- JPM Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

JPMorgan Chase & Co. (JPM) 424B2Prospectus for primary offering

Filed: 14 Feb 24, 5:02pm

| February , 2024 | Registration Statement Nos. 333-270004 and 333-270004-01; Rule 424(b)(2)  |

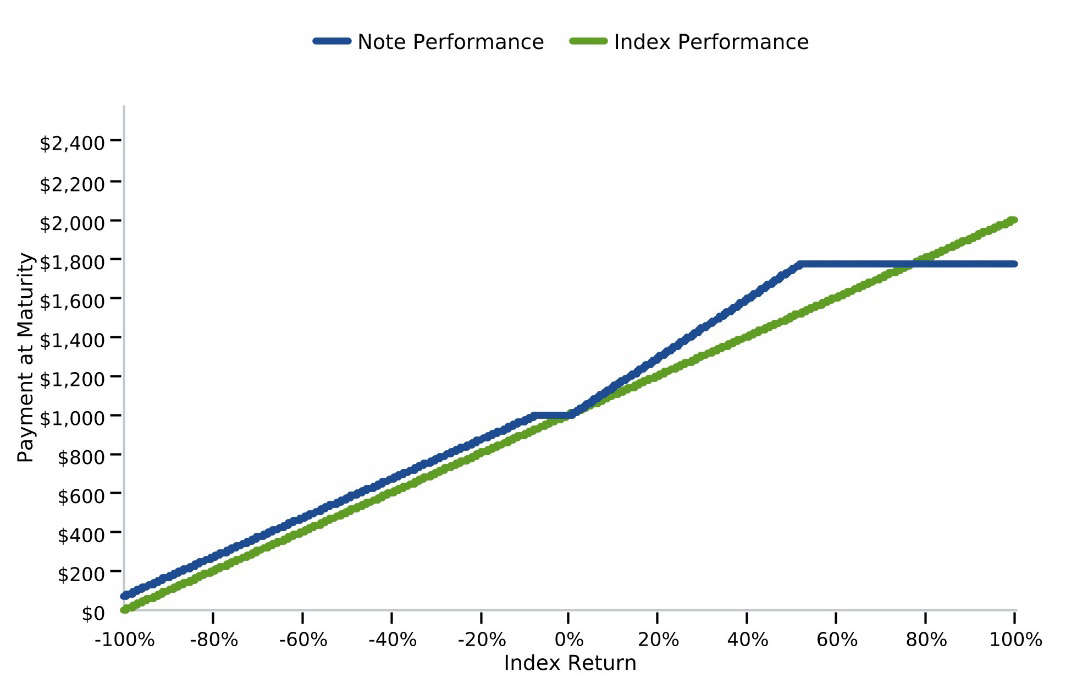

JPMorgan Chase Financial Company LLC Structured Investments Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index due February 16, 2029 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. ●The notes are designed for investors who seek a return of 1.50 times any appreciation of the S&P 500® Index, up to a maximum return of at least 77.00%, at maturity. ●Investors should be willing to forgo interest and dividend payments and be willing to lose up to 93.00% of their principal amount at maturity. ●The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. ●Minimum denominations of $1,000 and integral multiples thereof ●The notes are expected to price on or about February 14, 2024 (the “Pricing Date”) and are expected to settle on or about February 20, 2024. The Strike Value has been determined by reference to the closing level of the Index on February 13, 2024 and not by reference to the closing level of the Index on the Pricing Date. ●CUSIP: 48134WJK4 |

| | Price to Public (1) | Fees and Commissions (2) | Proceeds to Issuer |

| Per note | $1,000 | $ | $ |

| Total | $ | $ | $ |

(1) See “Supplemental Use of Proceeds” in this pricing supplement for information about the components of the price to public of the notes. (2) J.P. Morgan Securities LLC, which we refer to as JPMS, acting as agent for JPMorgan Financial, will pay all of the selling commissions it receives from us to other affiliated or unaffiliated dealers. In no event will these selling commissions exceed $2.50 per $1,000 principal amount note. See “Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement. | |||

Issuer: JPMorgan Chase Financial Company LLC, an indirect, wholly owned finance subsidiary of JPMorgan Chase & Co. Guarantor: JPMorgan Chase & Co. Index: The S&P 500® Index (Bloomberg ticker: SPX) Maximum Return: At least 77.00% (corresponding to a maximum payment at maturity of at least $1,770.00 per $1,000 principal amount note) (to be provided in the pricing supplement) Upside Leverage Factor: 1.50 Buffer Amount: 7.00% Strike Date: February 13, 2024 Pricing Date: On or about February 14, 2024 Original Issue Date (Settlement Date): On or about February 20, 2024 Observation Date*: February 13, 2029 Maturity Date*: February 16, 2029 * Subject to postponement in the event of a market disruption event and as described under “General Terms of Notes — Postponement of a Determination Date — Notes Linked to a Single Underlying — Notes Linked to a Single Underlying (Other Than a Commodity Index)” and “General Terms of Notes — Postponement of a Payment Date” in the accompanying product supplement | Payment at Maturity: If the Final Value is greater than the Strike Value, your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + ($1,000 × Index Return × Upside Leverage Factor), subject to the Maximum Return If the Final Value is equal to the Strike Value or is less than the Strike Value by up to the Buffer Amount, you will receive the principal amount of your notes at maturity. If the Final Value is less than the Strike Value by more than the Buffer Amount, your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + [$1,000 × (Index Return + Buffer Amount)] If the Final Value is less than the Strike Value by more than the Buffer Amount, you will lose some or most of your principal amount at maturity. Index Return: (Final Value – Strike Value) Strike Value Strike Value: The closing level of the Index on the Strike Date, which was 4,953.17. The Strike Value is not the closing level of the Index on the Pricing Date. Final Value: The closing level of the Index on the Observation Date |

| PS-1 | Structured Investments |  |

Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index |

Final Value | Index Return | Total Return on the Notes | Payment at Maturity |

| 180.0000 | 80.0000% | 77.00% | $1,770.00 |

| 170.0000 | 70.0000% | 77.00% | $1,770.00 |

| 160.0000 | 60.0000% | 77.00% | $1,770.00 |

| 151.3333 | 51.3333% | 77.00% | $1,770.00 |

| 150.0000 | 50.0000% | 75.00% | $1,750.00 |

| 140.0000 | 40.0000% | 60.00% | $1,600.00 |

| 130.0000 | 30.0000% | 45.00% | $1,450.00 |

| 120.0000 | 20.0000% | 30.00% | $1,300.00 |

| 110.0000 | 10.0000% | 15.00% | $1,150.00 |

| 105.0000 | 5.0000% | 7.50% | $1,075.00 |

| 101.0000 | 1.0000% | 1.50% | $1,015.00 |

100.0000 | 0.0000% | 0.00% | $1,000.00 |

| 95.0000 | -5.0000% | 0.00% | $1,000.00 |

| 93.0000 | -7.0000% | 0.00% | $1,000.00 |

| 90.0000 | -10.0000% | -3.00% | $970.00 |

| 85.0000 | -15.0000% | -8.00% | $920.00 |

| 80.0000 | -20.0000% | -13.00% | $870.00 |

| 70.0000 | -30.0000% | -23.00% | $770.00 |

| 60.0000 | -40.0000% | -33.00% | $670.00 |

| 50.0000 | -50.0000% | -43.00% | $570.00 |

| 40.0000 | -60.0000% | -53.00% | $470.00 |

| 30.0000 | -70.0000% | -63.00% | $370.00 |

| 20.0000 | -80.0000% | -73.00% | $270.00 |

| 10.0000 | -90.0000% | -83.00% | $170.00 |

| 0.0000 | -100.0000% | -93.00% | $70.00 |

| PS-2 | Structured Investments |  |

Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index |

| PS-3 | Structured Investments |  |

Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index |

| PS-4 | Structured Investments |  |

Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index |

| PS-5 | Structured Investments |  |

Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index |

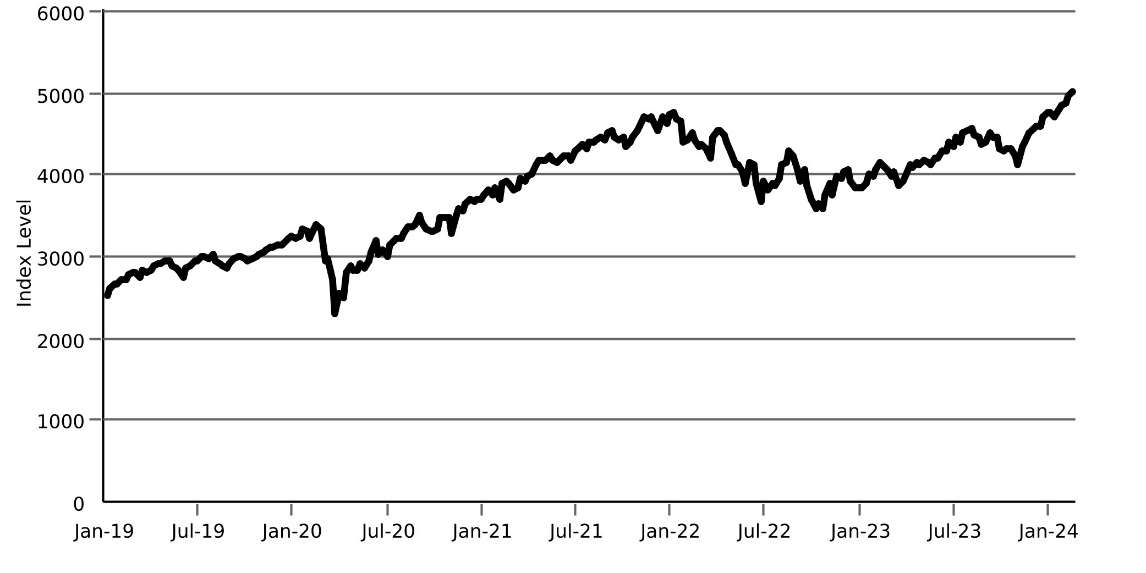

Historical Performance of the S&P 500® Index  Source: Bloomberg |

| PS-6 | Structured Investments |  |

Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index |

| PS-7 | Structured Investments |  |

Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index |

| PS-8 | Structured Investments |  |

Capped Buffered Return Enhanced Notes Linked to the S&P 500® Index |