2 0 1 7 A N N U A L S T R E S S T E S T D I S C L O S U R E Dodd-Frank Act Stress Test Results Supervisory Severely Adverse Scenario June 22, 2017

Page Agenda 2 0 1 7 A N N U A L S T R E S S T E S T D I S C L O S U R E 2017 Supervisory Severely Adverse Scenario Results 1 Capital Adequacy Assessment Processes and Risk Methodologies 7 2017 Supervisory Severely Adverse Scenario Design and Description 20 DFAST Results – In-Scope Bank Entities 21 Forward-Looking Statements 25

Overview The 2017 Annual Stress Test Disclosure presents results of the annual stress test conducted by JPMorgan Chase & Co. (“JPMorgan Chase” or the “Firm”) in accordance with the Dodd-Frank Act Stress Test (“DFAST”) requirements. The results reflect certain forecasted financial measures for the nine-quarter period (Q1 2017 through Q1 2019) under the Supervisory Severely Adverse scenario prescribed by the Board of Governors of the Federal Reserve System (“Federal Reserve”). The stress test has been executed in accordance with the Comprehensive Capital Analysis and Review (“CCAR”) 2017 Summary Instructions for LISCC1 and Large and Complex Firms published by the Federal Reserve on February 3, 2017 (“2017 CCAR Instructions”). The results presented were calculated using forecasting models and methodologies developed and employed by JPMorgan Chase. The processes used for JPMorgan Chase were also used for the results presented for the depository institutions, JPMorgan Chase Bank, N.A. (“JPMCB”) and Chase Bank USA, N.A. (“CUSA”). The Federal Reserve conducts stress testing of financial institutions, including JPMorgan Chase, based on forecasting models and methodologies the Federal Reserve employs. Because of the different models and methodologies employed by the Firm and the Federal Reserve, results published by the Federal Reserve may vary from those disclosed herein; JPMorgan Chase may not be able to explain the differences between the results published in this report and the results published by the Federal Reserve. The results presented reflect specific assumptions regarding planned capital actions as prescribed by the DFAST rule starting with the second quarter of the projection period (“DFAST capital actions”)2: � Common stock dividend payments are assumed to continue at the same dollar amount as the average of the prior-four quarters (Q2 2016 – Q1 2017) and include common stock dividends attributable to issuances related to employee compensation � Scheduled dividend, interest, or principal payments for other capital instruments are assumed to be paid � Repurchases of common stock and redemptions of other capital instruments are assumed to be zero � Issuances of new preferred, or common stock, other than issuances of common stock related to employee compensation, are assumed to be zero The results disclosed herein represent hypothetical estimates under the Supervisory Severely Adverse scenario prescribed by the Federal Reserve that reflect an economic outcome that is more adverse than expected, and do not represent JPMorgan Chase's forecasts of expected gains, losses, pre-provision net revenue, net income before taxes, capital, risk-weighted assets (“RWA”), or capital ratios. 2 0 1 7 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S 1 The Large Institutions Supervision Coordinating Committee (“LISCC”) is a Federal Reserve System-wide committee that is tasked with overseeing the supervision of the largest, most systemically important financial institutions in the United States. LISCC firms are those subject to the LISCC framework 2 The first quarter of the projection period (Q1 2017) reflects actual capital actions (e.g., actual common stock dividends and repurchases net of issuances, and issuances and redemptions of other capital instruments) 1

Firm-calculated projected stressed capital ratios1 (Q1 2017 – Q1 2019) Firm-calculated projected Q1 2019 risk-weighted assets DFAST results under the Supervisory Severely Adverse scenario Capital and RWA projections – JPMorgan Chase 1 All regulatory capital ratios are calculated in accordance with the transition arrangements provided in the Federal Reserve's revised capital framework, issued in July 2013, and using the definitions of capital, risk-weighted assets, leverage assets (for the tier 1 leverage ratio), and supplementary leverage exposures (for the supplementary leverage ratio), that are in effect during the applicable quarter of the planning horizon. For additional information on Basel III, see Capital Risk Management on pages 76 - 85 of JPMorgan Chase’s Annual Report on Form 10-K for the year ended December 31, 2016 2 The minimum capital ratio represents the lowest calculated stressed capital ratio during the period Q1 2017 to Q1 2019. Calculations do not include the impact of JPMorgan Chase’s 2017 CCAR capital actions request 3 The supplementary leverage ratio (“SLR”), defined as tier 1 capital divided by total leverage exposure, will become a minimum capital ratio requirement for firms subject to the advanced approaches capital framework on January 1, 2018. Pursuant to the 2017 CCAR instructions, bank holding companies subject to the advanced approaches capital framework, including JPMorgan Chase, must demonstrate an ability to maintain a SLR above 3 percent in each of the quarters of the planning horizon corresponding to Q1 2018 to Q1 2019 1 Risk-weighted assets are calculated under the Basel III standardized capital risk-based approach 2 0 1 7 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S Actual Q4 2016 Projected Q1 2019 Risk-weighted assets (billions of dollars)1 $1,465 $1,416 2017 2018 Q1 2019 Q1 2019 Minimum Common equity tier 1 capital ratio (%) 12.5% 4.5% 4.5% 4.5% 9.1% 7.8% Tier 1 risk-based capital ratio (%) 14.2% 6.0% 6.0% 6.0% 10.9% 9.5% Total risk-based capital ratio (%) 16.4% 8.0% 8.0% 8.0% 13.4% 11.7% Tier 1 leverage ratio (%) 8.4% 4.0% 4.0% 4.0% 6.4% 6.0% Supplementary leverage ratio (%)3 6.5% n/a 3.0% 3.0% 5.0% 4.6% Actual Q4 2016 2017 CCAR / Regulatory Minimums Stressed capital ratios2 2

DFAST results under the Supervisory Severely Adverse scenario Profit & Loss projections – JPMorgan Chase Firm-calculated 9-quarter cumulative projected losses, revenues, net income before taxes, and other comprehensive income (Q1 2017 – Q1 2019) Note: Numbers may not sum due to rounding 1 Average assets is the nine-quarter average of total assets (Q1 2017 through Q1 2019) 2 Pre-provision net revenue (“PPNR”) includes losses from operational-risk events, mortgage repurchase expenses, and other real estate owned (“OREO”) costs 3 Other revenue includes one-time income and (expense) items not included in pre-provision net revenue 4 Trading and counterparty losses include mark-to-market (“MTM”) and credit valuation adjustment (“CVA”) losses resulting from the assumed instantaneous global market shock, and losses arising from the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities 5 Other losses/gains includes projected changes in fair value of loans held for sale (“HFS”) and loans held for investment measured under the fair value option (“FVO”) 6 Other comprehensive income (“OCI”) includes net unrealized losses/gains on (a) available-for-sale (“AFS”) securities and on any held-to-maturity (“HTM”) securities that have experienced other than temporary impairment (“OTTI”), (b) foreign currency translation adjustments, (c) cash flow hedges, and (d) net losses and prior service costs related to defined benefit pension and other postretirement employee benefit (“OPEB”) plans 7 JPMorgan Chase, as an advanced approach bank holding company (“BHC”), is required to transition AOCI related to (a) AFS securities and (b) pension and OPEB plans into projected regulatory capital. The transition arrangements for AOCI included in projected regulatory capital are 60 percent for Q4 2016, 80 percent for full year 2017, and 100 percent for full year 2018 and beyond 2 0 1 7 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S Billions of dollars Percent of average assets1 Pre-provision net revenue2 $51.3 2.1% Other revenue3 0.0 less Provision for loan and lease losses 56.2 Realized losses/(gains) on securities (AFS/HTM) 0.2 Trading and counterparty losses4 27.4 Other losses/(gains)5 2.5 equals Net income (losses) before taxes ($35.0) (1.4%) Memo items Other comprehensive income 6 ($5.4) Other effects on capital Actual Q4 2016 Q1 2019 Accumulated other comprehensive income ("AOCI") in capital (billions of dollars) 7 ($0.7) ($3.9) 3

DFAST results under the Supervisory Severely Adverse scenario Loan loss projections – JPMorgan Chase Firm-calculated 9-quarter cumulative projected loan losses, by type of loan (Q1 2017 – Q1 2019) � For purposes of this disclosure, loan losses and loss rates are calculated to be consistent with the Federal Reserve’s methodology5, which includes impairments in the purchased credit-impaired (“PCI”) portfolios as part of loan losses (rather than being included as part of loan loss reserves) 2 0 1 7 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S Note: Numbers may not sum due to rounding 1 Average loan balances used to calculate portfolio loss rates exclude loans HFS and loans held-for-investment under the FVO, and are calculated over the nine-quarter period 2 Commercial and industrial loans include small- and medium-enterprise loans and corporate cards 3 Other consumer loans include student loans and automobile loans 4 Other loans include loans to financial institutions 5 As described in the Federal Reserve’s Dodd-Frank Act Stress Test 2016: Supervisory Stress Test Methodology and Results published on June 23, 2016 Loan Losses $43.4 5.0 % First lien mortgages, domestic 4.2 1.8 Junior liens and HELOCs, domestic 4.5 11.1 Commercial & industrial 2 7.6 5.1 Commercial real estate, domestic 3.6 3.4 Credit cards 19.7 15.3 Other consumer 3 1.6 2.5 Other 4 2.2 1.5 Billions of dollars Portfolio loss rates (%) 1 4

Key drivers of JPMorgan Chase’s DFAST pro forma CET1 ratio Firm-calculated CET1 ratio calculated under Supervisory Severely Adverse scenario (billions of dollars) Note: Numbers may not sum due to rounding 1 Q4 2016 and Q1 2019 reflect end-of-period amounts. Other amounts represent the cumulative nine-quarter impact (Q1 2017 – Q1 2019) 2 Includes projected changes in fair value of loans HFS and loans held for investment measured under the FVO 3 Represents other items, including income taxes, securities losses/gains, and goodwill and intangibles net of related deferred tax liabilities 4 Net capital distributions in the first quarter of the projection period (Q1 2017) reflect actual capital actions (e.g., actual amount of common stock dividends and repurchases net of issuances); the second through the ninth quarters (Q2 2017 – Q1 2019) assumes: common stock dividend payments continue at the same dollar amount as the average of the prior four quarters (Q2 2016 – Q1 2017) and include common stock dividends attributable to issuances related to employee compensation; scheduled dividend, interest, or principal payments for other capital instruments are paid; repurchases of common stock and redemptions of other capital instruments are zero; issuances of new preferred or common stock, other than issuances of common stock related to employee compensation, are zero 5 Risk-weighted assets are calculated under the Basel III standardized capital risk-based approach 2 0 1 7 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S CET1 impact $51 ($56) ($27) ($2) ($3) -- ($21) RWA⁵ $1,465 $1,416 12.5% $183 9.1% $129 3.5% 3.8% 1.9% 0.2% 0.2% 0.4% 1.1% 1.4% Launch point 2017 DFAST (Q4 2016)¹ Pretax PPNR (incl. op. losses) Pretax provisions for loan and lease losses Pretax trading and counterparty losses Pretax other losses² AOCI RWA Other³ Net capital distributions⁴ End point 2017 DFAST (Q1 2019)¹ 2017 CCAR Regulatory Minimum: 4.5% 5

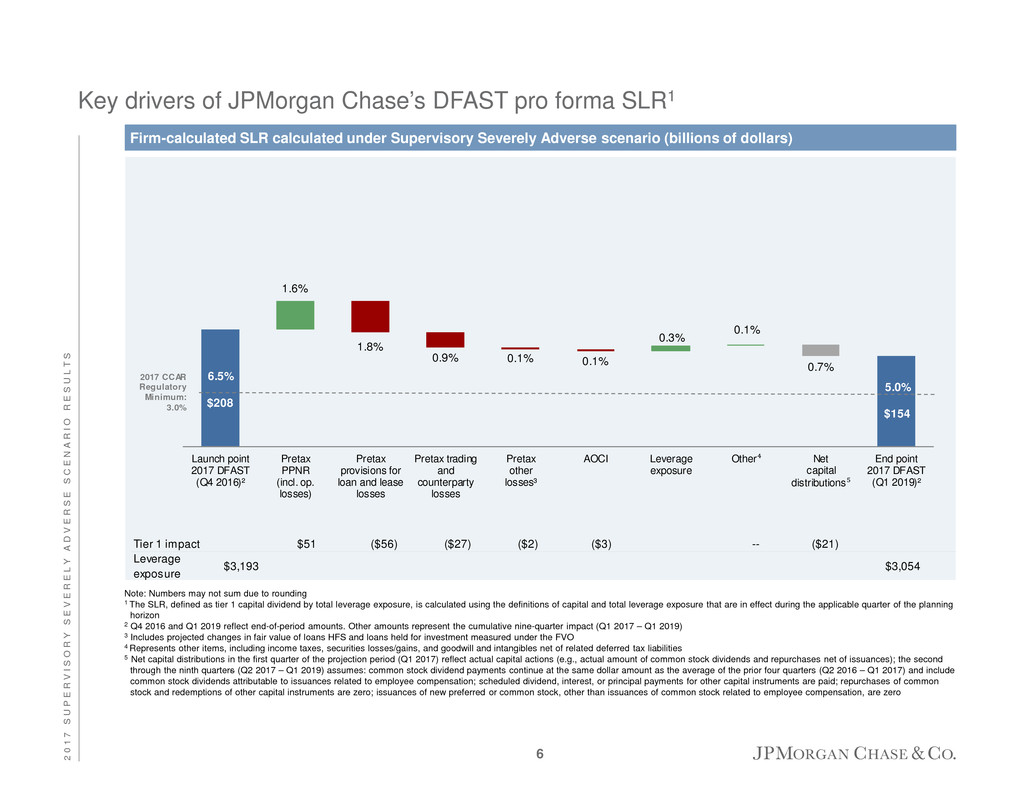

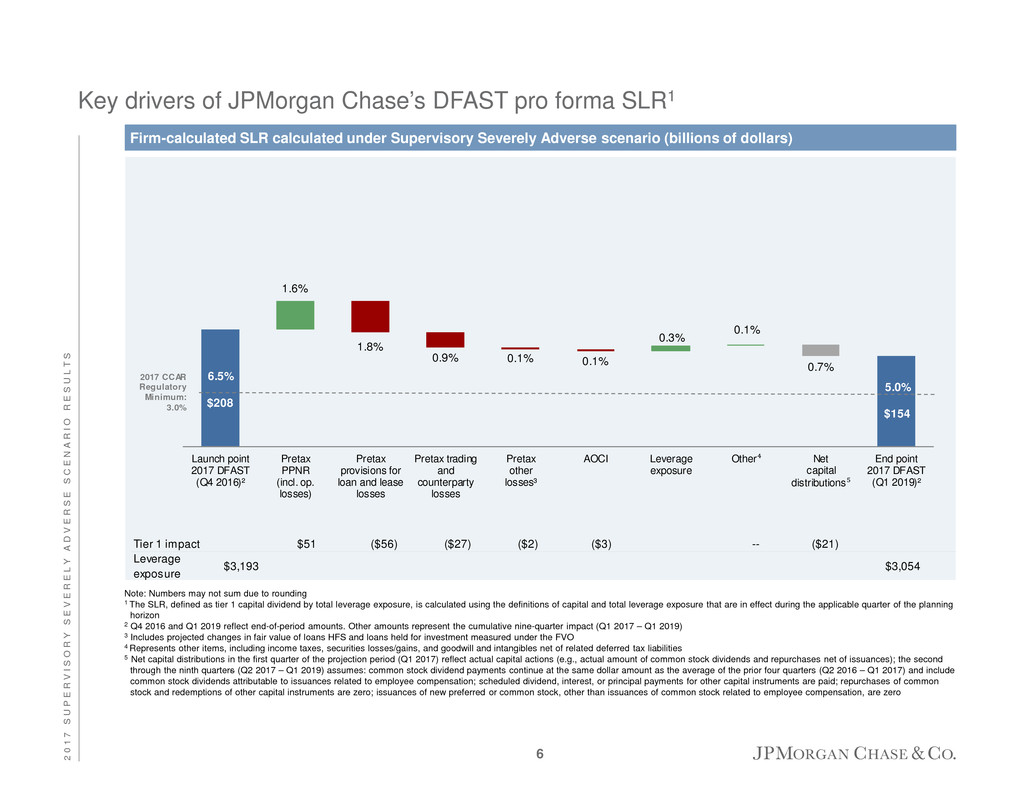

Key drivers of JPMorgan Chase’s DFAST pro forma SLR1 Note: Numbers may not sum due to rounding 1 The SLR, defined as tier 1 capital dividend by total leverage exposure, is calculated using the definitions of capital and total leverage exposure that are in effect during the applicable quarter of the planning horizon 2 Q4 2016 and Q1 2019 reflect end-of-period amounts. Other amounts represent the cumulative nine-quarter impact (Q1 2017 – Q1 2019) 3 Includes projected changes in fair value of loans HFS and loans held for investment measured under the FVO 4 Represents other items, including income taxes, securities losses/gains, and goodwill and intangibles net of related deferred tax liabilities 5 Net capital distributions in the first quarter of the projection period (Q1 2017) reflect actual capital actions (e.g., actual amount of common stock dividends and repurchases net of issuances); the second through the ninth quarters (Q2 2017 – Q1 2019) assumes: common stock dividend payments continue at the same dollar amount as the average of the prior four quarters (Q2 2016 – Q1 2017) and include common stock dividends attributable to issuances related to employee compensation; scheduled dividend, interest, or principal payments for other capital instruments are paid; repurchases of common stock and redemptions of other capital instruments are zero; issuances of new preferred or common stock, other than issuances of common stock related to employee compensation, are zero Firm-calculated SLR calculated under Supervisory Severely Adverse scenario (billions of dollars) 2 0 1 7 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O R E S U L T S 6.5% $208 5.0% $154 1.6% 1.8% 0.9% 0.1% 0.1% 0.3% 0.1% 0.7% Launch point 2017 DFAST (Q4 2016)² Pretax PPNR (incl. op. losses) Pretax provisions for loan and lease losses Pretax trading and counterparty losses Pretax other losses³ AOCI Leverage exposure Other⁴ Net capital distributions⁵ End point 2017 DFAST (Q1 2019)² 2017 CCAR Regulatory Minimum: 3.0% Tier 1 impact $51 ($56) ($27) ($2) ($3) -- ($21) Leverage exposure $3,193 $3,054 6

Page Agenda 2 0 1 7 A N N U A L S T R E S S T E S T D I S C L O S U R E Capital Adequacy Assessment Processes and Risk Methodologies 7 2017 Supervisory Severely Adverse Scenario Results 1 2017 Supervisory Severely Adverse Scenario Design and Description 20 DFAST Results – In-Scope Bank Entities 21 Forward-Looking Statements 25

� Both CCAR and DFAST stress tests are components of the Firm’s Internal Capital Adequacy Assessment Process (“ICAAP”) � Capital adequacy assessment processes are used to evaluate the Firm’s capital adequacy by providing management with a view of the impact of severe and unexpected events on earnings, balance sheet positions, reserves, and capital � A broad range of macroeconomic factors, interest rate sensitivities, market stresses, and idiosyncratic risks and events are assessed � Results are assessed relative to internal capital management policies and regulatory capital requirements, and are used in capital and risk management decisions � Semi-annual process � Centrally-defined economic scenarios applied uniformly across the Firm � CCAR: Three scenarios defined by the Federal Reserve, and at least one stress scenario defined by JPMorgan Chase’s economists � DFAST Mid-Cycle company-run: Three scenarios defined by JPMorgan Chase’s economists � Granular approach; forecasts and projections developed at the portfolio or line of business (“LOB”) level � On-going governance of the Firm’s model and non-model estimation methods policies including but not limited to development, testing, documentation, inventory, validation, and on-going performance assessments � Forecasting results independently assessed by the Central Challenger team within the Firm’s Regulatory Capital Management Office (“RCMO”) � Results projected over 2+ year time horizon Key Features � Draws on the collective expertise and resources of the Firm (e.g., people, systems, technology and control functions) � Leverages employees across LOBs and Firmwide functions, many of whom carry out ICAAP and risk management processes as part of their core responsibilities � Centrally coordinated and supervised by Corporate Capital Stress Testing group within the Firm’s RCMO Key Resources Overall results reviewed with the Firm’s Capital Governance Committee and Board of Directors Overview of capital adequacy assessment processes C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 7

Governance and control processes Capital adequacy assessment governance and control processes Board of Directors � Reviews results of the capital adequacy assessment, which encompasses the effectiveness of the capital adequacy process, the appropriateness of the risk tolerance levels, and the robustness of the control infrastructure � Approves capital management policies � Approves annual capital plan Capital Governance Committee � Governs the capital adequacy assessment process, including the overall design, assumptions, and risk streams incorporated in the process, and is responsible for ensuring that capital stress test programs are designed to adequately capture the idiosyncratic risks across the Firm’s businesses LOB Chief Financial / Risk Officers � Responsible for the results of the capital stress testing process for their respective LOB, including adherence to Firmwide guidelines � Manages execution of LOB quality control and assurance processes in accordance with established control standards � Formally attests to LOB capital stress testing control processes, results, and supporting documentation Regulatory Capital Management Office � Manages and administers the capital adequacy assessment process � Conducts independent risk-based assessments of the capital adequacy assessment forecasts with the purpose of providing transparency and escalation to the appropriate governing bodies � Establishes and oversees the control framework for the capital adequacy assessment process, including: � Centrally-provided training and guidance � Senior-level steering committee meetings � Risk and Controls Self Assessments, in coordination with the Firmwide Oversight and Control function � Assessment of the integrity of the Firm’s end-to-end capital planning processes � Capital adequacy, including stress testing, is central to JPMorgan Chase’s business strategy and as such is subject to oversight at the most senior levels of the Firm – both the CCAR and DFAST Mid-Cycle stress tests leverage this governance framework Model Risk Governance & Review � Establishes and manages the on-going governance of the Firm’s model and non-model estimation methods policies including but not limited to development, testing, documentation, inventory, validation, and on-going performance assessments Internal Audit � Conducts a program of audit coverage to evaluate the adequacy and effectiveness of the internal controls supporting the Firm’s capital planning processes C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 8

Capital management objectives and assessment of results � Maintain “well-capitalized” status according to the regulatory framework applicable to the Firm and its principal bank subsidiaries � Support risks underlying business activities � Maintain sufficient capital in order to continue to build and invest in its businesses through the cycle and in stressed environments � Retain flexibility to take advantage of future investment opportunities � Serve as a source of strength to its subsidiaries � Meet capital distribution objectives � Maintain sufficient capital resources to operate throughout a resolution period in accordance with the Firm’s preferred resolution strategy JPMorgan Chase’s capital management objectives are to hold capital sufficient to: Firmwide capital ratios are assessed relative to: � Applicable regulatory standards � CCAR guidelines established by the Federal Reserve � Internal capital management policies Capital management decisions: � Through the cycle business growth and investment � Sustainable, upward-trending dividends � Issuance/redemption plans across capital structure � Balance sheet management and strategy Results inform C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 9

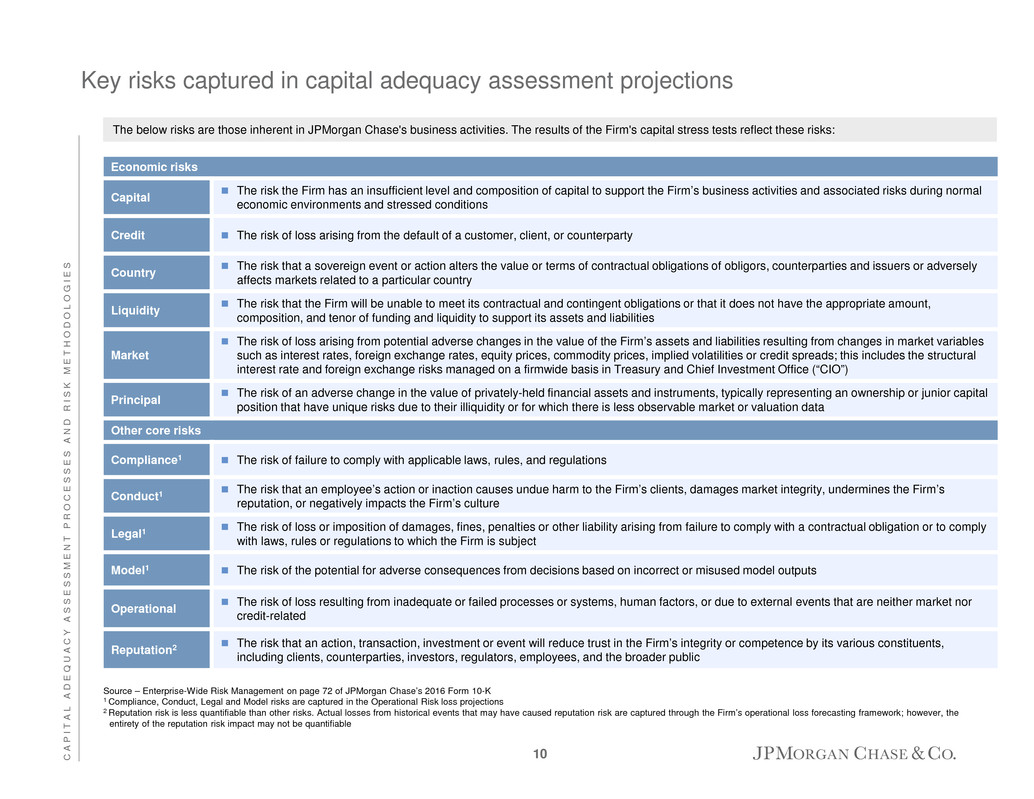

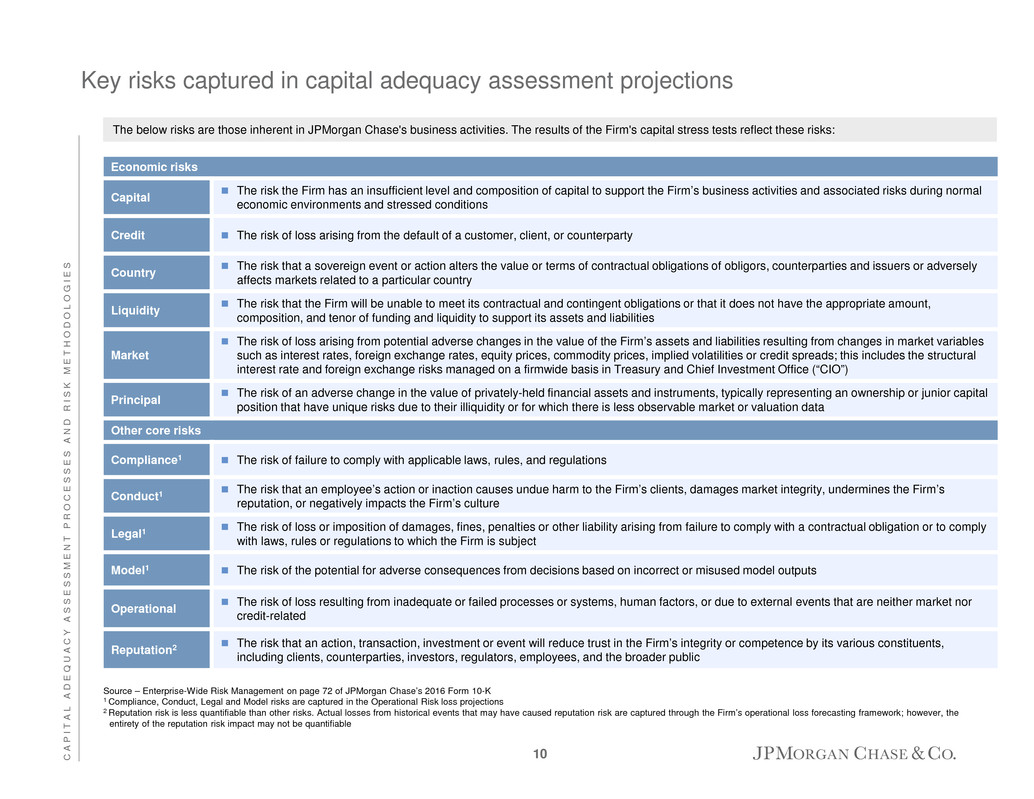

Economic risks Capital � The risk the Firm has an insufficient level and composition of capital to support the Firm’s business activities and associated risks during normal economic environments and stressed conditions Credit � The risk of loss arising from the default of a customer, client, or counterparty Country � The risk that a sovereign event or action alters the value or terms of contractual obligations of obligors, counterparties and issuers or adversely affects markets related to a particular country Liquidity � The risk that the Firm will be unable to meet its contractual and contingent obligations or that it does not have the appropriate amount, composition, and tenor of funding and liquidity to support its assets and liabilities Market � The risk of loss arising from potential adverse changes in the value of the Firm’s assets and liabilities resulting from changes in market variables such as interest rates, foreign exchange rates, equity prices, commodity prices, implied volatilities or credit spreads; this includes the structural interest rate and foreign exchange risks managed on a firmwide basis in Treasury and Chief Investment Office (“CIO”) Principal � The risk of an adverse change in the value of privately-held financial assets and instruments, typically representing an ownership or junior capital position that have unique risks due to their illiquidity or for which there is less observable market or valuation data Other core risks Compliance1 � The risk of failure to comply with applicable laws, rules, and regulations Conduct1 � The risk that an employee’s action or inaction causes undue harm to the Firm’s clients, damages market integrity, undermines the Firm’s reputation, or negatively impacts the Firm’s culture Legal1 � The risk of loss or imposition of damages, fines, penalties or other liability arising from failure to comply with a contractual obligation or to comply with laws, rules or regulations to which the Firm is subject Model1 � The risk of the potential for adverse consequences from decisions based on incorrect or misused model outputs Operational � The risk of loss resulting from inadequate or failed processes or systems, human factors, or due to external events that are neither market nor credit-related Reputation2 � The risk that an action, transaction, investment or event will reduce trust in the Firm’s integrity or competence by its various constituents, including clients, counterparties, investors, regulators, employees, and the broader public The below risks are those inherent in JPMorgan Chase's business activities. The results of the Firm's capital stress tests reflect these risks: Key risks captured in capital adequacy assessment projections Source – Enterprise-Wide Risk Management on page 72 of JPMorgan Chase’s 2016 Form 10-K 1 Compliance, Conduct, Legal and Model risks are captured in the Operational Risk loss projections 2 Reputation risk is less quantifiable than other risks. Actual losses from historical events that may have caused reputation risk are captured through the Firm’s operational loss forecasting framework; however, the entirety of the reputation risk impact may not be quantifiable C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 10

Key risks by business activity captured in capital adequacy assessment projections Business activities Key risks Consumer & Community Banking � Consumer & Business Banking � Consumer Banking / Chase Wealth Management � Business Banking � Mortgage Banking � Mortgage Production � Mortgage Servicing � Real Estate Portfolios � Card, Commerce Solutions & Auto � Credit � Liquidity � Market � Principal � Model � Operational, legal, and compliance Corporate & Investment Bank � Banking � Investment Banking � Treasury Services � Lending � Markets & Investor Services � Fixed Income / Equity Markets � Securities Services � Credit Adjustments & Other � Credit � Liquidity � Market � Principal � Model � Operational, legal, and compliance � Country Commercial Banking � Middle Market Banking � Corporate Client Banking � Commercial Term Lending � Real Estate Banking � Credit � Liquidity � Market � Principal � Model � Operational, legal, and compliance � Country Asset & Wealth Management � Asset Management � Wealth Management � Credit � Liquidity � Market � Principal � Model � Operational, legal, and compliance � Country Corporate � CIO and Treasury � Other Corporate (including Private Equity) � Credit � Liquidity � Market1 � Principal � Capital � Model � Operational, legal, and compliance � Country 1 Includes the Firm's structural interest rate and non-USD FX risks which arise from activities undertaken by its four major reportable business segments and is centrally managed by CIO and Treasury within Corporate C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 11

Capital and risk components captured in capital adequacy assessment projections � Quantitative approach applied across all scenarios; non-model estimation also a critical component of process � Approach employs econometric models and historical regressions where appropriate Capital componentsKey risks captured Provision for loan and lease losses � Projections of net charge-offs, reserves, and loan balances based on composition and characteristics of wholesale and consumer loan portfolios across: � Wholesale – sector, region, and risk rating segments � Consumer – loan level, asset class, and behavioral segments Credit � Credit risks, which are impacted by: � Probability of obligor or counterparty downgrade or default, or sovereign rating downgrade or default � Loan transition to different payment status (i.e., current, delinquent, default) and risk grade � Loss severity � Changes in exposure at default including utilization of commitments 2 Trading & counterparty losses (market shock) � Projections of the effect of instantaneous market shocks on trading positions � Losses are reflected in first quarter of projection period Market � Market risk factors including directional exposure, volatility, basis, and issuer default risk � Impact on credit valuation adjustments � Probability of derivatives and securities financing transactions (“SFT”) counterparty defaults 3 Capital (Earnings) PPNR � Product-centric models and forecasting frameworks for revenue forecasts based on JPMorgan Chase’s historical experience supplemented by industry data and non-model estimation, where appropriate � Granular, LOB-level projections for expense forecasts, governed by Firmwide expense reduction guidelines for severe stress environments � Projections reflect macroeconomic factors, anticipated client behavior, and business activity, among other factors Gains/losses on securities � Projections of gains/losses on AFS and HTM positions Losses on HFS/FVO loans � Projections of changes in valuations of HFS loans and loans accounted for under FVO � Revenue depletion and expense volatility associated with Firm’s business activities and products. Risks include: � Interest rate duration � Equity prices � Mortgage repurchase � FX � Basis � Convexity � Prepayment � Credit-related other than temporary impairment (“OTTI”) losses � Changes in credit spreads � Operational, legal, and compliance 1 Capital position / actions � Capital projections reflect balance sheet management strategies � Capital actions reflect specific assumptions prescribed by the DFAST rule and do not include the impact of JPMorgan Chase’s 2017 CCAR capital actions request RWA � Projections of Basel III standardized RWA� Market risk factors including directional exposure, volatility, basis, and structural risk � Credit risk factors affecting balances, including probability of obligor or counterparty downgrade or default, or country risk downgrade 4 AOCI � AOCI projections account for amortization, callability, and maturity � Reflects application of Basel III standardized transitional provisions � Market risk factors including interest rates, FX, and credit spreads5 C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 12

Risks embedded in earnings – PPNR1 Scope � Represents total net revenue less noninterest expense; includes operational risk expense and excludes credit costs Approach � Granular forecast across all products by individual PPNR component � Loan balances, deposits, net interest income (“NII”), trading revenue, fee revenue, compensation expense, operational losses, and other expense � Projections capture variability of spreads, pricing, prepayments, basis movement, etc., observed in the underlying economic scenarios � Projections reflect potential exposure due to failed processes or systems, external events, or resulting from fines, penalties or other liability arising from failure to comply with a contractual obligation or applicable laws or regulations Types of risks identified and captured � Market � Sales & trading revenue � Investment banking revenue � Asset and Wealth management revenue � Investment services revenue � Principal investments gains and losses � Structural interest rate � Consumer and wholesale deposit NII Consumer and wholesale loan NII � Investment securities NII � Mortgage servicing rights (“MSR”) valuation � Prepayment � Residential and commercial lending revenue � Operational, legal, and compliance � Operational losses Methodologies � Econometric and regression models and forecasting frameworks used, as appropriate, to establish relationships between macroeconomic factors and JPMorgan Chase’s historical experience � P&L and on- and off-balance sheet projections capture: � Interest rate, FX, and basis risks through projections of JPMorgan Chase’s core nontrading business activities � Investment risk from private equity and other principal investments � Expense management actions driven by the underlying economic factors � Operational loss projections are based on the relationship between macroeconomic variables and JPMorgan Chase’s historical loss experience where appropriate, as well as scenario analysis to capture potential exposures more aligned to the Firm’s current risk profile Non-model estimations � Non-model estimation is applied, including: � To define key business assumptions/inputs, including: – Assumptions related to business activities (e.g., market size, market share, and trading flows) – Assumptions surrounding expense levels in a stressed environment � As the primary method to produce projections when statistical models cannot be used due to limited or insufficient data, or when components are not sensitive to changes in the economic environment C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 13

Risks embedded in earnings – Gains/losses on AFS & HTM securities Scope � Represents OTTI on the investment securities portfolio Approach � Investment securities are assessed for OTTI, and OTTI is recognized when the Firm determines that it does not expect to recover the entire amortized cost of an investment security � Separate methodologies developed for individual asset classes � Assumes no securities are sold throughout the forecast period Types of risks identified and captured � Potential credit-related OTTI � Credit risks, which are impacted by estimates of the probability of default, loss given default, and prepayment assumptions Methodologies � The methodologies used to assess the portfolio include: � Issuer credit migrations for non-securitized products (e.g.,corporate debt, non-U.S. government debt, and municipal bonds) � Cash flow model-based methodology used for securitized products – Cash flows are projected to identify any principal shortfalls Non-model estimations � Non-model estimation is applied to determine key inputs/assumptions used in the projection of OTTI in lieu of statistical models where there is limited or insufficient data for certain securities, including: � Default rates; � Recovery rates; and � Prepayment rates for certain securitized products 1 C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 14

Risks embedded in earnings – Losses on HFS loans and loans accounted for under the FVO Scope � Represents changes in valuation of HFS loans and commitments pending syndication, as well as loans accounted for under FVO in the Firm’s wholesale loan portfolio Approach � Projections are based on the estimated change in value of loans and commitments (i.e., lower of cost or fair value for HFS loans, and fair value for FVO loans) Types of risks identified and captured � Market risk resulting from changes in credit spreads � Credit risk resulting from default Methodologies � Projections capture the Firm’s exposure to changes in the fair value of HFS/FVO loans primarily due to credit spreads based on facility rating Non-model estimations � Non-model estimation is applied, including: � To estimate the timing and extent of funding a pending syndication � To estimate the timing of pending sales over the nine-quarter forecast horizon 1 C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 15

Credit risk – Provision for loan and lease losses 2 Scope � Represents losses inherent in the Firm’s retained loans portfolios and related commitments Approach � Provision projections based on composition and characteristics of wholesale and consumer loan portfolios across all asset classes and customer segments � Considers estimated delinquencies, charge-offs/recoveries, and changes in reserves � Risks assessed on a risk-rated basis for the wholesale portfolio and on a scored basis for the consumer portfolio � The consumer loan portfolio excludes certain risk-rated business banking and auto dealer loans which are included in the wholesale loan portfolio1 Types of risks identified and captured � Credit risk impacted by: � Probability of obligor or counterparty downgrade or default, or sovereign rating downgrades or default � Loan transition to different payment statuses (i.e., current, delinquent, default) and risk grade � Loss severity � Changes in exposure at default including utilization of commitments Methodologies � Model-based approach, which captures the inherent, idiosyncratic risks that are unique to the Firm’s portfolios � Reflects credit migration and changes in delinquency trends driven by the underlying economic factors (e.g., U.S. gross domestic product (“GDP”), unemployment rate, house price index (“HPI”), which influence the frequency and severity of potential losses � Considers characteristics such as credit rating, geographic distribution, product and industry mix, and collateral type � Leverages loss experience data relevant to the Firm’s asset classes and portfolios � Reflects reserve levels calculated in accordance with accounting principles generally accepted in the U.S. (“U.S. GAAP”), regulatory guidelines, and the Firm’s internal accounting policies and procedures Non-model estimations � Non-model estimation is applied, including: � To define key business assumptions/inputs, including credit quality of new originations � To determine the timing of recognition of loan loss reserves builds/releases C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 1 These loans are included in the wholesale portfolio for CCAR and reported as part of the consumer portfolio in the Firm’s SEC disclosures 16

Market risk – Trading & counterparty losses (market shock)3 Scope � Represents an instantaneous global market shock applied to trading and counterparty positions as of January 5, 20171 Approach � Instantaneous P&L impact with no re-hedging and no recovery assumed over the forecast period Types of risks identified and captured � Market risks on trading, principal investments and other assets carried at fair value � Market risk factors including directional exposure, volatility, and basis risks � Counterparty credit risk (“CCR”) � CVA captures valuation adjustments which reflect counterparty credit risk � Counterparty default assumes an instantaneous and unexpected default of the counterparty which would result in the largest loss across derivatives and securities financing transaction (“SFT”) activities after the market shock � Trading issuer default losses (“IDL”) captures additional projected losses from the default of underlying issuers on the Firm’s trading positions Methodologies � Results measure the Firm’s exposure to changes in the fair value of financial instruments primarily due to movements in: � Interest rates � FX rates � Equity prices � Credit spreads � Commodity prices � Leverages the existing Firmwide stress framework and methodologies across all LOBs � Trade-level results, reflecting the instantaneous impact of the shock, are aggregated for all counterparties to produce the stressed MTM, CVA, and other credit metrics Non-model estimations � No significant non-model estimation applied 1 As prescribed in the Federal Reserve’s CCAR 2017 Summary Instructions and Guidance published on February 03, 2017 the “as-of” date can be any date during the business week of January 3, 2017 C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 17

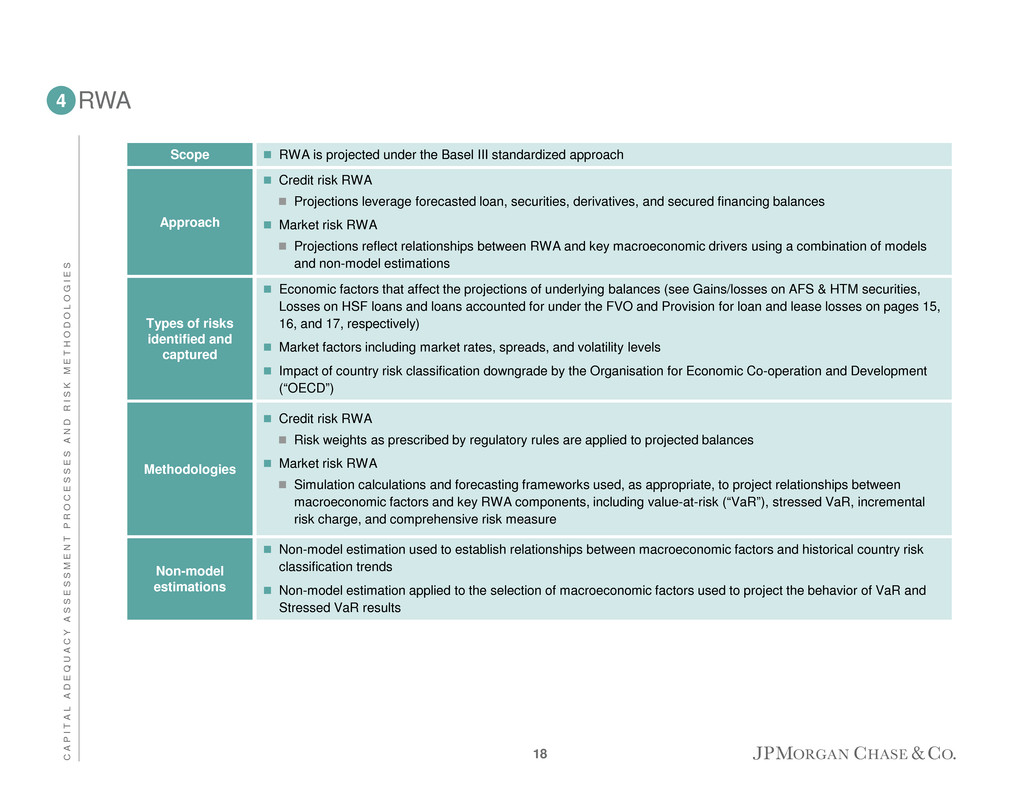

RWA4 Scope � RWA is projected under the Basel III standardized approach Approach � Credit risk RWA � Projections leverage forecasted loan, securities, derivatives, and secured financing balances � Market risk RWA � Projections reflect relationships between RWA and key macroeconomic drivers using a combination of models and non-model estimations Types of risks identified and captured � Economic factors that affect the projections of underlying balances (see Gains/losses on AFS & HTM securities, Losses on HSF loans and loans accounted for under the FVO and Provision for loan and lease losses on pages 15, 16, and 17, respectively) � Market factors including market rates, spreads, and volatility levels � Impact of country risk classification downgrade by the Organisation for Economic Co-operation and Development (“OECD”) Methodologies � Credit risk RWA � Risk weights as prescribed by regulatory rules are applied to projected balances � Market risk RWA � Simulation calculations and forecasting frameworks used, as appropriate, to project relationships between macroeconomic factors and key RWA components, including value-at-risk (“VaR”), stressed VaR, incremental risk charge, and comprehensive risk measure Non-model estimations � Non-model estimation used to establish relationships between macroeconomic factors and historical country risk classification trends � Non-model estimation applied to the selection of macroeconomic factors used to project the behavior of VaR and Stressed VaR results C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 18

AOCI5 Scope � AOCI primarily includes the after-tax change in unrealized gains and losses on investment securities and net loss and prior service costs/(credit) related to the Firm’s defined benefit pension and OPEB plans Approach � Projections are based on the estimated change in value of the existing portfolio and the forecasted reinvestment portfolio Types of risks identified and captured � Market risk factors including interest rates, FX, and credit spreads Methodologies � The forecasting methodologies used vary depending on the type of security to appropriately stress the underlying risks: � Full revaluation approach is used for agency mortgage-backed securities (“MBS”), municipal bonds, and U.S. Treasuries � Sensitivity-based approach is used for other securities and swap hedges Non-model estimations � Non-model estimation is applied to determine the appropriate parameters for producing spread forecasts for credit sensitive assets C A P I T A L A D E Q U A C Y A S S E S S M E N T P R O C E S S E S A N D R I S K M E T H O D O L O G I E S 19

Page Agenda 2 0 1 7 A N N U A L S T R E S S T E S T D I S C L O S U R E 2017 Supervisory Severely Adverse Scenario Design and Description 20 Capital Adequacy Assessment Processes and Risk Methodologies 7 2017 Supervisory Severely Adverse Scenario Results 1 DFAST Results – In-Scope Bank Entities 21 Forward-Looking Statements 25

2017 DFAST Annual Supervisory Severely Adverse scenario – Overview � The Supervisory Severely Adverse scenario, as constructed and prescribed by the Federal Reserve, is characterized by a severe global recession, accompanied by a period of heightened stress in corporate loan markets and commercial real estate markets � Results are forecasted over a nine-quarter planning horizon � Results capture the impact of stressed economic and market conditions on capital and risk-weighted assets, including: � Potential losses on all on- and off-balance sheet positions � Pre-provision net revenue � Accumulated other comprehensive income Key economic variables from Supervisory Severely Adverse scenario prescribed by the Federal Reserve1 � U.S. real GDP – GDP declines 6.6% between the fourth quarter of 2016 and its trough in the first half of 2018 � U.S. inflation rate – The annualized rate of change in the Consumer Price Index (“CPI”) drops from 3.4% in the fourth quarter of 2016 to 1.3% in the second and third quarters of 2017 � U.S. unemployment rate – Unemployment rate increases by 5.3 percentage points from its level in the fourth quarter of 2016, peaking at 10% in the third quarter of 2018 � Real estate prices – House prices decline by 25% through the first quarter of 2019 relative to their level in the fourth quarter of 2016; commercial real estate prices decline by 35% through the first quarter of 2019 relative to their level in the fourth quarter of 2016 � Equity markets – Equity prices decline by 50% between the fourth quarter of 2016 and their trough in the fourth quarter of 2017. Equity market volatility peaks in the first quarter of 2017 � Short-term and long-term rates – Short-term Treasury rates drop from 0.40% in the fourth quarter of 2016 to 0.10% in the first quarter of 2017, where they remain for the duration of the forecast period; long-term Treasury rates trough at 0.80% in the first and second quarters of 2017 and rise gradually thereafter to 1.50% in the first quarter of 2019; the 30-year mortgage rate gradually rises from 3.90% in the fourth quarter of 2016 to 4.60% in the fourth quarter of 2017, before gradually reverting to reach 4.10% in the first quarter of 2019 � Credit spreads – Spreads on investment-grade corporate bonds increase from approximately 190 basis points in the fourth quarter of 2016 to 540 basis points at their peak in the third and fourth quarters of 2017 � International – The international component features severe recessions in the Euro area, the United Kingdom, and Japan, and a marked growth slowdown in developing Asia 1 For the full scenario description and a complete set of economic variables provided by the Federal Reserve, see Board of Governors of the Federal Reserve System “2017 Supervisory Scenarios for Annual Stress Tests Required under the Dodd-Frank Act Stress Testing Rules and the Capital Plan Rule” (February 10, 2017) 2 0 1 7 S U P E R V I S O R Y S E V E R E L Y A D V E R S E S C E N A R I O D E S I G N A N D D E S C R I P T I O N 20

Page Agenda 2 0 1 7 A N N U A L S T R E S S T E S T D I S C L O S U R E DFAST Results – In-Scope Bank Entities 21 Capital Adequacy Assessment Processes and Risk Methodologies 7 2017 Supervisory Severely Adverse Scenario Design and Description 20 2017 Supervisory Severely Adverse Scenario Results 1 Forward-Looking Statements 25

DFAST results under the Supervisory Severely Adverse scenario Capital projections – JPMCB JPMCB - calculated projected stressed capital ratios1 (Q1 2017 – Q1 2019) D F A S T R E S U L T S – I N - S C O P E B A N K E N T I T I E S 1 All regulatory capital ratios are calculated in accordance with the transition arrangements provided in the OCC’s revised capital framework, issued in July 2013, and using the definitions of capital, risk-weighted assets, leverage assets (for the tier 1 leverage ratio), and supplementary leverage exposures (for the supplementary leverage ratio), that are in effect during the applicable quarter of the planning horizon. For additional information on Basel III, see Capital Risk Management on pages 76 – 85 of JPMorgan Chase’s Annual Report on Form 10-K for the year ended December 31, 2016 2 Changes in capital ratios over the projection horizon are primarily driven by PPNR, provisions for loan and lease losses, trading and counterparty losses, AOCI, changes in RWA, and capital distributions to the BHC. Stressed capital ratios are calculated in accordance with the OCC’s Annual Stress Test rule requirements (12 CFR Part 46). See 77 Fed. Reg. 61238 (December 3, 2014). The stressed capital ratios reflect the capital actions JPMCB would expect to take if the stress scenario was realized and consistent with JPMCB’s internal capital management policy. The minimum capital ratio represents the lowest calculated stressed capital ratio during the period Q1 2017 to Q1 2019. 3 The SLR, defined as tier 1 capital divided by total leverage exposure, will become a minimum capital ratio requirement for firms subject to the advanced approaches capital framework on January 1, 2018. Pursuant to the 2017 CCAR instructions, bank holding companies subject to the advanced approaches capital framework, including JPMorgan Chase, must demonstrate an ability to maintain a SLR above 3 percent in each of the quarters of the planning horizon corresponding to Q1 2018 to Q1 2019 Q1 2019 Minimum Common equity tier 1 capital ratio (%) 13.9% 14.0% 11.7% Tier 1 risk-based capital ratio (%) 13.9% 14.0% 11.8% Total risk-based capital ratio (%) 14.8% 15.1% 12.9% Tier 1 leverage ratio (%) 8.6% 8.4% 7.9% Supplementary leverage ratio3 (%) n/a 6.6% 6.1% Actual Q4 2016 Stressed capital ratios2 21

DFAST results under the Supervisory Severely Adverse scenario Profit & Loss projections – JPMCB JPMCB - calculated 9-quarter cumulative projected losses, revenues, net income before taxes, and other comprehensive income (Q1 2017 – Q1 2019) D F A S T R E S U L T S – I N - S C O P E B A N K E N T I T I E S Note: Numbers may not sum due to rounding 1 Average assets is the nine-quarter average of total assets (Q1 2017 through Q1 2019) 2 PPNR includes losses from operational-risk events, mortgage repurchase expenses, and OREO costs 3 Other revenue includes one-time income and (expense) items not included in pre-provision net revenue 4 Trading and counterparty losses include MTM and CVA losses resulting from the assumed instantaneous global market shock, and losses arising from the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities 5 Other losses/gains includes projected changes in fair value of loans HFS and loans held for investment measured under the FVO 6 OCI includes net unrealized losses/gains on (a) AFS securities and on any HTM securities that have experienced OTTI, (b) foreign currency translation adjustments, (c) cash flow hedges, and (d) net losses and prior service costs related to defined benefit pension and OPEB plans 7 JPMorgan Chase Bank, N.A., as a wholly-owned subsidiary of an advanced approach BHC, is required to transition AOCI related to (a) AFS securities and (b) pension and OPEB plans into projected regulatory capital. The transition arrangements for AOCI are 60, 80, and 100 percent included in projected regulatory capital for Q4 2016, full year 2017, full year 2018 and beyond, respectively Billions of dollars Percent of average assets1 Pre-provision net revenue2 $44.9 2.2% Other revenue3 0.0 less Provision for loan and lease losses 37.7 Realized losses/(gains) on securities (AFS/HTM) 0.2 Trading and counterparty losses4 17.3 Other losses/(gains)5 2.5 equals Net income (losses) before taxes ($12.9) (0.6%) Memo items Other comprehensive income 6 ($1.4) Other effects on capital Actual Q4 2016 Q1 2019 Accumulated other comprehensive income ("AOCI") in capital (billions of dollars) 7 $0.7 $0.6 22

DFAST results under the Supervisory Severely Adverse Scenario Capital projections – CUSA CUSA - calculated projected stressed capital ratios1 (Q1 2017 – Q1 2019) 1 All regulatory capital ratios are calculated in accordance with the transition arrangements provided in the OCC’s revised capital framework, issued in July 2013, and using the definitions of capital, risk-weighted assets, leverage assets (for the tier 1 leverage ratio), and supplementary leverage exposures (for the supplementary leverage ratio), that are in effect during the applicable quarter of the planning horizon. For additional information on Basel III, see Capital Risk Management on pages 76 – 85 of JPMorgan Chase’s Annual Report on Form 10-K for the year ended December 31, 2016 2 Changes in capital ratios over the projection horizon are primarily driven by PPNR, provisions for loan and lease losses, changes in RWA, and capital distributions indirectly to the BHC. Stressed capital ratios are calculated in accordance with the OCC’s Annual Stress Test rule requirements (12 CFR Part 46). See 77 Fed. Reg. 61238 (December 3, 2014). The stressed capital ratios reflect the capital actions CUSA would expect to take if the stress scenario was realized and consistent with CUSA’s internal capital management policy. The minimum capital ratio represents the lowest calculated stressed capital ratio during the period Q1 2017 to Q1 2019. 3 The SLR, defined as tier 1 capital divided by total leverage exposure, will become a minimum capital ratio requirement for firms subject to the advanced approaches capital framework on January 1, 2018. Pursuant to the 2017 CCAR instructions, bank holding companies subject to the advanced approaches capital framework, including JPMorgan Chase, must demonstrate an ability to maintain a SLR above 3 percent in the quarters of the planning horizon corresponding to Q1 2018 to Q1 2019 D F A S T R E S U L T S – I N - S C O P E B A N K E N T I T I E S Q1 2019 Minimum Common equity tier 1 capital ratio (%) 14.9% 11.6% 10.6% Tier 1 risk-based capital ratio (%) 14.9% 11.6% 10.6% Total risk-based capital ratio (%) 20.4% 17.7% 16.4% Tier 1 leverage ratio (%) 14.0% 10.6% 9.9% Supplementary leverage ratio3 (%) n/a 7.6% 7.1% Actual Q4 2016 Stressed capital ratios2 23

DFAST results under the Supervisory Severely Adverse Scenario Profit & Loss projections – CUSA CUSA - calculated 9-quarter cumulative projected losses, revenues, net income before taxes, and other comprehensive income (Q1 2017 – Q1 2019) Note: Numbers may not sum due to rounding 1 Average assets is the nine-quarter average of total assets (Q1 2017 through Q1 2019) 2 Other revenue includes one-time income and (expense) items not included in pre-provision net revenue 3 Trading and counterparty losses include MTM and CVA losses resulting from the assumed instantaneous global market shock, and losses arising from the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities 4 Other losses/gains includes projected changes in fair value of loans HFS and loans held for investment measured under the FVO D F A S T R E S U L T S – I N - S C O P E B A N K E N T I T I E S Billions of dollars Percent of average assets1 Pre-provision net revenue $14.6 11.6% Other revenue2 0.0 less Provision for loan and lease losses 18.5 Realized losses/(gains) on securities (AFS/HTM) 0.0 Trading and counterparty losses3 (0.0) Other losses/(gains)4 0.0 equals Net income (losses) before taxes ($4.0) (3.2%) Memo items Other comprehensive income $0.0 Other effects on capital Actual Q4 2016 Q1 2019 Accumulated other comprehensive income ("AOCI") in capital (billions of dollars) $0.0 $0.0 24

Page Agenda 2 0 1 7 A N N U A L S T R E S S T E S T D I S C L O S U R E Forward-Looking Statements 25 Capital Adequacy Assessment Processes and Risk Methodologies 7 2017 Supervisory Severely Adverse Scenario Design and Description 20 DFAST Results – In-Scope Bank Entities 21 2017 Supervisory Severely Adverse Scenario Results 1

Forward-looking statements The 2017 Dodd-Frank Act Annual Stress Test Results Disclosure (the “Stress Test Results”) presented herein contains forward-looking projections that represent estimates based on the hypothetical, severely adverse economic and market scenarios and assumptions under the Supervisory Severely Adverse scenario prescribed by the Board of Governors of the Federal Reserve System (“Federal Reserve”). The Stress Test Results do not represent JPMorgan Chase's forecasts of actual expected gains, losses, pre-provision net revenue, net income before taxes, capital, risk-weighted assets (“RWA”), or capital ratios. JPMorgan Chase’s actual future financial results will be influenced by actual economic and financial conditions and various other factors as described in its reports filed with the Securities and Exchange Commission (“SEC”), which are available on JPMorgan Chase’s website (http://investor.shareholder.com/jpmorganchase/sec.cfm), and on the Securities and Exchange Commission’s website (www.sec.gov). F O R W A R D - L O O K I N G S T A T E M E N T S 25