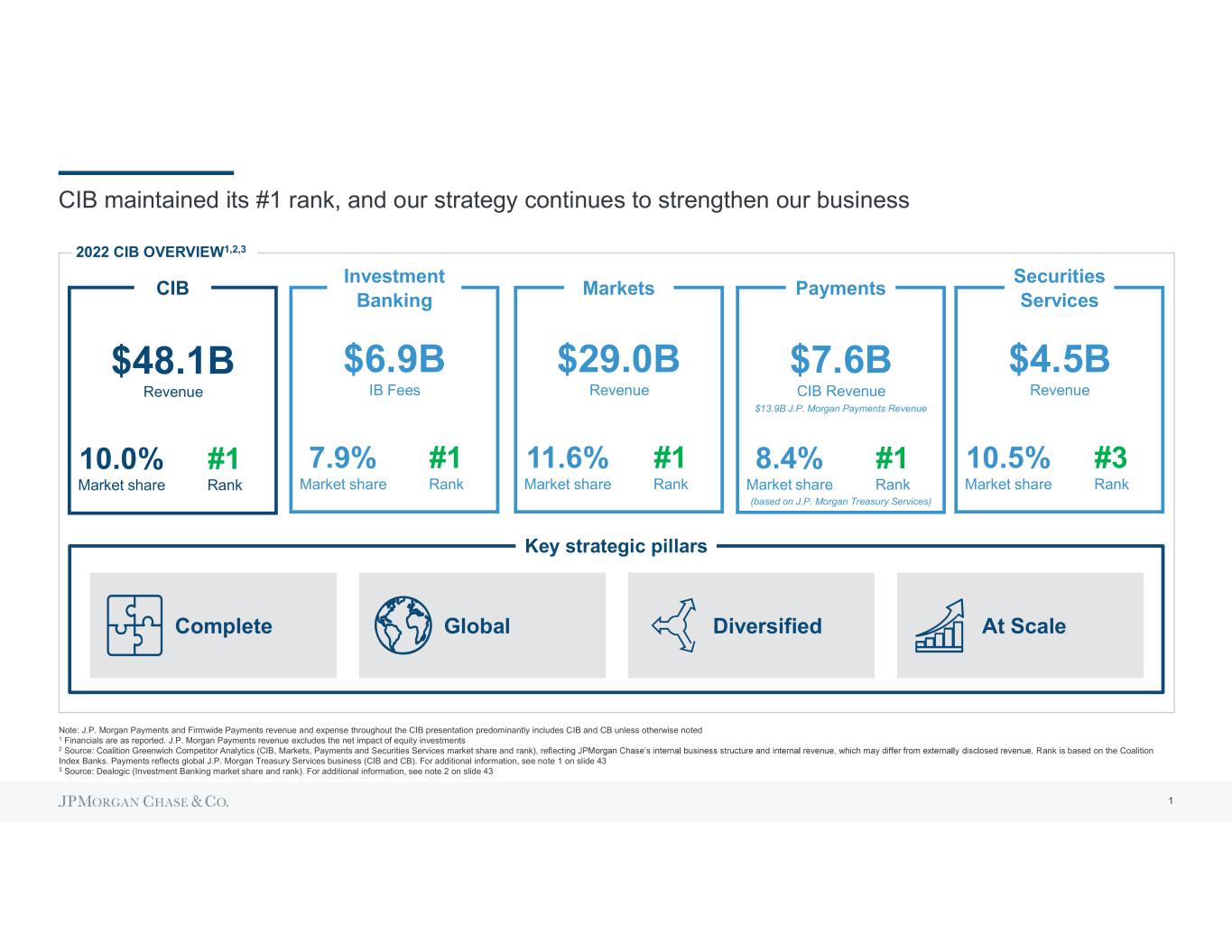

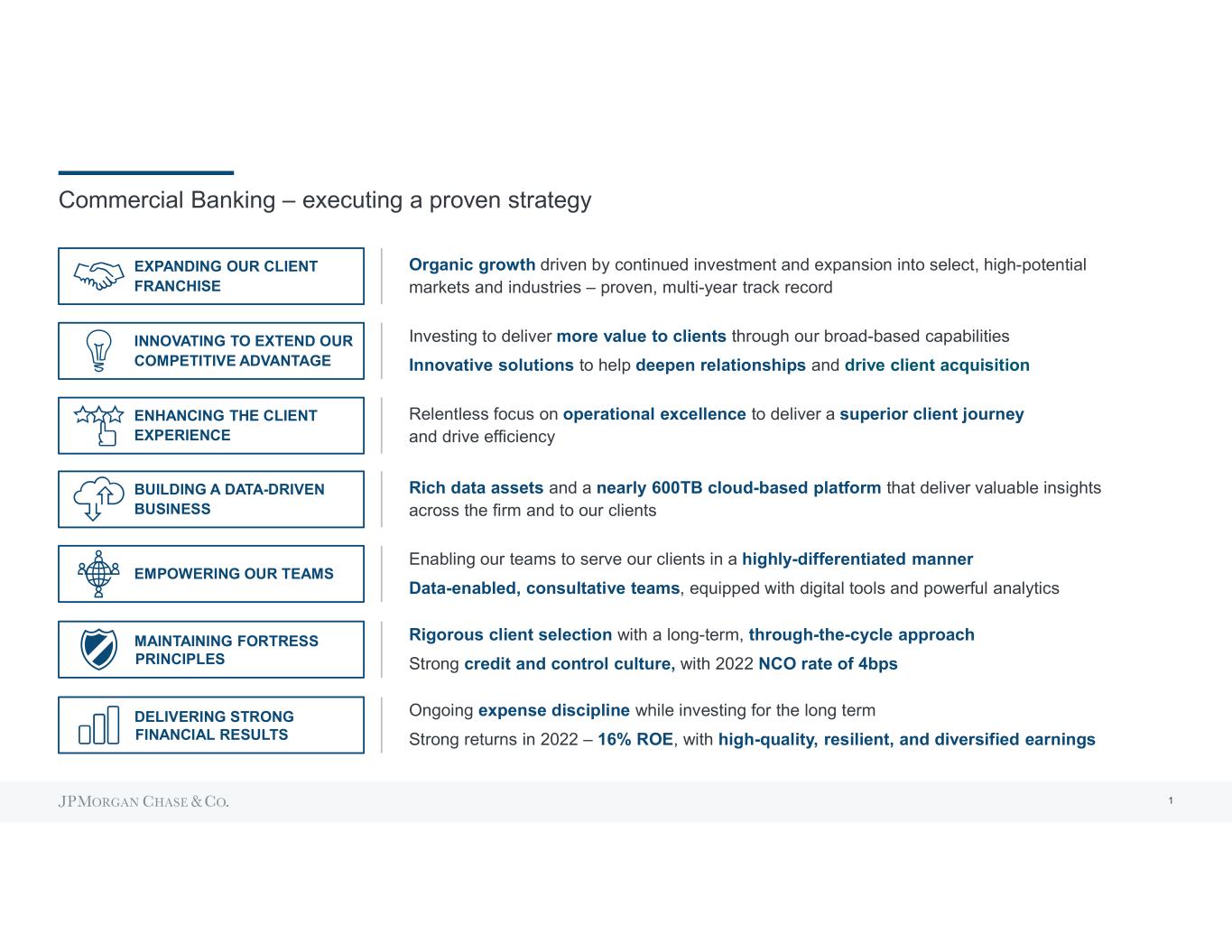

Topics of discussion Firm overview Operating environment Financial results Outlook Conclusion 1

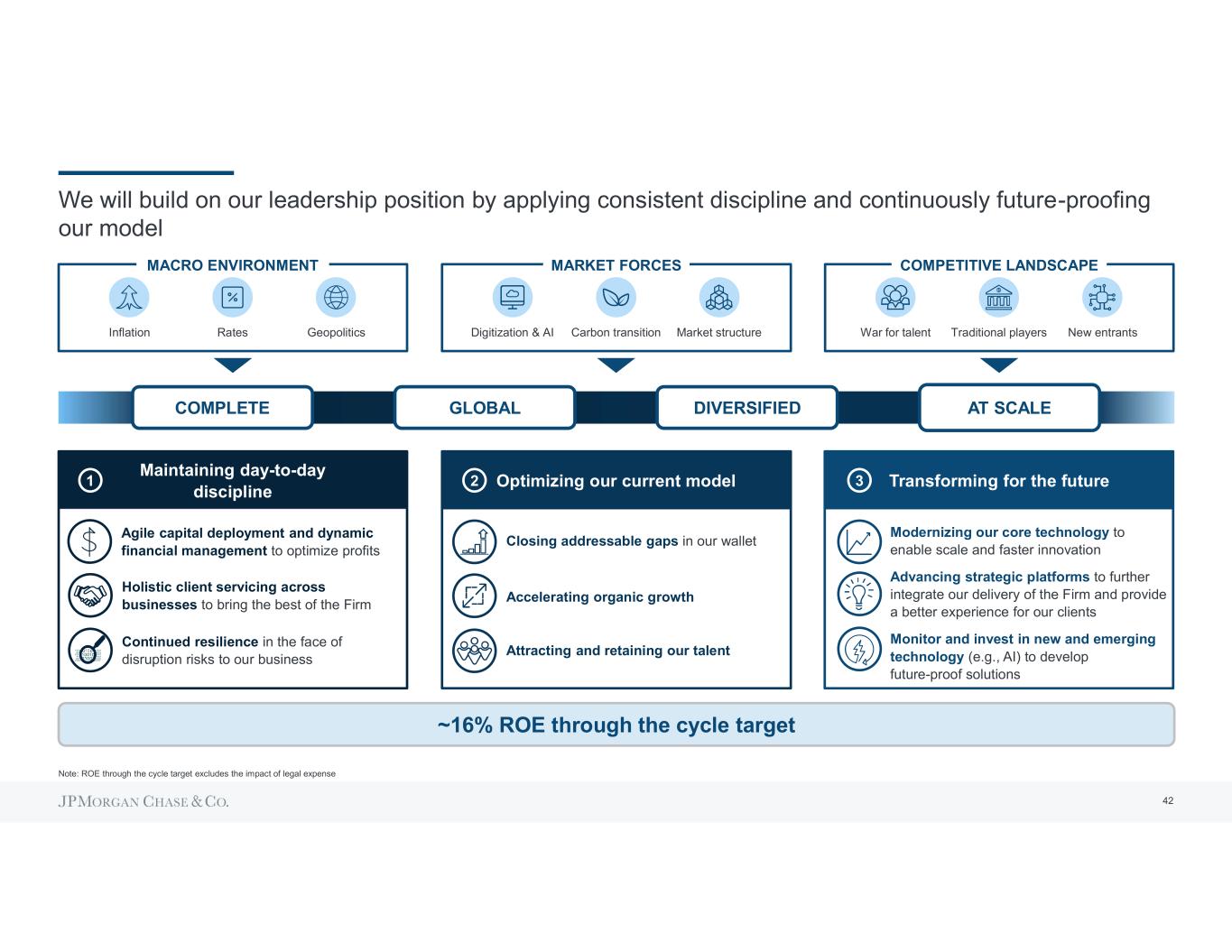

We have a proven operating model that is supported by a consistent strategic framework Complete Global Diversified At Scale Customer centric and easy to do business with Comprehensive set of products and services Focus on safety and security Powerful brands Continuously investing in the future while maintaining expense discipline Focus on customer experience and innovation Employer of choice for top and diverse talent Fortress balance sheet Risk governance and controls Culture and conduct Operational resilience Investing in and supporting our communities Integrating environmental sustainability into business and operating decisions Serving a diverse customer base Promoting sound governance Exceptional client franchises Unwavering principles Long-term shareholder value Sustainable business practices 2

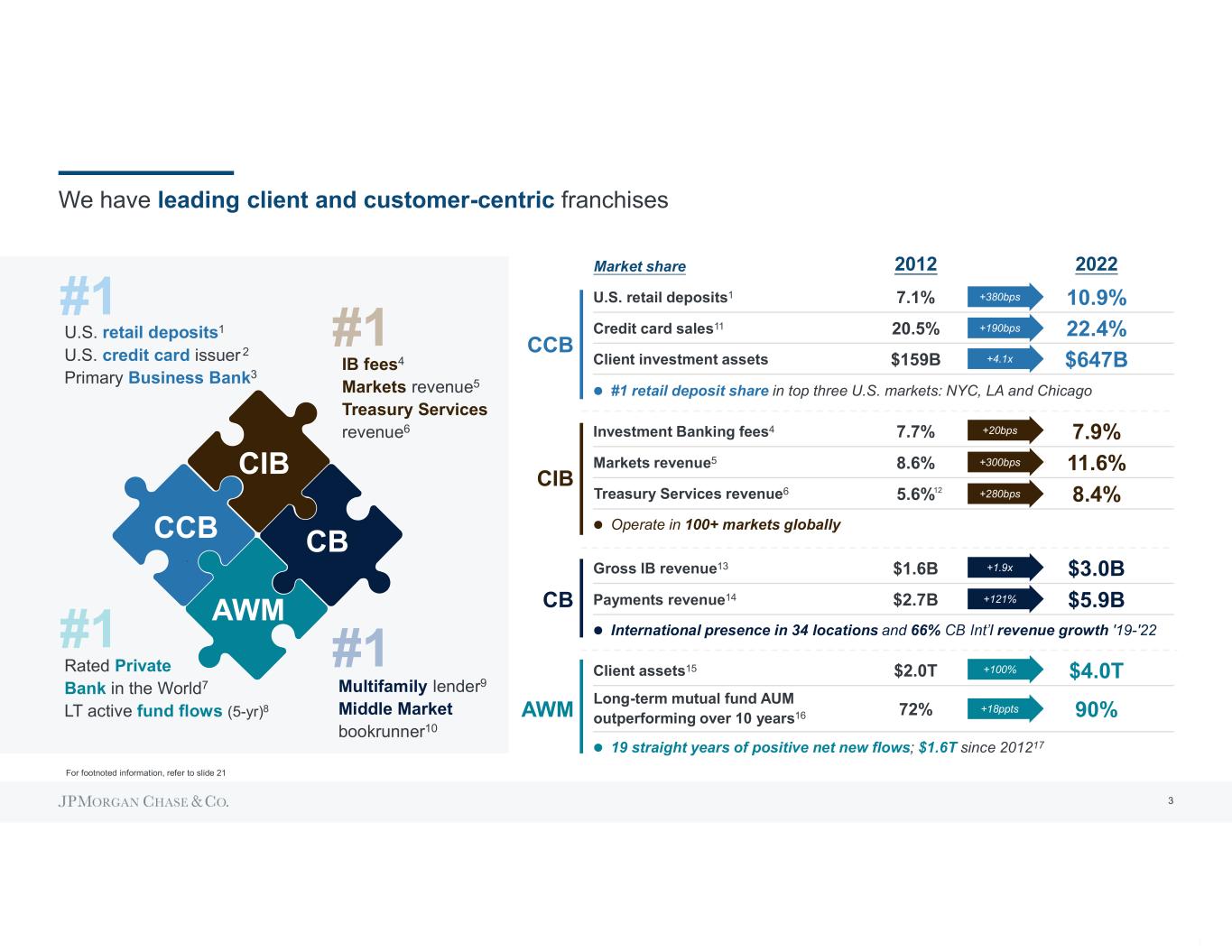

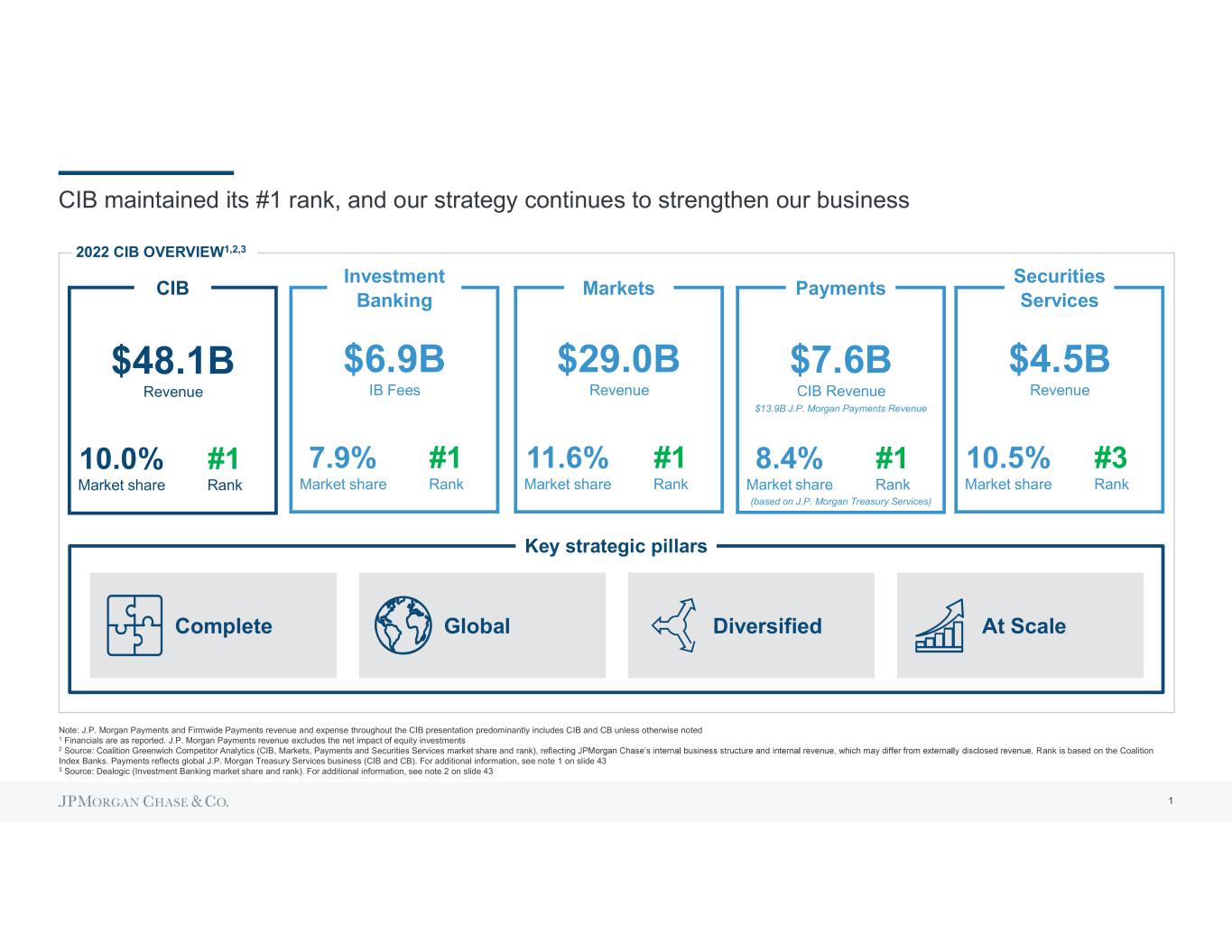

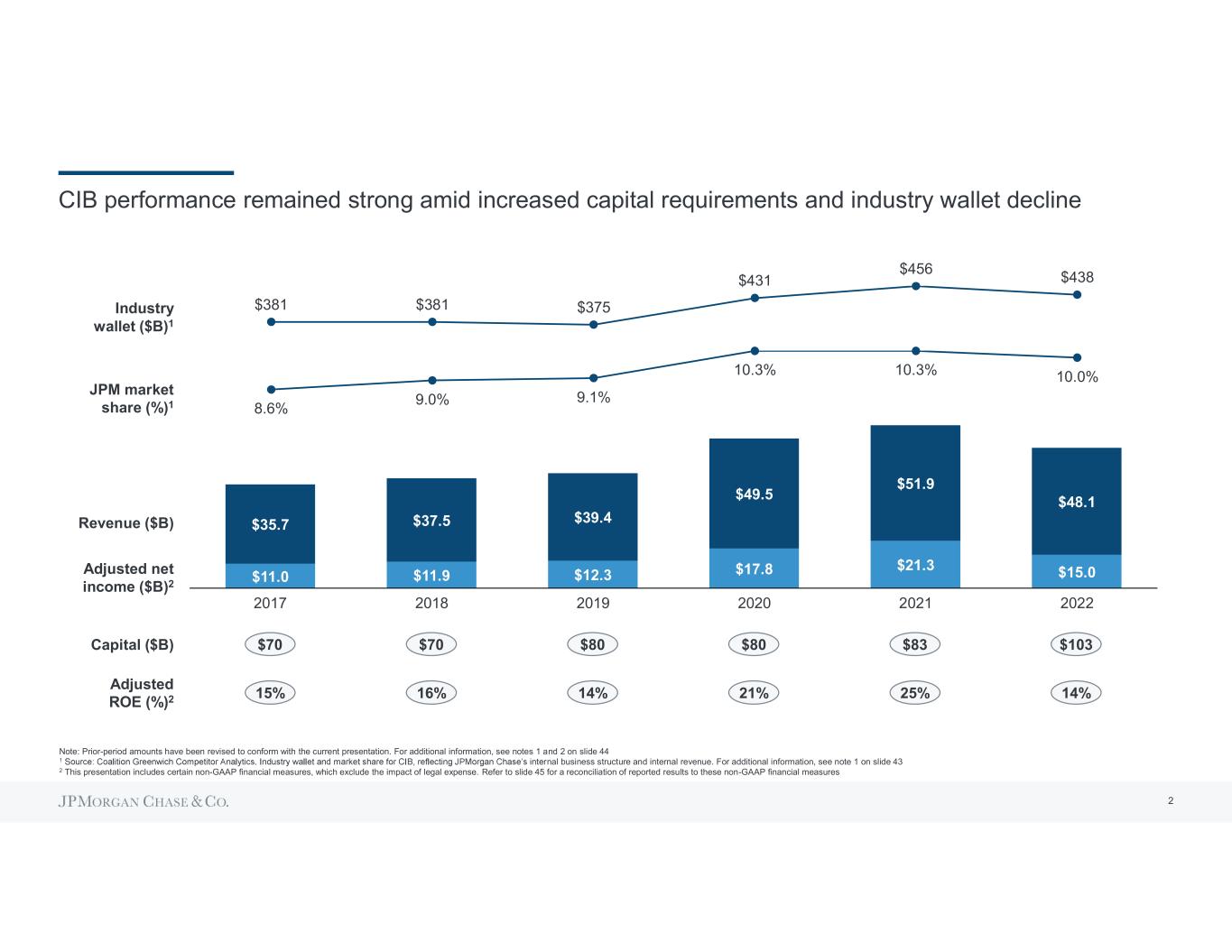

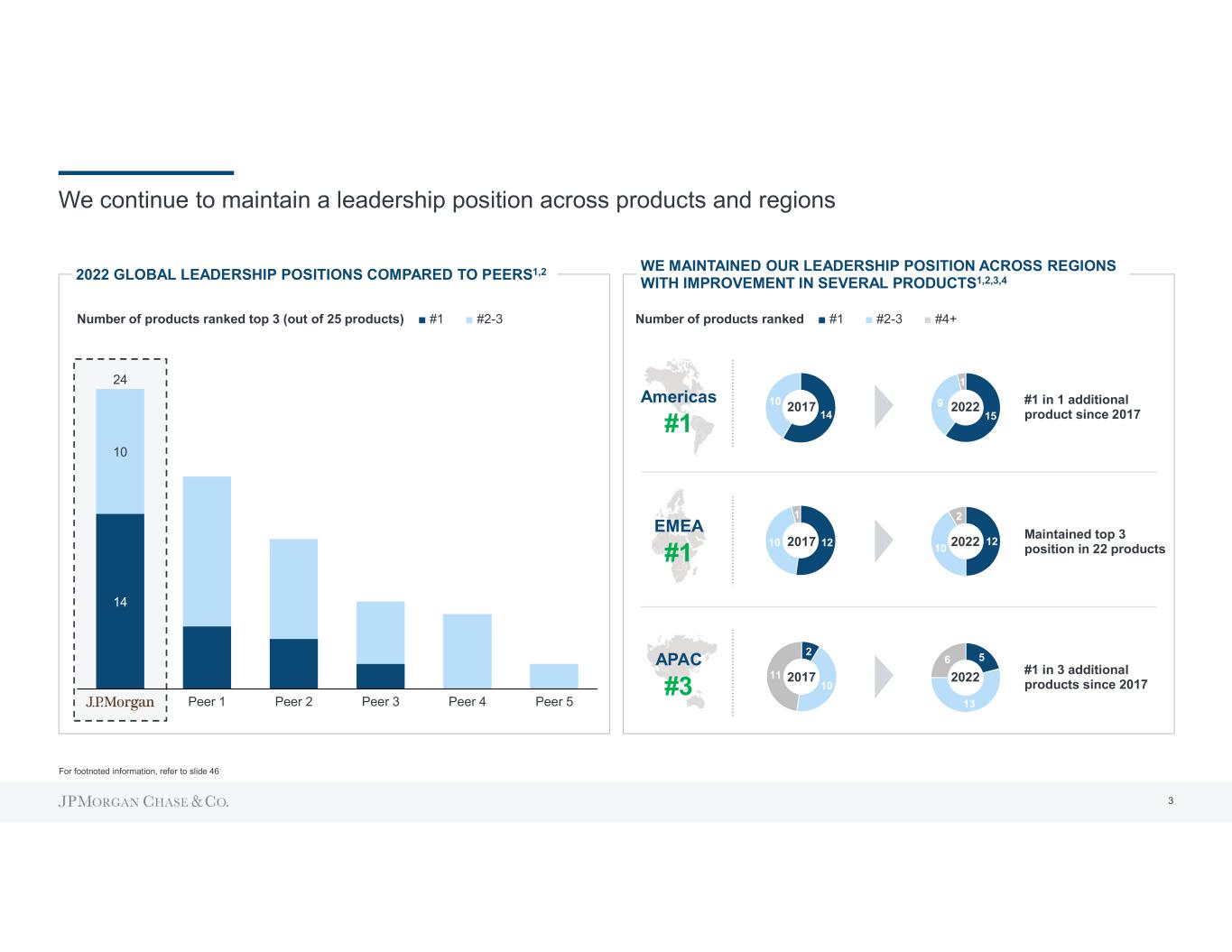

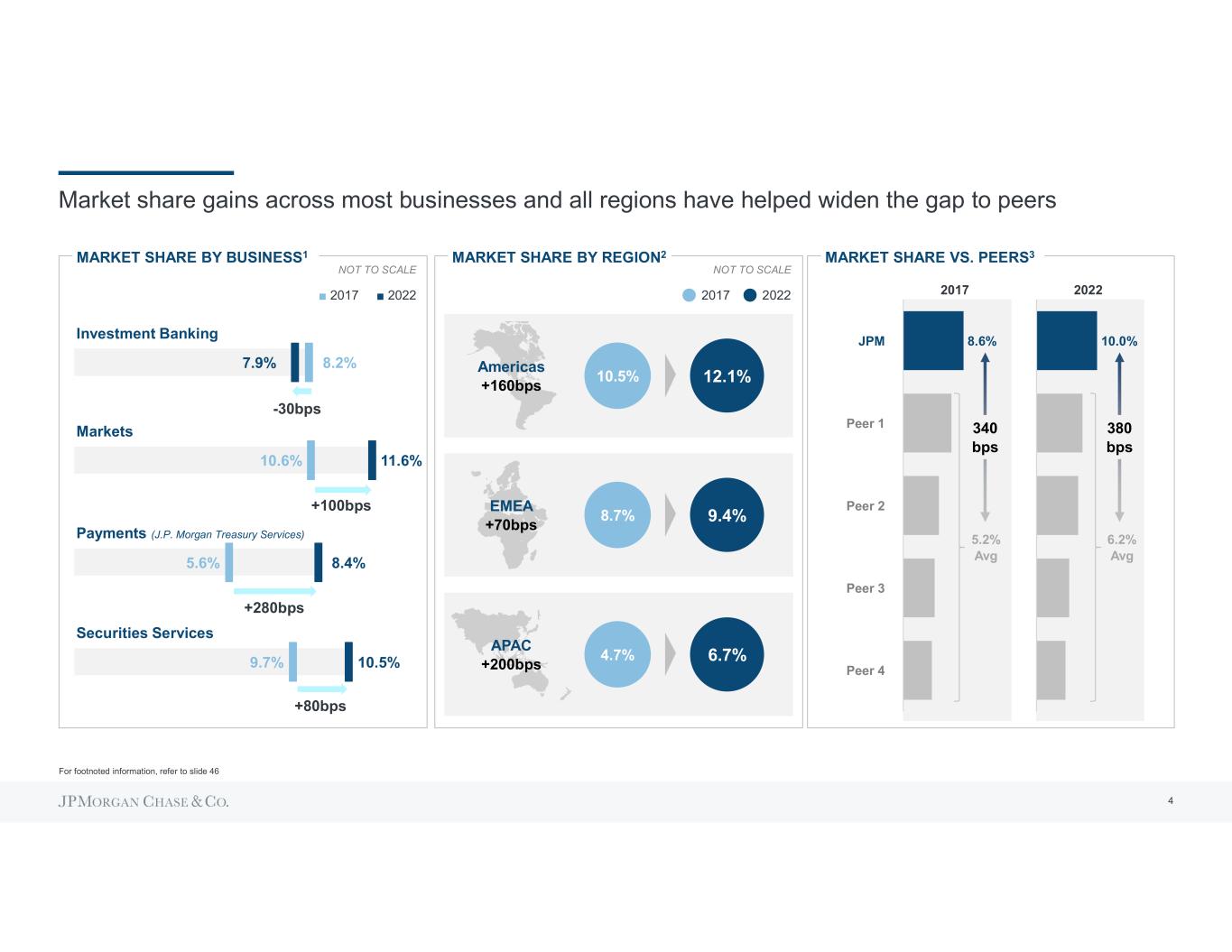

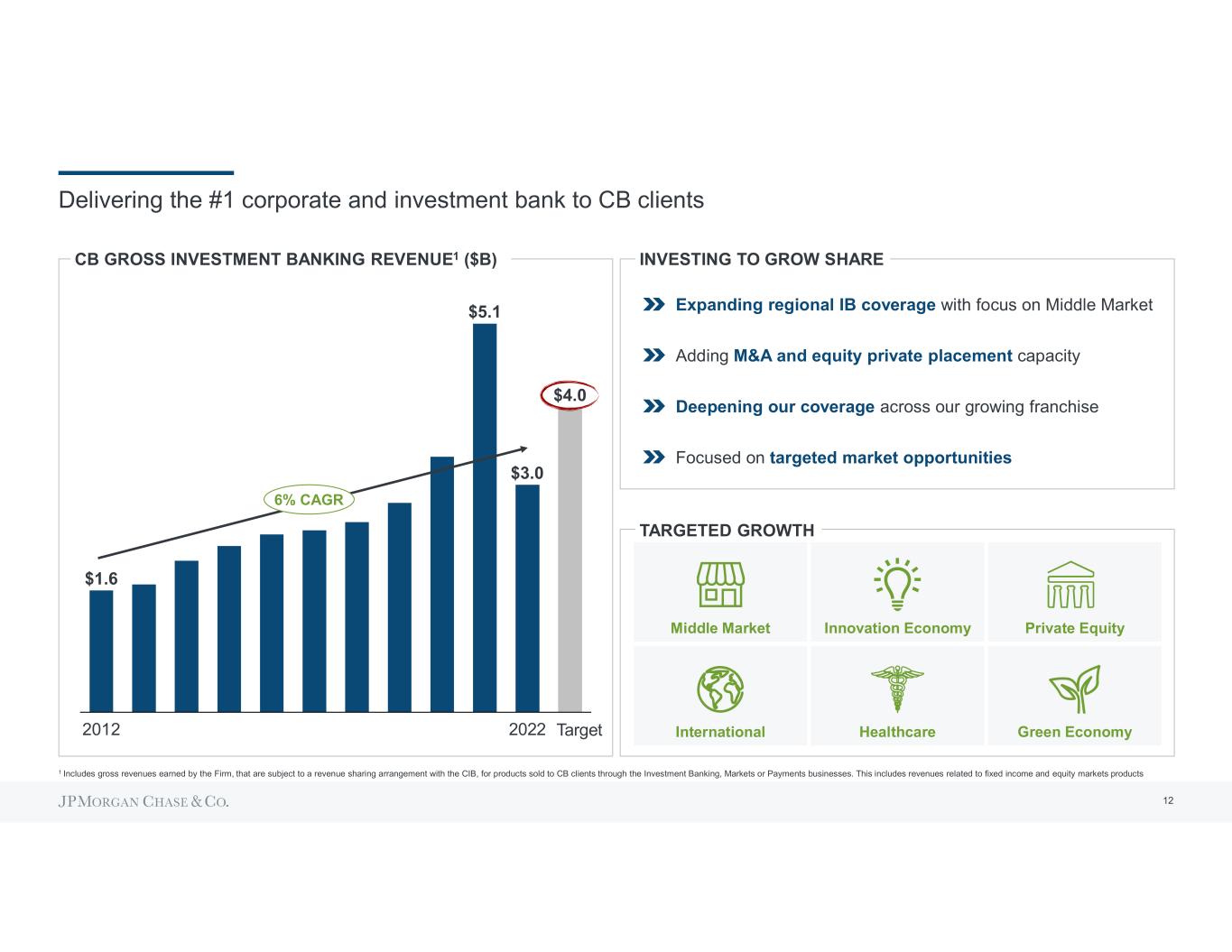

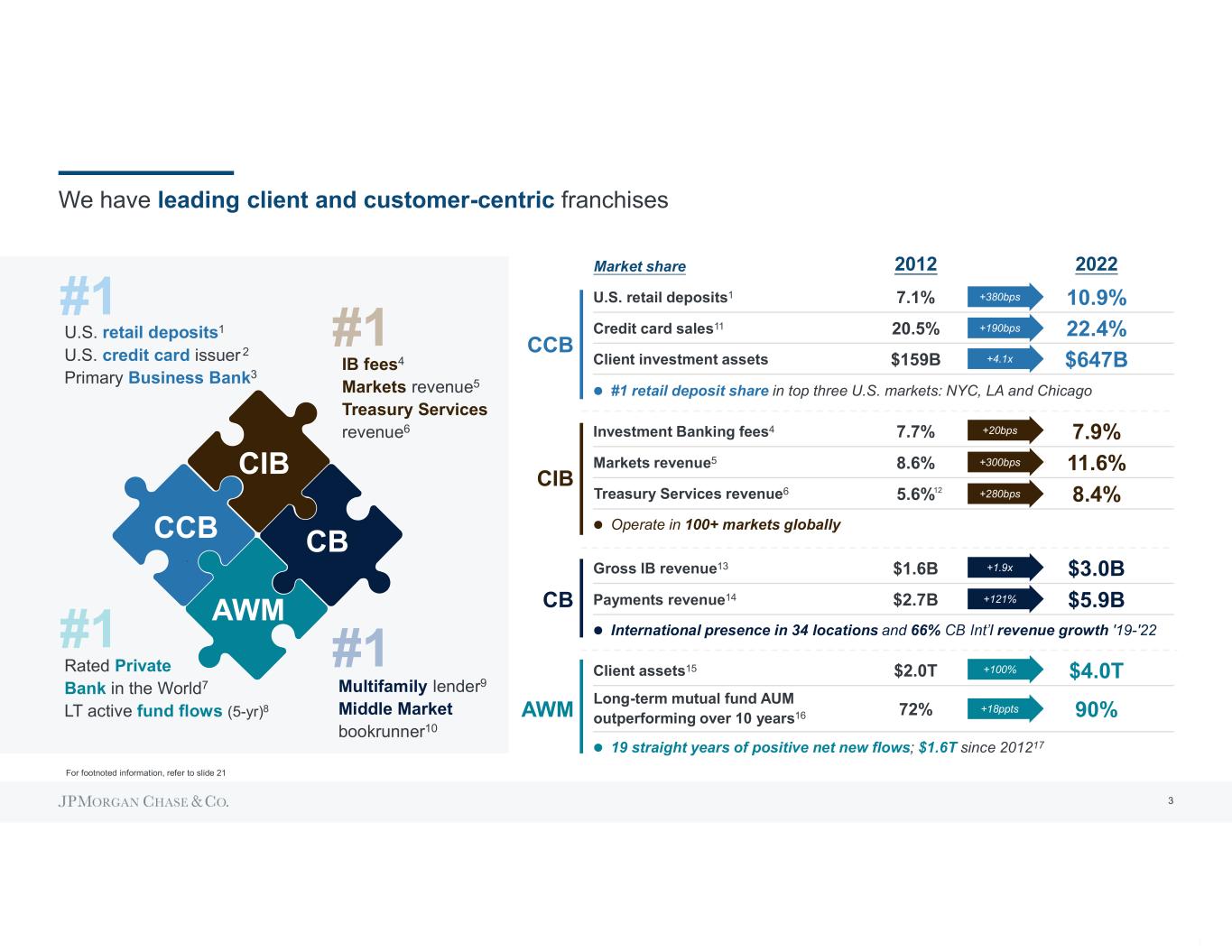

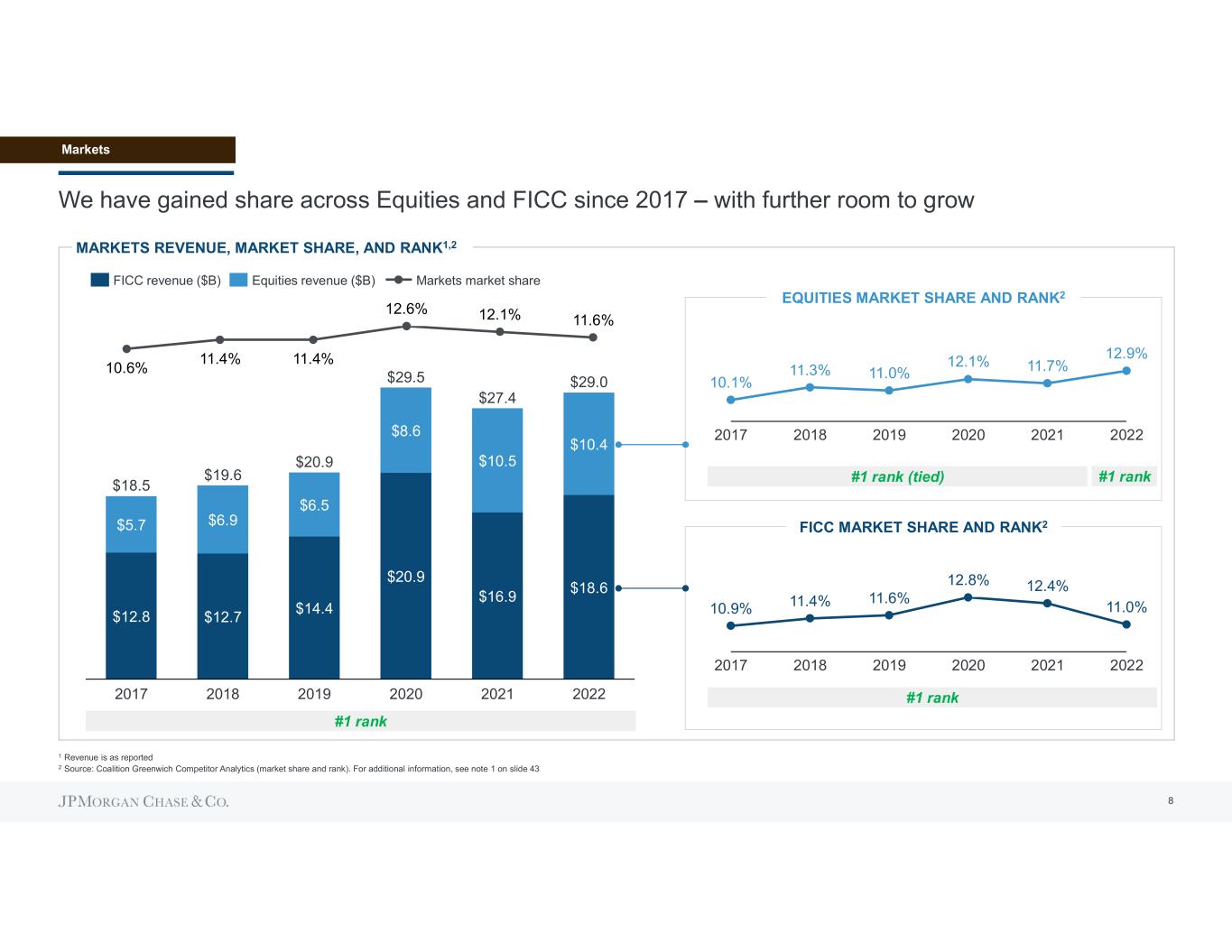

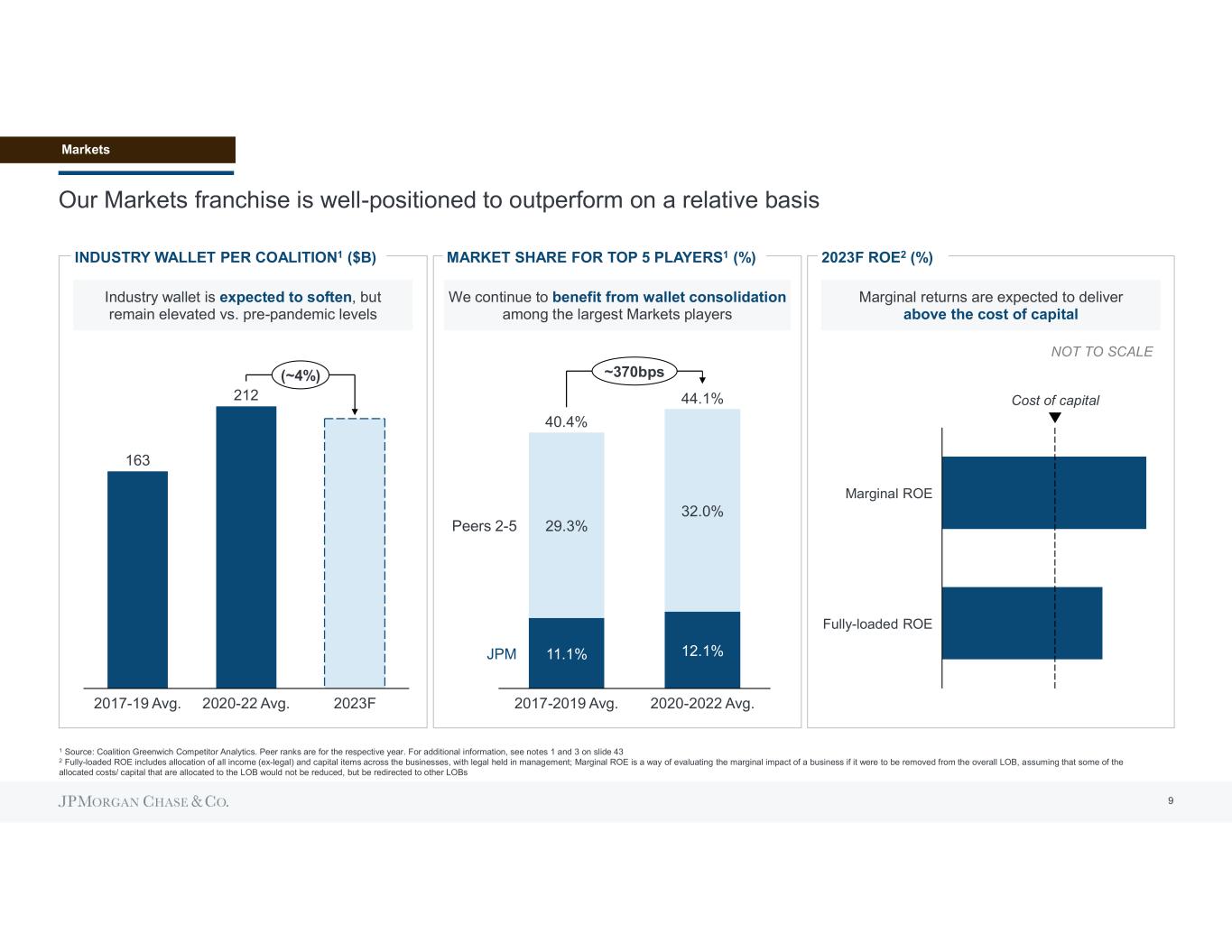

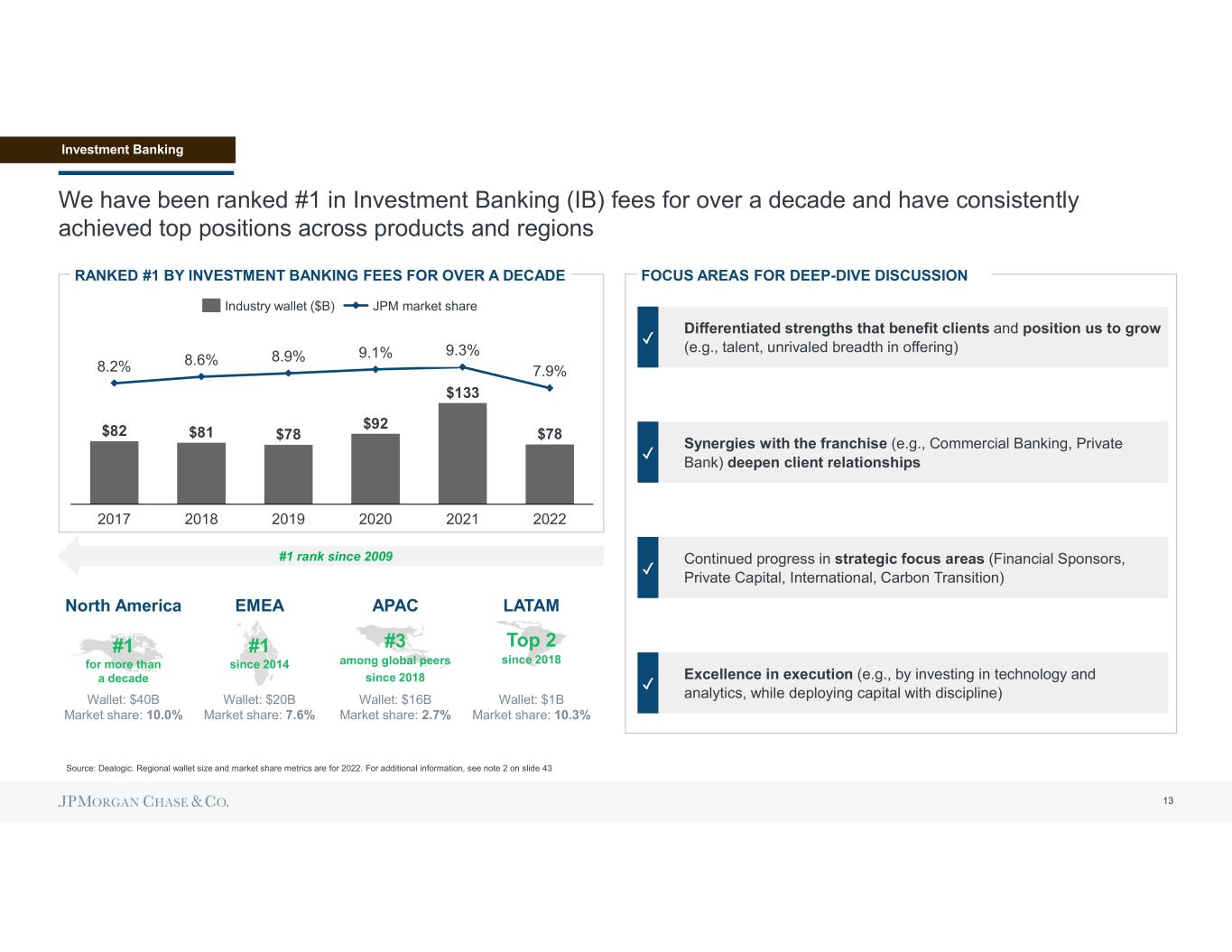

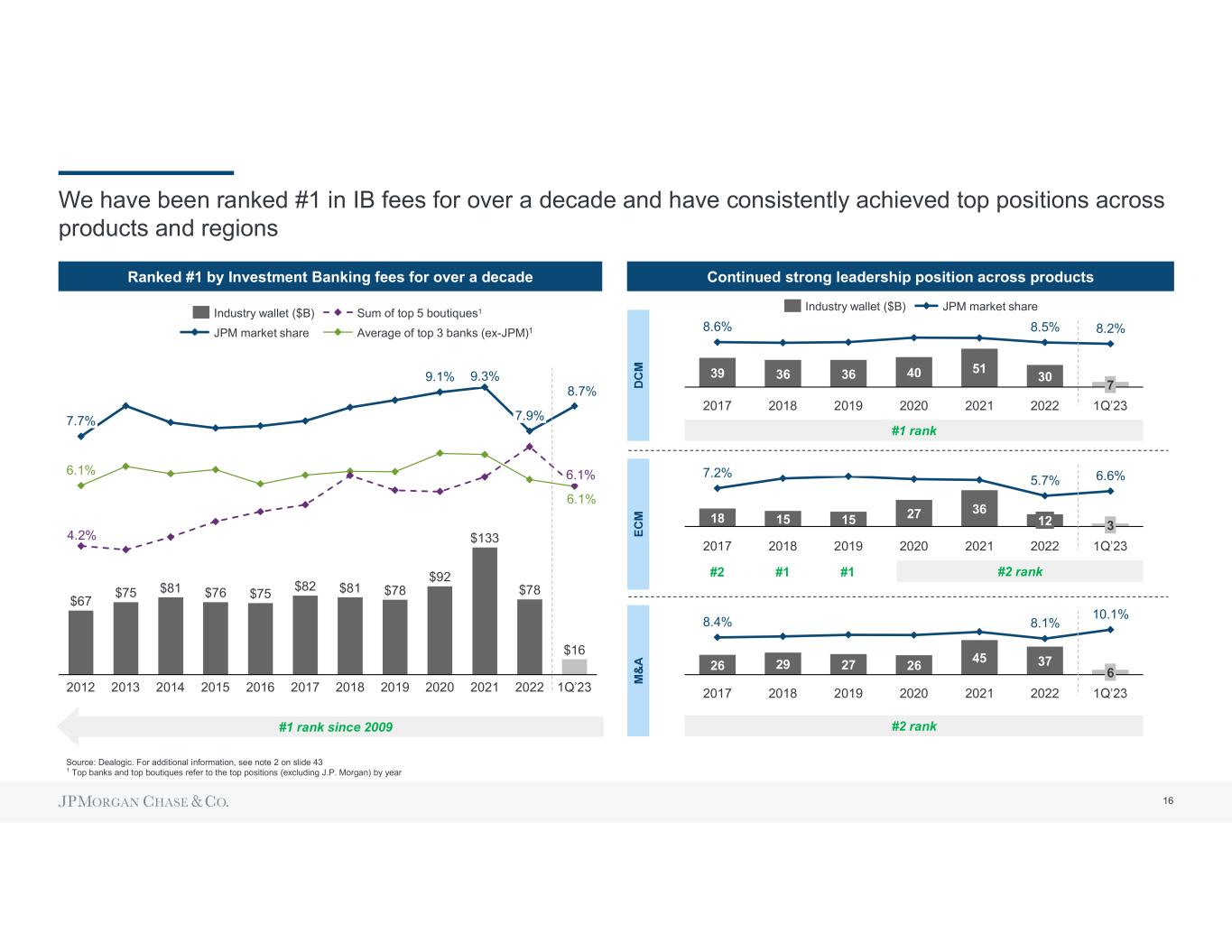

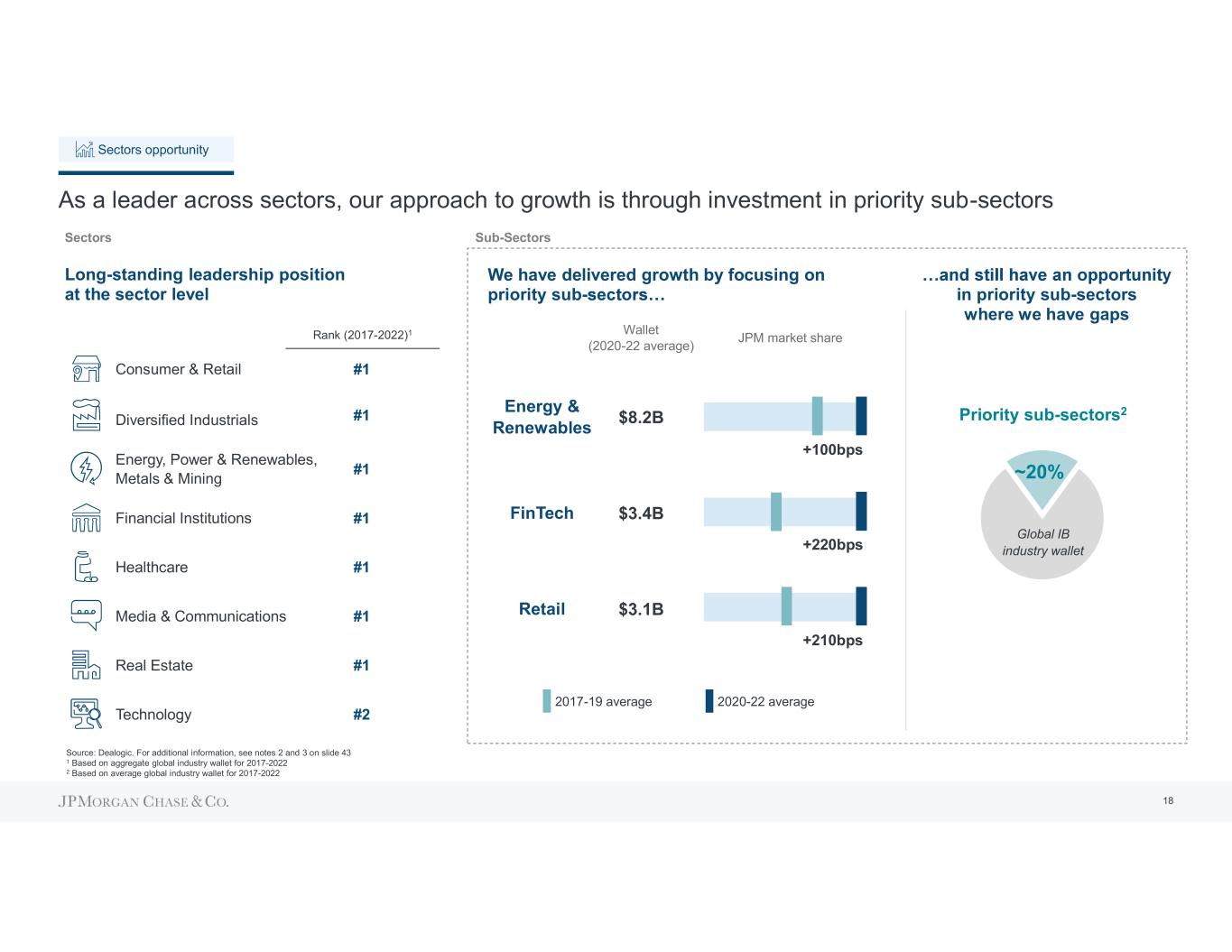

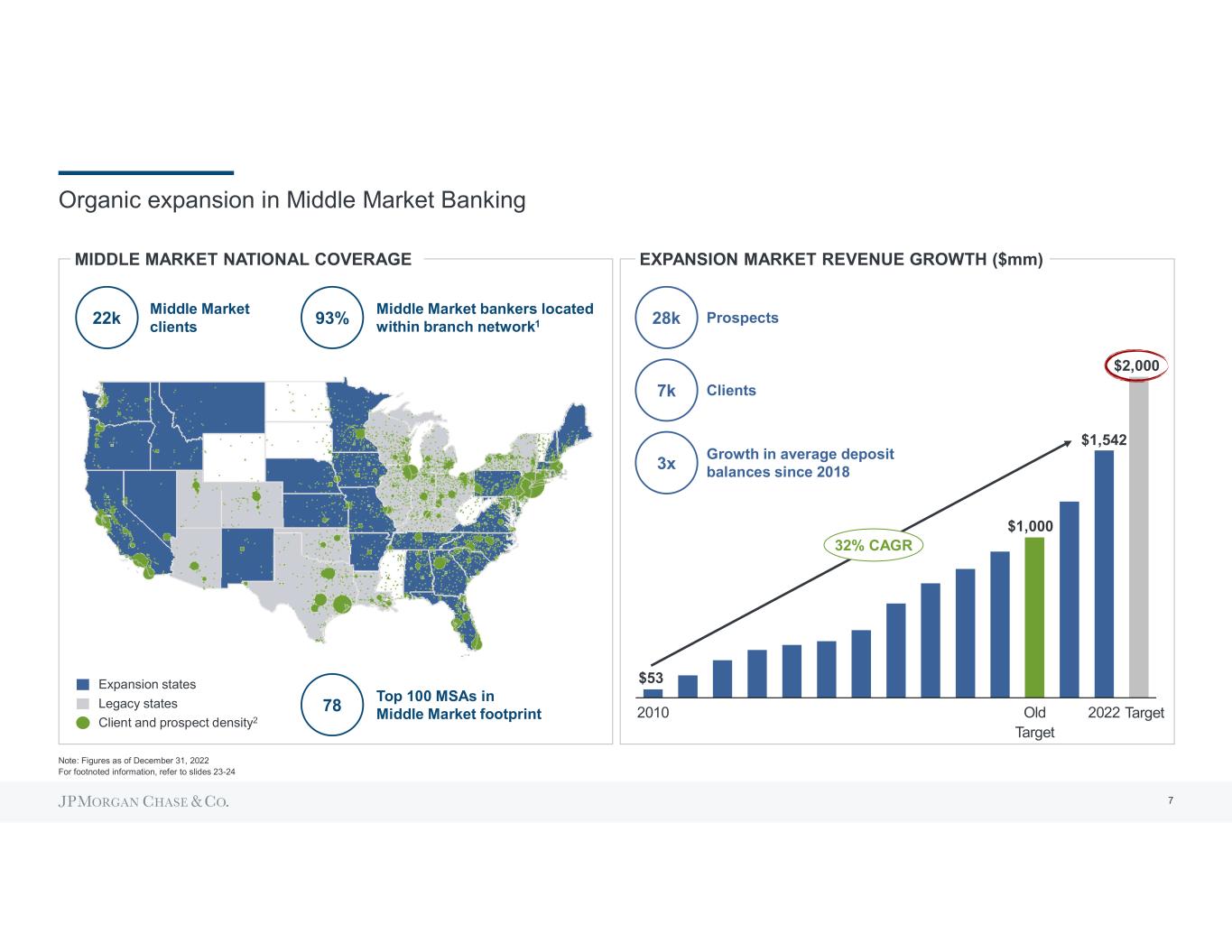

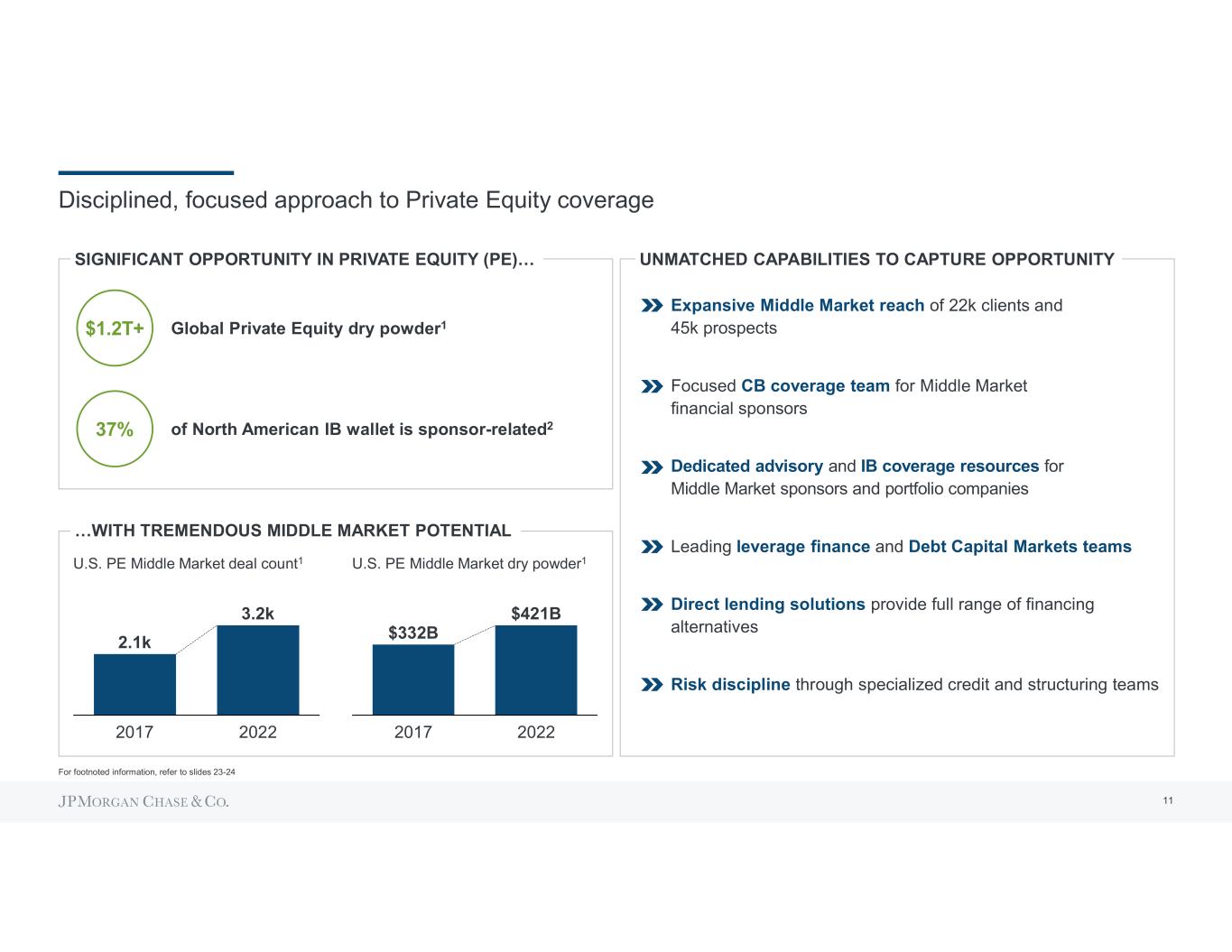

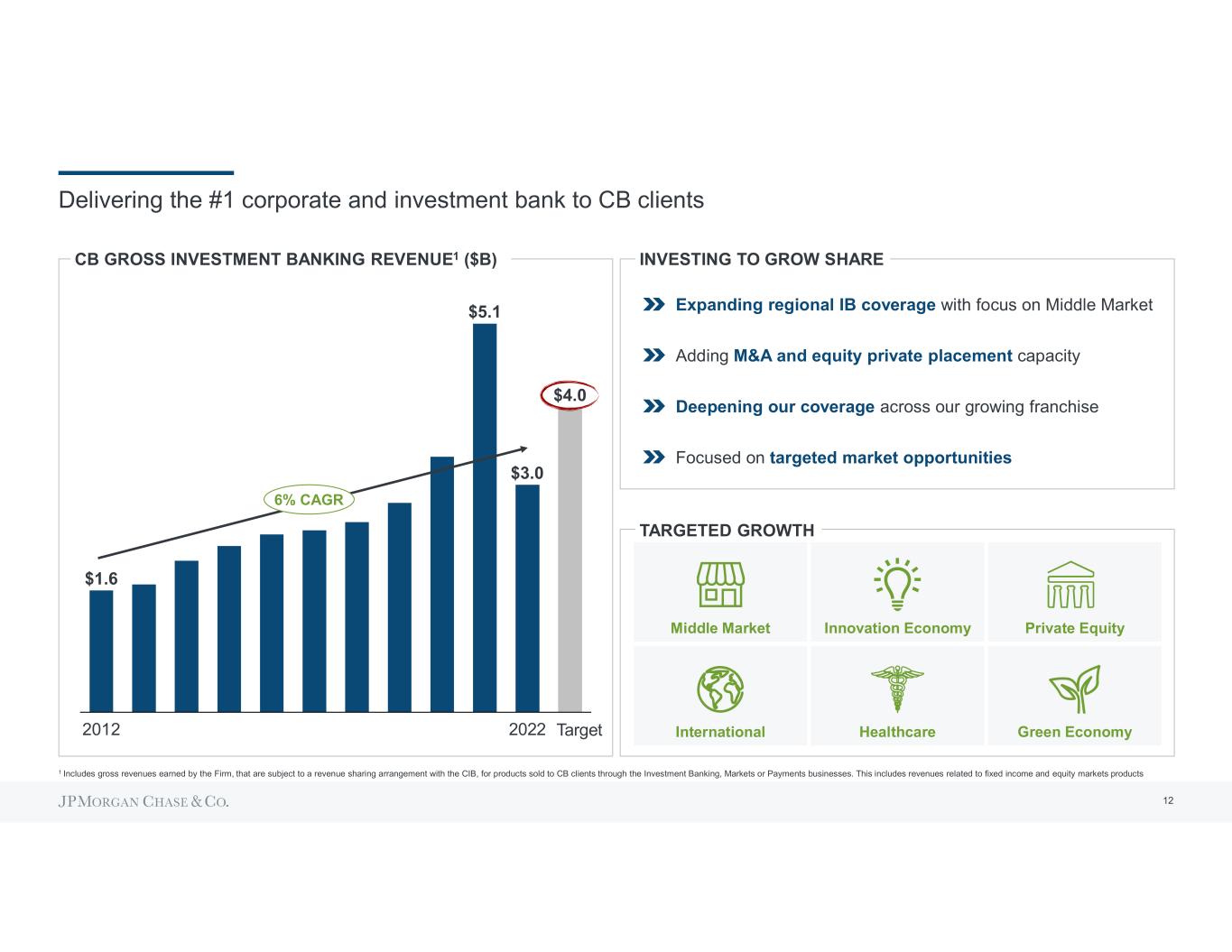

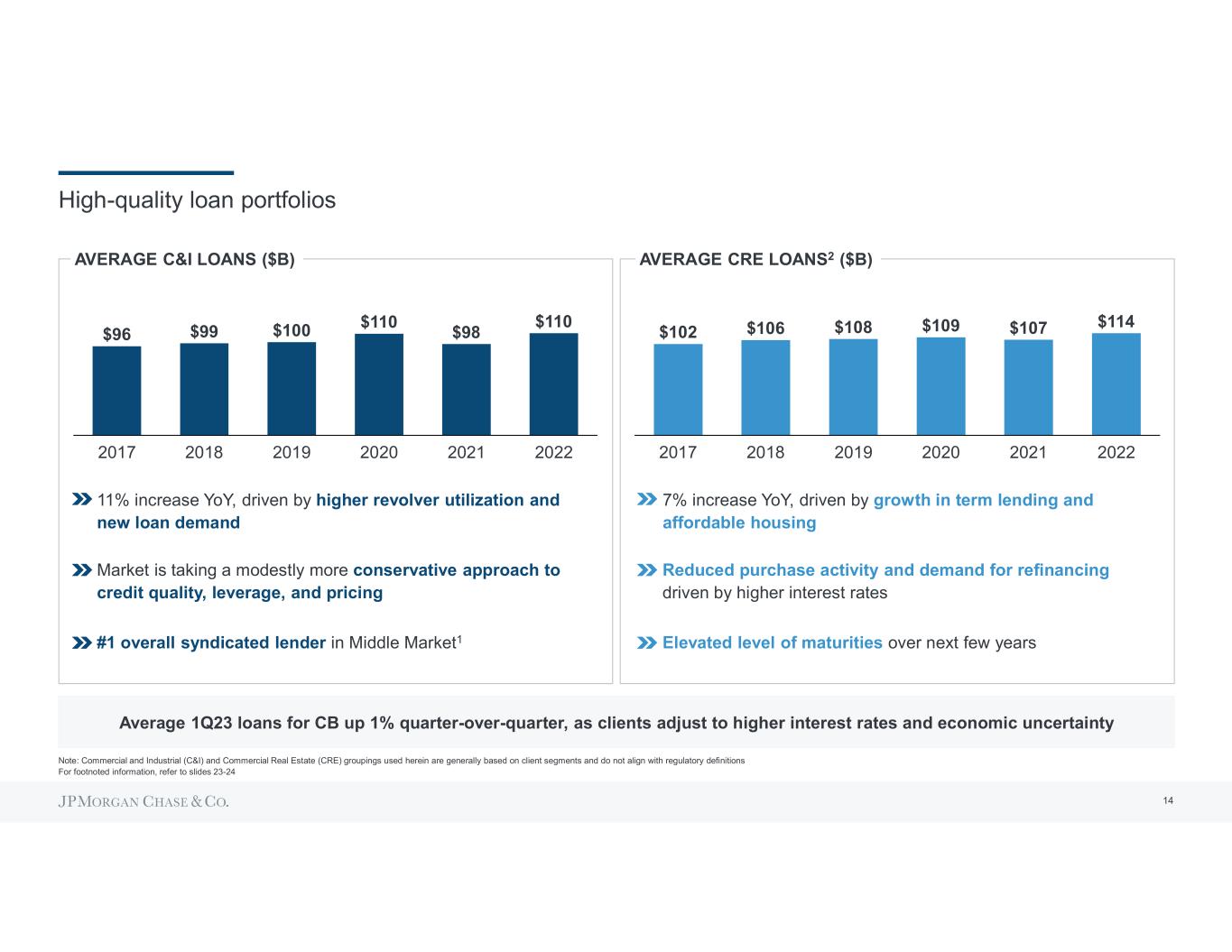

We have leading client and customer-centric franchises CCB AWM CB CIB IB fees4 Markets revenue5 Treasury Services revenue6 Rated Private Bank in the World7 LT active fund flows (5-yr)8 U.S. retail deposits1 U.S. credit card issuer 2 Primary Business Bank3 Multifamily lender9 Middle Market bookrunner10 CCB U.S. retail deposits1 7.1% 10.9% Credit card sales11 20.5% 22.4% Client investment assets $159B $647B #1 retail deposit share in top three U.S. markets: NYC, LA and Chicago CIB Investment Banking fees4 7.7% 7.9% Markets revenue5 8.6% 11.6% 5.6% 8.4% Operate in 100+ markets globally CB Gross IB revenue13 $1.6B $3.0B Payments revenue14 $2.7B $5.9B International presence in 34 locations and 66% revenue growth '19-'22 AWM Client assets15 $2.0T $4.0T 72% 90% 19 straight years of positive net new flows; $1.6T since 201217 Market share 2012 2022 +380bps +260bps+190bps +3.5x4.1 +3.5x+20bps +3.5x+300bps +3.5x+280bps +3.5x1.9 +3.5x+121% +3.5x+100% +3.5x+18ppts Long-term mutual fund AUM outperforming over 10 years16 Treasury Services revenue6 For footnoted information, refer to slide 21 12 3

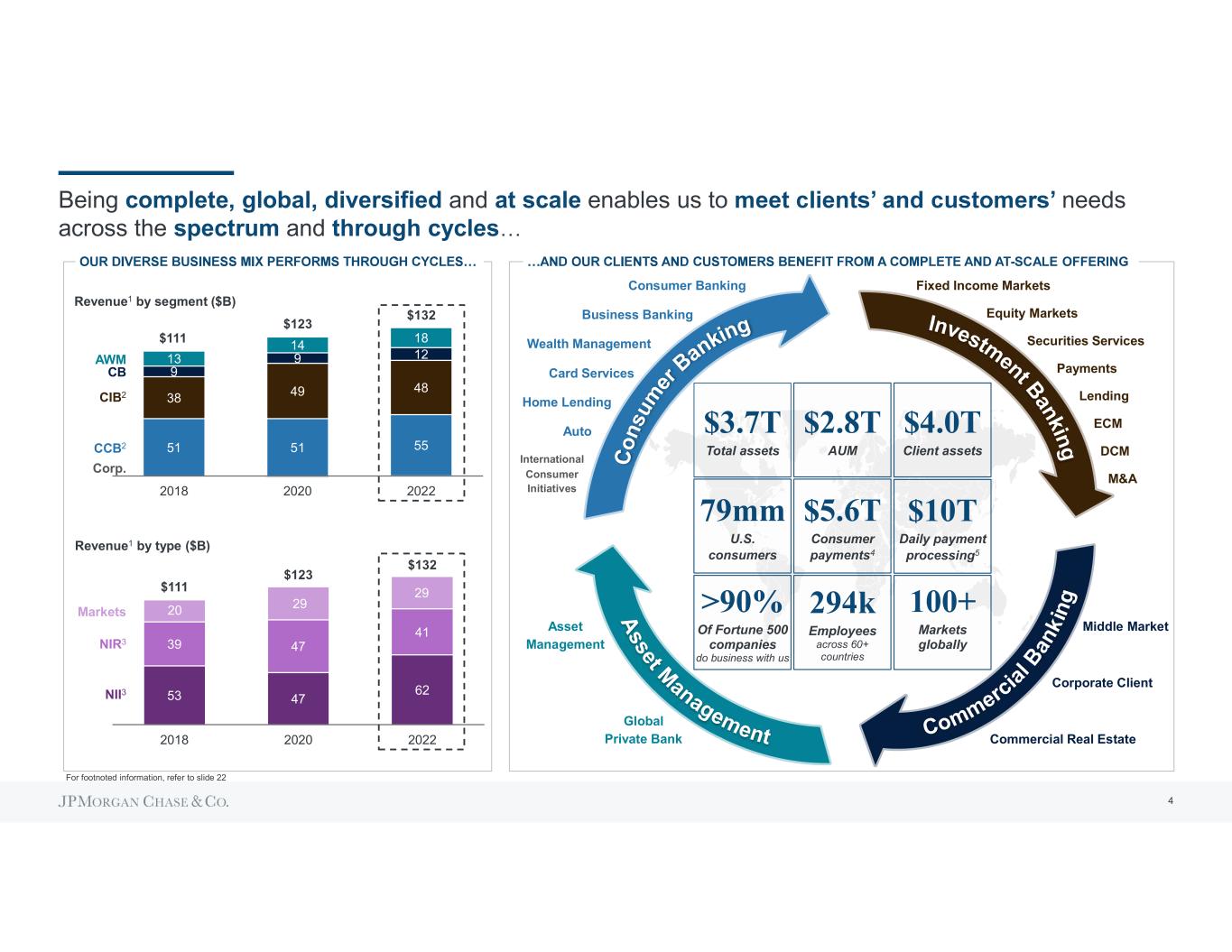

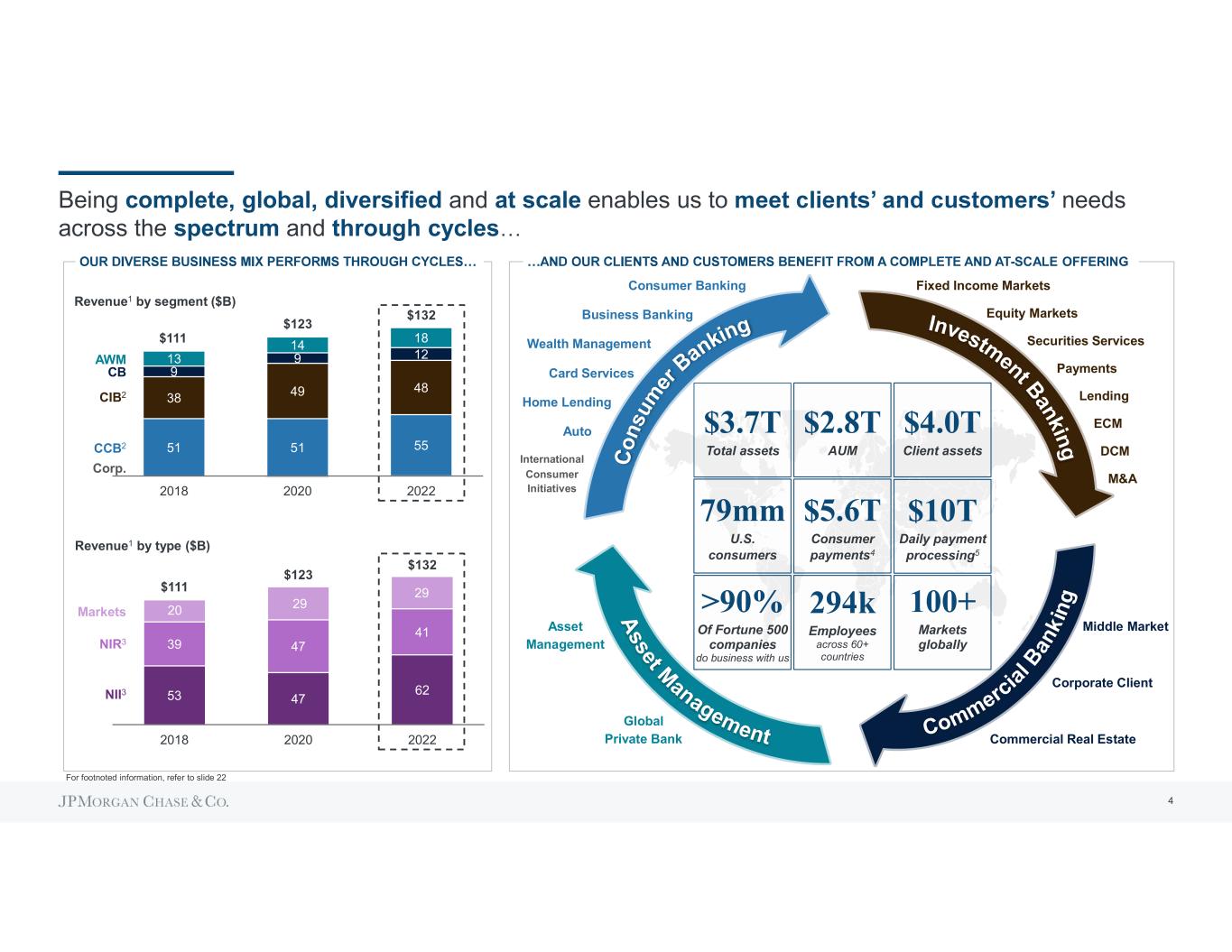

Being complete, global, diversified and at scale enables us to needs across the spectrum and through cycles CCB2 CIB2 CB AWM Corp. Revenue1 by segment ($B) $111 $123 $132 51 51 55 38 49 48 9 9 1213 14 18 2018 2020 2022 $111 $123 $132 53 47 62 39 47 41 2018 2020 2022 20 29 29 NII3 NIR3 Markets Revenue1 by type ($B) -SCALE OFFERING $3.7T Total assets Wealth Management Commercial Real Estate Fixed Income Markets Global Private Bank International Consumer Initiatives $2.8T AUM 79mm U.S. consumers $4.0T Client assets 294k Employees across 60+ countries >90% Of Fortune 500 companies do business with us $5.6T Consumer payments4 $10T Daily payment processing5 Payments Asset Management M&A ECM DCM Equity Markets Lending Securities Services Middle Market Corporate Client Consumer Banking Business Banking Card Services Home Lending Auto For footnoted information, refer to slide 22 100+ Markets globally 4

multi-LOB partnerships and delivering all of JPMorgan Chase to clients throughout their lifetimes Individuals Small Businesses Middle Markets Larger Corporates Financial & Investment Markets / SS Banking PaymentsGPB AM CCB CIB CBAWM 50 Market Leadership Teams in the U.S. 7 U.S. regions; 700+ senior leaders 43 Senior Country Officers globally All focused on cross-LOB growth opportunities ~30% of leaders have cross business/function experience1 Denotes primary relationships Our product completeness and scale make us uniquely positioned to strengthen our value proposition to each client segment Relationships with adjacent segments (e.g., employees) or cross-LOB solution CIBCBAWMCCB Select cross-LOB solutions strengthening segment value propositions Advanced Chase Wealth Management products and capabilities powered by Global PB Payment solutions including real time bill payment and global remittances Integrated Payment solutions (QuickAccept) embedded into Chase Complete Banking Employee benefits and retirement accounts provided by Everyday 401K Payment solutions tailored to Middle Market and specific sectors (e.g., Healthcare, e- Commerce) Sponsor and VC coverage spanning portfolio companies, GPs and Founders Global Shares for capital table management and share plan management for employees Range of customized lending, treasury, markets, and custody solutions to meet needs of complex financial institutions For footnoted information, refer to slide 22 Our value proposition is further enhanced by constant investment in Technology 5

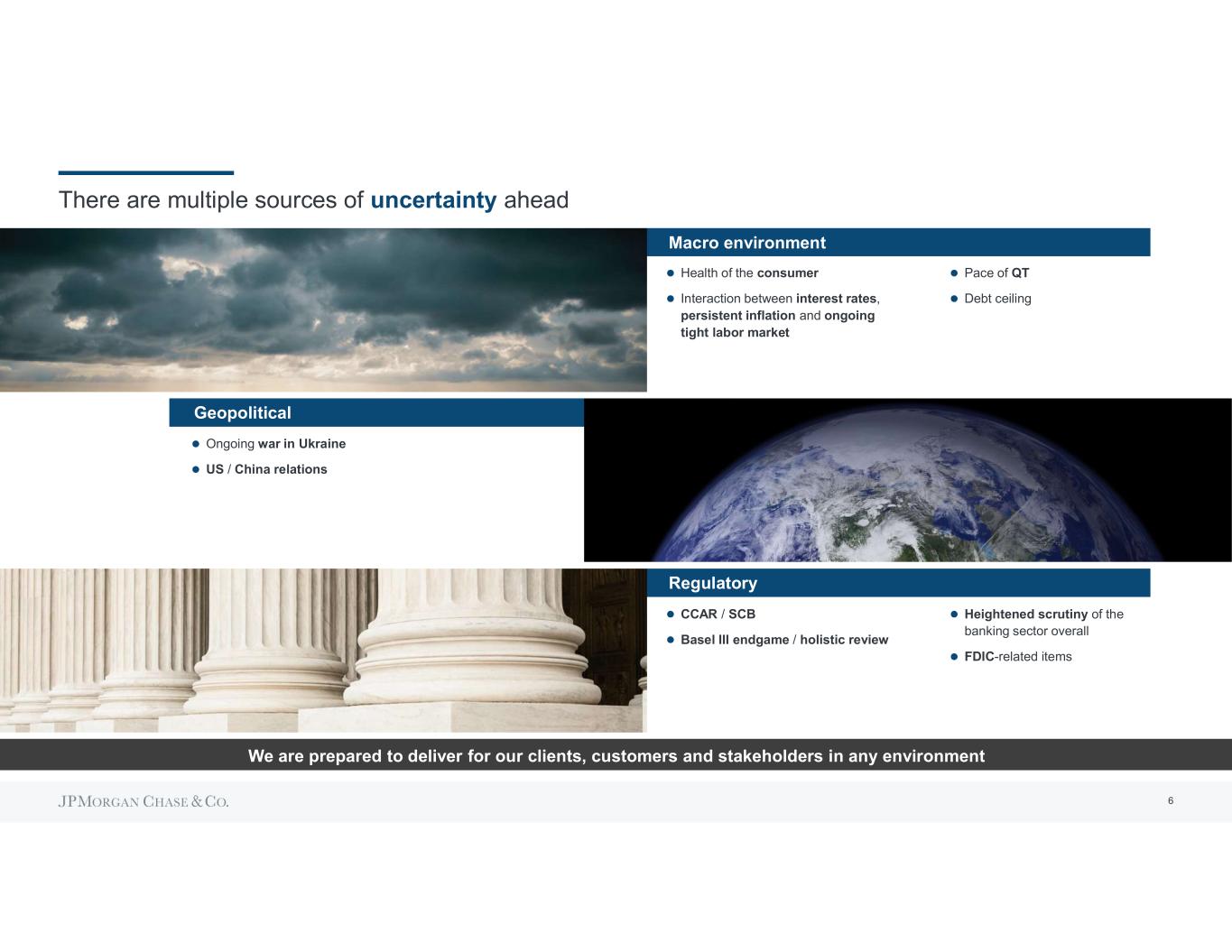

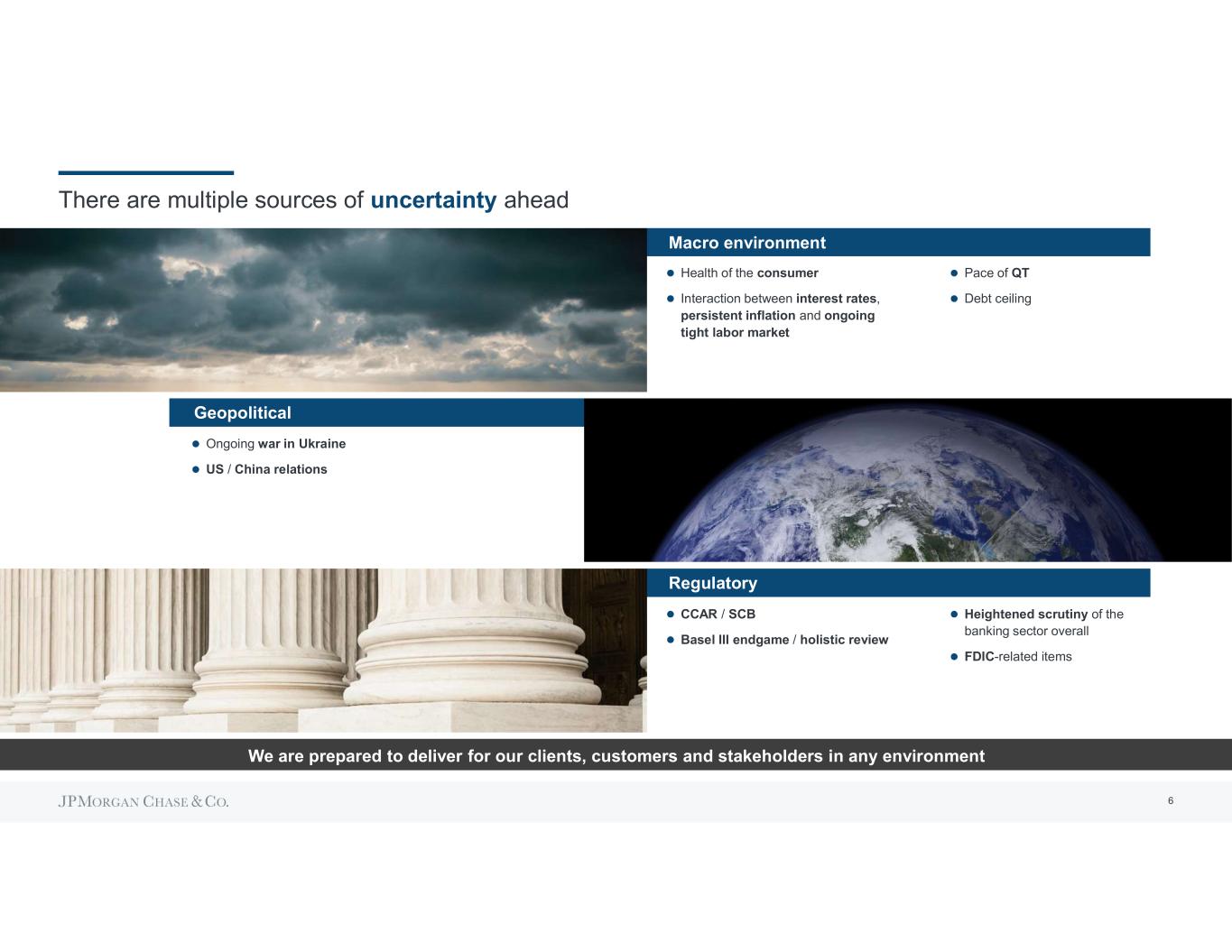

There are multiple sources of uncertainty ahead Macro environment Health of the consumer Interaction between interest rates, persistent inflation and ongoing tight labor market We are prepared to deliver for our clients, customers and stakeholders in any environment Pace of QT Debt ceiling Geopolitical Ongoing war in Ukraine US / China relations Regulatory CCAR / SCB Basel III endgame / holistic review Heightened scrutiny of the banking sector overall FDIC-related items 6

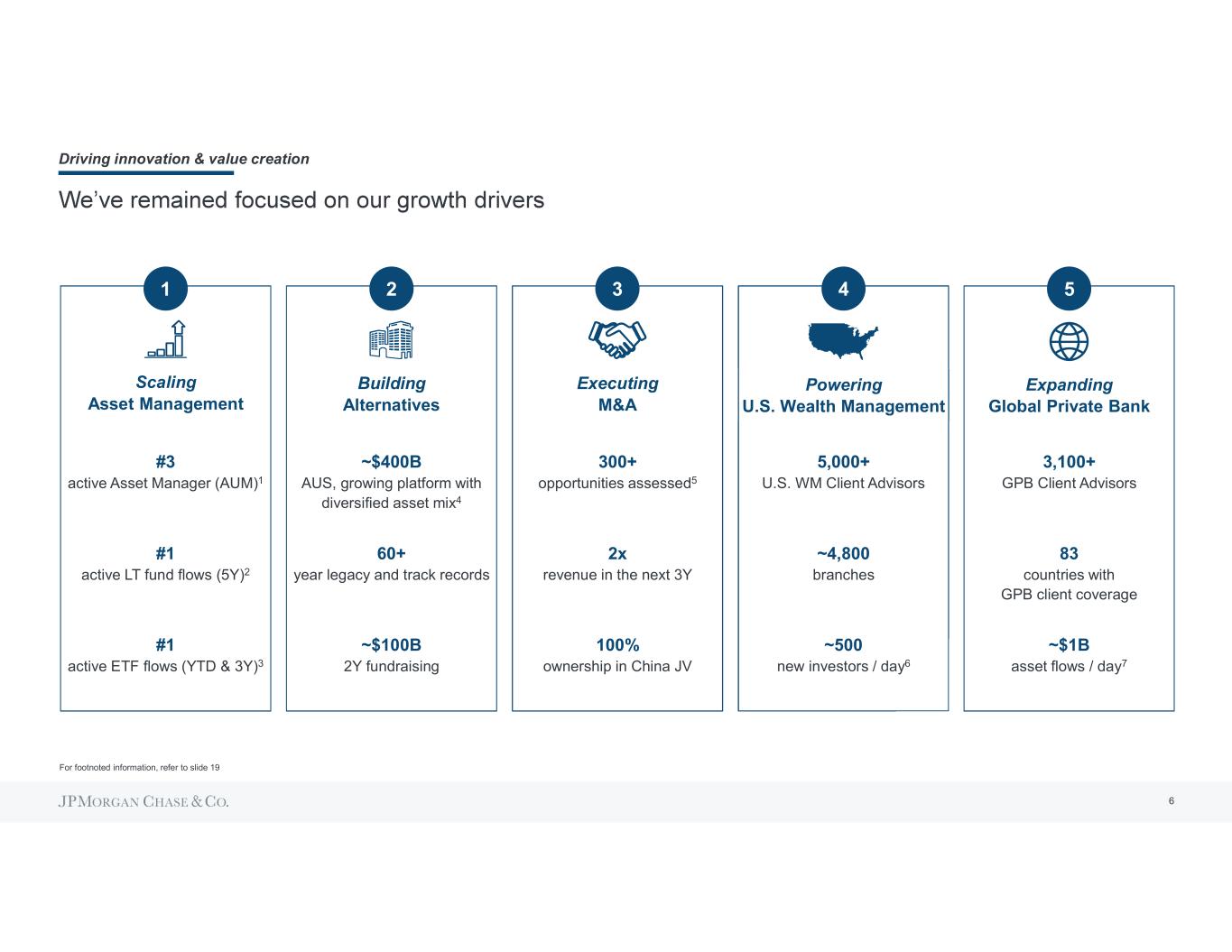

Cybersecurity and risk management remain non-negotiable priorities Provide operational resiliency and security Address multi-jurisdictional sanctions money in movement and data Minimize fraud and cyber risk Comply with AML1 laws and KYC2 protocols We are an integral part of a safe, sound and resilient financial system Compliance Fraud Cyber KYC Control Management Legal Finance Risk For footnoted information, refer to slide 22 Three lines of defense Front Line Units Independent Risk Management Internal Audit Human Resources Technology 7

We remain committed to advancing a sustainable and inclusive economy Sustainable Development Target: $2.5T over 10 years1 Racial Equity Commitment: $30B over 5 years1 Community Development Striving to advance economic inclusion in developed markets $102B cumulative progress by the end of 2022 $482B reported progress by the end of 2022 ~$29B Approved funding of ~$18B in loans to incentivize the preservation of nearly 170k affordable housing rental units in the U.S. Opened 16 Community Center Branches2 and hired 146 Community Managers Refinanced 14,000+ incremental mortgage loans totaling ~$3B Invested $100mm+ of equity in Minority Depository Institutions and Community Development Financial Institutions 406,000 net new low-cost checking accounts with no overdraft fees Development Finance Working to support socioeconomic development in emerging economies $204B Green $1T goal Aiming to drive climate action and sustainable resource management $176B For footnoted information, refer to slide 22 95% 19% 8

9% compound annual growth rate since 2004 $15 $16 $19 $22 $23 $27 $30 $34 $39 $41 $45 $48 $51 $54 $56 $61 $66 $72 $73 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 Our strong track record has laid the foundation for our continued success TBVPS1 ($) 18% ROTCE1 $132B Revenue3 58% Overhead ratio3 445bps > peers2 $38B Net Income vs. 69% for peers2 vs. 12% for peers2 Complete Global At ScaleDiversified quality of earnings. This means consistently - Jamie Dimon, 2007 Technology Bankers, Advisors & Branches Marketing Digital, Data, AI & Product Design New and Expanded Businesses For footnoted information, refer to slide 22 2022 9

For footnoted information, refer to slide 22 $1.4T HQLA and marketable securities 140% Bank LCR $488B Total Loss-Absorbing Capacity 5.9% Firm SLR 13.8% Standardized CET1 ratio LIQUID BALANCE SHEET $460B Our fortress balance sheet principles are designed so we can be a pillar of strength in any environment 114% Firm LCR 13.9% Advanced CET1 ratio STRONG CAPITAL POSITION Tier 1 $254B $488B TLAC Allowance JPM Current JPM Loss- Absorbing Capacity All U.S. bank loan losses during the GFC4 As of March 31, 2023 Sources of liquidity1 $1.6T $2.3T Deposits1 NIM3: 4Q21 3.1% 1.9% 3.8% (120bps) 190bps Cash HQLA-eligible securities2 Other unencumbered securities2 $203B $453B $421B $557B$236B $421B 4Q19 1Q23 ~$600B increase in liquidity sources $1.4T $0.9T 10 $713B $1,113B $855B $1,208B 4Q19 1Q23 ~$800B net deposit inflows since QE restarted CCB CIB, CB, AWM, Corp.

2023 Outlook as of 1Q23 Impact of First Republic 2023 Outlook Medium-term NII ex. Markets outlook increasing to ~$84B due to First Republic, though sources of uncertainty remain ~$84 Deposit reprice Magnitude and timing Competitive dynamics and consumer behavior Balance sheet growth and mix Card Services revolve normalization Securities reinvestment strategy Impact of policy choices and macro environment Pace of quantitative tightening (QT) Path of Fed Funds rate Size and terms of RRP Severity of any recession 1Q23 $20.9 NET INTEREST INCOME EX. MARKETS1 ($B) SOURCES OF UNCERTAINTY 2Q23 3Q23 4Q23 $81 Mid-$70s ~$3 Medium-term impact to be determined For footnoted information, refer to slide 23 Assumes Fed Funds target upper bound reaches 4.75% by year end, with two cuts in 4Q23 Assumptions Mid-single digit loan growth Card Services revolve growth continues Moderate Wholesale loan growth Deposits down slightly YoY Rate headwinds partially offset by moderate loan growth Assumptions Meaningful catch up in deposit repricing as lags are removed from the current run rate Potential upside from First Republic franchise 11

Should the terms of RRP be reevaluated given the extent of deposit drainage? Credit extension How long can unprecedented pace of QT continue before triggering reserve scarcity? System-wide deposit levels will depend on how QT interacts with RRP and customer behavior Key questions U.S. Treasury MMFs FHLB $18.1 $17.1 17 ($0.4) ($0.6) ($0.7) $0.8 Dec '21 Loans and securities Fed B/S TGA and RRP Other Apr '23 Size of Fed balance sheet Federal Reserve Outlook: continued QT (~$80B per month) Mix of Fed liabilities Increase in AUM, invested in non- RRP assets (e.g., T-bills) RRP facility Outlook: growth in RRP likely to continue absent increase in available T-bills Spending of Treasury General Account (TGA) Issue treasuries to increase TGA Outlook: ~neutral over time Growth in advances, if funded by MMFs selling RRP Growth in advances, if funded by discount notes purchased using bank deposits Individuals, corporations and institutions Increases deposits Repay loans / purchase securities from banks Outlook: modest loan growth to continue Evolution of U.S. commercial bank deposits ($T)1 Fed B/S TGA & Loans & s rities Regardless of macro pressures on deposits, our strategy remains the same: focus on maintaining primary banking relationships Borrow from / sell securities to banks Decreases deposits FHLB & other2 vs. $4.6T Fed B/S expansion during QE For footnoted information, refer to slide 23 12

Our 2023 expense outlook is unchanged excluding expenses associated with First Republic ADJUSTED EXPENSE1 ($B) 1 2 31 33 27 28 5 5 12 12 2022 2023 Outlook before First Republic Impact of First Republic 2023 Outlook ~$5 ~$81 CCB CIB CB AWM Corp. $76 ~$2B increase in investment expense ~$3B increase in structural expense Includes $0.6B of investments transitioned into BAU Includes $0.5B of FDIC assessment announced in 2022 Modest decrease in volume- and revenue- related expense ~$3.5 ~$84.5 Includes integration costs 2024 CONSIDERATIONS FDIC CONSIDERATIONS Moderating labor inflation Continued investments Market-dependent increase in volume- and revenue-related expenses Continued efficiencies Integration costs related to First Republic Potential increases to regular-way FDIC assessments For footnoted information, refer to slide 23 Finalization of special assessment related to systemic risk determination Based on May 11 NPR: Approximately $3B, pre-tax Likely to be accrued in 2023 Assessment associated with First Republic No indication of a special assessment $13B estimated loss to the DIF can be rebuilt through regular-way assessments Potential redesign to deposit insurance special assessment FDIC 13

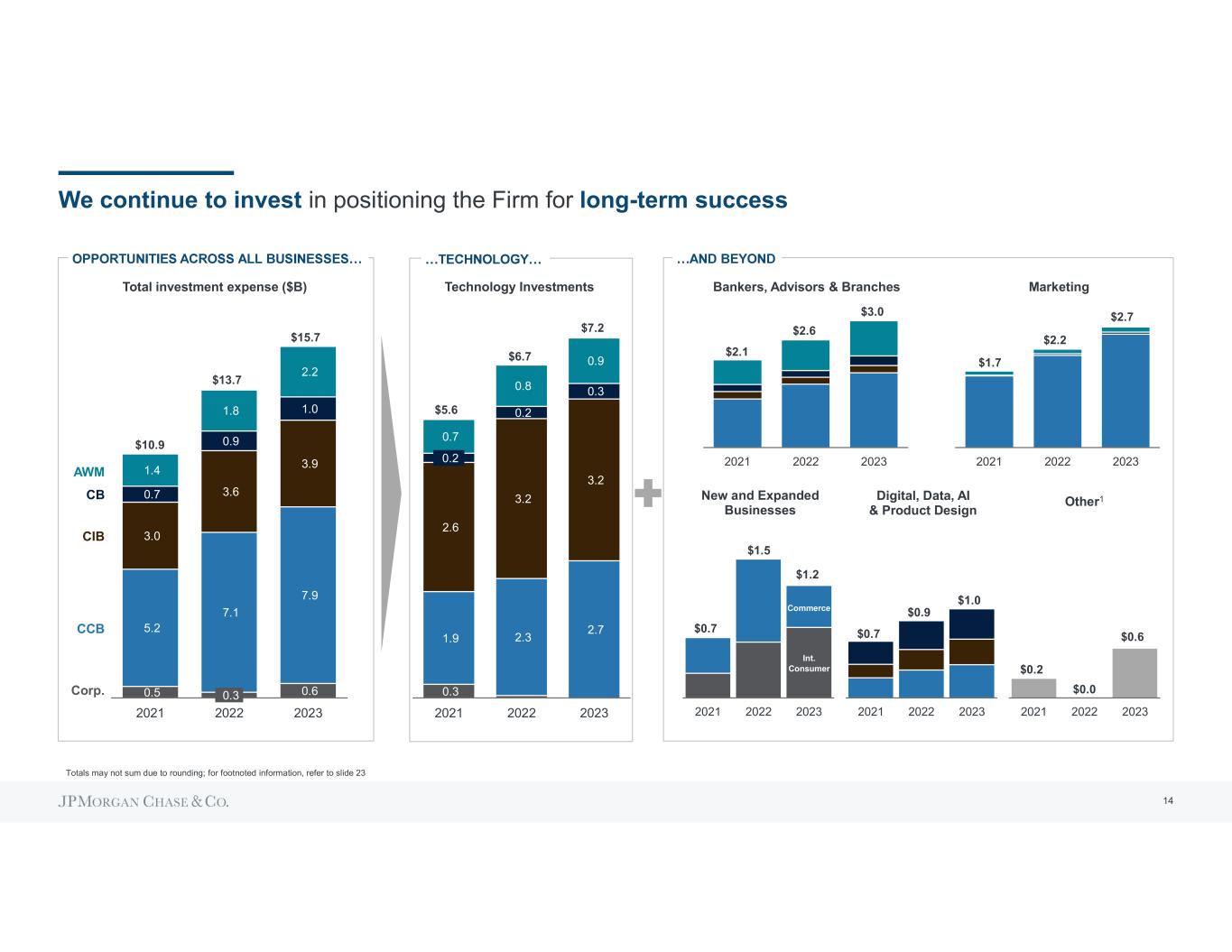

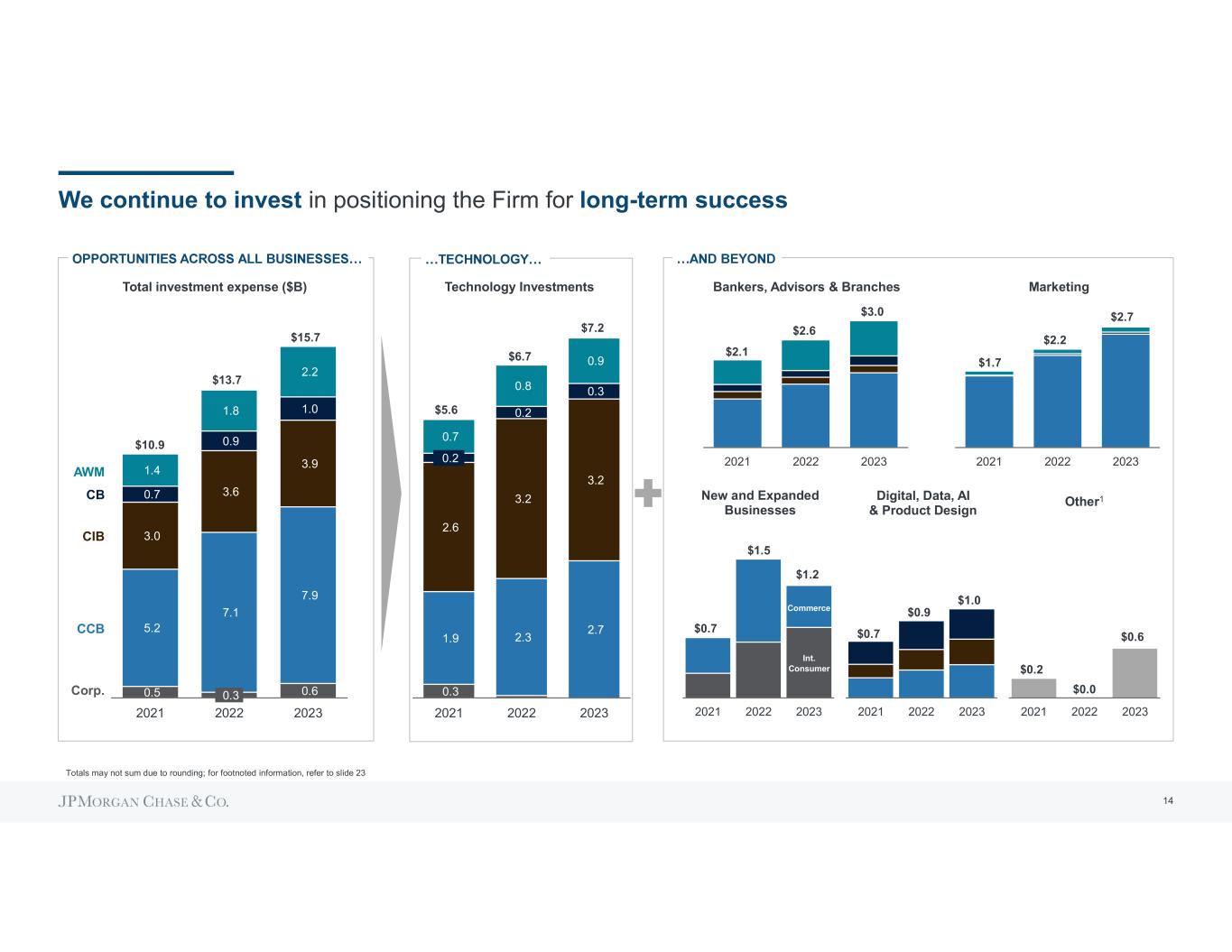

We continue to invest in positioning the Firm for long-term success $5.6 $6.7 $7.2 0.3 1.9 2.3 2.7 2.6 3.2 3.2 0.2 0.2 0.3 0.7 0.8 0.9 2021 2022 2023 Technology InvestmentsTotal investment expense ($B) CCB CIB CB AWM Corp. $10.9 $13.7 $15.7 0.5 0.3 0.6 5.2 7.1 7.9 3.0 3.6 3.9 0.7 0.9 1.0 1.4 1.8 2.2 2021 2022 2023 $1.7 $2.2 $2.7 2021 2022 2023 $2.1 $2.6 $3.0 2021 2022 2023 $0.7 $1.5 $1.2 2021 2022 2023 Bankers, Advisors & Branches Marketing Digital, Data, AI & Product Design New and Expanded Businesses Commerce Int. Consumer $0.7 $0.9 $1.0 2021 2022 2023 Other1 Totals may not sum due to rounding; for footnoted information, refer to slide 23 $0.2 $0.6 2021 2022 2023 $0.0 14

The regulatory capital environment is uncertain Today Comment periodNPR Phase-in period Final rule Final implementation MULTIPLE FACTORS AT PLAY, THOUGH ANY POTENTIAL REGULATORY CHANGE 4.5% GSIB CCyBLending RWA Buffers 1Q25 earliest 4.0% 0% Today Rule ? ? Period ? Final implementation ? Trading (incl. Repos & FRTB) SCBOperational Risk and CVA Although the ultimate direction of the various components of capital requirements is uncertain, we are prepared for overall requirements to increase Basel III endgame Holistic review 15

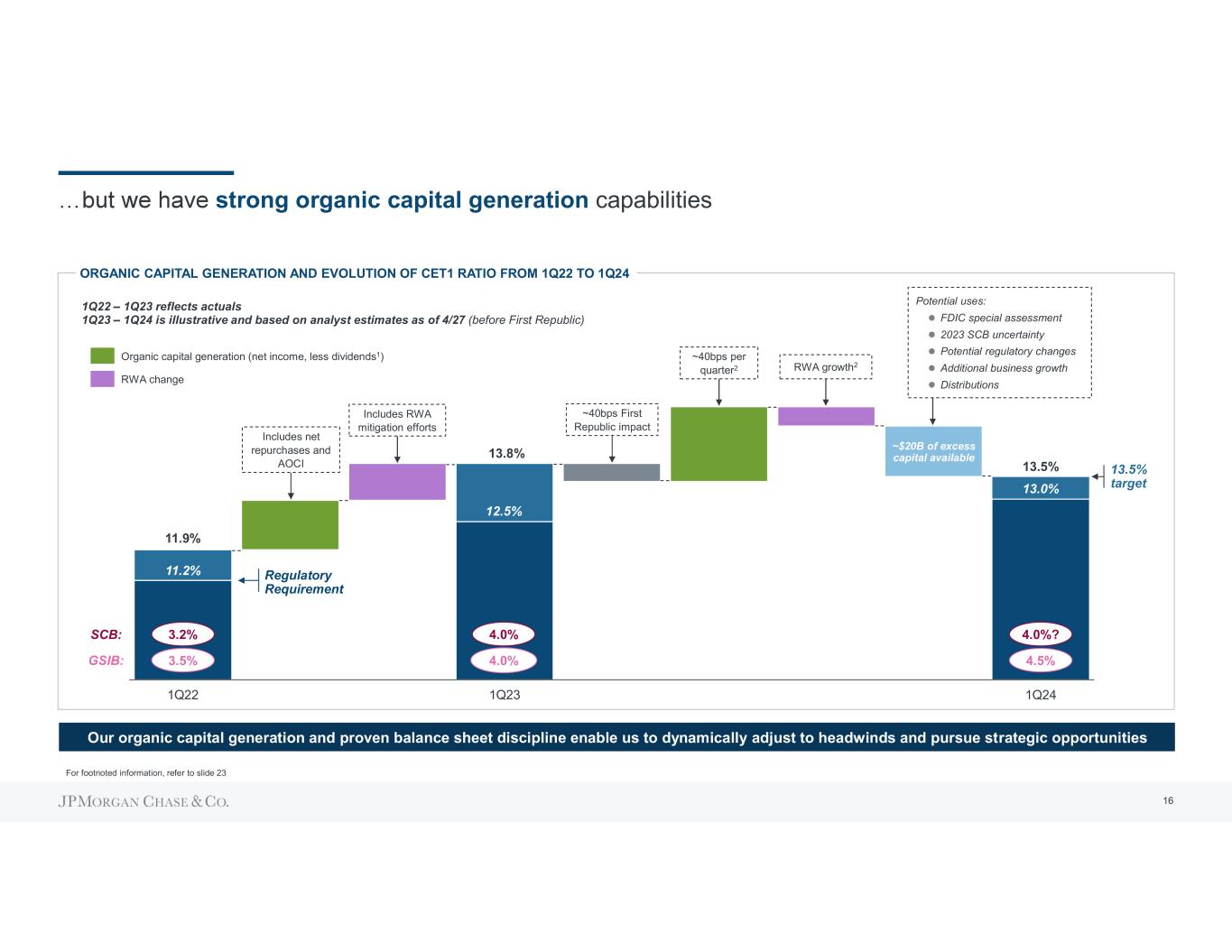

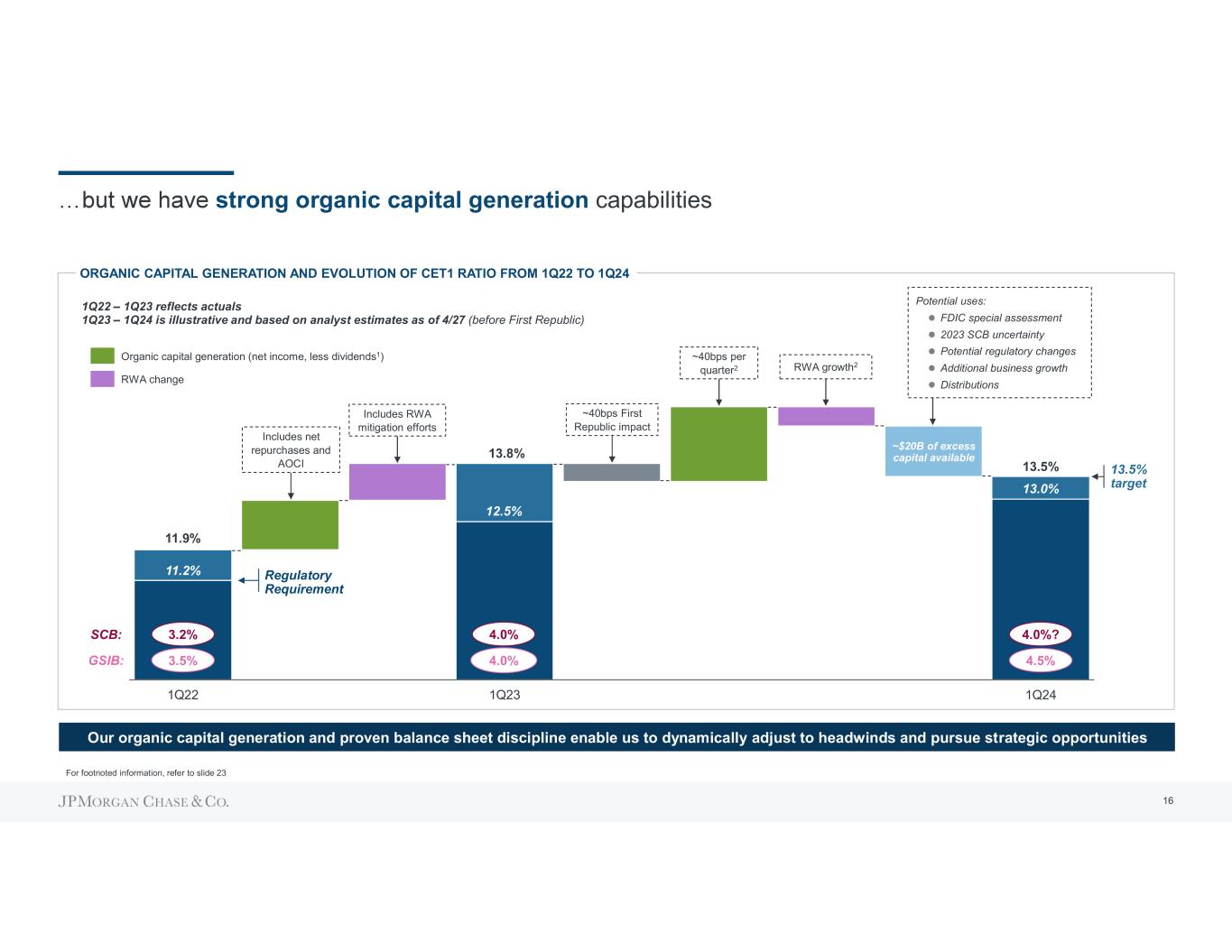

strong organic capital generation capabilities For footnoted information, refer to slide 23 11.9% 13.8% 1Q22 1Q23 1Q24 13.5% target Our organic capital generation and proven balance sheet discipline enable us to dynamically adjust to headwinds and pursue strategic opportunities 1Q22 1Q23 reflects actuals 1Q23 1Q24 is illustrative and based on analyst estimates as of 4/27 (before First Republic) 11.2% 13.5% 12.5% Regulatory Requirement Organic capital generation (net income, less dividends1) RWA change SCB: GSIB: 3.2% 3.5% 4.0% 4.0% 4.0%? 4.5% ORGANIC CAPITAL GENERATION AND EVOLUTION OF CET1 RATIO FROM 1Q22 TO 1Q24 Includes RWA mitigation efforts RWA growth2 ~40bps per quarter2 Potential uses: FDIC special assessment 2023 SCB uncertainty Potential regulatory changes Additional business growth Distributions ~$20B of excess capital available Includes net repurchases and AOCI ~40bps First Republic impact 13.0% 16

Credit remains benign, but we expect continued normalization throughout the year 5.8% 5.3% Q0 Q1 Q2 Q3 Q4 Q5 Q6 Q7 Q8 WE ARE RESERVED FOR PEAK UNEMPLOYMENT OF 5.8% IN LATE 20241 8-quarter weighted average UER forecasts (%) 10.3 11.4 1.9 1.7 6.5 9.5 18.7 22.8 4Q21 total allowance Economic drivers Loan growth / mix and credit quality 1Q23 total allowance Card Services Consumer ex. Card Wholesale Firmwide allowance ($B) WE HAVE BUILT RESERVES AS THE OUTLOOK HAS DETERIORATED 3 WE EXPECT NORMALIZED NCOS BY THE END OF 2023 NCO rate (%) 0.6% 0.6% 0.3% 0.3% 2019 2020 2021 2022 2023 Outlook Card Services Consumer ex. Card Wholesale Firmwide 3.10% 2.93% 1.94% 1.47% 2.60% For footnoted information, refer to slide 23 4Q21 1Q23 Pre-pandemic 2017 2019 average 3,4 2 17

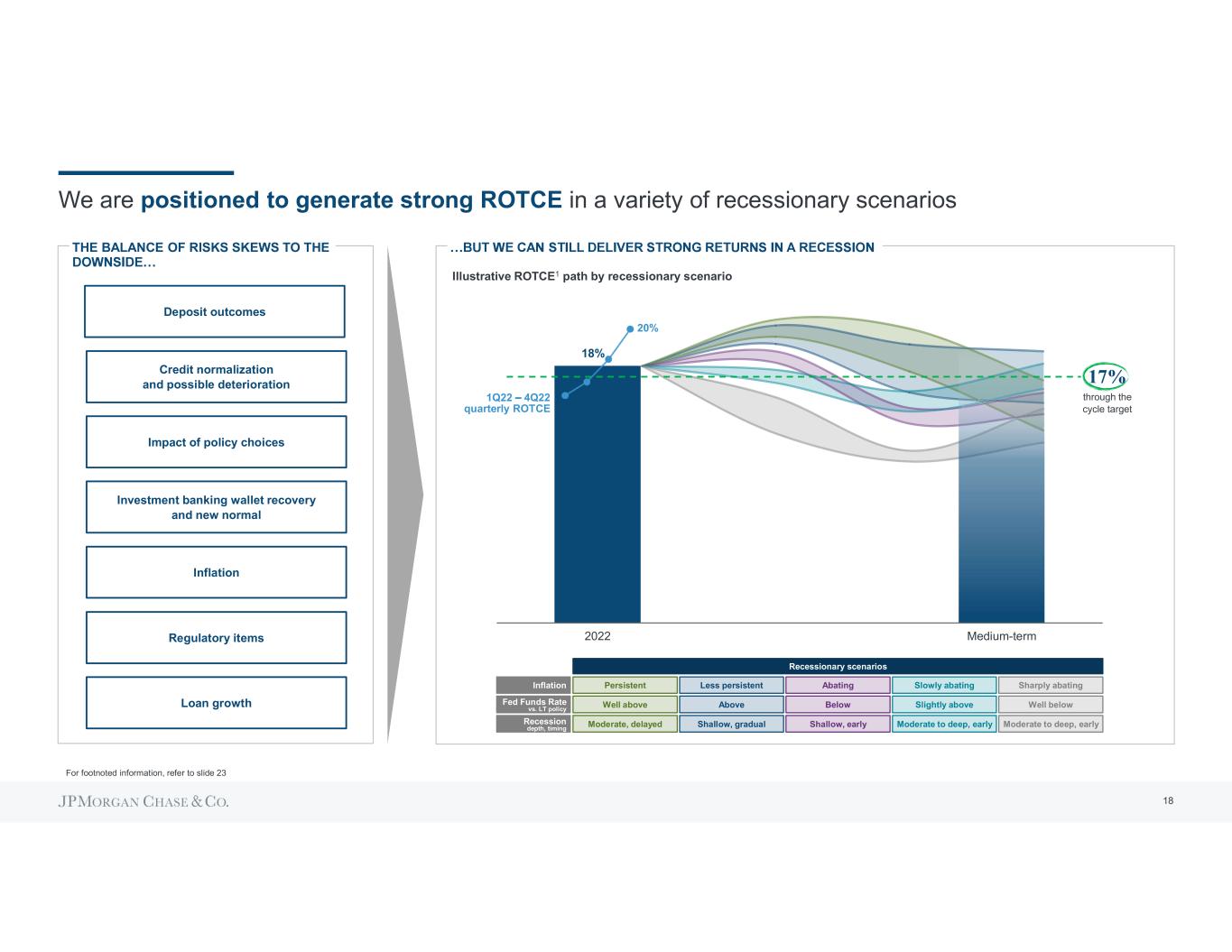

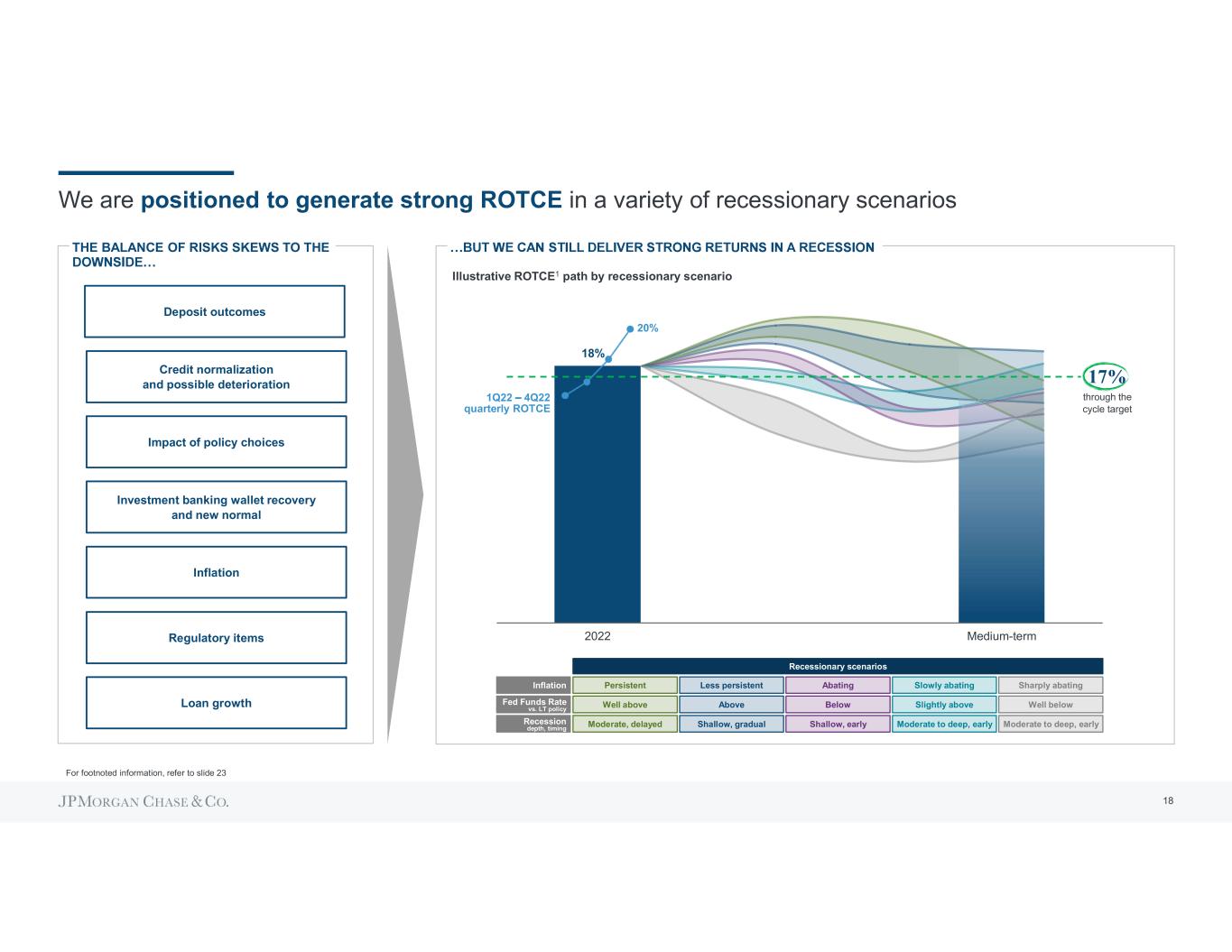

18% 2022 Medium-term We are positioned to generate strong ROTCE in a variety of recessionary scenarios For footnoted information, refer to slide 23 Deposit outcomes Credit normalization and possible deterioration Impact of policy choices Investment banking wallet recovery and new normal Inflation Regulatory items Loan growth THE BALANCE OF RISKS SKEWS TO THE Illustrative ROTCE1 path by recessionary scenario 17% through the cycle target Moderate to deep, earlyModerate, delayedRecession depth, timing Moderate to deep, earlyShallow, gradual Shallow, early Well belowWell aboveFed Funds Rate vs. LT policy Slightly aboveAbove Below Sharply abatingPersistentInflation Slowly abatingLess persistent Abating Recessionary scenarios 1Q22 4Q22 quarterly ROTCE 20% 18

We remain committed to serving our clients and customers with the full breadth of our offering, while producing strong returns for all our constituents ~17% ROTCE target ~$84B 2023 NII and NII ex. Markets ~$84.5B 2023 adjusted expense 13.5% Target CET1 ratio at 1Q24 Promotes stronger and deeper relationships with customers Allows us to serve more clients everywhere Supports more stable earnings in any operating environment Offsets margin compression through volume growth and facilitates efficiencies Complete Global Diversified At Scale See notes on slide 20 for additional information on ROTCE, NII ex. Markets and adjusted expense 19

Notes on non-GAAP financial measures 1. rat are non- ition of managed basis starts, in each case, with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm and each of the reportable business segments on a fully taxable-equivalent basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable investments and securities. These financial measures allow management to assess the comparability of revenue from year-to-year arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax- exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. For a reconciliation of the Annual Report on Form 10-K for the year ended December 31, - -G Annual Report on Form 10-K for each respective year 2. nt which is composed of Fixed Income Markets and Equity Markets). Markets revenue consists of principal transactions, fees, commissions and other income, as well as net interest income. These metrics, which exclude Markets, are non-GAAP financial measures. Management reviews these metrics to assess the performance of t -liability management) and deposit-raising activities, without the volatility associated with Markets activities. In addition, management also assesses Markets business performance on a total revenue basis as offsets may occur across revenue lines. For example, securities that generate net interest income may be risk-managed by derivatives that are reflected at fair value in principal transactions revenue. Management believes that disclosure of these measures provides investors and analysts with alternative measures to analyze the revenue trends of the Firm. For a reconciliation of NII, net yield, and NIR from reported to excluding Markets for the full year 2022 and the first quarter of 202 -K and page -Q for the quarter ended March 31, 2023, respectively. For all other periods presented, refer to the Explanation and Reconciliation of the - -K for each respective year 3. ach non-GAAP financial measures. TCE represents the angible assets (other than mortgage servicing rights), net of related VPS -end divided by common shares at period-end. TCE, ROTCE and TBVPS are utilized by the Firm, as well as investors and analysts, in assessing the -K. For all other periods presented, refer to the Explanation and - -K for each respective year 4. Adjusted expense, which excludes Firmwide legal expense, is a non-GAAP financial measure. Adjusted noninterest expense excludes Firmwide legal expense of $266mm for the full year ended December 31, 2022. Management believes this information helps investors understand the effect of certain items on reported resul performance 20

Notes on slide 3 Slide 3 We have leading client and customer-centric franchises 1. Federal Deposit Insurance Corporation (FDIC) 2022 Summary of Deposits survey per S&P Global Market Intelligence applies a $1B deposit cap to Chase and industry branches for market share. While many of our branches have more than $1B in retail deposits, applying a cap consistently to ourselves and the industry is critical to the integrity of this measurement. Includes all commercial banks, savings banks and savings institutions as defined by the FDIC 2. Based on 2022 sales volume and loans outstanding disclosures by peers (American Express Company (AXP), Bank of America Corporation, Capital One Financial Corporation, Citigroup Inc. and Discover Financial Services) and JPMorgan Chase estimates. Sales volume excludes private label and Commercial Card. AXP reflects the U.S. Consumer segment and JP private label, AXP Charge Card, Citi Retail Cards and Commercial Card 3. Barlow Research Associates, Primary Bank Market Share Database as of 4Q22. Rolling 8-quarter average of small businesses with revenue of more than $100,000 and less than $25mm 4. Dealogic as of April 3, 2023. Rank for 2022 5. ased on Coalition Index Banks for Markets 6. Coalition Greenwich Competitor Analytics. Reflects global J.P. Morgan Treasury Services business (CIB and CB). Based on JPMorgan Banks for Treasury Services 7. Euromoney 8. Active ETF Rank (Simfund) 9. In the U.S.. S&P Global Market Intelligence as of December 31, 2022 10. Refinitiv LPC, 2022 11. Represents general purpose credit card spend, which excludes private label and Commercial Card. Based on company filings and JPMorgan Chase estimates 12. Data as of 2017 13. Includes gross revenues earned by the Firm, that are subject to a revenue sharing arrangement with the CIB, for products sold to CB clients through the Investment Banking, Markets or Payments businesses. This includes revenues related to fixed income and equity markets products 14. In the fourth quarter of 2022, certain revenue from CIB markets products was reclassified from investment banking to payments. In the first quarter of 2020, the Merchant Services business was realigned from CCB to CIB. With the realignment, revenue is now reported across CCB, CIB and CB based primarily on client relationship. Financials from 2012 were revised to conform with the current presentation. Includes growth of $161mm that is also included in the Gross IB revenue metric 15. In the fourth quarter of 2020, the Firm realigned certain wealth management clients from AWM to CCB. Prior-period amounts have been revised to conform with the current presentation 16. 90% of 10-year J.P. Morgan Asset Management long-term mutual fund AUM performed above peer median. All quartile rankings, the assigned peer categories and the asset values used to derive this analysis are sourced from the fund ranking providers. Quartile rankings are done on the net-of-fee absolute return of each fund. The data providers re-denominate the asset values into U.S. dollars. This % of AUM is based on fund performance and associated peer rankings at the share class level for U.S.- lasses defined are not available, the oldest share class is used as the primary share class. The performance data could have been different if all share classes would have been included. Past performance is not indicative of future results. Effective September 2021, the Firm has changed the peer group ranking source from Lipper to Morningstar for U.S.-domiciled funds (except for Municipal and Investor Funds) and Taiwan-domiciled funds, to better align these funds to the providers and peer groups it believes most appropriately reflects their competitive positioning. This change may positively or adversely impact, substantially in some cases, the quartile rankings for one or more of these funds as compared with how they would have been ranked by Lipper for this reporting period or future reporting periods. The source for determining the rankings for all other funds remains the same. The based on internal investment management structures 17. Refers to total client asset flows 21

Notes on slides 4-10 Slide 4 1. Totals may not sum due to rounding. See note 1 on slide 20 2. In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with this presentation 3. Ex. Markets. See note 2 on slide 20 4. PayChase, Zelle, RTP, External Transfers, Digital Wires), Non-digital (Non-digital Wires, ATM, Teller, Checks) and credit and debit card payment outflows 5. Based on firmwide data using regulatory reporting guidelines as prescribed by the Federal Reserve Board Slide 5 -LOB partnerships and delivering all of JPMorgan Chase to clients throughout their lifetimes 1. As of May 5, 2023, 30% of MD employees up to two levels down from the Operating Committee had cross-sub-LOB and/or cross-function mobility since 2017 Slide 7 Cybersecurity and risk management remain non-negotiable priorities 1. Anti- 2. Slide 8 We remain committed to advancing a sustainable and inclusive economy 1. Select highlights, refer to our 2022 ESG report for additional detail 2. Total Community Center Branches as of April 30, 2023 Slide 9 Our strong track record has laid the foundation for our continued success 1. See note 3 on slide 20 2. Peers include Bank of America, Citigroup, Goldman Sachs, Morgan Stanley and Wells Fargo 3. See note 1 on slide 20 Slide 10 Our fortress balance sheet principles are designed so we can be a pillar of strength in any environment 1. Totals may not sum due to rounding. Deposits are average for the quarter 2. HQLA- gan Chase Bank, National Association ("JPMorgan Chase Bank, N.A.") that is in excess of its stand-alone 100% minimum LCR requirement and not transferable to non- eported HQLA under the LCR rule. Other unencumbered securities includes other end- of-period unencumbered marketable securities, such as equity and debt securities 3. Net yield on average interest-earning assets excluding Markets. See note 2 on slide 20 4. -2011). S&P Capital IQ 22

Notes on slides 11-18 Slide 11 NII ex. Markets outlook increasing to ~$84B due to First Republic, though sources of uncertainty remain 1. See notes 1 and 2 on slide 20 Slide 12 System-wide deposit levels will depend on how QT interacts with RRP and customer behavior 1. Totals may not sum due to rounding 2. Includes items from both the Fed balance sheet and all Commercial Banks balance sheets that influence deposits but are not reflected in the other data presented Slide 13 Our 2023 expense outlook is unchanged excluding expenses associated with First Republic 1. See note 4 on slide 20. Totals may not sum due to rounding Slide 14 We continue to invest in positioning the Firm for long-term success 1. Other includes selected LOB- Slide 16 1. Dividends include common and preferred stock dividends 2. Represents the median consensus of research analyst estimates as of April 27, 2023 Slide 17 Credit remains benign, but we expect continued normalization throughout the year 1. As of March 31, 2023 2. Wholesale includes allowance for credit losses in Corporate 3. Totals may not sum due to rounding; 4Q21 and 1Q23 total allowance include $42mm and $90mm, respectively, on investment securities 4. On January 1, 2023, the Firm adopted changes to the TDR accounting guidance. The adoption of this guidance resulted in a net reduction in the allowance for loan losses of approximately $600mm Slide 18 We are positioned to generate strong ROTCE in a variety of recessionary scenarios 1. See note 3 on slide 20. ROTCE ranges indicated are estimates 23

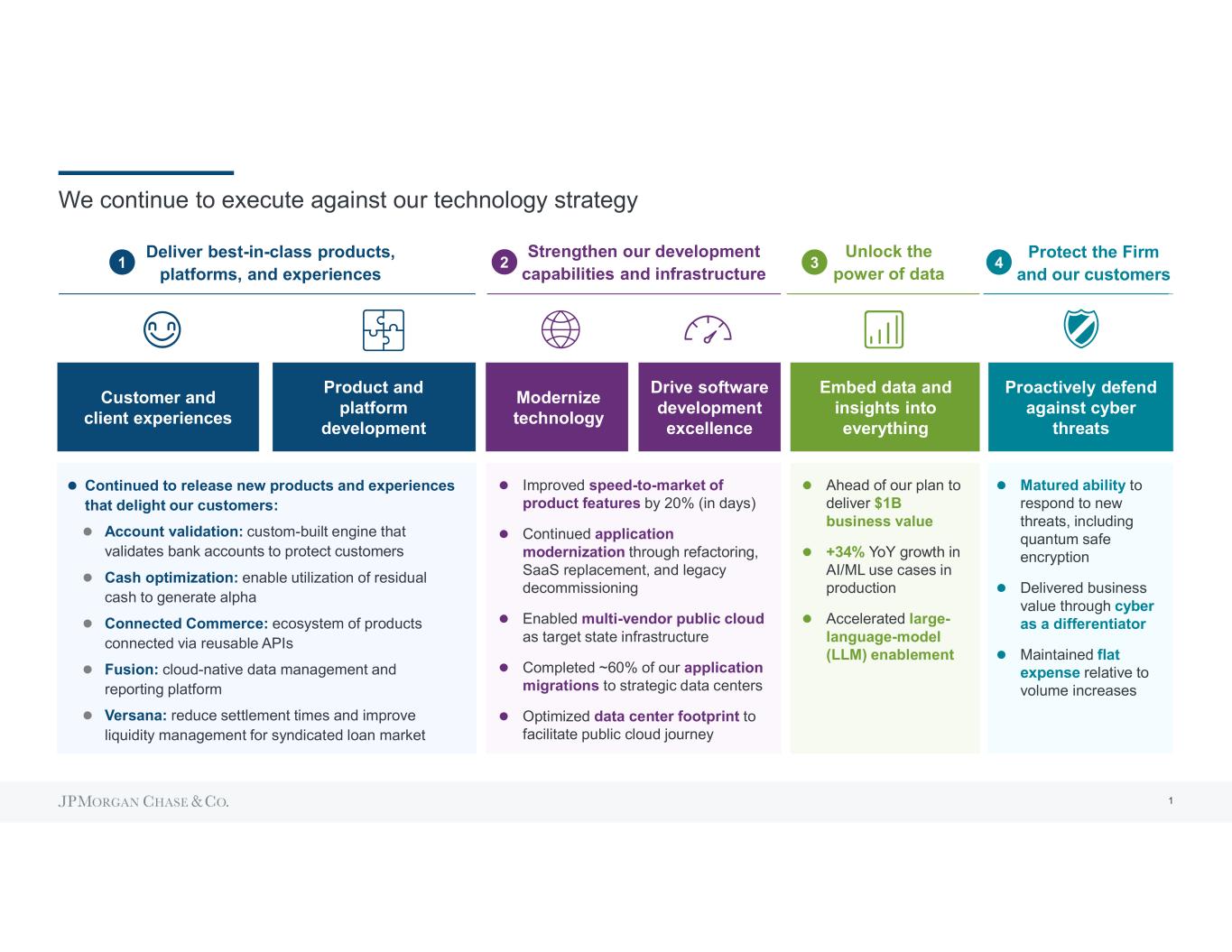

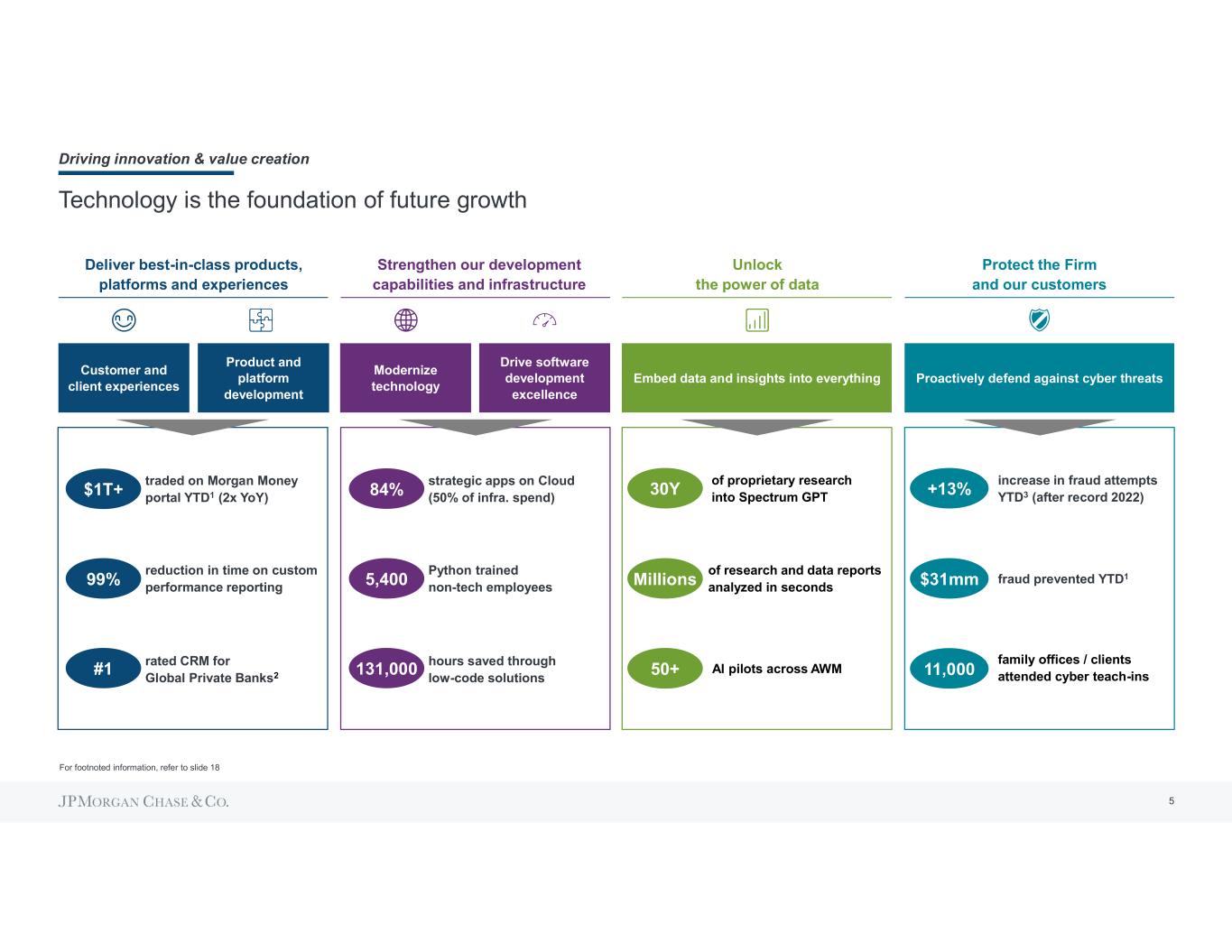

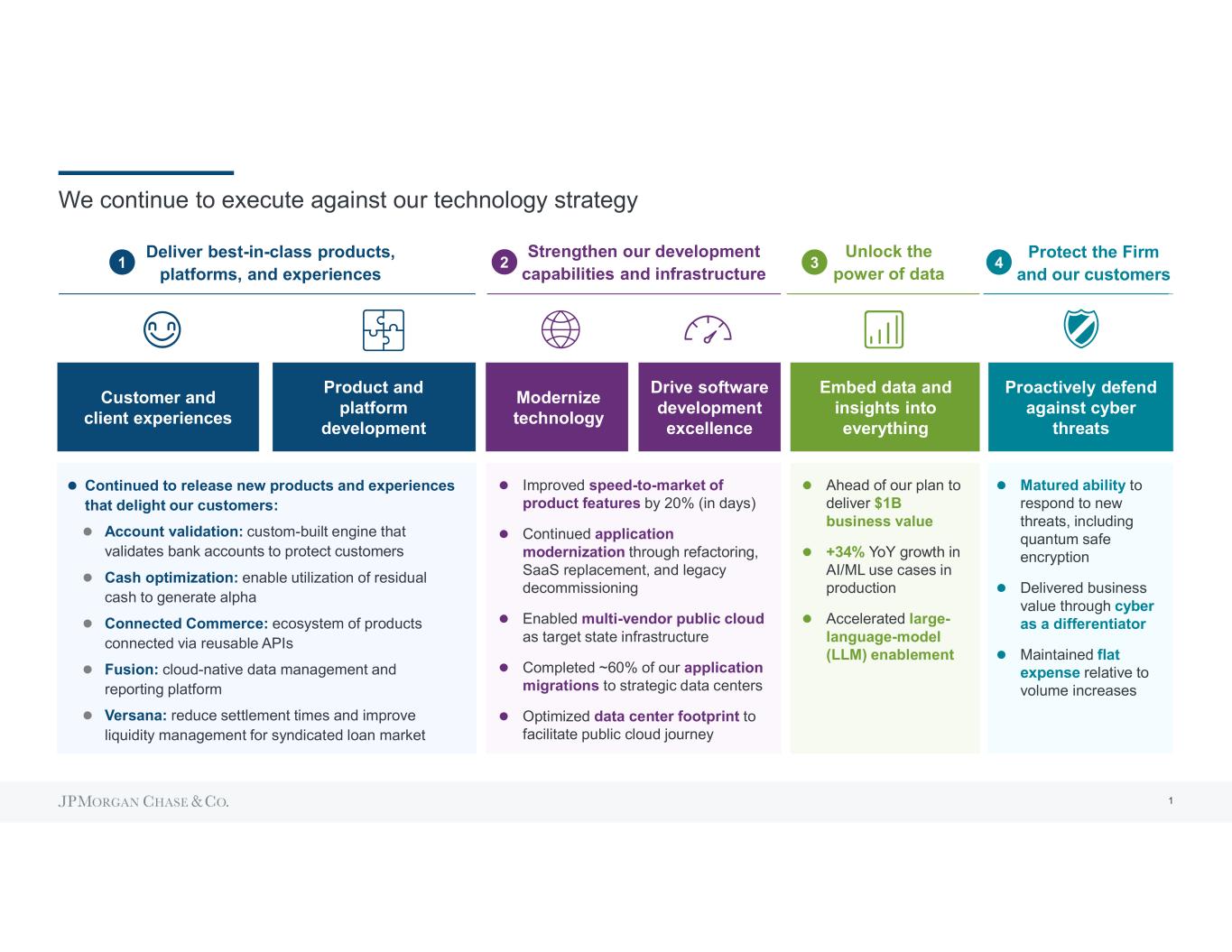

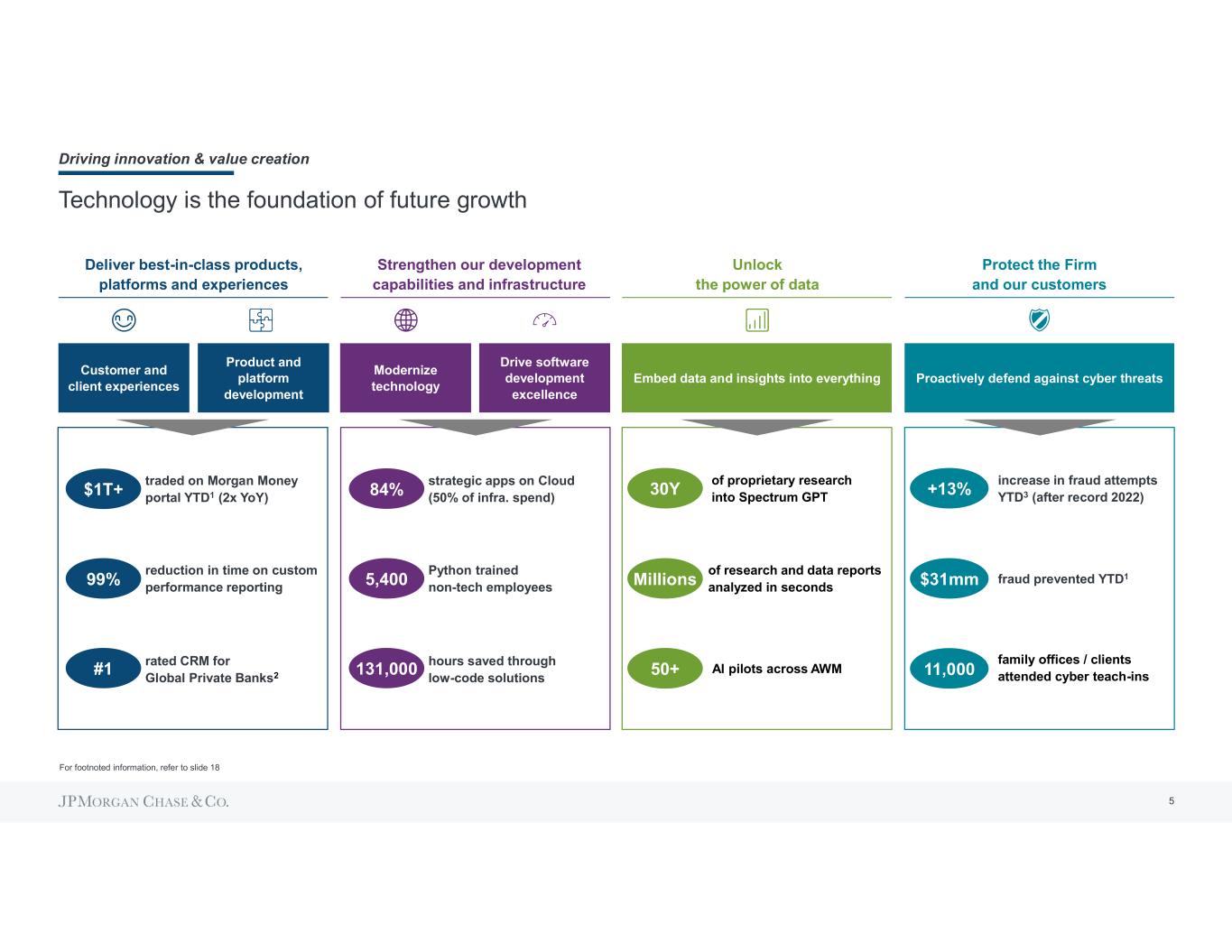

We continue to execute against our technology strategy Deliver best-in-class products, platforms, and experiences Unlock the power of data Strengthen our development capabilities and infrastructure Customer and client experiences Product and platform development Modernize technology Drive software development excellence Embed data and insights into everything Continued to release new products and experiences that delight our customers: Account validation: custom-built engine that validates bank accounts to protect customers Cash optimization: enable utilization of residual cash to generate alpha Connected Commerce: ecosystem of products connected via reusable APIs Fusion: cloud-native data management and reporting platform Versana: reduce settlement times and improve liquidity management for syndicated loan market Improved speed-to-market of product features by 20% (in days) Continued application modernization through refactoring, SaaS replacement, and legacy decommissioning Enabled multi-vendor public cloud as target state infrastructure Completed ~60% of our application migrations to strategic data centers Optimized data center footprint to facilitate public cloud journey Ahead of our plan to deliver $1B business value +34% YoY growth in AI/ML use cases in production Accelerated large- language-model (LLM) enablement Matured ability to respond to new threats, including quantum safe encryption Delivered business value through cyber as a differentiator Maintained flat expense relative to volume increases Proactively defend against cyber threats Protect the Firm and our customers 1 2 3 4 1

Products, platforms, and experiences $4.0B Modernize technology and software development excellence $3.2BUnlock the power of data Protect the Firm and our customers Total $7.2B $0.7 $1.1 $0.5 $0.5 2019 2021 Structural / volume- related Investments 2022 Structural / volume- related Investments 2023 $11.7 $12.5 $14.3 $15.3 +7% CAGR Our expense growth is driven by investments, volumes, and structural factors CAGR 2019-23 11% 4% CIB $3.2B CCB $2.7B AWM $0.9B CB $0.3B Total $7.2B Infrastructure Software licenses Application and production support Wage inflation +$0.5 Volumes / other +$0.5 Internal efficiencies ($0.5) 2 Wage inflation +$0.6 Volumes / other +$0.5 Internal efficiencies ($0.4) TECH INVESTMENTS BY STRATEGY, 2023 FULLY LOADED TECH INVESTMENTS BY LOB, 2023 RUN THE BANK INCLUDES Investments / change the bank Run the bank TOTAL TECHNOLOGY EXPENSE ($B) Note that totals may not sum due to rounding

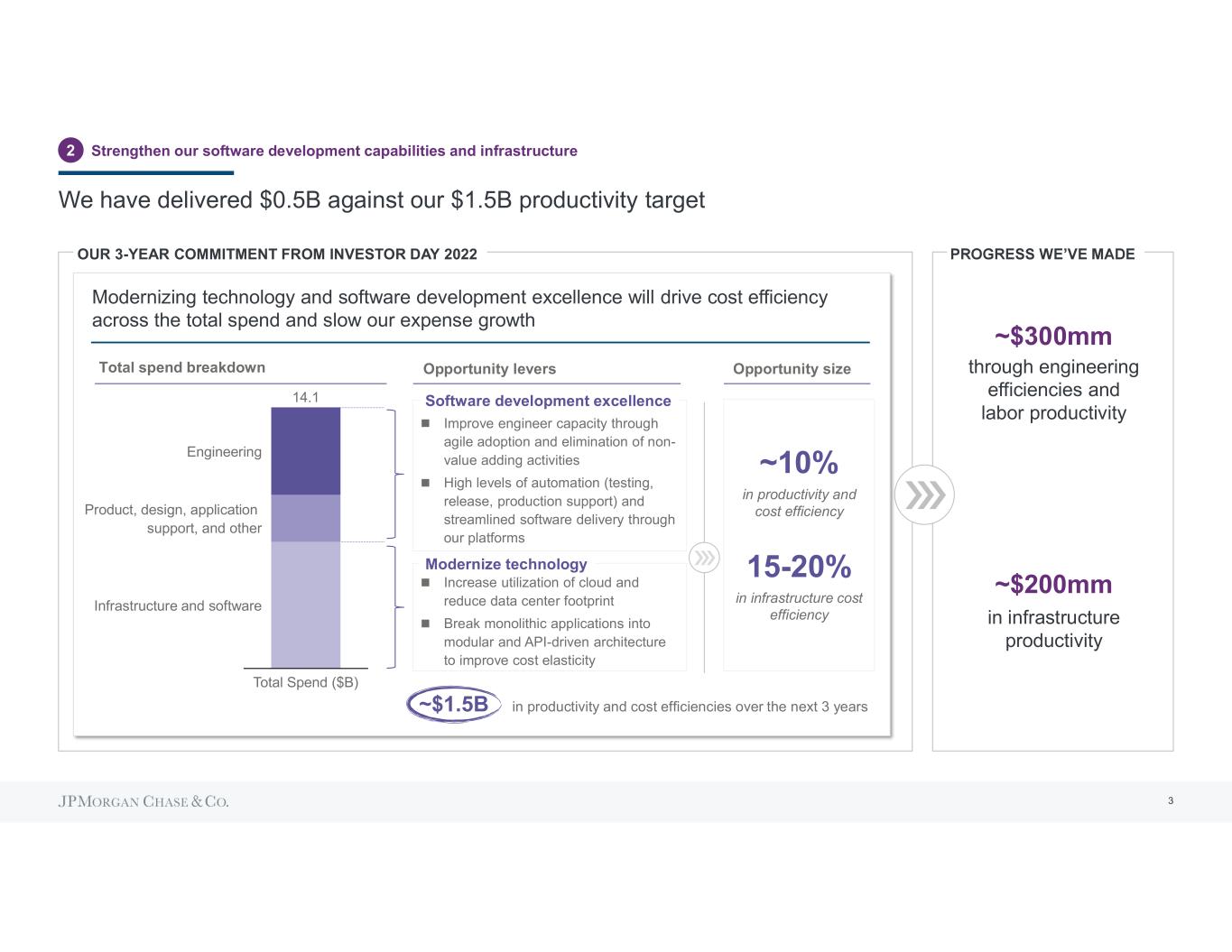

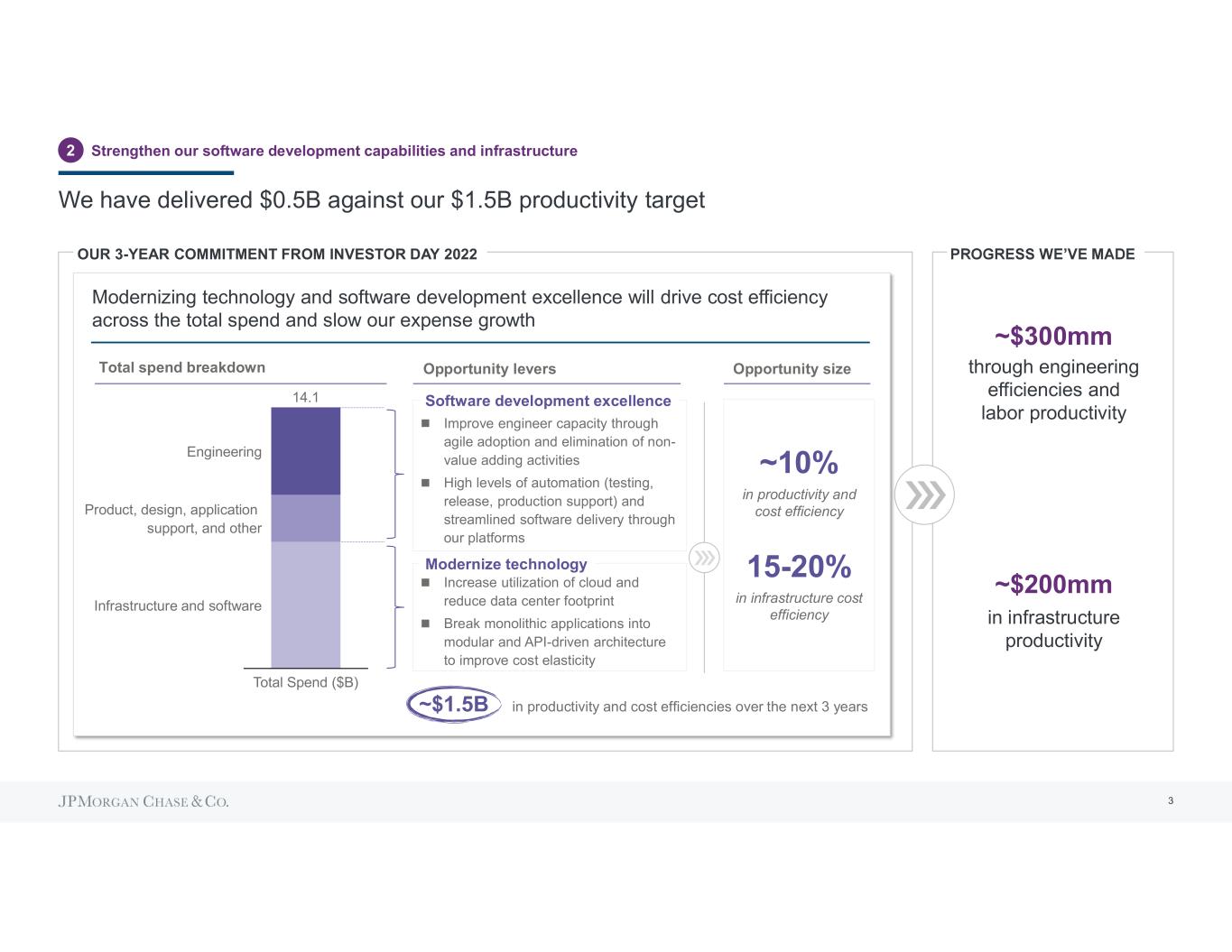

Increase utilization of cloud and reduce data center footprint Break monolithic applications into modular and API-driven architecture to improve cost elasticity Improve engineer capacity through agile adoption and elimination of non- value adding activities High levels of automation (testing, release, production support) and streamlined software delivery through our platforms We have delivered $0.5B against our $1.5B productivity target 3 ~$300mm through engineering efficiencies and labor productivity ~$200mm in infrastructure productivity OUR 3-YEAR COMMITMENT FROM INVESTOR DAY 2022 Modernizing technology and software development excellence will drive cost efficiency across the total spend and slow our expense growth Total spend breakdown Opportunity sizeOpportunity levers Total Spend ($B) Engineering Product, design, application support, and other Infrastructure and software 14.1 15-20% ~10% in infrastructure cost efficiency in productivity and cost efficiency Software development excellence Modernize technology ~$1.5B in productivity and cost efficiencies over the next 3 years Strengthen our software development capabilities and infrastructure2

~560 2022 2023 +14% Growth in SaaS applications We continue to modernize our technology estate while keeping infrastructure RTB expense relatively flat 4 We have increased SaaS adoption to replace non-differentiating applications with industry-leading SaaS solutions And we have continued our legacy application decommissioning journey In the last year, we have been modernizing our on-premise infrastructure and growing cloud use Over time, this has resulted in our infrastructure run-the-bank expense remaining relatively flat while our volumes have increased 30% 38% 2022 2023 Cloud as a percentage of total infra spend ~60% of in-scope applications have fully migrated to our modern data centers 2019 2022 +50% Storage and compute volumes 2019 2022 +2% CAGR Infrastructure run-the-bank expense Strengthen our software development capabilities and infrastructure2 ~490 ~2,200 ~2,500 2022 2023 +300 Volume of applications decommissioned since 2017

feature delivery and slow our expense growth AGILITY Adopt and continuously improve agile practices to free engineer capacity SPEED Accelerate development and deployment of features into production STABILITY Minimize failed changes and unplanned outages 60% of apps 60% of teams 100% of apps ~100% Toolchain adoption by YE 2023 84% On Enterprise Toolchain Exceeded 80% 2022 target 5 Strengthen our software development capabilities and infrastructure2 WHAT WE MEASURE ACROSS SOFTWARE DEVELOPMENT LIFECYCLE COVERAGE 99.9% change success rate while change volumes have gone up ~60% ~70% of CCB teams improved YoY performance on agile practices ~20% improvement in days from backlog to deployment

Our modernization strategy is enabling us to deliver significant value across the business 6 Strengthen our software development capabilities and infrastructure2 Completed migration of internet- facing Chase.com to the public cloud in 4Q22, serving all customers through Amazon Web Services Chase.com 22% increase in change volume 15 Chase.com releases weekly, 2 mobile app releases monthly 100% customers onboarded (including 63mm+ active digital customers) Moving up-funnel to meet customers earlier in their journeys, protecting our core franchise, and disrupting incumbents in Commerce Connected Commerce Innovative API-driven platform to automate partner onboarding and simplify integration with Chase ecosystem 35% increase in speed to deliver product features YoY Offers and recommendations delivered $350mm impact over two months in 2023 Graphite is a scalable, modern strategic platform for processing payments globally, including real-time payments JPM Payments Transaction Engine Third largest payments platform by volume Reduced time to launch a new real-time payment market from ~18 months to ~3-6 months Each payment capability built with its own independent component architecture Regulatory data warehouse responsible for global regulatory reporting for Cash Equities, Futures, and Options in 15+ countries Markets Regulatory Reporting Platform Reduced monthly running cost by >50% Running on public cloud, enabling real-time audit trail calculation and report generation Increased ability to scale to 2.5B trades per day on public cloud from 500mm trades per day on-premise

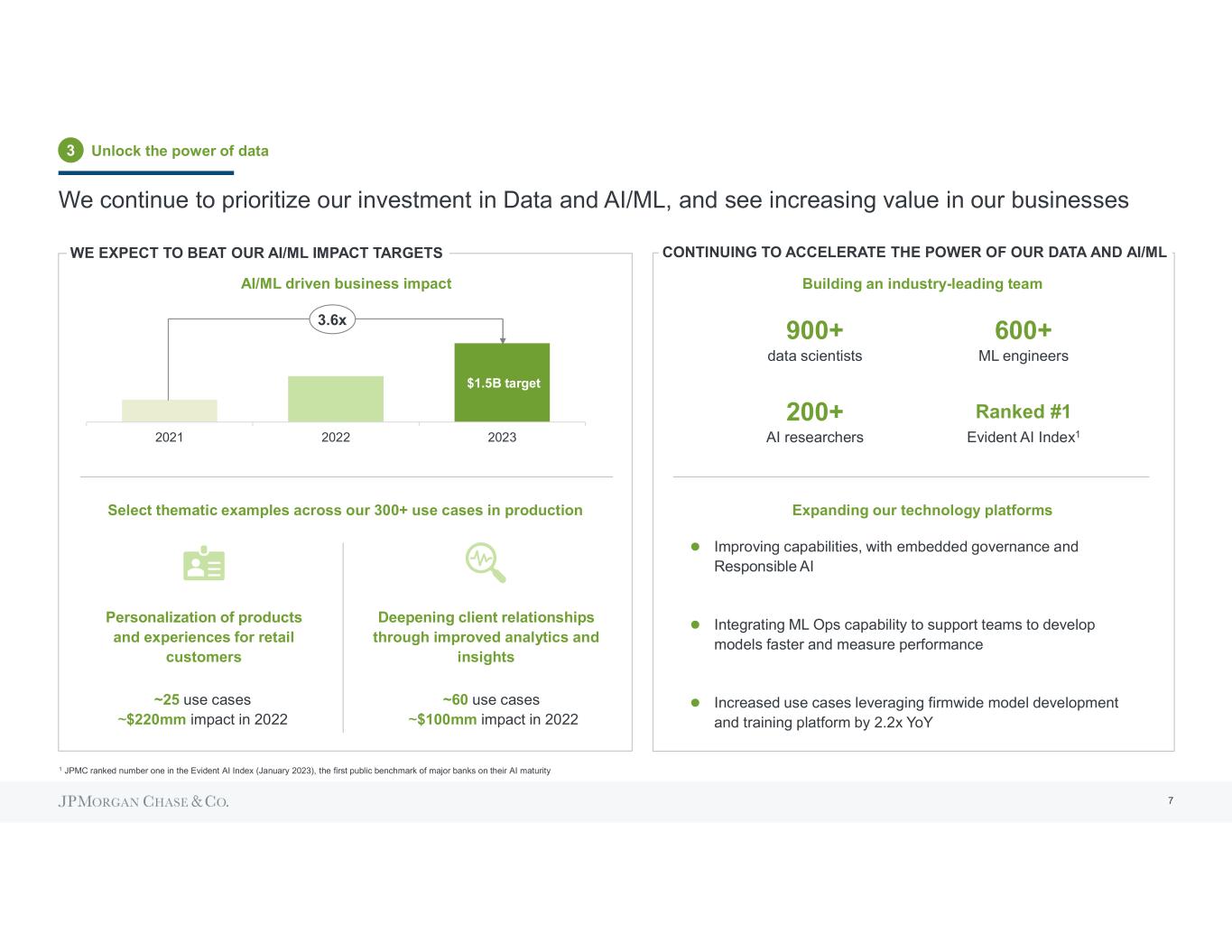

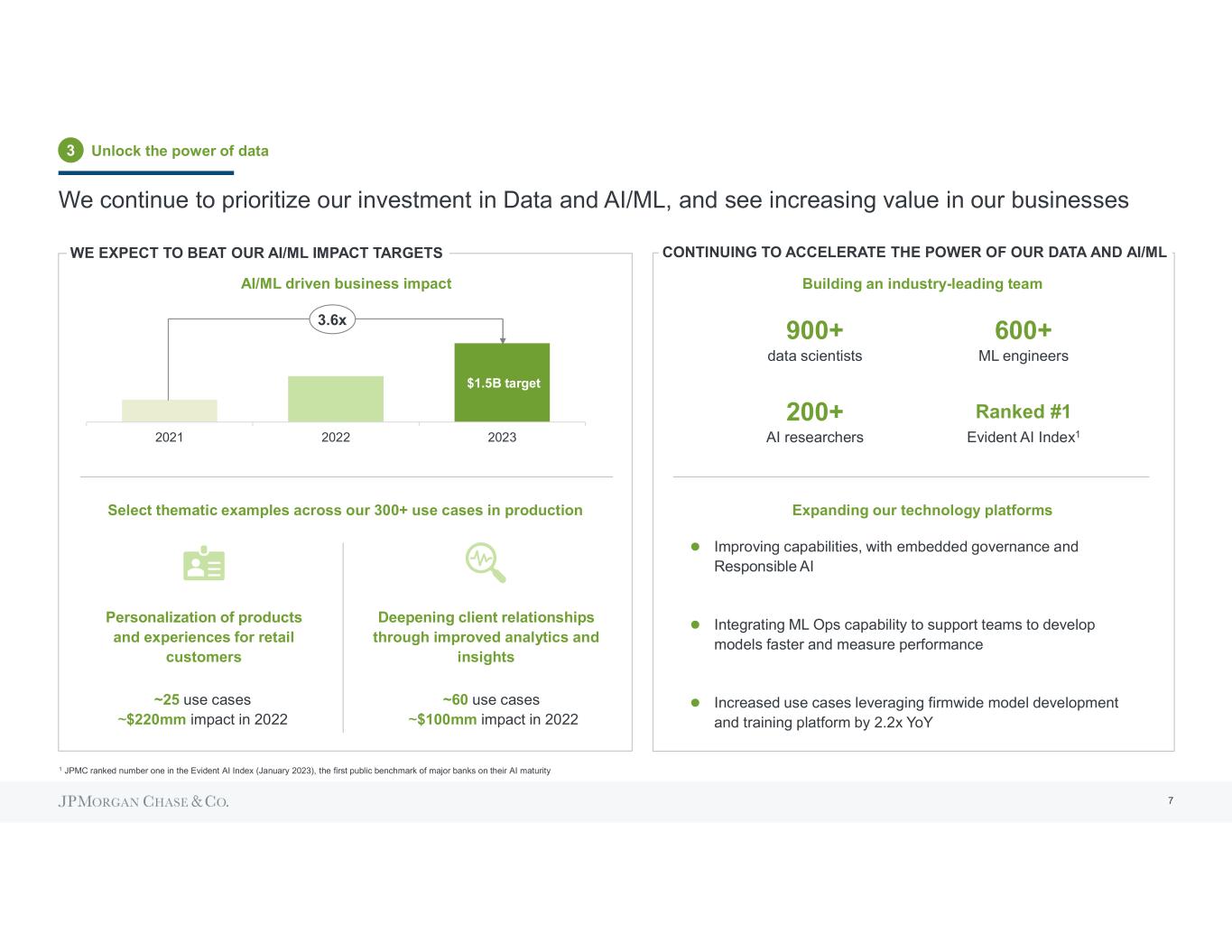

$1.5B target 2021 2022 2023 3.6x AI/ML driven business impact 7 Unlock the power of data3 Building an industry-leading team WE EXPECT TO BEAT OUR AI/ML IMPACT TARGETS CONTINUING TO ACCELERATE THE POWER OF OUR DATA AND AI/ML We continue to prioritize our investment in Data and AI/ML, and see increasing value in our businesses Expanding our technology platformsSelect thematic examples across our 300+ use cases in production Personalization of products and experiences for retail customers Deepening client relationships through improved analytics and insights ~25 use cases ~$220mm impact in 2022 ~60 use cases ~$100mm impact in 2022 1 JPMC ranked number one in the Evident AI Index (January 2023), the first public benchmark of major banks on their AI maturity 600+ ML engineersdata scientists 900+ 200+ AI researchers Ranked #1 Evident AI Index1 Improving capabilities, with embedded governance and Responsible AI Integrating ML Ops capability to support teams to develop models faster and measure performance Increased use cases leveraging firmwide model development and training platform by 2.2x YoY

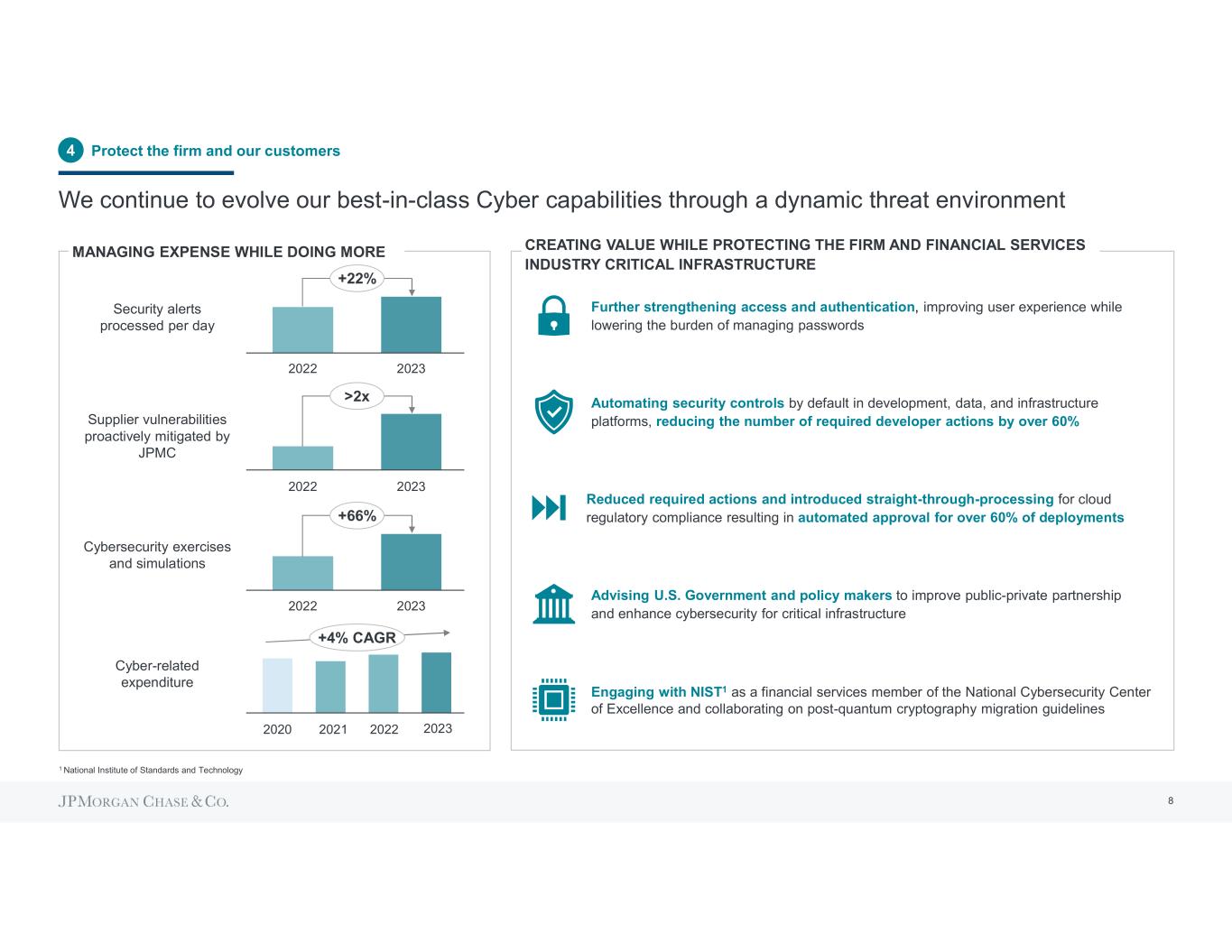

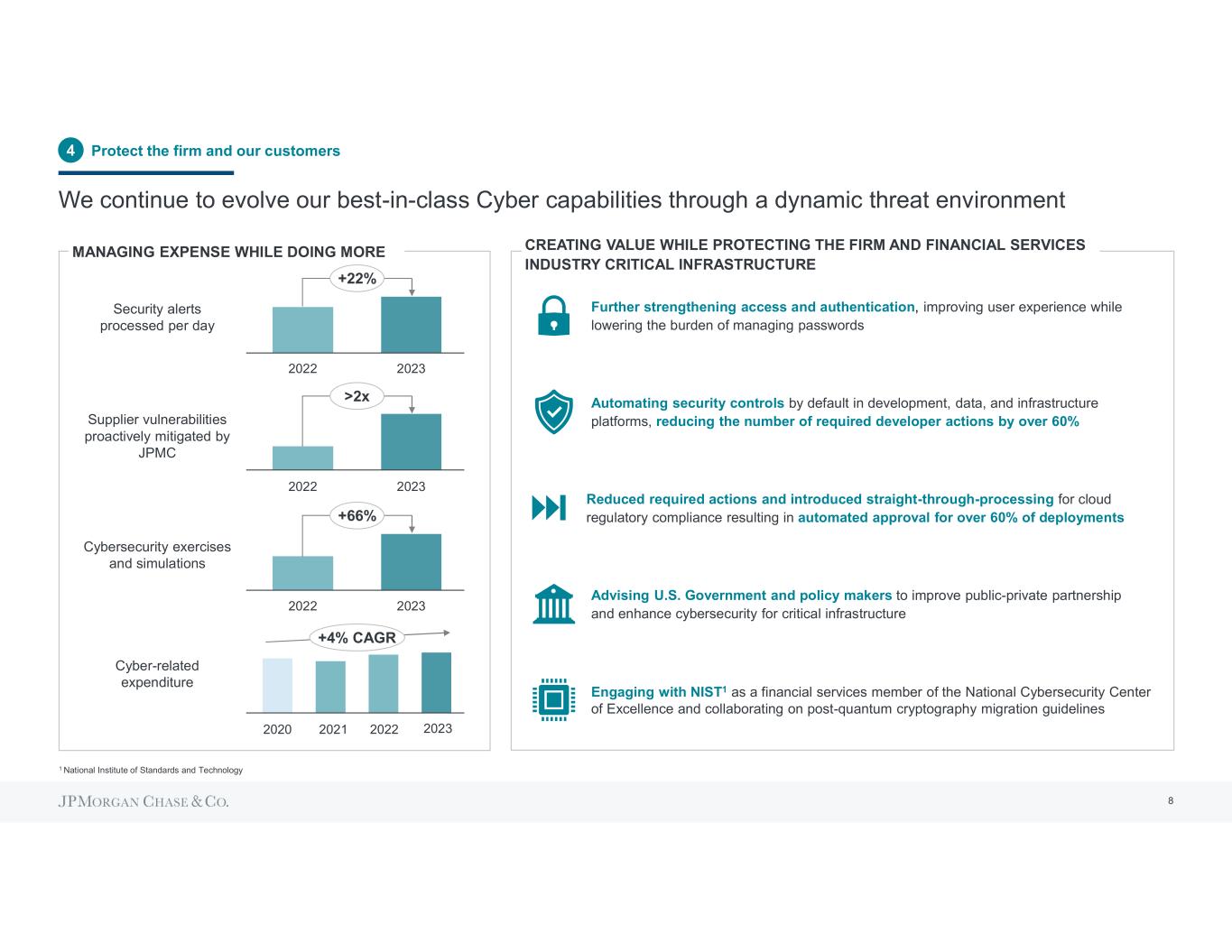

We continue to evolve our best-in-class Cyber capabilities through a dynamic threat environment 8 20222020 20232021 Security alerts processed per day Advising U.S. Government and policy makers to improve public-private partnership and enhance cybersecurity for critical infrastructure Automating security controls by default in development, data, and infrastructure platforms, reducing the number of required developer actions by over 60% Further strengthening access and authentication, improving user experience while lowering the burden of managing passwords Engaging with NIST1 as a financial services member of the National Cybersecurity Center of Excellence and collaborating on post-quantum cryptography migration guidelines 2022 2023 Cybersecurity exercises and simulations 2022 2023 Supplier vulnerabilities proactively mitigated by JPMC 2022 2023 Cyber-related expenditure 1 National Institute of Standards and Technology Reduced required actions and introduced straight-through-processing for cloud regulatory compliance resulting in automated approval for over 60% of deployments Protect the firm and our customers4 MANAGING EXPENSE WHILE DOING MORE CREATING VALUE WHILE PROTECTING THE FIRM AND FINANCIAL SERVICES INDUSTRY CRITICAL INFRASTRUCTURE +22% >2x +66% +4% CAGR

We are well positioned to lead across our businesses, backed by resilient, innovative technology, for years to come Unlock the power of data Protect the Firm and our customers Deliver best-in-class products and experiences to customers Strengthen our software development capabilities and infrastructure 1 2 3 4 9 Continued to release new products and experiences that delight our customers Improved speed-to-market of product features by 20% $0.5B productivity impact delivered against $1.5B target ~100% Enterprise Toolchain adoption by year-end Ahead of our plan to deliver $1B business value 300+ use cases in production $1.5B value target to be delivered by year-end 2023 Creating value while protecting our Firm and customers Optimizing our expense while volumes increase

S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L

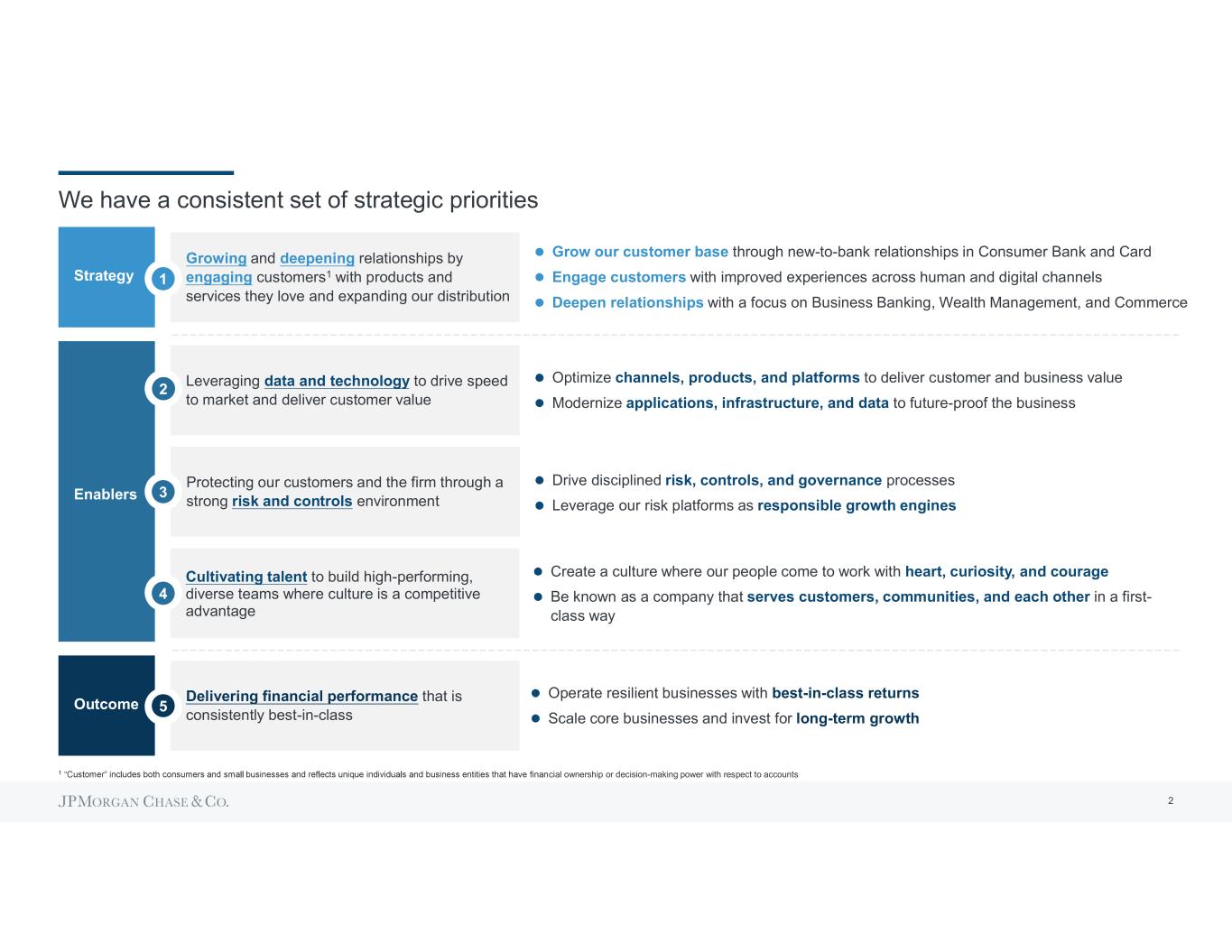

We have a consistent set of strategic priorities Growing and deepening relationships by engaging customers1 with products and services they love and expanding our distribution Delivering financial performance that is consistently best-in-class Leveraging data and technology to drive speed to market and deliver customer value Grow our customer base through new-to-bank relationships in Consumer Bank and Card Engage customers with improved experiences across human and digital channels Deepen relationships with a focus on Business Banking, Wealth Management, and Commerce Operate resilient businesses with best-in-class returns Scale core businesses and invest for long-term growth Protecting our customers and the firm through a strong risk and controls environment Cultivating talent to build high-performing, diverse teams where culture is a competitive advantage Optimize channels, products, and platforms to deliver customer and business value Modernize applications, infrastructure, and data to future-proof the business Drive disciplined risk, controls, and governance processes Leverage our risk platforms as responsible growth engines Create a culture where our people come to work with heart, curiosity, and courage Be known as a company that serves customers, communities, and each other in a first- class way Strategy Enablers Outcome 1 5 2 3 4 1 cial ownership or decision-making power with respect to accounts 2

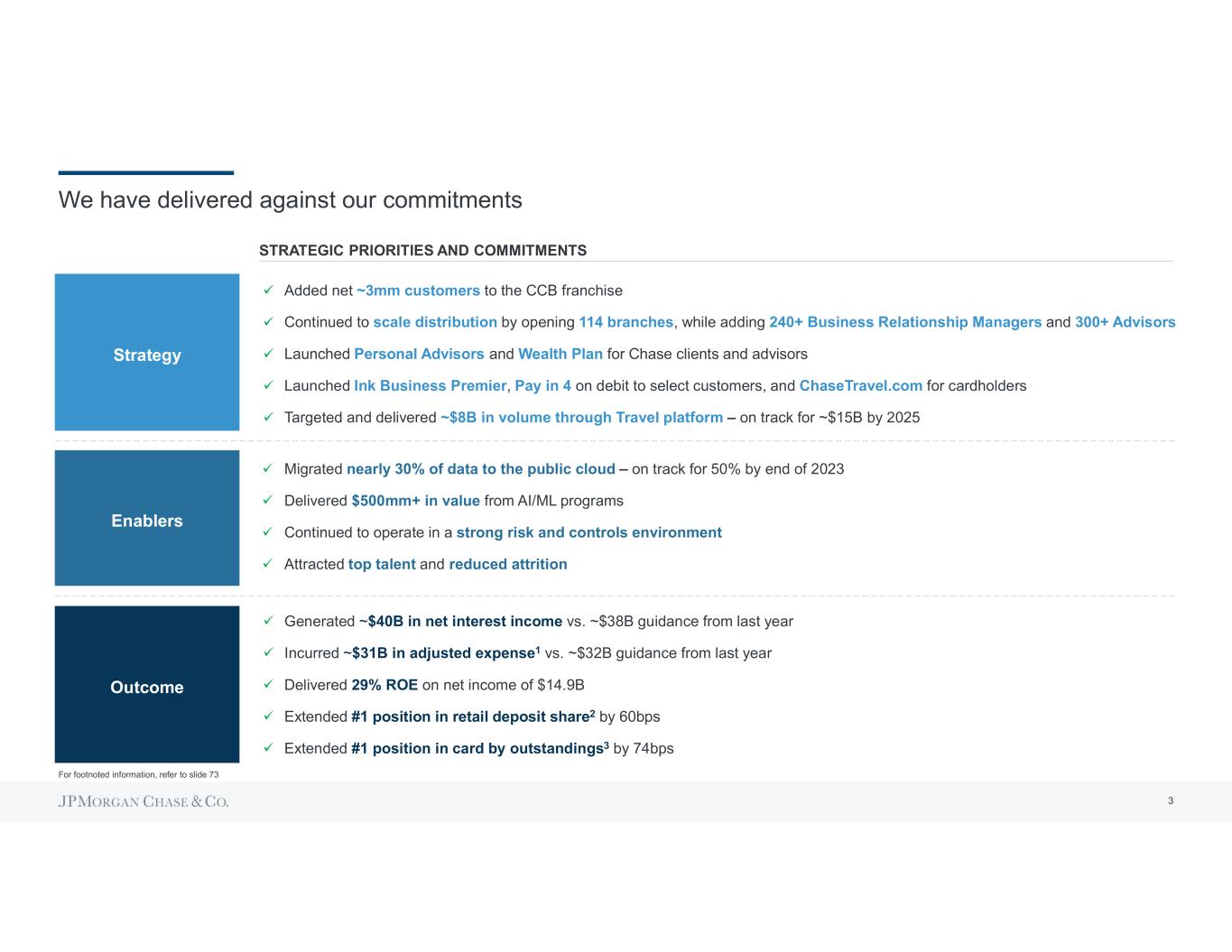

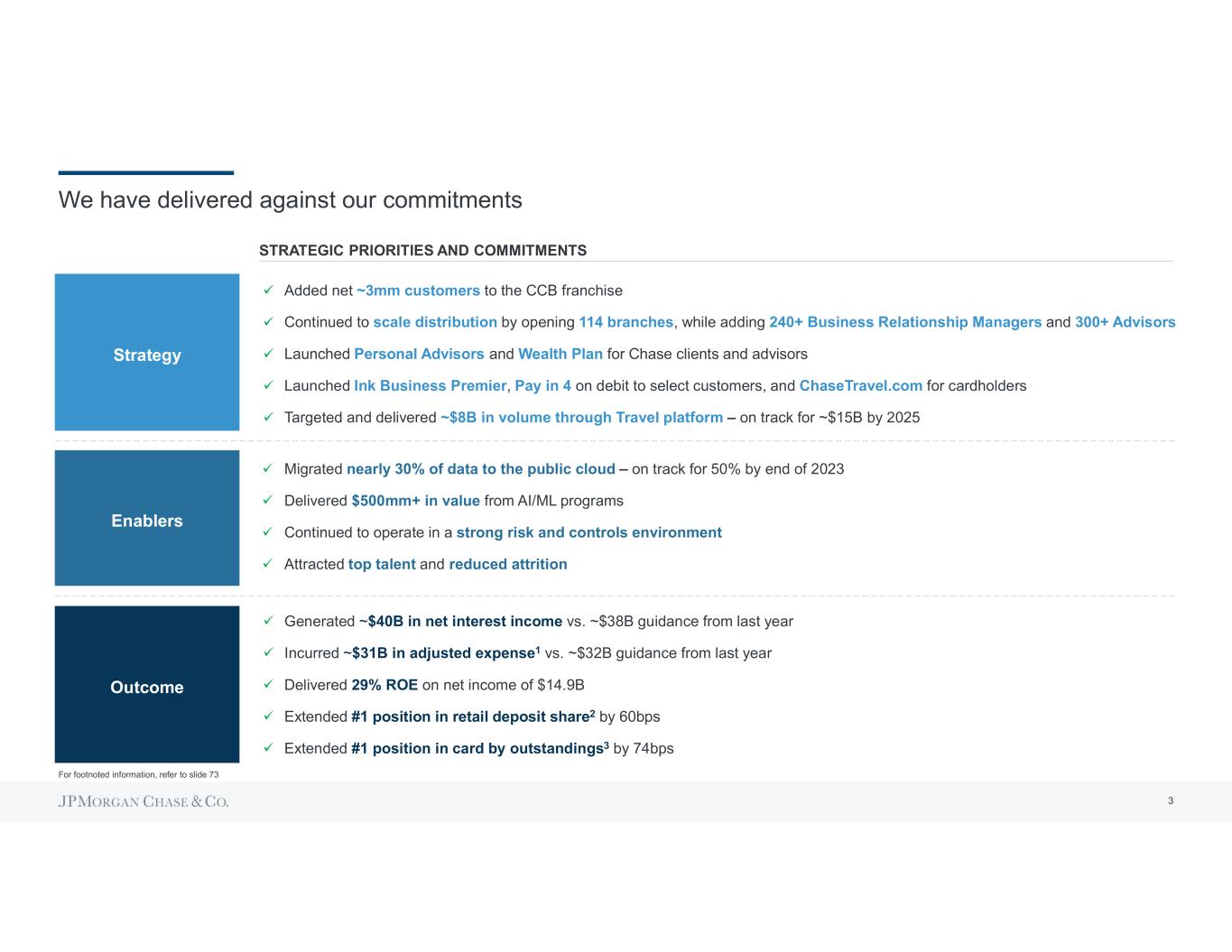

We have delivered against our commitments Added net ~3mm customers to the CCB franchise Continued to scale distribution by opening 114 branches, while adding 240+ Business Relationship Managers and 300+ Advisors Launched Personal Advisors and Wealth Plan for Chase clients and advisors Launched Ink Business Premier, Pay in 4 on debit to select customers, and ChaseTravel.com for cardholders Targeted and delivered ~$8B in volume through Travel platform on track for ~$15B by 2025 Migrated nearly 30% of data to the public cloud on track for 50% by end of 2023 Delivered $500mm+ in value from AI/ML programs Continued to operate in a strong risk and controls environment Attracted top talent and reduced attrition Generated ~$40B in net interest income vs. ~$38B guidance from last year Incurred ~$31B in adjusted expense1 vs. ~$32B guidance from last year Delivered 29% ROE on net income of $14.9B Extended #1 position in retail deposit share2 by 60bps Extended #1 position in card by outstandings3 by 74bps Strategy Enablers Outcome STRATEGIC PRIORITIES AND COMMITMENTS For footnoted information, refer to slide 73 3

73.6 74.3 76.3 79.0 4.6 4.9 5.3 5.7 2019 2020 2021 2022 Small businesses Consumers We continue to drive significant customer growth the catalyst for the franchise Retail deposit share2 9.1% (#3) 9.6% (#3) 10.3% (#1) 10.9% (#1) Business Banking primary bank share3 9.4% (#1) 9.5% (#1) 9.2% (#1) 9.3% (#1) Card sales share4 22.4% (#1) 22.3% (#1) 22.4% (#1) 22.4% (#1) Card O/S share4 16.6% (#1) 16.6% (#1) 16.5% (#1) 17.3% (#1) CCB customers (mm) Since 2019, we have grown our overall customer base by 8% and multi-LOB relationships5 by ~20% 8% 1 For footnoted information, refer to slide 74 4

We strive to make it easy to do business with us by engaging customers across channels In 2022, we achieved record high satisfaction across channels5 active digital customers3 63mm+ digital logins4 >15B mobile logins per user per month >20 unique visitors to branches per day ~900k U.S. population within a 10-min. drive to a branch 60% customers met with a banker >20mm #1 Digital banking platform1 1st Retail bank in all lower 48 states2 Enabling customers to manage their full financial lives through our digital banking, lending, and investing capabilities Our branch network is a local storefront for customers who want to engage with our bankers and advisors Increasing branch density For footnoted information, refer to slide 75 5

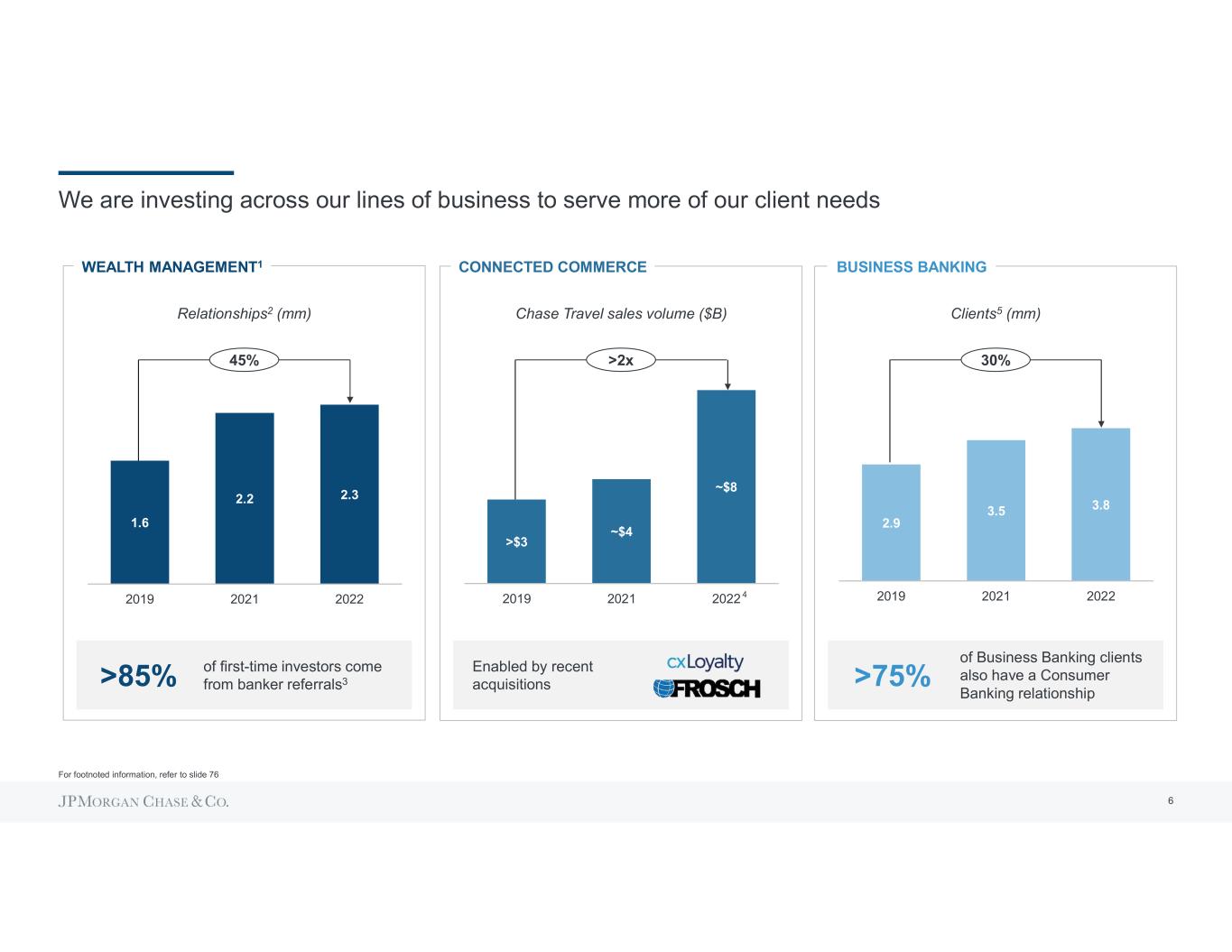

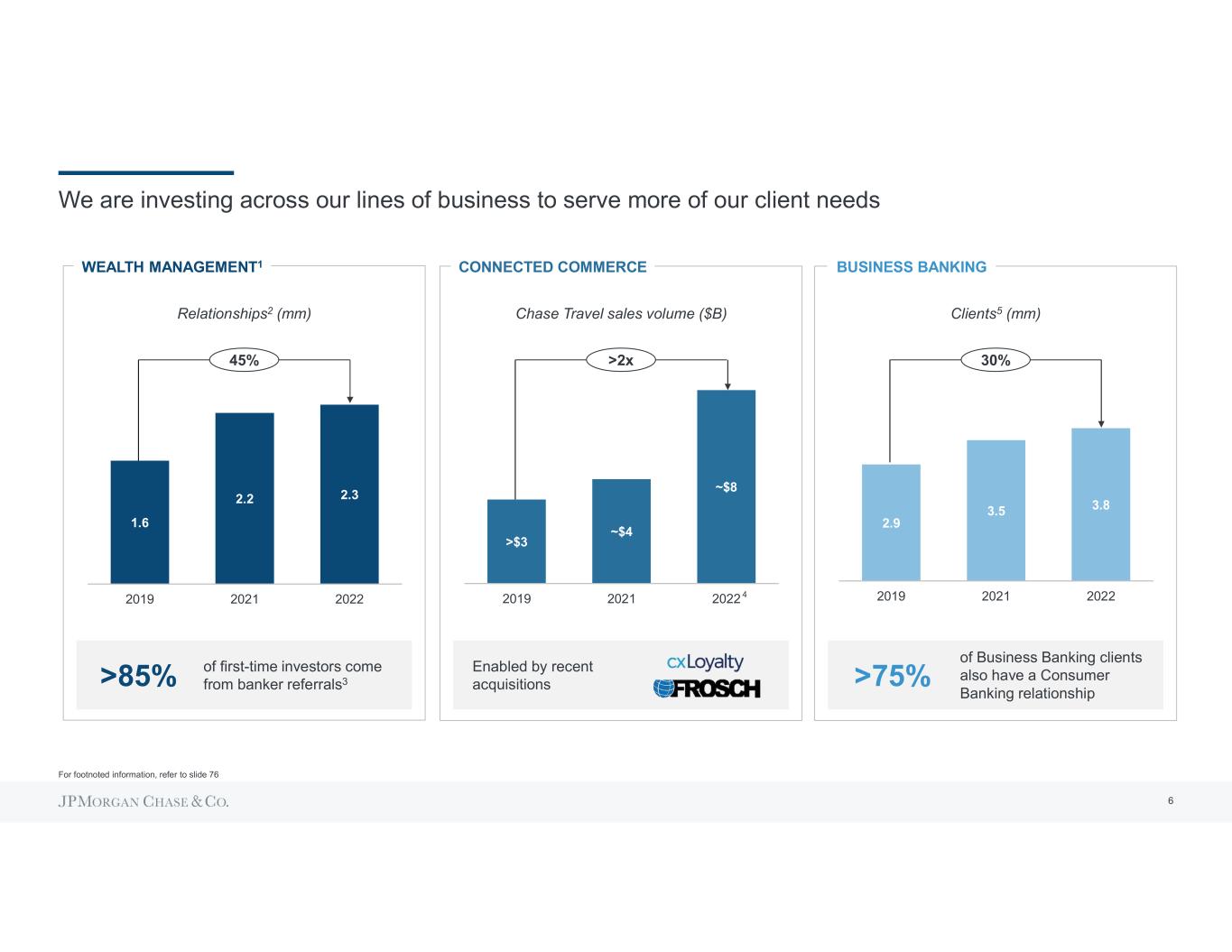

We are investing across our lines of business to serve more of our client needs CONNECTED COMMERCE Customers (mm) 1.6 2.2 2.3 2019 2021 2022 45% Relationships2 (mm) 2.9 3.5 3.8 2019 2021 2022 >75% of Business Banking clients also have a Consumer Banking relationship >85% of first-time investors come from banker referrals3 BUSINESS BANKING Clients5 (mm) WEALTH MANAGEMENT1 Enabled by recent acquisitions >$3 ~$4 ~$8 2019 2021 2022 Chase Travel sales volume ($B) 4 >2x 30% For footnoted information, refer to slide 76 6

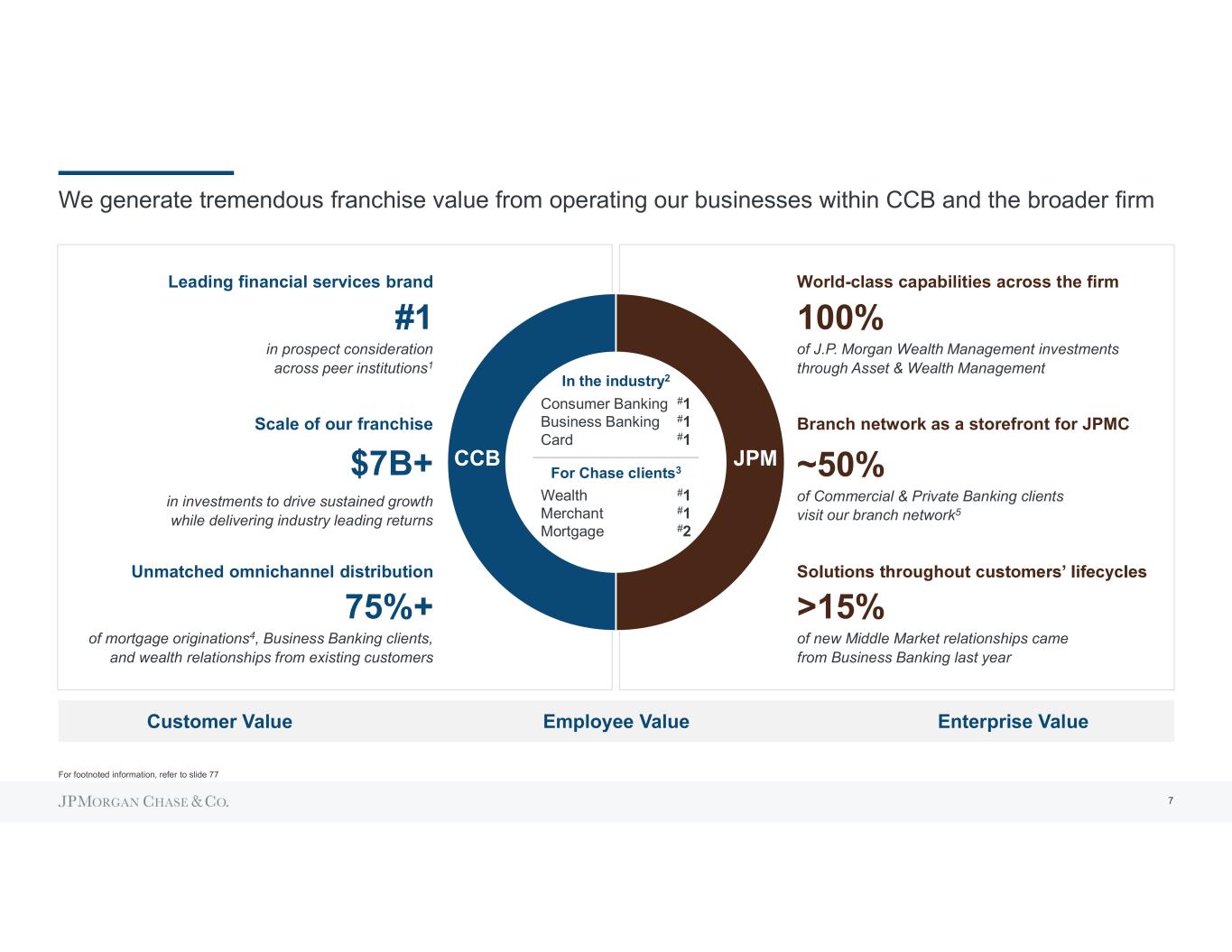

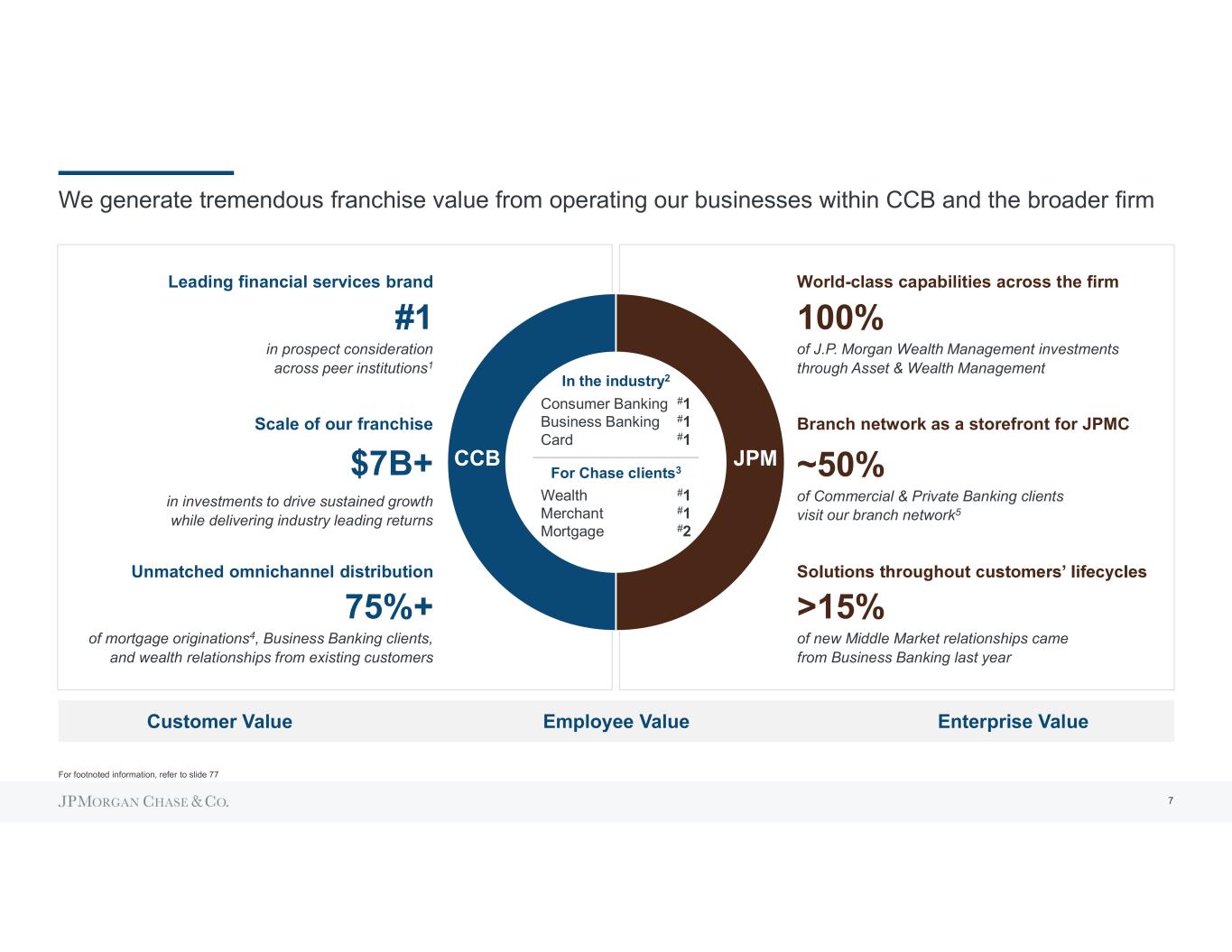

We generate tremendous franchise value from operating our businesses within CCB and the broader firm World-class capabilities across the firm 100% of J.P. Morgan Wealth Management investments through Asset & Wealth Management >15% of new Middle Market relationships came from Business Banking last year Unmatched omnichannel distribution Scale of our franchise Leading financial services brand #1 in prospect consideration across peer institutions1 $7B+ in investments to drive sustained growth while delivering industry leading returns CCB JPM Customer Value Employee Value Enterprise Value ~50% of Commercial & Private Banking clients visit our branch network5 Branch network as a storefront for JPMC #1 #1 #1 Consumer Banking Business Banking Card Wealth Merchant Mortgage #1 #1 #2 For Chase clients3 In the industry2 75%+ of mortgage originations4, Business Banking clients, and wealth relationships from existing customers For footnoted information, refer to slide 77 7

2019 2021 2022 Average deposits ($B) $698 $1,055 $1,163 Average loans ($B) $478 $434 $439 Average Card outstandings ($B) $156 $140 $163 Revenue ($B)2 $55.0 $49.9 $54.8 Deposit margin3 2.48% 1.27% 1.71% Expense ($B)2 $28.1 $29.0 $31.2 ROE 31.0% 41.0% 29.0% $21.7 $18.1 $20.9 We continue to deliver strong financial performance CCB Pretax Income ex. LLR ($B)1,2 For footnoted information, refer to slide 78 8

$49.9 $54.8 $3.5 $1.9 ($0.7) ($0.7) $1.0 2021 Macro rate Volume Overdraft changes Margin MSR / Other 2022 We continue to drive core growth in the business: 2021-2022 Deposit growth Card loan and spend growth Increase in Card acquisition costs Home Lending production volumes Auto leases 1 In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with the current presentation 2 Totals may not sum due to rounding Net Interest Income ($B) 2022 Actual ~$40 2023 Outlook ex. FRC ~$50 ( Card loan yield Home Lending production margin Card renewals and refreshes 2 CCB REVENUE ($B)1 9

$49.1 $54.8 ($5.1) $13.0 ($1.0) ($0.3) ($0.9) 2012 Macro rate Volume Overdraft changes Margin MSR / Other 2022 Revenue walk: 2012-2022 Net Interest Income ($B) 2022 Actual ~$40 2023 Outlook ex. FRC ~$50 ( Deposit Margin2 2.57% Deposit Margin2 1.71% 1 In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with the current presentation 2 Banking & Wealth Management CCB REVENUE ($B)1 10

$1,173 $1,134 $80 ($47) ($118) $46 1Q22 Customer growth Customer activity Yield-seeking outflows Yield-seeking inflows 1Q23 We are retaining and growing primary bank relationships and capturing money in motion JPM WM investments Internal migration3 External brokerages Online banks Internal migration6 Net new money $35 JPM WM investments $81 retention of yield seeking flows7 ~60% of banking customers outflow to an online bank with no change in primary bank %5 ~5% YoY customer growth2 >3% Total yield-seeking inflows 4 52% checking 52% checking Core Drivers ~4% For footnoted information, refer to slide 79 decline in deposit balances driven by higher taxes and spend BANKING & WEALTH MANAGEMENT DEPOSIT BALANCES ($B)1 11

23.9 24.2 We are maintaining expense discipline while we continue to invest for the future $23.8 $24.0 ~$25 $29.0 $(0.8) $0.9 $0.1 $31.2 ~$(0.1) ~$1.1 ~$0.3 ~$33 $1.9 ~$0.7 2021 Volume- & revenue-related Structural Investments Other 2022 Actuals Volume- & revenue-related Structural Investments Other 2023 Outlook Investments Wage inflation Higher headcount Technology Auto lease depreciation Core volume growth Salesforce incentives $7.0 $5.2 2022 FDIC base assessment CCB ADJUSTED EXPENSE ($B)1,2,3 For footnoted information, refer to slide 80 ex. FRC 12

2021 2022 2023 Outlook ~3% CAGR $23.8B ~$25B ~30% Customers per branch6 >15% Tenured Advisors7 >15% Sales productivity per branch8 BRANCH NETWORK & FIELD COST PER ACCOUNT $24.0B 2019 2022 2023 Outlook (5%) For footnoted information, refer to slide 81 >20% Servicing calls per customer3 >50% Total transaction volume4 ~5% Fraud loss rate per transaction5 OPERATIONS & FRAUD COST PER ACCOUNT 2019 2022 2023 Outlook (11%) We are realizing benefits of scale and efficiencies across our business ADJUSTED EXPENSE1,2 (EX. INVESTMENTS) ARE GROWING MODESTLY Other volume- related Other structural Tech production Operations & fraud Branch network & field 13

$7.1 ~$7.9 $2.7 $3.1 $3.2 $3.9 $1.2 $0.9 2022 2023 Outlook From 2022-2023, we will continue to invest in growing the franchise Wealth Management Connected Commerce2 Branch Network Marketing Roll-off of travel platform operating expenses Deal integration & amortization (cxLoyalty, FROSCH) Advisor hiring New builds in expansion and mature markets Banker hiring Acquisitions & deepening Branding 6 year payback 4 year break-even 4 year break-even 2 3x ROI Growth businesses $0.5 $0.4 $1.4 $2.5 Note: marketing investments are part of ~$8B total gross marketing spend3 Technology & product Channels, products, and platform development Infrastructure, applications, and data modernization ~50% pays back in <5 years4 Disciplined investment process focus on long-term growth and profitability $0.71 2023 Status 2022 Return Profile Distribution For footnoted information, refer to slide 82 14 CCB INVESTMENTS REPRESENT ~$7.9B OF ~$15.7B IN TOTAL FIRMWIDE INVESTMENTS ($B)

We continue to deliver customer and business value as we modernize our technology $1.2 $1.4 $1.1 $1.3 $0.3 $0.4 2022 2023 Outlook ~$3.1 Tech modernization Product & design org Tech modernization: Improve speed and quality to help future-proof the business Tech product development: Deliver experiences customers love Tech product development $2.7 Channels Evolve our self-service and digital capabilities Products Offer new products and features Platforms Continuously improve to meet customer needs Digital channels Improved self-service capabilities to reduce call volumes by 20% per customer since 2019 Engagement Total active digital users up 20% vs. 2019 as we continue to launch new features and products Account opening ~11mm accounts opened digitally, up 37% vs. 2019 $0.4 Infrastructure Increase resiliency, scalability, and delivery Applications Faster speed to market Data Transform our data housing and consumption New data centers & public cloud ~50% of applications have migrated out of legacy data centers, on track to migrate ~95% by YE 2024 Interoperability ~65% of customer digital account opening flows moved to target platform, on track to reach 99% goal by YE 2023 Cloud migration ~30% of data is in the public cloud, on target to reach 50% by YE 2023 Looking forward we expect total CCB investment spend growth to moderate consistent with a profitable growing franchise IMPACT BEING DRIVEN BY OUR TECHNOLOGY INVESTMENTS (SELECT EXAMPLES) 1 Note: Totals may not sum due to rounding 15 TECHNOLOGY AND PRODUCT INVESTMENTS ($B)1

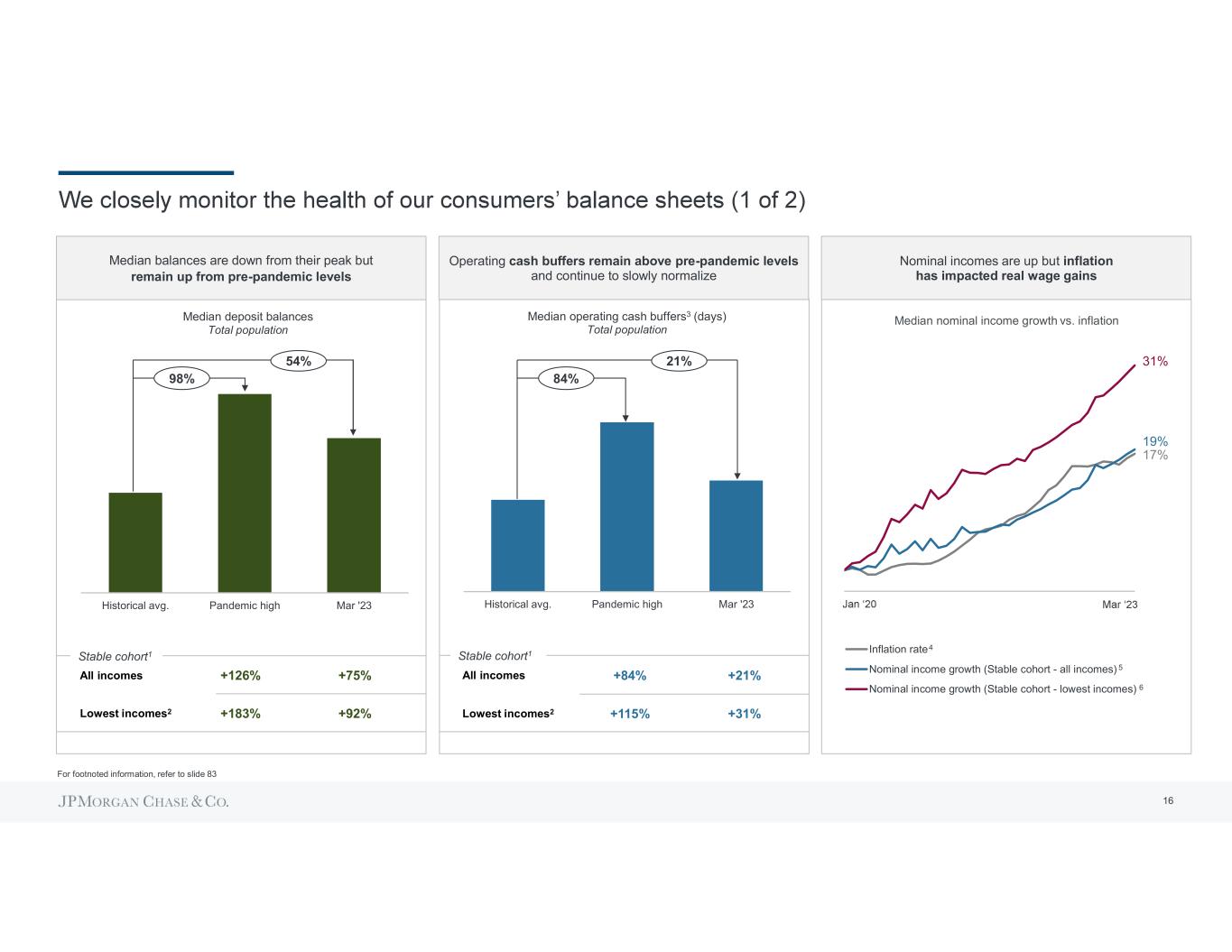

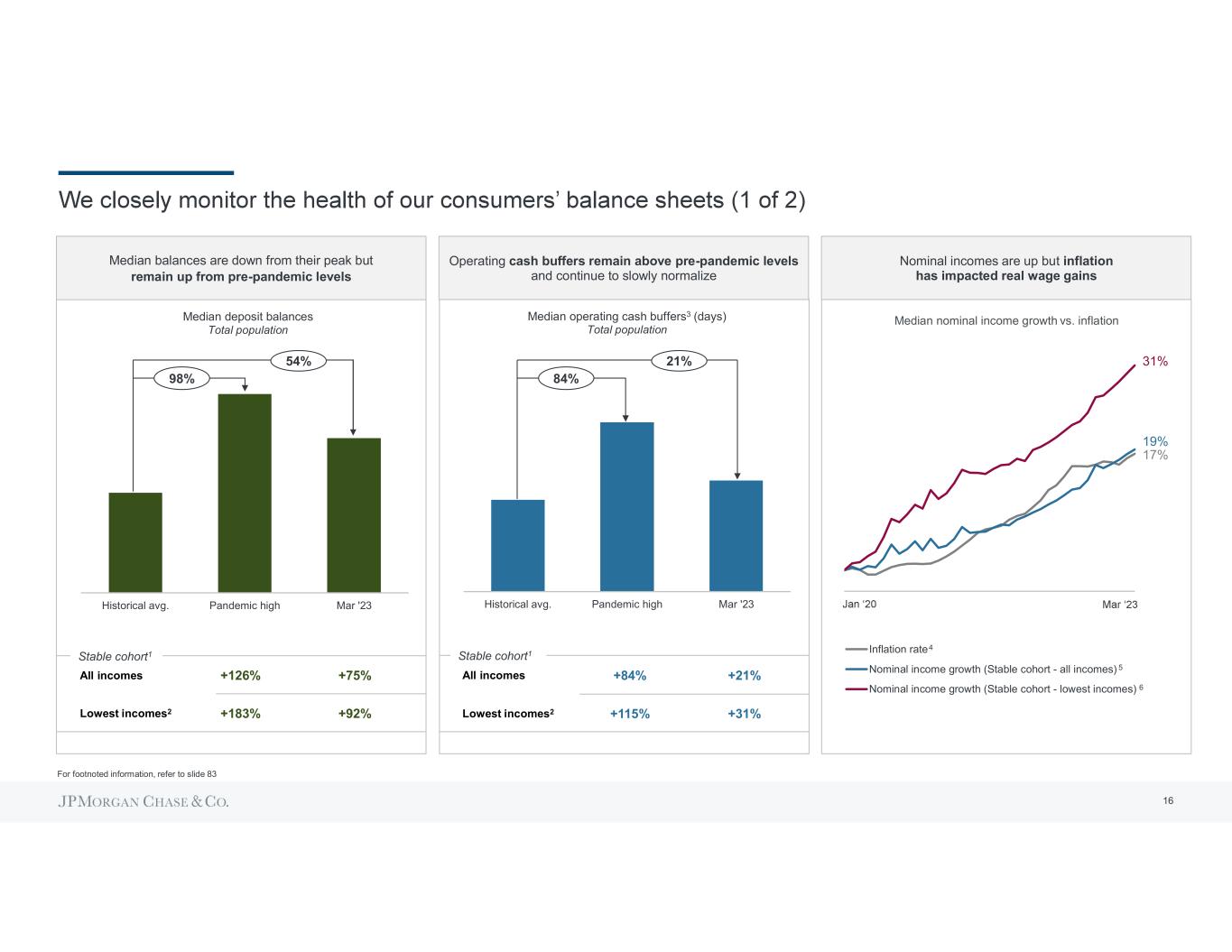

Median balances are down from their peak but remain up from pre-pandemic levels Historical avg. Pandemic high Mar '23 Median deposit balances Total population Historical avg. Pandemic high Mar '23 Median operating cash buffers3 (days) Total population 17% 19% Median nominal income growth vs. inflation Inflation rate Nominal income growth (Stable cohort - all incomes) Nominal income growth (Stable cohort - lowest incomes) Operating cash buffers remain above pre-pandemic levels and continue to slowly normalize Nominal incomes are up but inflation has impacted real wage gains All incomes +84% +21% Lowest incomes2 +115% +31% All incomes +126% +75% Lowest incomes2 +183% +92% 31% 4 Stable cohort1Stable cohort1 5 6 For footnoted information, refer to slide 83 16 98% 54% 84% 21%

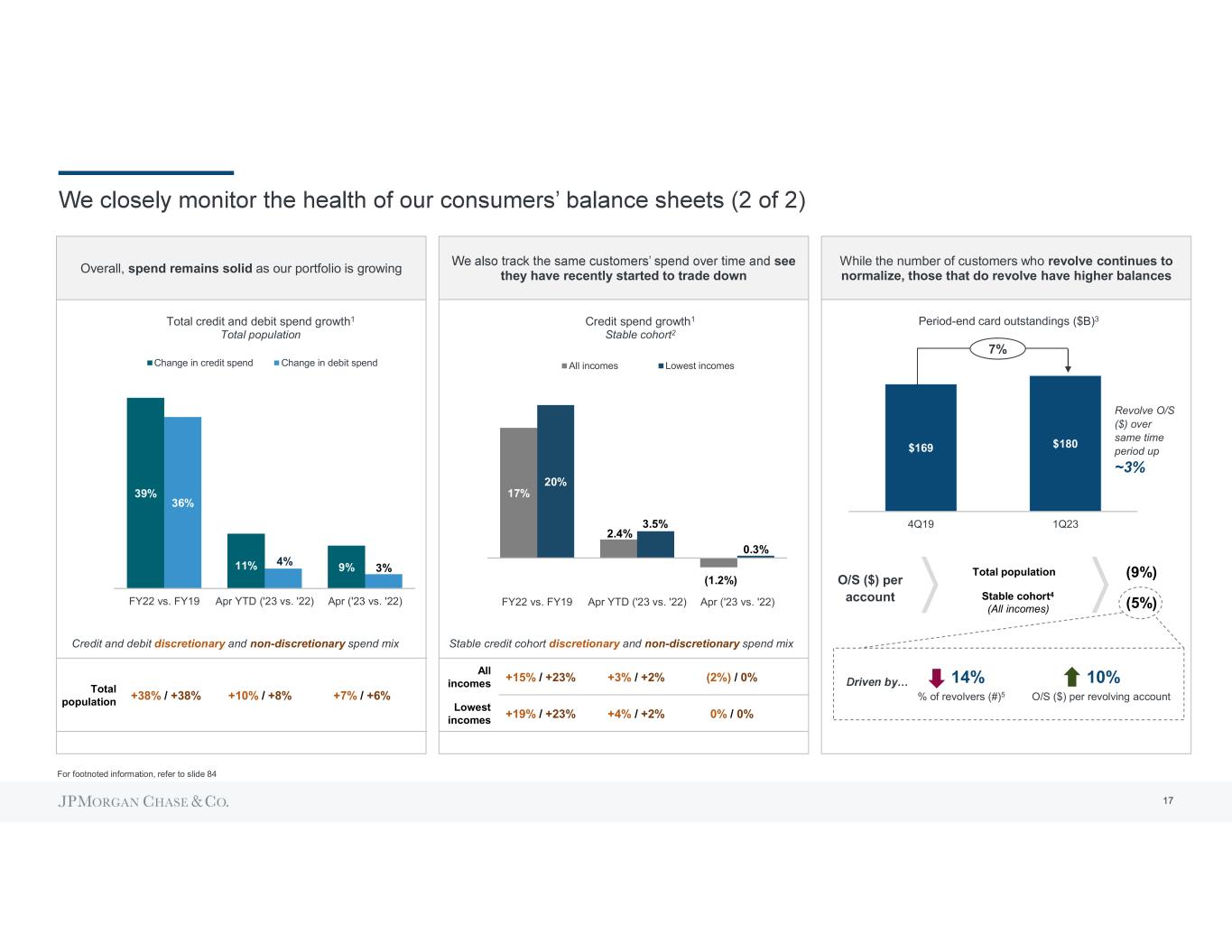

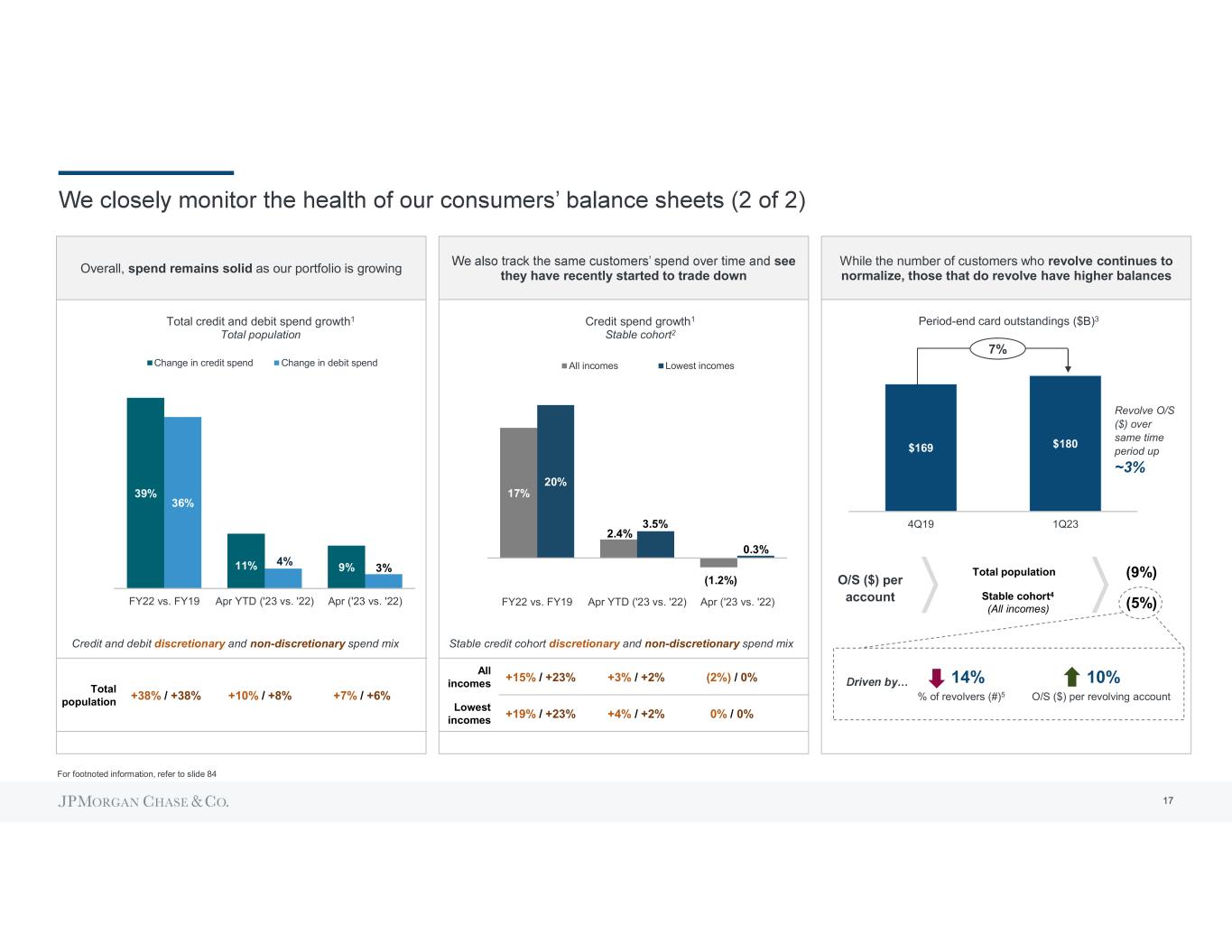

39% 11% 9% 36% 4% 3% FY22 vs. FY19 Apr YTD ('23 vs. '22) Apr ('23 vs. '22) Total credit and debit spend growth1 Total population Change in credit spend Change in debit spend Overall, spend remains solid as our portfolio is growing see they have recently started to trade down $169 $180 4Q19 1Q23 Period-end card outstandings ($B)3 7% O/S ($) per account Revolve O/S ($) over same time period up ~3% While the number of customers who revolve continues to normalize, those that do revolve have higher balances 10% O/S ($) per revolving account 14% % of revolvers (#)5 17% 2.4% - 0 20% 3.5% 0.3% FY22 vs. FY19 Apr YTD ('23 vs. '22) Apr ('23 vs. '22) Credit spend growth1 Stable cohort2 All incomes Lowest incomes (1.2%) Total population (9%) Stable cohort4 (All incomes) (5%) All incomes +15% / +23% +3% / +2% (2%) / 0% Lowest incomes +19% / +23% +4% / +2% 0% / 0% Stable credit cohort discretionary and non-discretionary spend mix Total population +38% / +38% +10% / +8% +7% / +6% Credit and debit discretionary and non-discretionary spend mix For footnoted information, refer to slide 84 17

Card1 Issuer Sub-Prime Mix Sub-Prime Mix 30+ DQs Net Credit Losses 3 4Q19 4Q22 4Q22 as a % of 4Q19 4Q22 as a % of 4Q19 Peer 1 N/D N/D 63% 46% Chase 16% 13% 78% 54% Peer 2 18% 16% 77% 56% Peer 3 20% 18% 97% 70% Peer 4 23% 20% 79% 59% Peer 5 32% 20% 79% 70% Peer 6 28% 26% 82% 68% Peer 7 33% 31% 87% 75% Auto1,2 Issuer 30+ DQs Net Credit Losses 3 4Q22 as a % of 4Q19 4Q22 as a % of 4Q19 Peer 1 82% 87% Chase 89% 80% Peer 2 99% 111% Peer 3 103% 137% INDUSTRY RISK PERFORMANCE METRICS 1 Peer information sourced from public disclosures 2 Chase Auto excludes Wholesale (DCS) & Lease 3 Represents net charge-offs 18

2012 2019 2022 Card % of portfolio <660 FICO score1 16% 16% 13% % of outstandings from balance parker segment2 20% 9% 5% Auto3 % of portfolio <660 credit score4 22% 18% 16% % of portfolio <660 FICO score and LTV >1205 1.6% 2.1% 1.3% Home Lending6 Owned-portfolio avg. FICO1 692 758 769 Owned-portfolio avg. CLTV 79% 55% 51% 2019 2022 Card % of originations <660 credit score Industry7 10% 13% 3ppts Chase 3% 3% - Auto3 Industry7 12% 18% 6ppts Chase 5% 5% - Home Lending % LTV >80 HFI jumbo origination mix Industry8 11% 13% 2ppts Chase 9% 10% 1ppt ORIGINATION RISK METRICSPORTFOLIO RISK METRICS For footnoted information, refer to slide 85 19

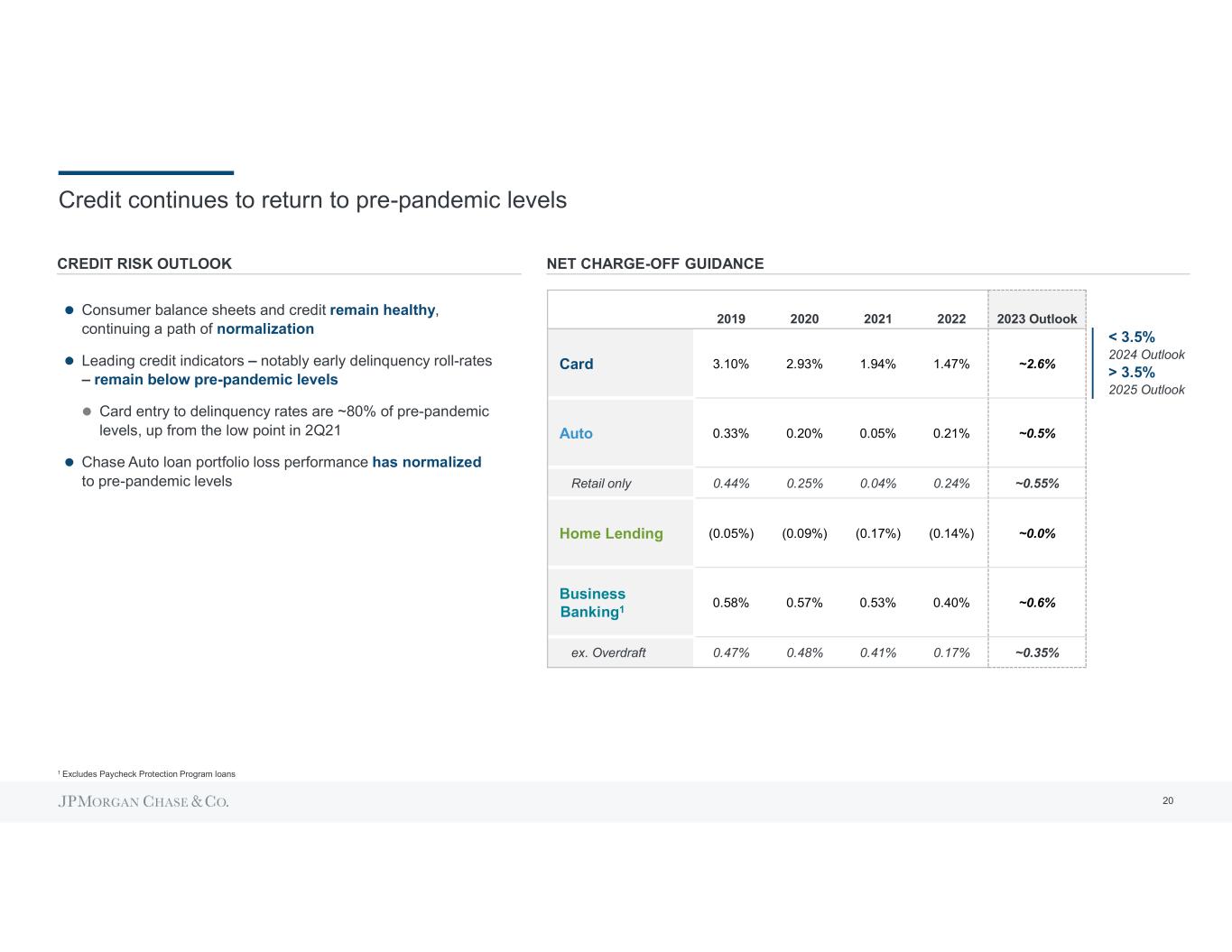

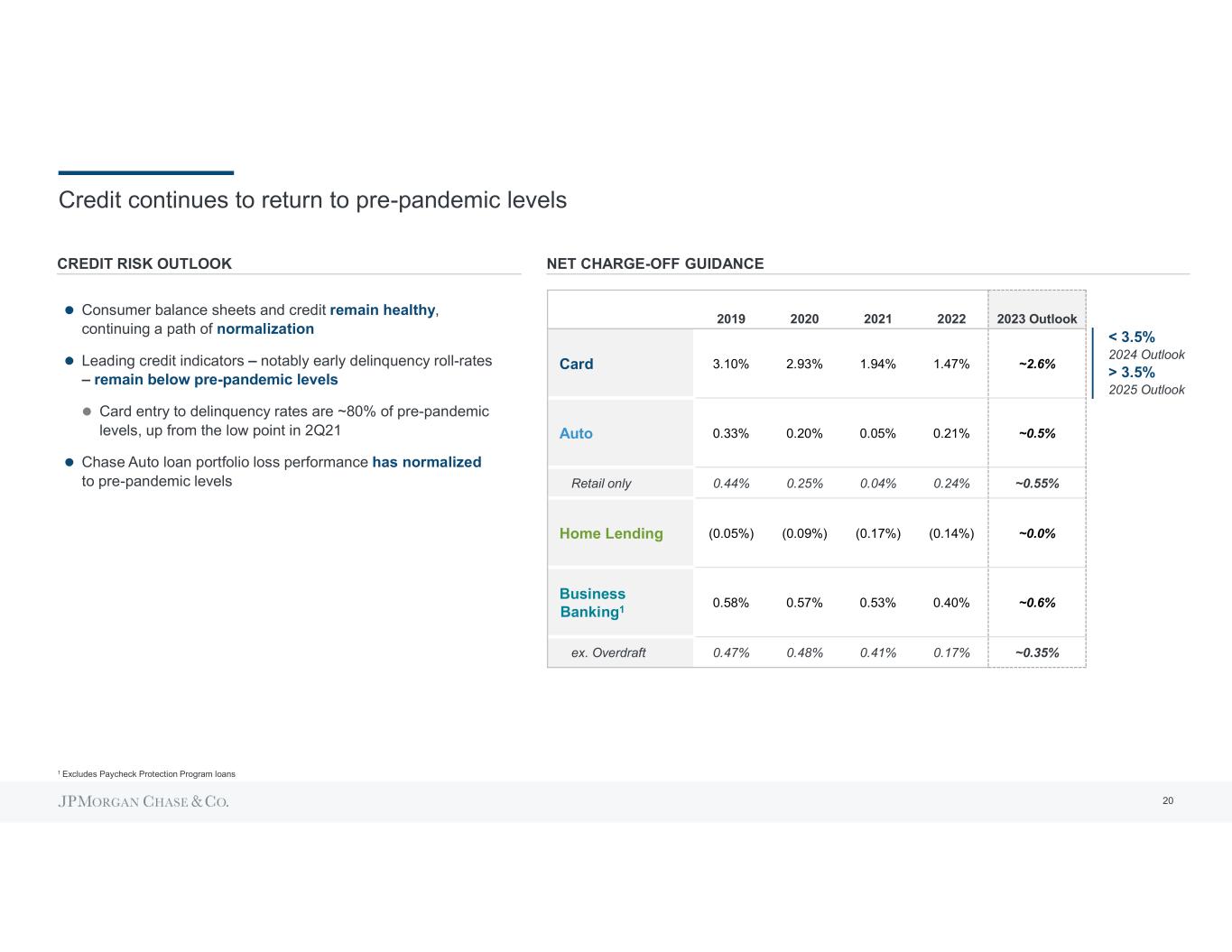

Credit continues to return to pre-pandemic levels Consumer balance sheets and credit remain healthy, continuing a path of normalization Leading credit indicators notably early delinquency roll-rates remain below pre-pandemic levels Card entry to delinquency rates are ~80% of pre-pandemic levels, up from the low point in 2Q21 Chase Auto loan portfolio loss performance has normalized to pre-pandemic levels 2019 2020 2021 2022 2023 Outlook Card 3.10% 2.93% 1.94% 1.47% ~2.6% Auto 0.33% 0.20% 0.05% 0.21% ~0.5% Retail only 0.44% 0.25% 0.04% 0.24% ~0.55% Home Lending (0.05%) (0.09%) (0.17%) (0.14%) ~0.0% Business Banking1 0.58% 0.57% 0.53% 0.40% ~0.6% ex. Overdraft 0.47% 0.48% 0.41% 0.17% ~0.35% < 3.5% 2024 Outlook > 3.5% 2025 Outlook CREDIT RISK OUTLOOK NET CHARGE-OFF GUIDANCE 1 Excludes Paycheck Protection Program loans 20

Primary driver of stress scenario is unemployment rate (UER) Losses typically lag UER, and will vary depending on when UER peaks and shape of recovery Table on the right shows annualized average losses over the two-year period 1Q24-4Q25, and cumulative losses over the same period Annualized avg. (%) Cumulative ($) Central case ~3.5% ~$15.5B Moderate recession scenario ~4.8% ~$18.8B Incremental +130bps +$3.3B Estimated 2-Year net credit losses (2024-2025) Unemployment rate 0% 1% 2% 3% 4% 5% 6% 7% 8% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 1Q26 2Q26 3Q26 4Q26 Moderate recession (peak 3Q24) Central case 5.1% 7.1% KEY ASSUMPTIONS NOT AN OUTLOOK1 Stress scenario analysis for Card 1 Federal Reserve's 2022 DFAST Results and Methodology Disclosure remains instructive data point for more severe recession 21

Our Home Lending portfolio is in a position of strength with low delinquencies and strong LTVs Our business is well-positioned given current levels of equity and portfolio quality Home Lending portfolio by CLTV1,2 30+ Delinquency % (based on $) Financial Crisis Pre-Covid Current 20103 13.5% 1.5% 0.8% We continue to prepare for a variety of stress scenarios 30+ delinquency rate at 0.2% if vintages prior to 2010 are excluded ~5% of portfolio resides in 80%+ HPI trough (5%) (15%) Peak UER 5.1% 7.1% Central case Moderate recession Estimated 2024-2025 NCOs ($mm) < 100 < 300 47% 21% 16% 11% 4% 1% <50% 50-60% 60-70% 70-80% 80-90% >=90% Home prices remain elevated but have begun to decline from recent peaks Major markets with >10% forecasted HPI4,5 declines from peak to YE 2023 Actual decline (2022 peak to current) % HFI 2022 originations6 -13% -11% -10% -9% -11% -6% -9% -7% -9% -6% -8% -6% -7% -7% -7% -8% -6% -8% -5% -7% -4% -7% -5% -3% 9% 6% 2% 3% 3% 1% 1% 3% 1% 1% 4% 11% -20% -18% -17% -17% -16% -14% -14% -14% -13% -13% -13% -10% San Francisco-Oakland-Hayward, CA Seattle-Tacoma-Bellevue, WA Austin-Round Rock, TX Phoenix-Mesa-Scottsdale, AZ San Jose-Sunnyvale-Santa Clara, CA Portland-Vancouver-Hillsboro, OR-WA Las Vegas-Henderson-Paradise, NV Denver-Aurora-Lakewood, CO Sacramento-Roseville-Arden-Arcade, CA Nashville-Davidson-Murfreesboro-Franklin, TN San Diego-Carlsbad, CA Los Angeles-Long Beach-Anaheim, CA For footnoted information, refer to slide 86 22

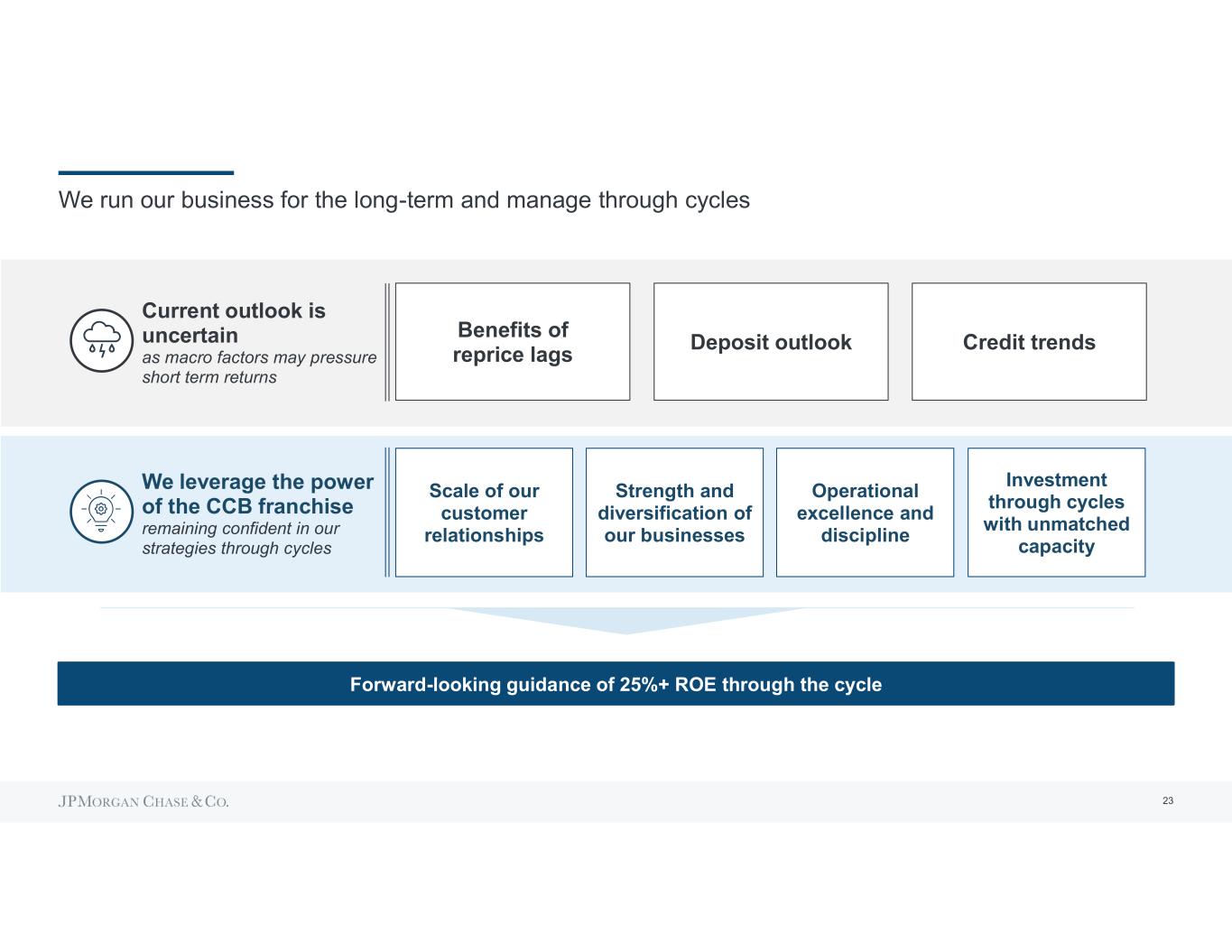

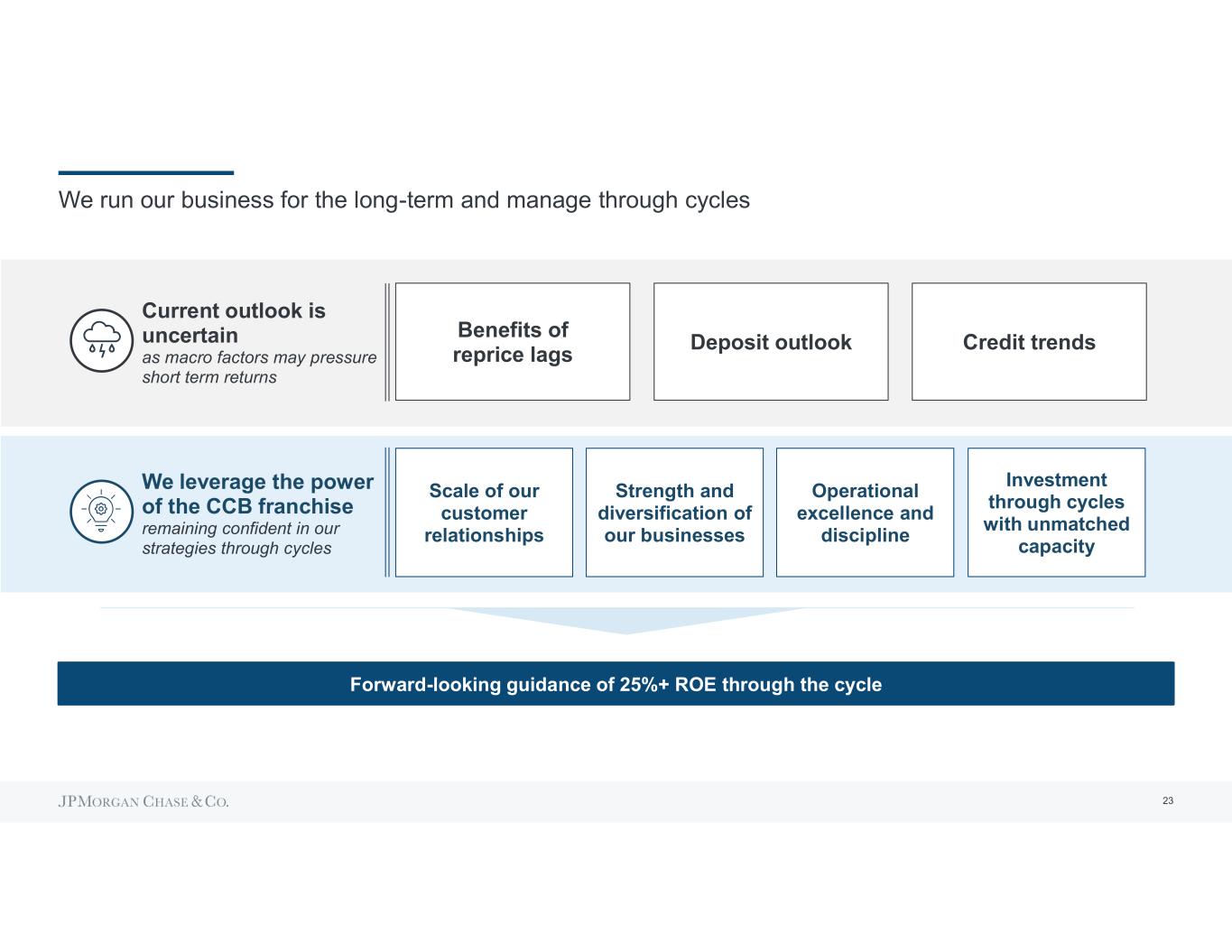

We run our business for the long-term and manage through cycles Forward-looking guidance of 25%+ ROE through the cycle Current outlook is uncertain as macro factors may pressure short term returns Benefits of reprice lags Deposit outlook Credit trends We leverage the power of the CCB franchise remaining confident in our strategies through cycles Scale of our customer relationships Strength and diversification of our businesses Operational excellence and discipline Investment through cycles with unmatched capacity 23

We have consistently driven core growth and strong returns over the long term For footnoted information, refer to slide 87 $11.7 $12.3 $13.4 $14.4 $15.2 $15.0 $19.4 $21.7 $18.8 $18.1 $20.9 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $1,066 $2,249 7.1% (#3) 10.9% (#1) 20.5% (#2) 22.4% (#1) 17.7% (#1) 17.3% (#1) 6.2% (#3) 9.3% (#1) Fed Funds effective rate6 CCB pretax income ex. LLR ($B)5 CCB ROE ex. LLR5 Client balances ($B)7: 8% CAGR Retail deposit share (%)8: +380bps Card sales market share (%)9: +190bps BB Primary bank share (%)10: +310bps 0.14% 0.11% 0.09% 0.13% 0.40% 1.00% 1.83% 2.16% 0.38% 0.08% 1.68% 16% 15% 15% 17% 18% 18% 28% 31% 26% 26% 31% Card O/S share (%): (40bps) Card O/S share is up >200bps since 2012 when adjusting for risk- appetite CONSUMER & COMMUNITY BANKING 10-YEAR PERFORMANCE1,2,3,4 24

25

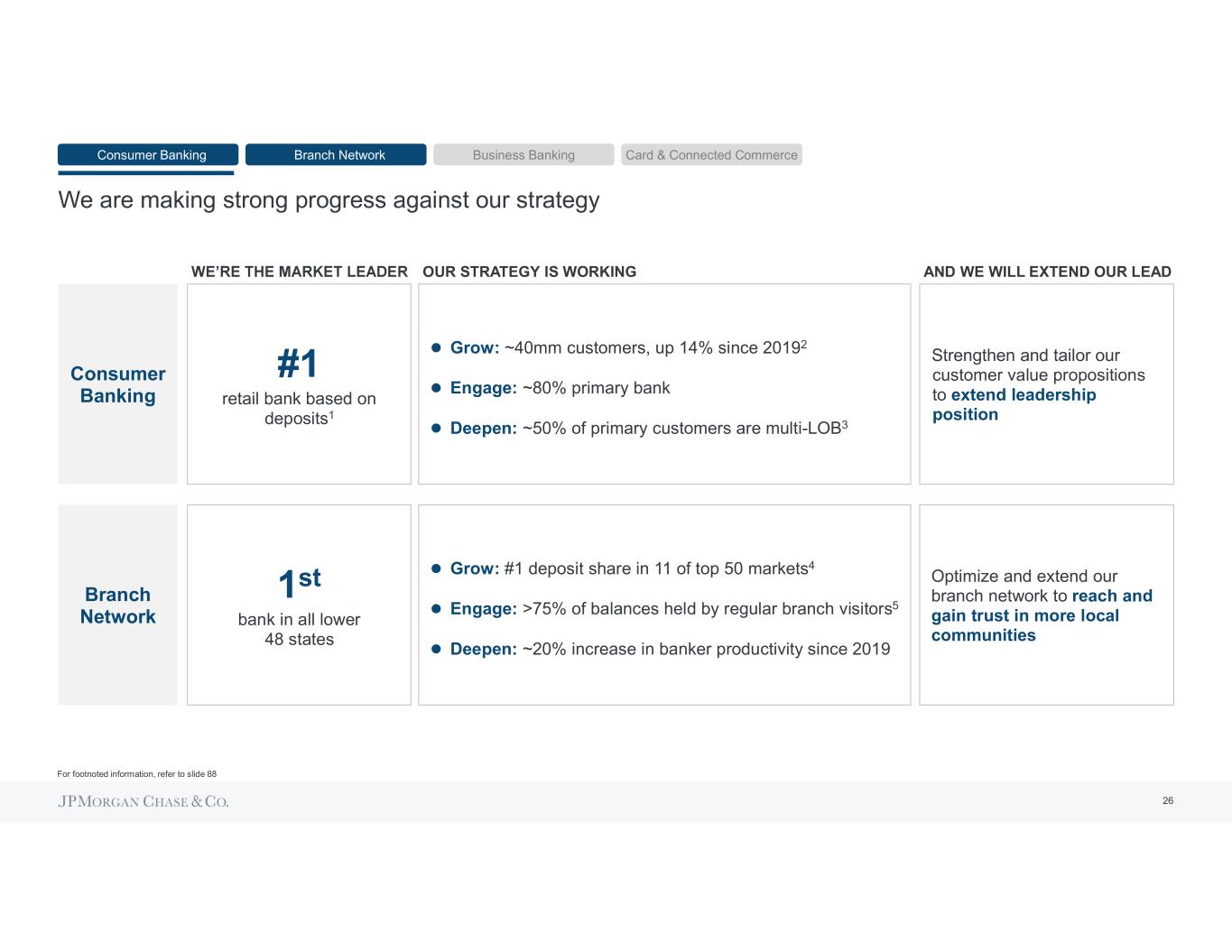

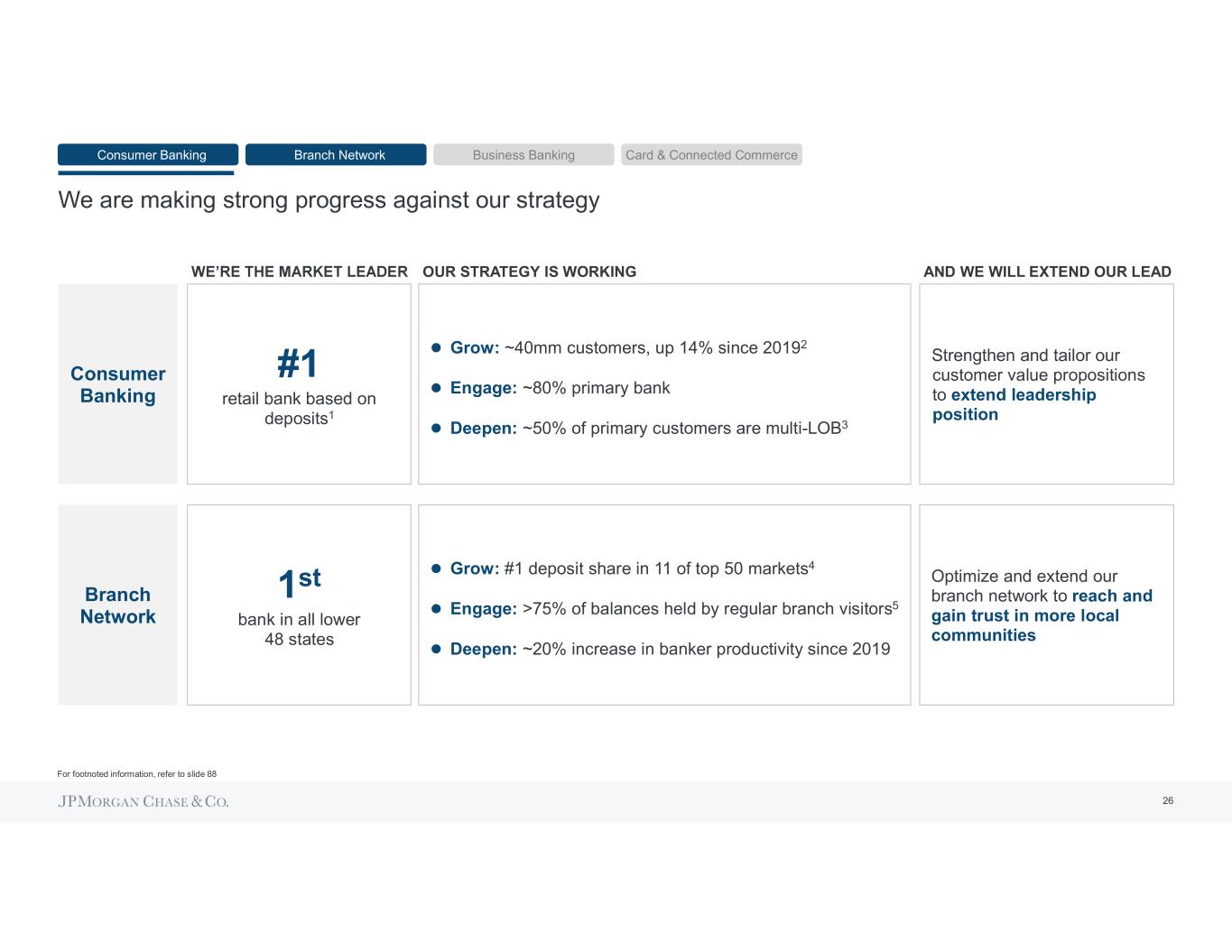

We are making strong progress against our strategy #1 retail bank based on deposits1 Consumer Banking Branch Network Grow: ~40mm customers, up 14% since 20192 Engage: ~80% primary bank Deepen: ~50% of primary customers are multi-LOB3 1st bank in all lower 48 states Grow: #1 deposit share in 11 of top 50 markets4 Engage: >75% of balances held by regular branch visitors5 Deepen: ~20% increase in banker productivity since 2019 Optimize and extend our branch network to reach and gain trust in more local communities Strengthen and tailor our customer value propositions to extend leadership position Consumer Banking Branch Network Business Banking Card & Connected Commerce OUR STRATEGY IS WORKING AND WE WILL EXTEND OUR LEAD For footnoted information, refer to slide 88 26

We have continued to drive core growth in our business Consumer Banking Branch Network Business Banking Card & Connected Commerce 27 1 o Consumer Banking accounts 14% 11% 35.4 37.9 39.2 40.4 2019 2020 2021 2022 14% We added 1.6mm net new checking accounts in 2022 4.5% CAGR Consumer Banking customers (mm)1 Average deposits ($B) $535 $629 $772 $848 Debit card sales ($B) $314 $339 $414 $431

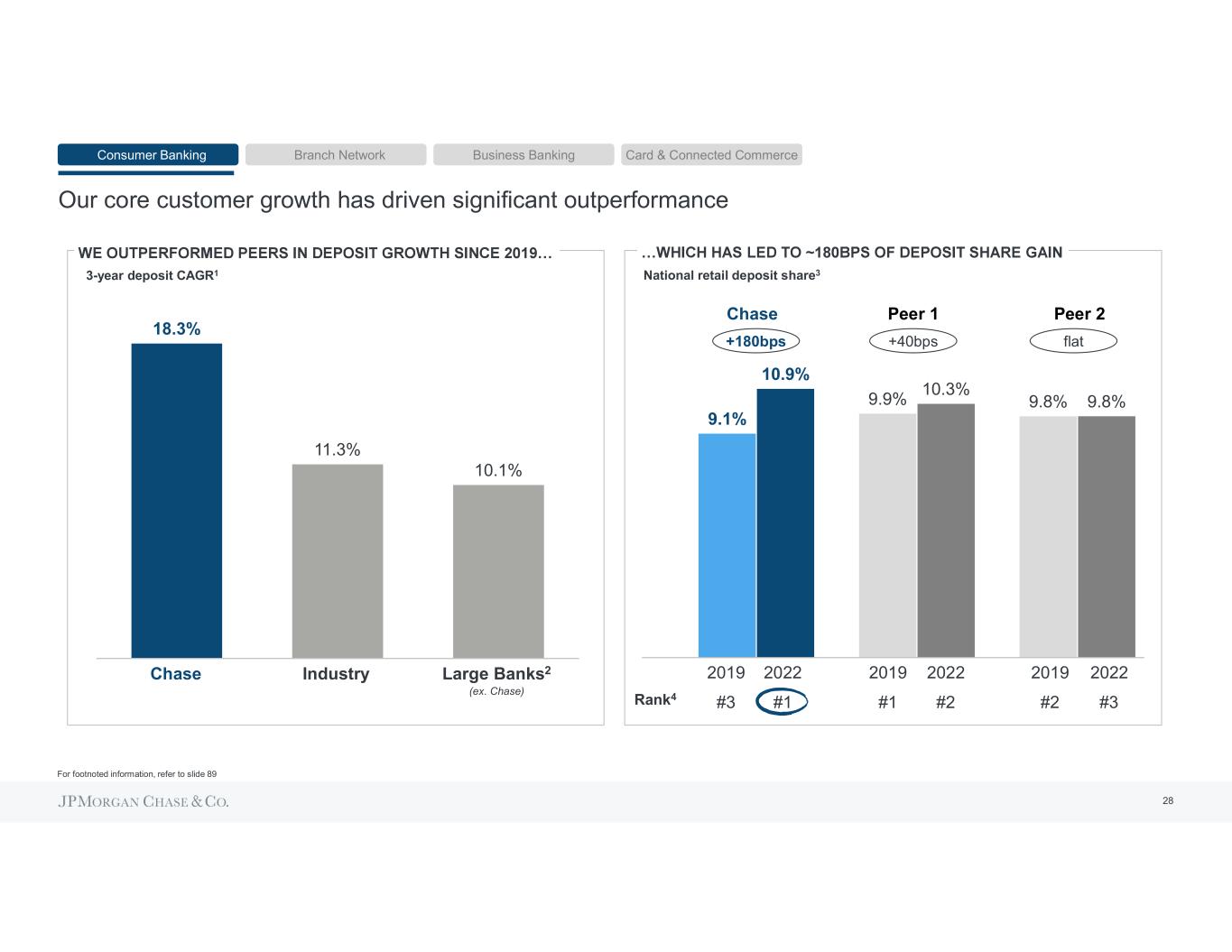

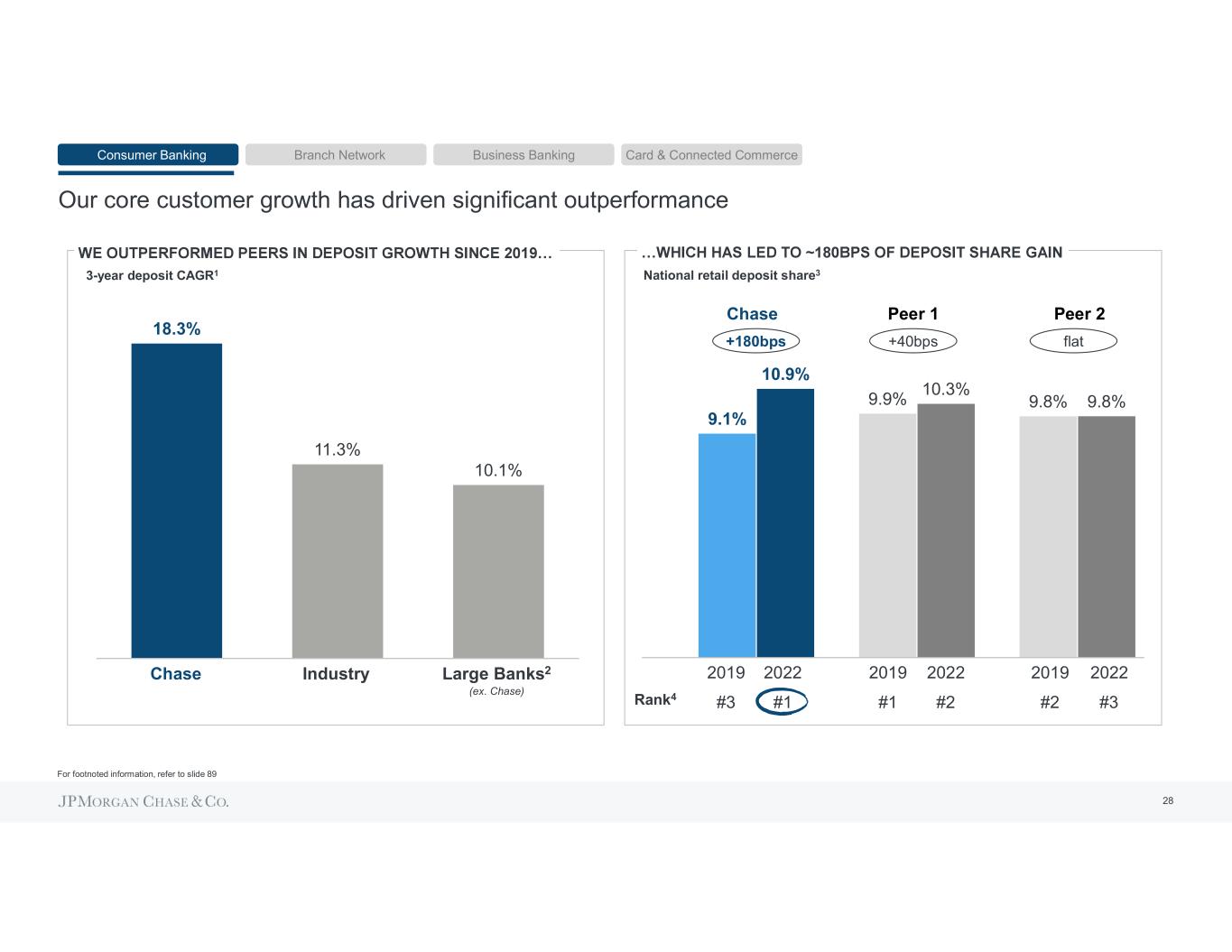

18.3% 11.3% 10.1% Our core customer growth has driven significant outperformance 9.1% 9.9% 9.8% 10.9% 10.3% 9.8% 2019 2022 2019 2022 2019 2022 #3 #1 #1 #2 #2 #3Rank4 +180bps +40bps flat Chase Peer 1 Peer 2 Chase Large Banks2Industry (ex. Chase) 3-year deposit CAGR1 National retail deposit share3 Consumer Banking Branch Network Business Banking Card & Connected Commerce For footnoted information, refer to slide 89 28

Satisfied Loyal Engaged Our primary bank customers are satisfied, loyal, and engaged ~80% of primary bank customers would recommend Chase2 of Consumer Banking checking customers partner with us as their primary bank1 ~80% of Consumer Banking Gen Z and Millennial consumer checking customers are primary bank retention rate among primary bank customers4 >95% >75% >75% >75% of customers are mobile active7 of balances held by customers who regularly use branches6 customer satisfaction across branch and digital channels3 Record high of primary bank customers choose Chase for other financial needs5 ~50% Consumer Banking Branch Network Business Banking Card & Connected Commerce For footnoted information, refer to slide 90 29

Our customers engage with Chase to make payments and manage their finances 2019 2022 Cash & check Debit Digital ~40% (25%) ~26mm active Zelle customers2 >35 monthly debit transactions per active debit customer3 2019 2022 Mobile-active >75% +9ppts Not mobile-active ~50% of mobile-active Consumer Banking users engage with our financial health tools5 ~9B digital logins by Consumer Banking users6 Transactions by method of payment1 Mobile engagement4 Consumer Banking Branch Network Business Banking Card & Connected Commerce For footnoted information, refer to slide 91 30

Wealth Management Business Banking Credit Card Home Lending >75% of retail volume is from Consumer Banking customers >75% of Business Banking clients also have a Consumer Banking relationship >45% of Branded Card members are also Consumer Banking customers1 ~90% of Wealth Management relationships also have a Consumer Banking relationship2 ~50% of Consumer Banking primary customers are engaged across products Increases relationship value Strengthens banking relationshipLowers cost of acquisition Consumer Banking CONSUMER BANKING SERVES A HIGH PROPORTION OF CUSTOMERS ACROSS EACH LOB AND GENERATES TREMENDOUS VALUE FOR THE FIRM Consumer Banking Branch Network Business Banking Card & Connected Commerce 31 1 Excludes small business customers 2 Consumer and small businesses with Wealth Management relationships with balances >$0

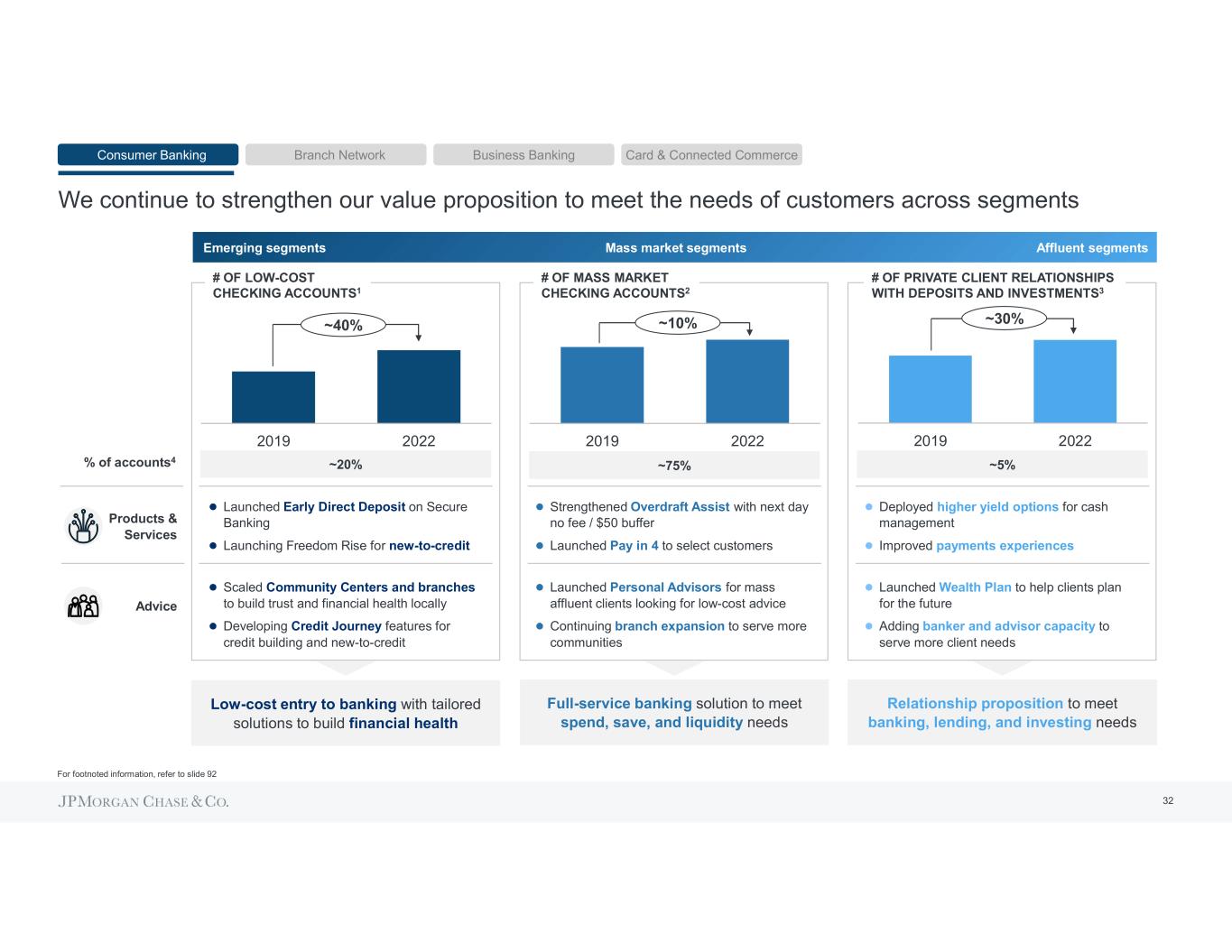

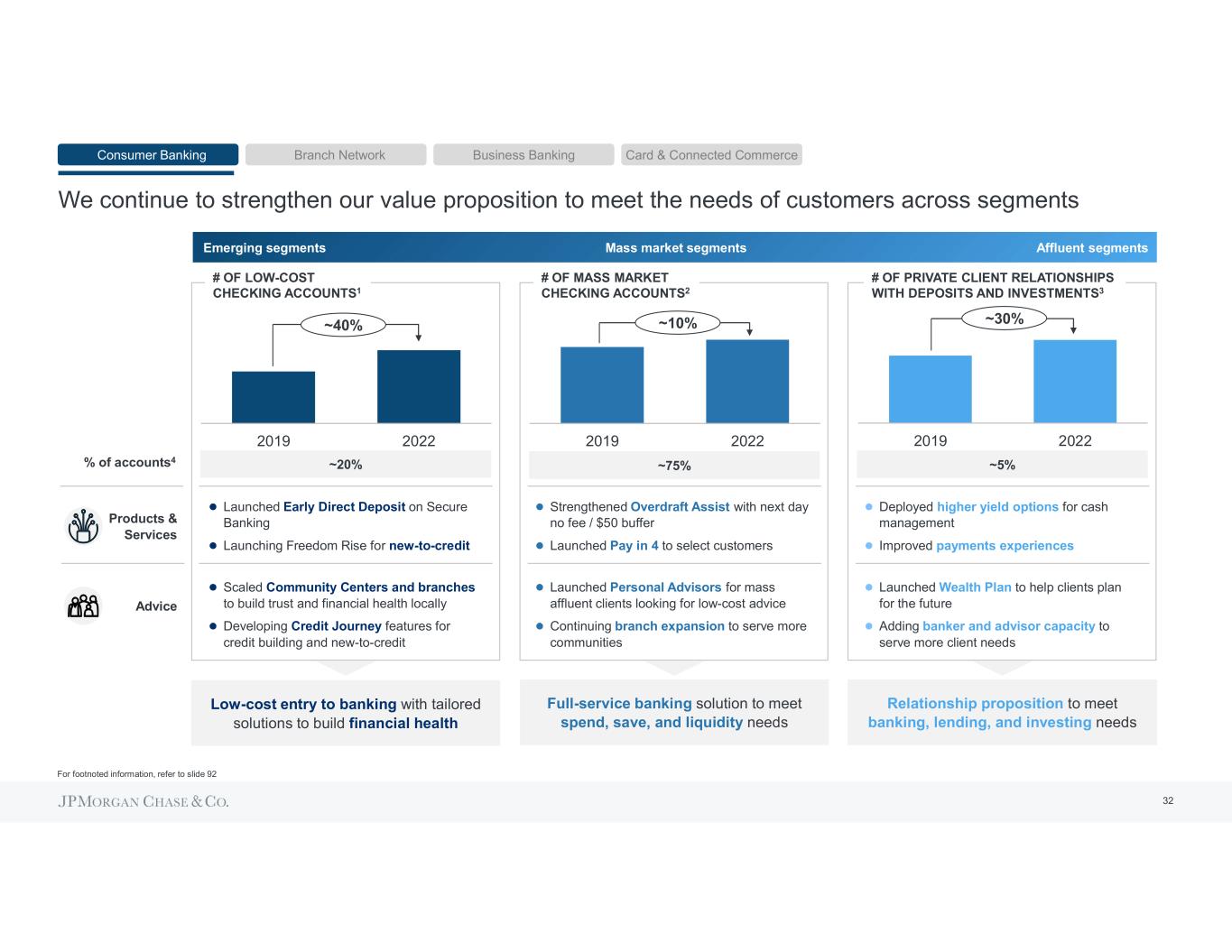

We continue to strengthen our value proposition to meet the needs of customers across segments 2019 2022 2019 2022 Products & Services Advice Launched Early Direct Deposit on Secure Banking Launching Freedom Rise for new-to-credit Scaled Community Centers and branches to build trust and financial health locally Developing Credit Journey features for credit building and new-to-credit Deployed higher yield options for cash management Improved payments experiences Launched Wealth Plan to help clients plan for the future Adding banker and advisor capacity to serve more client needs Low-cost entry to banking with tailored solutions to build financial health Relationship proposition to meet banking, lending, and investing needs 2019 2022 Strengthened Overdraft Assist with next day no fee / $50 buffer Launched Pay in 4 to select customers Launched Personal Advisors for mass affluent clients looking for low-cost advice Continuing branch expansion to serve more communities Full-service banking solution to meet spend, save, and liquidity needs Emerging segments Affluent segmentsMass market segments ~75% ~5%~20%% of accounts4 # OF LOW-COST CHECKING ACCOUNTS1 # OF MASS MARKET CHECKING ACCOUNTS2 # OF PRIVATE CLIENT RELATIONSHIPS WITH DEPOSITS AND INVESTMENTS3 Consumer Banking Branch Network Business Banking Card & Connected Commerce ~40% ~10% ~30% For footnoted information, refer to slide 92 32

33

5,293 4,831 2017 2022 We have accelerated our growth as we have extended and optimized our branch network $119 $227 2017 2022 Chase Large banks2 (ex. Chase) % of current network opened in the last five years4 15% 3% % of network consolidated in the last five years5 22% 24% (1.8%) CAGR Large Banks2 (ex. Chase) (4.7%) CAGR 13.8% CAGR Large banks2 (ex. Chase) $165mm3 Chase Large banks2 (ex. Chase) Deposits per branch (10+ years cohort)4 $259mm $170mm Deposits per branch (5-10 years cohort)4 $154mm $97mm BRANCH COUNT1 DEPOSITS PER BRANCH ($mm)1,6 Consumer Banking Branch Network Business Banking Card & Connected Commerce We have increased the number of consumer and small business customers per branch by ~30% from 2019 to 20227 For footnoted information, refer to slide 93 34

Network expansion creates an unparalleled growth engine Meaningful contribution: 7% 3% 15% 5% 3% 6% 79%88% 94% ChaseLarge banks2 (ex. Chase) 0-5 years 10+ years ~$85B in deposit growth since 2017 from branches <10 years old3 5-10 years ~4 year break-even on new builds4 More upside: ~$160B in incremental deposits as our branches mature to look like our seasoned network5 <5% branch share in 19 of the top 50 markets, including 3 of the top 10 (DC, Boston, Philadelphia)1,6Industry Branch network by age cohort1 WE HAVE INVESTED IN NEW BRANCHES FASTER THAN PEERS THESE INVESTMENTS ARE CONTRIBUTING MEANINGFULLY TO OUR PERFORMANCE, WITH MORE UPSIDE Consumer Banking Branch Network Business Banking Card & Connected Commerce For footnoted information, refer to slide 94 35

We have a demonstrated ability to grow in different starting positions and markets 11.6% 14.8% 20.4% 2012 2017 2022 1.6% 4.2% 6.3% 2012 2017 2022 0.8% 2012 2017 2022 Out of footprint 8.8ppts 111 new builds from 2012-20224 ~$9B deposit growth from 2012-20221 ~$2B deposit growth from 2017-20221 4.7ppts 13.7% 16.5% 16.9%Branch share2 5.7% 6.7% 8.7% Branch share2 0.0% 0.0% 2.6%Branch share2,3 ~$86B deposit growth from 2012-20221 42 new builds from 2017-20224 35 new builds from 2012-20224 0.8ppts Deposit share1 LOS ANGELES Deposit share1 ATLANTA Deposit share1 BOSTON Consumer Banking Branch Network Business Banking Card & Connected Commerce For footnoted information, refer to slide 95 36

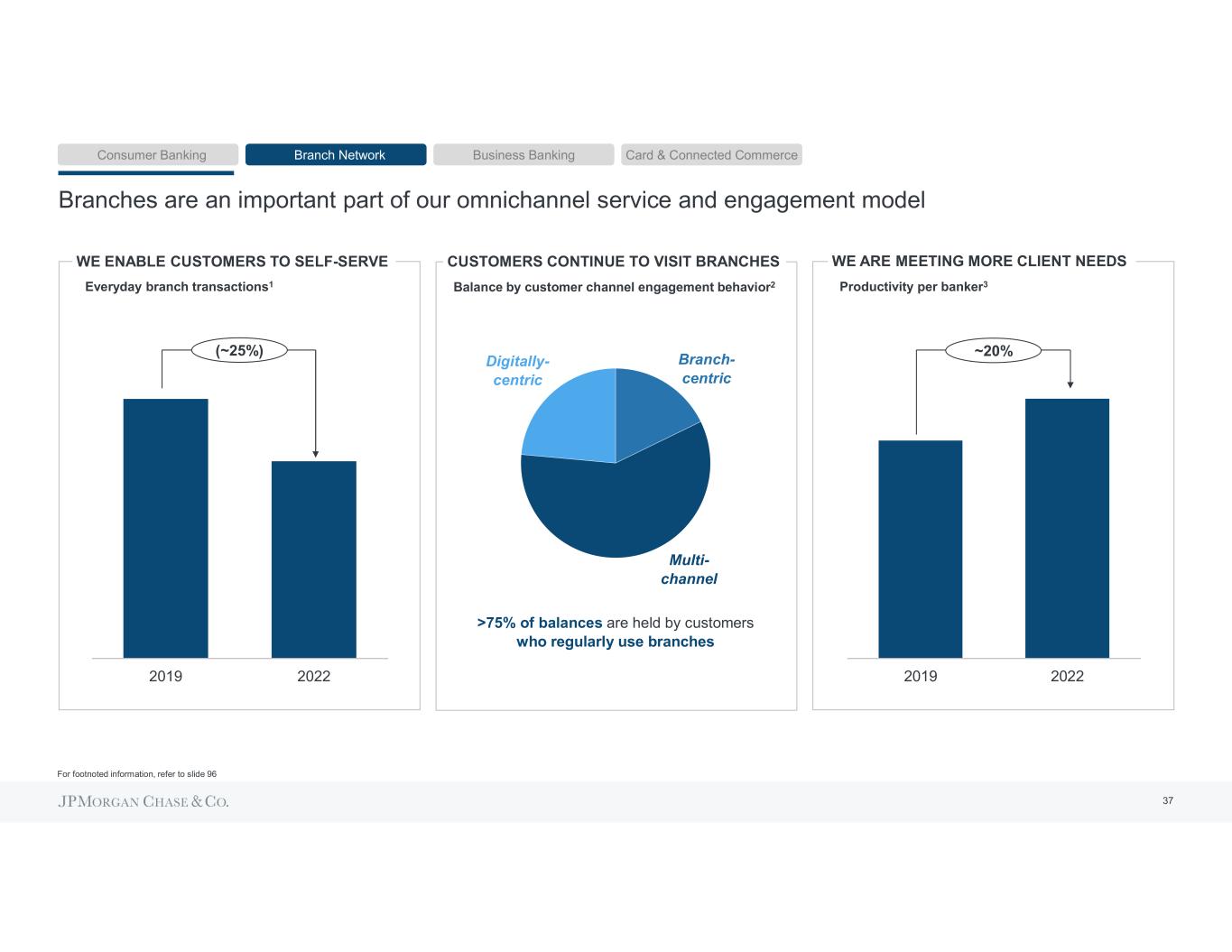

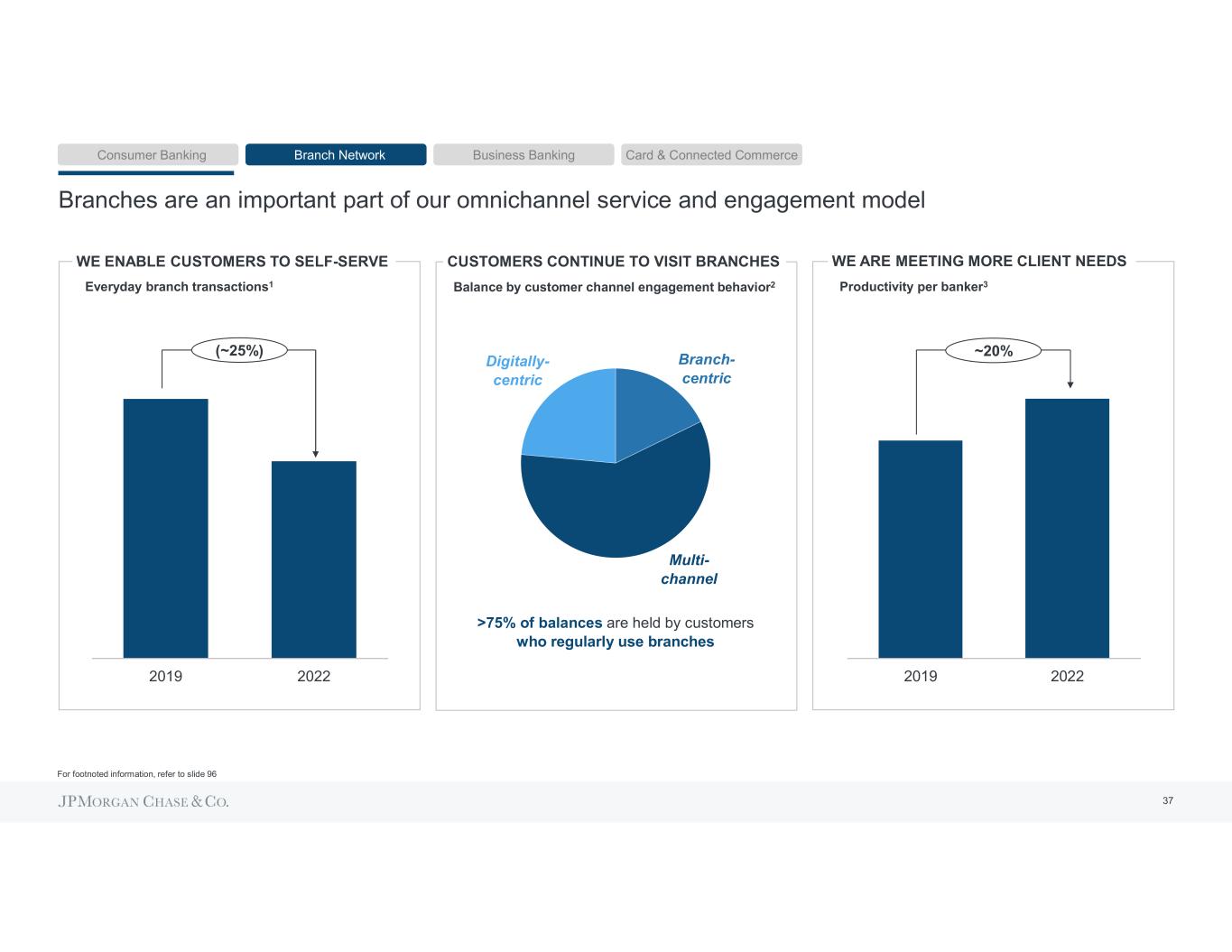

Branches are an important part of our omnichannel service and engagement model 2019 2022 Branch- centric Multi- channel Digitally- centric 2019 2022 >75% of balances are held by customers who regularly use branches (~25%) ~20% Everyday branch transactions1 WE ENABLE CUSTOMERS TO SELF-SERVE Balance by customer channel engagement behavior2 CUSTOMERS CONTINUE TO VISIT BRANCHES Productivity per banker3 WE ARE MEETING MORE CLIENT NEEDS Consumer Banking Branch Network Business Banking Card & Connected Commerce For footnoted information, refer to slide 96 37

Wealth Management Business Banking Credit Card Home Lending Our branches are the storefront for JPMC across lines of business ~50% of mortgages are originated in branches2 ~85% of business checking accounts are opened in branches ~25% of Branded credit cards are opened in branches >85% of first-time investors come from banker referrals1 Branch team of experts OUR BRANCH TEAMS GENERATE TREMENDOUS VALUE FOR THE FIRM ACROSS CCB AND JPMC MORE BROADLY Creates a talent pipeline Serves a wide range of client needsDrives acquisitions across channels Consumer Banking Branch Network Business Banking Card & Connected Commerce 38 1 Represents first-time investors with full-service relationships through Chase Wealth Management 2 Represents mortgage originations from branch Home Lending Advisors

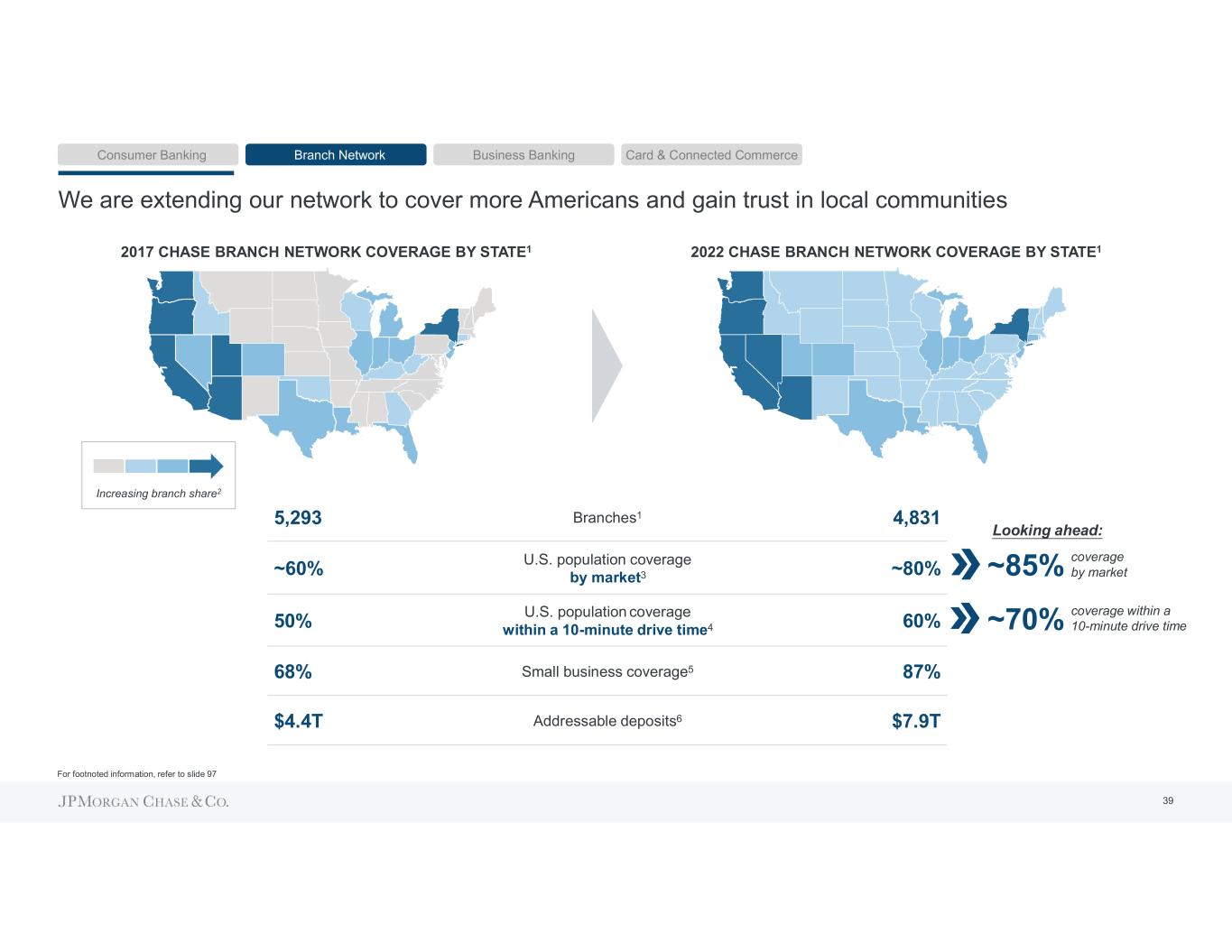

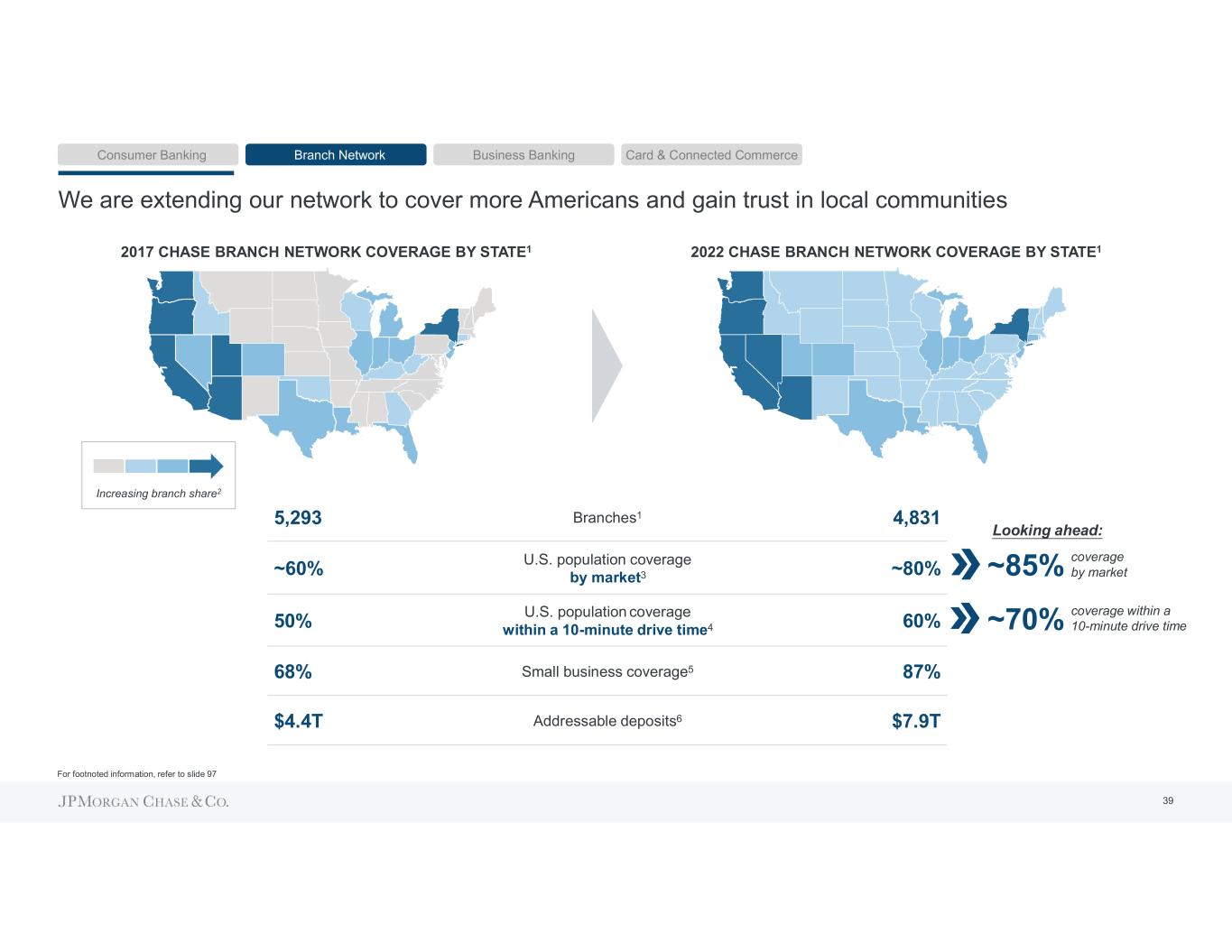

We are extending our network to cover more Americans and gain trust in local communities 5,293 Branches1 4,831 ~60% U.S. population coverage by market3 ~80% 50% U.S. population coverage within a 10-minute drive time4 60% 68% Small business coverage5 87% $4.4T Addressable deposits6 $7.9T ~85% coverage by market Looking ahead: ~70% coverage within a 10-minute drive time 2017 CHASE BRANCH NETWORK COVERAGE BY STATE1 2022 CHASE BRANCH NETWORK COVERAGE BY STATE1 Consumer Banking Branch Network Business Banking Card & Connected Commerce Increasing branch share2 For footnoted information, refer to slide 97 39

40

41 585 The small business ecosystem remains healthy despite economic headwinds Monthly small business formations (#k)1 Small business formations are elevated vs. pre- 40 140 240 340 440 540 640 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23 Consumer Banking Branch Network Business Banking Card & Connected Commerce Small business optimism index2 80 85 90 95 100 105 110 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23 Cash buffers (# of days of reserves, indexed to start of period)3 30-day delinquency rates (relative to start of period)3 60% 80% 100% 120% 140% 160% 180% 200% Jan-19 Jan-20 Jan-21 Jan-22 Jan-23 -0.8% -0.4% 0.0% 0.4% 0.8% 615 355 101 90 100% 187% 130% Start 91 Pandemic peak Jan-19 Jan-20 Jan-21 Jan-22 Jan-23 +46bps -13bps 80bps 40bps bps +40bps +80bps 1 Source: U.S. Census Business and Industry Time Series, Monthly Business Formation Statistics; not seasonally adjusted 2 Source: NFIB: Optimism Index 3 Cash buffers data based on fixed cohort of clients active in both January 2020 and November 2022, with balances/outflows tracked from January 2019 March 2023; delinquency rates based on both Business Banking line/loan and Chase Small Business Card excl. PPP loans, overdrafts

42 We serve ~6mm small- and medium-sized businesses (SMBs) across Chase for Business1 Consumer Banking Entrepreneurs who start businesses Chase for Business <$20mm sales size Commercial Banking ~$20mm-$2B sales size2 Corporate & Investment Bank >$2B sales size Business Banking Business Card Payments Services #1 Primary bank market share3 #2 SMB credit card spend3 #1 Payment provider for Business Banking clients1 Consumer Banking Branch Network Business Banking Card & Connected Commerce 1 6MM client count as of December 2022; payment provider rank as of April 2023 2 Annual sales size thresholds are directional and do not apply to select core segments and specialized industries within Commercial Banking 3 Primary bank market share sourced from Barlow Research Associates as of 4Q22. Rolling 8-quarter average of small businesses with sales size between $100k-$25mm; SMB credit card spend share based on internal estimates of Nilson (only 2021 available) and 2022 actuals if available

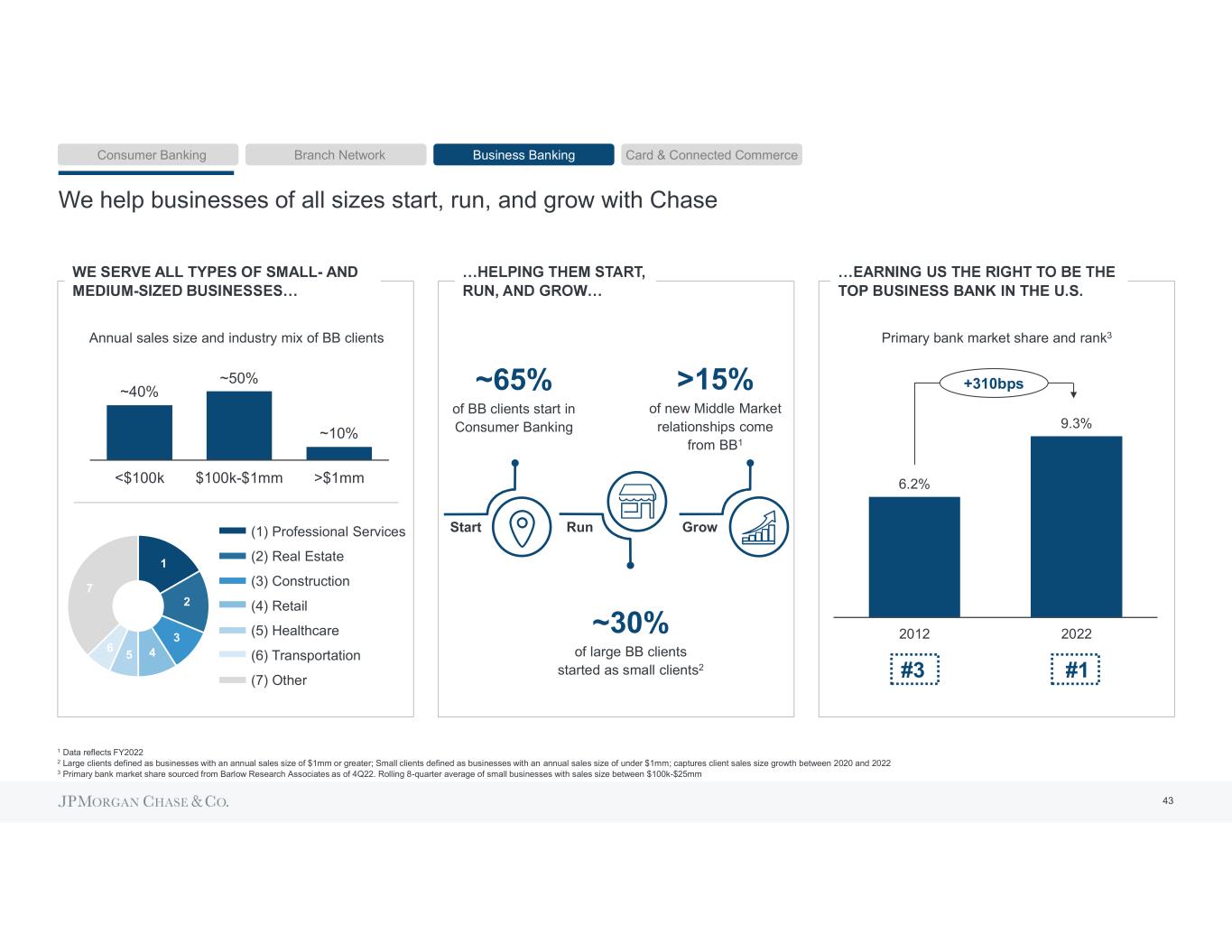

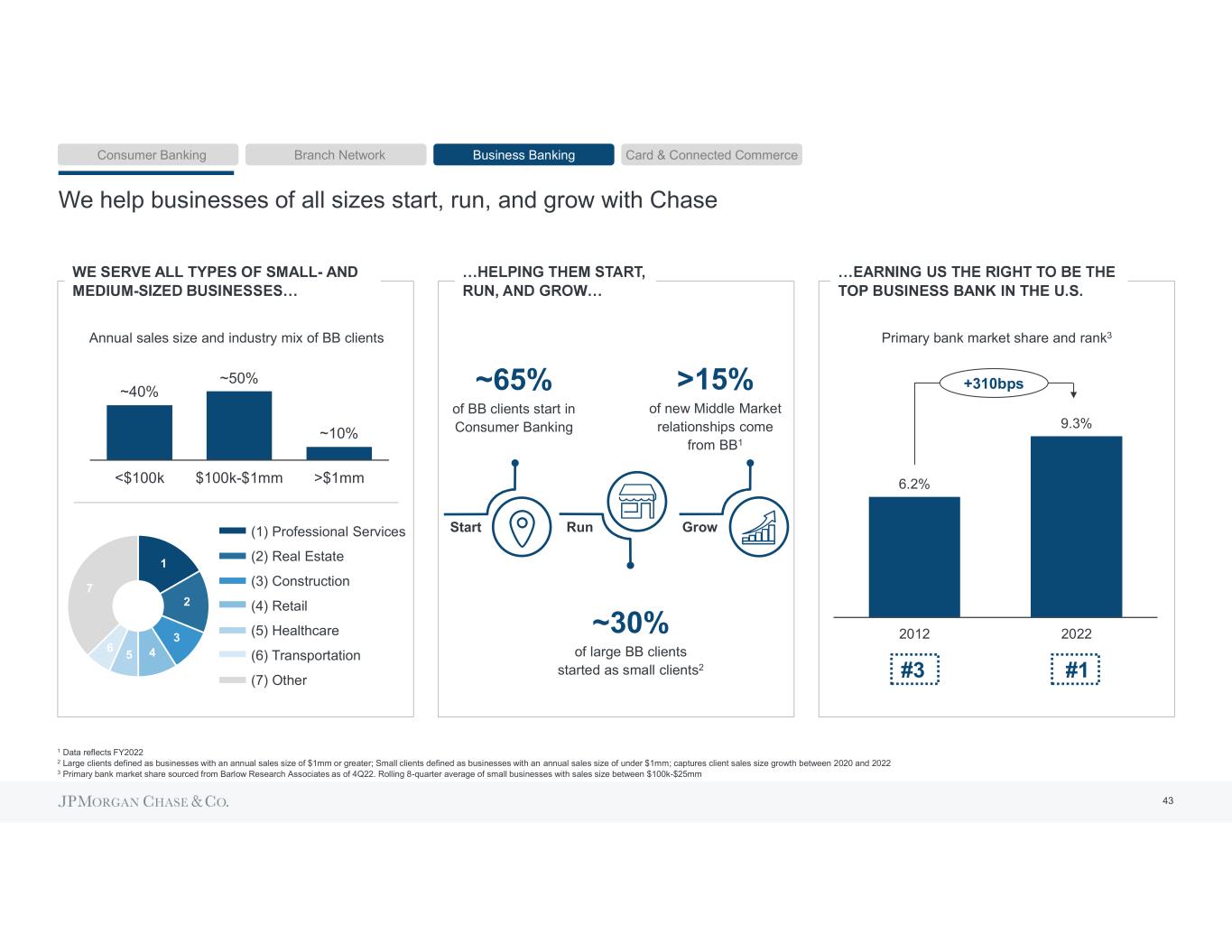

43 We help businesses of all sizes start, run, and grow with Chase WE SERVE ALL TYPES OF SMALL- AND MEDIUM- ~65% of BB clients start in Consumer Banking ~30% of large BB clients started as small clients2 >15% of new Middle Market relationships come from BB1 Start Run Grow ~40% ~50% ~10% <$100k $100k-$1mm >$1mm (1) Professional Services (2) Real Estate (3) Construction (4) Retail (5) Healthcare (6) Transportation (7) Other 6.2% 9.3% 2012 2022 #3 #1 +310bps Primary bank market share and rank3Annual sales size and industry mix of BB clients Consumer Banking Branch Network Business Banking Card & Connected Commerce 1 2 3 45 6 7 TOP BUSINESS BANK IN THE U.S. 1 Data reflects FY2022 2 Large clients defined as businesses with an annual sales size of $1mm or greater; Small clients defined as businesses with an annual sales size of under $1mm; captures client sales size growth between 2020 and 2022 3 Primary bank market share sourced from Barlow Research Associates as of 4Q22. Rolling 8-quarter average of small businesses with sales size between $100k-$25mm

44 Our business is growing rapidly and delivers strong economics Business Banking clients (mm) 2.9 3.2 3.5 3.8 0 0.5 1 1.5 2 2.5 3 3.5 4 2019 2020 2021 2022 Average deposits ($B) $136 $175 $226 $259 Average loans ex. PPP ($B) $24 $24 $22 $20 Primary bank rank1 #1 #1 #1 #1 30% ~3x higher balances per average BB account vs. average Consumer Banking account ~80% of balances in noninterest- bearing checking accounts ~9% CAGR + 90% We originated >340k net new checking accounts in 2022 Consumer Banking Branch Network Business Banking Card & Connected Commerce HAVE STRONG ECONOMICS 1 Primary bank market share sourced from Barlow Research Associates as of 4Q22. Rolling 8-quarter average of small businesses with sales size between $100k-$25mm

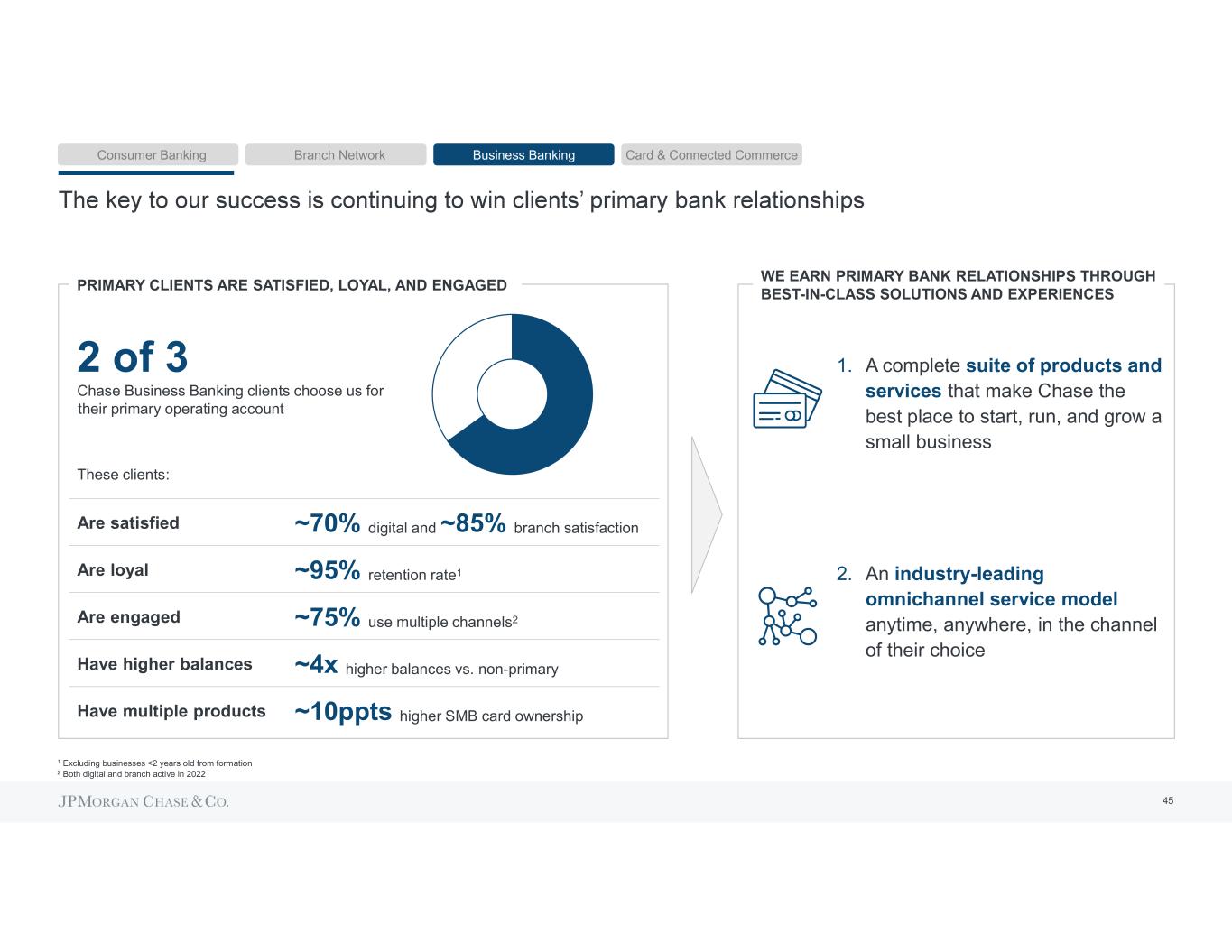

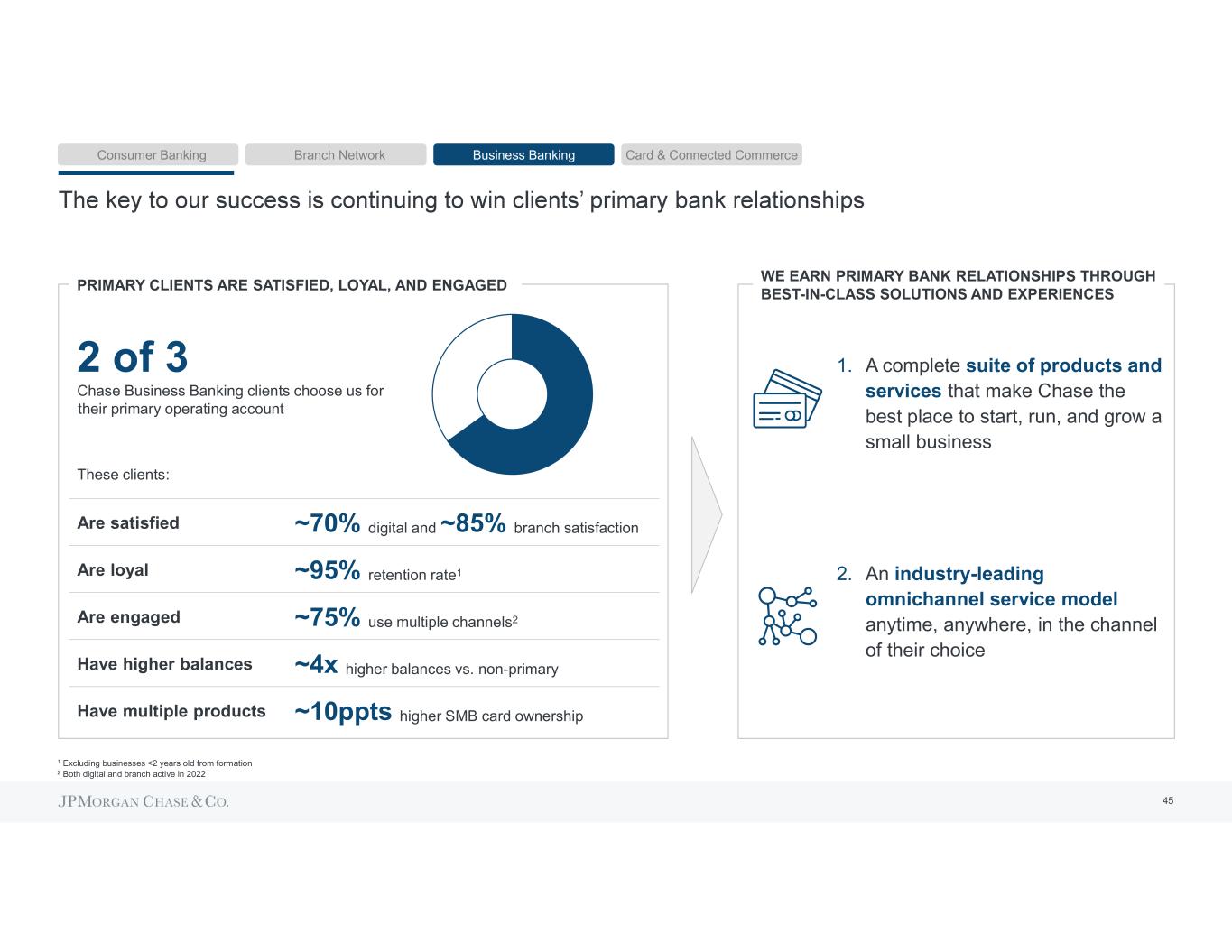

45 Are satisfied ~70% digital and ~85% branch satisfaction Are loyal ~95% retention rate1 Are engaged ~75% use multiple channels2 Have higher balances ~4x higher balances vs. non-primary Have multiple products ~10ppts higher SMB card ownership 2 of 3 Chase Business Banking clients choose us for their primary operating account These clients: 2. An industry-leading omnichannel service model anytime, anywhere, in the channel of their choice 1. A complete suite of products and services that make Chase the best place to start, run, and grow a small business PRIMARY CLIENTS ARE SATISFIED, LOYAL, AND ENGAGED Consumer Banking Branch Network Business Banking Card & Connected Commerce WE EARN PRIMARY BANK RELATIONSHIPS THROUGH BEST-IN-CLASS SOLUTIONS AND EXPERIENCES 1 Excluding businesses <2 years old from formation 2 Both digital and branch active in 2022

46 Our comprehensive suite of financial products and services makes Chase the best place to start, run, and grow a small business Entry-level and premium checking LegalZoom partnership Payments services including Zelle, Wires, Bill Pay Coming soon: Digitizing more customer activities Coming soon: Invoicing Banking and Cash Management Invoicing Entry-level, premium, and co-brand credit cards SBA1, small- and large-dollar lending, digital lending Coming soon: Expanding Credit Journey Credit Card / Lending Lending platform modernization 6 app inputs (vs. 50+)2 <5 mins to complete Automated post-app tasks Merchant Services integrated with core banking Everyday 401(k) Fraud Hub Coming soon: Tap To Pay Coming soon: Payroll Merchant and Adjacent Services Everyday 401(k) Consumer Banking Branch Network Business Banking Card & Connected Commerce 1 Small Business Administration 2 Comparison reflects comparable product on modernized platform vs. legacy

47 Our best-in-class omnichannel offering allows us to serve our clients anytime, anywhere, in the channel of their choice Multi- channel ~80% of clients are digitally active ~65% of clients are multi- channel active Deliver more omnichannel experiences: Interactive demos for prospects Video meetings for bankers and clients Schedule a banker meeting online Amplify our digital channels with: Enhanced merchant offers Expanded Credit Journey Enhanced customer insights >1B digital log-ins in 2022 ~85% branch satisfaction, ~70% digital satisfaction Serving our clients anytime, anywhere, in the channel of their choice Digital People Physical Network ~90% of assigned clients met with a Relationship Manager2 ~80% of clients visit a branch Continue to leverage our expanding branch footprint which currently covers 87% of U.S. small businesses1 Hire ~1,000 Relationship Managers by 2025, given assigned clients have: Higher retention More multi-product relationships Higher customer satisfaction ~4,800 Chase branches, >15,000 ATMs ~12,000 Consumer Bankers & ~2,300 Business Relationship Managers Consumer Banking Branch Network Business Banking Card & Connected Commerce 1 Small business coverage by CBSA based on Dun and Bradstreet Small Business locations. Small business defined as <$20mm in annual sales size 2 180-day contact rate for clients assigned to either a remote or in-person Business Relationship Manager

48 The value of Business Banking relationships extends to the rest of CCB and JPMC >15% of new Middle Market relationships came from BB last year ~40% of total CCB deposits held by BB clients1 >5ppt higher share of Private Bank client wallet when they have BB relationship2 ~50% more Business Card clients with a BB relationship vs. 2019 >75% >2x of accounts opened by existing CCB clients are originated without a marketing offer higher average BB client revenue when clients have multiple CCB relationships (vs. BB-only) Increased revenue per clientLower cost of acquisition Business Banking generates tremendous value significantly from CCB and JPMC Card Banking & Wealth Private Bank Commercial Banking Business Banking Consumer Banking Branch Network Business Banking Card & Connected Commerce 1 Includes deposits held by Business Banking clients in business and personal accounts; as of January 2023 2 Excludes Private Bank clients who are only associated with Business Banking clients generating <$100k sales size, and client records that do not have wallet share data available; as of May 2023

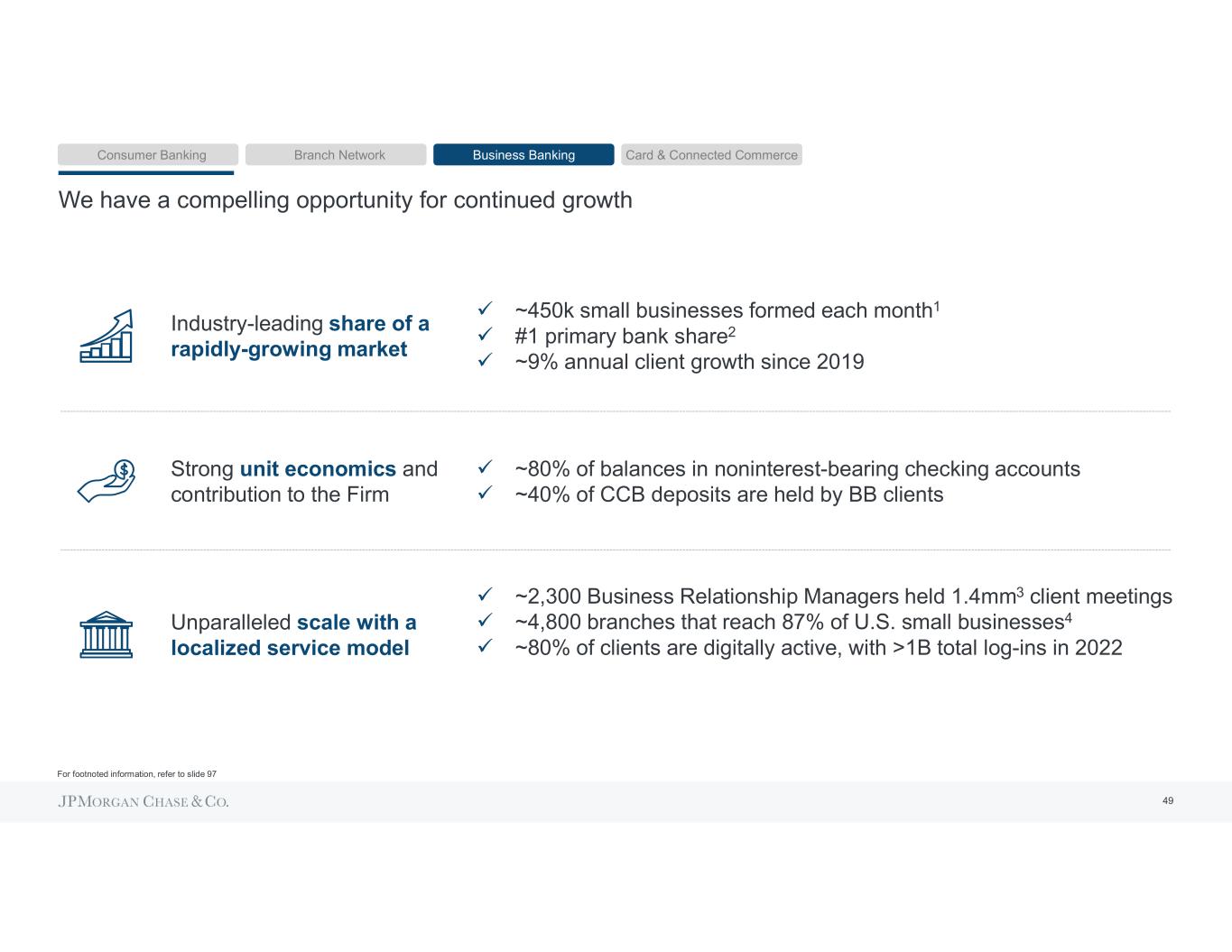

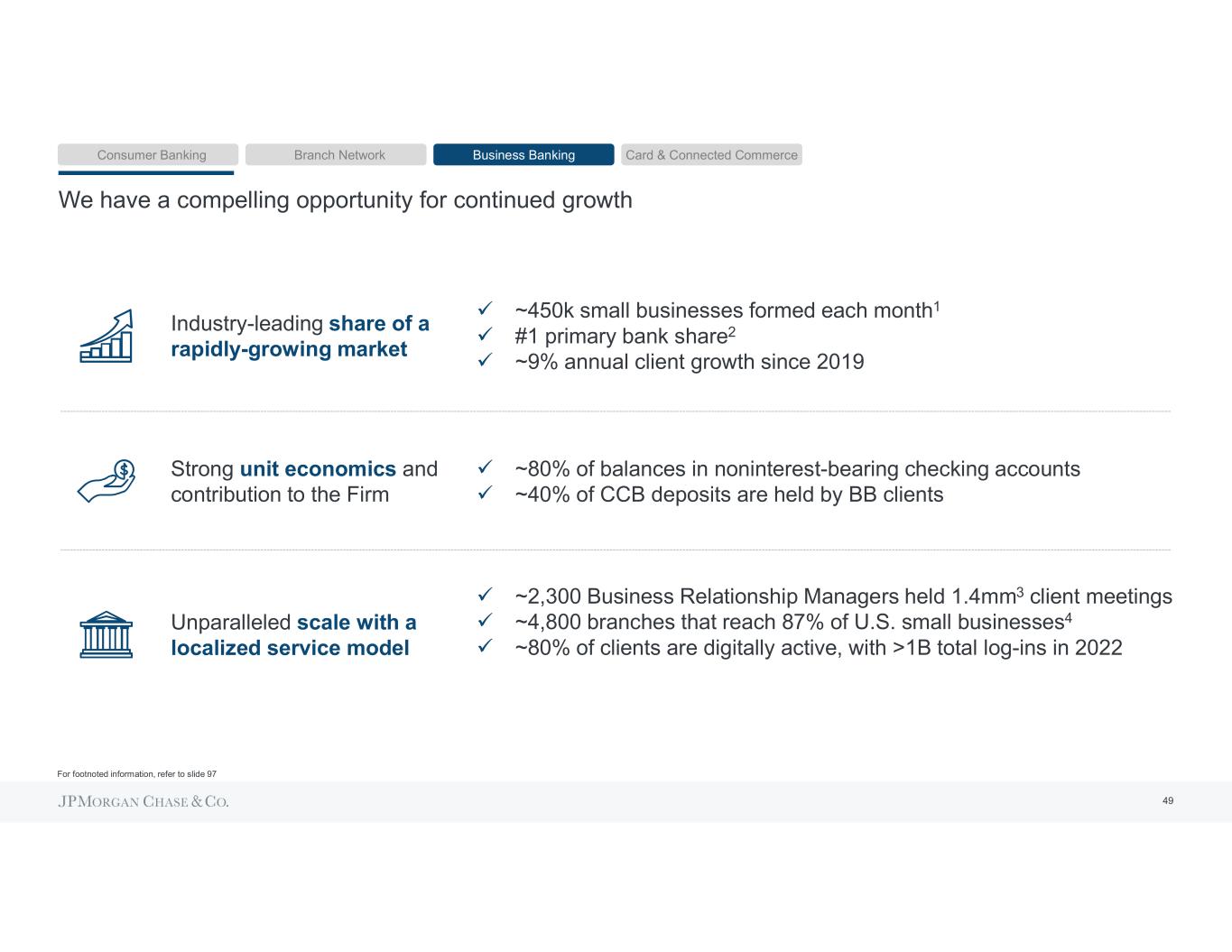

49 We have a compelling opportunity for continued growth Industry-leading share of a rapidly-growing market ~450k small businesses formed each month1 #1 primary bank share2 ~9% annual client growth since 2019 ~80% of balances in noninterest-bearing checking accounts ~40% of CCB deposits are held by BB clients ~2,300 Business Relationship Managers held 1.4mm3 client meetings ~4,800 branches that reach 87% of U.S. small businesses4 ~80% of clients are digitally active, with >1B total log-ins in 2022 Unparalleled scale with a localized service model Strong unit economics and contribution to the Firm Consumer Banking Branch Network Business Banking Card & Connected Commerce For footnoted information, refer to slide 97

50

4.8 2.7 2.4 2019 2021 2022 5.9 6.4 6.5 2019 2021 2022 11.5 12.1 13.7 2019 2021 2022 31% 35% 32% 2019 2021 2022 Our Card franchise continues to be the industry leader in sales and outstanding balances 43 47 52 2019 2021 2022 16.4 14.8 16.1 2019 2021 2022 156 140 163 2019 2021 2022 763 893 1,065 2019 2021 2022 Active accounts (mm)2 Average outstandings ($B)Sales volume ($B) Revenue ($B)3 21% 40% 4% Risk-adjusted revenue ($B)3,4 19% Net charge-offs ($B) ROE ex. LLR4 (50%) Pretax income ex. LLR ($B)4 10% 3.10% 1.94% 1.47% NCO Rate (2%) #1 in card sales volume since 20171 #1 in card outstandings for more than a decade1 98% customer retention in 2022 WE CONTINUED TO SCALE ACTIVE ACCOUNTS AND SALES AND HAVE SEEN AVERAGE OUTSTANDINGS REBOUND FROM PANDEMIC LOWS WE MAINTAINED OUR POSITION OF STRENGTH 1Q23 EOP O/S of $180B Consumer Banking Branch Network Business Banking Card & Connected Commerce 51 For footnoted information, refer to slide 99

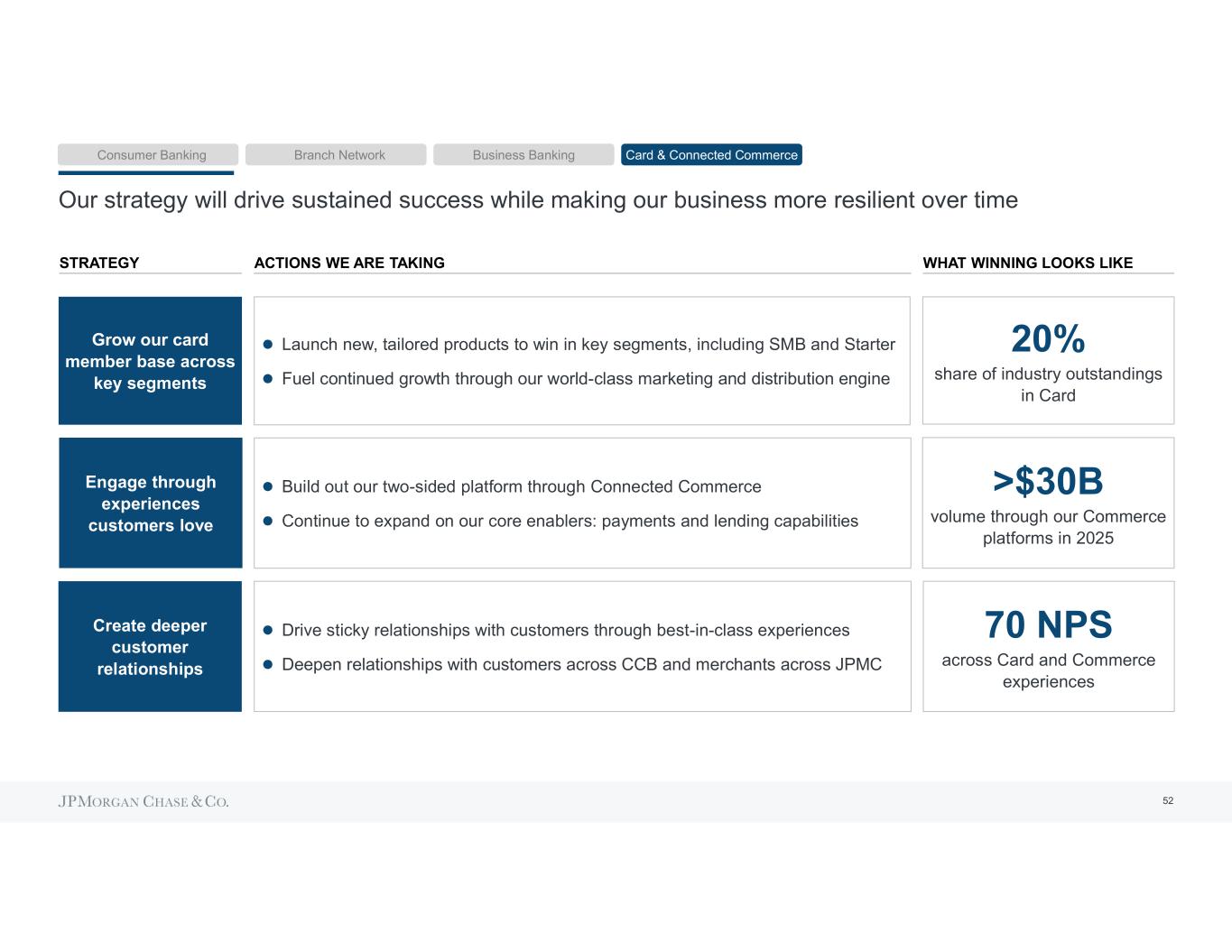

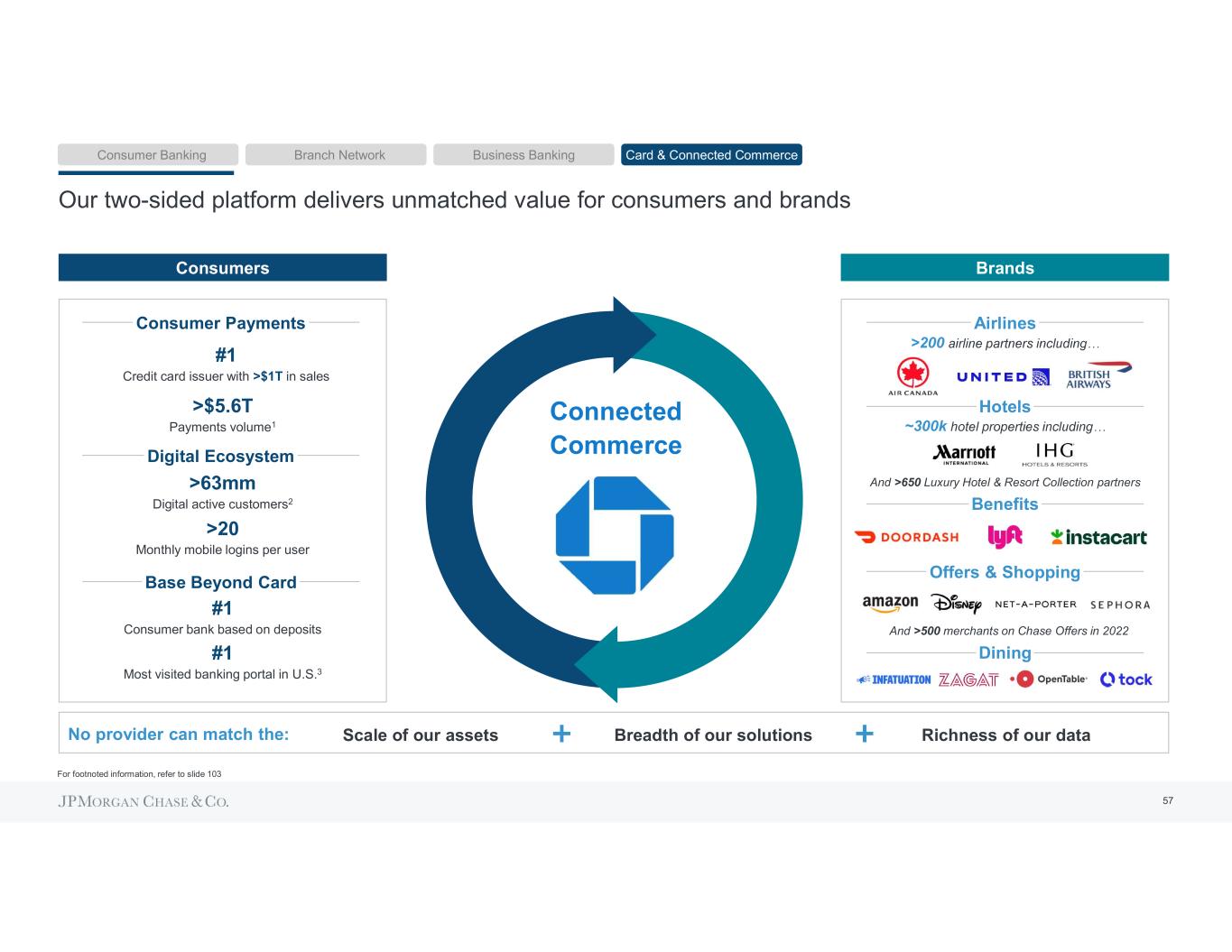

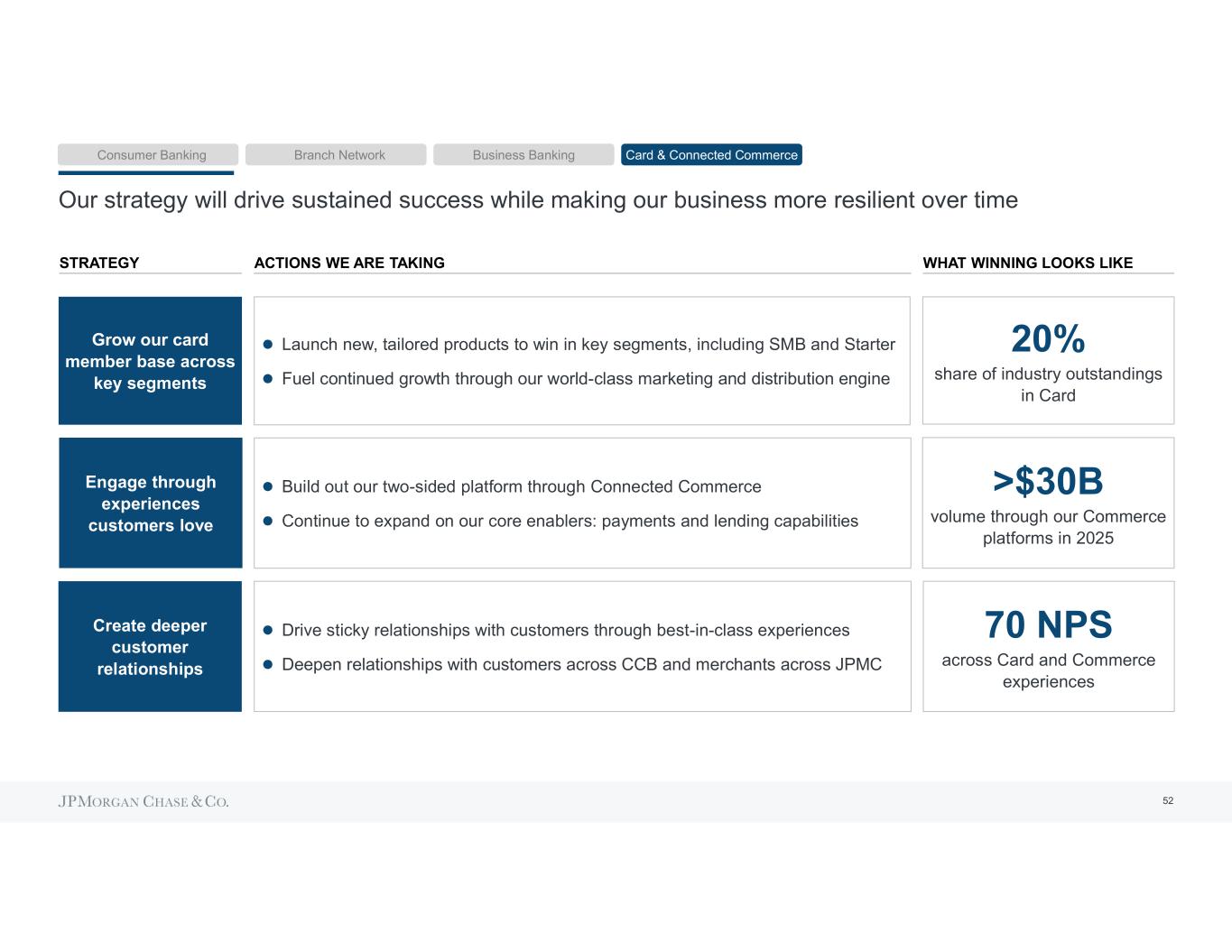

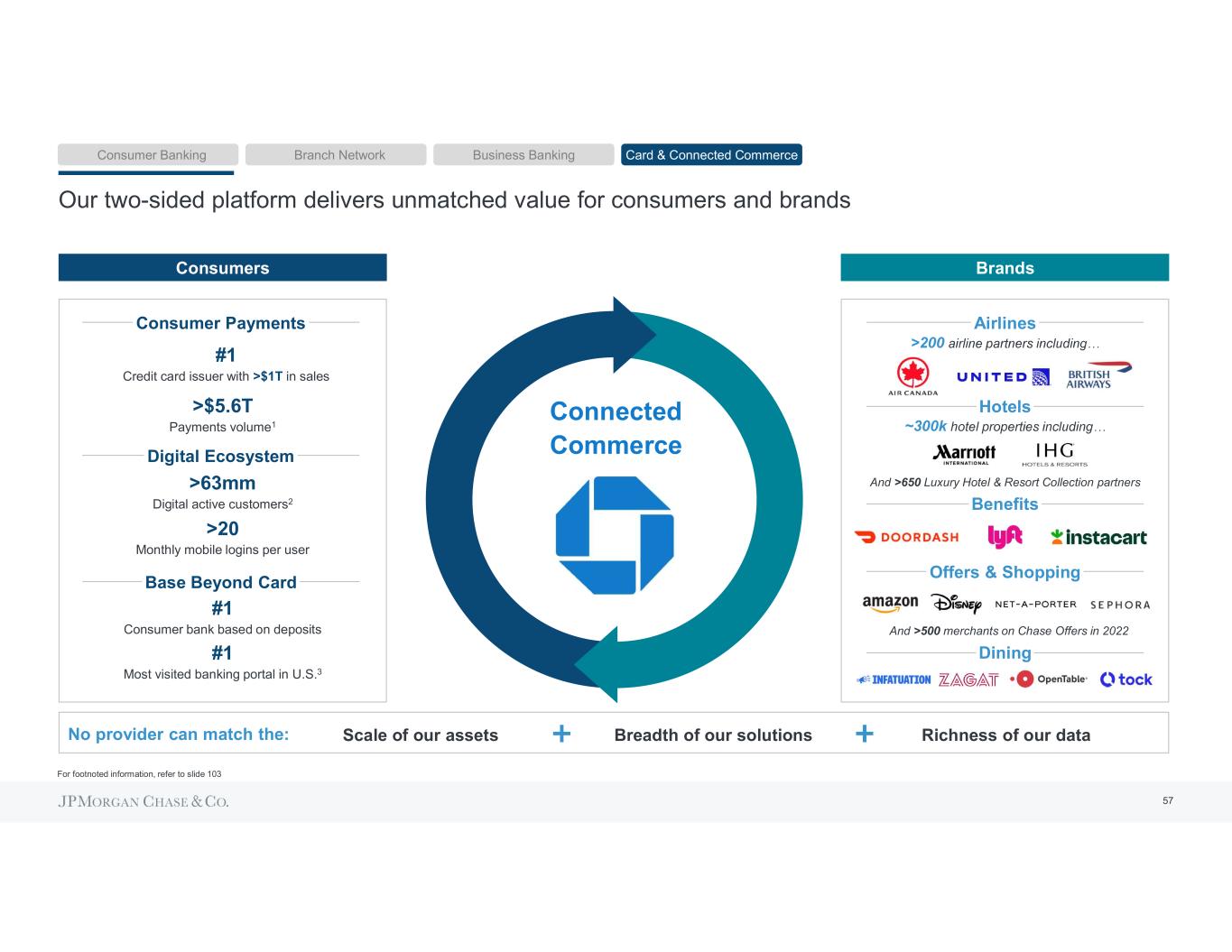

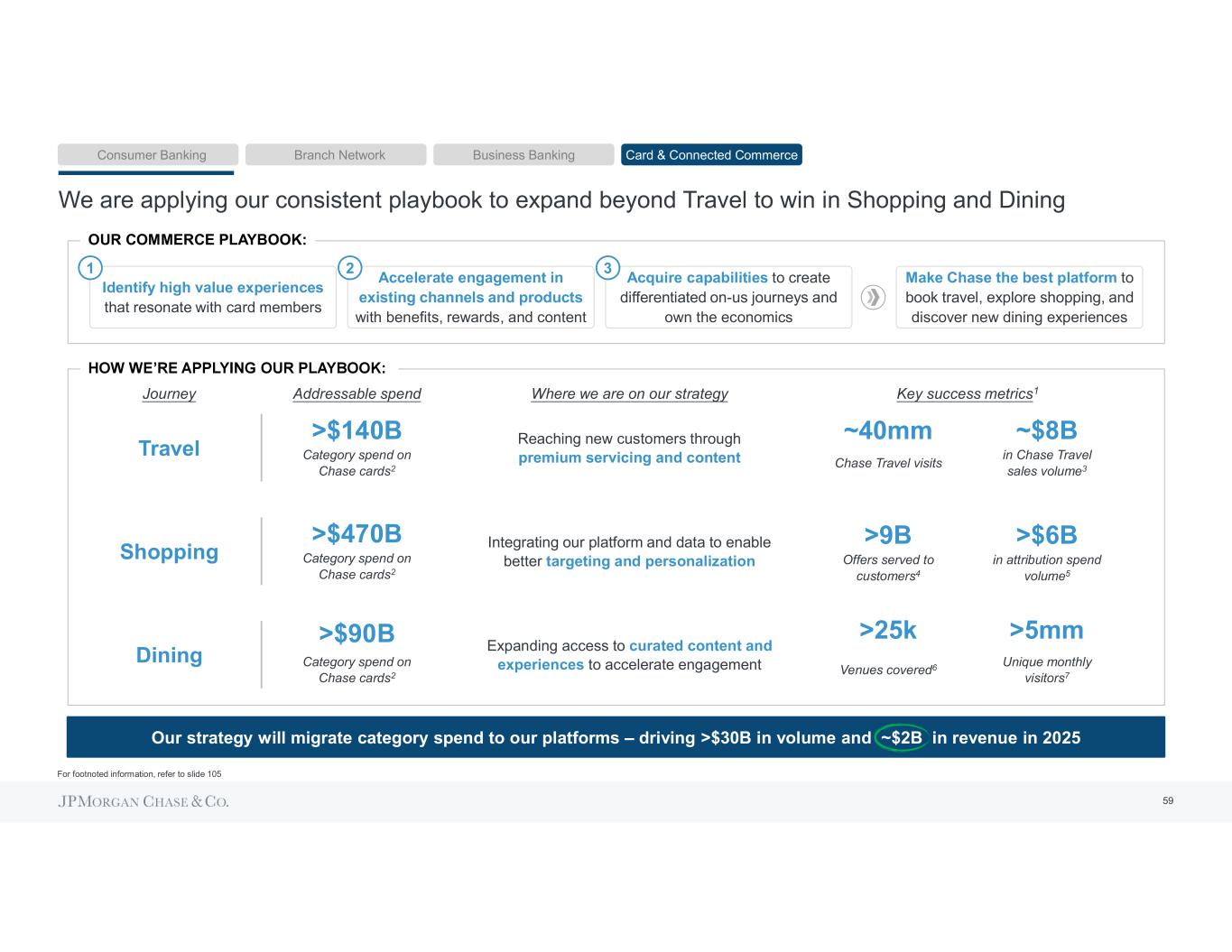

Our strategy will drive sustained success while making our business more resilient over time STRATEGY Create deeper customer relationships Grow our card member base across key segments Engage through experiences customers love WHAT WINNING LOOKS LIKE >$30B volume through our Commerce platforms in 2025 70 NPS across Card and Commerce experiences Drive sticky relationships with customers through best-in-class experiences Deepen relationships with customers across CCB and merchants across JPMC Launch new, tailored products to win in key segments, including SMB and Starter Fuel continued growth through our world-class marketing and distribution engine Build out our two-sided platform through Connected Commerce Continue to expand on our core enablers: payments and lending capabilities 20% share of industry outstandings in Card ACTIONS WE ARE TAKING Consumer Banking Branch Network Business Banking Card & Connected Commerce 52

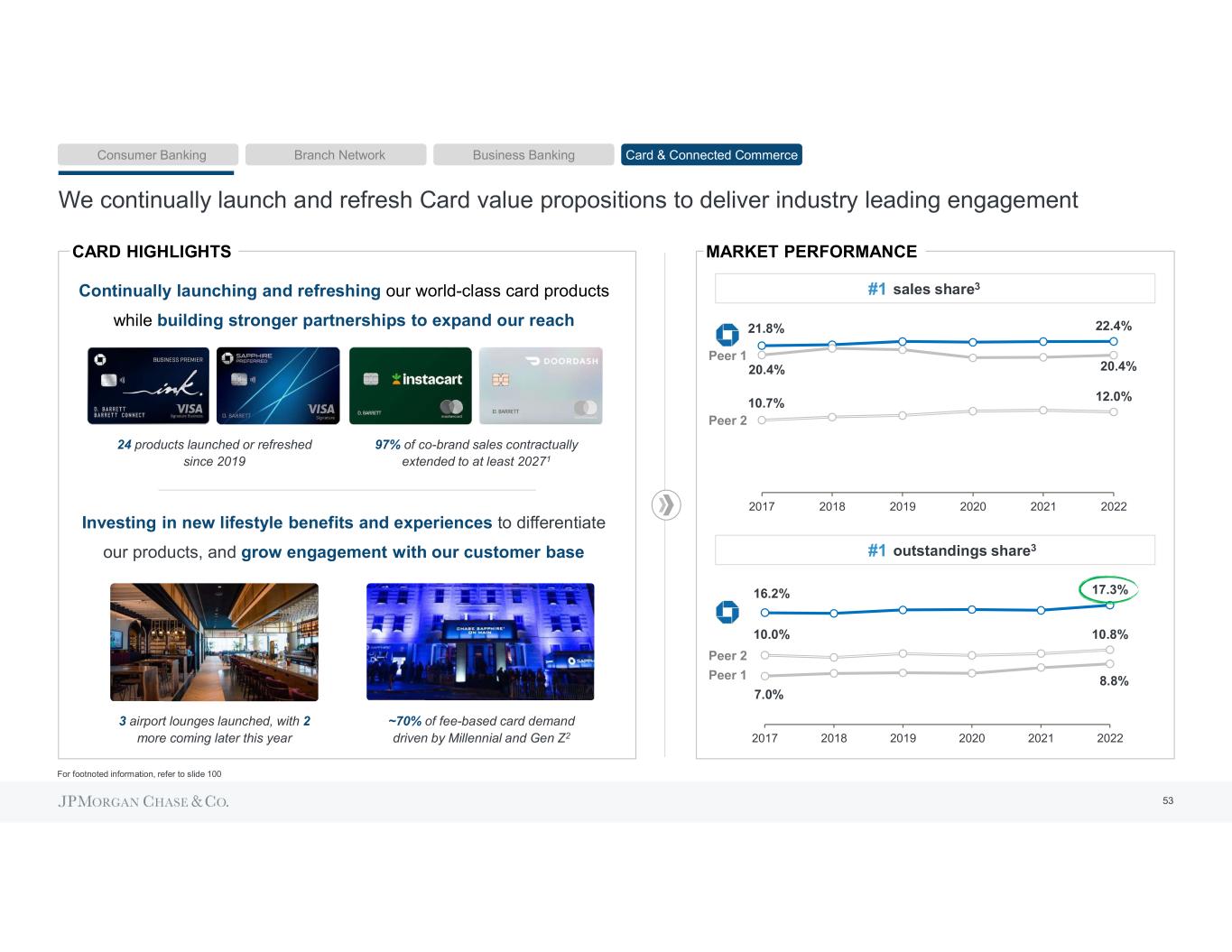

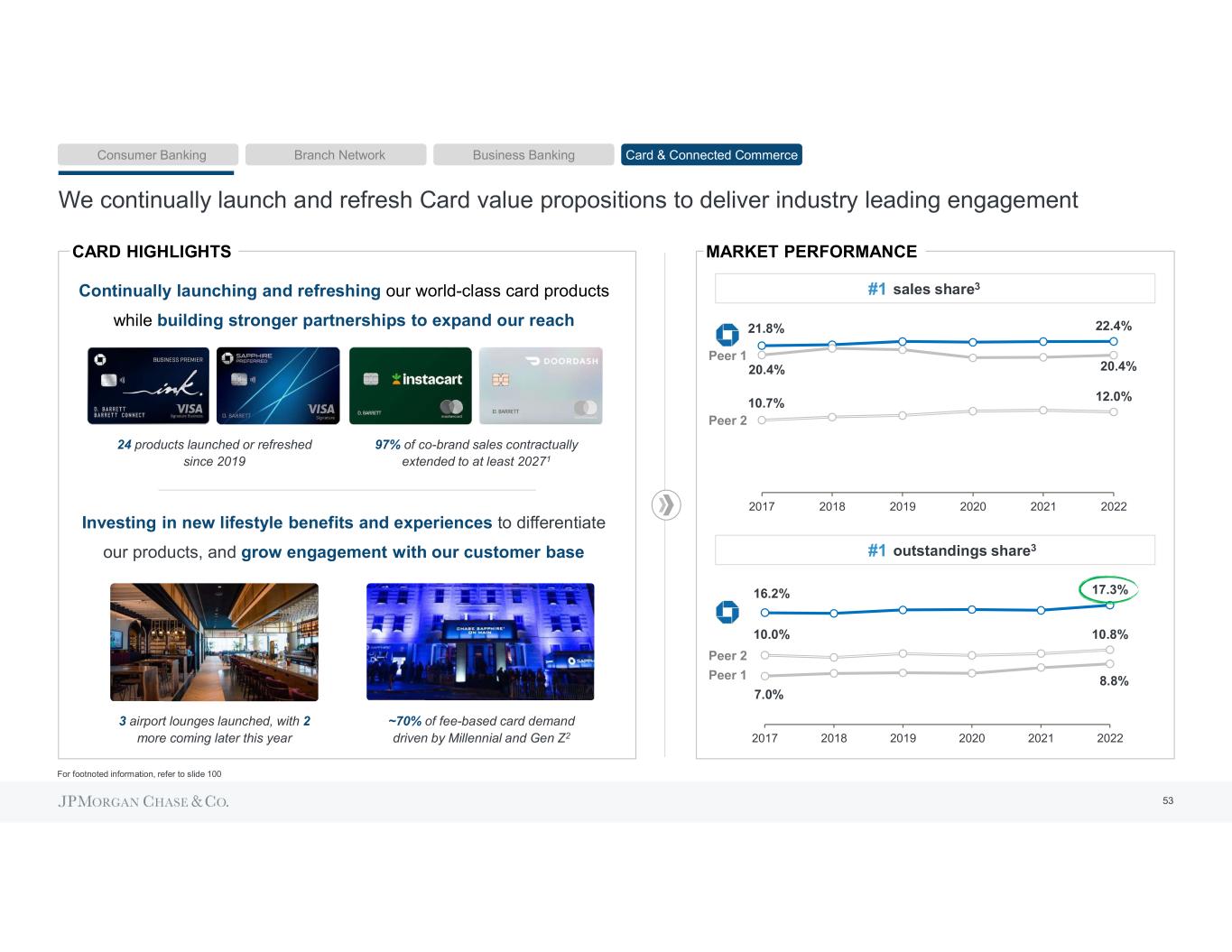

10.7% 12.0% 21.8% 22.4% 20.4% 20.4% 2017 2018 2019 2020 2021 2022 We continually launch and refresh Card value propositions to deliver industry leading engagement sales share3#1 Peer 1 Peer 2 10.0% 10.8% 16.2% 17.3% 7.0% 8.8% 2017 2018 2019 2020 2021 2022 outstandings share3#1 Peer 1 Peer 2 24 products launched or refreshed since 2019 97% of co-brand sales contractually extended to at least 20271 CARD HIGHLIGHTS Continually launching and refreshing our world-class card products while building stronger partnerships to expand our reach Investing in new lifestyle benefits and experiences to differentiate our products, and grow engagement with our customer base 3 airport lounges launched, with 2 more coming later this year ~70% of fee-based card demand driven by Millennial and Gen Z2 Consumer Banking Branch Network Business Banking Card & Connected Commerce MARKET PERFORMANCE 53 For footnoted information, refer to slide 100

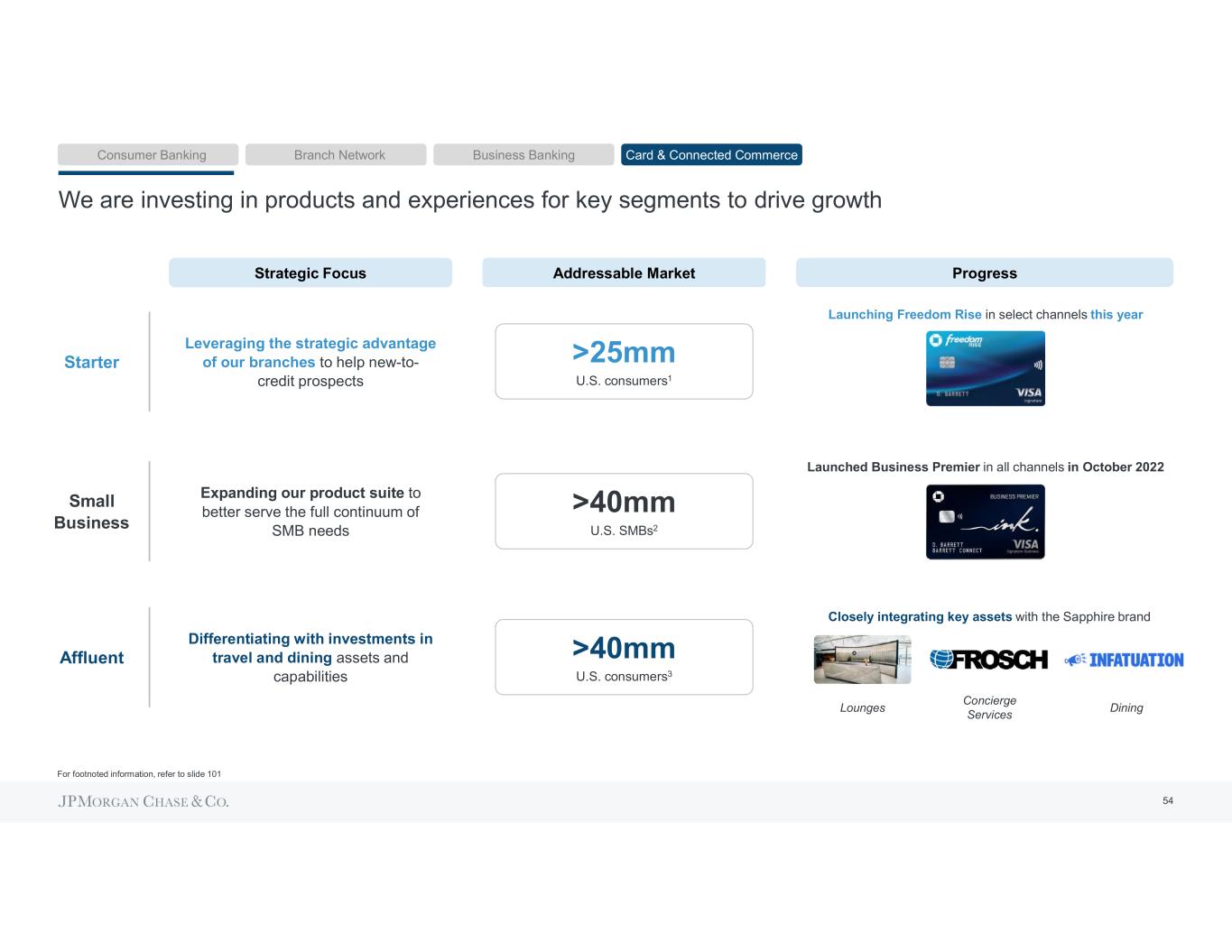

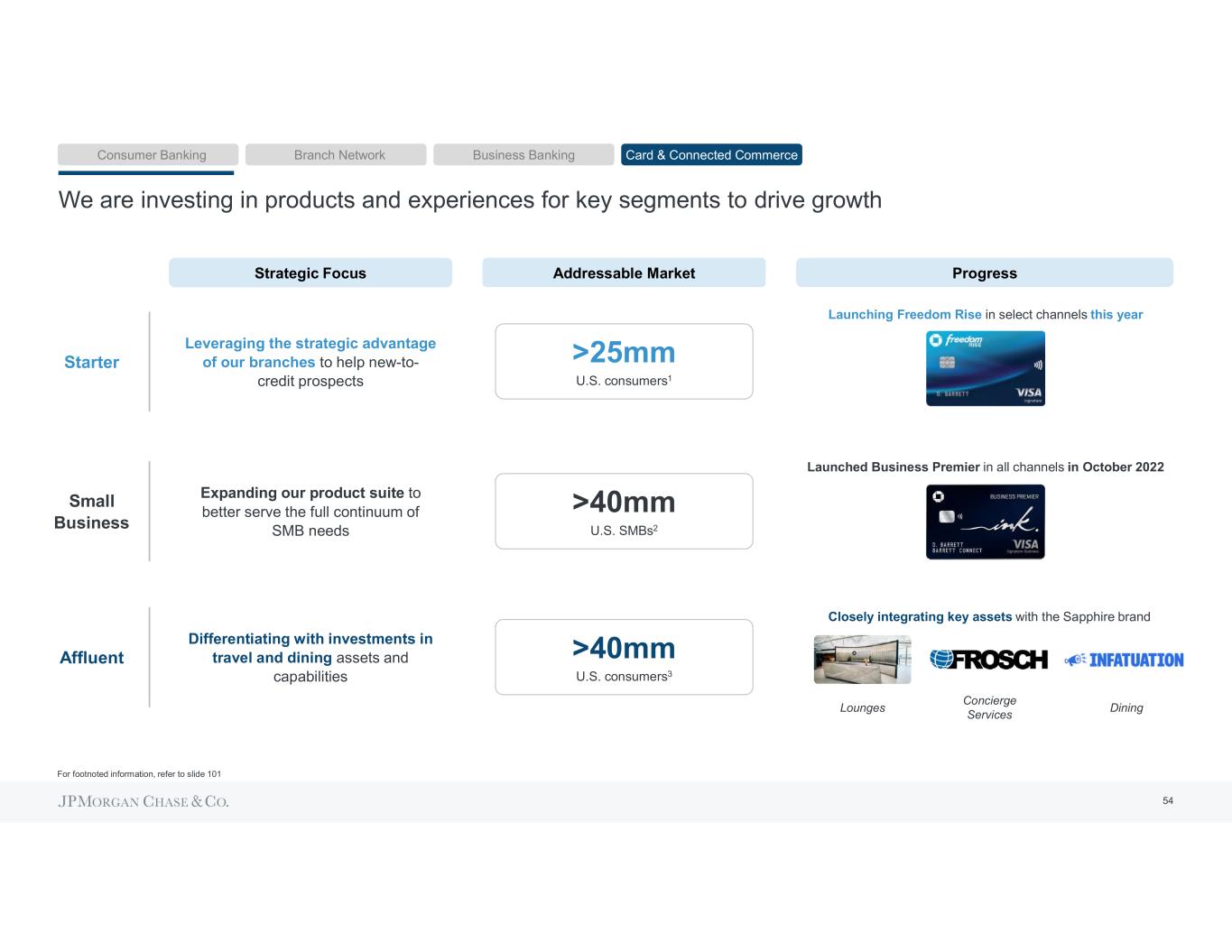

We are investing in products and experiences for key segments to drive growth Strategic Focus Progress Starter Launching Freedom Rise in select channels this year Leveraging the strategic advantage of our branches to help new-to- credit prospects Affluent Differentiating with investments in travel and dining assets and capabilities Closely integrating key assets with the Sapphire brand Small Business Expanding our product suite to better serve the full continuum of SMB needs Launched Business Premier in all channels in October 2022 Lounges Concierge Services Dining Addressable Market U.S. consumers1 >25mm U.S. SMBs2 >40mm U.S. consumers3 >40mm Consumer Banking Branch Network Business Banking Card & Connected Commerce 54 For footnoted information, refer to slide 101

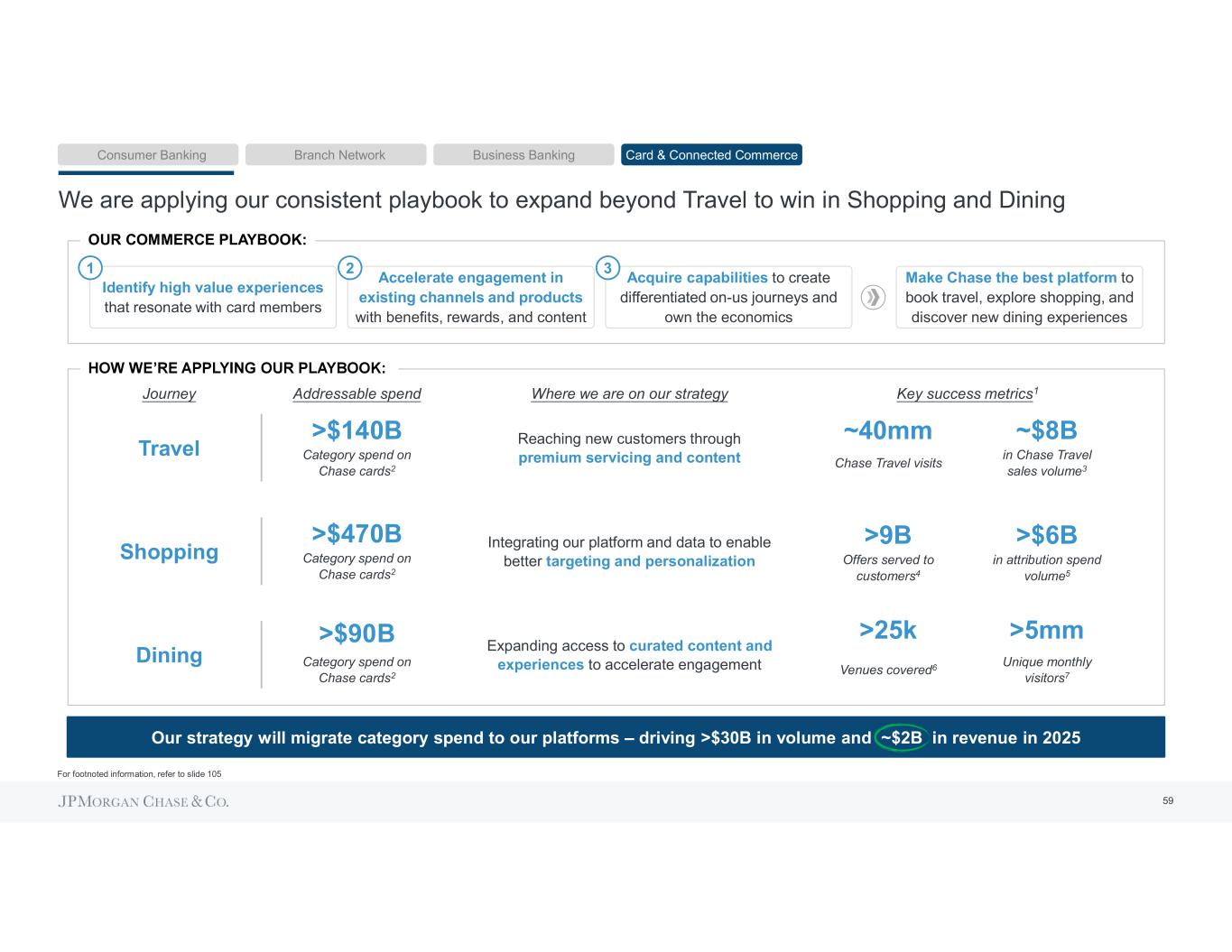

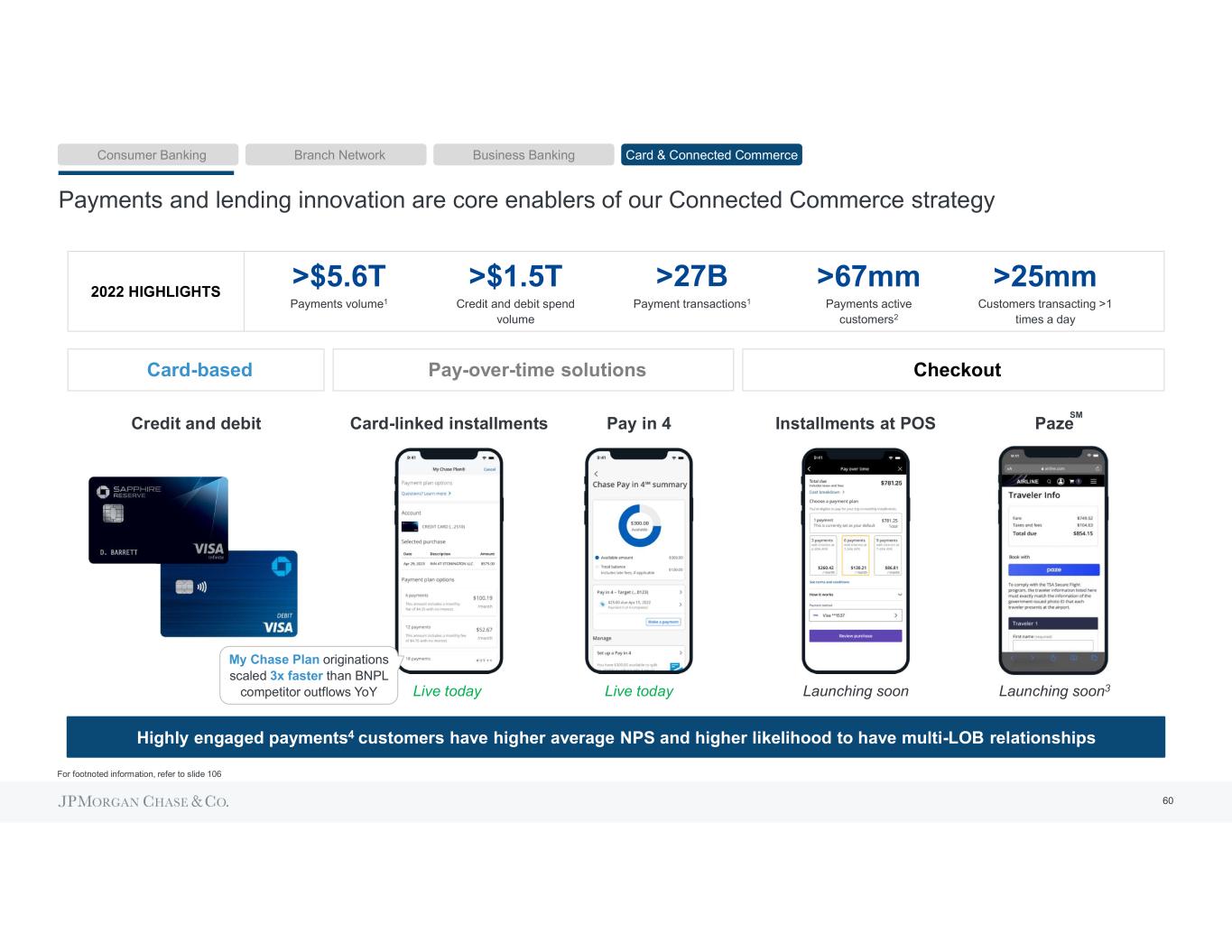

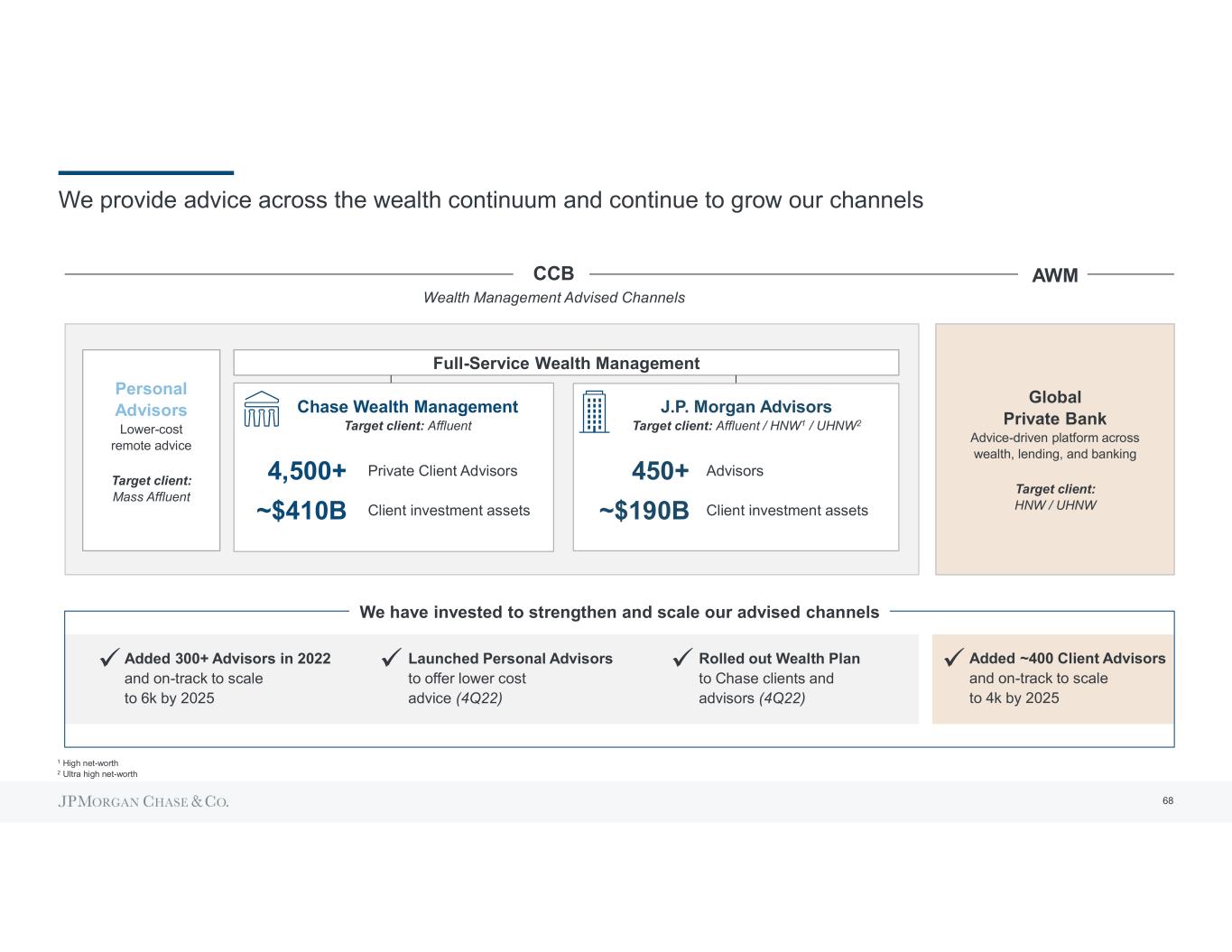

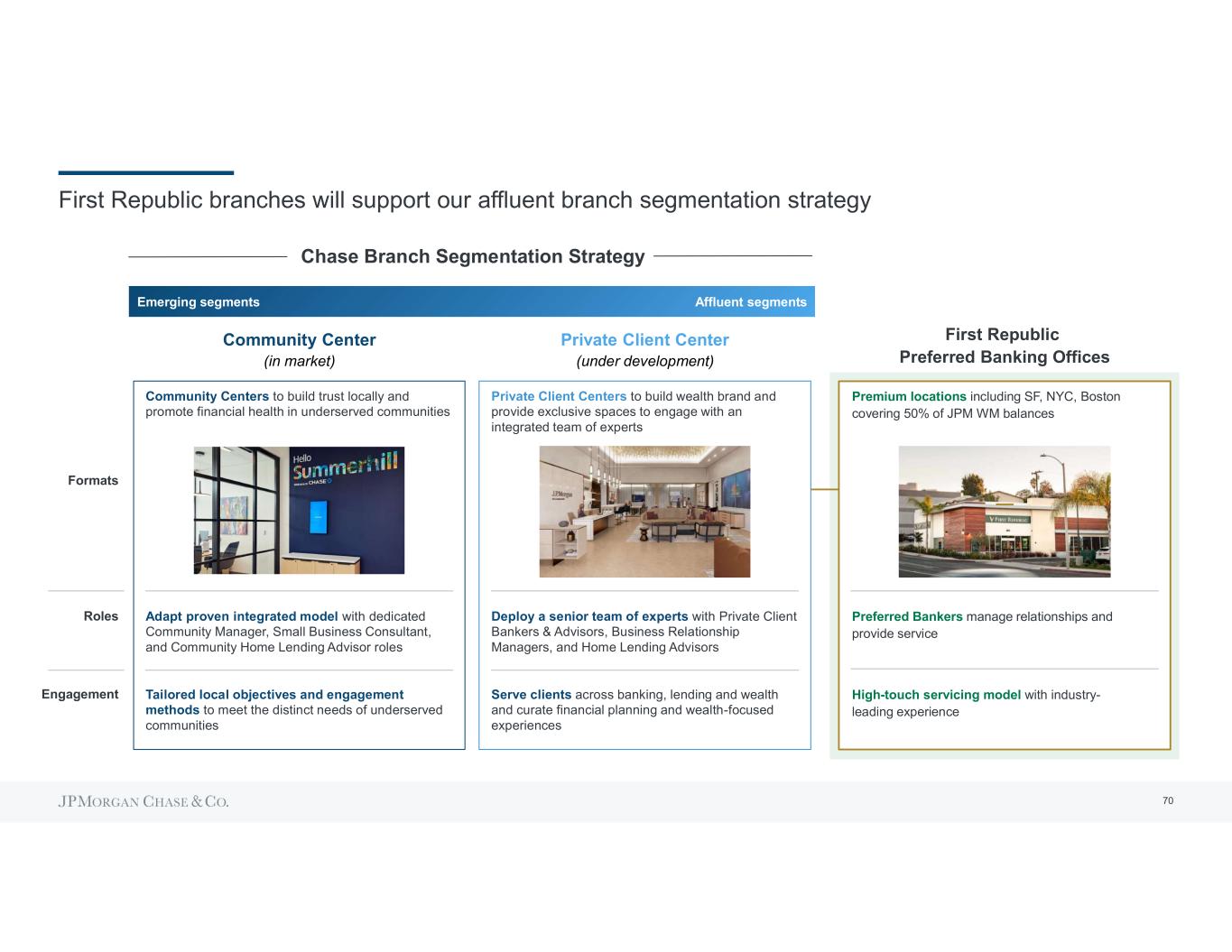

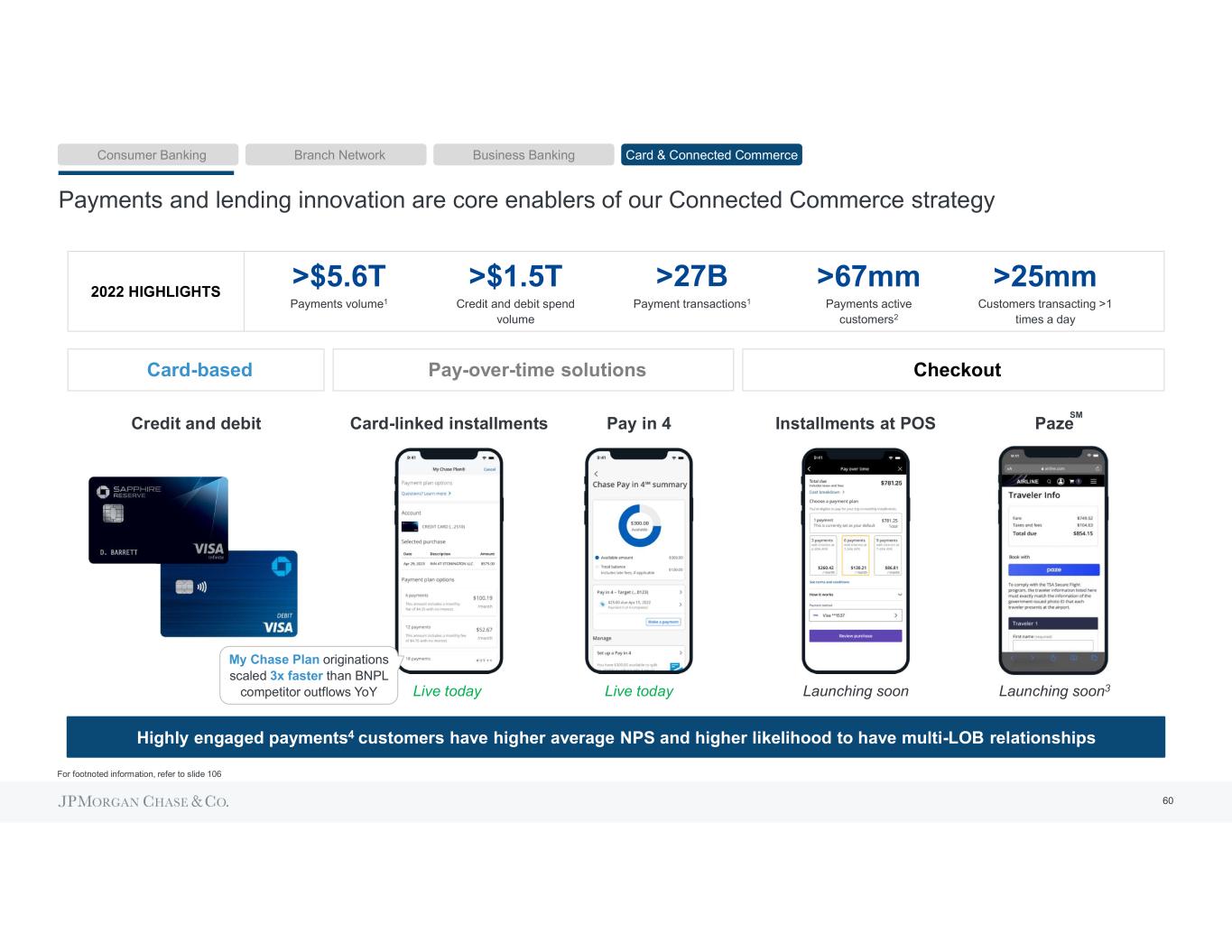

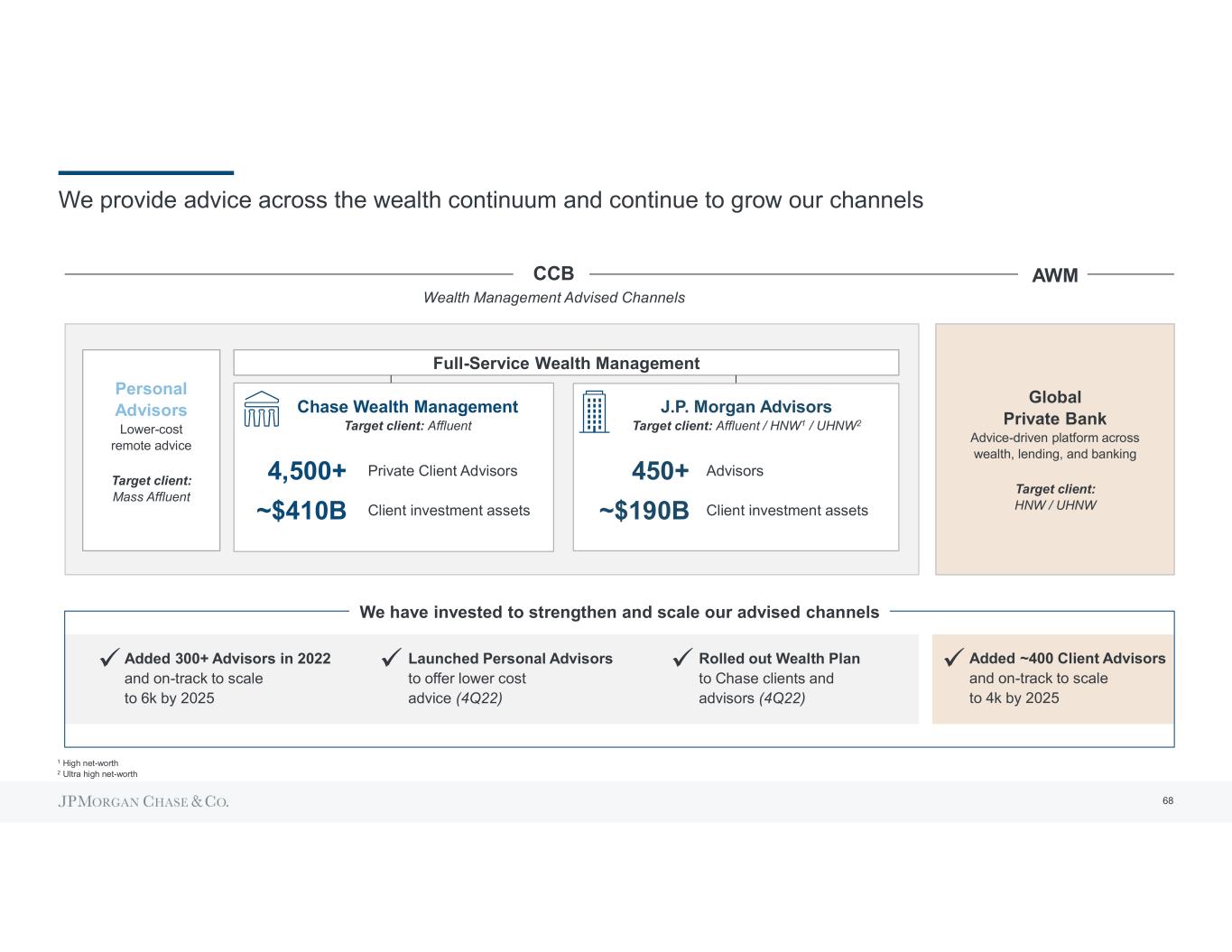

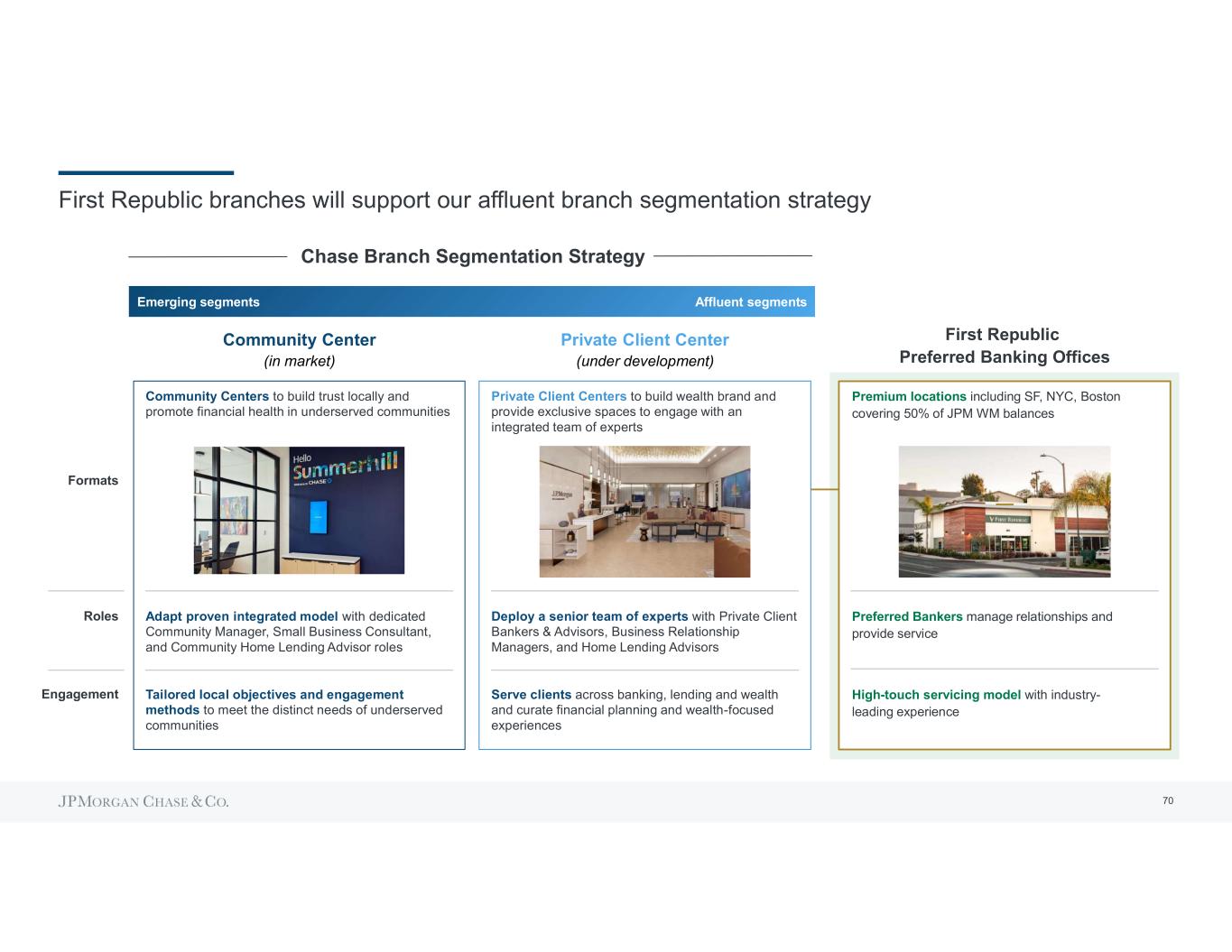

$3.1 $2.1 $3.8 $4.0 $4.3 $1.3 $1.1 $1.4 $1.7 $1.6 2019 2020 2021 2022 ID Outlook 2022 Actuals Product Benefits (incl. co-brand) Acquisition, Distribution & Media Our marketing engine fuels our scale and distribution CARD GROSS CASH MARKETING SPEND ($B)1 KEY DRIVERS AND PERFORMANCE METRICS $4.5 $5.9 Revenue Outlook from 2022 ID Revised Outlook >30%2 >50%2 New accounts 2022 vintage vs. 2019 New accounts 14% 23% Active accounts Outlook from 2022 ID 2022 Actuals 16% 21% Total portfolio 2022 vs. 2019 Sales volume 33% 40% Annual fee revenue 20% 28% $3.2 $5.2 $5.7 Our disciplined approach to marketing enables us to generate predictable returns Lifetime value >1.5x3 >1.7x3 Consumer Banking Branch Network Business Banking Card & Connected Commerce 55 For footnoted information, refer to slide 102