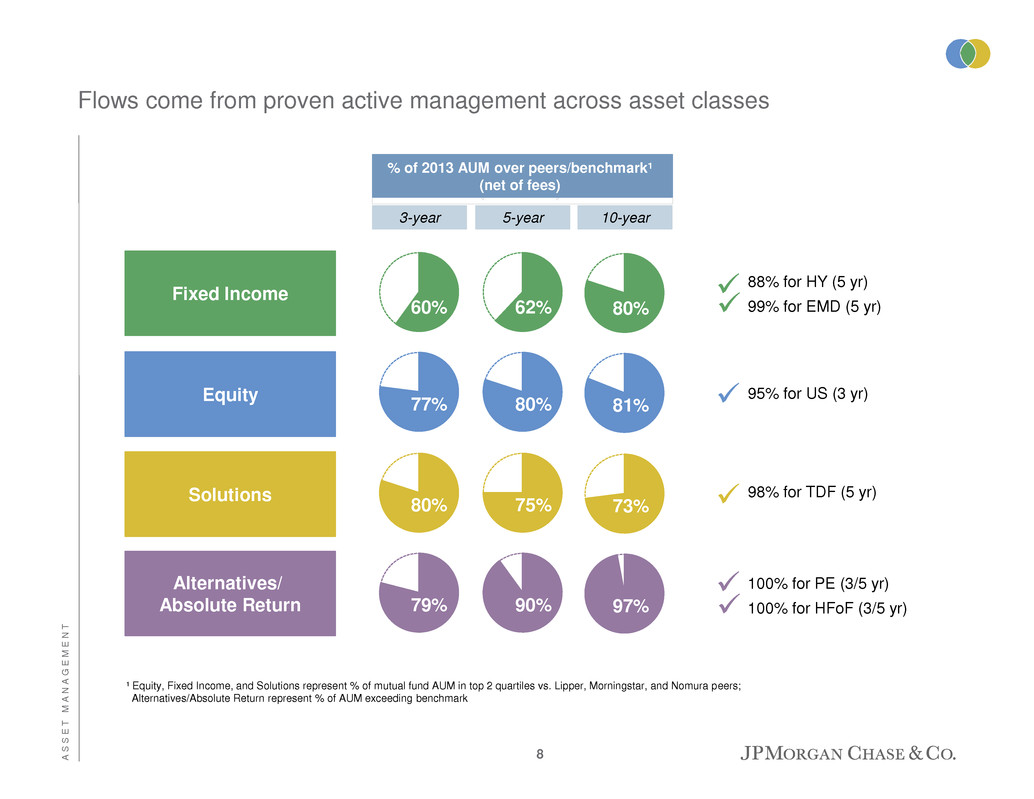

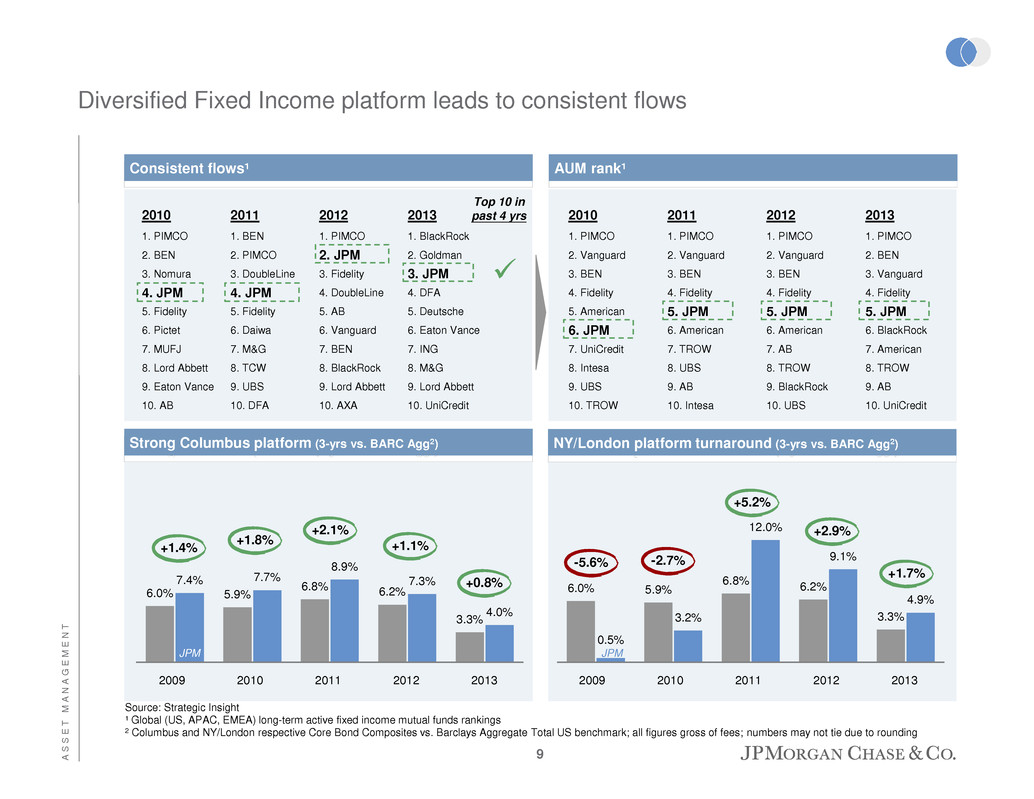

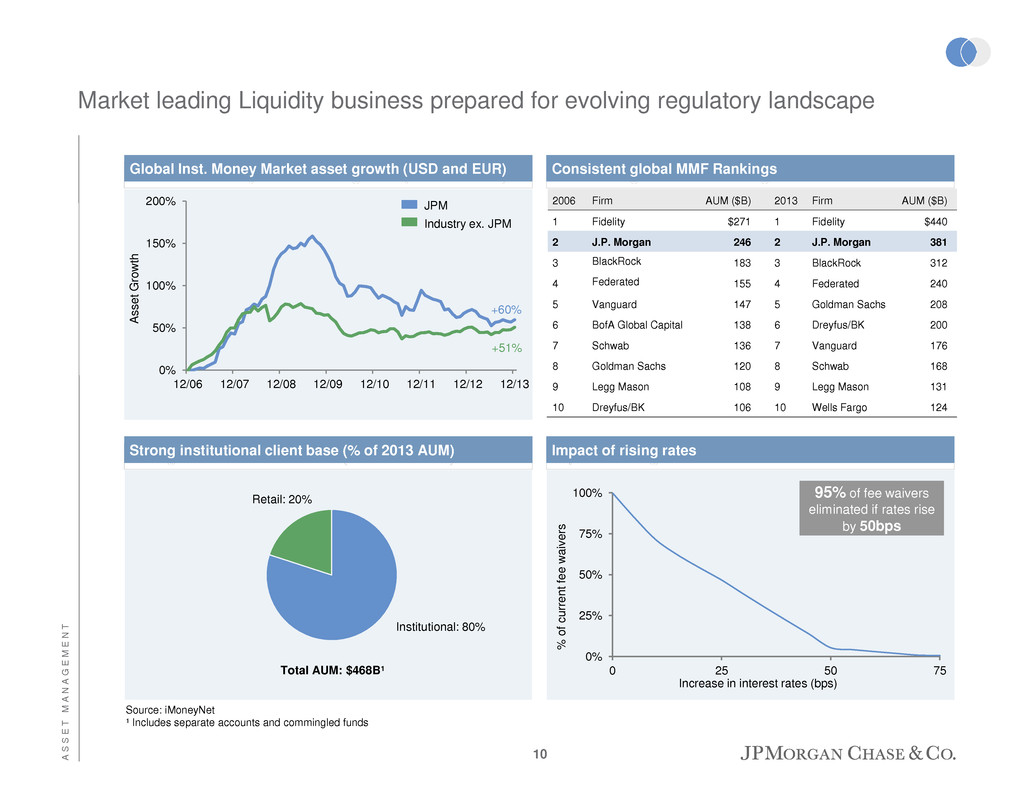

J P M O R G A N C H A S E O V E R V I E W CAGR 2013 2010-2013 CBB deposits (Avg) $435 8.4% Client inv. assets (EOP) 189 12.4 Mortgage originations1 166 NM Card sales volume 420 10.3 Auto originations 26 4.3 Merchant processing volume 750 16.9 Loans (EOP) $108 8.6% Client deposits (Avg)2 384 15.6 AUC ($T, EOP) 20 8.3 Average VaR ($mm)3 47 NM Loans (EOP) $137 11.5% Deposits (Avg) 198 12.6 AUM (EOP) $1,598 7.2% Long-term AUM Flows 90 NM Loans (EOP) 95 29.4 Deposits (Avg) 140 17.5 CCB CIB CB AM CCB Deposit growth more than 2x industry average6 #1 credit card issuer in the U.S.7 Record credit card sales and client investment assets CIB Top 3 in 15 product categories out of 168 #1 in global IB fees with 8.6% market share9 – up 110 bps from 2012 #1 in markets revenue with 16.0% market share10 – up 140 bps from 2012 – FICC: 18.6% market share10 – up 300 bps from 2012 CB 14 consecutive quarters of loan growth #1 traditional Middle Market syndicated lender in the U.S. #1 U.S. multifamily lender Strong credit performance – <5 bps net charge-offs in 2012 and 2013 AM 19 consecutive quarters of positive long-term flows 80% of 10-year mutual fund AUM in top 2 quartiles 29% pretax margin11, up 90 bps YoY ~50% of U.S. households have a Chase relationship ~80% of Fortune 500 companies are our clients4 #1 customer satisfaction among largest banks for the 2nd year in a row5 Nearly 900 new quality clients added in CB in 2013 Key drivers/statistics/highlights ($B, except where noted) Maintain excellent client-based franchises JPMorgan Chase overview Note: For footnoted information, refer to slide 42 Four unparalleled client franchises… …and together driving $18B of gross synergies …each performing strongly… Record gross IB revenue from CB clients12 CB clients generate 29% of NA IB fees ~55% of retail mortgages & ~40% of Chase branded cards sold through branches ~55% of CB clients & ~35% of PB households visit branches each quarter CWM assets managed by AM increased by 34% YoY to $90B 4

$33.45 $36.59 $36.15 $39.88 $43.04 $46.59 $51.27 $53.25 $18.88 $21.96 $22.52 $27.09 $30.18 $33.69 $38.75 $40.81 2006 2007 2008 2009 2010 2011 2012 2013 ($B) 2006 2010 2013 %Δ '06-'13 Tangible common equity $65.4 $118.0 $153.3 134% Basel I Tier 1 common 7.3% 9.8% 10.7% 3.4 Loan loss reserve $7.3 $32.3 $16.3 $9.0 EOP Deposits $638.8 $930.4 $1,287.8 102% J P M O R G A N C H A S E O V E R V I E W Book value per share – growing our fortress balance sheet JPMorgan Chase overview Shares outstanding (EOP) 3.7B 3.9B 3.9B 3.8B 3.4B 3.5B 1 See note 4 on slide 49 2 Actual change 3 CAGR Key metrics since FY20061 3.8B Since 2010, JPM's profits were ~$76B, despite ~$20B in after-tax legal expense and ~$9B of regulatory costs Over last 4 years, added ~$47B to capital after return to shareholders of ~$23B 3.8B B3T1C of 9.5% as of 4Q13 2 2 Durbin – Card Act – Reg E Controls – Regulatory assessments – Liquidity compliance Growth YoY 5Y3 10Y3 BVPS 4% 8 9% TBVPS 5 13 9 5

Agenda Section F I R M O V E R V I E W 6 New financial architecture 6 JPMorgan Chase overview 1 Balance sheet/NII and credit update 15 Expense, investments and outlook 21 Appendix – investor topics 27 Appendix – other 32

N E W F I N A N C I A L A R C H I T E C T U R E New financial architecture Capital requirements Liquidity requirements Other notable requirements B3T1C Advanced approach2 Interim final October 2013 Annual/ongoing Final/proposed1 G-SIB & 50-100 bps buffer Pro-cyclicality of credit and market risk AOCI volatility Operational risk capital Basel revised securitization framework Review of trading book LCR NSFR Internal stress framework Final/proposed1 Proposed Basel January 2014 Internal Firm compliant Final U.S. rules expected in 2014 Firm compliant U.S. proposal outstanding Firm compliant with internal 90 day peak & 365 day stress CCAR/DFAST Supplementary leverage Submitted 2014 CCAR Transition to B3 advanced and SLR Leverage actions with no material franchise impact The Firm has made significant progress toward compliance and is well-positioned against a clearer framework Resolution & Recovery LTD requirement/OLA Volcker Title VII/Derivatives For many of the rules above, there are compliance considerations at the LOB, sub-LOB and legal entity levels Annual Pending Final December 2013 Various M ana g e Im p lemen tin g Public section of JPM’s Resolution Plan available Fed NPR on minimum debt expected in 1H14 SPOE proposed framework released December 2013 Global cooperation important Manage implementation over next 17 months Multiple reforms in various jurisdictions Changes in derivatives market structure Clarity as of 2014 YTD M o n it o r Pending Note: For footnoted information, refer to slide 43; estimated compliance based on current understanding of rules 7

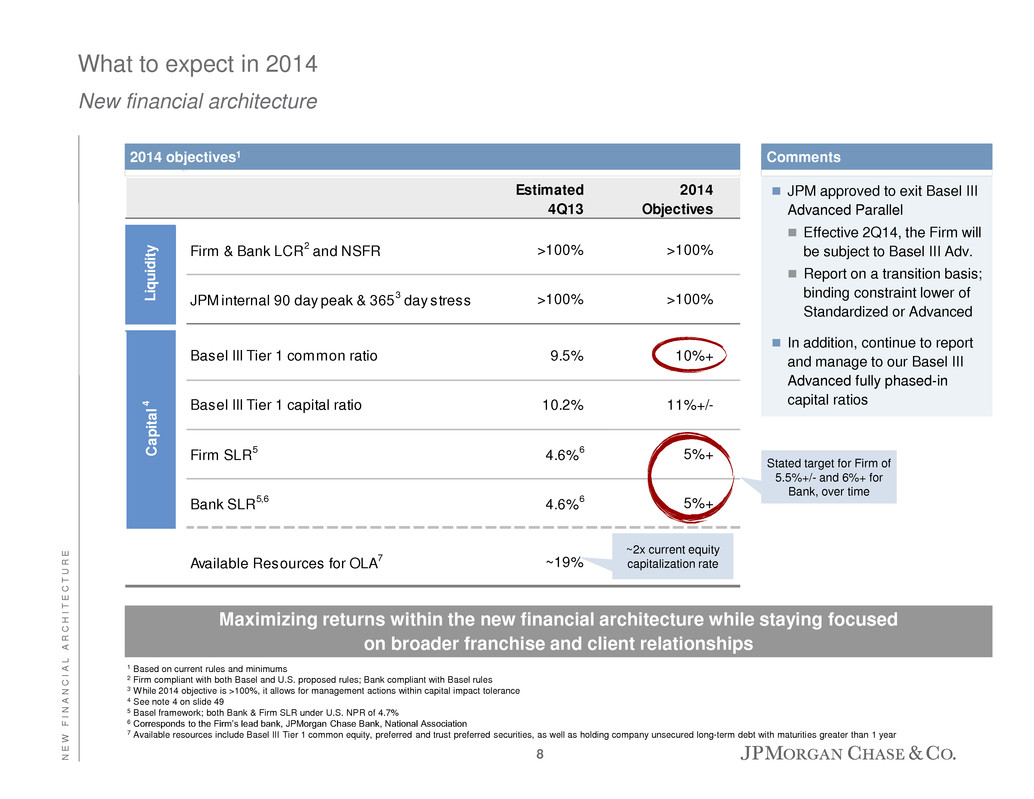

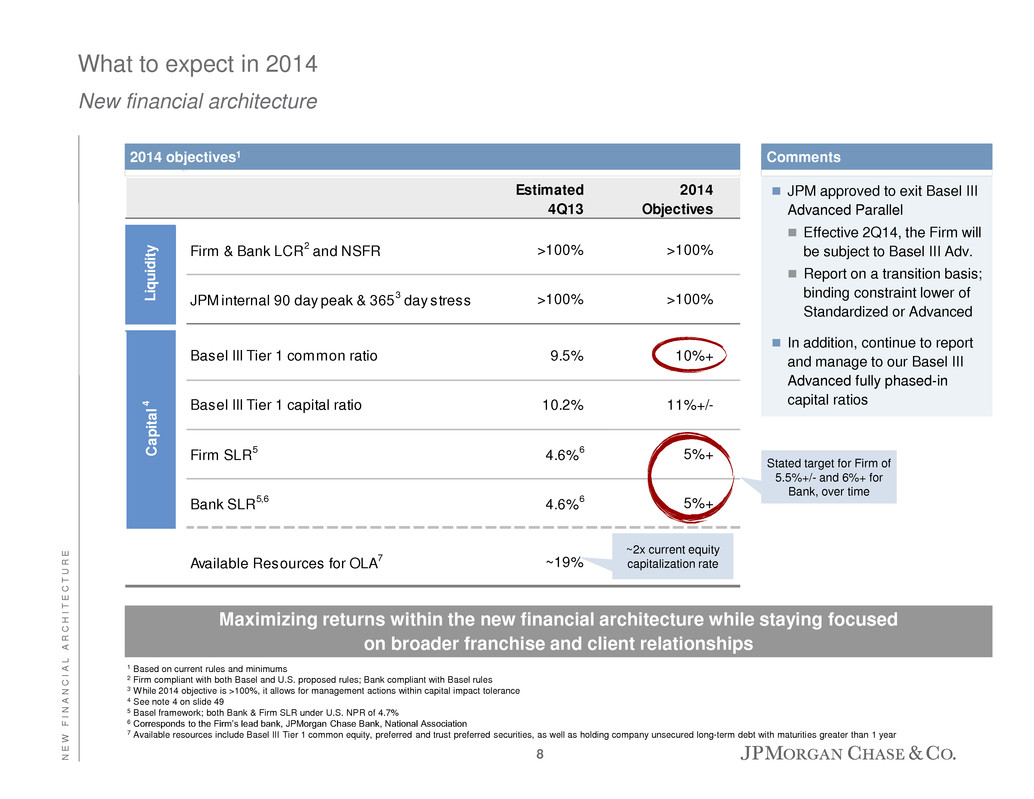

N E W F I N A N C I A L A R C H I T E C T U R E Estimated 4Q13 2014 Objectives Firm & Bank LCR 2 and NSFR >100% >100% JPM internal 90 day peak & 365 3 day stress >100% >100% Basel III Tier 1 common ratio 9.5% 10%+ Basel III Tier 1 capital ratio 10.2% 11%+/- Firm SLR 5 4.6% 6 5%+ Bank SLR 5,6 4.6% 6 5%+ Available Resources for OLA 7 ~19% Li qu id ity C ap ita l 4 What to expect in 2014 New financial architecture Stated target for Firm of 5.5%+/- and 6%+ for Bank, over time Maximizing returns within the new financial architecture while staying focused on broader franchise and client relationships 1 Based on current rules and minimums 2 Firm compliant with both Basel and U.S. proposed rules; Bank compliant with Basel rules 3 While 2014 objective is >100%, it allows for management actions within capital impact tolerance 4 See note 4 on slide 49 5 Basel framework; both Bank & Firm SLR under U.S. NPR of 4.7% 6 Corresponds to the Firm’s lead bank, JPMorgan Chase Bank, National Association 7 Available resources include Basel III Tier 1 common equity, preferred and trust preferred securities, as well as holding company unsecured long-term debt with maturities greater than 1 year ~2x current equity capitalization rate 2014 objectives1 JPM approved to exit Basel III Advanced Parallel Effective 2Q14, the Firm will be subject to Basel III Adv. Report on a transition basis; binding constraint lower of Standardized or Advanced In addition, continue to report and manage to our Basel III Advanced fully phased-in capital ratios Comments 8

N E W F I N A N C I A L A R C H I T E C T U R E Basel III Supplementary Leverage Ratio (“SLR”) New financial architecture Leverage compliance achievable with minimal client or financial impact Anticipated 2014 leverage actions 1 Derivatives Potential Future Exposure (PFE) model change denotes change from Current Exposure Method (CEM) to Non-Internal Models Methodology (NIMM). Best estimate of impact is ~40 bps for the Bank Run-off in CCB as well as legacy structured credit portfolios in CIB Reduce discretionary short-term financing transactions (repos) in CIB Targeted reduction of non-operating deposits in CB/CIB Additional cash collateral netting and reduced derivative margin requirements Estimate under final Basel framework 2014 Leverage actions Near-term capital generation Target leverage ratio Firm pro forma Basel III SLR with exposure reduction and capital generation – illustrative case ~25bps 4.6% 5%+ Bank 4.6% Estimated future improvement to leverage exposure 5%+ Excludes the following: Issuance of preferred Additional capital generation Leverage actions in 2015 ~30 bps for Derivatives PFE model change1 December 2013 ~25bps Capital generation to reach 10%+ B3T1C target Anticipated December 2014 9

N E W F I N A N C I A L A R C H I T E C T U R E JPM falls within the 2.5% G-SIB bucket G-SIB score is a function of our operating model, including our complete platform, leadership positions and market share, which we believe are a competitive advantage CIB is the main contributor to the Firm’s score, but also key to synergies JPM is currently at 9.5%, consistent with peers’ average target All peers operating above stated targets – peer average >10% – which is consistent with JPM’s target G-SIB and balance sheet optimization New financial architecture Commentary Synergies drive positive SVA on any incremental capital Basel III Tier 1 common capital – 4Q13 peer comparison Source: Company disclosures 1 Peers include BAC, C, GS, MS and WFC 2 For additional details on synergies, refer to slide 29 3 Assumes 12% cost of equity based on the 5-year historical average using CAPM and $1,591B Basel III RWA as of December 31, 2013 4 Assumes 50% overhead ratio and 38% tax rate Two great brands Diversification and depth of funding access Complete platform – deep client relationships and global reach Competitive pricing through scale advantage Experienced management team – deep bench Benefits of JPM operating model $18B gross synergies2 Revenue: $15B, Expense: $3B Only $3-6B required to be SVA positive on an incremental 50-100 bps of B3T1C3,4 JPM Peer average1 Tier 1 common regulatory minimum 9.5% 8.5% Reported 9.5% >10% Target 10%+ ~9.5% Equates to $6-7B net income contribution4 10

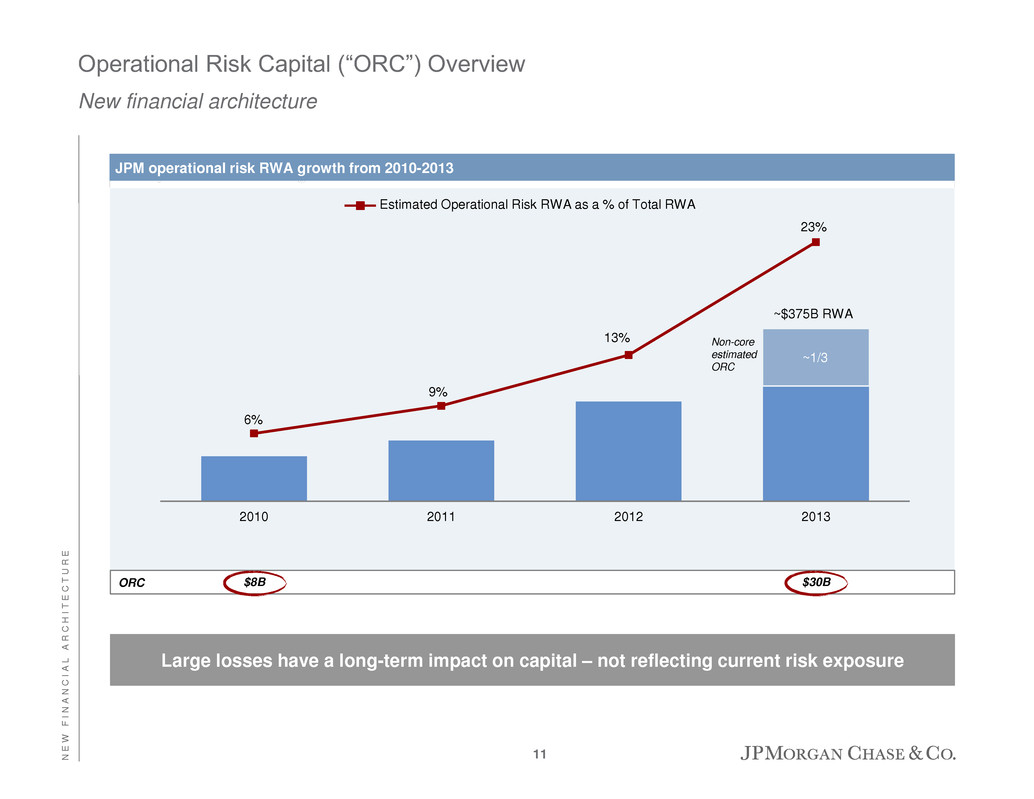

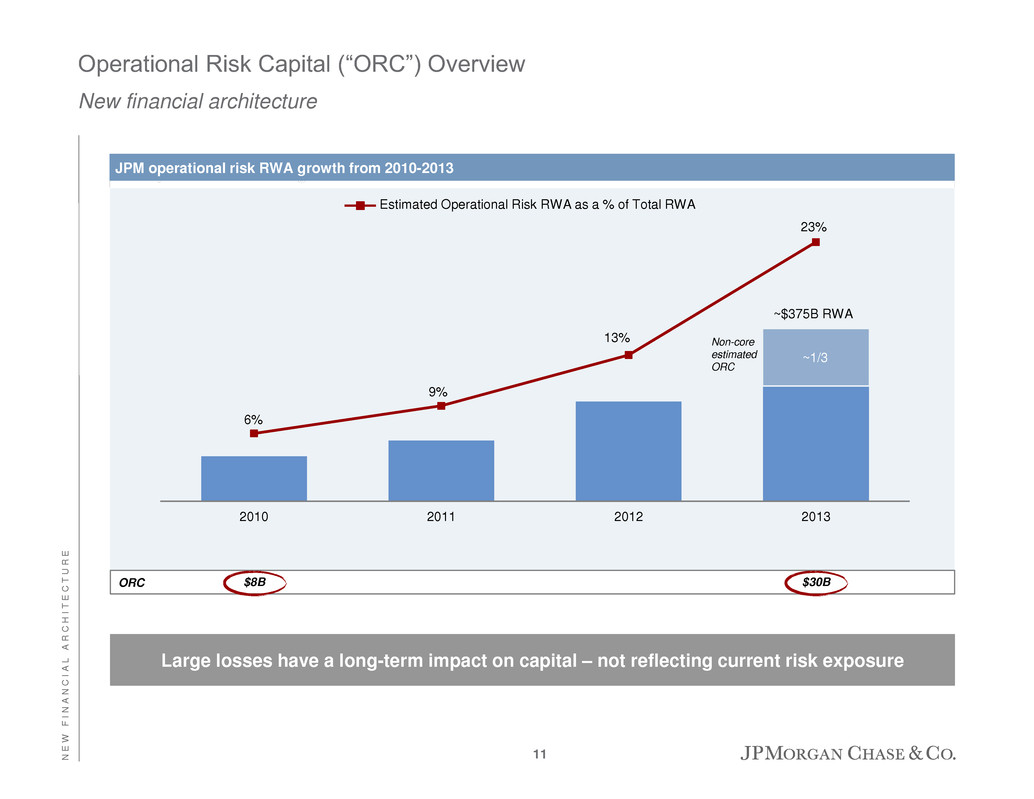

N E W F I N A N C I A L A R C H I T E C T U R E Operational Risk Capital (“ORC”) Overview New financial architecture JPM operational risk RWA growth from 2010-2013 6% 9% 13% 23% 2010 2011 2012 2013 Non-core estimated ORC Estimated Operational Risk RWA as a % of Total RWA Large losses have a long-term impact on capital – not reflecting current risk exposure ORC $8B $30B ~1/3 ~$375B RWA 11

2013 2014 2015 Analysts estimated net income2 ~$23 ~$24 RWA, beginning $1,650 $1,591 $1,550 Models and run-off, net of growth (59) (40) (50) RWA, at year-end $1,591 $1,550 $1,500 Pre-share repurchase B3T1C (%)3 9.5% ≥10.5% ≥11.5% Cumulative excess capital at 10% B3T1C >$10 ~$30 N E W F I N A N C I A L A R C H I T E C T U R E Capital simulations New financial architecture B3T1C ratio 2013 FRB capital stress Simulated B3 Advanced RWA and capital impacts Simulated stressed B3 Advanced Tier 1 common ratio Basel III advanced simulation under stress (300-350) bps (50-100) bps 1 Note: Minimum requirements for CCAR may evolve over time Additional capital cushion to potential stress min. 10%+ 6%+/- 5.5%+/- (150) bps+/- 0 bps+ ~4% (current B1 minimum) Firm Leverage Stress impacts Current minimum 350 bps 450 bps 4.50% ~$30B ~$15B Baseline Basel III advanced simulation – after dividends, before share repurchases ($B) 2015 RWA projected to be down ~$150B from YE2012 incl. the impact of ORC Note: Totals may not sum due to rounding 1 ~300 bps FRB capital impact excludes ~110 bps impact of Basel 2.5 market risk rule, effective 1Q13, and ~50 bps impact of projected repurchases 2 Reflects Bloomberg average of analysts’ estimates for net income of $23.1B in 2014 and $24.2B in 2015 as of 2/19/14 3 Includes net income after common stock and existing preferred dividends, AOCI and employee issuance Capital targets withstand stress scenarios and should allow for excess capital to be used or returned 12

N E W F I N A N C I A L A R C H I T E C T U R E Source: SNL Financial, FactSet, Alacra 1 Cost of equity based on most recent one-month average using Capital Asset Pricing Model (GEM3 historical beta used). TTC ROTCE based on Gordon Growth Model We believe our stock price is attractive – even significantly above current valuation New financial architecture Exceptional franchises – will continue to deliver strong profitability and returns JPM has traded at a discount to peers since the crisis on a P/E and P/TBVPS vs. ROTCE regression basis JPM stock price reflects cost of equity of ~10%1, which implies a TTC ROTCE for JPM of 13%1 – below target of 15-16% Reasons why JPM stock is attractive Capital return framework JPM’s view of share repurchases takes capital hierarchy and valuation into account Based upon regression analysis of P/TBVPS vs. ROTCE – repurchasing stock at prices significantly higher than current levels creates shareholder value Available capital is used to support business growth Excess capital is used to: Pay common stock dividends – objective to increase payout over time from current levels Share repurchases – offset employee issuance and consider additional repurchases Capital hierarchy 13

N E W F I N A N C I A L A R C H I T E C T U R E Retained common equity 2013 Investor Day 2014 Investor Day Pro forma 2013 ROE1 TTC ROE target Basel III Tier 1 Common Total Consumer & Community Banking $46.0 $51.0 21% 20%+ 9.5% Consumer & Business Bank ing 11.0 10.9 26% 30%+ 9.5% Mortgage Bank ing 19.5 18.0 17% 15%+/- 9.5% Card Services 12.4 15.4 28% 20%+/- 9.5% Auto & Student 3.1 3.7 15% 16%+/- 9.5% Corporate & Investment Bank 56.5 61.0 16% 15%+/- 10.5% Commercial Banking 13.5 14.0 18% 18%+/- 9.5% Asset Management6 9.0 9.0 23% 25%+ 9.5% Total LOBs $125.0 $135.0 18%+/- Corporate 28.0 25.7 Total Firm (ex. Corporate Goodwill8) $153.0 ~$161 15-16% 10%+ Memo: Corporate Goodwill 8 $42.0 $42.0 2013 Investor Day at 9.5% 2014 Investor Day at 10% Comments Legacy Portfolio & Model Enhancements $19.1 $12.4 Accelerated benefits of short-term legacy portfolios and model enhancements Private Equity/Other Corporate 8.9 13.2 Includes PE, retained operational risk capital, real estate, BOLI/COLI, DTA, and pension Total Corporate $28.0 $25.7 Retained common equity Common equity allocation and performance targets New financial architecture Common equity and performance targets ($B) Corporate detail as of 1/1/2014 ($B) Note: Totals may not sum due to rounding 1 Reflects 2013 net income divided by 2014 retained common equity 2 Includes $3B of legacy mortgage servicing operational risk capital held at CCB level 3 TTC Mortgage Banking ROE excludes liquidating portfolios 4 TTC Auto & Student ROE excludes liquidating student lending portfolio 5 Excludes FVA/DVA; CIB's pro forma ROE using reported net income was 14%; see note 5 on slide 49 6 AM pretax margin target at 30-35% TTC; see note 6 on slide 49 7 Cost of preferred embedded in LOB targets 8 Total Firm goodwill of $48B 9 Total Firm ROTCE 9 at 10% 5 3 2 4 Corporate net income ~0+/- with legal expense offsetting return on Corporate assets A A 7 14

Agenda Section F I R M O V E R V I E W 15 Balance sheet/NII and credit update 15 JPMorgan Chase overview 1 New financial architecture 6 Expense, investments and outlook 21 Appendix – investor topics 27 Appendix – other 32

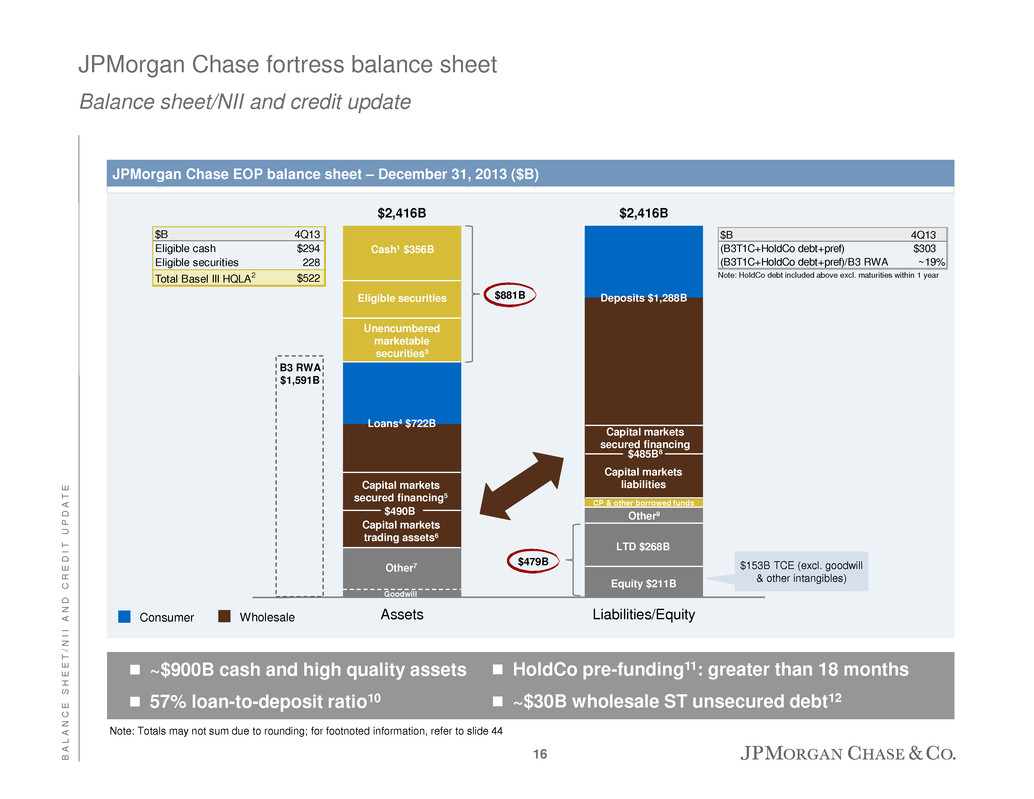

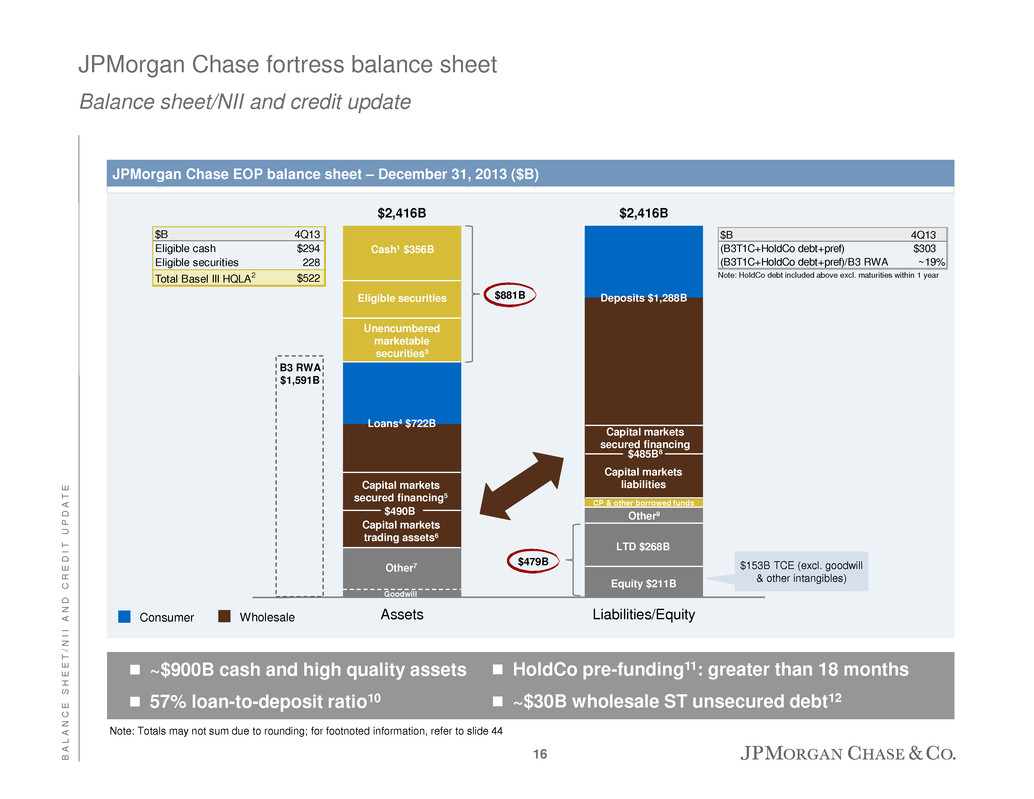

B A L A N C E S H E E T / N I I A N D C R E D I T U P D A T E JPMorgan Chase fortress balance sheet Balance sheet/NII and credit update Assets Liabilities/Equity LTD $268B Note: Totals may not sum due to rounding; for footnoted information, refer to slide 44 ~$900B cash and high quality assets 57% loan-to-deposit ratio10 HoldCo pre-funding11: greater than 18 months ~$30B wholesale ST unsecured debt12 JPMorgan Chase EOP balance sheet – December 31, 2013 ($B) Wholesale Consumer $2,416B $2,416B Goodwill Other7 Loans4 $722B Eligible securities Cash1 $356B Unencumbered marketable securities3 Capital markets liabilities Capital markets secured financing $485B8 Other9 Equity $211B B3 RWA $1,591B Capital markets secured financing5 Capital markets trading assets6 $490B Deposits $1,288B CP & other borrowed funds $881B $479B Note: HoldCo debt included above excl. maturities within 1 year $B 4Q13 (B3T1C+HoldCo debt+pref) $303 (B3T1C+HoldCo debt+pref)/B3 RWA ~19% $B 4Q13 Eligible cash $294 Eligible securities 228 Total Basel III HQLA2 $522 $153B TCE (excl. goodwill & other intangibles) 16

B A L A N C E S H E E T / N I I A N D C R E D I T U P D A T E Total average interest-earning assets ($B) Retail Retail Wholesale Wholesale FY2012 FY2013 Interest-earning assets and deposit growth Balance sheet/NII and credit update Total average deposits ($B) $1,106B $1,189B YoY (%) 10% 6% YoY (%) Expect core loan growth of 5%+/- in 20147 Total loans 1% $1,842B $1,970B 8% Other int. earning assets Other int. earning assets Consumer Consumer CIB CIB CB CB AM AM Run-off (MB & other) Run-off (MB & other) Securities Securities Secured financing Secured financing Deposits with banks Deposits with banks FY2012 FY2013 5% (3)% 10% 13% Core 5% (14%) 0% (2)% (6)% 127% 7% 6 6 1 1 2,3 5 5 2,3 4 4 Note: For footnoted information, refer to slide 45 17

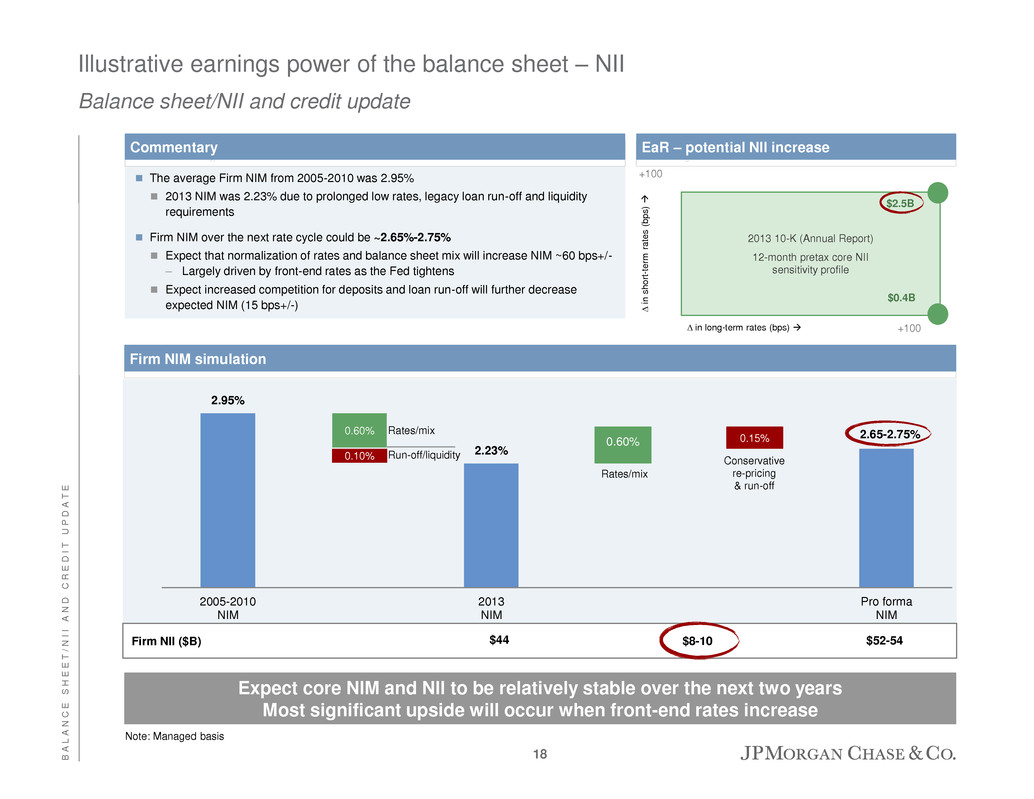

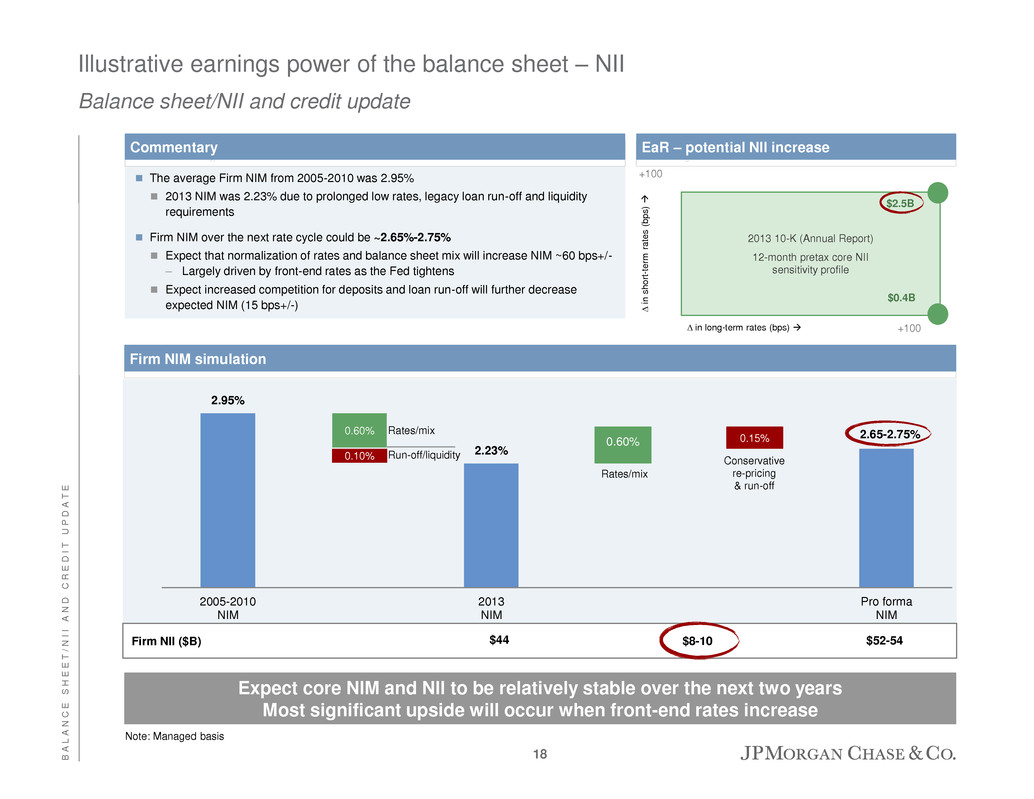

B A L A N C E S H E E T / N I I A N D C R E D I T U P D A T E The average Firm NIM from 2005-2010 was 2.95% 2013 NIM was 2.23% due to prolonged low rates, legacy loan run-off and liquidity requirements Firm NIM over the next rate cycle could be ~2.65%-2.75% Expect that normalization of rates and balance sheet mix will increase NIM ~60 bps+/- – Largely driven by front-end rates as the Fed tightens Expect increased competition for deposits and loan run-off will further decrease expected NIM (15 bps+/-) Illustrative earnings power of the balance sheet – NII Balance sheet/NII and credit update Firm NIM simulation Expect core NIM and NII to be relatively stable over the next two years Most significant upside will occur when front-end rates increase 0.10% 0.60% 0.15% 2.95% 2.23% 0.60% 2.65-2.75% 2005-2010 NIM 2013 NIM Pro forma NIM Rates/mix Conservative re-pricing & run-off Rates/mix Run-off/liquidity Firm NII ($B) $44 $8-10 $52-54 ∆ in long-term rates (bps) +100 2013 10-K (Annual Report) 12-month pretax core NII sensitivity profile ∆ in s h o rt -t e rm r a te s ( b p s ) $2.5B $0.4B +100 Commentary EaR – potential NII increase Note: Managed basis 18

B A L A N C E S H E E T / N I I A N D C R E D I T U P D A T E Card Card Card Card MB MB MB MB $27.3B $21.9B $16.2B $12.1B LLR, excl. PCI 2010 2011 2012 2013 CCB CIB CB LLR, ex-PCI Credit quality trends Balance sheet/NII and credit update NCOs by line of business ($B) 1 1 1 1 $24B $12B $9B $6B The Firm’s net charge-offs and nonperforming loans are down 84%8 and 52%8, respectively, from peak levels MB NCI – reserve of $2.6B as of 2013; expect to reduce to $1.5B+/- by YE 2015 MB PCI – reserve of $4.2B as of 2013 Card – reserve of $3.8B as of 2013 Strong coverage and reserve position Adjusted NPLs2 $15B $8B NCO rate MB3 3.59%4 2.70% 2.10%5 NCO rate Card7 9.73% 5.44% 3.95% $16.3B LLR, incl. PCI $10B $6B 0.96%6 3.14% 4Q13 0.57%6 2.86% Note: For footnoted information, refer to slide 46 Expect an incremental $1B+/- in releases over next two years9 – majority in 2014 Expect $200mm+/- release for each MB and Card in 1Q14 19

B A L A N C E S H E E T / N I I A N D C R E D I T U P D A T E 2013 NCO rate (%) 4Q13 NCO rates (%) TTC NCO rate (%) MB 1 0.96% 0.57% 0.25%+/- Card 4 3.14 2.86 3.75+/- Auto 0.31 0.39 0.75 Business Banking 5 0.92 1.11 1.00 CIB excl. trade and conduits (0.16) (0.09) 1.00 Trade and conduits (0.01) 0.03 0.05 CB CB 0.03 0.07 0.50 Lending 0.06 0.02 0.15 Mortgage 6 0.03 0.04 0.05 CCB CIB AM Net charge-off trends and estimates Balance sheet/NII and credit update ~$6B NCOs ~$7B NCOs Through-the-cycle (TTC) net charge-off estimates Expect NCO rates in Card, CIB and CB to remain low in 2014 and 2015 Expect firmwide NCOs of $5B+/- in 2014 and <$5B in 2015 2 Note: For footnoted information, refer to slide 47 3 2 20

Agenda Page F I R M O V E R V I E W 21 Expense, investments and outlook 21 JPMorgan Chase overview 1 New financial architecture 6 Balance sheet/NII and credit update 15 Appendix – investor topics 27 Appendix – other 32

E X P E N S E , I N V E S T M E N T S A N D O U T L O O K 53.4 57.4 59.7 59.0 1.7 0.7 1.0 6.1 4.8 4.6 10.5 2010 2011 2012 2013 2014E Firmwide expense targets – strong expense discipline Expense, investments and outlook Firmwide adjusted expense ($B); headcount in 000s $64.7B <59.0 1 Excludes FRM 2 Adjusted expense newly defined as total expense, excluding total legal expense and FRM; former definition of adjusted expense only excluded Corporate legal expense and FRM 3 MB expense reduction excludes the impact of $0.4B legal expense and $0.3B FRM in 2013 4 Includes employees and contractors; 2013 headcount adjusted for ~1,250 reduction effective January 1, 2014 60.1 2013 down ($0.7)B ($1.7)B efficiencies offset by ~$1B in controls 2014 expense ~flat to down ~($1.5)B lower expense in MB3 ~($1)B business simplification ~$1B business growth, principally AM ~$1B controls 60.0 2014 headcount down ~5K CCB headcount down ~8K in 2014 Adj. Overhead Ratio 52% 58% 58% 59% [ 60% +/- ] Total H adcount4 258 2 0 276 265 260 CCB4 1 177 1 3 157 148 0.4 $70.5B $62.9B $61.2B 55.1 58.1 Total expense Less: Non-Corporate legal expense Less: Corporate legal expense Less: Foreclosure-related matters = Adjusted expense2 149 Adjusted expense2 Non-Corporate legal expense1 Corporate legal expense and FRM 22

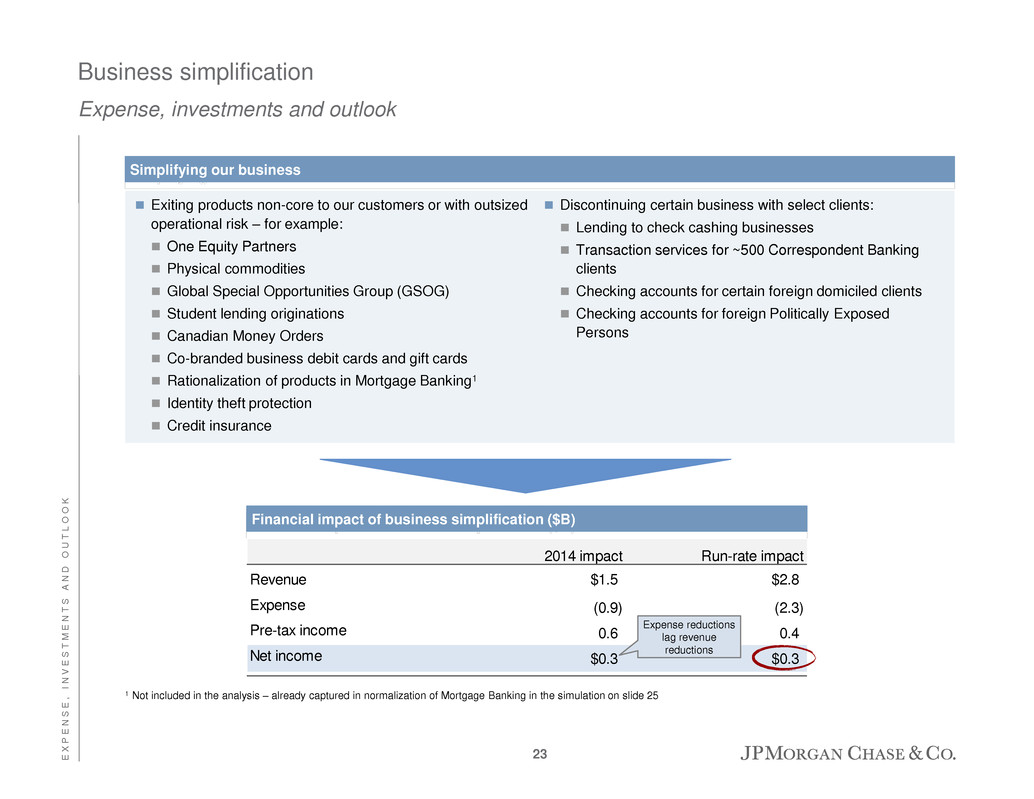

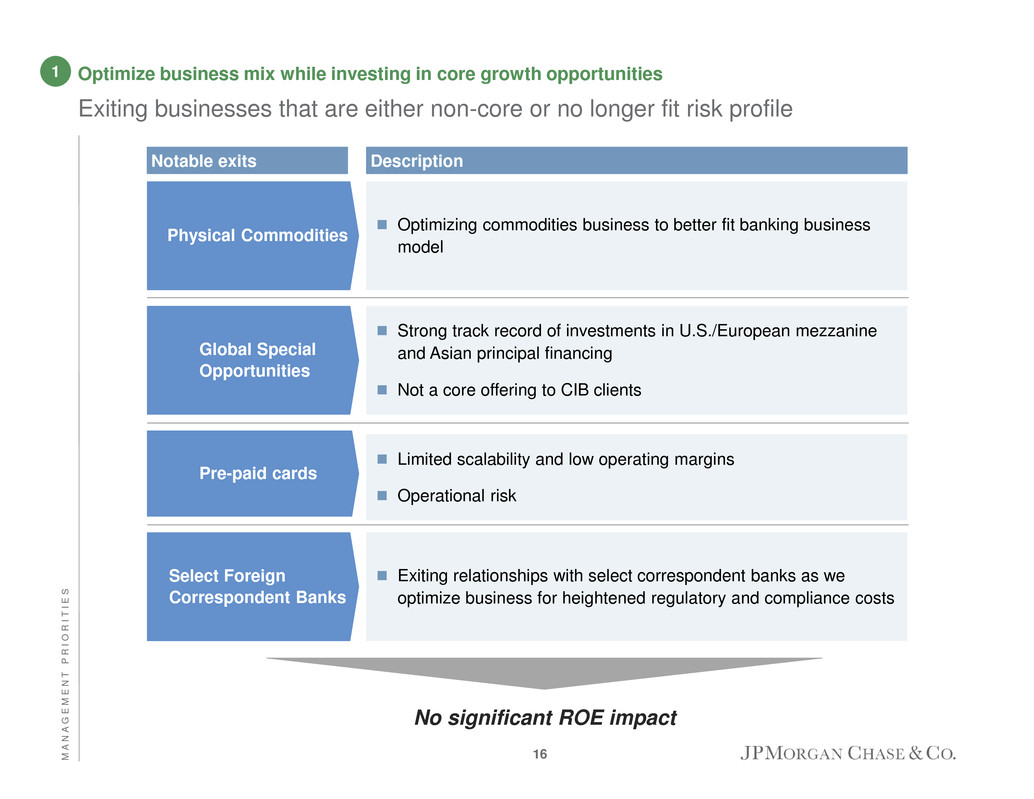

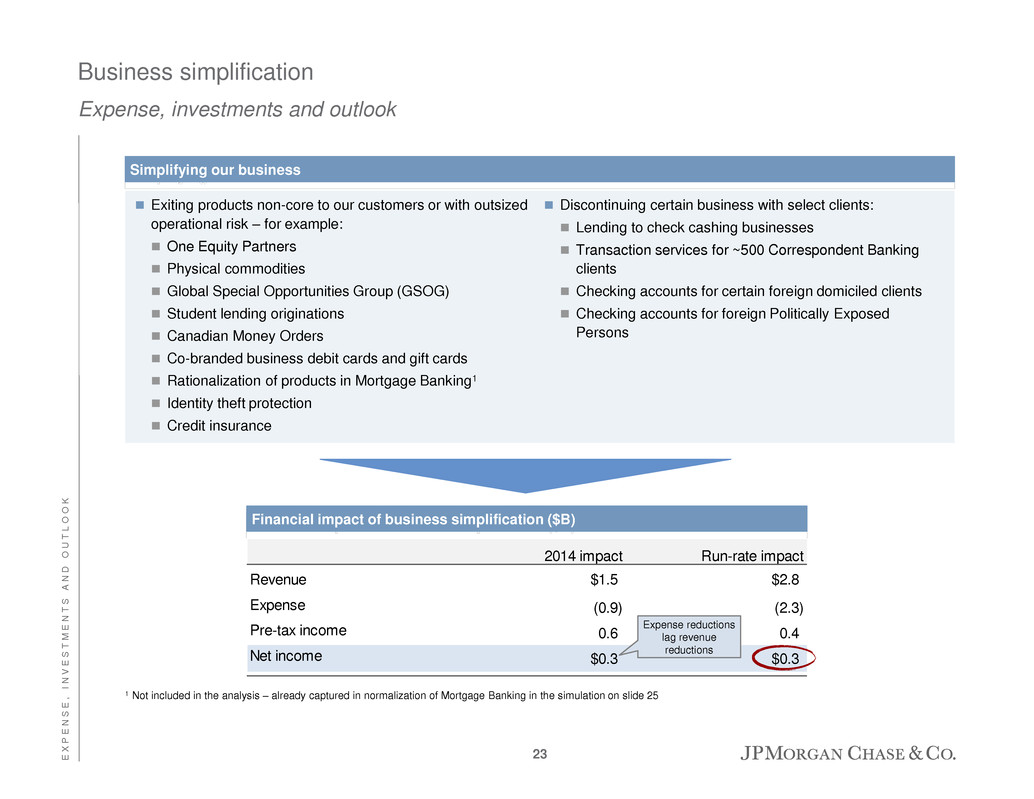

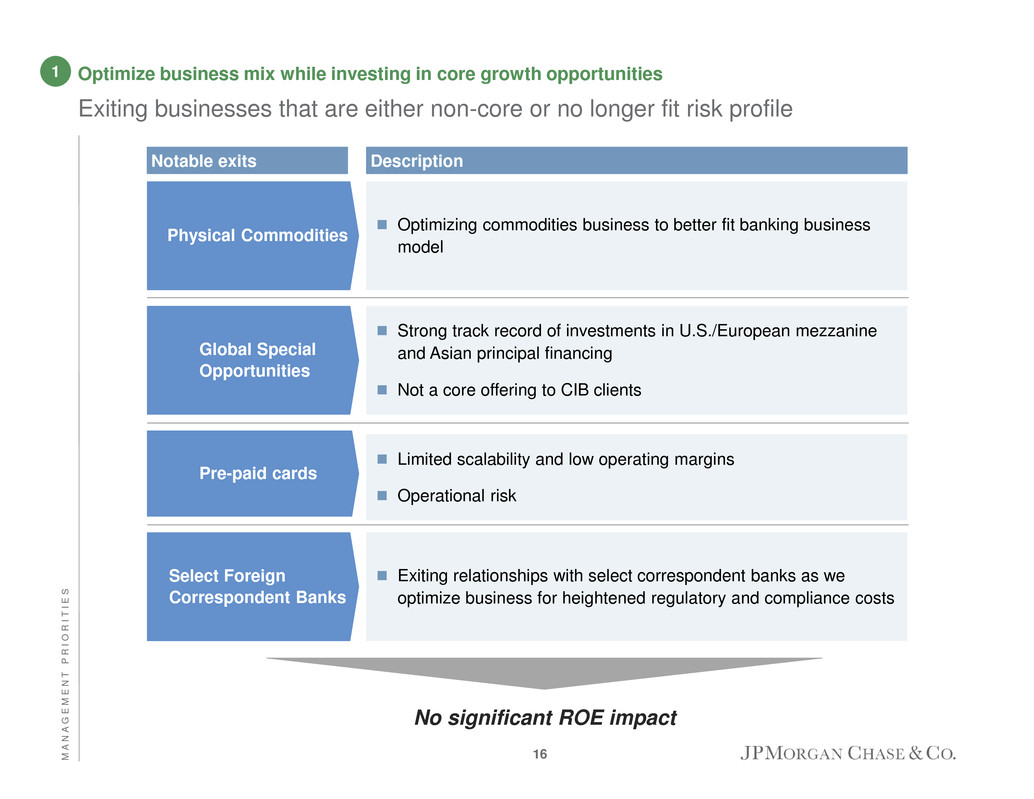

E X P E N S E , I N V E S T M E N T S A N D O U T L O O K 2014 impact Run-rate impact Revenue $1.5 $2.8 Expense (0.9) (2.3) Pre-tax income 0.6 0.4 Net income $0.3 $0.3 Business simplification Expense, investments and outlook Exiting products non-core to our customers or with outsized operational risk – for example: One Equity Partners Physical commodities Global Special Opportunities Group (GSOG) Student lending originations Canadian Money Orders Co-branded business debit cards and gift cards Rationalization of products in Mortgage Banking1 Identity theft protection Credit insurance Simplifying our business Financial impact of business simplification ($B) Expense reductions lag revenue reductions Discontinuing certain business with select clients: Lending to check cashing businesses Transaction services for ~500 Correspondent Banking clients Checking accounts for certain foreign domiciled clients Checking accounts for foreign Politically Exposed Persons 1 Not included in the analysis – already captured in normalization of Mortgage Banking in the simulation on slide 25 23

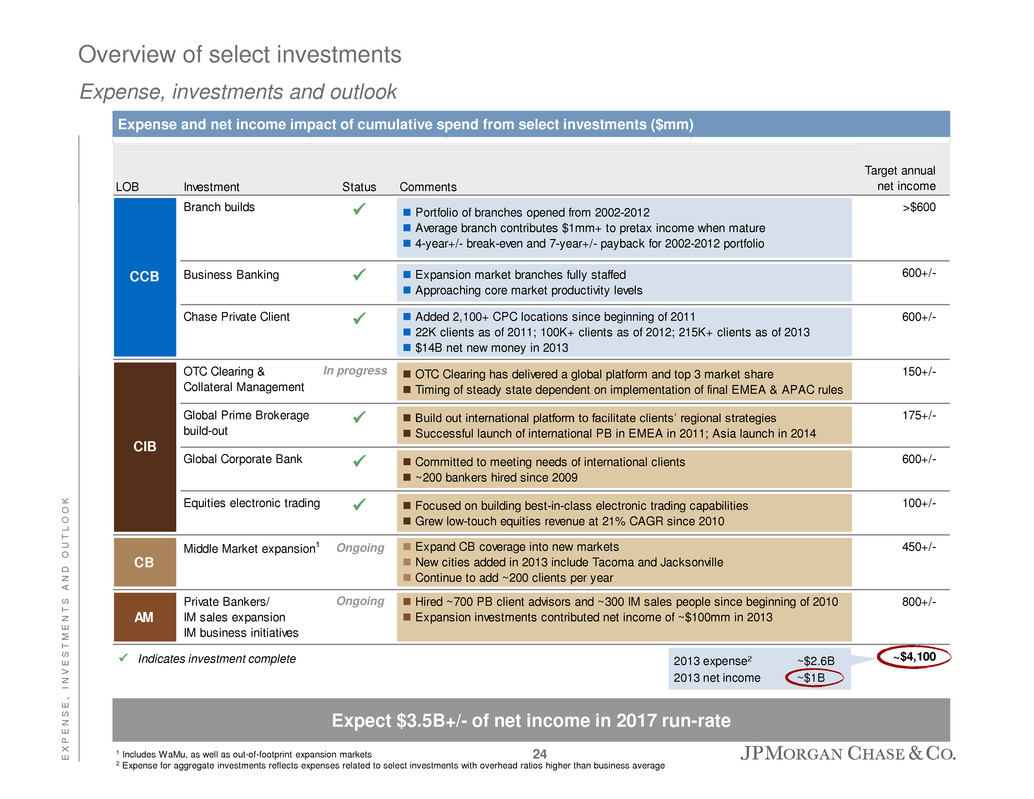

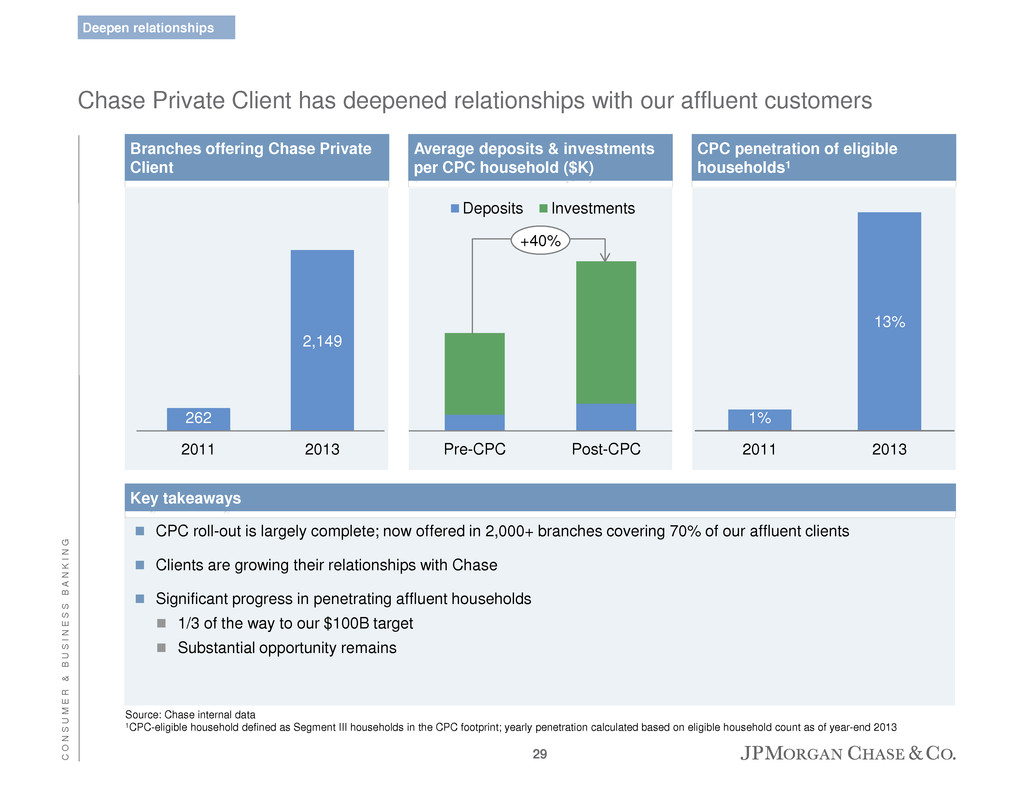

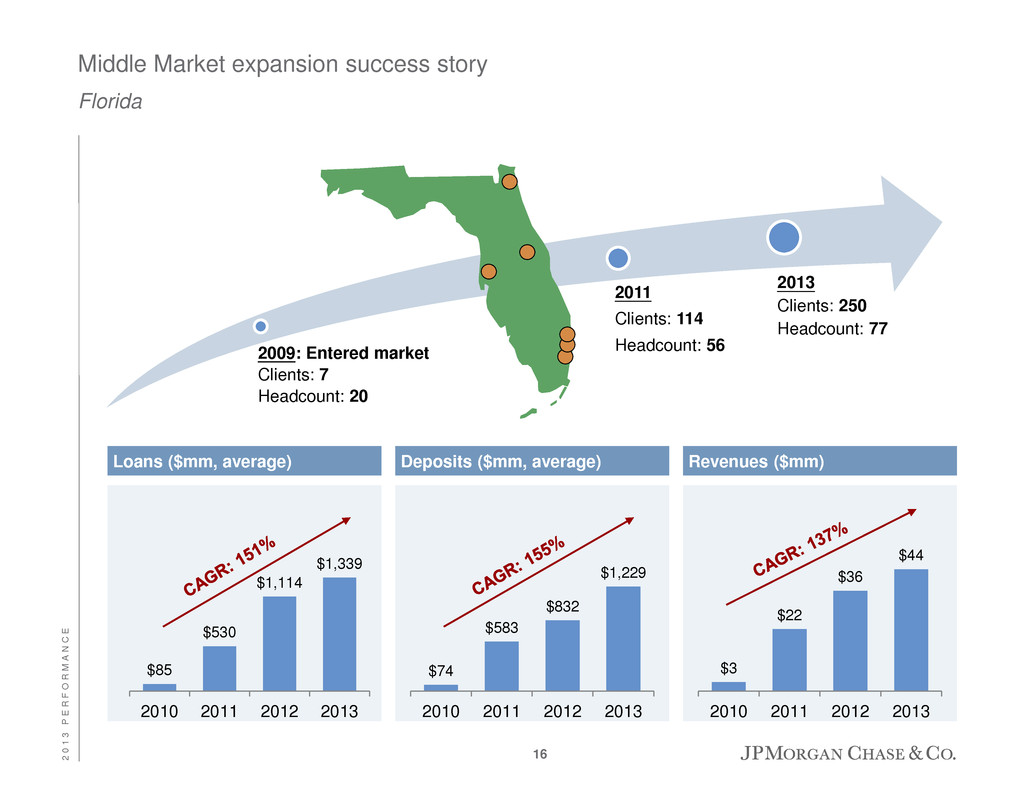

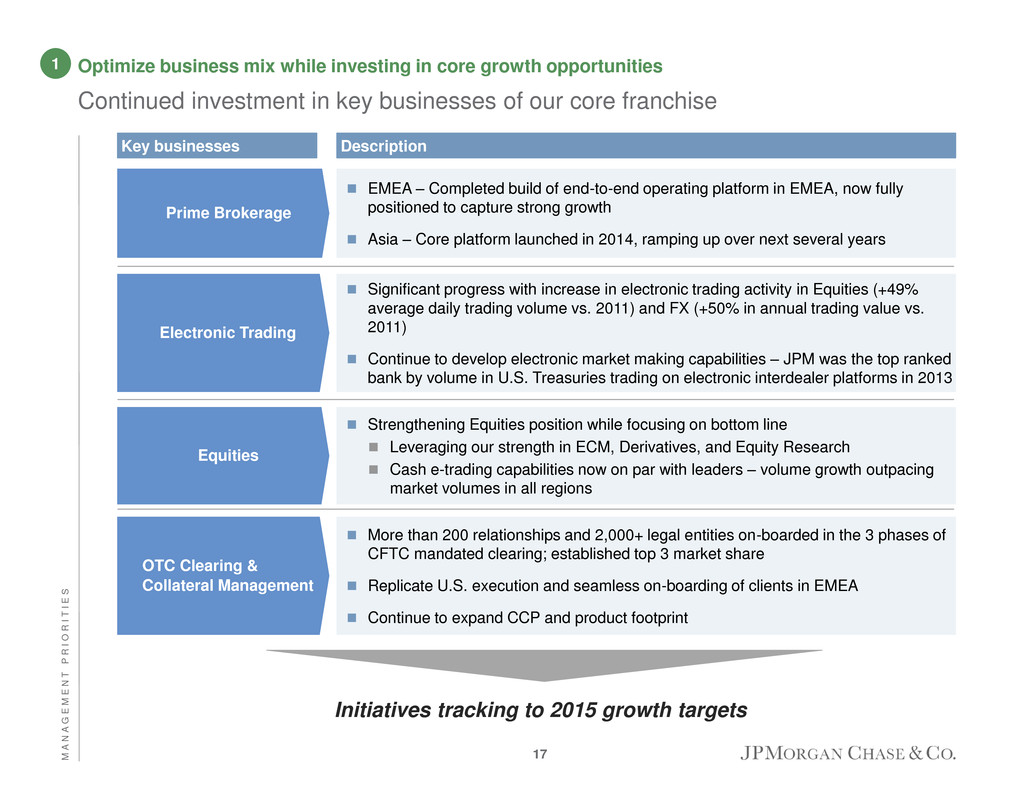

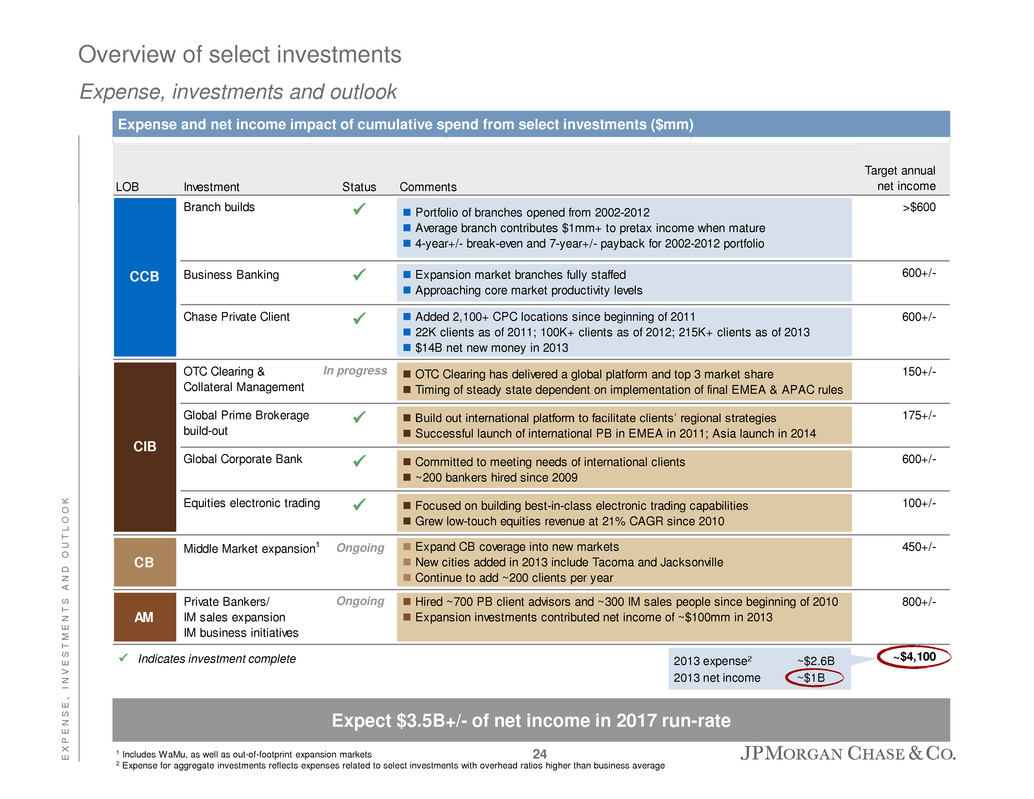

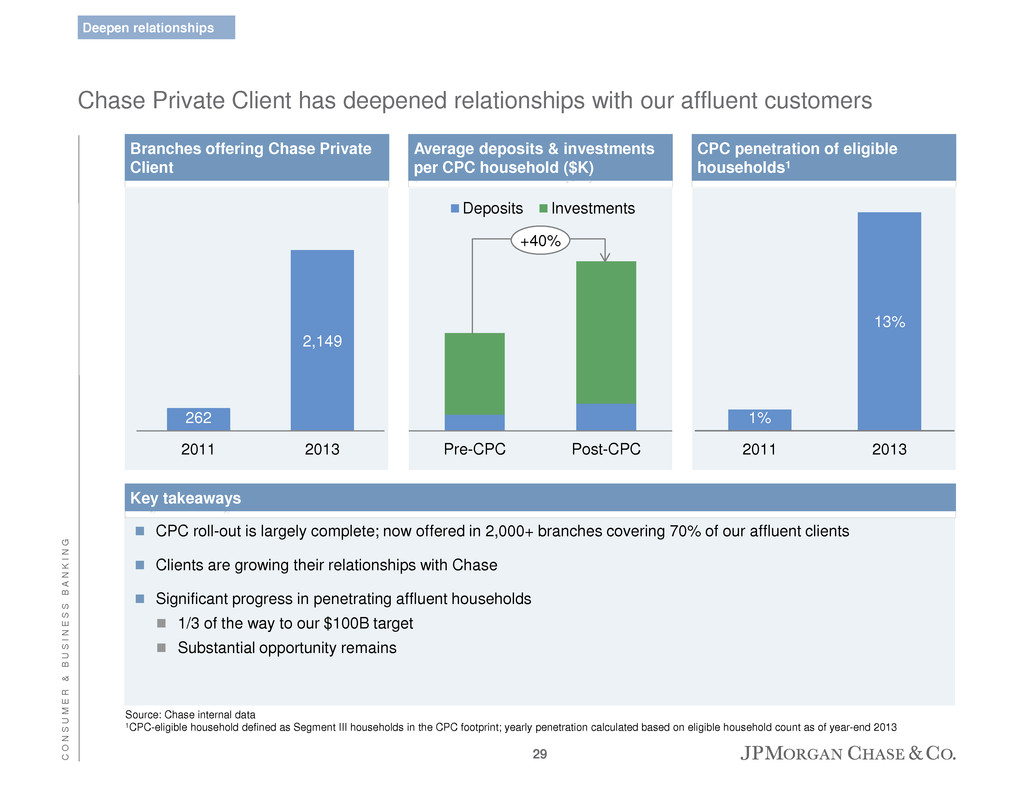

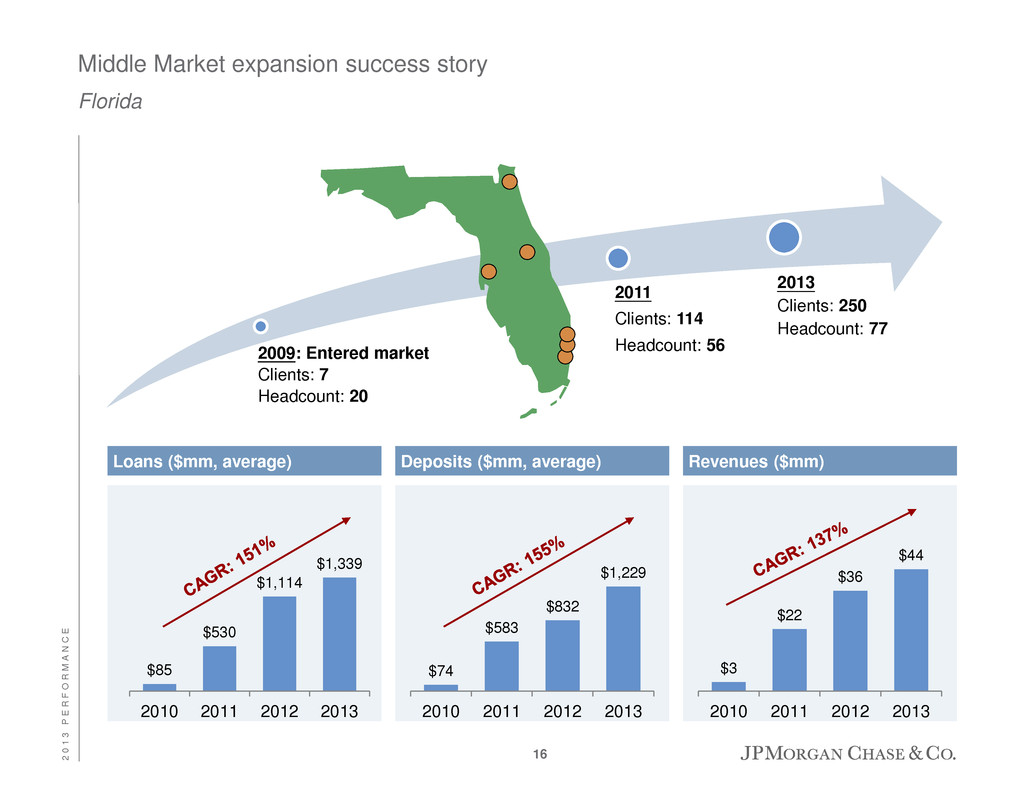

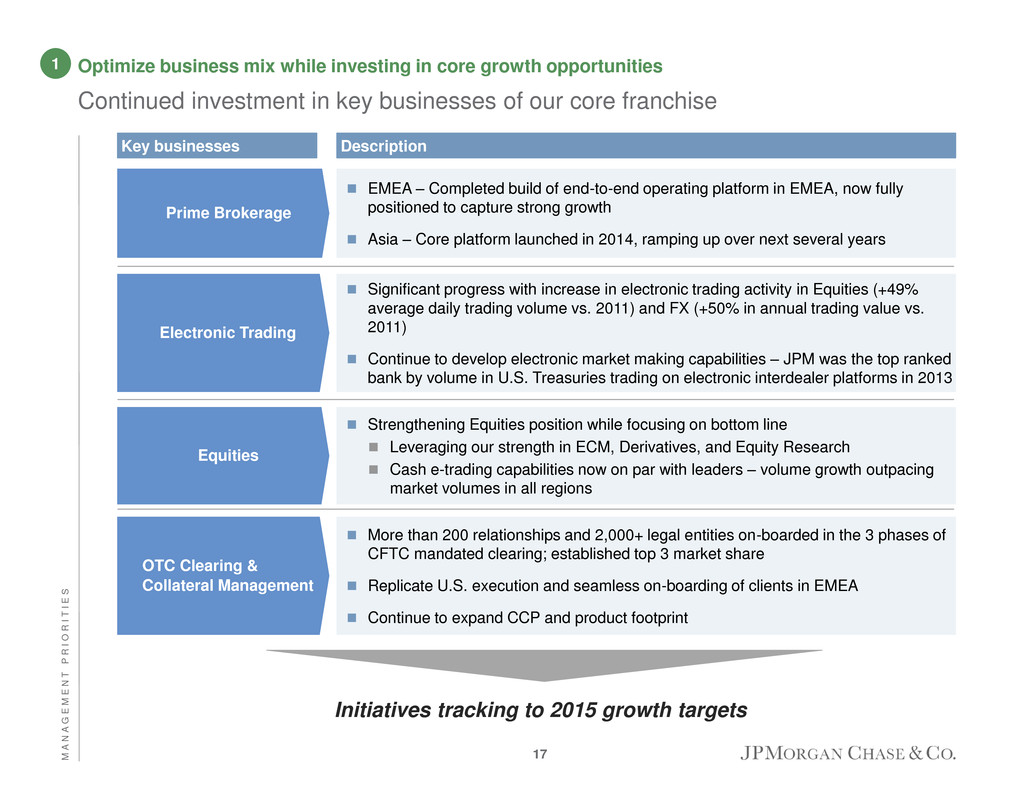

E X P E N S E , I N V E S T M E N T S A N D O U T L O O K Overview of select investments Expense, investments and outlook 1 Includes WaMu, as well as out-of-footprint expansion markets 2 Expense for aggregate investments reflects expenses related to select investments with overhead ratios higher than business average Expect $3.5B+/- of net income in 2017 run-rate Indicates investment complete Expense and net income impact of cumulative spend from select investments ($mm) 2013 expense2 ~$2.6B 2013 net income ~$1B Ongoing Ongoing In progress LOB Investment Status Comments Target annual net income >$600 600+/- 600+/- OTC Clearing & Collateral Management OTC Clearing has delivered a global platform and top 3 market share Timing of steady state dependent on implementation of final EMEA & APAC rules 150+/- Global Prime Brokerage build-out Build out international platform to facilitate clients’ regional strategies Successful launch of international PB in EMEA in 2011; Asia launch in 2014 175+/- Global Corporate Bank Committed to meeting needs of international clients ~200 bankers hired since 2009 600+/- Focused on building best-in-class electronic trading capabilities Grew low-touch equities revenue at 21% CAGR since 2010 100+/- CB Middle Market expansion1 Expand CB coverage into new markets New cities added in 2013 include Tacoma and Jacksonville Continue to add ~200 clients per year 450+/- AM Private Bankers/ IM sales expansion IM business initiatives Hired ~700 PB client advisors and ~300 IM sales people since beginning of 2010 Expansion investments contributed net income of ~$100mm in 2013 800+/- ~$4,100 CCB Chase Private Client CIB Business Banking Expansion market branches fully staffed Approaching core market productivity levels Branch builds Portfolio of branches opened from 2002-2012 Average branch contributes $1mm+ to pretax income when mature 4-year+/- break-even and 7-year+/- payback for 2002-2012 portfolio Added 2,100+ CPC locations since beginning of 2011 22K clients as of 2011; 100K+ clients as of 2012; 215K+ clients as of 2013 $14B net new money in 2013 Equities electronic trading 24

E X P E N S E , I N V E S T M E N T S A N D O U T L O O K Net income build simulation ($B) – 4-5 year horizon CCB excl. MB efficiencies: $0.5B MB in target state: $0.2B 1 2 3 Run-rate Corp. legal exp.4: ($1.0B) Control spend: ($0.6B) Markets reform: ($0.4B) Business simplification: ($0.3B) Leverage actions: ($0.2B) RWA ROTCE Overhead ratio5 $1.6T 11% 71% ~$1.6T 15-16% ~55%+/- $1.6T 15% 59%6 Earnings power – simulation Expense, investments and outlook Note: Numbers may not sum due to rounding for illustrative purposes. Figures are tax effected at an incremental tax rate of 38%, where applicable 1 Includes 2013 disclosed significant items. See note 2 on slide 48 2 Represents estimated NII benefit from normalized rates (includes incremental charge-offs to support loan growth; overlap with investments and MB has been removed) 3 Increase in NCOs due to normalized through-the-cycle rates and assumes no release 4 Simulation includes assumed total pretax legal expense of $2B. Amount is for illustrative purposes only, and is not intended to be forward-looking guidance. Actual amounts may vary from assumed amount 5 Managed basis 6 Represents adjusted overhead ratio Normalized rates combined with flat RWA delivers ROTCE of 15-16% and implied overhead ratio of ~55%+/- 25

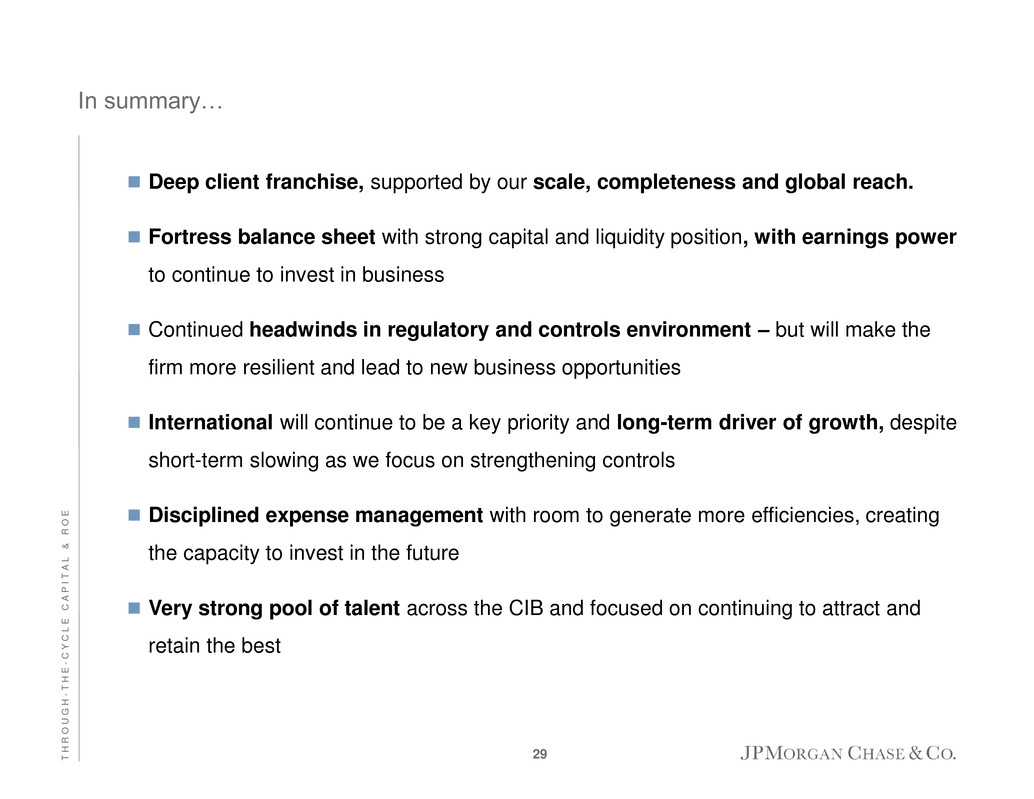

E X P E N S E , I N V E S T M E N T S A N D O U T L O O K Conclusion Four best-in-class client franchises – each performing strongly Together driving significant synergies – diversification, complete platform, scale and efficiencies Demonstrated earnings capacity, resilience and superior returns Maintain best-in-class margins and improve operating leverage Experienced management teams with deep talent Regulatory, control and simplification agendas Executing on our regulatory and control agendas Significant effort – will make us a better company Business simplification agenda – reduce complexity and focus on core competencies New financial architecture Optimize returns against capital targets Manage at granular level – legal entity, sub-LOB, product and client level Focus on impact to broader franchise and client relationships Continue progress towards Firm’s capital targets while balancing capital returns Transition year – protect franchise value and future earnings power 26 Excellent client franchises

Agenda Page F I R M O V E R V I E W 27 Appendix – investor topics 27 JPMorgan Chase overview 1 New financial architecture 6 Balance sheet/NII and credit update 15 Expense, investments and outlook 21 Appendix – other 32

A P P E N D I X – I N V E S T O R T O P I C S Jamie Dimon Chairman and Chief Executive Officer Daniel Pinto Co-CEO, Corporate & Investment Bank 31 years at JPM 31 in industry Mike Cavanagh Co-CEO, Corporate & Investment Bank 14 years at JPM 26 in industry Gordon Smith CEO, Consumer & Community Banking 7 years at JPM 33 in industry Doug Petno CEO, Commercial Banking 25 years at JPM 25 in industry Mary Erdoes CEO, Asset Management 18 years at JPM 24 in industry John Donnelly Head of Human Resources 5 years at JPM 35 in industry Ashley Bacon Chief Risk Officer 21 years at JPM 21 in industry Matt Zames Chief Operating Officer 9 years at JPM 21 in industry Steve Cutler General Counsel 7 years at JPM 13 in industry Marianne Lake Chief Financial Officer 14 years at JPM 22 in industry Note: Years shown inside of boxes indicate tenure at JPM and years of industry experience; not all direct reports to Jamie Dimon are shown 1 Direct reports include business heads only Attrition rates among best in industry – <4% over last year for Managing Directors/Senior Vice Presidents 16 direct reports1 Average industry experience ~25 years Average years at JPM ~16 years 6 direct reports1 Avg. industry experience ~24 years Avg. years at JPM ~12 yrs 9 direct reports1 Avg. industry experience ~32 years Avg. years at JPM ~21 yrs 7 direct reports1 Avg. industry experience ~26 years Avg. years at JPM ~18 yrs 2 5 2 3 6 3-5 5-10 10-15 15-20 >20 Tenure at JPM (years) 2 2 6 3-10 10-20 >20 Tenure at JPM (years) 2 3 3 3-10 10-20 >20 Tenure at JPM (years) 4 1 1 1 1-10 10-15 15-20 >20 Tenure at JPM (years) 28

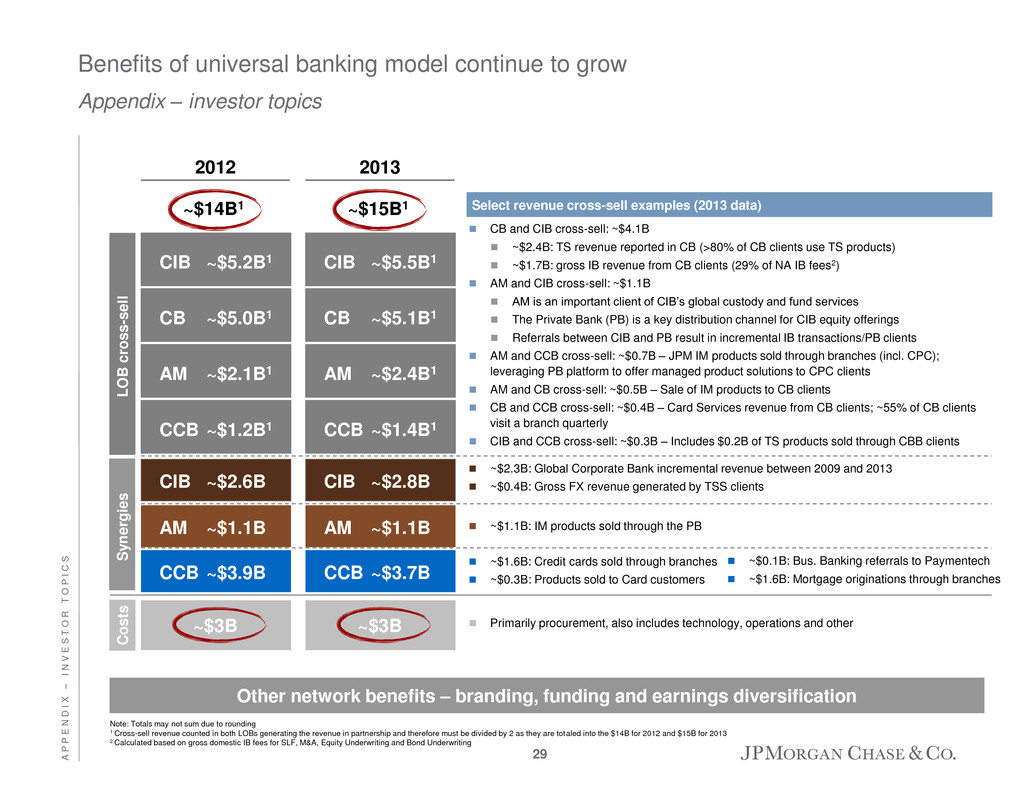

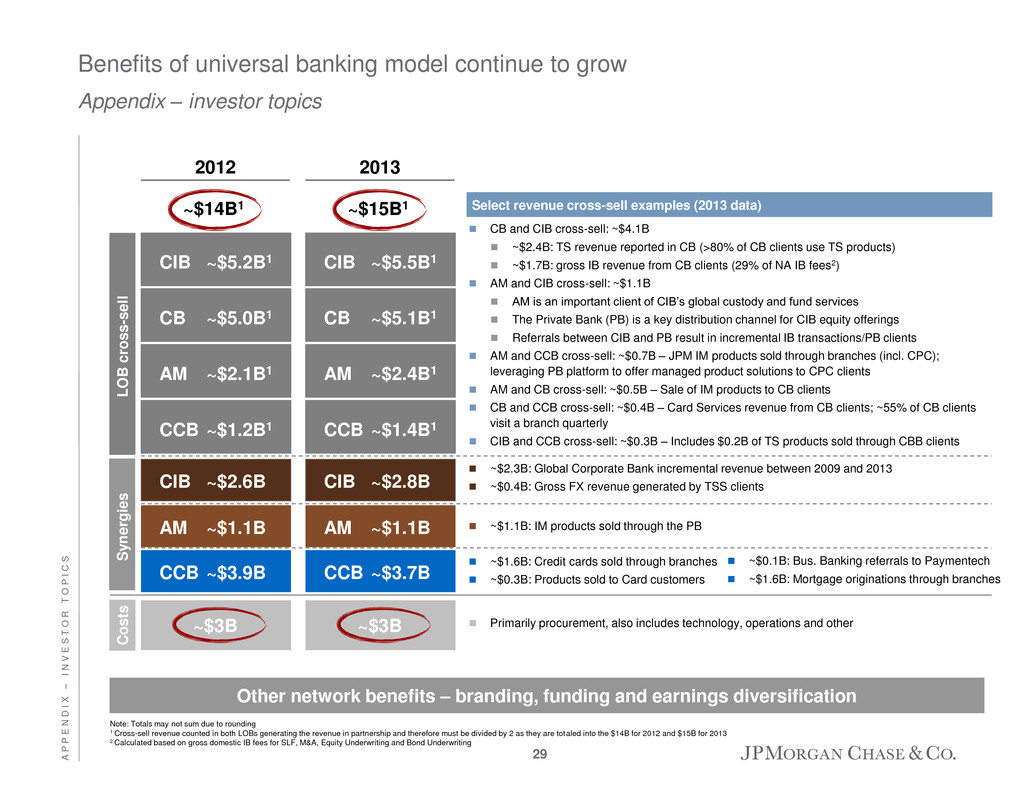

A P P E N D I X – I N V E S T O R T O P I C S ~$3B Benefits of universal banking model continue to grow Appendix – investor topics Other network benefits – branding, funding and earnings diversification Note: Totals may not sum due to rounding 1 Cross-sell revenue counted in both LOBs generating the revenue in partnership and therefore must be divided by 2 as they are totaled into the $14B for 2012 and $15B for 2013 2 Calculated based on gross domestic IB fees for SLF, M&A, Equity Underwriting and Bond Underwriting Primarily procurement, also includes technology, operations and other ~$15B1 ~$2.3B: Global Corporate Bank incremental revenue between 2009 and 2013 ~$0.4B: Gross FX revenue generated by TSS clients ~$1.1B: IM products sold through the PB ~$1.6B: Credit cards sold through branches ~$0.3B: Products sold to Card customers CB and CIB cross-sell: ~$4.1B ~$2.4B: TS revenue reported in CB (>80% of CB clients use TS products) ~$1.7B: gross IB revenue from CB clients (29% of NA IB fees2) AM and CIB cross-sell: ~$1.1B AM is an important client of CIB’s global custody and fund services The Private Bank (PB) is a key distribution channel for CIB equity offerings Referrals between CIB and PB result in incremental IB transactions/PB clients AM and CCB cross-sell: ~$0.7B – JPM IM products sold through branches (incl. CPC); leveraging PB platform to offer managed product solutions to CPC clients AM and CB cross-sell: ~$0.5B – Sale of IM products to CB clients CB and CCB cross-sell: ~$0.4B – Card Services revenue from CB clients; ~55% of CB clients visit a branch quarterly CIB and CCB cross-sell: ~$0.3B – Includes $0.2B of TS products sold through CBB clients Select revenue cross-sell examples (2013 data) LOB cro s s -s e ll S y n e rg ie s ~$3B C o s ts ~$0.1B: Bus. Banking referrals to Paymentech ~$1.6B: Mortgage originations through branches CIB ~$5.5B1 CIB ~$2.6B CB ~$5.1B1 AM ~$2.4B1 CCB ~$1.4B1 CIB ~$2.8B AM ~$1.1B CCB ~$3.7B ~$3B ~$14B1 CIB ~$5.2B1 CB ~$5.0B1 AM ~$2.1B1 CCB ~$1.2B1 CIB ~$2.6B AM ~$1.1B CCB ~$3.9B 2012 2013 29

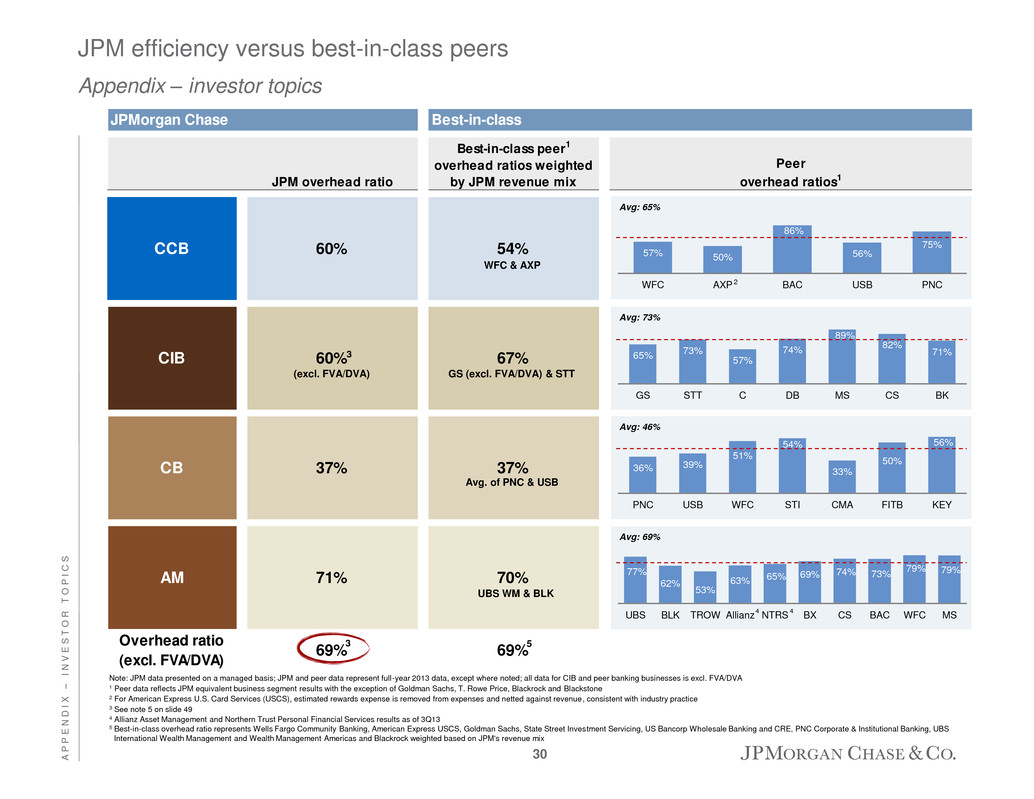

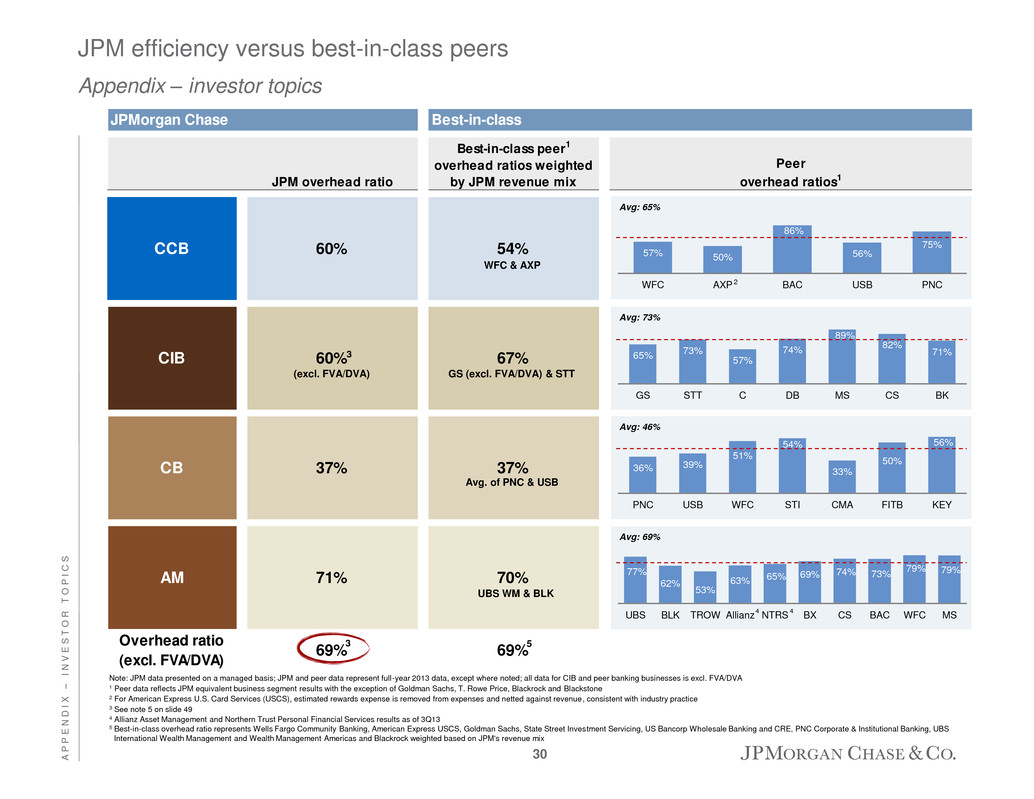

A P P E N D I X – I N V E S T O R T O P I C S JPMorgan Chase Best-in-class JPM overhead ratio Best-in-class peer1 overhead ratios weighted by JPM revenue mix Peer overhead ratios1 CCB 60% 54% CIB 60% 67% CB 37% 37% AM 71% 70% Overhead ratio (excl. FVA/DVA) 69% 69% JPM efficiency versus best-in-class peers Appendix – investor topics Note: JPM data presented on a managed basis; JPM and peer data represent full-year 2013 data, except where noted; all data for CIB and peer banking businesses is excl. FVA/DVA 1 Peer data reflects JPM equivalent business segment results with the exception of Goldman Sachs, T. Rowe Price, Blackrock and Blackstone 2 For American Express U.S. Card Services (USCS), estimated rewards expense is removed from expenses and netted against revenue, consistent with industry practice 3 See note 5 on slide 49 4 Allianz Asset Management and Northern Trust Personal Financial Services results as of 3Q13 5 Best-in-class overhead ratio represents Wells Fargo Community Banking, American Express USCS, Goldman Sachs, State Street Investment Servicing, US Bancorp Wholesale Banking and CRE, PNC Corporate & Institutional Banking, UBS International Wealth Management and Wealth Management Americas and Blackrock weighted based on JPM's revenue mix WFC & AXP GS (excl. FVA/DVA) & STT Avg. of PNC & USB UBS WM & BLK 5 57% 50% 86% 56% 75% WFC AXP BAC USB PNC Avg: 65% 2 65% 73% 57% 74% 89% 82% 71% GS STT C DB MS CS BK Avg: 73% 36% 39% 51% 54% 33% 50% 56% PNC USB WFC STI CMA FITB KEY Avg: 46% 77% 62% 53% 63% 65% 69% 74% 73% 79% 79% UBS BLK TROW Allianz NTRS BX CS BAC WFC MS Avg: 69% 4 4 (excl. FVA/DVA) 3 3 30

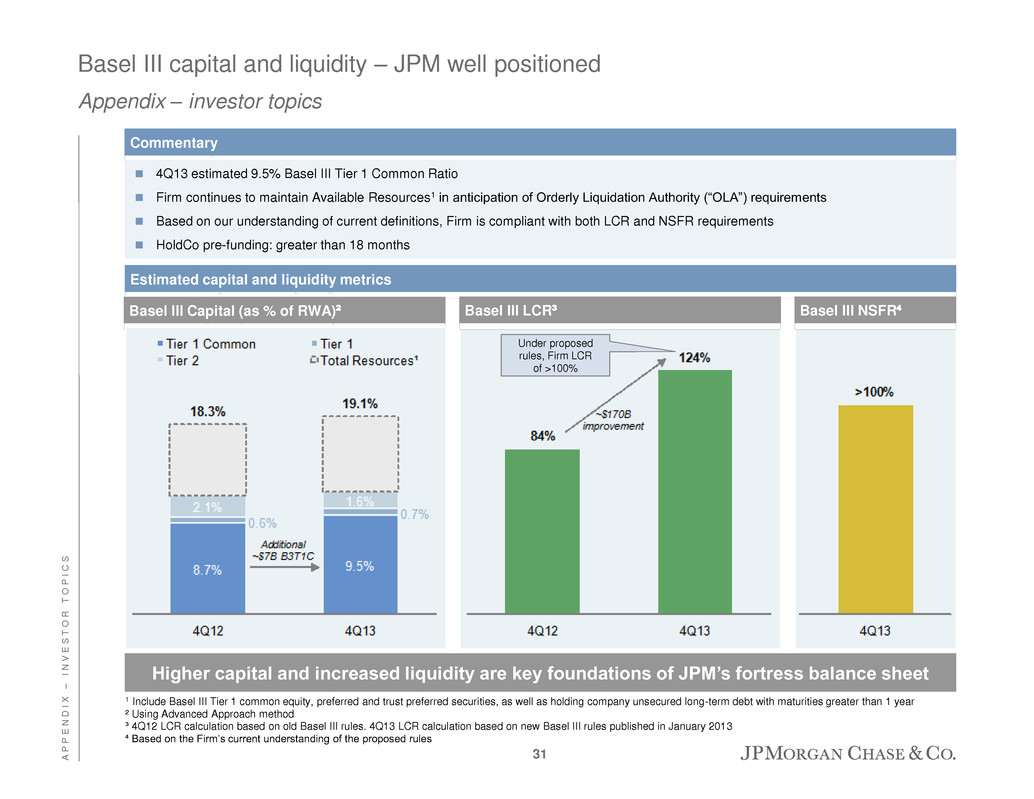

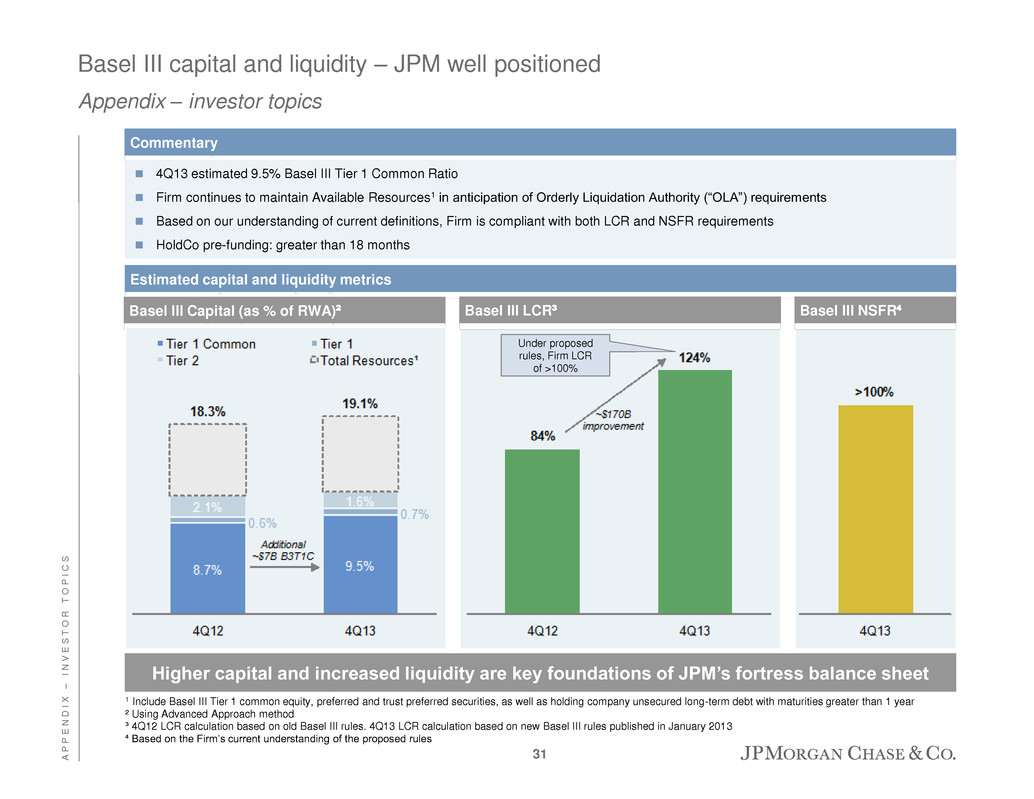

A P P E N D I X – I N V E S T O R T O P I C S Estimated capital and liquidity metrics Basel III capital and liquidity – JPM well positioned Appendix – investor topics Higher capital and increased liquidity are key foundations of JPM’s fortress balance sheet 1 Include Basel III Tier 1 common equity, preferred and trust preferred securities, as well as holding company unsecured long-term debt with maturities greater than 1 year ² Using Advanced Approach method ³ 4Q12 LCR calculation based on old Basel III rules. 4Q13 LCR calculation based on new Basel III rules published in January 2013 ⁴ Based on the Firm’s current understanding of the proposed rules Commentary 4Q13 estimated 9.5% Basel III Tier 1 Common Ratio Firm continues to maintain Available Resources1 in anticipation of Orderly Liquidation Authority (“OLA”) requirements Based on our understanding of current definitions, Firm is compliant with both LCR and NSFR requirements HoldCo pre-funding: greater than 18 months Basel III Capital (as % of RWA)² Basel III LCR³ Basel III NSFR⁴ Under proposed rules, Firm LCR of >100% 31

Agenda Page F I R M O V E R V I E W 32 Appendix – other 32 JPMorgan Chase overview 1 New financial architecture 6 Balance sheet/NII and credit update 15 Expense, investments and outlook 21 Appendix – investor topics 27

A P P E N D I X – O T H E R Managed financial results1 Firmwide results ($mm) Net income by lines of business ($mm) 1 See note 1on slide 48 2 See note 4 on slide 49 2011 2012 2013 Consumer & Community Banking $6,105 $10,551 $10,749 Corporate & Investment Banking 7,993 8,406 8,546 Commercial Banking 2,367 2,646 2,575 Asset Management 1,592 1,703 2,031 Corporate/Private Equity 919 (2,022) (5,978) Total Firm net income $18,976 $21,284 $17,923 33

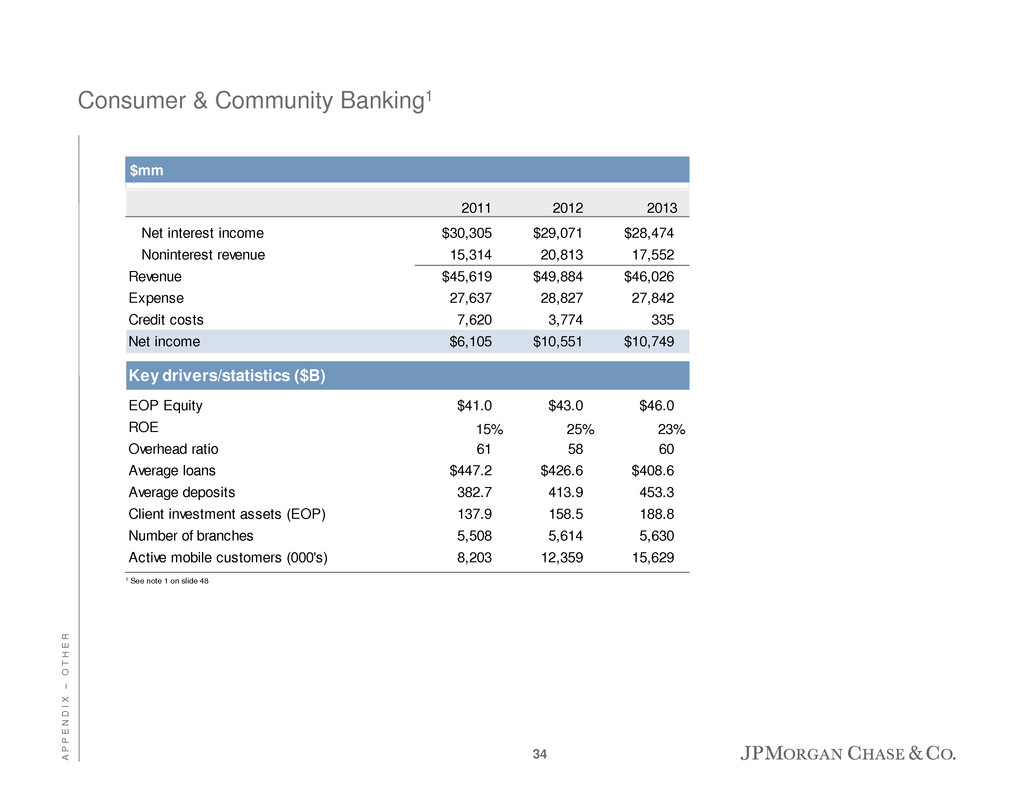

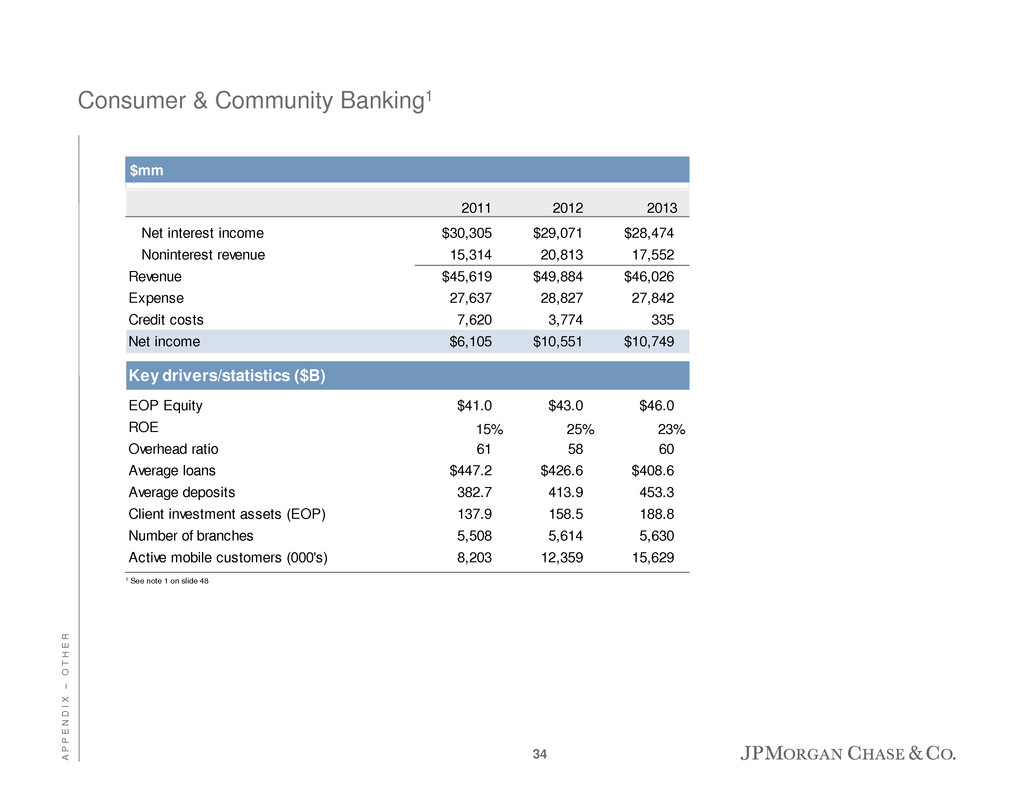

A P P E N D I X – O T H E R Consumer & Community Banking1 1 See note 1 on slide 48 $mm 2011 2012 2013 Net interest income $30,305 $29,071 $28,474 Noninterest revenue 15,314 20,813 17,552 Revenue $45,619 $49,884 $46,026 Expense 27,637 28,827 27,842 Credit costs 7,620 3,774 335 Net income $6,105 $10,551 $10,749 Key drivers/statistics ($B) EOP Equity $41.0 $43.0 $46.0 ROE 15% 25% 23% Overhead ratio 61 58 60 Average loans $447.2 $426.6 $408.6 Average deposits 382.7 413.9 453.3 Client investment assets (EOP) 137.9 158.5 188.8 Number of branches 5,508 5,614 5,630 Active mobile customers (000's) 8,203 12,359 15,629 34

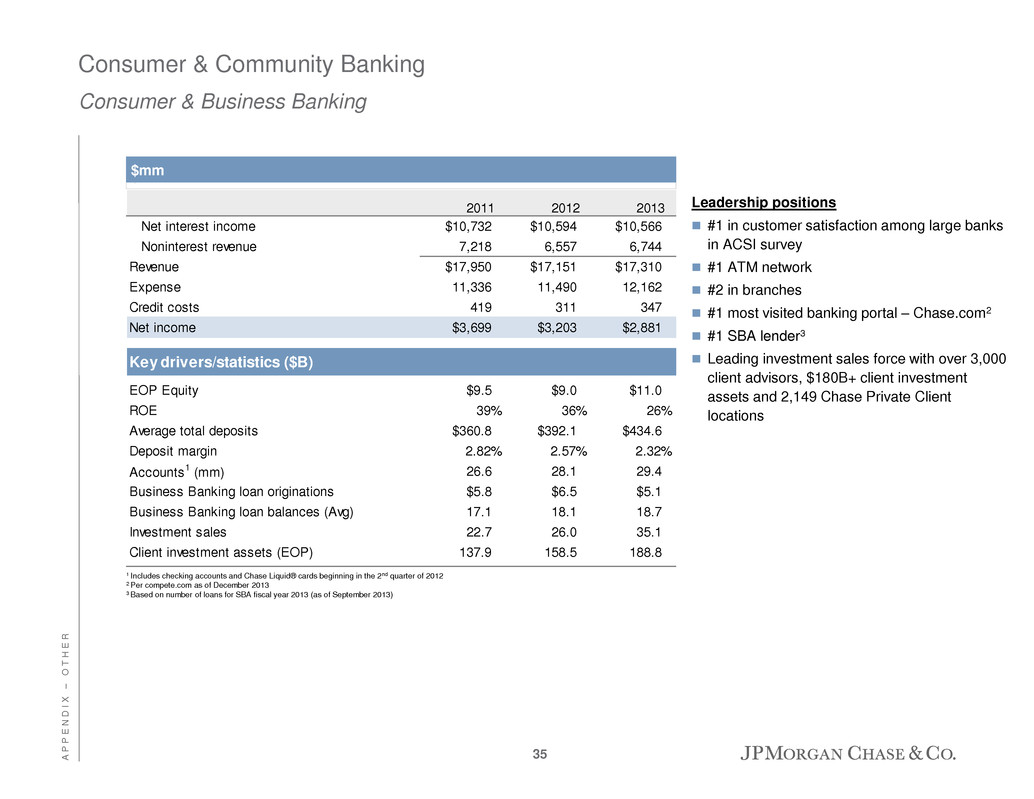

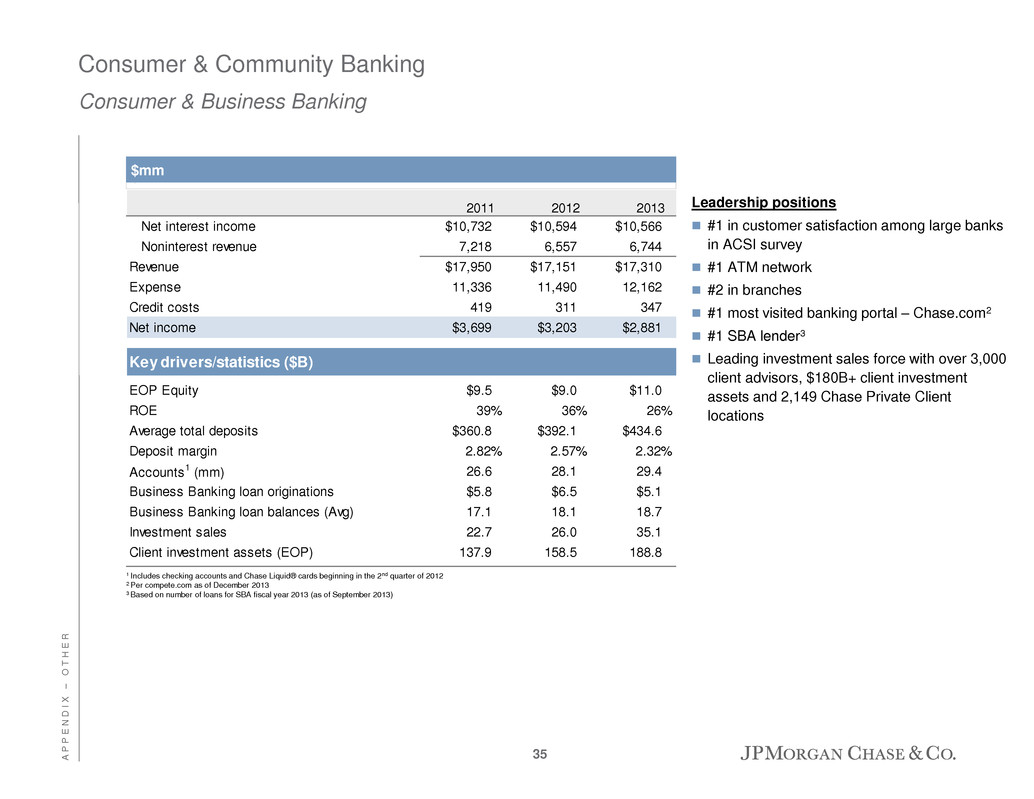

A P P E N D I X – O T H E R Consumer & Community Banking Consumer & Business Banking 1 Includes checking accounts and Chase Liquid® cards beginning in the 2nd quarter of 2012 2 Per compete.com as of December 2013 3 Based on number of loans for SBA fiscal year 2013 (as of September 2013) $mm Leadership positions #1 in customer satisfaction among large banks in ACSI survey #1 ATM network #2 in branches #1 most visited banking portal – Chase.com2 #1 SBA lender3 Leading investment sales force with over 3,000 client advisors, $180B+ client investment assets and 2,149 Chase Private Client locations 2011 2012 2013 Net interest income $10,732 $10,594 $10,566 Noninterest revenue 7,218 6,557 6,744 Revenue $17,950 $17,151 $17,310 Expense 11,336 11,490 12,162 Credit costs 419 311 347 Net income $3,699 $3,203 $2,881 Key drivers/statistics ($B) EOP Equity $9.5 $9.0 $11.0 ROE 39% 36% 26% Average total deposits $360.8 $392.1 $434.6 Deposit margin 2.82% 2.57% 2.32% Accounts1 (mm) 26.6 28.1 29.4 Business Banking loan originations $5.8 $6.5 $5.1 Business Banking loan balances (Avg) 17.1 18.1 18.7 Investment sales 22.7 26.0 35.1 Client investment assets (EOP) 137.9 158.5 188.8 35

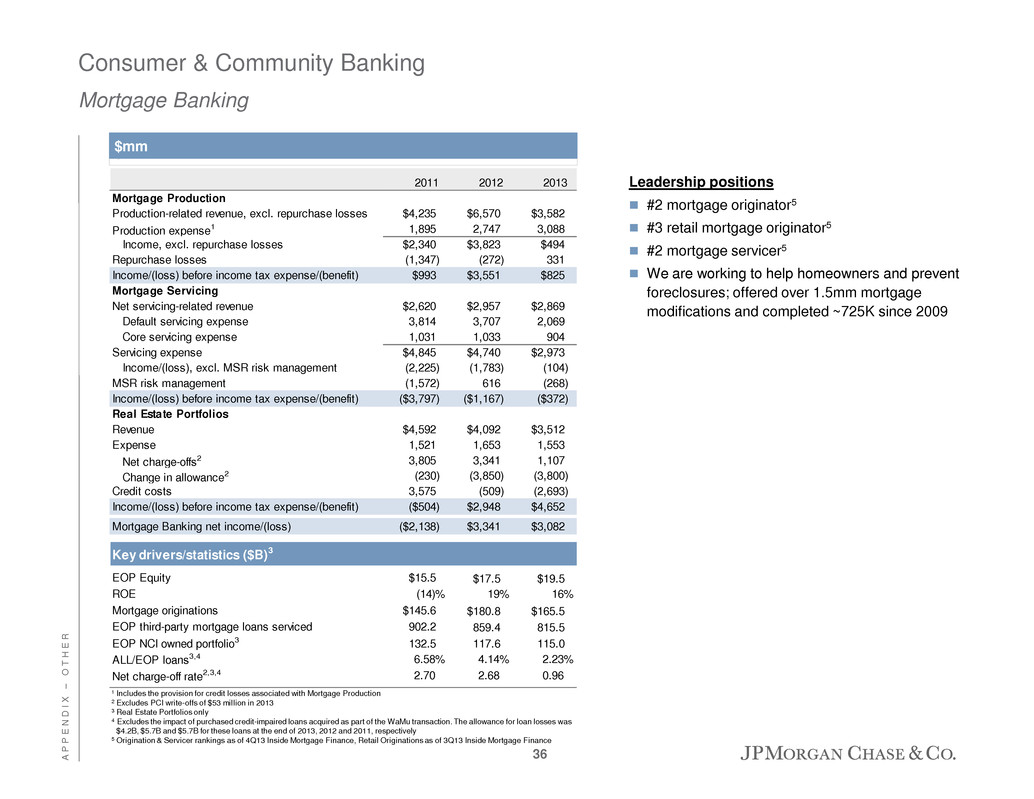

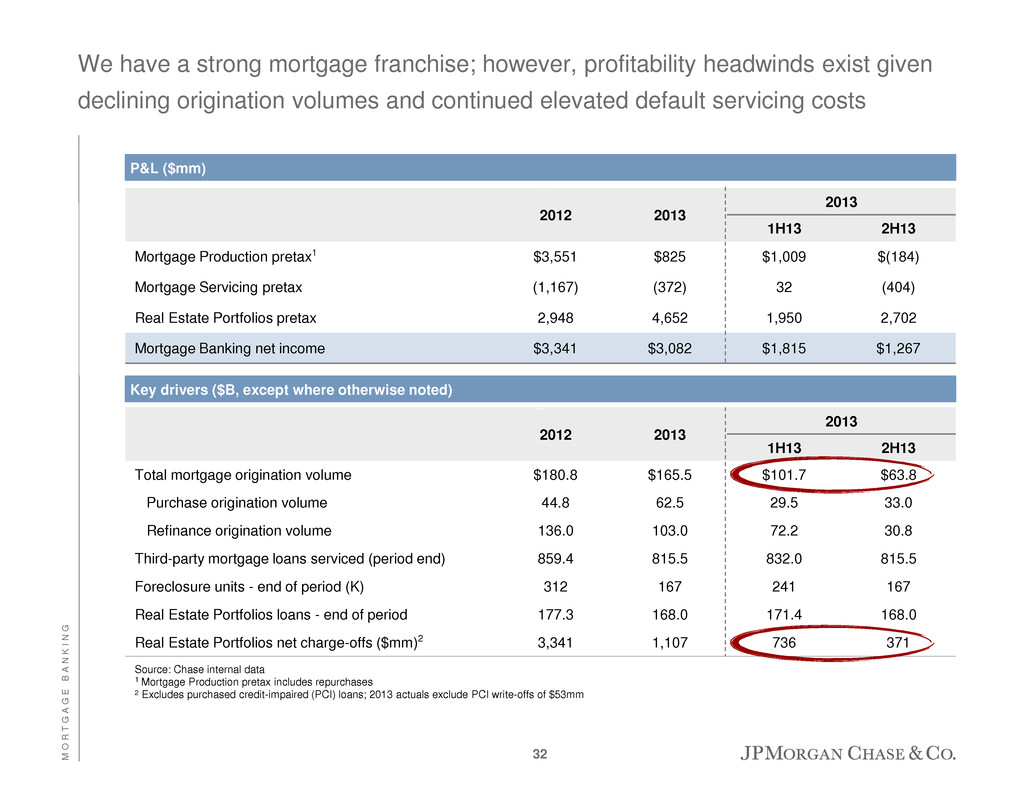

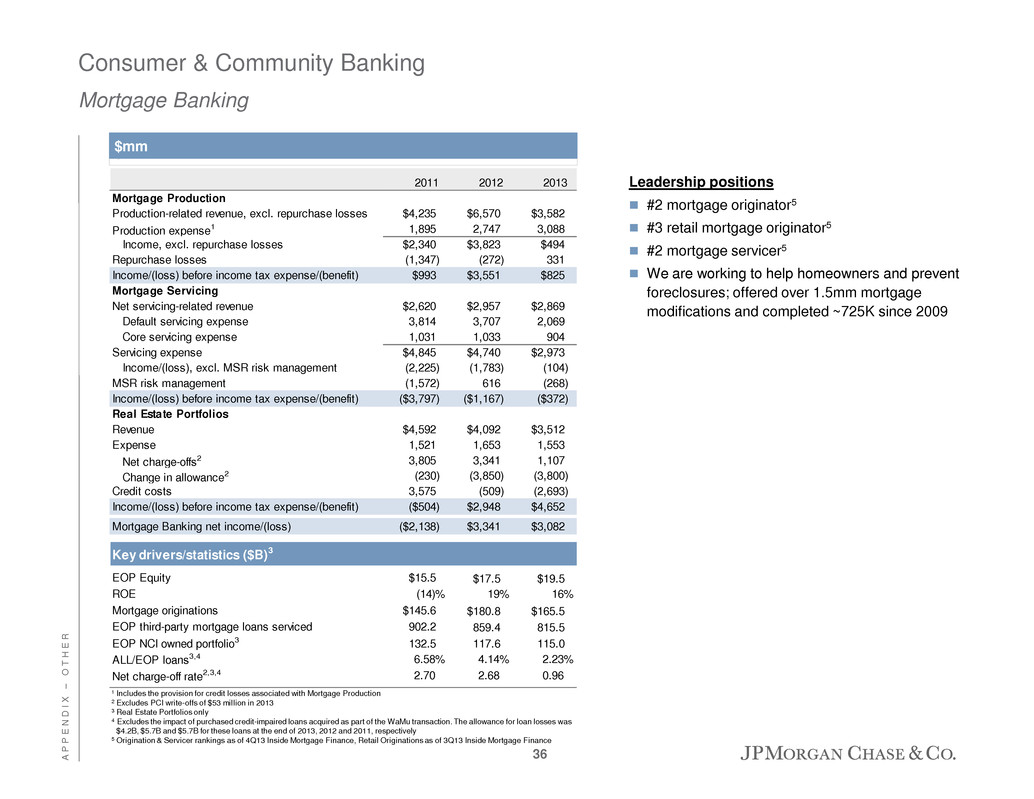

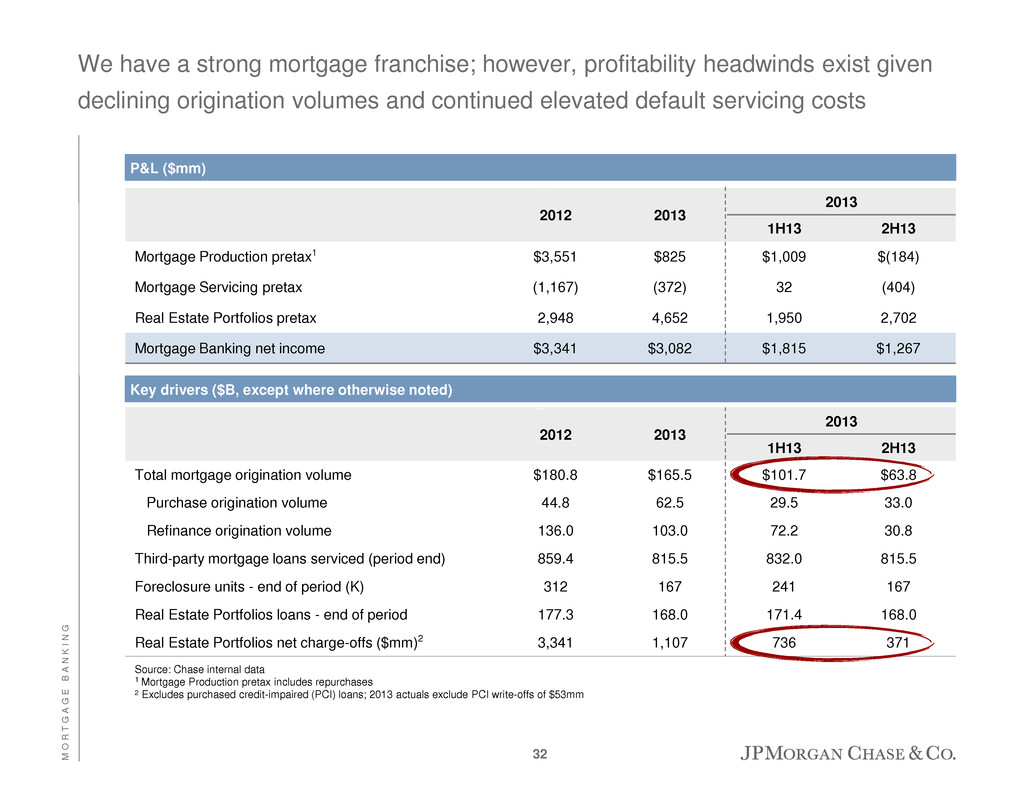

A P P E N D I X – O T H E R Consumer & Community Banking Mortgage Banking Leadership positions #2 mortgage originator5 #3 retail mortgage originator5 #2 mortgage servicer5 We are working to help homeowners and prevent foreclosures; offered over 1.5mm mortgage modifications and completed ~725K since 2009 1 Includes the provision for credit losses associated with Mortgage Production 2 Excludes PCI write-offs of $53 million in 2013 3 Real Estate Portfolios only 4 Excludes the impact of purchased credit-impaired loans acquired as part of the WaMu transaction. The allowance for loan losses was $4.2B, $5.7B and $5.7B for these loans at the end of 2013, 2012 and 2011, respectively 5 Origination & Servicer rankings as of 4Q13 Inside Mortgage Finance, Retail Originations as of 3Q13 Inside Mortgage Finance 2011 2012 2013 Mortgage Production Production-related revenue, excl. repurchase losses $4,235 $6,570 $3,582 Production expense1 1,895 2,747 3,088 Income, excl. repurchase losses $2,340 $3,823 $494 Repurchase losses (1,347) (272) 331 Income/(loss) before income tax expense/(benefit) $993 $3,551 $825 Mortgage Servicing Net servicing-related revenue $2,620 $2,957 $2,869 Default servicing expense 3,814 3,707 2,069 Core servicing expense 1,031 1,033 904 Servicing expense $4,845 $4,740 $2,973 Income/(loss), excl. MSR risk management (2,225) (1,783) (104) MSR risk management (1,572) 616 (268) Income/(loss) before income tax expense/(benefit) ($3,797) ($1,167) ($372) Real Estate Portfolios Revenue $4,592 $4,092 $3,512 Expense 1,521 1,653 1,553 Net charge-offs2 3,805 3,341 1,107 Change in allowance2 (230) (3,850) (3,800) Credit costs 3,575 (509) (2,693) Income/(loss) before income tax expense/(benefit) ($504) $2,948 $4,652 Mortgage Banking net income/(loss) ($2,138) $3,341 $3,082 Key drivers/statistics ($B)3 EOP Equity $15.5 $17.5 $19.5 ROE (14)% 19% 16% Mortgage originations $145.6 $180.8 $165.5 EOP third-party mortg ge loans serviced 902.2 859.4 815.5 EOP NCI owned portfolio3 132.5 117.6 115.0 ALL/EOP loans3,4 6.58% 4.14% 2.23% Net charge-off rate2,3,4 2.70 2.68 0.96 $mm 36

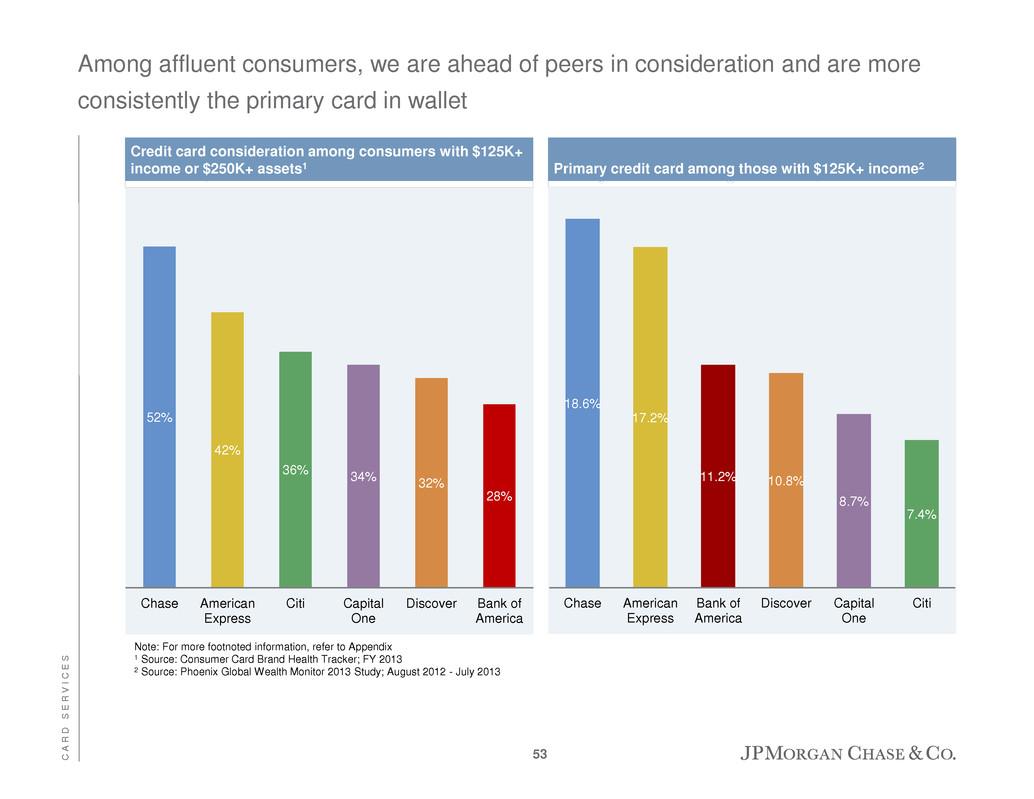

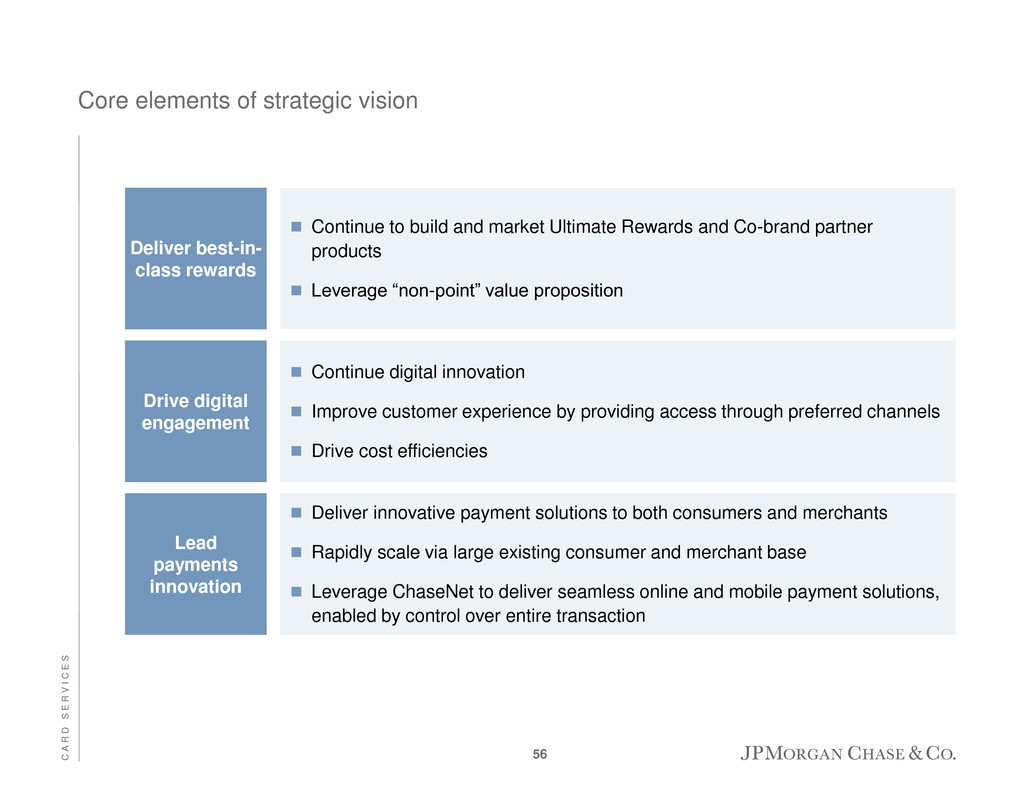

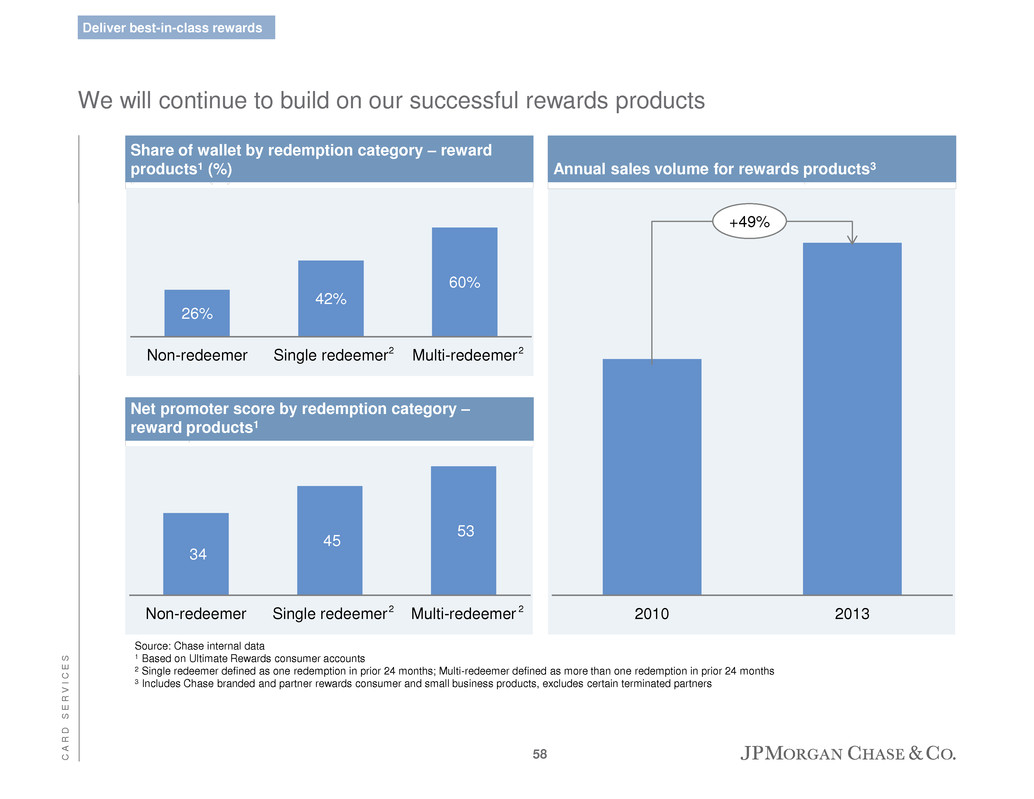

A P P E N D I X – O T H E R Consumer & Community Banking Card, Merchant Services & Auto $mm Leadership positions #1 credit card issuer in the U.S. based on loans outstanding3 #1 Global Visa issuer based on consumer and business credit card sales volume4 #1 U.S. co-brand credit card issuer3 #2 wholly-owned merchant acquirer5 #3 non-captive auto lender6 1 Net charge-offs and the net charge-off rate for full year 2012 included $53 million of charge-offs of Chapter 7 loans 2 Excludes Commercial Card 3 Based on disclosures by peers and internal estimates as of 4Q13 4 Based on Visa data as of 4Q13 5 Based on Nilson report ranking of largest merchant acquirers for 2012 6 As of December 31, 2013 data per Autocount 2011 2012 2013 Revenue $19,141 $18,770 $18,690 Expense 8,045 8,216 8,078 Net charge-offs1 7,511 5,509 4,370 Change in allowance (3,890) (1,556) (1,701) Credit costs $3,621 $3,953 $2,669 Net income $4,544 $4,007 $4,786 EOP Equity 16,000 16,500 15,500 ROE 28% 24% 31% Card Services – Key drivers/statistics ($B) Average loans $128.2 $125.5 $123.6 Sales volume2 343.7 381.1 419.5 Net revenue rate 12.35% 12.35% 12.49% Net charge-off rate 5.44 3.95 3.14 30+ Day delinquency rate 2.81 2.10 1.67 # of accounts with sales activity (mm)2 30.7 30.6 32.3 % of accounts acquired online2 32% 51% 55% Merchant Services – Key drivers ($B) erchant processing volume $553.7 $655.2 $750.1 # of total transacti s 24.4 29.5 35.6 Auto – Key drivers ($B) Average loans $47.0 $48.4 $50.7 Originations 21.0 23.4 26.1 37

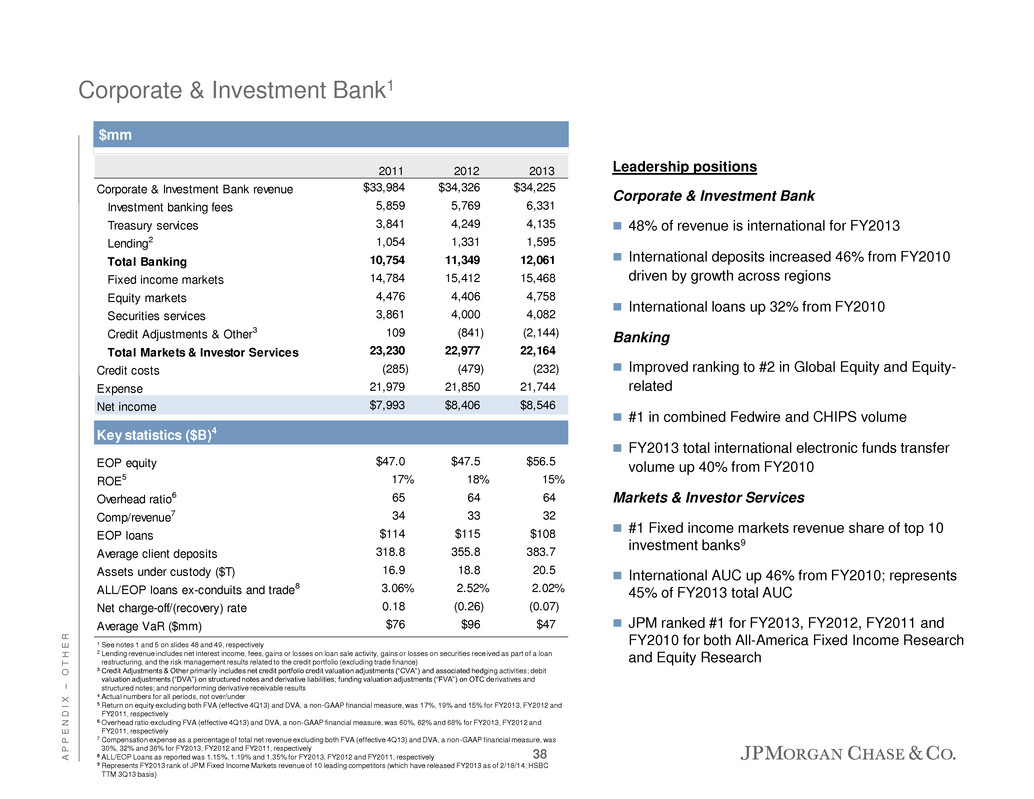

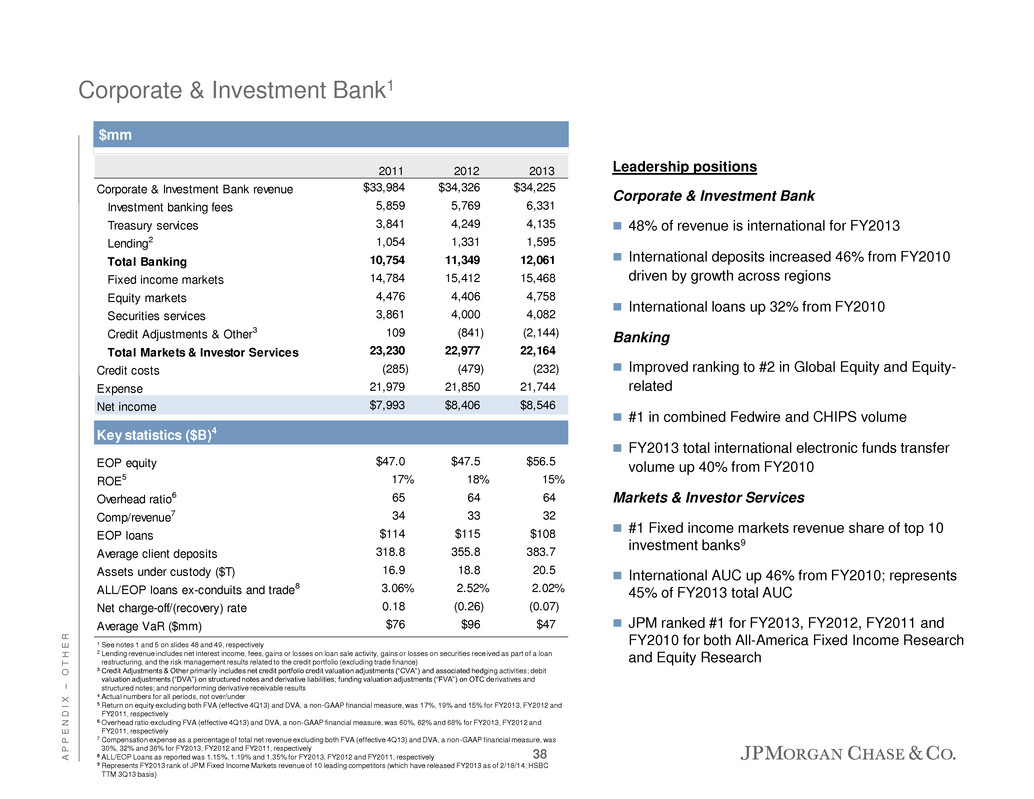

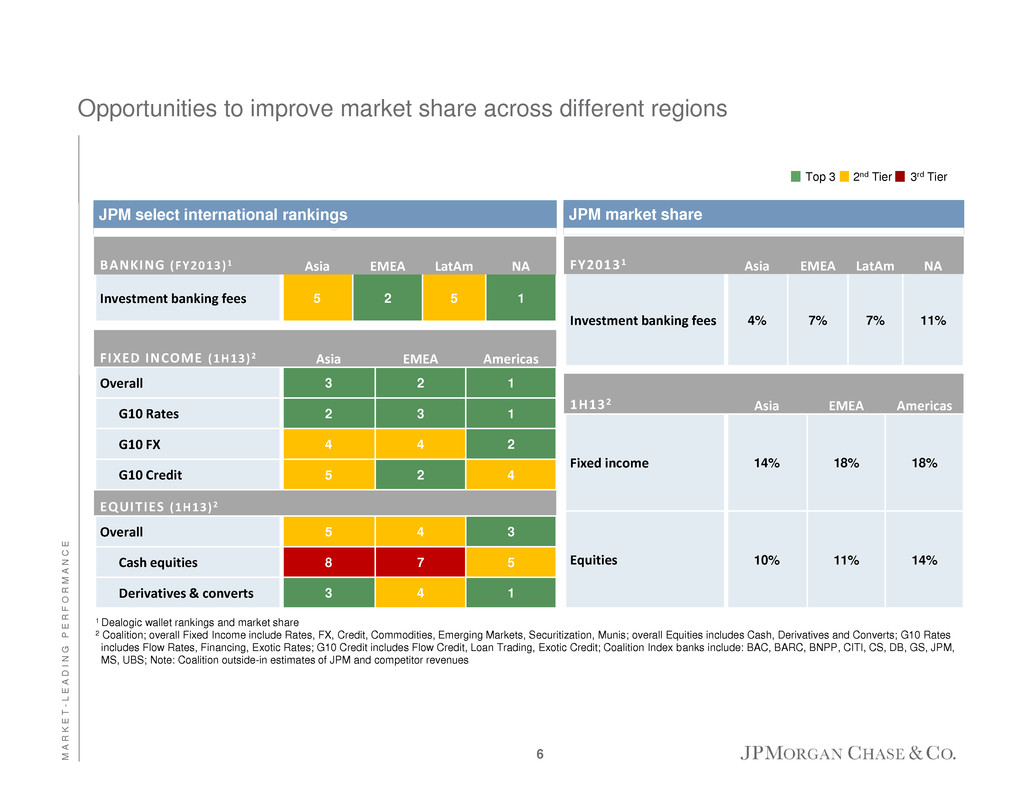

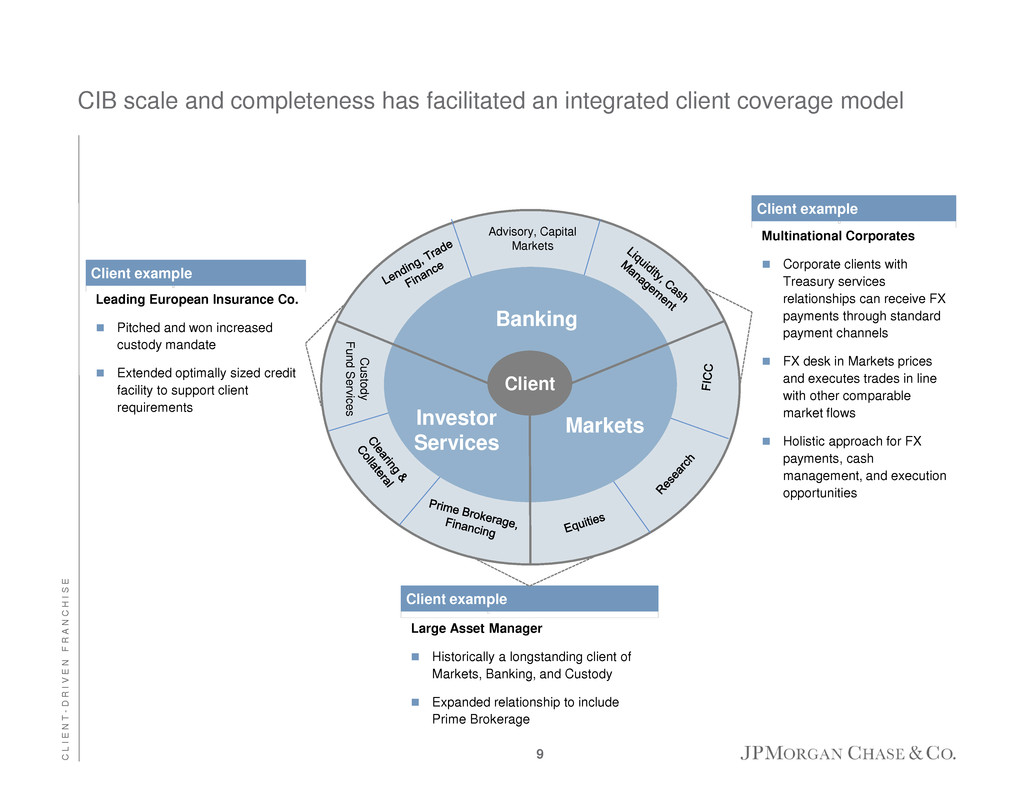

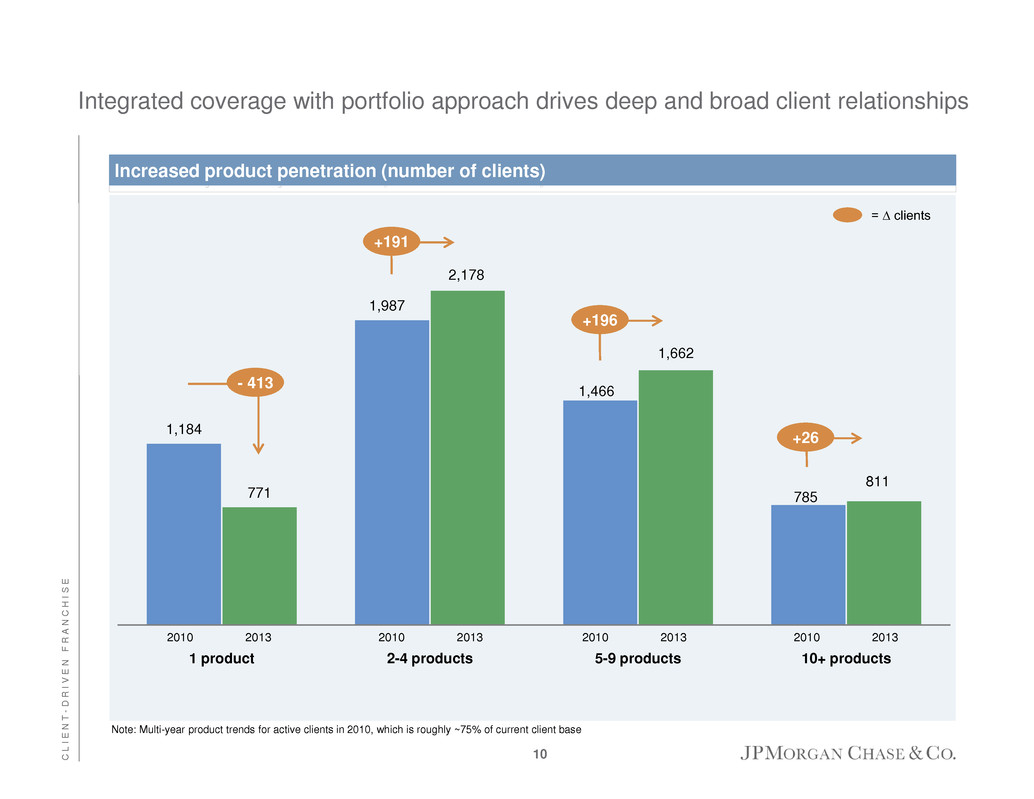

A P P E N D I X – O T H E R Corporate & Investment Bank1 1 See notes 1 and 5 on slides 48 and 49, respectively 2 Lending revenue includes net interest income, fees, gains or losses on loan sale activity, gains or losses on securities received as part of a loan restructuring, and the risk management results related to the credit portfolio (excluding trade finance) 3 Credit Adjustments & Other primarily includes net credit portfolio credit valuation adjustments (“CVA”) and associated hedging activities; debit valuation adjustments (“DVA”) on structured notes and derivative liabilities; funding valuation adjustments (“FVA”) on OTC derivatives and structured notes; and nonperforming derivative receivable results 4 Actual numbers for all periods, not over/under 5 Return on equity excluding both FVA (effective 4Q13) and DVA, a non-GAAP financial measure, was 17%, 19% and 15% for FY2013, FY2012 and FY2011, respectively 6 Overhead ratio excluding FVA (effective 4Q13) and DVA, a non-GAAP financial measure, was 60%, 62% and 68% for FY2013, FY2012 and FY2011, respectively 7 Compensation expense as a percentage of total net revenue excluding both FVA (effective 4Q13) and DVA, a non-GAAP financial measure, was 30%, 32% and 36% for FY2013, FY2012 and FY2011, respectively 8 ALL/EOP Loans as reported was 1.15%, 1.19% and 1.35% for FY2013, FY2012 and FY2011, respectively 9 Represents FY2013 rank of JPM Fixed Income Markets revenue of 10 leading competitors (which have released FY2013 as of 2/18/14; HSBC TTM 3Q13 basis) Leadership positions Corporate & Investment Bank 48% of revenue is international for FY2013 International deposits increased 46% from FY2010 driven by growth across regions International loans up 32% from FY2010 Banking Improved ranking to #2 in Global Equity and Equity- related #1 in combined Fedwire and CHIPS volume FY2013 total international electronic funds transfer volume up 40% from FY2010 Markets & Investor Services #1 Fixed income markets revenue share of top 10 investment banks9 International AUC up 46% from FY2010; represents 45% of FY2013 total AUC JPM ranked #1 for FY2013, FY2012, FY2011 and FY2010 for both All-America Fixed Income Research and Equity Research 2011 2012 2013 Corporate & Investment Bank revenue $33,984 $34,326 $34,225 Investment banking fees 5,859 5,769 6,331 Treasury services 3,841 4,249 4,135 Lending2 1,054 1,331 1,595 Total Banking 10,754 11,349 12,061 Fixed income markets 14,784 15,412 15,468 Equity markets 4,476 4,406 4,758 Securities services 3,861 4,000 4,082 Credit Adjustments & Other3 109 (841) (2,144) Total Markets & Investor Services 23,230 22,977 22,164 Credit costs (285) (479) (232) Expense 21,979 21,850 21,744 Net income $7,993 $8,406 $8,546 Key statistics ($B)4 EOP equity $47.0 $47.5 $56.5 ROE5 17% 18% 15% Overhead ratio6 65 64 64 Comp/revenue7 34 33 32 EOP loa s $114 $115 $108 Average client deposit 318.8 355.8 383.7 Assets under custody ($T) 16.9 18.8 20.5 ALL/EOP loans ex-conduits and trade8 3.06% 2.52% 2.02% Net charge-off/(recovery) rate 0.18 (0.26) (0.07) Average VaR ($mm) $76 $96 $47 $mm 38

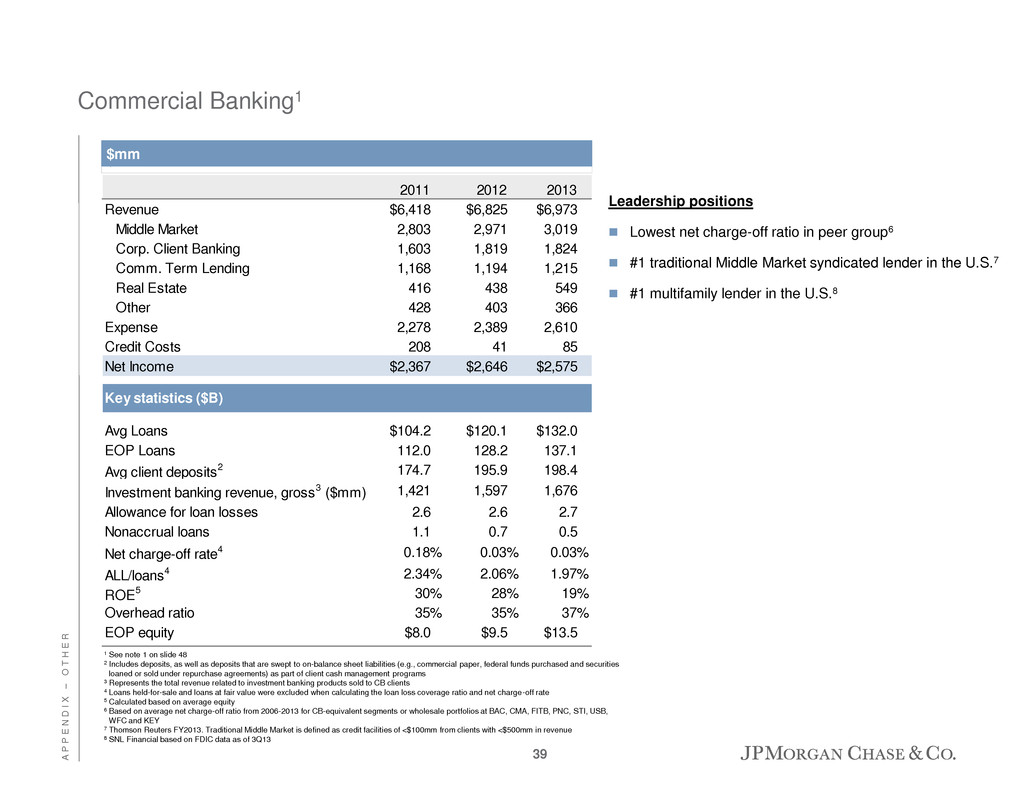

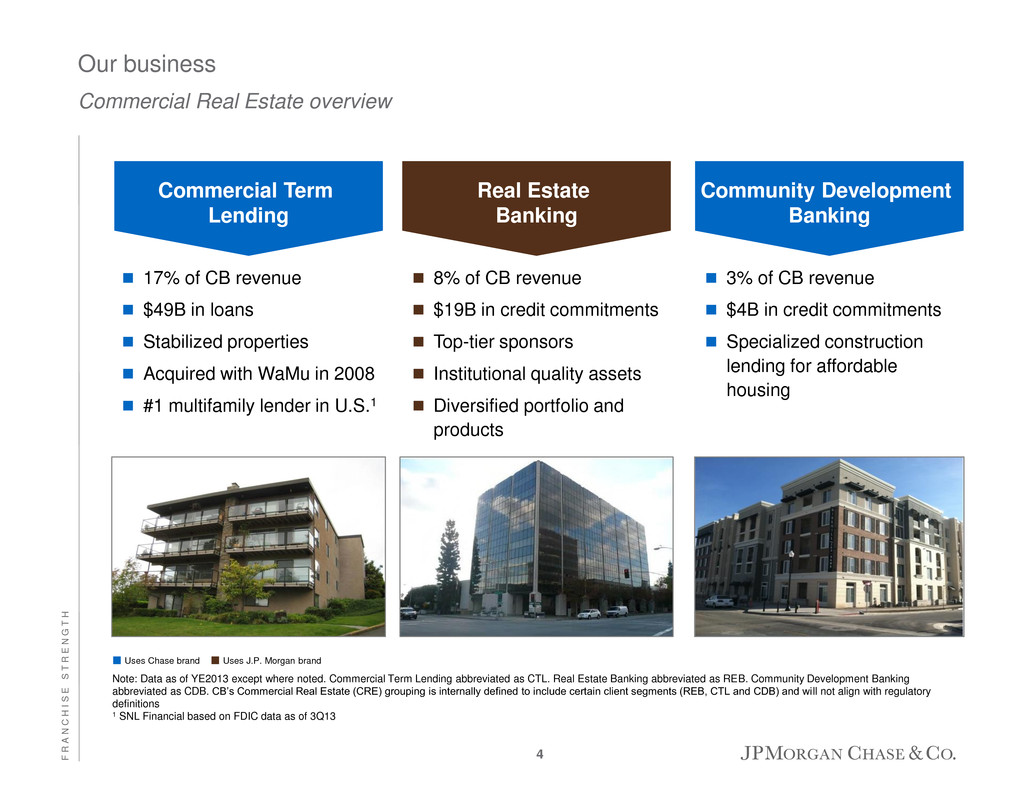

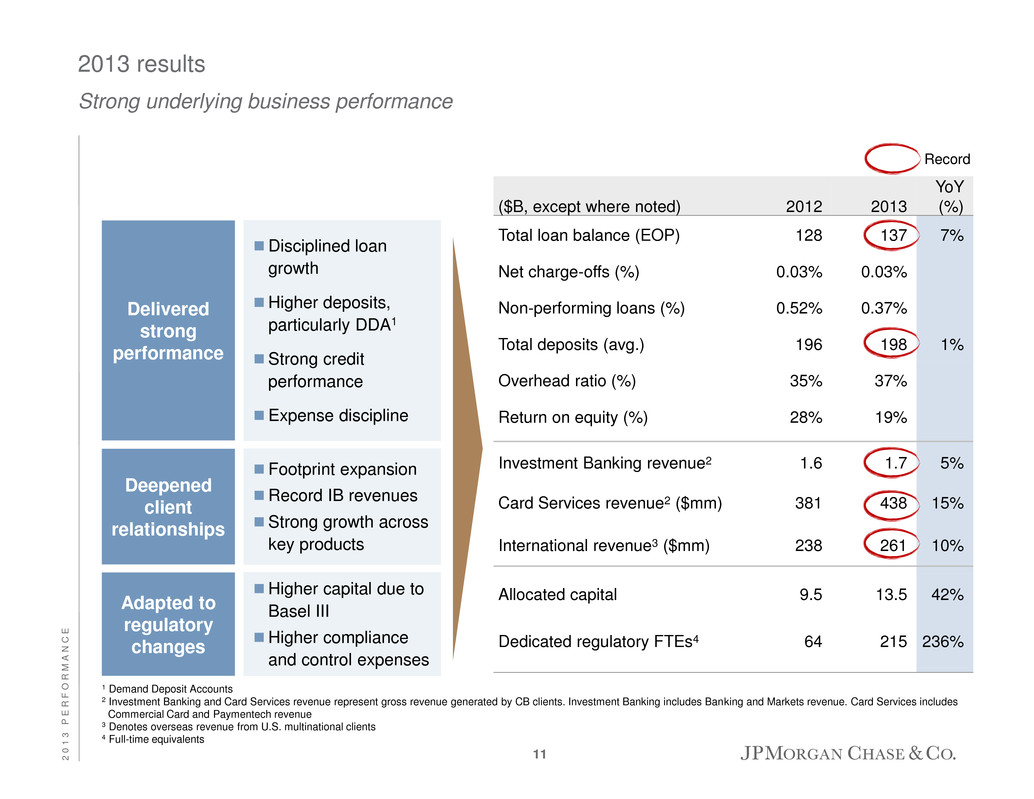

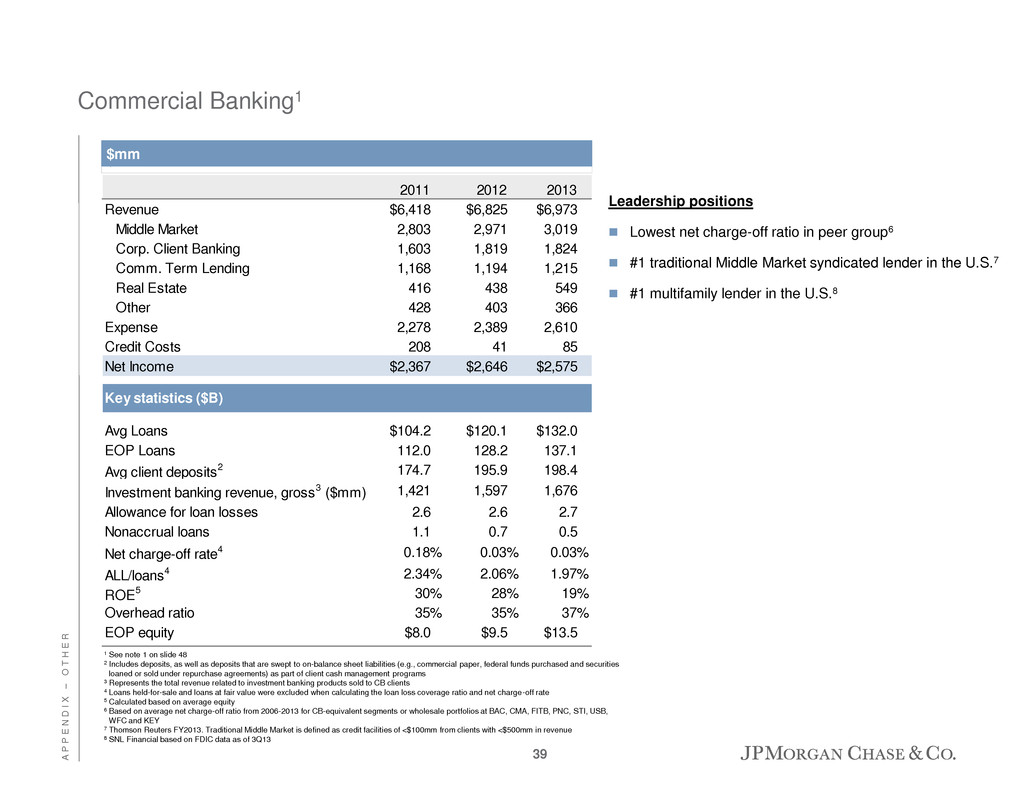

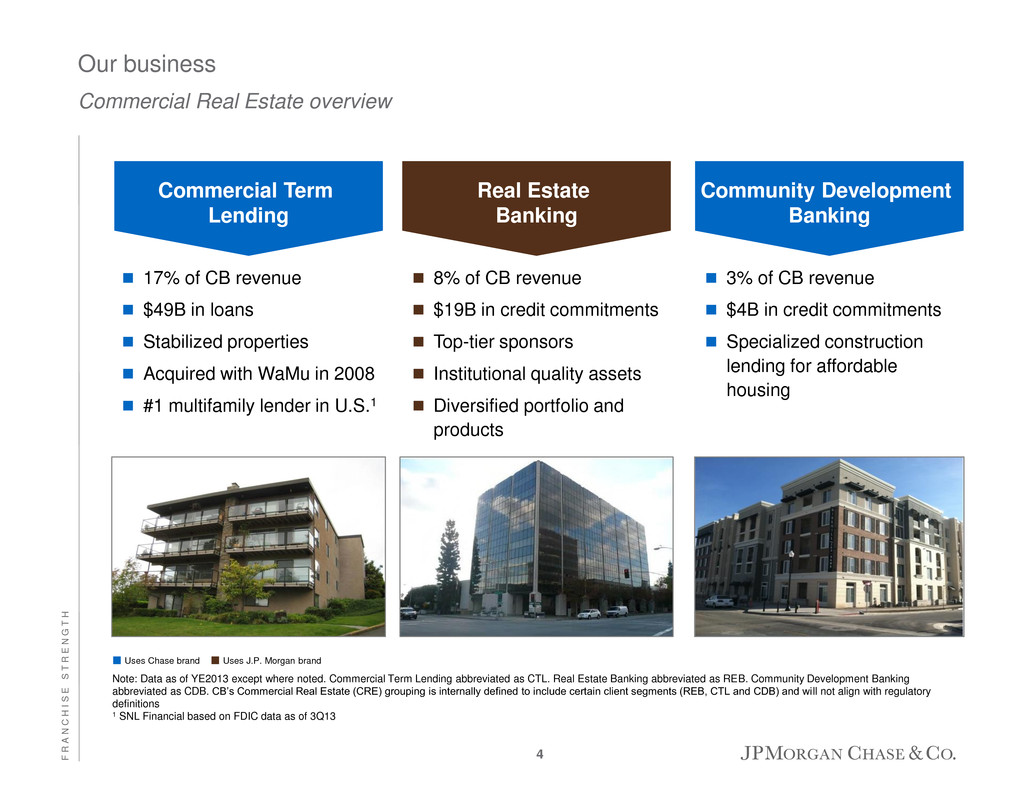

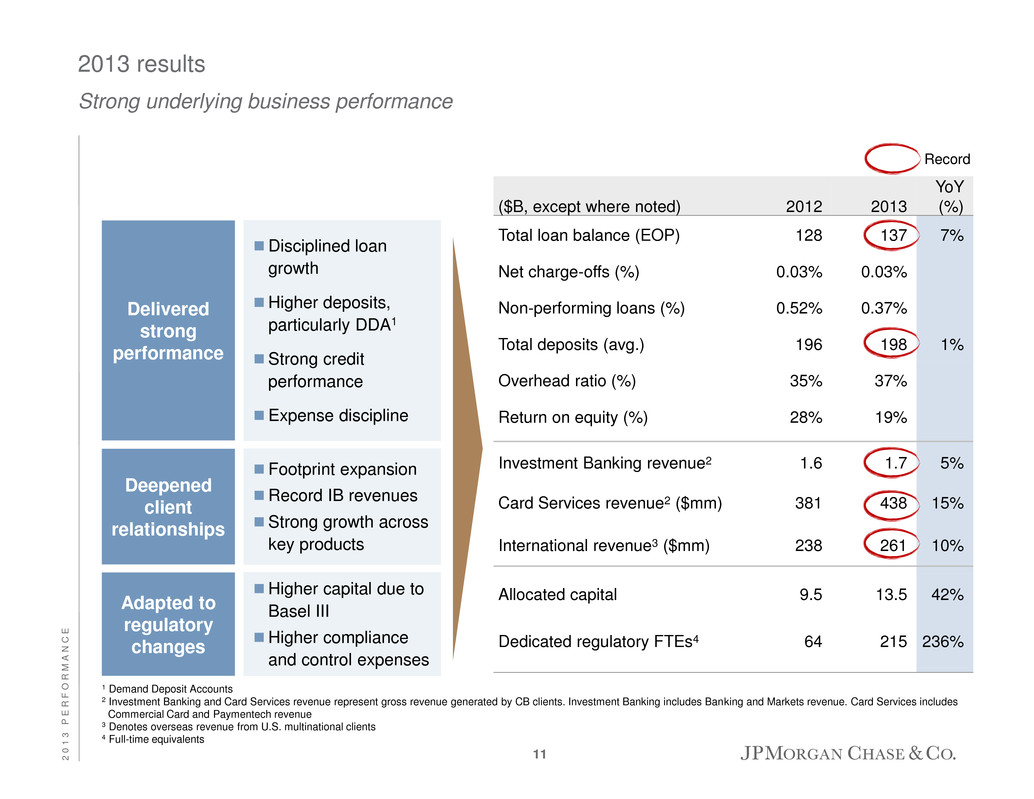

A P P E N D I X – O T H E R 1 See note 1 on slide 48 2 Includes deposits, as well as deposits that are swept to on-balance sheet liabilities (e.g., commercial paper, federal funds purchased and securities loaned or sold under repurchase agreements) as part of client cash management programs 3 Represents the total revenue related to investment banking products sold to CB clients 4 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off rate 5 Calculated based on average equity 6 Based on average net charge-off ratio from 2006-2013 for CB-equivalent segments or wholesale portfolios at BAC, CMA, FITB, PNC, STI, USB, WFC and KEY 7 Thomson Reuters FY2013. Traditional Middle Market is defined as credit facilities of <$100mm from clients with <$500mm in revenue 8 SNL Financial based on FDIC data as of 3Q13 Commercial Banking1 Leadership positions Lowest net charge-off ratio in peer group6 #1 traditional Middle Market syndicated lender in the U.S.7 #1 multifamily lender in the U.S.8 $mm 2011 2012 2013 Revenue $6,418 $6,825 $6,973 Middle Market 2,803 2,971 3,019 Corp. Client Banking 1,603 1,819 1,824 Comm. Term Lending 1,168 1,194 1,215 Real Estate 416 438 549 Other 428 403 366 Expense 2,278 2,389 2,610 Credit Costs 208 41 85 Net Income $2,367 $2,646 $2,575 Key statistics ($B) Avg Loans $104.2 $120.1 $132.0 EOP Loans 112.0 128.2 137.1 Avg client deposits2 174.7 195.9 198.4 Investment banking revenue, gross3 ($mm) 1,421 1,597 1,676 Allowance for loan losses 2.6 2.6 2.7 Nonaccrual loans 1.1 0.7 0.5 Net charge-off rate4 0.18% 0.03% 0.03% ALL/loans4 2.34% 2.06% 1.97% ROE5 30% 28% 19% Overhead ratio 35% 35% 37% EOP equity $8.0 $9.5 $13.5 39

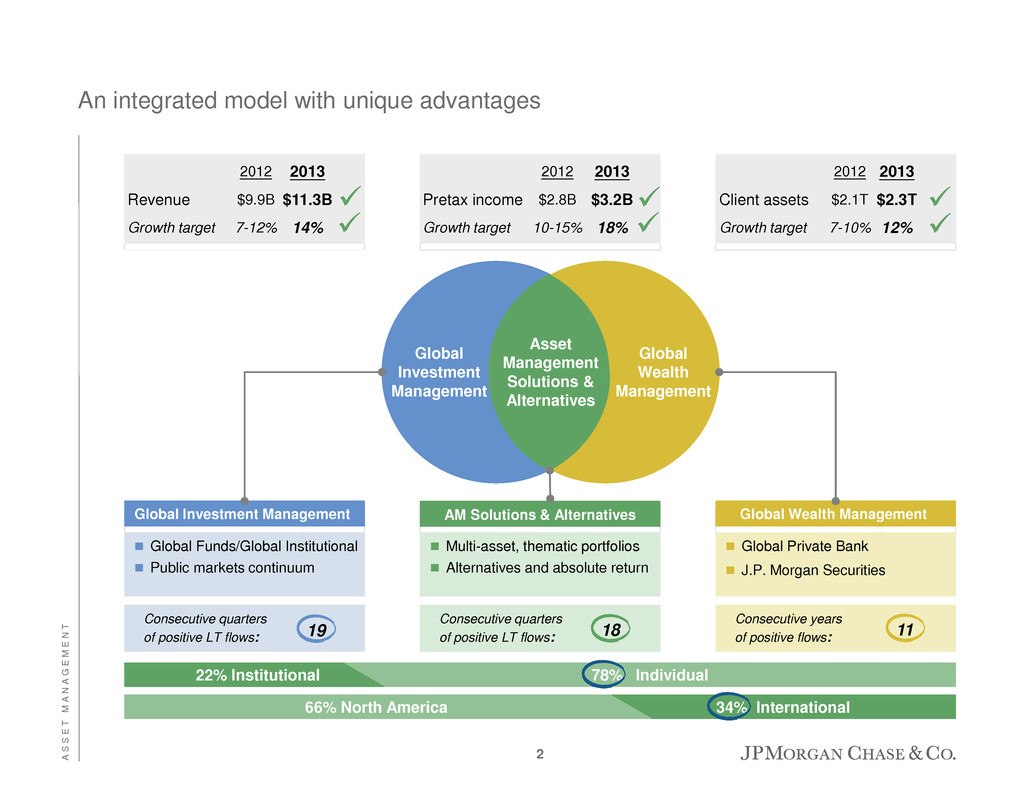

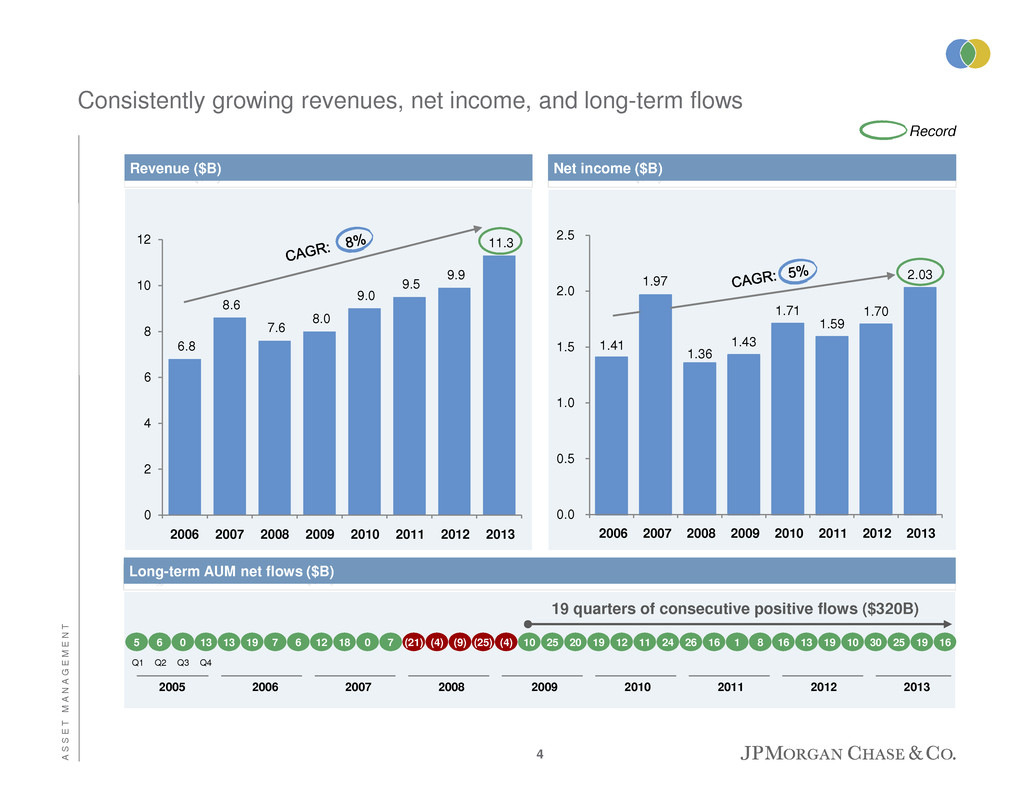

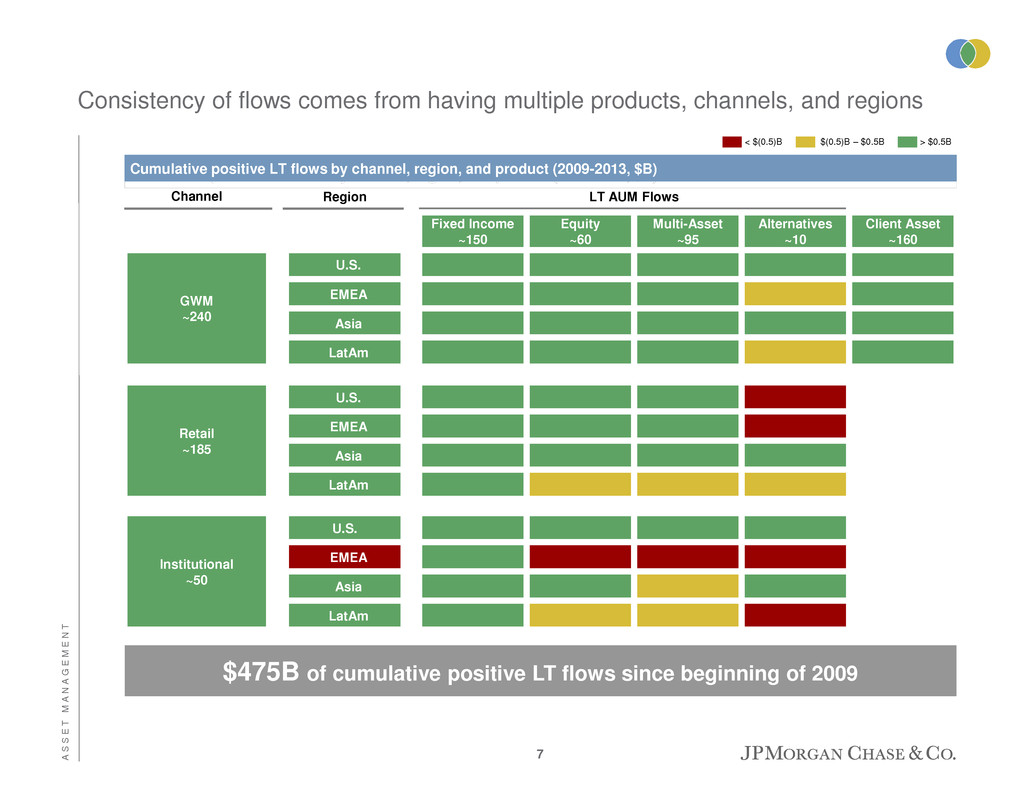

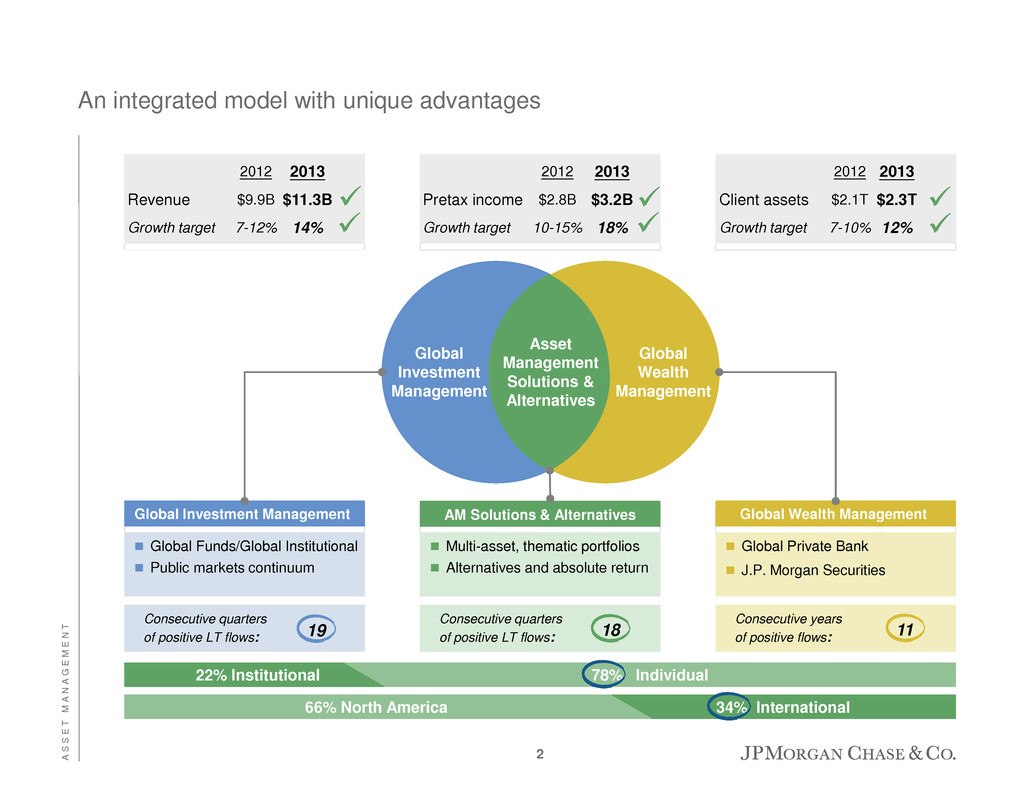

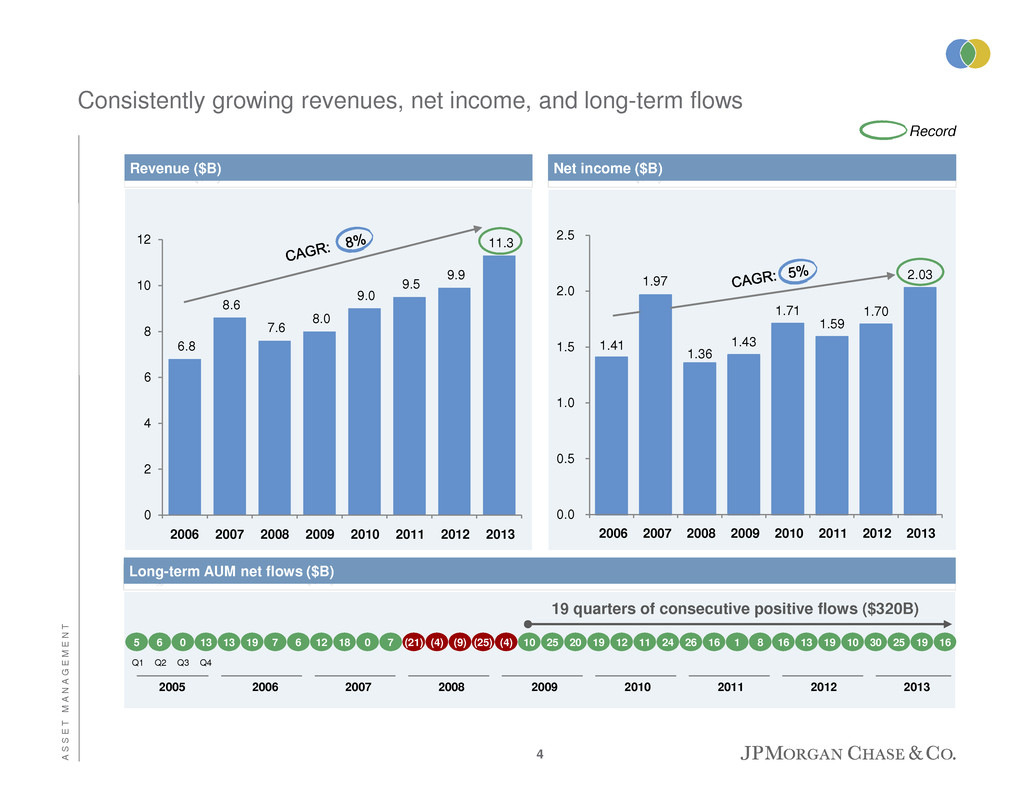

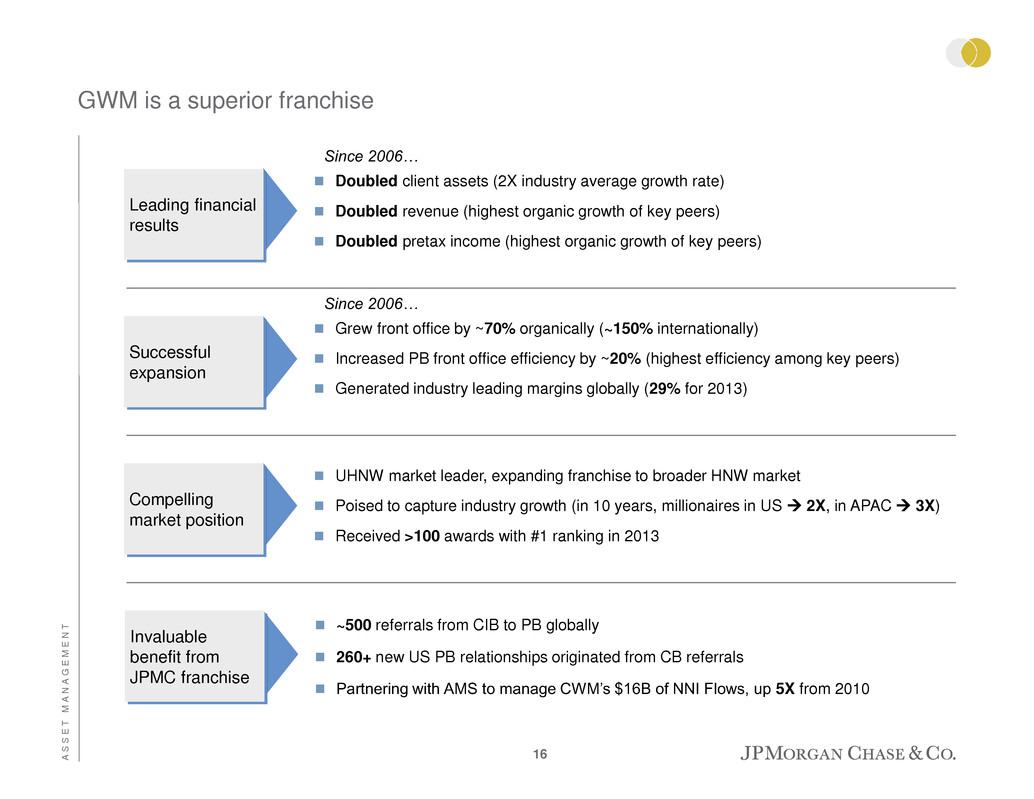

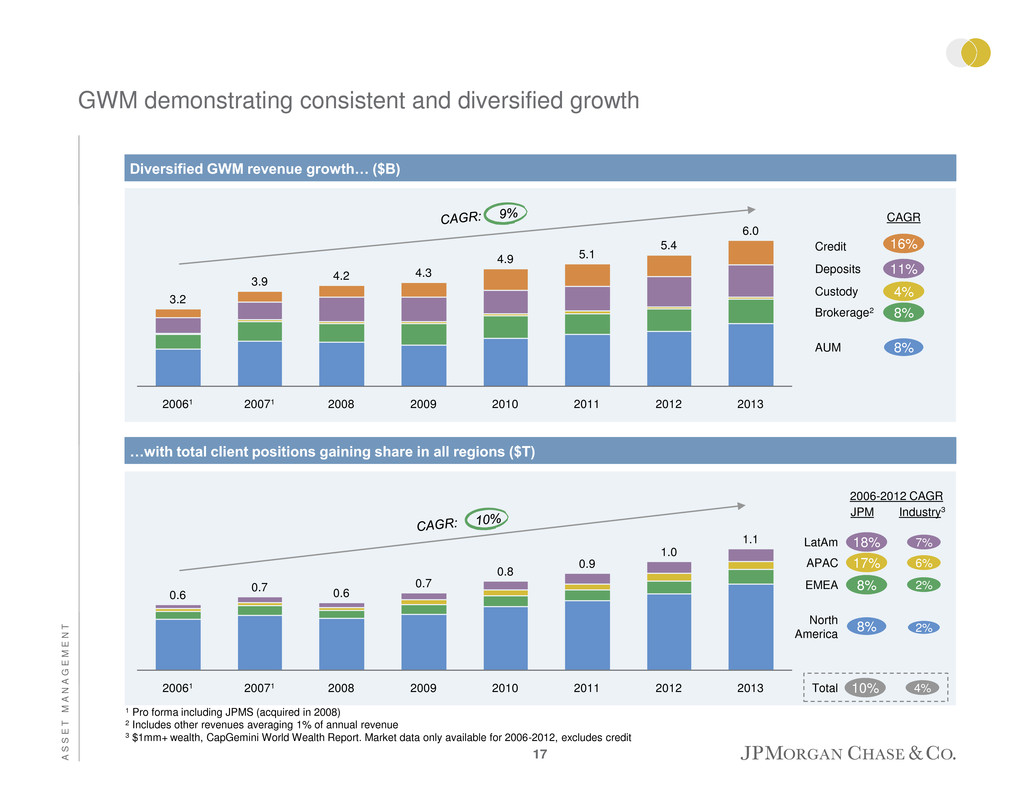

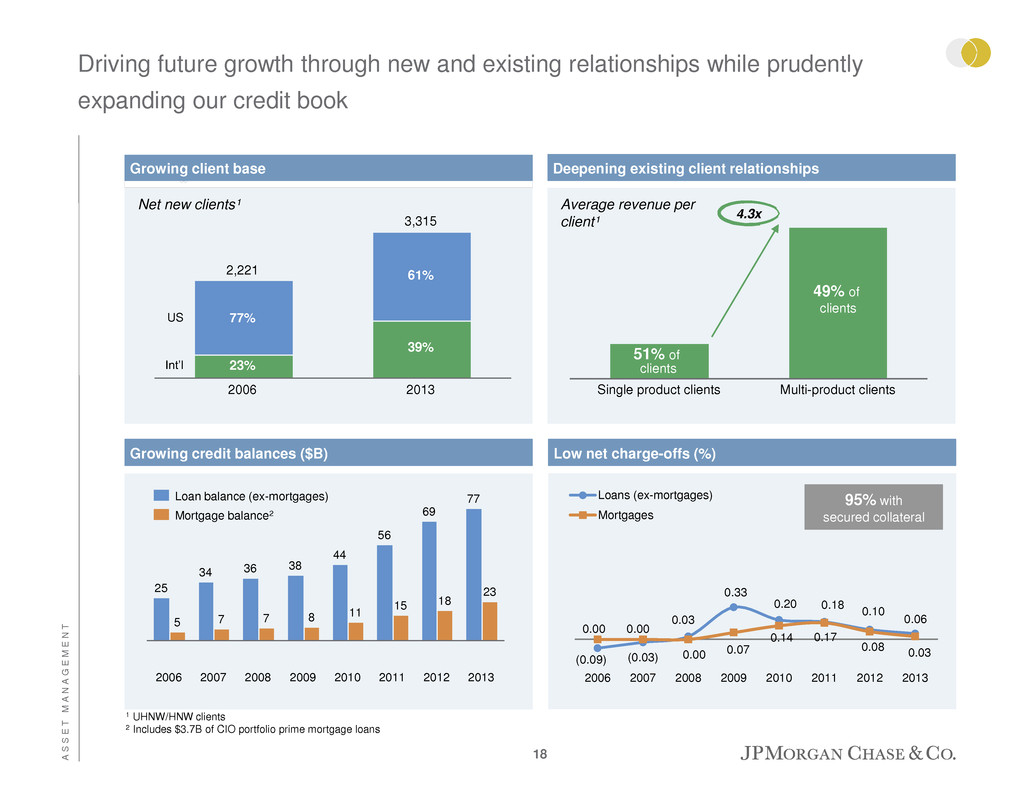

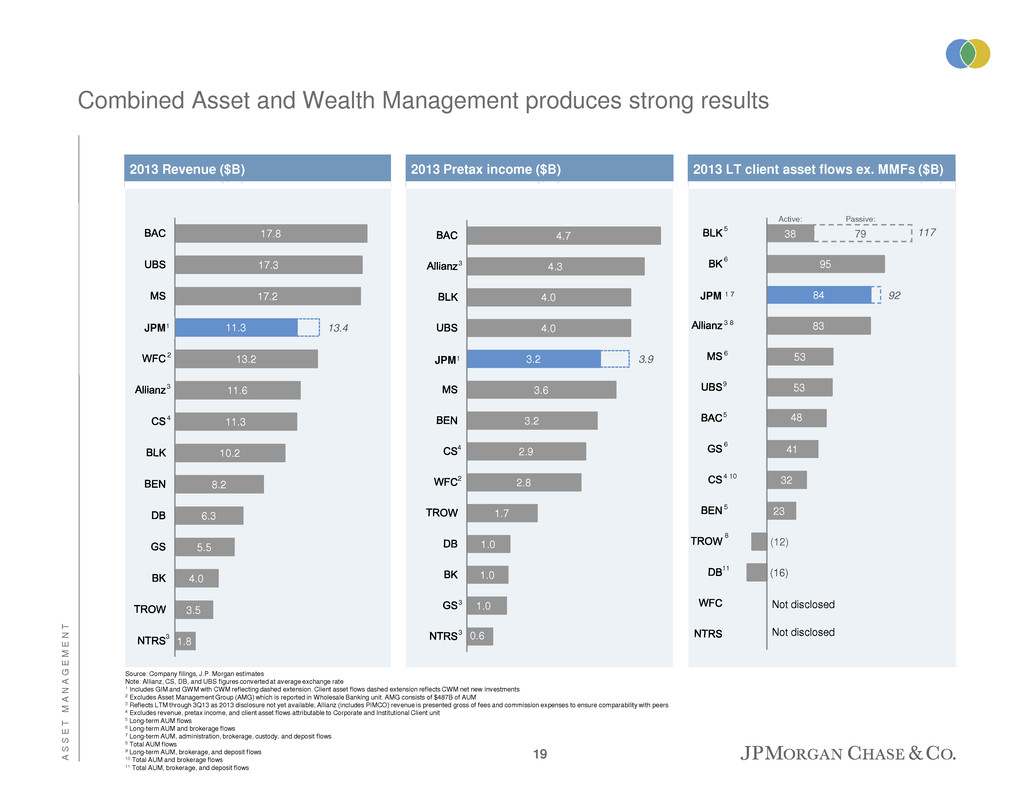

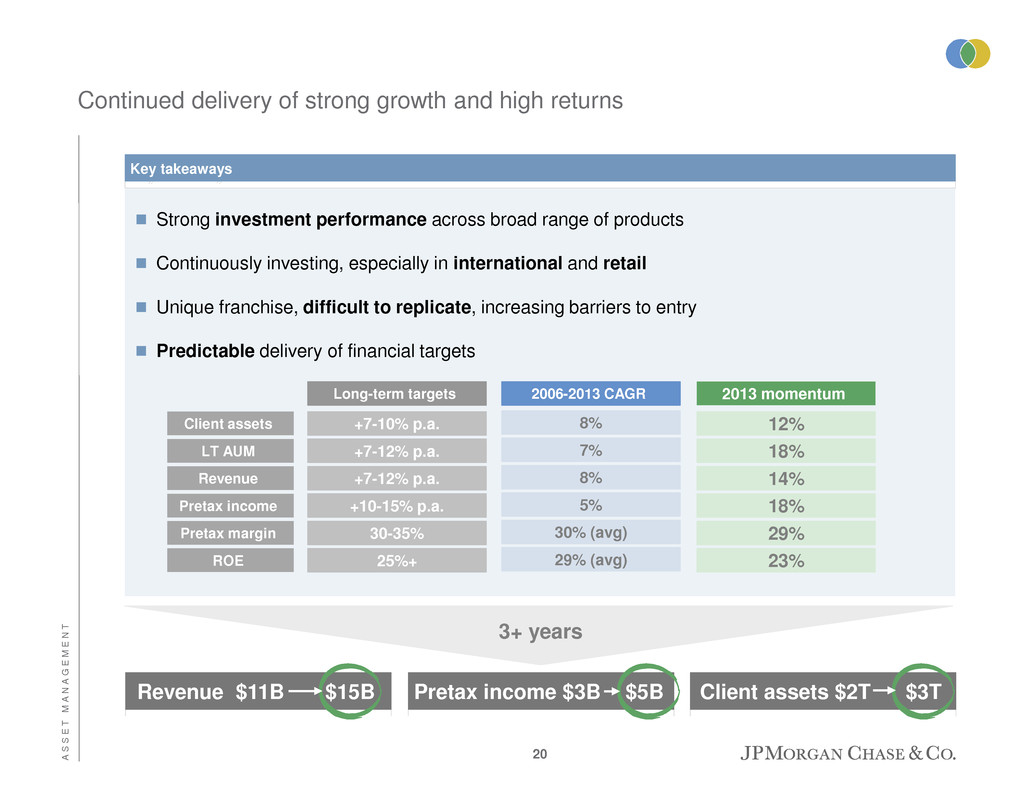

A P P E N D I X – O T H E R Asset Management1 1 See note 1 on slide 48 2 Calculated based on average equity 3 See note 6 on slide 49 4 Source: iMoneyNet, 2013 5 Source: Euromoney, 2013 6 Source: Institutional Investor, 2013 7 Source: Pensions & Investments, 2013 8 Source: Absolute Return, 2013 9 Source: Strategic Insight, 2013 10 Source: Thomson Reuters Extel, 2013 11 Source: The Asset, 2013 $mm Leadership positions #1 Institutional Money Market Fund Manager Worldwide4 #1 Ultra-High-Net-Worth Global Private Bank5 #1 U.S. Mid Cap Value Equity Manager of the Year6 #1 U.S. Real Estate Money Manager7 #2 Hedge Fund Manager8 #1 active equity mutual fund flows in the U.S. and globally9 Top European Buyside Firm10 Best Asset Management Company for Asia11 2011 2012 2013 Revenue $9,543 $9,946 $11,320 Private Banking 5,116 5,426 6,020 Institutional 2,273 2,386 2,536 Retail 2,154 2,134 2,764 Credit Costs $67 $86 $65 Expense 7,002 7,104 8,016 Net Income $1,592 $1,703 $2,031 Key statistics ($B) EOP Equity $6.5 $7.0 $9.0 ROE2 25% 24% 23% Pretax margin3 26 28 29 Assets under management $1,336 $1,426 $1,598 Client assets 1,921 2,095 2,343 Average loans 50.3 68.7 86.1 EOP loans 57.6 80.2 95.4 Average deposits 106.4 129.2 139.7 40

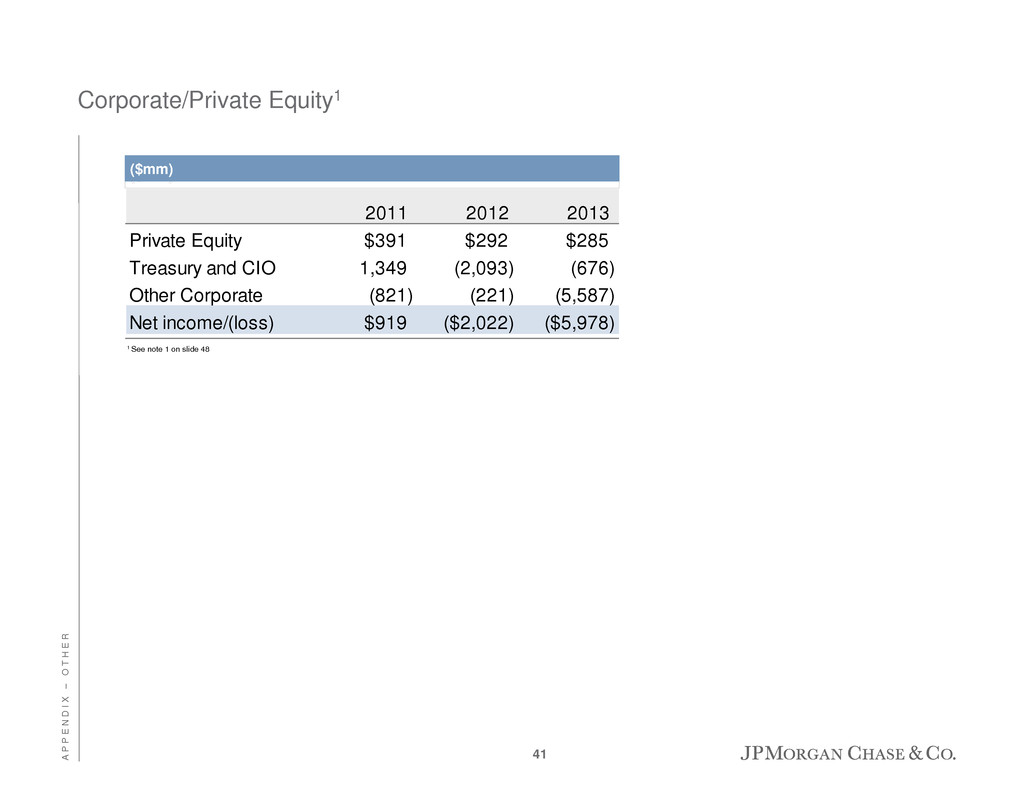

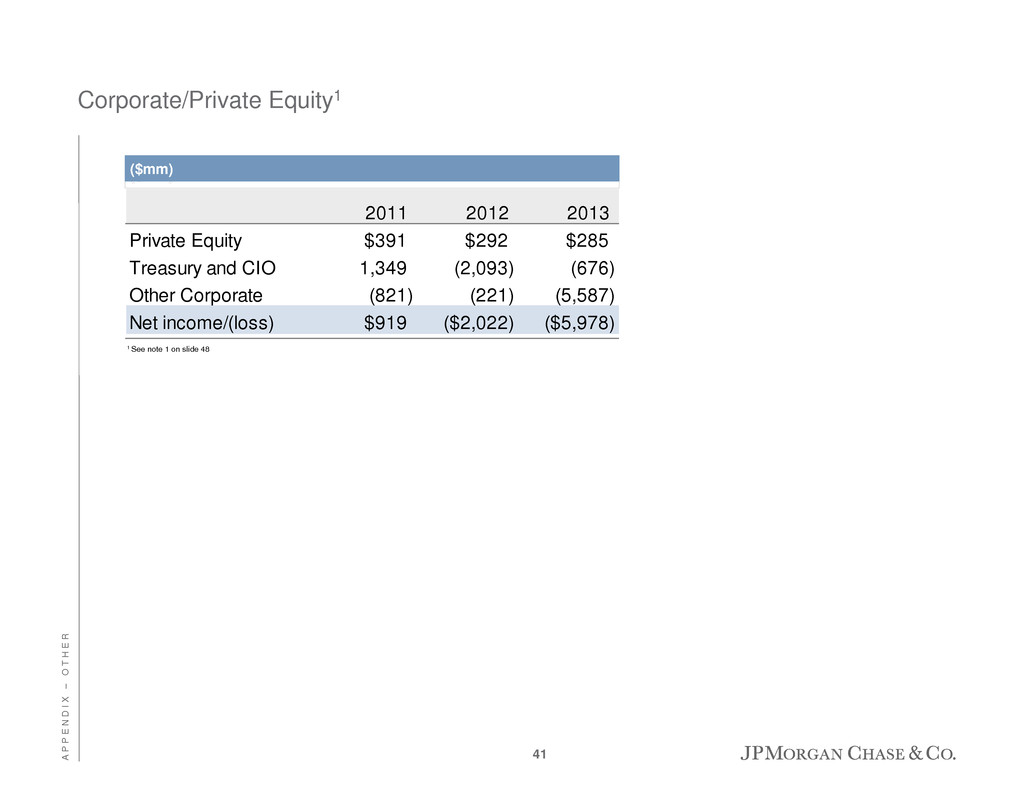

A P P E N D I X – O T H E R Corporate/Private Equity1 1 See note 1 on slide 48 2011 2012 2013 Private Equity $391 $292 $285 Treasury and CIO 1,349 (2,093) (676) Other Corporate (821) (221) (5,587) Net income/(loss) $919 ($2,022) ($5,978) ($mm) 41

A P P E N D I X – O T H E R Notes on slide 4 – Maintain excellent client-based franchises 1. CAGR 2010-2013 for mortgage originations was 2% 2. Represents client deposits and other third-party liabilities 3. Represents total CIB trading and Credit Portfolio VaR 4. As of FY2012 5. By both J.D. Power (April 2013) and the American Customer Satisfaction Index (ACSI) for the second straight year (December 2012 and 2013); Chase ranked #4 by J.D. Power (April 2013) for customer satisfaction in retail banking among large bank peers 6. Based on FDIC 2013 Summary of Deposits survey per SNL Financial 7. Based on disclosures by peers and internal estimates as of 4Q13; based on loans outstanding 8. Dealogic FY2013 wallet rankings for Banking and Coalition 3Q13 YTD rankings for Markets & Investor Services; includes Origination & Advisory, Equities and FICC 9. Dealogic for 2013 (vs. 7.5% in 2012) 10. Rank of JPM Markets and Fixed Income Markets revenue of 10 leading competitors based on reported information, excluding FVA/DVA 11. As of FY2013 12. Based on gross IB fees for SLF, M&A, Equity Underwriting and Bond Underwriting as of FY2013 42

A P P E N D I X – O T H E R Notes on slide 7 – New financial architecture Note: LCR – Liquidity Coverage Ratio; NSFR – Net Stable Funding Ratio; B3T1C – Basel III Tier 1 common CCAR – Comprehensive Capital Analysis Review; SLR – Supplementary Leverage Ratio; OLA – Orderly Liquidity Authority; SPOE – Single Point of Entry 1. Basel rules finalized. U.S. NPR released October 2013; final rule pending 2. Monitor Basel standardized approaches 43

A P P E N D I X – O T H E R Notes on slide 16 – JPMorgan Chase fortress balance sheet 1. In addition to eligible cash included in High Quality Liquid Assets (“HQLA”), cash balance includes non-operational deposits with third party banks and float (considered inflows under Basel III Liquidity Coverage Ratio (“LCR”)), as well as operational cash primarily used for settlement purposes 2. HQLA is the estimated amount of assets the Firm believes will qualify for inclusion in the Basel III LCR 3. The Firm has approximately $282 billion of unencumbered marketable securities, such as equity and fixed income securities available to raise liquidity if required 4. Net of allowance for loan losses 5. Other capital secured financing includes resales, securities borrowed and cash and due from banks from CIB not included in the $881 billion total cash and unencumbered securities 6. Includes CIB trading assets and derivatives receivables 7. Includes other assets, other intangible assets, MSR, premises and equipment, accrued interest and accounts receivable and non-CIB trading assets 8. Includes trading liabilities, Fed funds purchased and securities loaned or sold under repurchase agreements, VIEs, other borrowed funds and other liabilities all in CIB and derivatives payable 9. Includes accounts payable and other liabilities, Fed funds purchased and securities loaned or sold under repurchase agreements and VIEs (excluding CIB) 10. Loan-to-deposit ratio is calculated on a gross loans basis 11. Number of months of pre-funding: the Firm targets pre-funding of the parent holding company to ensure that both contractual and non-contractual obligations can be met for at least 18 months assuming no access to wholesale funding markets 12. Includes wholesale CP funding and a portion of other borrowed funds, which are unsecured 44

A P P E N D I X – O T H E R Notes on slide 17 – Interest-earning assets and deposit growth 1. Includes federal funds sold and securities purchased under resale agreements and securities borrowed 2. MB run-off portfolio includes WaMu purchased credit-impaired, discontinued products, broker originated loans, limited documentation loans, and certain loans with effective combined loan to value ratios greater than 80% 3. Other includes Card run-off portfolio, including certain legacy WaMu loans, legacy balance transfer programs and terminated partner portfolios (e.g., Kohl’s), and CBB run-off portfolio, including discontinued products 4. Includes Wholesale loans originated by AM and other Wholesale loans that are held in Corporate 5. Includes CBB, MB and Card, Merchant Services & Auto loans and prime mortgage loans held by AM and Corporate that are classified as Consumer loans (classification is consistent with SEC filings) 6. Includes trading assets (debt instruments) and other assets (incl. margin loans) 7. Will depend on decisions to retain or sell mortgage loans 45

A P P E N D I X – O T H E R Notes on slide 19 – Credit quality trends 1. Card, Merchant Services & Auto 2. 2012 NPLs are impacted by regulatory guidance issued in the first quarter of 2012 as a result of which the Firm began reporting performing junior liens that are subordinate to nonaccrual senior liens as nonaccrual loans and by regulatory guidance issued in the third quarter of 2012 requiring loans not reaffirmed by the borrower and discharged under Chapter 7 bankruptcy to be reported as nonaccrual loans. For reference, reported NPLs were $14,841mm, $9,993mm, $10,892mm and $8,540mm for 2010, 2011, 2012 and 2013, respectively 3. Represents Real Estate Portfolios (“REP”) only; excludes the impact of purchased credit-impaired loans acquired as part of the WaMu transaction 4. Excludes a one-time $632mm adjustment related to the timing of when the Firm recognizes charge-offs on delinquent loans 5. Excludes the effect of incremental net charge-offs based on regulatory guidance 6. Excludes PCI write-offs of $53mm 7. Represents Credit Card only; excludes loans held-for-sale 8. Based on peak levels of NCOs and reported NPLs in 3Q09 9. Represents net reduction to reserves 46

A P P E N D I X – O T H E R Notes on slide 20 – Net charge-off trends and estimates 1. Represents Real Estate Portfolios (“REP”) only; excludes the impact of purchased credit-impaired loans acquired as part of the WaMu transaction 2. Excludes PCI write-offs of $53mm 3. TTC NCO rate of 0.25%+/- will depend on portfolio mix of mortgage and home equity 4. Excludes loans held-for-sale 5. CBB reported NCO rate was 1.79% in 2013 and 2.13% in 4Q13, including Business banking and the impact of retail overdraft losses 6. Includes mortgages originated in PB but held in CIO 47

A P P E N D I X – O T H E R Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews the Firm’s results and the results of the lines of business on a “managed” basis, which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm (and each of the business segments) on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from investments that receive tax credits and tax exempt securities is presented in the managed results on a basis comparable to taxable securities and investments. This non-GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. 2. The Firm presents revenue, credit costs, expense, net income and earnings per share excluding certain reported significant items. These measures should be viewed in addition to, and not as a substitute for, the Firm’s reported results. Management believes this information helps investors understand the effect of these items on reported results and provides an additional presentation of the Firm's performance. The tables below provide a reconciliation of reported results to these non-GAAP measures. Notes 48 2013 Revenue Credit costs Expense Net income Reported EPS Reported $99,798 ($225) ($70,467) $17,923 $4.35 Adjustments: Gain on sale of Visa shares (1,310) (812) (0.21) Gain on sale of One Chase Manhattan Plaza (493) (306) (0.08) FVA/DVA 1,912 1,221 0.31 Reduced reserves in CCB (5,500) (3,409) (0.86) Firmwide legal expense (a) 847 1,052 0.27 Corporate legal expense (b) 9,720 7,572 1.92 Adjusted $99,907 ($5,725) ($59,900) $23,241 $5.70 (a) 4Q13 (b) 2Q13 and 3Q13 2012 Revenue Credit costs Expense Net income Reported EPS Reported $99,890 ($3,385) ($64,729) $21,284 $5.20 Adjustments: WaMu bankruptcy settlement - Merger-related (1,126) (687) (0.17) DVA 930 577 0.15 CIO trading losses 5,787 3,588 0.90 CIO s curiti gai s (1,013) (628) (0.16) Tr sury xting ishment gains on redeemed TruPS (888) (551) (0.14) Merger-related – Maiden Lane B-Note (545) (338) (0.08) Reduced reserves in CCB (4,625) (2,867) (0.72) Foreclosure-related matters 900 558 0.14 Corporate legal expense 3,198 1,983 0.50 Benefit from tax adjustments (620) (0.16) Adjusted $103,035 ($8,010) ($60,631) $22,299 $5.46

A P P E N D I X – O T H E R Notes on non-GAAP financial measures (cont'd) 3. Adjusted expense, a non-GAAP financial measure, excludes firmwide legal expense and expense related to foreclosure-related matters (“FRM”). Where indicated, this definition formerly only excluded Corporate legal expense and disclosed FRM. Management believes this information helps investors understand the effect of these items on reported results and provides an alternate presentation of the Firm’s performance. 4. Tangible common equity (“TCE”), return on tangible common equity (“ROTCE”), tangible book value per share (“TBVPS”), Tier 1 common under Basel I and III rules, Tier 1 capital under Basel III rules, and the supplementary leverage ratio (“SLR”) are each non-GAAP financial measures. TCE represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. ROTCE measures the Firm’s earnings as a percentage of TCE. TBVPS represents the Firm’s tangible common equity divided by period-end common shares. Tier 1 common under Basel I and III rules, and Tier 1 capital and the SLR under Basel III rules, are used by management, bank regulators, investors and analysts to assess and monitor the Firm’s capital position and liquidity. TCE, ROTCE, and TBVPS are meaningful to the Firm, as well as analysts and investors in assessing the Firm’s use of equity. For additional information on Tier 1 common under Basel I and III, and Tier 1 capital and the SLR under Basel III rules, see Regulatory capital on pages 161-165 of JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2013. All of the aforementioned measures are useful to the Firm, as well as analysts and investors, in facilitating comparisons of the Firm with competitors. 5. CIB provides several non-GAAP financial measures which exclude the impact of FVA (effective Q4 2013) and DVA on: net revenue, net income, overhead ratio, compensation ratio and return on equity. Further, the impact of FVA/DVA is excluded from the calculation of the firmwide overhead ratio. These measures are used by management to assess the underlying performance of the business and for comparability with peers. The ratio for the allowance for loan losses to period-end loans is calculated excluding the impact of trade finance loans and consolidated Firm-administered multi- seller conduits, to provide a more meaningful assessment of CIB’s allowance coverage ratio. Additional notes on financial measures 6. Pretax margin represents income before income tax expense divided by total net revenue, which is, in management’s view, a comprehensive measure of pretax performance derived by measuring earnings after all costs are taken into consideration. It is, therefore, another basis that management uses to evaluate the performance of AM against the performance of their respective peers. Notes 49

February 25, 2014 C O N S U M E R & C O M M U N I T Y B A N K I N G Gordon Smith, Chief Executive Officer Consumer & Community Banking

Agenda Page C O N S U M E R & C O M M U N I T Y B A N K I N G 1 Consumer & Community Banking 1 Consumer & Business Banking 17 Mortgage Banking 31 Card Services 48 Appendix 68

C O N S U M E R & C O M M U N I T Y B A N K I N G The Chase Consumer & Community Banking (“CCB”) franchise has leadership positions across all its businesses FY 2013 ROE: CCB: 23%; Consumer & Business Banking (“CBB”): 26%; Mortgage Banking: 16%; Card, Merchant Services & Auto: 31% Strong financial returns Chase Private Client integration with J.P. Morgan Private Bank investments platform Business Banking access to Commercial Bank specialty lending and Treasury Services Firmwide capabilities to meet customer needs Branch network concentrated in the highest growth U.S. markets #1 ATM and #2 retail branch network for the 2nd year in a row2 Attractive footprint #1 online financial services destination (Chase.com)3 and #1 mobile banking functionality4 Leading position in digital banking #1 in total U.S. credit and debit payments volume5 #2 wholly-owned merchant acquirer6 Proprietary end-to-end payments solution World-class payments franchise #1 credit card issuer in the U.S. based on loans outstanding7 and #1 U.S. co-brand credit card issuer7 #2 mortgage originator8 and servicer8 #3 non-captive auto lender9 National, scale lending businesses Powerful customer franchise Consumer relationships with almost half of U.S. households #1 in customer satisfaction among the largest banks for the 2nd year in a row1 Note: For footnoted information, refer to Appendix 2

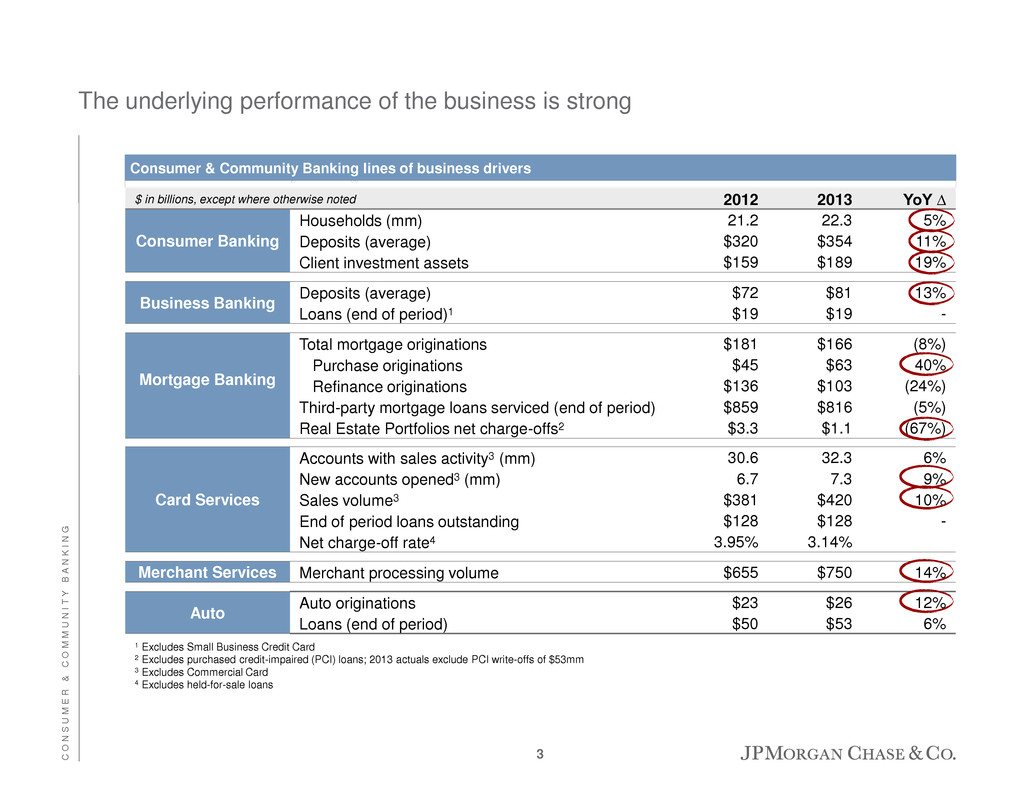

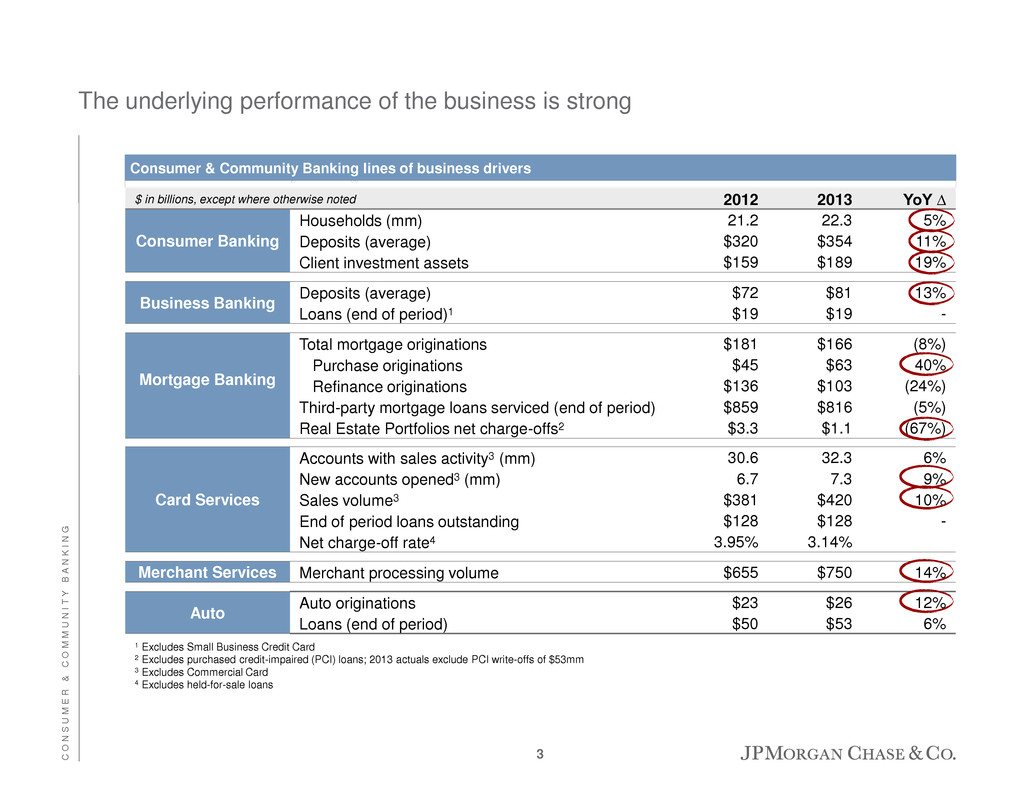

C O N S U M E R & C O M M U N I T Y B A N K I N G The underlying performance of the business is strong $ in billions, except where otherwise noted 2012 2013 YoY ∆ Consumer Banking Households (mm) 21.2 22.3 5% Deposits (average) $320 $354 11% Client investment assets $159 $189 19% Business Banking Deposits (average) $72 $81 13% Loans (end of period)1 $19 $19 - Mortgage Banking Total mortgage originations $181 $166 (8%) Purchase originations $45 $63 40% Refinance originations $136 $103 (24%) Third-party mortgage loans serviced (end of period) $859 $816 (5%) Real Estate Portfolios net charge-offs2 $3.3 $1.1 (67%) Card Services Accounts with sales activity3 (mm) 30.6 32.3 6% New accounts opened3 (mm) 6.7 7.3 9% Sales volume3 $381 $420 10% End of period loans outstanding $128 $128 - Net charge-off rate4 3.95% 3.14% Merchant Services Merchant processing volume $655 $750 14% Auto Auto originations $23 $26 12% Loans (end of period) $50 $53 6% 1 Excludes Small Business Credit Card 2 Excludes purchased credit-impaired (PCI) loans; 2013 actuals exclude PCI write-offs of $53mm 3 Excludes Commercial Card 4 Excludes held-for-sale loans Consumer & Community Banking lines of business drivers 3

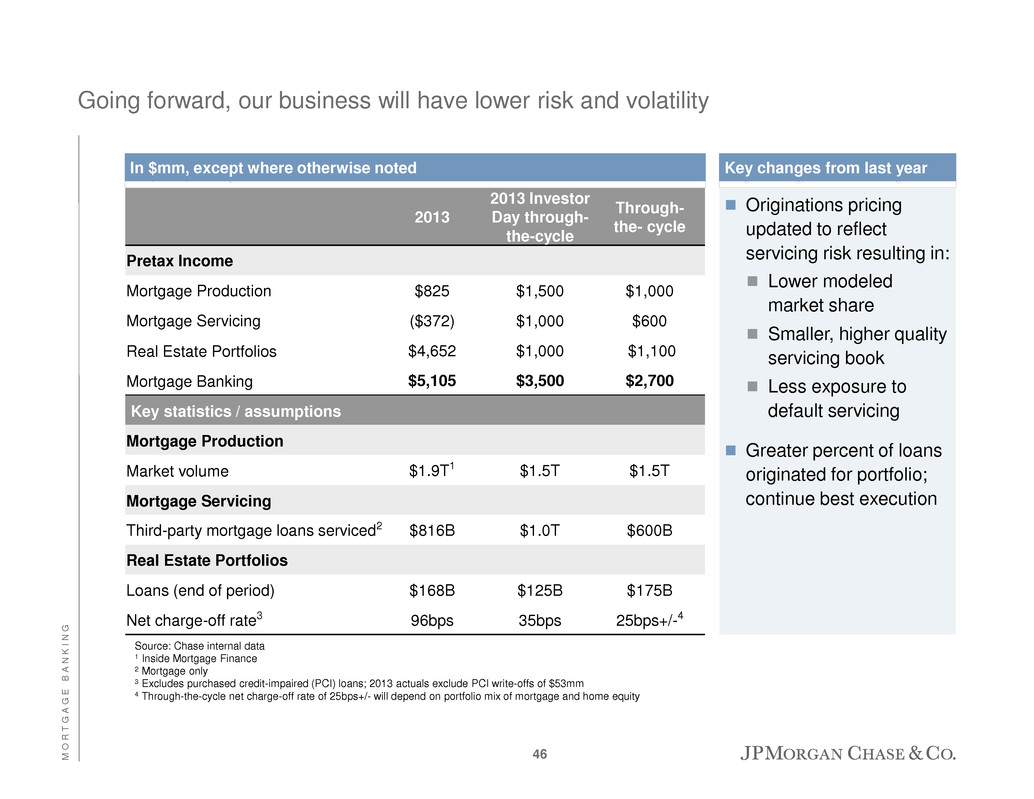

C O N S U M E R & C O M M U N I T Y B A N K I N G Performance targets Consumer & Community Banking 2013 actuals 2013 Investor Day targets Targets Consumer & Business Banking ROE 26% 30% + 30% + Mortgage Banking Net charge-off rate1 0.96% 0.35% +/- 0.25% +/-2 ROE 16% 15% +/- 15% +/-3 Card Services Revenue margin 12.49% 12.0-12.5% 12.0-12.5% Net charge-off rate4 3.14% 4.0% +/- 3.75% +/- ROE 34% 23% +/- 20% +/- Auto Finance ROE 26% 18% +/- 16% +/- Consumer & Community Banking ROE 23% 20% + 20% + Source: Chase internal data 1 Real Estate Portfolios only, excluding purchased credit-impaired (PCI) loans; 2013 actuals exclude PCI write-offs of $53mm 2 Through-the-cycle net charge-off rate of 0.25% +/- will depend on portfolio mix of mortgage and home equity 3 Target ROE excludes liquidating real estate portfolios 4 Excludes held-for-sale loans 4

C O N S U M E R & C O M M U N I T Y B A N K I N G We have exceeded our 2013 targets and are updating 2014 targets Mortgage Banking Consumer & Business Banking Card, Merchant Services & Auto 2013 Investor Day targets ~3% expense growth in 2013 3-4K1 headcount reduction by YE 2014 Full year expense down $3B in 2014 vs. 2012 13-15K1 headcount reduction by YE 2014 2013 performance 2.7% expense growth in 2013 Reduced headcount by 5.5K1 in 2013 Reduced $1.5B in expense in 2013 Reduced headcount by 11K1,2 in 2013 ~1% expense growth in 2014 ~2K1 headcount reduction in 2014 2014 updated targets While we continue to control costs, we also continue to invest in the business Source: Chase internal data 1 Includes employees and contractors 2 2013 headcount reduction of 11K includes 1,250 effective January 1, 2014 3 Includes reductions of ~$0.4B related to litigation and ~$0.3B related to foreclosure-related matters Expense reduction of ~$2B3 from 2013 to 2014 ~6K1 headcount reduction in 2014 5

C O N S U M E R & C O M M U N I T Y B A N K I N G Reduce cost-to-serve through use of digital channels and self-service for transactional needs Automate manual controls and processes Simplify our business through exit of non-core products Further consolidate operating centers Continue optimizing our branch network and operating model based on customer needs and branch usage trends Consolidate and rationalize vendors Continue to actively manage down mortgage default inventory Key expense reduction initiatives across CCB We expect to exit 2016 with expense ~$2B lower than 2014 expense 6

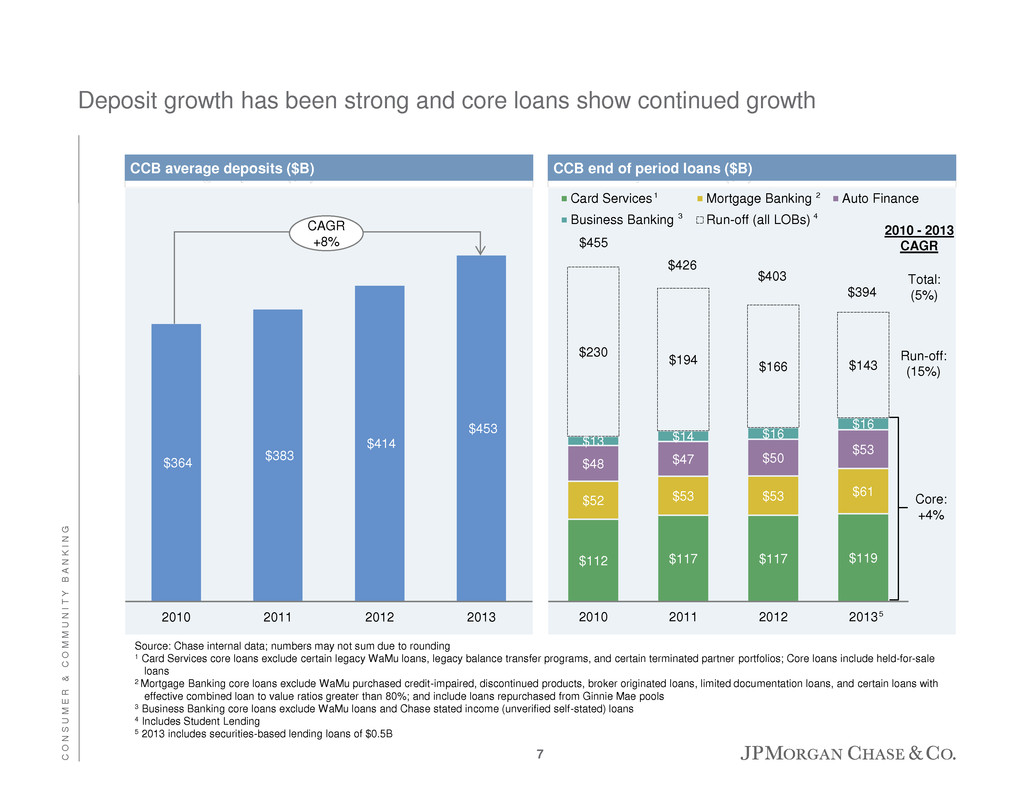

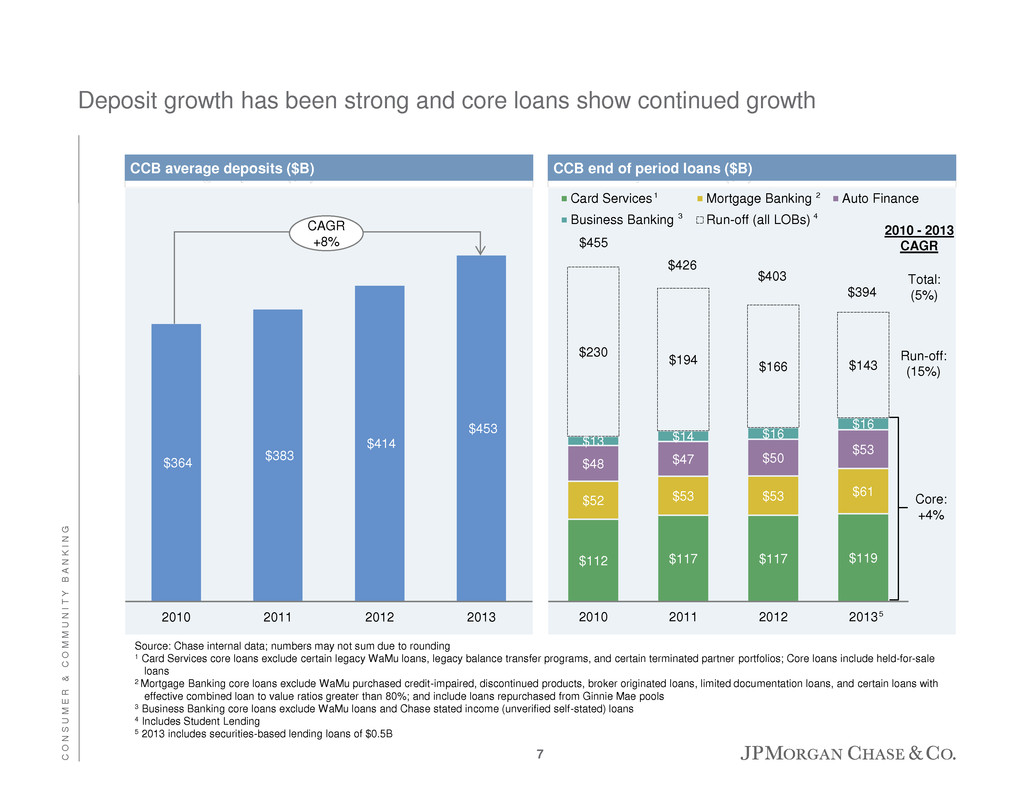

C O N S U M E R & C O M M U N I T Y B A N K I N G Deposit growth has been strong and core loans show continued growth $364 $383 $414 $453 2010 2011 2012 2013 CCB average deposits ($B) CAGR +8% CCB end of period loans ($B) $112 $117 $117 $119 $52 $53 $53 $61 $48 $47 $50 $53 $13 $14 $16 $16 $230 $194 $166 $143 2010 2011 2012 2013 Card Services Mortgage Banking Auto Finance Business Banking Run-off (all LOBs) 1 2 3 $455 $426 $403 $394 2010 - 2013 CAGR Run-off: (15%) 4 Source: Chase internal data; numbers may not sum due to rounding 1 Card Services core loans exclude certain legacy WaMu loans, legacy balance transfer programs, and certain terminated partner portfolios; Core loans include held-for-sale loans 2 Mortgage Banking core loans exclude WaMu purchased credit-impaired, discontinued products, broker originated loans, limited documentation loans, and certain loans with effective combined loan to value ratios greater than 80%; and include loans repurchased from Ginnie Mae pools 3 Business Banking core loans exclude WaMu loans and Chase stated income (unverified self-stated) loans 4 Includes Student Lending 5 2013 includes securities-based lending loans of $0.5B 5 Core: +4% Total: (5%) 7

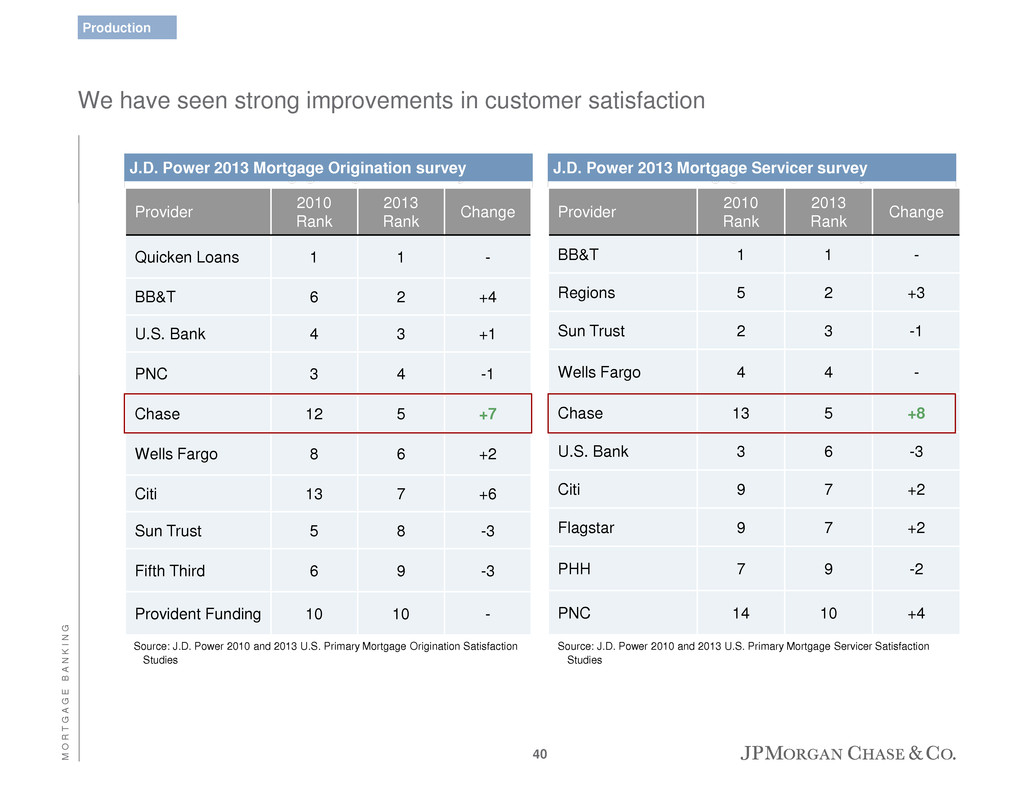

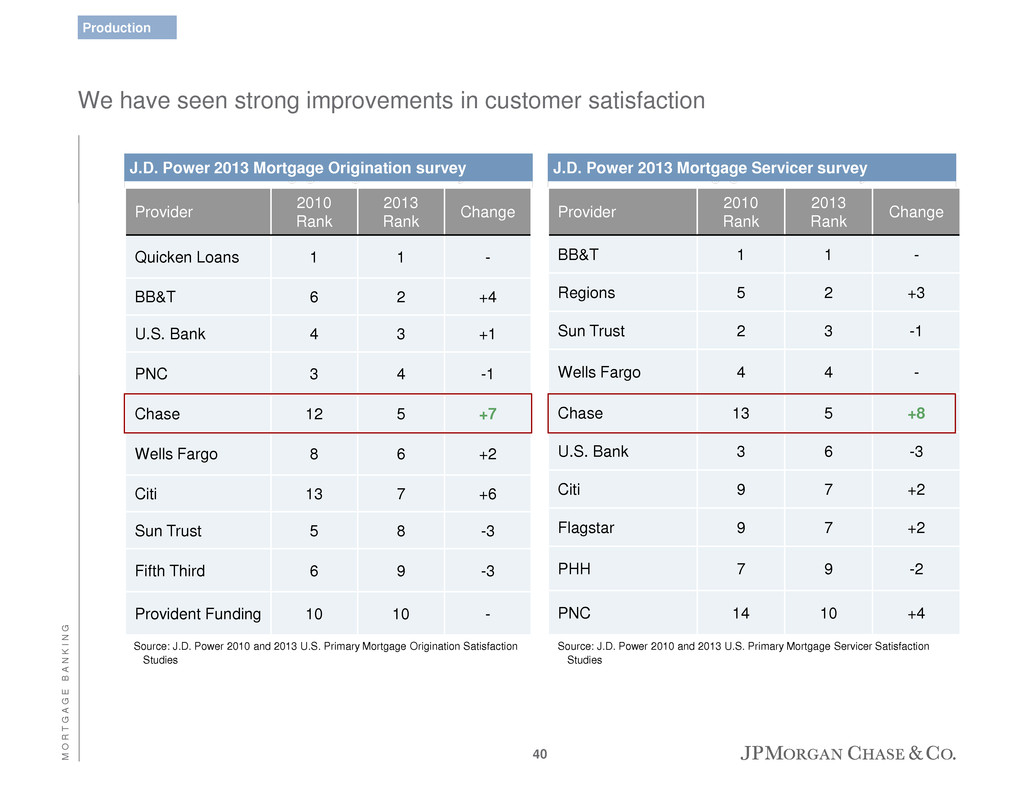

C O N S U M E R & C O M M U N I T Y B A N K I N G Customer experience continues to improve… Net promoter scores1 S e p-1 1 Dec-1 1 M a r- 1 2 Ju n -1 2 S e p -1 2 Dec-1 2 M a r- 1 3 J u n -1 3 S e p -1 3 Dec-1 3 Consumer Banking Business Banking Card Mortgage Originations J.D. Power rankings 42 23 61 43 6 32 61 70 Line of Business 2010 rank 2013 rank Retail Banking2 #13 #4 Small Business3 #22 #1 in West, Midwest, and South #5 in Northeast Credit Card4 #5 #3 Mortgage Banking5 Originations: #12 Servicing: #13 Originations: #5 Servicing: #5 Note: For footnoted information, refer to Appendix 8

C O N S U M E R & C O M M U N I T Y B A N K I N G 2010 2011 2012 2013 Source: Chase internal data 1 Includes households with Chase Liquid® cards 2 Reflects accounts that had sales activity during the year; excludes Commercial Card and certain terminated partner portfolios 3 Includes households that close all Chase accounts; average of annualized monthly attrition rate over 12 months …resulting in deeper relationships and lower attrition with existing customers Household attrition rates3 Business Banking Consumer Banking Card 2010 2013 Net new investments per investment household 2010 2011 2012 2013 Average deposit and investment balance per household1 2010 2011 2012 2013 Credit card spend per account2 CAGR +6% CAGR +77% CAGR +8% (5) ppt (4) ppt (2) ppt 9

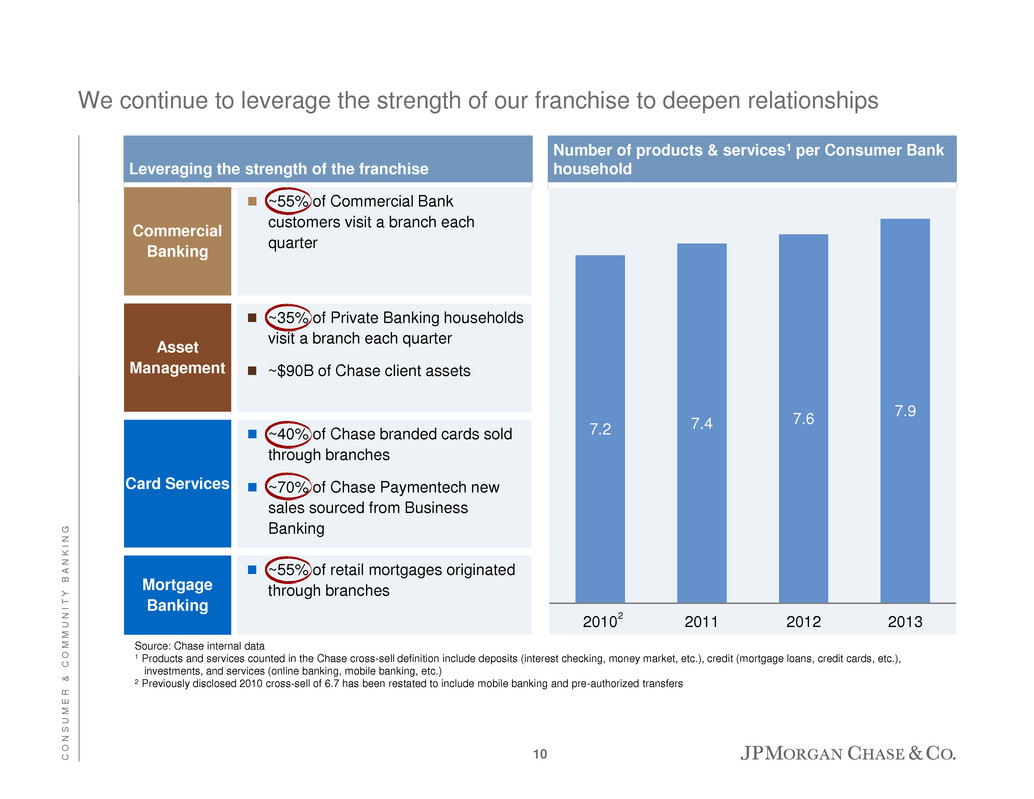

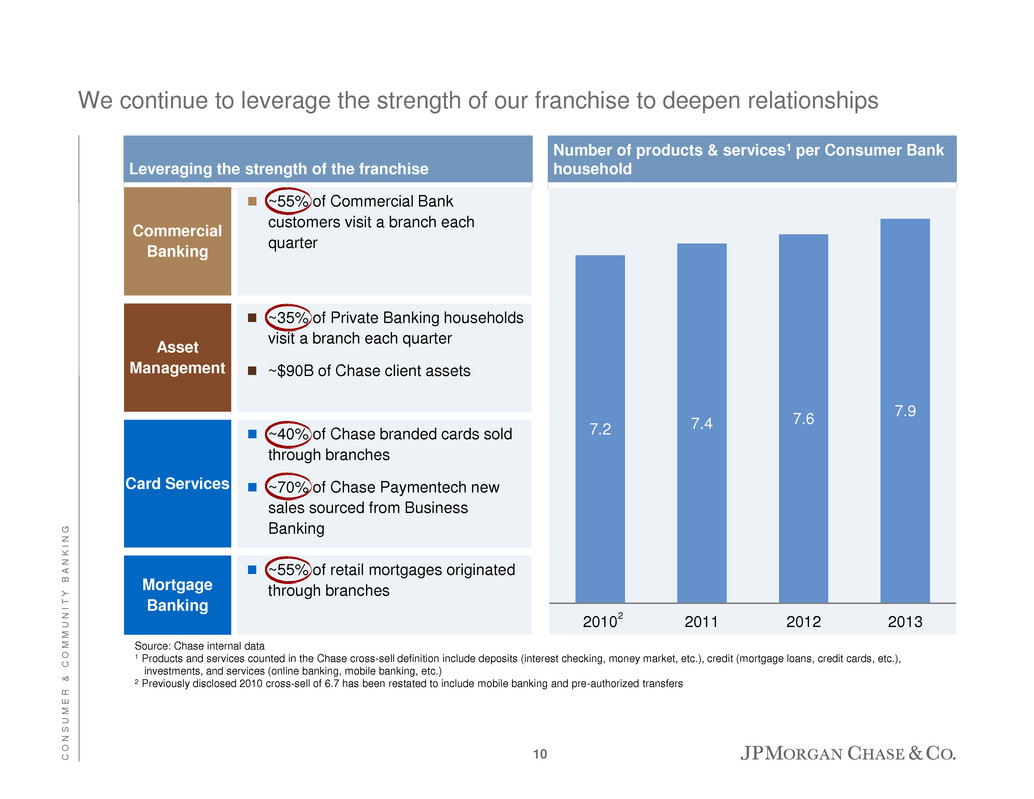

C O N S U M E R & C O M M U N I T Y B A N K I N G Source: Chase internal data 1 Products and services counted in the Chase cross-sell definition include deposits (interest checking, money market, etc.), credit (mortgage loans, credit cards, etc.), investments, and services (online banking, mobile banking, etc.) 2 Previously disclosed 2010 cross-sell of 6.7 has been restated to include mobile banking and pre-authorized transfers Number of products & services1 per Consumer Bank household 7.2 7.4 7.6 7.9 2010 2011 2012 2013 2 We continue to leverage the strength of our franchise to deepen relationships Leveraging the strength of the franchise Mortgage Banking ~55% of retail mortgages originated through branches Card Services ~40% of Chase branded cards sold through branches ~70% of Chase Paymentech new sales sourced from Business Banking Commercial Banking ~55% of Commercial Bank customers visit a branch each quarter Asset Management ~35% of Private Banking households visit a branch each quarter ~$90B of Chase client assets 10

C O N S U M E R & C O M M U N I T Y B A N K I N G We are responding to the current environment… Established Controls organization Significant investments to ensure quality Disciplined focus on distinct customer segments Rationalizing the cost structure Continuing to strengthen controls Digital self-service Optimize branch network Less density Smaller branches Automation of processes and controls Fewer people Simplifying our product offering Products targeted to specific market segments Exiting products non-core to our customers and de- risking through client exits Less than $100mm reduction in pretax income 11

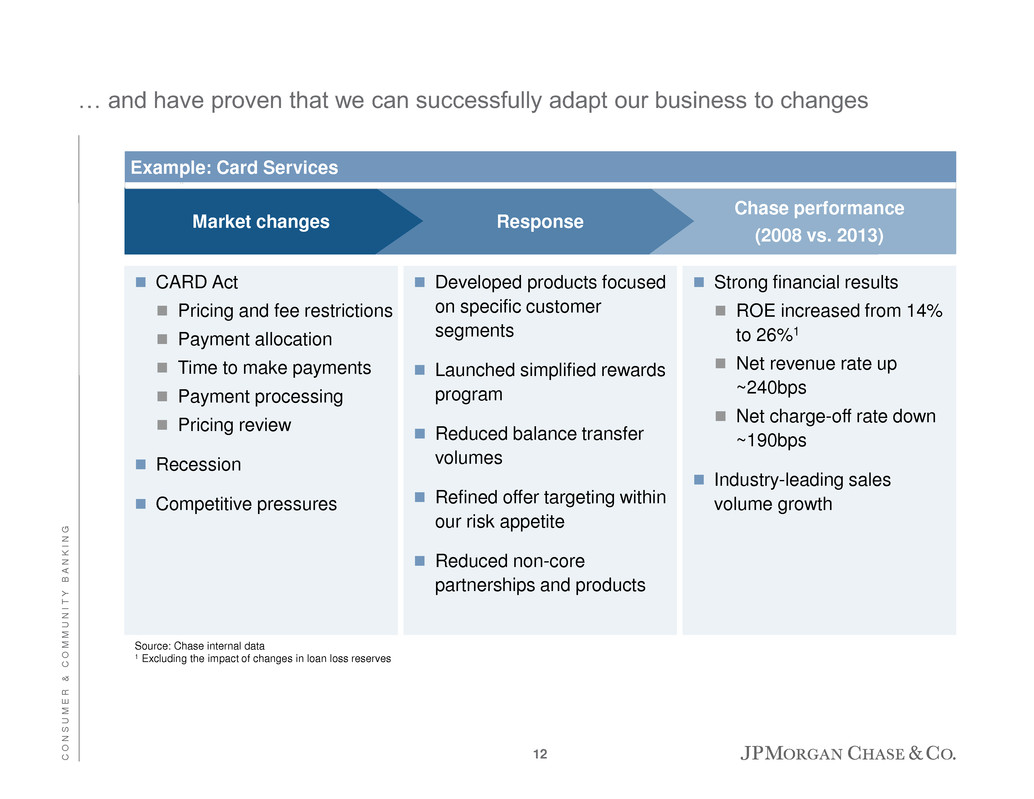

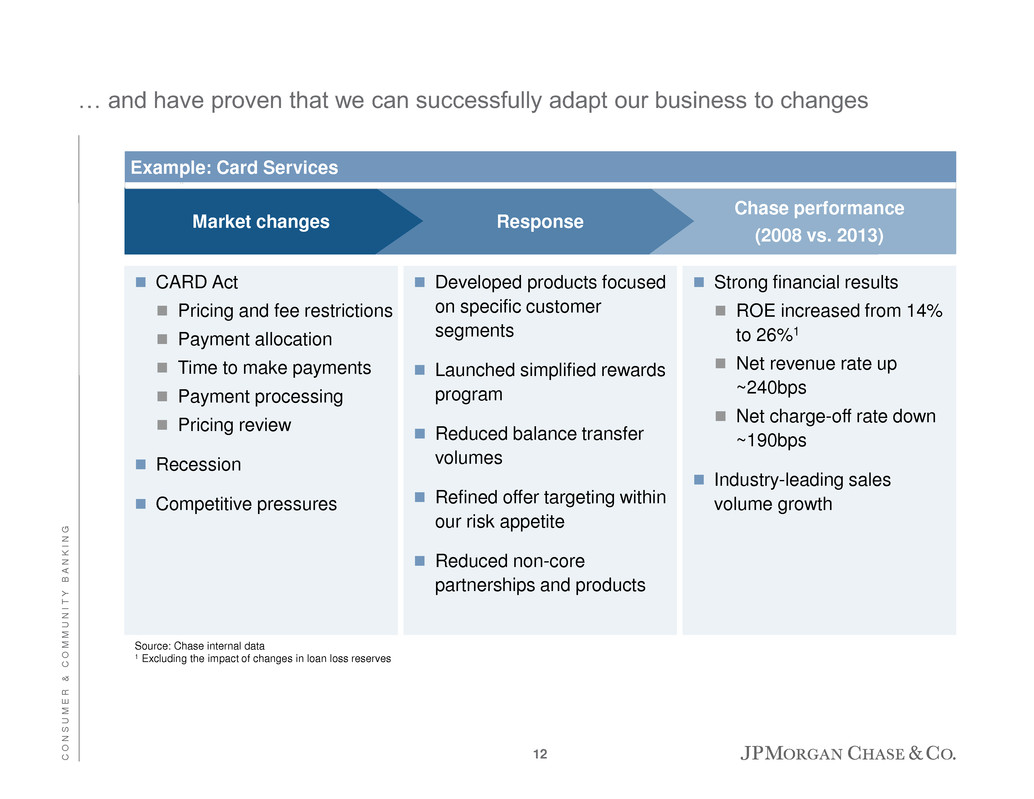

C O N S U M E R & C O M M U N I T Y B A N K I N G … and have proven that we can successfully adapt our business to changes Market changes Response Chase performance (2008 vs. 2013) CARD Act Pricing and fee restrictions Payment allocation Time to make payments Payment processing Pricing review Recession Competitive pressures Strong financial results ROE increased from 14% to 26%1 Net revenue rate up ~240bps Net charge-off rate down ~190bps Industry-leading sales volume growth Developed products focused on specific customer segments Launched simplified rewards program Reduced balance transfer volumes Refined offer targeting within our risk appetite Reduced non-core partnerships and products Source: Chase internal data 1 Excluding the impact of changes in loan loss reserves Example: Card Services 12

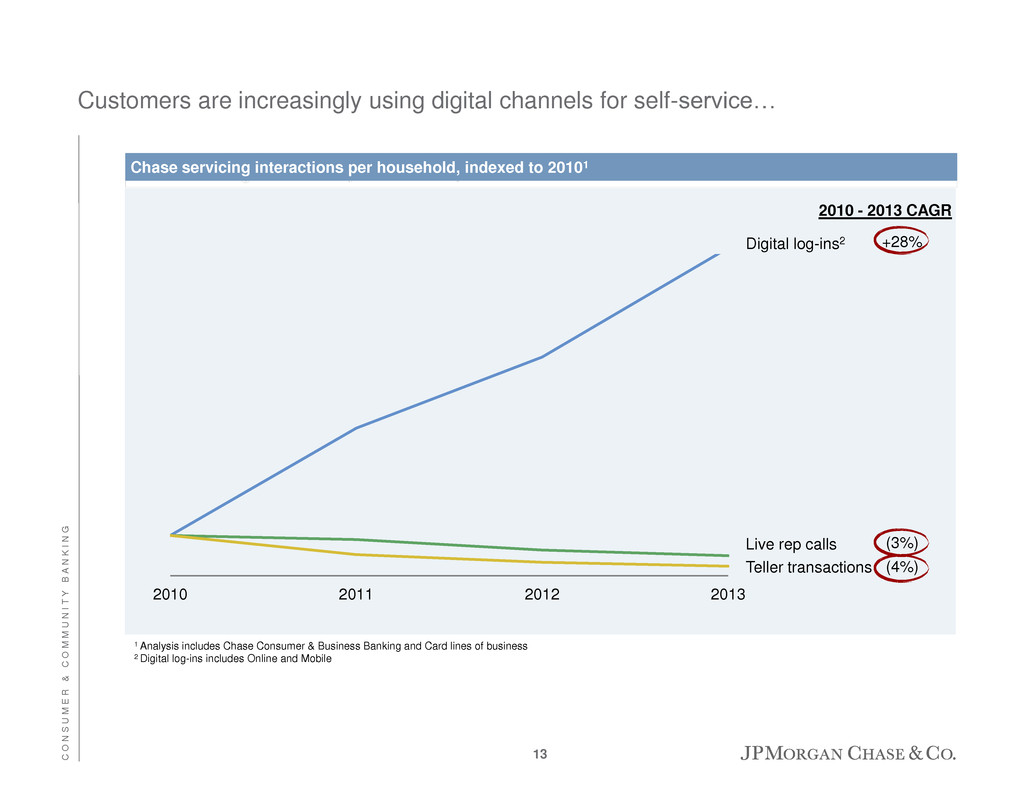

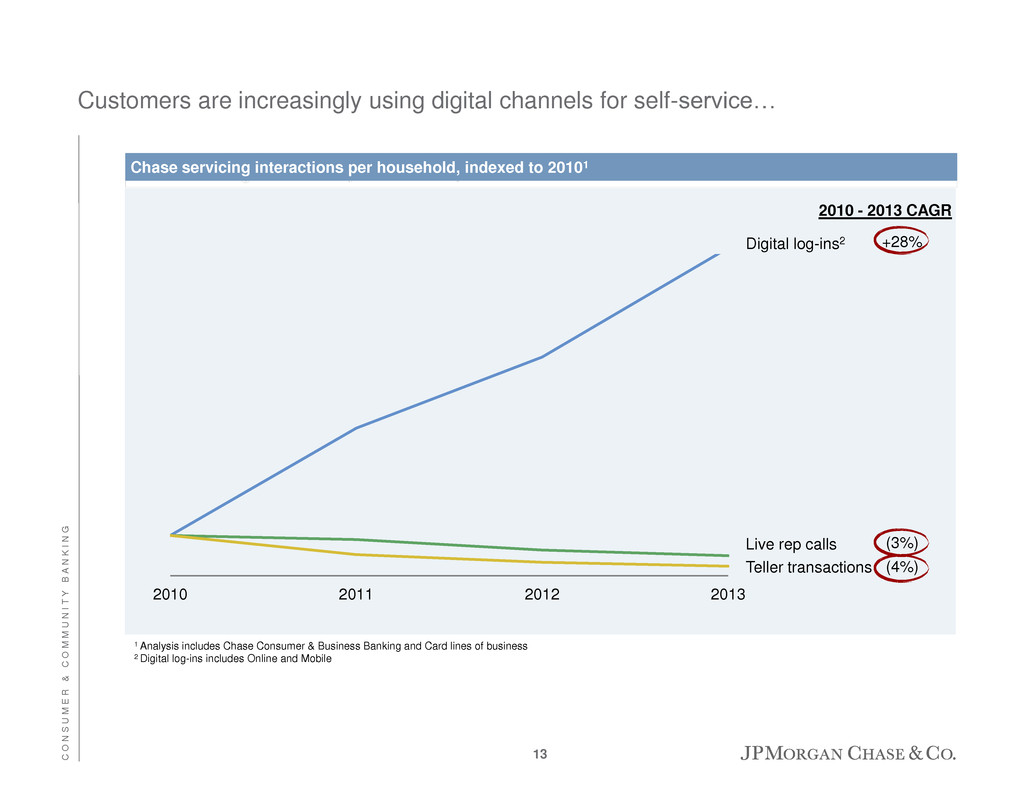

C O N S U M E R & C O M M U N I T Y B A N K I N G Customers are increasingly using digital channels for self-service… 1 Analysis includes Chase Consumer & Business Banking and Card lines of business 2 Digital log-ins includes Online and Mobile Chase servicing interactions per household, indexed to 20101 2010 2011 2012 2013 (3%) (4%) Digital log-ins2 +28% Teller transactions Live rep calls 2010 - 2013 CAGR 13

C O N S U M E R & C O M M U N I T Y B A N K I N G … which will have significant cost benefits Example: Ultimate Rewards mobile app redemption activity Source: Chase internal data 1 Based on variable cost; call center redemption cost based on average redemption transaction time of ~4 minutes Enabled mobile app- based reward redemptions in December 2013 Within first month, app- based redemptions reached 15% of daily redemption volume A mobile redemption costs ~$0.011 vs. a call center redemption cost of ~$31 Ending in (4040) 14

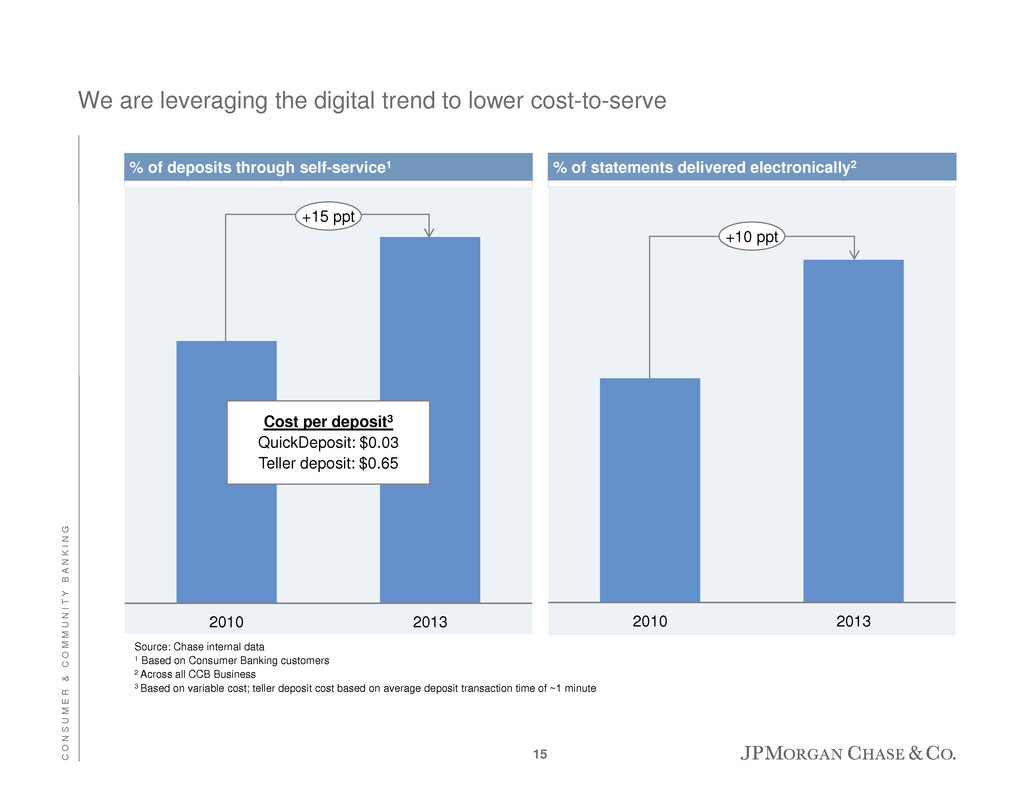

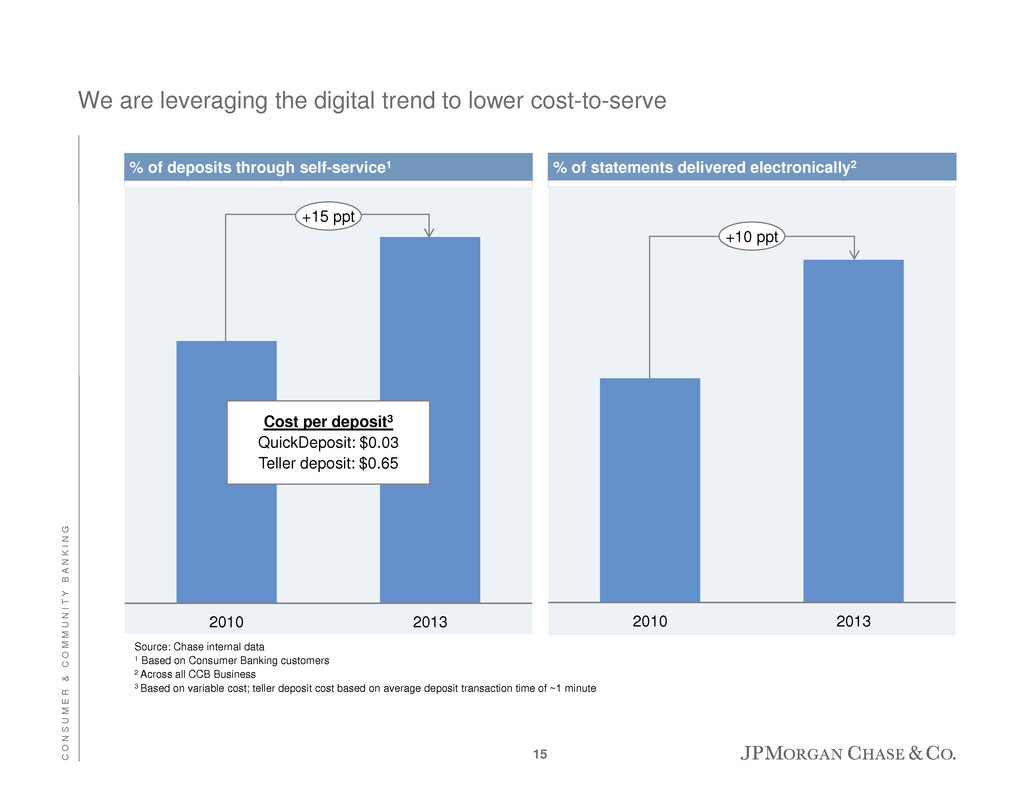

C O N S U M E R & C O M M U N I T Y B A N K I N G % of deposits through self-service1 % of statements delivered electronically2 We are leveraging the digital trend to lower cost-to-serve Source: Chase internal data 1 Based on Consumer Banking customers 2 Across all CCB Business 3 Based on variable cost; teller deposit cost based on average deposit transaction time of ~1 minute 2010 2013 2010 2013 +15 ppt Cost per deposit3 QuickDeposit: $0.03 Teller deposit: $0.65 +10 ppt 15

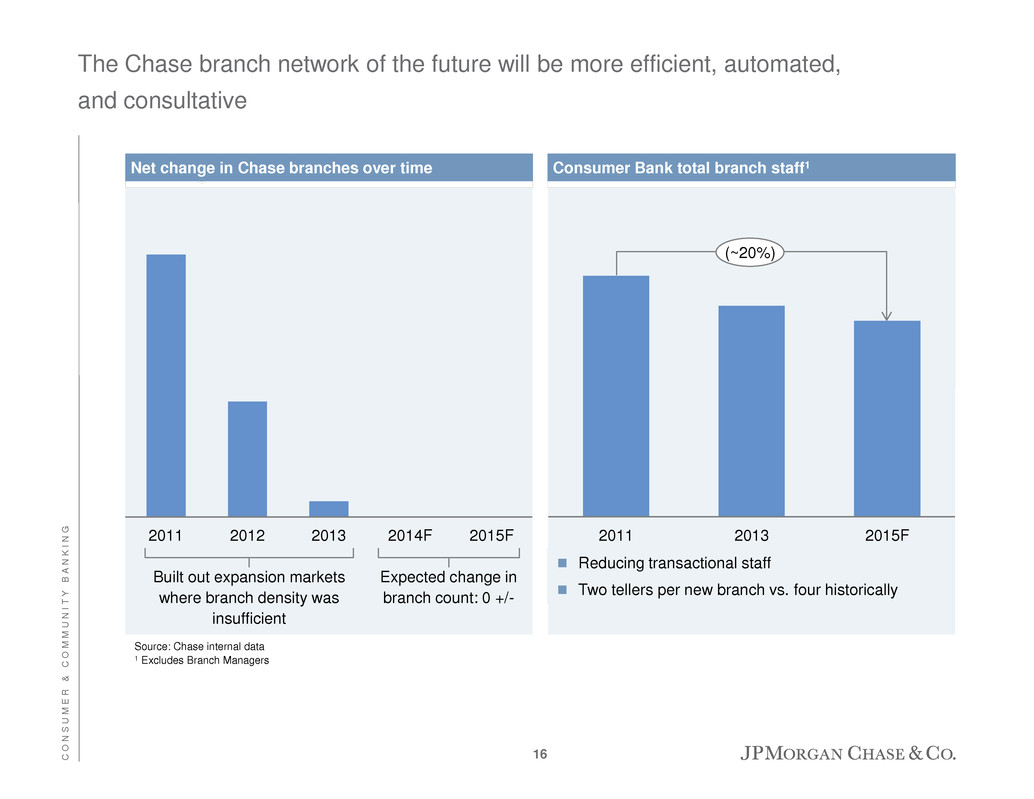

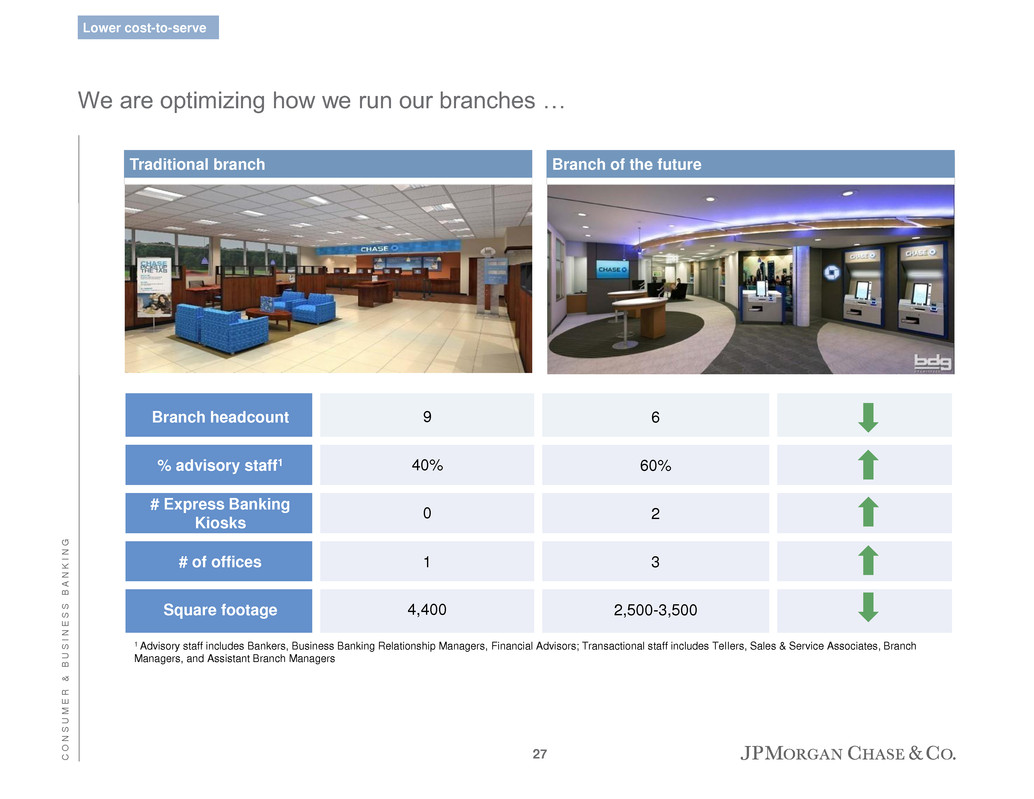

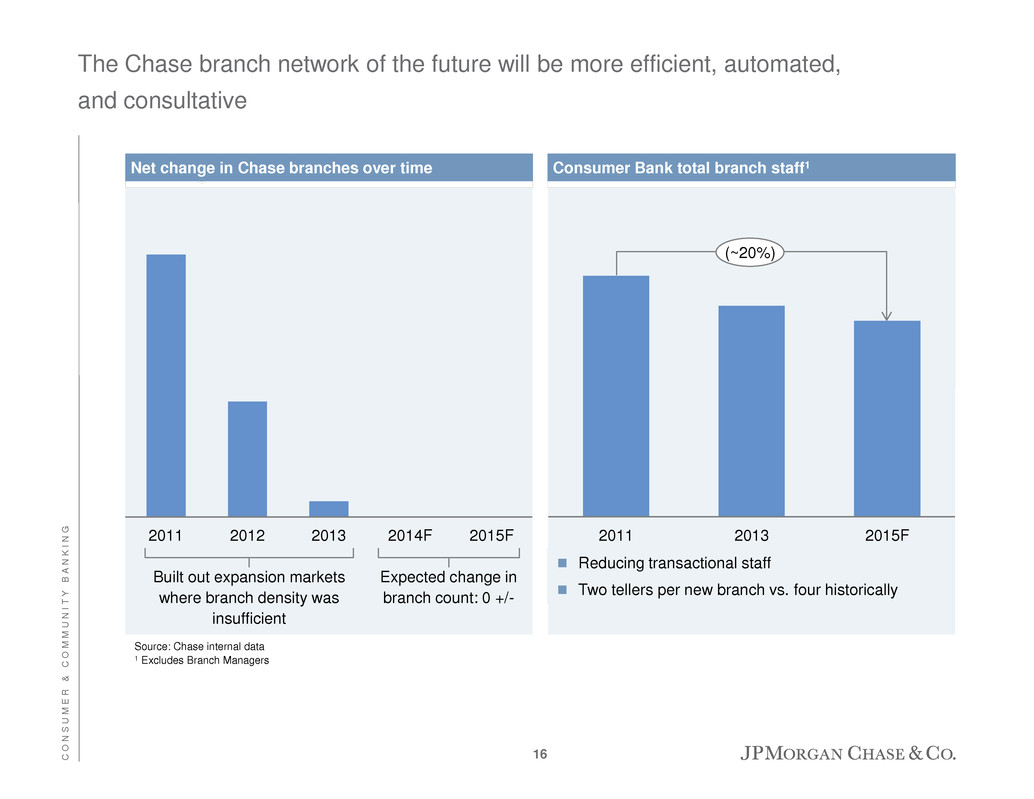

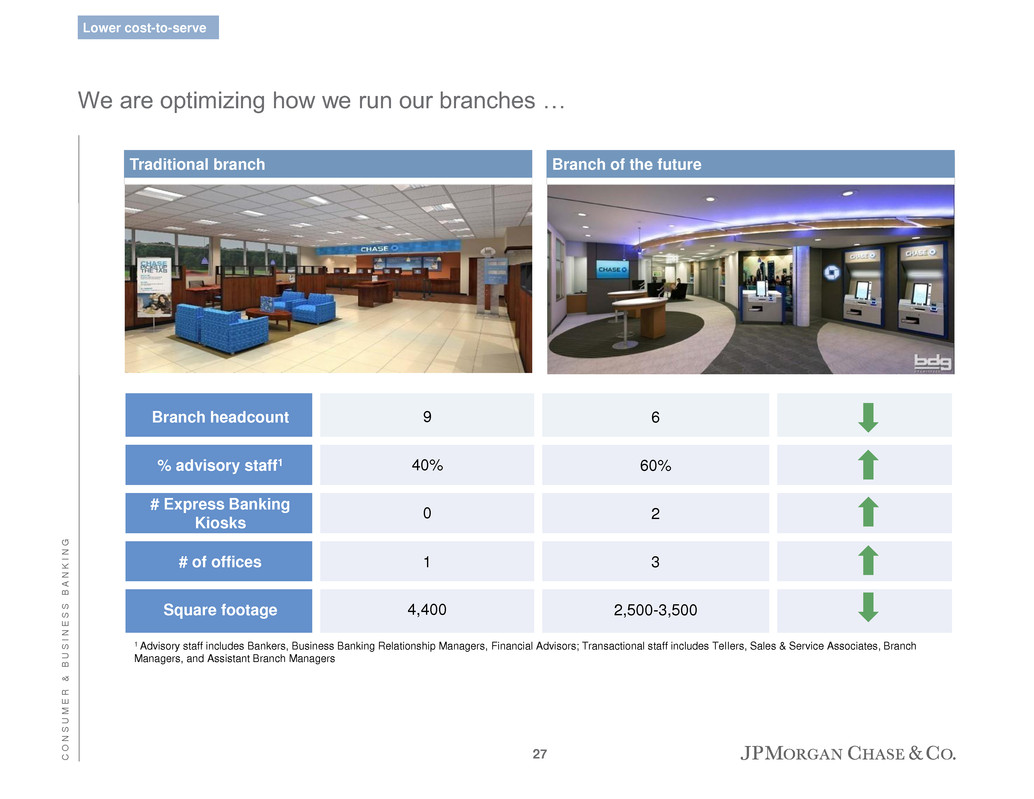

C O N S U M E R & C O M M U N I T Y B A N K I N G The Chase branch network of the future will be more efficient, automated, and consultative Net change in Chase branches over time 2011 2012 2013 2014F 2015F Built out expansion markets where branch density was insufficient Expected change in branch count: 0 +/- Consumer Bank total branch staff1 2011 2013 2015F Reducing transactional staff Two tellers per new branch vs. four historically (~20%) Source: Chase internal data 1 Excludes Branch Managers 16

Agenda Page C O N S U M E R & C O M M U N I T Y B A N K I N G 17 Consumer & Business Banking 17 Consumer & Community Banking 1 Mortgage Banking 31 Card Services 48 Appendix 68

C O N S U M E R & B U S I N E S S B A N K I N G Consumer and Business Banking business drivers 2012 2013 YoY Δ Relationships Consumer household relationships (mm) 21.2 22.3 5% Consumer bank household attrition rate1 11% 10% Business client relationships (mm) 2.2 2.3 2% Business bank client attrition rate1 17% 15% Deposits & Investment Balances ($B) Average deposit balances 392.1 434.6 11% Client investment assets (end of period) 159 189 19% % managed assets 29% 36% Net new investments 11.1 16.0 44% Distribution channels Branches 5,614 5,630 - Branch employees2 (K) 64.4 59.2 (8%) ATMs 18,699 19,211 3% % Self-service deposits3 49% 53% Active mobile users (mm) 12.4 15.6 26% Performance ($B) Net revenue 17.2 17.3 1% Net income 3.2 2.9 (10%) ROE 36% 26% Source: Chase internal data 1 Households and clients that close all Chase account relationships 2 Includes all CBB branch employees: Tellers (FTE), Personal Bankers, Branch management, Sales and Service Associates, Financial Advisors, and Relationship Managers 3 Data for fourth quarter; includes ATM / Express Banking Kiosk and mobile Consumer & Business Banking business drivers 18

C O N S U M E R & B U S I N E S S B A N K I N G Customer satisfaction and retention are at all time highs Consumer Bank overall satisfaction1 Household attrition (annualized rate)2 Source: Chase internal data Note: Consumer bank only 1 Top 2 box on a 10 point scale, overall satisfaction 2 Adjusted for incremental 25K households in October 2012 due to escheatment rule changes 55% 60% 65% 70% 75% 80% M a r- 1 1 J u n -1 1 S e p -1 1 Dec-1 1 M a r- 1 2 J u n -1 2 S e p -1 2 Dec-1 2 M a r- 1 3 J u n -1 3 S e p -1 3 Dec-1 3 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% M a r- 1 1 J u n -1 1 S e p -1 1 Dec-1 1 M ar -1 2 J u n -1 2 S e p -1 2 Dec-1 2 M a r- 1 3 Ju n -1 3 S e p -1 3 Dec-1 3 (6) ppt +15 ppt 19

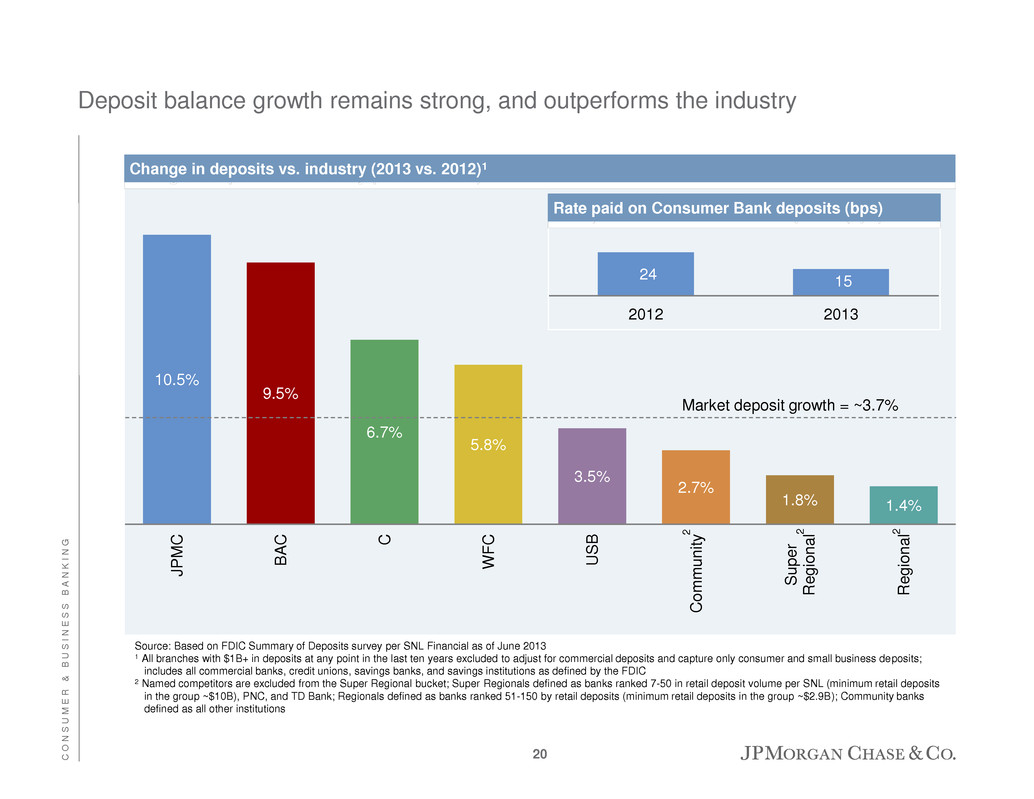

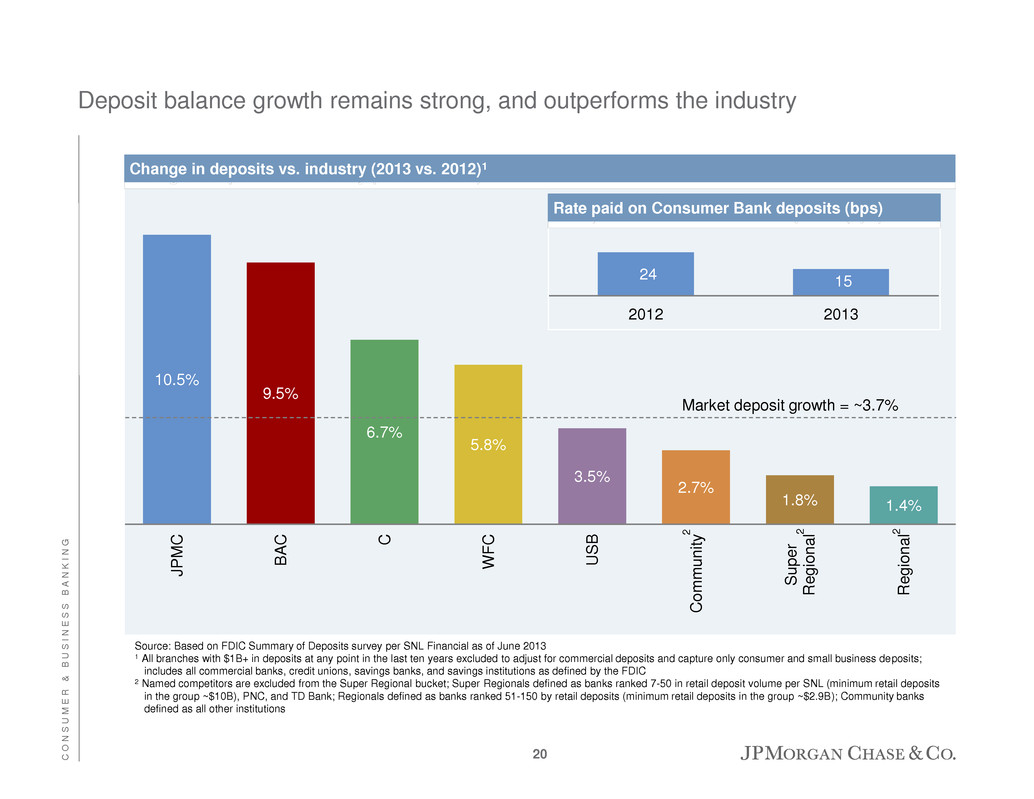

C O N S U M E R & B U S I N E S S B A N K I N G 10.5% 9.5% 6.7% 5.8% 3.5% 2.7% 1.8% 1.4% J P M C B A C C W F C U S B C o m m u n it y S u p e r R e g io n a l R e g io n a l Deposit balance growth remains strong, and outperforms the industry Source: Based on FDIC Summary of Deposits survey per SNL Financial as of June 2013 1 All branches with $1B+ in deposits at any point in the last ten years excluded to adjust for commercial deposits and capture only consumer and small business deposits; includes all commercial banks, credit unions, savings banks, and savings institutions as defined by the FDIC 2 Named competitors are excluded from the Super Regional bucket; Super Regionals defined as banks ranked 7-50 in retail deposit volume per SNL (minimum retail deposits in the group ~$10B), PNC, and TD Bank; Regionals defined as banks ranked 51-150 by retail deposits (minimum retail deposits in the group ~$2.9B); Community banks defined as all other institutions 10.5% 9.5% 6.7% 5.8% 3.5% 2.7% 1.8% 1.4% JPM C B A C C W F C US B Com m u n it y S u p e r Re g io n a l Re g io n a l Change in deposits vs. industry (2013 vs. 2012)1 Market deposit growth = ~3.7% 24 15 2012 2013 Rate paid on Consumer Bank deposits (bps) 2 2 2 20

C O N S U M E R & B U S I N E S S B A N K I N G Investment balance growth is at record levels Client investment assets ($B) $138 $159 $189 2011 2012 2013 Net new investments $6 $11 $16 +37% Investments are critical to becoming our customers’ primary bank Growth has been driven by $33B of net new investment flows over the past 3 years 70% of revenue is fee-based Chase Private Client is key to more investment relationships with our currently deposit-only clients We are leveraging JPM Asset Management product capabilities and infrastructure to support further investment growth Key takeaways Source: Chase internal data 21

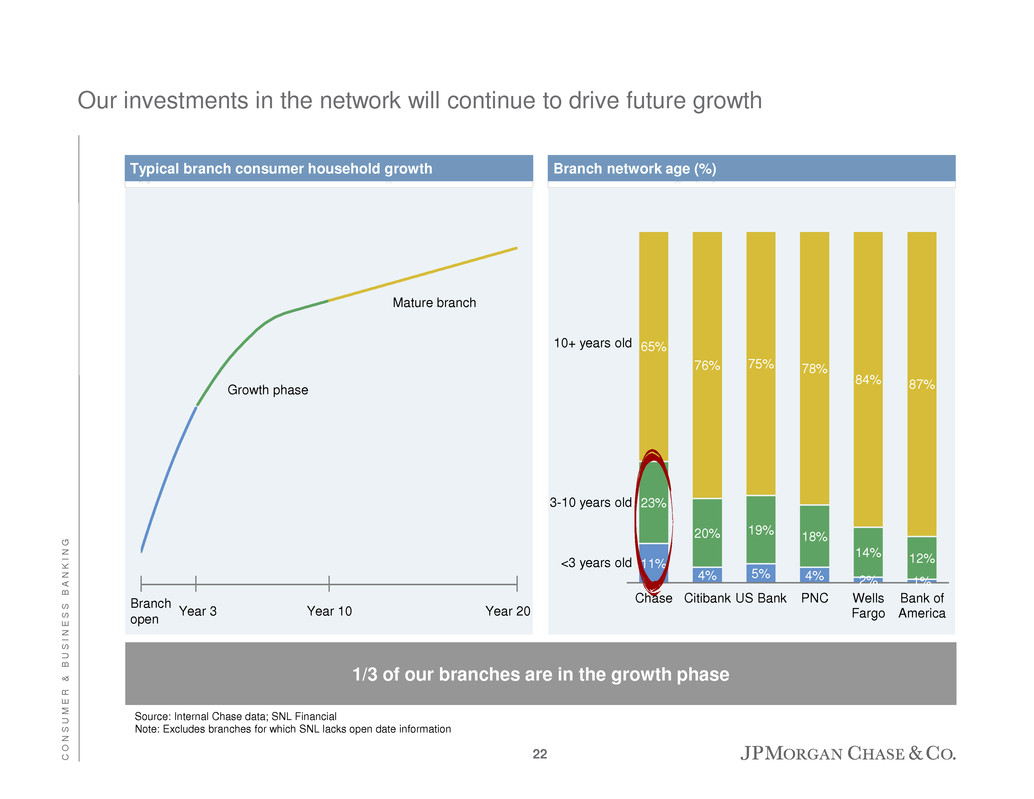

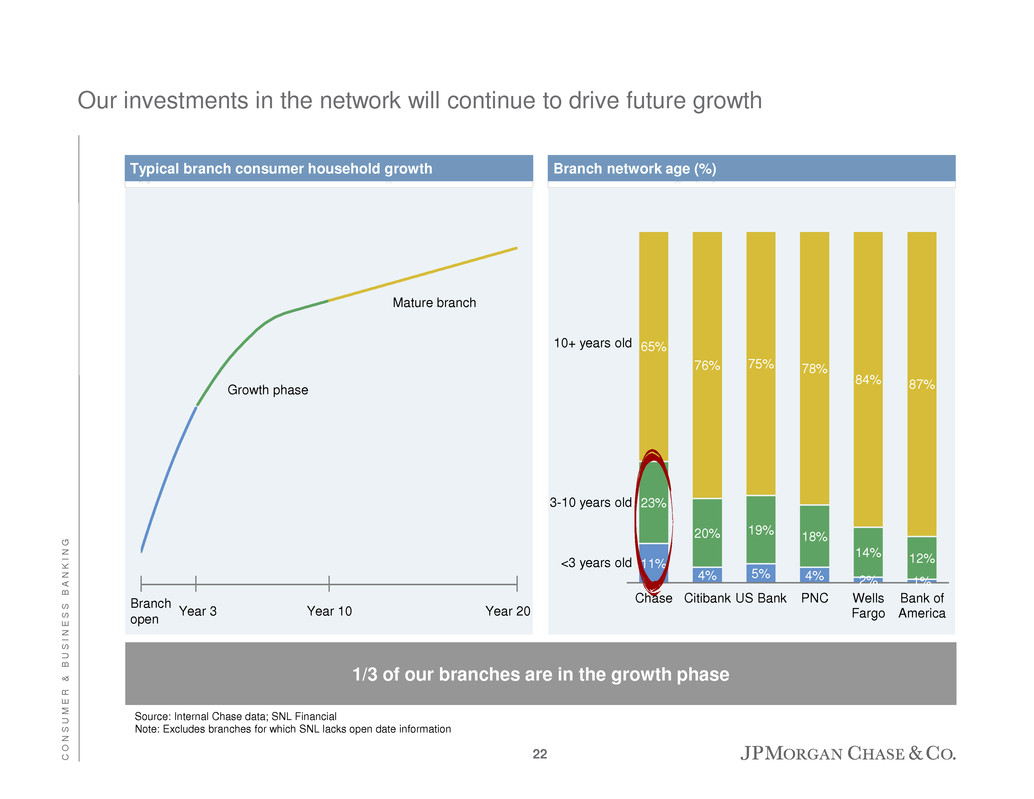

C O N S U M E R & B U S I N E S S B A N K I N G Our investments in the network will continue to drive future growth Source: Internal Chase data; SNL Financial Note: Excludes branches for which SNL lacks open date information Branch network age (%) Typical branch consumer household growth Year 10 Branch open Year 3 Year 20 11% 4% 5% 4% 2% 1% 23% 20% 19% 18% 14% 12% 65% 76% 75% 78% 84% 87% Chase Citibank US Bank PNC Wells Fargo Bank of America <3 years old 3-10 years old 10+ years old Growth phase Mature branch 1/3 of our branches are in the growth phase 22

C O N S U M E R & B U S I N E S S B A N K I N G Core elements of strategic vision Branch footprint Transactions to advice Optimize our branch network Efficiency through innovations Branch staffing models Lower cost- to-serve Become customers’ primary bank Chase Private Client Deepen relationships 23

C O N S U M E R & B U S I N E S S B A N K I N G We have completed our build-out in key expansion markets, resulting in an attractive footprint Source: SNL Financial; Chase internal data 1 JPMC is tied for #1 branch count rank in Riverside 2 Market indicates Core Based Statistical Area Chase branch count and rank in select expansion markets Key highlights 2 0 0 9 2 0 1 3 2 0 0 9 2 0 1 3 2 0 0 9 2 0 1 3 2 0 0 9 2 0 1 3 2 0 0 9 2 0 1 3 Los Angeles Miami San Francisco San Diego Riverside1 Branch count of #1 network in market #3 #1 #3 #3 #3 #3 #3 #2 #4 #1 Branch count rank # ~2/3 of new builds in California and Florida #1 branch share in the top three deposit markets Markets in our footprint account for ~2/3 of deposit and investment opportunity in the U.S.2 Optimize our branch network 24

C O N S U M E R & B U S I N E S S B A N K I N G We will continue to optimize our network Source: Chase internal data Network activity 2011 2012 2013 Beginning branch count 5,268 5,508 5,614 Network management Total new branches opened 282 179 156 New builds 260 150 132 Relocations 22 29 24 Total branches closed (42) (73) (140) Consolidations (20) (44) (116) Relocations (22) (29) (24) Net branches opened 240 106 16 Ending branch count 5,508 5,614 5,630 Source: Chase internal data Optimize our branch network 25

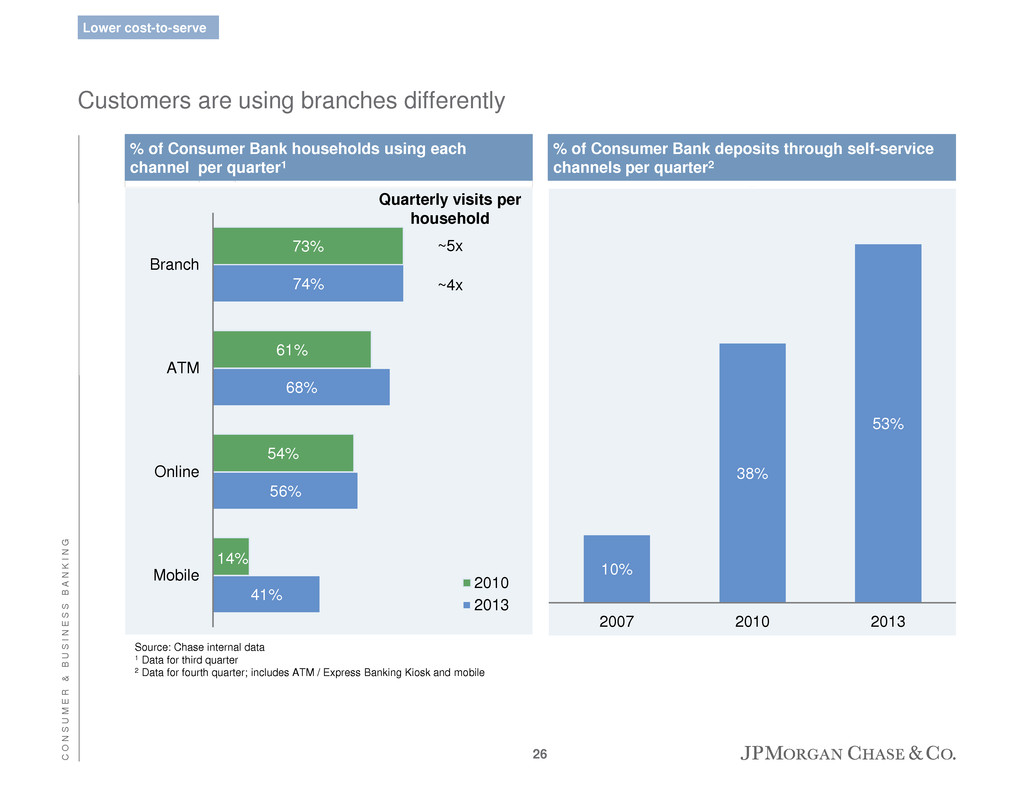

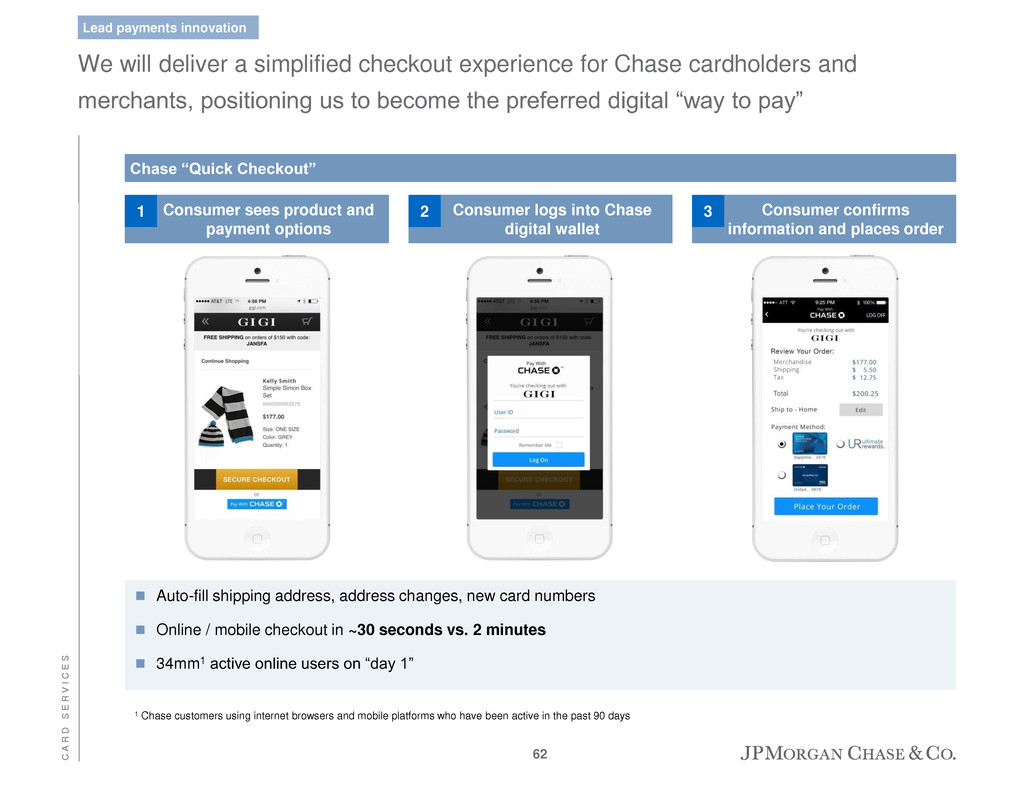

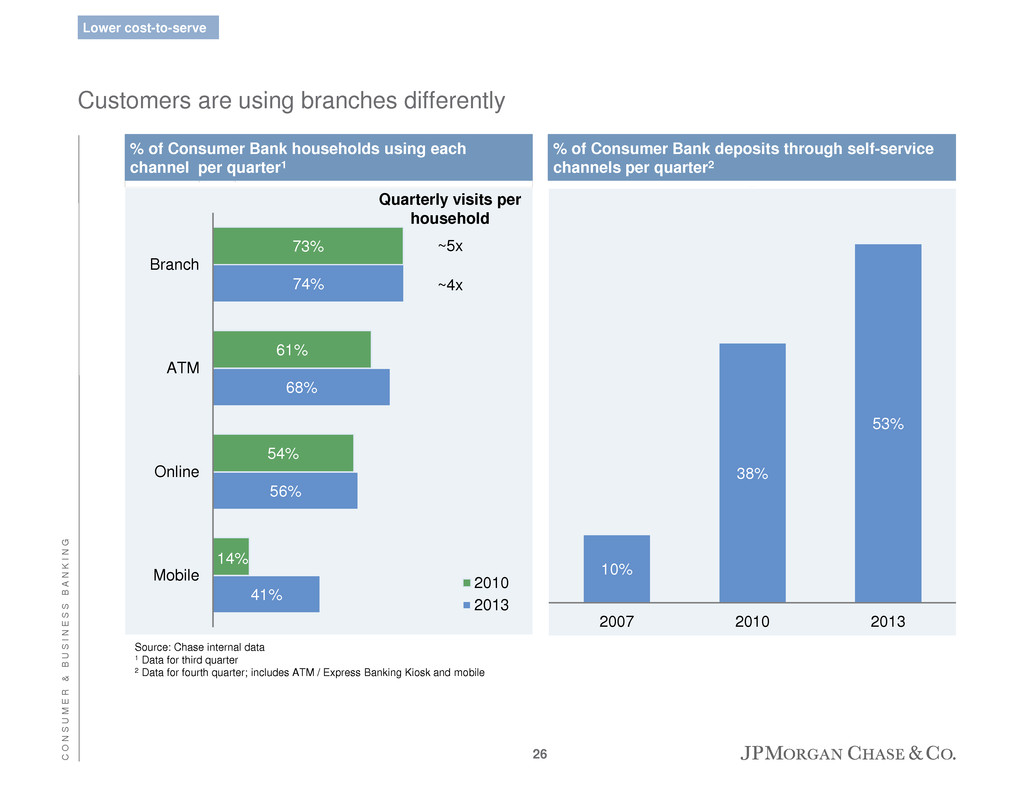

C O N S U M E R & B U S I N E S S B A N K I N G Customers are using branches differently 10% 38% 53% 2007 2010 2013 % of Consumer Bank deposits through self-service channels per quarter2 Source: Chase internal data 1 Data for third quarter 2 Data for fourth quarter; includes ATM / Express Banking Kiosk and mobile % of Consumer Bank households using each channel per quarter1 41% 56% 68% 74% 14% 54% 61% 73% Mobile Online ATM Branch 2010 2013 ~5x ~4x Quarterly visits per household Lower cost-to-serve 26