- JPM Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

JPMorgan Chase & Co. (JPM) 424B2Prospectus for primary offering

Filed: 15 Feb 24, 4:35pm

| February , 2024 | Registration Statement Nos. 333-270004 and 333-270004-01; Rule 424(b)(2)  |

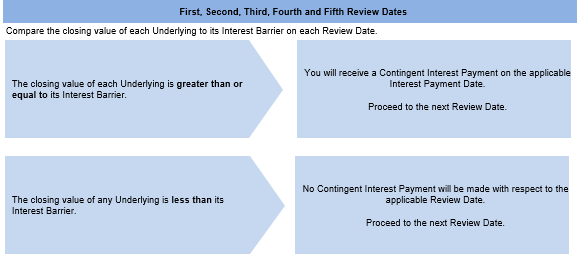

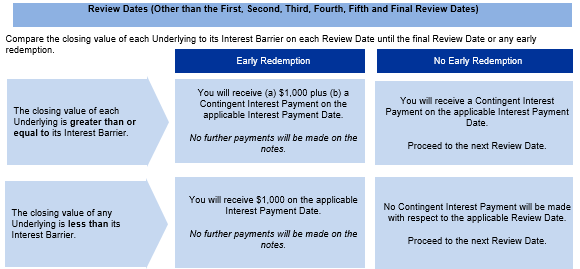

JPMorgan Chase Financial Company LLC Structured Investments Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF due November 20, 2025 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. ●The notes are designed for investors who seek a Contingent Interest Payment with respect to each Review Date for which the closing value of each of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF, which we refer to as the Underlyings, is greater than or equal to 70.00% of its Initial Value, which we refer to as an Interest Barrier. ●The notes may be redeemed early, in whole but not in part, at our option on any of the Interest Payment Dates (other than the first, second, third, fourth, fifth and final Interest Payment Dates). ●The earliest date on which the notes may be redeemed early is August 21, 2024. ●Investors should be willing to accept the risk of losing some or all of their principal and the risk that no Contingent Interest Payment may be made with respect to some or all Review Dates. ●Investors should also be willing to forgo fixed interest and dividend payments, in exchange for the opportunity to receive Contingent Interest Payments. ●The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. ●Payments on the notes are not linked to a basket composed of the Underlyings. Payments on the notes are linked to the performance of each of the Underlyings individually, as described below. ●Minimum denominations of $1,000 and integral multiples thereof ●The notes are expected to price on or about February 16, 2024 and are expected to settle on or about February 22, 2024. ●CUSIP: 48134WLD7 |

| | Price to Public (1) | Fees and Commissions (2) | Proceeds to Issuer |

| Per note | $1,000 | $ | $ |

| Total | $ | $ | $ |

(1) See “Supplemental Use of Proceeds” in this pricing supplement for information about the components of the price to public of the notes. (2) J.P. Morgan Securities LLC, which we refer to as JPMS, acting as agent for JPMorgan Financial, will pay all of the selling commissions it receives from us to other affiliated or unaffiliated dealers. In no event will these selling commissions exceed $7.25 per $1,000 principal amount note. See “Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement. | |||

Issuer: JPMorgan Chase Financial Company LLC, an indirect, wholly owned finance subsidiary of JPMorgan Chase & Co. Guarantor: JPMorgan Chase & Co. Underlyings: The Russell 2000® Index (Bloomberg ticker: RTY) and the S&P 500® Index (Bloomberg ticker: SPX) (each an “Index” and collectively, the “Indices”) and the SPDR® S&P® Regional Banking ETF (Bloomberg ticker: KRE) (the “Fund”) (each of the Indices and the Fund, an “Underlying” and collectively, the “Underlyings”) Contingent Interest Payments: If the notes have not been previously redeemed early and the closing value of each Underlying on any Review Date is greater than or equal to its Interest Barrier, you will receive on the applicable Interest Payment Date for each $1,000 principal amount note a Contingent Interest Payment equal to at least $10.9167 (equivalent to a Contingent Interest Rate of at least 13.10% per annum, payable at a rate of at least 1.09167% per month) (to be provided in the pricing supplement). If the closing value of any Underlying on any Review Date is less than its Interest Barrier, no Contingent Interest Payment will be made with respect to that Review Date. Contingent Interest Rate: At least 13.10% per annum, payable at a rate of at least 1.09167% per month (to be provided in the pricing supplement) Interest Barrier: With respect to each Underlying, 70.00% of its Initial Value Trigger Value: With respect to each Underlying, 60.00% of its Initial Value Pricing Date: On or about February 16, 2024 Original Issue Date (Settlement Date): On or about February 22, 2024 Review Dates*: March 18, 2024, April 16, 2024, May 16, 2024, June 17, 2024, July 16, 2024, August 16, 2024, September 16, 2024, October 16, 2024, November 18, 2024, December 16, 2024, January 16, 2025, February 18, 2025, March 17, 2025, April 16, 2025, May 16, 2025, June 16, 2025, July 16, 2025, August 18, 2025, September 16, 2025, October 16, 2025 and November 17, 2025 (the “final Review Date”) Interest Payment Dates*: March 21, 2024, April 19, 2024, May 21, 2024, June 21, 2024, July 19, 2024, August 21, 2024, September 19, 2024, October 21, 2024, November 21, 2024, December 19, 2024, January 22, 2025, February 21, 2025, March 20, 2025, April 22, 2025, May 21, 2025, June 20, 2025, July 21, 2025, August 21, 2025, September 19, 2025, October 21, 2025 and the Maturity Date Maturity Date*: November 20, 2025 *Subject to postponement in the event of a market disruption event and as described under “General Terms of Notes — Postponement of a Determination Date — Notes Linked to Multiple Underlyings” and “General Terms of Notes — Postponement of a Payment Date” in the accompanying product supplement | Early Redemption: We, at our election, may redeem the notes early, in whole but not in part, on any of the Interest Payment Dates (other than the first, second, third, fourth, fifth and final Interest Payment Dates) at a price, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment, if any, applicable to the immediately preceding Review Date. If we intend to redeem your notes early, we will deliver notice to The Depository Trust Company, or DTC, at least three business days before the applicable Interest Payment Date on which the notes are redeemed early. Payment at Maturity: If the notes have not been redeemed early and the Final Value of each Underlying is greater than or equal to its Trigger Value, you will receive a cash payment at maturity, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment, if any, applicable to the final Review Date. If the notes have not been redeemed early and the Final Value of any Underlying is less than its Trigger Value, your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + ($1,000 × Least Performing Underlying Return) If the notes have not been redeemed early and the Final Value of any Underlying is less than its Trigger Value, you will lose more than 40.00% of your principal amount at maturity and could lose all of your principal amount at maturity. Least Performing Underlying: The Underlying with the Least Performing Underlying Return Least Performing Underlying Return: The lowest of the Underlying Returns of the Underlyings Underlying Return: With respect to each Underlying, (Final Value – Initial Value) Initial Value Initial Value: With respect to each Underlying, the closing value of that Underlying on the Pricing Date Final Value: With respect to each Underlying, the closing value of that Underlying on the final Review Date Share Adjustment Factor: The Share Adjustment Factor is referenced in determining the closing value of the Fund and is set equal to 1.0 on the Pricing Date. The Share Adjustment Factor is subject to adjustment upon the occurrence of certain events affecting the Fund. See “The Underlyings – Funds – Anti-Dilution Adjustments” in the accompanying product supplement for further information. |

| PS-1 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

| PS-2 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

Number of Contingent Interest Payments | Total Contingent Interest Payments |

| 21 | $229.2500 |

| 20 | $218.3333 |

| 19 | $207.4167 |

| 18 | $196.5000 |

| 17 | $185.5833 |

| 16 | $174.6667 |

| 15 | $163.7500 |

| 14 | $152.8333 |

| 13 | $141.9167 |

| 12 | $131.0000 |

| 11 | $120.0833 |

| 10 | $109.1667 |

| 9 | $98.2500 |

| 8 | $87.3333 |

| 7 | $76.4167 |

| 6 | $65.5000 |

| 5 | $54.5833 |

| 4 | $43.6667 |

| 3 | $32.7500 |

| 2 | $21.8333 |

| 1 | $10.9167 |

| 0 | $0.0000 |

| PS-3 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

Date | Closing Value of Least Performing Underlying | Payment (per $1,000 principal amount note) |

| First Review Date | 95.00 | $10.9167 |

| Second Review Date | 85.00 | $10.9167 |

Third through Twentieth Review Dates | Less than Interest Barrier | $0 |

| Final Review Date | 90.00 | $1,010.9167 |

| Total Payment | $1,032.75 (3.275% return) |

Date | Closing Value of Least Performing Underlying | Payment (per $1,000 principal amount note) |

| First Review Date | 95.00 | $10.9167 |

| Second Review Date | 85.00 | $10.9167 |

Third through Twentieth Review Dates | Less than Interest Barrier | $0 |

| Final Review Date | 60.00 | $1,000.00 |

Total Payment | $1,021.8333 (2.18333% return) |

Date | Closing Value of Least Performing Underlying | Payment (per $1,000 principal amount note) |

| First Review Date | 55.00 | $0 |

| Second Review Date | 50.00 | $0 |

Third through Twentieth Review Dates | Less than Interest Barrier | $0 |

| Final Review Date | 40.00 | $400.00 |

Total Payment | $400.00 (-60.00% return) |

| PS-4 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

| PS-5 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

| PS-6 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

| PS-7 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

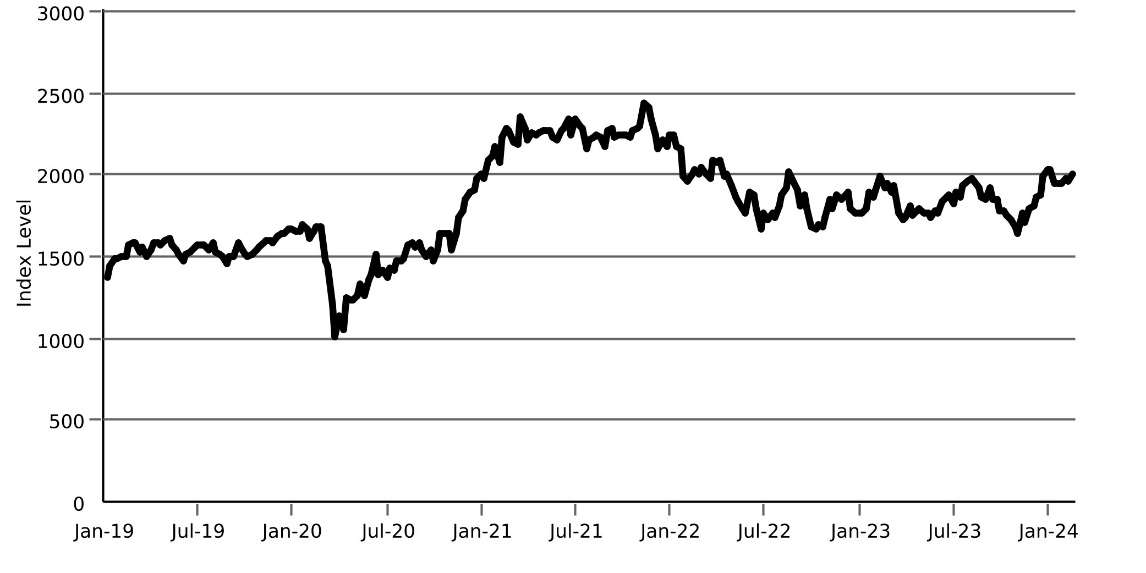

Historical Performance of the Russell 2000® Index  Source: Bloomberg |

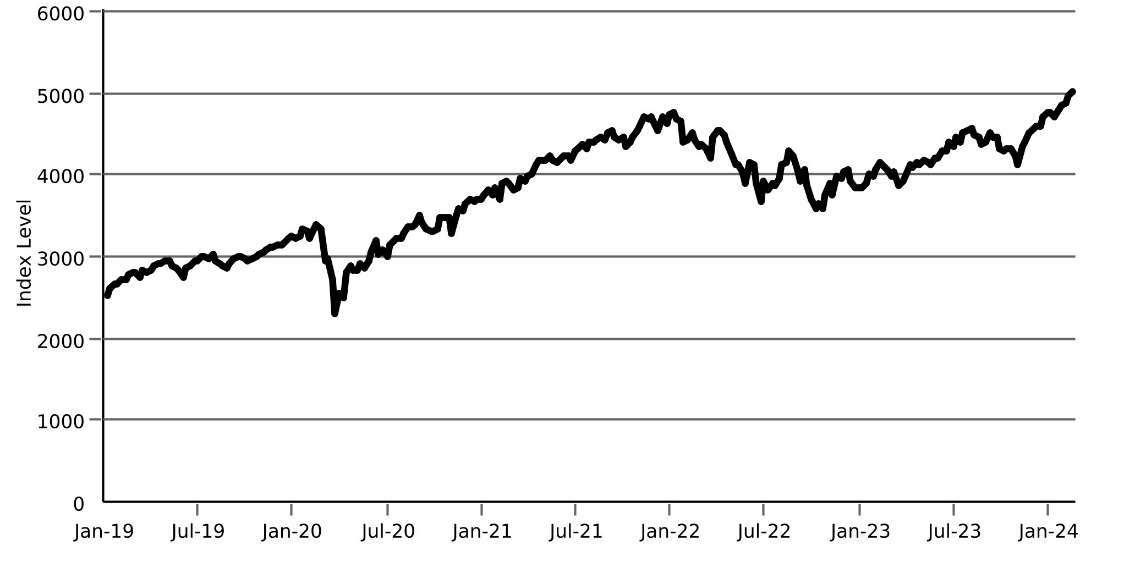

Historical Performance of the S&P 500® Index  Source: Bloomberg |

| PS-8 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

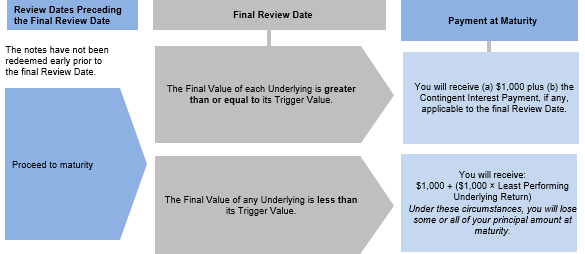

Historical Performance of the SPDR® S&P® Regional Banking ETF  Source: Bloomberg |

| PS-9 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

| PS-10 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |

| PS-11 | Structured Investments |  |

Callable Contingent Interest Notes Linked to the Least Performing of the Russell 2000® Index, the S&P 500® Index and the SPDR® S&P® Regional Banking ETF |