April 13, 2016 F I N A N C I A L R E S U L T S 1Q16

Pretax Net income8 EPS8 Wholesale credit costs ($773) ($479) ($0.13) F I N A N C I A L R E S U L T S Note: Oil & Gas (O&G) includes Natural Gas Pipelines. Metals & Mining (M&M) 1 See note 2 on slide 18 2 Represents estimated common equity Tier 1 (“CET1”) capital and ratio under the Basel III Fully Phased-In capital rules to which the Firm will be subject as of January 1, 2019. See note 3 on slide 18 3 See note 1 on slide 18 4 Last twelve months (“LTM”). Net of employee issuance 5 See note 4 on slide 18 6 See note 8 on slide 18 7 Net of employee issuance 8 Assumes a tax rate of 38% for items that are tax deductible 1Q16 net income of $5.5B and EPS of $1.35 Revenue of $24.1B3 Adjusted expense of $13.9B5 and adjusted overhead ratio of 58%5 Fortress balance sheet Average core loans6 up 17% YoY and 3% QoQ Basel III Fully Phased-In CET1 capital of $176B2, Advanced CET1 ratio of 11.7%2 and Standardized CET1 ratio of 11.9%2 Delivered strong capital return $3.0B7 returned to shareholders in 1Q16, including $1.3B of net repurchases Common dividend of $0.44 per share ROTCE1 12% Overhead ratio3 57% Net payout ratio LTM4 48% CET1 ratio2 11.7% Significant items ($mm, excluding EPS) 1Q16 Financial highlights 1 Reserve build O&G: ($529)mm M&M: ($162)mm

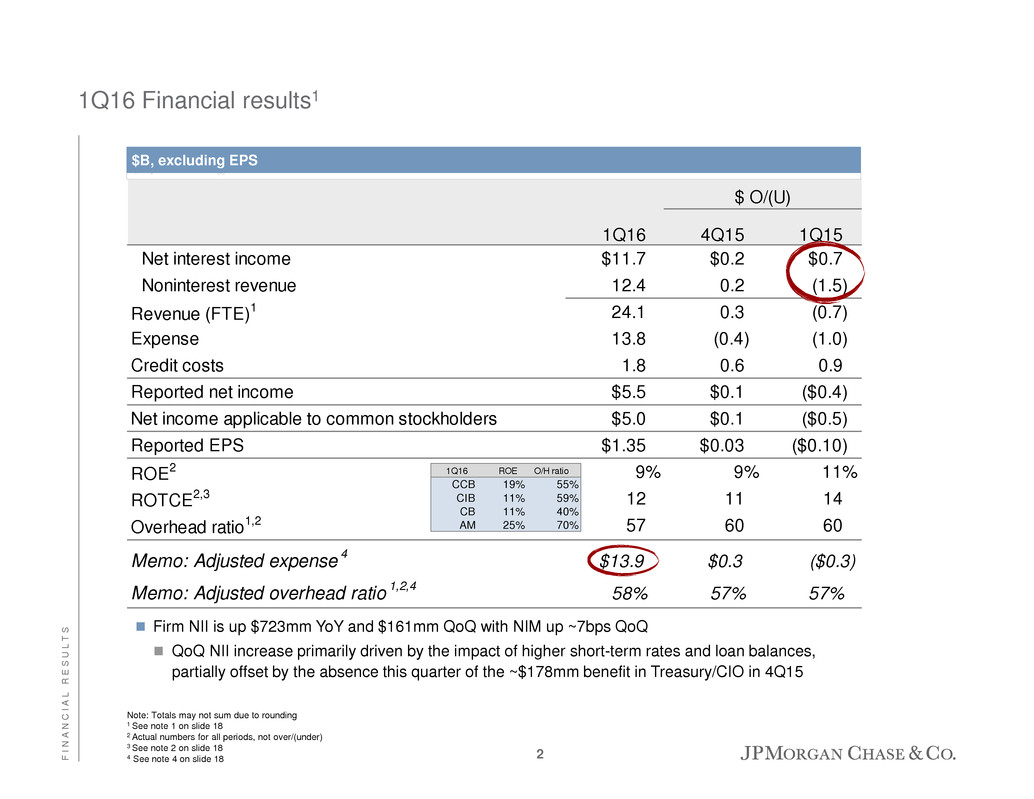

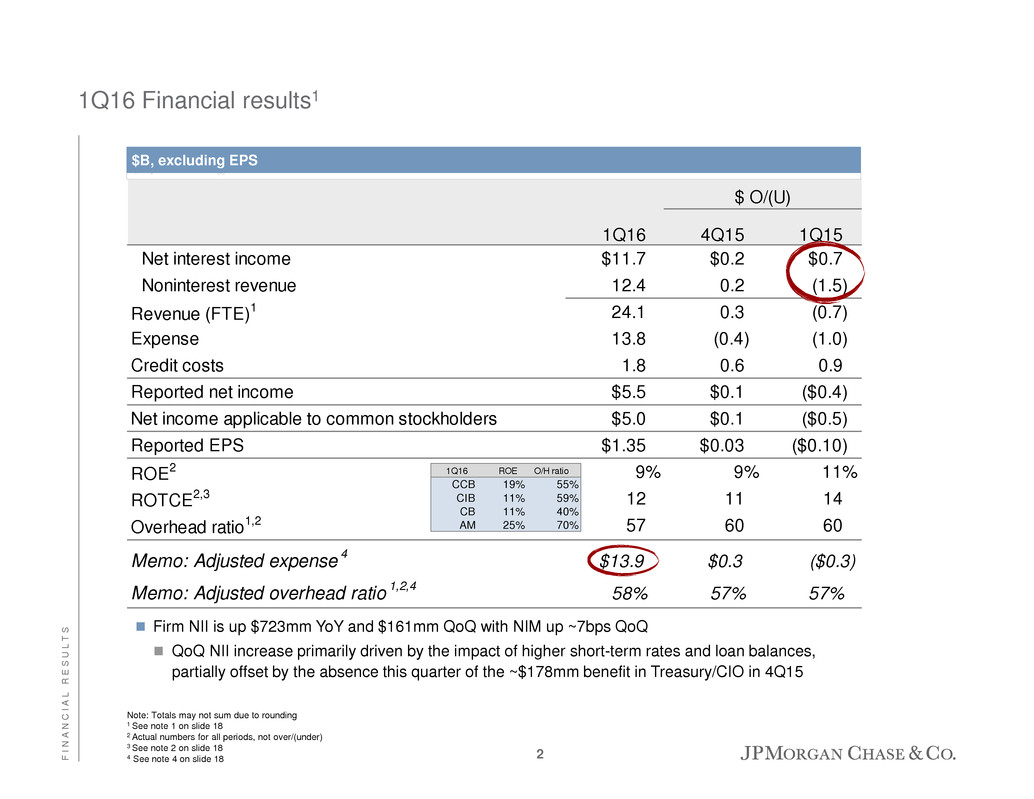

$ O/(U) 1Q16 4Q15 1Q15 Net interest income $11.7 $0.2 $0.7 Noninterest revenue 12.4 0.2 (1.5) Revenue (FTE)1 24.1 0.3 (0.7) Expense 13.8 (0.4) (1.0) Credit costs 1.8 0.6 0.9 Reported net income $5.5 $0.1 ($0.4) Net income applicable to common stockholders $5.0 $0.1 ($0.5) Reported EPS $1.35 $0.03 ($0.10) ROE2 9% 9% 11% ROTCE2,3 12 11 14 Overhead ratio1,2 57 60 60 Memo: Adjusted expense 4 $13.9 $0.3 ($0.3) Memo: Adjusted overhead ratio 1,2,4 58% 57% 57% 1Q16 ROE O/H ratio CCB 19% 55% CIB 11% 59% CB 11% 40% AM 25% 70% F I N A N C I A L R E S U L T S Note: Totals may not sum due to rounding 1 See note 1 on slide 18 2 Actual numbers for all periods, not over/(under) 3 See note 2 on slide 18 4 See note 4 on slide 18 $B, excluding EPS 1Q16 Financial results1 2 Firm NII is up $723mm YoY and $161mm QoQ with NIM up ~7bps QoQ QoQ NII increase primarily driven by the impact of higher short-term rates and loan balances, partially offset by the absence this quarter of the ~$178mm benefit in Treasury/CIO in 4Q15

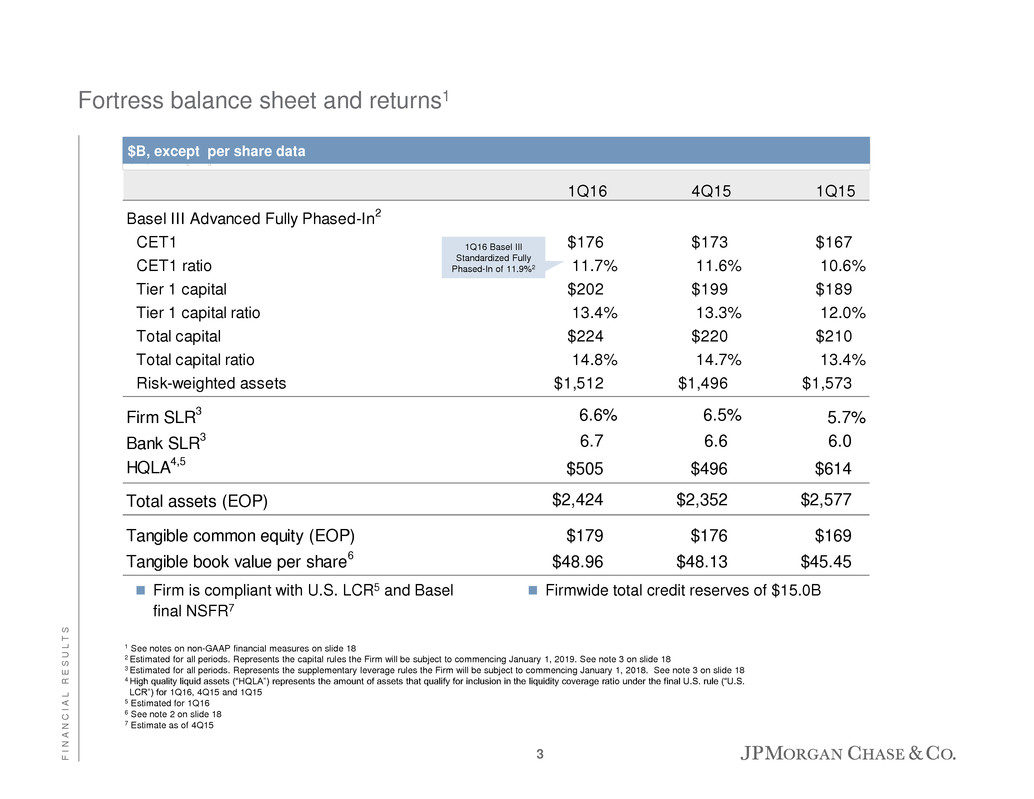

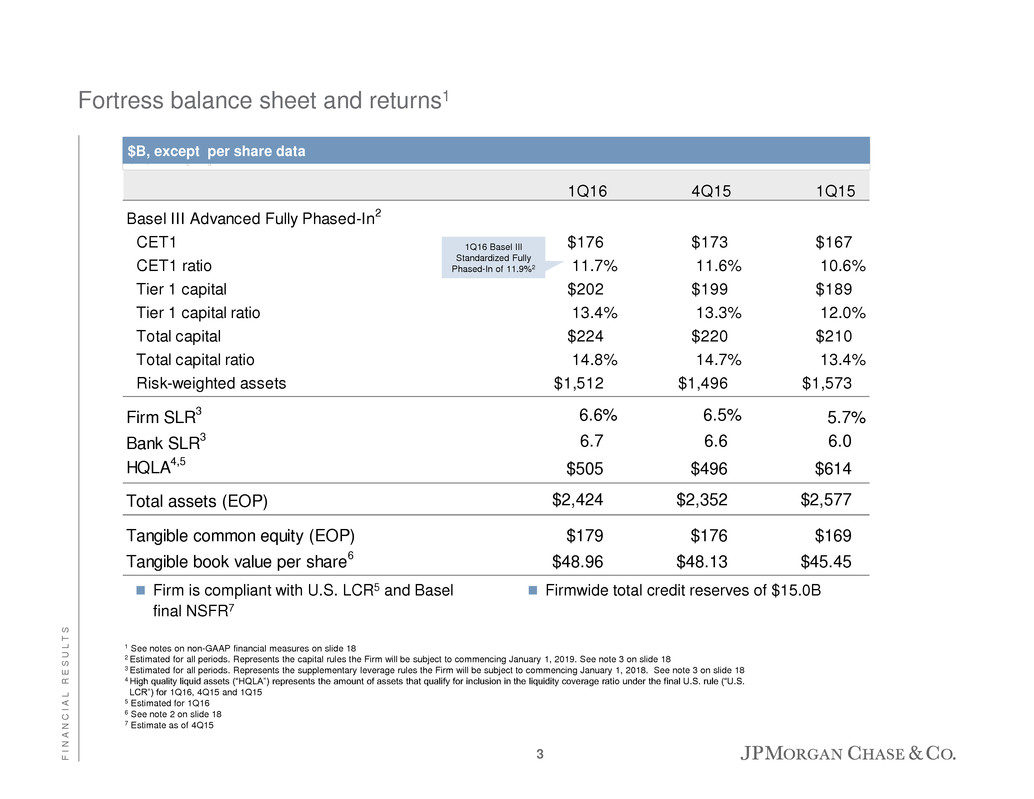

1Q16 4Q15 1Q15 Basel III Advanced Fully Phased-In2 CET1 $176 $173 $167 CET1 ratio 11.7% 11.6% 10.6% Tier 1 capital $202 $199 $189 Tier 1 capital ratio 13.4% 13.3% 12.0% Total capital $224 $220 $210 Total capital ratio 14.8% 14.7% 13.4% Risk-weighted assets $1,512 $1,496 $1,573 Firm SLR 3 6.6% 6.5% 5.7% Bank SLR 3 6.7 6.6 6.0 HQLA 4,5 $505 $496 $614 Total assets (EOP) $2,424 $2,352 $2,577 Tangible common equity (EOP) $179 $176 $169 Tangible book value per share 6 $48.96 $48.13 $45.45 F I N A N C I A L R E S U L T S $B, except per share data Firm is compliant with U.S. LCR5 and Basel final NSFR7 Firmwide total credit reserves of $15.0B 1 See notes on non-GAAP financial measures on slide 18 2 Estimated for all periods. Represents the capital rules the Firm will be subject to commencing January 1, 2019. See note 3 on slide 18 3 Estimated for all periods. Represents the supplementary leverage rules the Firm will be subject to commencing January 1, 2018. See note 3 on slide 18 4 High quality liquid assets (“HQLA”) represents the amount of assets that qualify for inclusion in the liquidity coverage ratio under the final U.S. rule (“U.S. LCR”) for 1Q16, 4Q15 and 1Q15 5 Estimated for 1Q16 6 See note 2 on slide 18 7 Estimate as of 4Q15 1Q16 Basel III Standardized Fully Phased-In of 11.9%2 Fortress balance sheet and returns1 3

1Q16 4Q15 1Q15 EOP Equity $51.0 $51.0 $51.0 ROE 19% 18% 17% Overhead ratio 55 56 58 Average loans $445.8 $437.8 $398.1 Average deposits 562.3 545.7 512.2 CCB households (mm) 58.5 57.8 57.4 Active mobile customers (mm) 23.8 22.8 20.0 Debit & credit card sales volume $187.2 $197.3 $174.2 $ O/(U) 1Q16 4Q15 1Q15 Revenue $11,117 ($105) $413 Consumer & Business Banking 4,550 (37) 192 Mortgage Banking 1,876 196 127 Card, Commerce Solutions & Auto 4,691 (264) 94 Expense 6,088 (184) (102) Credit costs ,050 2 120 Net charge-offs 1,05 12 (4) Change in allowance – – 124 Net income $2,490 $83 $271 Key drivers/statistics ($B) – detail by business F I N A N C I A L R E S U L T S Consumer & Community Banking1 $mm 4 Net income of $2.5B, up 12% YoY Revenue of $11.1B, up 4% YoY, driven by net interest income on loan and deposit growth and auto lease revenue, partially offset by the impact of Card co-brand renegotiations Expense of $6.1B, down 2% YoY Expense initiatives funding investments and growth Credit costs of $1.1B, up 13% YoY, reflecting the absence of loan loss reserve releases Financial performance Key drivers/statistics ($B)2 1 See note 1 on slide 18 For additional footnotes see slide 19 Average loans up 12% YoY and core loans up 25% Average deposits up 10% YoY CCB households up ~1mm since last year Active mobile customers up 19% YoY 1Q16 4Q15 1Q15 Consumer & Business Banking Average Business Banking loans 3 $21.3 $20.9 $20.1 Business Banking loan originations 1.7 1.6 1.5 Client investment assets (EOP) 220.0 218.6 219.2 Deposit margin 1.86% 1.83% 1.99% Mortgage Banking Average loans $226.4 $220.7 $187.5 Loan originations 4 22.4 22.5 24.7 EOP total loans serviced 898.7 910.1 924.3 Net charge-off rate 5,6 0.13% 0.13% 0.30% Card, Commerce Solutions & Auto Card av r ge loans $127.3 $127.6 $125.0 Aut av rage loans and leased assets 70.9 67.5 61.9 Auto loan and lease originations 9.6 9.2 7.3 Card net charge-off rate 2.62% 2.42% 2.62% Card Services net revenue rate 11.81 12.54 12.19 Card sales volume 7 $121.7 $130.8 $112.8 Merchant processing volume 247.5 258.2 221.2

$ O/(U) 1Q16 4Q15 1Q15 Corporate & Investment Bank revenue $8,135 $1,066 ($1,447) Investment banking revenue 1,231 (239) (399) Treasury Services 884 (17) (46) Lending 302 (88) (133) Total Banking 2,417 (344) (578) Fixed Income Markets 3,597 1,023 (557) Equity Markets 1,576 512 (75) Securities Services 881 (52) (53) Credit Adjustments & Other (336) (73) (184) Total Markets & Investor Services 5,718 1,410 (869) Expense 4,808 372 (849) Credit costs 459 378 490 Net income $1,979 $231 ($558) Key drivers/statistics ($B)2 EOP equity $64.0 $62.0 $62.0 ROE 11% 10% 16% Overhead ratio 59 63 59 Comp/revenue 32 26 32 IB fees ($mm) $1,321 $1,538 $1,761 Average loans 111.9 106.9 103.2 Average client deposits3 358.9 364.8 444.2 Assets under custody ($T) 20.3 19.9 20.6 ALL/EOP loans ex-conduits and trade4,5 2.11% 1.88% 1.64% Net charge-off/(recovery) rate 0.17 0.02 (0.05) Average VaR ($mm) $55 $52 $43 F I N A N C I A L R E S U L T S Corporate & Investment Bank1 $mm Financial performance 1 See note 1 on slide 18 2 Actual numbers for all periods, not over/(under) 3 Client deposits and other third party liabilities pertain to the Treasury Services and Securities Services businesses 4 ALL/EOP loans as reported was 1.37%, 1.18%, and 1.06% for 1Q16, 4Q15, and 1Q15, respectively 5 See note 6 on slide 18 Net income of $2.0B on revenue of $8.1B Banking revenue IB revenue of $1.2B, down 24% YoY driven by lower debt and equity underwriting fees, partially offset by higher advisory fees – Ranked #1 in Global IB fees for 1Q16 Treasury Services revenue of $884mm, down 5% YoY Lending revenue of $302mm, down 31% YoY, reflecting mark-to- market losses on hedges of accrual loans and lower gains on securities received from restructurings Markets & Investor Services revenue Markets revenue of $5.2B, down 11% YoY – Fixed Income Markets down 13% Y Y, reflecting an increase in the Rates business which was more than offset by lower performance across other asset classes – Equity Markets down 5% YoY Securities Services revenue of $881mm, down 6% YoY Credit Adjustments & Other, a loss of $336mm, on wider credit spreads Expense of $4.8B, down 15% YoY, primarily driven by lower compensation and lower legal expense Credit costs of $459mm, primarily reflecting higher reserves driven by Oil & Gas and Metals & Mining 5

1Q16 4Q15 1Q15 Revenue $1,803 $43 $61 Middle Market Banking 717 15 40 Corporate Client Banking 501 31 (63) Commercial Term Lending 361 30 53 Real Estate Banking 140 2 24 Other 84 (35) 7 Expense 713 (37) 4 Credit costs 304 187 243 Net income $496 ($54) ($102) Key drivers/statistics ($B)2 EOP equity $16.0 $14.0 $14.0 ROE 11% 15% 17% Overhead ratio 40 43 41 Gross IB Revenue ($mm) $483 $455 $753 Average loans 170.3 165.9 150.3 Average client deposits 173.1 178.6 210.0 Allowance for loan losses 3.1 2.9 2.5 Nonaccrual loans 1.3 0.4 0.3 Net charge-off/(recovery) rate3 0.01% 0.04% 0.03% ALL/loans3 1.79 1.71 1.64 $ O/(U) $mm F I N A N C I A L R E S U L T S Commercial Banking1 Net income of $496mm, down 17% YoY and 10% QoQ Revenue of $1.8B, up 4% YoY and 2% QoQ Expense of $713mm, up 1% YoY and down 5% QoQ Prior quarter included $50mm impairment on leased corporate aircraft Credit costs of $304mm driven by Oil & Gas reserves Net charge-off rate of 1bp, 13th consecutive quarter of single digit NCO rate or net recoveries Average loan balances up 13% YoY and 3% QoQ C&I4 loans up 9% YoY, 1% QoQ CRE5 loans up 18% YoY, 5% QoQ Average client deposits down 18% YoY and 3% QoQ, largely reflecting the reduction in non-operating deposits 1 See note 1 on slide 18 2 Actual numbers for all periods, not over/(under) 3 Loans held-for-sale and loans at fair value were excluded when calculating the net charge- off/(recovery) rate and loan loss coverage ratio 4 CB’s Commercial and Industrial (C&I) grouping is internally defined to include certain client segments (Middle Market, which includes nonprofit clients, and Corporate Client Banking) and does not align with regulatory definitions 5 CB's Commercial Real Estate (CRE) grouping is internally defined to include certain client segments (Real Estate Banking, Commercial Term Lending and Community Development Banking) and does not align with regulatory definitions 6 Financial performance

F I N A N C I A L R E S U L T S Asset Management1 1 See note 1 on slide 18 2 Actual numbers for all periods, not over/(under) Net income of $587mm, up 17% YoY and up 16% QoQ Revenue of $3.0B, down 1% YoY and down 2% QoQ Expense of $2.1B, down 5% YoY and down 6% QoQ AUM of $1.7T, down 5% YoY and down 3% QoQ Net inflows of $12B into long-term products and net outflows of $27B from liquidity products Client assets of $2.3T, down 3% YoY and down 1% QoQ Average loan balances of $110.5B, up 7% YoY and flat QoQ Average deposit balances of $150.6B, down 5% YoY and up 3% QoQ Strong investment performance 80% of mutual fund AUM ranked in the 1st or 2nd quartiles over 5 years 7 $mm Financial performance 1Q16 4Q15 1Q15 Revenue $2,972 ($73) ($33) Global Investment Management 1,499 (116) (34) Global Wealth Management 1,473 43 1 Expense 2,075 (121) (100) Credit costs 13 (4) 9 Net income $587 $80 $85 Key drivers/statistics ($B)2 EOP equity $9.0 $9.0 $9.0 ROE 25% 21% 22% Pretax margin 30 27 27 Assets under anagement (AUM) $1,676 $1,723 $1,759 Client assets 2,323 2,350 2,405 Average loans 110.5 110.3 103.3 Average dep sits 150.6 145.6 158.2 $ O/(U)

1Q16 4Q15 1Q15 Treasury and CIO ($111) ($249) $110 Other Corporate 79 (5) (200) Net income ($32) ($254) ($90) $ O/(U) F I N A N C I A L R E S U L T S Corporate1 Treasury and CIO Prior quarter results included a pre-tax benefit of ~$178mm as a result of recognizing the unamortized discount on certain debt securities which were called at par 1 See note 1 on slide 18 8 $mm Financial performance

F I N A N C I A L R E S U L T S Outlook Firmwide Expect 2016 net interest income to be up ~$2B+ YoY Expect 2016 noninterest revenue to be ~$50B, market dependent Expect 2016 adjusted expense to be $56B+/- Expect 2016 net charge-offs to be ≤$4.75B, with the YoY increase driven by both loan growth and Oil & Gas Consumer & Community Banking Expect Mortgage Banking net charge-offs to be ~$60mm per quarter in 2016 Expect Card net charge-off rate for 2016 of 2.50%+/- 9 Expect 2Q16 revenue to be ≤$3B, market dependent Asset Management Expect Securities Services revenue to be ~$875mm per quarter for the remainder of 2016, market dependent Corporate & Investment Bank Expect 2Q16 revenue to be up modestly QoQ Expect 2Q16 expense to be ~$725mm Commercial Banking

Agenda Page F I N A N C I A L R E S U L T S 10 Appendix 10

League table results – wallet share 1Q16 FY2015 Rank Share Rank Share Based on fees 7 : Global Debt, Equity & Equity-related 1 6.7 % 1 7.7 % U.S. Debt, Equity & Equity-related 1 12.4 % 1 11.6 % Global Long-term Debt8 2 6.4 % 1 8.3 % U.S. Long-term Debt 1 11.3 % 1 11.9 % Global Equity & Equity-related9 1 7.3 % 1 7.0 % U.S. Equity & Equity-related 1 14.7 % 1 11.2 % Global M&A10 1 11.3 % 2 8.5 % U.S. M&A 1 13.8 % 2 9.9 % Global Loan Syndications 2 6.2 % 2 7.3 % U.S. Loan Syndications 2 8.4 % 2 10.5 % Global IB fees7,11 1 8.2 % 1 7.9 % A P P E N D I X Select leadership positions Corporate & Investment Bank Consumer & Community Banking 11 Consumer & Business Banking Deposit volume growing at nearly twice the industry growth rate1 Largest active mobile customer base among major U.S. banks2 growing at 19% YoY #1 in consumer retail banking nationally for the fourth consecutive year, according to TNS, and winner of three TNS Choice Awards in 2016 Mortgage Banking #2 mortgage originator and servicer3 Card, Commerce Solutions & Auto #1 credit card issuer in the U.S. based on loans outstanding4 #1 U.S. co-brand credit card issuer5 #1 wholly-owned merchant acquirer6 For footnoted information see slide 20 Asset Management Commercial Banking #1 in customer satisfaction12 #1 multifamily lender in the U.S.13 Top 3 in overall middle market, large middle market and ABL bookrunner14 #2 in global active long-term open-end mutual fund AUM flows15 #1 North America Private Bank16

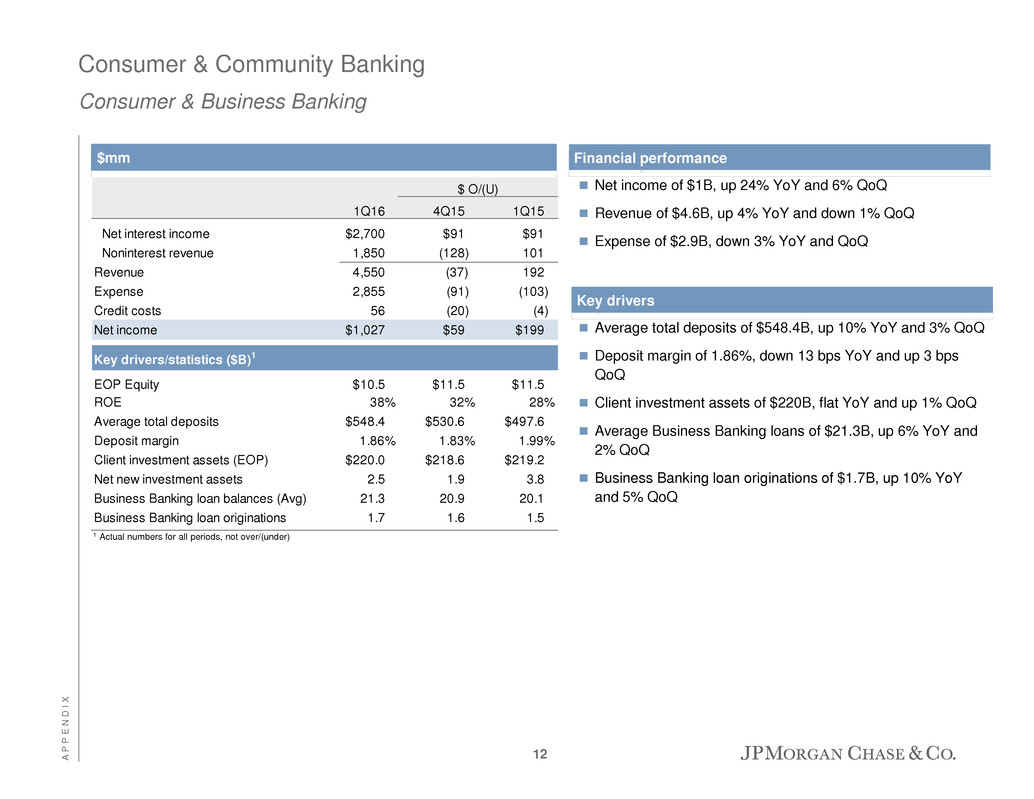

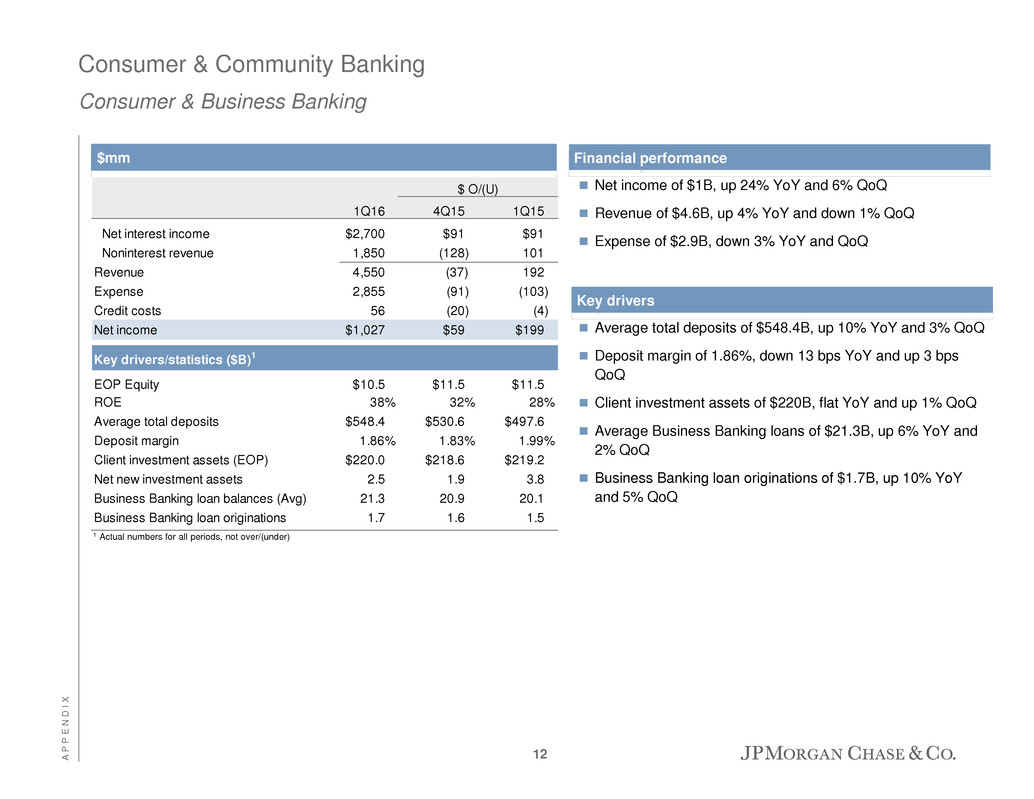

$ O/(U) 1Q16 4Q15 1Q15 Net interest income $2,700 $91 $91 Noninterest revenue 1,850 (128) 101 Revenue 4,550 (37) 192 Expense 2,855 (91) (103) Credit costs 56 (20) (4) Net income $1,027 $59 $199 Key drivers/statistics ($B)1 EOP Equity $10.5 $11.5 $11.5 ROE 38% 32% 28% Average total deposits $548.4 $530.6 $497.6 Deposit margin 1.86% 1.83% 1.99% Client investment assets (EOP) $220.0 $218.6 $219.2 Net new investment assets 2.5 1.9 3.8 Business Banking loan balances (Avg) 21.3 20.9 20.1 Business Banking loan originations 1.7 1.6 1.5 A P P E N D I X Consumer & Community Banking Consumer & Business Banking $mm 1 Actual numbers for all periods, not over/(under) Financial performance Key drivers Net income of $1B, up 24% YoY and 6% QoQ Revenue of $4.6B, up 4% YoY and down 1% QoQ Expense of $2.9B, down 3% YoY and QoQ Average total deposits of $548.4B, up 10% YoY and 3% QoQ Deposit margin of 1.86%, down 13 bps YoY and up 3 bps QoQ Client investment assets of $220B, flat YoY and up 1% QoQ Average Business Banking loans of $21.3B, up 6% YoY and 2% QoQ Business Banking loan originations of $1.7B, up 10% YoY and 5% QoQ 12

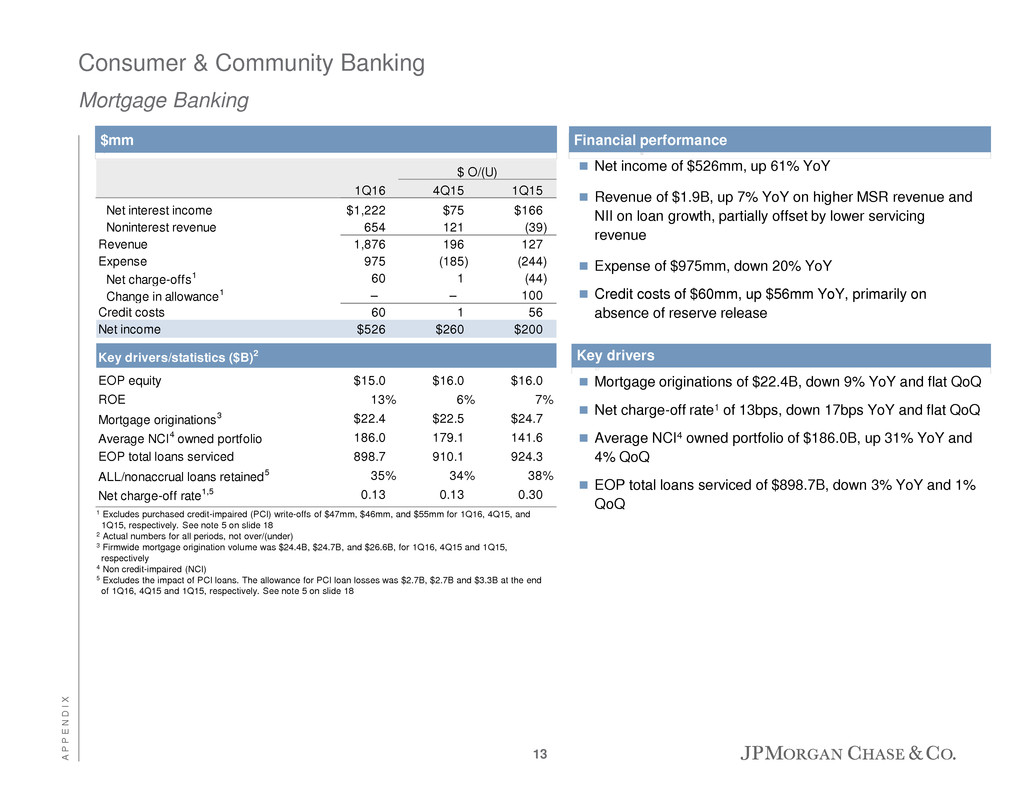

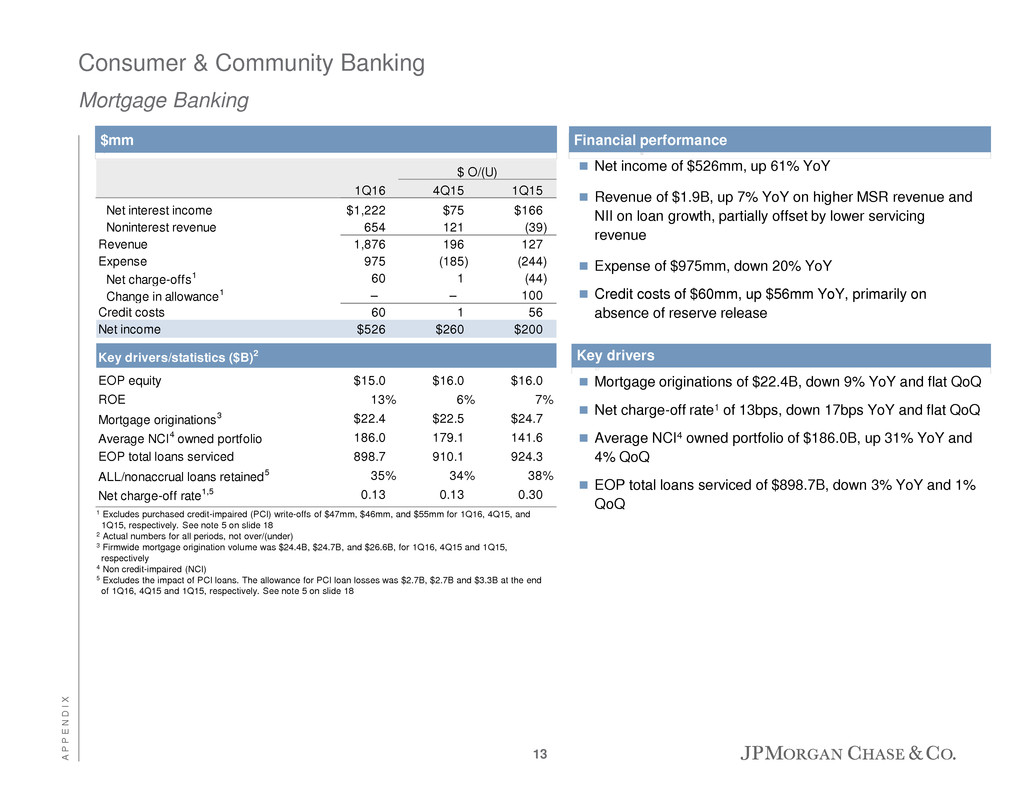

$ O/(U) 1Q16 4Q15 1Q15 Net interest income $1,222 $75 $166 Noninterest revenue 654 121 (39) Revenue 1,876 196 127 Expense 975 (185) (244) Net charge-offs1 60 1 (44) Change in allowance1 – – 100 Credit costs 60 1 56 Net income $526 $260 $200 Key drivers/statistics ($B)2 EOP equity $15.0 $16.0 $16.0 ROE 13% 6% 7% Mortgage originations3 $22.4 $22.5 $24.7 Average NCI4 owned portfolio 186.0 179.1 141.6 EOP total loans serviced 898.7 910.1 924.3 ALL/nonaccrual loans retained5 35% 34% 38% Net charge-off rate1,5 0.13 0.13 0.30 A P P E N D I X Consumer & Community Banking Mortgage Banking $mm Financial performance Key drivers Net income of $526mm, up 61% YoY Revenue of $1.9B, up 7% YoY on higher MSR revenue and NII on loan growth, partially offset by lower servicing revenue Expense of $975mm, down 20% YoY Credit costs of $60mm, up $56mm YoY, primarily on absence of reserve release Mortgage originations of $22.4B, down 9% YoY and flat QoQ Net charge-off rate1 of 13bps, down 17bps YoY and flat QoQ Average NCI4 owned portfolio of $186.0B, up 31% YoY and 4% QoQ EOP total loans serviced of $898.7B, down 3% YoY and 1% QoQ 13 1 Excludes purchased credit-impaired (PCI) write-offs of $47mm, $46mm, and $55mm for 1Q16, 4Q15, and 1Q15, respectively. See note 5 on slide 18 2 Actual numbers for all periods, not over/(under) 3 Firmwide mortgage origination volume was $24.4B, $24.7B, and $26.6B, for 1Q16, 4Q15 and 1Q15, respectively 4 Non credit-impaired (NCI) 5 Excludes the impact of PCI loans. The allowance for PCI loan losses was $2.7B, $2.7B and $3.3B at the end of 1Q16, 4Q15 and 1Q15, respectively. See note 5 on slide 18

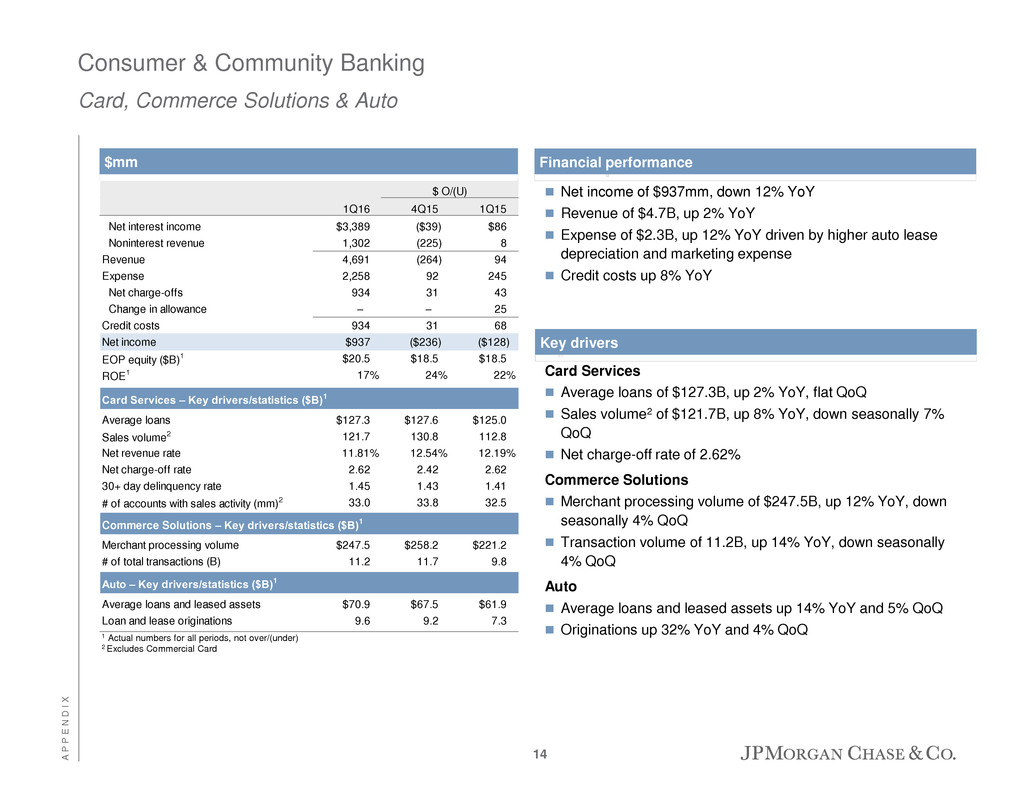

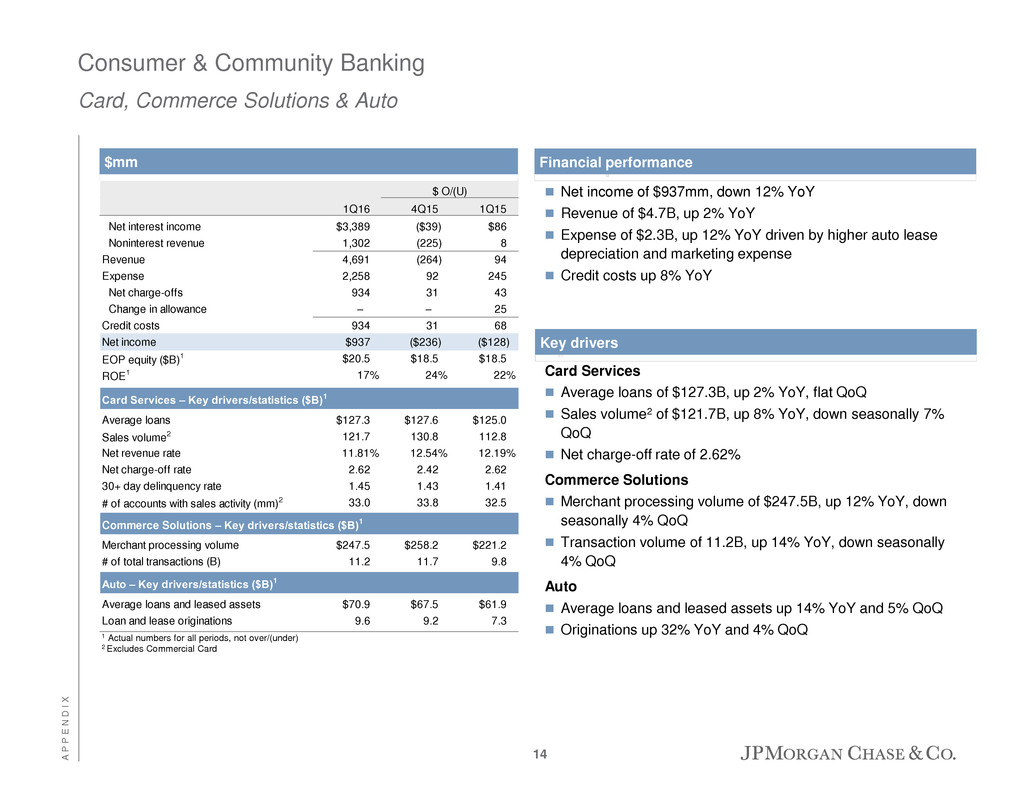

1Q16 4Q15 1Q15 Net interest income $3,389 ($39) $86 Noninterest revenue 1,302 (225) 8 Revenue 4,691 (264) 94 Expense 2,258 92 245 Net charge-offs 934 31 43 Change in allowance – – 25 Credit costs 934 31 68 Net income $937 ($236) ($128) EOP equity ($B)1 $20.5 $18.5 $18.5 ROE1 17% 24% 22% Card Services – Key drivers/statistics ($B)1 Average loans $127.3 $127.6 $125.0 Sales volume2 121.7 130.8 112.8 Net revenue rate 11.81% 12.54% 12.19% Net charge-off rate 2.62 2.42 2.62 30+ day delinquency rate 1.45 1.43 1.41 # of accounts with sales activity (mm)2 33.0 33.8 32.5 Commerce Solutions – Key drivers/statistics ($B)1 Merchant processing volume $247.5 $258.2 $221.2 # of total transactions (B) 11.2 11.7 9.8 Auto – Key drivers/statistics ($B)1 Average loans and leased assets $70.9 $67.5 $61.9 Loan and lease originations 9.6 9.2 7.3 $ O/(U) A P P E N D I X Consumer & Community Banking Card, Commerce Solutions & Auto $mm 1 Actual numbers for all periods, not over/(under) 2 Excludes Commercial Card Key drivers Net income of $937mm, down 12% YoY Revenue of $4.7B, up 2% YoY Expense of $2.3B, up 12% YoY driven by higher auto lease depreciation and marketing expense Credit costs up 8% YoY Card Services Average loans of $127.3B, up 2% YoY, flat QoQ Sales volume2 of $121.7B, up 8% YoY, down seasonally 7% QoQ Net charge-off rate of 2.62% Commerce Solutions Merchant processing volume of $247.5B, up 12% YoY, down seasonally 4% QoQ Transaction volume of 11.2B, up 14% YoY, down seasonally 4% QoQ Auto Average loans and leased assets up 14% YoY and 5% QoQ Originations up 32% YoY and 4% QoQ Financial performance 14

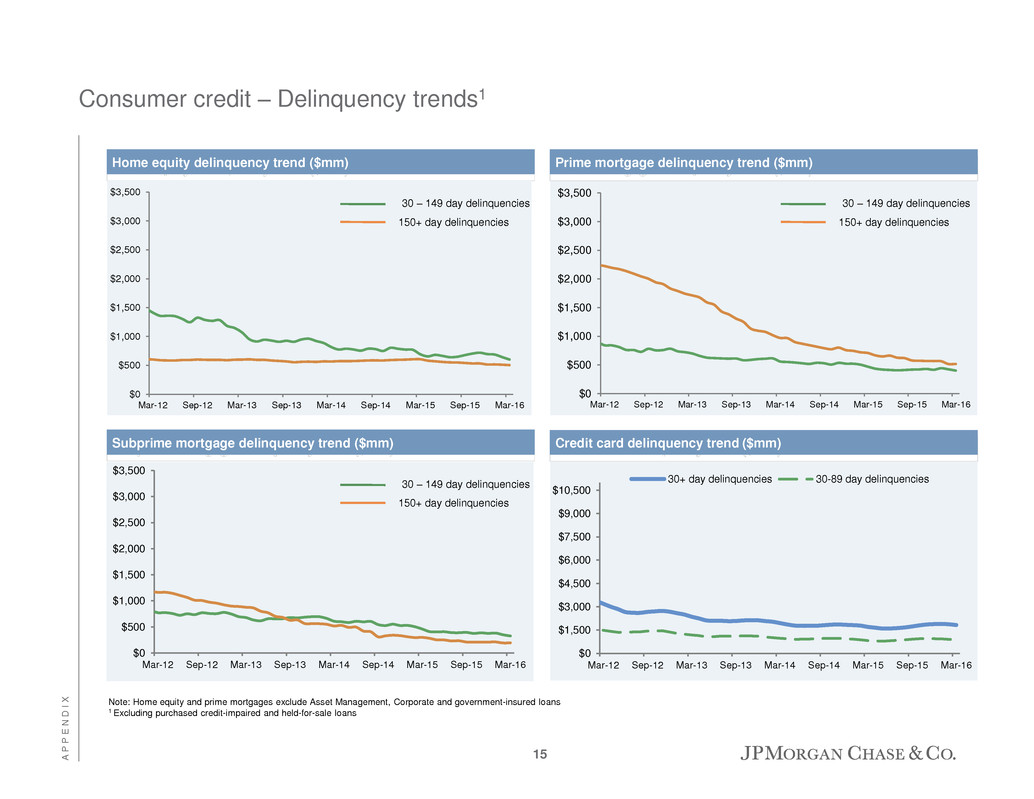

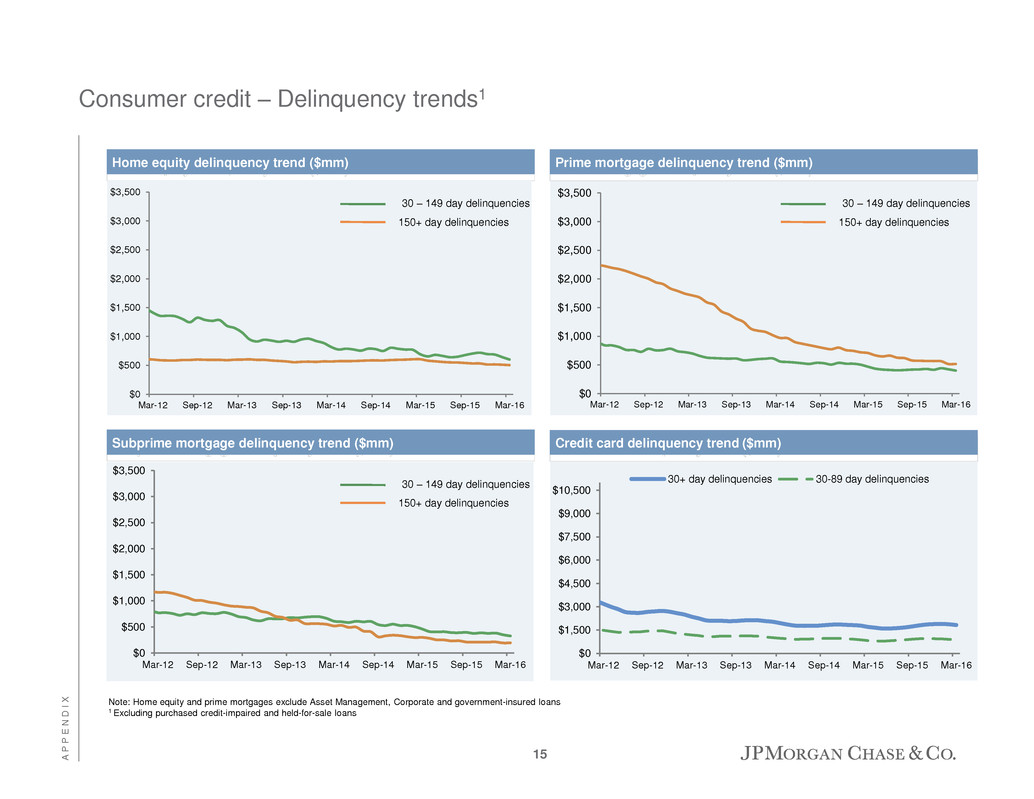

A P P E N D I X Consumer credit – Delinquency trends1 Note: Home equity and prime mortgages exclude Asset Management, Corporate and government-insured loans 1 Excluding purchased credit-impaired and held-for-sale loans Prime mortgage delinquency trend ($mm) Home equity delinquency trend ($mm) Subprime mortgage delinquency trend ($mm) Credit card delinquency trend ($mm) 15 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 30 – 149 day delinquencies 150+ day delinquencies 30 – 149 day delinquencies 150+ day delinquencies $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 30 – 149 day delinquencies 150+ day delinquencies $0 $1,500 $3,000 $4,500 $6,000 $7,500 $9,000 $10,500 Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15 Mar-16 30+ day delinquencies 30-89 day delinquencies

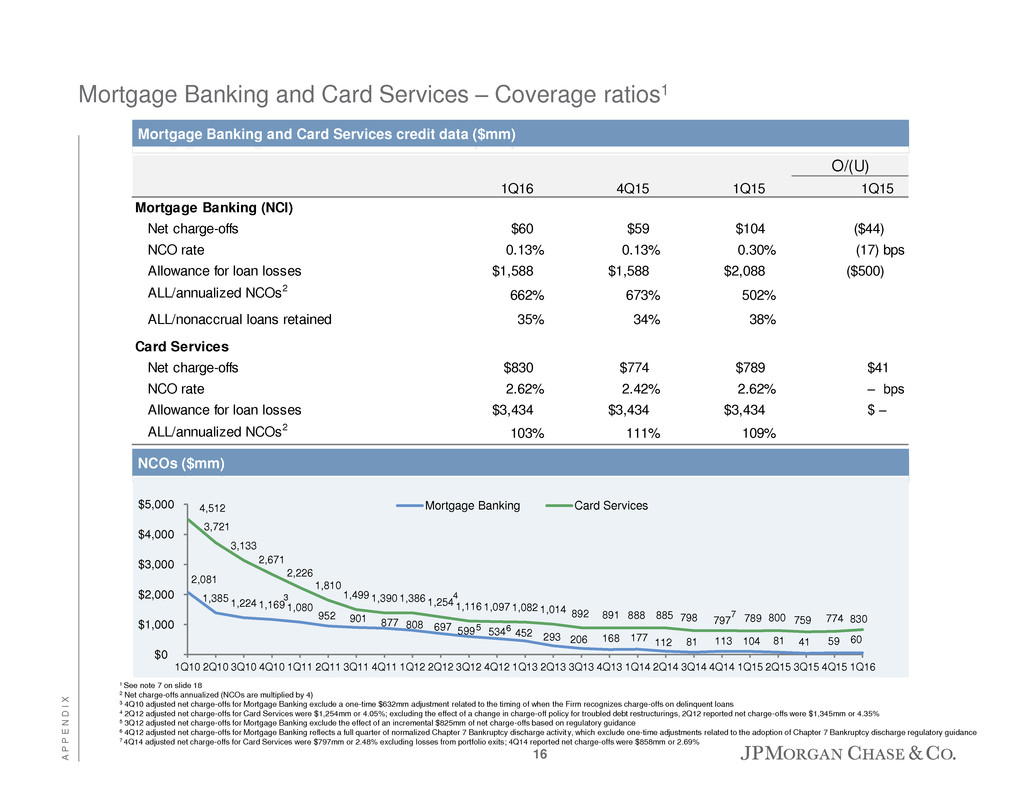

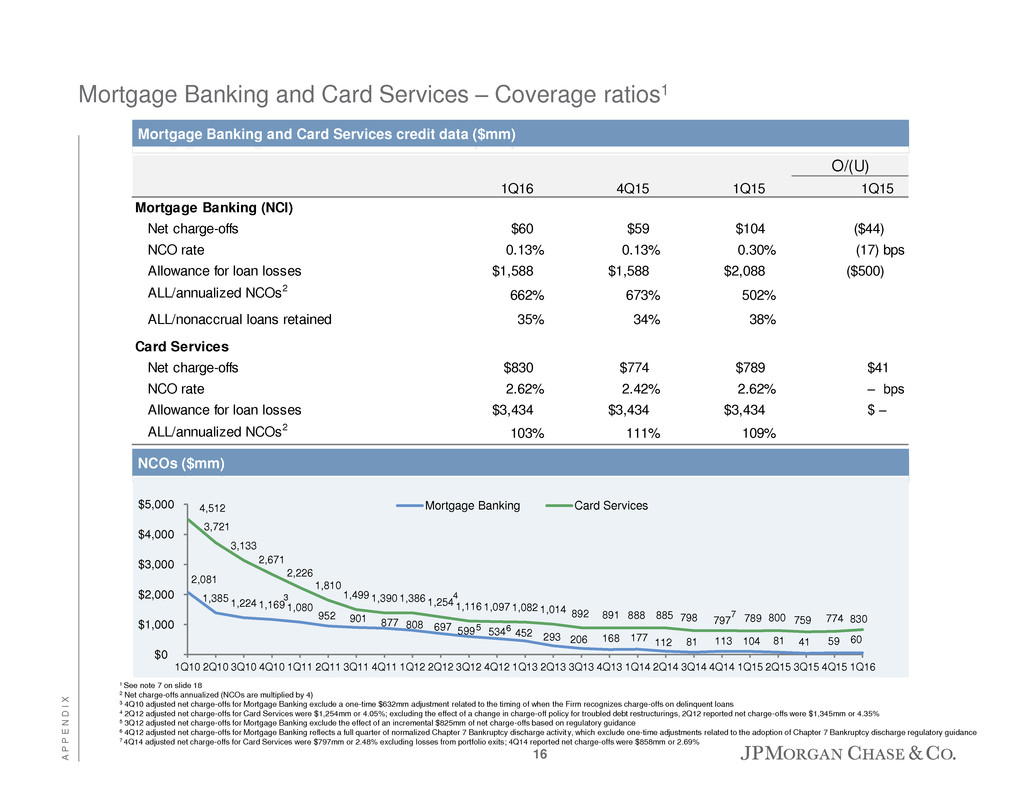

O/(U) 1Q16 4Q15 1Q15 1Q15 Mortgage Banking (NCI) Net charge-offs $60 $59 $104 ($44) NCO rate 0.13% 0.13% 0.30% (17) bps Allowance for loan losses $1,588 $1,588 $2,088 ($500) ALL/annualized NCOs2 662% 673% 502% ALL/nonaccrual loans retained 35% 34% 38% Card Services Net charge-offs $830 $774 $789 $41 NCO rate 2.62% 2.42% 2.62% – bps Allowance for loan losses $3,434 $3,434 $3,434 $ – ALL/annualized NCOs2 103% 111% 109% A P P E N D I X Mortgage Banking and Card Services – Coverage ratios1 Mortgage Banking and Card Services credit data ($mm) NCOs ($mm) 16 1 See note 7 on slide 18 2 Net charge-offs annualized (NCOs are multiplied by 4) 3 4Q10 adjusted net charge-offs for Mortgage Banking exclude a one-time $632mm adjustment related to the timing of when the Firm recognizes charge-offs on delinquent loans 4 2Q12 adjusted net charge-offs for Card Services were $1,254mm or 4.05%; excluding the effect of a change in charge-off policy for troubled debt restructurings, 2Q12 reported net charge-offs were $1,345mm or 4.35% 5 3Q12 adjusted net charge-offs for Mortgage Banking exclude the effect of an incremental $825mm of net charge-offs based on regulatory guidance 6 4Q12 adjusted net charge-offs for Mortgage Banking reflects a full quarter of normalized Chapter 7 Bankruptcy discharge activity, which exclude one-time adjustments related to the adoption of Chapter 7 Bankruptcy discharge regulatory guidance 7 4Q14 adjusted net charge-offs for Card Services were $797mm or 2.48% excluding losses from portfolio exits; 4Q14 reported net charge-offs were $858mm or 2.69% 2,081 1,385 1,224 1,169 1,080 952 901 877 808 697 599 534 452 293 206 168 177 112 81 113 104 81 41 59 60 4,512 3,721 3,133 2,671 2,226 1,810 1,499 1,390 1,386 1,254 1,116 1,097 1,082 1,014 892 891 888 885 798 797 789 800 759 774 830 $0 $1,000 $2,000 $3,000 $4,000 $5,000 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Mortgage Banking Card Services 3 4 5 6 7

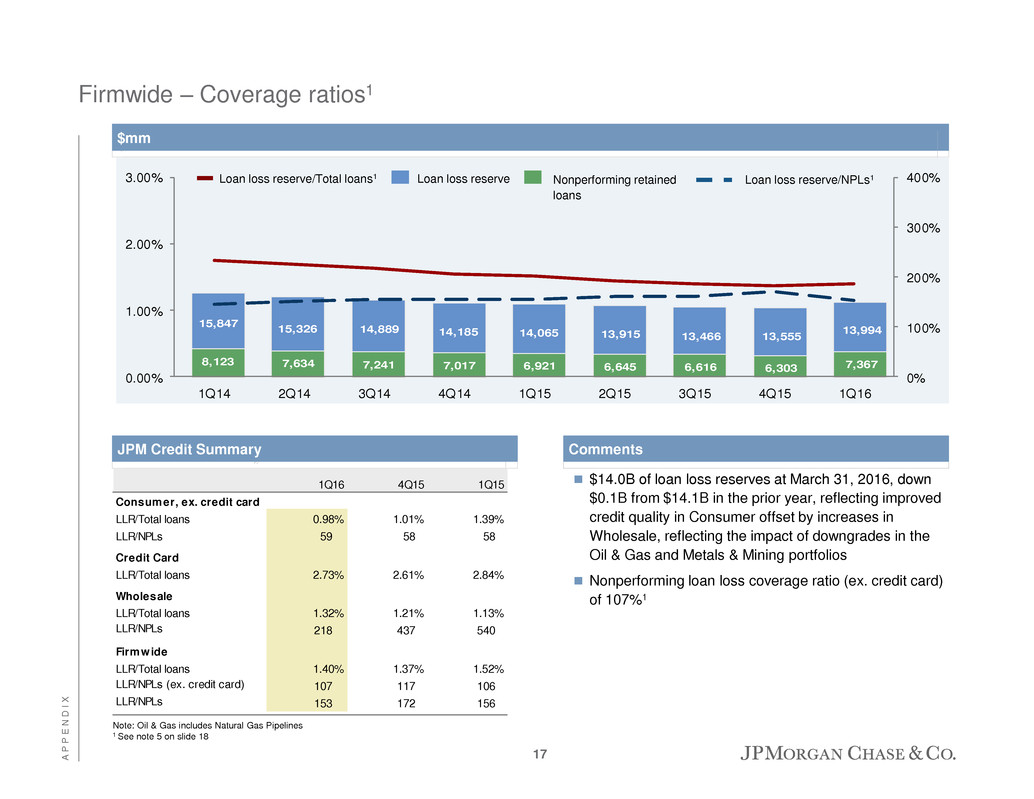

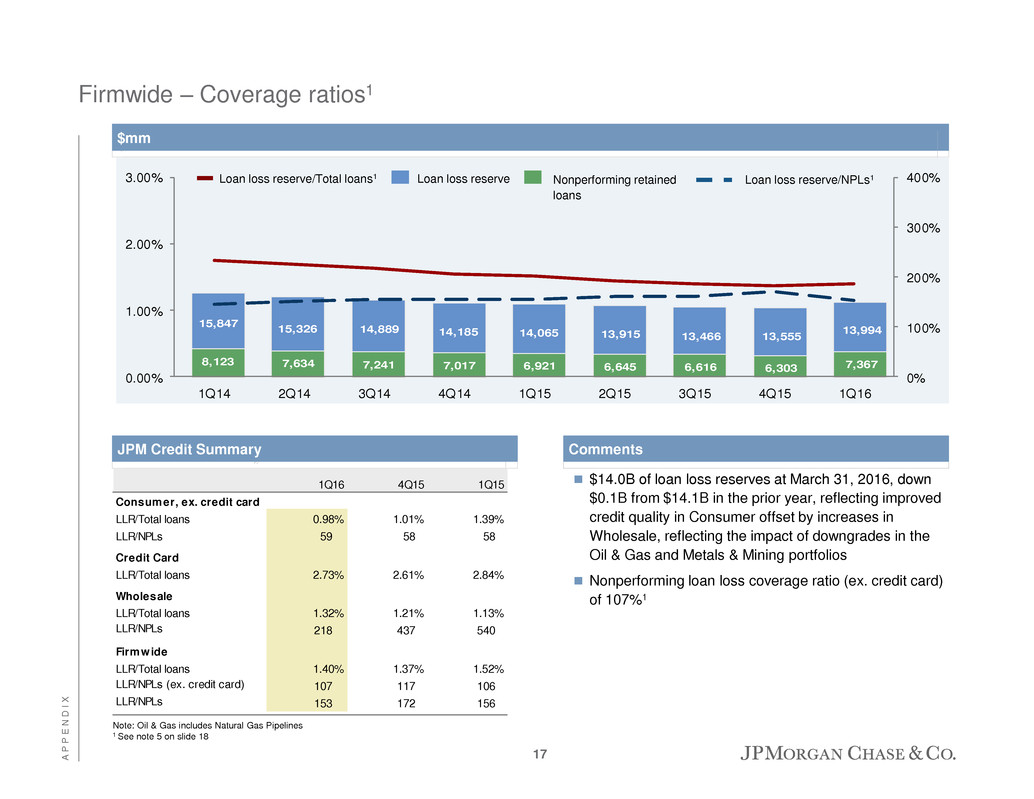

8,123 7,634 7,241 7,017 6,921 6,645 6,616 6,303 7,367 15,847 15,326 14,889 14,185 14,065 13,915 13,466 13,555 13,994 0.00% 1.00% 2.00% 3.00% 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 0% 100% 200% 300% 400% A P P E N D I X Firmwide – Coverage ratios1 $14.0B of loan loss reserves at March 31, 2016, down $0.1B from $14.1B in the prior year, reflecting improved credit quality in Consumer offset by increases in Wholesale, reflecting the impact of downgrades in the Oil & Gas and Metals & Mining portfolios Nonperforming loan loss coverage ratio (ex. credit card) of 107%1 Note: Oil & Gas includes Natural Gas Pipelines 1 See note 5 on slide 18 Comments JPM Credit Summary JPM Credit Summary $mm $mm 17 1Q16 4Q15 1Q15 Consumer, ex. credit card LLR/Total loans 0.98% 1.01% 1.39% LLR/NPLs 59 58 58 Credit Card LLR/Total loans 2.73% 2.61% 2.84% Wholesale LLR/Total loans 1.32% 1.21% 1.13% LLR/NPLs 218 437 540 Firmwide LLR/Total loans 1.40% 1.37% 1.52% LLR/NPLs (ex. credit card) 107 117 106 LLR/NPLs 153 172 156 Loan loss reserve Nonperforming retained loans Loan loss reserve/Total loans1 Loan loss reserve/NPLs1

A P P E N D I X Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews the Firm’s results, including the overhead ratio, and the results of the lines of business on a “managed” basis, which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm (and each of the business segments) on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable securities and investments. This non- GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. 2. Tangible common equity (“TCE”), return on tangible common equity (“ROTCE”) and tangible book value per share (“TBVPS”), are each non-GAAP financial measures. TCE represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. ROTCE measures the Firm’s net income applicable to common equity as a percentage of average TCE. TBVPS represents the Firm’s tangible common equity divided by period-end common shares. TCE, ROTCE, and TBVPS are meaningful to the Firm, as well as investors and analysts, in assessing the Firm’s use of equity. 3. Common equity Tier 1 (“CET1”) capital, Tier 1 capital, Total capital, risk-weighted assets (“RWA”) and the CET1, Tier 1 capital and total capital ratios and the supplementary leverage ratio (“SLR”) under the Basel III Fully Phased-In capital rules, to which the Firm will be subject commencing January 1, 2019, are each non-GAAP financial measures. These measures are used by management, bank regulators, investors and analysts to assess and monitor the Firm’s capital position. For additional information on these measures, see Capital Management on pages 149-158 of JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2015. 4. Adjusted expense and adjusted overhead ratio are each non-GAAP financial measures, and exclude Firmwide legal expense. Management believes this information helps investors understand the effect of this item on reported results and provides an alternate presentation of the Firm’s performance. 5. The ratios of the allowance for loan losses to end-of-period loans retained and allowance for loan losses to nonperforming loans exclude the following: loans accounted for at fair value and loans held-for-sale; purchased credit-impaired (“PCI”) loans; and the allowance for loan losses related to PCI loans. Additionally, net charge-offs and net charge-off rates exclude the impact of PCI loans. 6. The ratio of the allowance for loan losses to end-of-period loans is calculated excluding the impact of consolidated Firm-administered multi-seller conduits and trade finance loans, to provide a more meaningful assessment of CIB’s allowance coverage ratio. 7. Net charge-offs for Mortgage Banking and Card Services may be adjusted for significant items, as indicated. These adjusted charge-offs are non-GAAP financial measures used by management to facilitate comparisons with prior periods. Additional notes on financial measures 8. Core loans include loans considered central to the Firm’s ongoing businesses; core loans exclude loans classified as trading assets, runoff portfolios, discontinued portfolios and portfolios the Firm has an intent to exit. Notes 18

A P P E N D I X Additional Notes on slide 4 – Consumer & Community Banking 2. Actual numbers for all periods, not over/(under) 3. Includes predominantly Business Banking loans as well as deposit overdrafts 4. Firmwide mortgage origination volume was $24.4B, $24.7B, and $26.6B, for 1Q16, 4Q15 and 1Q15, respectively 5. Excludes purchased credit-impaired (PCI) write-offs of $47mm, $46mm, and $55mm for 1Q16, 4Q15, and 1Q15, respectively. See note 5 on slide 18 6. Excludes the impact of PCI loans. See note 5 on slide 18 7. Excludes Commercial Card Notes 19

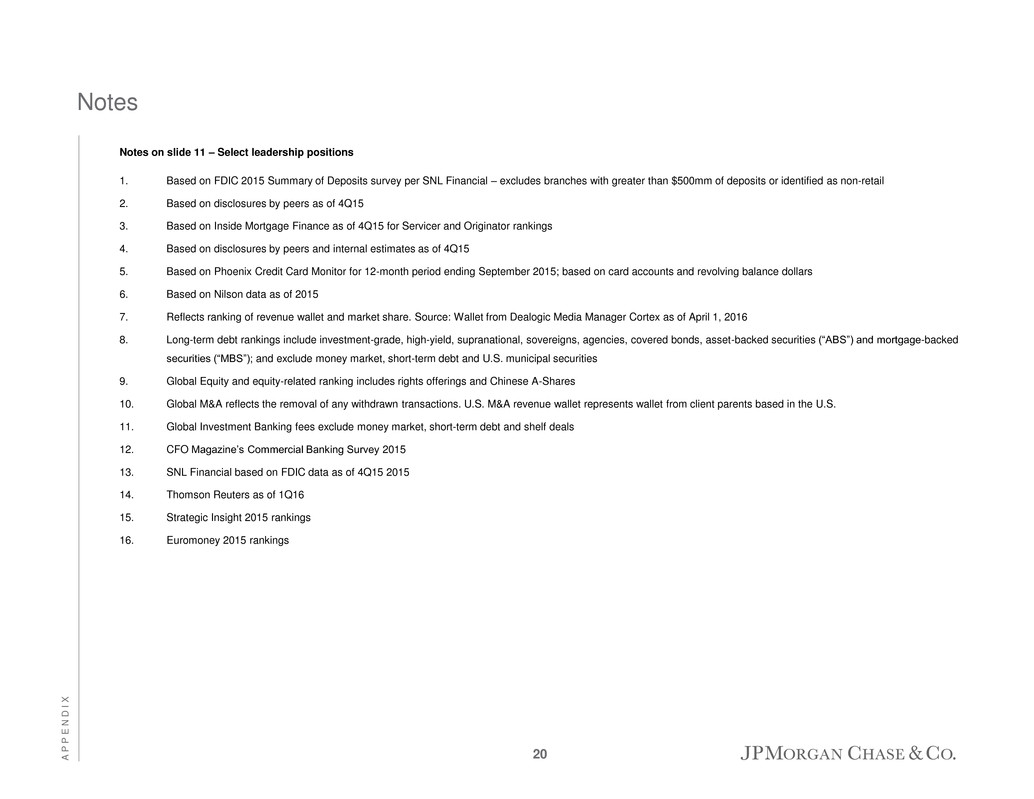

A P P E N D I X Notes on slide 11 – Select leadership positions 1. Based on FDIC 2015 Summary of Deposits survey per SNL Financial – excludes branches with greater than $500mm of deposits or identified as non-retail 2. Based on disclosures by peers as of 4Q15 3. Based on Inside Mortgage Finance as of 4Q15 for Servicer and Originator rankings 4. Based on disclosures by peers and internal estimates as of 4Q15 5. Based on Phoenix Credit Card Monitor for 12-month period ending September 2015; based on card accounts and revolving balance dollars 6. Based on Nilson data as of 2015 7. Reflects ranking of revenue wallet and market share. Source: Wallet from Dealogic Media Manager Cortex as of April 1, 2016 8. Long-term debt rankings include investment-grade, high-yield, supranational, sovereigns, agencies, covered bonds, asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”); and exclude money market, short-term debt and U.S. municipal securities 9. Global Equity and equity-related ranking includes rights offerings and Chinese A-Shares 10. Global M&A reflects the removal of any withdrawn transactions. U.S. M&A revenue wallet represents wallet from client parents based in the U.S. 11. Global Investment Banking fees exclude money market, short-term debt and shelf deals 12. CFO Magazine’s Commercial Banking Survey 2015 13. SNL Financial based on FDIC data as of 4Q15 2015 14. Thomson Reuters as of 1Q16 15. Strategic Insight 2015 rankings 16. Euromoney 2015 rankings Notes 20

A P P E N D I X Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2015, which has been filed with the Securities and Exchange Commission and is available on JPMorgan Chase & Co.’s website (http://investor.shareholder.com/jpmorganchase/sec.cfm), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements. 21