PS-1 | Structured Investments

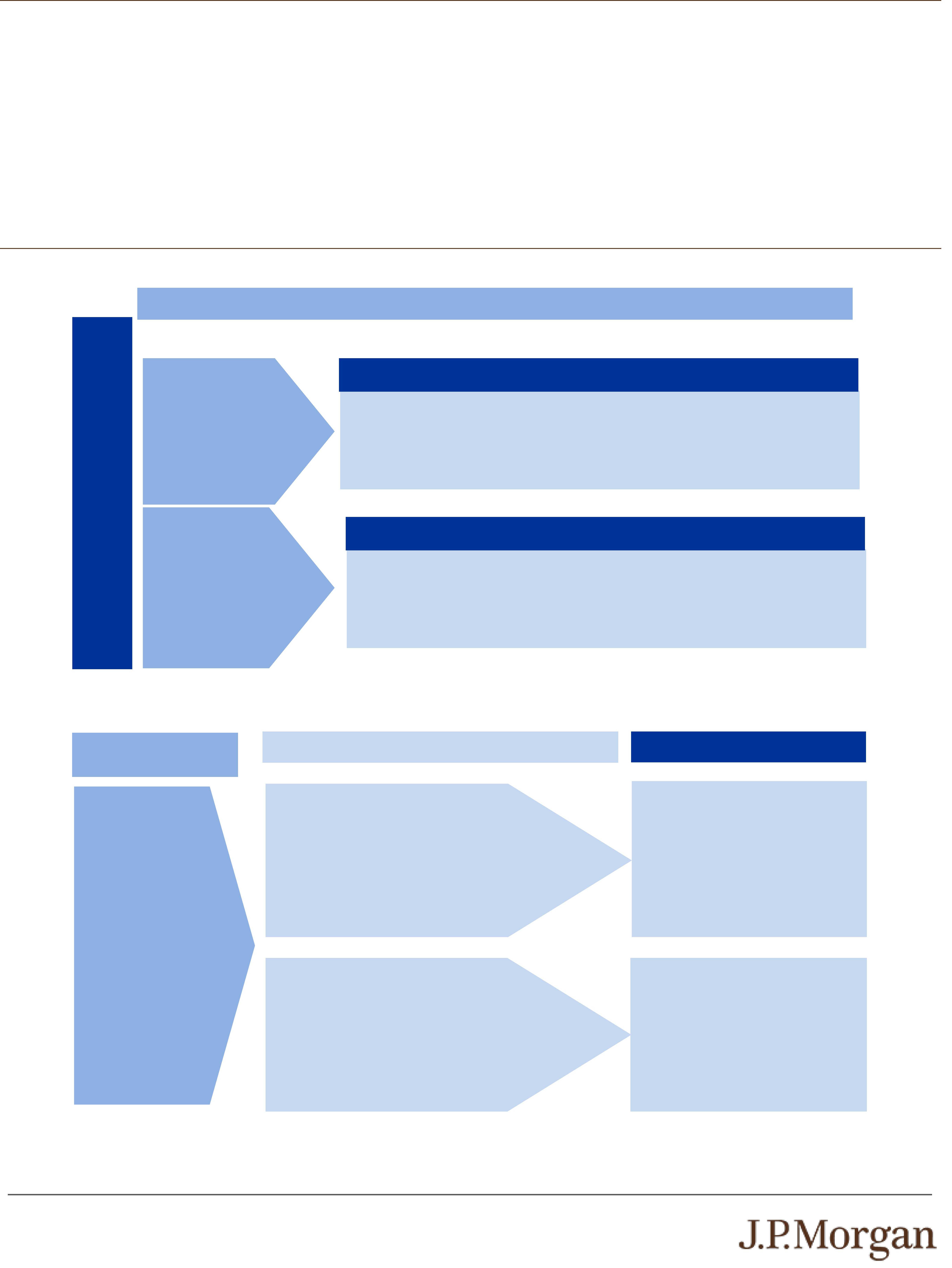

Review Notes Linked to the MerQube US Large-Cap Vol Advantage Index

Issuer: JPMorgan Chase Financial Company LLC, a direct, wholly

owned finance subsidiary of JPMorgan Chase & Co.

Guarantor: JPMorgan Chase & Co.

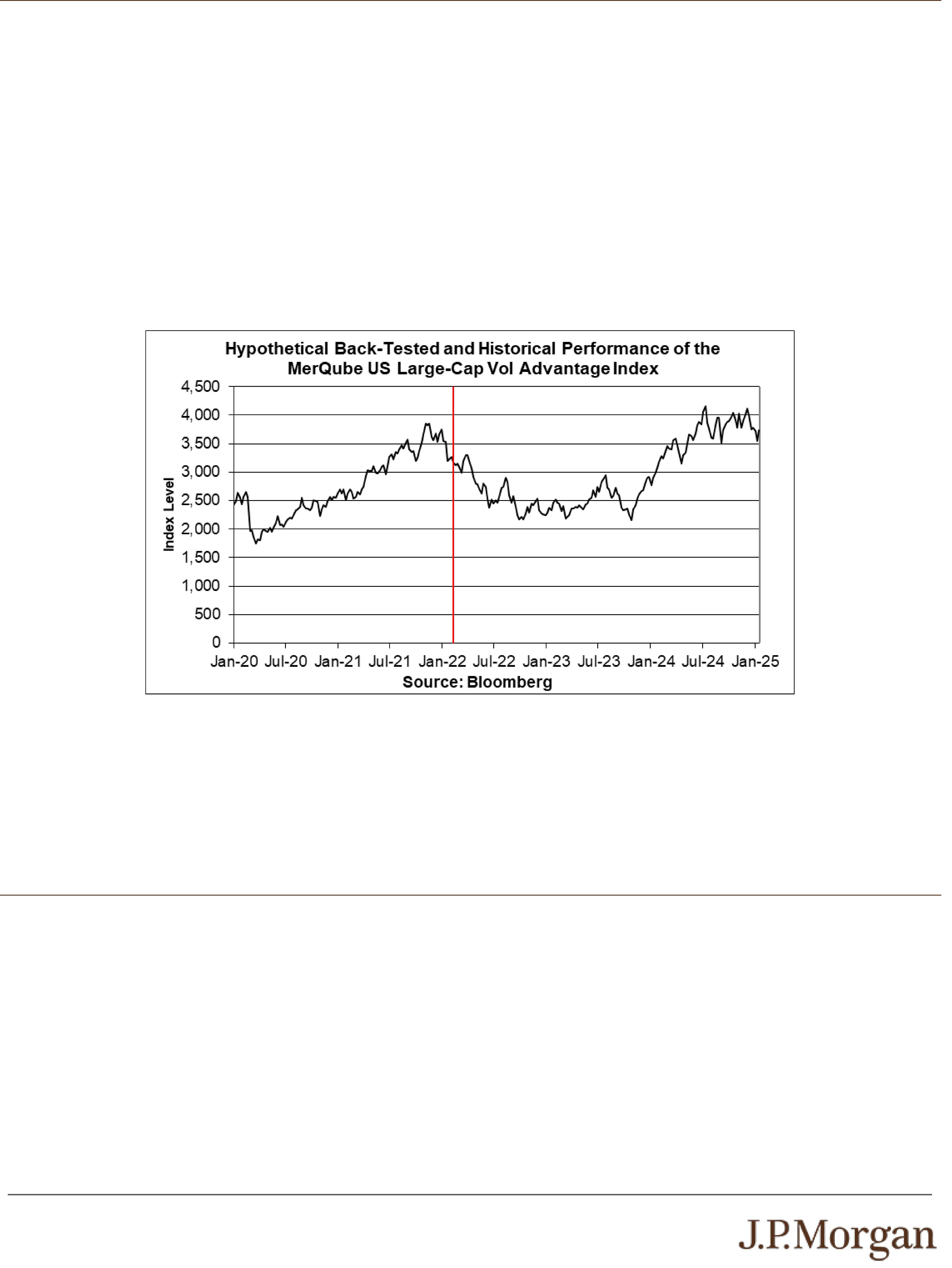

Index: The MerQube US Large-Cap Vol Advantage Index

(Bloomberg ticker: MQUSLVA). The level of the Index reflects a

deduction of 6.0% per annum that accrues daily.

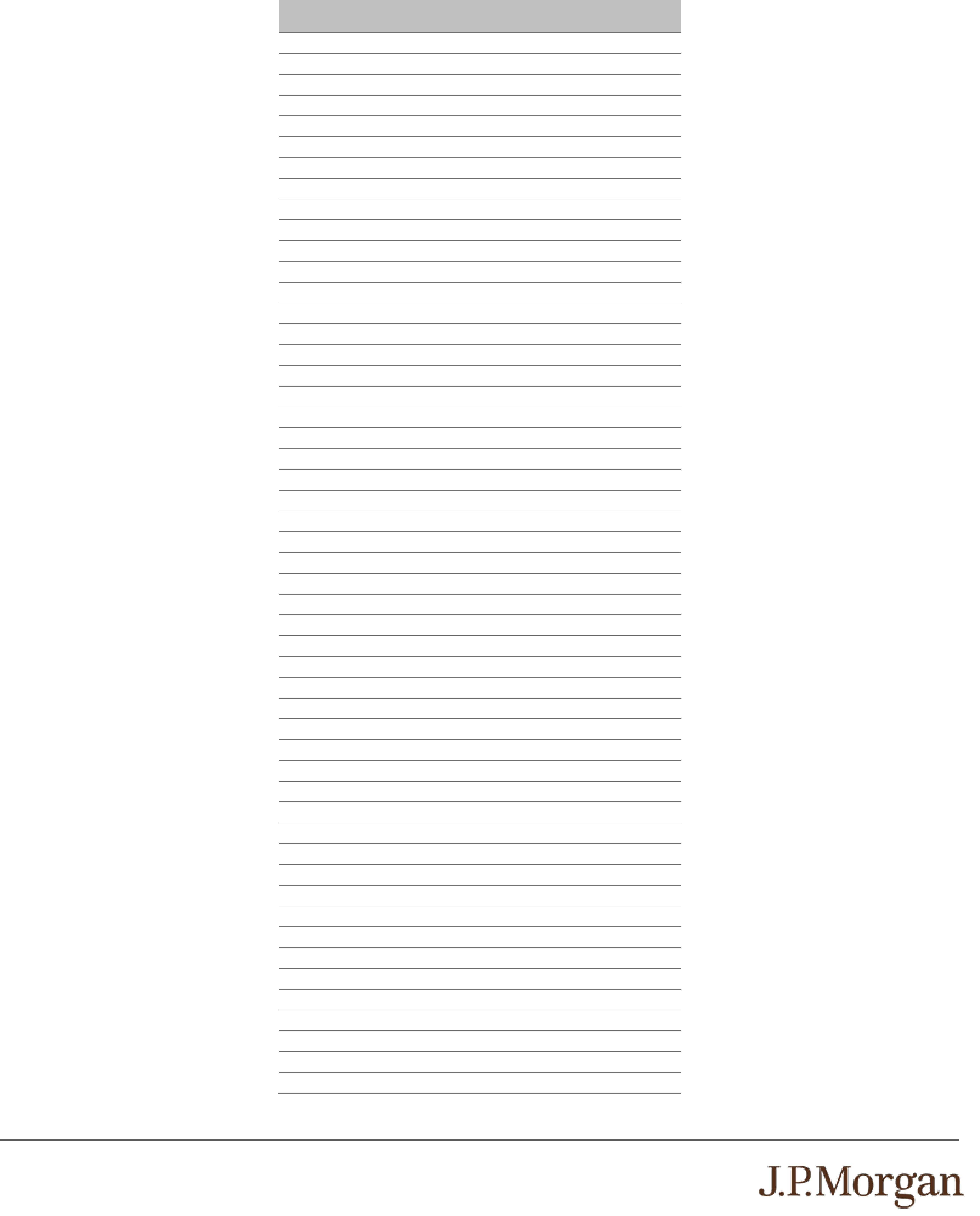

Call Premium Amount: The Call Premium Amount with respect to

each Review Date is set forth below:

at least 9.50000% × $1,000

at least 11.08333% × $1,000

at least 12.66667% × $1,000

at least 14.25000% × $1,000

at least 15.83333% × $1,000

at least 17.41667% × $1,000

at least 19.00000% × $1,000

at least 20.58333% × $1,000

at least 22.16667% × $1,000

at least 23.75000% × $1,000

at least 25.33333% × $1,000

at least 26.91667% × $1,000

• thirteenth Review Date:

at least 28.50000% × $1,000

• fourteenth Review Date:

at least 30.08333% × $1,000

at least 31.66667% × $1,000

at least 33.25000% × $1,000

• seventeenth Review Date:

at least 34.83333% × $1,000

• eighteenth Review Date:

at least 36.41667% × $1,000

• nineteenth Review Date:

at least 38.00000% × $1,000

at least 39.58333% × $1,000

• twenty-first Review Date:

at least 41.16667% × $1,000

• twenty-second Review Date:

at least 42.75000% × $1,000

• twenty-third Review Date:

at least 44.33333% × $1,000

• twenty-fourth Review Date:

at least 45.91667% × $1,000

• twenty-fifth Review Date:

at least 47.50000% × $1,000

• twenty-sixth Review Date:

at least 49.08333% × $1,000

• twenty-seventh Review Date:

at least 50.66667% × $1,000

• twenty-eighth Review Date:

at least 52.25000% × $1,000

• twenty-ninth Review Date:

at least 53.83333% × $1,000

at least 55.41667% × $1,000

• thirty-first Review Date:

at least 57.00000% × $1,000

• thirty-second Review Date:

at least 58.58333% × $1,000

• thirty-third Review Date:

at least 60.16667% × $1,000

• thirty-fourth Review Date:

at least 61.75000% × $1,000

• thirty-fifth Review Date:

at least 63.33333% × $1,000

• thirty-sixth Review Date:

at least 64.91667% × $1,000

• thirty-seventh Review Date:

at least 66.50000% × $1,000

• thirty-eighth Review Date:

at least 68.08333% × $1,000

• thirty-ninth Review Date:

at least 69.66667% × $1,000

at least 71.25000% × $1,000

• forty-first Review Date:

at least 72.83333% × $1,000

• forty-second Review Date:

at least 74.41667% × $1,000

• forty-third Review Date:

at least 76.00000% × $1,000

• forty-fourth Review Date:

at least 77.58333% × $1,000

• forty-fifth Review Date:

at least 79.16667% × $1,000

• forty-sixth Review Date:

at least 80.75000% × $1,000

• forty-seventh Review Date:

at least 82.33333% × $1,000

• forty-eighth Review Date:

at least 83.91667% × $1,000

• forty-ninth Review Date:

at least 85.50000% × $1,000

at least 87.08333% × $1,000

• fifty-first Review Date:

at least 88.66667% × $1,000

• fifty-second Review Date:

at least 90.25000% × $1,000

• fifty-third Review Date:

at least 91.83333% × $1,000

• fifty-fourth Review Date:

at least 93.41667% × $1,000

• fifty-fifth Review Date:

at least 95.00000% × $1,000

• fifty-sixth Review Date:

at least 96.58333% × $1,000

• fifty-seventh Review Date:

at least 98.16667% × $1,000

• fifty-eighth Review Date:

at least 99.75000% × $1,000

• fifty-ninth Review Date:

at least 101.33333% × $1,000

at least 102.91667% × $1,000

• sixty-first Review Date:

at least 104.50000% × $1,000

• sixty-second Review Date:

at least 106.08333% × $1,000

• sixty-third Review Date:

at least 107.66667% × $1,000

• sixty-fourth Review Date:

at least 109.25000% × $1,000

• sixty-fifth Review Date:

at least 110.83333% × $1,000

• sixty-sixth Review Date:

at least 112.41667% × $1,000

at least 114.00000% × $1,000

(in each case, to be provided in the pricing supplement)

Call Value: 100.00% of the Initial Value

Barrier Amount: 50.00% of the Initial Value

Pricing Date: On or about January 29, 2025

Original Issue Date (Settlement Date): On or about February 3,

2025

Review Dates*: July 29, 2025, August 29, 2025, September 29,

2025, October 29, 2025, December 1, 2025, December 29, 2025,

January 29, 2026, March 2, 2026, March 30, 2026, April 29, 2026,

May 29, 2026, June 29, 2026, July 29, 2026, August 31, 2026,

September 29, 2026, October 29, 2026, November 30, 2026,

December 29, 2026, January 29, 2027, March 1, 2027, March 29,

2027, April 29, 2027, June 1, 2027, June 29, 2027, July 29, 2027,

August 30, 2027, September 29, 2027, October 29, 2027, November

29, 2027, December 29, 2027, January 31, 2028, February 29, 2028,

March 29, 2028, May 1, 2028, May 30, 2028, June 29, 2028, July 31,

2028, August 29, 2028, September 29, 2028, October 30, 2028,

November 29, 2028, December 29, 2028, January 29, 2029,

February 28, 2029, March 29, 2029, April 30, 2029, May 29, 2029,

June 29, 2029, July 30, 2029, August 29, 2029, October 1, 2029,

October 29, 2029, November 29, 2029, December 31, 2029, January

29, 2030, February 28, 2030, March 29, 2030, April 29, 2030, May

29, 2030, July 1, 2030, July 29, 2030, August 29, 2030, September

30, 2030, October 29, 2030, November 29, 2030, December 30,

2030 and January 29, 2031 (final Review Date)

Call Settlement Dates*: August 1, 2025, September 4, 2025,

October 2, 2025, November 3, 2025, December 4, 2025, January 2,

2026, February 3, 2026, March 5, 2026, April 2, 2026, May 4, 2026,

June 3, 2026, July 2, 2026, August 3, 2026, September 3, 2026,

October 2, 2026, November 3, 2026, December 3, 2026, January 4,

2027, February 3, 2027, March 4, 2027, April 1, 2027, May 4, 2027,

June 4, 2027, July 2, 2027, August 3, 2027, September 2, 2027,

October 4, 2027, November 3, 2027, December 2, 2027, January 3,

2028, February 3, 2028, March 3, 2028, April 3, 2028, May 4, 2028,

June 2, 2028, July 5, 2028, August 3, 2028, September 1, 2028,

October 4, 2028, November 2, 2028, December 4, 2028, January 4,

2029, February 1, 2029, March 5, 2029, April 4, 2029, May 3, 2029,

June 1, 2029, July 5, 2029, August 2, 2029, September 4, 2029,

October 4, 2029, November 1, 2029, December 4, 2029, January 4,

2030, February 1, 2030, March 5, 2030, April 3, 2030, May 2, 2030,

June 3, 2030, July 5, 2030, August 1, 2030, September 4, 2030,

October 3, 2030, November 1, 2030, December 4, 2030, January 3,

2031 and the Maturity Date

Maturity Date*: February 3, 2031

Automatic Call:

If the closing level of the Index on any Review Date is greater than or

equal to the Call Value, the notes will be automatically called for a

cash payment, for each $1,000 principal amount note, equal to (a)

$1,000 plus (b) the Call Premium Amount applicable to that Review

Date, payable on the applicable Call Settlement Date. No further

payments will be made on the notes.

Payment at Maturity:

If the notes have not been automatically called and the Final Value is

greater than or equal to the Barrier Amount, you will receive the

principal amount of your notes at maturity.

If the notes have not been automatically called and the Final Value is

less than the Barrier Amount, your payment at maturity per $1,000

principal amount note will be calculated as follows:

$1,000 + ($1,000 × Index Return)

If the notes have not been automatically called and the Final Value is

less than the Barrier Amount, you will lose more than 50.00% of your

principal amount at maturity and could lose all of your principal

amount at maturity.

Index Return: (Final Value – Initial Value)

Initial Value

Initial Value: The closing level of the Index on the Pricing Date

Final Value: The closing level of the Index on the final Review Date

* Subject to postponement in the event of a market disruption event and as

described under “Supplemental Terms of the Notes — Postponement of a

Determination Date — Notes Linked Solely to an Index” in the accompanying

underlying supplement and “General Terms of Notes — Postponement of a

Payment Date” in the accompanying product supplement