Exhibit 4.6

DESCRIPTION OF SECURITIES OF JPMORGAN CHASE & CO.

REGISTERED PURSUANT TO SECTION 12 OF THE

SECURITIES EXCHANGE ACT OF 1934

As of the filing date of the Annual Report on Form 10-K to which this Exhibit is attached (the “Form 10-K”), the following outstanding securities issued by JPMorgan Chase & Co. are registered pursuant to Section 12 of the Securities Exchange Act of 1934: (i) common stock; (ii) six series of preferred stock represented by depositary shares; (iii) JPMorgan Chase & Co.’s guarantee of the Alerian MLP Index ETNs due January 28, 2044 issued by JPMorgan Chase Financial Company LLC; and (iv) JPMorgan Chase & Co.’s guarantee of the Callable Fixed Rate Notes due June 10, 2032 issued by JPMorgan Chase Financial Company LLC. All references herein to “JPMorganChase,” “we” or “us” are to JPMorgan Chase & Co.

DESCRIPTION OF COMMON STOCK

The following summary is not complete. You should refer to the applicable provisions of our Restated Certificate of Incorporation and our By-laws, each of which are incorporated by reference as Exhibits to the Form 10-K, and to the Delaware General Corporation Law (“DGCL”), for a complete statement of the terms and rights of our common stock, par value $1.00 per share, which we refer to herein as common stock. We encourage you to read our Restated Certificate of Incorporation, which we refer to herein as our certificate of incorporation, By-laws and the relevant provisions of the DGCL for additional information.

Authorized Shares

We are authorized to issue up to 9,000,000,000 shares of common stock.

Dividends

Holders of common stock are entitled to receive dividends if, as and when declared by our board of directors out of funds legally available for payment, subject to the rights of holders of our preferred stock.

Voting Rights

Each holder of common stock is entitled to one vote per share. Subject to the rights, if any, of the holders of any series of preferred stock under its applicable certificate of designations and applicable law, all voting rights are vested in the holders of shares of our common stock. Holders of shares of our common stock have noncumulative voting rights, which means that the holders of more than 50% of the shares voting for the election of directors can elect 100% of the directors and the holders of the remaining shares will not be able to elect any directors.

Rights Upon Liquidation

In the event of our voluntary or involuntary liquidation, dissolution or winding-up, the holders of our common stock will be entitled to share equally in any of our assets available for distribution after we have paid in full all of our debts and after the holders of all series of our outstanding preferred stock have received their liquidation preferences in full.

Miscellaneous

The issued and outstanding shares of common stock are fully paid and nonassessable. Holders of shares of our common stock are not entitled to preemptive rights or to the benefit of any sinking funds. Our common stock is not convertible into shares of any other class of our capital stock. Computershare Inc. is the transfer agent, registrar and dividend disbursement agent for our common stock.

Listing

Our common stock is listed on the New York Stock Exchange (“NYSE”) under the trading symbol “JPM”.

DESCRIPTION OF LISTED PREFERRED STOCK

The following summary is not complete. You should refer to our certificate of incorporation and to the Certificate of Designations, Powers, Preferences and Rights relating to each series of Listed Preferred Stock (as defined below), which we refer to herein as a certificate of designations, for the complete terms of that series of preferred stock. Copies of our certificate of incorporation and the certificate of designations for each series of Listed Preferred Stock are incorporated by reference as Exhibits to the Form 10-K. We encourage you to read our certificate of incorporation and the relevant certificates of designations for additional information.

Authorized Shares

Under our certificate of incorporation, our board of directors is authorized, without further stockholder action, to issue up to 200,000,000 shares of preferred stock, $1 par value per share, which we refer herein to as preferred stock, in one or more series, and to determine the voting powers and the designations, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions of each series. We may amend our certificate of incorporation to increase or decrease the number of authorized shares of preferred stock in a manner permitted by our certificate of incorporation and the DGCL.

Outstanding Preferred Stock

As of the filing date of the Form 10-K, we have 11 series of preferred stock issued and outstanding. The shares of each series of our preferred stock are represented by depositary shares, with each depositary share representing a fractional interest in a share of preferred stock of the relevant series. Of the 11 series of our issued and outstanding preferred stock, depositary shares representing the following six series of preferred stock are registered pursuant to Section 12 of the Securities Exchange Act of 1934, with each depositary share representing a 1/400th interest in a share of preferred stock of the relevant series:

a.5.75% Non-Cumulative Preferred Stock, Series DD;

b.6.00% Non-Cumulative Preferred Stock, Series EE;

c.4.75 Non-Cumulative Preferred Stock, Series GG;

d.4.55% Non-Cumulative Preferred Stock, Series JJ;

e.4.625% Non-Cumulative Preferred Stock, Series LL; and

f.4.20% Non-Cumulative Preferred Stock, Series MM.

We refer to the above six series of preferred stock herein collectively as the “Listed Preferred Stock”.

The Listed Preferred Stock is fully paid and nonassessable.

The terms of the depositary shares are summarized below under “Description of Depositary Shares”.

Ranking

The Listed Preferred Stock ranks, as to payment of dividends and distribution of assets upon our liquidation, dissolution or winding-up, on a parity with any series of preferred stock ranking on a parity with the Listed Preferred Stock and senior to our common stock and to any series of preferred stock ranking junior to the Listed Preferred Stock. The Listed Preferred Stock is subordinate to our existing and future indebtedness.

Dividend Rights

Holders of the Listed Preferred Stock are entitled to receive, when, as and if declared by our board of directors or any duly authorized committee of our board, cash dividends at the rates and on the dates described below under “Specific Terms of Listed Preferred Stock”. We will pay each dividend to the holders of record as they appear on our stock register on record dates determined by our board of directors or a duly authorized committee of our board. Dividends on the Listed Preferred Stock are noncumulative. If a dividend is not declared on any series of Listed Preferred Stock, because the dividends are noncumulative, then the right of holders of that series to receive that dividend will be lost, and we will have no obligation to pay the dividend for that dividend period, whether or not dividends are declared for any future dividend period.

We may not declare or pay or set aside for payment full dividends on any series of preferred stock ranking, as to dividends, equally with or junior to a series of Listed Preferred Stock unless we have previously declared and paid or set aside for payment, or we contemporaneously declare and pay or set aside for payment, full dividends on that series of Listed Preferred Stock for the most recently completed dividend period. When dividends are not paid in full on a particular series of Listed Preferred Stock and any other series of preferred stock ranking on a parity as to dividends with that series, all dividends declared and paid upon the shares of that series of Listed Preferred Stock and any other series of preferred stock ranking on a parity as to dividends with the that series will be declared and paid pro rata. For purposes of calculating the pro rata allocation of partial dividend payments, we will allocate dividend payments based on the ratio between the then-current dividends due on shares of that Listed Preferred Stock and (i) in the case of any series of non-cumulative preferred stock ranking on a parity as to dividends with that Listed Preferred Stock, the aggregate of the current and unpaid dividends due on such series of preferred stock and (ii) in the case of any series of cumulative preferred stock ranking on a parity as to dividends with that Listed Preferred Stock, the aggregate of the current and accumulated and unpaid dividends due on such series of preferred stock.

In addition, unless full dividends on all outstanding shares of the Listed Preferred Stock have been declared and paid or a sum sufficient for the payment thereof set aside for such payment in respect of the applicable most recently completed dividend period, with respect to a particular series of Listed Preferred Stock:

a. no dividend (other than a dividend in common stock or in any other capital stock ranking junior to that Listed Preferred Stock as to dividends and upon liquidation, dissolution or winding-up) will be declared or paid or a sum sufficient for the payment thereof set aside for such payment or other distribution declared or made upon our common stock or upon any other capital stock ranking junior to that Listed Preferred Stock as to dividends or upon liquidation, dissolution or winding-up, and

b.no common stock or other capital stock ranking junior or equally with that Listed Preferred Stock as to dividends or upon liquidation, dissolution or winding-up will be redeemed, purchased or otherwise acquired for any consideration (or any moneys be paid to or made available for a sinking fund for the redemption of any shares of any such capital stock) by us, except:

i.by conversion into or exchange for capital stock ranking junior to that Listed Preferred Stock;

ii.as a result of reclassification into capital stock ranking junior to that Listed Preferred Stock;

iii.through the use of the proceeds of a substantially contemporaneous sale of shares of capital stock ranking junior to that Listed Preferred Stock or, in the case of capital stock ranking on a parity with that Listed Preferred Stock, through the use of the proceeds of a substantially contemporaneous sale of other shares of capital stock ranking on a parity with that Listed Preferred Stock;

iv.in the case of capital stock ranking on a parity with that Listed Preferred Stock, pursuant to pro rata offers to purchase all or a pro rata portion of the shares of that Listed Preferred Stock and such capital stock ranking on a parity with that Listed Preferred Stock;

v.in connection with the satisfaction of our obligations pursuant to any contract entered into in the ordinary course prior to the beginning of the most recently completed dividend period; or

vi.any purchase, redemption or other acquisition of capital stock ranking junior to that Listed Preferred Stock pursuant to any of our or our subsidiaries’ employee, consultant or director incentive or benefit plans or arrangements (including any employment, severance or consulting arrangements) adopted before or after the issuance of that Listed Preferred Stock).

However, the foregoing will not restrict our ability or the ability of any of our affiliates to engage in underwriting, stabilization, market-making or similar transactions in our capital stock in the ordinary course of business. Subject to the conditions described above, and not otherwise, dividends (payable in cash, capital stock, or otherwise), as may be determined by our board of directors or a duly authorized committee of our board, may be declared and paid on our common stock and any other capital stock ranking junior to or on a parity with the Listed Preferred Stock from time to time out of any assets legally available for such payment, and the holders of the Listed Preferred Stock will not be entitled to participate in those dividends.

As used herein, “junior to a series of Listed Preferred Stock” and like terms refer to our common stock and any other class or series of our capital stock over which the Listed Preferred Stock has preference or priority, either as to dividends or upon liquidation, dissolution or winding-up, or both, as the context may require; “parity preferred stock” and “on a parity with a series of Listed Preferred Stock” and like terms refer to any class or series of our capital stock that ranks on a parity with the shares of a particular series of Listed Preferred Stock, either as to dividends or upon liquidation, dissolution or winding-up, or both, as the context may require; and “senior to a series of Listed Preferred Stock” and like terms refer to any class or series of our capital stock that ranks senior to a particular series of Listed Preferred Stock, either as to dividends or upon liquidation, dissolution or winding-up, or both, as the context may require.

We will compute the amount of dividends payable by annualizing the applicable dividend rate and dividing by the number of dividend periods in a year, except that the amount of dividends payable for any period greater or less than a full dividend period, other than the initial dividend period, will be computed on the basis of a 360-day year consisting of twelve 30-day months and, for any period less than a full month, the actual number of days elapsed in the period. Dollar amounts resulting from that calculation will be rounded to the nearest cent, with one-half cent being rounded upward.

Rights Upon Liquidation

In the event of our voluntary or involuntary liquidation, dissolution or winding-up, holders of each series of Listed Preferred Stock will be entitled to receive and to be paid out of our assets legally available for distribution to our stockholders the amount of $10,000 per share, plus any declared and unpaid dividends, without accumulation of undeclared dividends, before we make any distribution of assets to the holders of our common stock or any other class or series of shares ranking junior to the Listed Preferred Stock of such series. After the payment to such holders of the full preferential amounts to which they are entitled, such holders will have no right or claim to any of our remaining assets.

If, upon our voluntary or involuntary liquidation, dissolution or winding-up, we fail to pay in full the amounts payable with respect to a particular series of Listed Preferred Stock, and any stock having the same rank as that series, the holders of that series and of that other stock will share ratably in any such distribution of our assets in proportion to the full respective distributions to which they are entitled. For any series of Listed Preferred Stock, neither the sale of all or substantially all of our property or business, nor our merger or consolidation into or with any other entity will be considered a liquidation, dissolution or winding-up, voluntary of or involuntary, of us.

Because we are a holding company, our rights and the rights of our creditors and our stockholders, including the holders of the Listed Preferred Stock, to participate in the assets of any of our subsidiaries upon that subsidiary’s liquidation, dissolution, winding-up or recapitalization may be subject to the prior claims of that subsidiary’s creditors, except to the extent that we are a creditor with recognized claims against the subsidiary.

Holders of the Listed Preferred Stock are subordinate to all of our indebtedness and to other non-equity claims on us and our assets, including in the event that we enter into a receivership, insolvency, liquidation or similar proceeding. In addition, holders of the Listed Preferred Stock may be fully subordinated to interests held by the U.S. government in the event that we enter into a receivership, insolvency, liquidation or similar proceeding.

Redemption

We may redeem each series of Listed Preferred Stock on the dates and at the redemption prices set forth below under “Specific Terms of Listed Preferred Stock”. In addition, we may redeem each series of Listed Preferred Stock in whole, but not in part, at a redemption price equal to $10,000 per share (equivalent to $25 per depositary share), plus any declared and unpaid dividends, following the occurrence of a capital treatment event. For these purposes, “capital treatment event” means the good faith determination by JPMorganChase that, as a result of any:

a.amendment to, or change or any announced prospective change in, the laws or regulations of the United States or any political subdivision of or in the United States that is enacted or becomes effective after the initial issuance of any shares of such series of Listed Preferred Stock;

b.proposed change in those laws or regulations that is announced or becomes effective after the initial issuance of any shares of such series of Listed Preferred Stock; or

c.official administrative decision or judicial decision or administrative action or other official pronouncement interpreting or applying those laws or regulations that is announced or becomes effective after the initial issuance of any shares of such series of Listed Preferred Stock,

there is more than an insubstantial risk that JPMorganChase will not be entitled to treat an amount equal to the full liquidation amount of all shares of such series of Listed Preferred Stock then outstanding as “additional Tier 1 capital” (or its equivalent) for purposes of the capital adequacy guidelines or regulations of the appropriate federal banking agency, as then in effect and applicable, for as long as any share of such series of Listed Preferred Stock is outstanding. Redemption of any Listed Preferred Stock may be subject to our receipt of any required approvals from the Federal Reserve Board or any other regulatory authority.

If we elect to redeem shares of a series of Listed Preferred Stock, we will provide notice by first class mail, postage prepaid, addressed to the holders of record of such shares to be redeemed. Such mailing will be at least 30 days and not more than 60 days before the date fixed for redemption. Any notice so mailed will be conclusively presumed to have been duly given, whether or not the holder receives such notice, but failure to duly give such notice by mail, or any defect in such notice or in the mailing thereof, to any holder of shares of the series designated for redemption will not affect the validity of the proceedings for the redemption of any other shares of that series. Each notice of redemption will state:

a.the redemption date;

b.the number of shares of the series of Listed Preferred Stock to be redeemed and, if fewer than all the shares held by such holder are to be redeemed, the number of such shares to be redeemed from such holder;

c.the redemption price;

d.the place or places where the certificates representing such shares are to be surrendered for payment of the redemption price; and

e.that dividends on the shares to be redeemed will cease to accrue on the redemption date.

Notwithstanding the foregoing, if the series of Listed Preferred Stock is held in book-entry form through The Depository Trust Company, or “DTC”, we may give such notice in any manner permitted or required by DTC. For each series of Listed Preferred Stock, neither the holders of a series nor the holders of the related depositary shares have the right to require redemption of such series of Listed Preferred Stock.

In the case of any redemption of only part of the shares a series of Listed Preferred Stock at the time outstanding, the shares of the series to be redeemed will be selected either pro rata from the holders of record of that series in proportion to the number of shares held by such holders or by lot. From and after the redemption date, dividends will cease to

accumulate on the shares of Listed Preferred Stock called for redemption up to the redemption date and all rights of the holders of those shares, except the right to receive the redemption price, will cease.

In the event that we fail to pay full dividends, including accumulated but unpaid dividends, if any, on any series of Listed Preferred Stock, we may not redeem that series in part and we may not purchase or acquire any shares of that series, except by a purchase or exchange offer made on the same terms to all holders of that series.

Preemptive and Conversion Rights

The Listed Preferred Stock is not subject to any preemptive rights and is not convertible into property or shares of any other class or series of our capital stock.

Depositary, Transfer Agent, and Registrar

Computershare Inc. is the depositary, transfer agent and registrar for each series of the Listed Preferred Stock and the related depositary shares.

Voting Rights

Except as indicated below or except as expressly required by applicable law, the holders of the Listed Preferred Stock are not entitled to vote. Each share of Listed Preferred Stock a series is entitled to one vote on matters on which holders of that series are entitled to vote. The voting power of each series of Listed Preferred Stock depends on the number of shares in that series, and not on the aggregate liquidation preference or initial offering price of the shares of that series.

If, at any time or times, the equivalent of an aggregate of six quarterly dividends, whether or not consecutive, for any series of Listed Preferred Stock has not been paid, the number of directors constituting our board of directors will be automatically increased by two and the holders of each outstanding series of Listed Preferred Stock with such voting rights, together with holders of such other shares of any other class or series of parity preferred stock outstanding at the time upon which like voting rights have been conferred and are exercisable, which we refer to as “voting parity stock,” voting together as a class, will be entitled to elect those additional two directors, which we refer to as “preferred directors,” at that annual meeting and at each subsequent annual meeting of stockholders until full dividends have been paid for at least four quarterly consecutive dividend periods. At that time such right will terminate, except as expressly provided in the applicable certificate of designations or by law, subject to revesting. Upon any termination of the right of the holders of the Listed Preferred Stock and voting parity stock as a class to vote for directors as provided above, the preferred directors will cease to be qualified as directors, the term of office of all preferred directors then in office will terminate immediately and the authorized number of directors will be reduced by the number of preferred directors elected. Any preferred director may be removed and replaced at any time, with cause as provided by law or without cause by the affirmative vote of the holders of shares of the Listed Preferred Stock, voting together as a class with the holders of shares of voting parity stock, to the extent the voting rights of such holders described above are then exercisable. Any vacancy created by removal with or without cause may be filled only as described in the preceding sentence. If the office of any preferred director becomes vacant for any reason other than removal, the remaining preferred director may choose a successor who will hold office for the unexpired term in respect of which such vacancy occurred.

So long as any shares of a particular series of Listed Preferred Stock remains outstanding, we will not, without the affirmative vote of the holders of at least 66 2/3% in voting power of that series and any voting parity stock, voting together as a class, authorize, create or issue any capital stock ranking senior to that series as to dividends or upon liquidation, dissolution or winding-up, or reclassify any authorized capital stock into any such shares of such capital stock or issue any obligation or security convertible into or evidencing the right to purchase any such shares of capital stock. So long as any shares of a particular series of Listed Preferred Stock remain outstanding, we will not, without the affirmative vote of the holders of at least 66 2/3% in voting power of that series, amend, alter or repeal any provision of the applicable certificate of designations or our certificate of incorporation, including by merger, consolidation or otherwise, so as to adversely affect the powers, preferences or special rights of that series.

Notwithstanding the foregoing, none of the following will be deemed to adversely affect the powers, preferences or special rights of any series of Listed Preferred Stock:

a.any increase in the amount of authorized common stock or authorized preferred stock, or any increase or decrease in the number of shares of any series of preferred stock, or the authorization, creation and issuance of other classes or series of capital stock, in each case ranking on a parity with or junior to that series of Listed Preferred Stock as to dividends or upon liquidation, dissolution or winding-up;

b.a merger or consolidation of JPMorganChase with or into another entity in which the shares of that series remain outstanding; and

c.a merger or consolidation of JPMorganChase with or into another entity in which the shares of the that series are converted into or exchanged for preference securities of the surviving entity or any entity, directly or indirectly,

controlling such surviving entity and such new preference securities have powers, preferences and special rights that are not materially less favorable than that series;

provided that if the amendment would adversely affect such series but not any other series of preferred stock outstanding, then the amendment will only need to be approved by holders of at least two-thirds of the shares of the series of Listed Preferred Stock adversely affected.

In exercising the voting rights described above or when otherwise granted voting rights by operation of law or by us, each share of Listed Preferred Stock with respect to a series will be entitled to one vote (equivalent to 1/400th of a vote per relevant depositary share).

If we redeem or call for redemption all outstanding shares of a series of Listed Preferred Stock and irrevocably deposit in trust sufficient funds to effect such redemption, at or prior to the time when the act with respect to which such vote would otherwise be required or upon which the holders of such series will be entitled to vote will be effected, the voting provisions described above will not apply.

Our board of directors may also from time to time, without notice to or consent of holders of a series of Listed Preferred Stock, issue additional shares of such series. Delaware law provides that the holders of preferred stock will have the right to vote separately as a class on any amendment to our certificate of incorporation (including any certificate of designations) that would increase or decrease the aggregate number of authorized shares of such class, increase or decrease the par value of such class or adversely affect the powers, preferences and special rights of the shares of preferred stock. Notwithstanding the foregoing, as permitted by law, our certificate of incorporation provides that any increase or decrease in our authorized capital stock may be adopted by the affirmative vote of holders of capital stock representing not less than a majority of the voting power represented by the outstanding shares of our capital stock entitled to vote. If any proposed amendment would alter or change the powers, preferences or special rights of one or more series of preferred stock so as to affect them adversely, but would not so affect the entire class of preferred stock, only the shares of the series so affected will be considered a separate class for purposes of this vote on the amendment. This right is in addition to any voting rights that may be provided for in our certificate of incorporation (including any certificate of designations).

Under regulations adopted by the Federal Reserve Board, if the holders of any series of our preferred stock become entitled to vote for the election of directors because dividends on that series are in arrears, that series may then be deemed a “class of voting securities.” In such a case, a holder of 25% or more of the series, or a holder of 5% or more if that holder would also be considered to exercise a “controlling influence” over JPMorganChase, may then be subject to regulation as a bank holding company in accordance with the Bank Holding Company Act. In addition, (1) any other bank holding company may be required to obtain the prior approval of the Federal Reserve Board to acquire or retain 5% or more of that series, and (2) any person other than a bank holding company may be required to provide notice to the Federal Reserve Board prior to acquiring or retaining 10% or more of that series.

Description of Depositary Shares

The following summary of the terms of the depositary shares representing each series of the Listed Preferred Stock is not complete. You should refer to each of the deposit agreements among us, the depositary, and the holders from time to time of the depositary receipts evidencing the depositary shares relating to each series of the Listed Preferred Stock for the complete terms of those depositary shares. Each of those deposit agreements has been filed as an exhibit to a Current Report on Form 8-K filed in connection with the issuance of the depositary shares representing each series of the Listed Preferred Stock.

General. Each depositary share represents a 1/400th interest in a share of the relevant series of Listed Preferred Stock, and is evidenced by depositary receipts. In connection with the issuance of each series of Listed Preferred Stock, we deposited shares of that series of Listed Preferred Stock with Computershare Inc., as depositary under the deposit agreement relating to that series of Listed Preferred Stock. Subject to the terms of each deposit agreement, the depositary shares are entitled to all the powers, preferences and special rights of the relevant series of Listed Preferred Stock, as applicable, in proportion to the applicable fraction of a share of Listed Preferred Stock those depositary shares represent.

Dividends and Other Distributions. Each dividend payable on a depositary share will be in an amount equal to 1/400th of the dividend declared and payable on the related share of the Listed Preferred Stock.

The depositary will distribute all dividends and other cash distributions received on the relevant series of Listed Preferred Stock to the holders of record of the related depositary receipts in proportion to the number of depositary shares held by each holder. In the event of a distribution other than in cash, the depositary will distribute property received by it to the holders of record of the depositary receipts as nearly as practicable in proportion to the number of depositary shares held by each holder, unless the depositary determines that this distribution is not feasible, in which case the depositary may,

with our approval, adopt a method of distribution that it deems practicable, including the sale of the property and distribution of the net proceeds of that sale to the holders of the depositary receipts.

Record dates for the payment of dividends and other matters relating to the depositary shares will be the same as the corresponding record dates for the related shares of Listed Preferred Stock.

The amount paid as dividends or otherwise distributable by the depositary with respect to the depositary shares or the underlying Listed Preferred Stock will be reduced by any amounts required to be withheld by us or the depositary on account of taxes or other governmental charges.

Redemption of Depositary Shares. If we redeem a series of Listed Preferred Stock, in whole or from time to time in part, the corresponding depositary shares also will be redeemed with the proceeds received by the depositary from the redemption of the Listed Preferred Stock held by the depositary. The redemption price per depositary share will be 1/400th of the redemption price per share payable with respect to the Listed Preferred Stock, plus any declared and unpaid dividends, without accumulation of undeclared dividends.

If we redeem shares of a series of Listed Preferred Stock held by the depositary, the depositary will redeem, as of the same redemption date, the number of depositary shares representing those shares of the Listed Preferred Stock so redeemed. If we redeem less than all of the outstanding depositary shares, the depositary will select pro rata or by lot those depositary shares to be redeemed. The depositary will mail notice of redemption to record holders of the depositary receipts not less than 30 and not more than 60 days prior to the date fixed for redemption of the Listed Preferred Stock and the related depositary shares.

The redemption of depositary shares that are held in book-entry form through DTC will be effected in accordance with the applicable procedures of DTC.

Voting the Listed Preferred Stock. Because each depositary share represents a 1/400th interest in a share of Listed Preferred Stock, holders of depositary receipts will be entitled to 1/400th of a vote per depositary share under those limited circumstances in which holders of the Listed Preferred Stock are entitled to a vote.

When the depositary receives notice of any meeting at which the holders of a series of Listed Preferred Stock are entitled to vote, the depositary will mail the information contained in the notice to the record holders of the depositary shares relating to that Listed Preferred Stock. Each record holder of the depositary shares on the record date, which will be the same date as the record date for the applicable Listed Preferred Stock, may instruct the depositary to vote the amount of the Listed Preferred Stock represented by the holder’s depositary shares. To the extent practicable, the depositary will vote the amount of the Listed Preferred Stock represented by depositary shares in accordance with the instructions it receives. We will agree to take all actions that the depositary determines are necessary to enable the depositary to vote as instructed. If the depositary does not receive specific instructions from the holders of any depositary shares representing the Listed Preferred Stock, it will abstain from voting with respect to such shares.

Withdrawal of Listed Preferred Stock. Underlying shares of Listed Preferred Stock may be withdrawn from the depositary arrangement upon surrender of depositary receipts at the depositary’s office and upon payment of the taxes, charges and fees provided for in the deposit agreement. Subject to the terms of the relevant deposit agreement, the holder of depositary receipts will receive the appropriate number of shares of Listed Preferred Stock represented by such depositary shares. Only whole shares of Listed Preferred Stock may be withdrawn; if a holder holds an amount other than a whole multiple of 400 depositary shares, the depositary will deliver along with the withdrawn shares of Listed Preferred Stock a new depositary receipt evidencing the excess number of depositary shares. Holders of withdrawn shares of Listed Preferred Stock will not be entitled to redeposit such shares or to receive depositary shares.

Form and Notices. Each series of Listed Preferred Stock was issued in registered form to the depositary, and the depositary shares representing that Listed Preferred Stock were issued in book-entry only form through DTC. The depositary will forward to the holders of depositary shares all reports, notices, and communications from us that are delivered to the depositary and that we are required to furnish to the holders of the Listed Preferred Stock.

Amendment and Termination of the Deposit Agreement. We and the depositary may amend any form of depositary receipt evidencing depositary shares and any provision of any deposit agreement at any time regarding any depositary shares. However, any amendment that materially and adversely alters the rights of the holders of depositary shares representing a particular series of Listed Preferred Stock or would be materially and adversely inconsistent with the rights granted to holders of that underlying Listed Preferred Stock pursuant to our certificate of incorporation will not be effective unless the amendment has been approved by the holders of at least a majority of the related depositary shares then outstanding. The deposit agreement relating to the depositary shares representing a particular series of Listed Preferred Stock may be terminated by us or by the depositary only if:

a.all such outstanding depositary shares have been redeemed; or

b.there has been a final distribution of the relevant underlying Listed Preferred Stock in connection with our liquidation, dissolution or winding up and the preferred stock has been distributed to the holders of depositary receipts.

Charges of Depositary. We will pay all transfer and other taxes and governmental charges arising solely from the existence of the depositary arrangements regarding any depositary shares. We also pay charges of the depositary in connection with the initial deposit of each series of Listed Preferred Stock and any redemption of the Listed Preferred Stock. Holders of depositary receipts will pay transfer and other taxes and governmental charges and other charges with respect to their depositary receipts as expressly provided in the deposit agreement.

Resignation and Removal of Depositary. With respect to the depositary shares representing each series of Listed Preferred Stock, the depositary may resign at any time by delivering a notice to us of its election to do so. We may remove the depositary at any time. Any such resignation or removal will take effect upon the appointment of a successor depositary and its acceptance of its appointment. We must appoint a successor depositary within 60 days after delivery of the notice of resignation or removal.

Miscellaneous. The depositary will forward to holders of applicable depositary receipts all reports and communications from us that we deliver to the depositary and that we are required to furnish to the holders of the relevant Listed Preferred Stock.

Neither we nor the depositary will be liable if either of us is prevented or delayed by law or any circumstance beyond our control in performing our respective obligations under any deposit agreement. Our obligations and those of the depositary will be limited to performing in good faith our respective duties under any deposit agreement. Neither we nor the depositary will be obligated to prosecute or defend any legal proceeding relating to any depositary shares or Listed Preferred Stock unless satisfactory indemnity is furnished. We and the depositary may rely upon written advice of counsel or accountants, or upon information provided by persons presenting preferred stock for deposit, holders of depositary receipts or other persons we believe to be competent, and on documents we believe to be genuine.

Specific Terms of Listed Preferred Stock

5.75% Non-Cumulative Preferred Stock, Series DD

On September 21, 2018, we issued an aggregate of 169,625 shares of 5.75% Non-Cumulative Preferred Stock, Series DD, $1 par value, with a liquidation preference of $10,000 per share (the “Series DD Preferred Stock”). Shares of the Series DD Preferred Stock are represented by depositary shares, each representing a 1/400th interest in a share of preferred stock of the series.

Dividends. Dividends on the Series DD Preferred Stock are payable when, as, and if declared by our board of directors or a duly authorized committee of our board, at a rate of 5.75% per annum, payable quarterly in arrears, on March 1, June 1, September 1 and December 1 of each year, beginning on December 1, 2018. Dividends on the Series DD Preferred Stock are neither mandatory nor cumulative.

Redemption. The Series DD Preferred Stock may be redeemed on any dividend payment date on or after December 1, 2023, in whole or from time to time in part, at a redemption price equal to $10,000 per share (equivalent to $25 per depositary share), plus any declared and unpaid dividends. We may also redeem the Series DD Preferred Stock following the occurrence of a “capital treatment event,” as described above.

Listing. The depositary shares representing the Series DD Preferred Stock are listed on the NYSE under the trading symbol “JPM PR D”.

6.00% Non-Cumulative Preferred Stock, Series EE

On January 24, 2019, we issued an aggregate of 185,000 shares of 6.00% Non-Cumulative Preferred Stock, Series EE, $1 par value, with a liquidation preference of $10,000 per share (the “Series EE Preferred Stock”). Shares of the Series EE Preferred Stock are represented by depositary shares, each representing a 1/400th interest in a share of preferred stock of the series.

Dividends. Dividends on the Series EE Preferred Stock are payable when, as, and if declared by our board of directors or a duly authorized committee of our board, at a rate of 6.00% per annum, payable quarterly in arrears, on March 1, June 1, September 1 and December 1 of each year, beginning on June 1, 2019. Dividends on the Series EE Preferred Stock are neither mandatory nor cumulative.

Redemption. The Series EE Preferred Stock may be redeemed on any dividend payment date on or after March 1, 2024, in whole or from time to time in part, at a redemption price equal to $10,000 per share (equivalent to $25 per depositary share), plus any declared and unpaid dividends. We may also redeem the Series EE Preferred Stock following the occurrence of a “capital treatment event,” as described above.

Listing. The depositary shares representing the Series EE Preferred Stock are listed on the NYSE under the trading symbol “JPM PR C”.

4.75% Non-Cumulative Preferred Stock, Series GG

On November 7, 2019, we issued an aggregate of 90,000 shares of 4.75% Non-Cumulative Preferred Stock, Series GG, $1 par value, with a liquidation preference of $10,000 per share (the “Series GG Preferred Stock”). Shares of the Series GG Preferred Stock are represented by depositary shares, each representing a 1/400th interest in a share of preferred stock of the series.

Dividends. Dividends on the Series GG Preferred Stock are payable when, as, and if declared by our board of directors or a duly authorized committee of our board, at a rate of 4.75% per annum, payable quarterly in arrears, on March 1, June 1, September 1 and December 1 of each year, beginning on March 1, 2020. Dividends on the Series GG Preferred Stock are neither mandatory nor cumulative.

Redemption. The Series GG Preferred Stock may be redeemed on any dividend payment date on or after December 1, 2024, in whole or from time to time in part, at a redemption price equal to $10,000 per share (equivalent to $25 per depositary share), plus any declared and unpaid dividends. We may also redeem the Series GG Preferred Stock following the occurrence of a “capital treatment event,” as described above.

Listing. The depositary shares representing the Series GG Preferred Stock are listed on the NYSE under the trading symbol “JPM PR J”.

4.55% Non-Cumulative Preferred Stock, Series JJ

On March 17, 2021, we issued an aggregate of 150,000 shares of 4.55% Non-Cumulative Preferred Stock, Series JJ, $1 par value, with a liquidation preference of $10,000 per share (the “Series JJ Preferred Stock”). Shares of the Series JJ Preferred Stock are represented by depositary shares, each representing a 1/400th interest in a share of preferred stock of the series.

Dividends. Dividends on the Series JJ Preferred Stock are payable when, as, and if declared by our board of directors or a duly authorized committee of our board, at a rate of 4.55% per annum, payable quarterly in arrears, on March 1, June 1, September 1 and December 1 of each year, beginning on June 1, 2021. Dividends on the Series JJ Preferred Stock are neither mandatory nor cumulative.

Redemption. The Series JJ Preferred Stock may be redeemed on any dividend payment date on or after June 1, 2026, in whole at any time or from time to time in part, at a redemption price equal to $10,000 per share (equivalent to $25 per depositary share), plus any declared and unpaid dividends. We may also redeem the Series JJ Preferred Stock following the occurrence of a “capital treatment event,” as described above.

Listing. The depositary shares representing the Series JJ Preferred Stock are listed on the NYSE under the trading symbol “JPM PR K”.

4.625% Non-Cumulative Preferred Stock, Series LL

On May 20, 2021, we issued an aggregate of 185,000 shares of 4.625% Non-Cumulative Preferred Stock, Series LL, $1 par value, with a liquidation preference of $10,000 per share (the “Series LL Preferred Stock”). Shares of the Series LL Preferred Stock are represented by depositary shares, each representing a 1/400th interest in a share of preferred stock of the series.

Dividends. Dividends on the Series LL Preferred Stock are payable when, as, and if declared by our board of directors or a duly authorized committee of our board, at a rate of 4.625% per annum, payable quarterly in arrears, on March 1, June 1, September 1 and December 1 of each year, beginning on September 1, 2021. Dividends on the Series LL Preferred Stock are neither mandatory nor cumulative.

Redemption. The Series LL Preferred Stock may be redeemed on any dividend payment date on or after June 1, 2026, in whole at any time or from time to time in part, at a redemption price equal to $10,000 per share (equivalent to $25 per depositary share), plus any declared and unpaid dividends. We may also redeem the Series LL Preferred Stock following the occurrence of a “capital treatment event,” as described above.

Listing. The depositary shares representing the Series LL Preferred Stock are listed on the NYSE under the trading symbol “JPM PR L”.

4.20% Non-Cumulative Preferred Stock, Series MM

On July 29, 2021, we issued an aggregate of 200,000 shares of 4.20% Non-Cumulative Preferred Stock, Series MM, $1 par value, with a liquidation preference of $10,000 per share (the “Series MM Preferred Stock”). Shares of the Series MM

Preferred Stock are represented by depositary shares, each representing a 1/400th interest in a share of preferred stock of the series.

Dividends. Dividends on the Series MM Preferred Stock are payable when, as, and if declared by our board of directors or a duly authorized committee of our board, at a rate of 4.20% per annum, payable quarterly in arrears, on March 1, June 1, September 1 and December 1 of each year, beginning on December 1, 2021. Dividends on the Series MM Preferred Stock are neither mandatory nor cumulative.

Redemption. The Series MM Preferred Stock may be redeemed on any dividend payment date on or after September 1, 2026, in whole at any time or from time to time in part, at a redemption price equal to $10,000 per share (equivalent to $25 per depositary share), plus any declared and unpaid dividends. We may also redeem the Series MM Preferred Stock following the occurrence of a “capital treatment event,” as described above.

Listing. The depositary shares representing the Series MM Preferred Stock are listed on the NYSE under the trading symbol “JPM PR M”.

DESCRIPTION OF JPMORGAN CHASE FINANCIAL COMPANY LLC’S THE ALERIAN MLP INDEX ETNS DUE JANUARY 28, 2044, FULLY AND UNCONDITIONALLY GUARANTEED BY JPMORGAN CHASE & CO.

The following description of Alerian MLP Index ETNs due January 28, 2044 (the “Alerian ETNs”) is a summary and does not purport to be complete. It is subject to and qualified in its entirety by reference to the indenture dated February, 2016 (as may be amended or supplemented from time to time, the “2016 Indenture”), among JPMorgan Chase Financial Company LLC, as issuer (“JPMorgan Financial” or the “Issuer”), JPMorganChase, as guarantor (the “Guarantor”), and Deutsche Bank Trust Company Americas, as trustee (the “Trustee”), which is incorporated by reference as an Exhibit to the Form 10-K. We encourage you to read the 2016 Indenture for additional information.

General

The Alerian ETNs were originally issued on January 30, 2024 and are part of a series of JPMorgan Financial’s debt securities entitled “Global Medium-Term Notes, Series A” (the “Series A Notes”) that JPMorgan Financial may issue under the 2016 Indenture from time to time. For more information about the Series A Notes, please see the section titled “— Description of JPMorgan Chase Financial Company LLC’s Callable Fixed Rate Notes Due June 10, 2032, Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. — General Terms of the Series A Notes” below.

The Alerian ETNs are unsecured and unsubordinated obligations of JPMorgan Financial, the payment of which is fully and unconditionally guaranteed by JPMorganChase, the Guarantor. The Alerian ETNs will rank pari passu with all of JPMorgan Financial’s other unsecured and unsubordinated obligations. JPMorgan Chase & Co.’s guarantee of the Alerian ETNs will rank pari passu with all of JPMorgan Chase & Co.’s other unsecured and unsubordinated obligations. The Alerian ETNs do not guarantee any return of principal at, or prior to, maturity or upon early redemption or repurchase. Any payment on the Alerian ETNs is subject to the credit risk of JPMorgan Financial, as issuer of the Alerian ETNs, and JPMorgan Chase & Co., as guarantor of the Alerian ETNs.

The Alerian ETNs are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or by any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Unless otherwise specified, references herein to “holders” mean those in whose names the Alerian ETNs are registered on the books that JPMorgan Financial or the Trustee, or any successor trustee, as applicable, maintains for this purpose, and not those who own beneficial interests in the Alerian ETNs (registered in street name or otherwise).

Key Terms of the Alerian ETNs

General

Principal Amount: $26 per Alerian ETN (equal to the Initial VWAP Level divided by ten, rounded to the nearest cent).

Index: The return on the Alerian ETNs is linked to the performance of the Alerian MLP Index® (Bloomberg ticker: AMZ), which we refer to as the Index, as measured by its VWAP level, and to cash distributions on its components. See “— Terms Relating to Closing Intrinsic Note Value — VWAP Level” below.

The Index measures the composite performance of energy-oriented Master Limited Partnerships, or MLPs, that earn the majority of their cash flows from qualified activities involving energy commodities (the “Index Components”) using a capped, float-adjusted, capitalization-weighted methodology. MLPs are limited partnerships primarily engaged in the exploration, marketing, mining, processing, production, refining, storage, or transportation of any mineral or natural resource. The Index is calculated and maintained by VettaFi LLC (“VettaFi”).

Coupon Payments: For each Alerian ETN a holder holds on a Coupon Record Date, the holder will receive on the immediately following Coupon Payment Date an amount in cash equal to the Coupon Amount, if any, as of the immediately preceding Coupon Valuation Date.

Coupon Amount: The Coupon Amount as of any Coupon Valuation Date will equal:

a.the Reference Distribution Amount with respect to that Coupon Valuation Date, minus

b.the Accrued Investor Fee with respect to that Coupon Valuation Date,

provided that the Coupon Amount will not be less than $0.

If the Reference Distribution Amount on a Coupon Valuation Date is less than the Accrued Investor Fee on that Coupon Valuation Date, an amount equal to the excess of the Accrued Investor Fee over the Reference Distribution Amount (the “Investor Fee Shortfall”) will be included in the Accrued Investor Fee with respect to the next Coupon Valuation Date.

The Accrued Investor Fee will reduce each Coupon Amount. In addition, no Coupon Payment will be payable with respect to a Coupon Valuation Date if the Reference Distribution Amount is less than the Accrued Investor Fee, even if that Reference Distribution Amount is positive. The holders are not guaranteed any Coupon Payments.

The Coupon Amount is subject to adjustment in the event of a split or reverse split of the Alerian ETNs as described under “— Split or Reverse Split of the Alerian ETNs” below.

Payment at Maturity: For each Alerian ETN, unless earlier repurchased or redeemed, holders will receive at maturity a cash payment equal to the Closing Intrinsic Note Value determined over the Measurement Period with respect to the Final Valuation Date. If that amount is less than or equal to zero, the payment at maturity will be $0.

Issuer Redemption: On any Business Day on or after July 26, 2024, the Issuer may, in its sole discretion, redeem the Alerian ETNs, in whole or in part. If the Issuer exercises its right to redeem the Alerian ETNs prior to maturity, for each Alerian ETN that is redeemed, holders will receive on the Redemption Settlement Date a cash payment equal to the Closing Intrinsic Note Value determined over the Measurement Period with respect to the Redemption Valuation Date. If that amount is less than or equal to zero, the payment upon early redemption will be $0.

Weekly Repurchase: On a weekly basis, holders may request that we repurchase a minimum of 50,000 Alerian ETNs (subject to adjustment in the event of a split or reverse split of the Alerian ETNs) if holders comply with the required procedures, subject to a repurchase fee of 0.125%. For each Alerian ETN that is repurchased, holders will receive on the relevant Repurchase Date a cash payment equal to the Closing Intrinsic Note Value determined over the Measurement Period with respect to the Repurchase Valuation Date minus the Repurchase Fee Amount with respect to the Repurchase Valuation Date.

If the amount calculated above is less than or equal to zero, the payment upon early repurchase will be $0.

Terms Relating to Closing Intrinsic Note Value

Closing Intrinsic Note Value: As of any date of determination, an amount per Alerian ETN equal to:

a.the Principal Amount, multiplied by the Index Ratio as of that date, plus

b.the Coupon Amount as of that date, calculated as if that date were a Coupon Valuation Date (the “Stub Coupon Amount”), minus

c.any Investor Fee Shortfall determined in calculating that Stub Coupon Amount.

In addition, if the Coupon Ex-Date with respect to the Coupon Amount as of the immediately preceding Coupon Valuation Date has not yet occurred, the Closing Intrinsic Note Value will also include that Coupon Amount (an “Unpaid Coupon Amount”).

For purposes of determining the Closing Intrinsic Note Value over any Measurement Period, the Index Ratio is determined based on the arithmetic average of the VWAP Levels over that Measurement Period, and the date of determination for purposes of determining the Coupon Amount, any Investor Fee Shortfall and any Unpaid Coupon Amount is the final day of that Measurement Period.

The Closing Intrinsic Note Value is not the closing price or any other trading price of the Alerian ETNs in the secondary market and is not intended as a price or quotation, or as an offer or solicitation for the purchase or sale of the Alerian ETNs or as a recommendation to transact in the Alerian ETNs at the stated price. The trading price of the Alerian ETNs at any time may vary significantly from the Closing Intrinsic Note Value due to, among other things, imbalances of supply and demand (including as a result of any decision of ours to issue, stop issuing or resume issuing additional Alerian ETNs), lack of liquidity, transaction costs, credit considerations and bid-offer spreads.

If the Reference Distribution Amount used to calculate the Stub Coupon Amount on any Index Business Day is less than the Accrued Investor Fee used to calculate that Stub Coupon Amount, the resulting Investor Fee Shortfall will be deducted in calculating the Closing Intrinsic Note Value on that Index Business Day. Accordingly, the payment at maturity or upon early repurchase or redemption will be reduced by the amount of any Investor Fee Shortfall reflected in the relevant Closing Intrinsic Note Value.

Index Ratio: As of any date of determination, the Index Ratio is equal to:

VWAP Level

Initial VWAP Level

provided that, solely for purposes of determining the Closing Intrinsic Note Value in connection with any payment at maturity or upon early repurchase or redemption, the Index Ratio determined over the relevant Measurement Period is equal to:

Final VWAP Level

Initial VWAP Level

Initial VWAP Level: 260.0267 which is the arithmetic average of the VWAP Levels determined over a period of five Index Business Days ending on the Inception Date.

Final VWAP Level: With respect to a Measurement Period, the arithmetic average of the VWAP Levels on the five Index Business Days in that Measurement Period, as calculated by the Note Calculation Agent.

Measurement Period: With respect to the Final Valuation Date or any Repurchase Valuation Date or Redemption Valuation Date, the five Index Business Days starting from and including the Final Valuation Date or that Repurchase Valuation Date or Redemption Valuation Date, as applicable (or, if that day is not an Index Business Day, the five Index Business Days immediately following that day).

The Measurement Period is subject to postponement in the event of a market disruption event and as described under “— Postponement of an Averaging Date.”

VWAP Level: On any Index Business Day, as calculated by the VWAP Calculation Agent, the sum of the products for each Index Component of:

a.the VWAP of that Index Component as of that day; and

b.the Index Units of that Index Component as of that day, divided by the Index Divisor as of that day.

The calculation of the VWAP Level may be modified in circumstances described under “— Postponement of an Averaging Date” and “— Discontinuation of an Index; Alternation of Method of Calculation” below. The official closing level of the Index may vary significantly from the VWAP Level.

VWAP: With respect to each Index Component, as of any date of determination, the volume-weighted average price of one share of that Index Component as determined by the VWAP Calculation Agent based on the Primary Exchange for that Index Component.

Index Units: With respect to each Index Component, as of any date of determination, the number of units of that Index Component included in the Index for purposes of the calculation of the official level of the Index by the Index Calculation Agent.

Index Divisor: As of any date of determination, the divisor used in the calculation of the official level of the Index by the Index Calculation Agent.

Inception Date: January 26, 2024

Initial Issue Date: January 30, 2024

Final Valuation Date: January 20, 2044

Maturity Date: January 28, 2044. The Maturity Date is subject to postponement in the event of a market disruption event and as described under “— Postponement of a Payment Date” below.

Terms Relating to Coupon Payments

Accrued Investor Fee: The Accrued Investor Fee accrues at a rate of 0.85% per annum each day. In addition, the Accrued Investor Fee carries forward any shortfall if the Reference Distribution Amount determined in connection with any Coupon Payment is less than the Accrued Investor Fee at that time.

With respect to each Coupon Valuation Date, the Accrued Investor Fee is an amount equal to:

a.the Periodic Investor Fee with respect to that Coupon Valuation Date, plus

b.the Investor Fee Shortfall, if any, as of the immediately preceding Coupon Valuation Date, if any.

Periodic Investor Fee: With respect to each Coupon Valuation Date, an amount equal to the product of

a.the investor fee of 0.85% per annum;

b.the Principal Amount multiplied by the Index Ratio as of the immediately preceding Index Business Day that is not a Disrupted Day for any Index Component; and

c.the day count fraction, calculated using a 30/360 day count convention as described under “— Additional Terms — Day Count Fraction” below.

Reference Distribution Amount: With respect to each Coupon Valuation Date, an amount equal to the sum of the gross cash distributions that a Reference Holder would have been entitled to receive in respect of each Index Component held by that Reference Holder on the “record date” with respect to that Index Component, for those cash distributions whose “ex-dividend date” occurs during the Coupon Accrual Period for that Coupon Valuation Date.

Notwithstanding the foregoing, with respect to cash distributions for an Index Component that are scheduled to be paid prior to the applicable Coupon Ex-Date, if the issuer of that Index Component fails to pay the distribution to holders of that Index Component by the scheduled payment date for that distribution, that distribution will be assumed to be zero for the purposes of calculating the applicable Reference Distribution Amount.

Reference Holder: As of any date of determination, a hypothetical holder of a number of shares of each Index Component equal to:

a.the Index Units of that Index Component as of that date, divided by

b.the Index Divisor as of that date multiplied by 10,

provided that solely for purposes of determining the Reference Distribution Amount included in any Stub Coupon Amount payable at maturity or upon early repurchase or redemption, the Reference Holder will be deemed to hold four-fifths, three-fifths, two-fifths and one-fifth of the shares of each Index Component it would otherwise hold on the second, third, fourth and fifth Index Business Days, respectively, in the relevant Measurement Period.

The Accrued Investor Fee, the Periodic Investor Fee, the Reference Distribution Amount and the Reference Holder are each subject to adjustment in the event of a split or reverse split of the Alerian ETNs as described under “— Split or Reverse Split of the Alerian ETNs” below.

Coupon Accrual Period: With respect to each Coupon Valuation Date, the period from but excluding the immediately preceding Coupon Valuation Date (or, in the case of the first Coupon Valuation Date, from but excluding November 15, 2023) to and including that Coupon Valuation Date.

Coupon Valuation Date: The first Index Business Day occurring on or after the 15th of February, May, August and November of each calendar year during the term of the Alerian ETNs, beginning on February 15, 2024.

Coupon Ex-Date: With respect to a Coupon Amount, the first Exchange Business Day on which the Alerian ETNs trade without the right to receive that Coupon Amount. Under current NYSE Arca practice, the Coupon Ex-Date will generally be the first Exchange Business Day immediately preceding the applicable Coupon Record Date; however, beginning May 28, 2024, under NYSE Arca practice, the Coupon Ex-Date is expected to generally be the applicable Coupon Record Date. For purposes of this paragraph, “Exchange Business Day” means any day on which the primary exchange or market for trading of the Alerian ETNs is scheduled to be open for trading.

Coupon Record Date: The 9th Index Business Day following each Coupon Valuation Date.

Coupon Payment Date: The 15th Index Business Day following each Coupon Valuation Date, subject to postponement in the event of a market disruption event as described under “— Postponement of a Payment Date” below.

Terms Relating to Issuer Redemption

Early Redemption: On any Business Day on or after July 26, 2024, the Issuer may, in its sole discretion, redeem the Alerian ETNs, in whole or in part. If the Issuer exercises its right to redeem the Alerian ETNs, the Issuer will deliver an irrevocable redemption notice (the “Redemption Notice”) to DTC (the holder of the master note evidencing the Alerian ETNs) at least

five Business Days prior to the Redemption Valuation Date specified in the Redemption Notice. If fewer than all the Alerian ETNs are to be redeemed, the Issuer will specify in the Redemption Notice the principal amount of the Alerian ETNs to be redeemed, and the Trustee will select the Alerian ETNs to be redeemed pro rata, by lot or in such manner as it deems appropriate and fair.

Payment upon Early Redemption: If the Issuer exercises its right to redeem any Alerian ETNs prior to maturity, for each Alerian ETNs selected for redemption by the Trustee, holders will receive on the Redemption Settlement Date a cash payment equal to the Closing Intrinsic Note Value determined over the Measurement Period with respect to the Redemption Valuation Date. If that amount is less than or equal to zero, the payment upon early redemption will be $0.

Redemption Valuation Date: The date specified as the Redemption Valuation Date in the Redemption Notice.

Redemption Settlement Date: Unless otherwise specified in the Redemption Notice, the day that follows the final day in the Measurement Period with respect to the Redemption Valuation Date by a number of Business Days corresponding to the standard settlement cycle, which is currently two Business Days and which is expected to be one Business Day beginning May 28, 2024. In no event will the Redemption Notice specify a Redemption Settlement Date that follows the final day in the Measurement Period by more than five Business Days.

Terms Relating to Weekly Repurchase Right

Early Repurchase: On a weekly basis, holders may request that we repurchase a minimum of 50,000 Alerian ETNs (subject to adjustment in the event of a split or reverse split of the Alerian ETNs) if holders comply with the procedures described under “— Repurchase Procedures” below and unless holders have delivered a Redemption Notice to DTC to redeem all of the outstanding notes. The Issuer may from time to time, in its sole discretion, reduce the minimum number of the Alerian ETNs required for an early repurchase on a consistent basis for all holders of the Alerian ETNs, but the Issuer is under no obligation to do so.

Payment upon Early Repurchase: Subject to holders’ compliance with the required procedures, for each Alerian ETN that is repurchased, holders will receive on the relevant Repurchase Date a cash payment equal to the Closing Intrinsic Note Value determined over the Measurement Period with respect to the Repurchase Valuation Date minus the Repurchase Fee Amount with respect to the Repurchase Valuation Date. If that amount is less than or equal to zero, the payment upon early redemption will be $0.

Repurchase Fee Amount: With respect to any Repurchase Valuation Date, an amount per Alerian ETN in cash equal to 0.125% of the Closing Intrinsic Note Value with respect to that Repurchase Valuation Date (but excluding any Unpaid Coupon Amount included in that Closing Intrinsic Note Value).

Repurchase Valuation Date: The last Index Business Day of each week, generally Friday.

Repurchase Date: Unless otherwise specified in the Issuer’s acknowledgement, the day that follows the final day in the Measurement Period with respect to the Repurchase Valuation Date by a number of Business Days corresponding to the standard settlement cycle, which is currently two Business Days and which is expected to be one Business Day beginning May 28, 2024. In no event will the Issuer’s acknowledgement specify a Repurchase Date that follows the final day in the Measurement Period by more than five Business Days.

Repurchase Notice: A repurchase notice in the form specified by the Issuer.

Repurchase Procedures: In order to request that the Issuer repurchase a holder’s Alerian ETN, holders must instruct their broker or other person through which they hold Alerian ETNs to take the following steps:

a.send a completed Repurchase Notice to the Issuer via email at ETN_Repurchase@jpmorgan.com by no later than 4:00 p.m., New York City time, on the Business Day immediately preceding the applicable Repurchase Valuation Date;

b.instruct the holder’s DTC custodian to book a delivery versus payment trade with respect to that holder’s Alerian ETNs on the final day in the Measurement Period with respect to the relevant Repurchase Valuation Date at a price equal to the amount payable upon early repurchase of the Alerian ETNs; and

c.cause the holder’s DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m., New York City time, on the relevant Repurchase Date.

Different brokerage firms may have different deadlines for accepting instructions from their customers. Accordingly, holders should consult the brokerage firm through which they own their interest in the Alerian ETNs in respect of those deadlines.

Once delivered, a Repurchase Notice may not be revoked. If the Issuer does not receive a holder’s Repurchase Notice by the deadline, such holder’s Repurchase Notice will not be effective. The Issuer or its affiliate must acknowledge receipt of the Repurchase Notice on the same Business Day for it to be effective, such acknowledgment will be deemed to evidence

its acceptance of a holder’s repurchase request. The Note Calculation Agent will, in its sole discretion, resolve any questions that may arise as to the validity of a Repurchase Notice and the timing of receipt of a Repurchase Notice.

Additional Terms

Business Day: Any day other than a day on which the banking institutions in the City of New York are authorized or required by law, regulation or executive order to close or a day on which transactions in dollars are not conducted.

Index Business Day: Any day on which the Primary Exchange and the Related Exchange with respect to each Index Component are scheduled to be open for trading.

Primary Exchange: With respect to each Index Component, the primary exchange or market of trading of that Index Component.

Related Exchange: With respect to each Index Component, each exchange or quotation system where trading has a material effect (as determined by the Note Calculation Agent) on the overall market for futures or options contracts relating to that Index Component.

Disrupted Day: With respect to an Index Component, a day on which the Primary Exchange or any Related Exchange with respect to that Index Component fails to open for trading during its regular trading session or on which a market disruption event (as described under “— Market Disruption Events”) with respect to that Index Component has occurred or is continuing, and, in each case, the occurrence of which is determined by the Note Calculation Agent to have a material effect on the VWAP Level.

Index Sponsor and Index Calculation Agent: VettaFi

Note Calculation Agent, VWAP Calculation Agent and Published ETN Value Calculation Agent: J.P. Morgan Securities LLC (“JPMS”), one of our and JPMorgan Financial’s affiliates, will act as the Note Calculation Agent. Solactive AG will act as the VWAP Calculation Agent and the Published ETN Value Calculation Agent. We and JPMorgan Financial may appoint a different Note Calculation Agent, VWAP Calculation Agent or Published ETN Value Calculation Agent from time to time without holders’ consent and without notifying holders.

The Note Calculation Agent will make all necessary calculations and determinations in connection with the Alerian ETNs, including calculations and determinations relating to any payments on the Alerian ETNs and the assumptions used to determine the pricing of the Alerian ETNs, other than determinations to be made by the VWAP Calculation Agent. The VWAP Calculation Agent will determine the VWAP Level and the VWAP of each Index Component on each Index Business Day, except as described below under “— Postponement of an Averaging Date.” The Published ETN Value Calculation Agent is responsible for calculating the Daily Closing Intrinsic Note Value, the Intraday Intrinsic Note Value and the Interim Coupon or Shortfall Amount for purposes of publication. All determinations made by the Note Calculation Agent, the VWAP Calculation Agent or the Published ETN Value Calculation Agent will be at the sole discretion of the Note Calculation Agent, the VWAP Calculation Agent or the Published ETN Value Calculation Agent, as applicable, and will, in the absence of manifest error, be conclusive for all purposes and binding on holders, us and JPMorgan Financial.

The Note Calculation Agent will provide written notice to the Trustee at its New York office, on which notice the Trustee may conclusively rely, of any amount payable on the Alerian ETNs at or prior to 11:00 a.m., New York City time, on the date on which payment is to be made.

All values with respect to calculations in connection with the Alerian ETNs will be rounded to the nearest one hundred-thousandth, with five one-millionths rounded upward (e.g., 0.876545 would be rounded to 0.87655). Notwithstanding the foregoing, all dollar amounts related to determination of any payment on the Alerian ETNs per note will be rounded to the nearest ten-thousandth, with five one hundred-thousandths rounded upward (e.g., 0.76545 would be rounded up to 0.7655), and all dollar amounts payable, if any, on the aggregate principal amount of Alerian ETNs per holder will be rounded to the nearest cent, with one-half cent rounded upward.

Trustee: Deutsche Bank Trust Company Americas

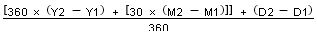

Day Count Fraction: With respect to each Coupon Valuation Date, the day count fraction is calculated as follows:

where:

a.“Y1” is the year, expressed as a number, in which the first day of the Coupon Accrual Period with respect to that Coupon Valuation Date falls;

b.“Y2” is the year, expressed as a number, in which the day immediately following the last day included in the Coupon Accrual Period with respect to that Coupon Valuation Date falls;

c.“M1” is the calendar month, expressed as a number, in which the first day of the Coupon Accrual Period with respect to that Coupon Valuation Date falls;

d.“M2” is the calendar month, expressed as a number, in which the day immediately following the last day included in the Coupon Accrual Period with respect to that Coupon Valuation Date falls;

e.“D1” is the first calendar day, expressed as a number, of the Coupon Accrual Period with respect to that Coupon Valuation Date, unless that number would be 31, in which case D1 will be 30; and

f.“D2” is the calendar day, expressed as a number, immediately following the last day included in the Coupon Accrual Period with respect to that Coupon Valuation Date, unless that number would be 31 and D1 is greater than 29, in which case D2 will be 30.

Split or Reverse Split of the Alerian ETNs

The Issuer may initiate a split or reverse split of the Alerian ETNs at any time. The Issuer will determine the ratio of such split or reverse split, as applicable, using relevant market indicia in its sole discretion. If the Issuer decides to initiate a split or reverse split, as applicable, the Issuer will issue a notice to holders of the Alerian ETNs and a press release announcing the split or reverse split and the ratio and specifying the effective date of the split or reverse split, which will be at least three Business Days after the date on which the split or reverse split, as applicable, is announced, which we refer to as the “announcement date.” The record date for a share split or reverse split will be the Business Day immediately preceding the effective date.

If the Alerian ETNs undergo a split or reverse split, the Issuer will adjust the terms of the Alerian ETNs as may be necessary or desirable to effectuate that split or reverse split, as applicable, including, without limitation, the Principal Amount, any Coupon Amount, the Closing Intrinsic Note Value, the Accrued Investor Fee, the Periodic Investor Fee, the Reference Distribution Amount, the number of shares held by a Reference Holder and the minimum number of Alerian ETNs holders may request that the Issuer repurchase. For example, if the Alerian ETNs undergo a 4-for-1 split, each Alerian ETN holder who holds one Alerian ETN via DTC prior to the split will, after the split, hold four Alerian ETNs, and the Principal Amount, any Coupon Amount, the Closing Intrinsic Note Value, the Accrued Investor Fee, the Periodic Investor Fee, the Reference Distribution Amount and the number of shares held by a Reference Holder will be adjusted as may be necessary or desirable to equal 1/4 of their respective values that would have prevailed in the absence of the 4-for-1 split. In addition, the minimum number of Alerian ETNs holders may request that the Issuer repurchase will be increased to equal 4 times its prior value. These adjustments may be applied retroactively for purposes of adjusting any Coupon Amount that has been determined but not yet paid.

In the case of a reverse split, holders who hold a number of Alerian ETNs that is not evenly divisible by the relevant ratio will receive the same treatment as all other holders for the maximum number of Alerian ETNs they hold that is evenly divisible by the relevant ratio, and the Issuer will have the right to compensate holders for their remaining or “partial” Alerian ETNs in a manner determined by the Note Calculation Agent in its sole discretion. The Issuer’s current intention is to provide holders with a cash payment for their partial Alerian ETNs in an amount equal to the appropriate percentage of the Closing Intrinsic Note Value (which may be calculated using an Index Ratio that reflects the average VWAP Level over a measurement period of five Index Business Days) on a specified Index Business Day no later than 20 Index Business Days following the announcement date, with payment to be made on a specified Business Day no later than five Business Days following the date on which the amount of the payment is determined.

Postponement of a Payment Date