- JPM Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

JPMorgan Chase & Co. (JPM) 424B2Prospectus for primary offering

Filed: 14 Feb 24, 2:10pm

| February 12, 2024 | Registration Statement Nos. 333-270004 and 333-270004-01; Rule 424(b)(2)  |

JPMorgan Chase Financial Company LLC Structured Investments $320,000 Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index due February 15, 2029 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. ●The notes are designed for investors who seek a Contingent Interest Payment with respect to each Review Date for which the closing level of the MerQube US Tech+ Vol Advantage Index, which we refer to as the Index, is greater than or equal to 60.00% of the Initial Value, which we refer to as the Interest Barrier. ●The notes will be automatically called if the closing level of the Index on any Review Date (other than the first and final Review Dates) is greater than or equal to the Initial Value. ●The earliest date on which an automatic call may be initiated is August 12, 2024. ●Investors should be willing to accept the risk of losing some or all of their principal and the risk that no Contingent Interest Payment may be made with respect to some or all Review Dates. ●Investors should also be willing to forgo fixed interest and dividend payments, in exchange for the opportunity to receive Contingent Interest Payments. ●On February 9, 2024, the Index ceased tracking an unfunded rolling position in E-Mini Nasdaq-100 futures and began tracking an unfunded position in the Invesco QQQ TrustSM, Series 1 (the “QQQ Fund”), calculated as the excess of the total return of the QQQ Fund over a notional financing cost. ●The Index is subject to a 6.0% per annum daily deduction, and the performance of the QQQ Fund is subject to a notional financing cost. These deductions will offset any appreciation of the components of the Index, will heighten any depreciation of those components and will generally be a drag on the performance of the Index. The Index will trail the performance of an identical index without such deductions. See “Selected Risk Considerations — Risks Relating to the Notes Generally — The Level of the Index Will Include a 6.0% per Annum Daily Deduction” and “Selected Risk Considerations — Risks Relating to the Notes Generally — The Level of the Index Will Include the Deduction of a Notional Financing Cost” in this pricing supplement. ●The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. ●Minimum denominations of $1,000 and integral multiples thereof ●The notes priced on February 12, 2024 and are expected to settle on or about February 15, 2024. ●CUSIP: 48134WAZ0 |

| | Price to Public (1) | Fees and Commissions (2) | Proceeds to Issuer |

| Per note | $1,000 | $37.50 | $962.50 |

| Total | $320,000 | $12,000 | $308,000 |

(1) See “Supplemental Use of Proceeds” in this pricing supplement for information about the components of the price to public of the notes. (2) J.P. Morgan Securities LLC, which we refer to as JPMS, acting as agent for JPMorgan Financial, will pay all of the selling commissions of $37.50 per $1,000 principal amount note it receives from us to other affiliated or unaffiliated dealers. See “Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement. | |||

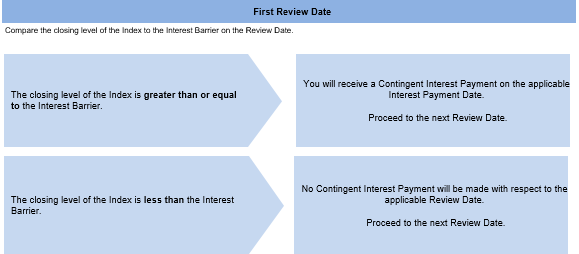

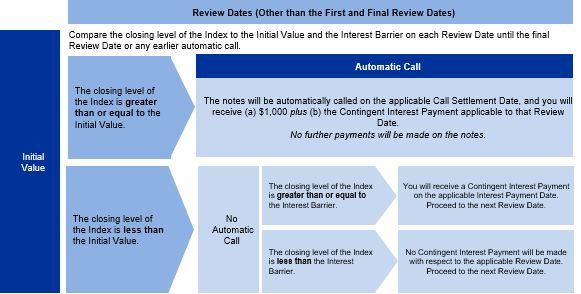

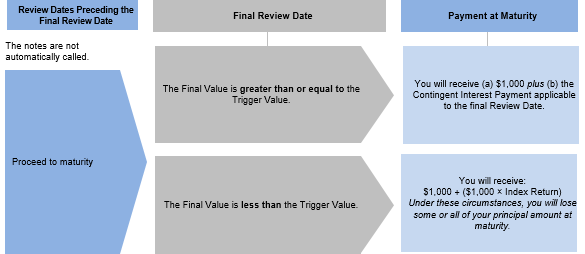

Issuer: JPMorgan Chase Financial Company LLC, an indirect, wholly owned finance subsidiary of JPMorgan Chase & Co. Guarantor: JPMorgan Chase & Co. Index: The MerQube US Tech+ Vol Advantage Index (Bloomberg ticker: MQUSTVA). The level of the Index reflects a deduction of 6.0% per annum that accrues daily, and the performance of the QQQ Fund is subject to a notional financing cost that accrues daily. Contingent Interest Payments: If the notes have not been automatically called and the closing level of the Index on any Review Date is greater than or equal to the Interest Barrier, you will receive on the applicable Interest Payment Date for each $1,000 principal amount note a Contingent Interest Payment equal to $30.625 (equivalent to a Contingent Interest Rate of 12.25% per annum, payable at a rate of 3.0625% per quarter). If the closing level of the Index on any Review Date is less than the Interest Barrier, no Contingent Interest Payment will be made with respect to that Review Date. Contingent Interest Rate: 12.25% per annum, payable at a rate of 3.0625% per quarter Interest Barrier/Trigger Value: 60.00% of the Initial Value, which is 6,322.872 Pricing Date: February 12, 2024 Original Issue Date (Settlement Date): On or about February 15, 2024 Review Dates*: May 13, 2024, August 12, 2024, November 12, 2024, February 12, 2025, May 12, 2025, August 12, 2025, November 12, 2025, February 12, 2026, May 12, 2026, August 12, 2026, November 12, 2026, February 12, 2027, May 12, 2027, August 12, 2027, November 12, 2027, February 14, 2028, May 12, 2028, August 14, 2028, November 13, 2028 and February 12, 2029 (final Review Date) Interest Payment Dates*: May 16, 2024, August 15, 2024, November 15, 2024, February 18, 2025, May 15, 2025, August 15, 2025, November 17, 2025, February 18, 2026, May 15, 2026, August 17, 2026, November 17, 2026, February 18, 2027, May 17, 2027, August 17, 2027, November 17, 2027, February 17, 2028, May 17, 2028, August 17, 2028, November 16, 2028 and the Maturity Date Maturity Date*: February 15, 2029 Call Settlement Date*: If the notes are automatically called on any Review Date (other than the first and final Review Dates), the first Interest Payment Date immediately following that Review Date * Subject to postponement in the event of a market disruption event and as described under “Supplemental Terms of Notes — Postponement of a Determination Date — Notes Linked Solely to an Index” in the accompanying underlying supplement and “General Terms of Notes — Postponement of a Payment Date” in the accompanying product supplement | Automatic Call: If the closing level of the Index on any Review Date (other than the first and final Review Dates) is greater than or equal to the Initial Value, the notes will be automatically called for a cash payment, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment applicable to that Review Date, payable on the applicable Call Settlement Date. No further payments will be made on the notes. Payment at Maturity: If the notes have not been automatically called and the Final Value is greater than or equal to the Trigger Value, you will receive a cash payment at maturity, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment applicable to the final Review Date. If the notes have not been automatically called and the Final Value is less than the Trigger Value, your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + ($1,000 × Index Return) If the notes have not been automatically called and the Final Value is less than the Trigger Value, you will lose more than 40.00% of your principal amount at maturity and could lose all of your principal amount at maturity. Index Return: (Final Value – Initial Value) Initial Value Initial Value: The closing level of the Index on the Pricing Date, which was 10,538.12 Final Value: The closing level of the Index on the final Review Date |

| PS-1 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-2 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-3 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-4 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

Number of Contingent Interest Payments | Total Contingent Interest Payments |

| 20 | $612.500 |

| 19 | $581.875 |

| 18 | $551.250 |

| 17 | $520.625 |

| 16 | $490.000 |

| 15 | $459.375 |

| 14 | $428.750 |

| 13 | $398.125 |

| 12 | $367.500 |

| 11 | $336.875 |

| 10 | $306.250 |

| 9 | $275.625 |

| 8 | $245.000 |

| 7 | $214.375 |

| 6 | $183.750 |

| 5 | $153.125 |

| 4 | $122.500 |

| 3 | $91.875 |

| 2 | $61.250 |

| 1 | $30.625 |

| 0 | $0.000 |

| PS-5 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

Date | Closing Level | Payment (per $1,000 principal amount note) |

| First Review Date | 105.00 | $30.625 |

| Second Review Date | 110.00 | $1,030.625 |

| Total Payment | $1,061.25 (6.125% return) |

Date | Closing Level | Payment (per $1,000 principal amount note) |

| First Review Date | 95.00 | $30.625 |

| Second Review Date | 85.00 | $30.625 |

Third through Nineteenth Review Dates | Less than Interest Barrier | $0 |

| Final Review Date | 90.00 | $1,030.625 |

| Total Payment | $1,091.875 (9.1875% return) |

| PS-6 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

Date | Closing Level | Payment (per $1,000 principal amount note) |

| First Review Date | 50.00 | $0 |

| Second Review Date | 55.00 | $0 |

Third through Nineteenth Review Dates | Less than Interest Barrier | $0 |

| Final Review Date | 50.00 | $500.00 |

Total Payment | $500.00 (-50.00% return) |

| PS-7 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-8 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-9 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-10 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

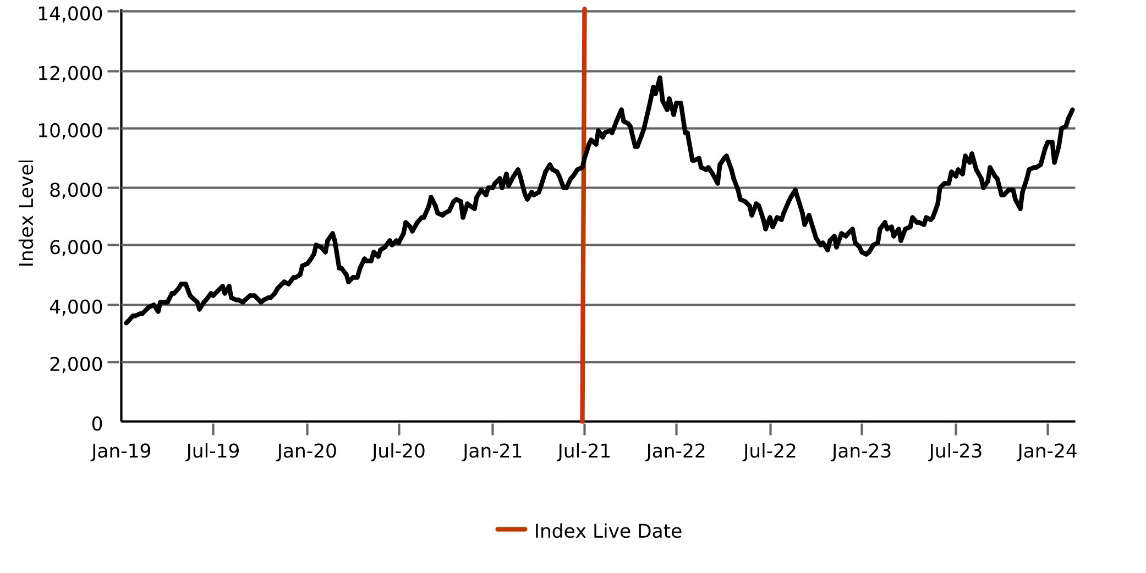

Hypothetical Back-Tested and Historical Performance of the MerQube US Tech+ Vol Advantage Index  Source: Bloomberg |

| PS-11 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-12 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-13 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-14 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-15 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-16 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-17 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |

| PS-18 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the MerQube US Tech+ Vol Advantage Index |