- JPM Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

JPMorgan Chase & Co. (JPM) 424B2Prospectus for primary offering

Filed: 15 Feb 24, 6:24pm

| February , 2024 | Registration Statement Nos. 333-270004 and 333-270004-01; Rule 424(b)(2)  |

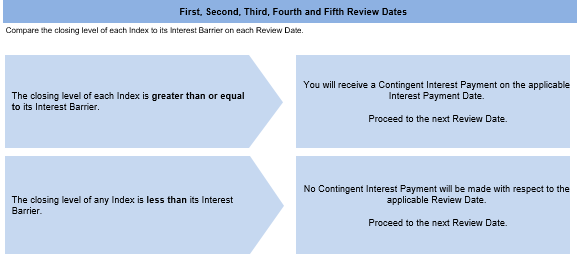

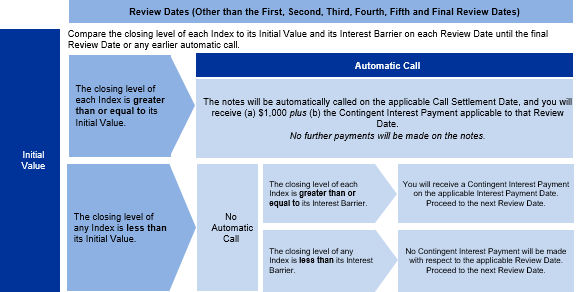

JPMorgan Chase Financial Company LLC Structured Investments Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index due March 5, 2026 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. ●The notes are designed for investors who seek a Contingent Interest Payment with respect to each Review Date for which the closing level of each of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index, which we refer to as the Indices, is greater than or equal to 70.00% of its Initial Value, which we refer to as an Interest Barrier. ●The notes will be automatically called if the closing level of each Index on any Review Date (other than the first, second, third, fourth, fifth and final Review Dates) is greater than or equal to its Initial Value. ●The earliest date on which an automatic call may be initiated is August 29, 2024. ●Investors should be willing to accept the risk of losing some or all of their principal and the risk that no Contingent Interest Payment may be made with respect to some or all Review Dates. ●Investors should also be willing to forgo fixed interest and dividend payments, in exchange for the opportunity to receive Contingent Interest Payments. ●The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. ●Payments on the notes are not linked to a basket composed of the Indices. Payments on the notes are linked to the performance of each of the Indices individually, as described below. ●Minimum denominations of $1,000 and integral multiples thereof ●The notes are expected to price on or about February 29, 2024 and are expected to settle on or about March 5, 2024. ●CUSIP: 48134WLY1 |

| | Price to Public (1) | Fees and Commissions (2) | Proceeds to Issuer |

| Per note | $1,000 | — | $1,000 |

| Total | $ | — | $ |

(1) See “Supplemental Use of Proceeds” in this pricing supplement for information about the components of the price to public of the notes. (2) All sales of the notes will be made to certain fee-based advisory accounts for which an affiliated or unaffiliated broker-dealer is an investment adviser. These broker-dealers will forgo any commissions related to these sales. See “Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement. | |||

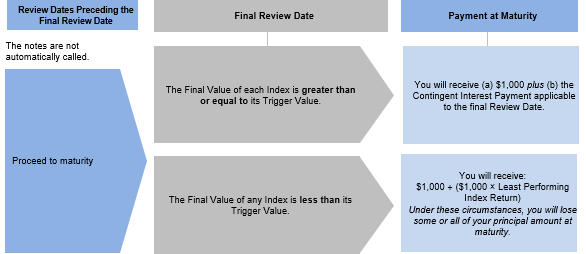

Issuer: JPMorgan Chase Financial Company LLC, an indirect, wholly owned finance subsidiary of JPMorgan Chase & Co. Guarantor: JPMorgan Chase & Co. Indices: The Dow Jones Industrial AverageTM (Bloomberg ticker: INDU), the Russell 2000® Index (Bloomberg ticker: RTY) and the S&P 500® Index (Bloomberg ticker: SPX) (each an “Index” and collectively, the “Indices”) Contingent Interest Payments: If the notes have not been automatically called and the closing level of each Index on any Review Date is greater than or equal to its Interest Barrier, you will receive on the applicable Interest Payment Date for each $1,000 principal amount note a Contingent Interest Payment equal to at least $6.875 (equivalent to a Contingent Interest Rate of at least 8.25% per annum, payable at a rate of at least 0.6875% per month) (to be provided in the pricing supplement). If the closing level of any Index on any Review Date is less than its Interest Barrier, no Contingent Interest Payment will be made with respect to that Review Date. Contingent Interest Rate: At least 8.25% per annum, payable at a rate of at least 0.6875% per month (to be provided in the pricing supplement) Interest Barrier/Trigger Value: With respect to each Index, 70.00% of its Initial Value Pricing Date: On or about February 29, 2024 Original Issue Date (Settlement Date): On or about March 5, 2024 Review Dates*: April 1, 2024, April 29, 2024, May 29, 2024, July 1, 2024, July 29, 2024, August 29, 2024, September 30, 2024, October 29, 2024, November 29, 2024, December 30, 2024, January 29, 2025, February 28, 2025, March 31, 2025, April 29, 2025, May 29, 2025, June 30, 2025, July 29, 2025, August 29, 2025, September 29, 2025, October 29, 2025, December 1, 2025, December 29, 2025, January 29, 2026 and March 2, 2026 (final Review Date) Interest Payment Dates*: April 4, 2024, May 2, 2024, June 3, 2024, July 5, 2024, August 1, 2024, September 4, 2024, October 3, 2024, November 1, 2024, December 4, 2024, January 3, 2025, February 3, 2025, March 5, 2025, April 3, 2025, May 2, 2025, June 3, 2025, July 3, 2025, August 1, 2025, September 4, 2025, October 2, 2025, November 3, 2025, December 4, 2025, January 2, 2026, February 3, 2026 and the Maturity Date Maturity Date*: March 5, 2026 Call Settlement Date*: If the notes are automatically called on any Review Date (other than the first, second, third, fourth, fifth and final Review Dates), the first Interest Payment Date immediately following that Review Date * Subject to postponement in the event of a market disruption event and as described under “General Terms of Notes — Postponement of a Determination Date — Notes Linked to Multiple Underlyings” and “General Terms of Notes — Postponement of a Payment Date” in the accompanying product supplement | Automatic Call: If the closing level of each Index on any Review Date (other than the first, second, third, fourth, fifth and final Review Dates) is greater than or equal to its Initial Value, the notes will be automatically called for a cash payment, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment applicable to that Review Date, payable on the applicable Call Settlement Date. No further payments will be made on the notes. Payment at Maturity: If the notes have not been automatically called and the Final Value of each Index is greater than or equal to its Trigger Value, you will receive a cash payment at maturity, for each $1,000 principal amount note, equal to (a) $1,000 plus (b) the Contingent Interest Payment applicable to the final Review Date. If the notes have not been automatically called and the Final Value of any Index is less than its Trigger Value, your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + ($1,000 × Least Performing Index Return) If the notes have not been automatically called and the Final Value of any Index is less than its Trigger Value, you will lose more than 30.00% of your principal amount at maturity and could lose all of your principal amount at maturity. Least Performing Index: The Index with the Least Performing Index Return Least Performing Index Return: The lowest of the Index Returns of the Indices Index Return: With respect to each Index, (Final Value – Initial Value) Initial Value Initial Value: With respect to each Index, the closing level of that Index on the Pricing Date Final Value: With respect to each Index, the closing level of that Index on the final Review Date |

| PS-1 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

| PS-2 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

Number of Contingent Interest Payments | Total Contingent Interest Payments |

| 24 | $165.000 |

| 23 | $158.125 |

| 22 | $151.250 |

| 21 | $144.375 |

| 20 | $137.500 |

| 19 | $130.625 |

| 18 | $123.750 |

| 17 | $116.875 |

| 16 | $110.000 |

| 15 | $103.125 |

| 14 | $96.250 |

| 13 | $89.375 |

| 12 | $82.500 |

| 11 | $75.625 |

| 10 | $68.750 |

| 9 | $61.875 |

| 8 | $55.000 |

| 7 | $48.125 |

| 6 | $41.250 |

| 5 | $34.375 |

| 4 | $27.500 |

| 3 | $20.625 |

| 2 | $13.750 |

| 1 | $6.875 |

| 0 | $0.000 |

| PS-3 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

Date | Closing Level of Least Performing Index | Payment (per $1,000 principal amount note) |

| First Review Date | 105.00 | $6.875 |

| Second Review Date | 110.00 | $6.875 |

| Third Review Date | 110.00 | $6.875 |

| Fourth Review Date | 105.00 | $6.875 |

| Fifth Review Date | 110.00 | $6.875 |

| Sixth Review Date | 120.00 | $1,006.875 |

| Total Payment | $1,041.25 (4.125% return) |

| PS-4 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

Date | Closing Level of Least Performing Index | Payment (per $1,000 principal amount note) |

| First Review Date | 95.00 | $6.875 |

| Second Review Date | 85.00 | $6.875 |

Third through Twenty-Third Review Dates | Less than Interest Barrier | $0 |

| Final Review Date | 90.00 | $1,006.875 |

| Total Payment | $1,020.625 (2.0625% return) |

Date | Closing Level of Least Performing Index | Payment (per $1,000 principal amount note) |

| First Review Date | 60.00 | $0 |

| Second Review Date | 65.00 | $0 |

Third through Twenty-Third Review Dates | Less than Interest Barrier | $0 |

| Final Review Date | 60.00 | $600.00 |

Total Payment | $600.00 (-40.00% return) |

| PS-5 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

| PS-6 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

| PS-7 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

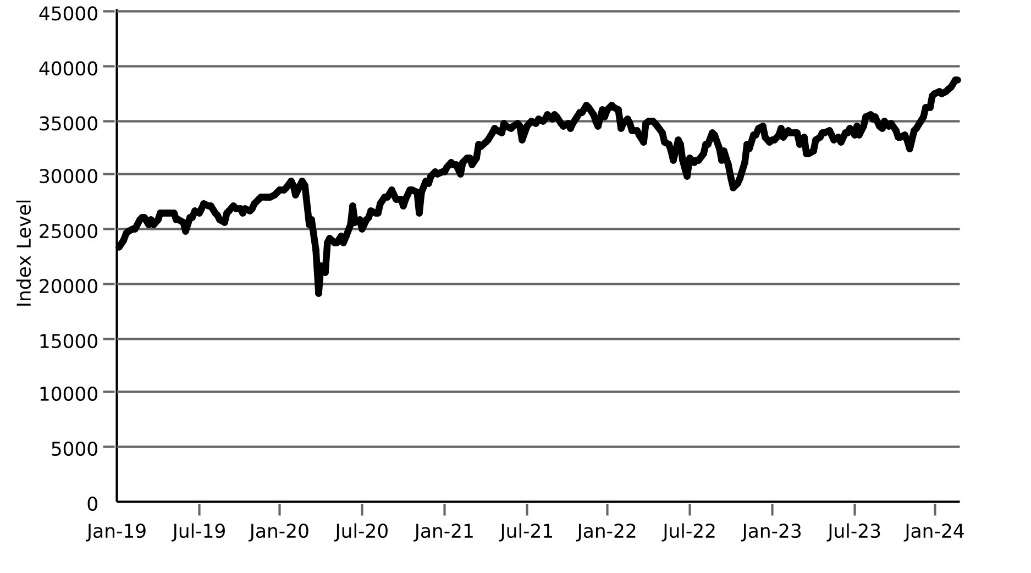

Historical Performance of the Dow Jones Industrial AverageTM  Source: Bloomberg |

Historical Performance of the Russell 2000® Index  Source: Bloomberg |

| PS-8 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

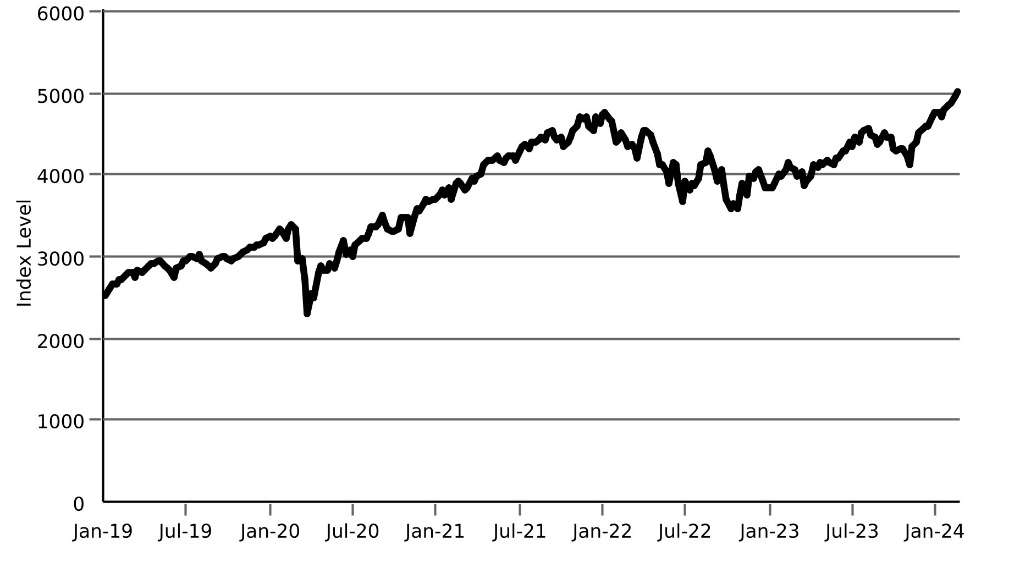

Historical Performance of the S&P 500® Index  Source: Bloomberg |

| PS-9 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

| PS-10 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |

| PS-11 | Structured Investments |  |

Auto Callable Contingent Interest Notes Linked to the Least Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the S&P 500® Index |