PS-7 | Structured Investments

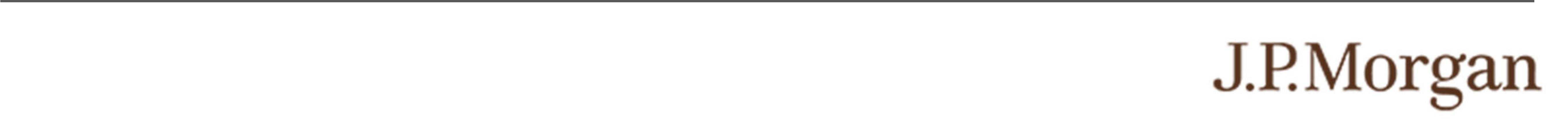

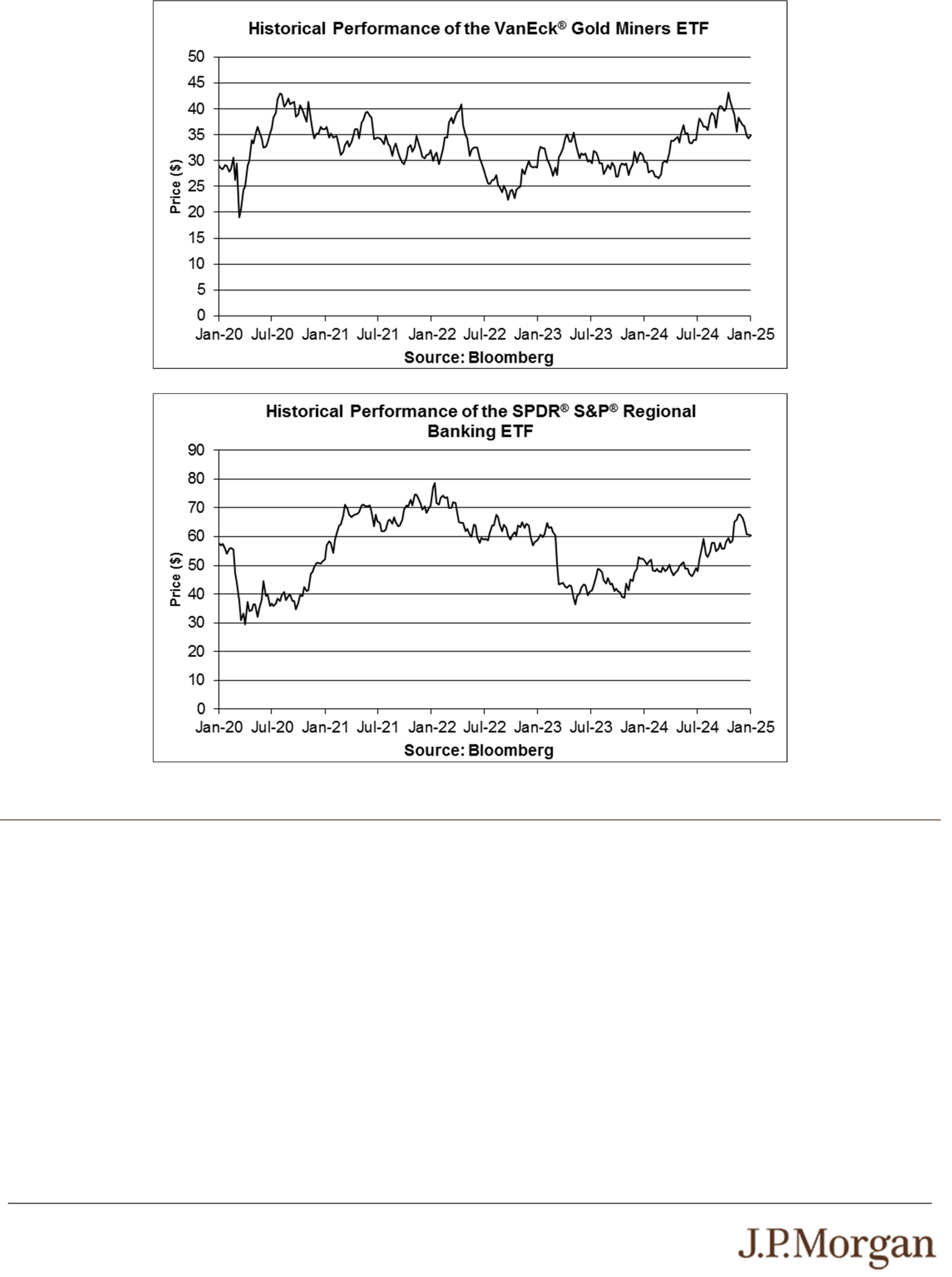

Review Notes Linked to the Least Performing of the Nasdaq-100 Index

®

,

the VanEck

®

Gold Miners ETF and the SPDR

®

S&P

®

Regional Banking ETF

also, because secondary market prices may exclude selling commissions, projected hedging profits, if any, and estimated hedging

costs that are included in the original issue price of the notes. As a result, the price, if any, at which JPMS will be willing to buy the

notes from you in secondary market transactions, if at all, is likely to be lower than the original issue price. Any sale by you prior to

the Maturity Date could result in a substantial loss to you.

• SECONDARY MARKET PRICES OF THE NOTES WILL BE IMPACTED BY MANY ECONOMIC AND MARKET FACTORS —

The secondary market price of the notes during their term will be impacted by a number of economic and market factors, which

may either offset or magnify each other, aside from the selling commissions, projected hedging profits, if any, estimated hedging

costs and the values of the Underlyings. Additionally, independent pricing vendors and/or third party broker-dealers may publish a

price for the notes, which may also be reflected on customer account statements. This price may be different (higher or lower)

than the price of the notes, if any, at which JPMS may be willing to purchase your notes in the secondary market. See “Risk

Factors — Risks Relating to the Estimated Value and Secondary Market Prices of the Notes — Secondary market prices of the

notes will be impacted by many economic and market factors” in the accompanying product supplement.

Risks Relating to the Underlyings

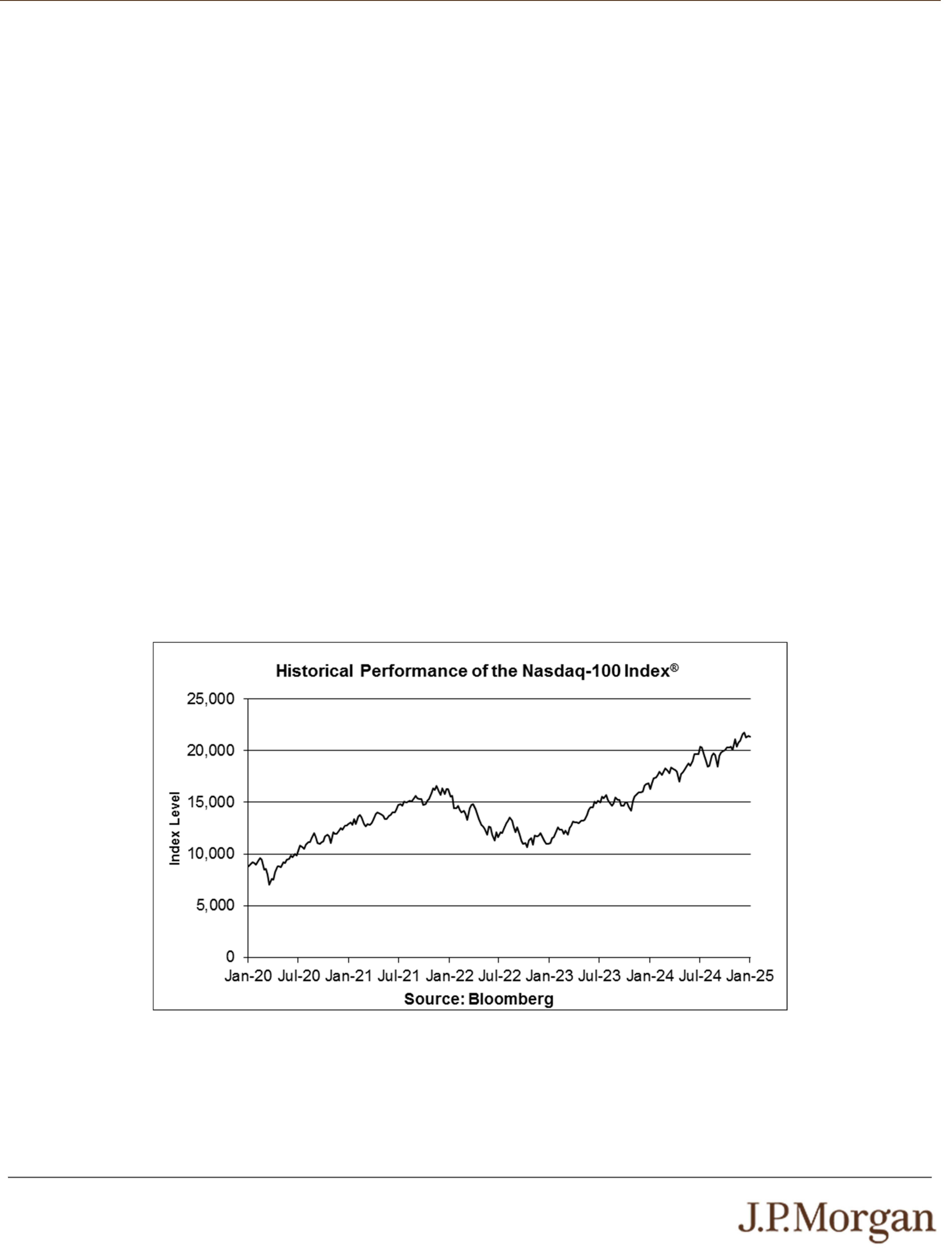

• NON-U.S. SECURITIES RISK WITH RESPECT TO THE INDEX AND THE VANECK

®

GOLD MINERS ETF

Some of the equity securities included in the Index and held by the VanEck

®

Gold Miners ETF have been issued by non-U.S.

companies. Investments in securities linked to the value of such non-U.S. equity securities involve risks associated with the home

countries and/or the securities markets in the home countries of the issuers of those non-U.S. equity securities. Also, there is

generally less publicly available information about companies in some of these jurisdictions than there is about U.S. companies

that are subject to the reporting requirements of the SEC.

• THERE ARE RISKS ASSOCIATED WITH THE FUNDS —

The Funds are subject to management risk, which is the risk that the investment strategies of the applicable Fund’s investment

adviser, the implementation of which is subject to a number of constraints, may not produce the intended results. These

constraints could adversely affect the market prices of the shares of the Funds and, consequently, the value of the notes.

• THE PERFORMANCE AND MARKET VALUE OF EACH FUND, PARTICULARLY DURING PERIODS OF MARKET

VOLATILITY, MAY NOT CORRELATE WITH THE PERFORMANCE OF THAT FUND’S UNDERLYING INDEX AS WELL AS

THE NET ASSET VALUE PER SHARE —

Each Fund does not fully replicate its Underlying Index (as defined under “The Underlyings” below) and may hold securities

different from those included in its Underlying Index. In addition, the performance of each Fund will reflect additional transaction

costs and fees that are not included in the calculation of its Underlying Index. All of these factors may lead to a lack of correlation

between the performance of each Fund and its Underlying Index. In addition, corporate actions with respect to the equity securities

underlying a Fund (such as mergers and spin-offs) may impact the variance between the performances of that Fund and its

Underlying Index. Finally, because the shares of each Fund are traded on a securities exchange and are subject to market supply

and investor demand, the market value of one share of each Fund may differ from the net asset value per share of that Fund.

During periods of market volatility, securities underlying each Fund may be unavailable in the secondary market, market

participants may be unable to calculate accurately the net asset value per share of that Fund and the liquidity of that Fund may be

adversely affected. This kind of market volatility may also disrupt the ability of market participants to create and redeem shares of

a Fund. Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to

buy and sell shares of a Fund. As a result, under these circumstances, the market value of shares of a Fund may vary

substantially from the net asset value per share of that Fund. For all of the foregoing reasons, the performance of each Fund may

not correlate with the performance of its Underlying Index as well as the net asset value per share of that Fund, which could

materially and adversely affect the value of the notes in the secondary market and/or reduce any payment on the notes.

• RISKS ASSOCIATED WITH THE GOLD AND SILVER MINING INDUSTRIES WITH RESPECT TO THE VANECK

®

GOLD

MINERS ETF —

All or substantially all of the equity securities held by the VanEck

®

Gold Miners ETF are issued by companies whose primary line of

business is directly associated with the gold and/or silver mining industries. As a result, the value of the notes may be subject to

greater volatility and be more adversely affected by a single economic, political or regulatory occurrence affecting these industries

than a different investment linked to securities of a more broadly diversified group of issuers. Investments related to gold and silver

are considered speculative and are affected by a variety of factors. Competitive pressures may have a significant effect on the

financial condition of gold and silver mining companies. Also, gold and silver mining companies are highly dependent on the price

of gold and silver bullion, respectively, but may also be adversely affected by a variety of worldwide economic, financial and

political factors. The price of gold and silver may fluctuate substantially over short periods of time, so the VanEck

®

Gold Miners