- JPM Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

JPMorgan Chase & Co. (JPM) 424B2Prospectus for primary offering

Filed: 2 Jul 24, 2:58pm

| June 28, 2024 | Registration Statement Nos. 333-270004 and 333-270004-01; Rule 424(b)(2)  |

JPMorgan Chase Financial Company LLC Structured Investments $297,000 Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index due July 2, 2026 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. ●The notes are designed for investors who seek a return of 2.00 times any appreciation of the lesser performing of the Russell 2000® Index and the S&P 500® Index up to a maximum return of 28.00% at maturity. ●Investors should be willing to forgo interest and dividend payments and be willing to lose some or all of their principal amount at maturity. ●The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. ●Payments on the notes are not linked to a basket composed of the Indices. Payments on the notes are linked to the performance of each of the Indices individually, as described below. ●Minimum denominations of $1,000 and integral multiples thereof ●The notes priced on June 28, 2024 and are expected to settle on or about July 3, 2024. ●CUSIP: 48135MH84 |

| | Price to Public (1) | Fees and Commissions (2) | Proceeds to Issuer |

| Per note | $1,000 | $3.50 | $996.50 |

| Total | $297,000 | $1,039.50 | $295,960.50 |

(1) See “Supplemental Use of Proceeds” in this pricing supplement for information about the components of the price to public of the notes. (2) J.P. Morgan Securities LLC, which we refer to as JPMS, acting as agent for JPMorgan Financial, will pay all of the selling commissions of $3.50 per $1,000 principal amount note it receives from us to other affiliated or unaffiliated dealers. See “Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement. | |||

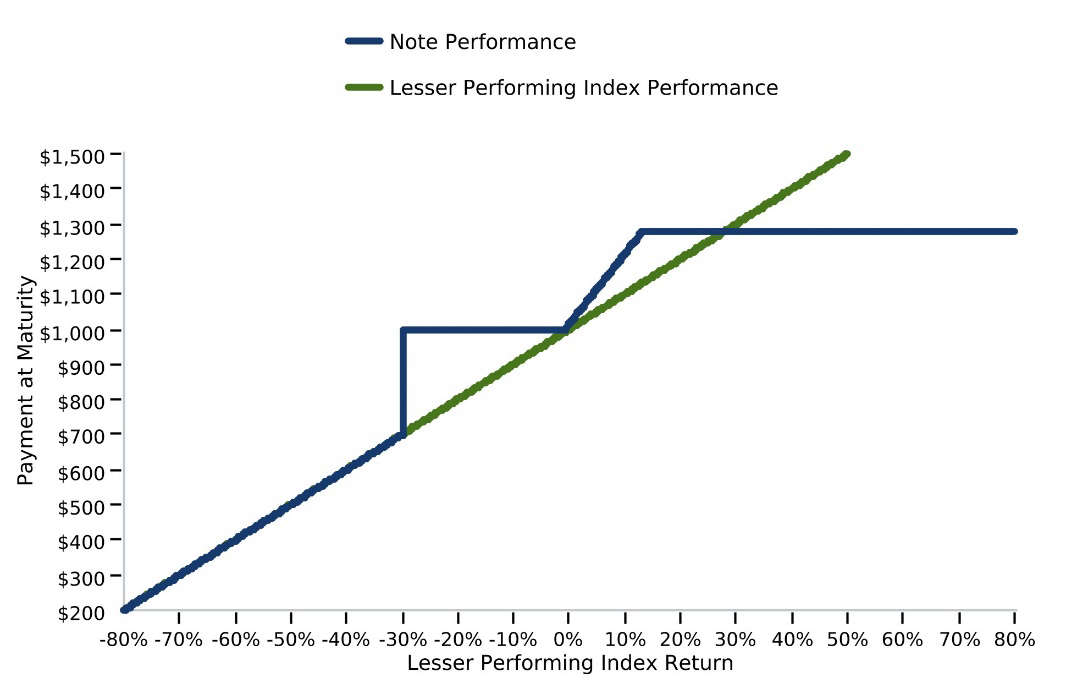

Issuer: JPMorgan Chase Financial Company LLC, a direct, wholly owned finance subsidiary of JPMorgan Chase & Co. Guarantor: JPMorgan Chase & Co. Indices: The Russell 2000® Index (Bloomberg ticker: RTY) and the S&P 500® Index (Bloomberg ticker: SPX) (each an “Index” and collectively, the “Indices”) Maximum Return: 28.00% (corresponding to a maximum payment at maturity of $1,280.00 per $1,000 principal amount note) Upside Leverage Factor: 2.00 Barrier Amount: With respect to each Index, 70.00% of its Initial Value, which is 1,433.3837 for the Russell 2000® Index and 3,822.336 for the S&P 500® Index Pricing Date: June 28, 2024 Original Issue Date (Settlement Date): On or about July 3, 2024 Observation Date*: June 29, 2026 Maturity Date*: July 2, 2026 * Subject to postponement in the event of a market disruption event and as described under “General Terms of Notes — Postponement of a Determination Date — Notes Linked to Multiple Underlyings” and “General Terms of Notes — Postponement of a Payment Date” in the accompanying product supplement | Payment at Maturity: If the Final Value of each Index is greater than its Initial Value, your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + ($1,000 × Lesser Performing Index Return × Upside Leverage Factor), subject to the Maximum Return If the Final Value of either Index is equal to or less than its Initial Value but the Final Value of each Index is greater than or equal to its Barrier Amount, you will receive the principal amount of your notes at maturity. If the Final Value of either Index is less than its Barrier Amount, your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + ($1,000 × Lesser Performing Index Return) If the Final Value of either Index is less than its Barrier Amount, you will lose more than 30.00% of your principal amount at maturity and could lose all of your principal amount at maturity. Lesser Performing Index: The Index with the Lesser Performing Index Return Lesser Performing Index Return: The lower of the Index Returns of the Indices Index Return: With respect to each Index, (Final Value – Initial Value) Initial Value Initial Value: With respect to each Index, the closing level of that Index on the Pricing Date, which was 2,047.691 for the Russell 2000® Index and 5,460.48 for the S&P 500® Index Final Value: With respect to each Index, the closing level of that Index on the Observation Date |

| PS-1 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |

Final Value of the Lesser Performing Index | Lesser Performing Index Return | Total Return on the Notes | Payment at Maturity |

| 180.00 | 80.00% | 28.00% | $1,280.00 |

| 170.00 | 70.00% | 28.00% | $1,280.00 |

| 160.00 | 60.00% | 28.00% | $1,280.00 |

| 150.00 | 50.00% | 28.00% | $1,280.00 |

| 140.00 | 40.00% | 28.00% | $1,280.00 |

| 130.00 | 30.00% | 28.00% | $1,280.00 |

| 120.00 | 20.00% | 28.00% | $1,280.00 |

| 114.00 | 14.00% | 28.00% | $1,280.00 |

| 110.00 | 10.00% | 20.00% | $1,200.00 |

| 105.00 | 5.00% | 10.00% | $1,100.00 |

| 101.00 | 1.00% | 2.00% | $1,020.00 |

100.00 | 0.00% | 0.00% | $1,000.00 |

| 95.00 | -5.00% | 0.00% | $1,000.00 |

| 90.00 | -10.00% | 0.00% | $1,000.00 |

| 80.00 | -20.00% | 0.00% | $1,000.00 |

| 70.00 | -30.00% | 0.00% | $1,000.00 |

| 69.99 | -30.01% | -30.01% | $699.90 |

| 60.00 | -40.00% | -40.00% | $600.00 |

| 50.00 | -50.00% | -50.00% | $500.00 |

| 40.00 | -60.00% | -60.00% | $400.00 |

| 30.00 | -70.00% | -70.00% | $300.00 |

| 20.00 | -80.00% | -80.00% | $200.00 |

| 10.00 | -90.00% | -90.00% | $100.00 |

| 0.00 | -100.00% | -100.00% | $0.00 |

| PS-2 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |

| PS-3 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |

| PS-4 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |

| PS-5 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |

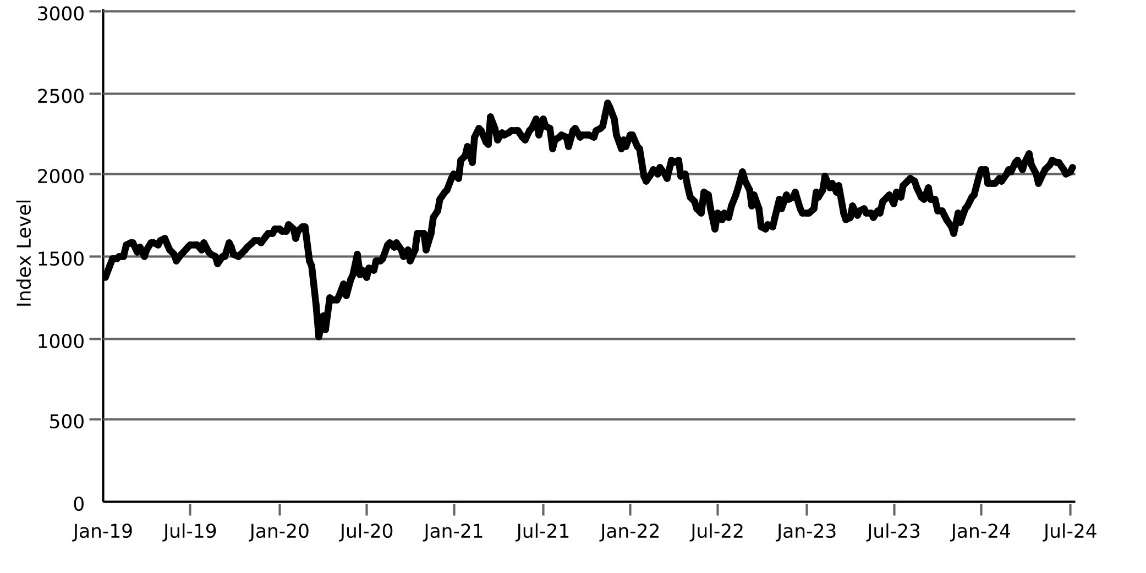

Historical Performance of the Russell 2000® Index  Source: Bloomberg |

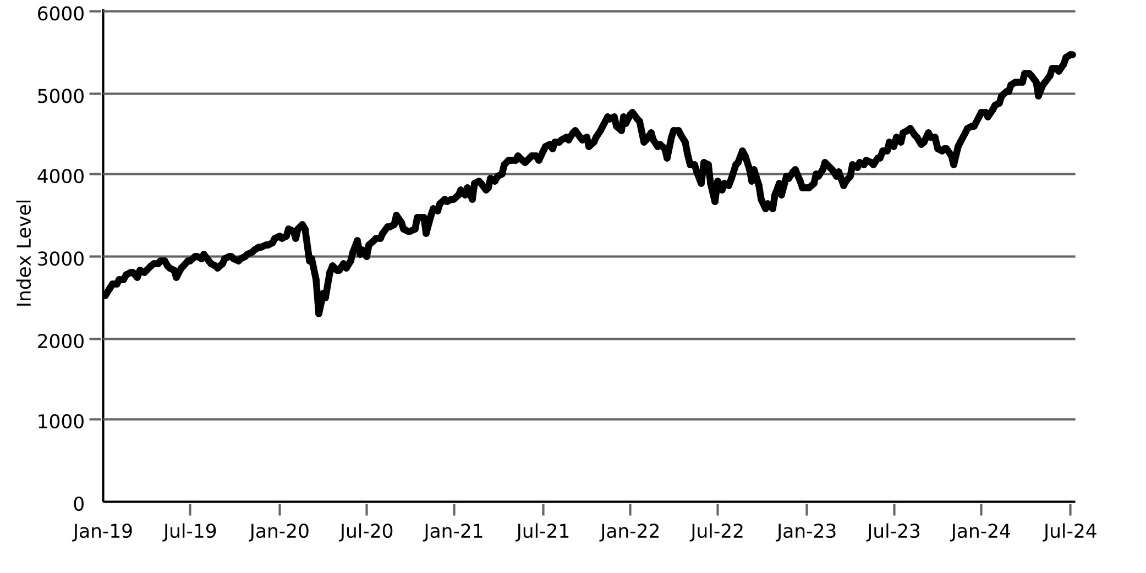

Historical Performance of the S&P 500® Index  Source: Bloomberg |

| PS-6 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |

| PS-7 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |

| PS-8 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |

| PS-9 | Structured Investments |  |

Capped Accelerated Barrier Notes Linked to the Lesser Performing of the Russell 2000® Index and the S&P 500® Index |