Exhibit 99.1

2009 Investor Day Agenda

| | | | |

Presentation | | Speaker | | Start time |

Opening Remarks | | Jamie Dimon | | 8:30 a.m. |

| | |

Firm Overview | | Mike Cavanagh | | 8:45 a.m. |

| | |

Home Lending | | Charlie Scharf | | 9:00 a.m. |

| | |

Commercial Banking | | Todd Maclin | | 9:45 a.m. |

| | |

| Break | | | | 10:15 a.m. |

| | |

Card Services | | Gordon Smith | | 10:25 a.m. |

| | |

Retail Banking | | Charlie Scharf | | 11:30 a.m. |

| | |

| Lunch | | | | 12:00 p.m. |

| | |

Asset Management | | Jes Staley | | 1:15 p.m. |

| | |

Investment Bank | | Steve Black | | 1:45 p.m. |

| | |

| Break | | | | 2:20 p.m. |

| | |

Derivatives | | Bill Winters | | 2:35 p.m. |

| | |

Closing Remarks and Q&A | | Jamie Dimon | | 4:00 p.m. |

FEBRUARY 26, 2009

FIRM OVERVIEW

Mike Cavanagh, Chief Financial Officer

Overview

FIRM OVERVIEW

| | • | | 2008 net income of $6B on managed revenue of $73B |

| | • | | 1Q09 QTD results are solidly profitable; outlook is roughly in line with Analyst expectations |

| • | | Excellent franchises with great long-term prospects |

| • | | Continuous, consistent investment in growth driving substantial increase in core earnings power |

| • | | Fortress balance sheet – strong capital position, credit reserves and liquidity |

| • | | Comments on Treasury & Securities Services |

| | |

| | 1 |

Excellent franchises position JPM well for the future

FIRM OVERVIEW

Investment Bank

• | | Continue to rank #1 in four capital raising league tables for 20081 |

| | • | | Global Debt, Equity & Equity-related |

| | • | | Global Equity & Equity-related |

| | • | | Global Loan Syndications |

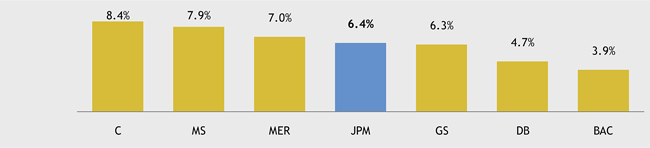

• | | Ranked #1 in Global Fees for 20082with 8.8% market share |

Retail Financial Services

• | | #3 in deposit market share3 |

• | | #3 in Mortgage Originations4 |

• | | #3 in Mortgage Servicing4 |

• | | #2 in Home Equity Originations5 |

• | | #1 in Auto Finance (non-captive)6 |

Card Services

• | | #1 U.S. Credit Card Issuer (by outstandings)7 |

• | | #2 U.S. Merchant Acquirer (by acquiring volumes)7 |

• | | #1 U.S. Visa Issuer (by # of cards)7 |

• | | #2 U.S. MasterCard Issuer (by # of cards)7 |

Commercial Banking

• | | Top 3 in Large Middle-market, Traditional Middle-market and Asset Based Lending8 |

• | | #1 originator of multi-family loans in the U.S.9 |

• | | #1 ranking in CB market penetration and lead share in 3 of the top 4 MSAs10 |

Treasury & Securities Services

• | | #1 in ACH Originations11 |

• | | #1 in US Dollar Treasury Clearing and Commercial Payments12 |

Asset Management

• | | Largest manager of AAA-rated global liquidity funds13 |

• | | Largest Hedge Fund manager14 |

Businesses operate stronger together than apart

3 | Source: SNL Corporation; market share data as of June 2008, updated for subsequent acquisitions for all banks through January 2009. Includes deposits in domestic offices (50 states and D.C.), Puerto Rico and U.S. Territories only and non-retail branches are not included |

4 | Source: Inside Mortgage Finance, 4Q08 |

5 | Source: Inside Mortgage Finance, 3Q08 |

6 | Source: Autocount (franchise), December 2008 |

7 | Source: Nilson Reports. Merchant Acquirer data adjusted for dissolution of First Data JV |

8 | Loan Pricing Corporation, FY08 |

9 | FDIC and OTS as of 9/30/08 |

10 | TNS Market Study, 3Q08 YTD |

12 | AsianInvestor, Global Pensions, Inter-national Custody and Fund Administration, The Asset |

13 | iMoneyNet, December 2008 |

14 | Absolute Return Magazine, September 2008 issue |

| | |

| | 2 |

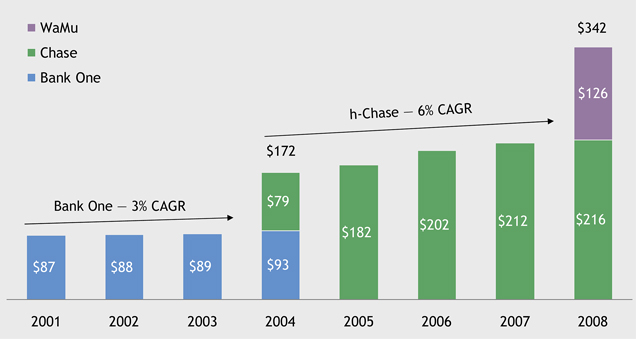

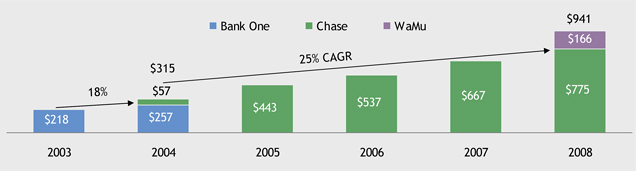

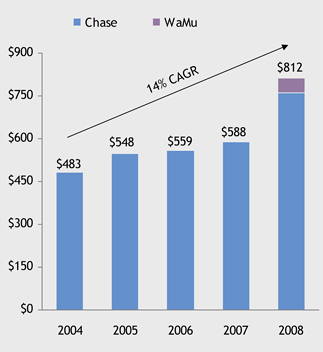

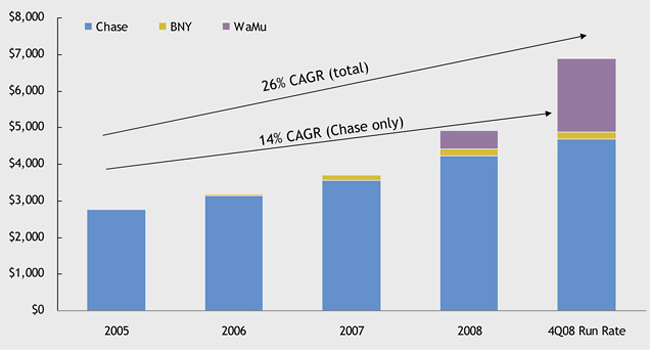

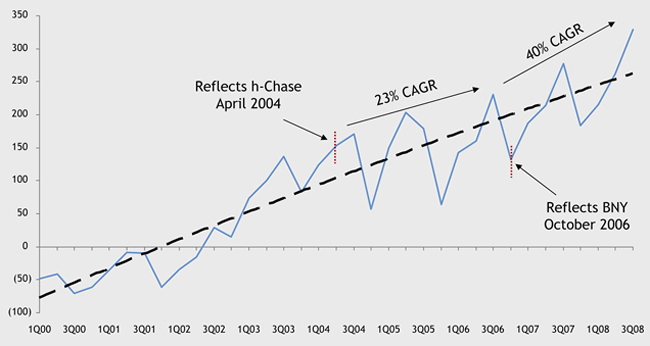

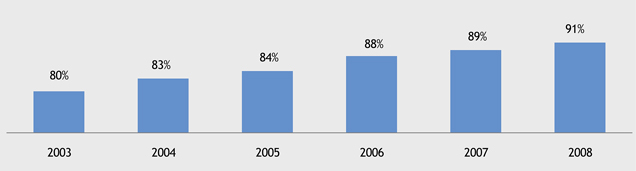

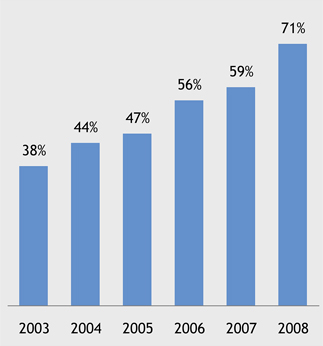

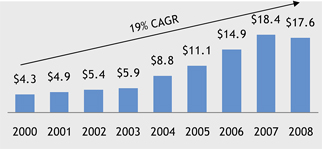

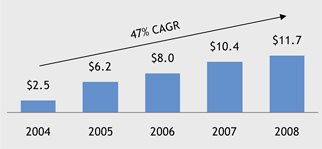

Consistently investing in revenue growth

FIRM OVERVIEW

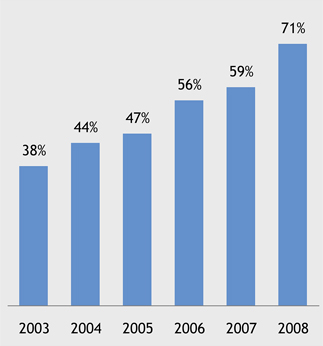

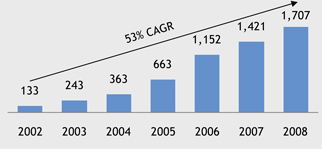

| • | | Good underlying momentum in core business drivers propelling organic growth across businesses |

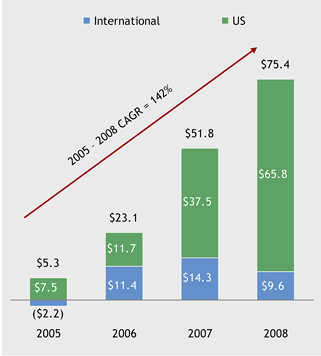

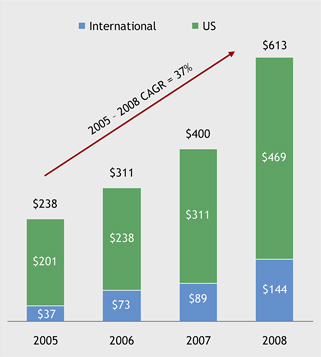

Growth Drivers ($ in billions)

| | | | | | | | | | | | | | | | | | | |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | | 2004-2008

CAGR | |

Investment Bank | | | | | | | | | | | | | | | | | | | |

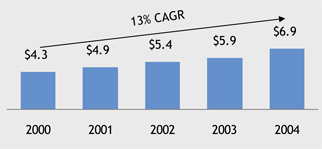

IB Fees ($mm) | | $ | 3,671 | | $ | 4,096 | | $ | 5,537 | | $ | 6,616 | | $ | 5,907 | | | 13 | % |

Advisory ($mm) | | | 939 | | | 1,263 | | | 1,659 | | | 2,273 | | | 2,008 | | | 21 | % |

Equity and Debt Underwriting ($mm) | | | 2,732 | | | 2,833 | | | 3,878 | | | 4,343 | | | 3,899 | | | 9 | % |

Equity Markets ($mm) | | | 1,704 | | | 1,998 | | | 3,458 | | | 3,903 | | | 3,611 | | | 21 | % |

International Revenue ($mm) | | | 5,985 | | | 6,648 | | | 9,232 | | | 10,005 | | | 9,684 | | | 13 | % |

Retail Financial Services | | | | | | | | | | | | | | | | | | | |

Retail Banking Average Deposits | | $ | 171.8 | | $ | 175.3 | | $ | 189.9 | | $ | 206.7 | | $ | 244.6 | | | 9 | % |

# of ATMs | | | 6,650 | | | 7,312 | | | 8,506 | | | 9,186 | | | 14,568 | | | 22 | % |

# of Branches | | | 2,508 | | | 2,641 | | | 3,079 | | | 3,152 | | | 5,474 | | | 22 | % |

# of Branch Bankers & Sales Specialists | | | 8,388 | | | 10,281 | | | 11,187 | | | 13,755 | | | 21,486 | | | 27 | % |

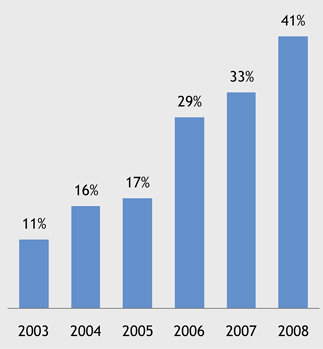

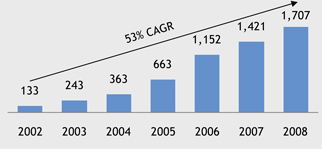

Credit Cards Originated in Branches | | | 408,794 | | | 666,387 | | | 1,152,166 | | | 1,420,884 | | | 1,707,072 | | | 43 | % |

Card Services | | | | | | | | | | | | | | | | | | | |

Average Outstandings | | $ | 128.8 | | $ | 136.4 | | $ | 141.1 | | $ | 149.3 | | $ | 162.9 | | | 6 | % |

Charge Volume | | $ | 282.7 | | $ | 301.9 | | $ | 339.6 | | $ | 354.6 | | $ | 368.9 | | | 7 | % |

Sales Volume | | $ | 218.1 | | $ | 233.7 | | $ | 267.6 | | $ | 292.1 | | $ | 309.7 | | | 9 | % |

# of New accts opened (000’s) | | | 9,697 | | | 11,362 | | | 15,870 | | | 16,152 | | | 14,910 | 1 | | 11 | % |

Note: 2004 data is presented on an unaudited pro forma combined basis that represents how the financial information of JPMorgan Chase & Co. and Bank One Corporation may have appeared had the two companies been merged for the full year

1 | Excludes approximately 13 million credit card accounts acquired in the WaMu transaction |

| | |

| | 3 |

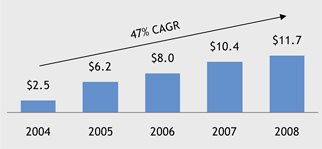

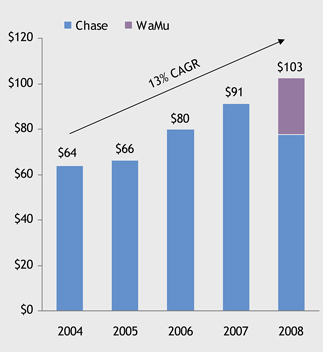

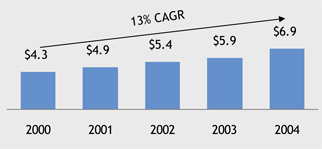

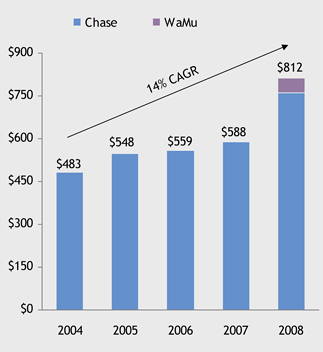

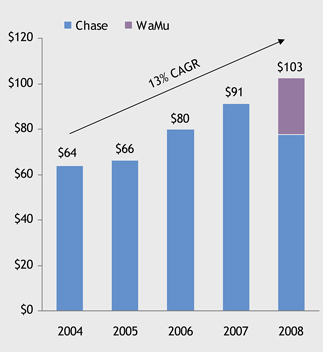

Consistently investing in revenue growth

FIRM OVERVIEW

Growth Drivers ($ in billions)

| | | | | | | | | | | | | | | | | | |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2004-2008

CAGR | |

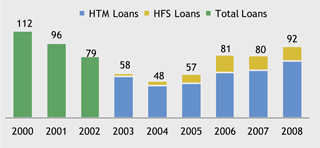

Commercial Banking | | | | | | | | | | | | | | | | | | |

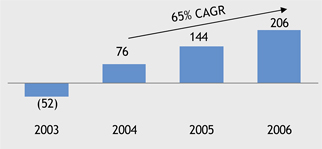

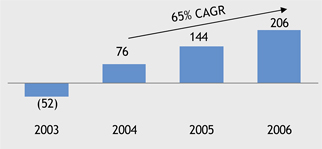

IB Revenue, Gross1($mm) | | | NA | | $ | 552 | | $ | 716 | | $ | 888 | | $ | 966 | | 21 | % |

Liability Balances2 | | $ | 62.6 | | $ | 66.1 | | $ | 73.6 | | $ | 87.7 | | $ | 103.1 | | 13 | % |

Loans | | $ | 46.3 | | $ | 48.1 | | $ | 53.6 | | $ | 61.1 | | $ | 82.3 | | 15 | % |

Treasury and Securities Services | | | | | | | | | | | | | | | | | | |

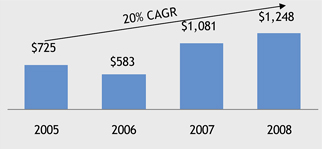

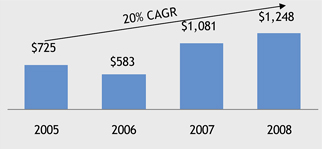

Liability Balances2 | | $ | 135.0 | | $ | 154.7 | | $ | 189.5 | | $ | 228.9 | | $ | 279.8 | | 20 | % |

Assets under Custody ($T) | | $ | 9.3 | | $ | 10.7 | | $ | 13.9 | | $ | 15.9 | | $ | 13.2 | | 9 | % |

Asset Management | | | | | | | | | | | | | | | | | | |

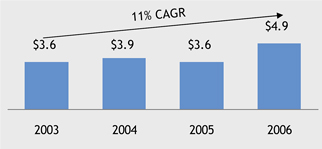

Assets under Management | | $ | 791 | | $ | 847 | | $ | 1,013 | | $ | 1,193 | | $ | 1,133 | | 9 | % |

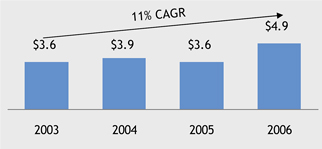

Loans3 | | $ | 25.1 | | $ | 26.6 | | $ | 26.5 | | $ | 29.5 | | $ | 38.1 | | 11 | % |

Deposits | | $ | 38.6 | | $ | 42.1 | | $ | 50.6 | | $ | 58.9 | | $ | 70.2 | | 16 | % |

Note: 2004 data is presented on an unaudited pro forma combined basis that represents how the financial information of JPMorgan Chase & Co. and Bank One Corporation may have appeared had the two companies been merged for the full year

1 | Represents total revenue related to investment banking products sold to Commercial Banking clients. CAGR is calculated for the period 2005-2008 |

2 | Includes deposits and deposits swept to on-balance sheet liabilities |

3 | Reflects the transfer in 2007 of held-for-investment prime mortgage loans from AM to Corporate within the Corporate/Private Equity segment |

| | |

| | 4 |

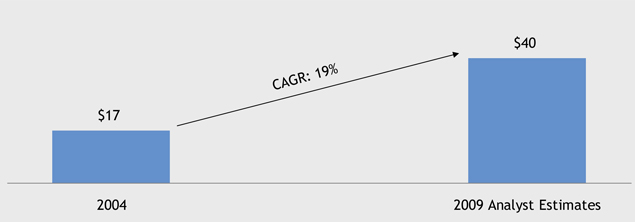

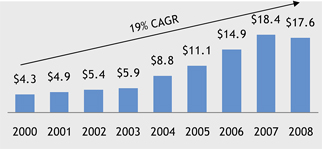

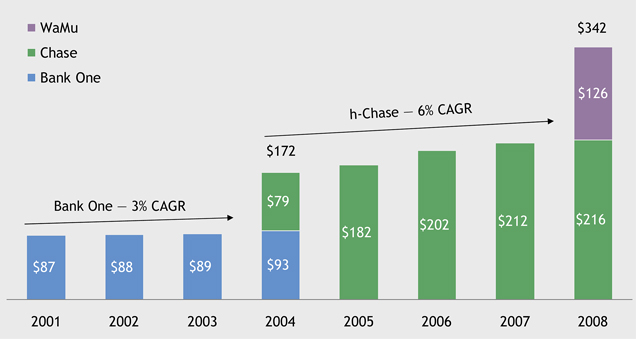

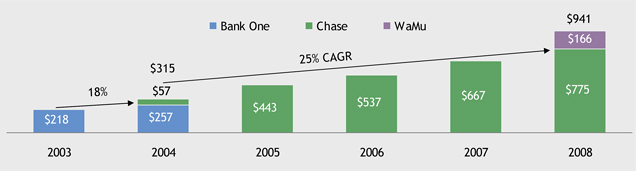

Substantial earnings power continues to grow

FIRM OVERVIEW

Pretax preprovision profit ($ in billions)

| • | | Solid earnings power helps counter impact of current economic environment |

| • | | Organic earnings growth trajectory will continue; reap benefits when credit costs abate |

| | |

| | 5 |

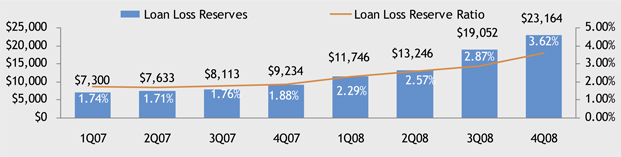

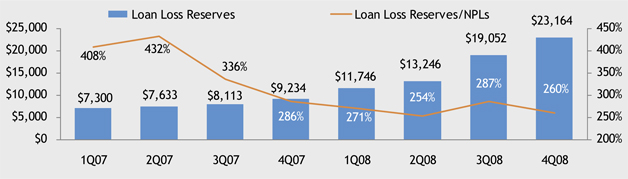

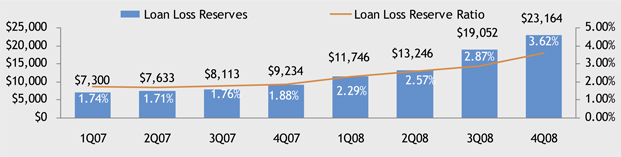

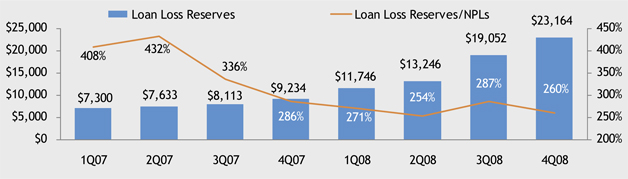

Substantially increased loan loss reserves, maintaining strong coverage ratios

FIRM OVERVIEW

Loan Loss Reserves to Total Loans1,2 ($ in millions)

1 | Excluding held-for-sale and loans at fair value |

2 | Excludes the impact of purchased credit impaired loans accounted for under SOP 03-3 that were acquired as part of the Washington Mutual transaction. These loans were accounted for at fair value on the acquisition date, which reflected expected cash flows (including credit losses), over the remaining life of the portfolio. Accordingly no charge-offs and no allowance for loan losses has been recorded for these loans. If these loans were included, the loan loss reserve ratio at 4Q08 and 3Q08 would have been 3.18% and 2.56%, respectively |

Loan Loss Reserves to NPLs3,4 ($ in millions)

3 | Excluding held-for-sale and loans at fair value |

4 | Excludes purchased credit impaired loans accounted for under SOP 03-03 that were acquired as part of the Washington Mutual transaction |

| | |

| | 6 |

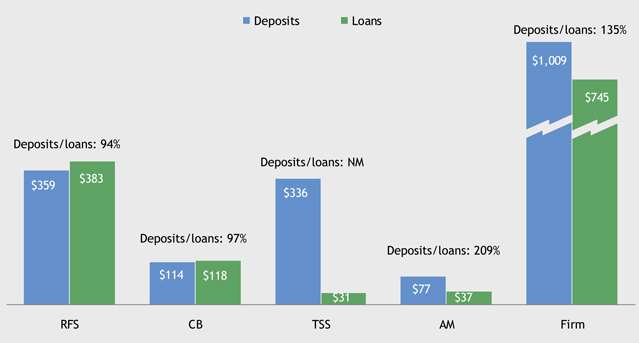

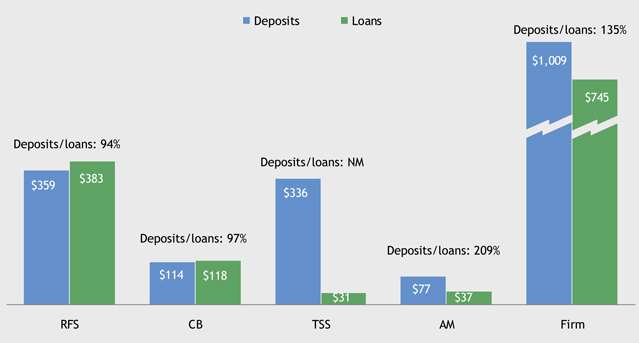

Naturally strong liquidity position across our businesses

FIRM OVERVIEW

| • | | Total deposits of $1.0T across retail and wholesale businesses |

4Q08 Customer deposits versus loans ($ in billions)

Note: Line of business data reflects average balances. Firm data is end-of-period. The Firm total includes the remaining lines of businesses (IB and Card)

| | |

| | 7 |

Fortress capital position

FIRM OVERVIEW

($ in billions)

| | | | | | | | | | | | |

| | | 2006 | | | 2007 | | | 2008 | |

Tier 1 Capital1 | | $ | 81 | | | $ | 89 | | | $ | 136 | |

Tangible Common Equity2 | | $ | 63 | | | $ | 72 | | | $ | 81 | |

Tier 1 Capital Ratio1 | | | 8.7 | % | | | 8.4 | % | | | 10.9 | % |

Tangible Common Equity/RWA2 | | | 6.8 | % | | | 6.8 | % | | | 6.5 | % |

Tangible Common Equity/Tangible Assets2 | | | 4.9 | % | | | 4.8 | % | | | 3.8 | % |

Potential Stress Environment Impact

| | | | |

| Extraordinary times call for extraordinary measures. We must necessarily be prepared to handle a highly stressed environment (although we are not predicting this) | | | | • Assumes unemployment reaching 10%+ in 2009/2010 and HPI decline of 40% peak-to-trough • Capital levels maintained while credit reserves further strengthened |

| | |

| | 8 |

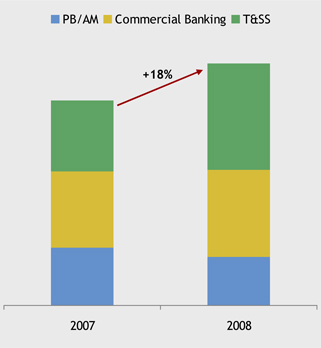

Treasury & Securities Services

FIRM OVERVIEW

($ in millions)

| | | | | | | | | | | |

| | | 2007 | | | 2008 | | | O/(U) | |

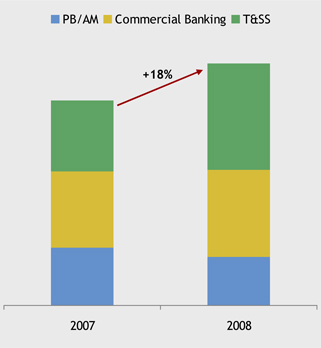

Revenue | | $ | 6,945 | | | $ | 8,134 | | | 17 | % |

Treasury Services | | | 3,013 | | | | 3,555 | | | 18 | % |

Worldwide Securities Svcs | | | 3,932 | | | | 4,579 | | | 16 | % |

Expense | | | 4,580 | | | | 5,223 | | | 14 | % |

Net Income | | $ | 1,397 | | | $ | 1,767 | | | 26 | % |

Key Statistics | | | | | | | | | | | |

Avg Liability Balances ($B)1 | | $ | 228.9 | | | $ | 279.8 | | | 22 | % |

Assets under Custody ($T) | | $ | 15.9 | | | $ | 13.2 | | | (17 | )% |

| | | |

Pretax Margin | | | 32 | % | | | 33 | % | | | |

ROE2 | | | 47 | % | | | 47 | % | | | |

| | | |

TSS Firmwide Revenue | | $ | 9,565 | | | $ | 11,081 | | | 16 | % |

TS Firmwide Revenue | | $ | 5,633 | | | $ | 6,502 | | | 15 | % |

TSS Firmwide Avg Liab Bal ($B)1 | | $ | 316.7 | | | $ | 382.9 | | | 21 | % |

EOP Equity ($B) | | $ | 3.0 | | | $ | 4.5 | | | | |

Leadership Positions

• | | #1 in ACH Originations3 |

• | | #1 in US Dollar Treasury Clearing and Commercial Payments4 |

• | | Named top Global Custodian5 |

• | | Received more than 110 best in class recognitions6 |

• | | Named European Cash Management Provider of the Year7 |

• | | Best Cash Management Specialist8 |

1 | Includes deposits and deposits swept to on-balance sheet liabilities |

2 | Calculated based on average equity. Average equity was $3.8B and $3.0B for 2008 and 2007, respectively |

5 | AsianInvestor, Global Pensions, International Custody and Fund Administration, The Asset |

7 | International Custody, Fund Administration |

| | |

| | 9 |

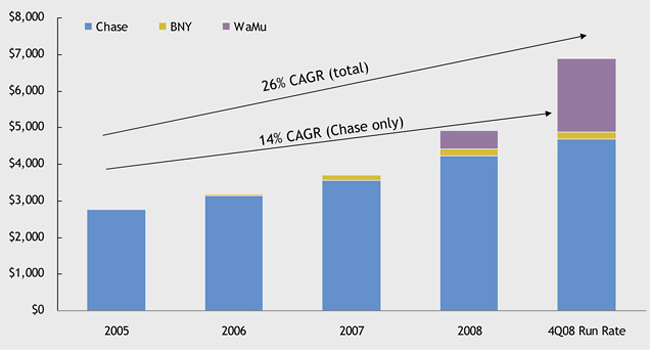

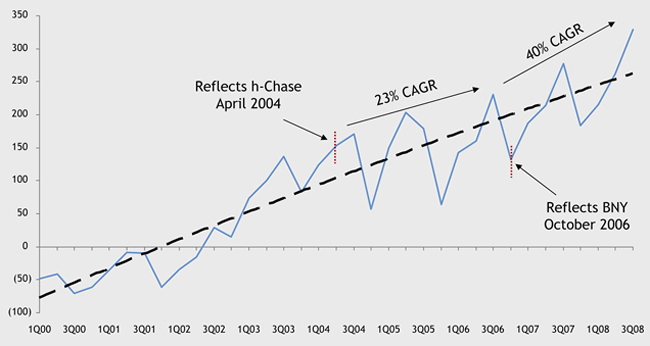

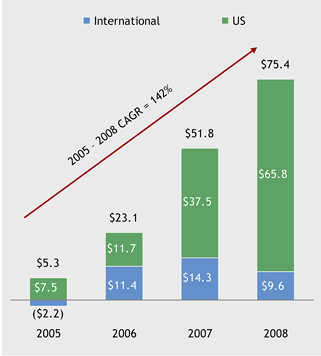

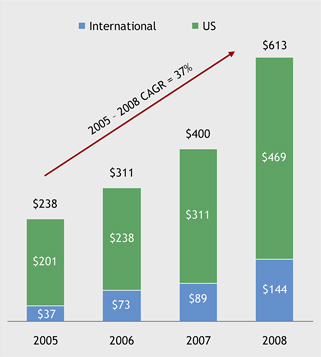

Strengths of Treasury & Securities Services

FIRM OVERVIEW

| • | | World class market leading franchise |

| • | | Record 2008 net income of $1.8B has more than doubled since 2005 |

| | • | | Approximately 50% of revenue is related to international businesses |

| • | | High return, low capital intensity, scale advantages |

| • | | Stable, annuity-like revenue stream - consistent growth in liability balances strongly linked to core cash and custody operating services |

| • | | Significant client and platform leverage across the entire firm (IB, RFS, Card, CB AM, Corporate) |

| | |

| | 10 |

APPENDIX

FIRM OVERVIEW

| | |

| | 11 |

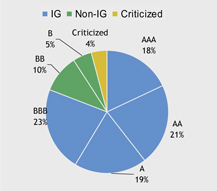

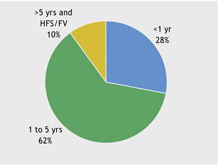

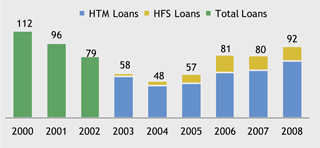

Investment Bank

FIRM OVERVIEW

($ in millions)

| | | | | | | | | | | |

| | | 2007 | | | 2008 | | | O/(U) | |

Revenue | | $ | 18,170 | | | $ | 12,214 | | | (33 | )% |

Investment Banking Fees | | | 6,616 | | | | 5,907 | | | (11 | )% |

Fixed Income Markets | | | 6,339 | | | | 1,957 | | | (69 | )% |

Equity Markets | | | 3,903 | | | | 3,611 | | | (7 | )% |

Credit Portfolio | | | 1,312 | | | | 739 | | | (44 | )% |

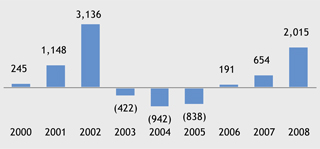

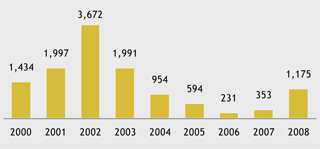

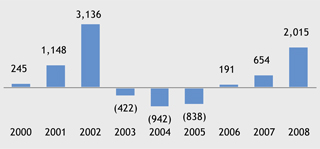

Credit Costs | | | 654 | | | | 2,015 | | | 208 | % |

Expense | | | 13,074 | | | | 13,844 | | | 6 | % |

Net Income | | $ | 3,139 | | | $ | (1,175 | ) | | NM | |

Key Statistics | | | | | | | | | | | |

Overhead Ratio | | | 72 | % | | | 113 | % | | | |

Comp/Revenue | | | 44 | % | | | 63 | % | | | |

| | | |

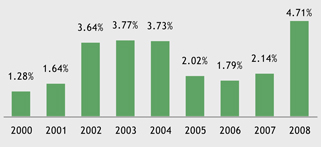

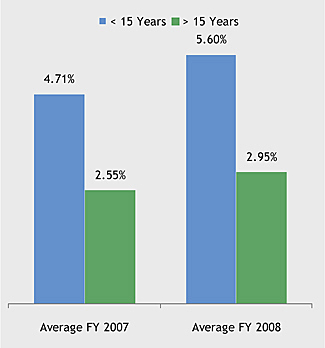

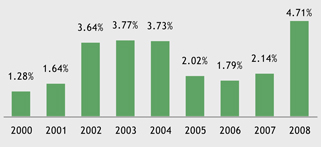

ALL / Total Loans | | | 2.14 | % | | | 4.71 | % | | | |

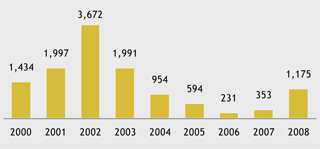

NPLs ($mm) | | $ | 353 | | | $ | 1,175 | | | 233 | % |

| | | |

ROE1 | | | 15 | % | | | (5 | )% | | | |

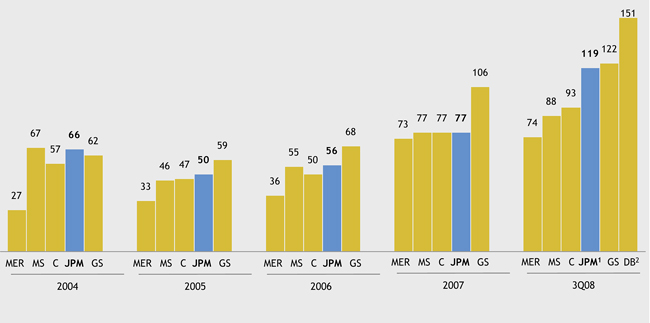

VAR ($mm)2 | | $ | 106 | | | $ | 202 | | | | |

EOP Equity ($B) | | $ | 21.0 | | | $ | 33.0 | | | | |

Leadership Positions

| • | | RiskBank Risk Manager of the Year |

• | | Continue to rank #1 in four capital raising league tables for 20083 |

| | • | | Global Debt, Equity & Equity-related |

| | • | | Global Equity & Equity-related |

| | • | | Global Loan Syndications |

• | | Ranked #1 in Global Fees for 20084 with 8.8% market share |

1 | Calculated based on average equity. Average equity was $26.1B and $21.0B for 2008 and 2007, respectively |

2 | Average Trading and Credit Portfolio VAR |

| | |

| | 12 |

Retail Financial Services — Drivers

FIRM OVERVIEW

($ in millions)

| | | | | | | | | | | |

| | | 2007 | | | 2008 | | | O/(U) | |

Retail Financial Services | | | | | | | | | | | |

Net Income | | $ | 2,925 | | | $ | 880 | | | (70 | )% |

ROE1 | | | 18 | % | | | 5 | % | | | |

EOP Equity ($B) | | $ | 16 | | | $ | 25 | | | | |

Retail Banking | | | | | | | | | | | |

Net Interest Income | | $ | 6,193 | | | $ | 7,659 | | | 24 | % |

Noninterest Revenue | | $ | 3,763 | | | $ | 4,951 | | | 32 | % |

| | | | | | | | | | | |

Total Revenue | | $ | 9,956 | | | $ | 12,610 | | | 27 | % |

Credit Costs | | $ | 79 | | | $ | 449 | | | 468 | % |

Expense | | $ | 6,166 | | | $ | 7,232 | | | 17 | % |

Net Income | | $ | 2,245 | | | $ | 2,982 | | | 33 | % |

Consumer Lending | | | | | | | | | | | |

Net Interest Income | | $ | 4,333 | | | $ | 6,506 | | | 50 | % |

Noninterest Revenue | | $ | 3,016 | | | $ | 4,404 | | | 46 | % |

| | | | | | | | | | | |

Total Revenue | | $ | 7,349 | | | $ | 10,910 | | | 48 | % |

Credit Costs | | $ | 2,531 | | | $ | 9,456 | | | 274 | % |

Expense | | $ | 3,739 | | | $ | 4,845 | | | 30 | % |

Net Income | | $ | 680 | | | $ | (2,102 | ) | | NM | |

Leadership Positions

• | | #3 in deposit market share2 |

• | | #1 in Auto Finance (non-captive)4 |

• | | #2 in Home Equity Originations5 |

• | | #3 in Mortgage Servicing6 |

• | | #3 in Mortgage Originations6 |

• | | 12.0% market share in Mortgage Originations6 |

1 | Calculated based on average equity. Average equity was $19.0B and $16.0B for 2008 and 2007, respectively |

2 | Source: SNL Corporation; market share data as of June 2008, updated for subsequent acquisitions for all banks through January 2009. Includes deposits in domestic offices (50 states and D.C.), Puerto Rico and U.S. Territories only and non-retail branches are not included |

3 | Source: 4Q08 company reports |

4 | Source: Autocount (franchise), December 2008 |

5 | Source: Inside Mortgage Finance, 3Q08 |

6 | Source: Inside Mortgage Finance, 4Q08 |

| | |

| | 13 |

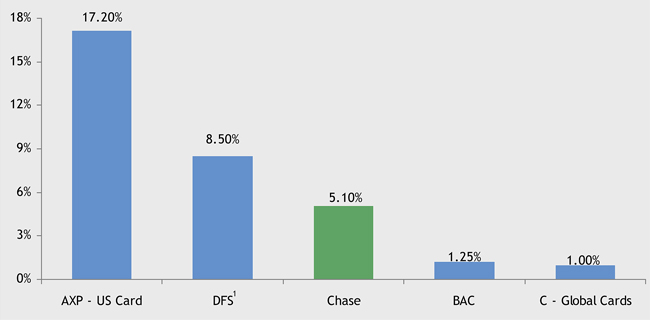

Card Services (Managed)

FIRM OVERVIEW

($ in millions)

| | | | | | | | | | | |

| | | 2007 | | | 2008 | | | O/(U) | |

Revenue | | $ | 15,235 | | | $ | 16,474 | | | 8 | % |

Credit Costs | | $ | 5,711 | | | $ | 10,059 | | | 76 | % |

Expense | | $ | 4,914 | | | $ | 5,140 | | | 5 | % |

Net Income | | $ | 2,919 | | | $ | 780 | | | (73 | )% |

Key Statistics Incl. WaMu ($B) | | | | | | | | | | | |

ROO (pretax) | | | 3.09 | % | | | 0.78 | % | | | |

ROE1 | | | 21 | % | | | 5 | % | | | |

EOP Equity | | $ | 14.1 | | | $ | 15.0 | | | | |

| | | |

Key Statistics Excl. WaMu ($B) | | | | | | | | | | | |

Avg Outstandings | | $ | 149.3 | | | $ | 155.9 | | | 4 | % |

EOP Outstandings | | $ | 157.1 | | | $ | 162.1 | | | 3 | % |

Charge Volume | | $ | 354.6 | | | $ | 361.1 | | | 2 | % |

Net Accts Opened (mm) | | $ | 16.4 | | | $ | 14.4 | | | (12 | )% |

Managed Margin | | | 8.16 | % | | | 8.16 | % | | | |

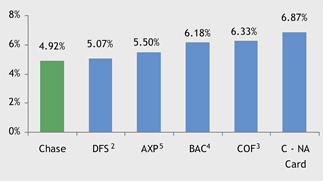

Net Charge-Off Rate | | | 3.68 | % | | | 4.92 | % | | | |

30+Day Delinquency Rate | | | 3.48 | % | | | 4.36 | % | | | |

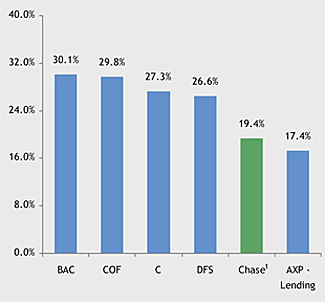

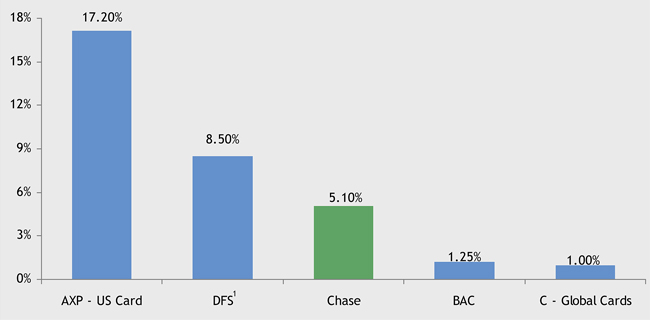

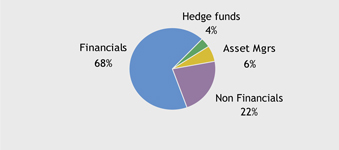

Industry Outstandings2 — 12/31/08

Note: Financial results are presented on a managed basis

1 | Calculated based on average equity. Average equity was $14.3B and $14.1B for 2008 and 2007, respectively |

2 | Domestic GPCC O/S, Source: 4Q08 Company reports. Bank of America data for U.S. consumer and small business card has been estimated since that disclosure was discontinued starting Q3’08; Citi GPCC data has been estimated as it no longer breaks out GPCC receivables; Cap One new US Card segment data includes US Consumer Credit Card, Small Business Card and Installment loans |

3 | Chase market share data includes WaMu receivables |

| | |

| | 14 |

Commercial Banking

FIRM OVERVIEW

($ in millions)

| | | | | | | | | | | |

| | | 2007 | | | 2008 | | | O/(U) | |

Revenue | | $ | 4,103 | | | $ | 4,777 | | | 16 | % |

Middle Market Banking | | | 2,689 | | | | 2,939 | | | 9 | % |

Commercial Term Lending | | | — | | | | 243 | | | NM | |

Mid-Corporate Banking | | | 815 | | | | 921 | | | 13 | % |

Real Estate Banking | | | 421 | | | | 413 | | | (2 | )% |

Other | | | 178 | | | | 261 | | | 47 | % |

Credit Costs | | | 279 | | | | 464 | | | 66 | % |

Expense | | | 1,958 | | | | 1,946 | | | (1 | )% |

Net Income | | $ | 1,134 | | | $ | 1,439 | | | 27 | % |

Key Statistics | | | | | | | | | | | |

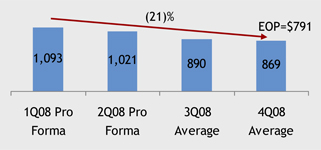

Avg Loans & Leases ($B) | | $ | 61.1 | | | $ | 82.3 | | | 35 | % |

Avg Liability Balances ($B)1 | | $ | 87.7 | | | $ | 103.1 | | | 18 | % |

| | | |

Overhead Ratio | | | 48 | % | | | 41 | % | | | |

Net Charge-Off Rate | | | 0.07 | % | | | 0.35 | % | | | |

| | | |

ALL / Average Loans | | | 2.81 | % | | | 3.04 | % | | | |

| | | |

NPLs ($mm) | | $ | 146 | | | $ | 1,026 | | | NM | |

| | | |

ROE2 | | | 17 | % | | | 20 | % | | | |

EOP Equity ($B) | | $ | 6.7 | | | $ | 8.0 | | | | |

Leadership Positions

• | | Top 3 in Large Middle-market, Traditional Middle-market and Asset Based Lending3 |

• | | #1 originator of multi-family loans in the U.S.4 |

• | | #1 ranking in CB market penetration and lead share in 3 of the top 4 MSAs5 |

1 | Includes deposits and deposits swept to on-balance sheet liabilities |

2 | Calculated based on average equity. Average equity was $7.3B and $6.5B for 2008 and 2007, respectively |

3 | Loan Pricing Corporation, FY08 |

4 | FDIC and OTS as of 9/30/08 |

5 | TNS Market Study, 3Q08 YTD |

| | |

| | 15 |

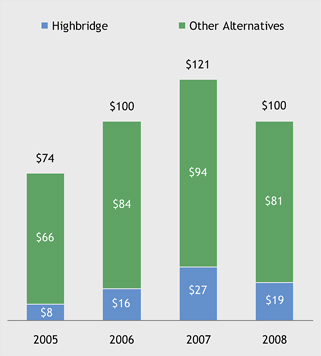

Asset Management

FIRM OVERVIEW

($ in millions)

| | | | | | | | | | | |

| | | 2007 | | | 2008 | | | O/(U) | |

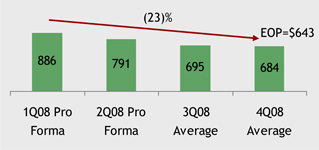

Revenue | | $ | 8,635 | | | $ | 7,584 | | | (12 | )% |

Private Bank | | | 2,362 | | | | 2,565 | | | 9 | % |

Institutional | | | 2,525 | | | | 1,775 | | | (30 | )% |

Retail | | | 2,408 | | | | 1,620 | | | (33 | )% |

Private Wealth Management | | | 1,340 | | | | 1,387 | | | 4 | % |

Bear Stearns Brokerage | | | — | | | | 237 | | | NM | |

Credit Costs | | | (18 | ) | | | 85 | | | NM | |

Expense | | | 5,515 | | | | 5,298 | | | (4 | )% |

Net Income | | $ | 1,966 | | | $ | 1,357 | | | (31 | )% |

Key Statistics ($B) | | | | | | | | | | | |

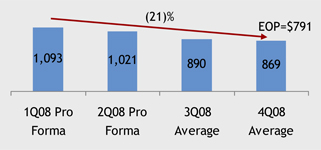

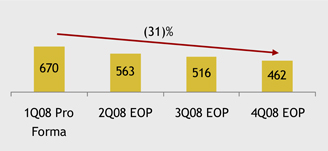

Assets under Management1 | | $ | 1,193 | | | $ | 1,133 | | | (5 | )% |

Assets under Supervision1 | | $ | 1,572 | | | $ | 1,496 | | | (5 | )% |

| | | |

Average Loans2 | | $ | 29.5 | | | $ | 38.1 | | | 29 | % |

Average Deposits | | $ | 58.9 | | | $ | 70.2 | | | 19 | % |

| | | |

Pretax Margin | | | 36 | % | | | 29 | % | | | |

ROE3 | | | 51 | % | | | 24 | % | | | |

EOP Equity | | $ | 4.0 | | | $ | 7.0 | | | | |

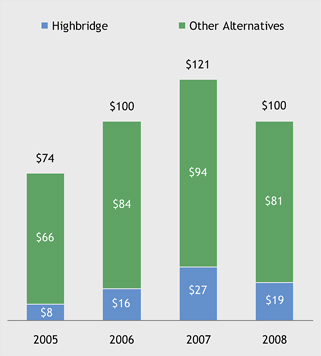

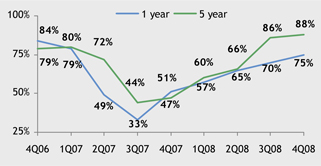

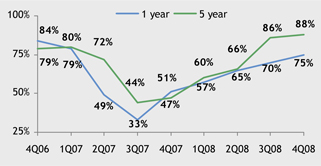

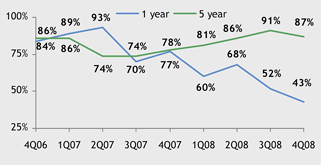

Leadership Positions

• | | Largest manager of AAA-rated global liquidity funds4 |

• | | Largest Hedge Fund manager5 |

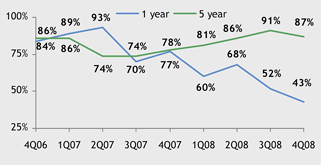

• | | % of AUM in 1st and 2nd Quartiles6 |

• | | 42% of customer assets in 4 & 5 star funds in 20087 |

1 | Reflects $15B for assets under management and $68B for assets under supervision from the Bear Stearns merger on May 30, 2008 |

2 | Reflects the transfer commencing in 1Q07 of held-for-investment prime mortgage loans from AM to Corporate within the Corporate/Private Equity segment |

3 | Calculated based on average equity. Average equity was $5.6B and $3.9B for 2008 and 2007, respectively |

4 | iMoneyNet, December 2008 |

5 | Absolute Return Magazine, September 2008 issue |

6 | Quartile rankings sourced from Lipper for the U.S. & Taiwan; Micropal for the UK, Luxembourg, & Hong Kong; & Nomura for Japan |

7 | Derived from Morningstar for the U.S.; Micropal for the UK, Luxembourg, Hong Kong, & Taiwan; & Nomura for Japan |

| | |

| | 16 |

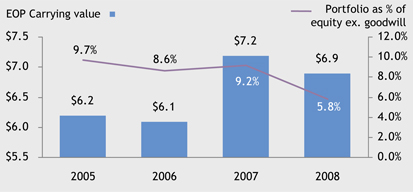

Corporate/Private Equity

FIRM OVERVIEW

Corporate/Private Equity Net Income ($ millions)

| | | | | | | | | | | |

| | | 2007 | | | 2008 | | | O/(U) | |

Private Equity | | $ | 2,165 | | | $ | (690 | ) | | NM | |

| | | |

Corporate | | | (150 | ) | | | 1,458 | | | NM | |

| | | |

Merger-related items | | | (130 | ) | | | (211 | ) | | NM | |

| | | |

Net Income | | $ | 1,885 | | | $ | 557 | | | (70 | )% |

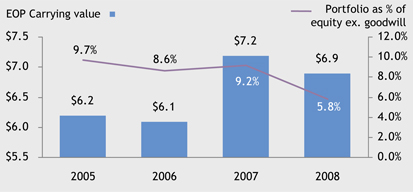

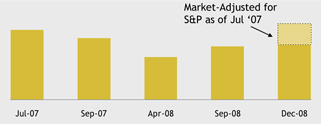

Private Equity Portfolio ($ in billions)

| | |

| | 17 |

Notes on non-GAAP financial measures

FIRM OVERVIEW

This presentation includes non-GAAP financial measures

| 1. | Tangible Common Equity(“TCE”) as shown on slide 8, is defined as common stockholders’ equity less identifiable intangible assets (other than MSRs) and goodwill. The TCE measures used in this presentation are not necessarily comparable to similarly titled measures provided by other firms due to differences in calculation methodologies. |

| 2. | Financial results are presented on a managed basis, as such basis is described in the firm’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2008 and in the Annual Report on Form 10-K for the year ended December 31, 2007. |

| 3. | All non-GAAP financial measures included in this presentation are provided to assist readers in understanding certain trend information. Additional information concerning such non-GAAP financial measures can be found in the above-referenced filings, to which reference is hereby made. |

| | |

| | 18 |

FEBRUARY 26, 2009

HOME LENDING

Charlie Scharf, Retail Financial Services Chief Executive Officer

Agenda

HOME LENDING

| | |

| | | Page |

Home Lending | | 1 |

| |

Home Equity | | 9 |

| |

Prime Mortgage | | 25 |

| |

Subprime Mortgage | | 33 |

| |

Other Items | | 36 |

| | |

| | 1 |

Home lending portfolio

HOME LENDING

Outstandings as of 12/31/08 ($ in billions)

| | | | | | | | | | | | | | | | | | | |

Portfolio | | Total Loans | | Chase | | + | | WaMu: Non-Credit-

Impaired | | = | | Total: Non-Credit-

Impaired | | WaMu: Credit-

Impaired |

Home Equity | | $ | 154.1 | | $ | 94.0 | | | | $ | 20.3 | | | | $ | 114.3 | | $ | 39.8 |

Option ARM | | | 50.6 | | | — | | | | | 9.0 | | | | | 9.0 | | | 41.6 |

Prime Mortgage | | | 97.3 | | | 47.4 | | | | | 24.9 | | | | | 72.3 | | | 25.0 |

Subprime Mortgage | | | 25.6 | | | 12.7 | | | | | 2.6 | | | | | 15.3 | | | 10.3 |

| | | | | | | | | | | | | | | | | | | |

Total Portfolio | | $ | 327.6 | | $ | 154.1 | | | | $ | 56.8 | | | | $ | 210.9 | | $ | 116.7 |

| • | | Total outstandings ~$328B |

| | • | | Non-Credit-Impaired ~$211B (64%) |

| | • | | Credit-Impaired ~$117B (36%) |

Notes: Credit impaired represents UPB not book value; excludes prime mortgage loans classified as held-for-sale

| | |

| | 2 |

Home lending portfolio

HOME LENDING

Outstandings as of 12/31/08 ($ in billions)

| | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio | | Total Loans | | | Chase | | | + | | WaMu: Non-Credit-

Impaired | | | = | | Total: Non-Credit-

Impaired | | | WaMu: Credit-

Impaired | |

Total Portfolio | | $ | 327.6 | | | $ | 154.1 | | | | | $ | 56.8 | | | | | $ | 210.9 | | | $ | 116.7 | |

| | | | | | | |

Loan Loss Reserve | | $ | 7.5 | | | $ | 6.6 | | | | | $ | 0.9 | | | | | $ | 7.5 | | | | NA | |

| | | | | | | |

Fair Value Mark Remaining | | $ | 27.9 | | | | NA | | | | | | NA | | | | | | NA | | | $ | 27.9 | |

| | | | | | | |

LLR as % of Loans | | | 2.3 | % | | | 4.3 | % | | | | | 1.6 | % | | | | | 3.6 | % | | | NA | |

Fair Value Mark % of Loans | | | NA | | | | NA | | | | | | NA | | | | | | NA | | | | 24 | % |

| • | | LLR against Non-Credit-Impaired |

| • | | Fair Value Mark against Credit-Impaired - $88.8B net book value |

Notes: Mark remaining as of Dec-08

| | |

| | 3 |

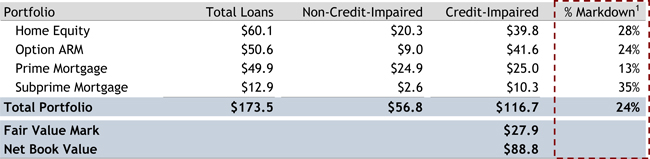

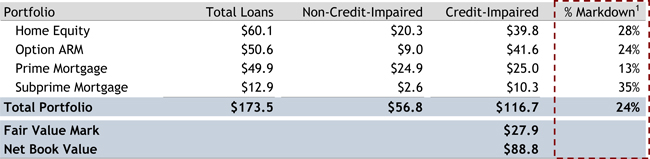

WaMu home lending portfolio — overview

HOME LENDING

Outstandings as of 12/31/08 ($ in billions)

| • | | 67% of WaMu portfolio Credit-Impaired |

| • | | Fair Value Mark 24% of Credit-Impaired Balances |

1 | Percent markdown of credit impaired UPB at 12/31/08, Outstandings represent UPB not Book Value |

| | |

| | 4 |

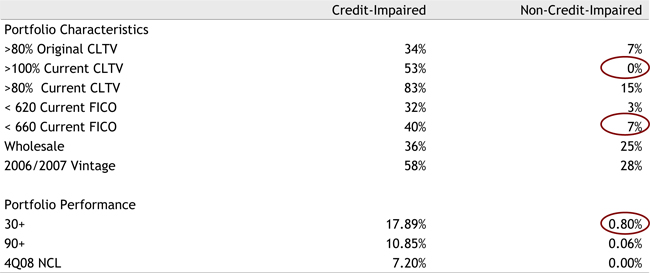

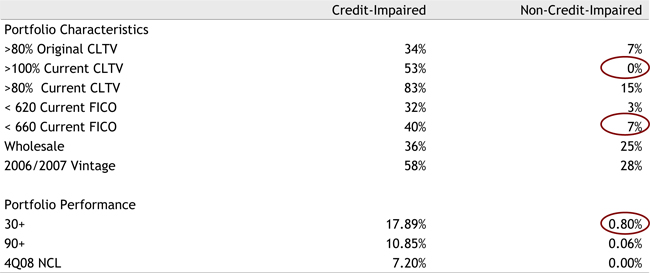

WaMu home lending portfolio — key characteristics

HOME LENDING

Key Credit Statistics

| • | | Credit-Impaired includes majority of high risk assets |

| • | | Non-Credit-Impaired has very low delinquency and no losses in 4Q08 |

| | |

| | 5 |

WaMu home lending portfolio — loss sensitivities

HOME LENDING

Loss Sensitivities

| | | | | | | | | | | | |

Peak to Trough HPI1 | | | (31 | )% | | | (36 | )% | | | (41 | )% |

| | | |

Remaining Lifetime Losses2From Sept 25, 2008 | | $ | 30-36B | | | $ | 32-38B | | | $ | 34-40B | |

| | | |

% Losses from Credit Impaired | | | 94 | % | | | 93 | % | | | 92 | % |

• | | The initial mark reflects $32.5B2 of remaining life losses beyond September 25, 2008 |

| • | | We have not yet experienced losses beyond initial expectations |

| • | | Additions to loan loss reserves would be required if and when delinquency and loss experience exceeds our initial expectations |

1 | Home Price Index, Moody’s/Economy.com Case-Shiller and JPMC Estimates |

2 | For the entire WaMu portfolio (both credit impaired and non-credit impaired) |

| | |

| | 6 |

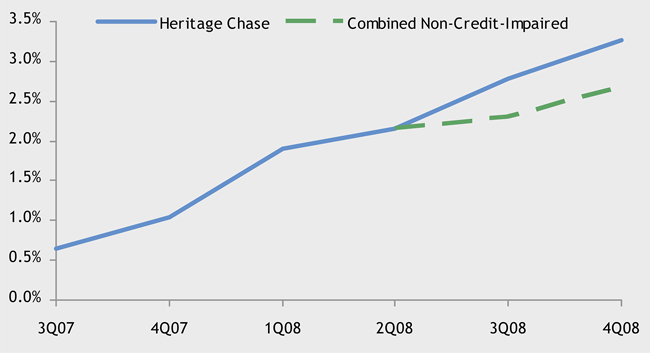

NonCredit impaired portfolio performance

HOME LENDING

Key Credit Statistics

1 | Loans held-for-sale and loans accounted for at fair value under SFAS 159 were excluded when calculating the net charge-off rates |

| | |

| | 7 |

Agenda

HOME LENDING

| | |

| | | Page |

Home Lending | | 1 |

| |

Home Equity | | 9 |

• Heritage Chase only | | |

| |

Prime Mortgage | | 25 |

| |

Subprime Mortgage | | 33 |

| |

Other Items | | 36 |

In the following pages, primarilyHeritage Chasestatistics are shown to provide a clear picture of portfolio performance

| | |

| | 8 |

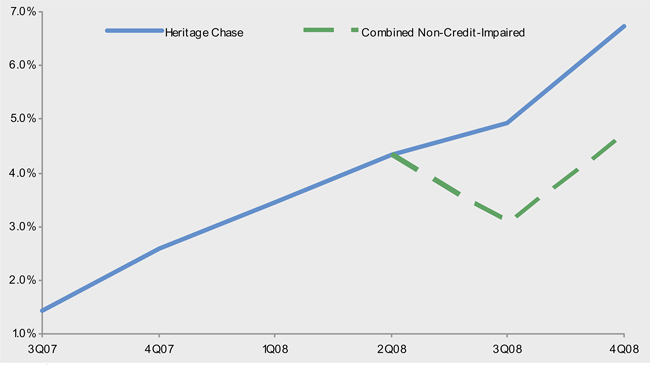

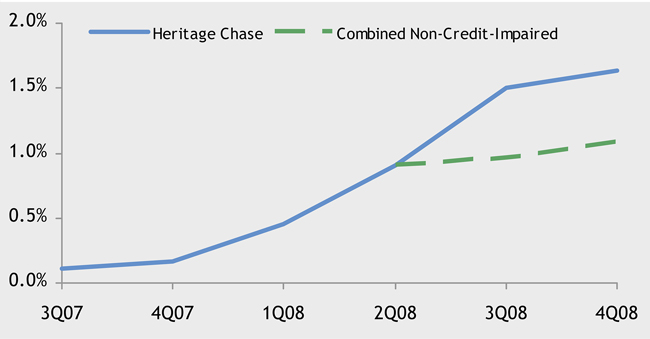

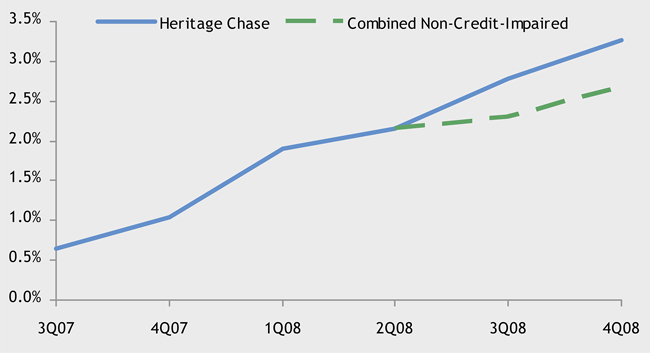

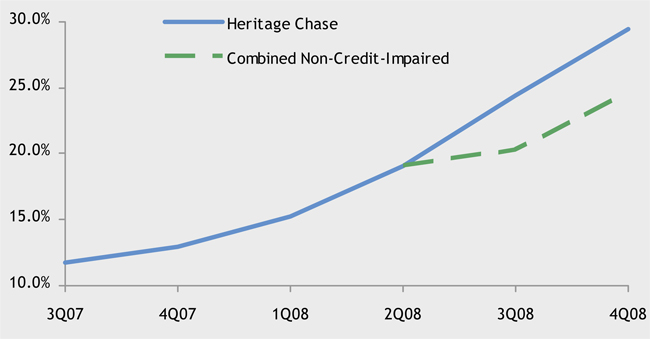

Home equity performance

HOME EQUITY

30+ Delinquency Rate

| • | | Delinquencies continue to grow |

| • | | Very low WaMu Non-Credit-Impaired delinquency - reduces overall rate |

| | |

| | 9 |

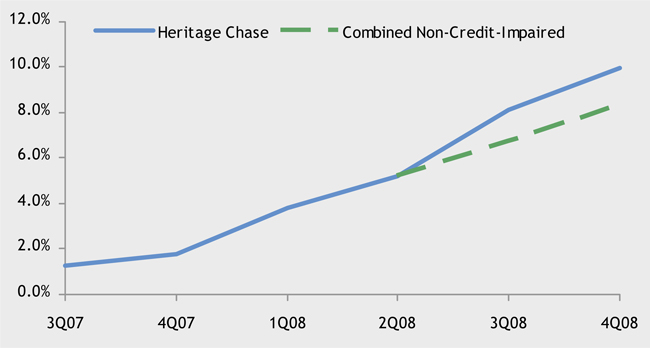

Home equity performance

HOME EQUITY

NCO $ Rate (annualized)

| • | | Losses continue to grow |

| • | | No WaMu Non-Credit-Impaired losses through 4Q08 – reduces overall rate |

| | |

| | 10 |

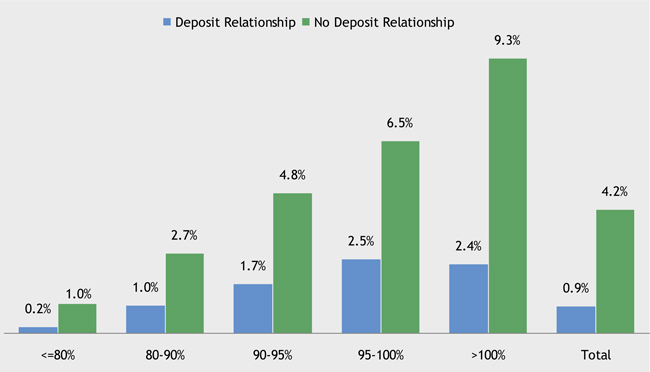

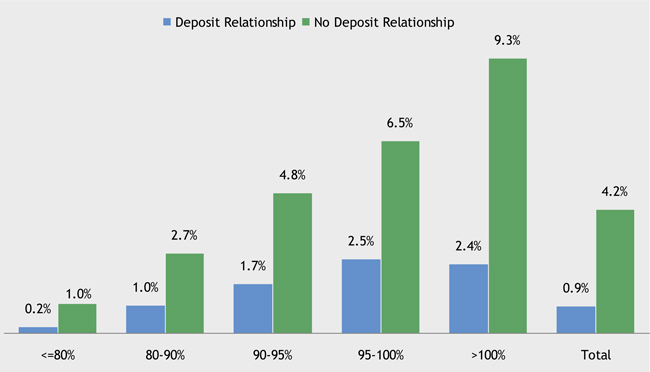

Home equity losses — deposit customers by current CLTV

HOME EQUITY

2008 NCL Rate (annualized)

| • | | Deposit customers have significantly lower loss rates across all CLTV segments |

Note: As ECLTV not available on charge off accounts, used ECLTV at Dec-07 to bucket charge off accounts

| | |

| | 11 |

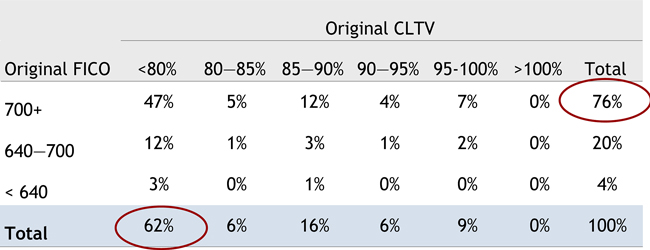

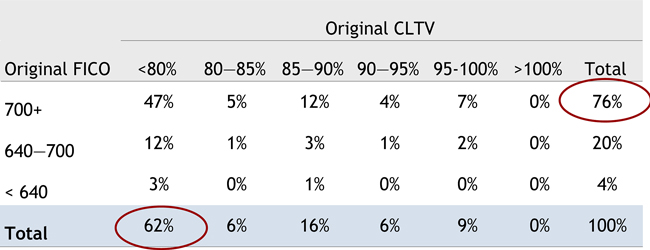

Home equity portfolio by CLTV & FICO at origination

HOME EQUITY

Outstanding as of 12/31/08 ($ in billions)

| • | | 15% of portfolio originated at 90-100 CLTV |

| • | | Majority of originations low LTV, high FICO |

| | |

| | 12 |

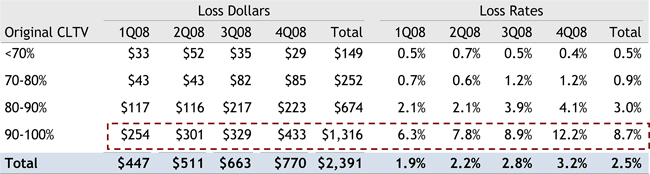

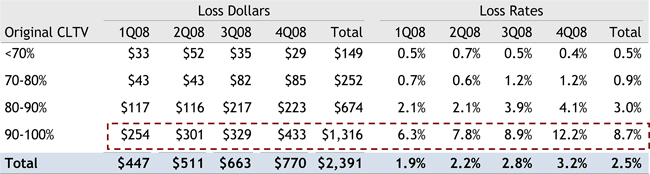

Home equity performance by original CLTV

HOME EQUITY

2008 Losses (Rates Annualized) – ($ in billions)

| • | | 90-100% CLTV generating 55% of losses |

| • | | Losses growing across all original CLTV bands |

| • | | High losses even in lower original CLTV segments |

| | |

| | 13 |

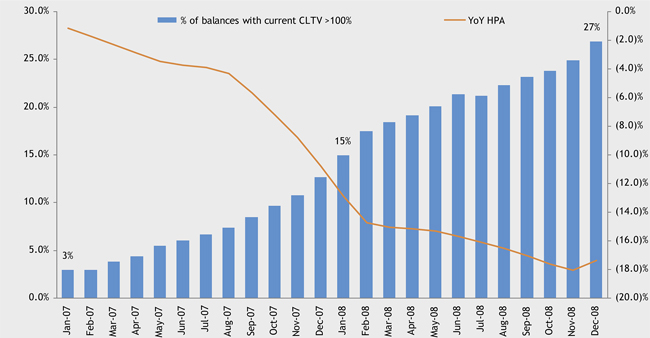

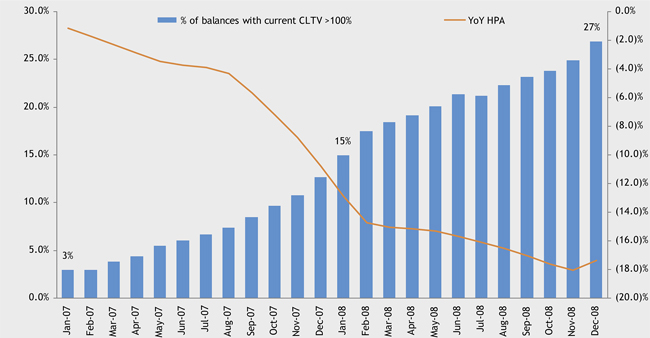

Home equity portfolio estimated CLTV >100%

HOME EQUITY

Note: Current CLTV defined as total line balance as a % of current home value estimated by applying Economy.com MSA level HPA estimates as of 12/31/08

Prime Home Equity Only

| | |

| | 14 |

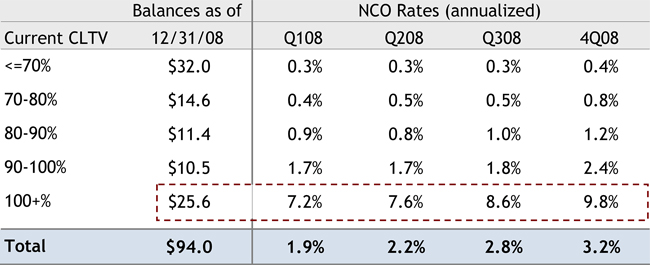

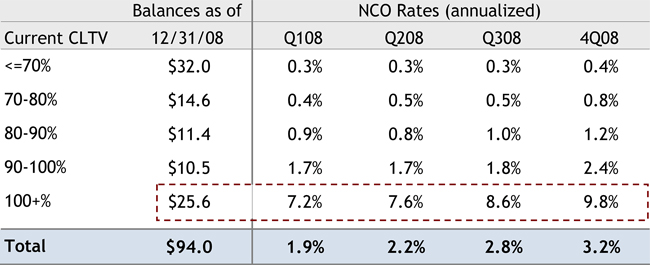

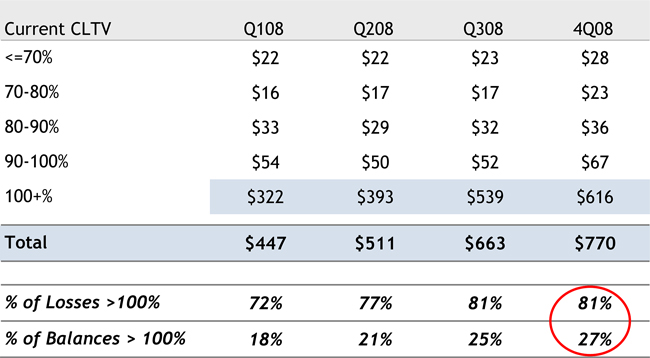

Home equity losses by current CLTV

HOME EQUITY

| • | | Highest loss rates for 100%+ Current CLTV |

| • | | Losses in lower Current CLTV bands growing as unemployment rises |

| | |

| | 15 |

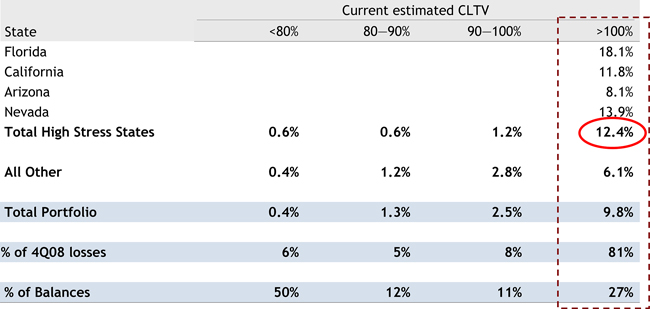

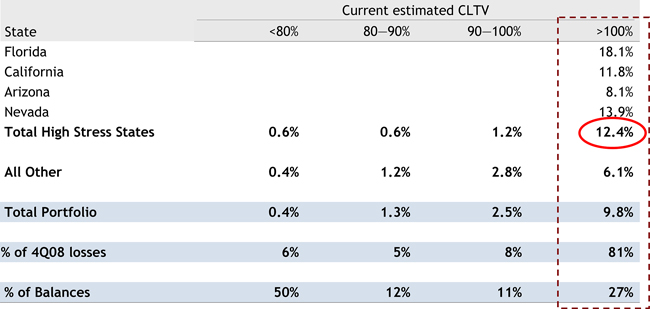

Home equity losses by current CLTV

HOME EQUITY

4Q08 Loss Rates (annualized)

| • | | Losses highest in states with most severe declines in house prices |

Note: Current CLTV defined as total line balance as a % of current home value estimated by applying Economy.com MSA level HPA estimates as of 12/31/08

Loss rates are annualized

| | |

| | 16 |

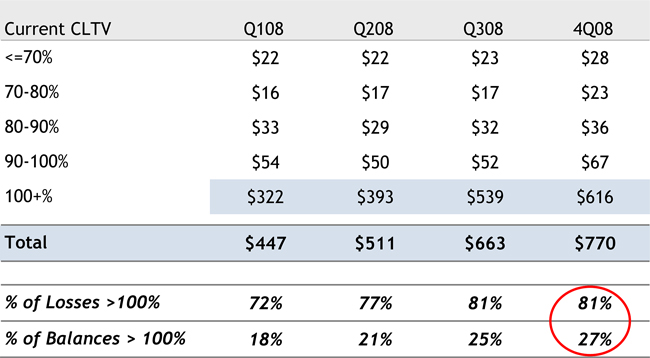

Home equity losses by current CLTV

HOME EQUITY

NCO ($ in millions)

| • | | Majority of losses from 100%+ Current CLTV |

| | |

| | 17 |

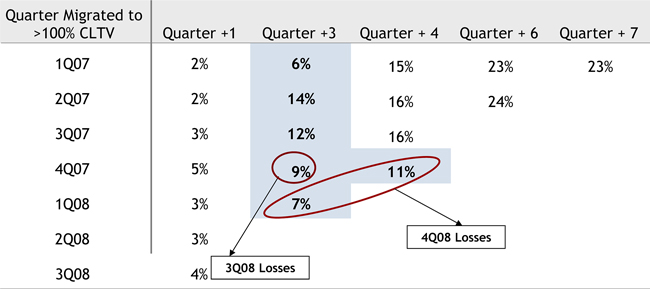

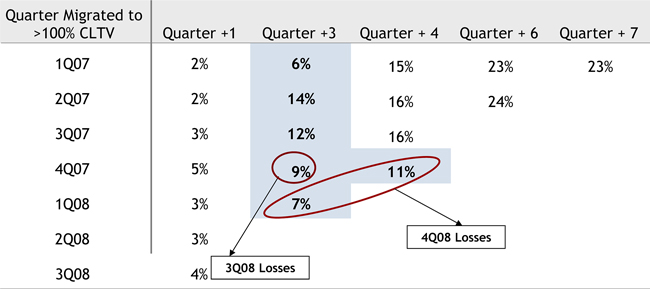

Home equity loss rates following migration to >100% CLTV

HOME EQUITY

Annualized Loss Rates

| • | | Relatively consistent credit deterioration in the older vintages |

| • | | Newer vintages could perform better |

| | |

| | 18 |

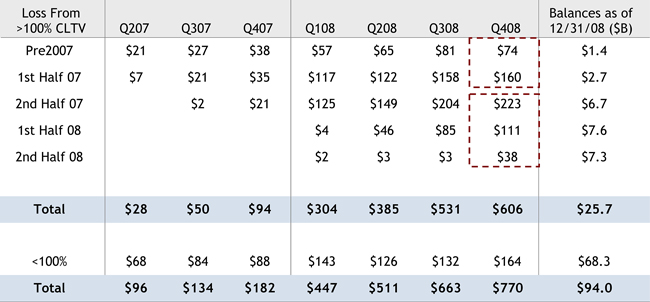

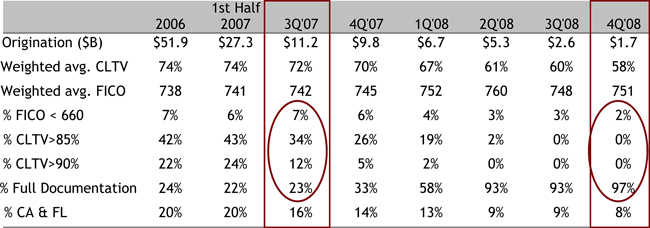

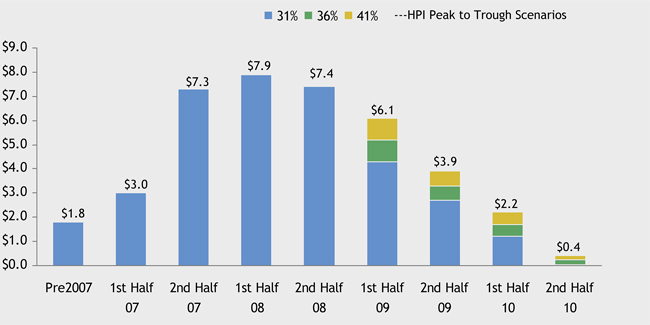

Home equity balances migrating to >100% CLTV

HOME EQUITY

($ in billions)

| • | | 27% of the portfolio >100% CLTV as of end of 2008 |

| • | | Based on HPI Peak to Trough range of 31-41% |

| | • | | 35-39% of the portfolio estimated to be >100% CLTV at the end of 2009 |

| | • | | 36-41% of the portfolio estimated to be >100% CLTV at the end of 2010 |

Note: Home Price Index, Moody’s/Economy.com Case-Shiller Forecast and JPM Estimates

| | |

| | 19 |

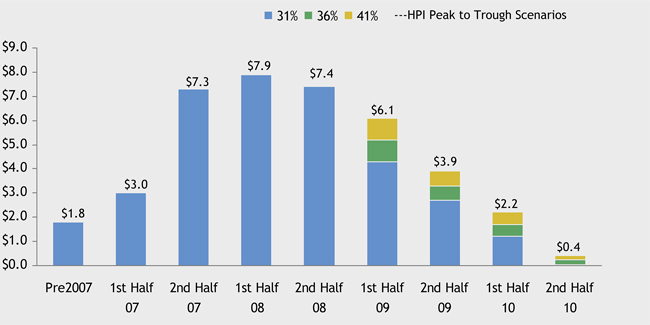

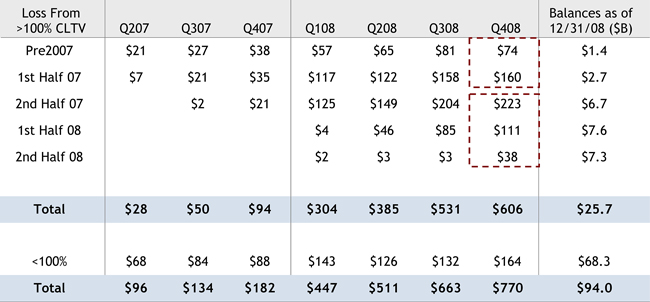

Home equity losses when exceed >100% CLTV

HOME EQUITY

($ in millions)

• | | Pre-2007 and 1st Half 2007 appear to have peaked |

• | | 2nd Half 2007 and 2008 will grow |

| | |

| | 20 |

Home equity unemployment effect

HOME EQUITY

| | | | | | | | | | | |

Current CLTV | | Change in

Unemployment | | Change in

Delinquency | | | Delinquency

Increase per

1pt Increase in

Unemployment | | | Loss

Effect |

<80% | | 1.2pts | | 20 | % | | 17 | % | | $ | 40mm |

80-100% | | 1.0pts | | 47 | % | | 47 | % | | $ | 150mm |

>100% | | 3.3pts | | 36 | % | | 11 | % | | | — |

| • | | Unemployment appears to be driving losses below 100% CLTV |

| • | | Does not appear to be meaningful over 100% CLTV as HPA is the primary driver |

Note: The time period for the changes reflected above are Jan-08 to Dec-08

| | |

| | 21 |

Prime home equity

HOME EQUITY

Originations Profile

| • | | Significant reduction in risk |

| | • | | Minimal volume in FICO under 700 |

| | • | | No loans > 85% CLTV and only 1% over 80%. 73% are <=70% |

Note: CLTV = Combined-Loan-to-Value. This metric represents how much equity the borrower has in the property

CLTV and FICO at origination

Construction and Private Banking loans are included in Full Documentation

Does not include Bulk Loan Purchases

| | |

| | 22 |

Home equity portfolio outlook

HOME EQUITY

| • | | Fewer balances will migrate to >100% CLTV going forward |

| • | | Losses are expected to grow for loans that recently migrated to >100% CLTV |

| • | | It is unclear if loss rates for loans that recently migrated to >100% CLTV will grow as high as older vintages |

| • | | Unemployment likely to impact <100 CLTV, but it will be less meaningful than HPA changes |

| • | | Quarterly losses expected to be $1B to $1.4B for Non-Credit-Impaired in 2009 |

| • | | Losses are expected to level off, but remain high in 2010 if current loss rate trends continue |

| | |

| | 23 |

Agenda

HOME LENDING

| | |

| | | Page |

| |

| Home Lending | | 1 |

| |

| Home Equity | | 9 |

| |

| Prime Mortgage | | 25 |

| |

• Heritage Chase only | | |

| |

| Subprime Mortgage | | 33 |

| |

| Other Items | | 36 |

In the following pages, primarilyHeritage Chasestatistics are shown to provide a clear picture of portfolio performance

| | |

| | 24 |

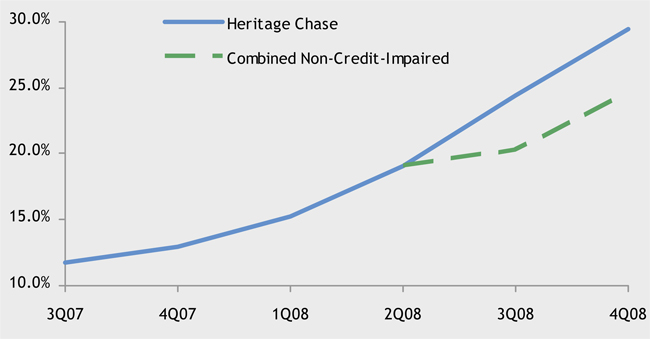

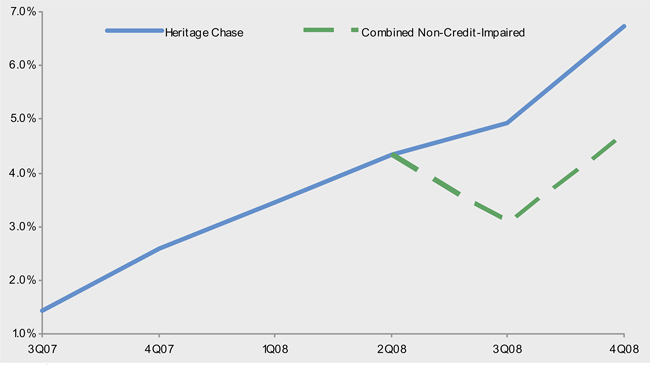

2008 prime mortgage performance

PRIME MORTGAGE

30+ Delinquency Rate

| • | | Delinquencies continue to grow |

| • | | Very low WaMu Non-Credit-Impaired delinquency - reduces overall rate |

| | |

| | 25 |

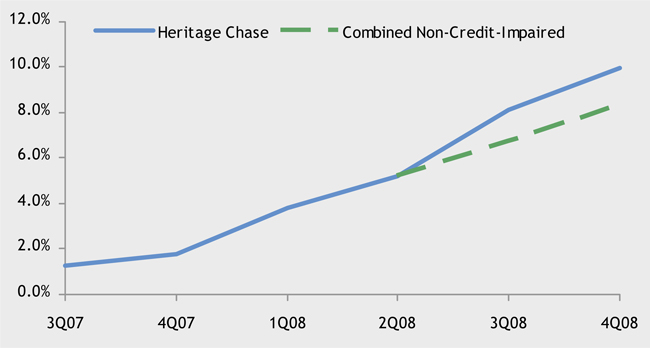

2008 prime mortgage performance

PRIME MORTGAGE

NCO $ Rate (Annualized)

| • | | Losses continue to grow |

| • | | No WaMu Non-Credit-Impaired losses to date – reduces overall rate |

| • | | Quarterly losses could be as high as $375-$475mm over next several quarters |

| | |

| | 26 |

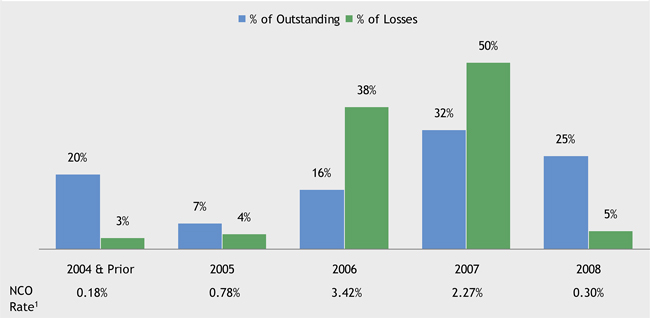

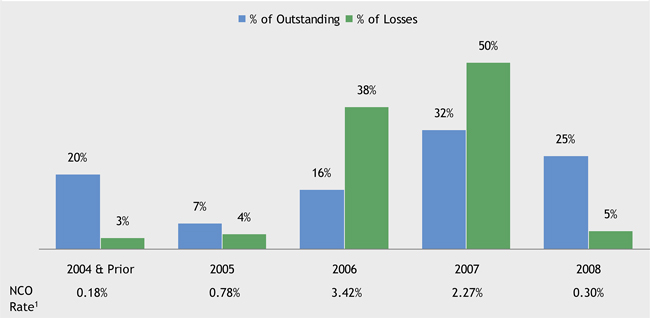

Prime mortgage losses by vintage

PRIME MORTGAGE

Vintage Breakdown as of 4Q08

| • | | 2006 and 2007 vintages generate 88% of losses |

1 | Loss rates are annualized |

Note: Does not include $25mm in losses that are GL adjustments and cannot be attributed to a vintage

| | |

| | 27 |

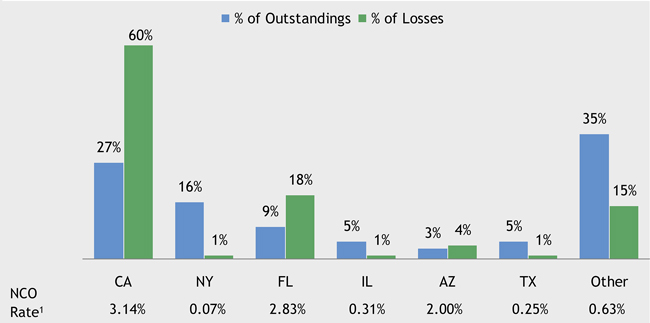

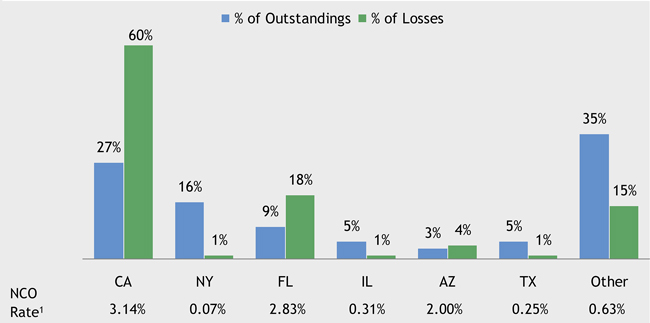

Prime mortgage losses by geography

PRIME MORTGAGE

Geographic Breakdown as of 4Q08

| • | | California and Florida generate 78% of losses |

1 | Loss rates are annualized |

Note: Does not include $25mm in losses that are GL adjustments and cannot be attributed to a state

| | |

| | 28 |

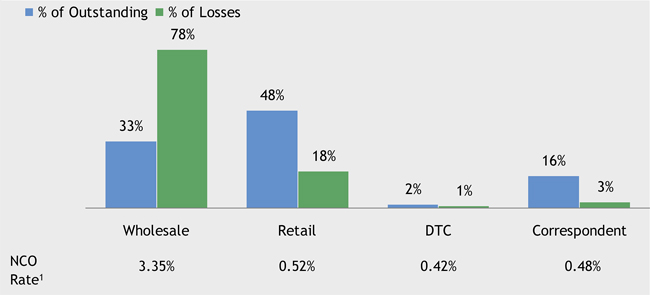

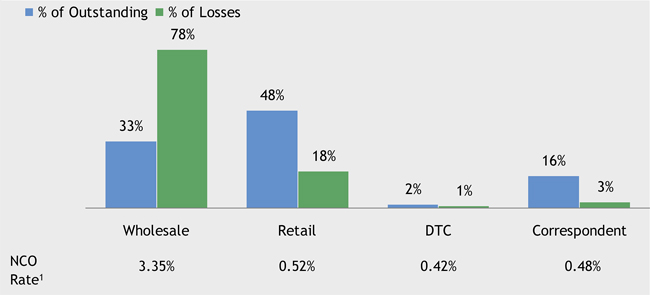

Prime mortgage losses by channel

PRIME MORTGAGE

Channel Breakdown as of 4Q08

| • | | Wholesale channel generates 78% of losses; exited the entire channel |

Note: Does not include $25mm in losses that are GL adjustments and cannot be attributed to a channel

| | |

| | 29 |

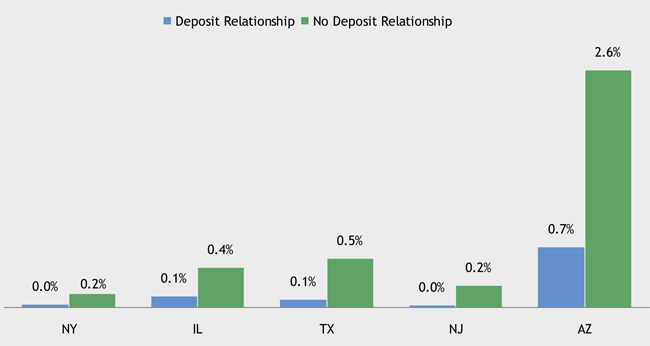

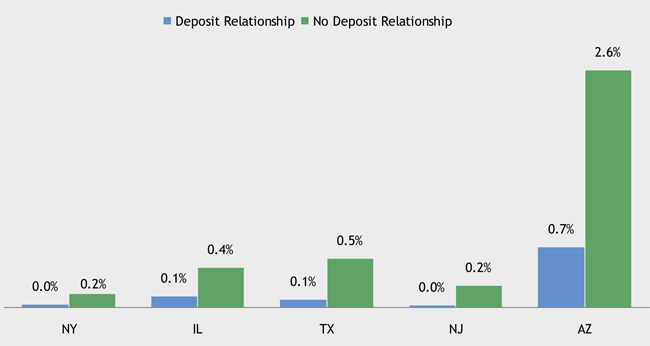

Prime mortgage losses — deposit customers by geography

PRIME MORTGAGE

2008 NCO Rate (Annualized)

| • | | Deposit customers perform better across all geographies |

| | |

| | 30 |

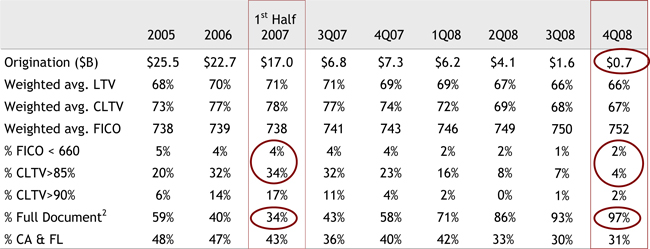

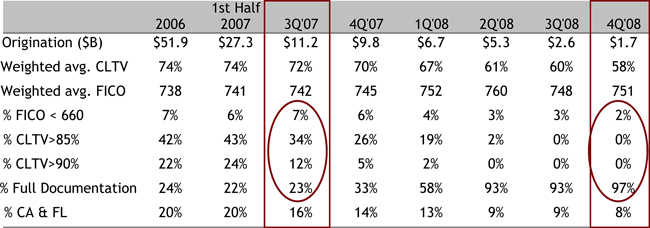

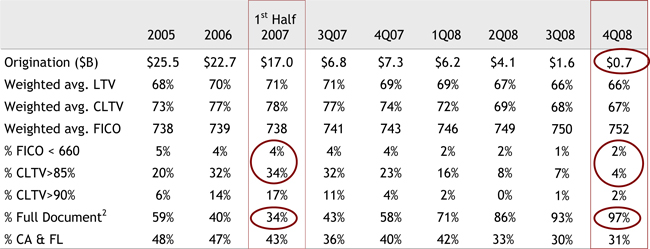

Prime mortgage nonagency jumbo

PRIME MORTGAGE

Originations Profile

| • | | Migration to higher FICO, Full Documentation and lower LTV / CLTV Loans |

Note:

CLTV = Combined-Loan-to-Value. This metric represents how much equity the borrower has in the property

CLTV and FICO at origination

Construction and Private Banking loans are included in Full Doc

Does not include Bulk Loan Purchases

| | |

| | 31 |

Agenda

HOME LENDING

| | |

| | | Page |

Home Lending | | 1 |

| |

Home Equity | | 9 |

| |

Prime Mortgage | | 25 |

| |

Subprime Mortgage | | 33 |

• Heritage Chase only | | |

| |

Other Items | | 36 |

In the following pages, primarilyHeritage Chasestatistics are shown to provide a clear picture of portfolio performance

| | |

| | 32 |

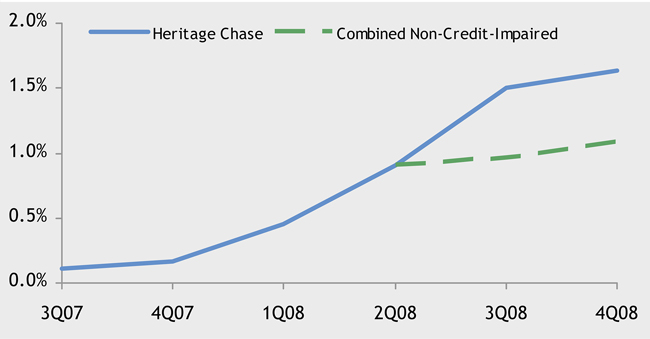

2008 subprime performance

SUBPRIME MORTGAGE

30+ Delinquency Rate

| • | | Delinquencies continue to grow |

| • | | Very low WaMu Non-Credit-Impaired delinquency - reduces overall rate |

| | |

| | 33 |

2008 subprime performance

SUBPRIME MORTGAGE

NCO $ Rate (Annualized)

| • | | Losses continue to grow |

| • | | No WaMu Non-Credit-Impaired losses to date - reduces overall rate |

| • | | Quarterly losses could be as high as $375-$475mm over next several quarters |

| | |

| | 34 |

Agenda

HOME LENDING

| | |

| | | Page |

Home Lending | | 1 |

| |

Home Equity | | 9 |

| |

Prime Mortgage | | 25 |

| |

Subprime Mortgage | | 33 |

| |

Other Items | | 36 |

| | |

| | 35 |

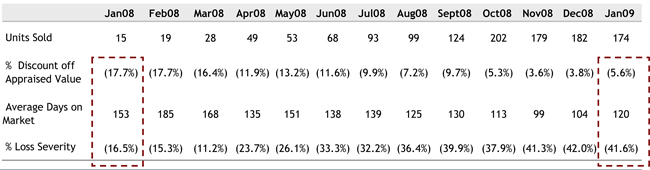

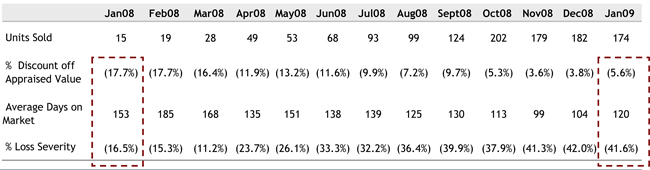

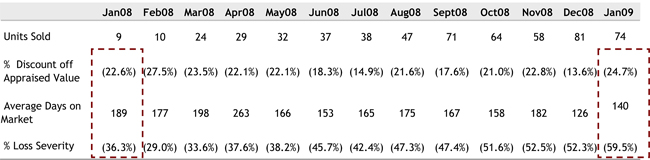

Chase owned REO sales — California vs Florida

OTHER ITEMS

California

Florida

| • | | Early signs of stabilization in CA |

| • | | No positive trend in FL |

| | |

| | 36 |

Loan modification re-performance

OTHER ITEMS

90+ Delinquency Performance after 6 Months (Chase+WaMu)

| | | | | | | | | | | | |

| | | 1Q08 | | 2Q08 |

| | | Imminent Default

With Income

Verification | | Loss Mitigation

With Income

Verification | | Loss Mitigation

Without Income

Verification | | Imminent Default

With Income

Verification | | Loss Mitigation

With Income

Verification | | Loss Mitigation

Without Income

Verification |

Owned | | 1.6% | | 15.9% | | 25.7% | | 4.0% | | 15.7% | | 26.4% |

| | | | | | |

Serviced | | 4.6% | | 11.5% | | 24.7% | | 4.4% | | 11.0% | | 26.1% |

| | | | | | |

Total | | 4.3% | | 13.1% | | 24.9% | | 4.3% | | 12.4% | | 26.2% |

Note: Numerator: 90+, REO and charged off accounts by month after modification (excludes pay off)

Denominator: All completed modifications during observation month. Includes all loans where loss mit activities have been completed, except for loans that were not brought current in the 3 months following mod completion due to op issues/timing

| | |

| | 37 |

Home Lending Point of View

OTHER ITEMS

| • | | Mortgage banking has been and will always be a complex management challenge. |

| • | | Losses will continue to grow as newer vintages mature |

| | • | | Very important relationship product |

| | • | | We have scale in bank branches to distribute — primary focus |

| | • | | Correspondent will add to scale — focus only on retail originations |

| • | | Properly done - expect reasonable Returns |

| | |

| | 38 |

FEBRUARY 26, 2009

COMMERCIAL BANKING

Todd Maclin, Commercial Banking Chief Executive Officer

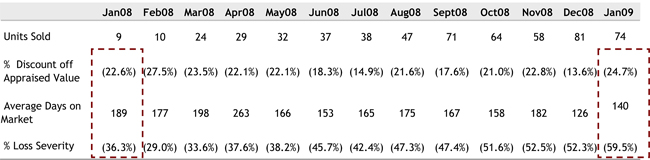

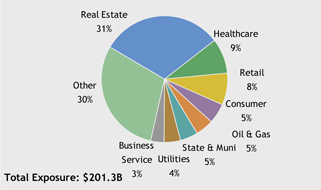

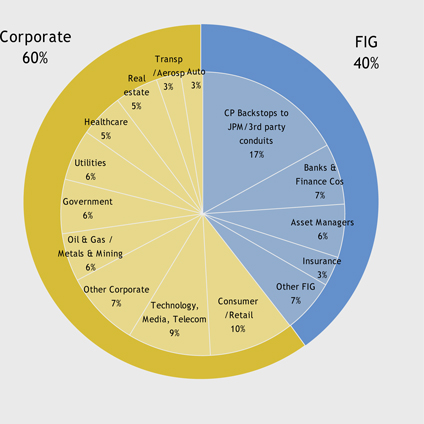

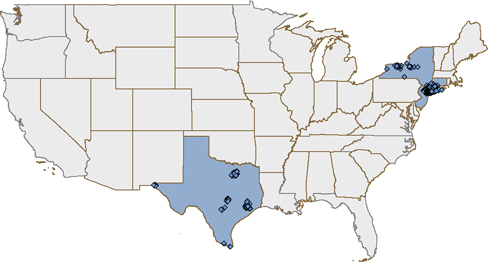

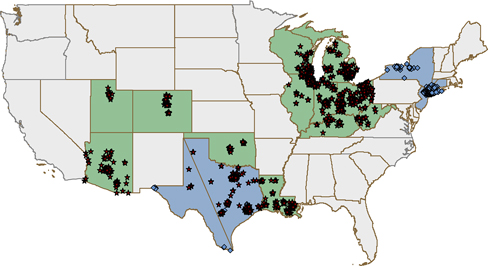

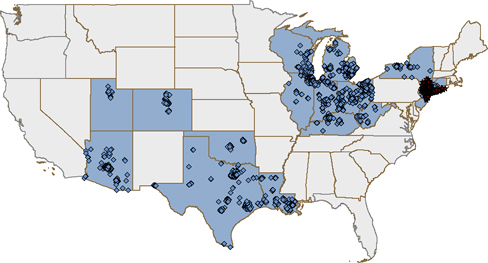

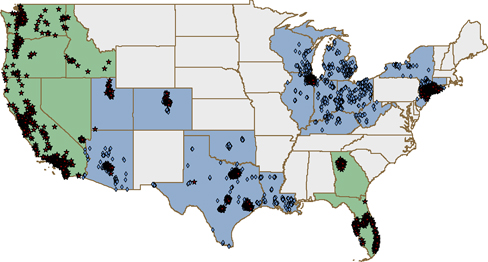

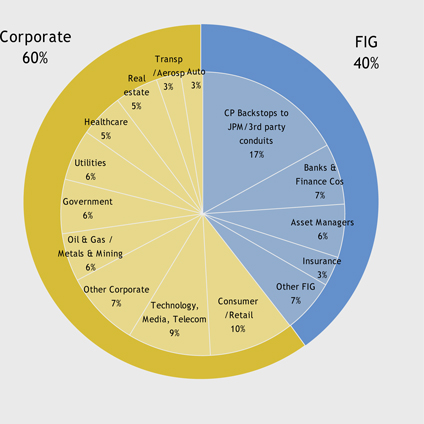

Strategy: lower credit risk/high portfolio diversity

COMMERCIAL BANKING

Highlights

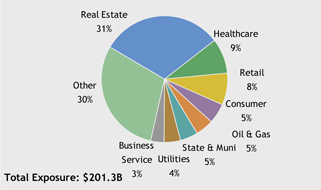

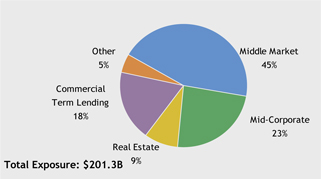

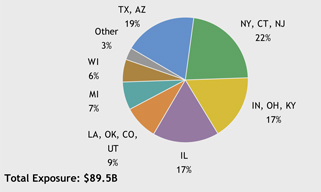

| • | | Geographic and industry diversity- Middle Market & Mid-Corporate (68% of CB portfolio) |

| • | | Limited exposure to leveraged acquisition finance and highly leveraged companies (2% of CB portfolio) |

| • | | Pre-WaMu, Real Estate represented only 12% of CB exposure |

| | • | | Increased to 31% with WaMu, a highly granular, term loan portfolio |

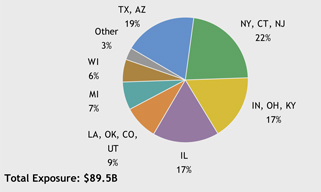

Exposure by Industry (12/31/08)

Exposure by Business (12/31/08)

Middle Market Exposure by Geography (12/31/08)

| | |

| | 1 |

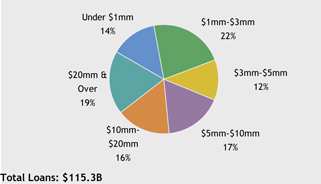

Strategy: portfolio granularity

COMMERCIAL BANKING

Highlights

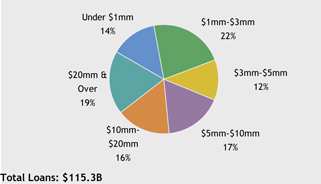

| • | | Middle Market loans average $1.8mm (36% of CB portfolio) |

| • | | WaMu Commercial Term Lending loans average $1.1mm (31% of CB portfolio) |

| • | | 81% of all CB loans are < $20mm |

| • | | Of the $85B unused or unfunded commitments: |

| | • | | 25% are backup lines of credit or unused availability for investment grade muni-bond issuance |

| | • | | 40% are subject to borrowing base or other pre-advance funding conditions |

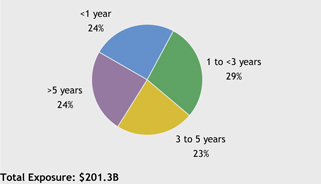

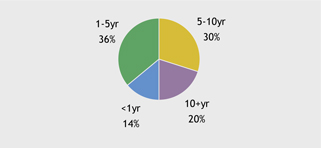

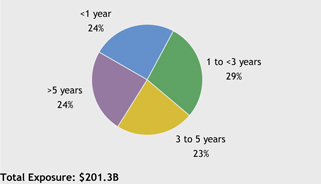

Maturity (12/31/08)

Outstandings by Loan Size (12/31/08)

| | |

| | 2 |

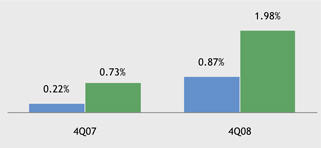

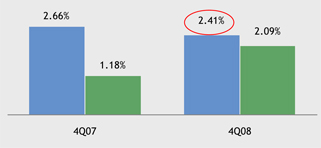

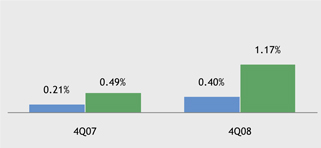

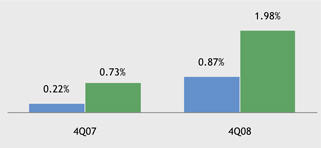

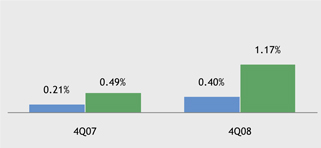

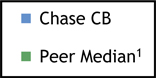

Chase CB performance against peers on key credit metrics

COMMERCIAL BANKING

Commercial NPL Ratio

Allowance for Loan Losses to Loans Ratio

Commercial NCO Ratio

| 1 | Peer median for NPL and NCO ratios reflect commercial equivalent metrics for key competitors (BAC, CMA, FITB, KEY, PNC, STI, USB, WFC, ZION); allowance to loans ratio reflects firmwide metric when the commercial-equivalent metric is not available |

| | |

| | 3 |

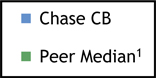

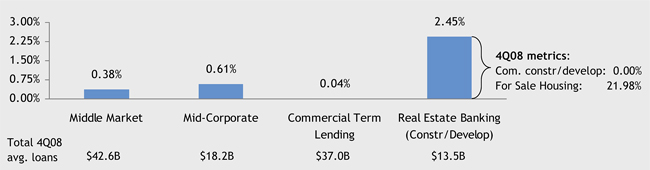

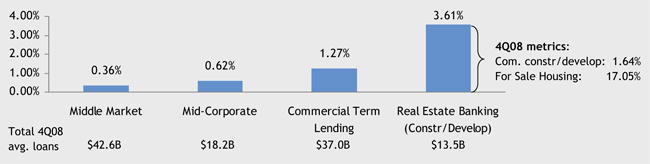

Construction and development lending is driving the problem commercial credit agenda for banks

COMMERCIAL BANKING

4Q08 NPL Ratio by Business

4Q08 NCO Ratio by Business

| | |

| | 4 |

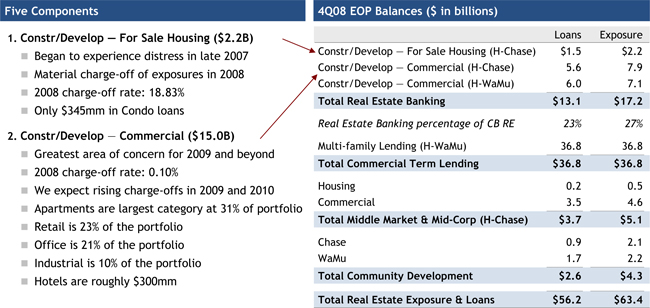

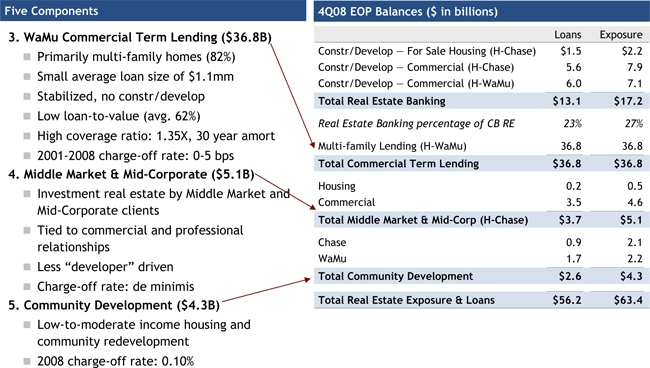

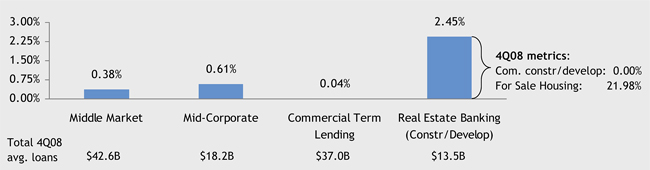

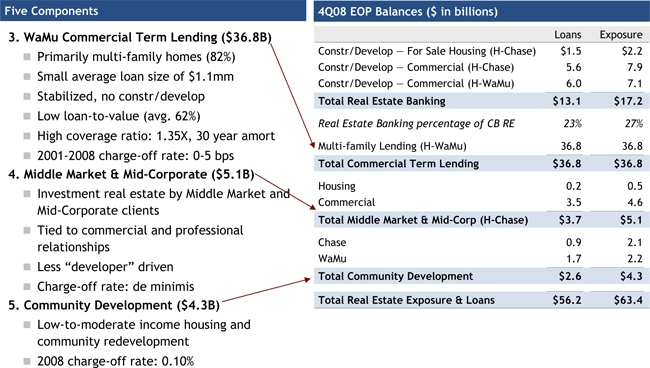

Chase CB real estate exposure

COMMERCIAL BANKING

| • | | Underwriting has been adjusted for market realities |

| | • | | Curtailed lending early in 2008 and increased equity requirements and cap rates |

| | • | | Current focus is on refinancing with pay-downs /workout of existing projects |

| | • | | We expect this segment to get much worse based on leasing trends, with retail being the most troubled segment |

| | |

| | 5 |

Chase CB real estate exposure

COMMERCIAL BANKING

| | |

| | 6 |

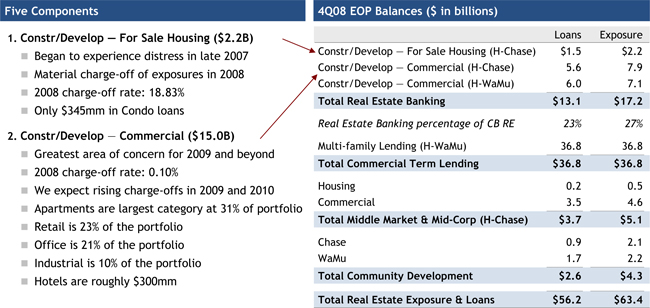

A word on WaMu . . . our Commercial Term Lending business operating model

COMMERCIAL BANKING

Overview

| • | | Borrowers: Small balance, value shoppers, seeking moderate leverage at a fair price |

| • | | Markets: Stable demand and natural supply constraints (zoning, etc.) |

| • | | Properties: Apartment units moderately priced and less volatile; the average age of the property is 53 years with a well-established rent roll |

| • | | Tenants: Renters by necessity – moderately priced housing in a good neighborhood |

Competitive Offering

| • | | Standardized Underwriting: Exclusive in-house appraisers, regimented property evaluations, and cash flow verification |

| • | | Differentiators: No legal or appraisal fees – scale allows for efficiencies |

| • | | Competitive Advantages: Competitive pricing and a fast and simple process |

| • | | Focus: Stabilized cash flows and lower leverage |

| • | | One Identified Weakness: Some limited portfolio issues in Florida and the Northeast when we deviated from this model several years ago – issue addressed prior to acquisition |

| | |

| | 7 |

A word on WaMu . . . changes made and future opportunities

COMMERCIAL BANKING

Actions We’ve Taken in the WaMu Portfolio

| • | | Added more than $700mm of reserves to the WaMu portfolio since acquisition |

Reserves to total loans ratio up from 0.5% before closing to 2.1%

| • | | Modified WaMu’s underwriting standards to conform with Chase’s existing standards and risk appetite |

| • | | Reduced production growth targets to reduce portfolio concentration |

| • | | Right-sized the organization to reflect the current underwriting and economic realities |

| • | | Consolidated construction and development lending into Chase’s existing platform |

Middle Market Expansion Effort

| • | | Build out a Middle Market business in the expanded WaMu branch network |

| • | | 7 key markets: Los Angeles, Orange County, San Francisco, Seattle, Portland, Atlanta, and Florida |

| • | | Continue to focus on prudent client selection and full product client relationships |

| • | | Strong Chase brand and product capabilities – entering new markets as customers are examining their banking relationships |

| • | | Create a strong business for the long haul |

| | |

| | 8 |

Other problem areas for commercial banks

CB has less exposure than most peers

COMMERCIAL BANKING

Leveraged Finance

| • | | Leveraged finance exposures $4.3B |

| | • | | 2% of portfolio; loans $2.7B |

| • | | $19mm average hold position |

| • | | No meaningful unsold, underwritten positions since the credit crisis started in mid ‘07 |

| • | | New leveraged finance transactions virtually non-existent since 1Q08 |

Retail & Discretionary Consumer

| • | | Retail exposures of $9.2B |

| | • | | 5% of portfolio; loans $4.4B |

| | • | | Non-discretionary exposure – $2.2B (food retailers, drugstores, discounters) |

| • | | Largest components: specialty stores ($3.1B) and restaurants ($2.3B): ~40% in McDonalds franchisee loans |

| • | | 23% are in asset-based lending |

| | • | | Highly structured and secured |

Highly Cyclical Industries

| • | | Construction/building materials |

| | • | | Exposures $6.7B; loans $3.1B |

| | • | | Additional $0.6B in related sectors |

| | • | | 60% tied to residential |

| | • | | Exposures $2.7B; loans $0.7B |

| | • | | Exposures $1.2B; loans $0.5B |

Automotive

| • | | Direct automotive exposures $2.8B at year-end |

| | • | | Include suppliers, dealers and aftermarket |

| • | | Additional $1.5B exposure indirectly linked (e.g. plastic, steel suppliers to the industry) |

| • | | Loans with high to medium at-risk dependency on domestic manufacturers estimated: <30% of automotive portfolio |

| • | | Actions taken over past few years to improve structure and collateral |

| | |

| | 9 |

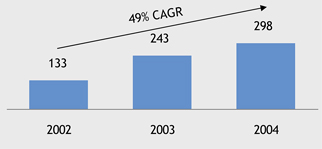

Government, Non-Profit, & Healthcare

A high quality credit growth opportunity

COMMERCIAL BANKING

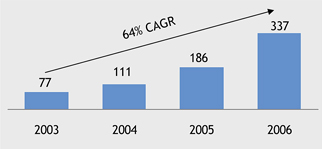

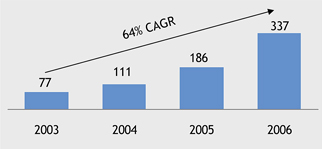

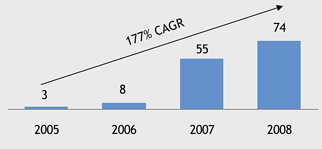

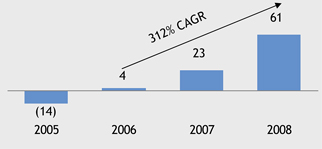

GNPH Exposure Growth ($ in millions)

| • | | GNPH exposure is up 51% YoY; majority of exposure is A or AA-rated |

| • | | Targeted GNPH customers are state and local municipalities, non-profit and healthcare entities, and educational institutions |

| • | | Underwriting of risk isALWAYSbased upon creditworthiness of the customer — no material value given to third party insurers |

| | |

| | 10 |

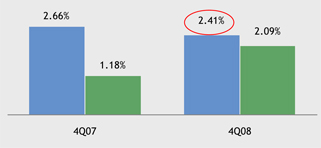

A conservative approach to credit

COMMERCIAL BANKING

Proactive Management

| • | | Took advantage of market liquidity in recent years to exit weak & unprofitable credits |

| | • | | Exited $1.5B annually from 2005-2007 |

| • | | Quarterly deep dive credit reviews with senior management |

| • | | Escalated approval of new exposures over $15mm |

| • | | Proactively discussing renewals and refinancing |

Strong Reserves and Capital

| • | | Building reserves and maintaining high loan loss coverage ratio |

| • | | Loan loss reserves to total loan ratio: 2.41% |

| | • | | Reserve ratio steady and strong through the cycle |

| • | | Loan loss reserves to nonperforming loans: 2.75x |

Stringent Focus on Recession Management

| • | | Reallocate resources (human and financial) to manage problems in existing portfolio |

| • | | Formed Problem Loan Prevention Teams |

| | • | | Led by experienced, top talent |

| • | | Engage senior management in more day-today account management decisions |

| • | | Track portfolio movement weekly and monthly to focus on emerging issues |

| • | | Dramatically cut discretionary spending |

Careful Client Selection

| • | | Continue our careful client selection – not just a reaction to the crisis |

| • | | Drive growth in high quality, low risk relationships; e.g. Government, Non-Profit & Healthcare |

| • | | Strict guidelines for pre-selecting prospects |

| • | | Eschew credit-only and/or unprofitable/risky relationships |

| | |

| | 11 |

Near-term outlook

COMMERCIAL BANKING

| | |

Loan demand is

waning | | • Lower sales mean clients borrow less for expansion or working capital • Line usage always decreases during recessions |

| |

Strong

capital/reserves for

credit deterioration | | • Always manage the business with the expectation of cyclical credit downturns • This commercial credit cycle is going to get worse for commercial banks before it gets better |

| |

Proactive

management of

problems | | • Reassign people and resources accordingly • Early warning systems • Address problems quickly |

| |

Aggressively

managing Real

Estate concentration | | • Commercial construction and development is the area of greatest concern • Stabilized multi-family lending has lower volatility |

| |

WaMu is a good

addition | | • #1 multi-family originator in the U.S. • Branch platform to expand Commercial Banking franchise |

| | |

| | 12 |

Why We Love this Business

COMMERCIAL BANKING

| | • | | Mostly privately-owned, multi-generational, family businesses |

| | • | | Loyal and conservative owners |

| | • | | Lots of experience managing in difficult times |

| • | | High demand for JPM’s product platform |

| | • | | Non-credit revenue represents 64% of total revenue |

| | • | | Average annual IB fee revenue growth 2005-2008: 21% |

| | • | | Loans to deposits ratio of 1.03x |

| • | | Prudent segment and client selection |

| | • | | Avoiding commercial real estate: no growth in the portfolio in the past four years |

| | • | | Avoiding leveraged loans to financial sponsors: less than 1% of total exposure |

| | • | | Pursuing GNPH segment: lower risk, improving spreads, profitable segment with high demand for non-credit products and services |

| • | | Mainstream C&I lending is more granular and better structured than large corporate lending |

| | • | | Loans generally collateralized with borrowing base advances |

| | • | | Higher standards for loan terms and financial covenants |

| • | | Significant benefits and economies of scale: |

| | • | | Non-credit expense essentially flat for three years |

| | • | | Reserves for losses maintained at the high end of the range |

| | • | | Capacity to invest in products and systems that produce deposits and non-credit revenue |

| | • | | Customer flight to quality/financial strength provides self-funding and cross-sell |

| | • | | Business that grows over time with United States |

| | |

| | 13 |

FEBRUARY 26, 2009

CARD SERVICES

Gordon Smith, Card Services Chief Executive Officer

Agenda

CARD SERVICES

| | |

Credit environment | | 2 |

| |

Portfolio positioning | | 12 |

| |

How has Chase reacted to the environment | | 20 |

| |

Core vision and strategy | | 27 |

| |

Overcoming medium-term financial challenges | | 36 |

| |

Managing through the downturn | | 40 |

Note: All data excludes WaMu portfolio performance, unless specifically noted

| | |

| | 1 |

Tougher credit environment

CREDIT ENVIRONMENT

| • | | We expect credit losses to materially increase in 2009 |

| • | | While we don’t predict unemployment rate, we are prepared for 9% by year-end |

| • | | Increasing deterioration in the labor market has exacerbated consumer stress, which has manifested in the form of lower payment rates |

| • | | Consumer confidence is at record lows and is having an adverse impact on sales volumes |

| • | | Accounts are rolling forward to charge-off at an accelerated pace |

| • | | Bankruptcy filings are normalizing to pre-2005 levels |

| • | | Home price depreciation stressed areas have seen a larger deterioration in credit performance |

| • | | Regions with higher unemployment rates are further impacting credit performance |

| | |

| | 2 |

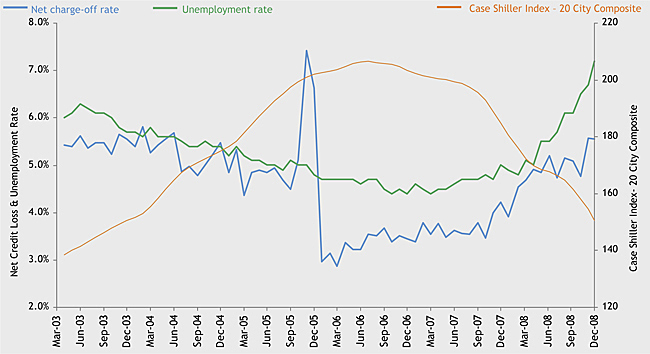

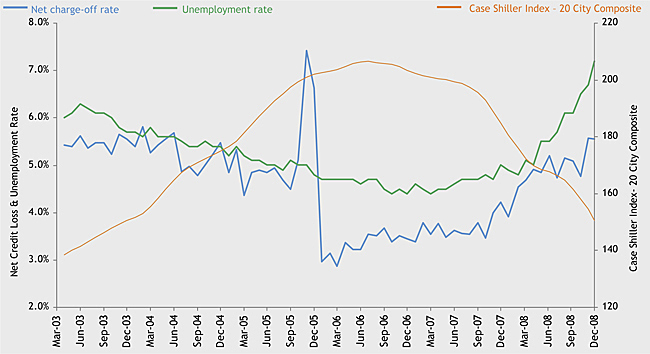

Home price depreciation was the largest driver of credit losses until mid-2008 when unemployment became a meaningful factor

CREDIT ENVIRONMENT

Net Charge-Off Rate (NCO) vs. Unemployment Rate

Source: Bureau of Labor Statistics for unemployment rate; S&P for Case Shiller Index data

| | |

| | 3 |

Unemployment rate will be the primary driver of credit losses in 2009

CREDIT ENVIRONMENT

| • | | In our portfolio, the relationship between losses and unemployment has been less than 1:1 because of our prime/superprime focus, coupled with our co-brand and rewards business model |

| • | | Relationship between unemployment rate and losses has changed in this downturn due to the compounding impact of home price depreciation, equities volatility and consumer confidence |

| • | | Reaffirm our NCO outlook of 7% for 1Q09 |

| | |

4Q09 Unemployment Scenarios | | Projected 4Q09 NCO Rate1 |

8% | | 8% +/- |

9% | | 9.0% - 9.5% |

10% | | 10.0% - 10.5% |

1 | Assumes receivables are flat relative to 1Q09 |

Source: Bureau of Labor Statistics for unemployment rate

| | |

| | 4 |

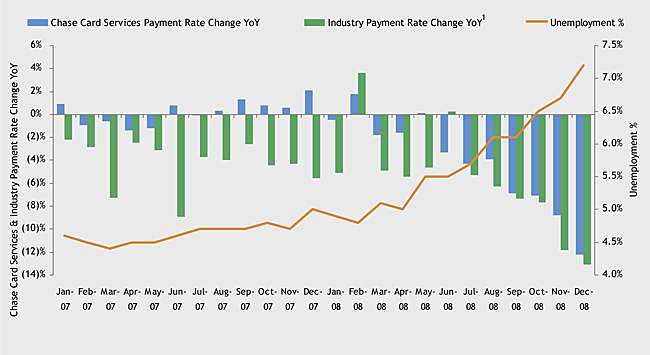

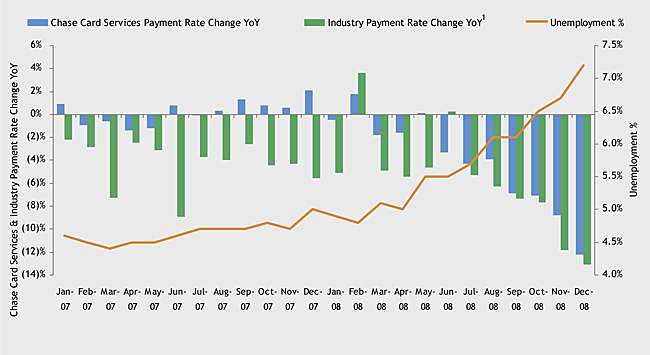

Increase in unemployment rates and home price declines has led to a marked slowdown in payment rates

CREDIT ENVIRONMENT

Unemployment vs. Chase Card Services Payment Rates

1 | Industry payment rates represent average of Chase, C, COF, BAC, AXP Lending, and DFS trusts |

Source: Bureau of Labor Statistics, Internal Chase data; SEC Trust Filings

| | |

| | 5 |

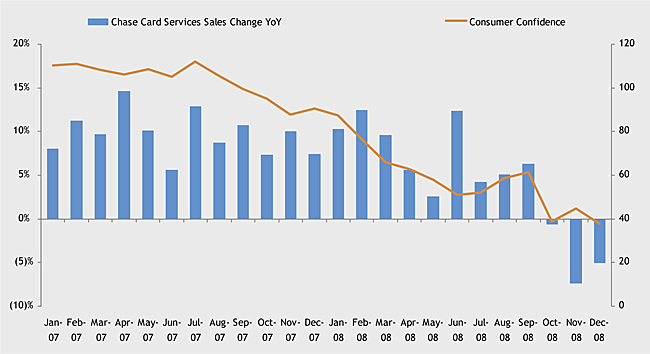

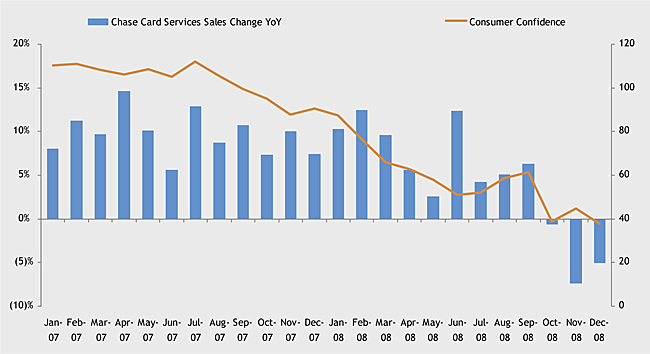

Drop in consumer confidence has been accompanied by falling sales volumes

CREDIT ENVIRONMENT

Consumer Confidence Index vs. Sales Volumes1

1 | Sales data excludes cash advances and balance transfers |

| Source: | Conference Board, Internal Chase data |

| | |

| | 6 |

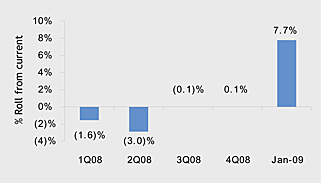

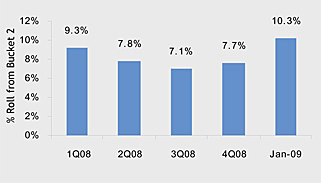

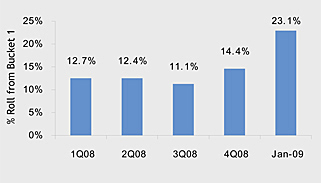

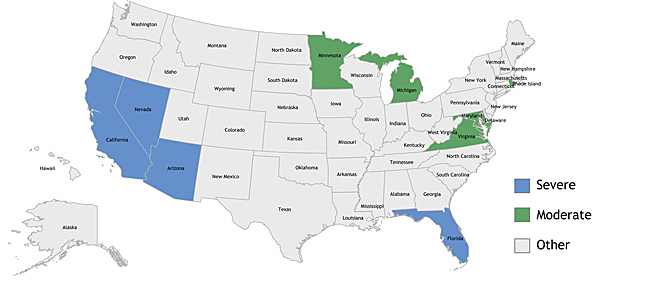

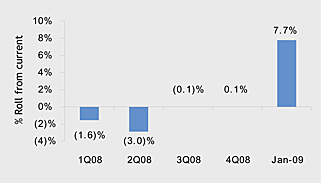

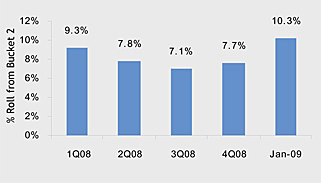

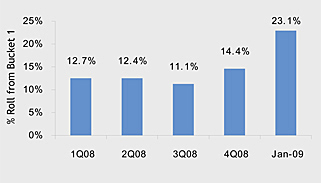

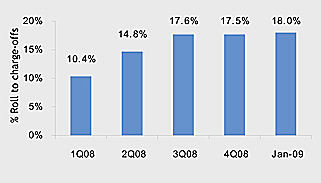

Accounts are rolling forward at a quicker rate with fewer curing in the delinquency buckets

CREDIT ENVIRONMENT

Current to 30 days – YoY % Change

60+ days to 90 days – YoY % Change

30+ days to 60 days – YoY % Change

90+ days to Charge- Off – YoY % Change

Source: Internal Chase data

| | |

| | 7 |

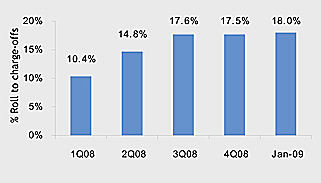

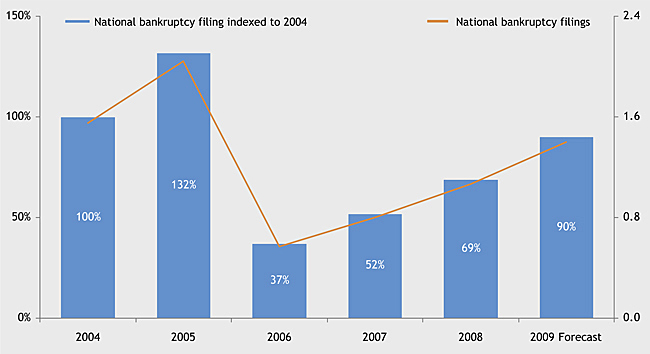

Bankruptcy filings are returning to pre-2005 levels

CREDIT ENVIRONMENT

National Bankruptcy Filings ($ in millions)

Source: Administrative office of the US Courts; Internal Chase forecast for 2009

| | |

| | 8 |

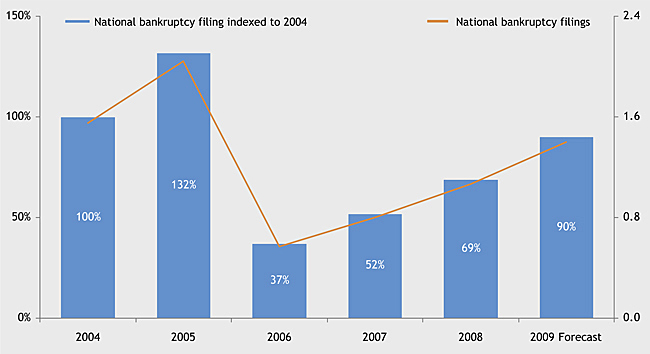

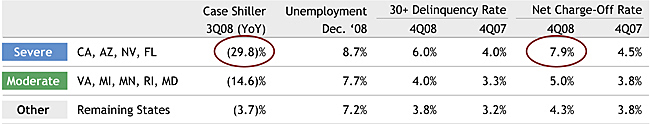

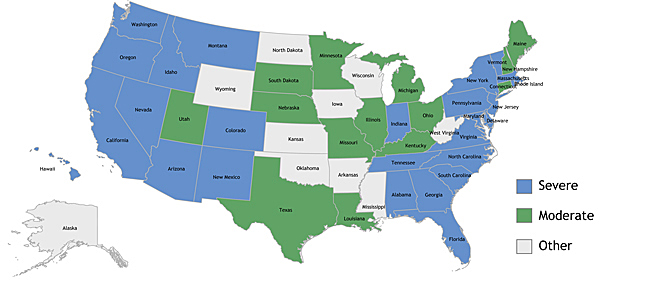

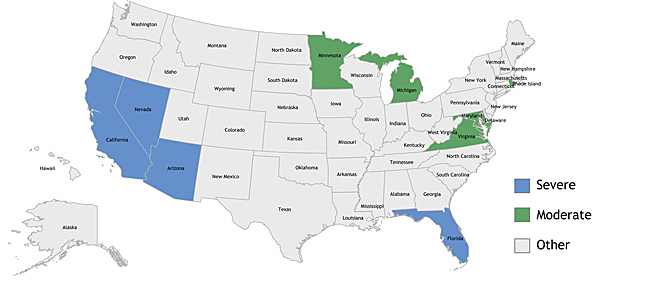

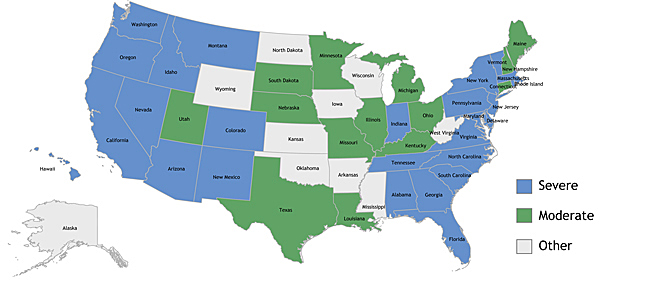

Impact of housing on credit performance

CREDIT ENVIRONMENT

Credit Performance

Source: S&P for Case Shiller Home Price Index; based on latest state level data available for housing price change (data as of 3Q08); Internal Chase data

| | |

| | 9 |

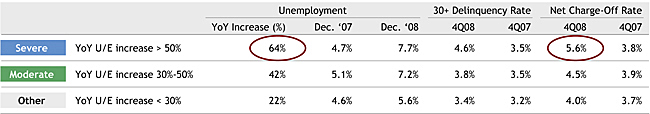

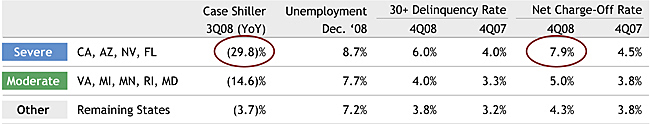

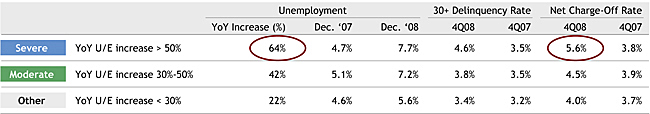

Impact of unemployment on credit performance

CREDIT ENVIRONMENT

Credit Performance

Source: Bureau of Labor Statistics for Unemployment rate; Internal Chase data

| | |

| | 10 |

Agenda

CARD SERVICES

| | |

Credit environment | | 2 |

| |

Portfolio positioning | | 12 |

| |

How has Chase reacted to the environment | | 20 |

| |

Core vision and strategy | | 27 |

| |

Overcoming medium-term financial challenges | | 36 |

| |

Managing through the downturn | | 40 |

| | |

| | 11 |

Portfolio mix and credit capabilities are an asset, but don’t isolate us from current downturn

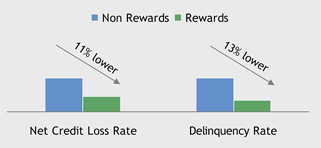

PORTFOLIO POSITIONING

| • | | Our increased focus on rewards and partner business has driven a positive risk selection |

| • | | Our exposure to the home price depreciation stressed areas of CA and FL is in line with peers |

| • | | We have a better risk profile relative to our peer group |

| • | | Our customers have longer credit histories relative to peer group, which translates into better credit performance |

| • | | Our portfolio has more established credit bureau profile compared to peers |

| • | | We have a higher percentage of homeowners in our portfolio relative to peers and they exhibit superior credit performance |

| | |

| | 12 |

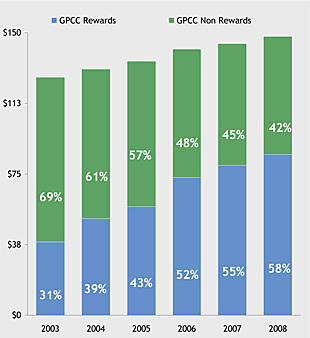

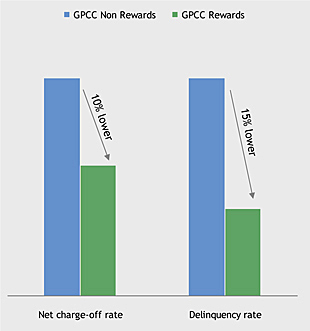

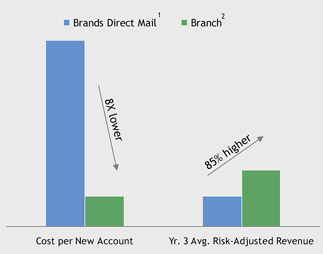

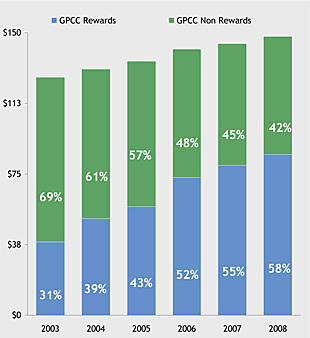

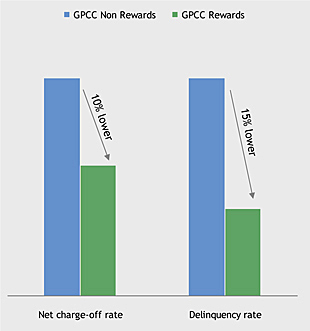

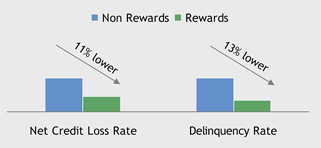

Increased focus on rewards and partnership business drive a positive risk selection

PORTFOLIO POSITIONING

| • | | Cards with rewards have higher level of loyalty, engagement, and superior risk performance |

| • | | Rewards represented 58% of outstandings |

Rewards as % of Outstandings ($ in billions)1

4Q08 Credit Performance1

Note: GPCC = General Purpose Credit Cards

Source: Internal Chase data

1 | Excludes Retail Partner GPCC |

| | |

| | 13 |

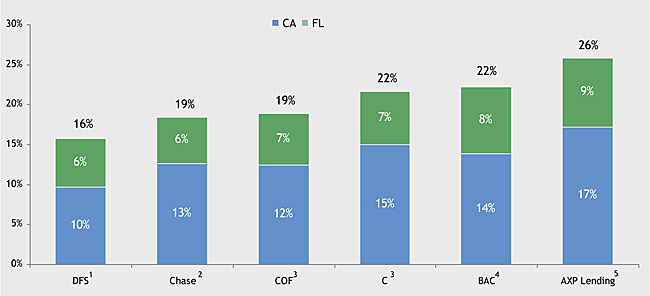

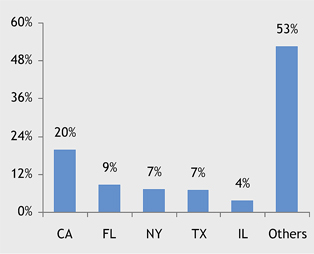

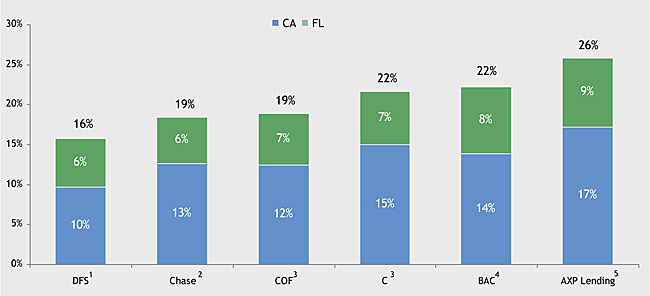

Portfolio positioning across peers

PORTFOLIO POSITIONING

| • | | Chase’s exposure to home price depreciation stressed regions of CA and FL is in line with peers |

Distribution of Receivables

3 | COF and C data as of Mar’08 |

Source: Trust filings

| | |

| | 14 |

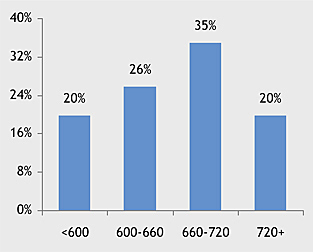

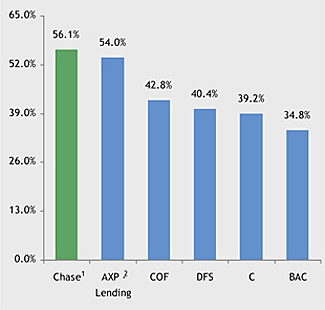

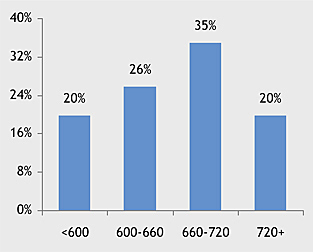

FICO distribution of securitized receivables

PORTFOLIO POSITIONING

| • | | Product mix, targeting and underwriting has led to a better risk profile |

Trust Receivables – FICO< 660 or No FICO Score

Trust Receivables – FICO>720

1 | Chase data as of Sep’08 represents Issuance Trust |

2 | AXP FICO>720 is based off disclosure in Fixed Income Investor Presentation |

Source: SEC Filings (C, COF – Mar’08, BAC – Jun’08; DFS – May’08; AXP – Aug’08; Chase – Sep’08); Investor Presentation

| | |

| | 15 |

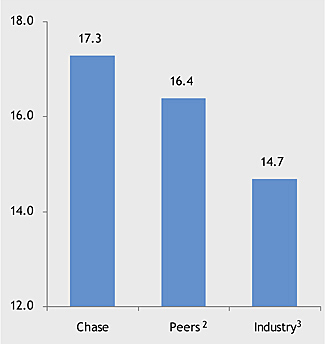

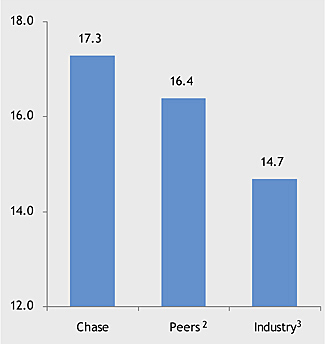

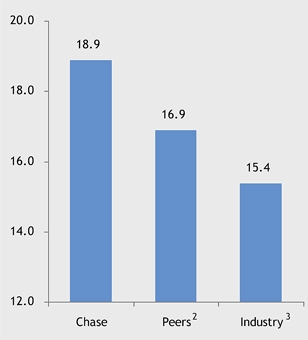

Chase profile vs. competitors and industry

PORTFOLIO POSITIONING

| • | | Chase Card Services’ customers have longer credit histories vs. the industry |

Avg. Duration of Customer Credit Profile (in Years)1

Chase 30+ % by Age of Oldest Credit Account

Source: Experian

2 | Peers: BAC, C, AXP, WFC, DFS |

3 | Industry is defined as all General Purpose Credit Card holders at Experian |

| | |

| | 16 |

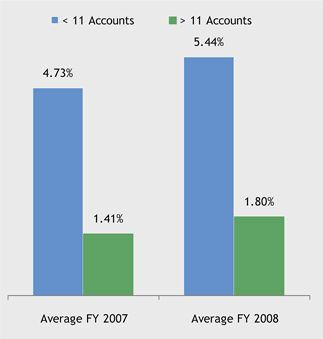

Chase profile vs. competitors and industry

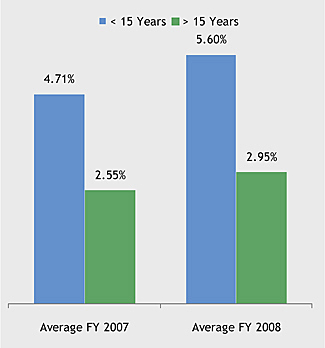

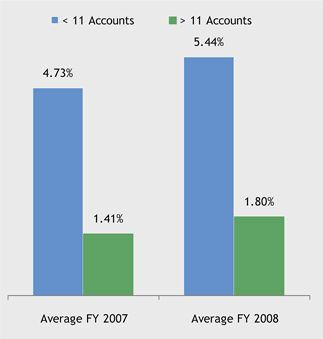

PORTFOLIO POSITIONING

| • | | Customers have more established credit profiles vs. the industry. These customers perform better than less established customers |

Avg. # of Credit Accounts in Good Standing1

Chase 30+ % by # Credit Accounts

Source: Experian

2 | Peers: BAC, C, AXP, WFC, DFS |

3 | Industry is defined as all General Purpose Credit Card holders at Experian |

| | |

| | 17 |

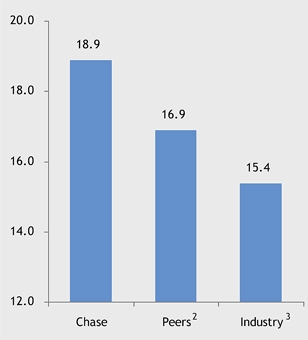

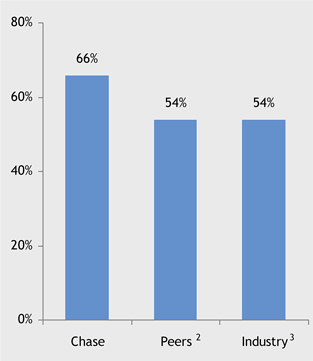

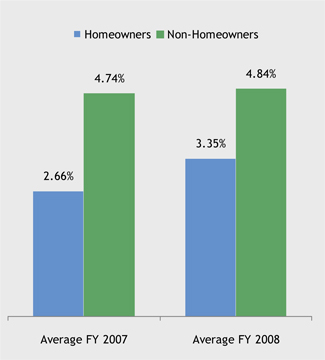

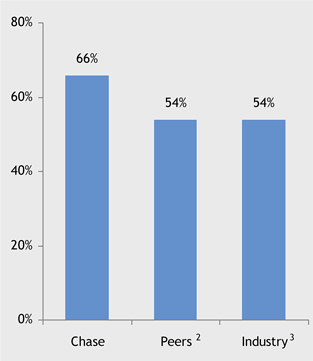

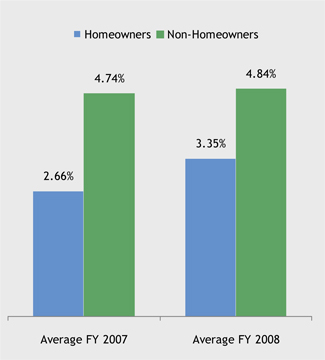

Chase profile vs. competitors and industry

PORTFOLIO POSITIONING

| • | | Homeowners have better risk performance, despite price declines |

Percentage of Customers that are Homeowners1

Chase 30+ Delinquency Rate Performance

Source: Experian

2 | Peers: BAC, C, AXP, WFC, DFS |

3 | Industry is defined as all General Purpose Credit Card holders at Experian |

| | |

| | 18 |

Agenda

CARD SERVICES

| | |

Credit environment | | 2 |

| |

Portfolio positioning | | 12 |

| |

How has Chase reacted to the environment | | 20 |

| |

Core vision and strategy | | 27 |

| |

Overcoming medium-term financial challenges | | 36 |

| |

Managing through the downturn | | 40 |

| | |

| | 19 |

How has Chase reacted to the environment. . .

HOW HAS CHASE REACTED TO THE ENVIRONMENT

| • | | We have tightened underwriting based on leading economic indicators, and continue to lend to creditworthy customers |

| • | | We have reduced our contingent liabilities by closing inactive accounts |

| • | | We have increased our collection efforts and intensity |

| | • | | Accelerated the start of calling efforts by 30%, while still staffing at 5-10% above capacity requirements |

| | • | | Added 850 collectors since 3Q07 |

| • | | We have expanded use of flexible payment programs, with 600,000 new enrollments in 2008 |

| | • | | Default performance is in line with expectations |

| | |

| | 20 |

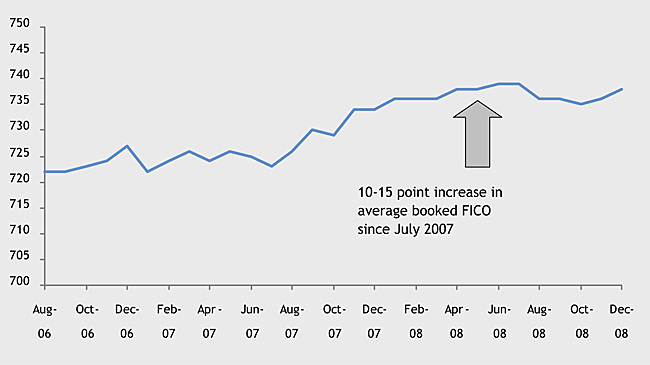

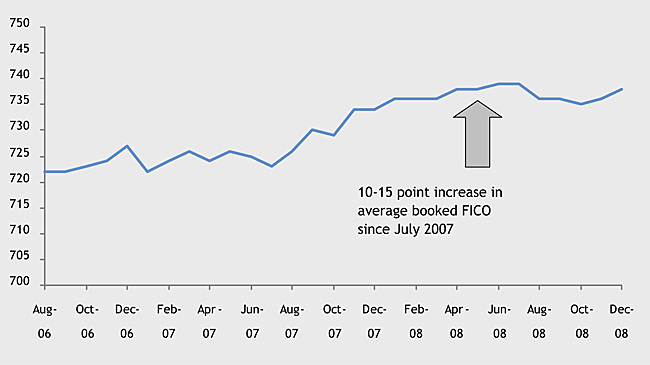

Average FICO score of new accounts has trended upwards

HOW HAS CHASE REACTED TO THE ENVIRONMENT

| • | | Reflects changes in product mix, targeting and tightened underwriting |

Chase Card Services Average Origination FICO

Source: Internal Chase data

| | |

| | 21 |

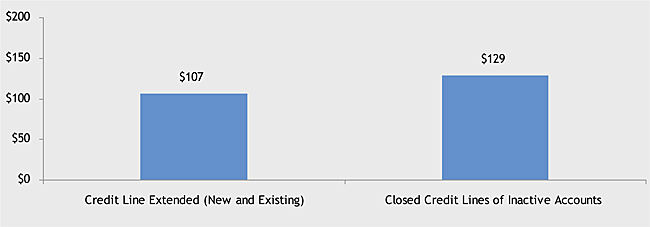

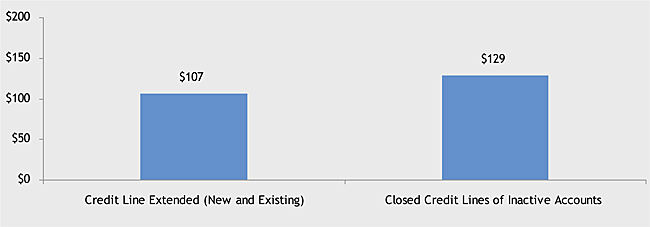

Credit Line Management

HOW HAS CHASE REACTED TO THE ENVIRONMENT

| • | | We have significantly tightened our line management practices, and continue to lend to existing and new customers |

| • | | At the same time, we have been proactive in reducing our contingent liabilities by closing inactive accounts |

Credit Line Management — 2008 ($ in billions)

Source: Internal Chase data

| | |

| | 22 |

WaMu card portfolio

HOW HAS CHASE REACTED TO THE ENVIRONMENT

| • | | Portfolio overview and recent actions |

| | • | | Conversion to Chase Card Services platform in March 2009 |

| | • | | Suspended all new accounts programs, except for branch applications |

| | • | | Pulled back on balance transfer and check programs |

| | • | | Reduced credit line exposure for consumer and business card programs |

| | • | | Aligned risk management practices with legacy Chase portfolio |

| | • | | Expect losses for WaMu book to approach 15% +/- in 1Q09 |

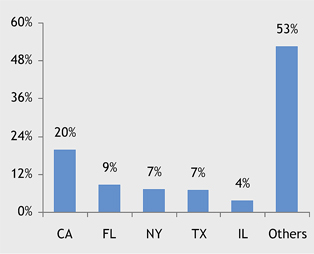

Geographic Distribution of Receivables

FICO Distribution of Receivables

Source: Internal Chase data

| | |

| | 23 |

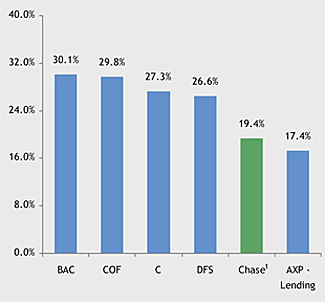

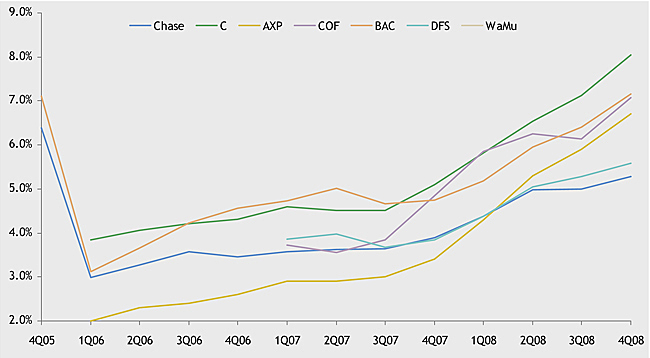

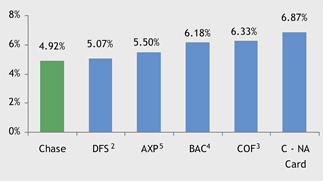

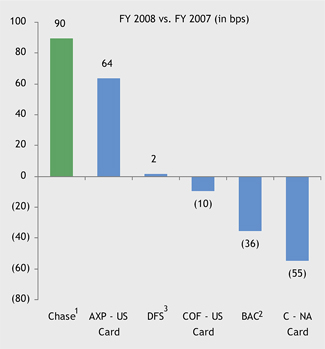

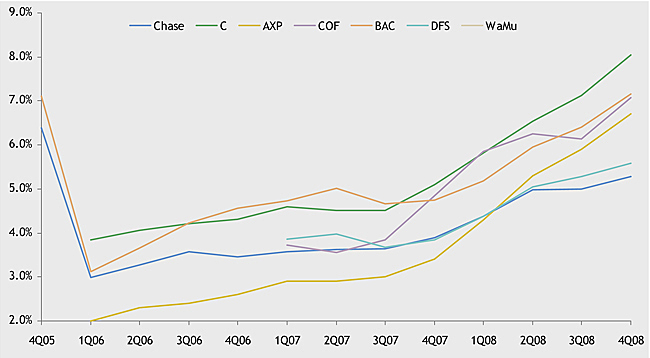

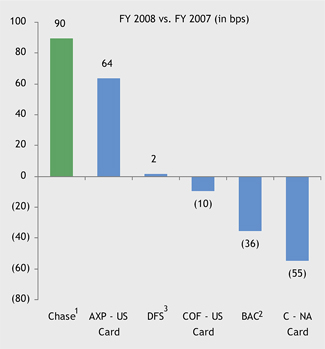

Credit trends — Chase Card Services vs. industry

HOW HAS CHASE REACTED TO THE ENVIRONMENT

Net Charge-Off Rate

Source: Earnings releases; SEC filings

Notes: BAC US Consumer credit and International Consumer credit segment, reorganized in 3Q08, excludes U.S. Small Business Card; C NA Card segment includes Canada and Puerto Rico but excludes Mexico, and includes sales finance loans formerly reflected in C Financial; COF US Card segment, reorganized in 1Q08, includes Consumer Credit Card, Small Business and Installment Loans and excludes international credit card; DFS data excludes international loans and installment lending; American Express US consumer and small business lending portfolios. WaMu excluded from Chase

| | |

| | 24 |

Summary

HOW HAS CHASE REACTED TO THE ENVIRONMENT

| • | | The macroeconomic environment has generated significant headwinds for 2009 and likely into 2010 |

| • | | We have been diligent with our risk management practices |

| | • | | Monthly monitoring of high risk geographies at MSA level |

| | • | | High-risk geographies defined by observed and forecasted data points for unemployment rate and home price depreciation |

| | • | | Adjustments to score cutoffs and criteria in high risk geographies |

| | • | | Explicit use of unemployment rate and home price depreciation data in loss forecasting models |

| • | | Our portfolio mix and credit capabilities have been a real advantage |

| • | | We continue to invest for growth |

| | |

| | 25 |

Agenda

CARD SERVICES

| | |

Credit environment | | 2 |

| |

Portfolio positioning | | 12 |

| |

How has Chase reacted to the environment | | 20 |

| |

Core vision and strategy | | 27 |

| |

Overcoming medium-term financial challenges | | 36 |

| |

Managing through the downturn | | 40 |

| | |

| | 26 |

We continue to stay focused on our core vision, despite a challenging business environment

CORE VISION AND STRATEGY

Vision

Create lifelong, engaged relationships with our customers by being a trusted provider of financial services

| | | | |

Brand | | Rewards | | Customer experience |

| | |

• Create a differentiated brand • Strong proprietary brand • Partnerships to enhance and extend brand • Distribution channels to raise recognition, reinforce • Build brand equity that delivers high performance • Business strategies are aligned with brand positioning • Consistency across all channels | | • Rationalize existing rewards products • Develop proprietary rewards platform • Develop targeted offers for each customer segment • Redemption to be easy and intuitive | | • Engage the customer early in the lifecycle • Leverage every interaction to enhance the relationship • Create a superior online experience • Improve customer service • POS authorizations • Disputes • Card replacement |

| | |

| | 27 |

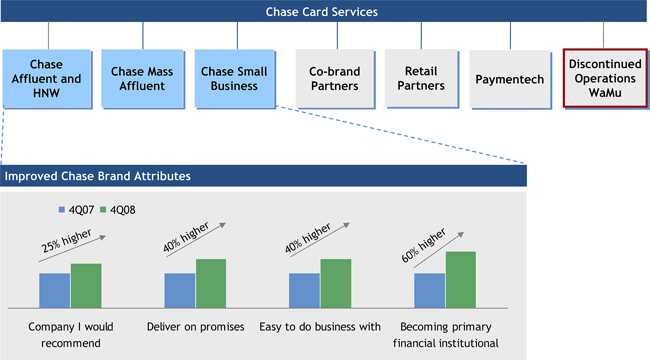

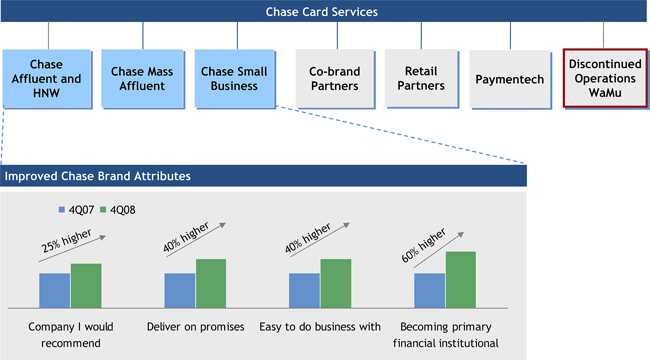

We maintain our focus on the Chase branded business

CORE VISION AND STRATEGY

| • | | Completed business reorganization discussed in 2008 |

| • | | Segmented marketing framework, e.g. acquisition and portfolio marketing |

Source: Chase Card Services brand tracker survey

| | |

| | 28 |

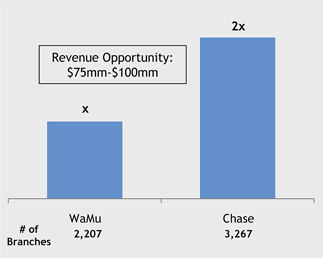

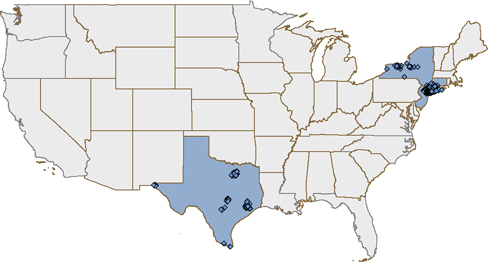

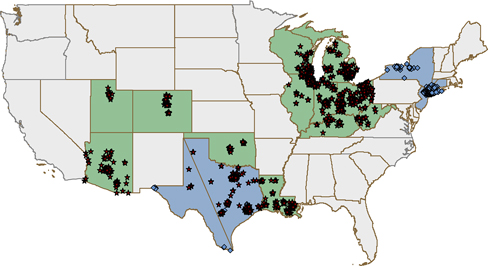

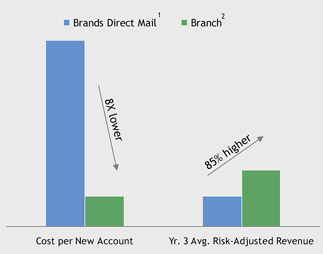

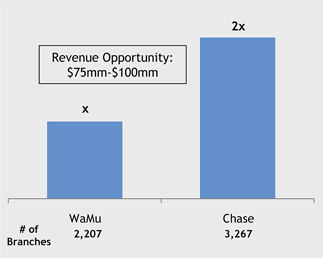

Our large distribution network will enable increase in brand awareness and customer engagement

CORE VISION AND STRATEGY

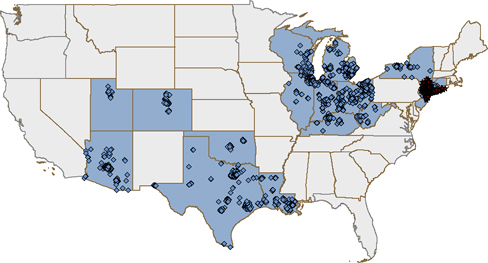

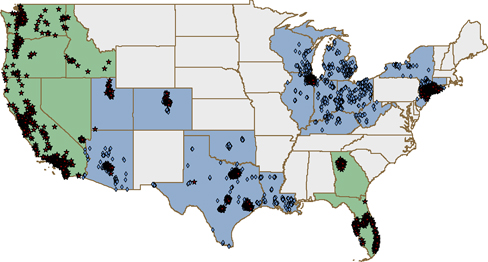

| • | | With the addition of 2,207 WaMu branches, Chase now has 5,474 branches across a national footprint |

| • | | Expanded retail footprint will create two significant benefits |

| | • | | In general, Chase experiences a 10%+ lift in overall acquisition rates (all channels except direct retail channels) in-footprint markets |

Branch Distribution Advantages

2008 Accounts/Branch/Month

1 | Brands Direct Mail data represents Chase Brands |

2 | Branch data represents Retail Branch Channel |

Source: Internal Chase data

| | |

| | 29 |

Our co-brand partner business continues to perform very well and we are focused on solidifying key partnerships

CORE VISION AND STRATEGY

| • | | In 2007/2008 we have extended key partner contracts |

| • | | We have also begun to rationalize our existing partner portfolio with a renewed focus on scale and profitability |

Co-brand vs. Chase Brand Performance

Our key co-brand partners provide us access to 80-100mm high-potential, loyal relationships

1 | Sales/active is for 2008, all vintages |

2 | Brands Direct Mail represents Chase Brands Direct Mail Channel |

3 | Cobrand/affinity data represents partner portfolio, excludes retail partner portfolio |

Source: Internal Chase data

| | |

| | 30 |

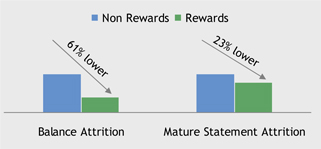

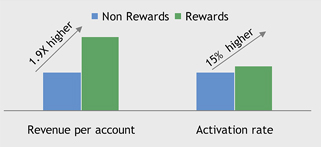

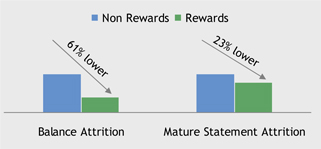

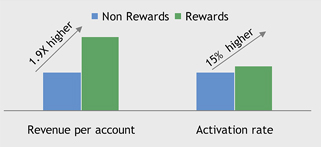

Benefits of rewards-based customer engagement

CORE VISION AND STRATEGY

| • | | Rewards customers have higher level of engagement which drives higher revenue |

| • | | Opportunity exists to increase level of engagement for non-rewards customers |

Increased Spending

Better Credit Performance

Greater Retention

Improved Profit

Source: Internal Chase data for FY 2008

| | |

| | 31 |

Launching a new proprietary, Chase rewards platform

CORE VISION AND STRATEGY

Vision Plan

| • | | Create a differentiated, points-based rewards offering to drive spend on Chase-branded cards |

| | • | | Strong earning options with ability to earn across multiple Chase product offerings |

| | • | | Exceptional array of redemption options with strong customer value |

| | • | | Simple, user-friendly interface with fully integrated online experience |

| • | | Help drive better risk-adjusted revenue growth for the Chase-branded business |

| | • | | Enhance value proposition of products, pricing power |

| | • | | Drive customer engagement—increased share of customer spend, borrowing needs, and lower attrition |

| • | | Maintain sustainable rewards economics |

| | • | | More favorable redemption category mix |

| | • | | Better utilization of Internet channel |

| | • | | Strategic partnerships and enhanced sourcing |

Graduated launch, starting in mid-2009

| | |

| | 32 |

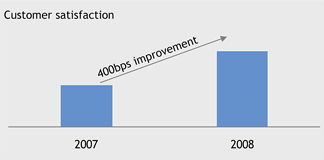

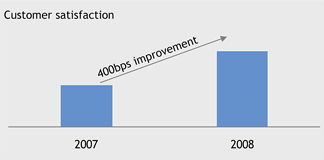

We continue to improve our customer experience

CORE VISION AND STRATEGY

The Chase Promise

| | |

POS Authorization | | • Your card will be available to use when and where you want |

| |

Card Replacement | | • If your card is lost or stolen, a new card will be delivered where and when you want it • Act as the customer’s advocate when they are “stranded” |

| |

| Customer Dispute Servicing | | • If a charge on your bill is wrong, a Chase advocate is in your corner |

| | |

| | 33 |

| | |

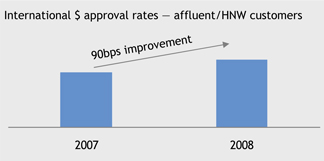

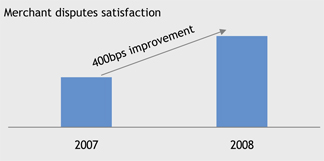

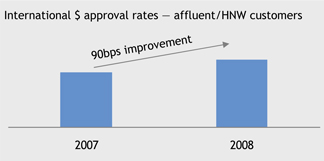

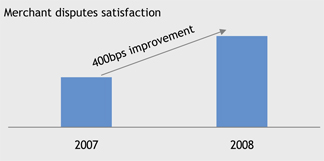

| Early benefits from our renewed focus on customer experience is already evident in our performance |

CORE VISION AND STRATEGY

Improved Customer Satisfaction1

Improved Card Replacement Strategy2

Improved POS Authorization Rates

Improved Service Quality

Results in higher wallet share and longer relationships for Chase

1 | Based on Internal Chase Customer Survey |

2 | Reflects December data for 2007 and 2008 as we introduced the metric in 2H’07 |

Source: Internal Chase data

| | |

| | 34 |

Agenda

CARD SERVICES

| | |

Credit environment | | 2 |

| |

Portfolio positioning | | 12 |

| |

How has Chase reacted to the environment | | 20 |

| |

Core vision and strategy | | 27 |

| |

Overcoming medium-term financial challenges | | 36 |

| |

Managing through the downturn | | 40 |

| | |

| | 35 |

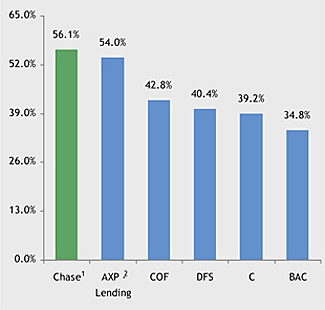

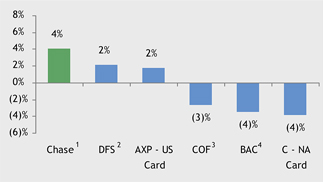

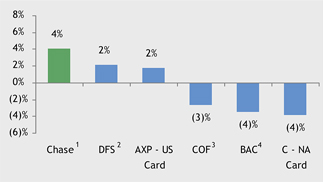

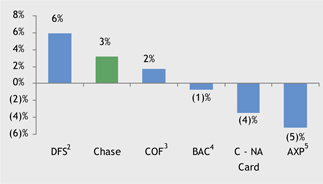

Chase led the industry in sales growth, coupled with lower credit losses

OVERCOMING MEDIUM - TERM FINANCIAL CHALLENGES

FY 2008 Sales Volume Growth YoY

FY 2008 Ending Receivables Growth YoY

FY 2008 Net Charge-Off Rate

1 | Chase purchase volumes reflect sales volume only and excludes cash advances and BT’s |

2 | DFS data represents fiscal year ending Nov’08; Purchase volume data represents sales volume only; NCO represents credit card loans only and excludes installment loans |

3 | COF data represents US Card segment, which includes consumer credit card, small business credit card and installment loans |

4 | BAC data represents Consumer Credit card portfolio (including international cards); excludes small business credit card portfolio |

5 | AXP US Lending portfolio |

Source: Earnings Releases and Supplements; SEC filings, Investor Presentation

| | |

| | 36 |

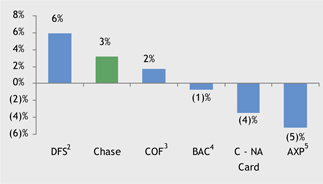

However, we are in the middle of the pack in terms of profitability

OVERCOMING MEDIUM - TERM FINANCIAL CHALLENGES

FY 2008 ROE

1 | DFS’s profits from continuing operations have been adjusted to exclude after tax impact of $863mm payment from MasterCard related to litigation settlement |

| Source: | SEC Filings; Earnings Releases and Supplements |

| | |

| | 37 |

We have focused efforts to improve aggregate portfolio returns, over time

OVERCOMING MEDIUM - TERM FINANCIAL CHALLENGES

| • | | Increased emphasis on capturing more of our existing customers’ business |

| | • | | A 100bps increase in share of wallet would generate ~$180mm in pre-tax income |

| • | | Reduce, significantly, small sub-scale partnerships |

| • | | Fewer low-rate promotional offers to customers who do no other business with us |

| • | | Strengthen our Chase Brand Rewards capabilities |

| • | | Selectively reprice customers on a segmented basis |

| | |

| | 38 |

Agenda

CARD SERVICES

| | |

Credit environment | | 1 |

| |

Portfolio positioning | | 11 |

| |

How has Chase reacted to the environment | | 19 |

| |

Core vision and strategy | | 26 |

| |

Overcoming medium-term financial challenges | | 35 |

| |

Managing through the downturn | | 39 |

| | |

| | 39 |

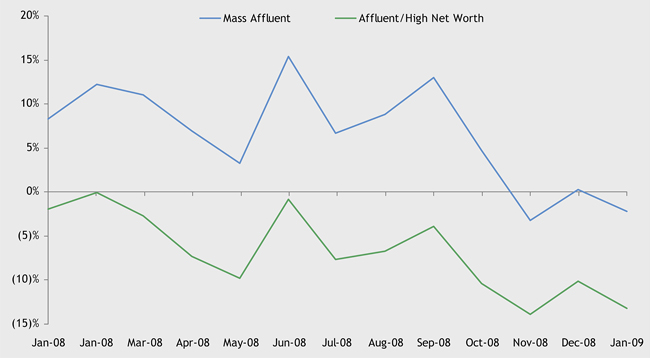

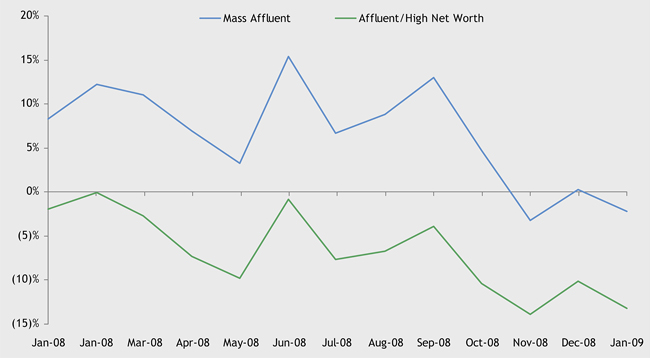

Spending from our more affluent customers has experienced the largest decline

MANAGING THROUGH THE DOWNTURN

Sales Growth – YoY

Source: Internal Chase Data

| | |

| | 40 |

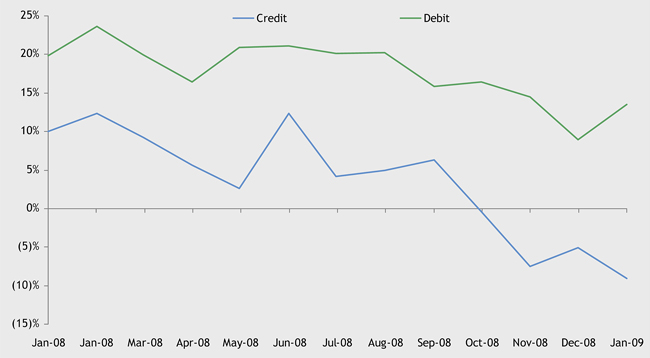

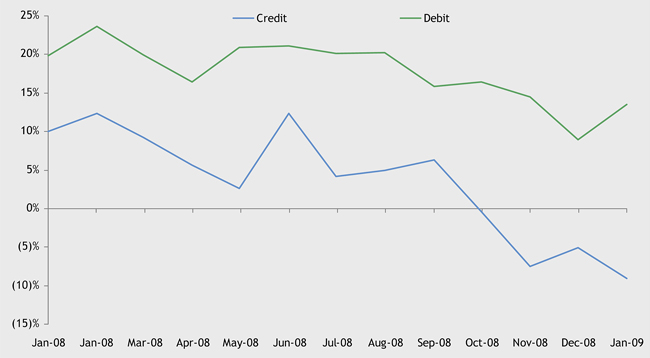

Both credit and debit are experiencing a slowdown in sales

MANAGING THROUGH THE DOWNTURN

Chase Debit vs. Credit Sales Growth – YoY

Source: Internal Chase data

| | |

| | 41 |

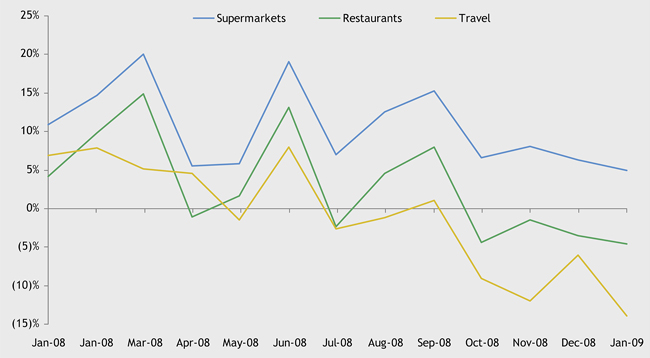

Consumers are spending less on discretionary items

MANAGING THROUGH THE DOWNTURN

Discretionary vs. Nondiscretionary Sales Growth – YoY

Source: Internal Chase data

| | |

| | 42 |

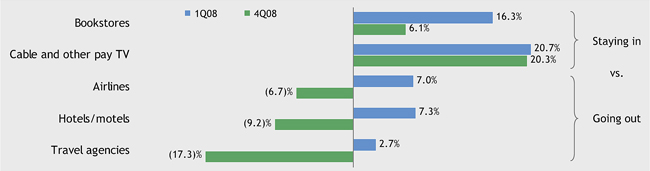

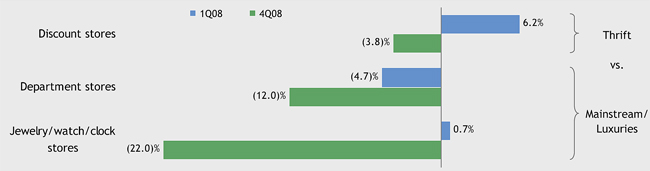

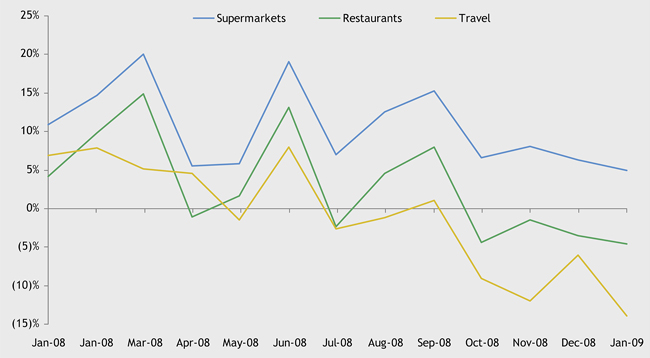

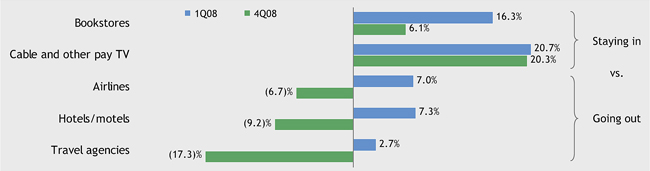

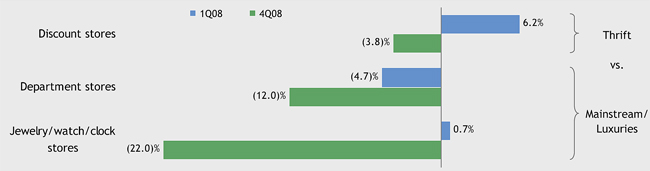

Consumers are becoming more focused on the simple pleasures in life as well as “finding deals”

MANAGING THROUGH THE DOWNTURN

Change in Sales YoY

Change in Sales YoY

Source: Internal Chase data

| | |

| | 43 |

However, Chase continued to gain sales volume market share in 2008

MANAGING THROUGH THE DOWNTURN

Sales Volume Market Share – FY 2008

Change in Sales Volume Market Share

1 | Chase data for computing market share includes cash advances but excludes balance transfers |

2 | BAC data represents consumer credit card portfolio, including international; excludes small business card portfolio |

3 | Discover data for computing market share includes cash advances |

Source: Earnings Releases and Supplements; Nilson Report (Issue # 918)

| | |

| | 44 |

Unfair and Deceptive Acts or Practices (UDAP) proposal

MANAGING THROUGH THE DOWNTURN

($ in millions)

| | |

| | | Description |

Summary impact | | • No 2009 impact • Effective date July 1, 2010 |

| |

| |

| Rate repricing restrictions | | • Limitations on ability to price existing customer balances for risk; limited to 30+ day delinquency with 45 day notice |

| |

Payment hierarchy / allocation | | • Payments will be allocated in one of two ways: • “Pro rata” to balances with different APRs • Highest APR balance first |

| |

| |

| |

Statement cycle time, payment processing | | • Customers will be given approximately 7 additional days to make a payment • Payment cutoff time defined as 5PM on due date |

| |

| |

Practices NOT used by Card Services | | • Prohibition of double cycle billing • Prohibition of “universal default,” or activity at another lender, to trigger a pricing change |

| |

| | |

| | 45 |

Potential UDAP mitigation strategies

MANAGING THROUGH THE DOWNTURN

| • | | Short term impact of 70 to 100bps on normalized pre-tax ROO |

| • | | Volatility expected through 2011 as marketplace adjusts to implementation of new rules |

| • | | Returns expected to reach existing levels on a potentially smaller base by late 2011, early 2012 |

| | |

| | | Potential Mitigants |

Pricing Strategy Changes | | • Move all pricing to variable index prior to compliance date • Shorten duration of acquisitions introductory rates • Targeted higher contract APRs at acquisition • Annual/Service Fee for low engagement/low usage customers |

| |

| |

| |

| |

| Policy and Universe Changes | | • Bias balance build programs toward limited duration promotions targeted at customers who actively use card product for purchasing and payments • Reduction in marketing to segments with marginal returns |

| |

| |

| Alternative Product Constructs | | • Evaluate alternative product constructs that maintain low contract APRs, offset with membership fees • Enable customers to restructure borrowing into fixed payment terms |

| |

| | |

| | 46 |

Key overall messages

MANAGING THROUGH THE DOWNTURN

| • | | Despite the challenging environment we remained focused on our vision to create lifelong, engaged relationships with our customers |

| • | | Our business reorganization is complete which has enabled a more refined focus on our Chase branded business |

| • | | The expanded Chase branch footprint is expected to have a significant benefit on the overall Chase branded business |

| • | | We are rationalizing our existing partnership portfolio and have taken steps to solidify and extend our key, strategic partner contracts |

| • | | Proprietary Chase rewards platform will be launched in 2009 |

| • | | We remain focused on providing a superior customer experience and initial results have confirmed our early progress |

| • | | Finally, we believe that in conjunction with our credit strategies, we have positioned ourselves well to manage through the downturn and emerge well positioned at the end of this cycle |

| | |

| | 47 |

FEBRUARY 26, 2009

RETAIL BANKING

Charlie Scharf, Retail Financial Services Chief Executive Officer

Agenda

RETAIL BANKING

| | |

| | | Page |

Retail Banking | | 1 |

| |

WaMu Update | | 22 |

| | |

| | 1 |

Retail Financial Services

RETAIL BANKING