2Q19 Financial Results July 16, 2019

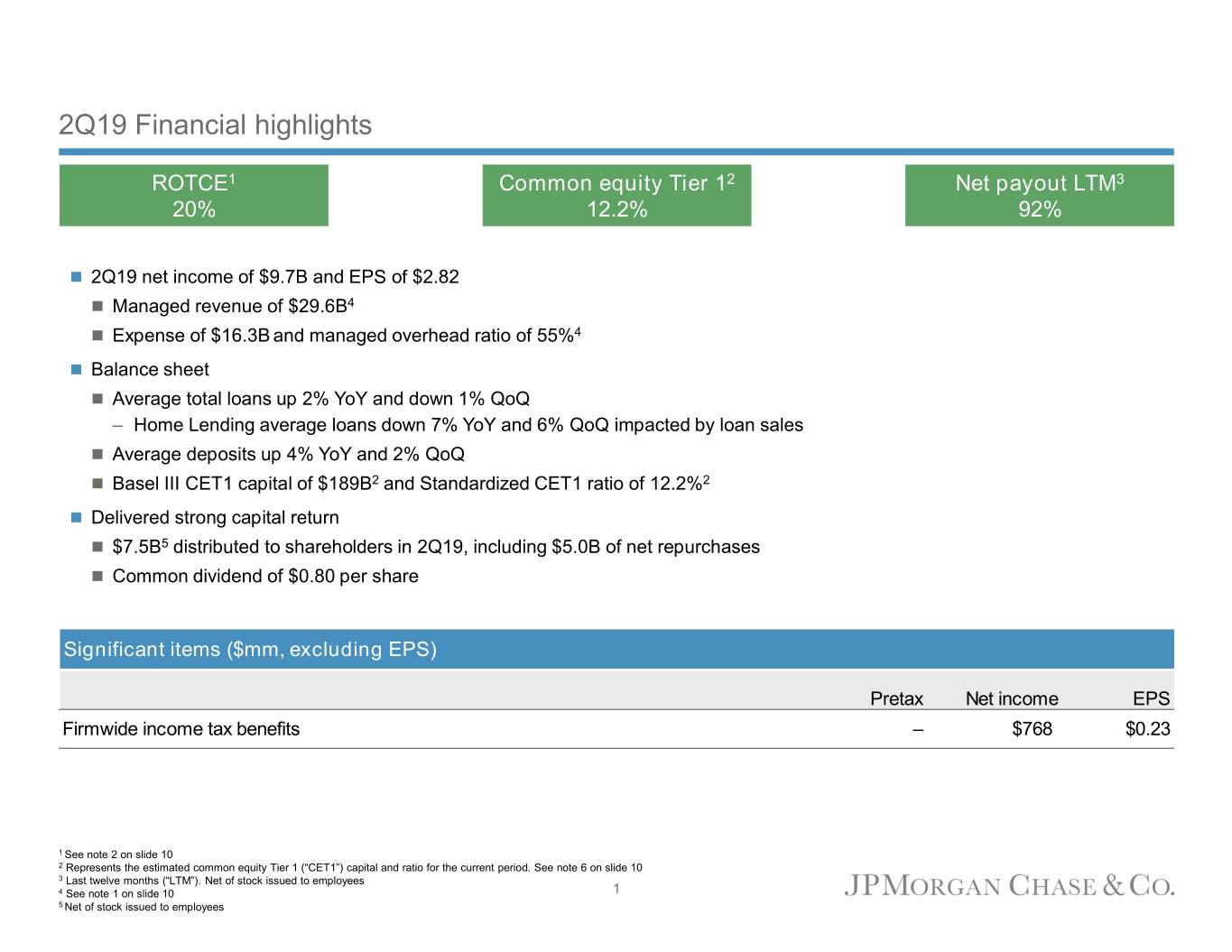

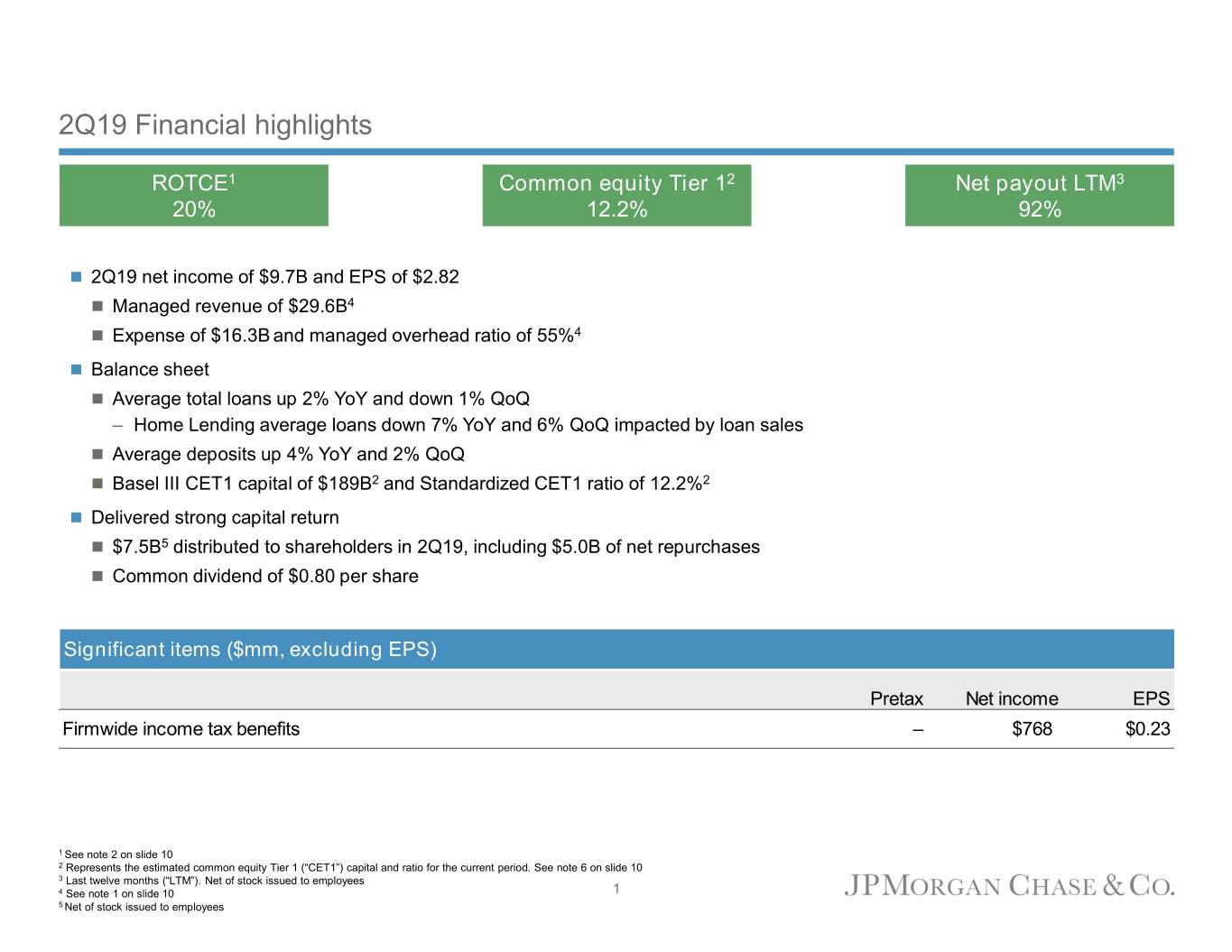

2Q19 Financial highlights ROTCE1 Common equity Tier 12 Net payout LTM3 20% 12.2% 92% 2Q19 net income of $9.7B and EPS of $2.82 Managed revenue of $29.6B4 Expense of $16.3B and managed overhead ratio of 55%4 Balance sheet Average total loans up 2% YoY and down 1% QoQ – Home Lending average loans down 7% YoY and 6% QoQ impacted by loan sales Average deposits up 4% YoY and 2% QoQ Basel III CET1 capital of $189B2 and Standardized CET1 ratio of 12.2%2 Delivered strong capital return $7.5B5 distributed to shareholders in 2Q19, including $5.0B of net repurchases Common dividend of $0.80 per share Significant items ($mm, excluding EPS) Pretax Net income EPS Firmwide income tax benefits – $768 $0.23 1 See note 2 on slide 10 2 Represents the estimated common equity Tier 1 (“CET1”) capital and ratio for the current period. See note 6 on slide 10 3 Last twelve months (“LTM”). Net of stock issued to employees 4 See note 1 on slide 10 1 5 Net of stock issued to employees

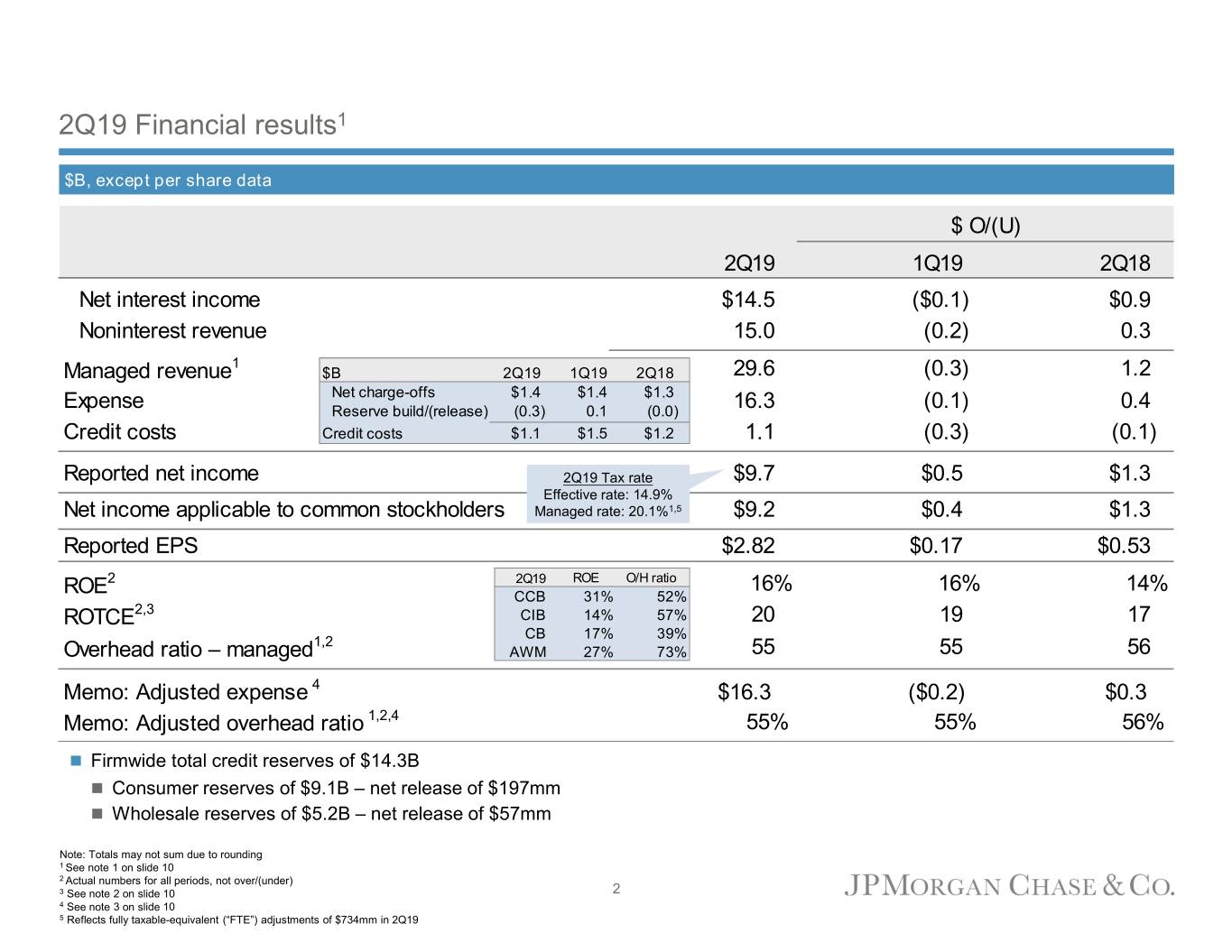

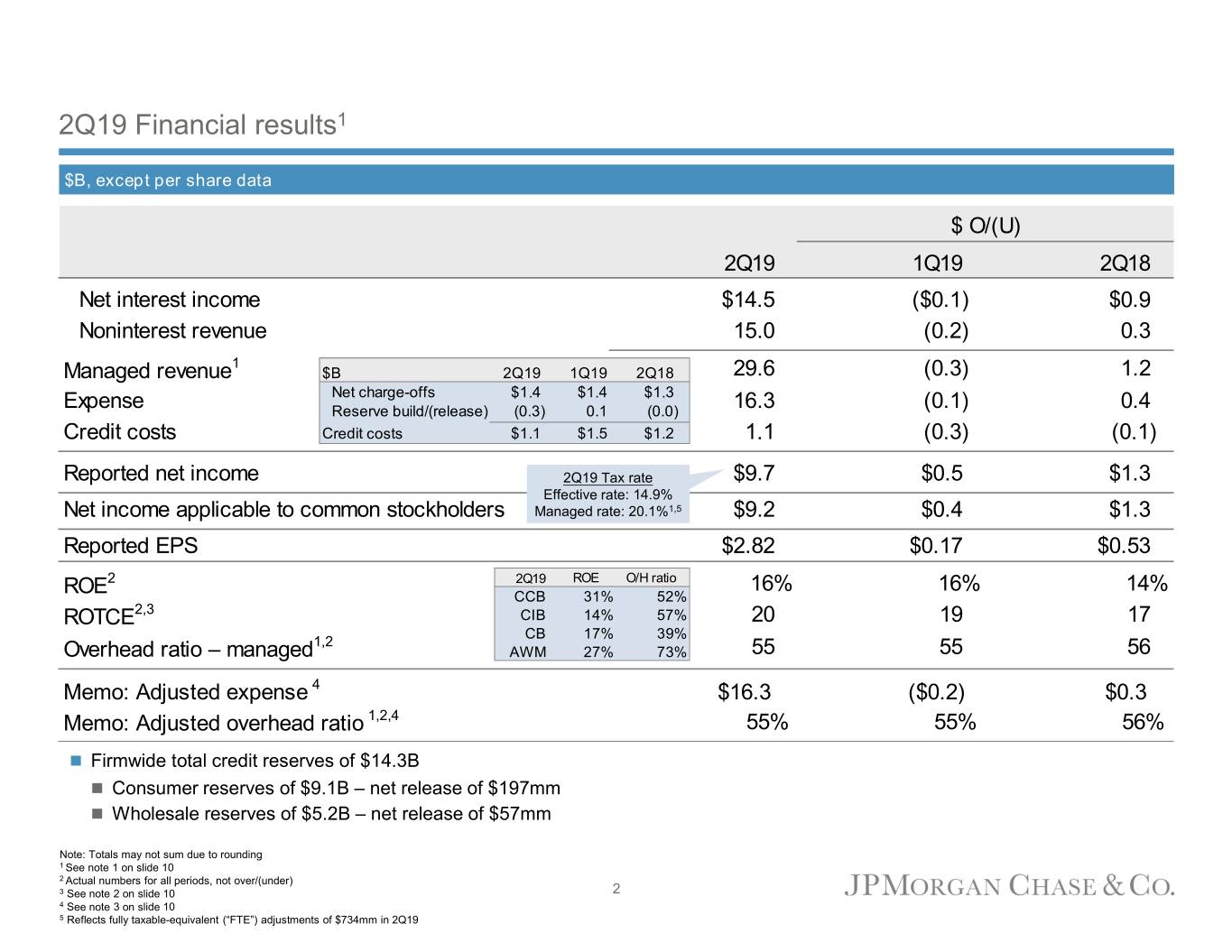

2Q19 Financial results1 $B, except per share data $ O/(U) 2Q19 1Q19 2Q18 Net interest income $14.5 ($0.1) $0.9 Noninterest revenue 15.0 (0.2) 0.3 1 Managed revenue $B 2Q19 1Q19 2Q18 29.6 (0.3) 1.2 Net charge-offs $1.4 $1.4 $1.3 Expense Reserve build/(release) (0.3) 0.1 (0.0) 16.3 (0.1) 0.4 Credit costs Credit costs $1.1 $1.5 $1.2 1.1 (0.3) (0.1) Reported net income 2Q19 Tax rate $9.7 $0.5 $1.3 Effective rate: 14.9% Net income applicable to common stockholders Managed rate: 20.1%1,5 $9.2 $0.4 $1.3 Reported EPS $2.82 $0.17 $0.53 2 2Q19 ROE O/H ratio 16% 16% 14% ROE CCB 31% 52% ROTCE2,3 CIB 14% 57% 20 19 17 CB 17% 39% 1,2 Overhead ratio – managed AWM 27% 73% 55 55 56 Memo: Adjusted expense 4 $16.3 ($0.2) $0.3 Memo: Adjusted overhead ratio 1,2,4 55% 55% 56% Firmwide total credit reserves of $14.3B Consumer reserves of $9.1B – net release of $197mm Wholesale reserves of $5.2B – net release of $57mm Note: Totals may not sum due to rounding 1 See note 1 on slide 10 2 Actual numbers for all periods, not over/(under) 3 See note 2 on slide 10 2 4 See note 3 on slide 10 5 Reflects fully taxable-equivalent (“FTE”) adjustments of $734mm in 2Q19

Fortress balance sheet and capital $B, except per share data 2Q19 1Q19 2Q18 Basel III Standardized1 CET1 capital $189 $186 $185 2Q19 Advanced CET1 capital ratio of 13.0%1 12.2% 12.1% 12.0% Tier 1 capital $215 $213 $210 Tier 1 capital ratio 13.9% 13.8% 13.6% Total capital $244 $241 $238 Total capital ratio 15.8% 15.7% 15.4% Risk-weighted assets $1,545 $1,543 $1,543 Firm SLR2 6.4% 6.4% 6.5% Total assets (EOP) $2,727 $2,737 $2,590 Tangible common equity (EOP)3 $190 $187 $185 Tangible book value per share3 $59.42 $57.62 $55.14 1 Estimated for the current period. See note 6 on slide 10 2 Estimated for the current period. Represents the supplementary leverage ratio (“SLR”) 3 See note 2 on slide 10 3

Consumer & Community Banking1 $mm Financial performance $ O/(U) Net income of $4.2B, up 22% YoY; revenue of $13.8B, up 11% 2Q19 1Q19 2Q18 Higher NII in CBB and Card, and higher auto lease volumes Revenue $13,833 $82 $1,336 2Q19 included negative MSR adjustments in Home Lending; Consumer & Business Banking 6,797 229 666 2Q18 included a card rewards liability adjustment Home Lending 1,118 (228) (229) Card, Merchant Services & Auto 5,918 81 899 Expense of $7.2B, up 4% YoY, largely driven by investments in Expense 7,162 (49) 283 the business and higher auto lease depreciation, partially offset Credit costs 1,120 (194) 12 by expense efficiencies and lower FDIC charges Net charge-offs 1,320 6 212 Credit costs of $1.1B, ~flat YoY Change in allowance (200) (200) (200) Higher net charge-offs in Card and Home Lending Net income $4,174 $211 $762 $400mm release in Home Lending PCI, $200mm build in Card Key drivers/statistics ($B)2 Key drivers/statistics ($B) – detail by business Equity $52.0 $52.0 $51.0 2Q19 1Q19 2Q18 ROE 31% 30% 26% Consumer & Business Banking Overhead ratio 52 52 55 Business Banking average loans $24.3 $24.3 $23.9 Average loans $467.2 $479.3 $475.7 Business Banking loan originations 1.7 1.5 1.9 Average deposits 690.9 681.0 673.8 Client investment assets (EOP) 328.1 312.3 283.7 Active mobile customers (mm) 35.4 34.4 31.7 Deposit margin 2.60% 2.62% 2.36% Debit & credit card sales volume $281.5 $255.1 $255.0 Home Lending Average loans $224.7 $238.9 $241.5 3 Average loans down 2% YoY Loan originations 24.5 15.0 21.5 EOP total loans serviced 780.1 791.5 802.6 Average deposits up 3% YoY Net charge-off/(recovery) rate4 (0.06)% (0.01)% (0.29)% Active mobile customers up 12% YoY Card, Merchant Services & Auto Card average loans $153.7 $151.1 $142.7 Client investment assets up 16% YoY Auto average loans and leased assets 83.6 83.6 83.8 Auto loan and lease originations 8.5 7.9 8.3 Credit card sales up 11% YoY Card net charge-off rate 3.24% 3.23% 3.27% Merchant processing volume up 12% YoY Card Services net revenue rate 11.48 11.63 10.38 Credit Card sales volume5 $192.5 $172.5 $174.0 1 See note 1 on slide 10 Merchant processing volume 371.6 356.5 330.8 For additional footnotes see slide 11 4

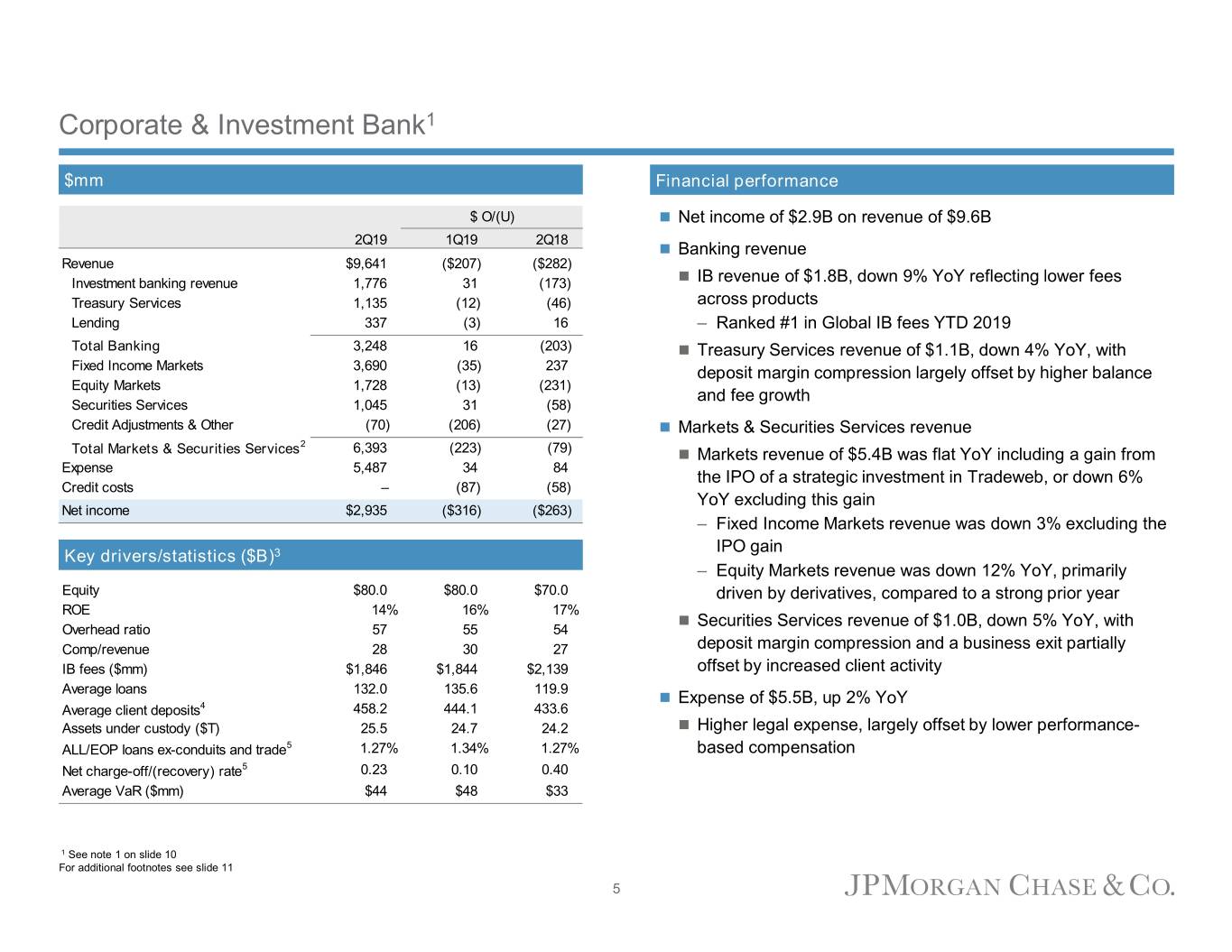

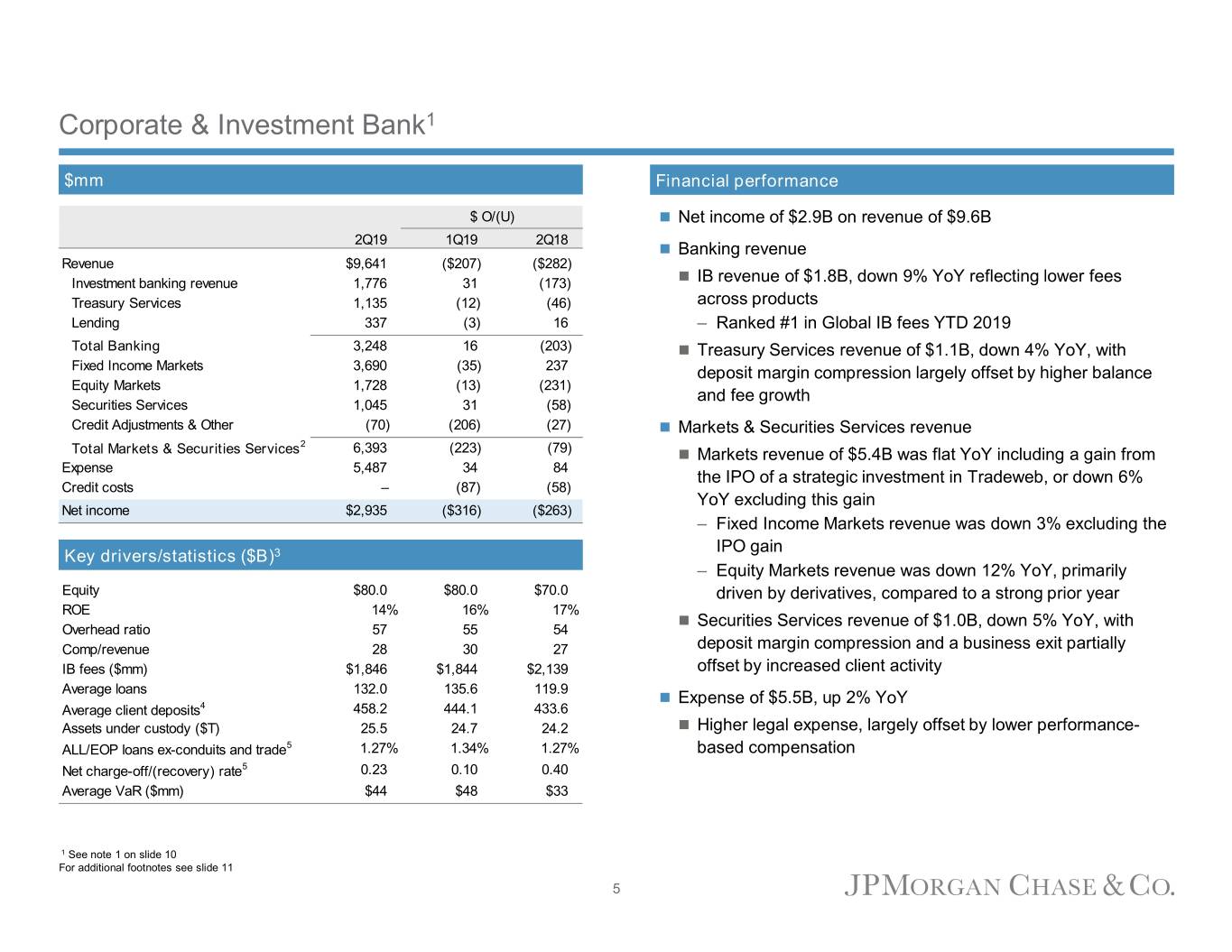

Corporate & Investment Bank1 $mm Financial performance $ O/(U) Net income of $2.9B on revenue of $9.6B 2Q19 1Q19 2Q18 Banking revenue Revenue $9,641 ($207) ($282) Investment banking revenue 1,776 31 (173) IB revenue of $1.8B, down 9% YoY reflecting lower fees Treasury Services 1,135 (12) (46) across products Lending 337 (3) 16 – Ranked #1 in Global IB fees YTD 2019 Total Banking 3,248 16 (203) Treasury Services revenue of $1.1B, down 4% YoY, with Fixed Income Markets 3,690 (35) 237 deposit margin compression largely offset by higher balance Equity Markets 1,728 (13) (231) and fee growth Securities Services 1,045 31 (58) Credit Adjustments & Other (70) (206) (27) Markets & Securities Services revenue 2 Total Markets & Securities Services 6,393 (223) (79) Markets revenue of $5.4B was flat YoY including a gain from Expense 5,487 34 84 the IPO of a strategic investment in Tradeweb, or down 6% Credit costs – (87) (58) YoY excluding this gain Net income $2,935 ($316) ($263) – Fixed Income Markets revenue was down 3% excluding the IPO gain Key drivers/statistics ($B)3 – Equity Markets revenue was down 12% YoY, primarily Equity $80.0 $80.0 $70.0 driven by derivatives, compared to a strong prior year ROE 14% 16% 17% Securities Services revenue of $1.0B, down 5% YoY, with Overhead ratio 57 55 54 Comp/revenue 28 30 27 deposit margin compression and a business exit partially IB fees ($mm) $1,846 $1,844 $2,139 offset by increased client activity Average loans 132.0 135.6 119.9 Expense of $5.5B, up 2% YoY Average client deposits4 458.2 444.1 433.6 Assets under custody ($T) 25.5 24.7 24.2 Higher legal expense, largely offset by lower performance- ALL/EOP loans ex-conduits and trade5 1.27% 1.34% 1.27% based compensation Net charge-off/(recovery) rate5 0.23 0.10 0.40 Average VaR ($mm) $44 $48 $33 1 See note 1 on slide 10 For additional footnotes see slide 11 5

Commercial Banking1 $mm Financial performance $ O/(U) Net income of $1.0B 2Q19 1Q19 2Q18 Revenue of $2.2B, down 5% YoY Revenue $2,211 ($127) ($105) Middle Market Banking 939 (12) 20 Net interest income of $1.7B, down 1% YoY Corporate Client Banking 709 (107) (98) Gross IB revenue of $592mm, down 20% YoY 2 Commerical Real Estate Banking 538 (9) (21) – YTD gross IB revenue of $1.4B, up 8% YoY Other2 25 1 (6) Expense 864 (9) 20 Expense of $864mm, up 2% YoY on continued investments in Credit costs 29 (61) (14) banker coverage and technology Net income $996 ($57) ($91) Credit costs of $29mm Net charge-off rate of 3bps 3 Key drivers/statistics ($B) Average loan balances of $207B, up 1% YoY and QoQ 5 Equity $22.0 $22.0 $20.0 C&I flat YoY and up 1% QoQ ROE 17% 19% 21% CRE5 up 2% YoY and flat QoQ Overhead ratio 39 37 36 Gross IB Revenue ($mm) $592 $818 $739 Average client deposits of $168B, down 1% YoY and up 1% Average loans 207.5 206.1 205.6 QoQ Average client deposits 168.2 167.3 170.7 Allowance for loan losses 2.8 2.8 2.6 Nonaccrual loans 0.6 0.5 0.5 Net charge-off/(recovery) rate4 0.03% 0.02% 0.07% ALL/loans4 1.32 1.35 1.27 1 See note 1 on slide 10 For additional footnotes see slide 11 6

Asset & Wealth Management1 $mm Financial performance $ O/(U) Net income of $719mm, down 5% YoY 2Q19 1Q19 2Q18 Revenue of $3.6B, relatively flat YoY Revenue $3,559 $70 ($13) Asset Management 1,785 24 (41) Impact from higher average market levels was offset by lower Wealth Management 1,774 46 28 investment valuation gains Expense 2,596 (51) 30 Expense of $2.6B, up 1% YoY, on continued investments in Credit costs 2 – – Net income $719 $58 ($36) advisors and technology, partially offset by lower distribution fees AUM of $2.2T and client assets of $3.0T, both up 7%, driven by Key drivers/statistics ($B)2 net inflows and the impact of higher market levels Equity $10.5 $10.5 $9.0 Net inflows of $36B into long-term products and $4B into liquidity ROE 27% 25% 33% products Pretax margin 27 24 28 Average loan balances of $146B, up 7% YoY Assets under management (AUM) $2,178 $2,096 $2,028 Client assets 2,998 2,897 2,799 Average deposit balances of $140B, up 1% YoY Average loans 146.5 145.4 136.7 Average deposits 140.3 138.2 139.6 1 See note 1 on slide 10 2 Actual numbers for all periods, not over/(under) 7

Corporate1 $mm Financial performance $ O/(U) Revenue 2Q19 1Q19 2Q18 Net revenue of $322mm compared with revenue of $80mm in Revenue $322 ($103) $242 the prior year Expense 232 21 (47) Credit costs (2) (4) (1) The increase was driven by higher net interest income on Net income $828 $577 $964 higher rates and balance sheet mix 2Q19 included approximately $100mm of net valuation losses on certain legacy private equity investments Expense Expense of $232mm was down $47mm YoY Income tax 2Q19 included income tax benefits of $742mm related to the resolution of certain tax audits 1 See note 1 on slide 10 8

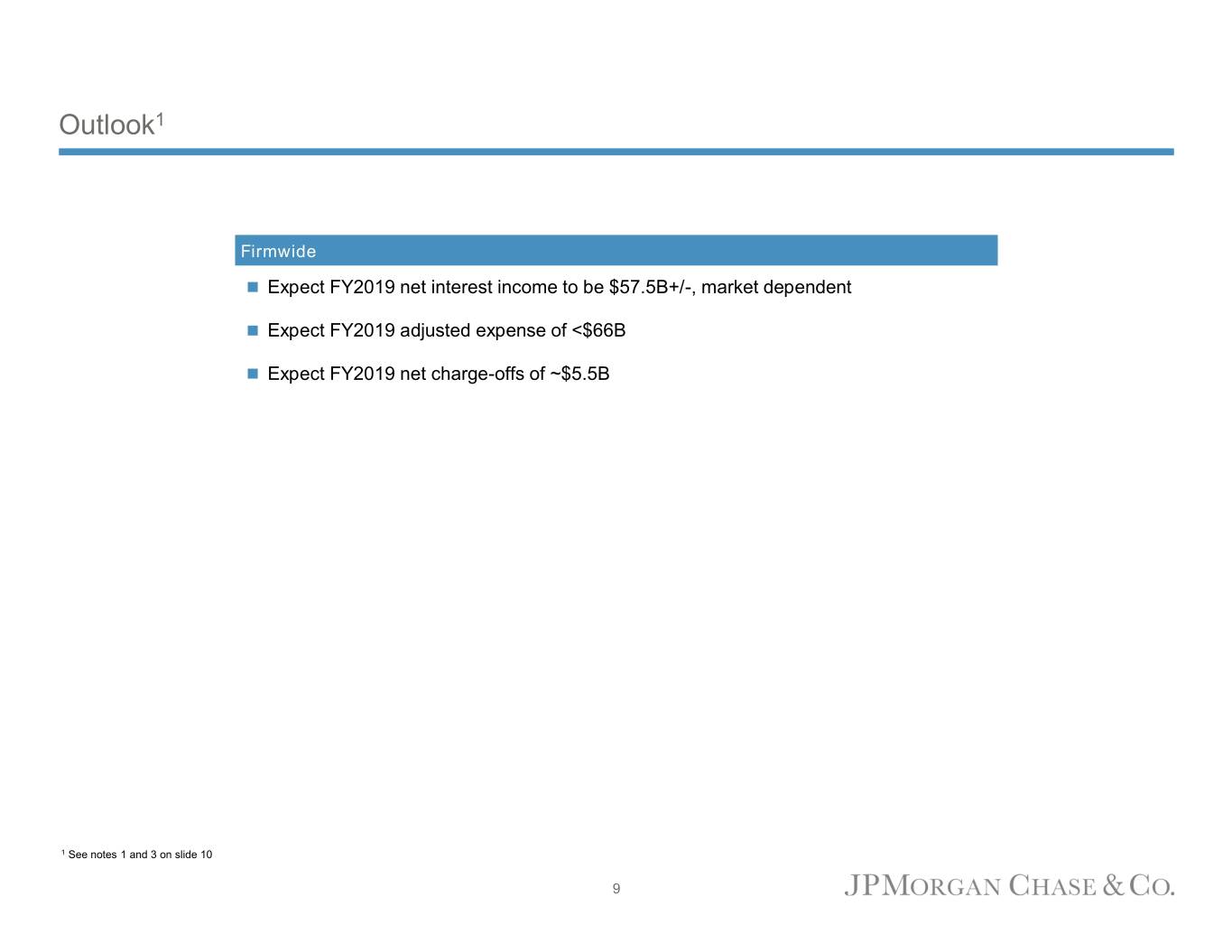

Outlook1 Firmwide Expect FY2019 net interest income to be $57.5B+/-, market dependent Expect FY2019 adjusted expense of <$66B Expect FY2019 net charge-offs of ~$5.5B 1 See notes 1 and 3 on slide 10 9

Notes Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews Firmwide results, including the overhead ratio, on a “managed” basis; these Firmwide managed basis results are non-GAAP financial measures. The Firm also reviews the results of the lines of business on a managed basis. The Firm’s definition of managed basis starts, in each case, with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm and each of the reportable business segments on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable investments and securities. These financial measures allow management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. For a reconciliation of the Firm’s results from a reported to managed basis, see page 7 of the Earnings Release Financial Supplement 2. Tangible common equity (“TCE”), return on tangible common equity (“ROTCE”) and tangible book value per share (“TBVPS”), are each non-GAAP financial measures. TCE represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. For a reconciliation from common stockholders’ equity to TCE, see page 9 of the Earnings Release Financial Supplement. ROTCE measures the Firm’s net income applicable to common equity as a percentage of average TCE. TBVPS represents the Firm’s TCE at period-end divided by common shares at period-end. Book value per share was $73.77, $71.78 and $68.85 at June 30, 2019, March 31, 2019 and June 30, 2018, respectively. TCE, ROTCE and TBVPS are utilized by the Firm, as well as investors and analysts, in assessing the Firm’s use of equity 3. Adjusted expense and adjusted overhead ratio are each non-GAAP financial measures. Adjusted expense excludes Firmwide legal expense/(benefit) of $69 million, $(81) million and $0 million for the three months ended June 30, 2019, March 31, 2019 and June 30, 2018, respectively. The adjusted overhead ratio measures the Firm’s adjusted expense as a percentage of adjusted managed net revenue. Management believes this information helps investors understand the effect of these items on reported results and provides an alternate presentation of the Firm’s performance 4. Net charge-offs and net charge-off rates exclude the impact of purchased credit-impaired (“PCI”) loans 5. CIB calculates the ratio of the allowance for loan losses to end-of-period loans (“ALL/EOP”) excluding the impact of consolidated Firm-administered multi-seller conduits and trade finance loans, to provide a more meaningful assessment of CIB’s allowance coverage ratio Additional notes 6. Represents the fully phased-in measures for each period presented. The Basel III regulatory capital, risk-weighted assets and capital ratios became fully phased-in effective January 1, 2019. The capital adequacy of the Firm is evaluated against the fully phased-in measures under Basel III and represents the lower of the Standardized or Advanced approaches. During 2018 the required capital measures were subject to the transitional rules. For additional information on these measures, see Key performance measures on page 59 and Capital Risk Management on pages 85-94 of the Firm’s 2018 Form 10-K and pages 32-36 of the Firm’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2019 10

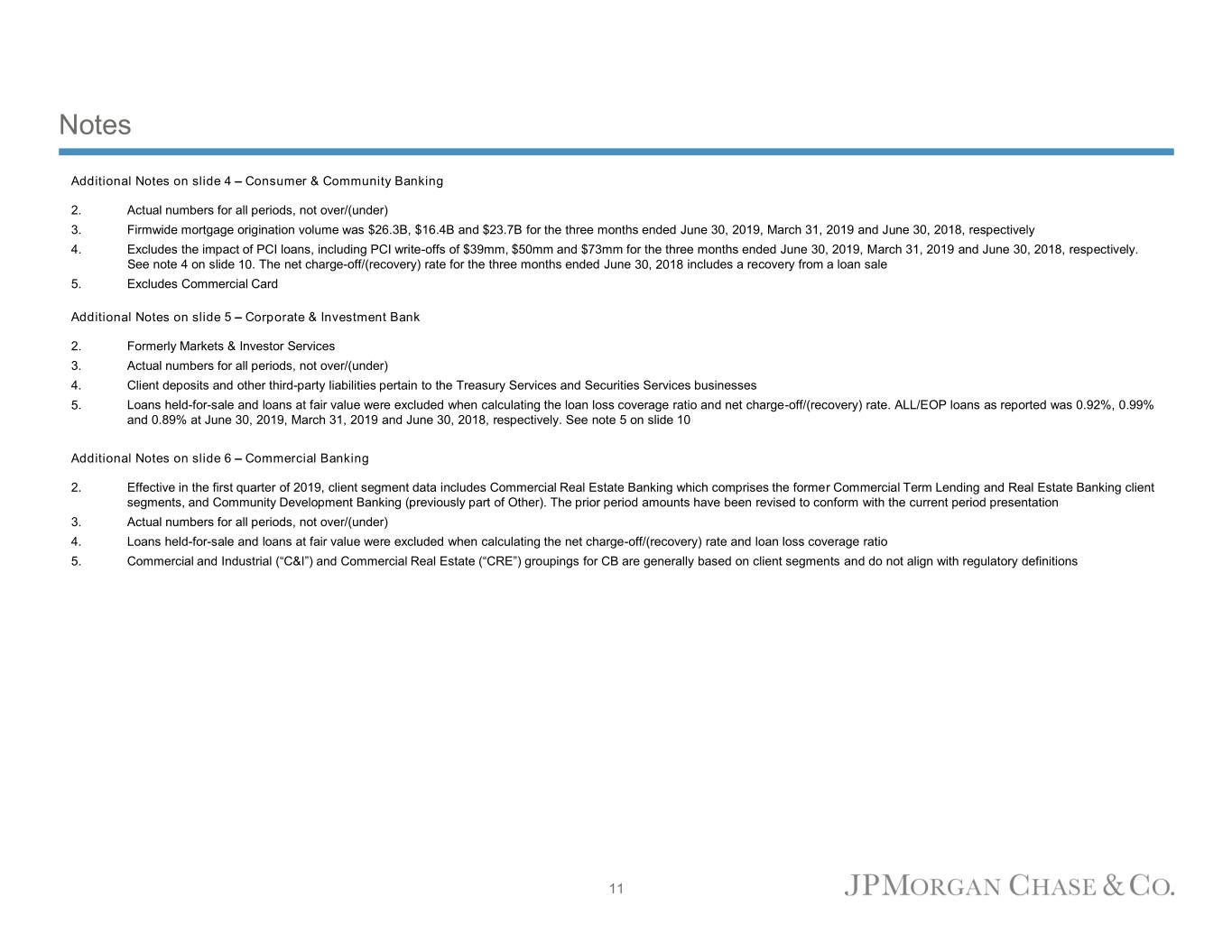

Notes Additional Notes on slide 4 – Consumer & Community Banking 2. Actual numbers for all periods, not over/(under) 3. Firmwide mortgage origination volume was $26.3B, $16.4B and $23.7B for the three months ended June 30, 2019, March 31, 2019 and June 30, 2018, respectively 4. Excludes the impact of PCI loans, including PCI write-offs of $39mm, $50mm and $73mm for the three months ended June 30, 2019, March 31, 2019 and June 30, 2018, respectively. See note 4 on slide 10. The net charge-off/(recovery) rate for the three months ended June 30, 2018 includes a recovery from a loan sale 5. Excludes Commercial Card Additional Notes on slide 5 – Corporate & Investment Bank 2. Formerly Markets & Investor Services 3. Actual numbers for all periods, not over/(under) 4. Client deposits and other third-party liabilities pertain to the Treasury Services and Securities Services businesses 5. Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off/(recovery) rate. ALL/EOP loans as reported was 0.92%, 0.99% and 0.89% at June 30, 2019, March 31, 2019 and June 30, 2018, respectively. See note 5 on slide 10 Additional Notes on slide 6 – Commercial Banking 2. Effective in the first quarter of 2019, client segment data includes Commercial Real Estate Banking which comprises the former Commercial Term Lending and Real Estate Banking client segments, and Community Development Banking (previously part of Other). The prior period amounts have been revised to conform with the current period presentation 3. Actual numbers for all periods, not over/(under) 4. Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate and loan loss coverage ratio 5. Commercial and Industrial (“C&I”) and Commercial Real Estate (“CRE”) groupings for CB are generally based on client segments and do not align with regulatory definitions 11

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2018 and Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2019, which have been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.’s website (https://jpmorganchaseco.gcs-web.com/financial- information/sec-filings), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update any forward-looking statements. 12