PS-1 | Structured Investments

Review Notes Linked to the Least Performing of the S&P 500

®

Index, the

Russell 2000

®

Index and the Nasdaq-100 Index

®

Key Terms

Issuer: JPMorgan Chase Financial Company LLC, a direct, wholly owned

finance subsidiary of JPMorgan Chase & Co.

Guarantor: JPMorgan Chase & Co.

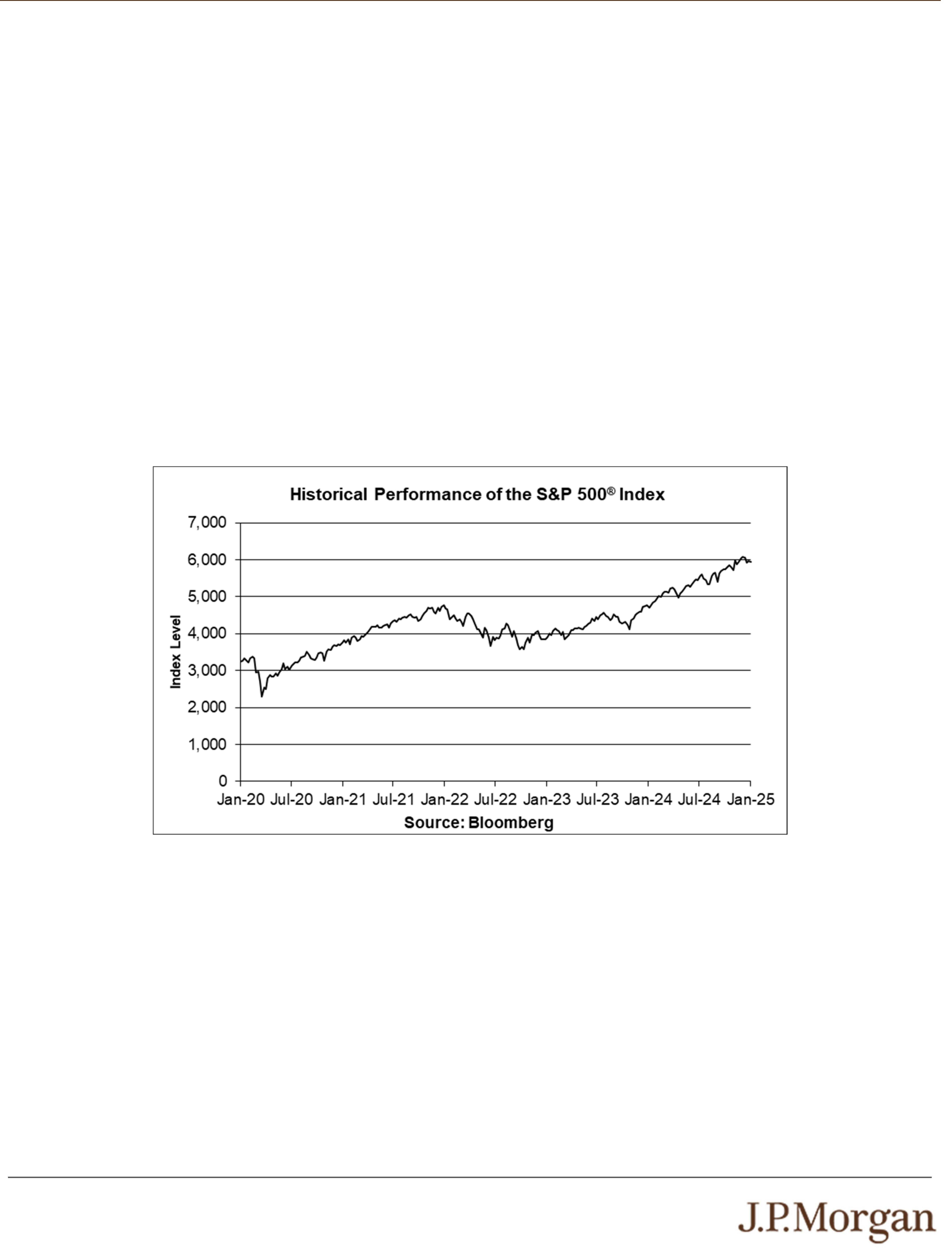

Indices: The S&P 500

®

Index (Bloomberg ticker: SPX), the

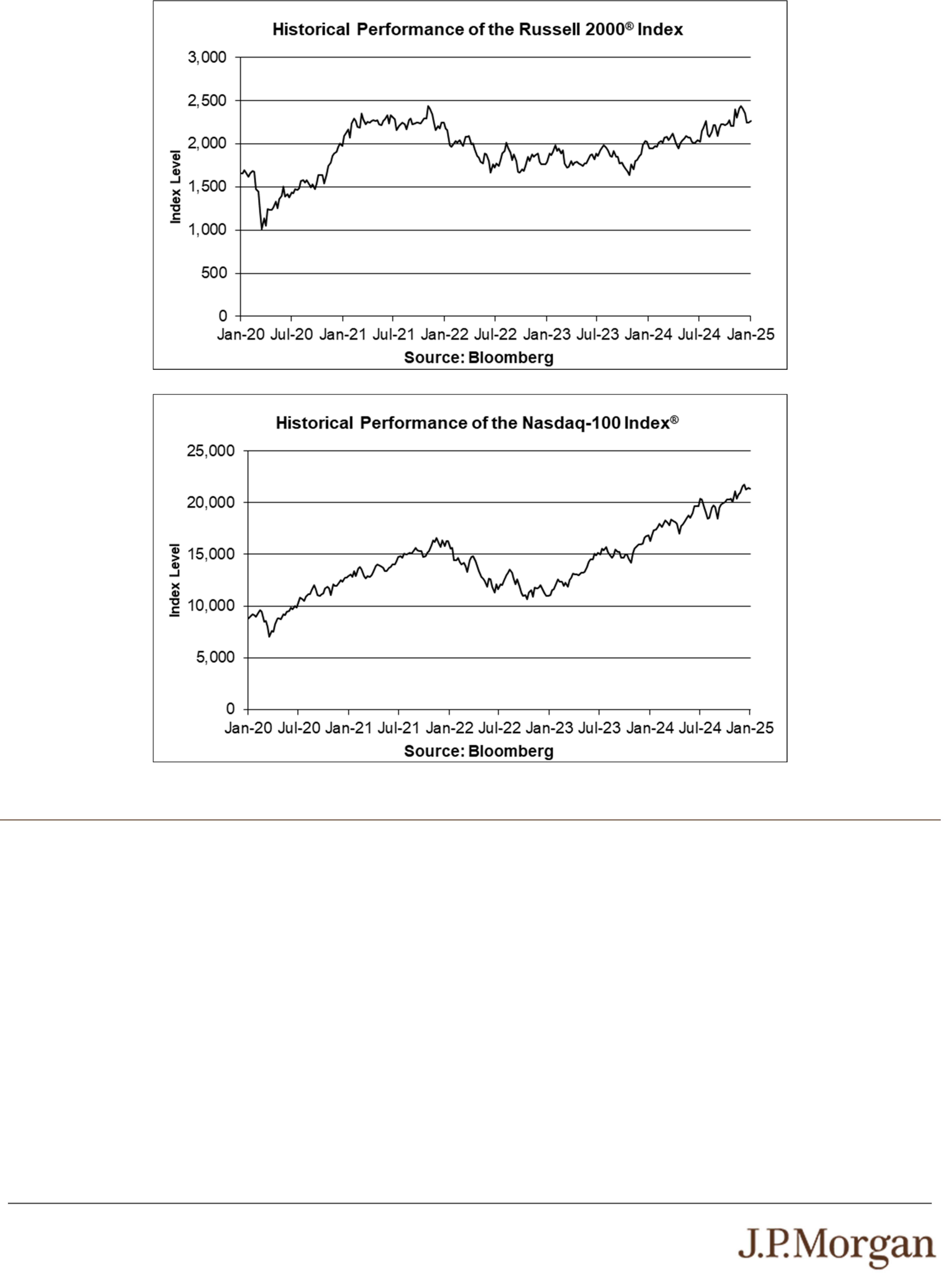

Russell 2000

®

Index (Bloomberg ticker: RTY) and the Nasdaq-100

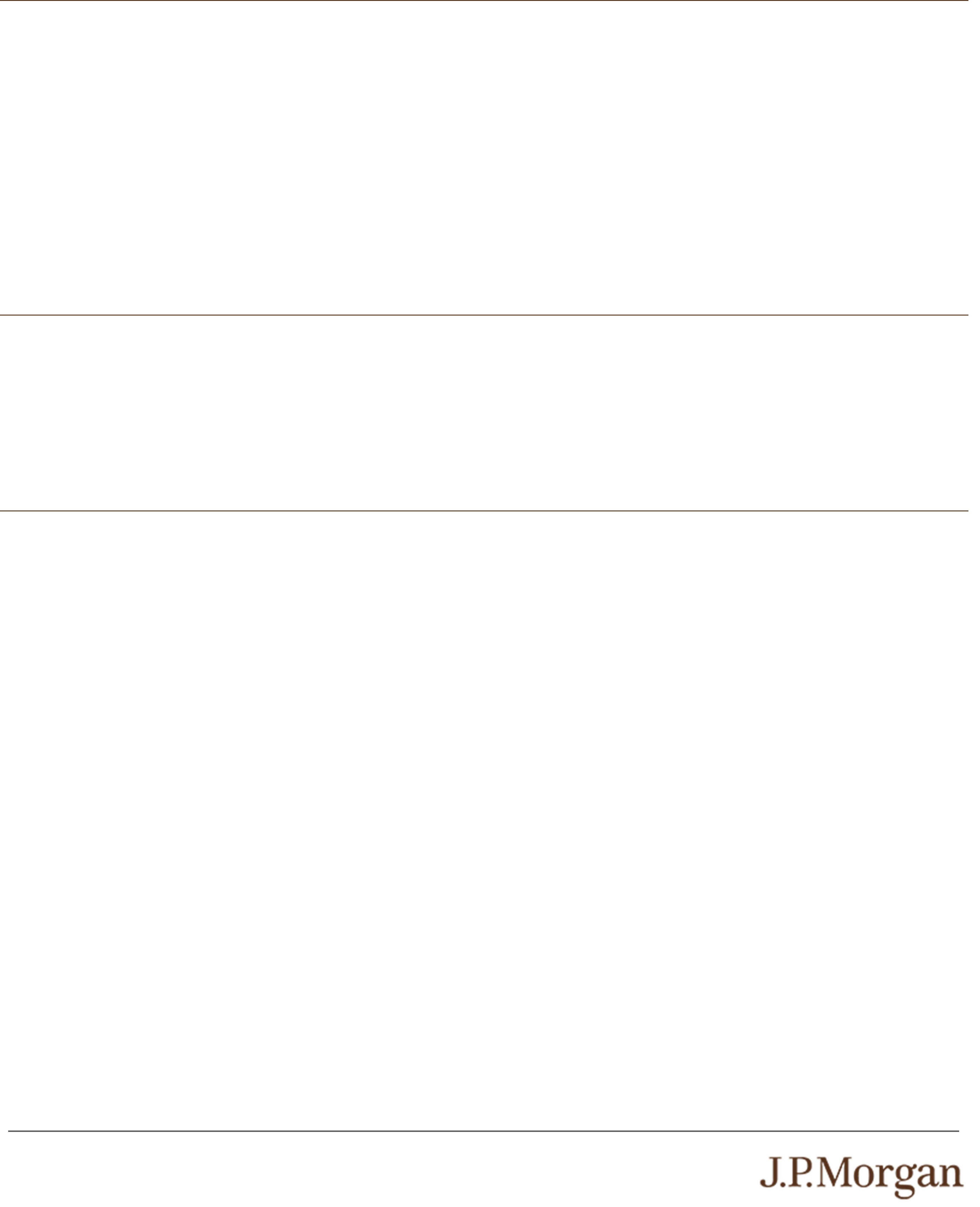

Index

®

Bloomber

ticker: NDX

a

rem

um

moun

:

e

a

rem

um

moun

w

respec

o

each Review Date is set forth below:

• first Review Date: at least 8.00000% ×

1,000

• second Review Date: at least 8.66667% ×

1,000

• third Review Date: at least 9.33333% ×

1,000

• fourth Review Date: at least 10.00000% ×

1,000

• fifth Review Date: at least 10.66667% ×

1,000

• sixth Review Date: at least 11.33333% ×

1,000

• seventh Review Date: at least 12.00000% ×

1,000

• ei

hth Review Date: at least 12.66667% ×

1,000

• ninth Review Date: at least 13.33333% ×

1,000

• tenth Review Date: at least 14.00000% ×

1,000

• eleventh Review Date: at least 14.66667% ×

1,000

• twelfth Review Date: at least 15.33333% ×

1,000

• thirteenth Review Date: at least 16.00000% ×

1,000

• fourteenth Review Date: at least 16.66667% ×

1,000

• fifteenth Review Date: at least 17.33333% ×

1,000

• sixteenth Review Date: at least 18.00000% ×

1,000

• seventeenth Review Date: at least 18.66667% ×

1,000

• ei

hteenth Review Date: at least 19.33333% ×

1,000

• nineteenth Review Date: at least 20.00000% ×

1,000

• twentieth Review Date: at least 20.66667% ×

1,000

• twent

-first Review Date: at least 21.33333% ×

1,000

• twent

-second Review Date: at least 22.00000% ×

1,000

• twent

-third Review Date: at least 22.66667% ×

1,000

• twent

-fourth Review Date: at least 23.33333% ×

1,000

• twent

-fifth Review Date: at least 24.00000% ×

1,000

• twent

-sixth Review Date: at least 24.66667% ×

1,000

• twent

-seventh Review Date: at least 25.33333% ×

1,000

• twent

-ei

hth Review Date: at least 26.00000% ×

1,000

• twent

-ninth Review Date: at least 26.66667% ×

1,000

• thirtieth Review Date: at least 27.33333% ×

1,000

• thirt

-first Review Date: at least 28.00000% ×

1,000

• thirt

-second Review Date: at least 28.66667% ×

1,000

• thirt

-third Review Date: at least 29.33333% ×

1,000

• thirt

-fourth Revie

Date: at least 30.00000% ×

1,000

• thirt

-fifth Review Date: at least 30.66667% ×

1,000

• thirt

-sixth Review Date: at least 31.33333% ×

1,000

• thirt

-seventh Review Date: at least 32.00000% ×

1,000

• thirt

-ei

hth Review Date: at least 32.66667% ×

1,000

• thirt

-ninth Review Date: at least 33.33333% ×

1,000

• fortieth Review Date: at least 34.00000% ×

1,000

• fort

-first Review Date: at least 34.66667% ×

1,000

• fort

-second Review Date: at least 35.33333% ×

1,000

• fort

-third Review Date: at least 36.00000% ×

1,000

• fort

-fourth Review Date: at least 36.66667% ×

1,000

• fort

-fifth Review Date: at least 37.33333% ×

1,000

• fort

-sixth Review Date: at least 38.00000% ×

1,000

• fort

-seventh Review Date: at least 38.66667% ×

1,000

• fort

-ei

hth Review Date: at least 39.33333% ×

1,000

• final Review Date: at least 40.00000% ×

1,000

in each case, to be

rovided in the

ricin

su

lement

Call Value: With res

ect to each Index, 100.00% of its Initial Value

Barrier Amount: With respect to each Index, 70.00% of its Initial

Value

Pricing Date: On or about January 15, 2025

Original Issue Date (Settlement Date): On or about January 21,

2025

Review Dates*: January 21, 2026, February 17, 2026, March 16,

2026, April 15, 2026, May 15, 2026, June 15, 2026, July 15, 2026,

August 17, 2026, September 15, 2026, October 15, 2026,

November 16, 2026, December 15, 2026, January 15, 2027,

February 16, 2027, March 15, 2027, April 15, 2027, May 17, 2027,

June 15, 2027, July 15, 2027, August 16, 2027, September 15,

2027, October 15, 2027, November 15, 2027, December 15, 2027,

January 18, 2028, February 15, 2028, March 15, 2028, April 17,

2028, May 15, 2028, June 15, 2028, July 17, 2028, August 15,

2028, September 15, 2028, October 16, 2028, November 15, 2028,

December 15, 2028, January 16, 2029, February 15, 2029, March

15, 2029, April 16, 2029, May 15, 2029, June 15, 2029, July 16,

2029, August 15, 2029, September 17, 2029, October 15, 2029,

November 15, 2029, December 17, 2029 and January 15, 2030

(final Review Date)

Call Settlement Dates*: January 26, 2026, February 20, 2026,

March 19, 2026, April 20, 2026, May 20, 2026, June 18, 2026, July

20, 2026, August 20, 2026, September 18, 2026, October 20, 2026,

November 19, 2026, December 18, 2026, January 21, 2027,

February 19, 2027, March 18, 2027, April 20, 2027, May 20, 2027,

June 21, 2027, July 20, 2027, August 19, 2027, September 20,

2027, October 20, 2027, November 18, 2027, December 20, 2027,

January 21, 2028, February 18, 2028, March 20, 2028, April 20,

2028, May 18, 2028, June 21, 2028, July 20, 2028, August 18,

2028, September 20, 2028, October 19, 2028, November 20, 2028,

December 20, 2028, January 19, 2029, February 21, 2029, March

20, 2029, April 19, 2029, May 18, 2029, June 21, 2029, July 19,

2029, August 20, 2029, September 20, 2029, October 18, 2029,

November 20, 2029, December 20, 2029 and the Maturity Date

Maturity Date*: January 18, 2030

Automatic Call:

If the closing level of each Index on any Review Date is greater than

or equal to its Call Value, the notes will be automatically called for a

cash payment, for each $1,000 principal amount note, equal to (a)

$1,000 plus (b) the Call Premium Amount applicable to that Review

Date, payable on the applicable Call Settlement Date. No further

payments will be made on the notes.

Payment at Maturity:

If the notes have not been automatically called and the Final Value

of each Index is greater than or equal to its Barrier Amount, you will

receive the principal amount of your notes at maturity.

If the notes have not been automatically called and the Final Value

of any Index is less than its Barrier Amount, your payment at

maturity per $1,000 principal amount note will be calculated as

follows:

$1,000 + ($1,000 × Least Performing Index Return)

If the notes have not been automatically called and the Final Value

of any Index is less than its Barrier Amount, you will lose more than

30.00% of your principal amount at maturity and could lose all of

your principal amount at maturity.

Least Performing Index: The Index with the Least Performing

Index Return

Least Performing Index Return: The lowest of the Index Returns

of the Indices

Index Return: With respect to each Index,

(Final Value – Initial Value)

Initial Value

Initial Value: With respect to each Index, the closing level of that

Index on the Pricing Date

Final Value: With respect to each Index, the closing level of that

Index on the final Review Date

* Subject to postponement in the event of a market disruption event

and as described under “General Terms of Notes — Postponement

of a Determination Date — Notes Linked to Multiple Underlyings”

and “General Terms of Notes — Postponement of a Payment Date”

in the accompanying product supplement