- JPM Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

JPMorgan Chase & Co. (JPM) 424B2Prospectus for primary offering

Filed: 15 Feb 24, 4:45pm

Underlying supplement no. 25-I To the prospectus dated April 13, 2023 and the prospectus supplement dated April 13, 2023 | Registration Statement Nos. 333-270004 Dated February 15, 2024 Rule 424(b)(2) |

JPMorgan Chase & Co.

Notes Linked to the J.P. Morgan Futures Index Series

JPMorgan Chase Financial Company LLC

Notes, Fully and Unconditionally Guaranteed by JPMorgan Chase & Co., Linked to the J.P. Morgan Futures Index Series

Each of JPMorgan Chase & Co. and JPMorgan Chase Financial Company LLC may, from time to time, offer and sell notes linked in whole or in part to an index in the J.P. Morgan Futures Index Series listed below (each, an “Index” and collectively the “Indices”):

| · | J.P. Morgan US Q Equities Futures Index |

| · | J.P. Morgan US Small Cap Equities Futures Index |

The issuer of the notes, as specified in the relevant terms supplement, is referred to in this underlying supplement as the “Issuer.” The Issuer will be either JPMorgan Chase & Co. or JPMorgan Chase Financial Company LLC. For notes issued by JPMorgan Chase Financial Company LLC, JPMorgan Chase & Co., in its capacity as guarantor of those notes, is referred to in this product supplement as the “Guarantor.”

This underlying supplement describes each Index, the relationship between JPMorgan Chase & Co., JPMorgan Chase Financial Company LLC and the sponsor of each Index and terms that will apply generally to notes linked in whole or in part to an Index and other relevant information. This underlying supplement supplements the terms described in the accompanying product supplement, the prospectus supplement and the prospectus. A separate term sheet or pricing supplement, as the case may be, will describe terms that apply to specific issuances of the notes, including any changes to the terms specified below. These term sheets and pricing supplements are referred to generally in this underlying supplement as terms supplements. The accompanying product supplement, the relevant terms supplement or another accompanying underlying supplement will describe any other index or reference asset to which the notes are linked. If the terms described in the relevant terms supplement are inconsistent with those described in this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus, the terms described in the relevant terms supplement will control. In addition, if this underlying supplement and the accompanying product supplement or another accompanying underlying supplement contain information relating to the same Index to which the notes are linked, the information contained in the document with the most recent date will control.

Investing in the notes involves a number of risks. See “Risk Factors” beginning on page S-2 of the prospectus supplement, “Risk Factors” in the accompanying product supplement and “Risk Factors” beginning on page US-3 of this underlying supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus. Any representation to the contrary is a criminal offense.

The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

February 15, 2024

TABLE OF CONTENTS

The Issuer and the Guarantor (if applicable) have not authorized anyone to provide any information other than that contained or incorporated by reference in the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus with respect to the notes offered by the relevant terms supplement and with respect to the Issuer and the Guarantor (if applicable). The Issuer and the Guarantor (if applicable) take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The relevant terms supplement, together with this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus, will contain the terms of the notes and will supersede all other prior or contemporaneous oral statements as well as any other written materials, including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials of the Issuer. The information in each of the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus may be accurate only as of the date of that document.

The notes are not appropriate for all investors and involve a number of risks and important legal and tax consequences that should be discussed with your professional advisers. You should be aware that the regulations of Financial Industry Regulatory Authority, Inc., or FINRA, and the laws of certain jurisdictions (including regulations and laws that require brokers to ensure that investments are suitable for their customers) may limit the availability of the notes. The relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus do not constitute an offer to sell or a solicitation of an offer to buy the notes under any circumstances in which that offer or solicitation is unlawful.

In this underlying supplement, “we,” “us” and “our” refer to the Issuer, unless the context requires otherwise, and “JPMorgan Financial” refers to JPMorgan Chase Financial Company LLC. To the extent applicable, each index described in this underlying supplement is deemed to be one of the “Indices” referred to in the accompanying product supplement.

Each index in the J.P. Morgan Futures Index Series (each, an “Index” and collectively, the “Indices”) was developed and is maintained and calculated by J.P. Morgan Securities LLC (“JPMS”). The description of the Indices and their methodology included in this underlying supplement is based on rules formulated by JPMS (the “Rules”). The Rules, and not this description, will govern the calculation and constitution of the Indices and other decisions and actions related to their maintenance. The Rules in effect as of the date of this underlying supplement are attached as Annex A to this underlying supplement. The Indices are the intellectual property of JPMS and its affiliates, and JPMS and its affiliates reserve all rights with respect to their ownership of the Indices. The Indices are reported by Bloomberg L.P. under the relevant ticker symbol set forth in the table below.

Each Index tracks the excess return of a notional rolling futures position in futures contracts (each, a “Futures Contract”) in the relevant futures contract series (each, a “Series”) set forth in the table below. Each Index generally tracks the front expiry futures contract in the relevant Series; however, each Index rolls to the next expiry futures contract in the relevant Series over a 5-day period shortly before the expiry of the front expiry futures contract. (The next expiry futures contract will become the front expiry futures contract upon the expiration of the original front expiry futures contract.)

Index | Ticker | Series | Reference Index | Base Date |

| J.P. Morgan US Q Equities Futures Index | JPUSNQEQ | E-mini® Nasdaq-100® Futures | Nasdaq-100 Index® | April 10, 1996 |

| J.P. Morgan US Small Cap Equities Futures Index | JPUSSMEQ | E-mini® Russell 2000® Futures* | Russell 2000® Index | February 4, 1993 |

* From February 4, 1993 to June 17, 2008, and since September 8, 2017, the J.P. Morgan US Small Cap Equities Futures Index has referenced E-mini® Russell 2000® futures contracts traded on the Chicago Mercantile Exchange (the “CME”). From June 12, 2008 to September 13, 2017, the J.P. Morgan US Small Cap Equities Futures Index referenced E-mini® Russell 2000® futures contracts traded on the ICE Futures U.S. The overlap in futures contracts is due to the rolling feature of the J.P. Morgan US Small Cap Equities Futures Index.

The closing level of each Index (the “Index Level”) was set equal to 100 on the base date of that Index. The Index Calculation Agent (as defined below) began calculating J.P. Morgan US Q Equities Futures Index on a live basis on December 22, 2020 and the J.P. Morgan US Small Cap Equities Futures Index on a live basis on November 29, 2021. Each Index is an “excess return” index because it provides notional exposure to futures contract returns that reflect changes in the price of those futures contracts, as well as any profit or loss realized when rolling the relevant futures contracts. Each Index is not a “total return” index because it does not reflect interest that could be earned on funds notionally committed to the trading of futures contracts.

JPMS is currently the sponsor of each Index (the “Index Sponsor”) and the calculation agent of each Index (the “Index Calculation Agent”).

See “The J.P. Morgan Futures Indices” in this underlying supplement for additional information about the Indices.

The Indices are described as notional portfolios or baskets of assets because there is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. The Indices merely reference certain assets, the performance of which will be used as a reference point for calculating the relevant Index Level.

The construction of the Indices does not reflect any investment strategy. Instead, the Indices have been constructed to track, in the manner described herein, the relevant futures contracts.

US-1

Your investment in the notes will involve certain risks. Investing in the notes is not equivalent to investing directly in any Index or any of the futures contracts underlying any Index, or any futures contracts or exchange-traded or over-the-counter instruments based on, or other instruments linked to, any of the foregoing. You should consider carefully the following discussion of risks, as well as the discussion of risks included in the relevant terms supplement, the accompanying product supplement and any other accompanying underlying supplement, before you decide that an investment in the notes is appropriate for you.

Capitalized terms used in this section without definition are as defined in “Summary” above.

Risks Relating to the Indices

JPMS, the Index Sponsor and the Index Calculation Agent, may adjust an Index in a way that affects its level, and JPMS has no obligation to consider your interests.

JPMS, one of our affiliates, currently acts as the Index Sponsor and the Index Calculation Agent and is responsible for calculating and maintaining the Indices and developing the guidelines and policies governing their composition and calculation. In performing these duties, JPMS may have interests adverse to the interests of the holders of the notes, which may affect your return on the notes, particularly where JPMS, as the Index Sponsor and the Index Calculation Agent, is entitled to exercise discretion. The rules governing the Indices may be amended at any time by the Index Sponsor, in its sole discretion. The rules also permit the use of discretion by the Index Sponsor and the Index Calculation Agent in relation to each Index in specific instances, including, but not limited to, the determination of whether to replace a Futures Contract with a substitute or successor upon the occurrence of certain events affecting that Futures Contract, the selection of any substitute or successor and the determination of the levels to be used in the event of market disruptions that affect the ability of the Index Calculation Agent to calculate and publish the levels of that Index and the interpretation of the rules governing the Indices. Although JPMS, acting as the Index Sponsor and the Index Calculation Agent, will make all determinations and take all action in relation to the Indices acting in good faith, it should be noted that JPMS may have interests adverse to the interests of the holders of the notes and the policies and judgments for which JPMS is responsible could have an impact, positive or negative, on the level of an Index and the value of your notes.

Although judgments, policies and determinations concerning the Indices are made by JPMS, JPMorgan Chase & Co. ultimately controls JPMS. JPMS has no obligation to consider your interests in taking any actions that might affect the value of your notes. Furthermore, the inclusion of any Futures Contract in an Index is not an investment recommendation by us or JPMS of that Futures Contract. See “The J.P. Morgan Futures Indices.”

Each Index is subject to significant risks associated with the relevant Futures Contract.

Each Index tracks the returns of a Futures Contract. The price of a Futures Contract depends not only on the price of the underlying asset referenced by that Futures Contract, but also on a range of other factors, including but not limited to changing supply and demand relationships, interest rates, governmental and regulatory policies and the policies of the exchanges on which the Futures Contracts trade. In addition, the futures markets are subject to temporary distortions or other disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators and government regulation and intervention. These factors and others can cause the prices of the Futures Contracts to be volatile and could adversely affect the level of the Indices and any payments on, and the value of, your notes.

Suspension or disruptions of market trading in a Futures Contract may adversely affect the value of your notes.

Futures markets are subject to temporary distortions or other disruptions due to various factors, including lack of liquidity, the participation of speculators, and government regulation and intervention. In

US-2

addition, futures exchanges generally have regulations that limit the amount of Futures Contract price fluctuations that may occur in a single day. These limits are generally referred to as “daily price fluctuation limits” and the maximum or minimum price of a contract on any given day as a result of these limits is referred to as a “limit price.” Once the limit price has been reached in a particular contract, no trades may be made at a price beyond the limit, or trading may be limited for a set period of time. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at potentially disadvantageous times or prices. These circumstances could delay the calculation of the level of each Index and could adversely affect the level of each Index and any payments on, and the value of, your notes.

An increase in the margin requirements for a Futures Contract may adversely affect the level of the relevant Index.

Futures exchanges require market participants to post collateral in order to open and keep open positions in a Futures Contract. If an exchange increases the amount of collateral required to be posted to hold positions in Futures Contract, market participants who are unwilling or unable to post additional collateral may liquidate their positions, which may cause the price or liquidity of that Futures Contract to decline significantly. As a result, the level of the relevant Index and any payments on, and the value of, the notes may be adversely affected.

An Index may in the future include a Futures Contract that is not traded on regulated futures exchanges.

Each Index is currently based solely on futures contracts traded on regulated futures exchanges (referred to in the United States as “designated contract markets”). If these exchange-traded futures contracts cease to exist, or if the Index Calculation Agent substitutes a Futures Contract in certain circumstances, the relevant Index may in the future include futures contract or over-the-counter contracts traded on trading facilities that are subject to lesser degrees of regulation or, in some cases, no substantive regulation. As a result, trading in such contracts, and the manner in which prices and volumes are reported by the relevant trading facilities, may not be subject to the provisions of, and the protections afforded by, the U.S. Commodity Exchange Act, or other applicable statutes and related regulations that govern trading on regulated U.S. futures exchanges or similar statutes and regulations that govern trading on regulated non-U.S. futures exchanges. In addition, many electronic trading facilities have only recently initiated trading and do not have significant trading histories. As a result, the trading of contracts on such facilities, and the inclusion of such contracts in an Index, may be subject to certain risks not presented by the Futures Contracts, including risks related to the liquidity and price histories of the relevant contracts.

Negative roll returns associated with a Futures Contract may adversely affect the performance of the relevant Index and the value of the notes.

Each Index references a Futures Contract. Unlike common equity securities, futures contracts, by their terms, have stated expirations. As the exchange-traded futures contracts that compose an Index approach expiration, they are replaced by similar contracts that have a later expiration. For example, a futures contract notionally purchased and held in June may specify a September expiration date. As time passes, the contract expiring in September is replaced by a contract for delivery in December. This is accomplished by notionally selling the September contract and notionally purchasing the December contract. This process is referred to as “rolling.” Excluding other considerations, if prices are higher in the distant delivery months than in the nearer delivery months, the notional purchase of the December contract would take place at a price that is higher than the price of the September contract, thereby creating a negative “roll return.” Negative roll returns adversely affect the returns of each Index and any payments on, and the value of, the notes. Because of the potential effects of negative roll returns, it is possible for the value of an Index to decrease significantly over time, even when the near-term or spot prices of the underlying assets or instruments are stable or increasing. Relatively higher interest rates can result in more negative roll yields. Accordingly, during periods of relatively higher interest rates, the likelihood that a roll return related to an Index will be negative, as well as the adverse effect of negative roll returns on an Index, will increase, as compared to periods of relatively lower interest rates.

US-3

Each Index is an “excess return” index and not a “total return” index because it does not reflect interest that could be earned on funds notionally committed to the trading of futures contracts.

Each Index is an excess return index and not a total return index. The return from investing in futures contracts derives from three sources: (a) changes in the price of the relevant futures contracts (which is known as the “price return”); (b) any profit or loss realized when rolling the relevant futures contracts (which is known as the “roll return”); and (c) any interest earned on the cash deposited as collateral for the purchase of the relevant futures contracts (which is known as the “collateral return”).

Some indices, including the Indices, that track futures contracts are excess return indices that measure the returns accrued from investing in uncollateralized futures contracts (i.e., the sum of the price return and the roll return associated with an investment in futures contracts). By contrast, a total return index, in addition to reflecting those returns, also reflects interest that could be earned on funds committed to the trading of the underlying futures contracts (i.e., the collateral return associated with an investment in futures contracts). Investing in an instrument linked to an Index will not generate the same return as would be generated from investing directly in the relevant Futures Contracts or in a total return index related to those Futures Contracts.

Each Index should not be compared to any other index or strategy sponsored by any of our affiliates (each, a “J.P. Morgan Index”) and cannot necessarily be considered a revised, enhanced or modified version of any other J.P. Morgan Index.

Each Index follows a notional rules-based proprietary strategy that may have objectives, features and/or constituents that are similar to those of other J.P. Morgan Indices. No assurance can be given that these similarities will form a basis for comparison between any Index and any other J.P. Morgan Index, and no assurance can be given that any Index would be more successful than or outperform any other J.P. Morgan Index. Each Index operates independently and does not necessarily revise, enhance, modify or seek to outperform any other J.P. Morgan Index.

Hypothetical back-tested data relating to an Index do not represent actual historical data and are subject to inherent limitations.

Hypothetical back-tested performance measures of an Index are purely theoretical and do not represent the actual historical performance of that Index and have not been verified by an independent third party. Hypothetical back-tested performance measures have inherent limitations. Alternative modelling techniques might produce significantly different results and may prove to be more appropriate. Past performance, and especially hypothetical back-tested performance, is not indicative of future results. This type of information has inherent limitations and you should carefully consider these limitations before placing reliance on such information. Hypothetical back-tested performance is derived by means of the retroactive application of a back-tested model that has been designed with the benefit of hindsight.

If the value of a Futures Contract changes, the level of the relevant Index and the market value of your notes may not change in the same manner.

Owning the notes is not the same as owning any Futures Contract. Accordingly, changes in the value of a Futures Contract may not result in a comparable change in the level of the relevant Index or the market value of your notes.

The Indices comprise notional assets and liabilities.

The exposures to the Futures Contract underlying an Index are purely notional and will exist solely in the records maintained by or on behalf of the Index Calculation Agent. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Consequently, you will not have any claim against any of the reference assets that compose the Indices.

US-4

The Indices have a limited operating history and may perform in unanticipated ways.

The J.P. Morgan US Q Equities Futures Index was established on December 22, 2020 and the J.P. Morgan US Small Cap Equities Futures Index was established on November 29, 2021 and therefore have a limited operating history. Past performance should not be considered indicative of future performance.

The Futures Contracts composing the Indices may be replaced by substitutes upon the occurrence of certain extraordinary events.

As described under “The J.P. Morgan Futures Indices — Succession and Extraordinary Events” below, following the occurrence of certain extraordinary events with respect to a Futures Contract, the affected Futures Contract may be replaced by a substitute futures contract or the calculation agent of an Index may cease calculation and publication of that Index on a date determined by the calculation agent of that Index. These extraordinary events generally include events that could materially interfere with the ability of market participants to transact in, or events that could materially change the underlying economic exposure of, positions with respect to an Index, any Futures Contract or any reference index, where that material interference or change is not acceptable to the calculation agent of the Indices. See “The J.P. Morgan Futures Indices — Succession and Extraordinary Events” below for a summary of events that could trigger an extraordinary event.

You should realize that the changing of a Futures Contract may affect the performance of an Index, and therefore, the return on the notes, as the replacement Futures Contract may perform significantly better or worse than the original Futures Contract.

Risks Relating to the J.P. Morgan US Q Equities Futures Index

The J.P. Morgan US Q Equities Futures Index will be subject to risks associated with non-U.S. securities markets.

Some of the equity securities included in the reference index underlying the Futures Contract included in the J.P. Morgan US Q Equities Futures Index have been issued by non-U.S. companies. An investment in the notes, therefore, involves risks associated with the home countries of the issuers of those non-U.S. equity securities. The prices of non-U.S. equity securities may be adversely affected by political, economic, financial and social factors in the home countries of the issuers of the non-U.S. companies, including changes in those countries’ government, economic and fiscal policies, currency exchange laws or other laws or restrictions.

Some or all of these factors may influence the value of the J.P. Morgan US Q Equities Futures Index. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors. You cannot predict the future performance of the J.P. Morgan US Q Equities Futures Index based on its historical performance. The value of the J.P. Morgan US Q Equities Futures Index may decrease, which may adversely affect any payments on, and the value of, the notes.

Risks Relating to the J.P. Morgan US Small Cap Equities Futures Index

The J.P. Morgan US Small Cap Equities Futures Index will be subject to risks associated with small-capitalization stocks.

The stocks that constituent the Russell 2000® Index, the reference index underlying the Futures Contract included in the J.P. Morgan US Small Cap Equities Futures Index, are issued by companies with relatively small market capitalization. The stock prices of smaller companies may be more volatile than stock prices of large-capitalization companies. Small-capitalization companies may be less able to withstand adverse economic, market, trade and competitive conditions relative to larger companies. These companies tend to be less well-established than large market capitalization companies. Small-capitalization companies are less likely to pay dividends on their stocks, and the presence of a dividend payment could be a factor that limits downward stock price pressure under adverse market conditions.

US-5

The relevant terms supplement or a separate underlying supplement will provide additional risk factors relating to any other index or reference assets to which the notes are linked.

US-6

The J.P. Morgan Futures Indices

Each index in the J.P. Morgan Futures Index Series (each, an “Index” and collectively, the “Indices”) was developed and is maintained and calculated by J.P. Morgan Securities LLC (“JPMS”). The description of the Indices and their methodology included in this underlying supplement is based on rules formulated by JPMS (the “Rules”). The Rules, and not this description, will govern the calculation and constitution of the Indices and other decisions and actions related to their maintenance. The Rules in effect as of the date of this underlying supplement are attached as Annex A to this underlying supplement. The Indices are the intellectual property of JPMS and its affiliates, and JPMS and its affiliates reserve all rights with respect to their ownership of the Indices. The Indices are reported by Bloomberg L.P. under the relevant ticker symbol set forth in the table below.

Each Index tracks the excess return of a notional rolling futures position in futures contracts (each, a “Futures Contract”) in the relevant futures contract series (each, a “Series”) set forth in the table below. Each Index generally tracks the front expiry futures contract in the relevant Series; however, each Index rolls to the next expiry futures contract in the relevant Series over a 5-day period shortly before the expiry of the front expiry futures contract. (The next expiry futures contract will become the front expiry futures contract upon the expiration of the original front expiry futures contract.)

Index | Ticker | Series | Reference Index | Base Date |

| J.P. Morgan US Q Equities Futures Index | JPUSNQEQ | E-mini® Nasdaq-100® Futures | Nasdaq-100 Index® | April 10, 1996 |

| J.P. Morgan US Small Cap Equities Futures Index | JPUSSMEQ | E-mini® Russell 2000® Futures* | Russell 2000® Index | February 4, 1993 |

* From February 4, 1993 to June 17, 2008, and since September 8, 2017, the J.P. Morgan US Small Cap Equities Futures Index has referenced E-mini® Russell 2000® futures contracts traded on the Chicago Mercantile Exchange (the “CME”). From June 12, 2008 to September 13, 2017, the J.P. Morgan US Small Cap Equities Futures Index referenced E-mini® Russell 2000® futures contracts traded on the ICE Futures U.S. The overlap in futures contracts is due to the rolling feature of the J.P. Morgan US Small Cap Equities Futures Index.

The closing level of each Index (the “Index Level”) was set equal to 100 on the base date of that Index. The Index Calculation Agent (as defined below) began calculating J.P. Morgan US Q Equities Futures Index on a live basis on December 22, 2020 and the J.P. Morgan US Small Cap Equities Futures Index on a live basis on November 29, 2021. Each Index is an “excess return” index because it provides notional exposure to futures contract returns that reflect changes in the price of those futures contracts, as well as any profit or loss realized when rolling the relevant futures contracts. Each Index is not a “total return” index because it does not reflect interest that could be earned on funds notionally committed to the trading of futures contracts.

The Indices are described as notional portfolios or baskets of assets because there is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. The Indices merely reference certain assets, the performance of which will be used as a reference point for calculating the relevant Index Level.

The construction of the Indices does not reflect any investment strategy. Instead, the Indices have been constructed to track, in the manner described herein, the relevant futures contracts.

Index Rolling

In connection with each roll, each Index exits its notional position in the front expiry futures contract in the relevant Series and enters a notional position in the next expiry futures contract in that Series. This roll of each Index is effected in equal increments over five roll days, occurring over the six Index Business Days before the Cut-off Day for the front expiry futures contract in the relevant Series. Roll days are

US-7

subject to postponement or adjustment if a market disruption affecting the futures contracts of the relevant Series has occurred or is continuing, as described under “Index Market Disruption Events” below.

With respect to each Index, an “Index Business Day” means a day on which the Exchange for that Index is scheduled to be open for its regular trading session.

With respect to a futures contract, the “Cut-off Day” means the earlier to occur of (i) the last scheduled trading day for that futures contract and (ii) the first notice date (as determined pursuant to the rules of the relevant Exchange) for that futures contract, in each case as specified by the relevant Exchange.

With respect to each Index, “Exchange” is defined in the Rules and generally means the exchange or quotation system on which the futures contracts of a Series are listed for trading (taking into account permanent or temporary successors or replacements).

Calculation and Publication of the Index Level

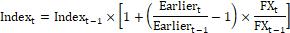

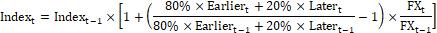

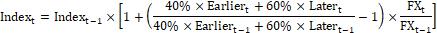

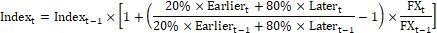

The Index Calculation Agent will calculate the Index Level with respect to each Index Trading Day and will publish the Index Level to an accuracy of two decimal places on that Index Trading Day. “Index Trading Day” is defined in the Rules as “Trading Day” and means generally an Index Business Day on which no market disruption occurs or on which the relevant Index rolls a portion of its exposure from one futures contract to the next, notwithstanding the occurrence of a market disruption.

The Index Level of an Index on each Index Trading Day reflects the weighted excess return performance of the futures contracts tracked by that Index on that Index Trading Day. The excess return performance of a futures contract reflects the performance of the official settlement price of that futures contract. See the Rules for additional information about the calculation of the Index Level.

While the Index Calculation Agent will publish the Index Level of each Index with respect each Index Trading Day to an accuracy of two decimal places, the Index Calculation Agent may calculate that Index to a greater degree of accuracy or specificity and may use any rounding convention it considers appropriate for any data used or calculations performed (which may include using data with a higher level of specificity than that which is published on any particular data source) to determine the Index Level.

Index Market Disruption Events

The calculation and publication of each Index Level and the roll of each Index will be affected by the occurrence of certain market disruptions relating to the futures contracts in the relevant Series. These events are set out in full in the Rules and include, without limitation, suspensions or disruptions of trading or data unavailability relating to the futures contracts in the relevant Series, their reference indices (if applicable) or related futures or option contracts that the Index Calculation Agent determines in its sole discretion could materially interfere with the ability of market participants to transact in positions with respect to the relevant Index, the futures contracts in the relevant Series their reference indices (if applicable) or related futures or option contracts.

If a market disruption is continuing on a scheduled roll day, that roll day will generally be postponed until no such market disruption is occurring. However, if that market disruption continues for a sustained period, the Index Calculation Agent may nevertheless roll the relevant Index using good faith estimates, and those estimates may be subject to later correction. Multiple roll days may occur on the same day if one or more roll days (with the aggregate roll amount for each such roll day being effectuated on that day) is postponed. The Index Level of an Index will not be calculated and published on any day on which a market disruption has occurred, except for a roll day on which the Index Calculation Agent rolls a portion of the exposure of that Index notwithstanding the occurrence of a market disruption.

See the Rules for additional information about market disruptions and their effects on the Indices.

US-8

Succession and Extraordinary Events

Upon the occurrence of certain succession events set out in the Rules that affect a Series, the Index Calculation Agent will replace the affected Series with a successor to that Series.

In addition, upon the occurrence of certain events set out in the Rules that are referred to as extraordinary events, and if Index Calculation Agent determines that the applicable event materially interferes with the ability of market participants to transact in positions with respect to an Index, then the Index Calculation Agent will replace the affected Series with a successor to that Series or with a substitute that the Index Calculation Agent determines, in its sole discretion, possesses substantially similar characteristics or provides substantially similar exposure as compared to the original Series. If no such substitute is available, the Index Calculation Agent will replace the affected Series with a substitute that the Index Calculation Agent determines to be an appropriate substitute, considering the context of that Index. In any such case, the Index Calculation Agent will, in good faith, make related adjustments to the Rules that it determines to be appropriate.

The extraordinary events are set out in full in the Rules and include, without limitation, (a) cancelation of, or a material change to the calculation of, or a material modification to, or a sustained failure to publish the level of, the reference index of a Series (if applicable), (b) the de-listing of a Series or the failure to list a futures contract in that Series, (c) the occurrence of a market disruption affecting a Series that continues for a sustained period, (d) the occurrence of a sustained premium or discount in the official settlement price of a Futures Contract as compared to its reference index (if applicable), (e) the termination or impairment of any relevant license or other right relied upon by the Index Calculation Agent in administering an Index, (f) the occurrence of certain changes in law and (g) certain other events affecting the trading, liquidity or listing of a Series.

The Index Sponsor (as defined below) may, in its discretion, at any time and without notice, terminate the calculation or publication of an Index, including, without limitation, subsequent to the occurrence of an extraordinary event. The Index Sponsor is under no obligation to continue the calculation and publication of any Index.

Corrections

If the official settlement price of any futures contract referenced by an Index is publicly corrected after its initial dissemination or if the Index Calculation Agent identifies an error or omission in respect of an Index, and if the Index Calculation Agent determines that the correction, error or omission is material, then the Index Calculation Agent may make an adjustment or correction to the relevant Index Level.

The Index Sponsor and the Index Calculation Agent

JPMS is currently the sponsor of the Indices (together with any successor sponsor or assign, the “Index Sponsor”). The Index Sponsor may appoint a successor sponsor or assign, delegate or transfer any or all of its rights, obligations or responsibilities in its capacity as Index Sponsor in connection with the Indices to one or more entities (including an unrelated third party) that the Index Sponsor determines is appropriate.

The Index Sponsor is also responsible for the appointment of the calculation agent of the Indices (the “Index Calculation Agent”), which may be the Index Sponsor, an unrelated third party or an affiliate or subsidiary of the Index Sponsor. JPMS is currently the Index Calculation Agent. The Index Sponsor may at any time and for any reason (i) appoint a successor Index Calculation Agent if the Index Sponsor is at that time the Index Calculation Agent or (ii) terminate the appointment of the Index Calculation Agent and appoint an alternative entity as a replacement Index Calculation Agent if the Index Sponsor is not at that time the Index Calculation Agent. The Index Calculation Agent (unless the Index Calculation Agent is the same entity as the Index Sponsor) must obtain written permission from the Index Sponsor prior to any delegation or transfer of the Index Calculation Agent’s responsibilities or obligations in connection with the Indices. The Index Calculation Agent is responsible for making calculations and determinations as described above and in the Rules.

US-9

Index Sponsor and Index Calculation Agent Determinations

The Index Calculation Agent will act in good faith and in a commercially reasonable manner in making determinations, interpretations and calculations pursuant to the Rules. Subject to the prior agreement of the Index Sponsor, the Index Calculation Agent’s determinations, and all calculations related to the Indices and the Index Calculation Agent’s interpretations of the Rules, will be final.

None of the Index Sponsor, the Index Calculation Agent and any of their respective affiliates and subsidiaries and any of their respective directors, officers, employees, representatives, delegates and agents (each, a “Relevant Person”) will have any responsibility to any person (whether as a result of negligence or otherwise) for any determinations, interpretations or calculations made or anything done (or omitted to be determined or done) in connection with the Indices or any use to which any person may put the Indices or the Index Levels.

Subject to the prior agreement of the Index Sponsor, the Index Calculation Agent may make certain determinations, adjustments, amendments and interpretations related to the Indices. All such determinations, adjustments, amendments and interpretations (in each case, subject to such prior agreement on the part of the Index Sponsor) of the Index Calculation Agent related to the Indices and all calculations performed by the Index Calculation Agent related to the Indices will be final, conclusive and binding and no person will be entitled to make any claim against the Index Sponsor, the Index Calculation Agent, or any of the Relevant Persons in respect thereof. Once a determination, adjustment, amendment or interpretation is made or action is taken by the Index Calculation Agent (in each case, as agreed in advance by the Index Sponsor) in relation to an Index, or a calculation is performed by the Index Calculation Agent in relation to an Index, none of the Index Sponsor, the Index Calculation Agent or any Relevant Person will be under any obligation to revise any such determination, adjustment, amendment, interpretation or calculation made or anything done (or omitted to be determined, adjusted, amended, interpreted, calculated or done) for any reason.

The Index Calculation Agent’s exercise of discretion or failure to exercise discretion in relation to an Index may have a detrimental effect on the Index Level of that Index and the volatility of that Index. The Index Sponsor or the Index Calculation Agent may make certain determinations or calculations based on information obtained from publicly available sources without independently verifying such information.

Amendment of the Rules; Termination of the Indices

The Rules may be supplemented, amended or restated from time to time in the sole discretion of JPMS in its capacity as the Index Sponsor. Although the Rules are intended to be comprehensive and accurate, ambiguities may arise and errors or omissions may have been made. Under these circumstances, the Index Sponsor will resolve these ambiguities and, if necessary, amend the Rules to reflect their resolution. In the case of any errors or omissions, the Index Sponsor may amend the Rules to address those errors or omissions. The Rules will be made available (in a manner determined by the Index Sponsor from time to time) following any supplementation, amendment or restatement. However, the Index Sponsor is under no obligation to inform any person about any amendments to any Index (except as required by law or regulation).

The Index Sponsor may at any time, for any reason and without notice, terminate or cease the calculation or publication of any Index.

US-10

Background on Futures Contracts

Futures contracts are contracts that legally obligate the holder to buy or sell an asset at a predetermined delivery price during a specified future time period. Each Index is an excess return index that tracks futures contracts. See “The J.P. Morgan Futures Indices” above.

Overview of Futures Markets

Futures contracts are traded on regulated futures exchanges, in the over-the-counter market and on various types of physical and electronic trading facilities and markets. As of the date of this underlying supplement, all of the futures contracts associated with the Indexes are exchange-traded futures contracts. An exchange-traded futures contract provides for the purchase and sale of a specified type and quantity of an underlying asset or financial instrument during a stated delivery month for a fixed price. A futures contract provides for a specified settlement month in which the cash settlement is made or in which the underlying asset or financial instrument is to be delivered by the seller (whose position is therefore described as “short”) and acquired by the purchaser (whose position is therefore described as “long”).

No purchase price is paid or received on the purchase or sale of a futures contract. Instead, an amount of cash or cash equivalents must be deposited with the broker as “initial margin.” This amount varies based on the requirements imposed by the exchange clearing houses, but it may be lower than 5% of the notional value of the contract. This margin deposit provides collateral for the obligations of the parties to the futures contract.

By depositing margin, which may vary in form depending on the exchange, with the clearing house or broker involved, a market participant may be able to earn interest on its margin funds, thereby increasing the total return that it may realize from an investment in futures contracts.

In the United States, futures contracts are traded on organized exchanges, known as “designated contract markets.” At any time prior to the expiration of a futures contract, a trader may elect to close out its position by taking an opposite position on the exchange on which the trader obtained the position, subject to the availability of a liquid secondary market. This operates to terminate the position and fix the trader’s profit or loss. Futures contracts are cleared through the facilities of a centralized clearing house and a brokerage firm, referred to as a “futures commission merchant,” which is a member of the clearing house.

Unlike common equity securities, futures contracts, by their terms, have stated expirations. At a specific point in time prior to expiration, trading in a futures contract for the current delivery month will cease. As a result, a market participant wishing to maintain its exposure to a futures contract on a particular asset or financial instrument with the nearest expiration must close out its position in the expiring contract and establish a new position in the contract for the next delivery month, a process referred to as “rolling.” For example, a market participant with a long position in a futures contract expiring in November who wishes to maintain a position in the nearest delivery month will, as the November contract nears expiration, sell the November contract, which serves to close out the existing long position, and buy a futures contract expiring in December. This will “roll” the November position into a December position, and, when the November contract expires, the market participant will still have a long position in the nearest delivery month.

Futures exchanges and clearing houses in the United States are subject to regulation by the Commodity Futures Trading Commission. Exchanges may adopt rules and take other actions that affect trading, including imposing speculative position limits, maximum price fluctuations and trading halts and suspensions and requiring liquidation of contracts in certain circumstances. Futures markets outside the United States are generally subject to regulation by comparable regulatory authorities. The structure and nature of trading on non-U.S. exchanges, however, may differ from this description.

US-11

The Futures Contracts

E-mini® Russell 2000® Futures

E-mini® Russell 2000® futures are U.S. dollar-denominated futures contracts (an “E-mini® Russell 2000® futures contract”), based on the Russell 2000® Index, traded on the CME, representing a contract unit of $50 multiplied by the Russell 2000® Index, measured in cents per index point. From February 4, 1993 to September 18, 2008, and since July 10, 2017, E-mini® Russell 2000® futures contracts have traded on the CME. From August 8, 2007 to June 15, 2018, E-mini® Russell 2000® futures contracts traded on the ICE Futures U.S.

E-mini® Russell 2000® futures contracts listed for the nearest five quarters, for each March, June, September and December are available for trading. Trading of the E-mini® Russell 2000® futures contracts will terminate at 9:30 A.M. Eastern time on the third Friday of the contract month.

The daily settlement prices of the E-mini® Russell 2000® futures contracts are based on trading activity in the relevant contract (and in the case of a lead month also being the expiry month, together with trading activity on lead month-second month spread contracts) on the CME during a specified settlement period. The final settlement price of E-mini® Russell 2000® futures contracts is determined through the end of month fair value procedure, which fixes a price based on CME Globex activity in the E-mini® Russell 2000® futures contracts between 2:59:30 P.M. and 3:00 P.M. Central time.

E-mini® Nasdaq-100® Futures

E-mini® Nasdaq-100® futures are U.S. dollar-denominated futures contracts (an “E-mini® Nasdaq-100® futures contract”), based on the Nasdaq-100 Index®, traded on the CME, representing a contract unit of $20 multiplied by the Nasdaq-100 Index®, measured in cents per index point. From April 10, 1996, the E-mini® Nasdaq-100® Futures contracts have traded on the CME.

E-mini® Nasdaq-100® futures contracts listed for six consecutive quarters for each March, June, September and December and four additional December contract months are available for trading. Trading of the E-mini® Russell 2000® futures contracts will terminate at 9:30 A.M. Eastern time on the third Friday of the contract month.

The daily settlement prices of the E-mini® Nasdaq-100® futures contracts are based on trading activity in the relevant contract (and in the case of a lead month also being the expiry month, together with trading activity on lead month-second month spread contracts) on the CME during a specified settlement period. The final settlement price of E-mini® Nasdaq-100® futures contracts is determined through the end of month fair value procedure, which fixes a price based on CME Globex activity in the E-mini® Nasdaq-100® futures contracts between 2:59:30 P.M. and 3:00 P.M. Central time.

US-12

Background on the NASDAQ-100 index®

All information contained in this underlying supplement regarding the Nasdaq-100 Index®, including, without limitation, its make-up, method of calculation and changes in its components, has been derived from publicly available information, without independent verification. This information reflects the policies of, and is subject to change by, Nasdaq, Inc. (“Nasdaq”). The Nasdaq-100 Index® is calculated, maintained and published by Nasdaq. Nasdaq has no obligation to continue to publish, and may discontinue publication of, the Nasdaq-100 Index®. The Nasdaq-100 Index® is reported by Bloomberg L.P. under the ticker symbol “NDX.”

The Nasdaq-100 Index® is a modified market capitalization-weighted index that is designed to measure the performance of 100 of the largest non-financial companies listed on The Nasdaq Stock Market. The Nasdaq-100 Index®, which includes companies across a variety of major industry groups, was launched on January 31, 1985, with a base index value of 125.00, as adjusted.

The index share weights of the component securities of the Nasdaq-100 Index® at any time are based upon the total shares outstanding (“TSO”) in each of those securities and are additionally subject, in certain cases, to rebalancing. Accordingly, each security’s influence on the level of the Nasdaq-100 Index® is directly proportional to the value of its index share weight.

Calculation of the Nasdaq-100 Index®

At any moment in time, the value of the Nasdaq-100 Index® equals the aggregate value of the then-current index share weights of each of the Nasdaq-100 Index® component securities, which are based on the TSO of each Nasdaq-100 Index® component security, multiplied by each security’s respective last sale price on The Nasdaq Stock Market (which may be the official closing price published by The Nasdaq Stock Market) and divided by a scaling factor (the “Divisor”), which becomes the basis for the reported Nasdaq-100 Index® value. The Divisor serves the purpose of scaling the aggregate value to a lower order of magnitude which is more desirable for index reporting purposes.

Security Eligibility Criteria

Eligible security types generally include American depositary receipts, common stocks, ordinary shares and tracking stocks. Companies organized as real estate investment trusts (“REITs”) are not eligible for index inclusion. If the security is a depositary receipt representing a security of a non-U.S. issuer, then references to the “issuer” are references to the underlying security and the TSO is the actual depositary shares outstanding as reported by the depositary banks.

If an issuer has listed multiple security classes, all security classes are eligible, subject to meeting all other security eligibility criteria.

The issuer of the security’s primary U.S. listing must exclusively be listed on the Nasdaq Global Select Market or the Nasdaq Global Market. If the issuer of the security is organized under the laws of a jurisdiction outside the United States, then that security must have listed options on a registered options market in the United States or be eligible for listed options trading on a registered options market in the United States.

The security must be classified as a non-financial company (any industry other than financials) according to the Industry Classification Benchmark.

There is no market capitalization eligibility criterion. Each security must have a minimum average daily trading volume of 200,000 shares (measured over the three calendar months ending with the month that includes the reconstitution reference date).

The security must have traded for at least three full calendar months, not including the month of initial listing, on an eligible exchange, which includes Nasdaq (Nasdaq Global Select Market, Nasdaq Global Market or Nasdaq Capital Market), NYSE, NYSE American or CBOE BZX. Eligibility is determined as of the constituent selection reference date and includes that month. A security that was added to the

US-13

Nasdaq-100 Index® as the result of a spin-off event will be exempt from the seasoning requirement. There is no float eligibility criterion.

The issuer of the security generally may not currently be in bankruptcy proceedings.

The issuer of the security generally may not have entered into a definitive agreement or other arrangement that would make it ineligible for index inclusion and where the transaction is imminent as determined by the Nasdaq Index Management Committee.

Reconstitution and Rebalancing of the Nasdaq-100 Index®

Nasdaq selects constituents once annually in December. The security eligibility criteria are applied using market data as of the end of October and TSO as of the end of November. Index reconstitutions are announced in early December and become effective after the close of trading on the third Friday in December.

The Nasdaq-100 Index® is rebalanced on a quarterly basis in March, June, September and December. The Nasdaq-100 Index® rebalance uses the TSO and last sale price of all Nasdaq-100 Index® securities as of the prior month-end (February, May, August and November respectively). Index rebalance changes are announced in early March, June, September and December and become effective after the close of trading on the third Friday in March, June, September and December. A special rebalance may be conducted at any time based on the weighting restrictions described in the index rebalance procedure if it is determined to be necessary to maintain the integrity of the Nasdaq-100 Index®.

Constituent Selection

A reconstitution is conducted on an annual basis, at which time all eligible issuers, ranked by market capitalization, are considered for index inclusion based on the following order of criteria:

| 1. | The top 75 ranked issuers will be selected for inclusion in the Nasdaq-100 Index®. |

| 2. | Any other issuers that were already members of the Nasdaq-100 Index® as of the reconstitution reference date and are ranked within the top 100 are also selected for inclusion in the Nasdaq-100 Index®. |

| 3. | In the event that fewer than 100 issuers pass the first two criteria, the remaining positions will first be filled, in rank order, by issuers currently in the Nasdaq-100 Index® ranked in positions 101-125 that were ranked in the top 100 at the previous reconstitution or replacement- or spin-off-issuers added since the previous reconstitution. |

| 4. | In the event that fewer than 100 issuers pass the first three criteria, the remaining positions will be filled, in rank order, by any issuers ranked in the top 100 that were not already members of the Nasdaq-100 Index® as of the reference date. |

Constituent Weighting

The Nasdaq-100 Index® is a modified market capitalization-weighted index.

Quarterly Weight Adjustment

The Nasdaq-100 Index® quarterly weight adjustment employs a two-stage weight adjustment scheme according to issuer- level constraints.

Nasdaq-100 Index® securities’ initial weights are determined using up to two calculations of market capitalization: TSO-derived market capitalization and index share-derived market capitalization. TSO-derived market capitalization is defined as a security’s last sale price times its TSO. Nasdaq-100 Index® share-derived market capitalization is defined as a security’s last sale price times its updated index shares as of the prior month end. Both TSO-derived and index share-derived market capitalizations can

US-14

be used to calculate TSO-derived and index share-derived initial index weights by dividing each index security’s (TSO- or index share-derived) market capitalization by the aggregate (TSO- or index share-derived) market capitalization of all index securities.

When the rebalance coincides with the reconstitution, only TSO-derived initial weights are used. When the rebalance does not coincide with the reconstitution, index share-derived initial weights are used when doing so results in no weight adjustment; otherwise, TSO-derived weights are used in both stages of the weight adjustment procedure. Issuer weights are the aggregated weights of the issuers’ respective index securities.

Stage 1. If no initial issuer weight exceeds 24%, initial weights are used as Stage 1 weights; otherwise, initial weights are adjusted so that no issuer weight may exceed 20% of the Nasdaq-100 Index®.

Stage 2. If the aggregate weight of the subset of issuers whose Stage 1 weights exceed 4.5% does not exceed 48%, Stage 1 weights are used as final weights; otherwise, Stage 1 weights are adjusted so that the aggregate weight of the subset of issuers whose Stage 1 weights exceed 4.5% is set to 40%.

Annual Weight Adjustment

The Nasdaq-100 Index® annual weight adjustment employs a two-stage weight adjustment scheme according to security-level constraints. Nasdaq-100 Index® securities’ initial weights are determined via the quarterly weight adjustment procedure.

Stage 1. If no initial security weight exceeds 15%, initial weights are used as Stage 1 weights; otherwise, initial weights are adjusted so that no security weight may exceed 14% of the Nasdaq-100 Index®.

Stage 2. If the aggregate weight of the subset of index securities with the five largest market capitalizations is less than 40%, Stage 1 weights are used as final weights; otherwise, Stage 1 weights are adjusted so that (i) the aggregate weight of the subset of index securities with the five largest market capitalizations is set to 38.5% and (ii) no security with a market capitalization outside the largest five may have a final index weight exceeding the lesser of 4.4% or the final index weight of the index security ranked fifth by market capitalization.

Maintenance of the Nasdaq-100 Index®

Deletion Policy

If, at any time other than an index reconstitution, Nasdaq determines that an index security is ineligible for index inclusion, the index security is removed as soon as practicable.

This may include:

| · | Listing on an ineligible index exchange. |

| · | Merger, acquisition or other major corporate event that would adversely impact the integrity of the Nasdaq-100 Index®. |

| · | If a company is organized as a REIT. |

| · | If an index security is classified as a financial company (financials industry) according to the ICB. |

| · | If the issuer has an adjusted market capitalization below 0.10% of the aggregate adjusted market capitalization of the Nasdaq-100 Index® for two consecutive month ends. |

| · | If a security that was added to the Nasdaq-100 Index® as the result of a spin-off event has an adjusted market capitalization below 0.10% of the aggregate adjusted market capitalization of |

US-15

| the Nasdaq-100 Index® at the end of its second day of regular way trading as a Nasdaq-100 Index® member. |

In the case of mergers and acquisitions, the effective date for the removal of an index issuer or security will be largely event-based, with the goal to remove the issuer or security as soon as completion of the acquisition or merger has been deemed highly probable. Notable events include, but are not limited to, completion of various regulatory reviews, the conclusion of material lawsuits and/or shareholder and board approvals.

If at the time of the removal of the index issuer or security there is not sufficient time to provide advance notification of the replacement issuer or security so that both the removal and replacement can be effective on the same day, the index issuer or security being removed will be retained and persisted in the index calculations at its last sale price until the effective date of the replacement issuer or security’s entry to the Nasdaq-100 Index®.

Securities that are added as a result of a spin-off may be deleted as soon as practicable after being added to the Nasdaq-100 Index®. This may occur when Nasdaq determines that a security is ineligible for inclusion because of reasons such as ineligible exchange, security type, industry or adjusted market capitalization. Securities that are added as a result of a spin-off may be maintained in the Nasdaq-100 Index® until a later date and then removed, for example, if a spin-off security has liquidity characteristics that diverge materially from the security eligibility criteria and could affect the integrity of the Nasdaq-100 Index®.

Replacement Policy

Securities may be added to the Nasdaq-100 Index® outside of the index reconstitution when there is a deletion. The index security (or all index securities under the same issuer, if appropriate) is replaced as soon as practicable if the issuer in its entirety is being deleted from the Nasdaq-100 Index®. The issuer with the largest market capitalization as of the prior month end which is not in the Nasdaq-100 Index® will replace the deleted issuer. Issuers that are added as a result of a spin-off are not replaced until after they have been included in a reconstitution.

For pending deletions set to occur soon after an index reconstitution and/or index rebalance effective date, Nasdaq may decide to remove the index security from the Nasdaq-100 Index® in conjunction with the index reconstitution and/or index rebalance effective date.

Corporate Actions

In the periods between scheduled index reconstitution and rebalancing events, individual index securities may be subject to a variety of corporate actions and events that require maintenance and adjustments to the Nasdaq-100 Index®.

At the quarterly rebalancing, no changes are made to the Nasdaq-100 Index® from the previous month end until the quarterly share change effective date, with the exception of corporate actions with an ex-date.

Governance of the Nasdaq-100 Index®

The Nasdaq Index Management Committee approves all new index methodologies. This committee is comprised of full-time professional members of Nasdaq. The committee meets regularly and reviews items including, but not limited to, pending corporate actions that may affect Nasdaq-100 Index® constituents, statistics comparing the composition of the Nasdaq-100 Index® to the market, companies that are being considered as candidates for addition to the Nasdaq-100 Index® and any significant market events.

US-16

Background on the Russell 2000® Index

All information contained in this underlying supplement regarding the Russell 2000® Index, including, without limitation, its make-up, method of calculation and changes in its components, has been derived from publicly available information, without independent verification. This information reflects the policies of, and is subject to change by, FTSE Russell (“FTSE”), which is wholly owned by the London Stock Exchange Group. The Russell 2000® Index, together with the Russell 1000® Index and the Russell 3000® Index (each, a “Russell Index,” and collectively, the “Russell Indices”), is calculated, maintained and published by FTSE. FTSE has no obligation to continue to publish, and may discontinue publication of, the Russell 2000® Index.

The Russell Indices are sub-indices of the Russell 3000E™ Index, which is composed of the 4,000 largest U.S. companies as determined by total market capitalization and represents approximately 97% of the U.S. equity market.

The Russell 2000® Index measures the capitalization-weighted price performance of 2,000 U.S. small-capitalization stocks listed on eligible U.S. exchanges and is designed to track the performance of the small-capitalization segment of the U.S. equity market. The companies included in the Russell 2000® Index are the middle 2,000 of the companies that form the Russell 3000E™ Index (i.e., those ranking from 1,001 to 3,000 in the Russell 3000E™ Index). The Russell 2000® Index represents approximately 7% of the Russell 3000® Index. The Russell 2000® Index is reported by Bloomberg L.P. under the ticker symbol “RTY.”

Selection of Stocks Underlying the Russell Indices

To be eligible for inclusion in the Russell 3000E™ Index and, consequently, a Russell Index, a company must meet the following criteria as of the rank day in April (except that initial public offerings (“IPOs”) are considered for inclusion on a quarterly basis):

| · | U.S. Equity Market. The company must be determined to be part of the U.S. equity market, meaning that its home country is the United States. If a company incorporates in, has a stated headquarters location in, and also trades in the same country (ADRs and ADSs are not eligible), the company is assigned to its country of incorporation. |

If any of the three criteria do not match, FTSE then defines three Home Country Indicators (“HCIs”): country of incorporation, country of headquarters and country of the most liquid exchange as defined by two-year average daily dollar trading volume from all exchanges within a country. After the HCIs are defined, the next step in the country assignment involves an analysis of assets by location. FTSE cross-compares the primary location of the company’s assets with the three HCIs. If the primary location of assets matches any of the HCIs, then the company is assigned to its primary asset location.

If there is not enough information to determine a company’s primary location of assets, FTSE uses the primary location of the company’s revenue for the same cross-comparison and assigns the company to the appropriate country in a similar fashion. FTSE uses an average of two years of assets or revenue data for analysis to reduce potential turnover.

If conclusive country details cannot be derived from assets or revenue, FTSE assigns the company to the country in which its headquarters are located unless the country is a Benefit Driven Incorporation (“BDI”) country. If the country in which its headquarters are located is a BDI country, the company is assigned to the country of its most liquid stock exchange. The BDI countries are Anguilla, Antigua and Barbuda, Aruba, Bahamas, Barbados, Belize, Bermuda, Bonaire, British Virgin Islands, Cayman Islands, Channel Islands, Cook Islands, Curacao, Faroe Islands, Gibraltar, Guernsey, Isle of Man, Jersey, Liberia, Marshall Islands, Panama, Saba, Sint Eustatius, Sint Maarten and Turks and Caicos Islands.

| · | U.S. Eligible Exchange. The following exchanges and markets are deemed to be eligible U.S. exchanges: the Chicago Board Options Exchange, the New York Stock Exchange, |

US-17

| NYSE American, The Nasdaq Stock Market and NYSE Arca. Stocks that are not traded on an eligible U.S. exchange (Bulletin Board, Pink Sheet and over-the-counter securities, including securities for which prices are displayed on the FINRA Alternative Display Facility) are not eligible for inclusion. |

| · | Minimum Closing Price. A stock must have a close price at or above $1.00 (on its primary exchange), subject to exceptions to reduce turnover. |

| · | Minimum Total Market Capitalization. Companies with a total market capitalization less than $30 million are not eligible for inclusion. |

| · | Minimum Free Float. Companies with less than an absolute 5% of their shares available in the marketplace are not eligible for inclusion. |

| · | Company Structure. Companies structured in the following ways are not eligible for inclusion: royalty trusts, U.S. limited liability companies, closed-end investment companies, business development companies (and other companies that are required to report Acquired Fund Fees and Expenses, as defined by the SEC), blank-check companies, special-purpose acquisition companies, limited partnerships, exchange-traded funds and mutual funds. |

| · | UBTI. Real estate investment trusts and publicly traded partnerships that generate or have historically generated unrelated business taxable income (“UBTI”) and have not taken steps to block UBTI to equity holders are not eligible for inclusion. Information used to confirm UBTI impact includes the following publicly available sources: 10-K, SEC Form S-3, K-1, company annual report, dividend notices or company website. |

| · | Security Types. The following types of securities are not eligible for inclusion: preferred and convertible preferred stock, redeemable shares, participating preferred stock, warrants, rights, depositary receipts, installment receipts and trust receipts. |

| · | Minimum Voting Rights. As of August 2017, more than 5% of a company’s voting rights (aggregated across all of its equity securities, including, where identifiable, those that are not listed or trading) must be in the hands of unrestricted shareholders. Shares referenced as “non-voting” or providing legally minimum rights only will be viewed as having no voting power as it relates to the minimum voting rights review. |

| · | Multiple Share Classes. If an eligible company trades under multiple share classes, each share class is reviewed independently for eligibility for inclusion. Share classes in addition to the primary share class must meet the following minimum size, liquidity and float requirements to be eligible: (i) total market capitalization must be larger than $30 million; (ii) average daily dollar trading value must exceed that of the global median; and (iii) more than 5% of shares must be available in the marketplace. |

Securities of eligible companies are included in Russell Indices based on total market capitalization. Total market capitalization is determined by multiplying total outstanding shares by the market price (generally, the last price traded on the primary exchange of the share class with the highest two-year trading volume, subject to exceptions) as of the rank day in April (except that IPOs are considered for inclusion on a quarterly basis). Common stock, non-restricted exchangeable shares and partnership units/membership interests (but not operating partnership units of umbrella partnership real estate investment trusts) are used to calculate a company’s total market capitalization. If multiple share classes of common stock exist, they are combined to determine total shares outstanding; however, in cases where the common stock share classes act independently of each other (e.g., tracking stocks), each class is considered for inclusion separately. For merger and spin-off transactions that are effective between rank day in April and the business day immediately before the index lock-down takes effect ahead of the annual reconstitution in June, the market capitalizations of the impacted securities are recalculated and membership is re-evaluated as of the effective date of the corporate action.

US-18

The 4,000 securities with the greater total market capitalization become members of the Russell 3000E™ Index. All remaining Russell Indices are a subset of the Russell 3000E™ Index. Market capitalization breakpoints for the Russell Indices are determined by the breaks between the rankings of companies (based on descending total market capitalization). Market capitalization breakpoints for the Russell 2000® Index are determined by the break between the companies ranked #1,001 through #3,000.

New members are assigned on the basis of the breakpoints, and existing members are reviewed to determine if they fall within a cumulative 5% market cap range around these new market capitalization breakpoints. If an existing member’s market cap falls within this cumulative 5% of the market capitalization breakpoint, it will remain in its current Russell Index rather than be moved to a different Russell Index.

After membership is determined, a security’s shares are adjusted to include only those shares available to the public (“free float”). The purpose of this adjustment is to exclude from market calculations the capitalization that is not available for purchase and is not part of the investable opportunity set. Stocks in the Russell Indices are weighted by their available (also called float-adjusted) market capitalization. The following types of shares are removed from total market capitalization to arrive at free float or available market capitalization, based on information recorded in SEC corporate filings: officers’ and directors’ holdings, private holdings exceeding 10% of shares outstanding, institutional holdings exceeding 30% of shares outstanding, shares held by publicly listed companies, shares held by an Employee Stock Ownership Plan or a Leveraged Employee Stock Ownership Plan; shares locked up during an IPO; direct government holdings; and indirect government holdings exceeding 10% of shares outstanding.

Reconstitution occurs on the fourth Friday in June. A full calendar for reconstitution is published each spring, with such reconstitution schedule governed by FTSE guidelines.

Corporate Actions and Events Affecting the Russell Indices

FTSE applies corporate actions to the Russell Indices on a daily basis. FTSE applies the following methodology guidelines, among others, when adjusting the applicable Russell Index in response to corporate actions:

| · | “No Replacement” Rule. Securities that leave the relevant Russell Index for any reason (e.g., mergers, acquisitions or other similar corporate activity) are not replaced. Thus, the number of securities in the relevant Russell Index over a year will fluctuate according to corporate activity. |

| · | Statement of Principles and Adjustments for Specific Corporate Events. FTSE has stated as general principles that the treatment of corporate events (a) should reflect how such events are likely to be dealt with in investment portfolios to maintain the portfolio structure in line with the target set out in the index objective and index methodology and (b) should normally be designed to minimize the trading activity required by investors to match the index performance. No assurance can be provided that corporate actions and events will be treated by FTSE in a manner consistent with its statement of general principles. |

In addition, FTSE has established guidance for the treatment of corporate actions and events, including, but not limited to, dividends, capital repayments, companies converting to a REIT structure, share buybacks, rights issues, mergers, acquisitions, tender offers, split-offs, spin-offs, bankruptcies, insolvencies, liquidations and trading suspensions. However, because of the complexities involved in some cases, those guidelines are not definitive rules that will determine FTSE’s actions in all circumstances. FTSE reserves the right to determine the most appropriate method of implementation for any corporate event which is not covered by those guidelines or which is of a complex nature.

US-19

Supplemental Terms of the Notes

The following supplemental terms of the notes supplement, and to the extent they are inconsistent, supersede, the description of the general terms of the notes set forth in the accompanying product supplement. Except as noted below, capitalized terms used in this section without definition are as defined in “The J.P. Morgan Futures Indices” above.

Postponement of a Determination Date

Notes linked solely to an Index

Notwithstanding any contrary provision in the accompanying product supplement, for notes linked solely to an Index, the following provisions will apply. If a Determination Date (as defined in the accompanying product supplement) is a Disrupted Day (as defined in the accompanying product supplement), the applicable Determination Date will be postponed to the immediately succeeding scheduled trading day that is not a Disrupted Day.