Underlying Index. Finally, because the shares of each Fund are traded on a securities exchange and are subject to market supply

and investor demand, the market value of one share of each Fund may differ from the net asset value per share of that Fund.

During periods of market volatility, securities underlying each Fund may be unavailable in the secondary market, market

participants may be unable to calculate accurately the net asset value per share of that Fund and the liquidity of that Fund may be

adversely affected. This kind of market volatility may also disrupt the ability of market participants to create and redeem shares of

a Fund. Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to

buy and sell shares of a Fund. As a result, under these circumstances, the market value of shares of a Fund may vary

substantially from the net asset value per share of that Fund. For all of the foregoing reasons, the performance of each Fund may

not correlate with the performance of its Underlying Index as well as the net asset value per share of that Fund, which could

materially and adversely affect the value of the notes in the secondary market and/or reduce any payment on the notes.

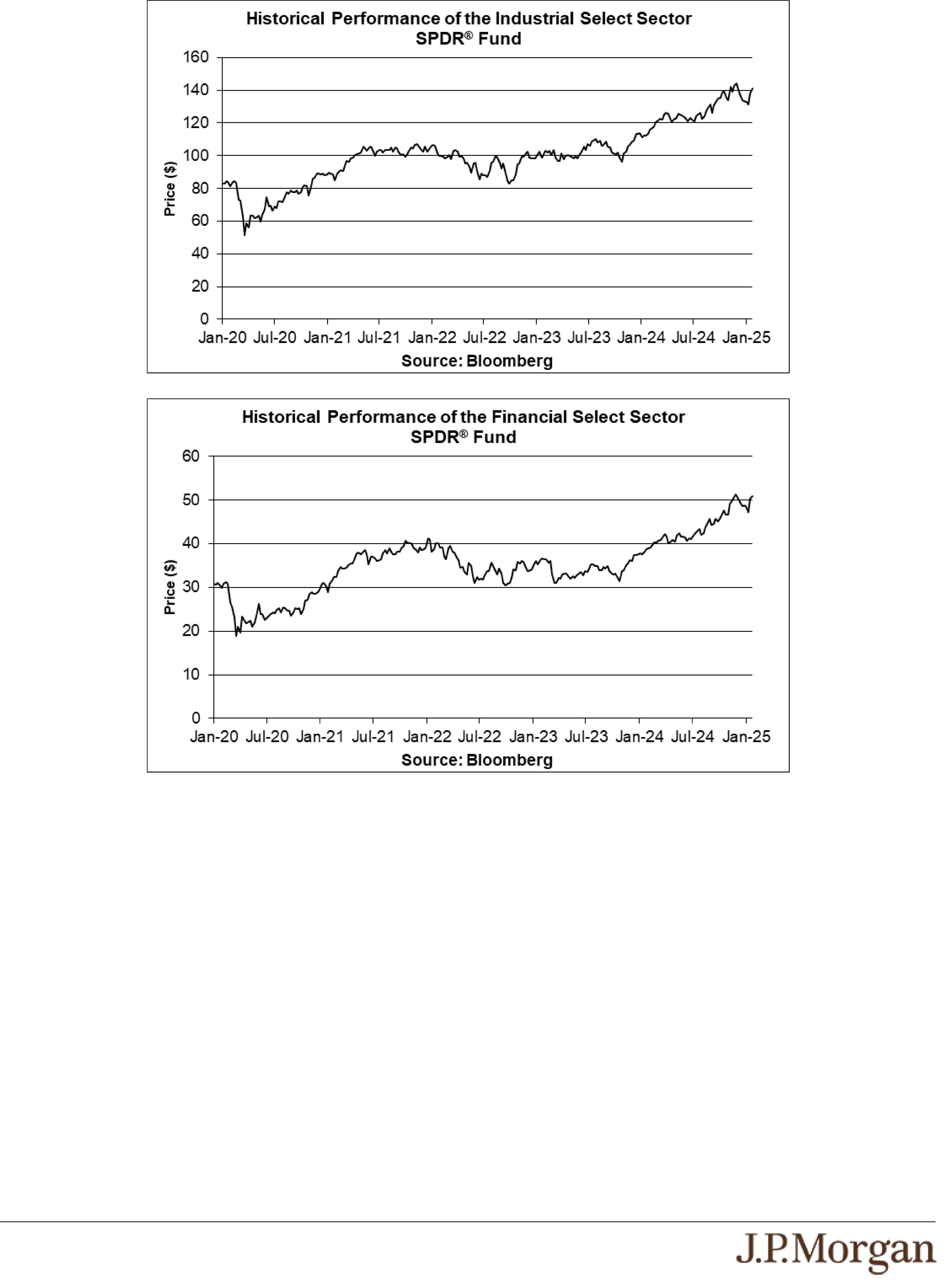

• RISKS ASSOCIATED WITH THE INDUSTRIALS SECTOR WITH RESPECT TO THE INDUSTRIAL SELECT SECTOR SPDR®

FUND —

All or substantially all of the equity securities held by the Industrial Select Sector SPDR® Fund are issued by companies whose

primary line of business is directly associated with the industrials sector. As a result, the value of the notes may be subject to

greater volatility and be more adversely affected by a single economic, political or regulatory occurrence affecting this sector than a

different investment linked to securities of a more broadly diversified group of issuers. Industrial companies are affected by supply

and demand both for their specific product or service and for industrial sector products in general. Government regulation, world

events, exchange rates and economic conditions, technological developments and liabilities for environmental damage and general

civil liabilities will likewise affect the performance of these companies. Aerospace and defense companies, a component of the

industrials sector, can be significantly affected by government spending policies because companies involved in this industry rely,

to a significant extent, on U.S. and foreign government demand for their products and services. Thus, the financial condition of,

and investor interest in, aerospace and defense companies are heavily influenced by governmental defense spending policies,

which are typically under pressure from efforts to control the U.S. (and other) government budgets. Transportation securities, a

component of the industrials sector, are cyclical and have occasional sharp price movements, which may result from changes in

the economy, fuel prices, labor agreements and insurance costs. These factors could affect the industrials sector and could affect

the value of the equity securities held by the Industrial Select Sector SPDR® Fund and the price of the Industrial Select Sector

SPDR® Fund during the term of the notes, which may adversely affect the value of your notes.

• RISKS ASSOCIATED WITH THE FINANCIAL SECTOR WITH RESPECT TO THE FINANCIAL SELECT SECTOR SPDR® FUND

—

All or substantially all of the equity securities held by the Financial Select Sector SPDR® Fund are issued by companies whose

primary line of business is directly associated with the financial sector. As a result, the value of the notes may be subject to greater

volatility and be more adversely affected by a single economic, political or regulatory occurrence affecting this sector than a

different investment linked to securities of a more broadly diversified group of issuers. Financial services companies are subject to

extensive government regulation, which may limit both the amounts and types of loans and other financial commitments they can

make, the interest rates and fees they can charge, the scope of their activities, the prices they can charge and the amount of

capital they must maintain. Profitability is largely dependent on the availability and cost of capital funds and can fluctuate

significantly when interest rates change or due to increased competition. In addition, deterioration of the credit markets generally

may cause an adverse impact in a broad range of markets, including U.S. and international credit and interbank money markets

generally, thereby affecting a wide range of financial institutions and markets. Certain events in the financial sector may cause an

unusually high degree of volatility in the financial markets, both domestic and foreign, and cause certain financial services

companies to incur large losses. Securities of financial services companies may experience a dramatic decline in value when

these companies experience substantial declines in the valuations of their assets, take action to raise capital (such as the issuance

of debt or equity securities) or cease operations. Credit losses resulting from financial difficulties of borrowers and financial losses

associated with investment activities can negatively impact the financial sector. Insurance companies may be subject to severe

price competition. Adverse economic, business or political developments could adversely affect financial institutions engaged in

mortgage finance or other lending or investing activities directly or indirectly connected to the value of real estate. These factors

could affect the financial sector and could affect the value of the equity securities held by the Financial Select Sector SPDR® Fund

and the price of the Financial Select Sector SPDR® Fund during the term of the notes, which may adversely affect the value of your

notes.

• RISKS ASSOCIATED WITH THE CONSUMER DISCRETIONARY SECTOR WITH RESPECT TO THE CONSUMER

DISCRETIONARY SELECT SECTOR SPDR® FUND —

All or substantially all of the equity securities held by the Consumer Discretionary Select Sector SPDR® Fund are issued by

companies whose primary line of business is directly associated with the consumer discretionary sector. As a result, the value of